Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Growing Manufacturing Companies & Startups (2024)

You may also like:

In the United States alone, the market size of the manufacturing industry is worth $3.17 trillion. It's projected to grow at a CAGR of 3.16% until 2028.

The rise of software and robotics has made a deep, lasting impact on the manufacturing industry as a whole.

Since manufacturing has so many different processes and complex stages of production, there is an insatiable demand for software and robotics to enhance automation and improve workflows.

Read on for our list of 20 manufacturing startups that are working on everything from cutting-edge analytics to state-of-the-art robotic assistants.

1. Cognite

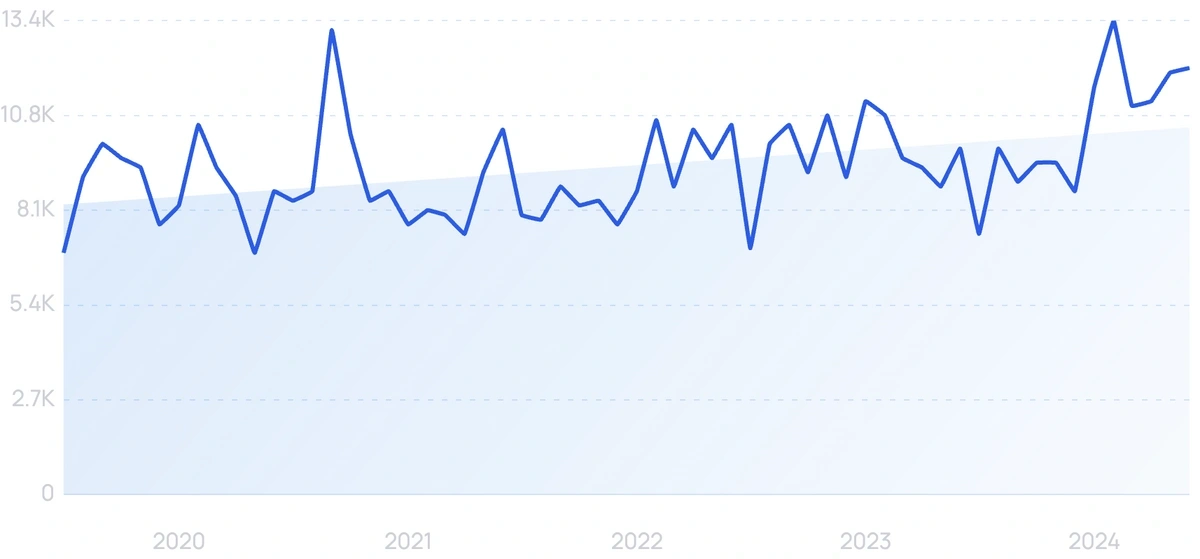

5-year search growth: 76%

Search growth status: Exploding

Year founded: 2016

Location: Lysaker, Norway

Funding: $338.2M (Secondary Market)

What they do: Used by heavy hitters like BP and Aramco, Cognite’s bread and butter product is an industrial data operations platform called Cognite Data Fusion (CDF). CDF allows the manufacturing and industrial customers to have a single home for data visualization while providing scale for AI and ML applications that can easily integrate with CDF.

For AkerBP, a major oil player from Norway, Cognite is saving the firm around $6M annually on top of reducing their environmental impact.

2. Electric Hydrogen

5-year search growth: 152%

Search growth status: Regular

Year founded: 2021

Location: Natick, Massachusetts

Funding: $798.3M (Debt Financing)

What they do: Electric Hydrogen is a startup that aims to reduce the carbon footprint of heavy-duty transportation by providing a hybrid hydrogen-electric solution. Their platform combines a hydrogen fuel cell system with electric batteries to provide a range of up to 600 miles, making it an attractive option for long-haul trucking. Their technology also allows for easy refueling and eliminates the need for costly and time-consuming battery recharging.

