Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 6 Packaging Trends for 2025

You may also like:

Today, packaging is second only to energy consumption in its role in shaping the current and future state of the earth.

Emerging research reveals that 34% of man-made GHG emissions are generated by the food sector, with packaging alone accounting for over 60 million tons of CO2 emissions every year.

In response to rising pressure, governments the world over are passing laws and drafting guidelines to help reduce the environmental impact of man-made materials.

And many have a strong focus on curtailing the use of ecologically harmful materials like single-use plastics (SUPs).

In short, the process of packaging is undergoing a radical transformation.

Below, you’ll see the top 6 packaging trends that are reshaping commerce around the world.

1. The Industry is Focused on Recycling Plastics

From the 1950s to 2015, world plastic production grew more than 200x.

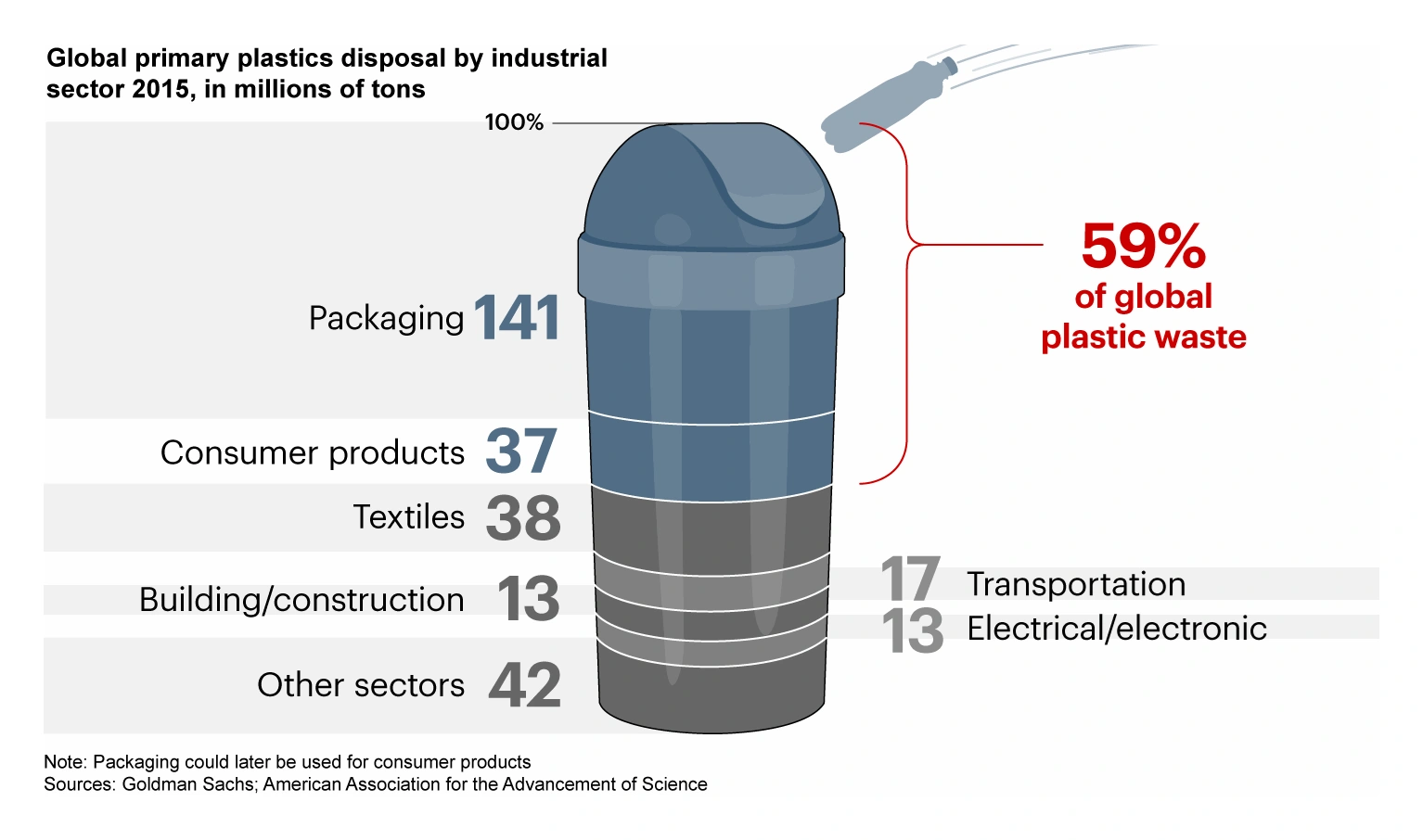

This means that annual volume jumped from 1.5 million tons to over 7.8 billion tons — that’s almost 1 ton per human being alive on the planet today, with 59% of this total coming from consumer products and packaging.

The components of global waste.

Single-use plastics account for over 130 million tons of the total quantity of plastic globally produced, putting out over 225 million tons of greenhouse gases (GHGs) during extraction and refining.

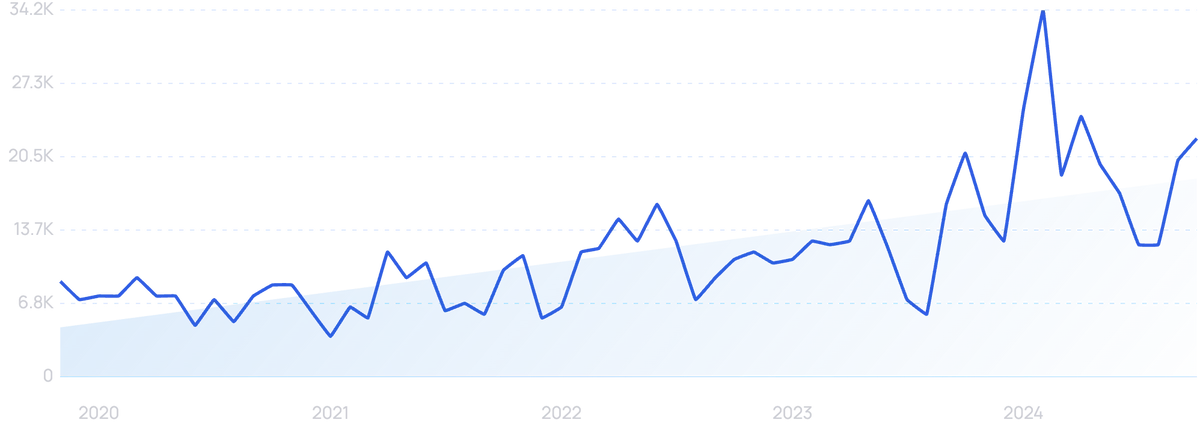

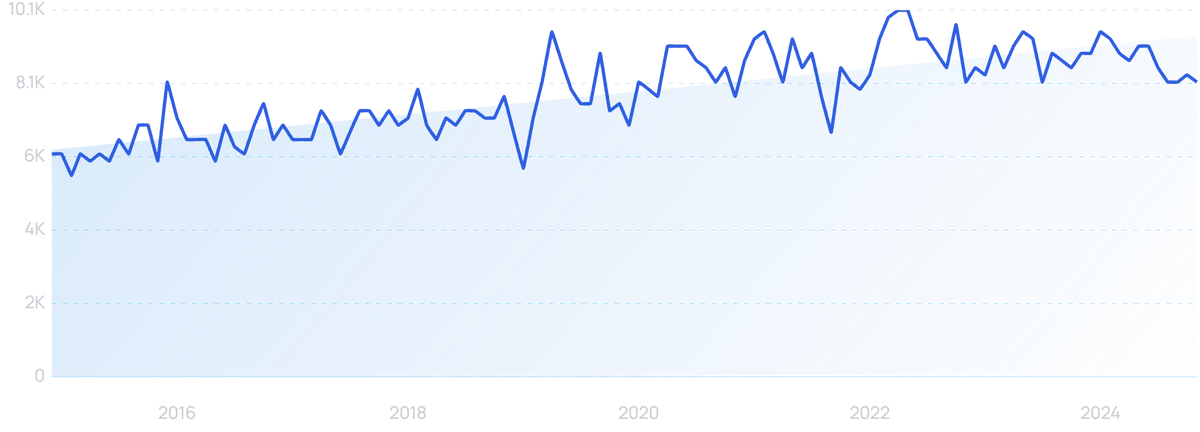

Searches for "single-use plastics" are up over 5 years.

