Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

5 Huge Snacking Trends (2024)

You may also like:

Snacking has gone from a relatively mainstream habit into a multibillion-dollar industry.

In fact, Cheetos alone sells more than $1 billion in products per year.

The space is growing quickly thanks to changing consumer preferences, dietary restrictions, and more.

Read on for our list of snacking trends that anyone in the food and beverage industry should know about.

1. Snacks as meals

Busy lifestyles and decreased access to dine-in restaurant options have led to more people replacing meals with snacks.

About 70% of millennials surveyed in 2021 said they prefer snacks to meals. Just over 90% of Americans surveyed said they have replaced at least one meal weekly with a snack, with 7% saying they eat no formal meals.

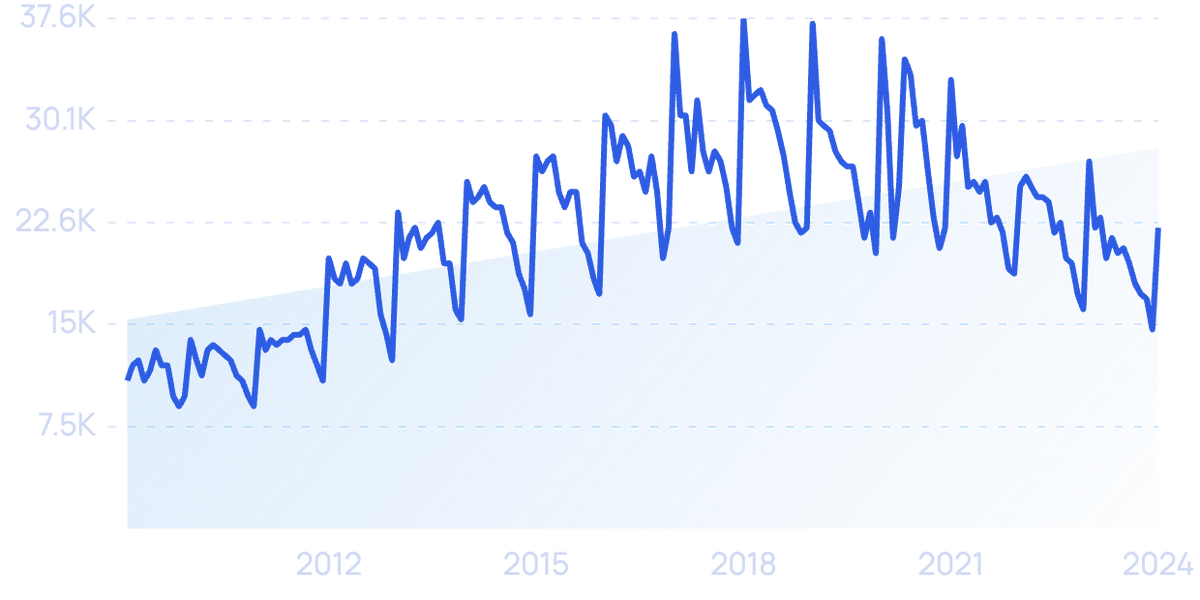

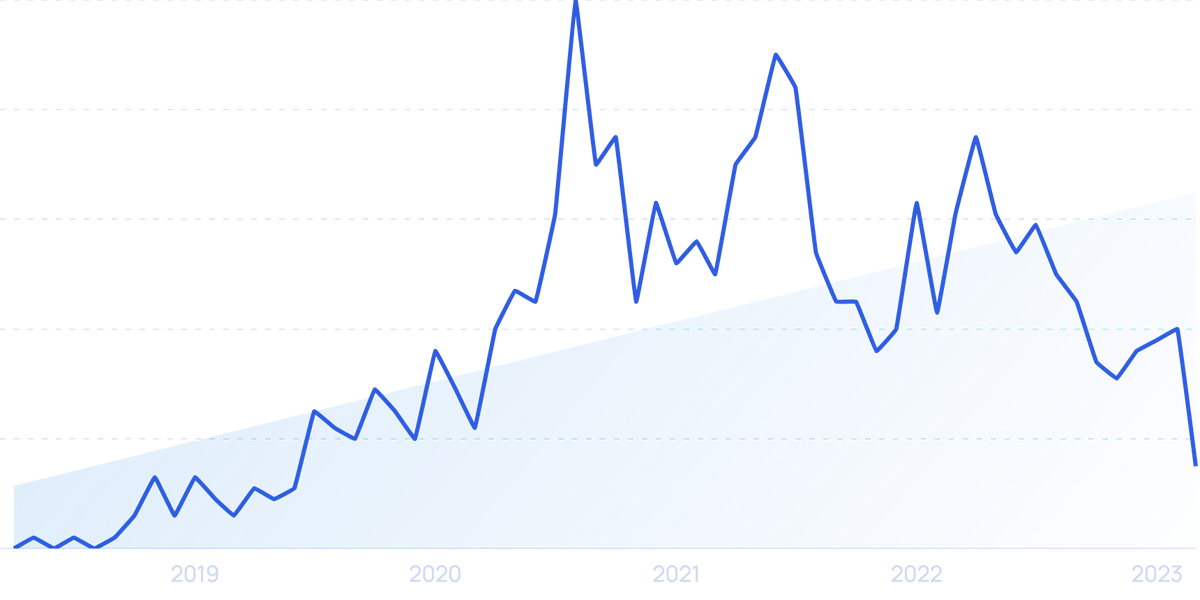

Searches for "meal replacement" are up over a 15-year span.

Manufacturers have responded. The meal replacement products market is forecast to grow at a CAGR of up to 8.26% from 2023 to 2028, with the most growth in the Asia-Pacific market.

With snacks taking on such an important nutritional and satiety role, 51% of respondents in a global poll said they’ve switched to high-protein treats.

Over half of surveyed consumers state that they prefer snacks with high protein content.

Nuts, trail mixes, and seeds (41% market share) are leading the global health and wellness snack market, followed by protein bars (20%).

About one-third of snack bars launched in 2020 claimed to be high-protein, and new this year include Switch Nutrition’s Snack Switch protein bar (also plant-based) and The Bountiful Company’s Pure Protein bars, which are chilled and boast clean labeling.

And other treats are jumping (or staying) on the protein train:

- Tribe Nature Bombs: These bite-sized nut butter treats are plant-based and low sugar, in flavors like Vegan Honeycomb and Cashew Butter.

- Icon Meals Protein Popcorn: A twist on the movie classic, with 10g of protein per serving and flavors like Cereal Milk and Orange Creamsicle.