3. EquipmentShare

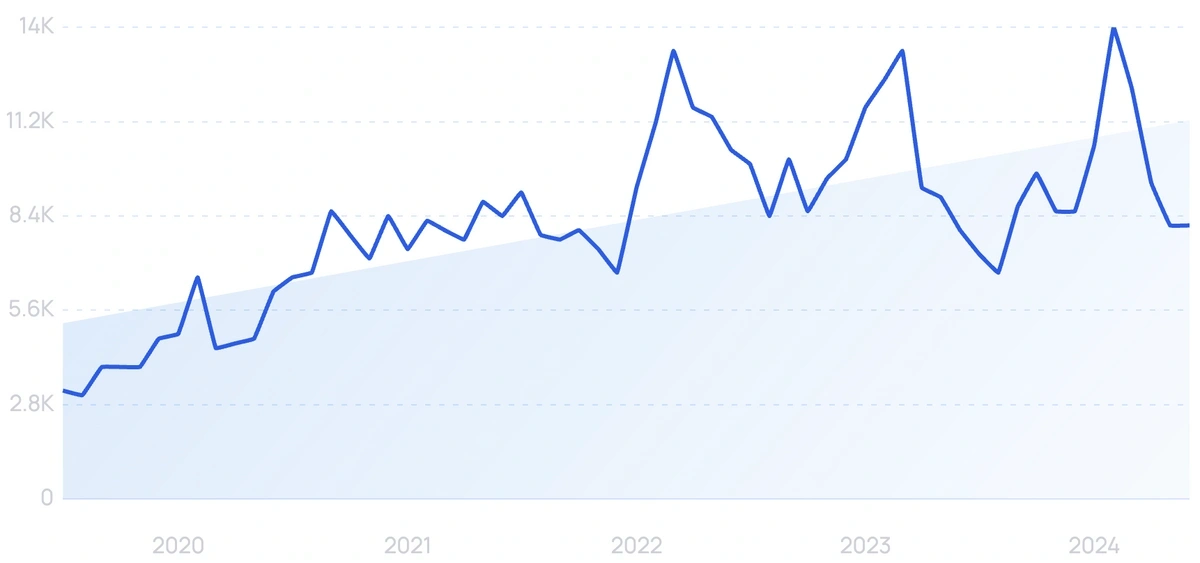

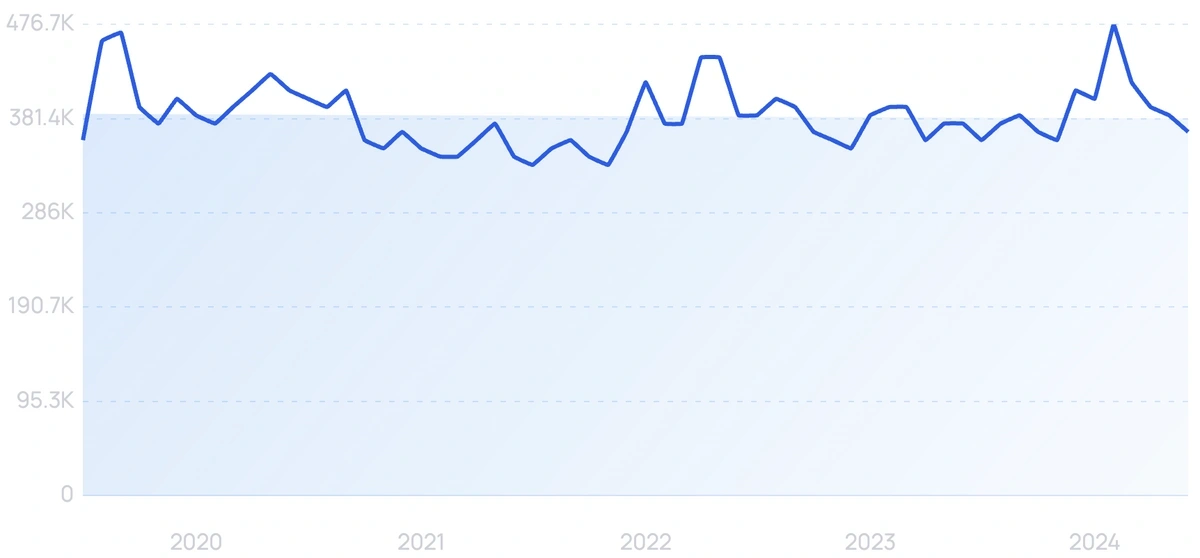

5-year search growth: 400%

Search growth status: Exploding

Year founded: 2014

Location: Columbia, Missouri

Funding: $3.5B (Debt Financing)

What they do: EquipmentShare noticed common problems that contractors had with the availability of flexible on-site machinery and equipment and invented a solution. Operating over 80 full-service facilities in 29 states, contractors can simply pick what’s needed on a certain project and then manage their rentals with EquipmentShare’s Track technology.

