Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

15+ Brand New Market Research Statistics for 2024

The market research industry is booming.

Today’s consumers have more brands competing for their attention and dollars than consumers did even 10 years ago. To keep their brands competitive, it’s not enough for decision-makers to follow their instincts — they need to deeply understand their target market.

Market researchers use surveys, focus groups, and interviews to understand what makes target demographics tick. Brands take those insights and use them to guide product development and fine-tune their customer experience.

It’s a multi-billion dollar industry that serves brands of all kinds, from media and consumer goods to healthcare and nonprofits.

Keep reading to learn about the state of market research in 2024.

Top Market Research Statistics

To get started, here are some of the most impressive market research statistics:

- The global market research industry generates more than $118 billion in annual revenue.

- The United States has a 53% market share in the market research industry.

- 20% of global market research spending goes to CRM and customer satisfaction surveys.

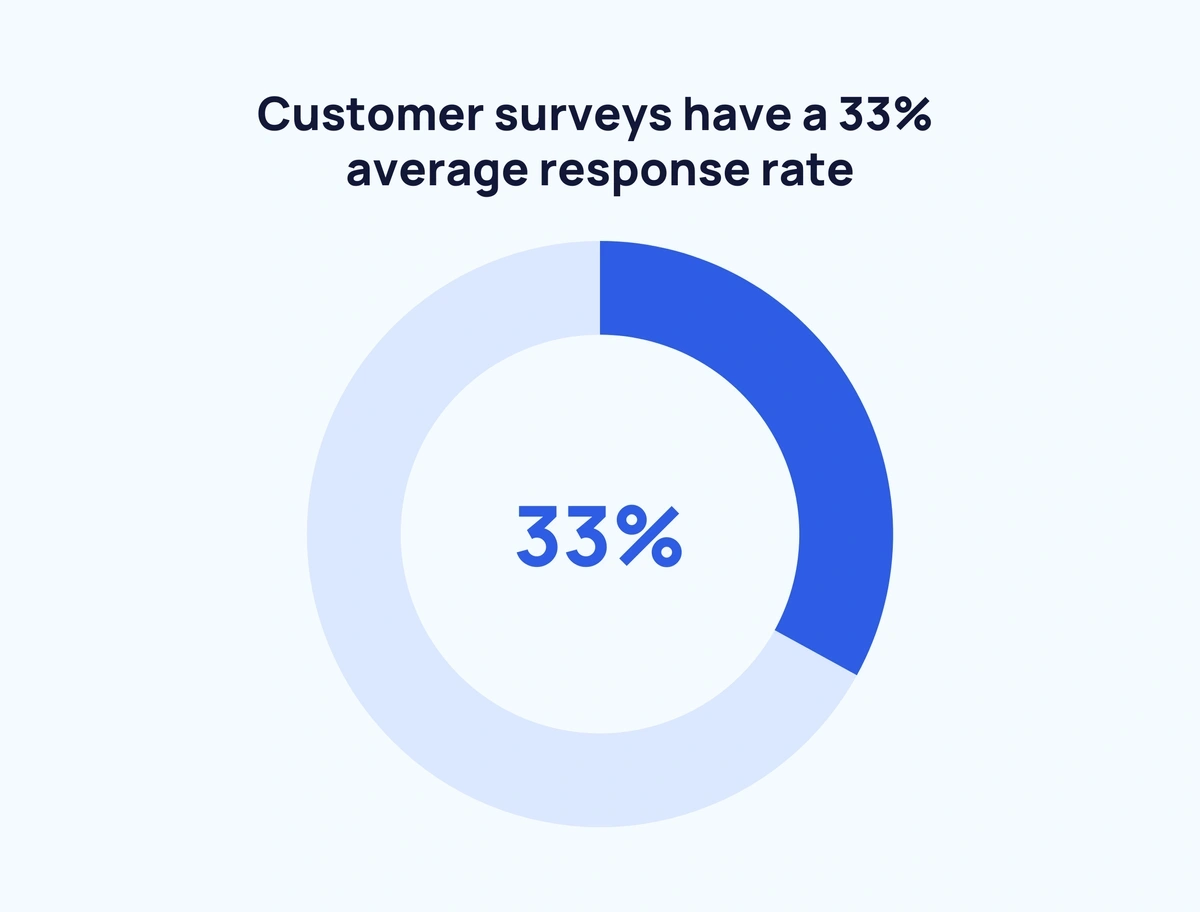

- Customer surveys have a 33% average response rate.

