Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

18 Growing Delivery Companies & Startups (2024)

You may also like:

If you’re reading this right now, you’ve most likely used a delivery or on-demand delivery service within the past year. From ride-hailing behemoths like Uber to mainstream food delivery with Doordash, the trend of getting anything we want, anytime we want, has only accelerated over the past few years.

In 2023 alone, food delivery revenue exceeded $910 billion. Major players have expanded into everything from prescription delivery to shopping at convenience stores and dropping off household items like toothpaste or toilet paper. Fun Fact: 59% of the on-demand market is in Asia.

Check out our list of the hottest on-demand delivery startups that are pushing the frontier of delivery with drones, software, and last-mile delivery in some of the trickiest places to navigate on Earth.

1. Ziply

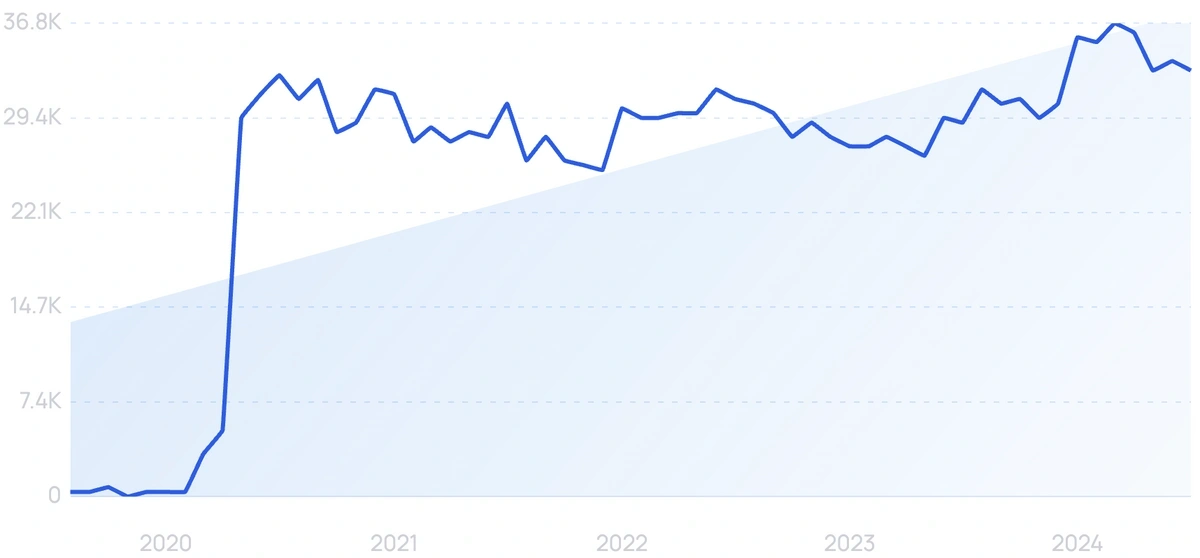

