Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Key Insurance Industry Trends for 2024

You may also like:

Worldwide, insurance companies generate over $6.75 trillion in premiums each year.

Yet much like their commercial banking cousins, they have long been considered stodgy and behind the times.

But things are quickly starting to change.

In fact, this data-intensive industry is transforming faster than ever before.

If you want to learn about changes set to shake up the insurance space, take a look at the trends below.

1. AI and Predictive Analytics Change The Way Insurance Is Offered

Since insurance is a data-heavy business, it’s expected that improvements in data analysis and predictive software are top-of-mind for the industry.

Predictive analytics typically involve some kind of improvement in data analysis that allows underwriters to better predict the risk profile or behavior of a certain person, group of people, business, or other entity.

Providers like Duck Creek allow traditional insurers to use software to better understand novel datasets.

“Duck Creek” searches are up 29% in 5 years.

And in insurance, understanding novel datasets is everything.

In fact, 83% of insurers say that predictive analytics are crucial to the future of underwriting.

But only around 1 in 4 (27%) currently have the technology required to leverage these advanced analytics.

Artificial intelligence (AI) and machine learning are helping to drive improvements in analytics.

With the amount of data increasing every day, insurers are in dire need of new ways to analyze it.

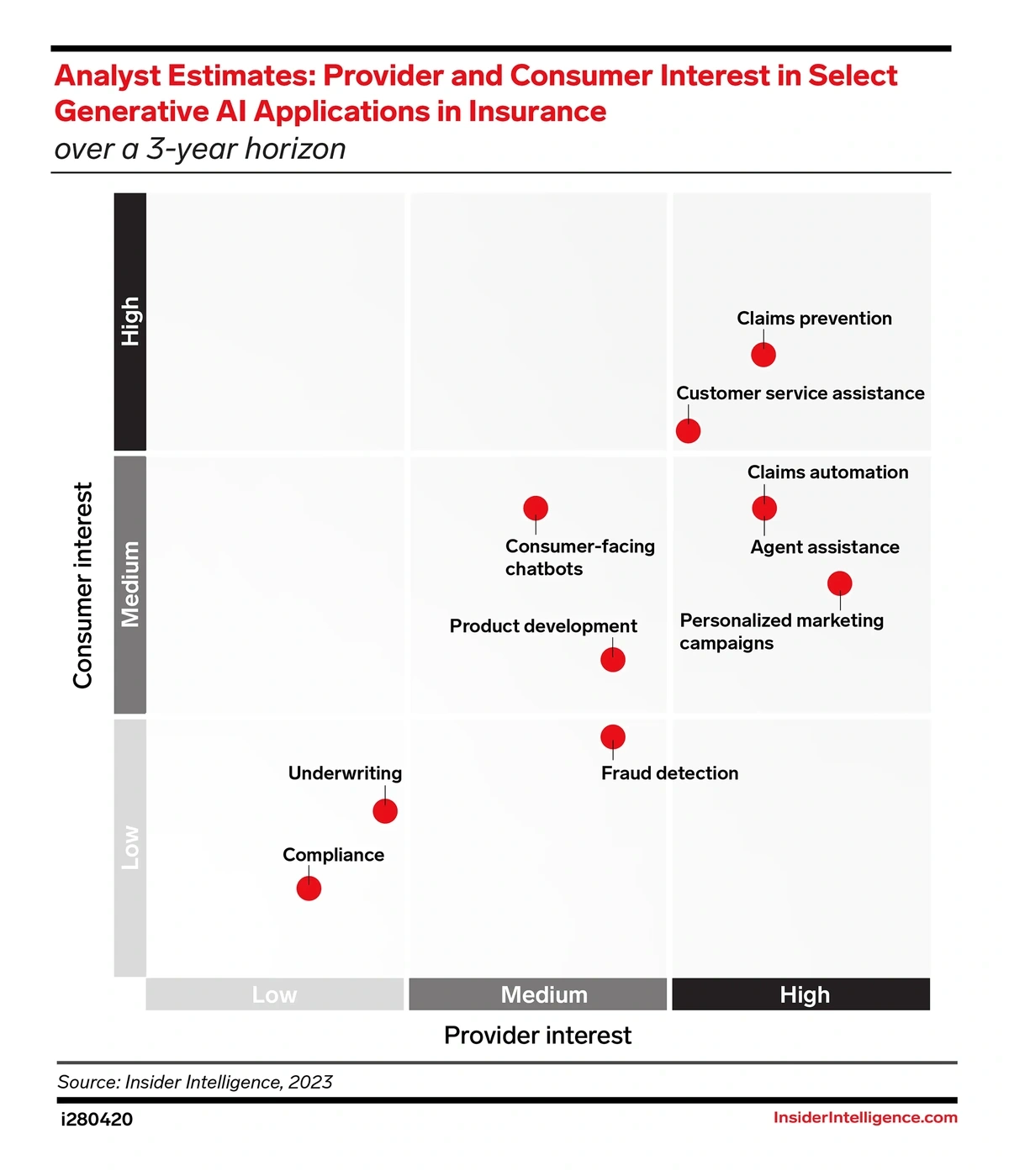

And underwriting is far from the only use of machine learning and AI within insurance. In fact, with improvements in generative AI, both providers and consumers are more interested in other use cases.

Areas where generative AI can be used in the insurance business.

85% of insurance CEOs envisage a return on investment in AI within 5 years.

OneDegree, a wholly virtual insurer based in Hong Kong, has partnered with Microsoft to introduce AI into its processes.

Searches for “OneDegree” are up 7200% in 5 years.

It saw a 59% increase in gross written premiums in 2023, with 2.5x growth in customers holding multiple policies.

Lemonade, which went public in 2020, has developed an AI-based model that it believes serves customers better.

Searches for "Lemonade insurance" have grown by 117% over the last 5 years.

The company uses AI to handle underwriting, claims, and customer service. Its fastest recorded claim was processed in just three seconds.

Lemonade offers renters, homeowners, term life, and pet insurance at extremely low prices, along with a UI designed to maximize the customer experience.

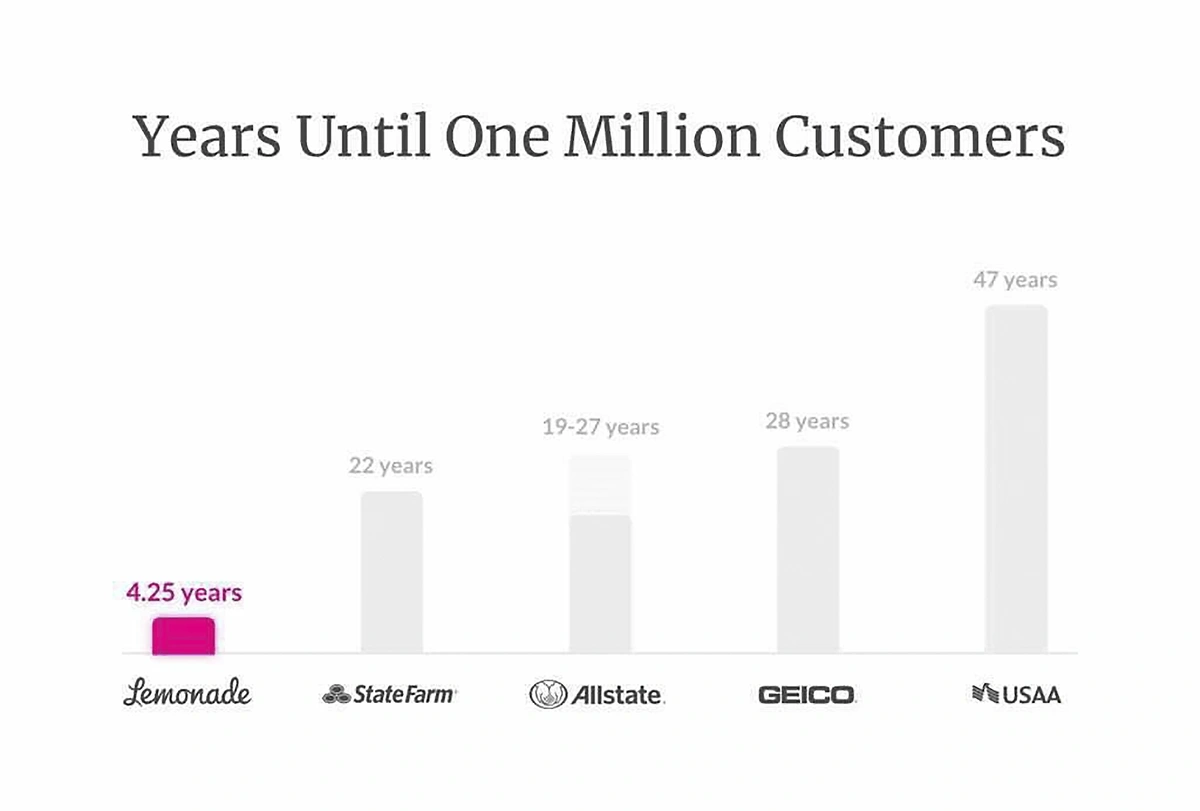

This is probably why it crossed 2 million customers by the end of 2023, reaching that milestone 35% faster than it secured its first 1 million.

That’s despite having reached 1 million customers in record time in the first place.

Lemonade reached 1 million customers in record time – 4.25 years.

2. Growing Number Of InsurTech Startups

You’ve probably heard of Fintech in the banking industry.

But you may not know that the insurance industry is also experiencing its own tech revolution.