- 23% of organizations don’t have a clear market research strategy.

Market Research Industry Statistics

The market research industry includes giant research firms like Nielson and Gartner, as well as research software companies like SurveyMonkey. Together they provide full-service market research and tools for in-house research teams.

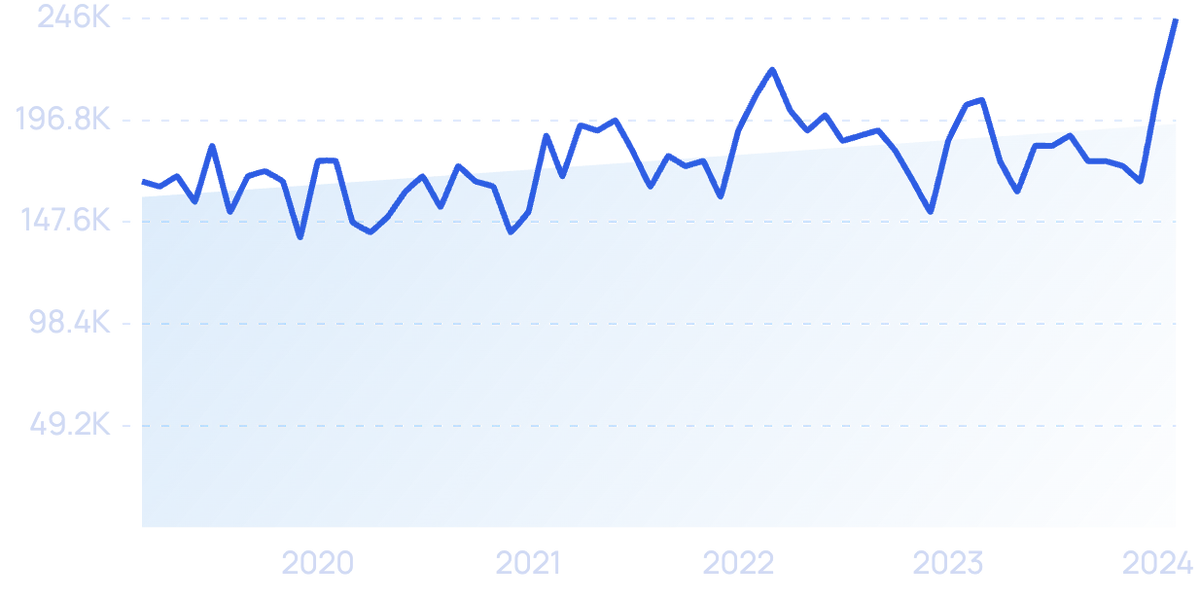

In total, the global market research industry generates more than $118 billion in annual revenue (ESOMAR)

The market research industry posted $118.8 billion in revenue in 2021, smashing the $89.75 billion record set in 2020. The United States generated $62.64 billion in revenue alone in 2021. Overall, the market has been on an impressive upward trend — global market research revenue has increased 358% since 2009.

Nielsen is the highest-earning company in the market research space (ESOMAR)

Nielsen generated $5.24 billion in revenue in 2021, securing its place as the leading market research company for at least the 6th consecutive year. Other top performers in 2021 were IQVIA with $5.21 billion in revenue, Gartner at $4.73 billion, SalesForce at $3.9 billion, and Adobe Systems at $3.87 billion.

IQVIA is the world’s leading healthcare market research company.

The United States has a 53% market share in the market research industry (ESOMAR)

The United States currently dominates the market research industry with a 53% global market share. The United Kingdom — with just a 9% market share — is its closest competitor. Other nations with significant market share are China (3%), India (2%), and Australia (2%). The rest of the world combined makes up 31% of the overall market.

20% of global market research spending goes to CRM and customer satisfaction surveys (ESOMAR)

How do organizations invest their market research dollars? Surprisingly, over 70% of all market research spending goes into five different areas: CRM and customer satisfaction surveys (20.7%), user experience surveys (14.2%), audience research (13.4%), usage and behavioral studies (11.7%), and market measurement (11.6%).

In total, 16.6% of global market research spending comes from pharmaceutical companies (ESOMAR)

Nearly half of all market research spending comes from three big client types: pharma companies (16.6%), media and entertainment groups (15.5%), and consumer goods producers (14.9%).