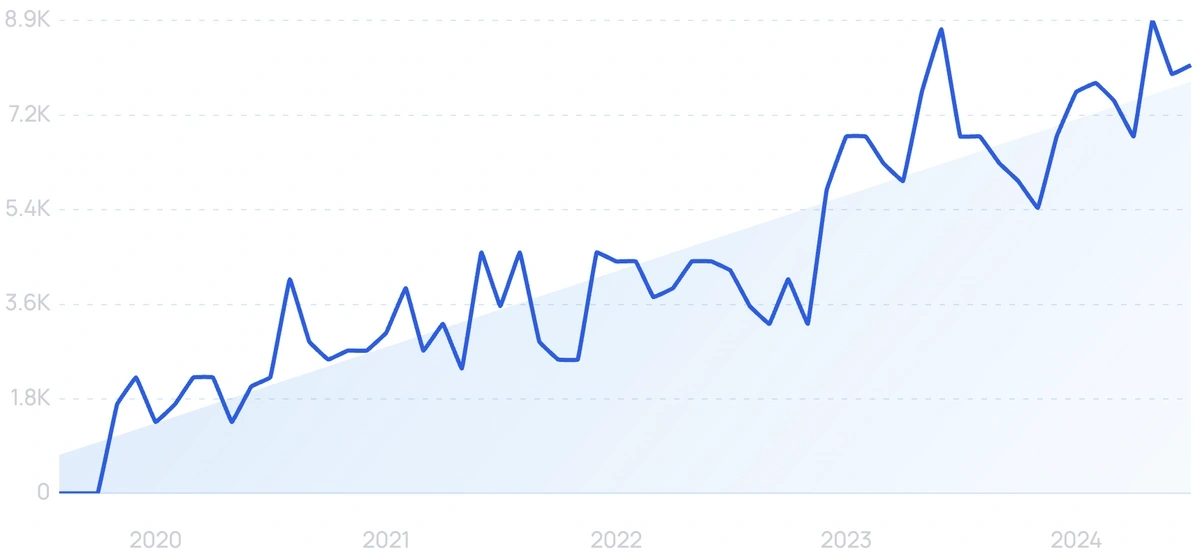

5-year search growth: 9,300%

Search growth status: Exploding

Year founded: 2014

Location: Beverly Hills, CA

Funding: Undisclosed

What they do: Ziply is a delivery startup that focuses on providing quick and affordable same-day delivery services for businesses. They offer a range of delivery options including on-demand and scheduled deliveries, with real-time tracking updates for customers.

Ziply's platform also provides businesses with analytics and data insights to optimize their delivery operations.

2. GoShare

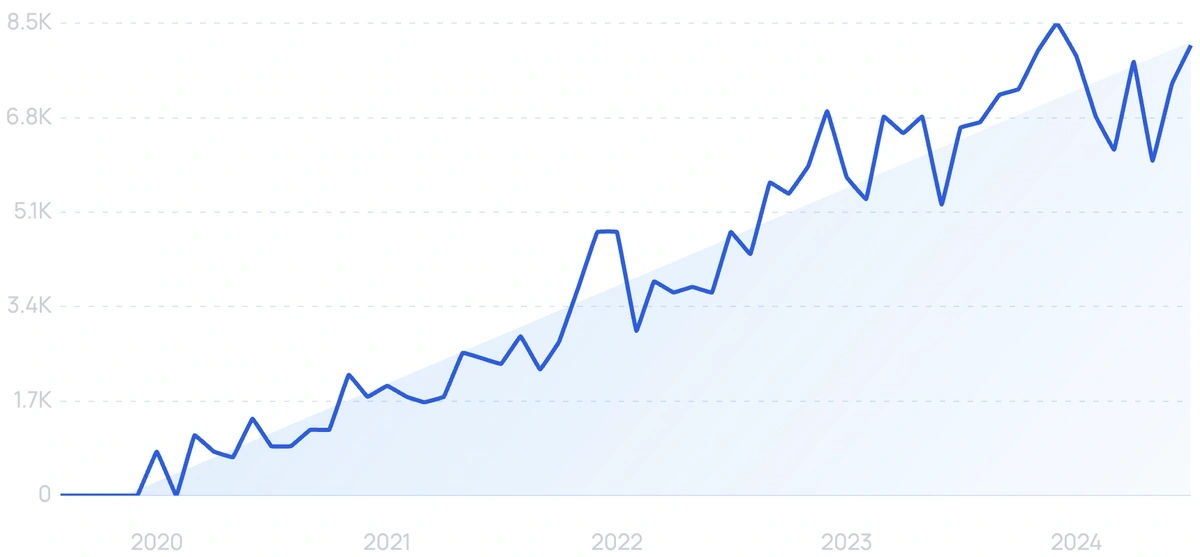

5-year search growth: 764%

Search growth status: Exploding

Year founded: 2014

Location: San Diego, California

Funding: $8M (Seed)

What they do: If you’ve ever wanted to pick up a piece of furniture or move a large object from one place to another, you’ve probably wished you could have a truck on demand for the time you need it, and then an easy return process.