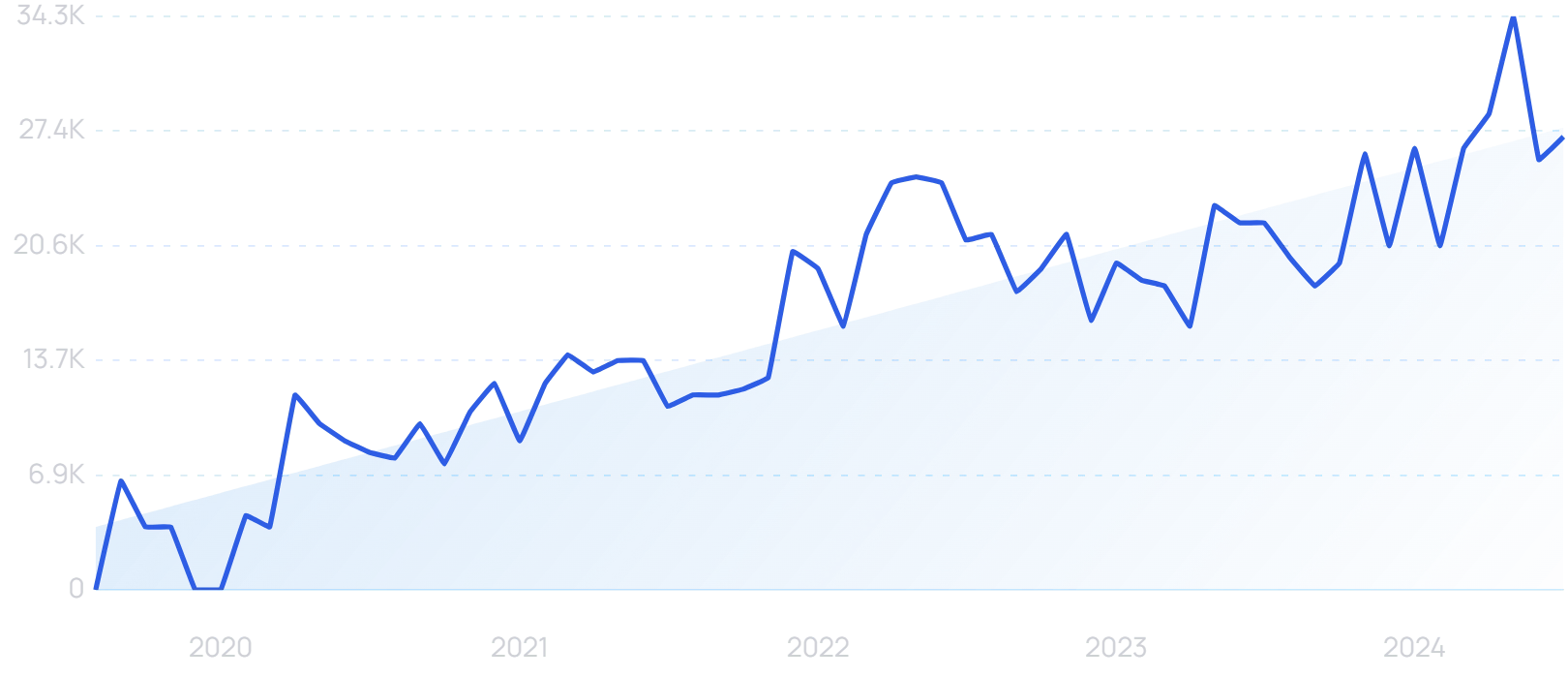

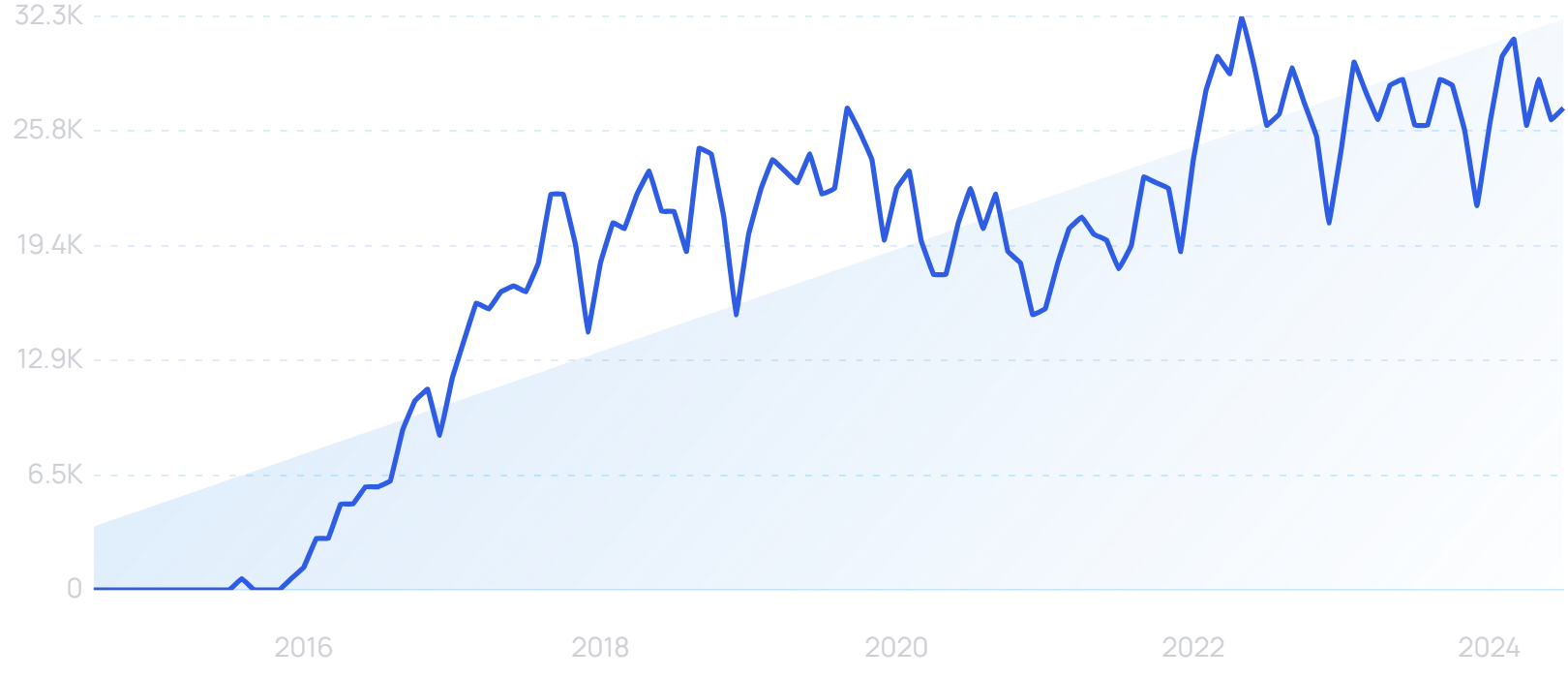

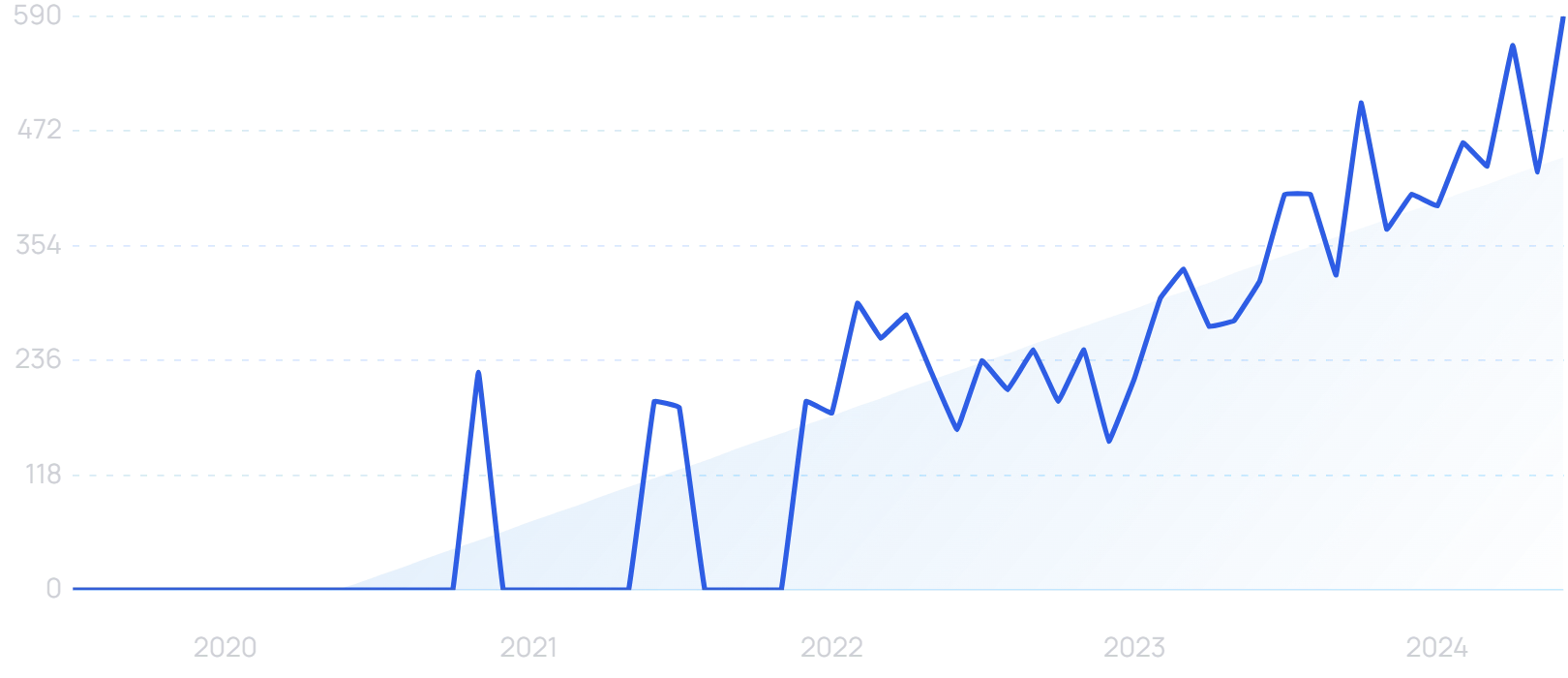

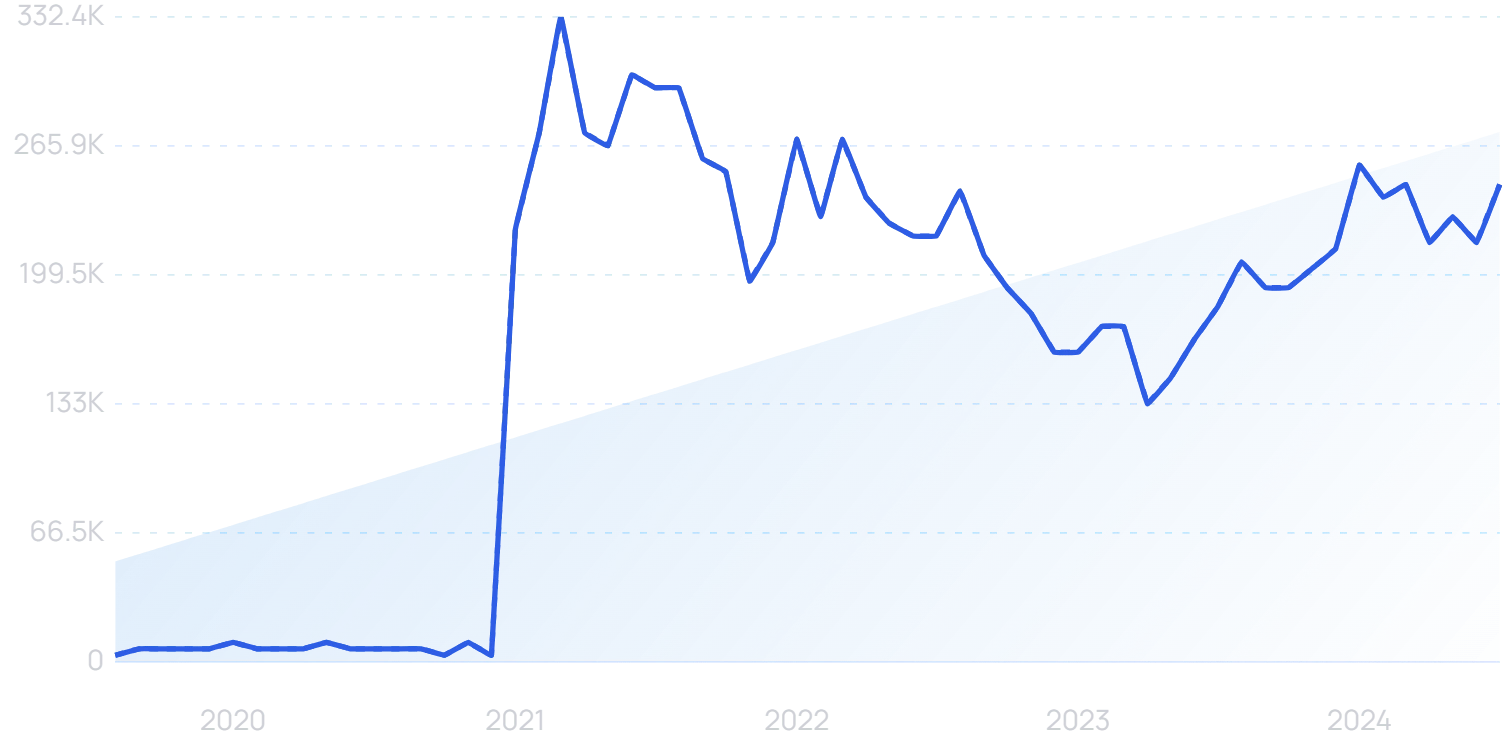

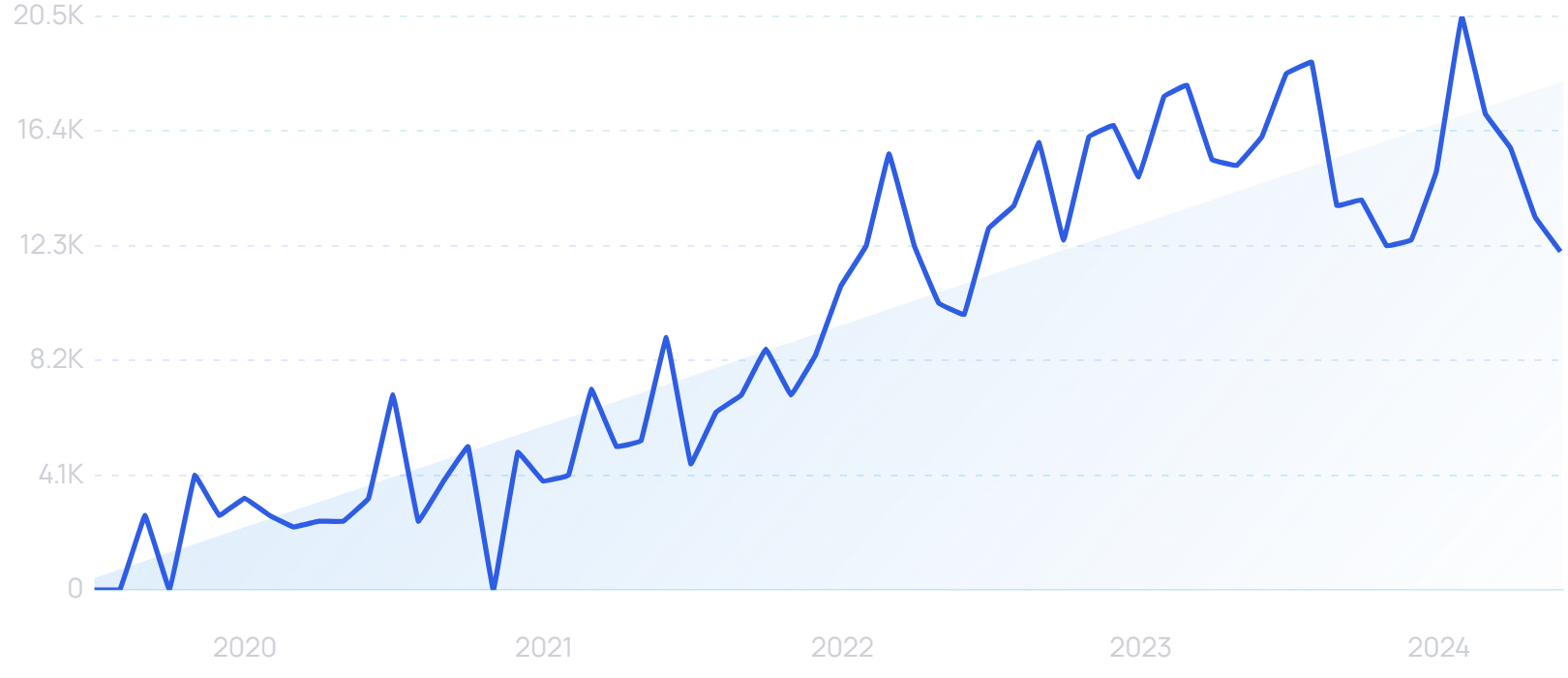

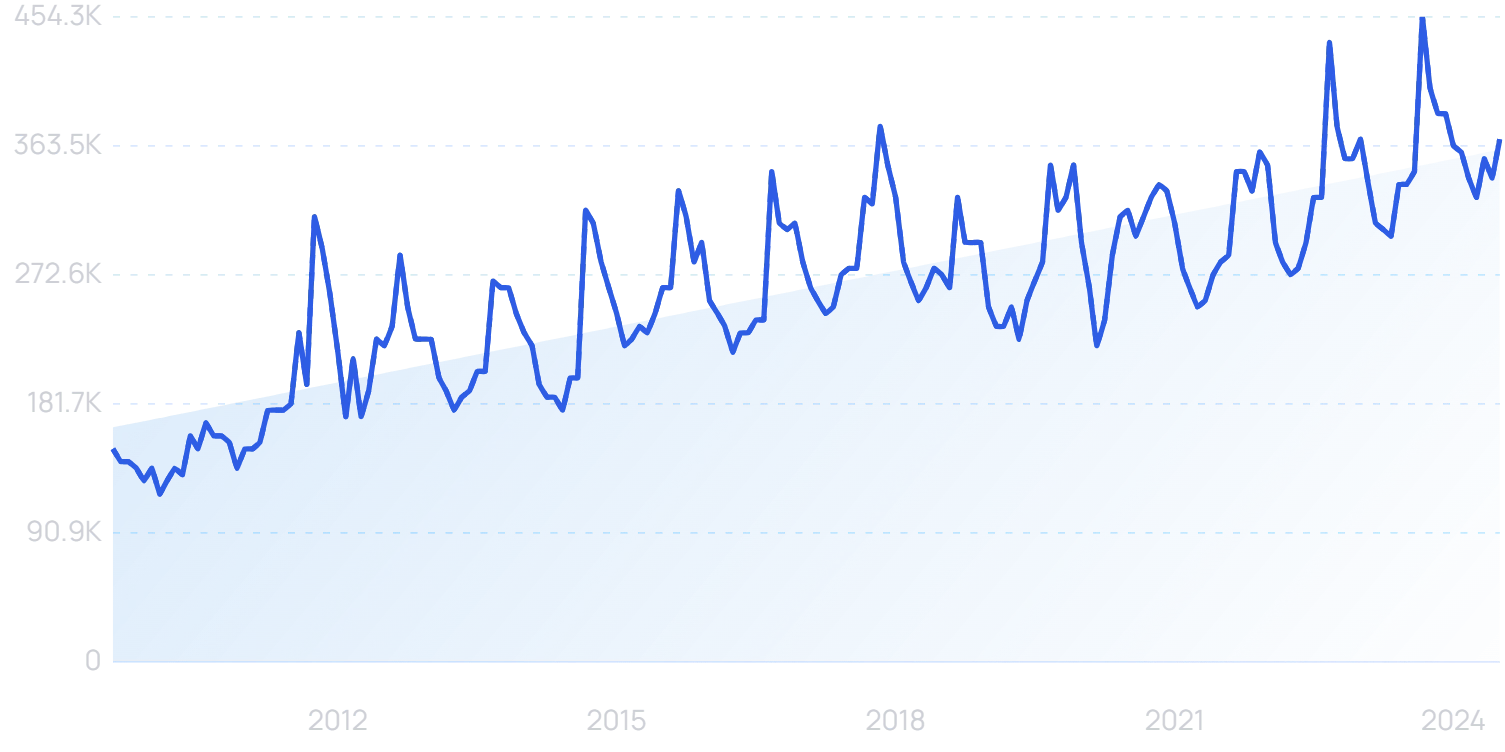

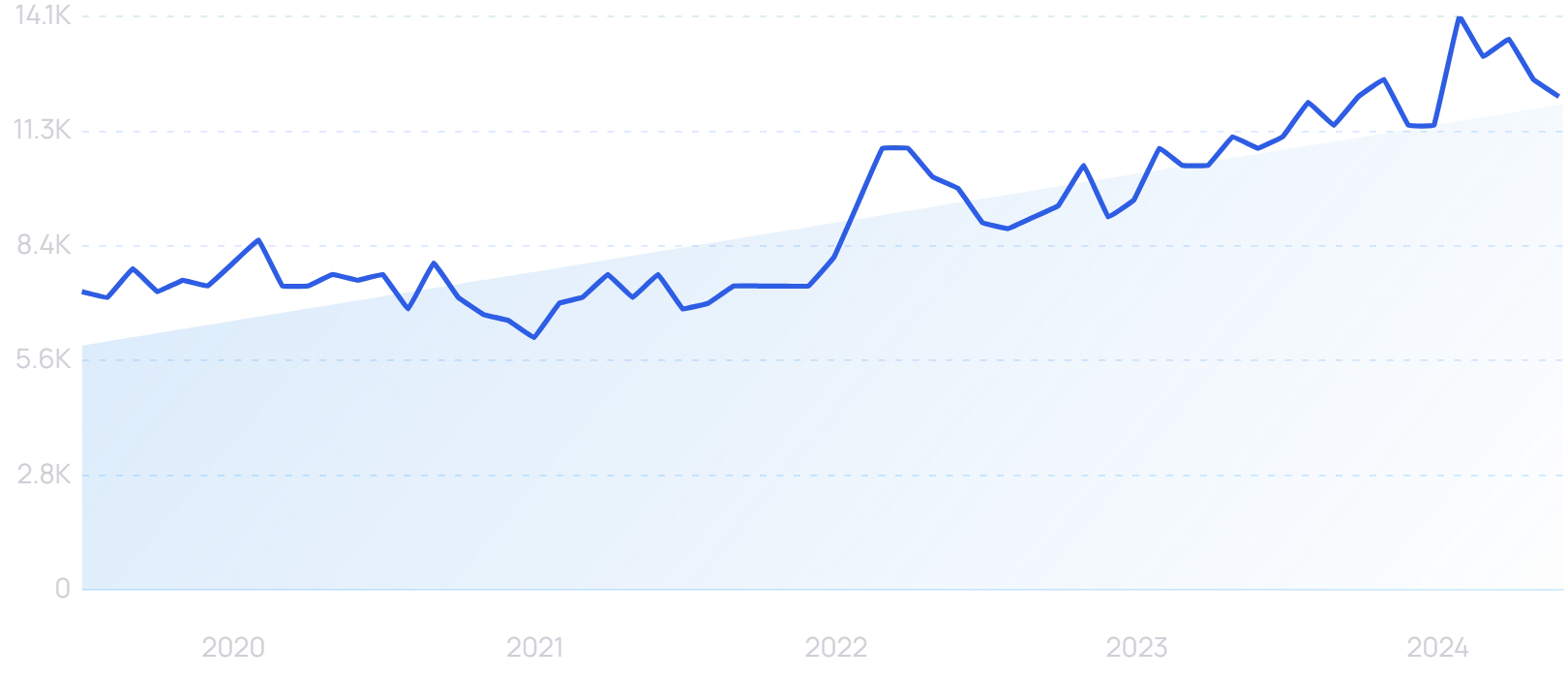

Searches for "InsurTech" have increased by 8,400% over the last 10 years.

Much like Fintech, InsurTech refers to upstarts in the insurance industry that use technology to provide insurance products in a more customer-friendly and cost-effective way.

Some InsurTech startups offer insurance directly. But many work with traditional insurers, who are embracing the benefits of new technology.

In fact, more than half of C-suite decision-makers within the insurance industry increased their investments in technology last year.

And 99% of insurance organizations have a plan to change their technology systems.

Of those, 41% plan to make a change in the next 12 months. Broker/agency management platforms and policy administration systems are key areas of change.

