Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

8 Key Healthcare Trends (2024-2027)

You may also like:

The US healthcare industry is worth an estimated $2.83 trillion.

In some ways, healthcare is a slow-moving industry. In many other ways, it's poised for disruption.

And in several cases, that disruption is already well underway.

In this guide, you'll see 8 of the biggest healthcare trends and opportunities to watch for in 2024 and beyond.

Along with examples of companies that are driving these trends forward.

1. AI Begins to Disrupt Healthcare

Artificial intelligence is already influencing dozens of different industries.

Healthcare is no exception.

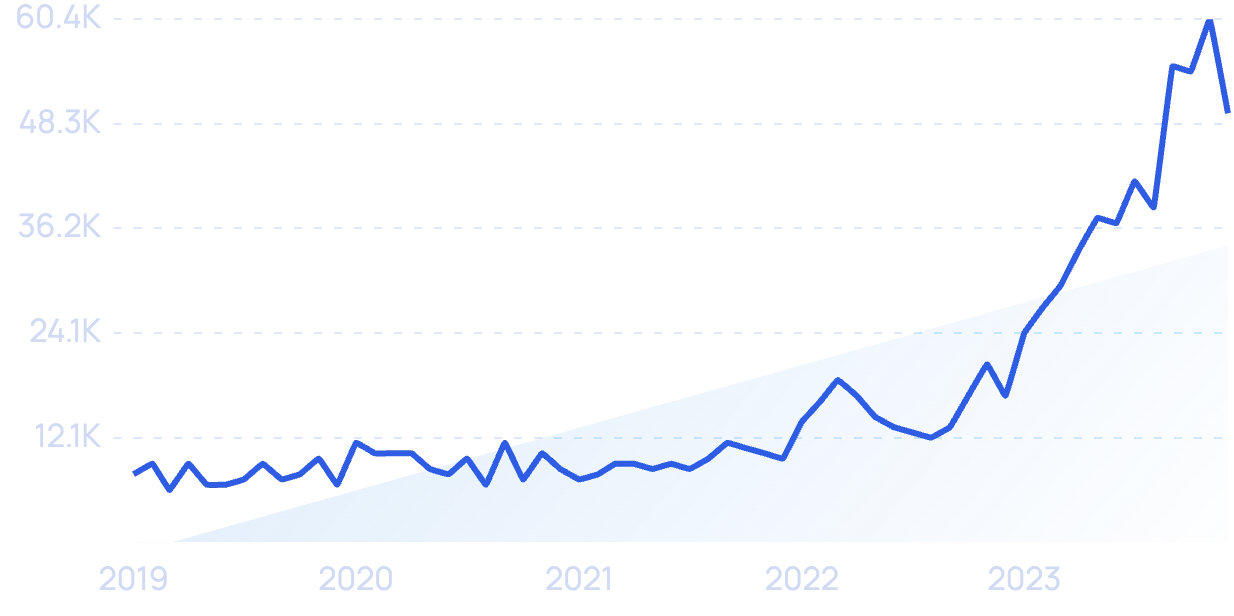

Searches for "AI and healthcare" are up 531% in the last 5 years.

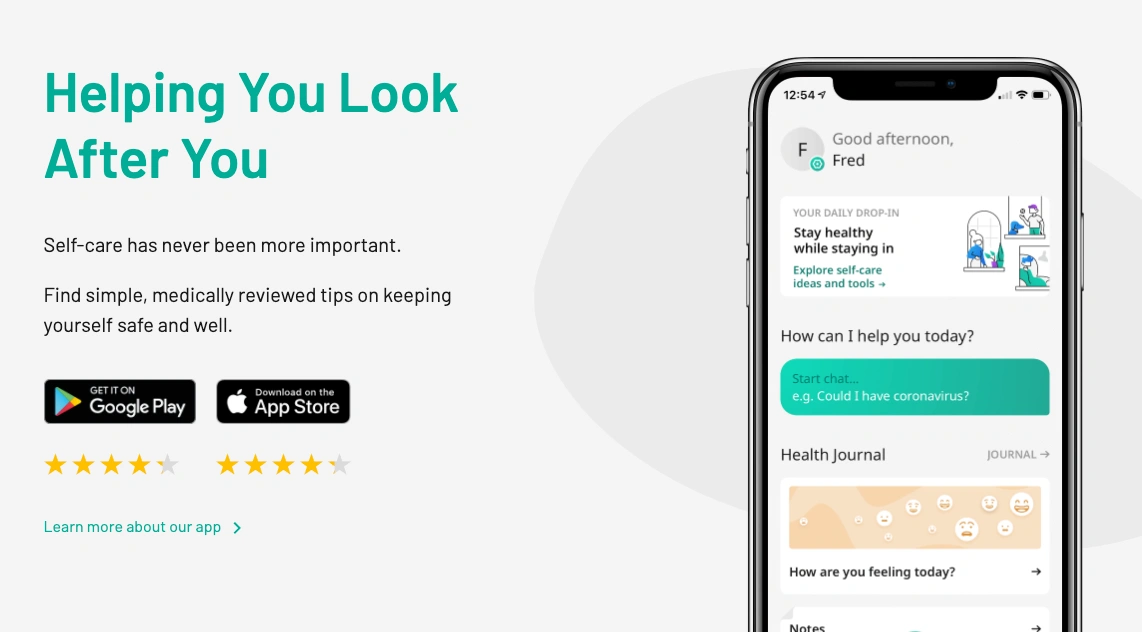

One example of this trend is Your.MD (also known as "Healthily").

The Your.MD mobile app uses AI to help people self-diagnose.

Founded in 2012, this medtech startup has secured $67.3 million in funding to date.