- Huel Black Edition: Huel already made meal replacement shakes and powders, but the black edition has more protein and half the carbs of the company’s previous product.

- Peckish Snackable Eggs: Refrigerated, free-range boiled eggs in flavors like Everything Bagel and Rancheros.

Meat and cheese treats also check the meal replacement box, with meal snacks expected to grow at a 9.16% CAGR through 2027. Sausage is the rising star of the category, especially in European and Asian markets.

Trending snacks in the meat category include:

- Krave Jerky: Available in flavors like Chili Lime and plant-based Korean BBQ.

- Biltong: Sold by companies like Kalahari Snacks and Stryve (among Men’s Health’s 50 Best Foods for Men in 2021), this South African dried meat snack is the international answer to traditional beef jerky.

Searches for "Biltong", a South African-inspired dried meat, have increased by 27% over the last 5 years.

- Sausage snacks: San Francisco-based 4505 Meats is among the players, launching new Butcher’s Snack sausage links in July. Each stick contains 24g of protein and is keto-friendly and gluten-free.

2. Snacks become “mood food”

Snack foods are increasingly seen as tools that can assist with mood enhancement and regulation.

New snacks claim to promote calm, sleep, focus, and energy through ingredients like vitamins, nootropics, mushrooms, and adaptogens.

Example of snack food that promotes its ability to improve mood.

In 2020, sales of mood support, stress management, and sleep supplements rose by 36%. And 55% of those surveyed said they were likely to turn to food or drink for those same ingredients.

As with everything from hygiene products to pet food, CBD is a big player in this trend, with the global CBD snack market forecast to grow at a 10.1% CAGR through 2028, reaching $2.6 billion.

Options range from Evo Hemp Protein Bars to Groovy Butter’s CBD nut butter.

Major players like Nestle and Molson Coors are also getting into the CBD game, with products like Molson Coors and HEXO Corp’s VeryVell drinks, which are CBD-infused and non-alcoholic.

