Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Skyrocketing Data Storage Companies & Startups (2024)

You may also like:

As a vital component of IT, the world of data storage continues to evolve.

The global next generation data storage market size is $66.7 billion in 2024.

By the end of 2029, it’s set to hit $95.1 billion at a CAGR of 7.3%.

Advancements in this industry — courtesy of rising data storage startups — is the reason why it still continues to grow. We’ve rounded up the best companies from this space that are worth keeping an eye on in 2024.

1. LucidLink

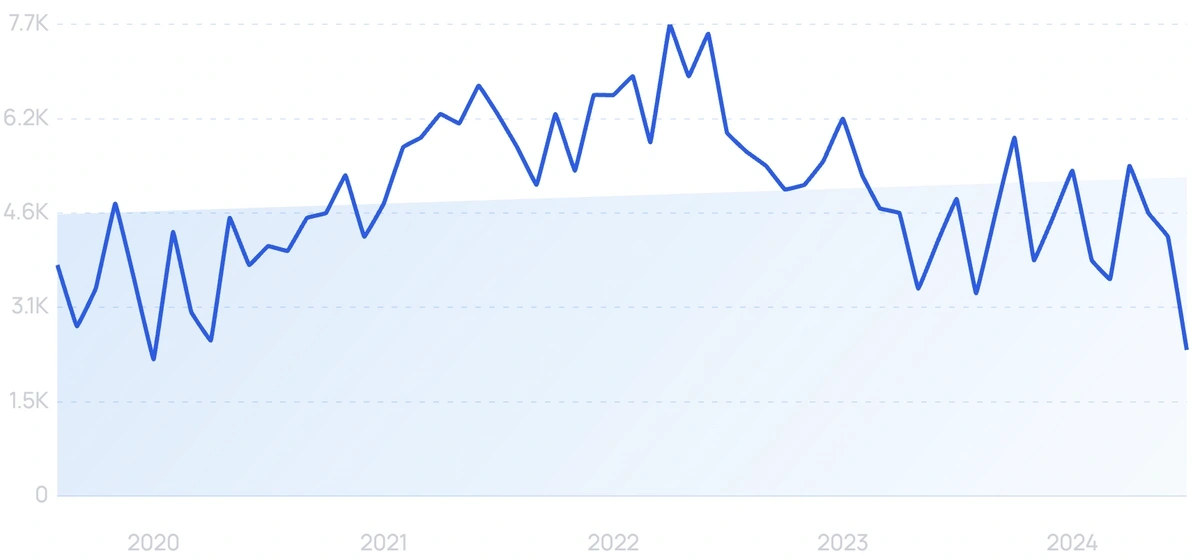

5-year search growth: 445%

Search growth status: Exploding

Year founded: 2016

Location: San Francisco, CA

Funding: $114.6M (Series C)

What they do: A file storage as a service company, LucidLink is known for their cloud-based network-attached storage (NAS) system. The startup provides a universal distributed file system, allowing users to store objects in the cloud and use it as local storage. Names like Baseline Ventures, BrightCap Ventures, and BainCapital have invested in this company.

