Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

6 Key Market Research Industry Trends (2025)

You may also like:

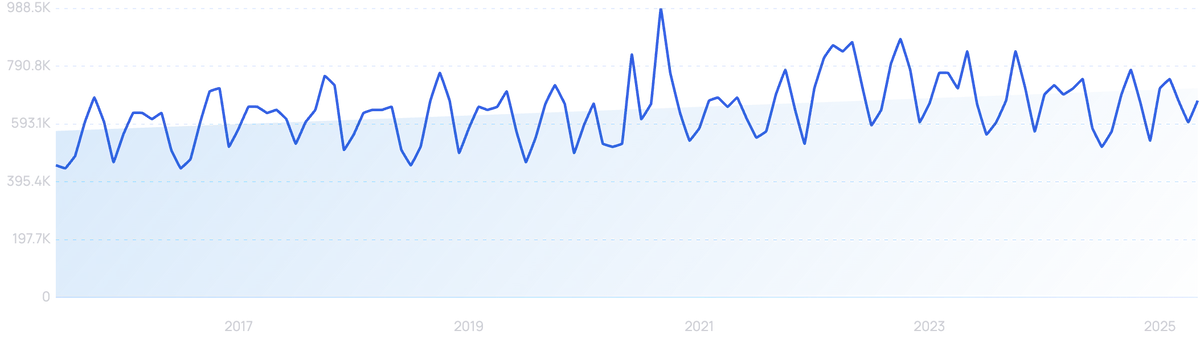

The value of the global market research industry grew by more than $40 billion between 2013 and 2023. The industry is currently worth over $84 billion and shows no signs of slowing down.

This valuation isn’t surprising — information is everywhere. Unprecedented volumes of data, up-to-the-minute insights, and truly global audiences mean the market research industry is constantly shifting in an effort to keep up with ever-changing consumer preferences.

In this report, read about the top six trends that we expect to drive the market research industry in 2025 and the years to come.

1. Market Research Gets Faster And More Effective

Companies cannot afford to be slow in their market research.

As one Chief Strategy Officer puts it, “the life cycle of data’s value has dramatically decreased”.

Traditional market research methods like focus groups still absolutely have their place. But speed is not their strength.

With the right tools, a lot of useful data for market research can be accessed instantly.

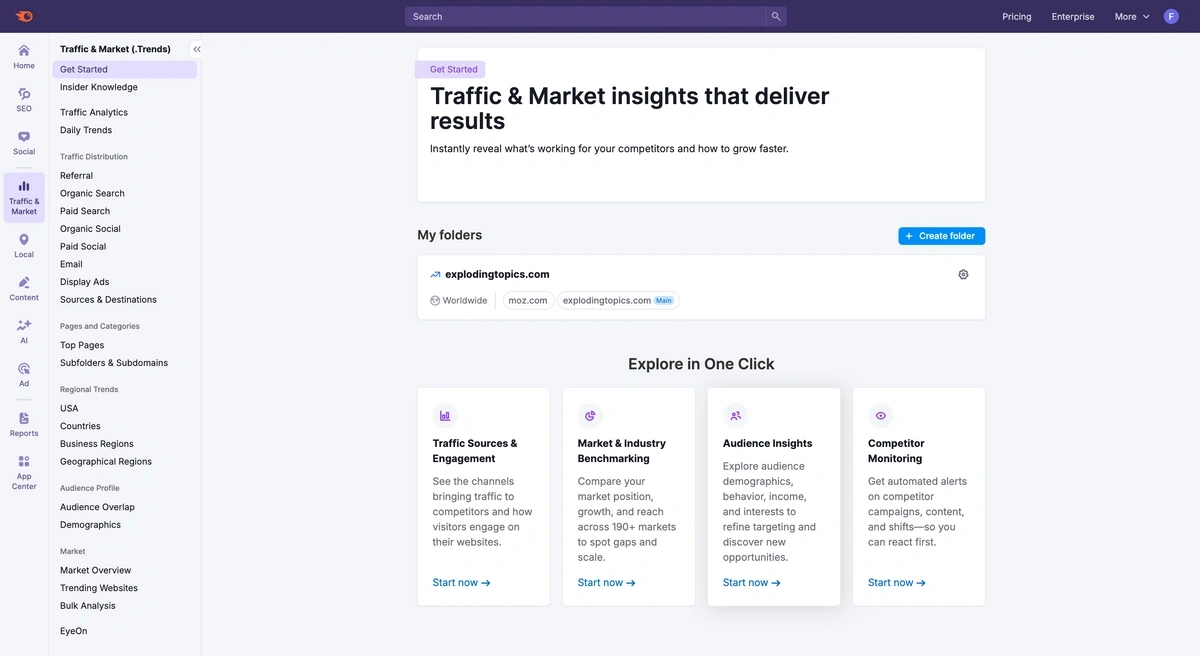

Semrush has a suite of tools designed for this purpose.