And $30 million of that came in a Series A round in October 2020.

Your.MD uses machine learning to display relevant health info in a mobile app.

This allows people to check their own symptoms.

Your.MD's user growth is up 350% between 2020 and 2021.

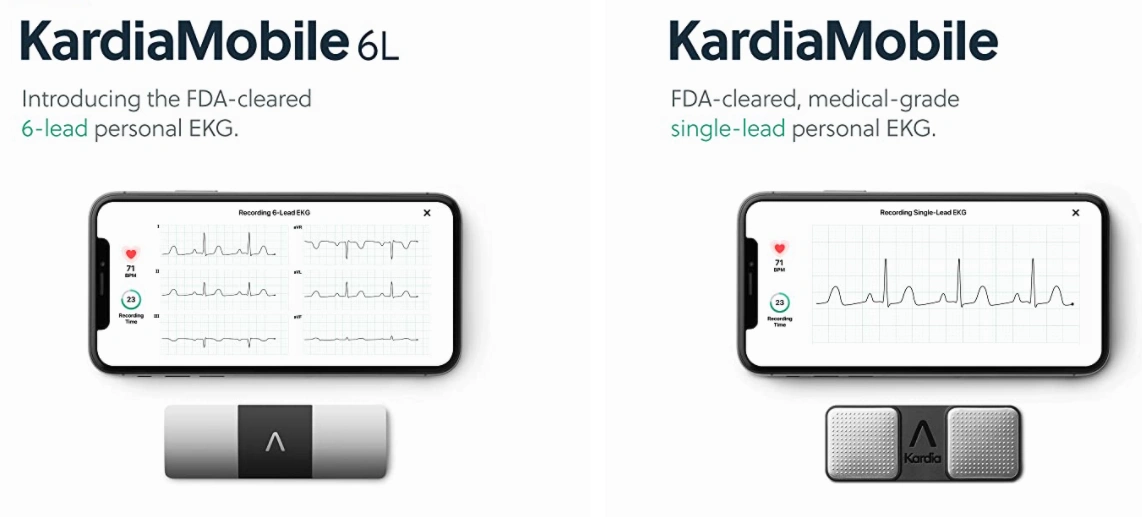

Another example of consumers using healthcare AI is Alivecor.

This company produces personal ECG devices that use artificial intelligence to detect and predict heart rhythm abnormalities.

AliveCor's KardiaMobile personal ECGs.

AI is also increasingly used by healthcare providers.

Often in the form of augmented intelligence.

According to the American Medical Association, "augmented intelligence" is the concept of using artificial intelligence for assistive purposes.

In other words: to enhance the intelligence of clinicians - not to replace it.