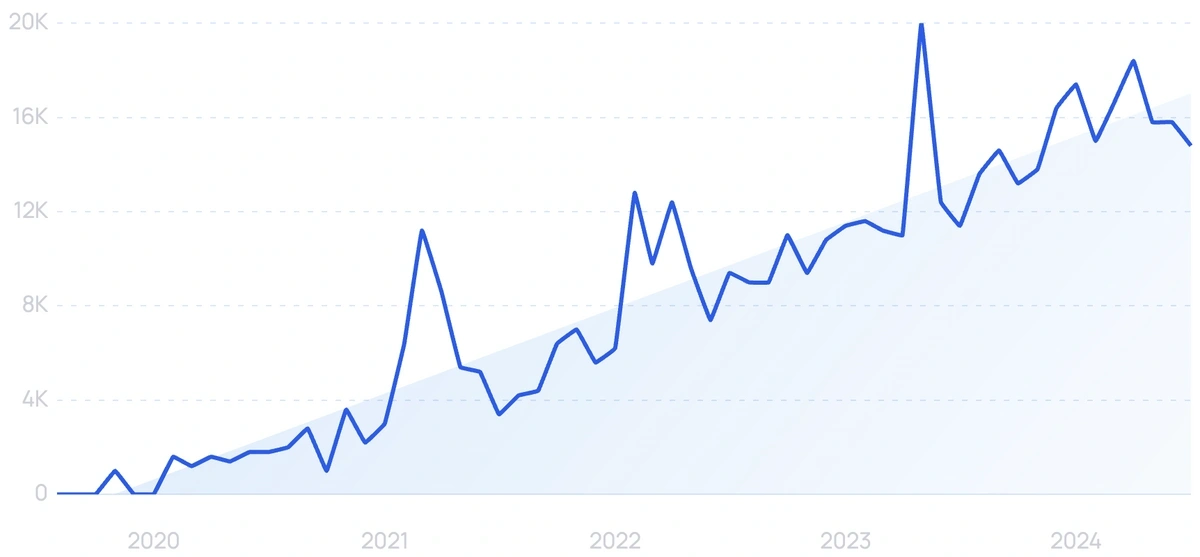

2. Internxt

5-year search growth: 3,800%

Search growth status: Regular

Year founded: 2020

Location: Valencia, Spain

Funding: $7M (Grant)

What they do: Internxt is a European startup founded in 2017 that offers secure cloud storage solutions, striving to make privacy and security the cornerstone of their business. Their platform, Internxt Drive, utilizes end-to-end encryption and decentralized storage to ensure the protection of user data. The company aims to make data privacy accessible to everyone and to provide a more sustainable alternative to traditional cloud storage providers.

3. MinIO

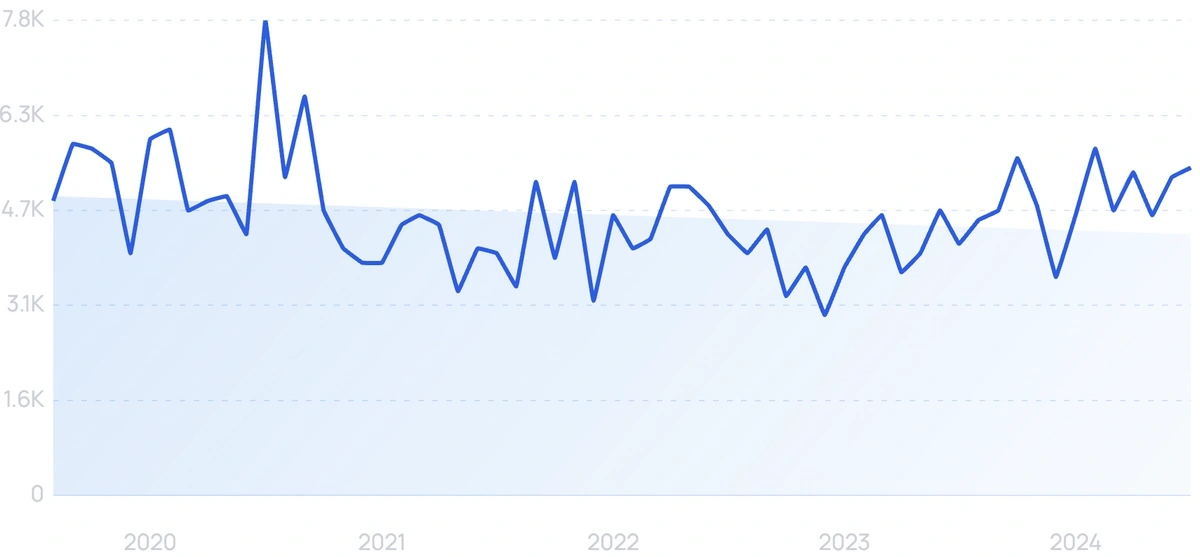

5-year search growth: 178%

Search growth status: Exploding

Year founded: 2014

Location: Redwood City, CA

Funding: $126.3M (Series B)

What they do: A cloud storage company, MinIO provides object storage solutions compatible with S3. This software-defined platform is open source under the GNU Affero General Public License version 3. The company states that MinIO is the only object storage tech that’s available in every public cloud. Organizations like Standard Chartered, ADP, and The Home Depot use MinIO.