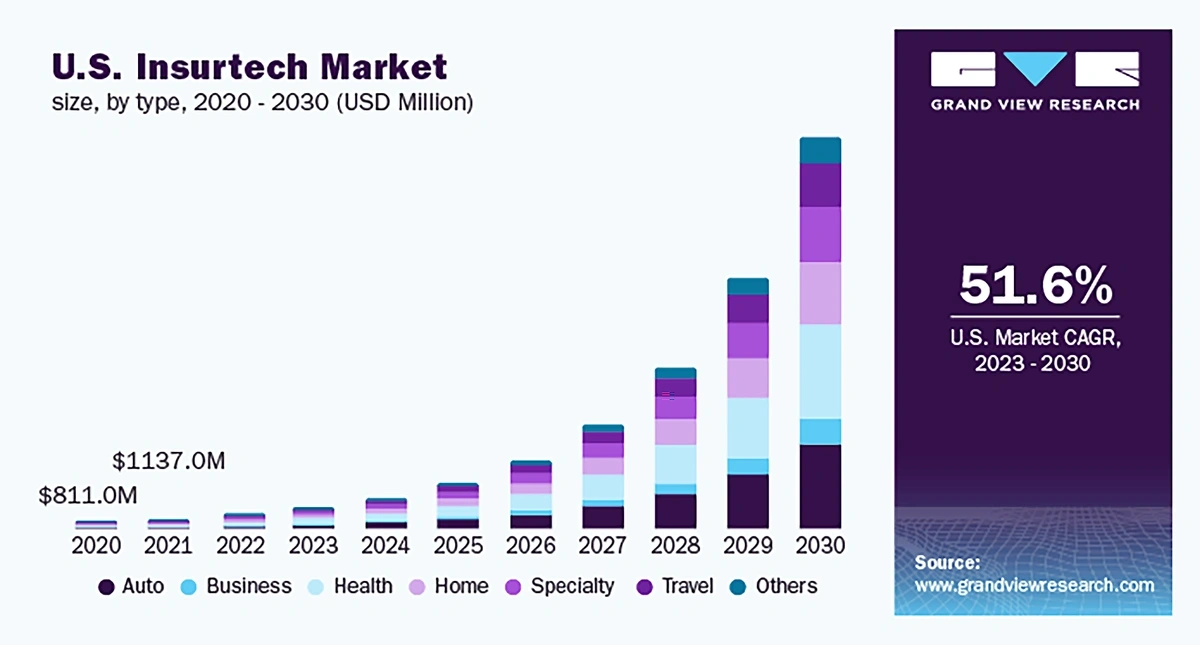

According to Grand View Research, the InsurTech market will grow at a CAGR of 51.6% between 2023 and 2030.

The chart above shows that growth in the InsurTech industry is forecast to explode over the next five years.

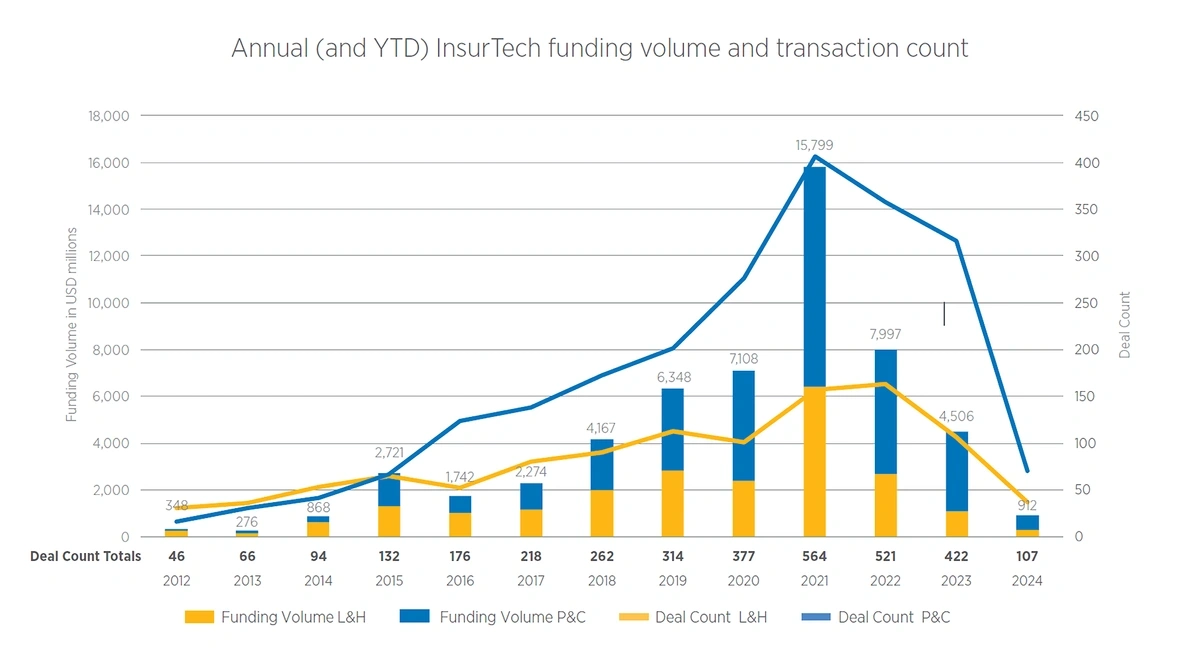

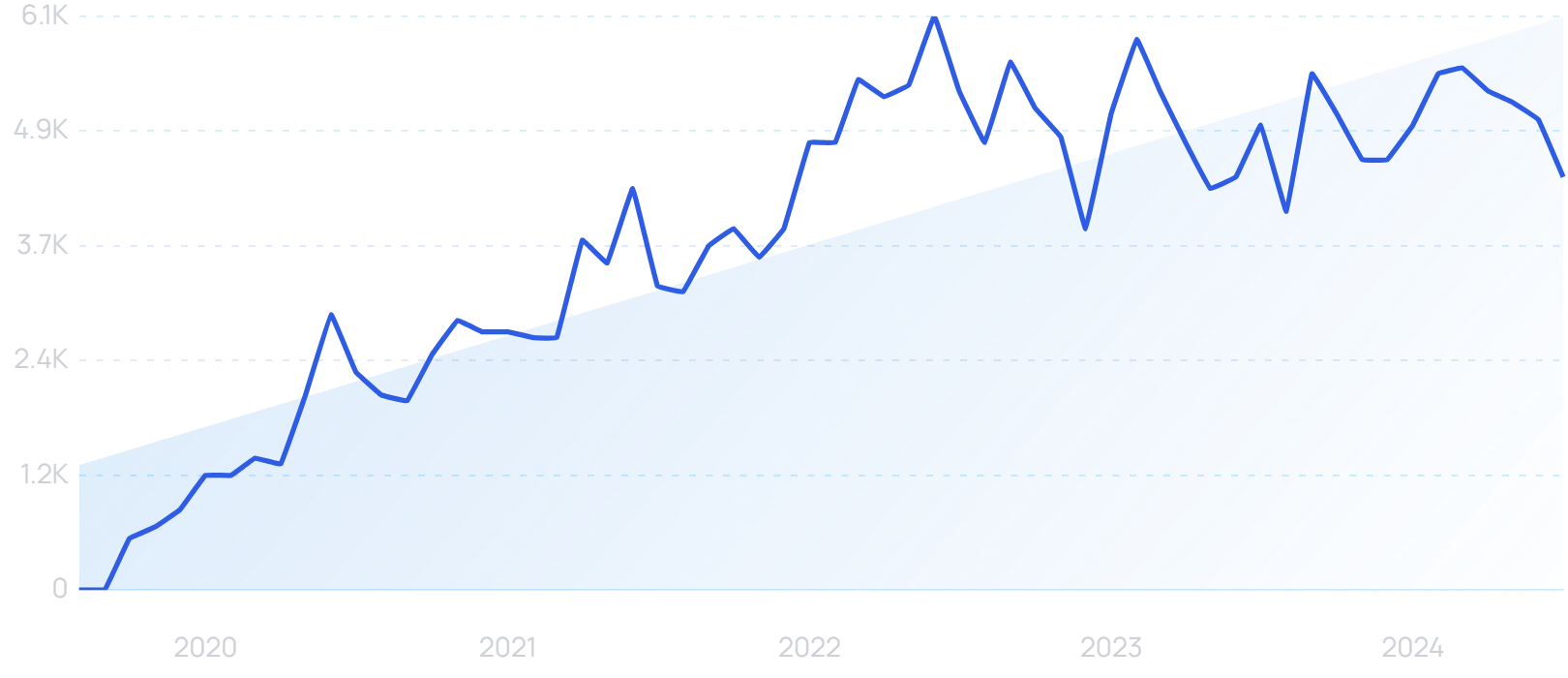

VCs pumped $4.6 billion into InsurTech startups in 2023.

There are some signs of slowing down. The average InsurTech deal size fell by 30.6% quarter-over-quarter in Q1 2024.

And for the first time since Q3 2017, there was no “mega-round” of funding attracting over $100m.

InsurTech funding volume by year, since 2012. The 2024 figures end at Q1.

But in the same period, early-stage InsurTech funding increased 26.5% quarter-on-quarter, showing a continued and growing appetite to invest in startups within the industry.

The largest single deal was a $73M Series B round for Hyperexponential, which is targeting expansion into the US.

Searches for “Hyperexponential” have grown by 8746% in the last 5 years.

The London-based company uses tech that turns data into pricing decisions for insurers. It claims a 3 to 6 percentage point improvement on the “combined ratio” - the sum of losses and expenses divided by earned premiums.

By 2025, it’s estimated that total premiums generated by InsurTech companies will be more than $500 billion.

While traditional insurers typically offer a broad range of services, some of the InsurTech startups have further specialized in a single area to better compete with the big boys.

Next Insurance focuses purely on small businesses and the self-employed.

Searches for “Next Insurance” are up 95% in 5 years.

It has tailored its offerings to be more efficient than other business insurance offerings.

And it is one of the few business insurers out there that allows customers to do everything online.

Next claims that AI and machine learning help to decrease costs by up to 30%, resulting in cheaper insurance options for small businesses.

As of 2024, it has raised over $1.1 billion in venture capital.

3. IoT Makes Insurance More Accurate And Cost-Effective

As the Internet of Things (IoT) proliferates, insurance companies are naturally finding more ways to collect data.

And the potential is huge.

There are more than 14 billion IoT devices being used. That number is expected to grow to over 25 billion by 2030.

IoT-connected devices could potentially touch every area of the insurance market.

And they will likely allow for improved underwriting and cheaper rates.

