Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

40 Growing Insurtech Companies & Startups (2024)

You may also like:

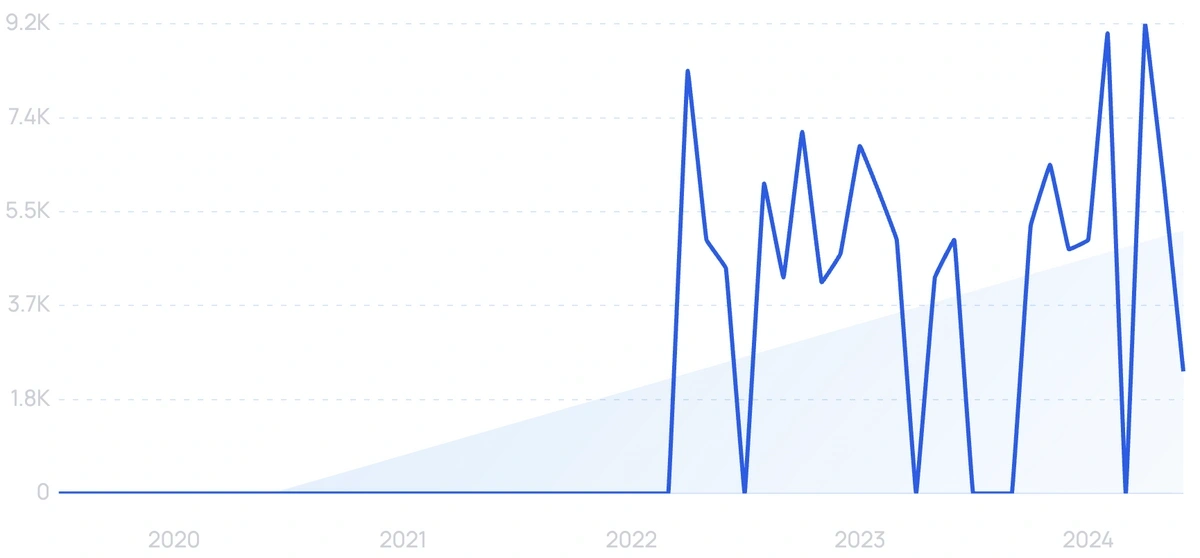

In 2022, funding in insurtech surpassed $7.3 billion. However, in 2023 funding fell to $4.6 billion, the lowest figure since 2017.

Despite the decline, the insurtech market is forecasted to grow at a CAGR of 8.3%, reaching $1.2 trillion by 2029.

With that, here’s our list of fast-growing startups in the insurance technology space.

1. Zego

5-year search growth: 217%

Search growth status: Regular

Year founded: 2016

Location: London, United Kingdom

Funding: $281.7M (Series C)

What they do: Zego offers commercial car insurance. The platform includes a range of options, including private car, scooter, and courier van insurance. They also offer fleet coverage for corporate clients. The pricing model is based on usage.

