Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

How to Do Market Research For E-commerce in 2024

Finding product ideas is easy, but choosing the best product depends on a variety of other questions like:

- Is the product in a growing market where demand will continue to outweigh supply in the coming months/years?

- Is the product well aligned with our brand and current customer base?

- Does the product have healthy profit margins?

- Is it realistic that we can be the market leader for this product?

The tricky part is efficiently finding high quality data to answer these questions.

So in this post, we’ll walk you through a simple yet effective step by step guide to E-commerce market research so that you can confidently select the best product for your store.

What Is Market Research For E-commerce?

Market research for E-commerce is the process of collecting market data, such as demand trends, profitability, consumer behavior, and competitive insights, regarding a particular product or market niche.

This data is then used to make better investment decisions for marketing campaigns, new product launches, demographic expansions, and other strategies.

Step-By-Step Market Research Process For E-commerce

Many E-commerce entrepreneurs overcomplicate the market research process and ultimately waste hours collecting data they don't know how to leverage.

To help you efficiently collect the data you need to make the best product selection, here’s a simple yet effective five step guide to E-commerce market research.

Step 1: Identify Products With Sustainable Growth Trends

There are plenty of E-commerce product research tools that provide product ideas.

Yet most of these tools use current best seller data from platforms like Amazon or even dropship supplier sales data to curate their databases of trending products.

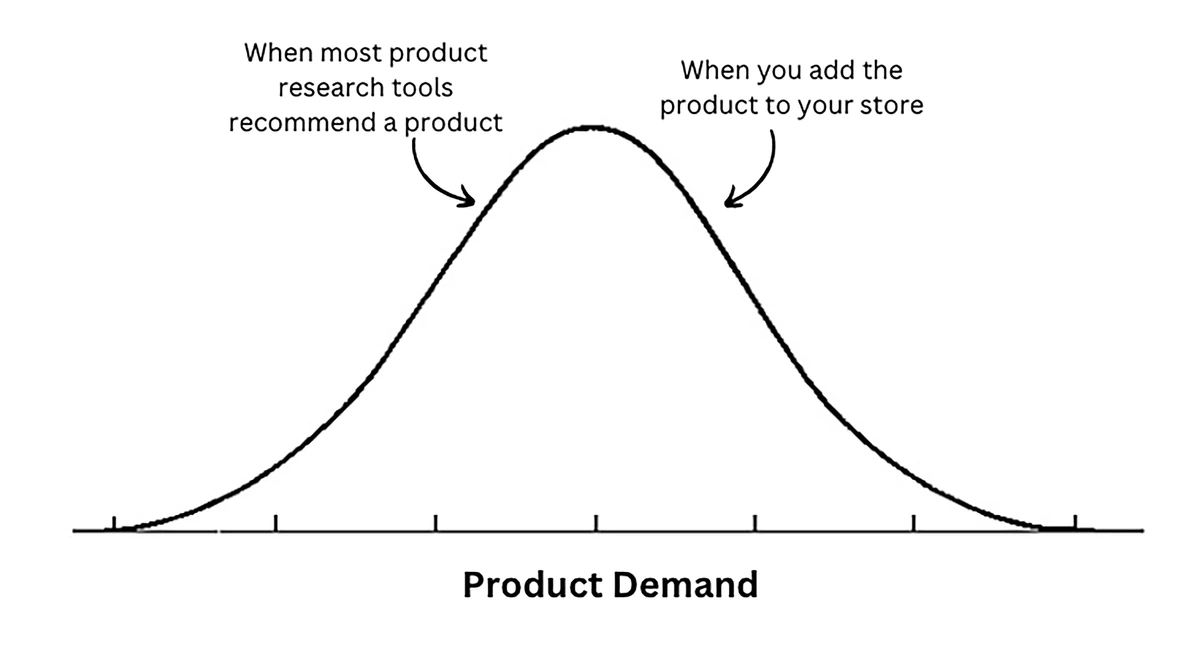

The problem with using data that shows current trending products (or the fastest growing products from the past week) is that these products are likely already peaking. Many of them are just fads that were popularized on social media, and you’ll find that demand is dead by the time you add the product to your store.

As a result, you’ll always enter the market when the trend is dying.

The solution to finding emerging products with strong long-term growth potential is to look at their historical growth trend from the past several months/years.

That’s why we built an E-commerce product research tool that offers a database of products that have a history of steady, sustainable growth from the past several months/years.

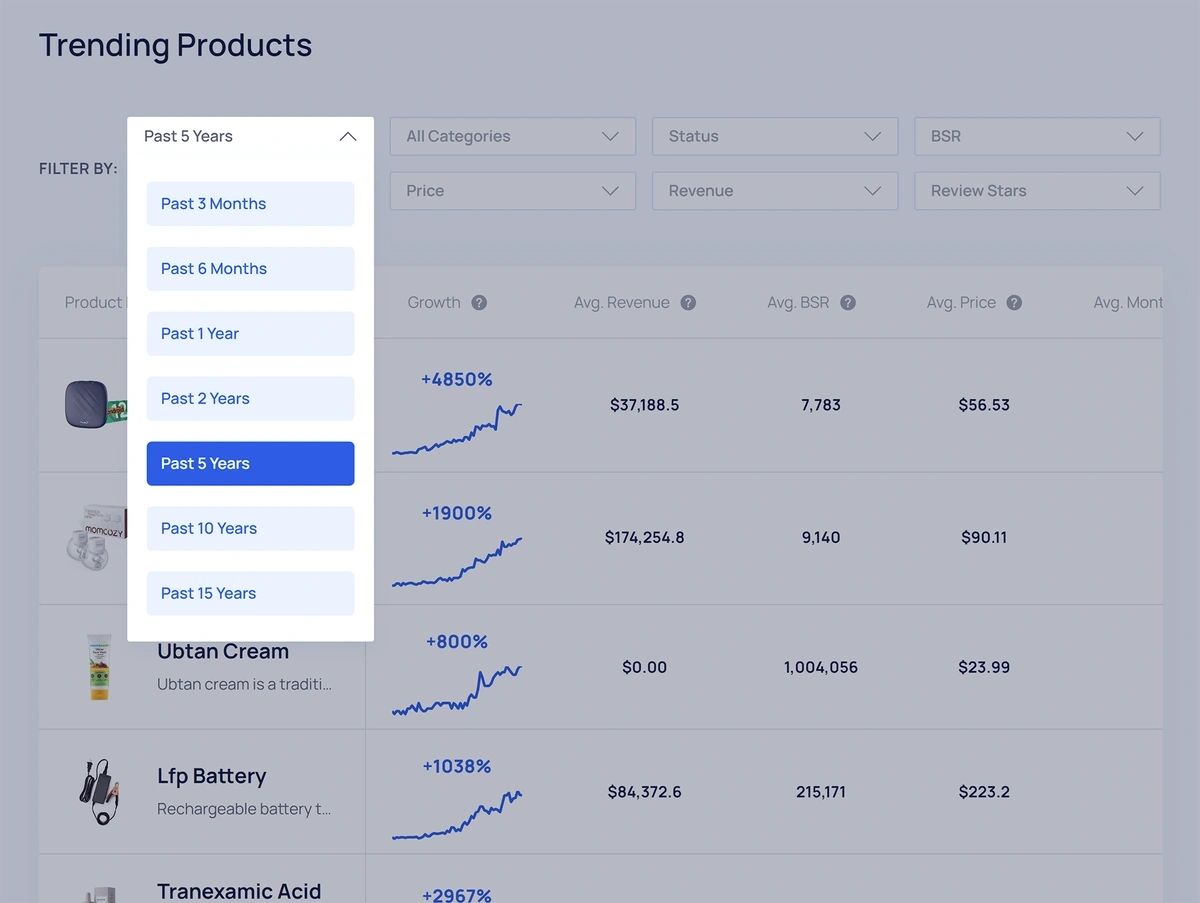

Select the time period and the database will adjust to show the products with the most promising growth over that selected time period.

The data we use to determine a product’s growth trend is the product keyword’s historical Google Search volume. Google Search volume is an accurate estimation of consumer interest as it’s based on a global data set rather than just one particular platform or supplier’s data.