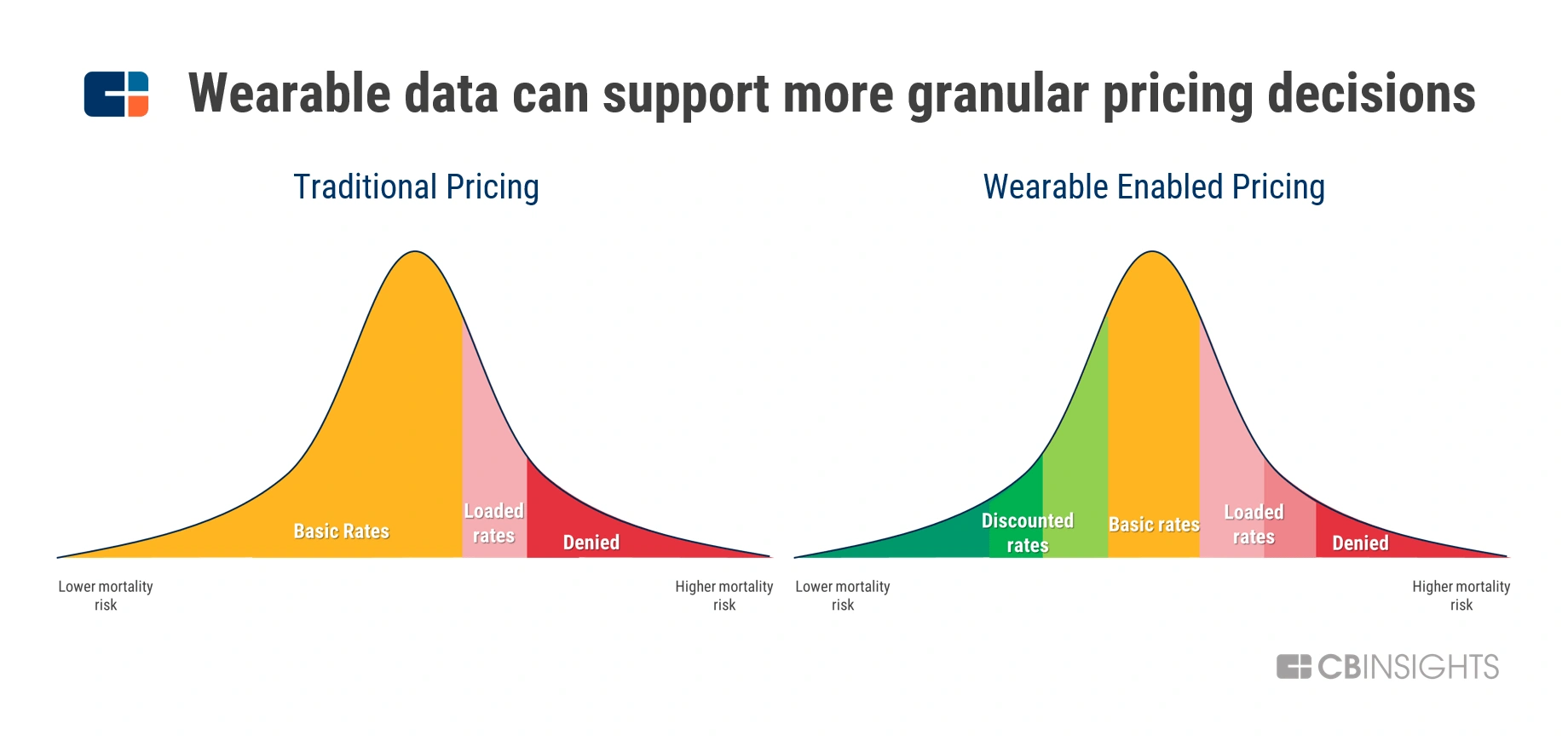

This graphic demonstrates how data collected from IoT devices can influence rates and policy decisions.

Embedded insurance is a concept that goes hand-in-hand with IoT devices.

Embedded insurance is basically insurance that is embedded in a product or a service, not sold separately to a customer.

Searches for "embedded insurance" have risen by 176% over 5 years.

Through sensors or some other method, the insurance company is able to collect data on the customer by embedding its insurance product in whatever the customer is buying.

By doing this, distribution and data collection are both enhanced simultaneously.

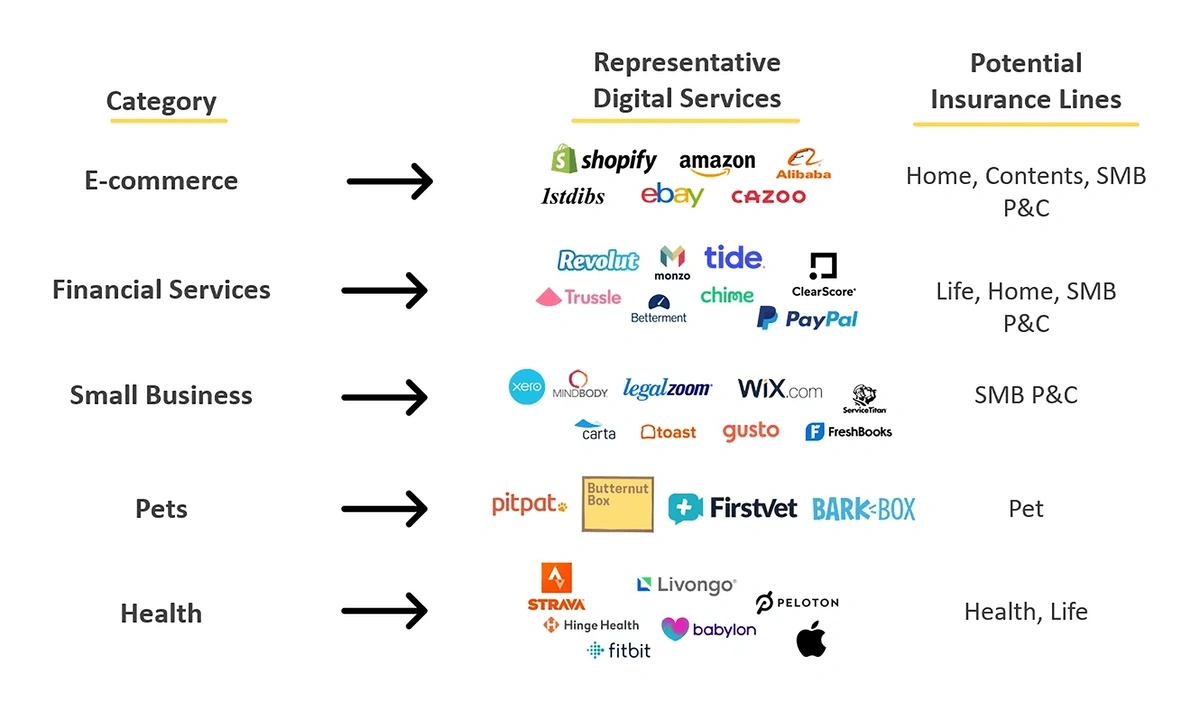

Venture capital firm Albion breaks the possibilities down into categories like this:

Different types of insurance based on the product or service it is embedded in.

And while this is just a glimpse into the future, you can see that the market potential is huge.

Let’s look at some current and upcoming examples to better understand how this kind of insurance distribution and underwriting would work.

The most obvious and talked-about example would probably be Tesla.

Tesla uses data collected by vehicles on the road to maintain a massive internal insurance company. A former CFO said it happened “kind of unintentionally”, in response to customer complaints that quotes from traditional insurers were either too high or unavailable altogether.

Root Insurance has also played a part in providing insurance through Tesla.

Searches for “Root Insurance” are up 7300% in the last 5 years.

Billed as “insurance for good drivers”, Root is one of the most prominent usage-based insurance (UBI) companies out there.

Here’s how it works: once the Root app is downloaded on a user’s phone, the phone’s sensors monitor their driving for a defined period of time.

The app then determines the driver’s safety level, and prices the auto insurance accordingly.

By pricing insurance based primarily on how a customer drives, Root feels that it is able to improve risk assessments.

Because of this, it claims that its innovative pricing methods can save customers up to 44% of the initial quote.

The auto insurance startup began in 2017 to provide discounts to Tesla customers who used the Tesla autopilot feature, Autosteer.

Waymo has found that autonomous driving technology reduces injury-causing accidents by 85%. That produces better outcomes for companies like Root - who may ultimately find that the “best driver”, and therefore the cheapest to insure, is AI.

But unless and until AI takes over entirely, UBI will remain a significant trend in the insurance industry.

Right now, there are about 20 million UBI policies within the automotive insurance industry.

ByMiles offers automotive insurance that is paid by the mile.

Searches for “ByMiles Insurance” are up 2200% in 5 years.

Rather than tracking quality of driving, it uses telemetrics to ascertain quantity. There’s a plug-in tracker, or some newer cars can be connected directly.

This kind of UBI will even survive the self-driving revolution. And the ByMiles CEO has predicted a whole new category of insurance, including cybersecurity insurance for these IoT-connected vehicles.

When it comes to health insurance, wearables look like the next area of interest.

Select health insurers are already “incentivizing” their insurance customers by offering discounted wearable devices (like Fitbits and Apple Watches) and rewards for attaining health goals that are tracked through the device.

And this isn’t just happening in the health space either.

Hippo Insurance offers select policyholders free smart home kits. And premiums may be discounted when the device is activated.

But even though this may improve underwriting and service, data privacy concerns are still a big issue.

Acceptance of IoT tech may be growing. But a significant minority (around a third) of consumers remain uncomfortable about sharing data with insurers.

But as more and more of the population engages with IoT devices, expect insurers to use this real-time data to their advantage.

4. Robotic Process Automation Improves Operations And Pricing

Because of its data-intensive nature, the insurance industry is ripe with repetitive tasks and labor-intensive operations.

Also, it is a highly regulated industry.

Because of this, robotic process automation (RPA) may be useful in increasing efficiency and protecting consumer safety and privacy.

The technology also offers a myriad of ways for new InsurTechs to service traditional insurance companies.

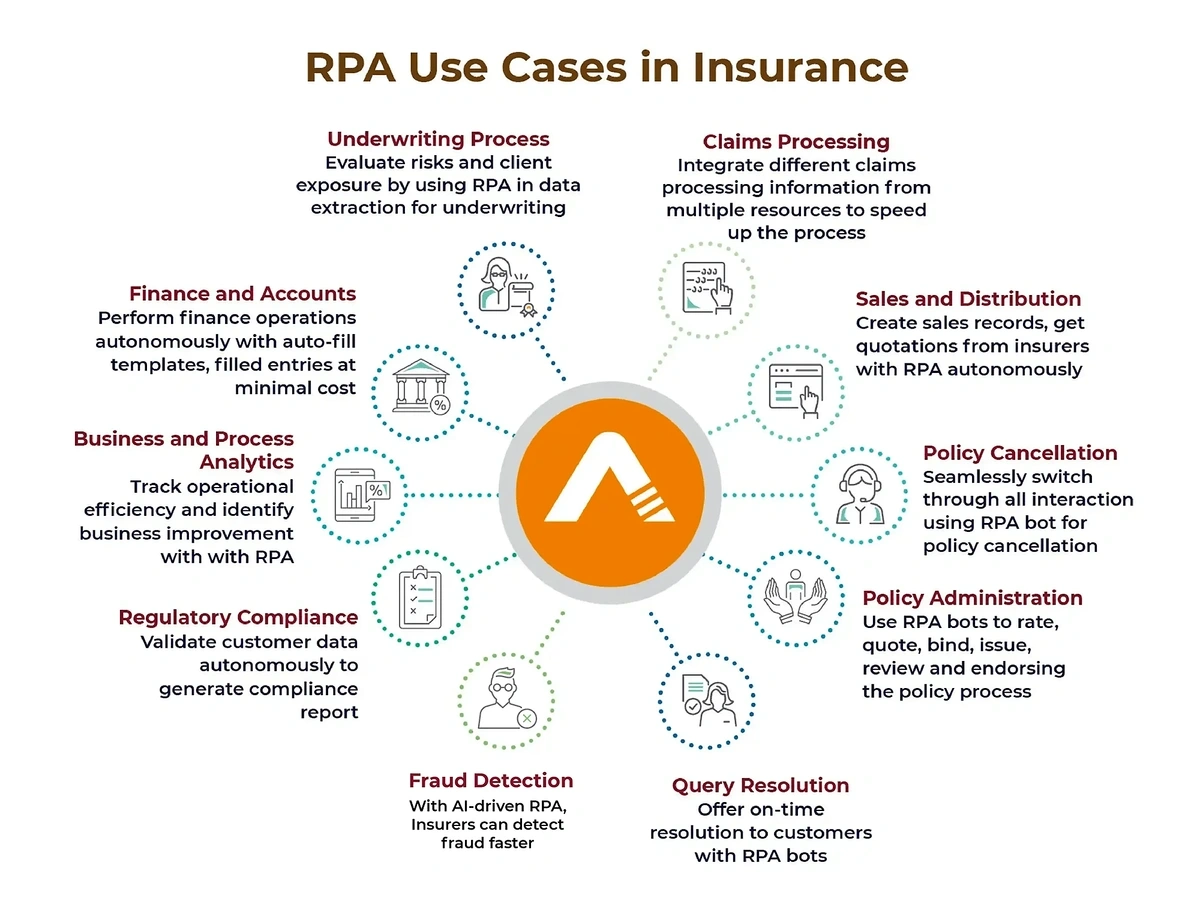

McKinsey estimates that a quarter of all insurance company processes can be automated by 2025. Automation Edge provides some examples:

RPA can be used at a variety of points in the insurance lifecycle.