Enter GoShare. GoShare is trusted by leading vendors like Costco, HomeGoods, Pepsi, and more for last-mile delivery. Individual users can download the GoShare app and have delivery professionals on demand in less than an hour. Their platform has over 25,000 independent delivery professionals serving 100,000+ customers in 50+ cities in the U.S.

3. Snappy Shopper

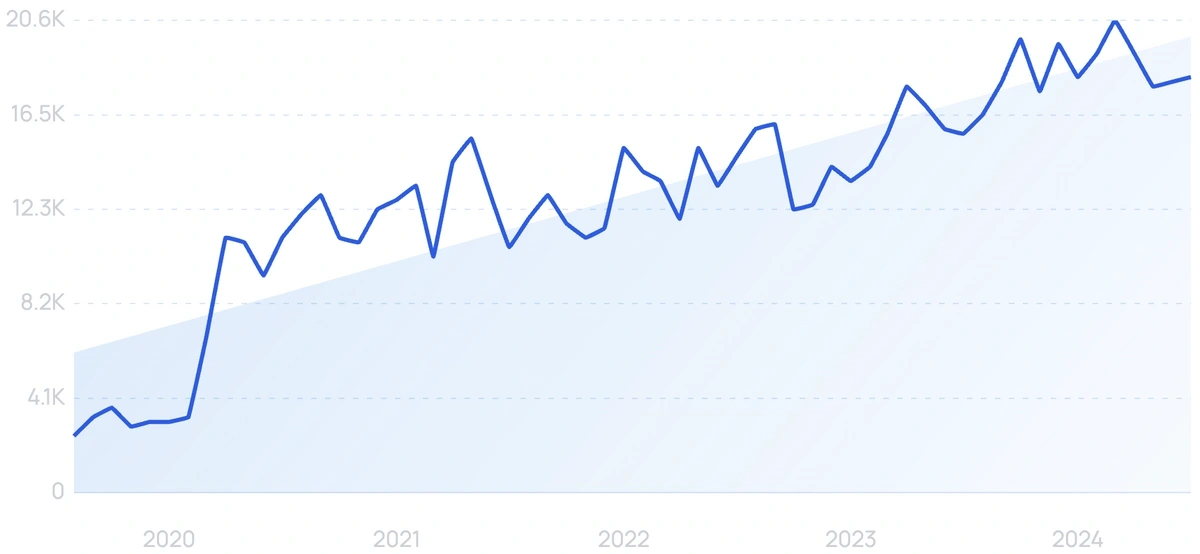

5-year search growth: 4,600%

Search growth status: Exploding

Year founded: 2017

Location: Dundee, United Kingdom

Funding: $23.6M (Series Unknown)

What they do: Snappy Shopper is a UK-based grocery delivery platform that partners with independent retailers to offer on-demand delivery to customers. The app connects shoppers with their local store, allowing them to browse and purchase products for delivery or collection.

The company also offers white-label solutions for retailers to create their own branded grocery delivery service.

4. Mylerz

5-year search growth: 8,300%

Search growth status: Exploding

Year founded: 2019

Location: Cairo, Egypt

Funding: $9.6M (Seed)

What they do: Mylerz is a fully integrated logistics platform that provides e-commerce delivery and fulfillment services. The company is environmentally friendly, only using compressed natural gas-powered vehicles and biodegradable shipping bags. The startup currently operates a fleet of 350+ vehicles and 21 fulfillment centers.

