Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Disruptive Ghost Kitchen Companies & Startups (2024)

You may also like:

- 5 Important Restaurant Industry Trends

- 25 Trending FoodTech Companies & Startups

- 5 Huge Snacking Trends

In today’s competitive landscape, restaurants are going all-in on optimizing their costs and resources.

Delivery-only restaurants are overcoming that challenge with the ghost kitchen model, which involves using a facility (sometimes shared by multiple brands) to prepare food.

At the end of 2023, the global ghost kitchen market size was estimated to be $71.1 billion. By 2032, this industry is estimated to grow to $170 billion.

Furthermore, in the US alone, there are more than 7,500 ghost kitchen businesses.

Every year, new tech startups and shared spaces are joining this sector. We’ve rounded up some of the fastest-growing ghost kitchen companies that you should follow in 2024.

1. We Cook

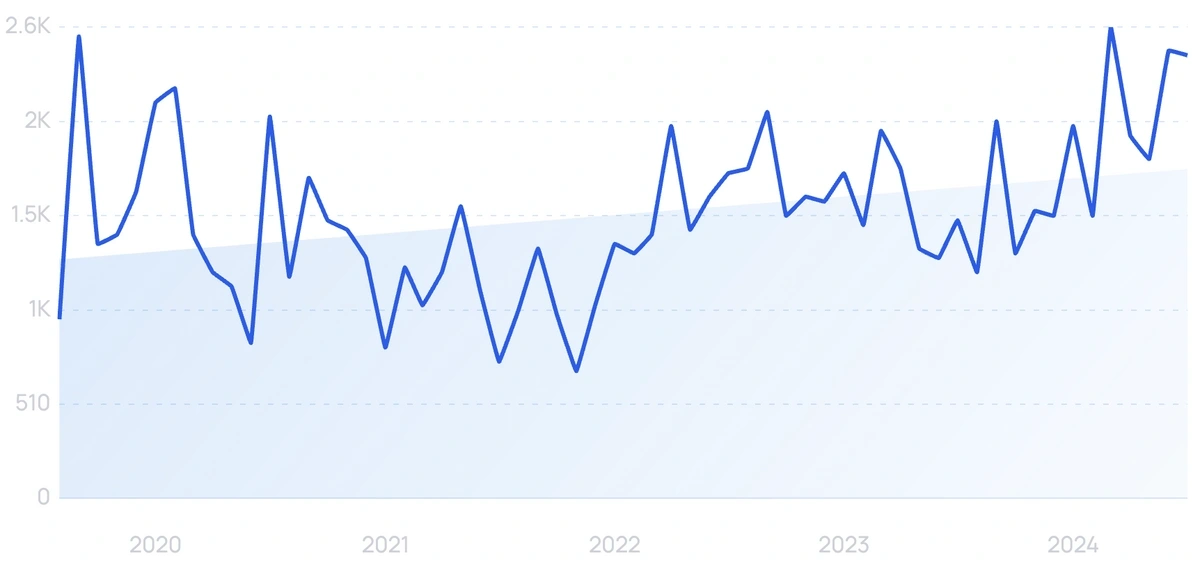

5-year search growth: 93%

Search growth status: Regular

Year founded: 2015

Location: Seoul, South Korea

Funding: $18.6M (Series B)

What they do: We Cook (previously “Simple Project”) offers shared kitchen spaces to restaurants in South Korea. They also provide the expertise needed to grow your F&B brand. It’s estimated that the startup is valued from $57.9M to $86.3M.