The least likely industries to spend money on market research? Research institutes (1.8%), tourism and recreation (1.6%), and non-profit organizations (0.9%).

Business knowledge is the most demanded skill by market research clients (GreenBook)

In a survey of 3,342 market research buyers and suppliers, 70% of buyers considered business knowledge a top priority skill for development. 56% of suppliers shared this view. For suppliers, market research expertise was the highest priority skill for development (70%), while only 34% of buyers agreed.

Around 1 in 4 organizations do not have a clear market research strategy (Qualtrics)

Market uncertainty is the biggest roadblock for market strategists, with 34% admitting it’s holding their strategies back. 26% of market researchers say budget constraints are impeding their market research strategies. Other challenges include communicating ROI, motivating team members, competing internal priorities, and lack of skill or expertise.

Market Research Approaches

In the early days of market research, focus groups and telephone interviews were the top methods used to gain customer insights. Today, most market research takes place online — mobile and online surveys help automate the market research process.

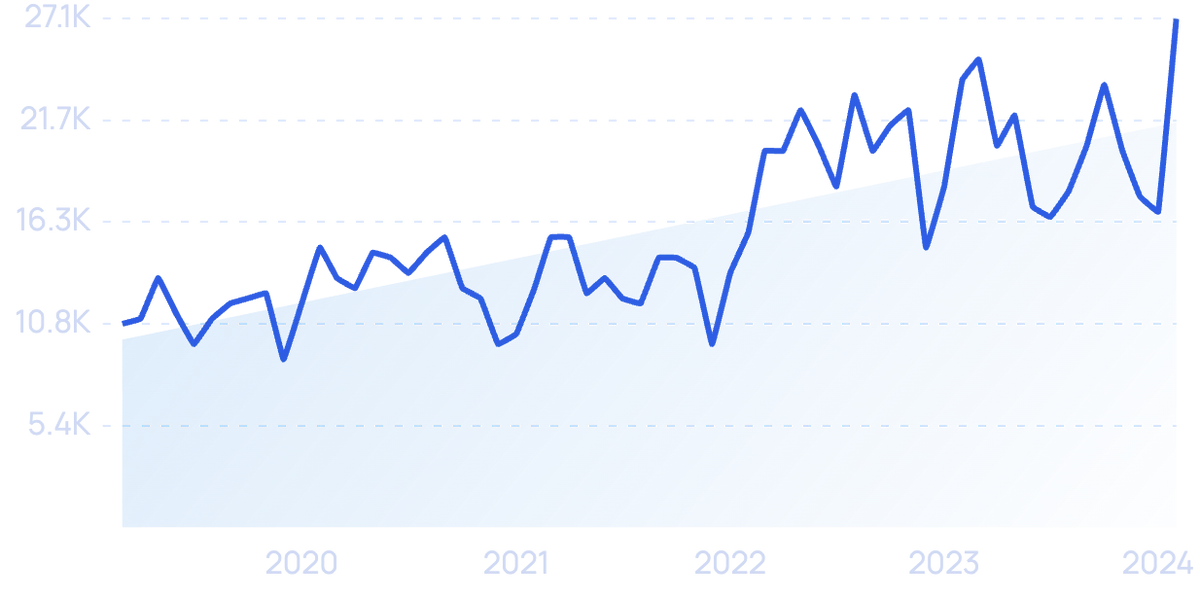

89% of market research suppliers and clients regularly use online surveys (GreenBook)

Online surveys are by far the most popular approach to quantitative market research. Other top approaches by the percentage of regular use among clients and suppliers are mobile surveys (60%), proprietary panels (45%), and online communities (31%).

Online survey provider QuestionPro lets users create free customer and employee surveys.

Online in-depth interviews and focus groups are the top qualitative market research approaches (GreenBook)

For qualitative market research, 41% of clients and suppliers regularly use online in-depth interviews conducted via webcam. Additionally, 40% use online focus groups conducted via webcam. Moapproaches include online communities (35%), telephone in-depth interviews (31%), and in-person focus groups (31%).

Mobile-first surveys are the top emerging method for conducting market research (GreenBook)

Market research professionals are always looking for innovative new ways to gain insights. Mobile-first surveys are the top emerging approach right now, with 64% already using the technology and an additional 13% considering adopting it in the near future.

Text analytics is another trending market research approach, having already been adopted by 61% of professionals and under consideration by an additional 18%.