The CBD-infused drink market alone is forecast to grow from $3.4 million in 2020 to $14.6 million in 2026, a 27.5% CAGR.

“Decluttering” and memory ingredients are also on the rise. Nootropics, sometimes called smart drugs, are ingredients said to boost mental function and performance. Globally, the nootropics market is forecast to reach $29.24 billion by 2029, a CAGR of 15%.

Among nootropic snacks are drinks and drink mixes like Brain Juice and Mental Mojo.

3. Consumers demand global flavors

The global ethnic food market is expected to grow at a CAGR of 8.33% through 2028.

And with 78% of Americans ranking travel as one of the things they miss most during the pandemic, global snack subscription boxes can give a taste of other countries.

Snackcrate rides this trend by offering a variety of snacks from around the world. Each month focuses on a different national theme.

The startup grew from sending out 200 boxes to Redditors in 2015 to a business with 60K subscribers 4 years later.

SnackSurprise works on much the same premise. Founded in 2019, the UK company has curated collections from the likes of Spain, Denmark, and South Korea.

"Snack box" searches are up 55% over 5 years.

The startup uses an influencer marketing strategy. Which has helped produce 3.6 million views on the #SnackSurprise TikTok hashtag. In a SocialPubli study, marketers ranked food as the industry with the second-most potential for influencer growth (behind only beauty).

Universal Yums also offers snacks from different nations each month. Like SnackSurprise, the brand is big on social media. Videos featuring its hashtag on TikTok have amassed over 10 million views.

The business has rapidly grown to a 40-employee company, turning over $20 million each year.

Bokksu focuses on a specific country — Japan. There is a US fascination with Japanese culture: a video of organizing consultant Marie Kondo folding clothes has amassed more than 13 million views on YouTube. While anime site Crunchyroll has more than 3 million paying subscribers.

The monthly box of Japan-themed snacks taps into this. Bokksu has more than 20,000 subscribed customers.

Annual revenue is $4.8 million — up from $300K in 2017.

"Bokksu" has seen strong search growth (307%) over the past 5 years.

Tanoshi Me Box is another subscription box that brings Japanese flavors to a global market.

SeoulBox is looking to do something similar for Korean snack food.

Revenue is a modest $48.6K per year, but the brand is steadily building a following. It has 54.6K Instagram followers.

Other country-specific snack boxes include Gusto di Roma (Italy), MexiCrate (Mexico), and IndiFix (India).