5. Lalamove

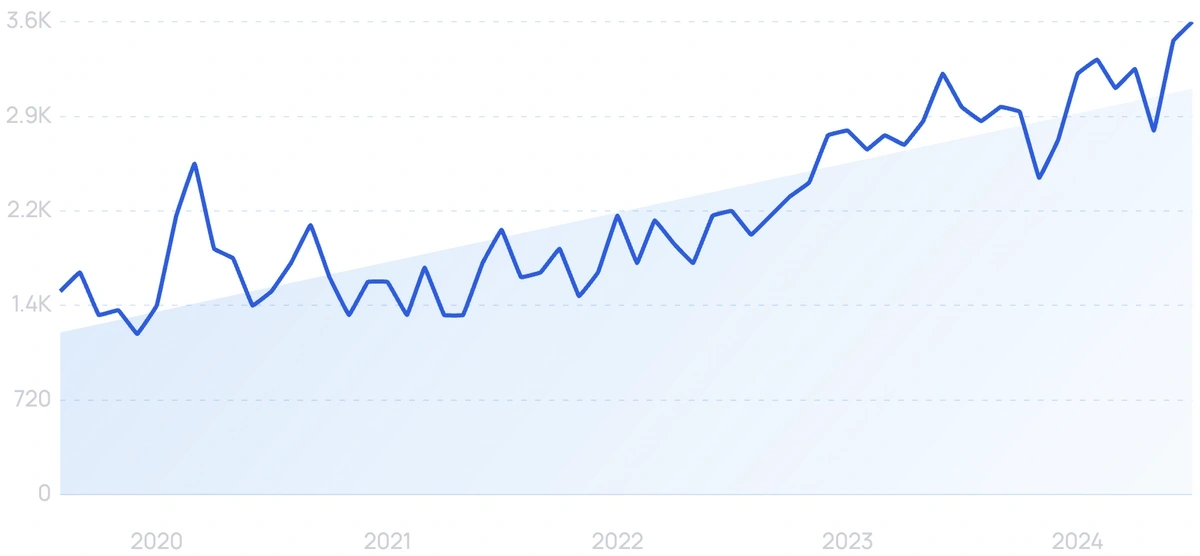

5-year search growth: 191%

Search growth status: Exploding

Year founded: 2013

Location: Hong Kong

Funding: $2.5B (Series F)

What they do: Lalamove is an on-demand delivery and logistics platform that specializes in same-day delivery services. Currently, the company mostly operates out of Asia in 11 markets. As of April 2024, they have more than 13.4 million users and 1.2 million driver partners on the platform.

6. Fantuan

5-year search growth: 633%

Search growth status: Regular

Year founded: 2014

Location: Burnaby, Canada

Funding: $90M (Series C)

What they do: Fantuan is a food and grocery delivery platform that currently operates in major cities in the United States, Canada, Australia, and the United Kingdom. The company's focus is on delivering high-quality Asian dishes to consumers in Western countries. Today, the app is used by more than 3.6 million users in four countries.

7. Zoomo

5-year search growth: 683%

Search growth status: Exploding

Year founded: 2017

Location: Sydney, Australia

Funding: $135.6M (Series B)

What they do: Zoomo is a technology startup that manufactures e-bikes for gig economy workers and delivery businesses. Other available rental options for businesses include e-mopeds and cargo e-bikes. Beyond their e-bikes, Zoomo also offers fleet management for vehicle maintenance, financing, GPS tracking, and more.