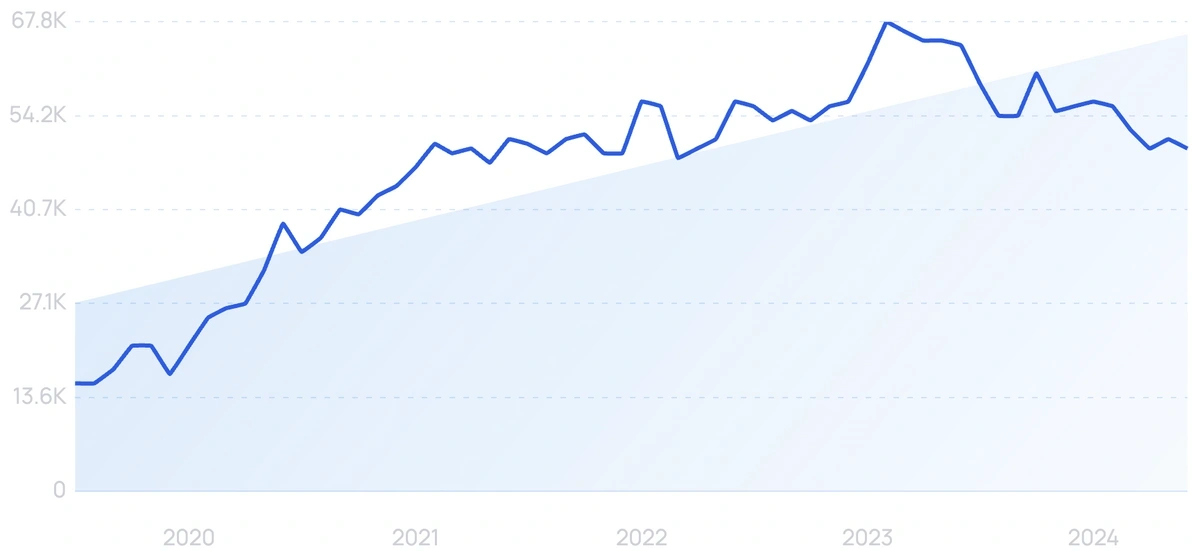

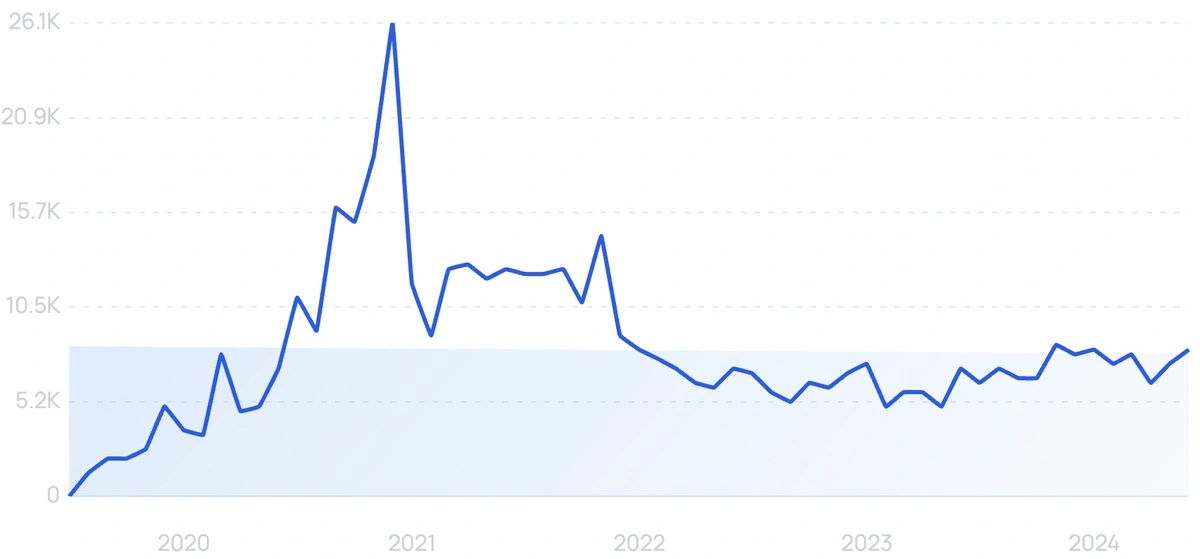

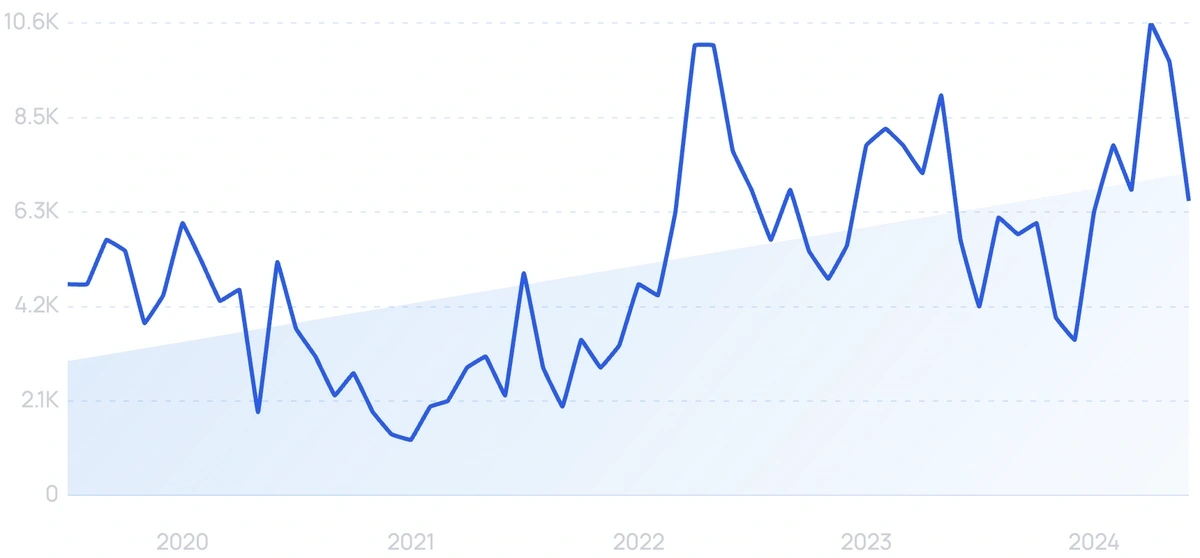

2. Kin Insurance

5-year search growth: 467%

Search growth status: Exploding

Year founded: 2016

Location: Chicago, IL

Funding: $458.2M (Series D)

What they do: Kin Insurance provides home insurance in 4 states across the US. The company provides coverage for natural disasters, including hurricanes, earthquakes. Kin’s platform takes into account thousands of property data points to offer customizable options for coverage.

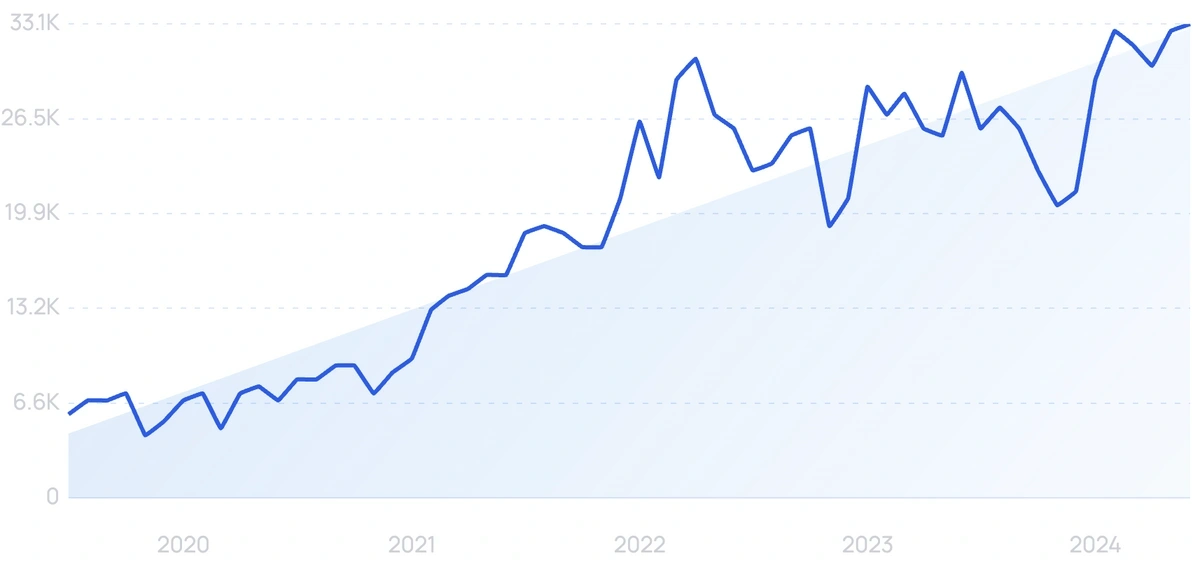

3. Marshmallow

5-year search growth: 507%

Search growth status: Exploding

Year founded: 2017

Location: London, United Kingdom

Funding: $134.8M (Debt Financing)

What they do: Marshmallow is a car insurance provider. The company’s algorithm considers international driving records in order to offer competitive prices to drivers with limited driving records in their current country of residence. The startup has sold over 100,000 policies to date.

4. Getsafe

5-year search growth: 59%

Search growth status: Regular

Year founded: 2015

Location: Heidelberg, Germany

Funding: $115.9M (Series B)

What they do: Getsafe is a digital-first insurance company offering liability, property, and car insurance. Insurance products can be purchased and managed via their mobile app. The startup has more than 300,000 customers across 3 markets (Germany, UK, and Austria).