2. Kitopi

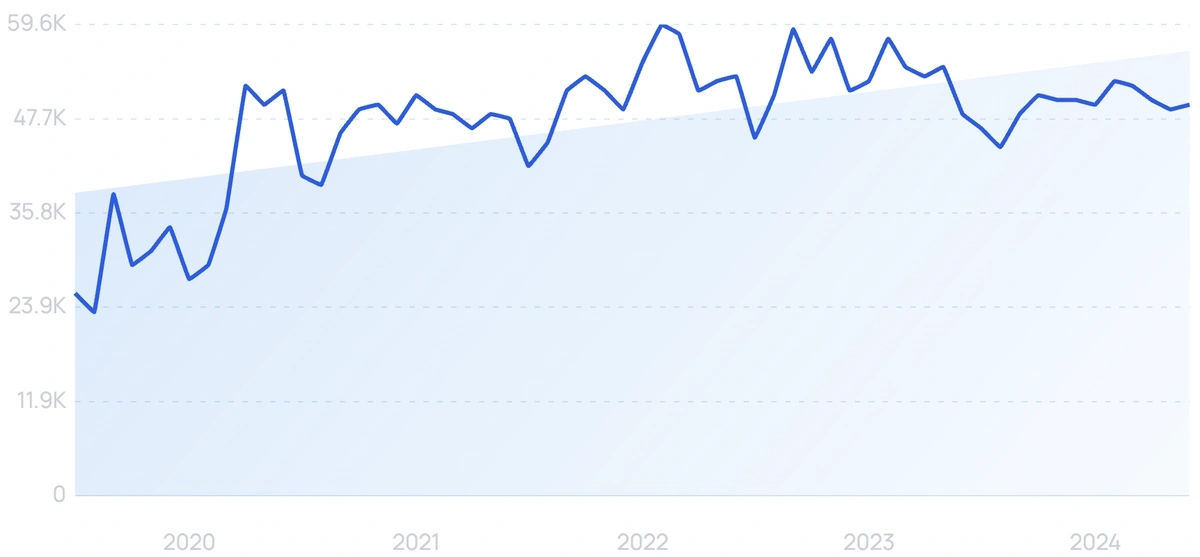

5-year search growth: 17%

Search growth status: Regular

Year founded: 2018

Location: Dubai, UAE

Funding: $804M (Series C)

What they do: A KaaS startup, Kitopi offers a managed cloud kitchen platform. Through a “smart kitchen operating system” (SKOS), they help restaurants scale by handling their operations. This involves prepping meals, packaging, and delivery. In addition, Kitopi also owns the customer experience for some of its partner brands. The startup has expanded to 6 countries and currently works with over 200 brands.