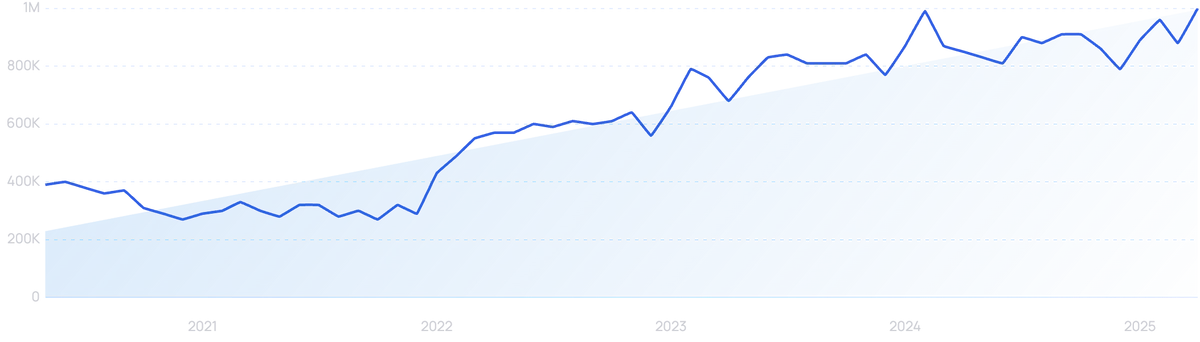

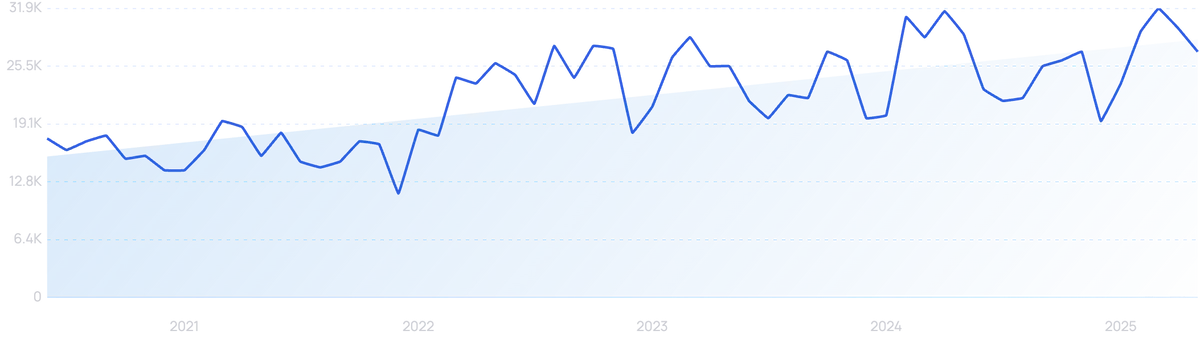

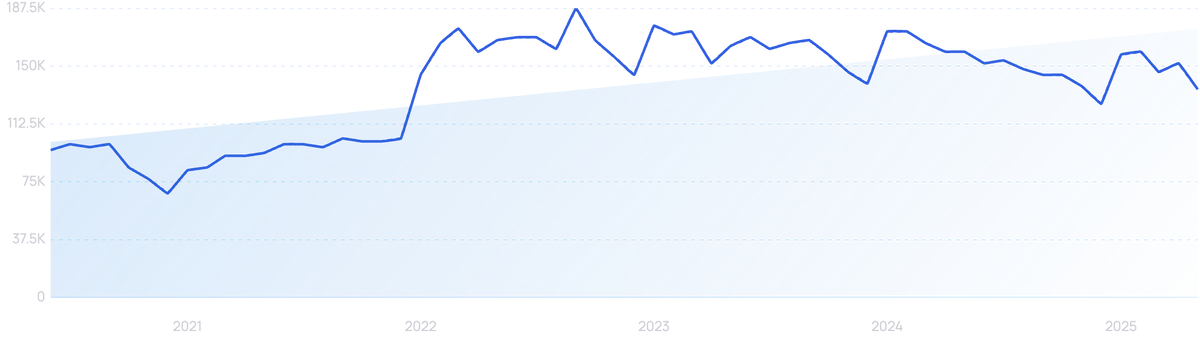

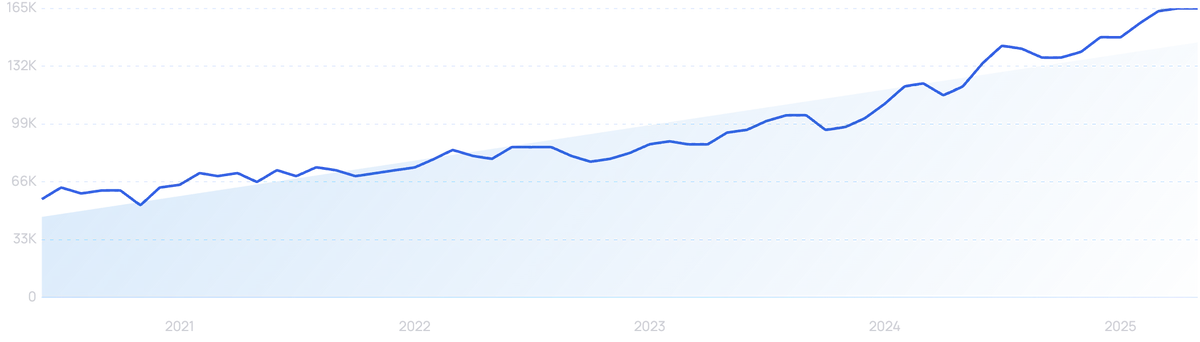

“Semrush” searches are up 156% in the last 5 years.

Boasting 500 terabytes of raw data and analyzing more than 1 billion events every day, Semrush can provide a complete overview of any market.

The Traffic & Market tab surfaces insights into market size, market potential, and key players, devising data-driven traffic generation strategies.

And the Traffic Analytics tool provides a detailed look at the online performance of various players within a given market, as well as valuable consumer segmentation data.

Semrush offers a variety of powerful market research tools.

A range of pricing plans caters to organizations of different sizes.