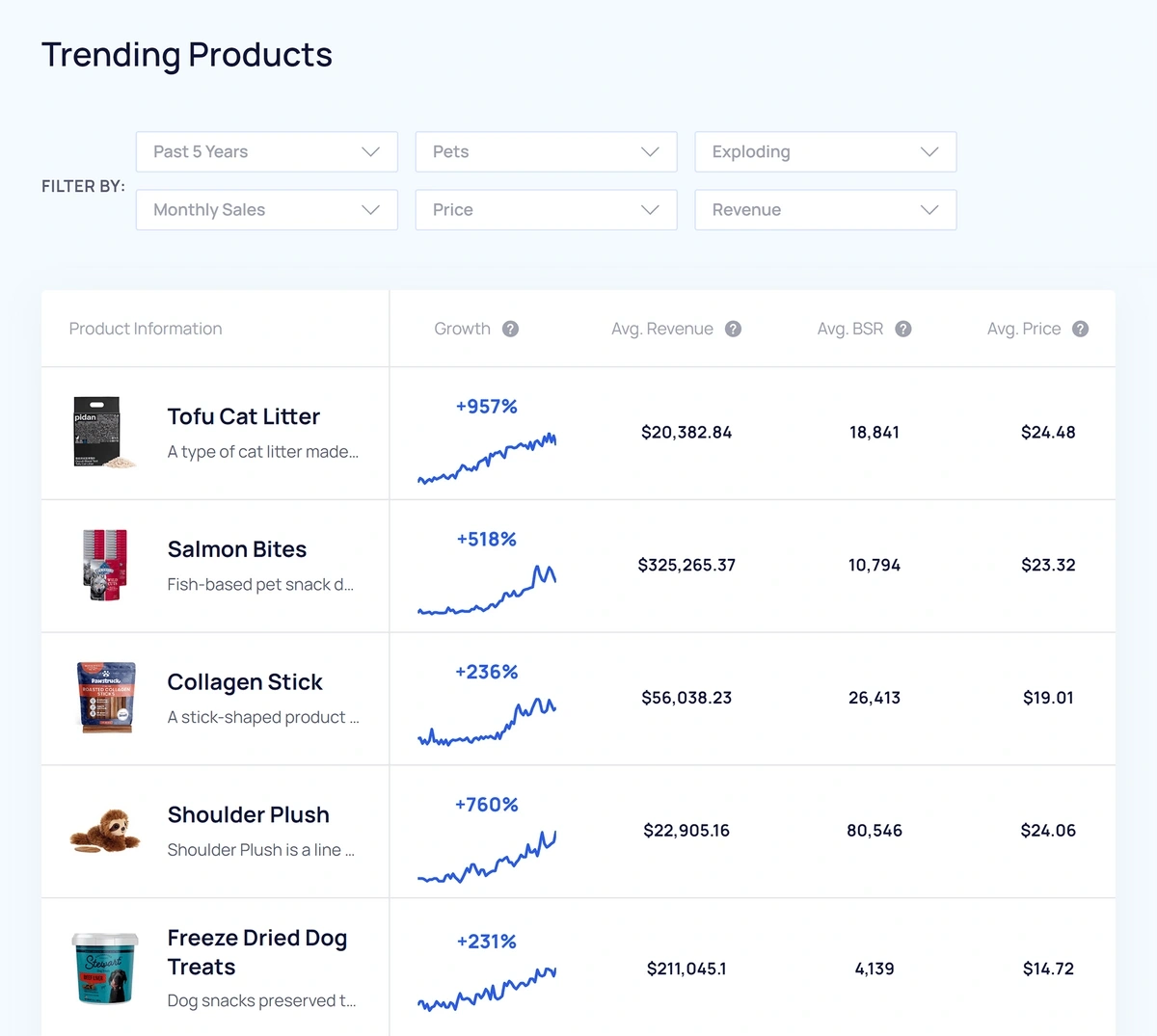

To start identifying new product ideas, follow these steps:

- Sort the database by the category most relevant to your niche (e.g., pets, sports, gaming, etc.).

- Set the time period filter to a time period that makes sense for you. In general, dropshippers can use a shorter time frame (three or six months) than those manufacturing their own products.

- Set the growth status to “Exploding:”

As you scroll through the list of trending products, look for products that:

- Have strong historical growth trends

- Are relevant to your store and your audience

At this point, you’re just collecting product ideas, so don’t worry about the other metrics. We’ll use those later to narrow down our list of products.

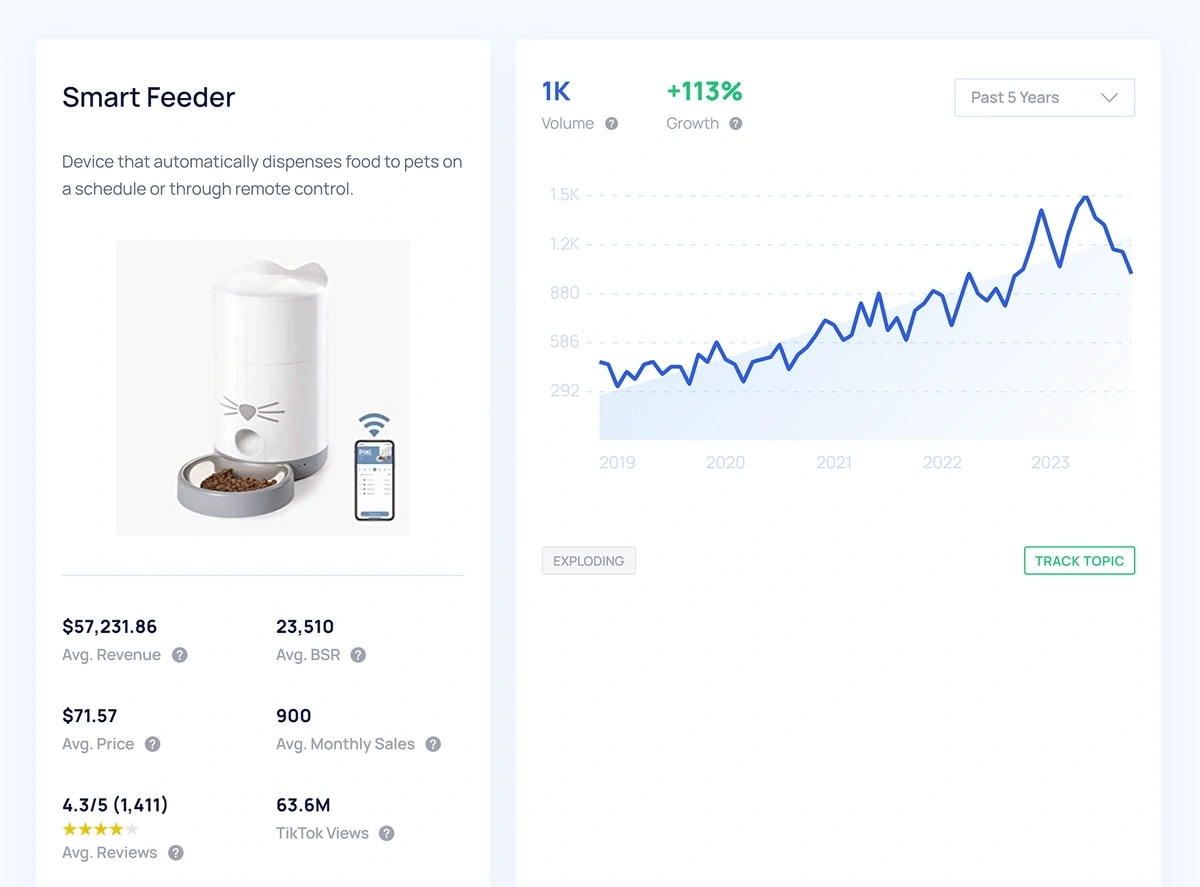

When you find a product with a promising growth trend, you can click on it for more details. If it looks like a good candidate, click “Track Topic” and add it to a Project.

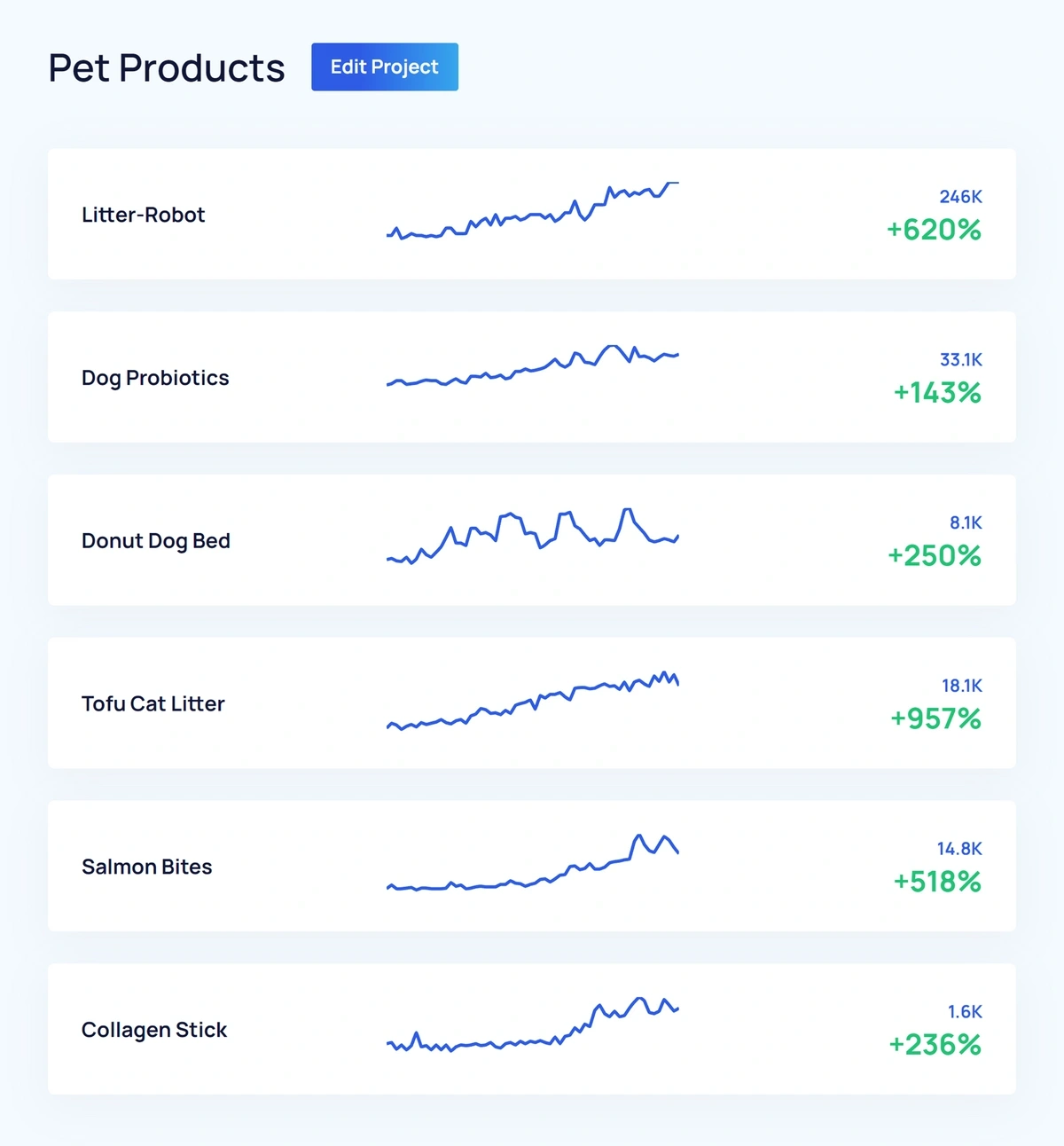

Projects are stored in the Exploding Topics dashboard and make it easy to track products for further analysis. For example, here is the Project I created and titled “Pet Products.” It lives inside the dashboard, and the growth trend is updated daily so that you can easily monitor each product’s growth in real time:

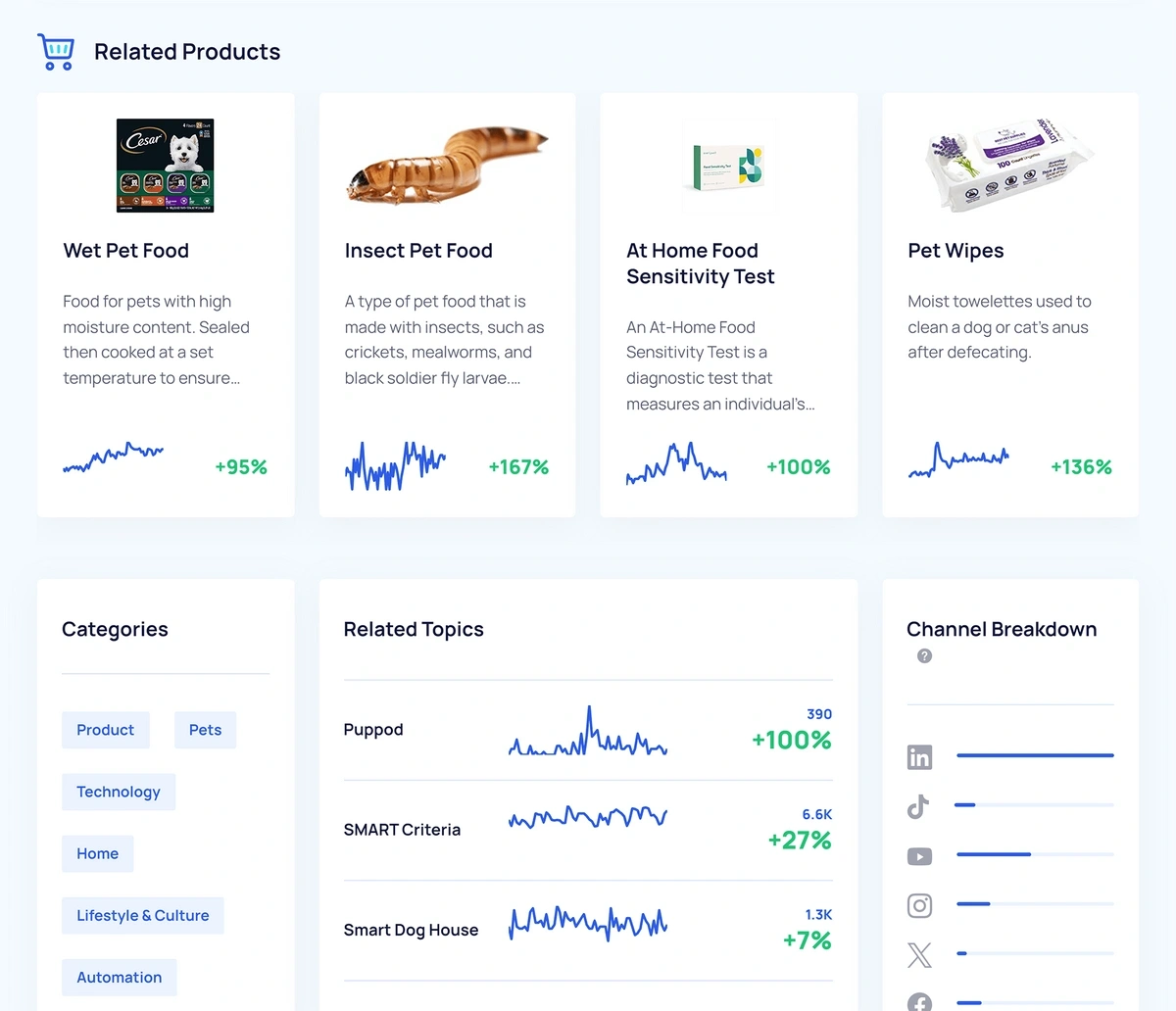

Going back to the product page, scroll to the bottom of the page, and you’ll see a list of other related products and trending topics.

Some of these related products, like the automatic dog feeder, might also be excellent candidates for your store. You’ll also see other related topics can lead to additional product ideas, like the Smart Dog House.

You can click on any of these products or topics as well and add them to one of your Projects.

Aim to collect at least 15-20 products, depending on your niche.

If you already have a store and a very specific niche (e.g., dog toys), your list of potential products will likely be much shorter than if you’re starting a brand new store and still not quite sure what niche you’ll specialize in.

Step 2: Identify Growing Markets

Your product's chances of success increase significantly if it's part of a growing market trend than if it's a single growing product in a stagnant or declining market.

To gauge a market's growth, you can start by browsing secondary research data.

Allied Market Research and Grand View Research offer free market research reports, and they usually provide quantitative data like market size, growth forecasts, compound annual growth rates, and other information that can help you determine the market's growth trajectory.

Some market reports also offer consumer insights like spending data, target market demographic data, and even market sentiment.

The problem with market reports is that they can be overwhelming for E-commerce business owners to read.

Sure, they provide plenty of market data, but you must know how to extract insights from that data to answer the main question; is this a good E-commerce industry to pursue?

The other problem is that most market research reports have conflicting data.

For example, the market report on smart pet feeders based on these two reports is drastically different:

These data discrepancies often occur because different reports use different parameters to define a market – but those differences can skew your market assessment. (And in some cases, the market reports just don't use quality data.)

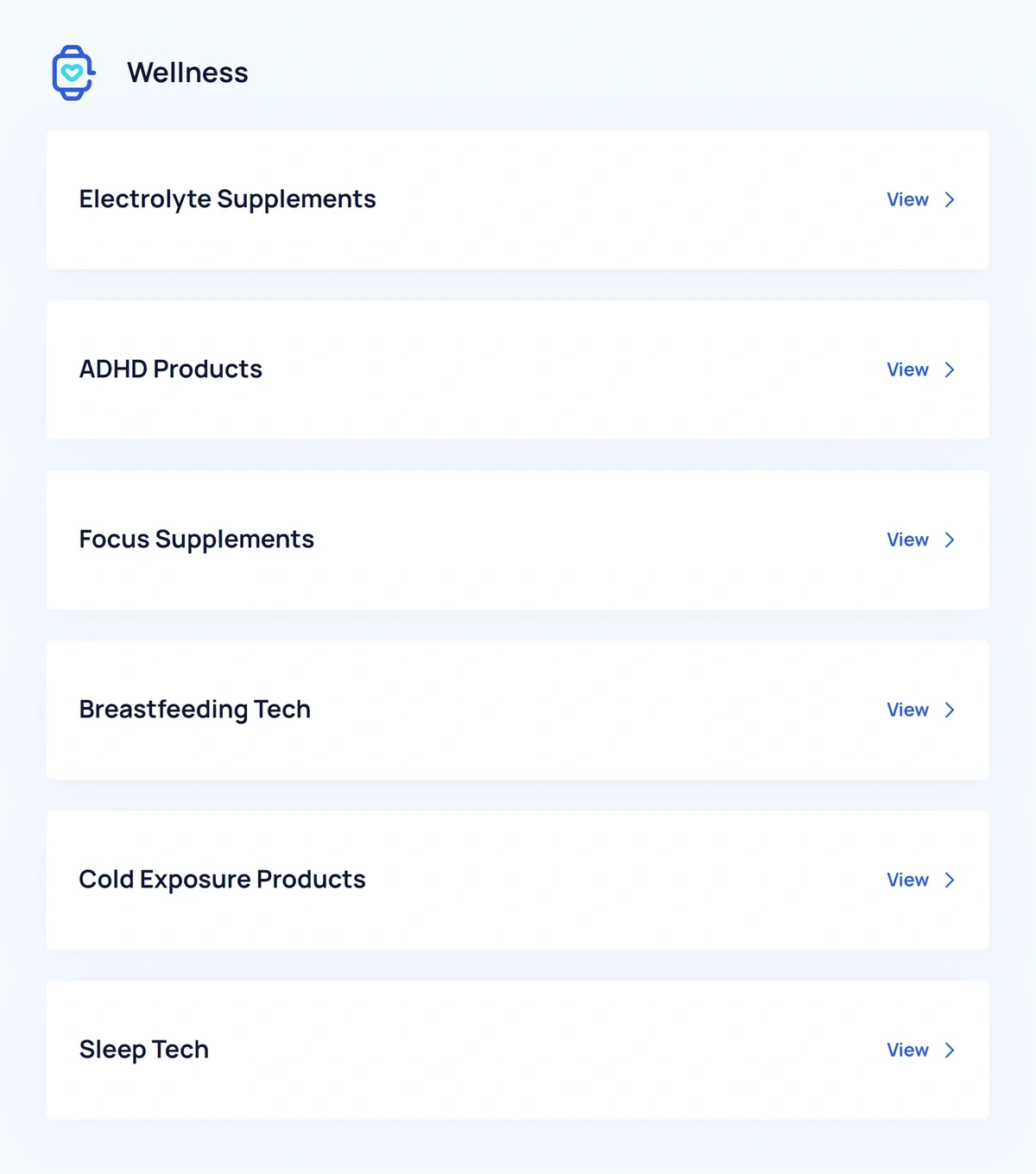

We wanted to make it easier for E-commerce owners to identify growing niche trends in seconds (rather than sifting through endless online market reports), so we created the Meta Trends feature.

It is a database of growing market niches discovered by AI and qualified by a human analyst. You can scroll down to the broader market category you're targeting and then browse the meta trends:

You can then click on any niche and see the trending products, topics, and brands within that growing niche.

If you see a new product you want to add to your list, you can just click "Track Topic" and add it to a Project.

While Meta Trends is a great place to find growing niche markets, many of the products you already saved in your Projects might not fit into one of the Meta Trends.

That doesn't necessarily mean those products are part of a dying market, though it's important to double check.