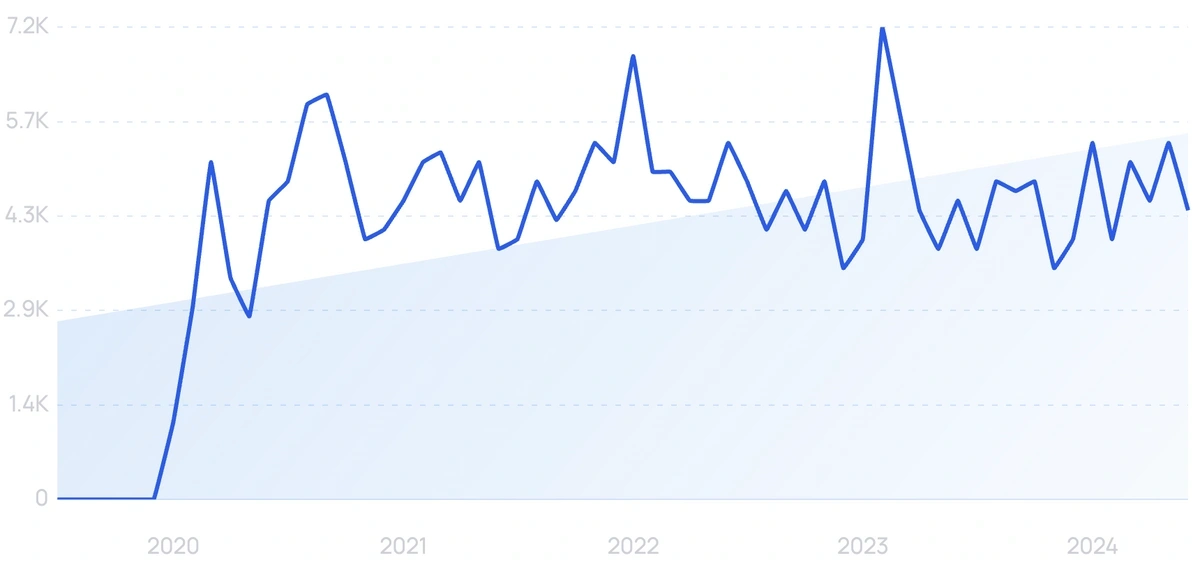

3. CloudKitchens

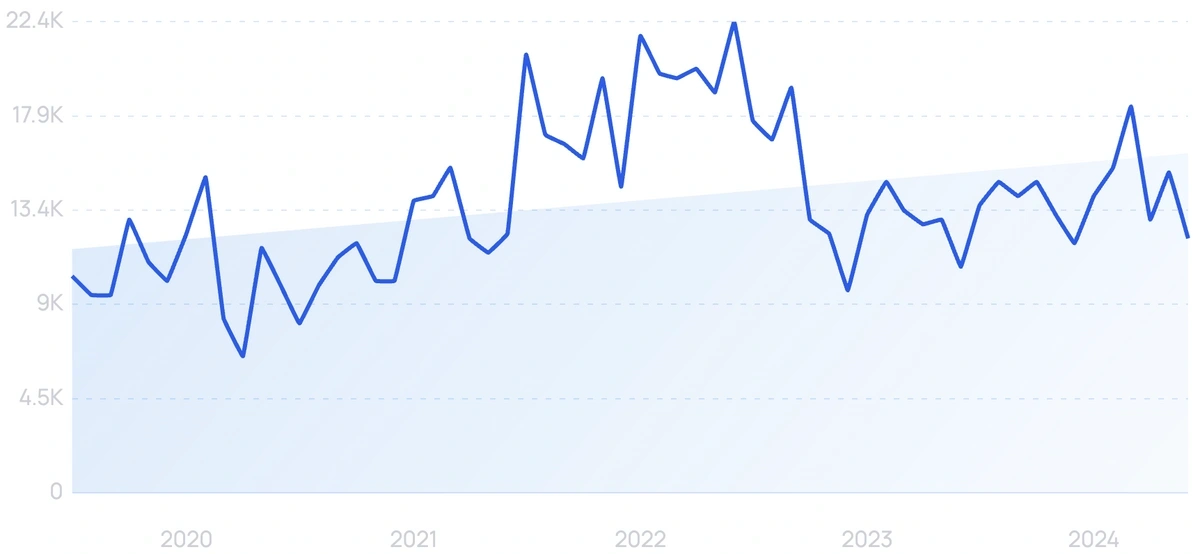

5-year search growth: 89%

Search growth status: Peaked

Year founded: 2016

Location: Los Angeles, CA

Funding: $1.3B (Series Unknown)

What they do: CloudKitchens is a real-estate company that specializes in providing commercial ghost kitchens to delivery-only restaurants. In addition to space, partner restaurants also get logistics (delivery) and facilities services. The startup also offers a delivery management system, designed to serve as a hub where restaurants can track their sales and deliveries. It’s estimated that CloudKitchens earns up to $5M in annual revenue.