Plastic recycling represents one of the major thrust areas in the global effort to curtail the detrimental effects of plastic packaging.

Currently, less than 9% of the world’s plastic waste is recycled.

But this is changing quickly.

The European Commission recently adopted a strategy for plastics that aims at significantly improved capacity for plastic recycling, with a target of 55% of the EU’s total plastic waste recycled by 2025.

Global consultant Deloitte estimates that an investment of between €4.1 and €6.5 billion was required to meet this target.

Graphic of which countries are currently banning or considering a ban on plastic bags.

The total global market size for recycled plastic was estimated at $53.69 billion in 2024.

The market is expected to grow at a CAGR of 9.01%, hitting $127.25 billion by 2034.

The push for plastics packaging recycling is backed by some of the biggest names in the industry: for instance, the ‘Ultra-Pure Polypropylene’ (UPRP) being commercialized by the US firm PureCycle is an innovation from the research labs of FMCG giant P&G.

PureCycle targeted a production capacity of 450,000 tons of UPRP in its two flagship plants by 2025.

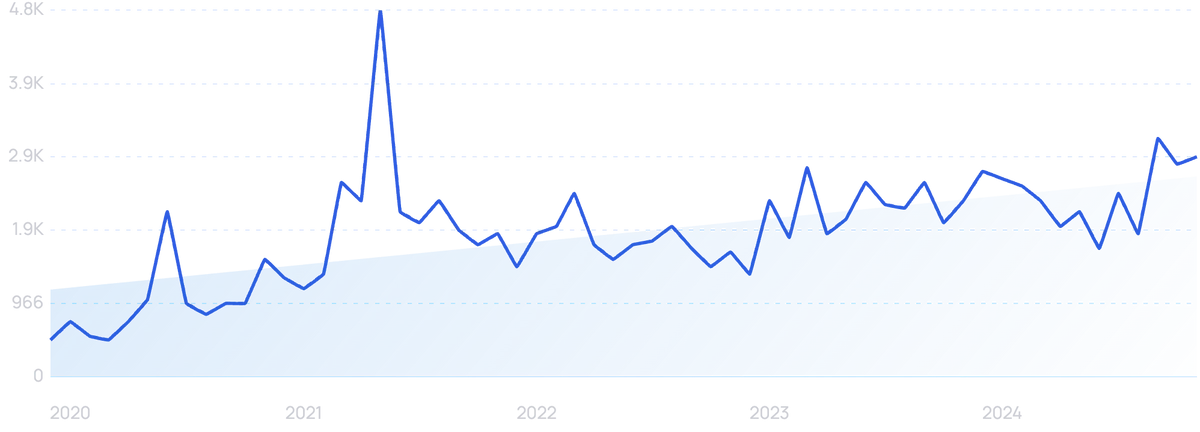

Search interest in "PureCycle" has risen over the last 5 years.

Other major-league players in the plastics packaging recycling business include Coca-Cola, Exxon Mobil, and the materials science engineering company Dow.

Spearheading the movement in plastics recycling are ‘advanced recycling’ technologies such as gasification, pyrolysis, and depolymerization.

Innovations that have met industry standards in several sectors include TACOIL created by Plastic Energy and the circular polymers developed by SABIC as part of its TRUCIRCLE portfolio.

Both processes use plastic waste to create liquid feedstock for the production of high-quality, recycled plastic.