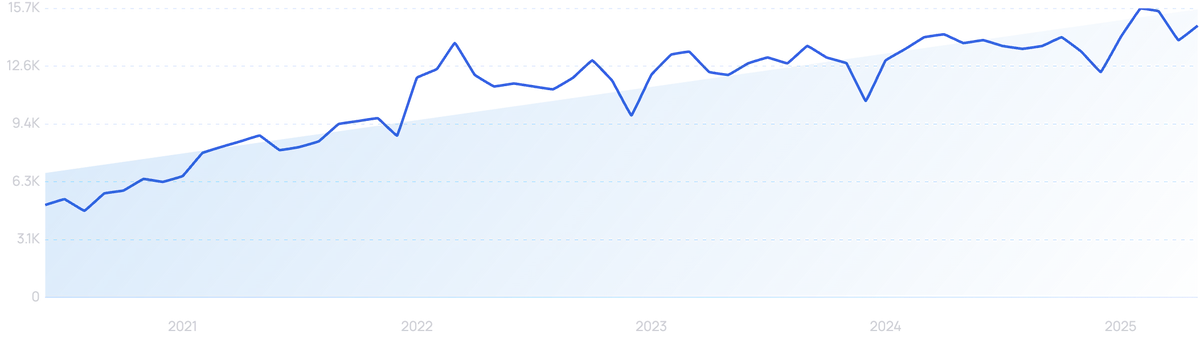

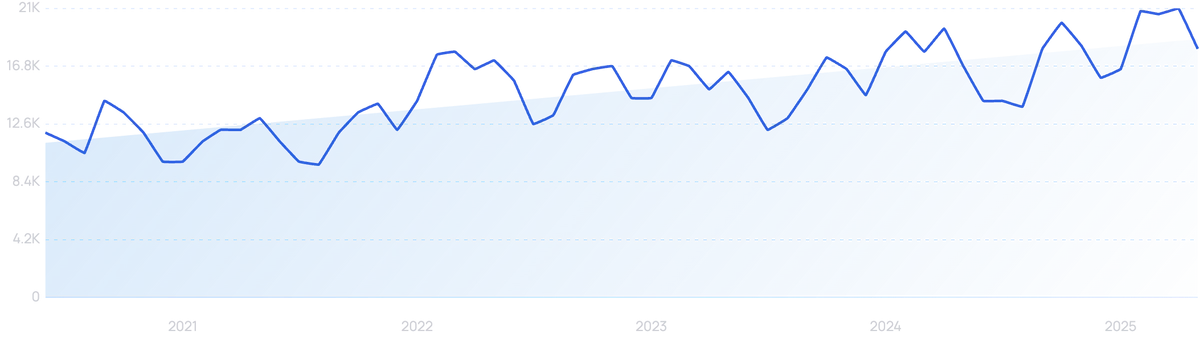

Zappi is a different kind of market research platform that’s also showing strong growth.

Searches for “Zappi” are up 194% in the last 5 years.

It specializes in agile market research, another way of expediting more traditional processes.

Agile market research is defined by gathering consumer feedback, applying technology, and launching campaigns quickly. That way, companies can test and make decisions without extended periods of time being devoted to each step.

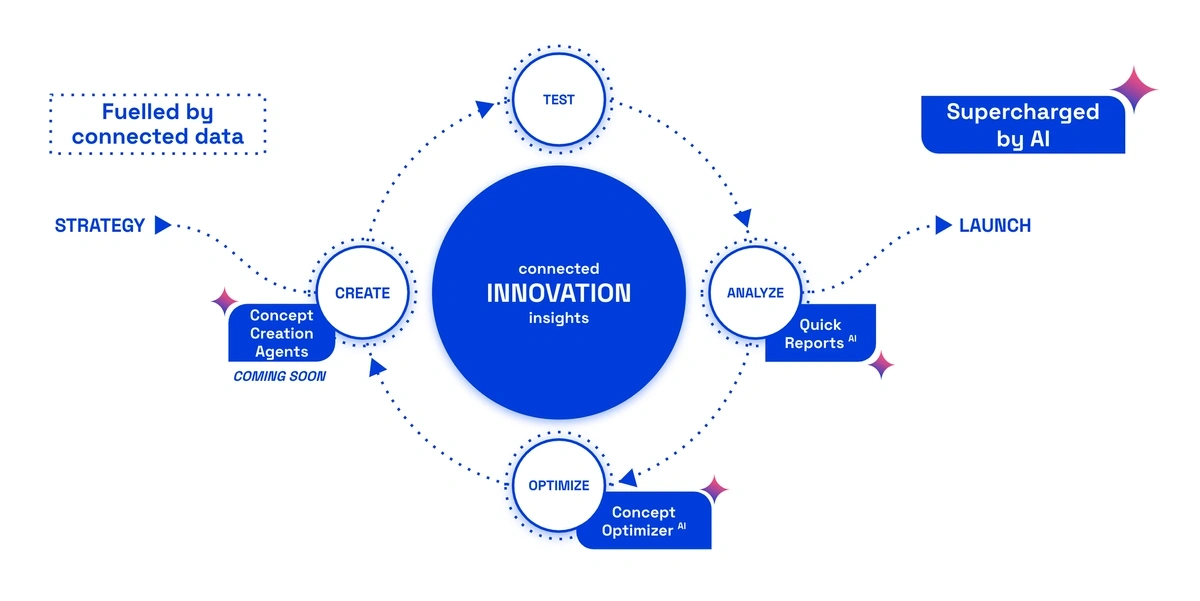

Zappi uses AI and automation to speed up processes. It recently launched AI Quick Reports, actionable steps that are instantly generated from raw data.

Zappi is introducing AI at multiple points in its agile process.

The company raised its most recent funding round of $170 million in December 2022, having hit $50 million in revenue the previous year. It counts McDonald’s and PepsiCo among its clients.

At least part of this dedication to faster results in market research is driven by budget constraints.

In the UK, there was a net fall of 5% in market research budgets in Q4 2023 and another drop in Q1 2024.