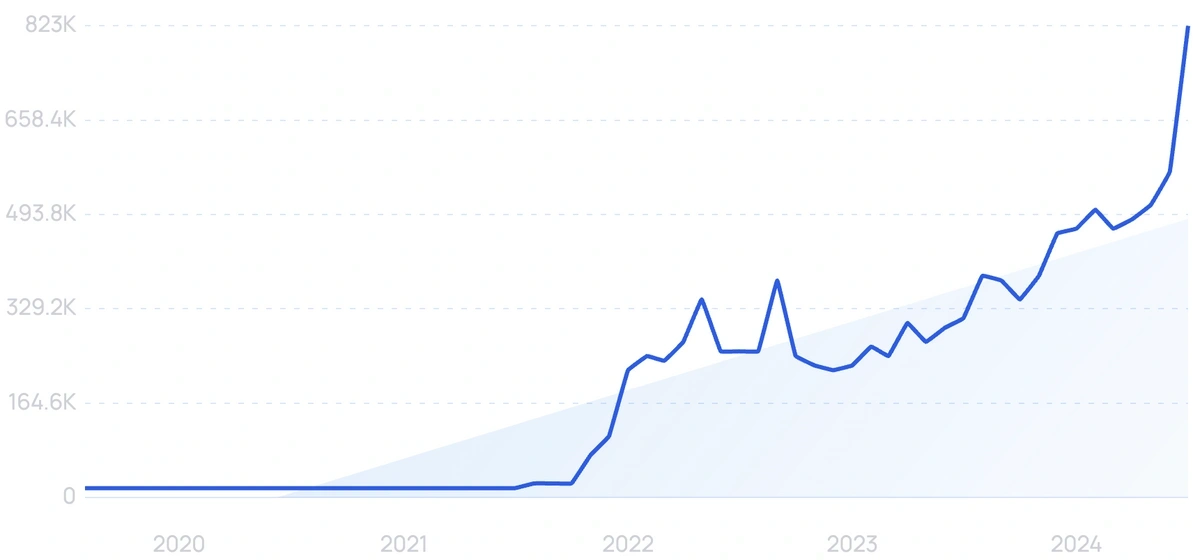

8. Zepto

5-year search growth: 4,900%

Search growth status: Exploding

Year founded: 2021

Location: Parel, India

Funding: $1.3B (Series F)

What they do: Zepto is an e-grocery delivery platform based in India that promises to make deliveries in 10 minutes or less. The startup operates a network of over 340 dark stores, where it stores inventory to help with rapid order fulfillment. In June 2024, Zepto raised $665 million in Series F funding at a valuation of $3.6 billion.

9. Snoonu

5-year search growth: 9,300%

Search growth status: Exploding

Year founded: 2019

Location: Doha, Qatar

Funding: $17M (Series B)

What they do: Based in Qatar, Snoonu is a food delivery and personal concierge company that offers customers quick service within 30 minutes. The company's services include food delivery, grocery delivery, pharmacy delivery, and more. With millions of users, the super app has generated more than 1 million downloads on the Google Play Store alone.

10. Darkstore

5-year search growth: 119%

Search growth status: Exploding

Year founded: 2017

Location: San Francisco, California

Funding: $81.6M (Undisclosed)

What they do: Dark stores are small fulfillment centers or branches that exist only as local delivery points to drastically speed up the time customers receive their orders.

Darkstore has the grand idea of making all of the world’s products available to anyone no matter where they are in the world. Speed is their core value, with logistics guru Lee Hnetika (former startup WunWun acquired by Alfred) having narrowed down on 1 hour delivery as a key advantage.

11. Shadowfax

5-year search growth: 239%

Search growth status: Regular

Year founded: 2015

Location: Bangalore, India

Funding: $212.8M (Debt Financing)

What they do: Shadowfax provides end-to-end delivery solutions, including e-commerce logistics, hyper-local delivery, and on-demand delivery. According to the startup's website, they've delivered more than 1 billion parcels while serving over 1 million customers.

12. NimbleRX

5-year search growth: 5,000%

Search growth status: Exploding

Year founded: 2015

Location: Redwood City, California

Funding: $74.9M (Series Unknown)

What they do: Nimble is one of America’s largest and fastest-growing on-demand prescription startups. The process for users is pretty simple: You sign up, enter your insurance, order your prescription, and have it delivered to your house. Pharmacies like it because it boosts customer retention, and patients because it simplifies an often tedious and annoying routine.

By the end of summer 2021, Nimble had achieved 85% coverage of the U.S. As of today, the startup has surpassed $3.7 billion in gross merchandise value.