4. OwnBackup

5-year search growth: 21%

Search growth status: Peaked

Year founded: 2012

Location: Englewood Cliffs, NJ

Funding: $507.3M (Series E)

What they do: A data recovery startup, OwnBackup provides cloud data protection for Salesforce customers (via generating daily backups of business-critical PaaS and SaaS data.) Furthermore, it offers tools designed to help with data recovery. OwnBackup currently has more than 3700 customers. They won the Salesforce Appy Award in 2018.

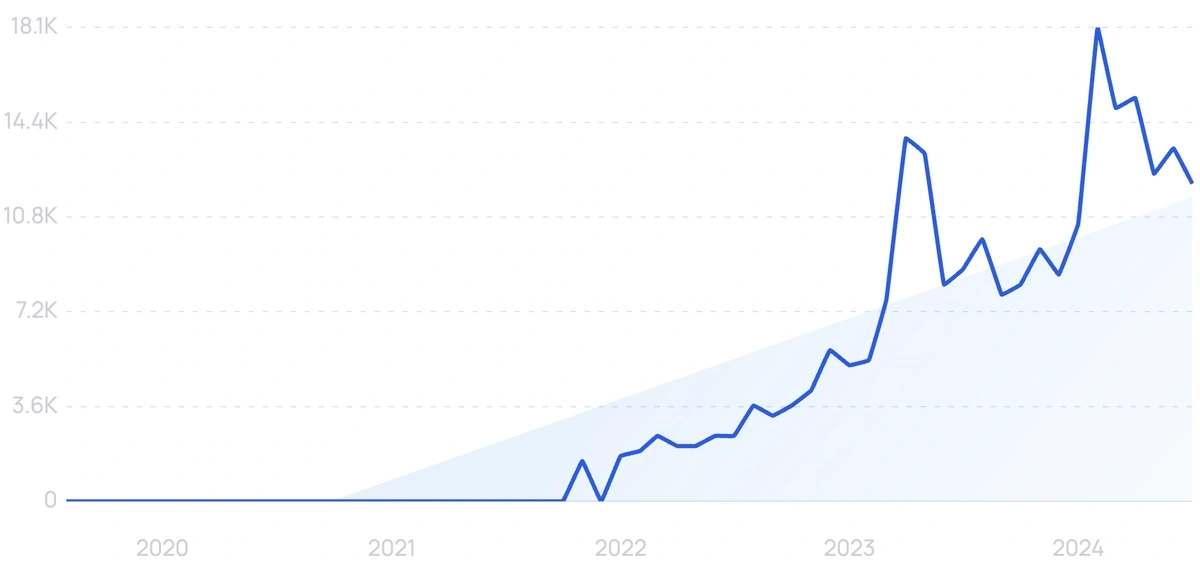

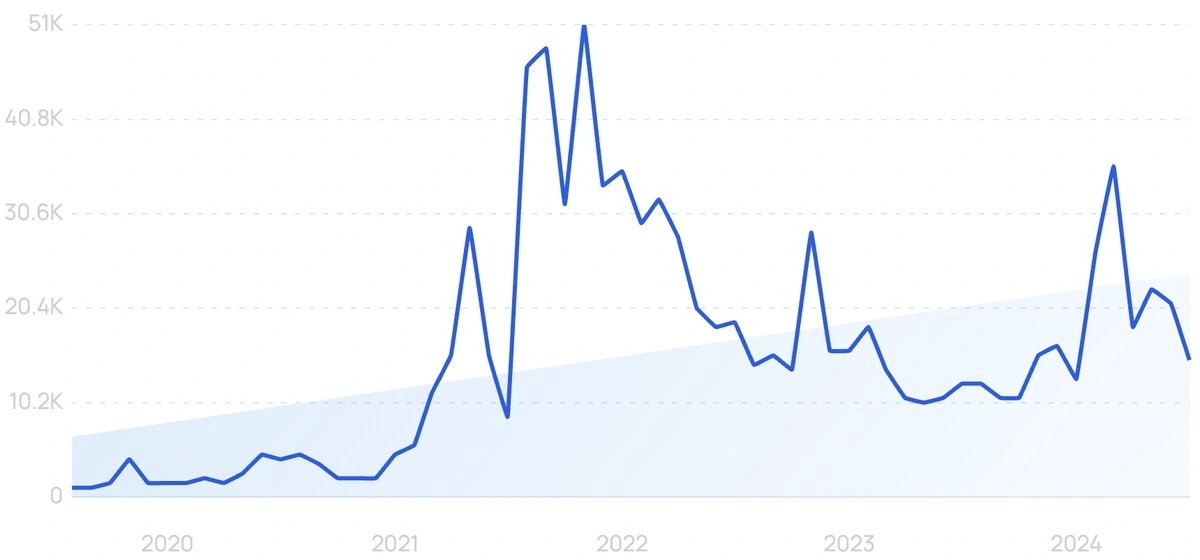

5. Upstash

5-year search growth: 7,000%

Search growth status: Regular

Year founded: 2021

Location: San Jose, California

Funding: $11.9M (Series A)