Their tracking technology allows managers to monitor equipment, get real-time alerts on status and location, and check on the health of the equipment over the life of the project. EquipmentShare was recognized by CIO Applications as a top 2021 Construction Tech firm.

4. Gecko Robotics

5-year search growth: 26%

Search growth status: Regular

Year founded: 2013

Location: Pittsburgh, Pennsylvania

Funding: $222M (Series C)

What they do: Infrastructure inspections for manufacturing or construction are often dangerous and fraught with risks for humans, not to mention costly scaffolding costs or special equipment needed for hard-to-reach places. Gecko Robotics’ innovative line of robots lined with sensors crawl into hard-to-reach spaces and perform inspections on boilers, piping, machinery, and more. Damage to critical machinery in hazardous industries like chemical and even pulp paper production can set teams and deadlines back for weeks at a time. Gecko safely goes where humans shouldn’t while collecting critical infrastructure data necessary for repairs.

5. Tulip Interfaces

5-year search growth: 100%

Search growth status: Peaked

Year founded: 2014

Location: Somerville, Massachusetts

Funding: $152.5M (Series C)

What they do: Tulip Interfaces connects systems, devices, machines, and people involved in the manufacturing process together in one streamlined platform. Manufacturing is often complicated and involves countless steps, protocols, and software in the endless pursuit of efficiency. Teams that Tulip Interfaces helps include operations, IT, engineering, and quality assurance. Tulip Interfaces keeps its clients under wraps, but their platform has been deployed by “dozens of global companies” in industries ranging from Aerospace to Pharmaceuticals.

6. Soft Robotics

5-year search growth: 20%

Search growth status: Regular

Year founded: 2013

Location: Bedford, Massachusetts

Funding: $86M (Series C)

What they do: Soft Robotics was well-positioned to take advantage of labor shortages in the food industry as a result of Covid-19. Their proprietary pneumatic powered gripper was designed for the delicate task of picking food and packaging, which typically requires a human being. Soft Robotics holds over 40 patents and applications around their custom machinery. The US fresh produce packing market size is around $27B today, and Soft Robotics is aiming to become the market leader in a niche that’s ripe for disruption.

7. FORT Robotics

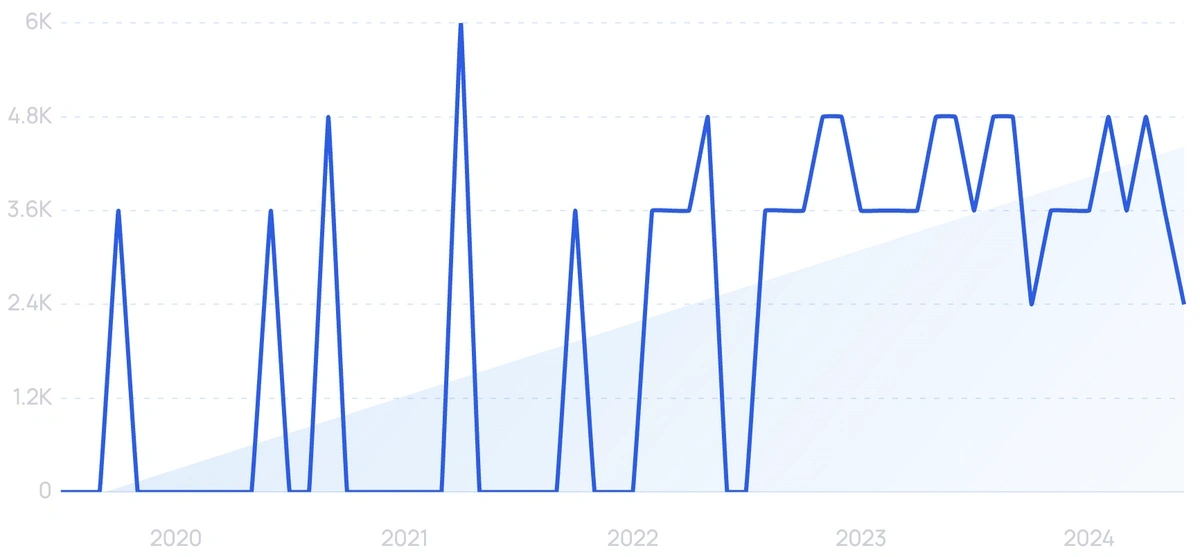

5-year search growth: 200%

Search growth status: Regular

Year founded: 2018

Location: Philadelphia, Pennsylvania

Funding: $38M (Series B)