Only 1 in 3 customer surveys get a response (Pointerpro)

33% is the average response rate across all survey types. Some surveys are far more likely to hold customers’ attention. In-person surveys have the highest response rates at 57%. In-app surveys are the worst performers with just a 13% response rate.

Here’s a full breakdown of each survey type and their average response rates:

- In-person survey: 57%

- Mail survey: 50%

- Email survey: 30%

- Online survey: 29%

- Telephone survey: 18%

- In-app survey: 13%

Mobile surveys are more popular worldwide, while non-mobile surveys are more popular in the United States (SurveyMonkey)

56.6% of global survey responses come from mobile devices compared to just 40.2% from non-mobile users. In the United States, however, the switch to mobile hasn’t quite caught on yet. 43.7% of US survey responses are on mobile while 51.7% are on non-mobile devices.

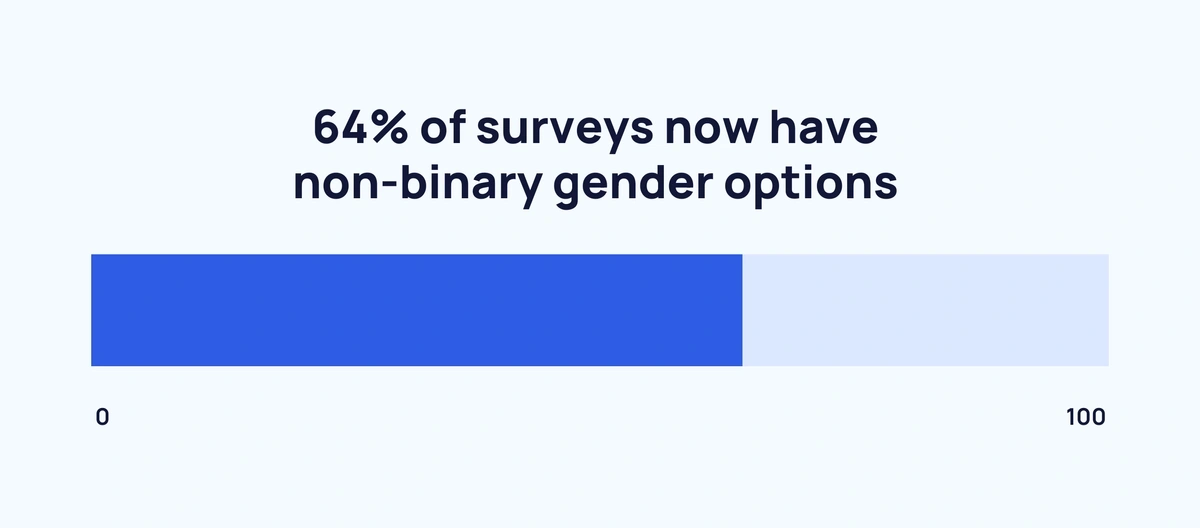

Nearly two-thirds of surveys now have non-binary gender options (SurveyMonkey)

The online survey space has become increasingly gender-inclusive over the past decade. In 2012, 16.4% of online surveys had non-binary options for respondents’ gender. In 2022, that number nearly quadrupled to 64%:

Gender options in online surveys (2022):

- 2: 35.9%

- 3: 27.1%

- 4: 20.6%

- 5 or more: 16.2%

After peaking in May 2020, less than 2% of today’s surveys mention the COVID-19 pandemic (SurveyMonkey)

The COVID-19 pandemic affected all aspects of life, including online surveys. In May 2020, 22.9% of all SurveyMonkey surveys mentioned “COVID-19.” Since then, the use of the term has steadily declined month after month. In November 2022, only 1.8% of SurveyMonkey surveys mentioned the pandemic.

Customer experience (CX) software is the #1 technology market researchers are investing in (Qualtrics)

A 2022 study by Qualtrics found that 71% of market researchers are investing in CX software. CX software gives researchers critical insights into customer experience, which can help guide organizational strategy.

Other top investment areas for market researchers are online consumer panels (69%), market research online communities (63%), and product testing software (62%).

Wrap Up

Market research has been constantly evolving since it first began almost 100 years ago. It’s a high-growth industry that’s been able to leverage new technology to offer even more value to brands.

While the industry is thriving, some organizations still struggle to establish and maintain market research strategies. Meanwhile, today’s technology means that even small business owners can conduct their own market research by using survey software and analyzing the results.

With the rise of AI and machine learning, market research will undoubtedly continue to innovate and evolve in the near future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more