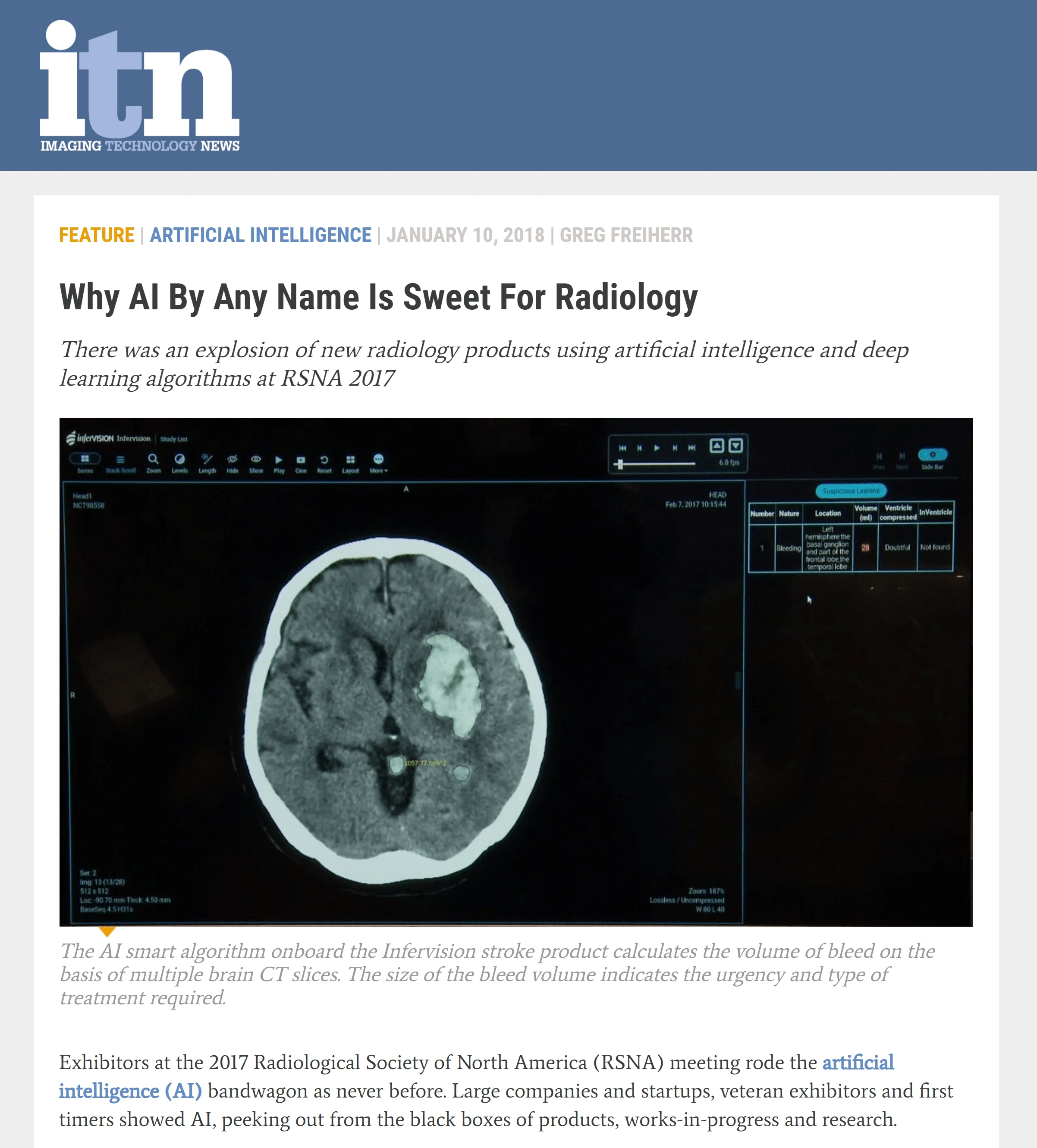

For example, Israeli startup Aidoc uses AI to help radiologists spot visual abnormalities in CT scans and other medical scans.

Example of AI being used in radiology.

The startup raised $27 million in Series B funding to grow its technology and go-to-market team, citing high demand for its solutions.

Overall, the global market for AI-enabled medical imaging solutions is projected to rise from $404 million in 2018 to $9.61 billion in 2029.

2. Healthcare Becomes More Personalized

Personalized healthcare (PHC) is all about customizing medical treatment for an individual patient's needs.

As Cleveland Clinic puts it, this includes "genetics and genomics but also includes any other biologic information that helps predict risk for disease or how a patient will respond to treatments”.

This allows for the use of precision medicine, which can both improve health outcomes and decrease costs.

Why is PHC such a fast-growing healthcare trend?

New, low-cost genetic testing products are one major reason.

23andMe used to sell their DNA testing kits for $999 each.

In 2012, the price dropped to $299.

And now, thanks to economies of scale and streamlined supply chains, anyone can buy one of their kits for under $100.

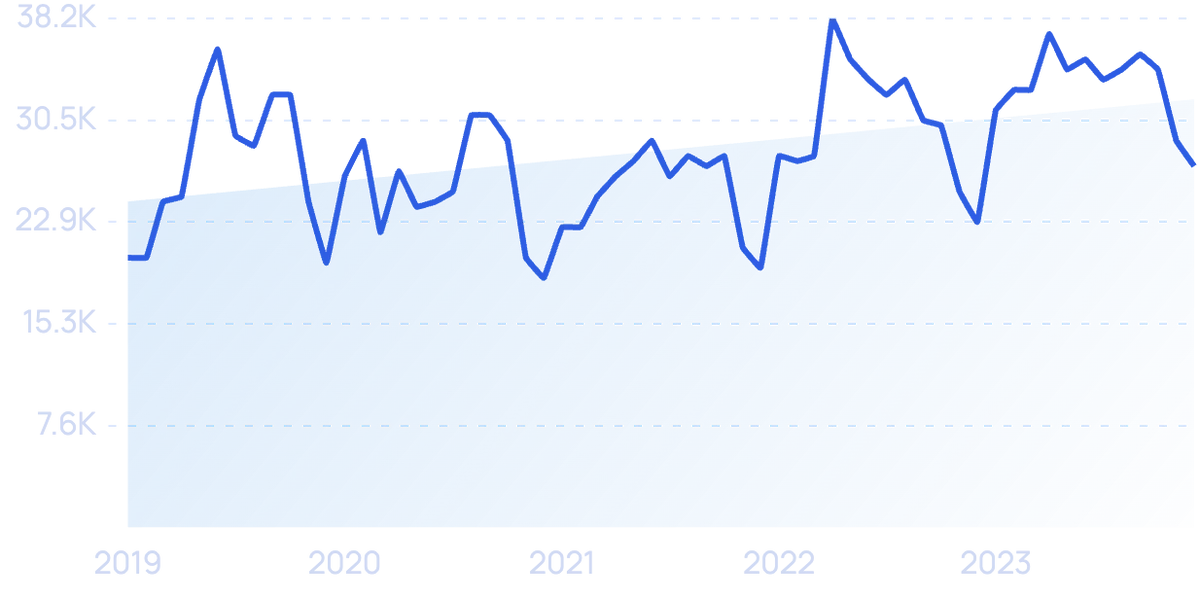

Search growth for "23andMe" has dipped since 2019. But searches are still relatively high.

In fact, there is now a wide variety of personal DNA kits on the market, some available on Amazon for under $60.

And while 23andMe has reported declining sales, it probably has more to do with such kits becoming a commodity than with any lack of interest in the product.