5. Ladder

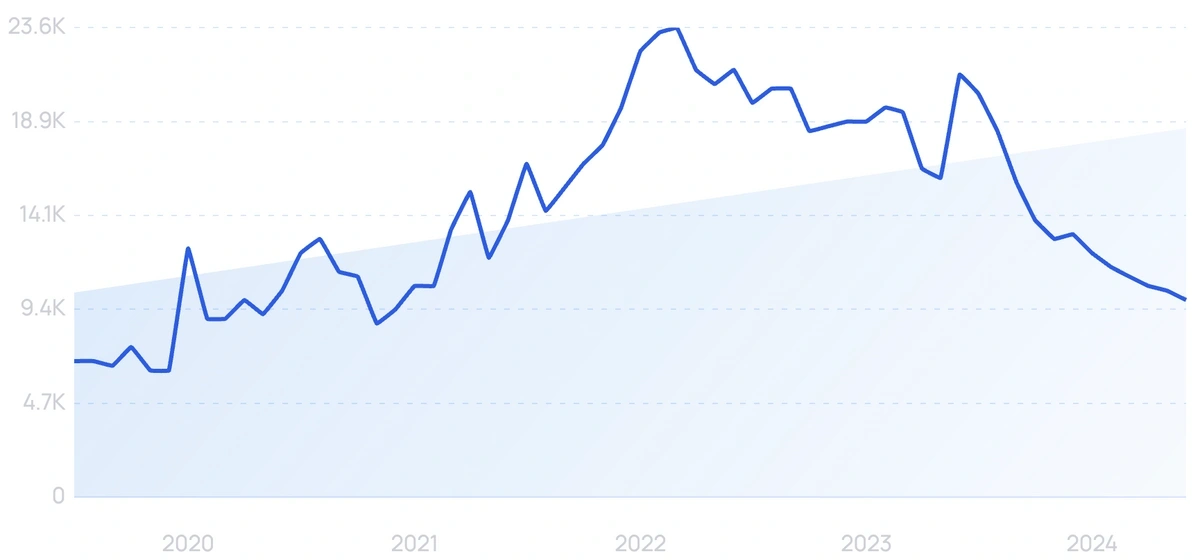

5-year search growth: 17%

Search growth status: Peaked

Year founded: 2015

Location: Palo Alto, CA

Funding: $194M (Series D)

What they do: Ladder is an online platform for term life insurance policies. The application process happens online with instant approvals. Plans can also be modified (or “Laddered”) based on needs over time.

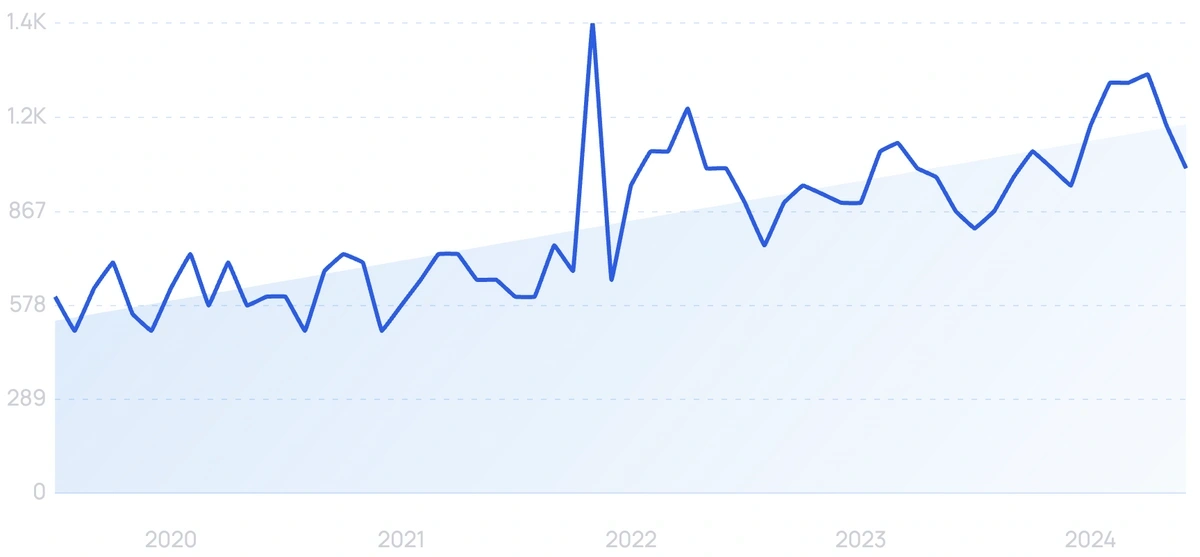

6. Cuvva

5-year search growth: 10%

Search growth status: Regular

Year founded: 2014

Location: London, United Kingdom

Funding: $21.3M (Series Unknown)

What they do: Cuvva is a car insurance app that offers temporary cover (from 1 hour to 28 days) along with more traditional monthly plans. The startup also provides in-app customer support with 1 minute average response time. To date, Cuvva has served over 1 million customers.

7. Shift Technology

5-year search growth: 54%

Search growth status: Regular

Year founded: 2013

Location: Paris, France

Funding: $540M (Series D)

What they do: Shift Technology is an insurtech startup that provides AI-powered fraud detection and claims automation solutions for the global insurance industry. Its technology uses advanced algorithms and data science to identify fraudulent claims in real-time and automate the entire claims handling process, resulting in improved efficiency, accuracy, and cost savings for insurers.

The company has raised over $220 million in funding and serves more than 100 customers in over 25 countries.