What they do: Upstash provides a serverless data platform for developers offering per-request pricing and Redis, QStash, Kafka, and Vector Database APIs. The company uses multi-tiered storage layers, meaning data is kept in memory and block storage (disk). In February 2024, the startup announced it reached $1 million ARR while raising $10 million in Series A funding.

6. ClickHouse

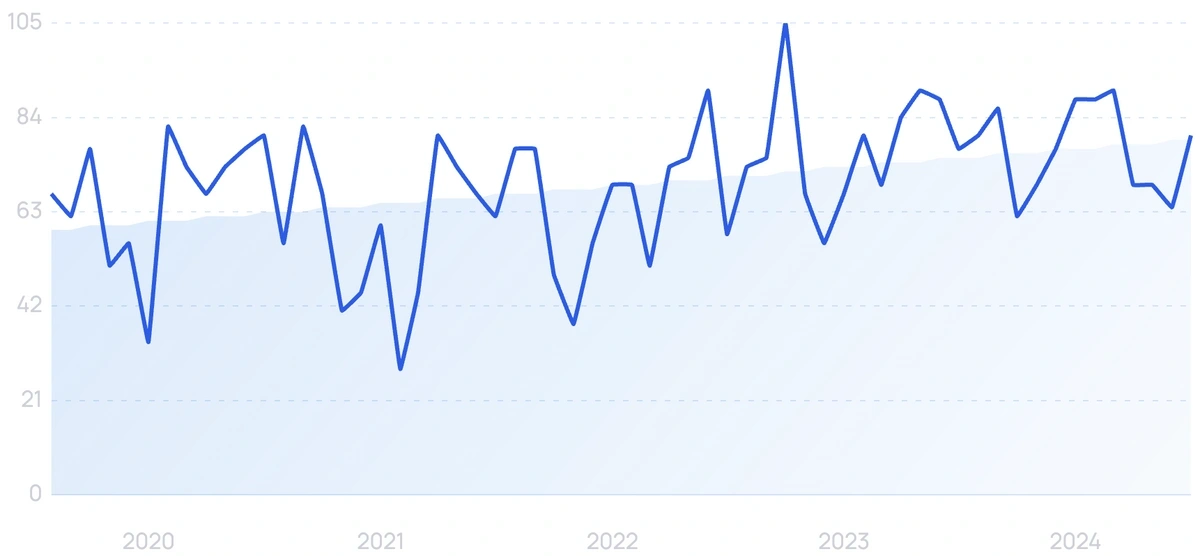

5-year search growth: 426%

Search growth status: Exploding

Year founded: 2021

Location: Portola Valley, California

Funding: $300M (Series B)

What they do: ClickHouse is an open-source database management system that assists users with online analytical processing. It allows users to create real-time analytical reports using SQL queries. Another notable feature is ClickHouse Cloud, a managed, serverless version, for users want to avoid managing servers on their own.

More than 100,000 customers are using ClickHouse today, including brands like Lyft, Vimeo, and Sony.

7. Qumulo

5-year search growth: 11%

Search growth status: Peaked

Year founded: 2012

Location: Seattle, WA

Funding: $347.3M (Series E)

What they do: Qumulo offers a file data platform for multi-cloud environments. It’s designed to replace legacy systems that handle large volumes of data. So far, more than 200 billion files have been managed on Qumulo. According to the startup, Qumulo was named a leader in the Gartner Magic Quadrant for Distributed File Systems & Object Storage for 3 years in a row.

8. InCountry

5-year search growth: 28%

Search growth status: Regular

Year founded: 2019

Location: San Francisco, CA

Funding: $40M (Series A)

What they do: A data residency-as-a-service company, InCountry provides data compliance for international businesses on a global level. The platform is designed to help multinational companies store international data locally. As of now, InCountry operates in 65 countries.