Defying expectations, there was a net increase of 3.2% in Q2 2024, although one commentator noted that the increase was still smaller than those experienced in other departments.

Automated market research is one way to support the agile method and deliver quicker insights with fewer people on staff.

Automation can improve the efficiency of market research in multiple ways.

It can cut down on costly human error – the cause of 80% of data breaches.

And 47% of researchers now say they use AI regularly in their market research.

2. Online Surveys Transition To Mobile-First

There are now more tools than ever at a market researcher’s disposal. But in embracing the new, there is no need to discard conventional wisdom: online surveys work.

One company alone — QuestionPro — poses 1 billion questions a year on behalf of more than 500,000 users.

“QuestionPro” offers beginner and enterprise-level research tools. Searches are up 55% over 5 years.

Market researchers have come to rely on online surveys because they’re fast and cost-effective.

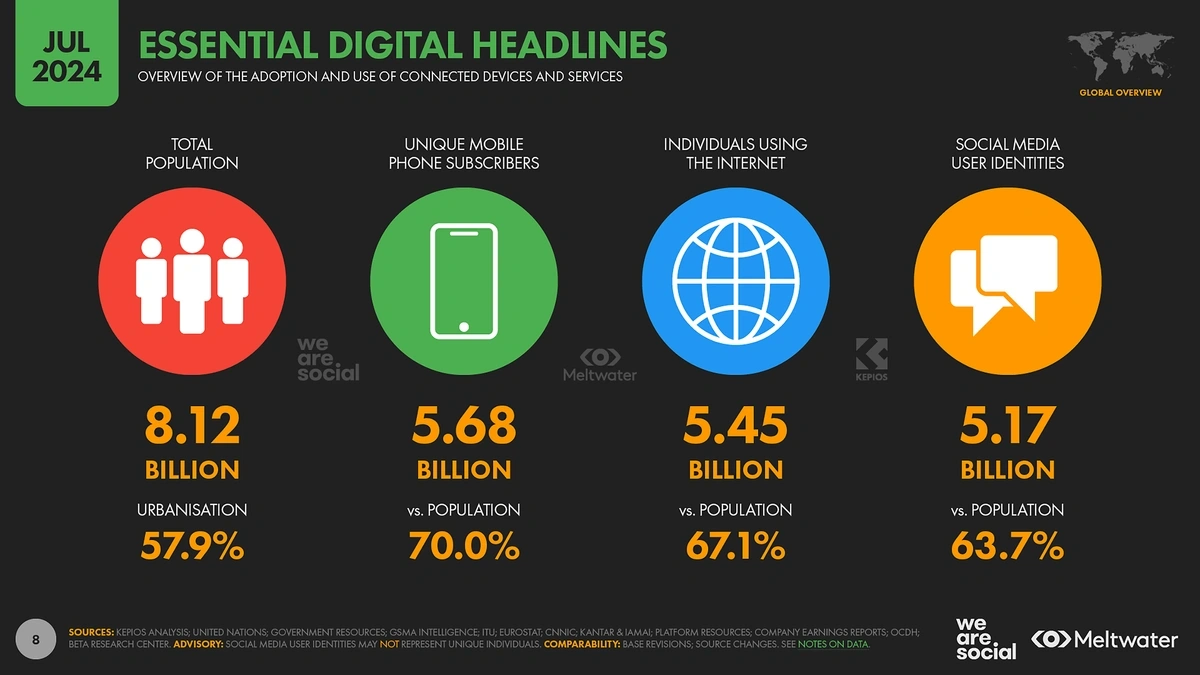

The vast majority of consumers are on the internet — only 33% of the world has never been online, with those people heavily concentrated in developing countries.

Statistics show that 5.45 billion people use the internet as of July 2024, and that number is growing by 3.2% each year.

For market researchers, the internet is the most reliable place to find their target audience.

Experts expect the popularity of the online survey market to stay high, growing more than 22% each year through 2028.

With the popularity of online surveys, it’s logical to expect to see similar popularity in mobile surveys.