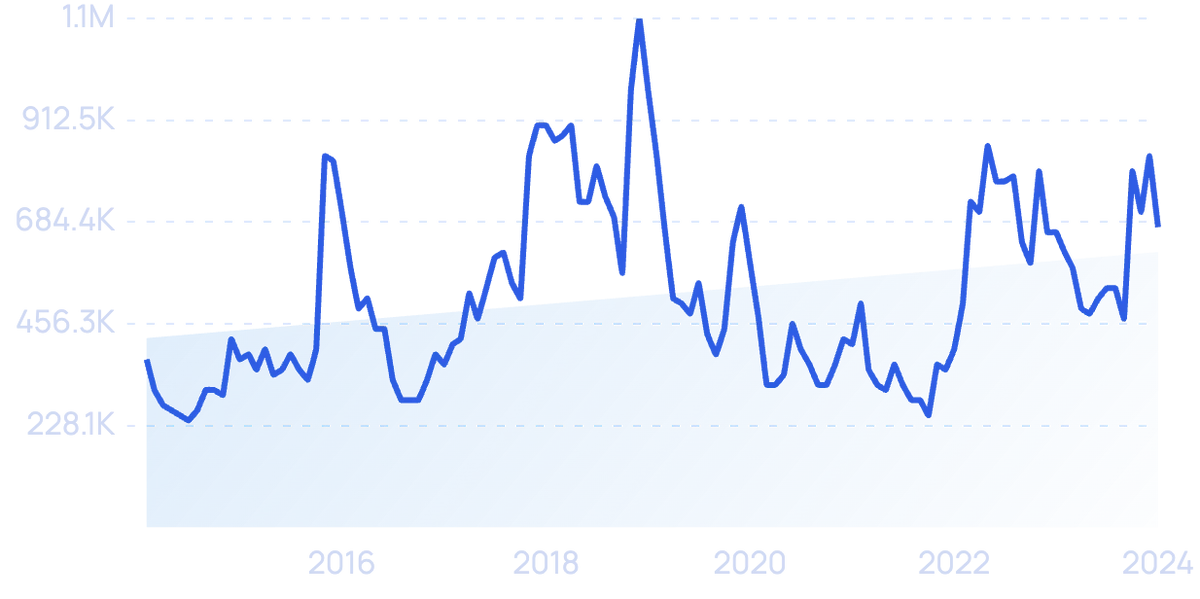

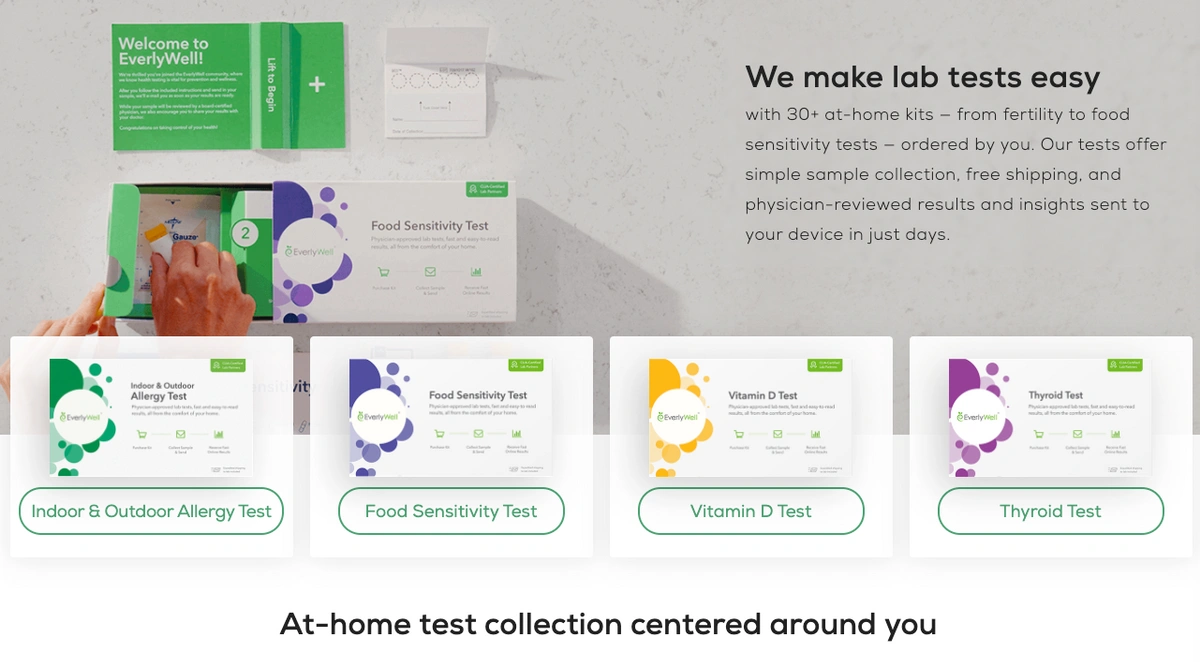

Beyond DNA, many other types of home testing kits are also now available.

Everlywell makes testing kits for ailments like hormone levels, allergies, food sensitivity, and vitamin deficiencies.

Everywell is growing quickly, with searches for the brand name more than doubling in the past two years.

A separate factor helping drive personalized healthcare forward is the number of wearable devices consumers use to monitor their health and habits.

This brings us to the next healthcare trend on our list.

3. Wearable Devices Go Mainstream

Wearable devices are increasingly overlapping with the medical field.

Oura, the maker of the popular Oura Ring wearable fitness tracker, collaborated with UCSF on a study to try to detect early signs of COVID-19 during the early days of the pandemic.

And Fitbit has undertaken a similar study of its own.