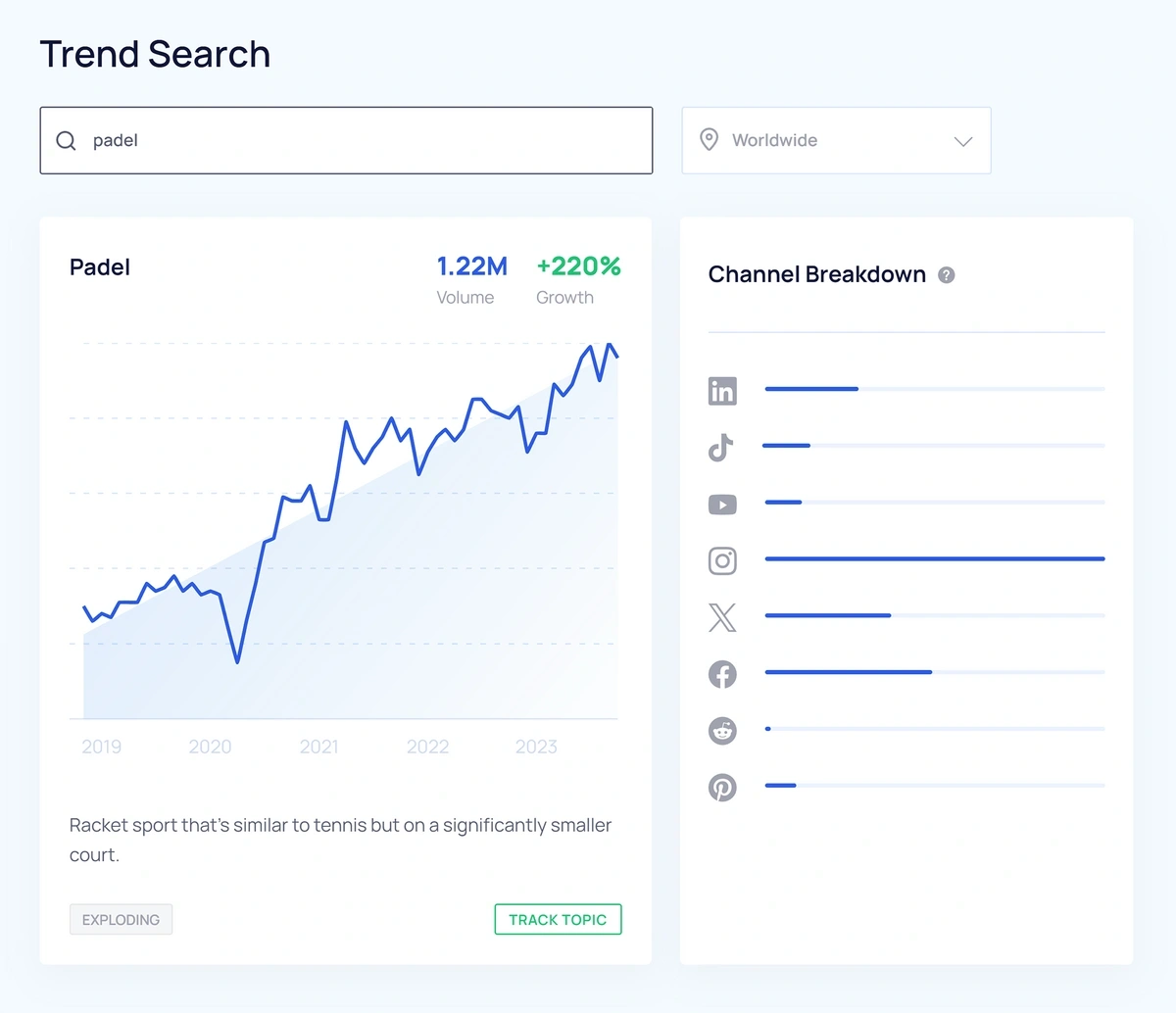

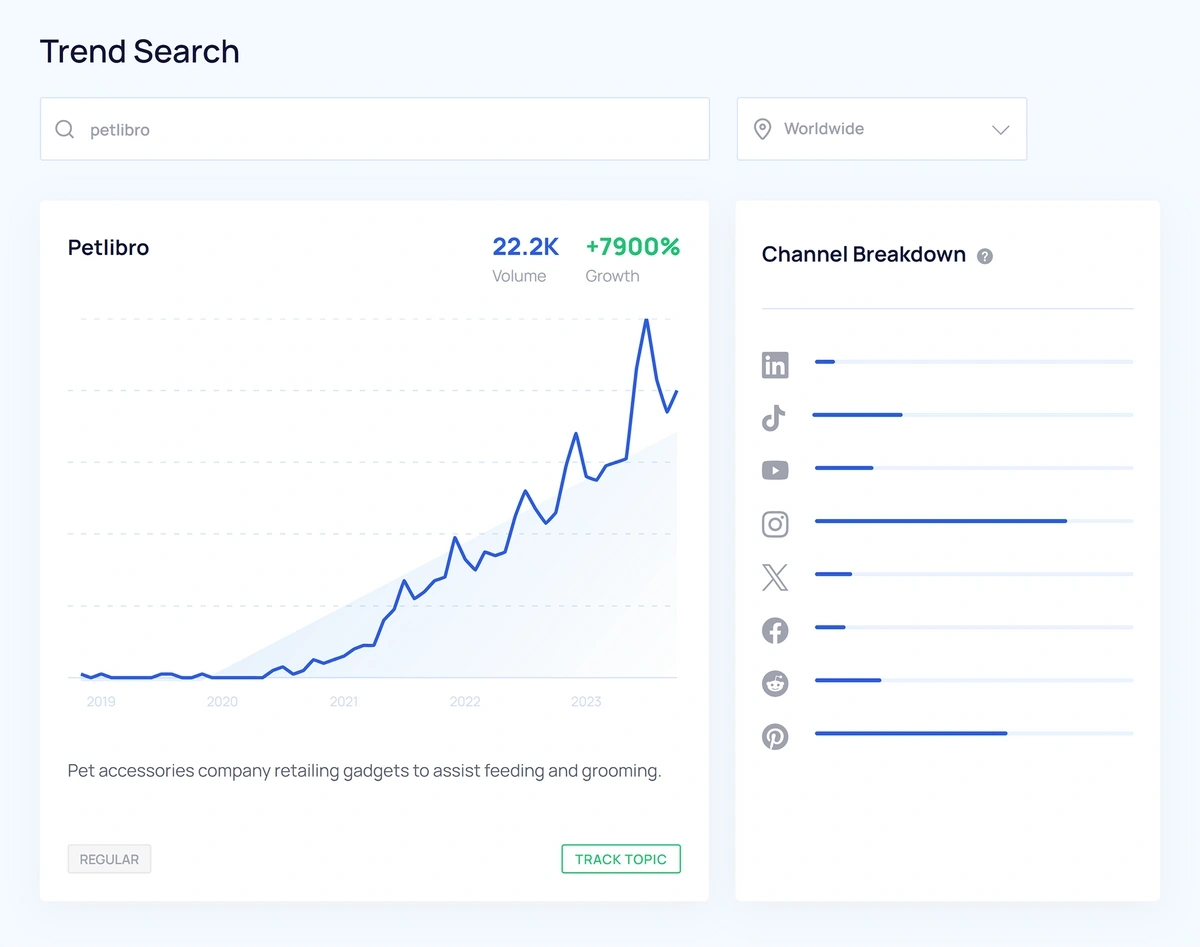

To make this easy, we created the Trends Search feature. You can type in any keyword and immediately see its historical Google Search volume trend.

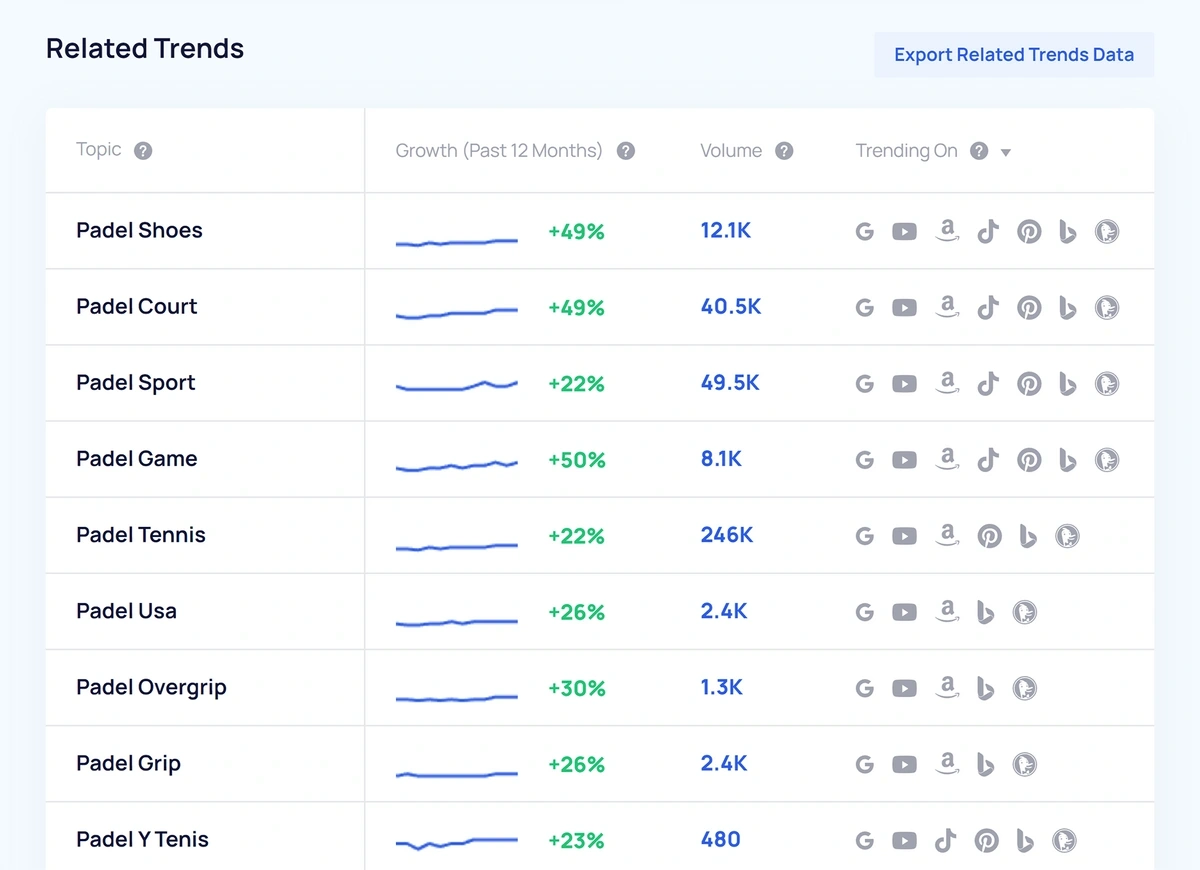

For example, one of the Trending Product suggestions was "Padel Racket."