An obvious requirement of the plastics recycling movement is the widespread adoption of “recyclates”, or plastic recycling end-products.

The European Union, with its goal of ensuring 100% recyclable plastic by 2030, is leading the world’s governing bodies in a drive to accept and adopt recyclates.

To meet its halfway target of 55% recycling by 2025, the EU needs to create an end market for 12 million tons of plastic recyclates by 2025.

The global market for recycled polyethylene terephthalate, or rPET, is projected to grow at a CAGR of 6.7%, to reach $14.4 billion by 2028, with 67% of manufacturers expected to make the switch.

rPet is basically just polyethylene that is made from already-existing PET, such as plastic bottles.

The shift from virgin PET to rPET will reduce energy consumption by an estimated 79%.

Most large FMCGs have already begun trialing recycled plastic packaging in a wide array of products.

Working with Ioniqa – a recycling technology firm – and Indorama Ventures – a packaging supplier – soft-drink giant Coca-Cola in 2019 developed a bottle made with 25% plastic recovered from the ocean.

The bottled water brand Danone also partnered with Loop Industries to create a new Evian bottle made with 100% recycled plastic launched in 2022.

And earlier this year, industry titan Unilever filed a patent for a premium, beauty packaging product made from PCR (post-consumer resin).

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

2. Paper & Glass Packaging Make a Comeback

A 2020 survey by BCG that polled over 3,000 consumers in 8 countries revealed that 87% of respondents believed that more environmentally-friendly products and services would play an essential role in shaping a better, post-pandemic world.

These results mirror a global trend in which consumers, especially Gen Z and millennials, voice a strong preference for more eco-friendly products.

Another survey by McKinsey consultants found that consumers across 9 countries including the US, UK, Germany, France, Japan, China, India, Brazil, and Indonesia expressed a desire to see increased use of paper and glass packaging.

Respondents preferred paper and board-based packaging alternatives for fresh produce, and glass for beverages and household products.

Projections for the pulp and paper market set a CAGR of 3.5%, to reach a targeted $679.7 billion by 2027.

Of this, a large portion of the packaging demand is expected to arise from the exponential growth in the online retail sector.

In particular, the demand for corrugated packing boxes that form the backbone of e-commerce packaging is estimated to grow at a CAGR of 4.3% through 2030.

Brands adopting paper-based packaging include H&M, P&G labels such as Secret and Old Spice, fast-food titan McDonald’s, and tech pioneer Apple.

H&M’s new paper-based recyclable packaging.

In the McKinsey survey of August 2020, a majority of respondents stated that they perceived glass to be the safest packaging material, outranking plastic, paper, aluminum, and other metals.

Searches for "sustainable packaging materials" rose by 335% over the last 5 years.

It’s little wonder that the global market for glass packaging materials is pegged at a CAGR of 4.4%, and is expected to hit $73.3 billion by 2026.

In spite of the fact that glass produces over 4 times the GHGs of the average PET bottle, the superior health and safety advantages of glass make it the preferred choice among international consumers.

Market research experts Frost and Sullivan project that increasing premiumization of cosmetics and skin-care products will see glass largely supplant plastic packaging in this segment.

3. Bioplastics are a Promising New Packaging Innovation

In 2018, developed nations received a blow when China’s ‘National Sword’ policy banning the import of plastic waste effectively blocked over 50% of their total plastic waste from being exported for processing.

The US alone had previously accounted for nearly 15 billion tons of plastic waste exports to China in a 5-year period. Many of these countries are likely to run out of landfill capacity in less than two decades.

This crisis is accelerating the hunt for sustainable alternatives to plastics.

One of the most promising options at present is bioplastics, which are plastic alternatives made from renewable and/or biodegradable materials.