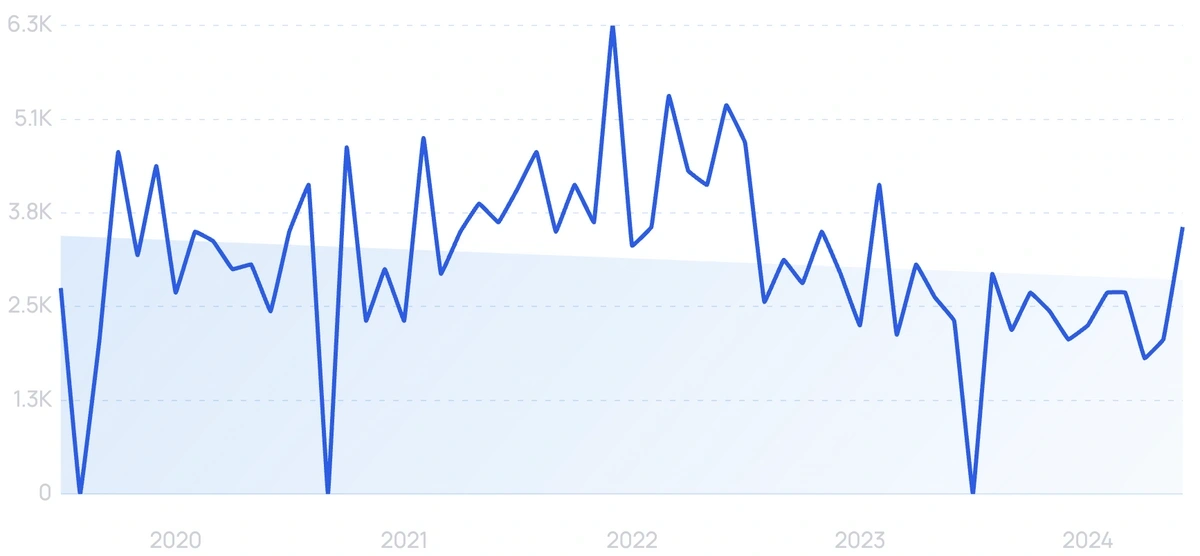

4. Swiggy

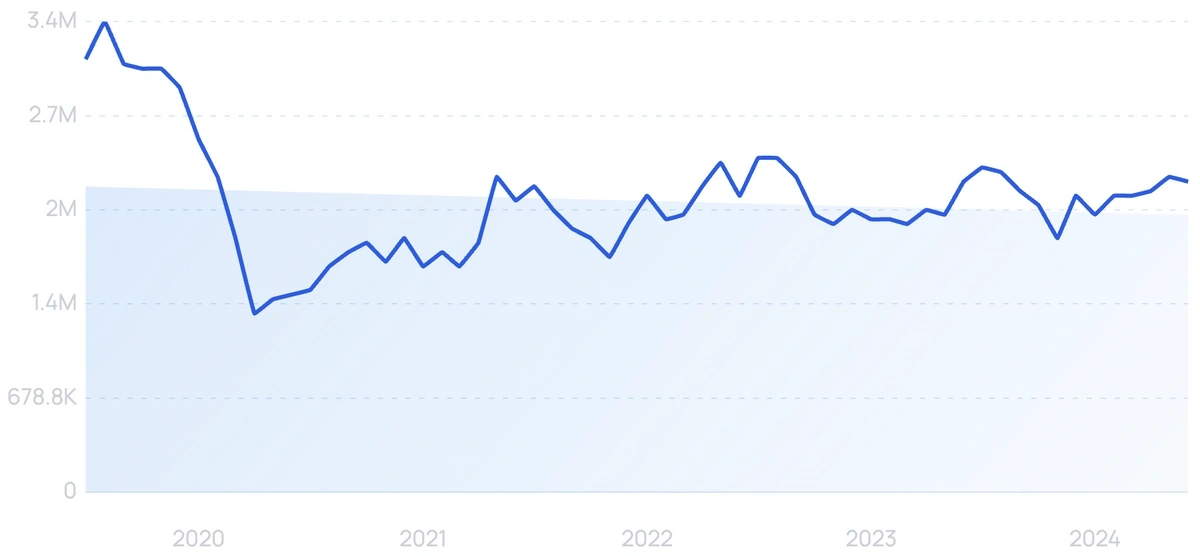

5-year search growth: -28%

Search growth status: Peaked

Year founded: 2014

Location: Bangalore, India

Funding: $3.6B (Series J)

What they do: Primarily a food delivery company in India, Swiggy joined the ghost kitchen market a few years ago with the launch of “Swiggy Access.” It’s a separate service that offers cloud kitchens to brands, with the goal of helping them expand their customer base. So far, over 1,000 brands have been launched through Swiggy Access.

5. Tovala

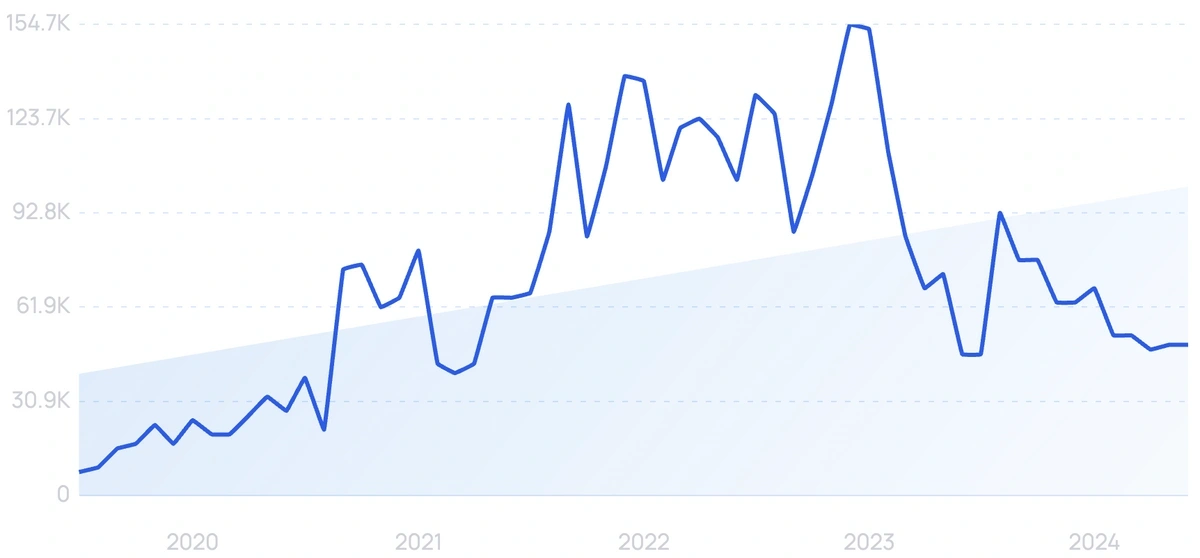

5-year search growth: 540%

Search growth status: Peaked

Year founded: 2015

Location: Chicago, IL

Funding: $68.6M (Series C)

What they do: Tovala is a meal delivery service that offers a unique combination of smart technology and gourmet food. Customers receive a countertop smart oven and can use it to cook healthy, chef-curated meals in minutes. The meals are pre-prepped and sent directly to the customer, allowing for a quick and easy dinner option without sacrificing quality.