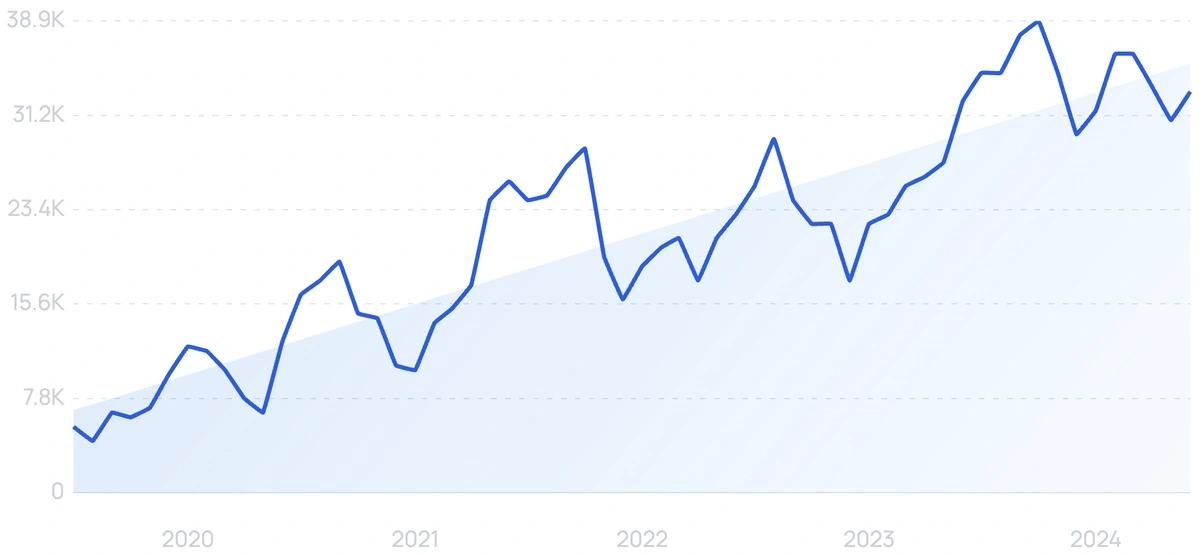

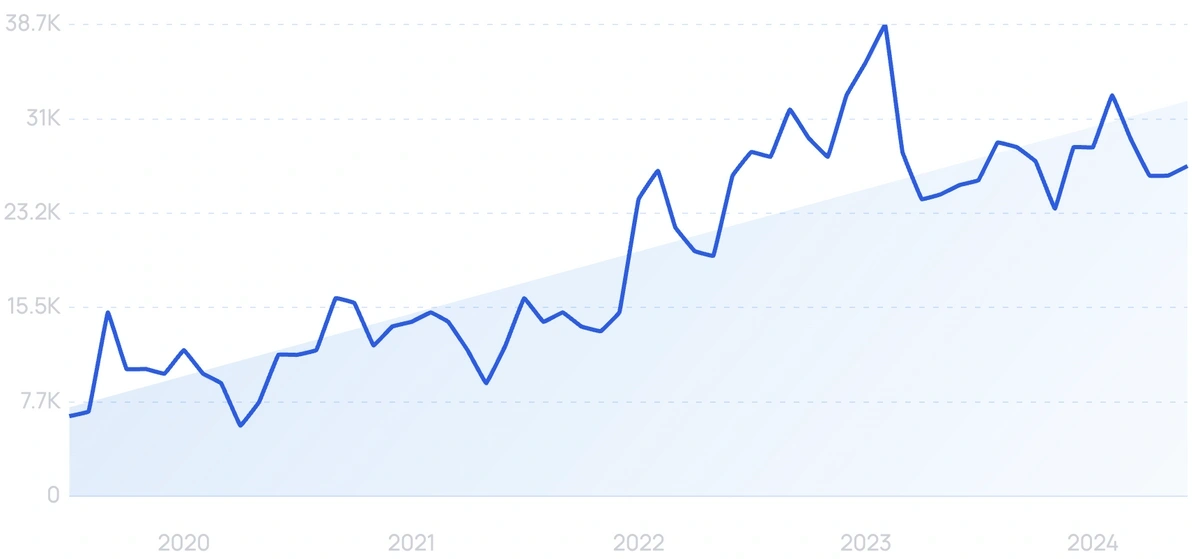

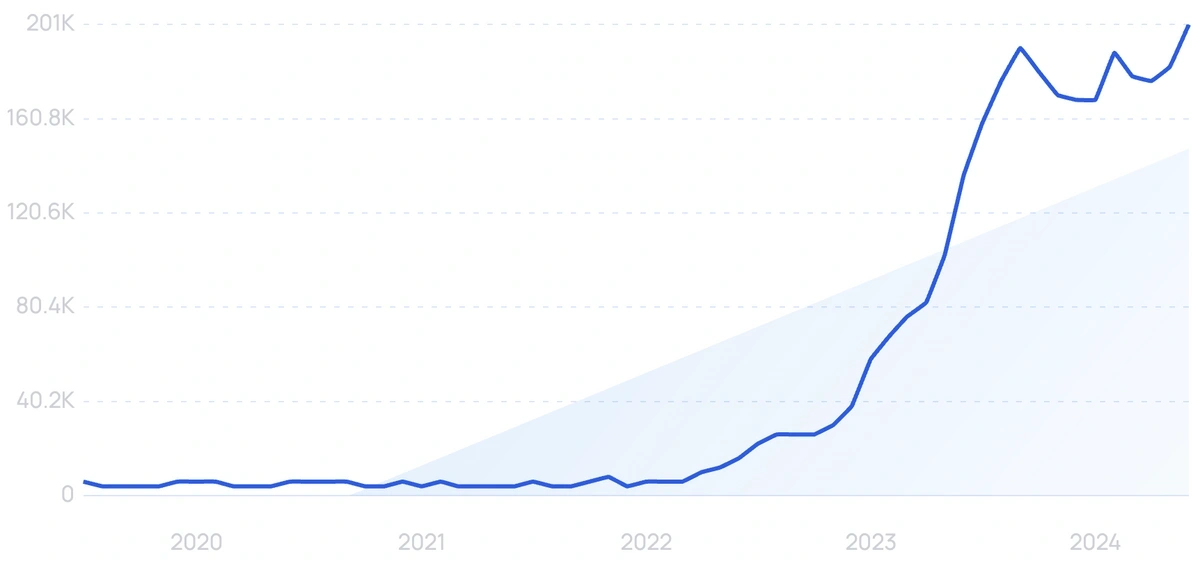

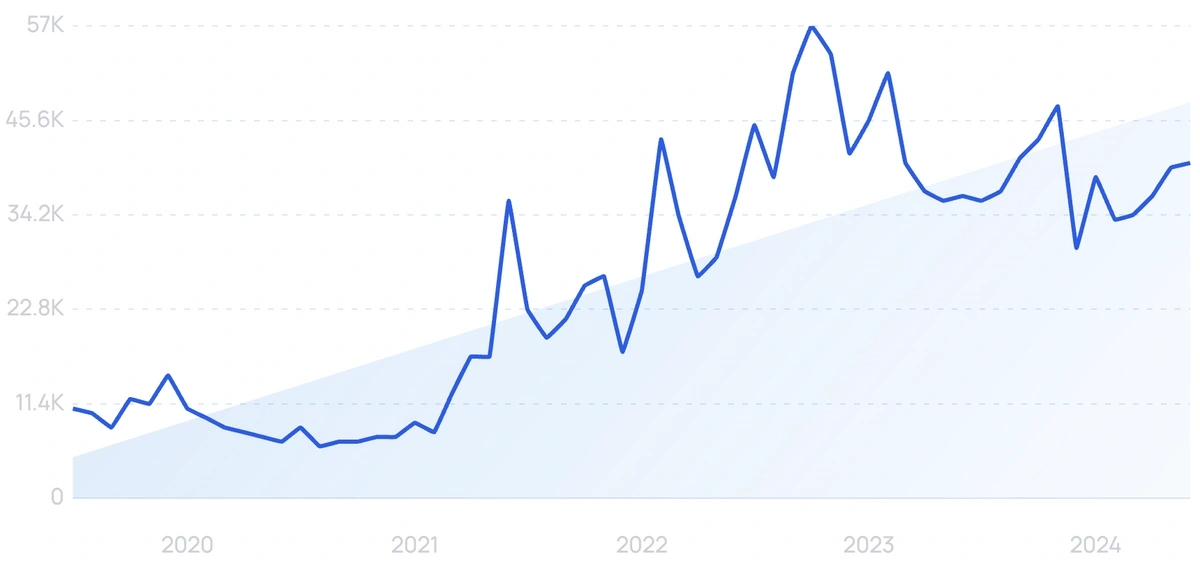

8. Insurify

5-year search growth: 488%

Search growth status: Exploding

Year founded: 2013

Location: Cambridge, MA

Funding: $129.6M (Series B)

What they do: Insurify is an insurance quote comparison website. The resource helps compare car, home, and life insurance quotes in the US. For each company, Insurify delivers a composite score based on the insurance company’s quality and reliability.