What they do: FORT Robotics is a safety and security technology company that focuses on developing systems for autonomous machines such as drones, forklifts, and robots. The company's products aim to ensure safe and secure use of these machines in industrial environments. FORT Robotics offers solutions such as software, sensors, and hardware to enable remote monitoring and control of machines to mitigate risks and prevent accidents.

8. Ready Robotics

5-year search growth: 2%

Search growth status: Regular

Year founded: 2016

Location: Columbus, Ohio

Funding: $41.5M (Corporate Round)

What they do: Ready Robotics is all about ease of use through their plug n’ play hardware. Manufacturers can rapidly deploy robots to the floor through simple software they call “Forge OS”. The idea is to create the standard for operating manufacturing robotics software much like Apple’s iOS for smartphones. Over 250 robots from companies like Epson, Yamaha, and Micron are supported by Forge OS and the list continues to grow.

9. Bright Machines

5-year search growth: 14%

Search growth status: Peaked

Year founded: 2018

Location: San Francisco, California

Funding: $437M (Series B)

What they do: Founded by former Autodesk executive Armar Hanspal in 2018, Bright Machines completely automates the electronic devices manufacturing process with a combination of cutting-edge software and robotics. Bright Machines has earned rave reviews from companies like BMW for their ability to help manufacturers scale in a flexible fashion and automate the assembly line tasks like fastening, welding, labeling, and assembling.

In June 2024, Bright Machines raised $126 million in Series C funding to continue developing new products and finding strategic partners at scale.

10. RightHand Robotics

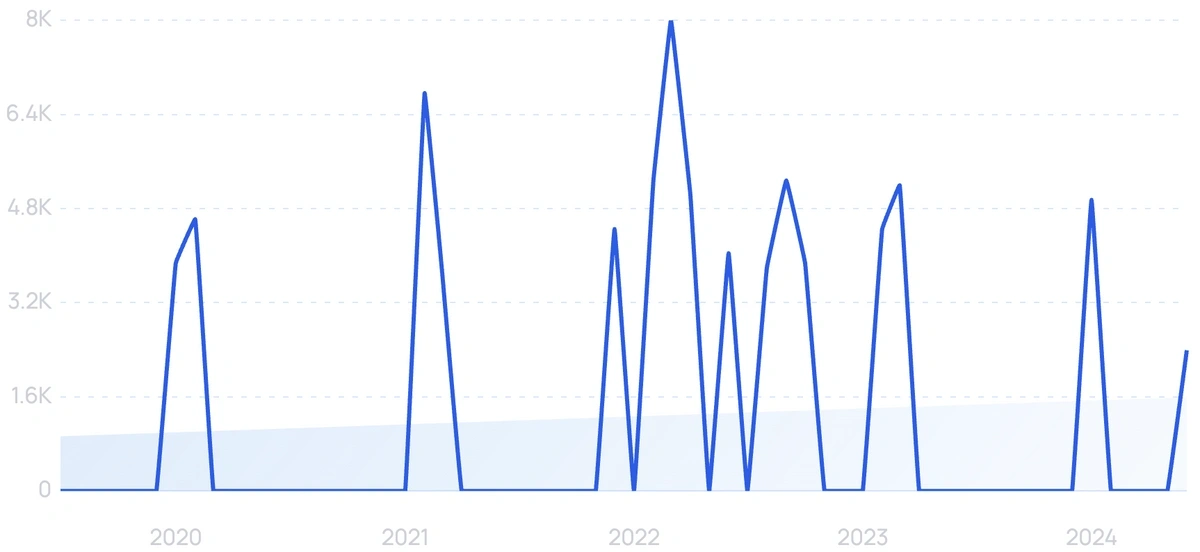

5-year search growth: 2,800%

Search growth status: Peaked

Year founded: 2015

Location: Somerville, Massachusetts

Funding: $101.3M (Series C)

What they do: The global piece-picking robotics market was valued at $148.1M in 2020 and is expected to reach $2.8B by 2026, a staggering compounded growth rate of 62.5% in the next 5 years. With the global pandemic, labor shortages, and uncontrollable amounts of online ordering, RightHand Robotics has received a boost for their robots that carefully pick pieces and automate manual tasks. RightHand’s robotics are able to fulfill tasks for e-commerce clients, pharma, groceries and more.