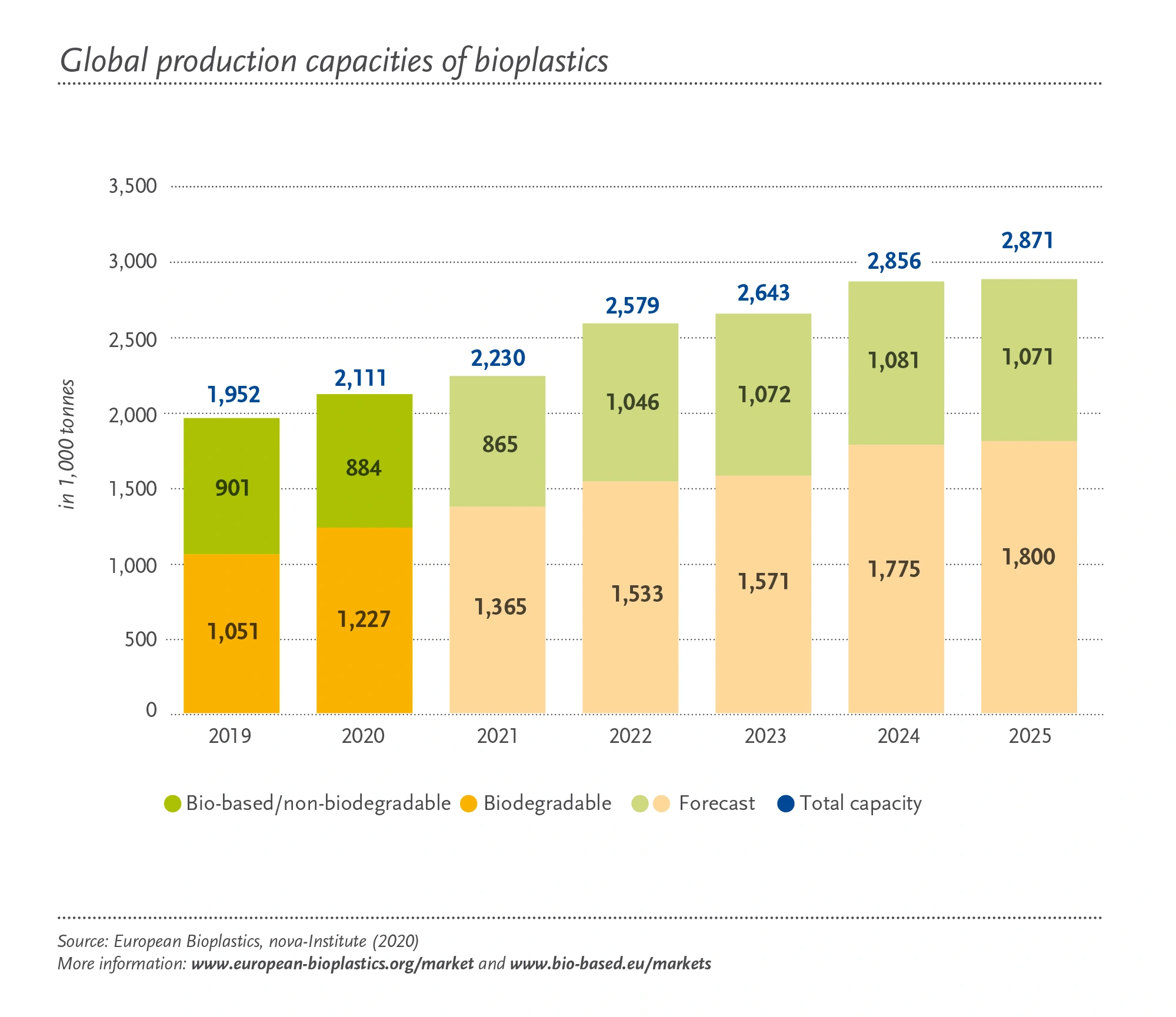

Bioplastics account for only 1% of world plastic consumption. However, rapid growth in production and adoption has led forecasters to value the bioplastics market at around $88 billion in 2033.

The predicted growth of the bioplastics market.

As early as 2009, industry majors began incorporating bio-PET in their packaging, with companies like Coca-Cola leading the way by sharing its PlantBottle technology with other brands like Kraft Heinz.