9. Next Insurance

5-year search growth: 93%

Search growth status: Regular

Year founded: 2016

Location: Palo Alto, CA

Funding: $1.1B (Series F)

What they do: Next Insurance is a digital insurance provider for self-employed and small businesses. The company offers general and professional liability insurance, as well as commercial property and auto coverage. The platform currently has coverage options for more than 1300 professions, including third-party Amazon sellers, contractors, and fitness instructors. Next Insurance reports that they have over 100,000 clients.

10. Ethos Life

5-year search growth: 195%

Search growth status: Regular

Year founded: 2016

Location: Austin, TX

Funding: $414M (Series D)

What they do: Ethos offers term and whole life insurance policies. Applications can be completed online, without agent assistance.

11. Bestow

5-year search growth: 31%

Search growth status: Regular

Year founded: 2016

Location: Dallas, TX

Funding: $137.5M (Series C)

What they do: Bestow operates a platform for purchasing term life insurance products. Plans have customizable coverage from $50 thousand to $1.5 million.

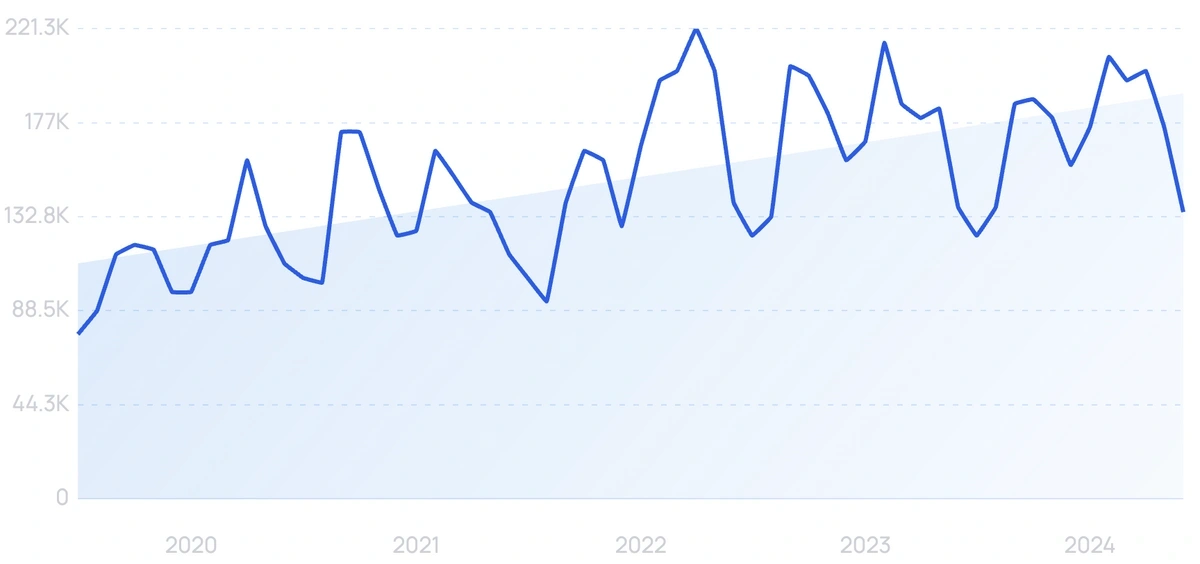

12. The Zebra

5-year search growth: 23%

Search growth status: Regular

Year founded: 2012

Location: Austin, TX

Funding: $256.5M (Series D)

What they do: The Zebra is an insurance comparison platform. The website helps compare car and home insurance quotes from more than 100 companies. The startup reached a valuation of $1 billion following its Series D funding round in April 2021.

13. Sidecar Health

5-year search growth: 3,000%

Search growth status: Peaked

Year founded: 2018

Location: El Segundo, CA

Funding: $163M (Series C)

What they do: Sidecar Health offers personalized health insurance plans. Members can have appointments with any licensed healthcare provider without network restrictions. The company provides coverage within 16 states and plans, with plans to expand into more states in the near future.

14. PasarPolis

5-year search growth: -6%

Search growth status: Peaked

Year founded: 2015

Location: Jakarta, Indonesia

Funding: $71M (Convertible Note)

What they do: PasarPolis is an insurance startup operating in Southeast Asia. The company’s partner network includes over 50 companies. PasarPolis currently offers insurance policies for health, real estate property, life, accident, and travel.

15. Element Insurance

5-year search growth: 57%

Search growth status: Regular

Year founded: 2017

Location: Berlin, Germany

Funding: $147.5M (Series C)

What they do: Element Insurance is an insurtech startup that offers digital insurance solutions to its customers. The company provides a platform for insurers to rapidly launch new products and services, and also uses artificial intelligence and data analytics to improve the customer experience and reduce costs.

16. Ottonova

5-year search growth: 9%

Search growth status: Peaked

Year founded: 2015

Location: Munich, Germany

Funding: $171.2M (Series F)

What they do: Ottonova offers health insurance policies in Germany. The company’s product portfolio includes various plans for German residents and expats. Besides their core insurance product, Ottonova includes a complimentary concierge service to help book appointments from the mobile app.