In areas like insurance claims, underwriting, compliance, and customer service, volume is extremely important.

If processes can be shortened, then the volume will skyrocket – improving overall outcomes.

UI Path predicts that RPA can cut out about 34% of the human expertise required to deal with typical insurance processes.

And if more insurers can get more done with the same personnel, it improves outcomes for customers and shareholders.

Roughly 23% of the time customers waste dealing with their insurance carriers can be eliminated by RPA.

Robocorp allows individuals and businesses to build their own Python “workers”, enabling automation at scale in a variety of scenarios.

Searches for “Robocorp” have grown by 5800% in the last 5 years.

In an insurance case study, Robocorp reduced process time by 83% and produced a 47% cost saving.

The drive for more automation can be seen across a variety of industries.

“Hyperautomation” searches are up by 7100% in the last 5 years.

5. Non-Traditional Companies Offer Insurance Products

While some of the top InsurTech startups are competing with traditional insurers, there is another new entrant that the insurance industry has to worry about now – Big Tech.

Companies like Amazon, Google, Apple, and Facebook already have a strong relationship with millions of customers.

They are now trying to leverage this to offer more products and services – specifically insurance.

Since some of the most popular wearables come from companies like Apple and Google, it can only be expected that those two would jump into the health insurance market.

Or at least partner with major providers to offer coverage.