To check if it's in a trending niche market, I entered "padel" into the Trends Search feature.

I can see that this is clearly a trending niche:

Pro Tip: If Trends Search shows that the niche market keyword you typed in is in decline, be sure to try a few different variations of the keyword before concluding that the market is in fact in decline.

Trends search also gives you some related topic suggestions, some of which may be additional product ideas, like “padel shoes.”

We've found that this is a much easier way to quickly gauge a market's demand than combing through endless market research reports.

So in this step, cross off any product ideas on your list that are clearly in declining markets and focus on products that are riding the growth of a rising niche market.

You can further validate using our free E-commerce keyword tool.

Note: As you get closer to making a final product selection, it's still a good idea to do some deeper background market research on each product. However, the Trends Search feature can help you narrow your initial product list by quickly identifying products in declining markets.

Step 3: Measure Profitability And Consumer Demand

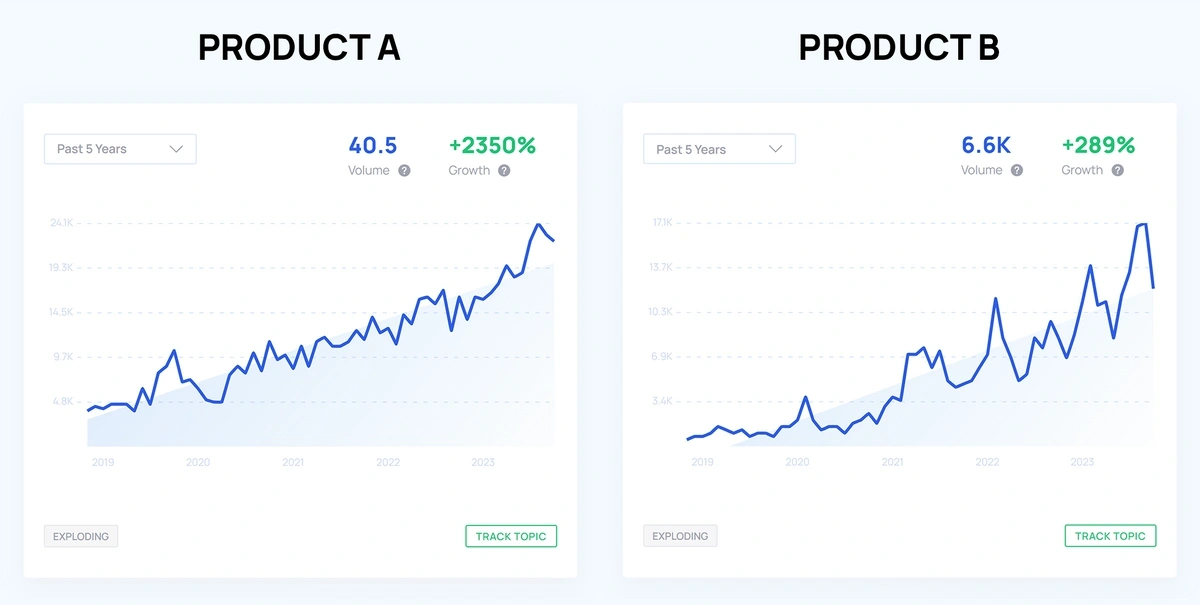

If you look at the two graphs below, it’s easy to guess at first glance that Product A is the best opportunity:

Yet if the profit margin and demand numbers looked like this, Product B now looks like the better opportunity:

| Profit Margin of One Unit | Average Monthly Sales | Average Monthly Revenue | |

| Product A | $10 | 100 | $1,000 |

| Product B | $1,000 | 10 | $10,000 |

This is why the next step in the E-commerce market research process is analyzing specific metrics to better understand the profitability of each product.