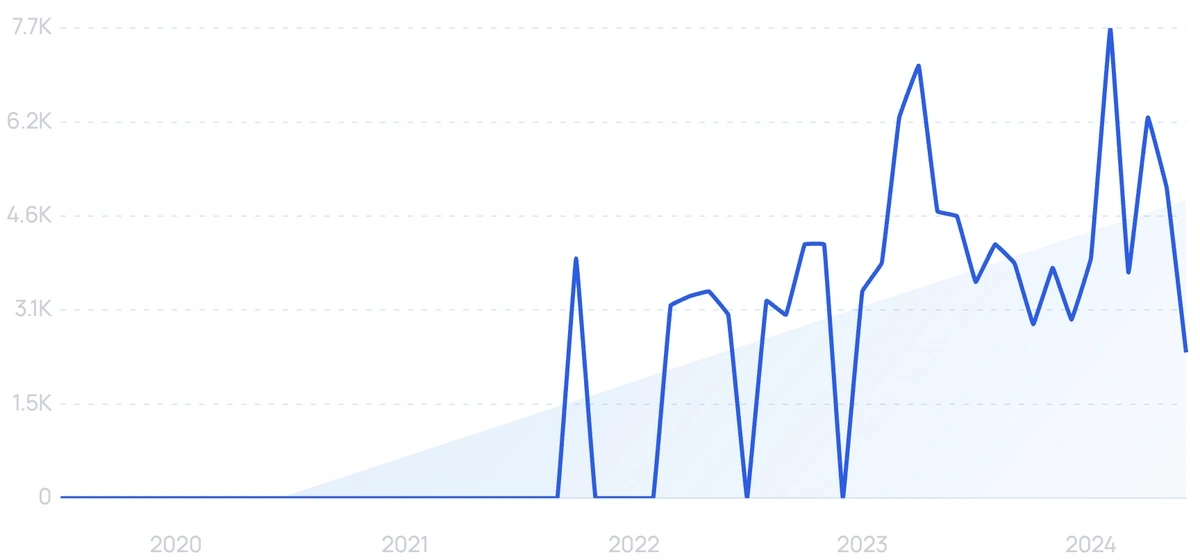

17. Pawlicy Advisor

5-year search growth: 3,000%

Search growth status: Regular

Year founded: 2018

Location: New York, NY

Funding: $19.6M (Series B)

What they do: Pawlicy Advisor is a pet insurance comparison platform. Users can get more than 100 quotes based on input from a single form. Quotes can be compared side-by-side. And the site includes robust filtering options.