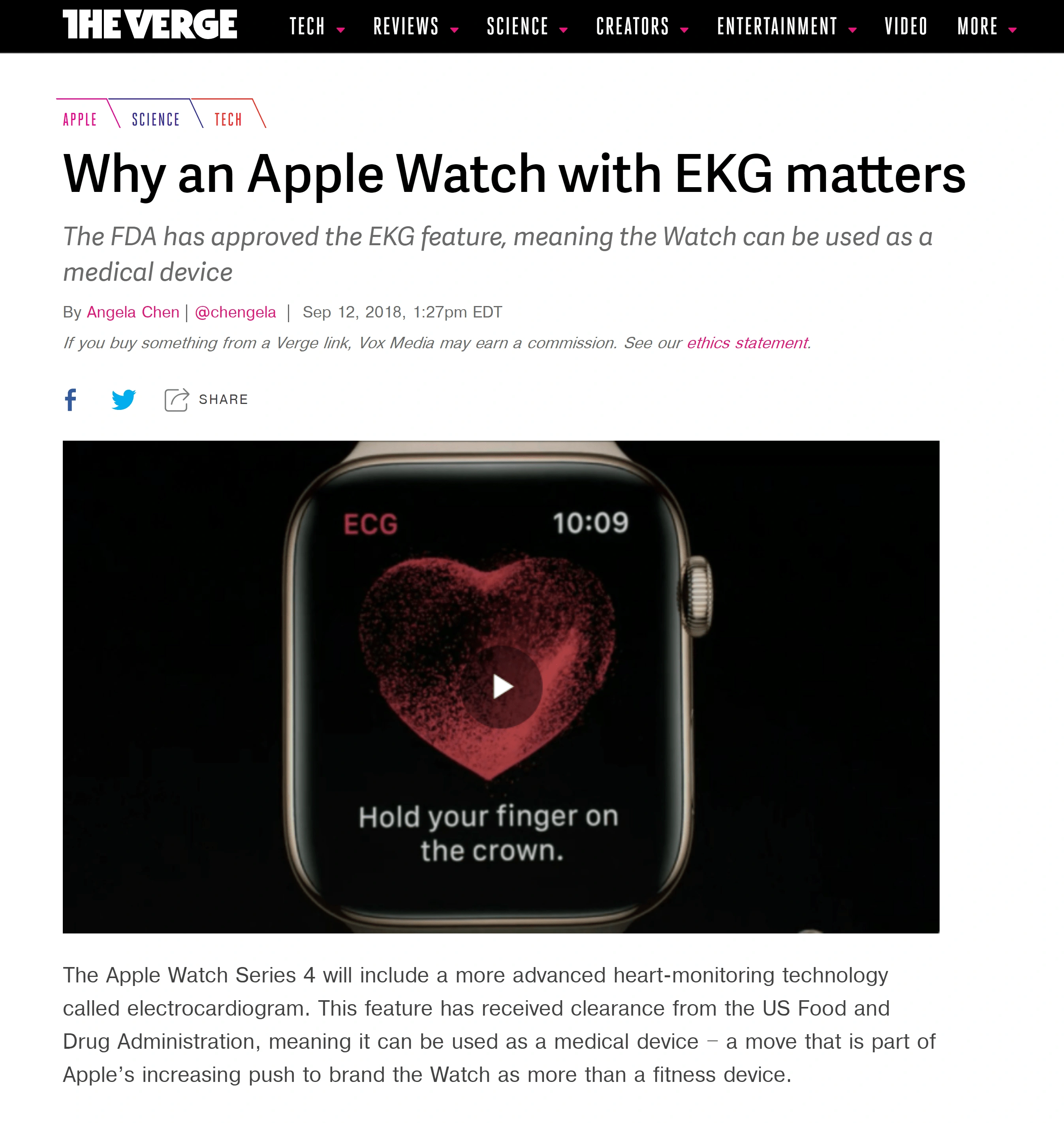

In 2018 the FDA approved the Apple Watch for use as a medical device.

Which allowed the product to be used and marketed for the purposes of running ECG tests and detecting atrial fibrillation.

The FDA considering the Apple Watch a medical device helped make consumer wearables legitimate healthcare monitoring tools.

With over 100 million active Apple Watch users, this also gave Apple access to incredible amounts of medical data.

Putting their scale to use, Apple partnered with Stanford University to run a study on irregular heart rhythms, related heart conditions, and the smartwatch's ability to detect them.

With over 400,000 participants, the study was the largest ever of its kind.

And last year, Apple announced it was partnering with Johnson & Johnson to run a new heart study using the Apple Watch (and iPhone) again.

This time, the study is focused on people over the age of 65.

Is Apple's entry into healthcare a temporary one?

Don't bet on it.

In 2019, Tim Cook said:

"I believe, if you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health."

In 2024, we're closer than ever to that reality.

The Apple Watch features heart rate monitoring.

In total, the Internet of Things (IoT) is estimated to save the US healthcare system tens of billions of dollars each year.

But not everyone is celebrating the achievements of Apple or other tech companies.

Many cardiologists have spoken out against what they are calling exaggerated claims on Apple's part.

Their chief concern: the widespread use of real-time monitoring may lead to unnecessary medical treatments.

There are also privacy concerns.

Few tech companies are known for keeping user information private.

In fact, The Washington Post reported that pregnancy-tracking app Ovia was selling its users' health data to their own employers.

While 23andMe shared genetic data from 5 million of its customers with drug maker GlaxoSmithKline.

With these concerns in mind, will people be reluctant to give Apple and other tech companies access to their health information?

So far, the answer seems to be "no".