The startup raised $15 million in a Series A funding round led by Global Founders Capital and Arbor Ventures, with participation from Charles River Ventures, Caffeinated Capital, and Felicis Ventures.

9. JetStream Software

5-year search growth: 21%

Search growth status: Regular

Year founded: 2016

Location: San Jose, CA

Funding: $11.5M (Series A)

What they do: JetStream Software offers data management solutions for hybrid cloud computing. According to the startup, their hypervisor-integrated solutions can run on infrastructures with multiple cloud services and data centers.

Their products include the “JetStream DR” (for business continuity and disaster recovery) and the “JetStream Migrate” (for live migration). JetStream Software was one of the winners of the Big50-2020 Challenge held by Startup 50.

10. Onehub

5-year search growth: 43%

Search growth status: Exploding

Year founded: 2008

Location: Seattle, Washington

Funding: $3.6M (Debt Financing)

What they do: Onehub is a cloud-based digital collaboration tool and a virtual data room that gives businesses a secure place to store and share files. To ensure customer security, this startup uses the same 256-bit encryption and physical security policies as banks. According to Onehub, over 1 million businesses use their data storage today.

11. TeraBox

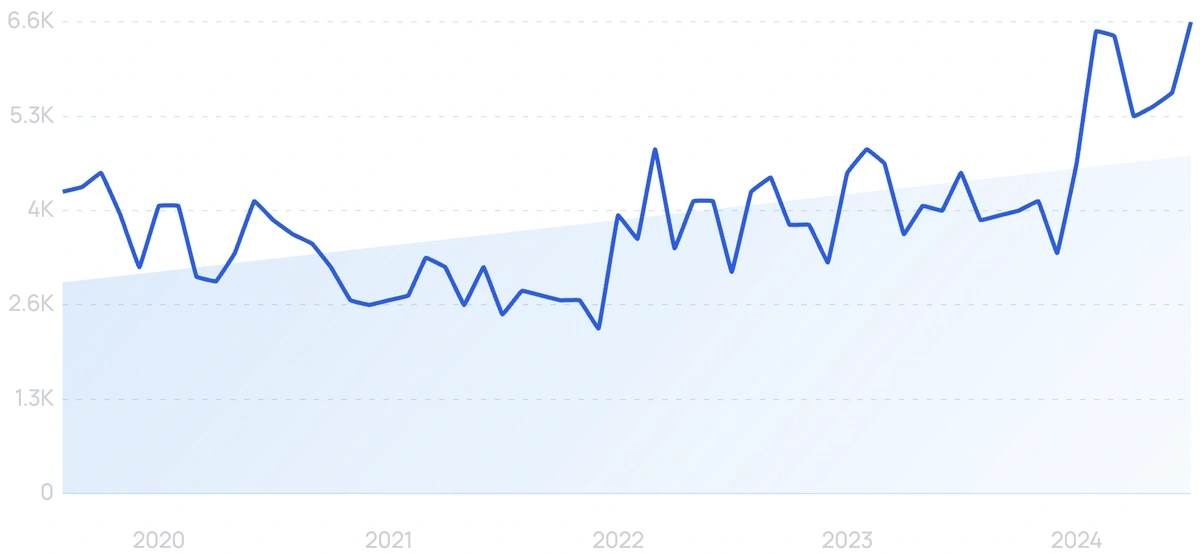

5-year search growth: 9,400%

Search growth status: Exploding

Year founded: 2020

Location: Tokyo, Japan

Funding: Undisclosed

What they do: TeraBox is a cloud storage startup offering users 1 TB of free storage. Users can upgrade to 2 TB of storage space for only $3.49/mo. The company recently announced they have over 250 million registered users, including 20 million daily active users.

12. CATALOG

Search growth status: Regular

Year founded: 2016

Location: Boston, MA

Funding: $54.3M (Series B)

What they do: CATALOG is a developer of DNA-based mass storage and computation solutions. Specializing in digital data archiving, their platform can be used to store information in DNA molecules. Estimates put CATALOG’s annual revenue at $5M.