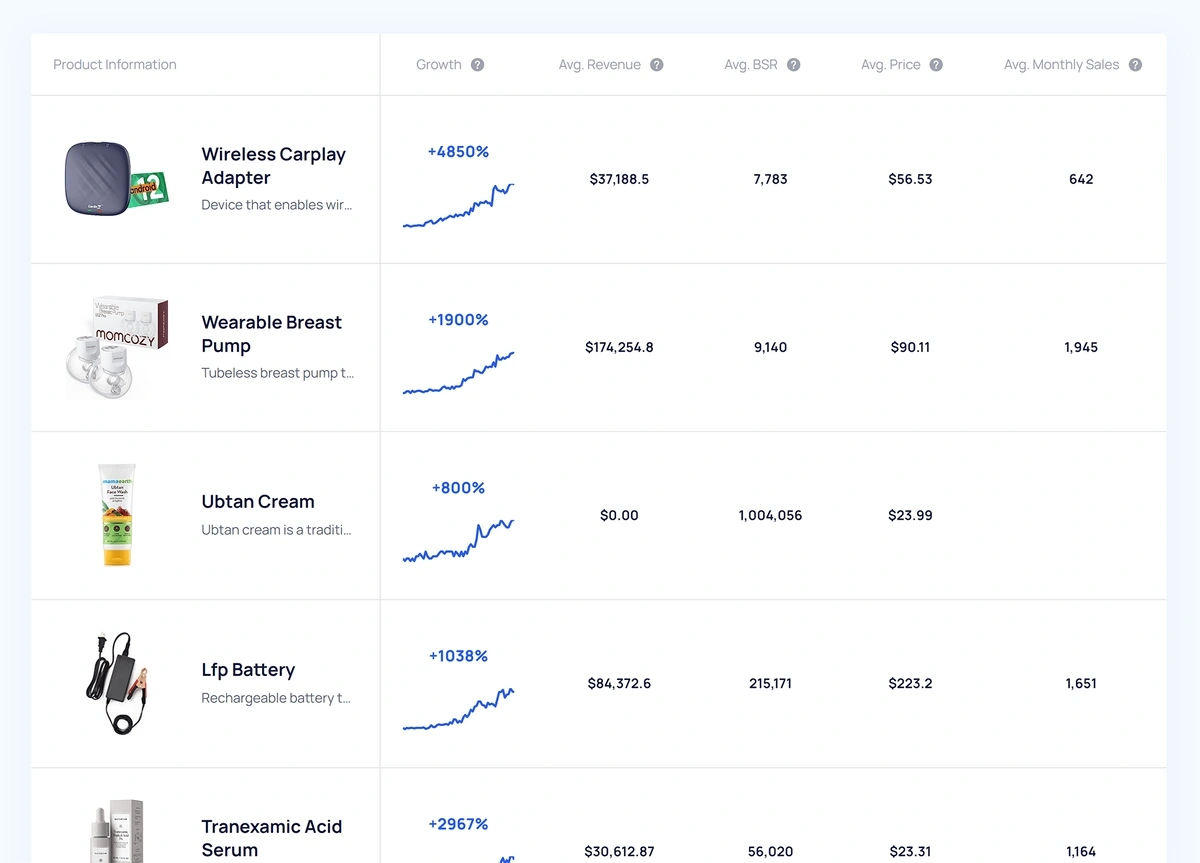

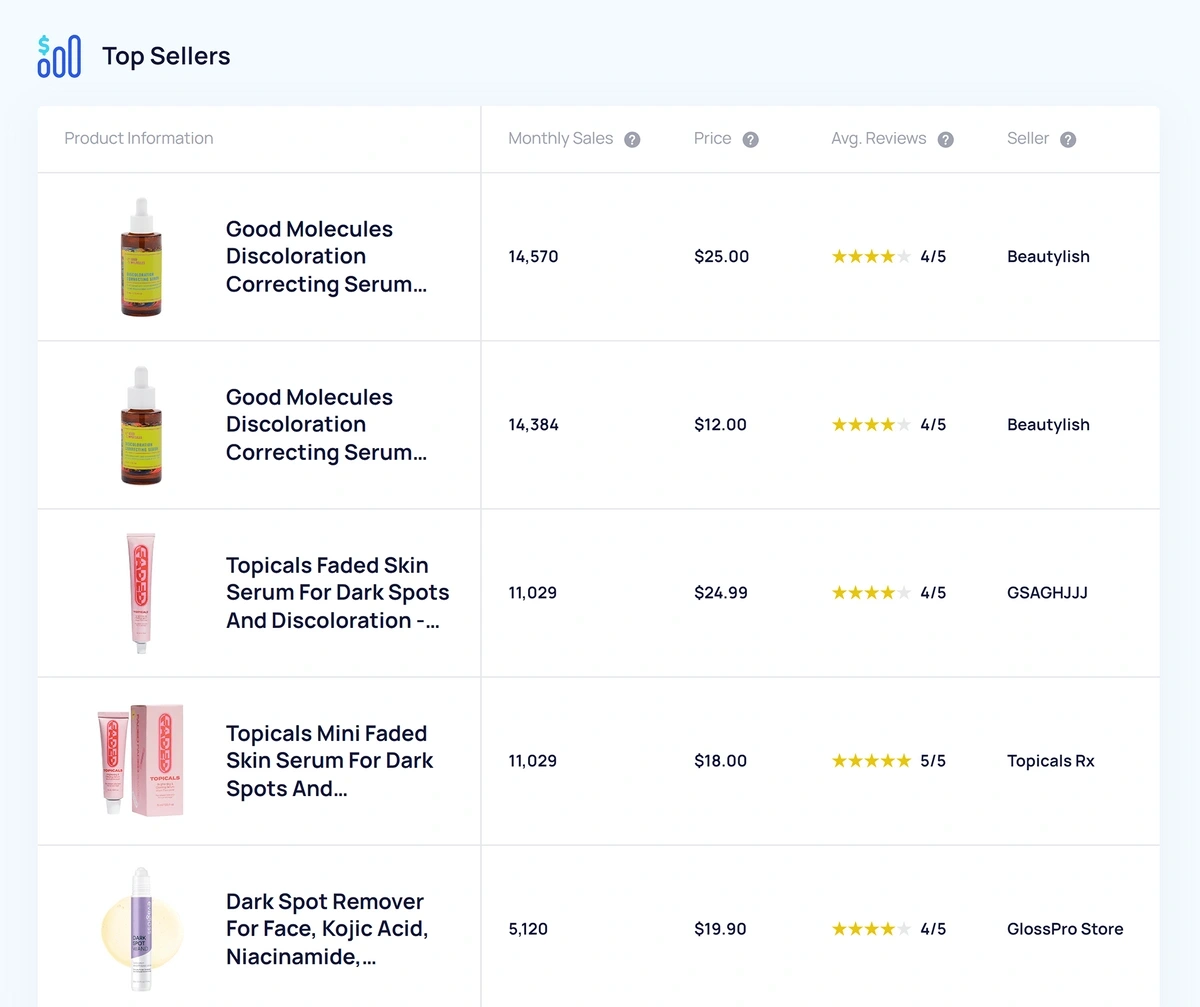

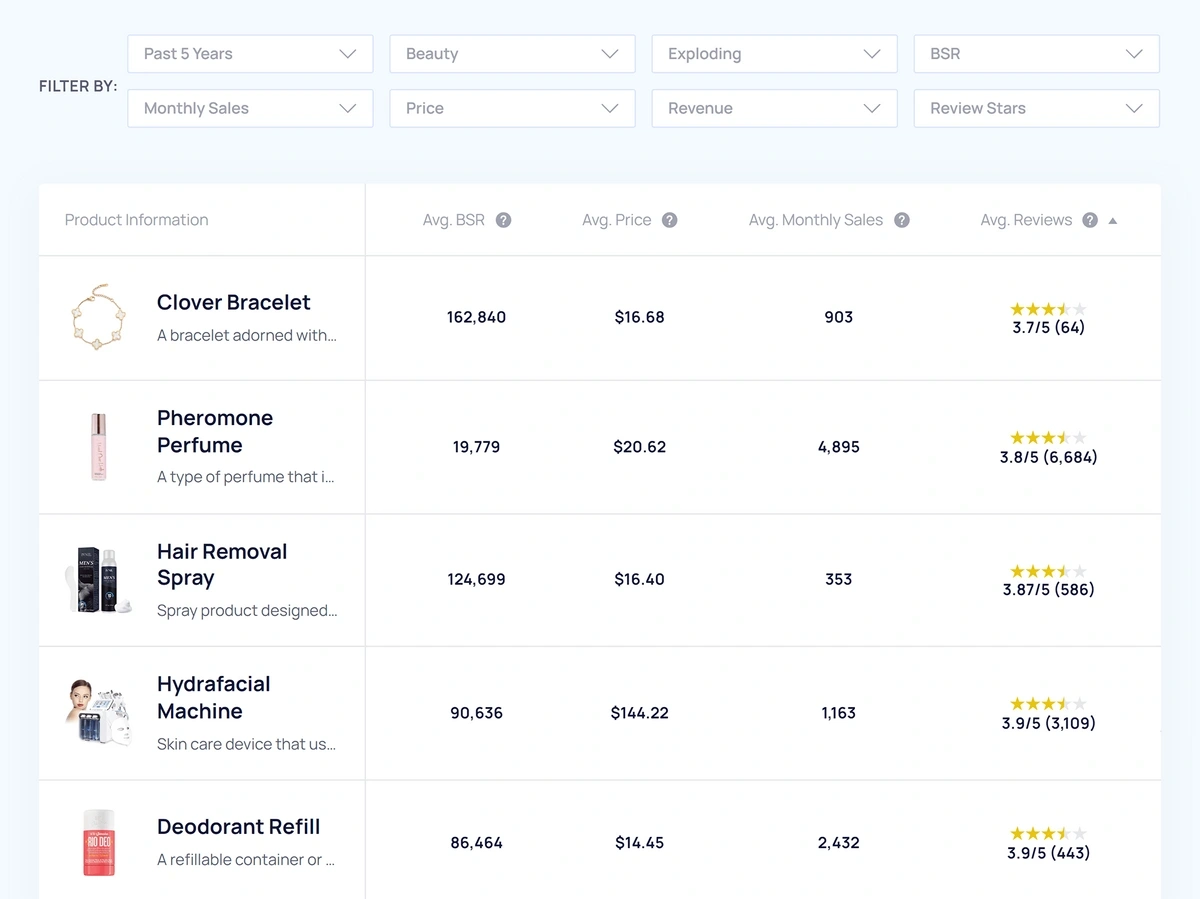

To do this, go back to the Trending Products dashboard in Exploding Topics. You’ll be able to see the average monthly sales, price, and revenue of each product:

Now that you have a list of products with long-term growth potential, start narrowing down the list by looking at which ones are most profitable.

Within Exploding Topics, you'll see average monthly sales, retail price, and revenue data (based on the top sellers of that product on Amazon).

You can then create a spreadsheet like the one below and fill in those numbers to estimate the gross profit margin per product.

| Product Name | Avg Retail Price

(per unit) | Manufacturing Cost / Wholesale Price | Avg Monthly Sales | Avg Gross Profit

(per unit) |

| Padel Racket | $133.83 | 58 | ||

| Iv Hydration | $26.44 | 36,159 |

The manufacturing and wholesale cost depend largely on the quality of the product and the supplier/manufacturer you choose.

For this, you'll have to make a rough estimation. You can look at wholesale websites like Alibaba, but we generally recommend against this as these tend to be lower quality products.

If you intend to build a sustainable brand with high quality products, you probably will end up manufacturing your own products or working with more exclusive suppliers, which can cost much more.

So search for market reports on Google, and you'll probably find some data on manufacturing costs.

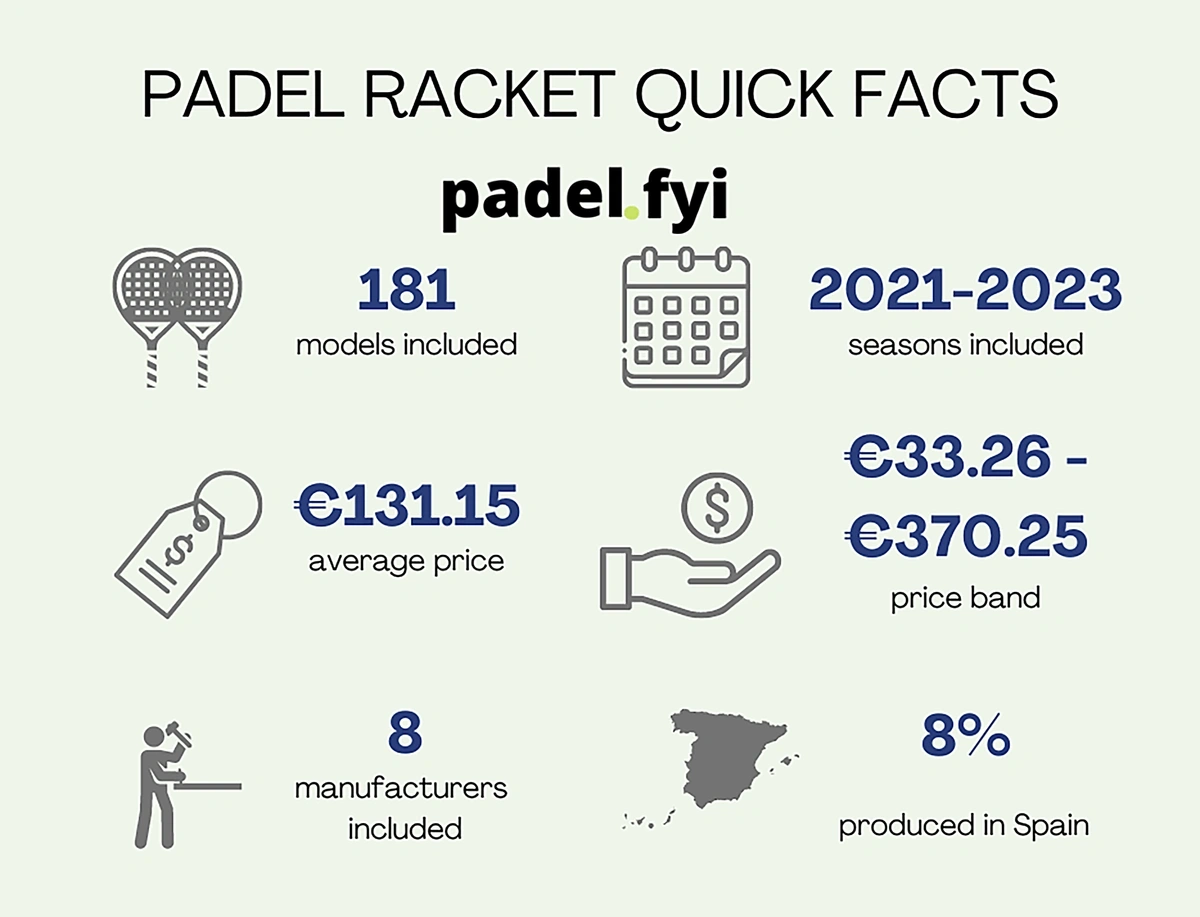

For example, this market report on padel rackets contains plenty of helpful information on the economics of creating padel rackets:

You can also talk to suppliers directly to estimate how much it costs to produce a single product unit. This will also help you better understand different variables that impact the cost of producing a single unit and other obstacles that you may not have considered.

Once you have a general estimate of the cost involved with producing a single unit, you can fill in the rest of the table to better estimate your monthly gross profit if you were to sell that product:

| Product Name | Avg Retail Price

(per unit) | Manufacturing Cost / Wholesale Price | Avg Monthly Sales

(per top seller) | Avg Monthly Gross Profit |

| Padel Racket | $133.83 | $100 | 58 | $1962.14 |

| Iv Hydration | $26.44 | $15 | 36,159 | $413,658.96 |

Step 4: Analyze Market Competition

Competition is a good sign that the market is stable, though too much competition can make it difficult to gain traction as your marketing costs will likely eat into your profits.

To analyze your competition, identify the top players in the space.