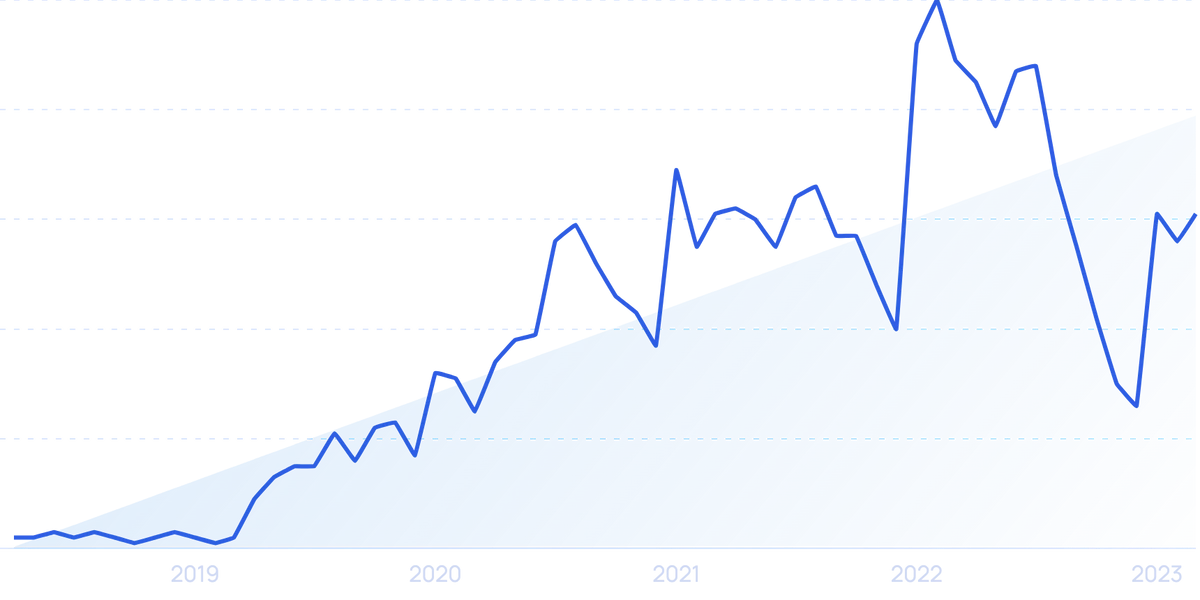

4. Plant-based snacks continue to see growth

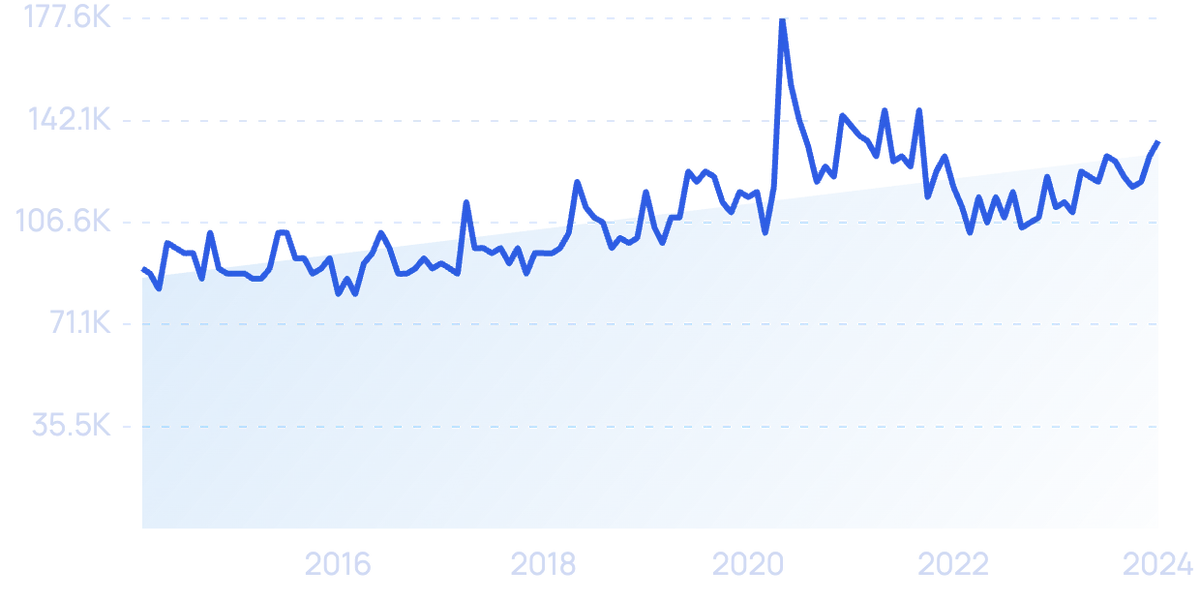

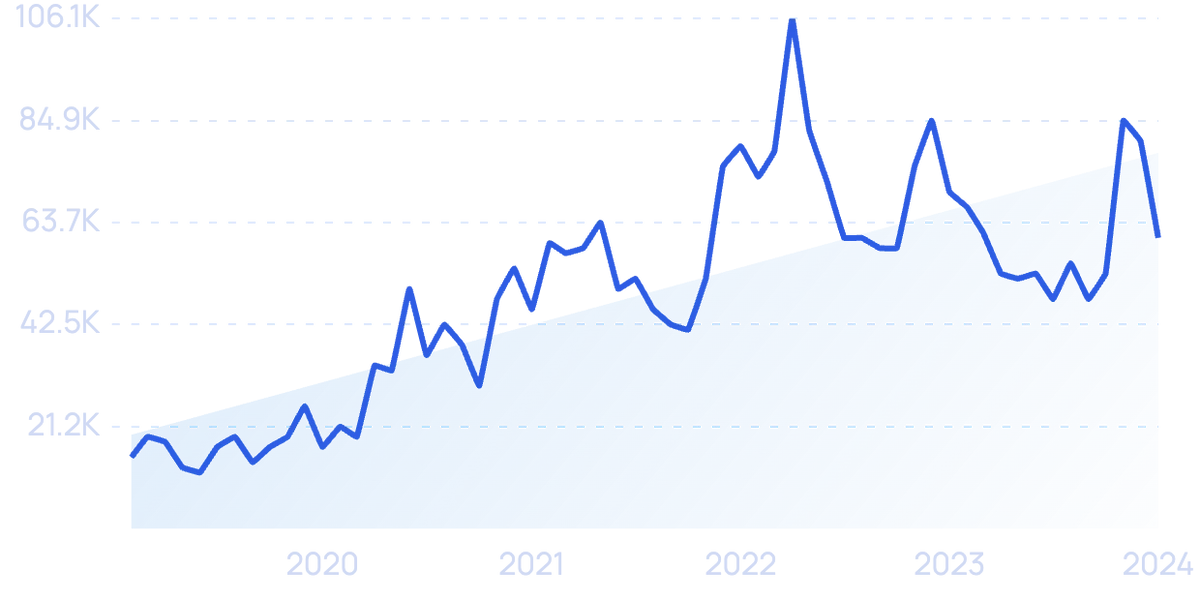

Searches for “plant-based diet” have increased 138% over 5 years.

“Plant-based” is a term slapped on a growing number of snack products.

And for good reason: consumers are increasingly looking for meals and snacks that use primarily plant ingredients.

Why the sudden interest in plant-based snack options?