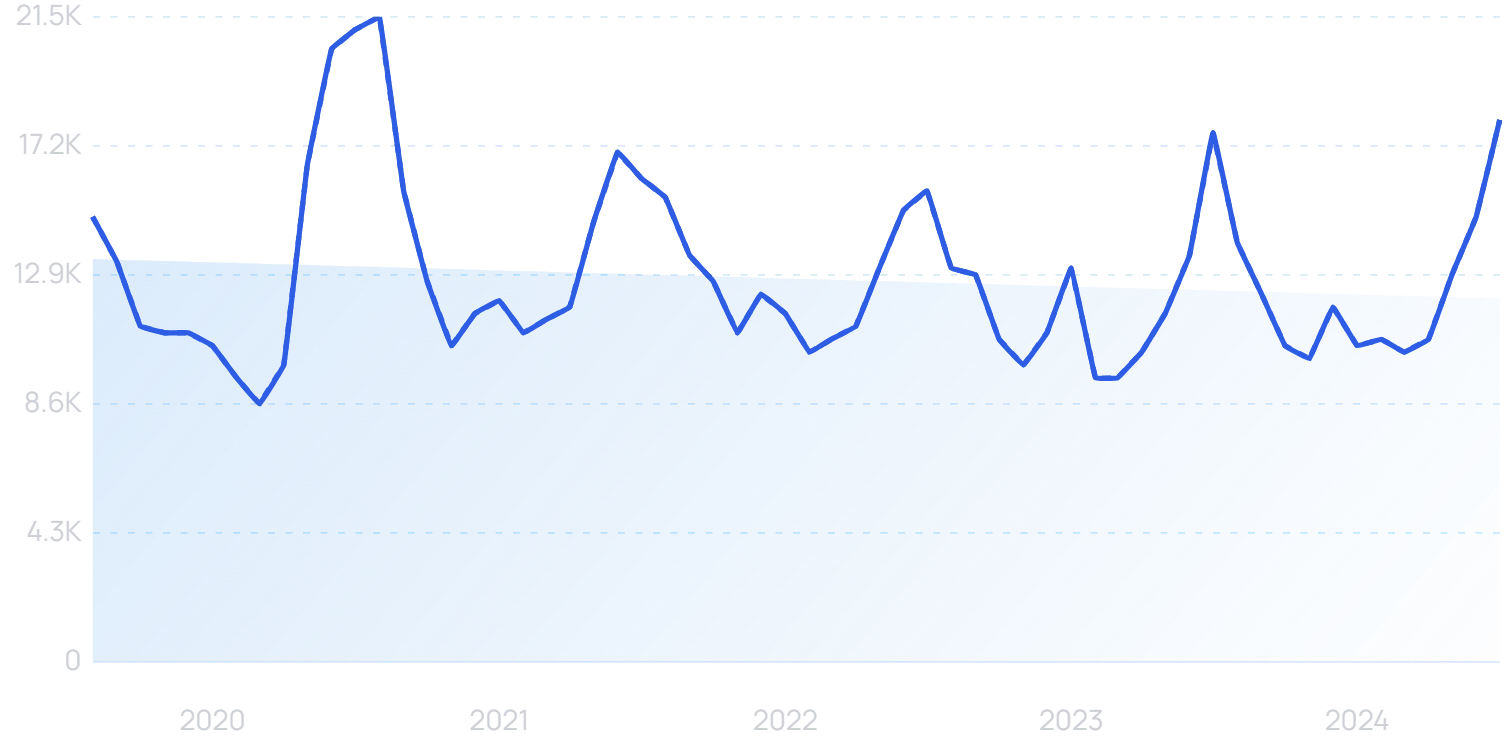

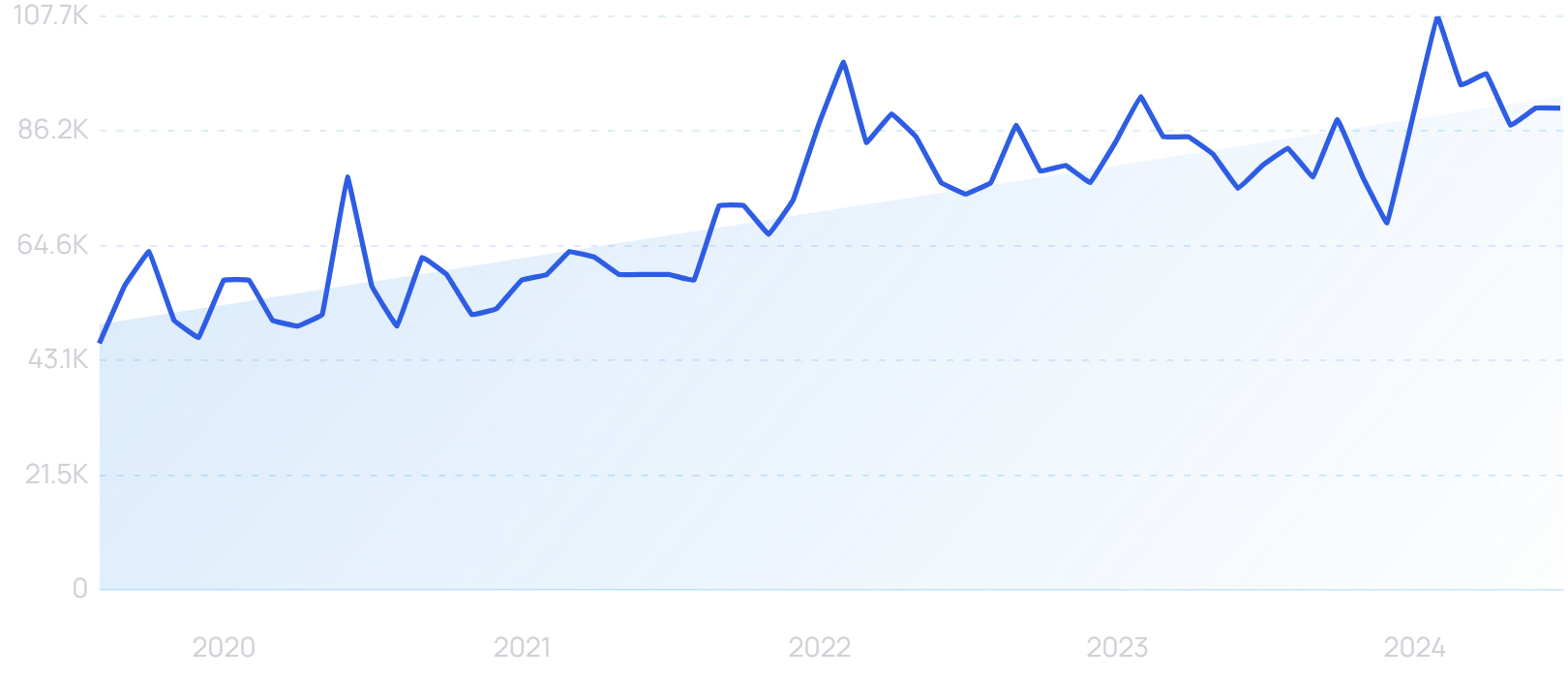

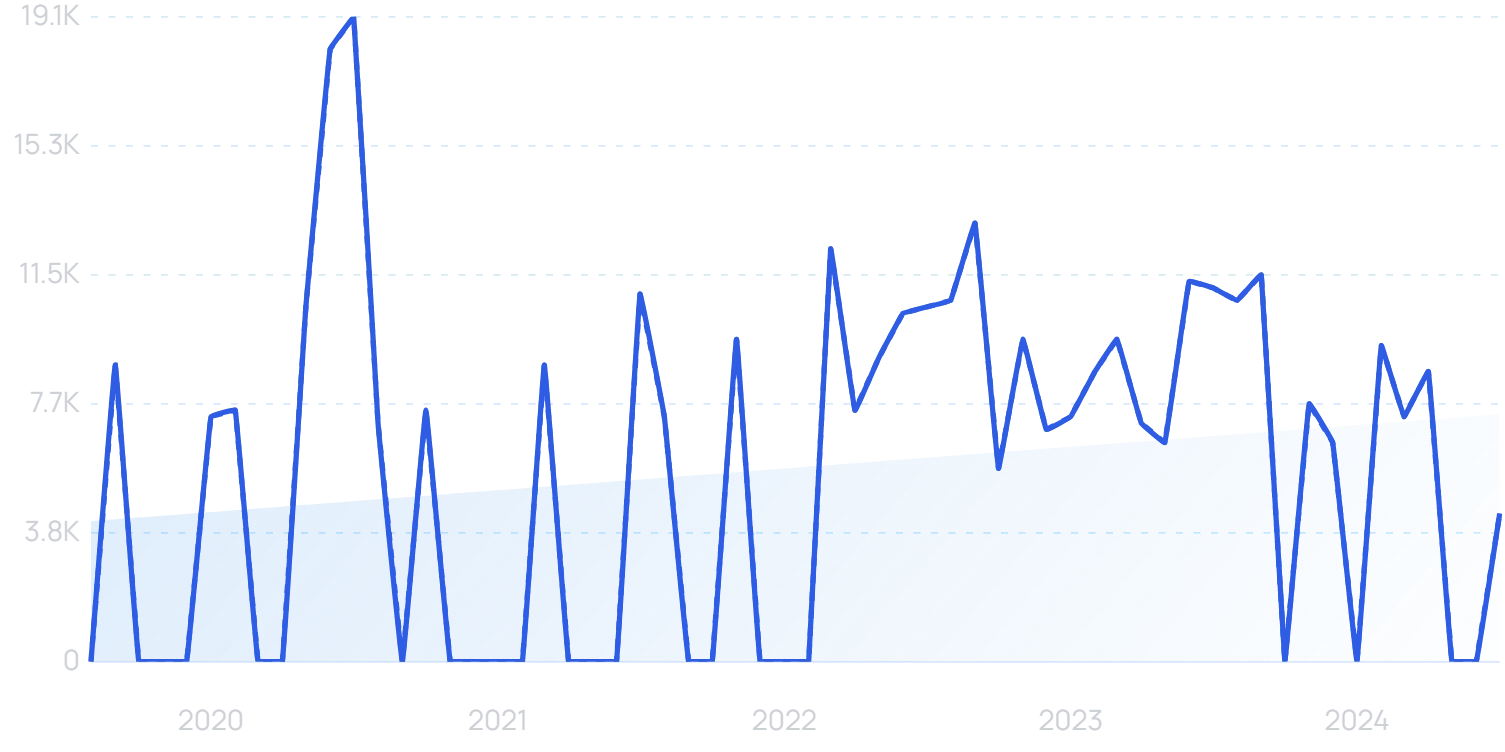

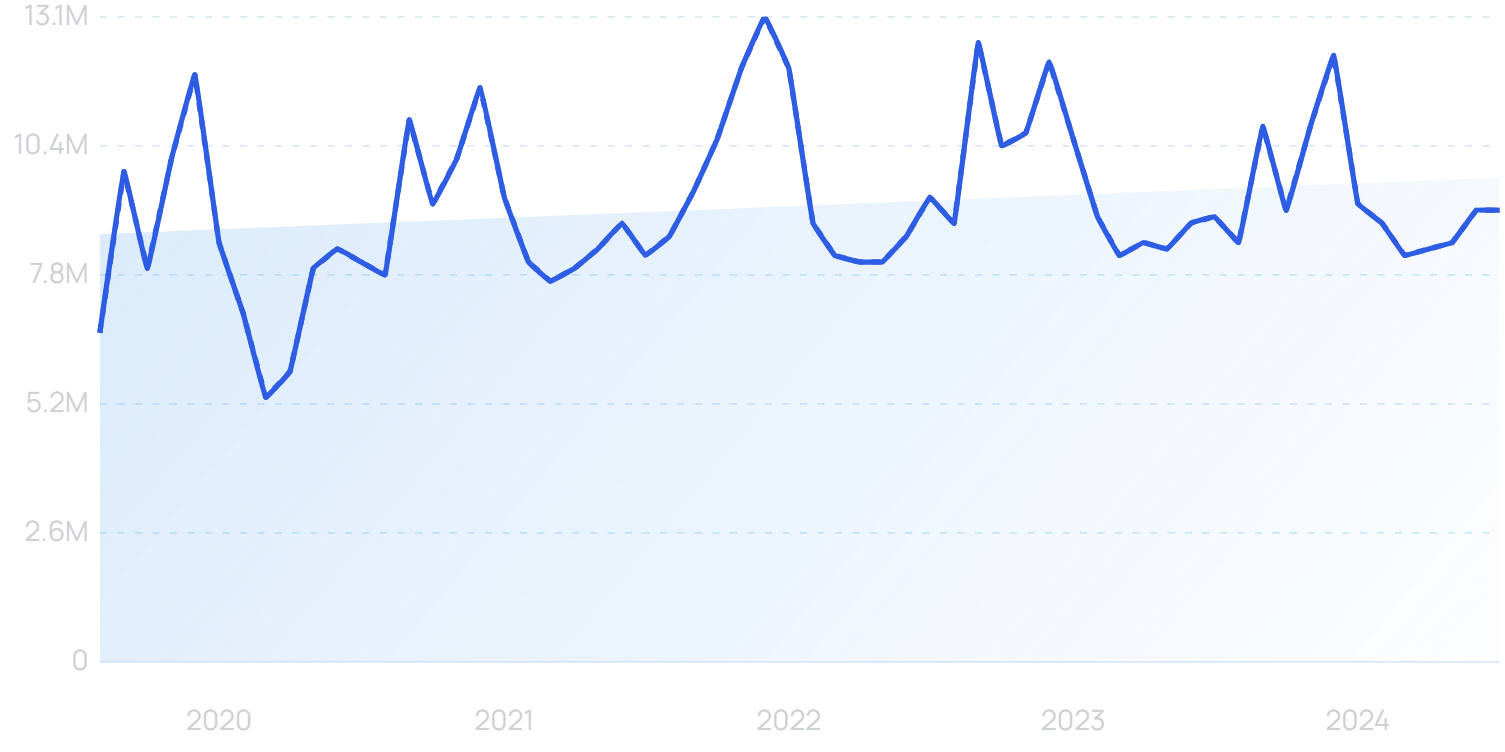

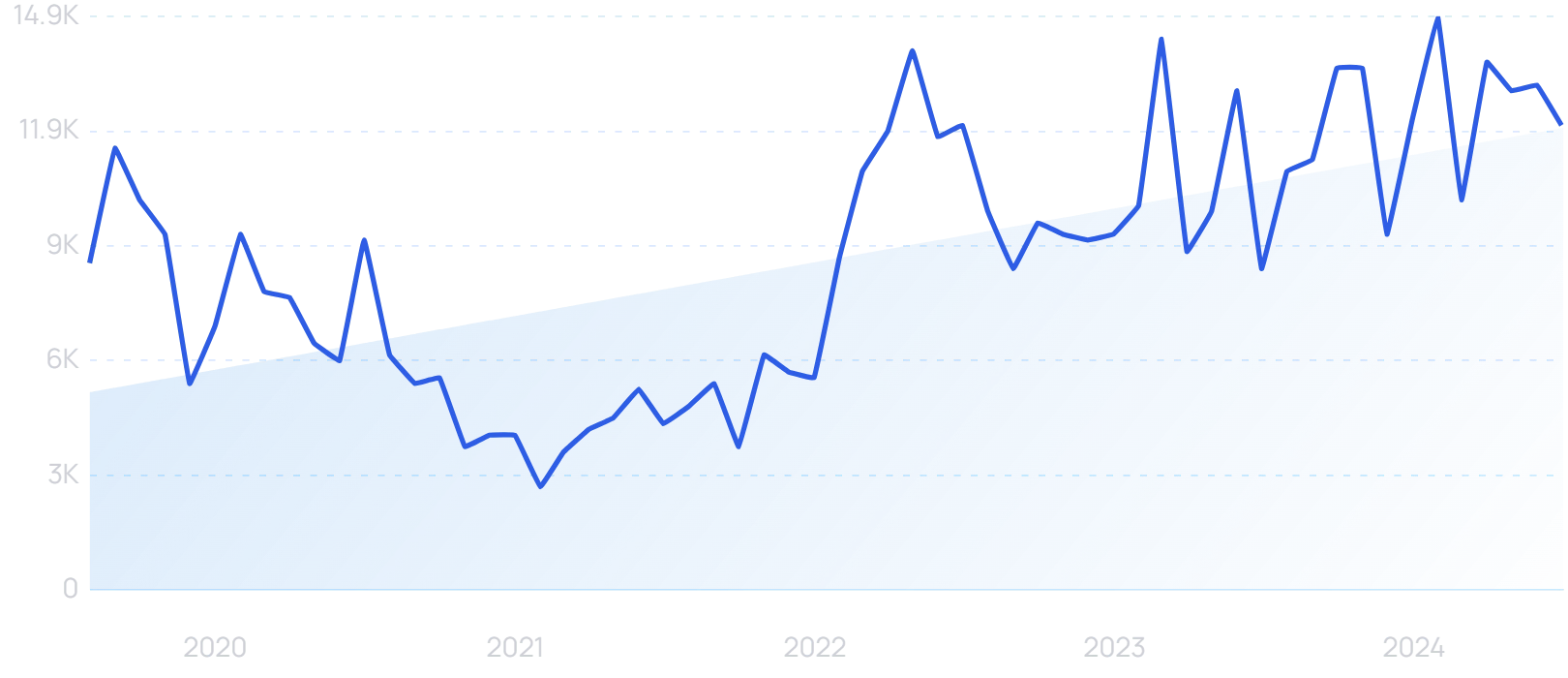

Searches for “Apple Watch” are up 31% in 5 years. Note the spike every January, a common theme in health and fitness.

In the home insurance market, Amazon and Google, with their smart home products, are primed to start offering policies supported by home monitoring.

Amazon has already tried and failed with a home insurance offering in the UK market, but Insurance Business Mag makes the case that it could still make its way to the US.

And big tech has also long been offering insurance for its own physical products.

Where traditional contents insurance has been slow to account for personal gadgets, AppleCare has become a major part of Apple’s business.

Searches for “Apple Care” have grown by 136% over 15 years.

In Q1 2024, the services side of Apple’s business - which includes its AppleCare offerings - brought in $23.87 billion.

6. Parametric Insurance Grows To Meet Climate Crisis

Traditional insurance works by covering the actual loss suffered as a result of a given event.

Parametric insurance simply pays out a pre-agreed amount when a trigger event happens, regardless of actual loss suffered.

It’s not a brand new phenomenon, but interest is clearly growing.