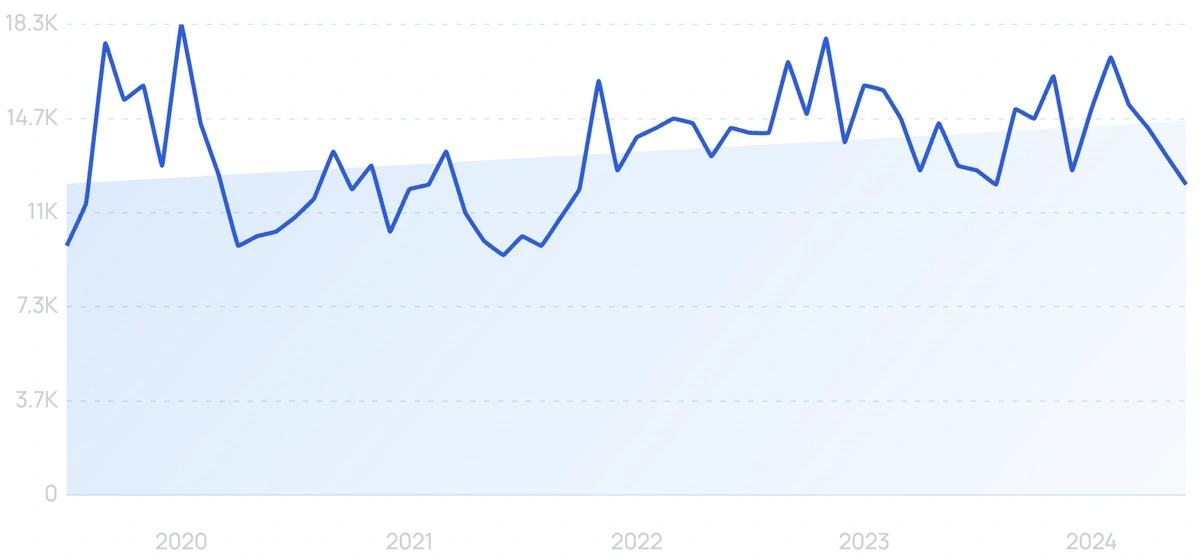

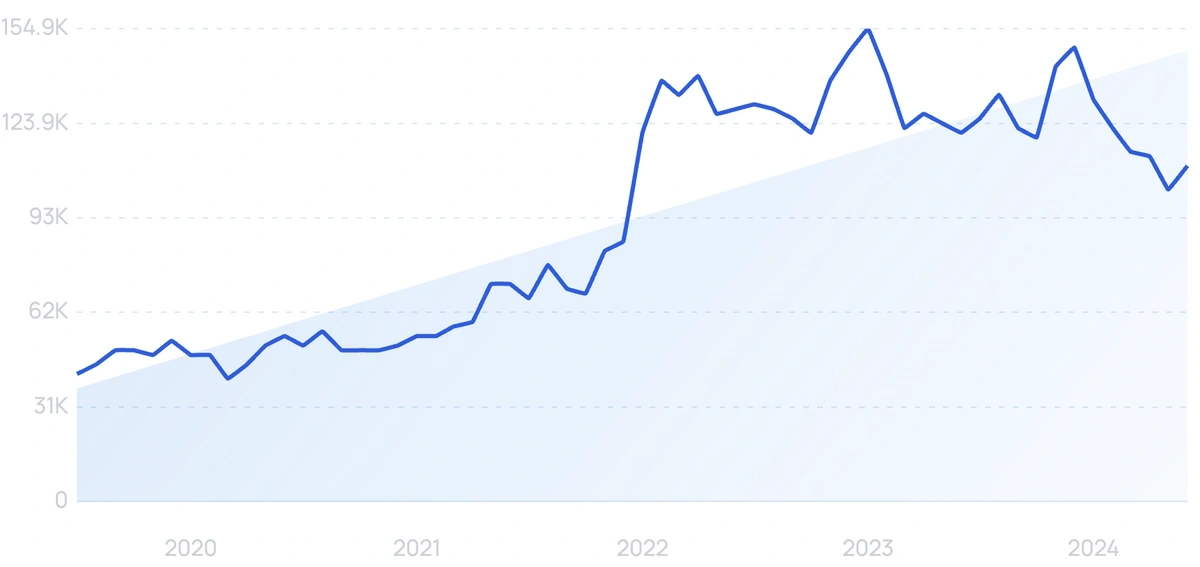

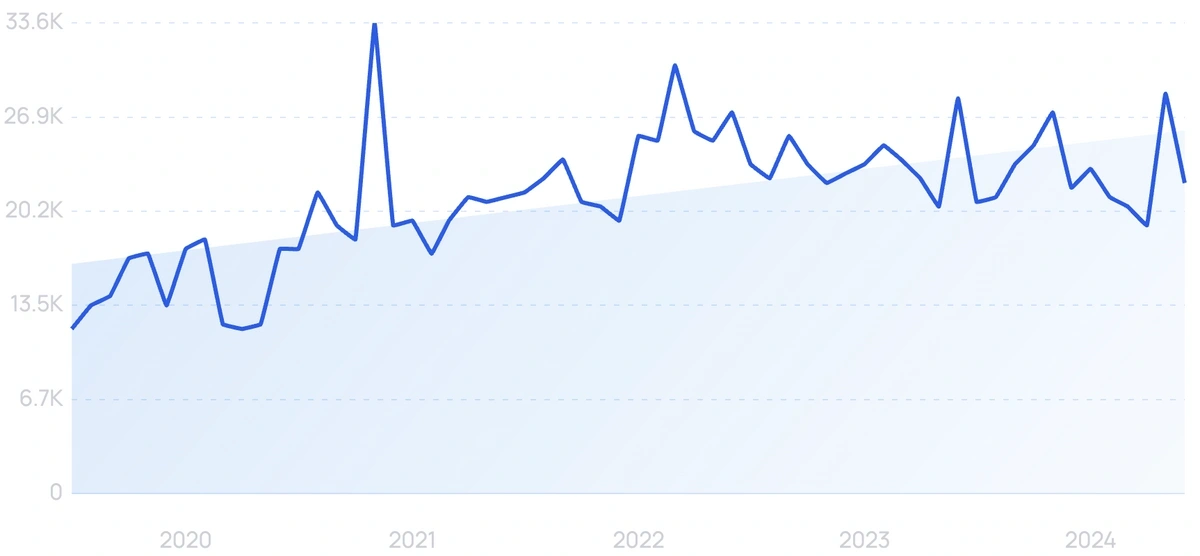

18. Policygenius

5-year search growth: 43%

Search growth status: Regular

Year founded: 2014

Location: New York, NY

Funding: $276.1M (Series E)

What they do: Policygenius is an online insurance marketplace. The broker helps compare quotes and shop for life, home, vehicle, and disability insurance. The startup claims to have sold over $90 billion in life insurance policies to date.

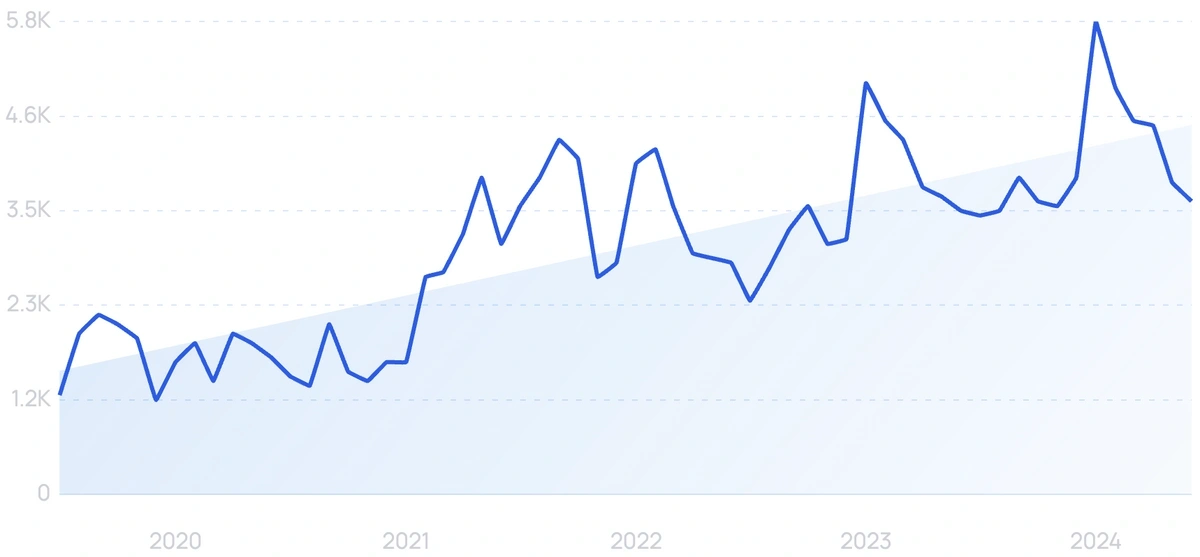

19. RenewBuy

5-year search growth: 312%

Search growth status: Exploding

Year founded: 2015

Location: Gurgaon, India

Funding: $132.7M (Series D)

What they do: RenewBuy is an online insurance platform that offers vehicle, health, and life insurance policies in India. The company’s product helps find and compare insurance quotes from 35 different partners.

20. Pie Insurance

5-year search growth: 25%

Search growth status: Regular

Year founded: 2017

Location: Denver, CO

Funding: $621M (Series D)

What they do: Pie Insurance offers workers’ compensation policies for small businesses using a cloud-based platform. Pie Insurance recently crossed a milestone of $100 million in premiums since its launch in 2017.

21. Newfront

5-year search growth: 39%

Search growth status: Regular

Year founded: 2017

Location: San Francisco, California

Funding: $310M (Series D)

What they do: SF-based Newfront recently closed a large $200M Series D round at a $2.2B valuation, led by impressive names like Goldman Sachs. A modern client dashboard and a focus on technology make Newfront a modern, 21st century insurance brokerage.

22. Hugo Insurance

5-year search growth: 3,233%

Search growth status: Exploding

Year founded: 2016

Location: Santa Monica, California

Funding: Undisclosed

What they do: Hugo Insurance offers pay-as-you-drive car insurance plans with zero down payments or upfront fees. Basically, customers can save money by only turning on coverage for the days they drive. If coverage runs out, customers can reload plans at no extra cost.

23. Sure

5-year search growth: 25%

Search growth status: Regular

Year founded: 2015

Location: New York, New York

Funding: $123.1M (Series C)

What they do: Insurance can be a complex industry full of math, predictive analytics, and legal jargon bundled together to create a policy. Sure’s secret sauce is a comprehensive insurance technology platform that handles everything from APIs to policies and claims.

Sure’s digital infrastructure is trusted by leading brands including Carvana, Mastercard, Intuit, and Revolut.

24. Better Agency

5-year search growth: 65%

Search growth status: Regular

Year founded: 2019

Location: Mesa, Arizona

Funding: $10.1M (Series A)

What they do: Selling insurance is a competitive endeavor. Even today, many insurance agents use antiquated tools instead of modern tech. Better provides a combined CRM and AMS tool that contains 100+ automation campaigns for renewals, contracts, proposals, and sales.

25. FutureProof Technologies

5-year search growth: 67%

Search growth status: Regular

Year founded: 2019

Location: San Diego, California

Funding: $9.5M (Series Unknown)

What they do: With global warming becoming an ever increasing issue, FutureProof has capitalized on a market opportunity for predictive weather analysis allowing smarter underwriting.

Their predictive analytics ingest climate data and formulate outputs around property insurance.

26. AKKO

5-year search growth: 163%

Search growth status: Exploding

Year founded: 2018

Location: San Francisco, California

Funding: $14.8M (Series A)

What they do: AKKO has developed a lean, digital first smartphone insurance product that was ranked #1 by Gadget Review and Investopedia, even against AppleCare and Geek Squad.