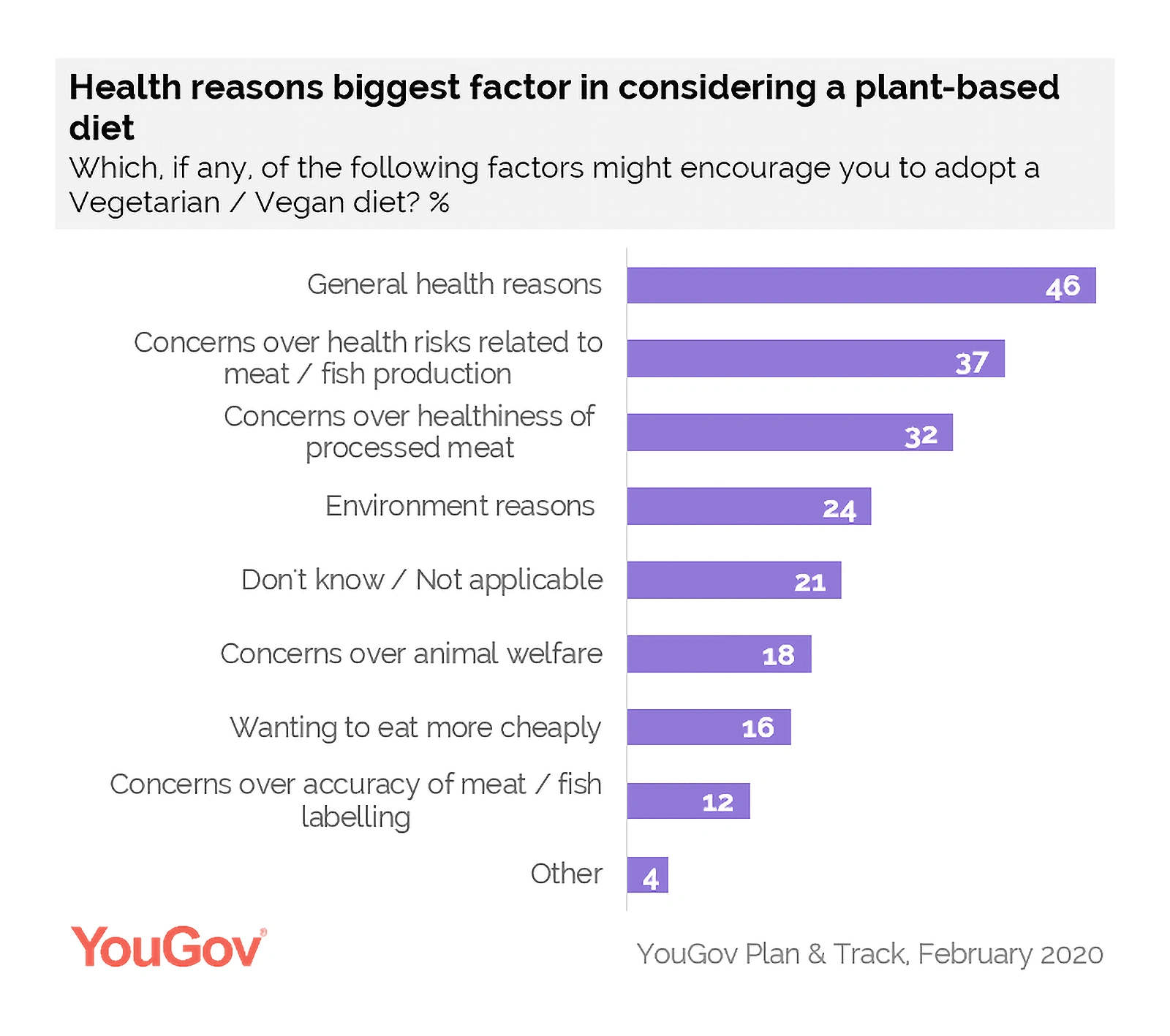

Mainly health concerns. In fact, nearly half of consumers state that they choose plant-based foods due to “general health reasons”. While 24% report wanting to limit their environmental impact.

A recent survey found that consumers choose plant-based options in an effort to improve their overall health.

5. Snacks go DTC

Many consumers say they’re now purchasing food from direct-to-consumer vendors.

A growing number of DTC-first snack brands are reaping the benefits of this trend.

IWON Organics is one example of a fast-growing startup in this space.

The company, which uses only organic peas, rice, and navy beans to make high-protein snacks, has raised about $850,000 since 2020.

IWON began in the sports nutrition field. But has expanded to the consumer market and saw an online business boom during the pandemic after a partnership with DTC giant Thrive Market.

IWON Organics also earned recognition in 2020 as one of Whole Foods’ Suppliers of the Year for “resilience, creativity and commitment to quality.”

In January 2021, Outstanding Foods raised $10 million for its plant-based but meaty-sounding snacks like PigOut Pigless Pork Rinds and TakeOut Meal-In-A-Bag Puffs.

The products are available in a growing number of retail stores, but most of the company’s sales are DTC.

The company’s cofounder Dave Anderson also helped develop meatless beef products for the vegan unicorn company Beyond Meat.

Snacklins, a New Jersey-based company offering vegan pork rinds and crisps, raised $250,000 from Mark Cuban of “Shark Tank” in 2019. In 2020, the company’s annual revenue was $1.8 million.

The company has doubled down on its branding and website during the pandemic. It is also among nine companies chosen for the inaugural 2021 Snack Futures Colab startup accelerator, earning it $20,000 and mentorship from Mondelez International.

New York-based SnackMagic was a direct result of the pandemic.

The company launched in 2020 and jumped immediately onto the virtual meetings wave, offering bundles and swag for attendees who weren’t able to meet in person. Hosts can choose from pre-curated packages or let each participant choose their own snacks from the site.

The company had $20 million in revenue in the first eight months of the pandemic and raised $15 million in April 2021.