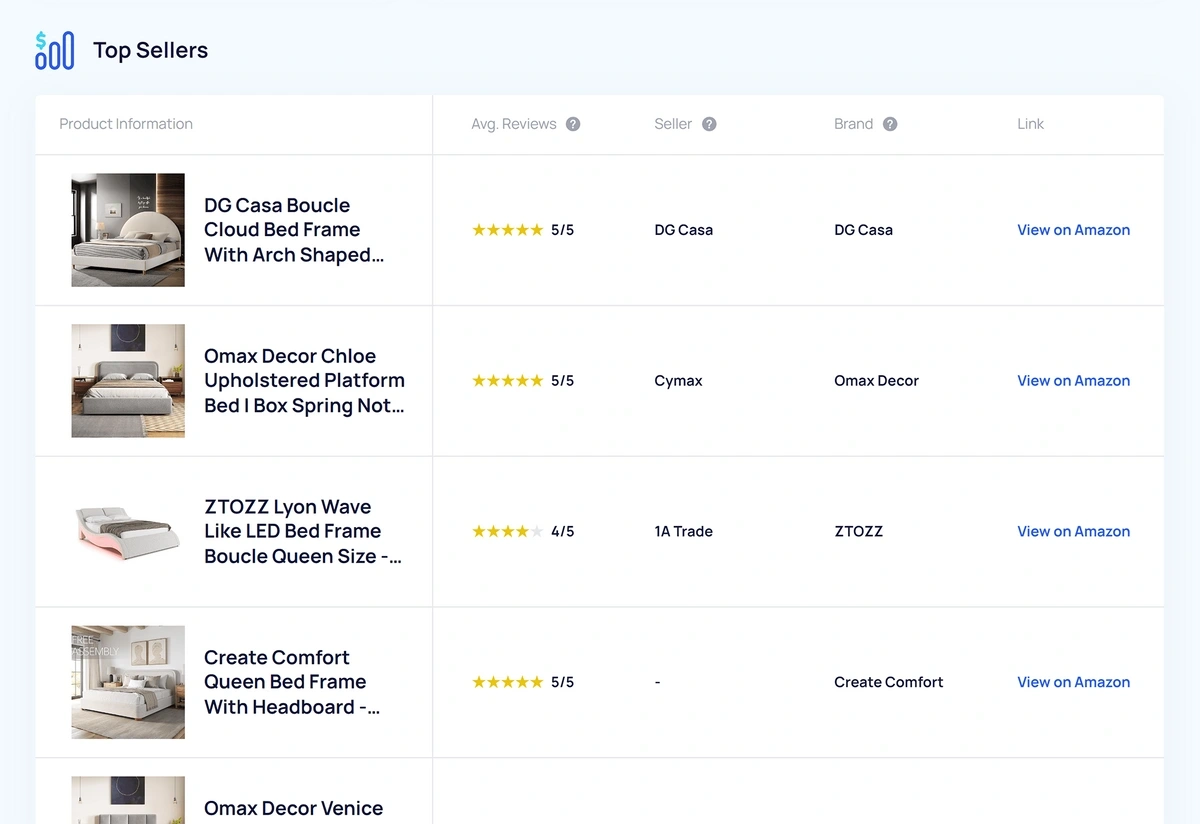

You can do that by looking at the product profile in Exploding Topics. Scroll down to the "Top Sellers" category, and you'll see a list of the top brands for that product (your competitors).

Next, make a list of these top brands for further analysis.

Note: Brands are the companies that create the products, and vendors are the companies that sell the products. We recommend analyzing brands rather than vendors because some of the vendors also sell other unrelated products. So, even if a vendor is growing, that doesn't mean that demand for the particular product you're researching is growing.

Once you have a list of brands, check how long they've been in business.

If most brands are less than a year old, the market might not be stable, and it could be more of a fad than a sustainable industry trend. However, if these brands have been in business for a few years, there's a good chance that the product or niche is stable and profitable.

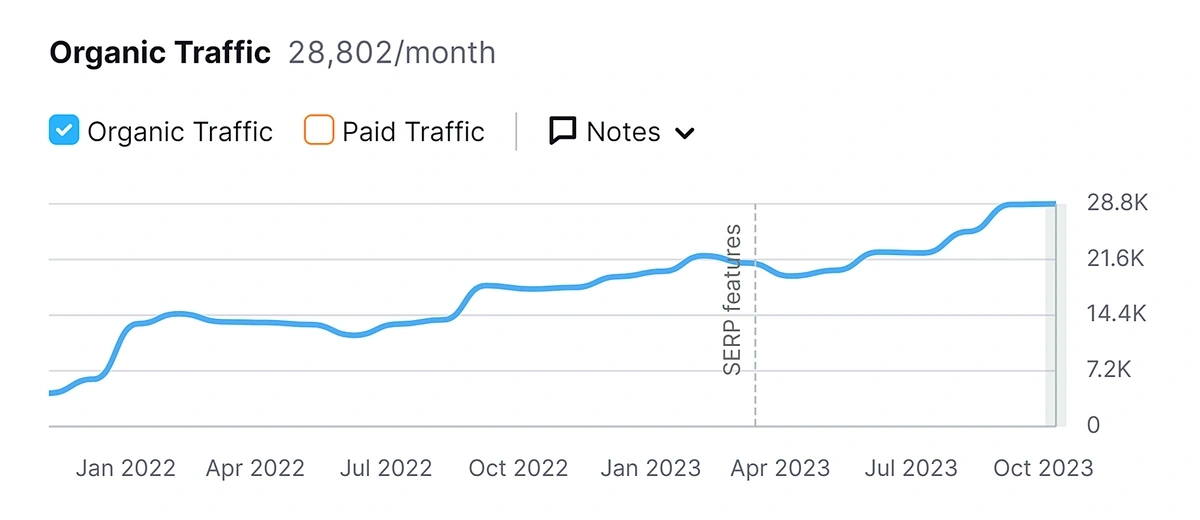

Next, check the brand's traffic growth.

Search traffic is a good indicator of consumer demand, so you want to see that the brand's traffic (and ideally, branded search query traffic) has steadily increased over the past few years.

To check traffic growth, you can use our free E-commerce keyword research tool. You can also look at full site traffic trends using Semrush.

For example, if you're selling dog toys, you can see that the traffic trend growth for a top competitor in the space, PetLibro, is fairly promising:

Alternatively, you can also use Trends Search to see how brand queries are trending:

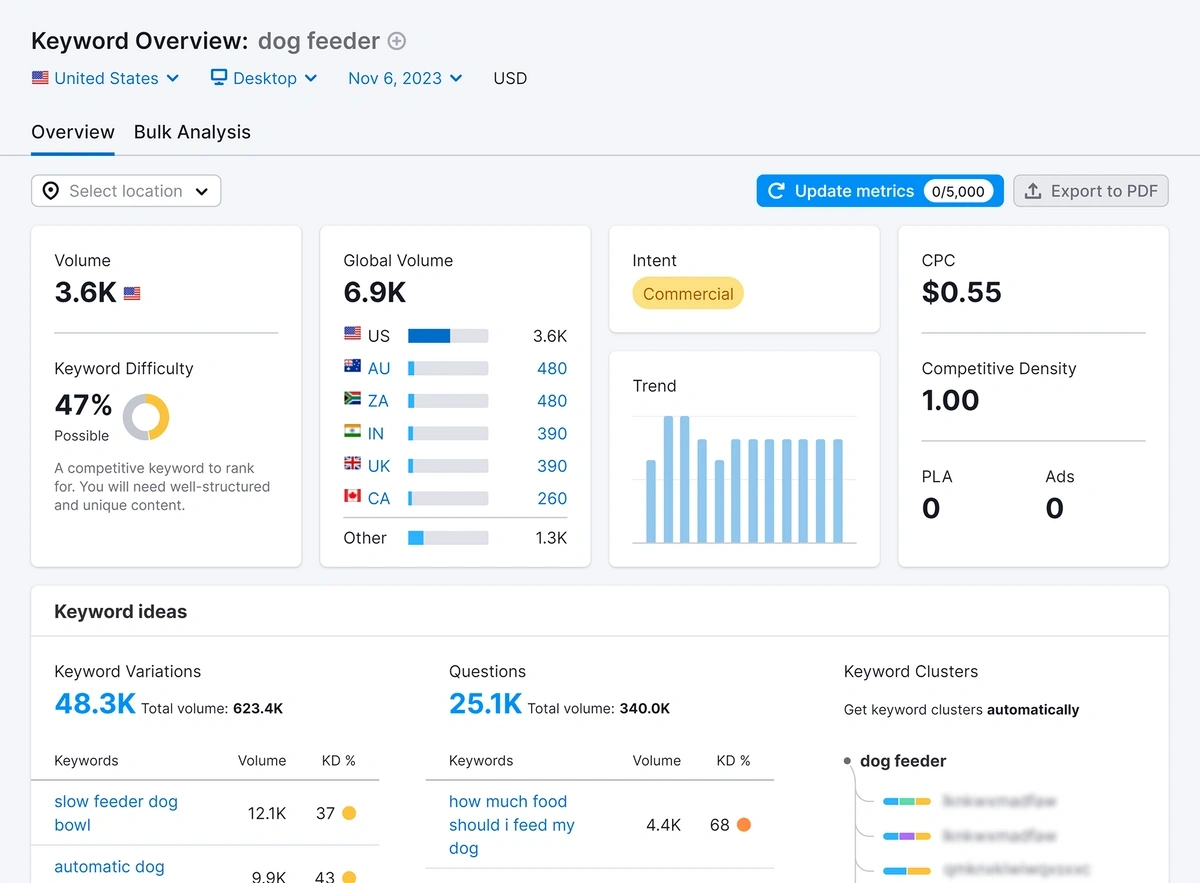

Once you’ve validated that the top players in the market are growing, you can gauge the general competitive landscape by looking at the following metrics for the main product/market keywords:

- Keyword Search Volume: Ideally, you want this number to be high, as it indicates there is strong demand.

- Keyword Difficulty: Any number above 40 or 50 will require substantial resources to get your page to rank for that product keyword if you don’t already have a strong domain with strong topical authority. The lower, the better.

- Cost per Click: Another excellent way to estimate the difficulty of a keyword is to look at approximately how much it would cost to pay for that keyword if you were to pay to rank for it in Google ads. And if you intend to run paid ads, this number will give you an estimate of how much you can expect to spend to acquire a customer.