13. Ninja Van

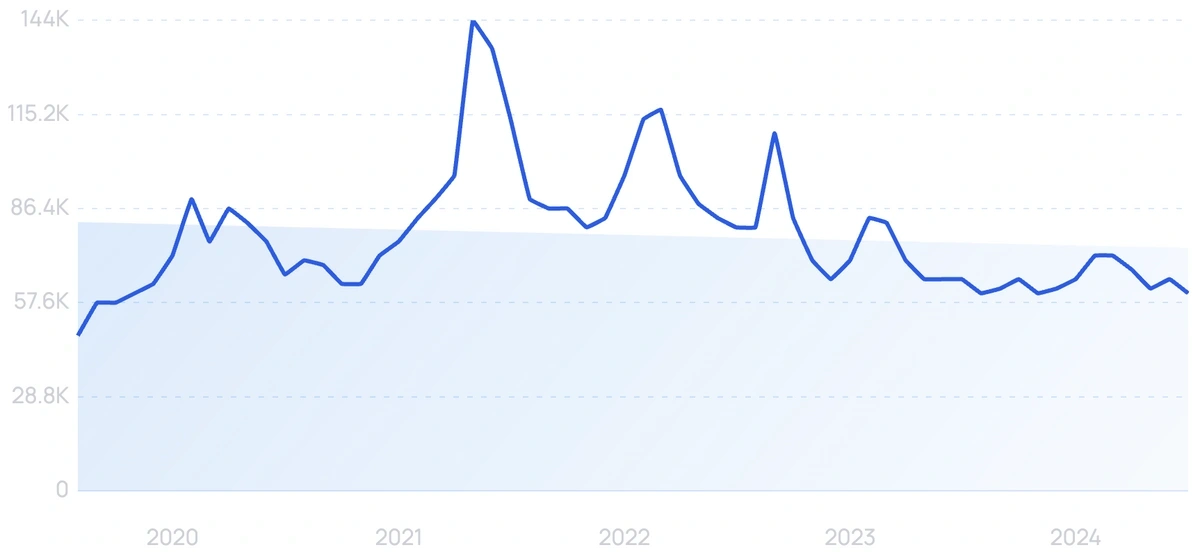

Search growth status: Peaked

Year founded: 2014

Location: Singapore, Singapore

Funding: $974.5M (Series E)

What they do: Last-mile delivery is a huge challenge in Asia, where congested roads and millions of people mean that simply dropping off a package can be the hardest part of the journey. Ninja Van, and their proprietary software and logistics network, serve over 117,000,000 Southeast Asians and deliver over 2M packages each day.

Over 600,000 sellers in Asia utilize Ninja to successfully deliver packages via air or road.