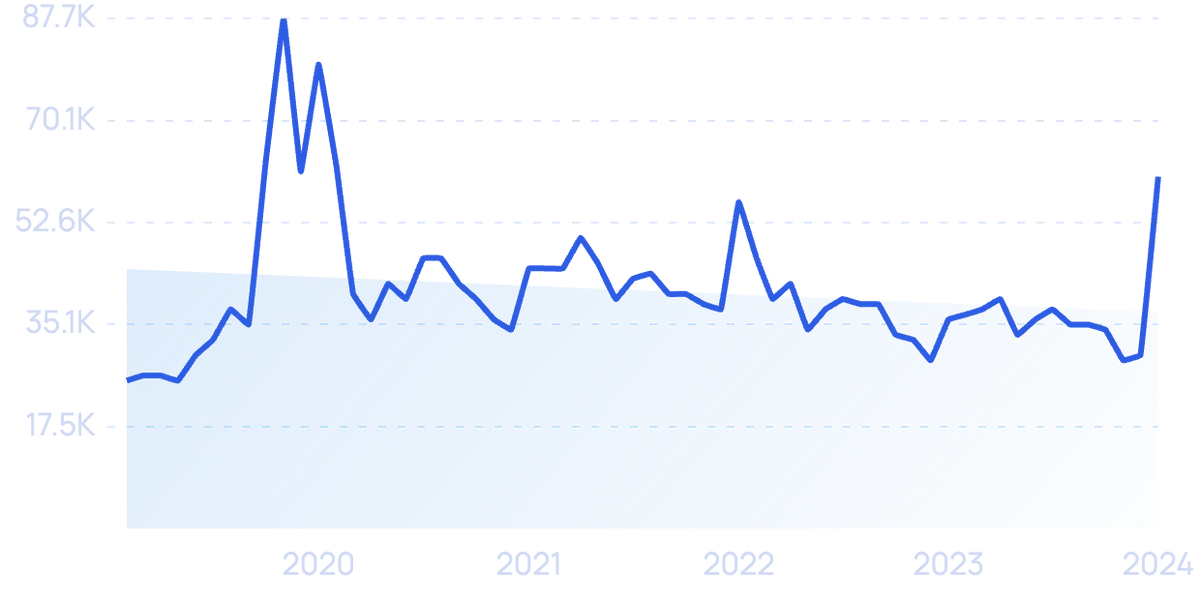

Magic Spoon, which offers childlike cereals for adults, has raised $120.8 million, of which $85 million came from a venture round in June 2022.

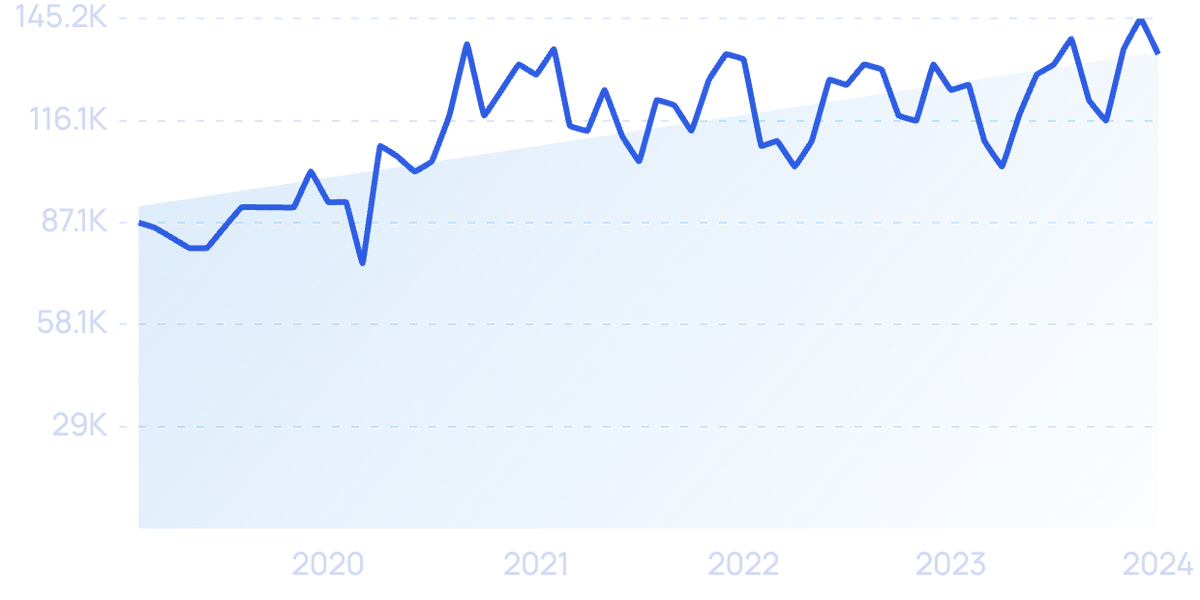

Searches for DTC cereal company Magic Spoon are up 2,200% in 5 years.

Magic Spoon’s offerings also tick several diet boxes: keto-friendly, gluten-free, and non-GMO.

Sales of Olipop, a plant-based and gluten-free healthy soda alternative, grew by about 900% in 2020.

And Flying Embers sells their “hard kombucha” largely DTC.

Searches for "Flying Embers" are up 233% over the last 5 years.

Conclusion

That wraps up our list of snacking trends set to shake up the food space this year.

From sustainability concerns to a focus on a plant-based diet, one factor that ties many of these trends together is a de-emphasis on taste. While taste remains important, modern snackers are putting more weight into environmental and health concerns.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more