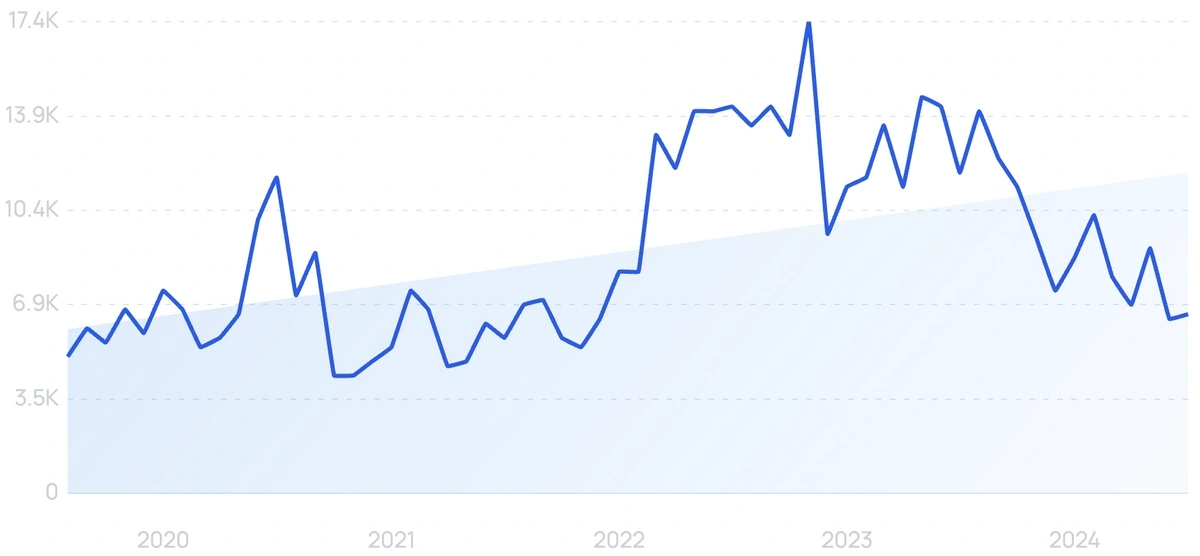

13. pCloud

5-year search growth: 36%

Search growth status: Regular

Year founded: 2013

Location: Baar, Switzerland

Funding: $3M (Series A)

What they do: A cloud storage service, pCloud provides a secure and simple way to manage digital assets online. The company pairs affordable cloud-based data storage with 4096-bit RSA and 256-bit AES encryption. In fact, pCloud was so confident in its security that it hosted a hacking challenge for a $100,000 prize. No one who competed was able to beat their client-side encryption. Today, pCloud serves over 19 million customers worldwide.

14. Nextcloud

5-year search growth: 52%

Search growth status: Regular

Year founded: 2016

Location: Stuttgart, Germany

Funding: $1.2M (Series A)

What they do: Nextcloud is an open-source, self-hosted data storage and communication platform. Users can store, access, and sync files, contacts, and calendars across different devices in one place. Nextcloud works similarly to well-known competitor Dropbox but adds an additional feature where individual users can decide how their data is stored and who can access it.

Today, there are over 400.000 Nextcloud servers online.

15. Nasuni

5-year search growth: 56%

Search growth status: Exploding

Year founded: 2009

Location: Boston, Massachusetts

Funding: $247M (Undisclosed)

What they do: Nasuni is a cloud storage startup used by enterprise organizations to replace traditional file servers and network-attached storage systems. Users can access unlimited scalability, multi-site file synchronization, automatic cost optimization, and much more. Today, the company services over 10,000 locations while managing more than 27 billion files.

16. Burlywood

Search growth status: Regular

Year founded: 2015

Location: Longmont, CO

Funding: $19.1M (Series Unknown)

What they do: An IT company, Burlywood develops storage solutions for cloud applications and hyper-scale data centers. They were the first to create a flash controller architecture software called the “FlashOS™.” Burlywood raised $10.6 million in a Series A funding round led by investors John Scarano and Michael Jones, with participation from Acadia Woods Partners.

17. Storj

5-year search growth: 86%

Search growth status: Peaked

Year founded: 2014

Location: Atlanta, GA

Funding: $35.4M (Initial Coin Offering)

What they do: A blockchain startup, Storj is a developer of decentralized cloud storage (DCS) solutions. Their object storage is designed for developers that prefer full control over their data. The platform also offers drop-in S3 compatibility. The Storj DCS currently has 13,000+ active nodes, with more than 39 billion objects stored on it.