11. Robust AI

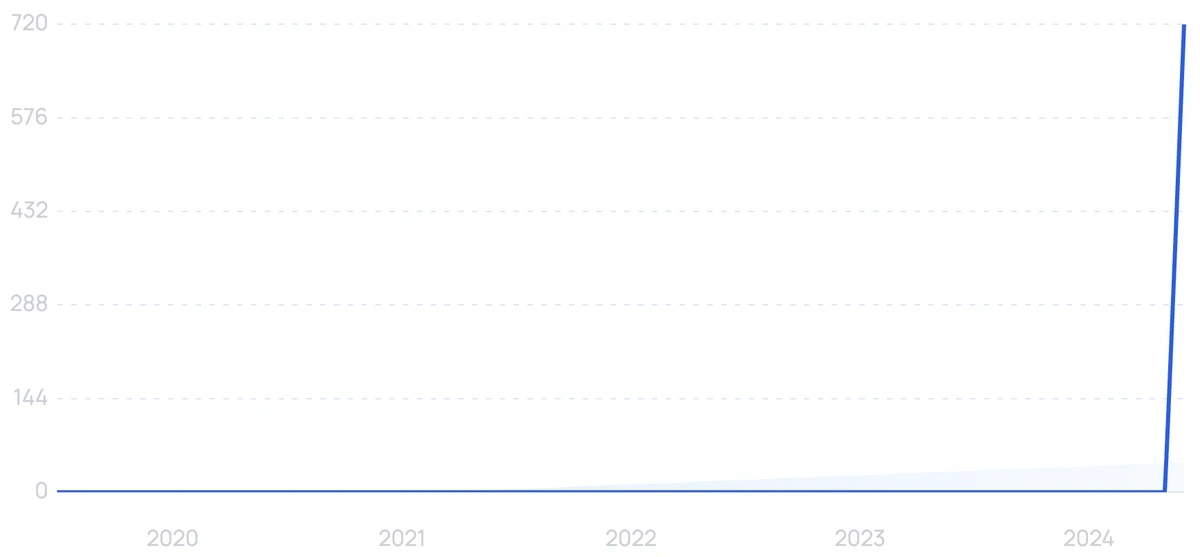

5-year search growth: 99x+

Search growth status: Exploding

Year founded: 2019

Location: San Carlos, California

Funding: $42.5M (Series A)

What they do: Robust AI is making life easier in manufacturing warehouses with its intelligent robots and AI systems. Robust products integrate with existing manufacturing environments by streamlining warehouse logistics and manufacturing processes. The company's primary product is the Carter, an Autonomous Mobile Robot (AMR) that can adapt to real-time warehouse conditions and work alongside other warehouse employees. The startup raised $20 million in their last funding round in 2023.

12. Path Robotics

5-year search growth: 74%

Search growth status: Regular

Year founded: 2014

Location: Columbus, Ohio

Funding: $171M (Series C)

What they do: Path Robotics has focused solely on the use of robots for welding. Welders are some of the costliest parts of manufacturing (often between $150-$200 hourly), and often require highly skilled and experienced humans the more complex the manufacturing. Their goal is simple: they develop manufacturing robots that scan, position, and weld parts without the need for human oversight. This in turn drives efficiency, safety, and speed for the manufacturer.

13. Dobot

Search growth status: Regular

Year founded: 2015

Location: Shenzhen, China

Funding: $79.3M (Series Unknown)

What they do: Dobot is China’s version of many of the U.S.-based robotics startups on our list. They offer robots covering two different verticals, educational and industrial. The educational robotics consist of sophisticated lab robotics and even robots designed to help instill a love of science in K-12 children with easy-to-use software. Industrial models cover medical, retail, chemical, and more. Leading safety technology like collision detection and cutting-edge software reduces the risk of error and hazards on the production floor.