14. Wolt

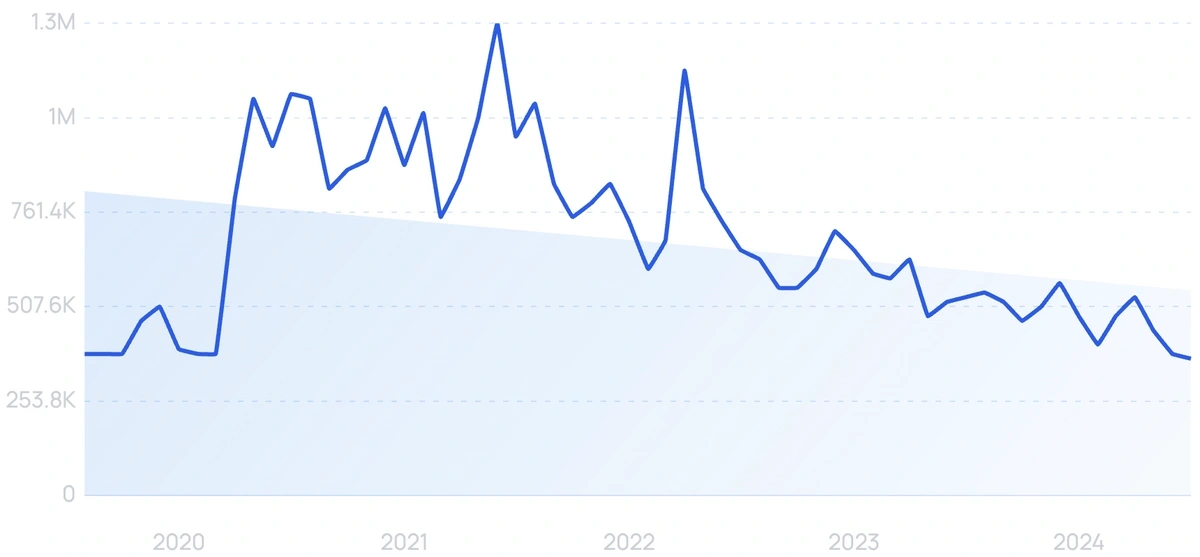

5-year search growth: 304%

Search growth status: Exploding

Year founded: 2014

Location: Helsinki, Finland

Funding: $822.5M (Series E)

What they do: Wolt is a technology company that operates a food delivery platform across more than 20 countries. Users can order food from thousands of restaurants and have it delivered directly to their doorstep.

Wolt offers a seamless user experience, with features such as real-time tracking, live chat support, and personalized recommendations.

15. Kitopi

5-year search growth: 59%

Search growth status: Regular

Year founded: 2018

Location: Dubai, United Arab Emirates

Funding: $804M (Series C)

What they do: Kitopi is a managed cloud kitchen platform that helps restaurants make and deliver food. The company procures the ingredients, prepares the meals, packages them, and delivers them while the brand owner manages and markets the restaurant. In 2023, Kitopi reached $125.6M in revenue and works with over 200 kitchens in UAE, KSA, Kuwait, Bahrain, and Qatar.

16. Printful

5-year search growth: 68%

Search growth status: Regular

Year founded: 2013

Location: Charlotte, NC

Funding: $130M (Private Equity)

What they do: Printful is a print-on-demand dropshipping service that enables individuals and businesses to design, sell, and distribute custom apparel, accessories, and home decor products online. With Printful, users can upload their own designs or use the platform's design tools to create products for their online store, without worrying about inventory or fulfillment.

Printful's integration with major ecommerce platforms and marketplaces makes it easy for anyone to start selling their custom products online.

17. Rinse

5-year search growth: 133%

Search growth status: Exploding

Year founded: 2013

Location: San Francisco, California

Funding: $23.5M (Seed)

What they do: Doing laundry is one of the most tedious weekly tasks that we face, unless you’re in a household with an in-unit washer and dryer. Rinse solves this with their on-demand laundry delivery service coordinated through their app. Subscribers can get monthly laundry service for a flat fee of $60/month, or a variety of customized solutions including dry cleaning.

Rinse claims to save users 3 hours per load of laundry, with over 250 years of customer time saved already. Their workforce is entirely composed of W2 employees instead of relying on freelancers like many other on-demand platforms.

18. Nuro

5-year search growth: 28%

Search growth status: Peaked

Year founded: 2016

Location: Mountain View, California

Funding: $2.1B (Series D)

What they do: Nuro’s ubiquitous self-driving delivery vehicles deliver everything from a Domino’s Pizza to medicine from CVS and even a burrito bowl from Chipotle. The vessel itself is a zero-emission, electric propulsion car with maximum protection for pedestrians like emergency braking and a rounded front end.

Nuro was the first company to have a commercial deployment permit from California, one of the most difficult places to receive a self-driving license fit for public roads.

Conclusion

As software continues to “eat the world” and consumers demand more and more convenience, expect the growing on-demand market to innovate through drones, autonomous vehicles, and other innovative methods of reducing the time it takes to get the things we need.

Delivery startups are unique in their near-universal equality since the barriers to entry are fairly low, and demand is high worldwide. Watch for several trends like self-driving vehicles, Web 3.0, and more powerful software to further impact this competitive space.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more