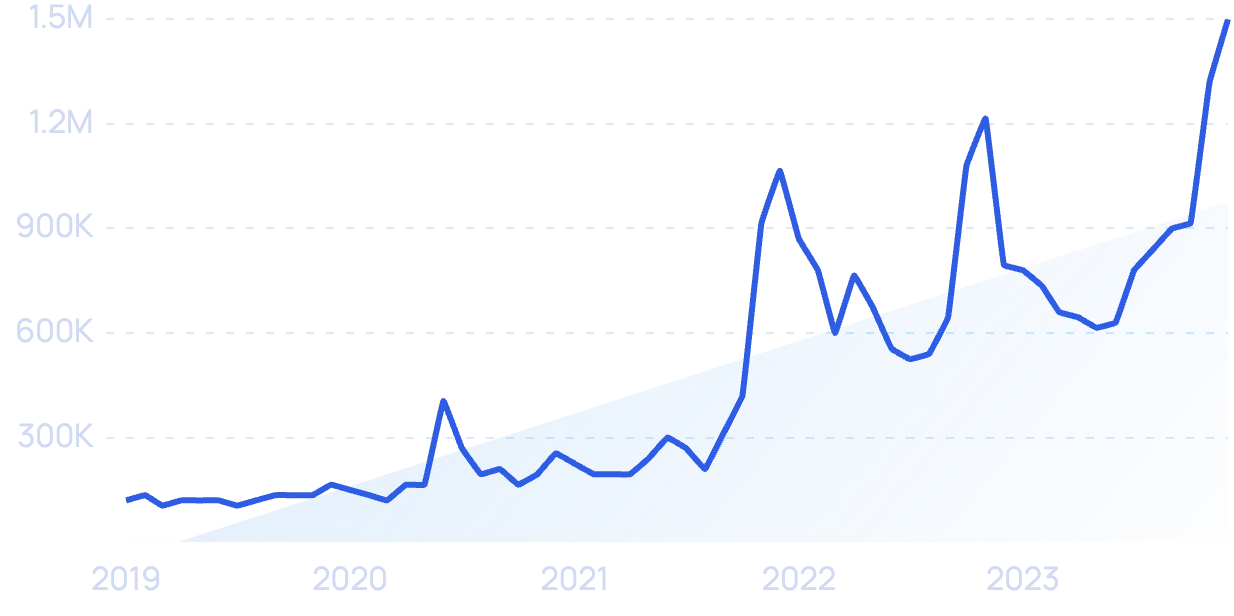

4. Virtual Healthcare is Exploding

Telemedicine is a $30.4 billion industry in the United States.

And it's growing faster than ever.

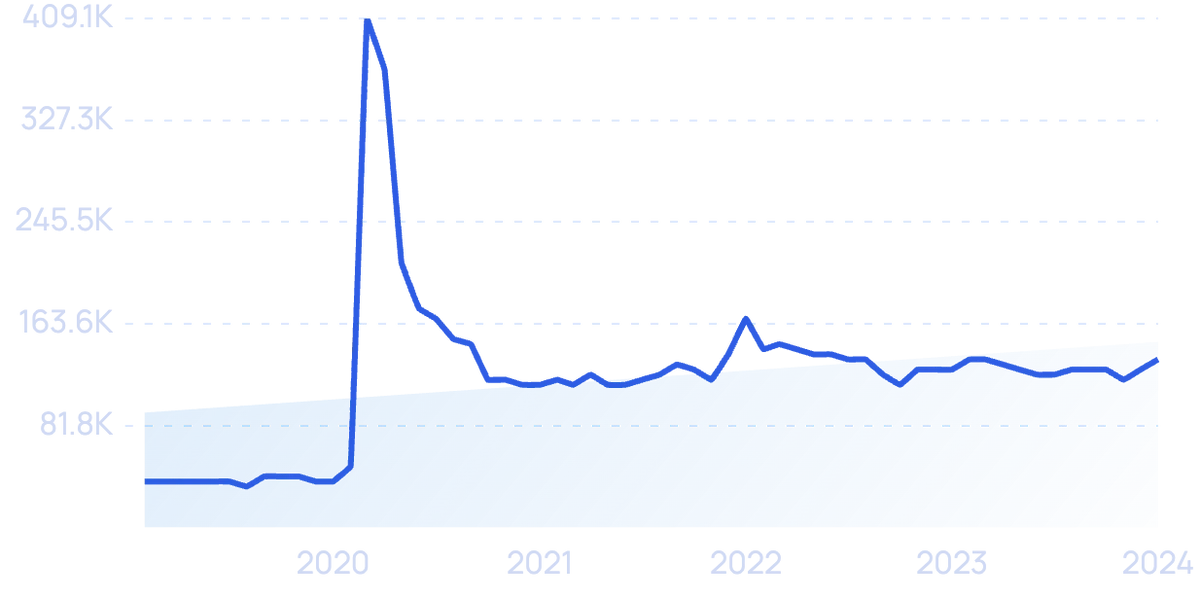

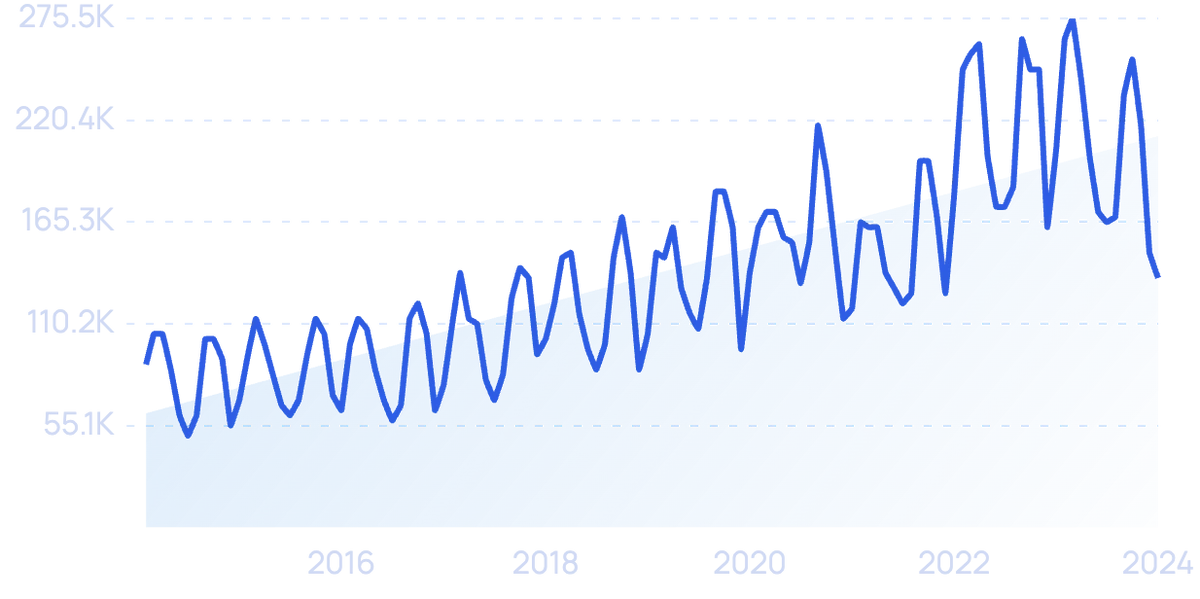

In fact, online searches for "telehealth" are on the rise.