14. MakinaRocks

5-year search growth: 99x+

Search growth status: Exploding

Year founded: 2017

Location: Seoul, South Korea

Funding: $24.2M (Series B)

What they do: MakinaRocks is focused on using ML and AI to continuously improve efficiency and detect anomalies in the manufacturing process. With only two core products, MakinaRocks is betting that ML will continue to rise in importance as robotics and processes go down the path of automation that improves on its own.

15. Moglix

5-year search growth: 3%

Search growth status: Regular

Year founded: 2015

Location: Singapore, Singapore

Funding: $472.2M (Series F)

What they do: Moglix has managed to build a successful e-commerce marketplace focused on industrial and manufacturing equipment for the Indian market. Moglix’s website is focused on simplicity and user experience, facilitating a massive amount of transactions. Moglix’s rapid growth allowed an expansion of industrial distribution centers across 25 major manufacturing hubs across India. They recently received a $250M funding round led by notable investors Tiger Global and Sequoia Capital.

16. Veryable

5-year search growth: 58%

Search growth status: Peaked

Year founded: 2016

Location: Dallas, Texas

Funding: $45.6M (Series A)

What they do: Veryable is an on-demand talent marketplace where manufacturing, logistics, and warehousing companies can find workers. The platform has grown considerably with more than 645,000 background-checked workers available for hire.

17. Automata

5-year search growth: -5%

Search growth status: Regular

Year founded: 2015

Location: London, United Kingdom

Funding: $99.8M (Series Unknown)

What they do: The team at Automata has come up with Eva, their proprietary industrial automation robot that completes basic repetitive tasks and frees up human labor for more productive uses. Trusted by legacy manufacturers like 3M, Samsung, and TDK, Eva was designed for small-scale production and can be set up in as little as 15 minutes. With the estimated global robotics market size around $49B, Automata is aiming to capture the affordable robotics niche that is largely being ignored by other more expensive robotics startups.