Semrush can provide all of this information for you:

It’s also important to realize that competitive difficulty in a marketplace is relative to your competitive advantage in the market (e.g., your expertise on that subject and your current audience).

For example, makeup is a highly competitive niche.

Yet Selena Gomez launched a brand in the market with instant success because she already had a large following of young women interested in beauty.

In fact, launching a beauty brand is likely easier for her than launching a brand in a market that has lower competition yet is unrelated to her followers’ interests (like a B2B marketing tool).

So even if a market is highly competitive, it might still be a good fit for your brand if you already have a loyal customer base that wants that product.

Step 5: Identify Customer Pain Points

Businesses exist to solve problems, so if your product doesn't solve a customer problem more effectively than your competitors, it probably won't succeed.

In fact, this is a key reason many E-commerce entrepreneurs transition from dropshipping to creating their own products. As a dropshipper, the customer experience is really the only differentiator you can offer in the marketplace, as you and your competitors are selling the same products to the same target audience.

So before introducing a new product to the marketplace, look at the most common complaints regarding existing products.

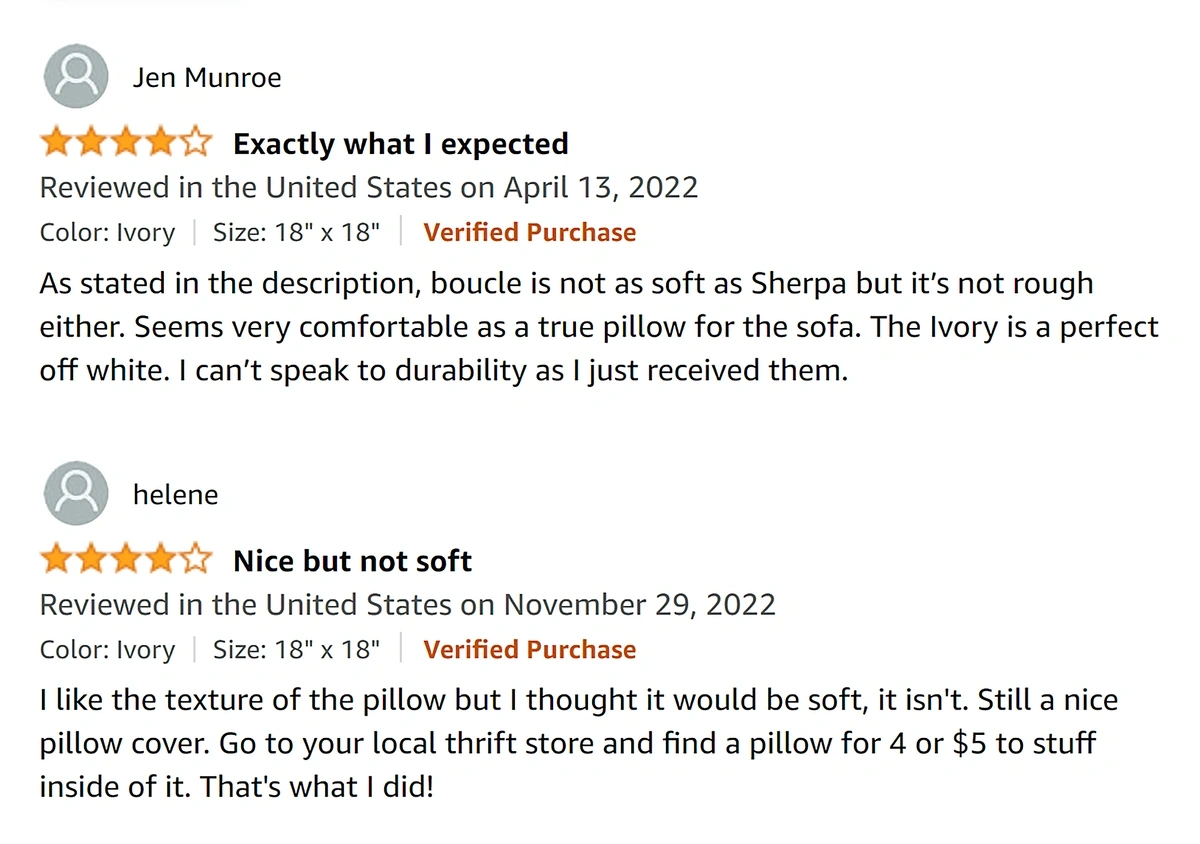

To do this, head back to your saved products in Exploding Topics and look at the average reviews and ratings for each product. Scroll down to the "Top Sellers" category and then click the "View On Amazon" link to read the product's reviews (especially the products with lower ratings):

As you're reading the reviews, answer the following questions in a spreadsheet:

- What are the specific pain points these customers are using the product to solve?

- What are the top 3 things people love about the product?

- What are the top 3 things people disliked about this product?

- Who is the ideal customer? (Average age, gender, nationality, interests, etc.).

This information is useful because it will help you identify how to make a better product and how to market your product. For example, a common pain point with the first product on the list is that it isn't as soft as people wanted. So, as you're creating and marketing your version of this product, make sure it's ultra soft:

You can also do a new product search and filter the results by star rating in descending order. For example, here are all of the lowest rated beauty products that still have exploding demand:

You can then repeat the same process of reading both the positive and negative reviews for each product.

If you already have an email list, you can also send a survey asking your current customers what other products they'd like that are similar to your existing products. In fact, you could even recruit some of those respondents to be part of a focus group for your new product idea.

Finally, look at a list of your best customers (those who buy the most frequently and spend the most money) and get on the phone with them.

A live conversation will allow you to ask follow-up questions and learn more about their interests, pain points, and desires. They may also tell you about new markets and product categories they're interested in, which can further aid your product research process.

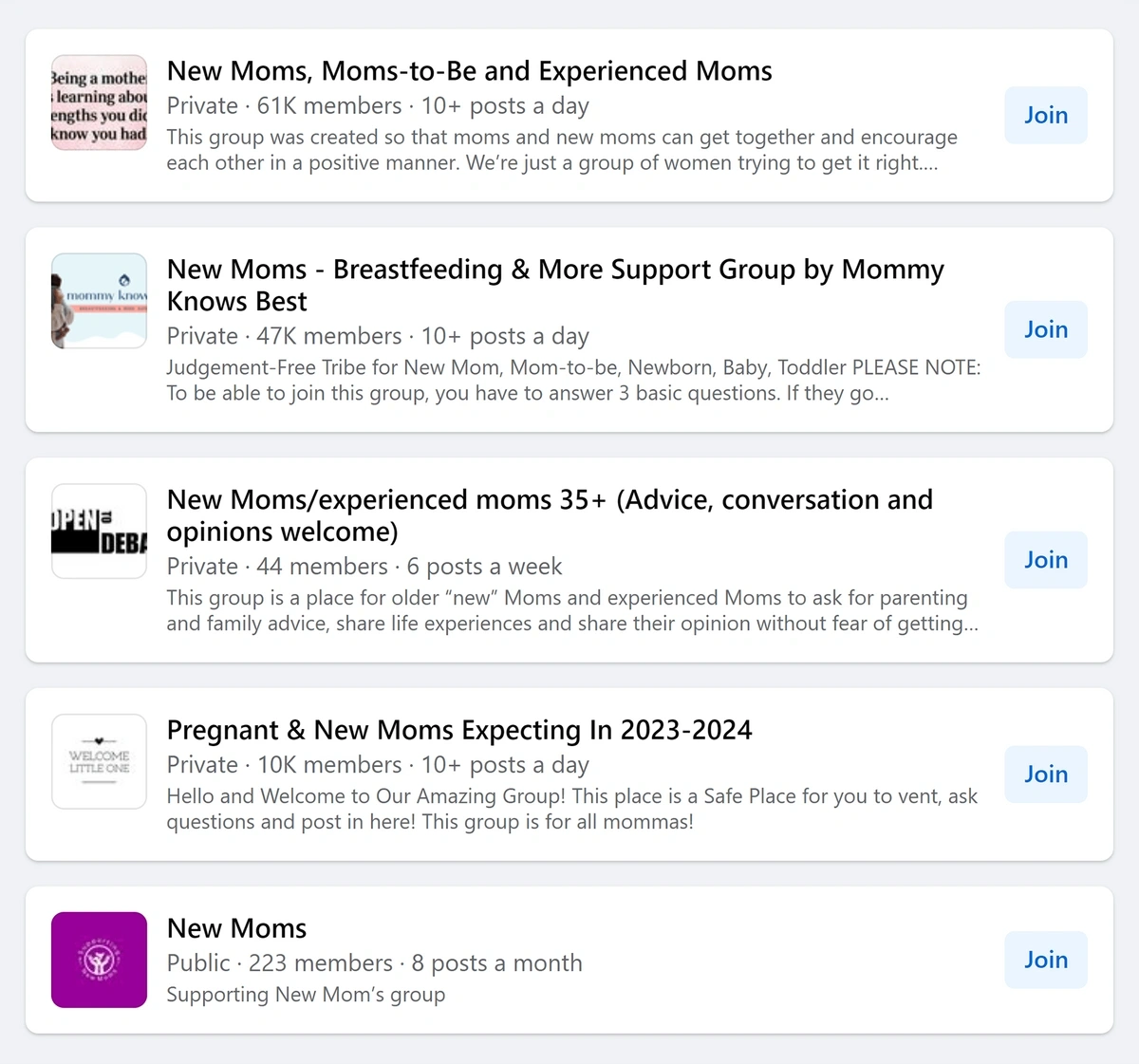

Even if you don't have an online business yet, you can still talk to potential customers while researching product ideas.

For example, if you want to launch a product for moms but aren't yet sure what products they like, join several Facebook groups for moms. Then, ask them which products they like and why.

You can also follow influencers in the space to see not only the products they recommend, but also read the comments to gauge what your target customers think of other related products.

Start The Market Research Process Today

There are plenty of different methods to execute market research for E-commerce, but we've found that most of them are time consuming and overwhelming.

We wanted to make E-commerce market research easier, so we designed Exploding Topics to do the market research for you and deliver the product ideas to you in a simple, clean dashboard.

If you feel overwhelmed by endless market research reports and primary research data, try Exploding Topics Pro for $1 to see if it's a more efficient solution to execute market research.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more