6. Foodology

5-year search growth: 850%

Search growth status: Exploding

Year founded: 2019

Location: Bogotá, Colombia

Funding: $86.5M (Series Unknown)

What they do: Foodology is a digital restaurant and cloud kitchen company that develops and scales food brands. Using geographical data, Foodology what consumers like in an area and creates new ghost kitchen brands with original dishes and delivery services. Today, the startup operates more than 85 ghost kitchens and has processed over 2 million orders.

7. Olga Ri

Search growth status: Regular

Year founded: 2016

Location: Sao Paulo, Brazil

Funding: $6.2M (Series A)

What they do: Olga Ri is a Brazilian ghost kitchen startup that produces and sells plant-based meat alternatives. Their products are made with natural and healthy ingredients, and they aim to provide a sustainable and ethical solution to the meat industry. Olga Ri offers a variety of plant-based products, including burgers, sausages, meatballs, and more.

8. Karma Kitchen

5-year search growth: 8%

Search growth status: Regular

Year founded: 2018

Location: London, UK

Funding: $448M (Series A)

What they do: Karma Kitchen transforms commercial spaces into kitchens and storage facilities for food and beverage companies. They offer both shared and private kitchens, along with space for anchor production. Their ghost kitchens come equipped with essential equipment and services designed for smooth day-to-day operations. The company recently raised £352M (about $448M) in series A funding, led by Vengrove Asset Management and Omakase Investment Club.

9. Sweetheart Kitchen

5-year search growth: 30%

Search growth status: Peaked

Year founded: 2019

Location: Dubai, UAE

Funding: $39.5M (Series C)

What they do: A network of delivery-only restaurants, Sweetheart Kitchen (bySWHK) creates its own virtual restaurant brands. The company currently operates 20 bySWHK brands, all of which run under the same facility. Unlike most traditional ghost kitchen companies, Sweetheart Kitchen doesn’t partner with external restaurants.

10. Ordermark

5-year search growth: 65%

Search growth status: Regular

Year founded: 2016

Location: Los Angeles, CA

Funding: $151M (Series C)

What they do: Ordermark is a California-based technology startup that offers solutions to restaurants. One of those solutions is Nextbite - a platform that curates and helps create turnkey delivery-only virtual restaurants. Nextbite has helped develop 15 brands, including celebrity brands by Wiz Khalifa and George Lopez.

11. RobinFood

5-year search growth: 133%

Search growth status: Peaked

Year founded: 2018

Location: Bogotá, Colombia

Funding: $90.3M (Series Unknown)

What they do: A cloud restaurant company, RobinFood (or MUY) provides technology solutions and shared kitchen spaces to virtual restaurants. The company’s goal is to reduce waste by making food more affordable and accessible. In Latam, Brasil alone, RobinFood has over 80 cloud restaurants. Furthermore, they have 500,000+ clients.

12. Curb Food

5-year search growth: 40%

Search growth status: Peaked

Year founded: 2020

Location: Stockholm, Sweden

Funding: $25.5M (Series A)

What they do: Curb Food offers a delivery-first, virtual food court. They provide curated dark kitchens to their customers based on their preferences. The startup recently secured €23.2M (about $25.2M) in a funding round led by Point72 Ventures.

13. Yummy Corp

5-year search growth: 147%

Search growth status: Exploding

Year founded: 2019

Location: Tangerang, Indonesia

Funding: $19.8M (Series B)

What they do: Yummy Corp is a food solutions provider for restaurants, including facility management, catering, and a managed cloud kitchen platform. They provide shared spaces to F&B businesses through Yummykitchen, which is their business arm for ghost kitchens. In addition to day-to-day operations (meal prep, packaging, etc.), they can even help hire employees. So far, they’ve opened their cloud kitchens in over 55 locations across Indonesia.

14. WeBox (Formerly Saltalk)

5-year search growth: 57%

Search growth status: Regular

Year founded: 2018

Location: Santa Clara, CA

Funding: $11M (Series A)

What they do: Focused on authentic Asian food, WeBox delivers curated brands and cuisines to their customers. All brands, including chefs and bakers, operate through the company’s commercial cloud kitchens. In 2023, Saltalk rebranded to WeBox to better represent what the company stood for and the services it offered.