And this is no surprise, considering 30% of the plastic used in PlantBottle is derived from sugarcane-based ethanol.

A critical drawback is the non-biodegradable nature of rigid bioplastics like bio-PET, despite their use of renewable raw materials (like sugarcane or corn starch).

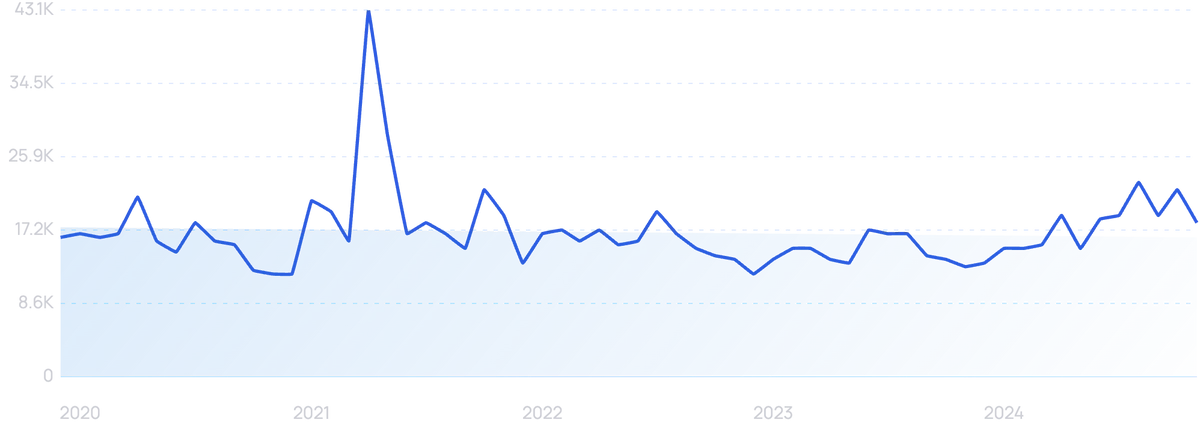

Search interest in "bio pet" over the last 10 years.

Recent innovations like Terratek by GreenDot Plastics and Evanesto by Carbiolice are likely to be game-changers in the bioplastics industry.

Unlike other bio-based but non-biodegradable bioplastics (which many experts predict will only exacerbate the plastic problem), these innovative products are actually biodegradable.

Terratek is a biocomposite made from jute, hemp, bamboo, sisal and flax, while Evanesto is an enzymatic additive that enables rigid bioplastic made from PLA to decompose within 255 days.

Compostable packaging potentially represents one of the ‘greenest’ alternatives to traditional SUP packaging.

This is especially the case since compostable bioplastics are designed to degrade under suitable composting conditions (typically including high temperatures and humidity).

Despite criticisms that current-day recycling streams are ill-equipped to process compostable packaging, this segment is receiving a great deal of industry attention and funding.

In October 2020, spirits manufacturer Bacardi announced its first compostable bottle.

The product is made from a PHA biopolymer which can degrade in a range of environments, including compost, regular soil, freshwater, and seawater.

The PaBoCo, or Paper Bottle Community, is another bioplastics innovation that could spell a more sustainable future for the planet.

PaBoCo boasts multiple early adopters having a worldwide reach and large market volumes.

The ‘paper bottles’ made by PaBoCo using different bio-fibers with a thin, inner bioplastic coating will soon be seen in a range of products, from Carlsberg beer to L’Oréal cosmetics.

The Composting Consortium, launched in November 2021, brings together research advisors, industry players, sustainability investors, and market stakeholders with the aim of developing unified standards to guide the growth of the nascent compostable packaging industry.

Big guns already on board include food services giants (Kraft Heinz, Mars, McDonald’s, PepsiCo, Starbucks), retail leaders like Target, and top FMCG brands like Colgate-Palmolive.

Industry experts estimate the compostable packaging segment to exhibit a CAGR of 6.2%, reaching a market size of $84.6 billion by 2031, with North America dominating the sector during this period.