Searches for "telehealth" spiked at the start of the COVID-19 pandemic. But remains higher than pre-pandemic levels.

According to Accenture's 2020 digital health consumer survey, 62% of healthcare consumers prefer virtual healthcare options.

The same survey found that 57% would like a remote monitoring option for ongoing health issues. And that 52% would choose virtual care for routine appointments.

Even for disease diagnosis, 42% of consumers would "definitely or probably" choose a virtual option if given the choice.

New telehealth services are now cropping up from health service providers like Babylon Health and others.

Babylon Health offers video appointments with healthcare providers.

Payers are improving their telehealth options as well:

43 US states as well as Washington DC now require private insurers to cover telehealth.

(Typically reimbursements are the equivalent of in-person visits and treatments.)

With 71.6 million Baby Boomers in the US in or approaching retirement, demands on the healthcare system will undoubtedly increase.

Telehealth offers a more efficient - and more hygienic - mode of treatment, which should help alleviate that burden.

At the same time, remote patient monitoring (RPM) programs are helping patients recover from surgery at home, reducing hospital admissions and cutting down emergency room visits.

5. SDOH Comes Into Focus

Google searches for "social determinants of health" are up and down.

Social Determinants of Health, or SDOH, describe how non-medical factors influence people's health.

According to the Agency for Healthcare Research and Quality, "minorities often receive poorer quality of care and face more barriers in seeking care” compared to Caucasians.

In some localities, the disparity in public health care is significant.

The Affordable Care Act (ACA) is designed to help reduce the disparity. But it appears that more can be done.

For example, the CDC has stated that African Americans, refugees, and children who were adopted from outside the US are all at higher risk for lead exposure.

Will 2024 be the year that these issues are 100% resolved?

Probably not.

But it is something that healthcare providers and policymakers are paying more attention to now. And big changes are likely to come.

6. Mental Health Becomes a Priority

Many of today’s chronic conditions are primarily caused by behavior.

Overeating, smoking, avoiding exercise, and substance abuse are all massive causes of morbidity in developed countries.

In fact, nearly half of all deaths in the US are linked to behavioral and other preventable causes.

What's more, it's estimated that up to one-third of adults meet the criteria for a behavioral health disorder.

So it's no surprise that behavioral medicine is getting attention.

Behavioral medicine includes aspects of psychology, occupational therapy, preventive medicine, biofeedback, and more.

In many ways, behavioral medicine is where mental health meets physical health.

That's why primary care physicians have started prescribing outdoor walks and forest bathing to improve mental well-being.

Global Google searches for "forest bathing" are up 34% over 5 years.

According to the American Hospital Association, fewer than half the adults with a mental health disorder receive treatment.

And 70% of adults with a behavioral health disorder also have a physical health condition.

That's partly why the AHA has announced support for policy changes to improve access to behavioral healthcare.

7. Corporate Healthcare Goes Direct

Over one-tenth of large American employers have set up direct-to-employer arrangements with healthcare providers.

Will these companies stop there?

It doesn't look like it.

When Amazon rolled out a telehealth service called Amazon Care for its Seattle-based employees in February 2020, there was speculation that it may also be preparing for a public debut.

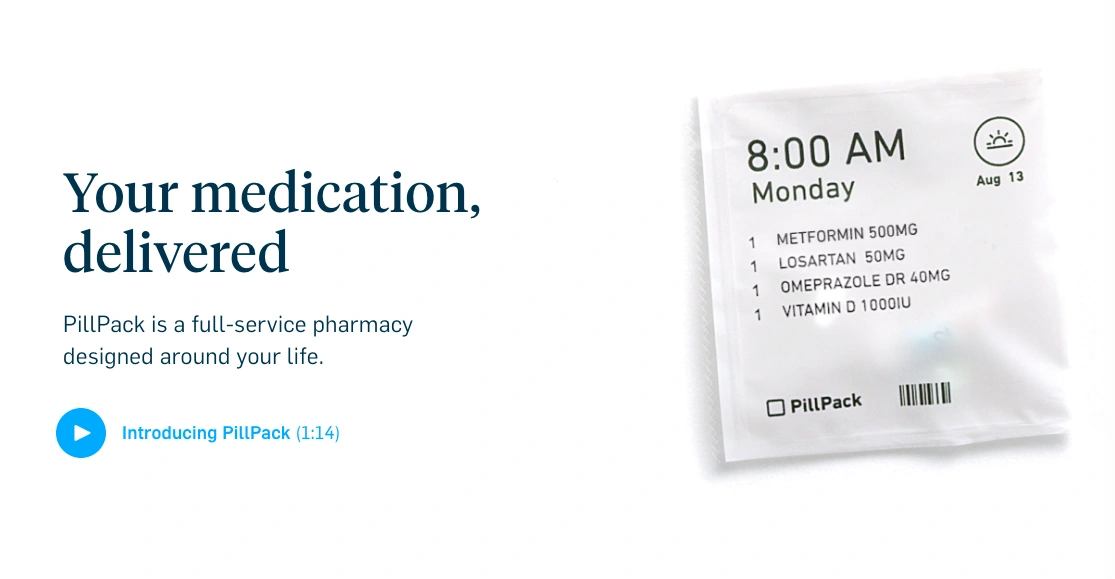

After getting a taste of the healthcare market with medication delivery service PillPack - acquired for $753 million in 2018 - Amazon seems to be hungry for more.