15. The Food Lab

5-year search growth: 71%

Search growth status: Regular

Year founded: 2020

Location: Cairo, Egypt

Funding: $4.5M (Seed)

What they do: The Food Lab is a ghost kitchen startup that specializes in developing plant-based meat alternatives. They use food science to create products that look and taste like meat, but are made entirely from plant-based ingredients. The company's mission is to provide a sustainable and healthy food option that reduces the environmental impact of traditional meat production.

16. Bigspoon

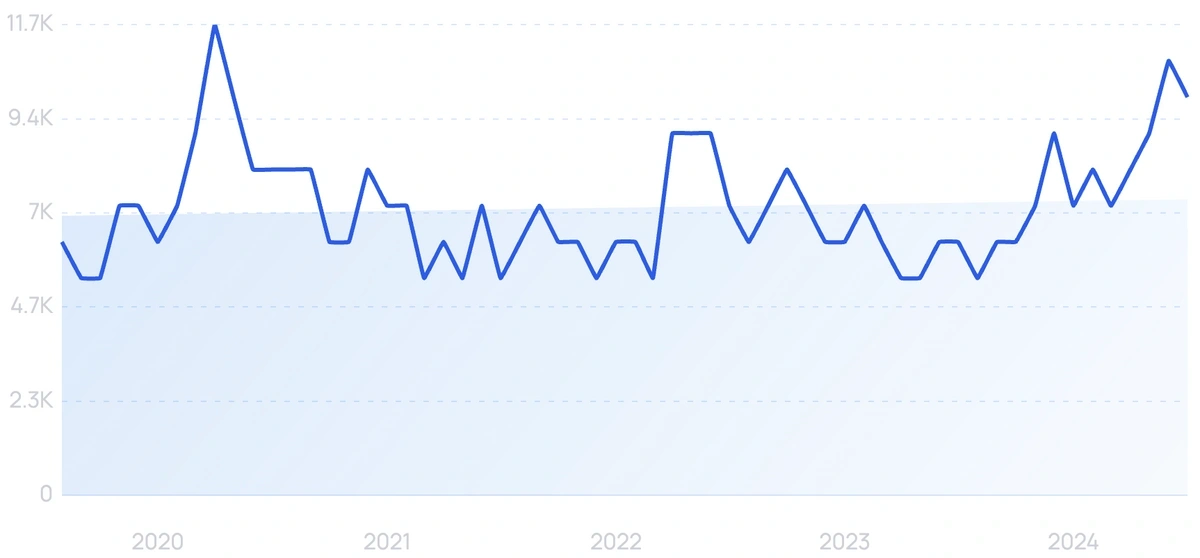

5-year search growth: 3,700%

Search growth status: Peaked

Year founded: 2019

Location: Ahmedabad, India

Funding: $16.8M (Series A)

What they do: Bigspoon is a multi-brand cloud kitchen that focuses on delivering food to tier 2 cities (those with populations ranging from 50k to 100k) in India. They also offer digital franchising opportunities to prospective partners. So far, the startup has launched 8 brands, all of which share the same kitchen, and delivers in 20 cities.