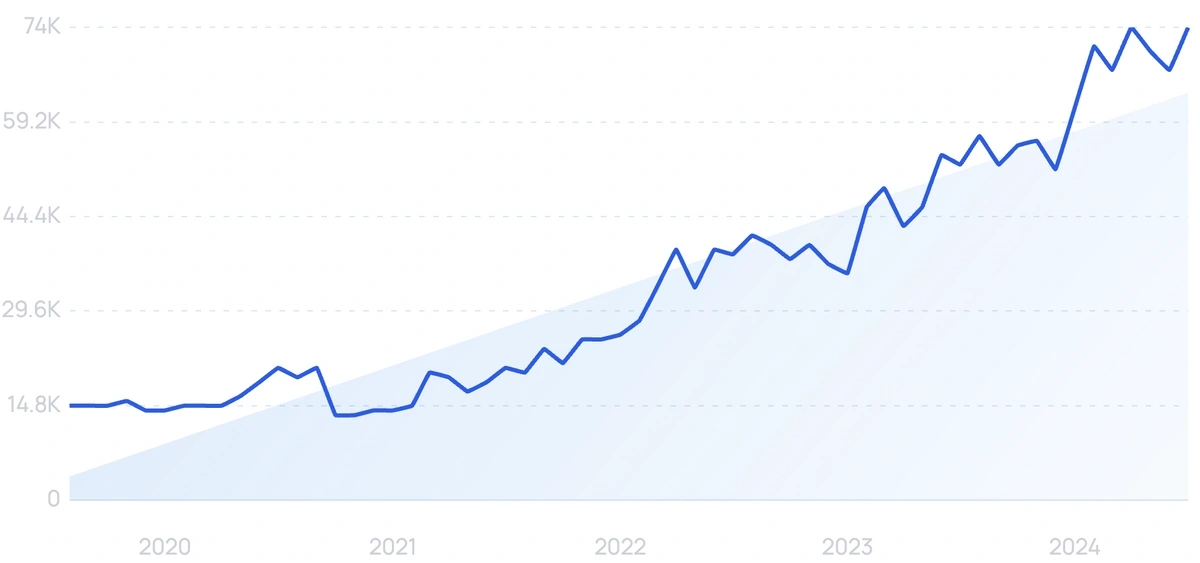

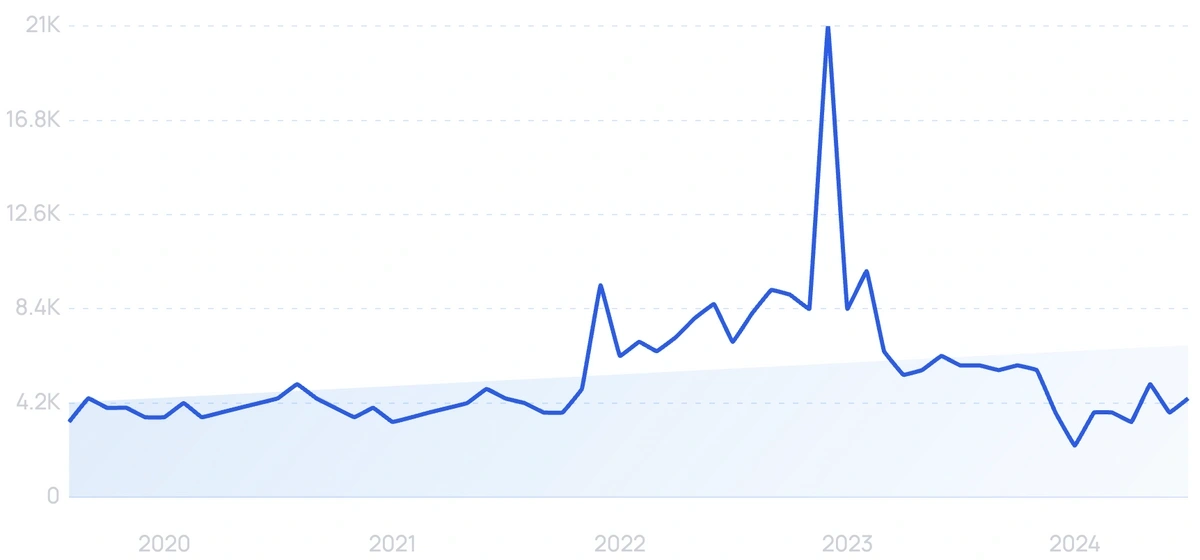

18. Databricks

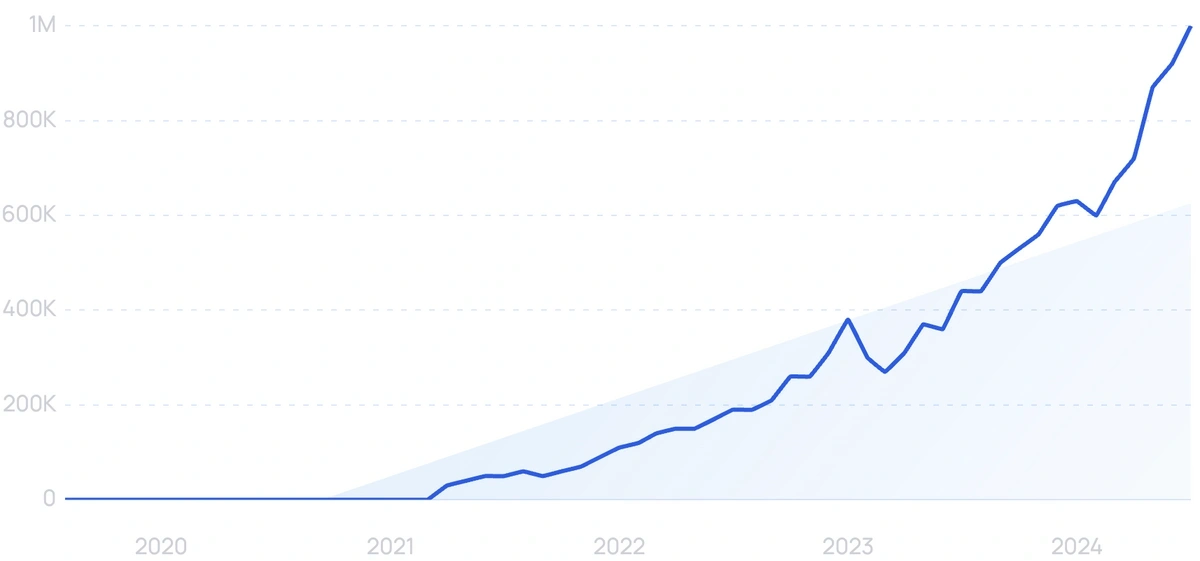

5-year search growth: 521%

Search growth status: Exploding

Year founded: 2013

Location: San Francisco, California

Funding: $4B (Series Unknown)

What they do: Databricks is a cloud-based data, analytics, and AI deployment platform built on top of Apache Spark. Key Databricks features include data and AI governance, data warehousing, the Data Intelligence Platform, and more. In September 2023, the startup raised $684.6M in Series I funding at a $43B valuation. The company also closed a deal to acquire MosaicML in 2023 to expand their generative AI capabilities.

19. Arweave

5-year search growth: 1,300%

Search growth status: Peakerd

Year founded: 2017

Location: Holborn, United Kingdom

Funding: $27M (Initial Coin Offering)

What they do: Arweave is a decentralized blockchain-based data storage network offering censorship-free permanent data storage. The Arweave protocol operates on a "blockweave" data structure instead of a traditional blockchain, which incentivizes miners to provide access to historical data. According to the Web3 platform's April 2024 update, they've reached 1.22 million total users.

20. Wasabi Technologies

Search growth status: Peaked

Year founded: 2015

Location: Boston, MA

Funding: $549.1M (Series D)

What they do: Wasabi Technologies offers “hot cloud object storage” for businesses. According to the company, their solutions are designed to offer complete protection against ransomware. Wasabi Technologies won the 2021 CRN Annual Report Card (ARC) Award in the “Cloud Storage” category.

Conclusion

That concludes our list of the hottest data storage startups to follow in 2024.

Breakthroughs in cloud computing, along with on-premise storage components, are paving the way for a brighter future for the data storage industry.

What’s more, the disruptions created in this market are creating new opportunities in other industries as well.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more