4. Return of the Reusable Pack

The concept of reusable or refillable packages is perhaps one of the few to have found favor with consumers, industry players, and environmental experts alike.

Emerging research suggests that reusable packaging could reduce the environmental impact of human consumerism by as much as 85%.

The first-of-its-kind Loop retail delivery chain offers eco-conscious consumers the choice of zero-waste shopping, by providing familiar products in reusable containers.

Loop has convinced several of the biggest FMCG brands to launch products in refillable/reusable packaging.

These brands range from Unilever’s refillable toothpaste tablets and deodorant containers to P&G’s refillable aluminum shampoo bottles to Nestlé’s Haagen Dazs ice cream in stainless steel buckets.

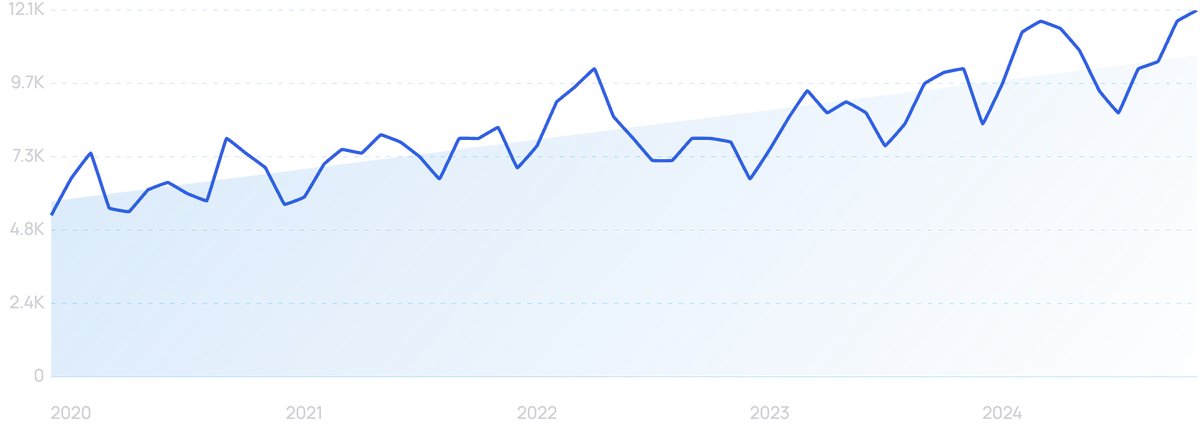

Searches for "toothpaste tablets" over the last 5 years.

Other firsts in reusable packaging include Ozzi’s reusable take-out food containers, Returnity’s customized, reusable packaging for e-commerce shipping, and Conscious Container’s partnership with Anheuser-Busch to produce ‘Refill My Beer’ beer bottles.

5. “Minimalism” is the Mantra in Product and Packaging Redesign

Next to reusable packaging, minimalistic design appears to be the most pro-ESG packaging strategy.

An example of minimalist packaging.

Unsurprisingly, a 2017 study found that 92% of respondents expressed a preference for minimalist packaging that was eco-friendly and/or biodegradable.

Two broad approaches can be identified in the minimalist movement ― redesigning products, and redesigning packaging.

Both approaches have proven their effectiveness in cutting down significantly on the carbon footprint of packaging, through the following means:

-

Reducing the number of packing materials such as plastics, paper, and glass

-

Increasing space utilization and eliminating wasteful, empty spaces during shipping

-

Improving recyclability through lower contamination from dyes, paints, and mixed materials