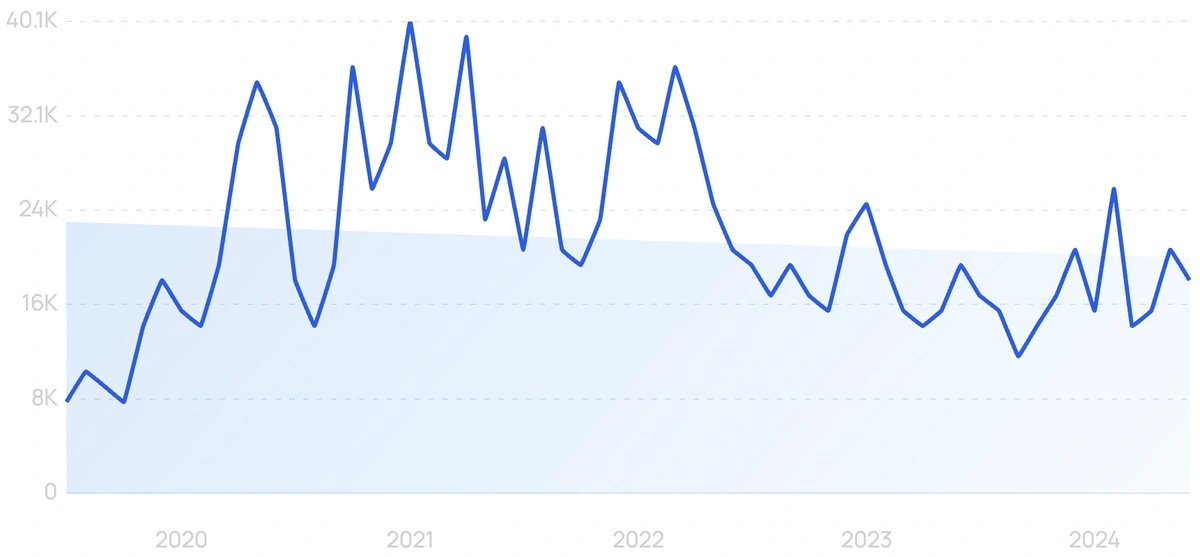

17. Rebel Foods

5-year search growth: 13%

Search growth status: Regular

Year founded: 2011

Location: Mumbai, India

Funding: $564.3M (Debt Financing)

What they do: Rebel Foods is a tech company that offers cloud kitchens to online restaurant brands. They provide entrepreneurs space, infrastructure, and technology needed to potentially launch their brands with minimal cost. Since their launch, they’ve expanded to 10 countries, created 450 shared kitchens, and onboarded over 4,000 brands.