Amazon's PillPack medication delivery service.

Other companies are now stepping into healthcare, too.

For example, rival retailer Sam's Club.

In September 2019, they announced publicly-available healthcare bundles including prescriptions, dental services, vision exams, preventative health screenings, prepaid health debit cards, and more.

While Google's parent company Alphabet helped to launch a clinic called Cityblock and has also been working on a project called Medical Digital Assist to build a "next gen clinical visit experience".

8. Healthcare Is Unbundling

As many Americans fight for universal healthcare, a public option, or "Medicare for all", there is a much different trend happening in parallel:

Unbundled healthcare.

Healthcare insurance companies like Bind are offering what they call "on-demand healthcare".

Bind is one of many insurance companies offering on-demand healthcare options.

This feature allows their customers to choose granular levels of coverage from a large menu of options.

And not locking patients into any specific network of healthcare providers.

In theory, this system leads to lower costs as people only pay for what they need - and get to comparison-shop between different doctors.

However, these new types of plans may also expose patients to big financial risks.

After all, it isn't easy to shop around for a good deal when you're having a medical emergency.

And Bind gets around the Affordable Care Act's cap on in-network out-of-pocket expenses by having no network to start with, and by classifying more expenses as premiums (which are not capped).

Others are opting for high-deductible insurance plans, using health savings accounts to help offset that risk.

Google searches for "HSA" over time.

As another alternative to traditional health insurance, cooperatives like Christian Healthcare Ministries allow large groups of people to pool their money together to help each other foot their medical bills.

For-profit alternatives are also on the market, such as the healthcare bundles from Sam's Club that we already covered above.

Urgent care centers and other walk-in clinics are another aspect of the unbundled healthcare movement.

There are approximately 9,300 urgent care centers in the US.

Google Maps result for "urgent care" in NYC.

These walk-in medical clinics offer after-hours medical attention for matters that are urgent but not life-threatening.

And they come with an average cost per visit of $125 to $150 without health insurance (compared to $2,032 for an emergency room visit.)

This helps cut back on unnecessary ER visits, which cost Americans $32 billion per year.

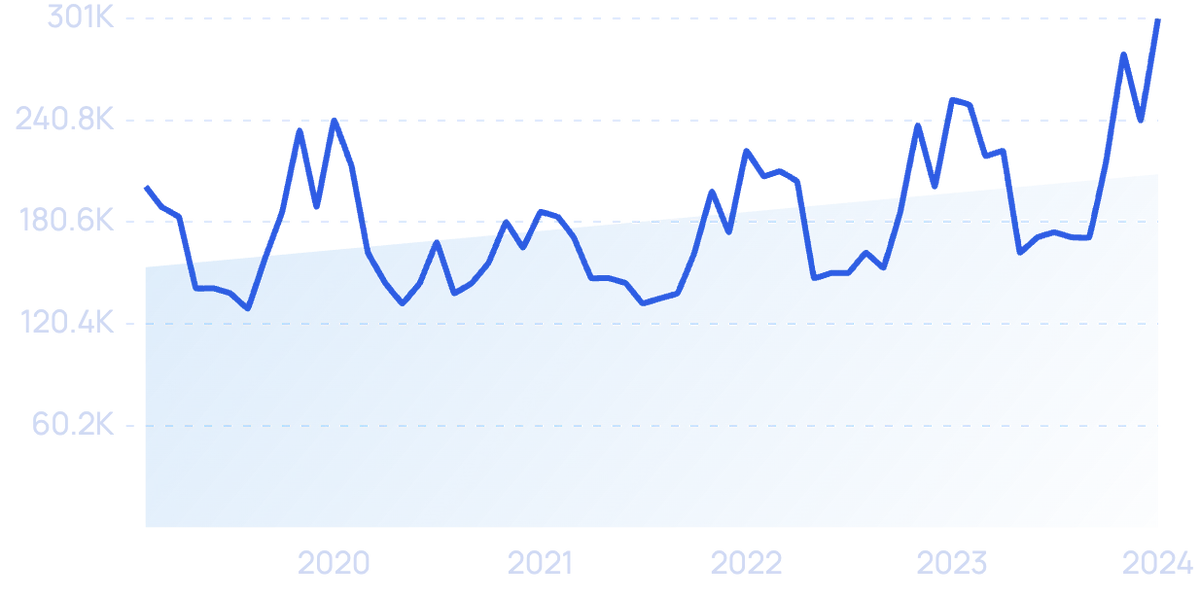

As a healthcare segment, urgent care centers have been growing rapidly.

The number of urgent care centers in the US grew by 44% from 2013 to 2018. And saw another 4.6% in 2022.

Acquired by UnitedHealth Group in 2015 for $1.5 billion, MedExpress is the largest urgent care operator in the US, with over 250 locations.

And in April 2017, private equity firm Warburg Pincus made a majority investment in urgent care provider CityMD, reportedly valuing it at around $600 million.

Conclusion

That's our list of the top trends in healthcare for 2024 and beyond.

Unbundled competitors are forcing health insurers and healthcare providers to innovate. While technology (like automation, analytics, and EHR) puts more power in consumers' hands, optimizing medical device supply chains, and making medical professionals more effective.

No one knows exactly what the future will bring.

However, healthcare organizations that bet on these trends will be well-positioned to thrive as the industry continues to evolve.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Brian is the co-founder of Exploding Topics. He is an internationally recognized SEO expert and also the founder of Backlinko. Bri... Read more