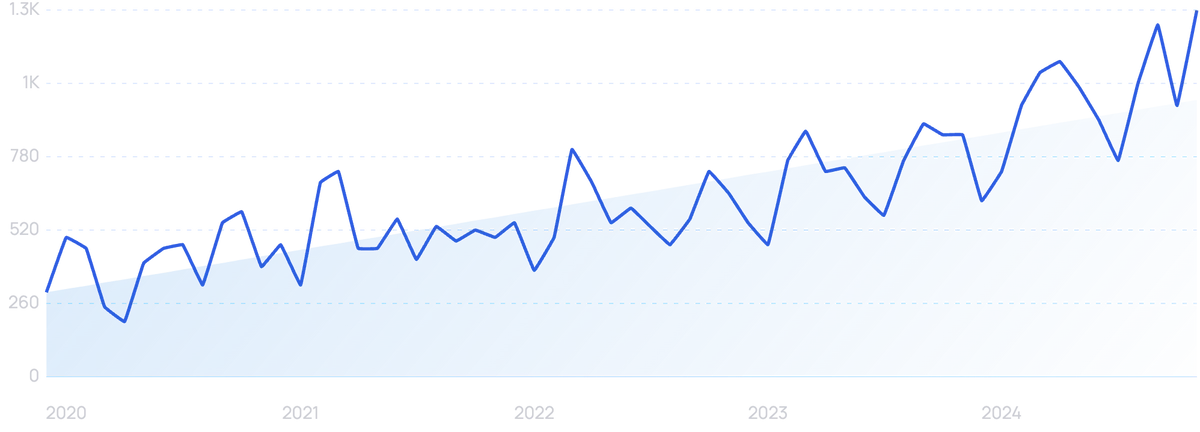

Searches for "sustainable packaging" have risen by 127% over the last 5 years.

The minimalist philosophy in packaging design isn’t really new.

For over 40 years, the popular herbal tea brand, Celestial Seasonings, has succeeded in keeping millions of pounds of waste out of landfills each year through thoughtful design that avoids staples, strings, and individual sachets for its tea bags.

From 2008 onwards, Amazon’s ‘Frustration-Free Packaging’ or FFP program has had a huge impact on sustainable packaging, encouraging businesses to develop leaner, recyclable packaging that can be shipped without secondary packaging by Amazon.

Between 2015 and 2021, Amazon’s FFP eliminated over 1 million tons of packing material from its outbound shipping, and over 2 million Amazon products are now FFP certified ― see the award-winning packaging redesign for Lenox wine glasses.

The creation of the E-Commerce Packaging Council and ISTA, the International Safe Transit Association, represent further steps in the direction of reducing waste through packaging innovations.

At present, the SIOC and ISTA6 Overbox tests developed through the Amazon ‑ ISTA collaboration represent the only guidelines available to e-commerce retailers for developing efficient secondary packaging.

6. Smart Label Technologies Improve Sustainability

The drive for unified industry standards and practices around recycling and sustainable packaging is resulting in collaborations between organizations like How2Recycle on one hand, and key industry players on the other.

A central goal of these standards is to create product labels that provide clear, easy-to-understand instructions for recycling both the product and its packaging.

A 2020 study by Ipsos highlighted the crucial role of product labels in consumers’ purchase decisions, with ESG labels such as “100% biodegradable packaging” and “packaging made from 100% recovered ocean plastic” perceived as providing high-priority information.

The use of ‘smart’ labeling technologies such as RFID (Radio Frequency Identification), EAS (Electronic Article Surveillance), and QR (Quick Response) codes on the product packaging allows users to interact with the label using devices such as cell phones and scanners to “read” product information such as product ID, catalog number and pricing.

As an increasing number of countries and commercial sectors adopt these technologies, market analysts predict rapid growth.

The smart labels market is valued at over $12 billion and is expected to reach around $35 billion by 2030.

Key Takeaways

The future of packaging can be summed up in two words – improved sustainability.

While plastic alternatives like paper and glass, increased recycling and bioplastics may provide the means of maintaining current levels of consumerism at lowered planetary costs, the real opportunity for building a more sustainable future is represented by approaches such as reusable and minimalist packaging.

Package labels in the near future will also likely carry a plethora of detail.

Not only will smart labels provide us with product pricing and disposal information, but they will also give us insights into the product’s manufacture, shipping history, and present condition.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more