18. Vention

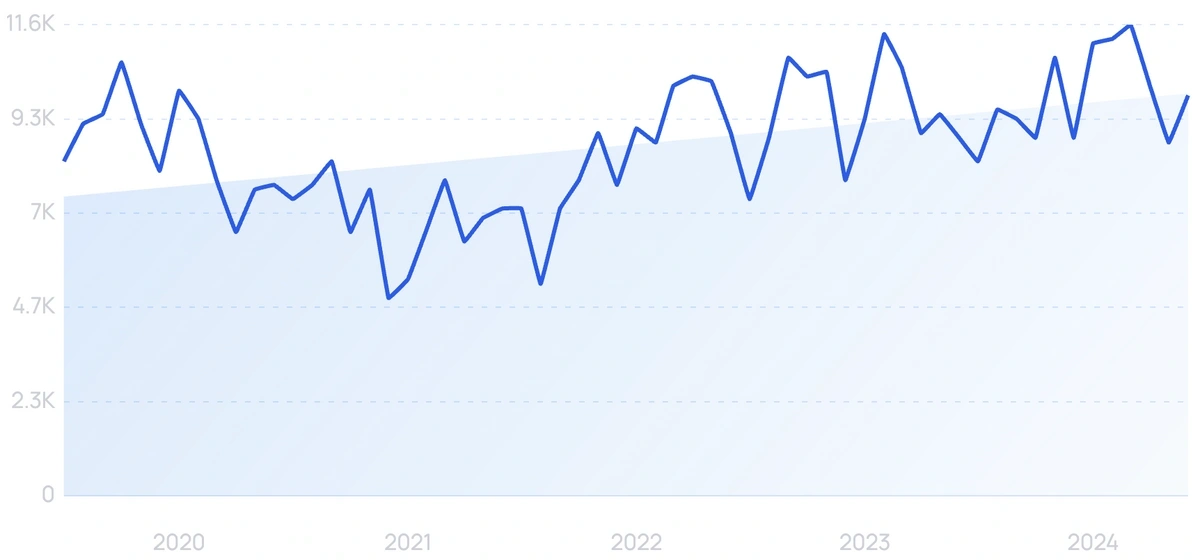

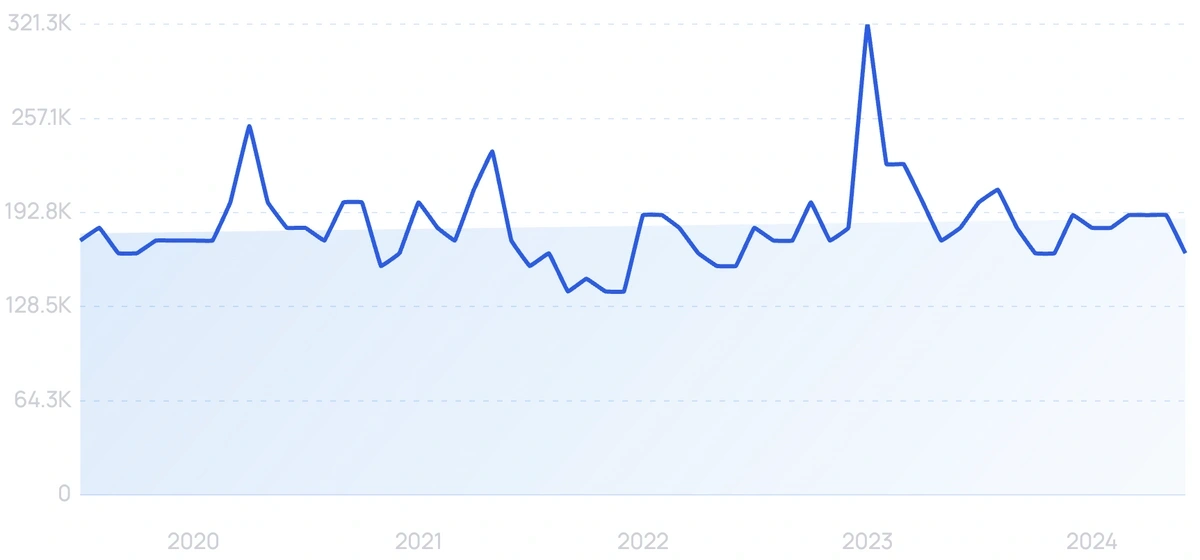

5-year search growth: 137%

Search growth status: Exploding

Year founded: 2016

Location: Montreal, Canada

Funding: $138.8M (Series C)

What they do: Vention’s core offering is their AI-enabled, cloud-based MachineBuilder3D. The MB3D platform lets enterprise customers like Google or Boeing custom design complex automated machines in easy-to-use 3D software. Not only can engineers design automated machines and have their custom parts built in days, but also code in their own automation program right on Vention’s platform. Vention’s site features a leaderboard where you can see the top users of the platform. The current leader has 24 public designs.

19. Mecuris

5-year search growth: 40%

Search growth status: Exploding

Year founded: 2016

Location: Munich, Germany

Funding: $7.9M (Series B)

What they do: Mecuris is a German startup that has developed innovative software for 3D printing or manually producing custom prostheses and orthoses. Aiming to disrupt the nearly $6.2B prosthetics market, Mecuris’s software simplifies the complexity of modeling limbs and unique body parts and then delivering measurements for an artificial limb.

20. Drishti

5-year search growth: -37%

Search growth status: Regular

Year founded: 2017

Location: Mountain View, California

Funding: $37.2M (Series B)

What they do: Drishti is tackling an old manufacturing problem that dates back to the time of Henry Ford with a novel solution. Manual activity in the factory is one of the most time-consuming and antiquated processes that exist today. Managers often still walk around with clipboards taking notes by hand. Drishti solves this with their video and data solution that records manual activities and analyzes them.

The use cases vary from recordings used for training employees to root cause analysis and even measuring efficiency and throughput on the floor. A Kearney study shows that 72% of factory tasks are still performed by humans and 68% of defects can be traced to human causes. Drishti hopes to be the answer to reducing human error.

Conclusion

The manufacturing industry is clearly ripe for a continued tidal wave of innovation, automation, and improvement both through robotics and software. As you’ve seen in our list, the applications span across critical verticals from medicine to retail to classic heavy manufacturing.

With the goal of improving safety, efficiency, and speed, these manufacturing startups are all poised to make a large dent in the ever-increasing need for automating physical tasks.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more