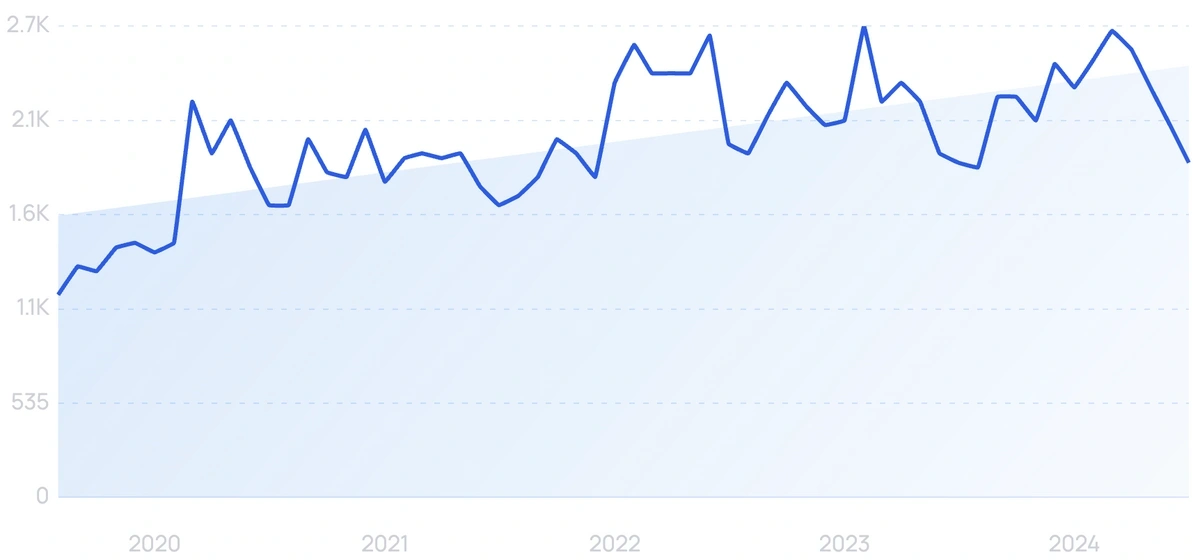

18. Petpooja

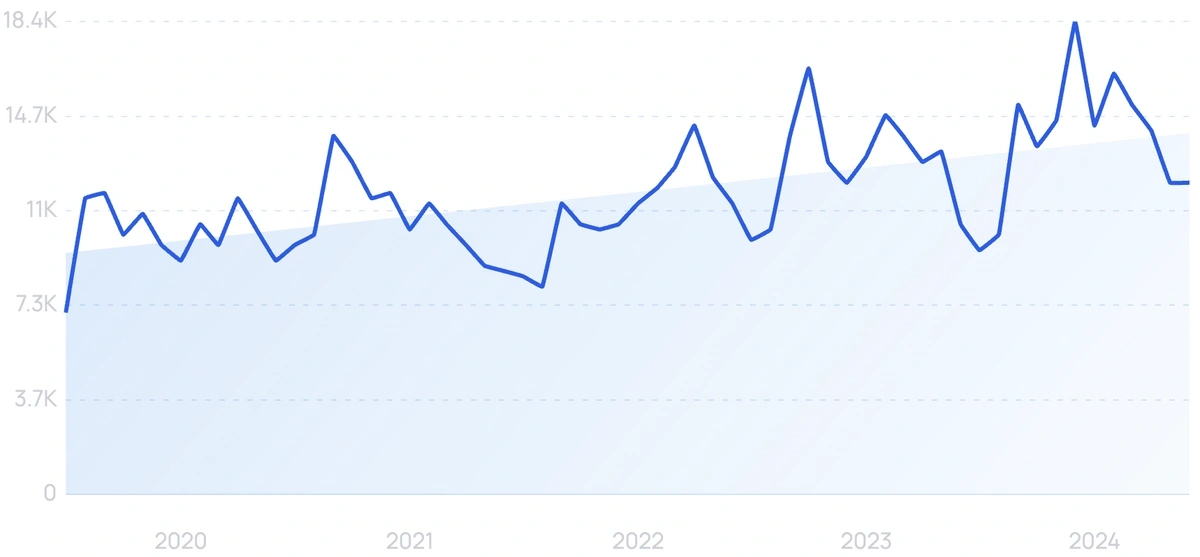

5-year search growth: 2,400%

Search growth status: Exploding

Year founded: 2011

Location: Ahmedabad, India

Funding: $8.9M (Series B)

What they do: While not a standard cloud kitchen, Petpooja offers a POS software and management system for restaurants and cloud kitchens. The platform allows users to track inventory, manage online orders, access advanced report and analytics, and more. Today, the company supports more than 75,000 customers around the world.

19. Kitchen Ventures

5-year search growth: -7%

Search growth status: Regular

Year founded: 2020

Location: London, UK

Funding: $2M (Seed)

What they do: Kitchen Ventures is a cloud kitchen provider that connects customers with multiple delivery-only F&B brands in London. The startup currently has two operational kitchens in East and West London. Furthermore, they’ve onboarded 6 brands so far.

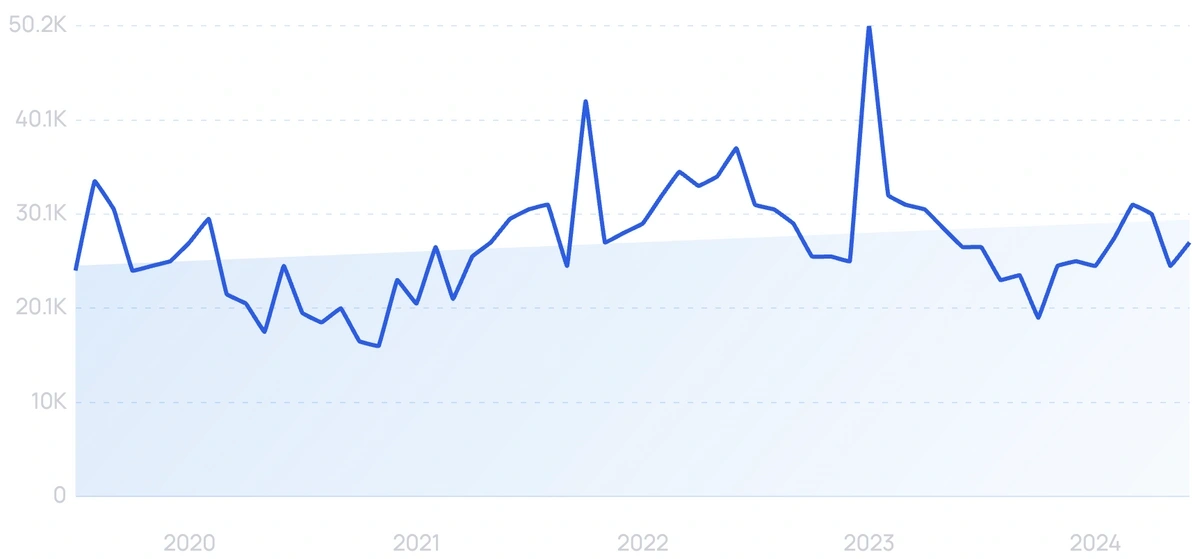

20. Hangry

5-year search growth: 104%

Search growth status: Exploding

Year founded: 2019

Location: Jakarta, Indonesia

Funding: $37M (Debt Financing)

What they do: A multi-brand restaurant, Hangry combines the menus of various restaurants into one. From fried chicken to coffee, the restaurant delivers a wide range of products. Since its launch, Hangry has expanded to 40+ locations across Indonesia.

Conclusion

And that concludes our list of the best ghost kitchen companies to keep an eye on in 2024.

These ventures are transforming the way restaurants operate, utilize their resources, and reach new customers. In that sense, not only are they beneficial from an economic perspective, but also from a sustainability point of view.

As the demand for virtual kitchens continues to grow, we can expect more startups to launch in the years to come.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more