27. Boost

5-year search growth: -44%

Search growth status: Peaked

Year founded: 2017

Location: New York, New York

Funding: $37M (Series Unknown)

What they do: Embedded insurance is one of the hottest topics in insurance, and Boost is one of the leading players in the space. Boost has helped brands provide over $60M in protection by offering a revenue stream and another avenue for increased customer LTV.

Adding insurance used to be slow and cumbersome but insurtech providers like Boost ensure that any brand or retailer can seamlessly add insurance options to their wares.

28. Stere

5-year search growth: 14%

Search growth status: Peaked

Year founded: 2021

Location: Dover, Delaware

Funding: $7M (Seed)

What they do: Stere provides an all inclusive digital platform for insurance businesses to access powerful data analytics and tools, but the real secret sauce is their Insurance Capacity Platform that connects insurtech companies with insurance carriers.

Stere’s growing lineup of clients includes large names in the insurance space like NFP, EverGuard, and numerous others.

29. ClearCover

5-year search growth: 45%

Search growth status: Peaked

Year founded: 2016

Location: Chicago, Illinois

Funding: $304.5M (Series D)

What they do: Settling a car insurance claim in 7 minutes might sound impossible, but ClearCover’s intuitive app quickly scans your damaged car and asks a few questions to decide quickly on claims.

Based on customer reviews, savings over traditional car insurance providers like Geico or Progressive range from $400 all the way to $2000.

30. Wefox

5-year search growth: 274%

Search growth status: Exploding

Year founded: 2015

Location: Berlin, Germany

Funding: $1.5B (Debt Financing)

What they do: Wefox is a digital insurance platform that provides customers with personalized insurance products and services. The company uses advanced technology, such as machine learning and data analysis, to provide customers with tailored insurance solutions and a seamless customer experience.

Wefox provides customers with a more efficient, transparent, and user-friendly insurance solution, while also assisting them in making informed decisions about their lifestyle needs.

31. HDVI (High Definition Vehicle Insurance)

5-year search growth: -22%

Search growth status: Peaked

Year founded: 2017

Location: Chicago, Illinois

Funding: $48.5M (Series B)

What they do: HDVI offers modern vehicle insurance for commercial truck fleets, combining the existing camera and telematics equipment already in large trucks with proprietary software that rewards safe driving.

A comprehensive fleet portal with safety dashboard allows trucking companies to have key insurance, compliance, and driving data in one place.

32. Corvus Insurance

5-year search growth: -25%

Search growth status: Peaked

Year founded: 2017

Location: Boston, Massachusetts

Funding: $160.8M (Series C)

What they do: Corvus Insurance is a fast growing insurtech startup that officially hit 10,000 policies at the end of 2020, and closed a $100M Series C round in March of 2021.

Corvus’ focus on the ever growing cyber security space and cultivating a strong culture has led them to be named a Top 10 startup on Forbes’ America’s Best Startup Employers 2022.

33. Steadily

5-year search growth: 74%

Search growth status: Regular

Year founded: 2020

Location: Austin, Texas

Funding: $54.9M (Series B)

What they do: Landlord insurance is a $38B industry, protecting landlords from hazards ranging from fire to lawsuits from tenants. Steadily emerged from “stealth” mode in October 2020 to serve this niche market that’s been overlooked for many years.

The aim is to modernize and simplify the typically complex world of landlord insurance according to CEO Darren Nix.

34. Luko

5-year search growth: 89%

Search growth status: Regular

Year founded: 2016

Location: Paris, France

Funding: $77.5M (Series B)

What they do: More than 400,000 clients use Luko, the European insurtech startup providing everything from mortgage insurance to landlord insurance.

Similar to others on this list of insurance startups, Luko uses digital tools to make the cumbersome process of insurance an almost instant, transparent process.

35. Pumpkin Insurance

5-year search growth: 1,280%

Search growth status: Exploding

Year founded: 2019

Location: Brooklyn, New York

Funding: Undisclosed

What they do: Pumpkin Insurance is a pet insurance company that offers various plans for dogs and cats. The company's plans include coverage for things like dental illnesses, behavioral issues, and exam fees with a fixed 90% reimbursement rate.

36. EvolutionIQ

5-year search growth: 2,500%

Search growth status: Regular

Year founded: 2019

Location: New York, New York

Funding: $43.3M (Series Unknown)

What they do: EvolutionIQ’s proprietary AI-powered claims software guides insurance adjusters and examiners to the right claims, at the right time. The results are lower expense ratios and lower claim costs.

Their Series A finished in April 2022, led by notable investors like FirstMark Capital, FirstRound Capital, and Altai Ventures.

37. TheGuarantors

5-year search growth: 8,100%

Search growth status: Exploding

Year founded: 2015

Location: New York, New York

Funding: $111.7M (Debt Financing)

What they do: TheGuarantors has provided over $1.5B in coverage since their inception in 2015, protecting landlords from delinquent tenants and nonpayment of rent.

On the flip side, they also help renters secure desirable apartments and act as a guarantor on the property by providing insurance to landlords.

38. Tractable

5-year search growth: 4%

Search growth status: Regular

Year founded: 2014

Location: London, UK

Funding: $184.9M (Series E)

What they do: Tractable’s AI technology has propelled the London startup to becoming a powerhouse in the insurance space. Over 1M households have been helped and $2B a year in vehicle repairs

Glowing testimonials, including one from Geico CEO Todd Combs, demonstrate how Tractable’s software helps insurance companies analyze and process insurance claims much more rapidly than the traditional process.

39. Sensible Weather

Search growth status: Exploding

Year founded: 2019

Location: Santa Monica, California

Funding: $16.3M (Series A)

What they do: Sensible Weather has cooked up a unique business model of insuring events and travel against unpredictable weather changes, protecting consumers and giving travel partners additional tools in their selling arsenal.

Sensible claims that weather guarantees have five times the conversation rate of traditional travel insurance and also offer revenue sharing models with travel providers. So far, they’ve partnered with TripScout, Collective Retreats, and other small but fast growing travel brands.

40. PolicyMe

5-year search growth: 2,900%

Search growth status: Regular

Year founded: 2018

Location: Toronto, Canada

Funding: $21.8M (Series A)

What they do: PolicyMe is Canada’s iteration of the rapidly growing wave of digital life insurance providers. A few quick questions and minutes later an approval decision is made on the app.

PolicyMe now has $5B of coverage active in Canada.

Conclusion

That completes our list of 40 high-growth insurtech startups.

From car to workers compensation insurance, a growing number of insurance startups serve customers worldwide, including a sizable share of first-time policyholders.

Another thing that ties these insurance startups together is a strong focus on technology and data analytics to bring competitive offerings to the market.

With the rise in Insurtech funding, we can expect more innovation and new players in this multi-billion dollar industry.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more