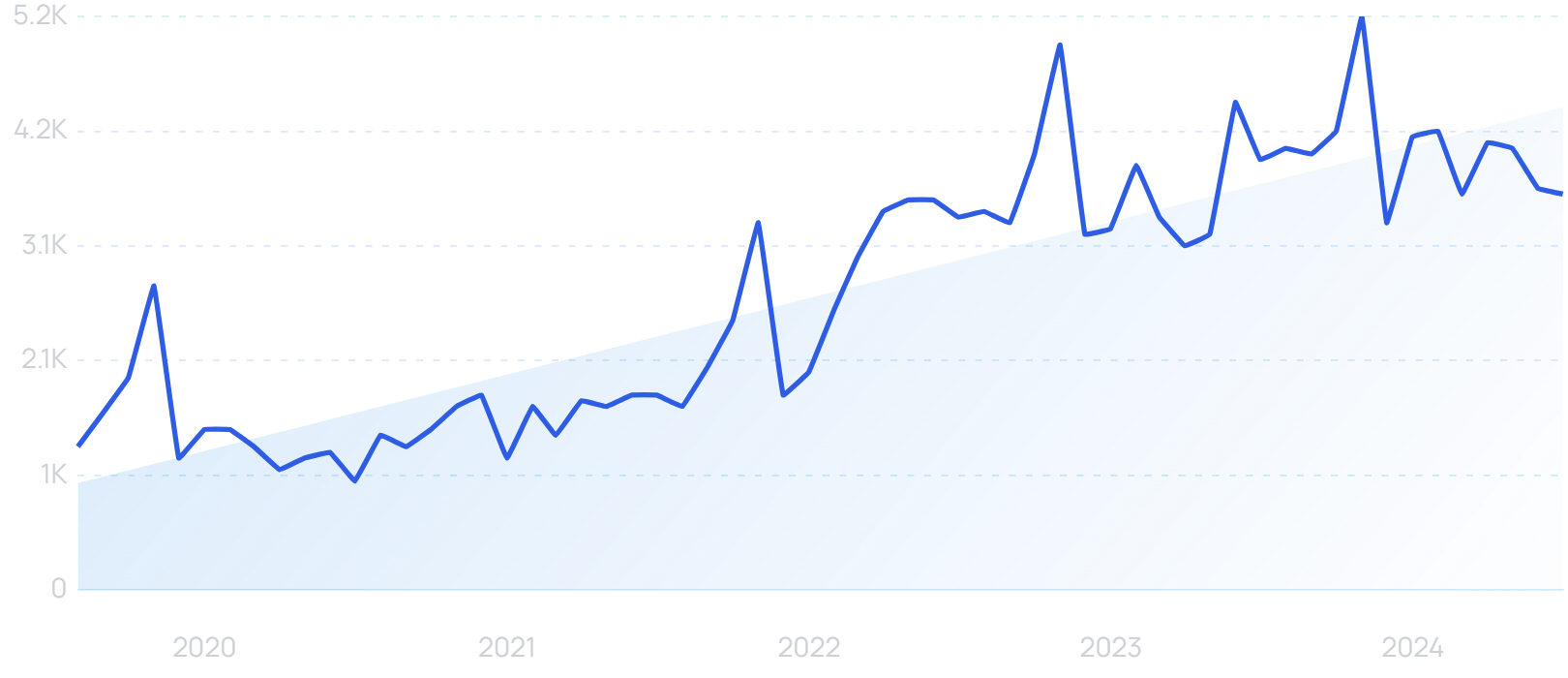

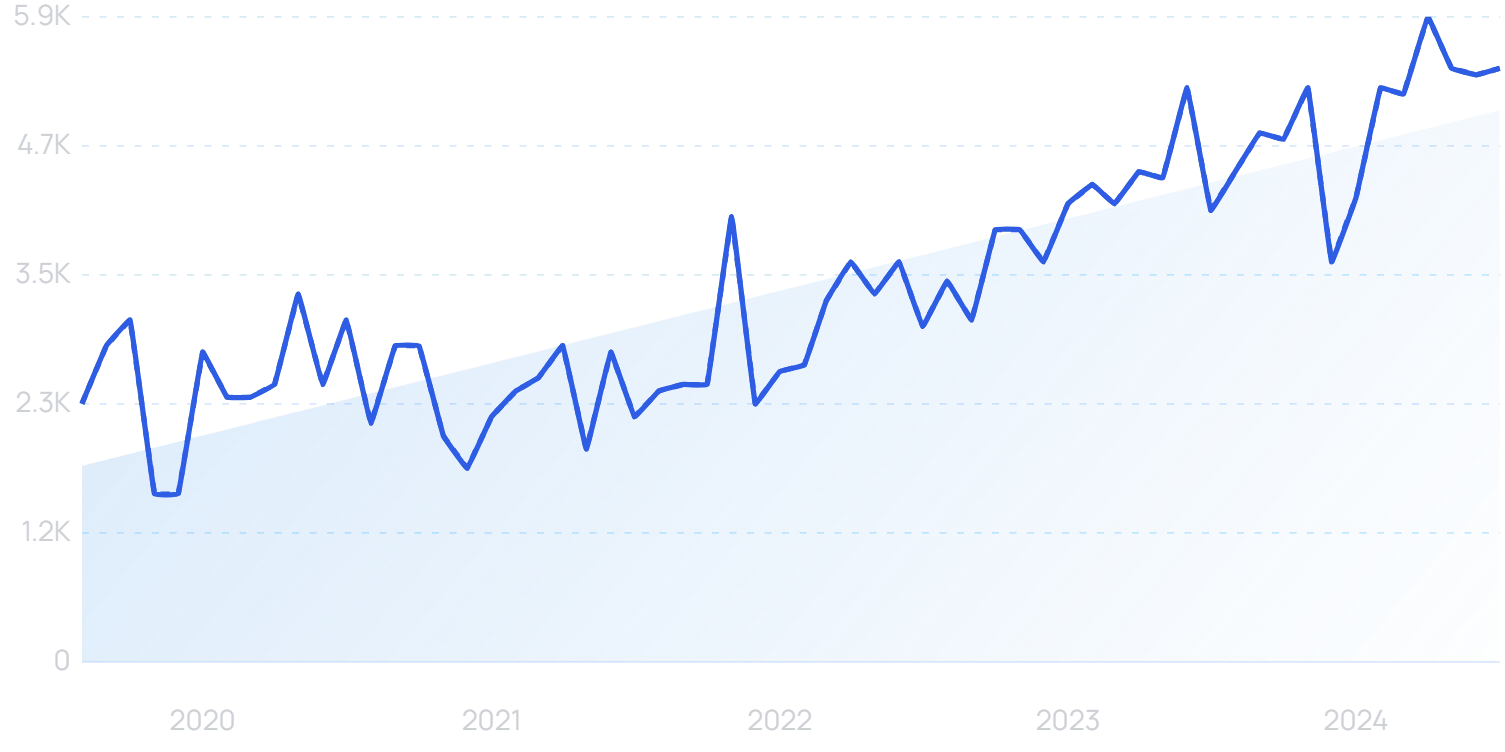

Searches for “parametric insurance” have grown by 130% over 5 years.

And much of the interest focuses on weather phenomena, where objective criteria like points on the Richter Scale can be used to determine when a policy pays out.

Allianz reports that insured costs for natural disasters exceeded $100bn for the fourth year in a row in 2023, which it attributes to climate change.

And companies with certain intangible costs or hard-to-insure items may prefer a simple payout upon the occurrence of a climate event, as opposed to traditional cover.

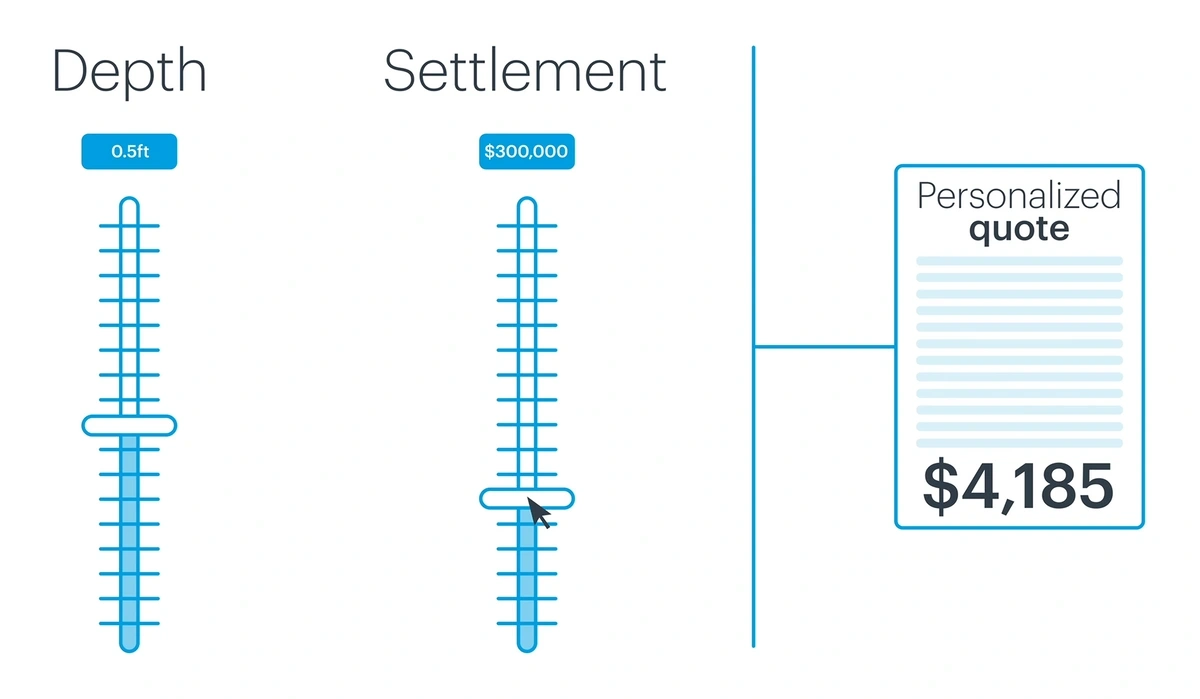

FloodFlash offers parametric insurance against floods.

A visualization of the FloodFlash parametric insurance offering.

Customers select a depth of flood water and a level of cover, and receive a quote. Sensors are then installed, and if water ever reaches the agreed depth, the policy pays out.

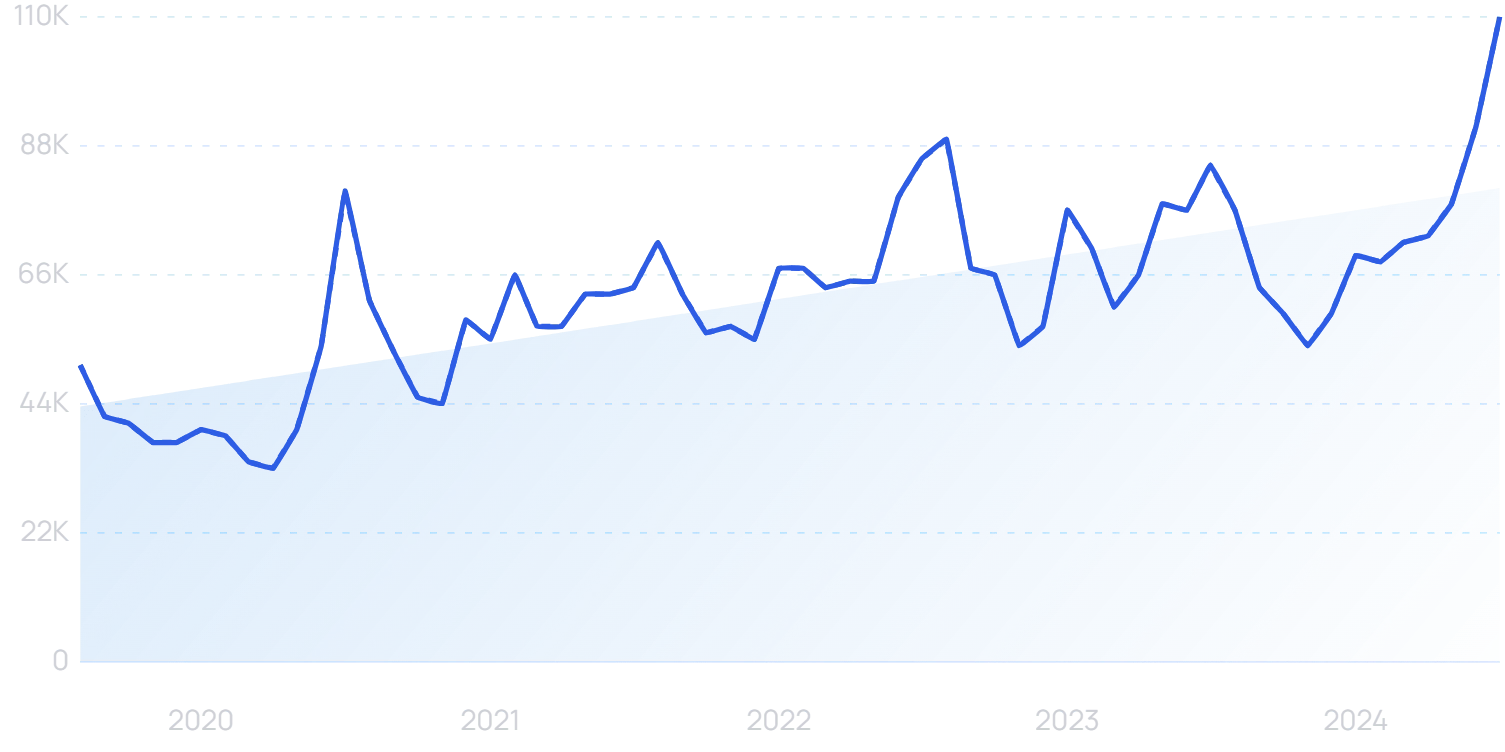

7. Technology Rises To Fraud Detection Challenge

In the US alone, an estimated $308.6 billion is lost to insurance fraud every year.

It’s thought that this comes at the cost of approximately $900 per customer, primarily through increased premiums.

Naturally, insurers are keen to detect and prevent fraudulent claims.

“Fraud detection” searches are up 65% in the last 5 years.

A Q1 2024 report from Gallagher Re names fraud detection as a “high impact” area for AI innovation.

ComplyAdvantage provides AI-driven fraud detection software to the insurance industry, among others.

“ComplyAdvantage” searches are up 42% over 5 years.

It raised $70m at its last funding round, with Goldman Sachs among the investors.

Conclusion

That’s all for the top insurance industry trends.

You never know what’s going to happen when innovation starts to occur in an industry as heavily regulated and as static as insurance. But it’s always interesting when new companies start to enter the fray. Or when existing insurance giants adapt their business models to changes in tech or customer preferences.

Overall, many of the top InsurTech companies are leveraging new technologies. And going all-in with digital transformation. Without RPA or AI, companies like Hippo and Next Insurance wouldn’t be able to provide such efficient offerings.

Expect to see this trend spread across the traditional insurance industry as the technologies improve.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more