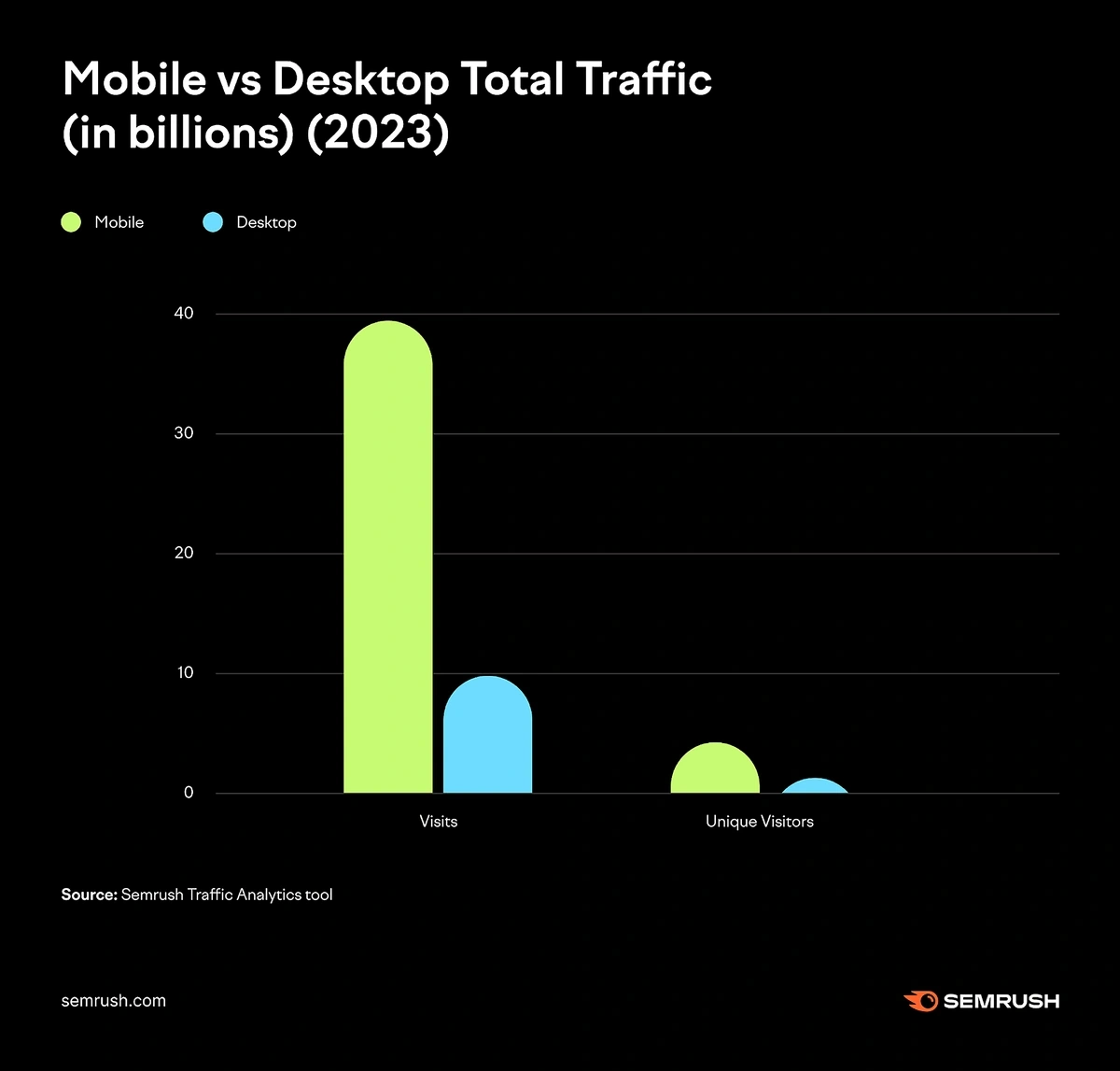

Across the globe in 2023, there was nearly 4x more mobile traffic than desktop traffic.

Mobiles are now the go-to devices for browsing the internet.

This shift is being seen when it comes to surveys as well. By the highest estimates, as many as 65% of participants now complete surveys on mobile.

That’s a substantial increase from 2013, when only 3-7% of surveys were taken on smartphones.

But many surveys are still not optimized for mobile. SurveyMonkey data indicates that it takes users 11% longer on average to complete surveys on mobile devices.

Experts point to poor UX and survey length as reasons why consumers often have a hard time completing surveys on their smartphones.

Searches for "UX design" have increased by 41% in the last 5 years.

SurveySparrow, a company founded in 2017, aims to make mobile-first surveys the future of market research.

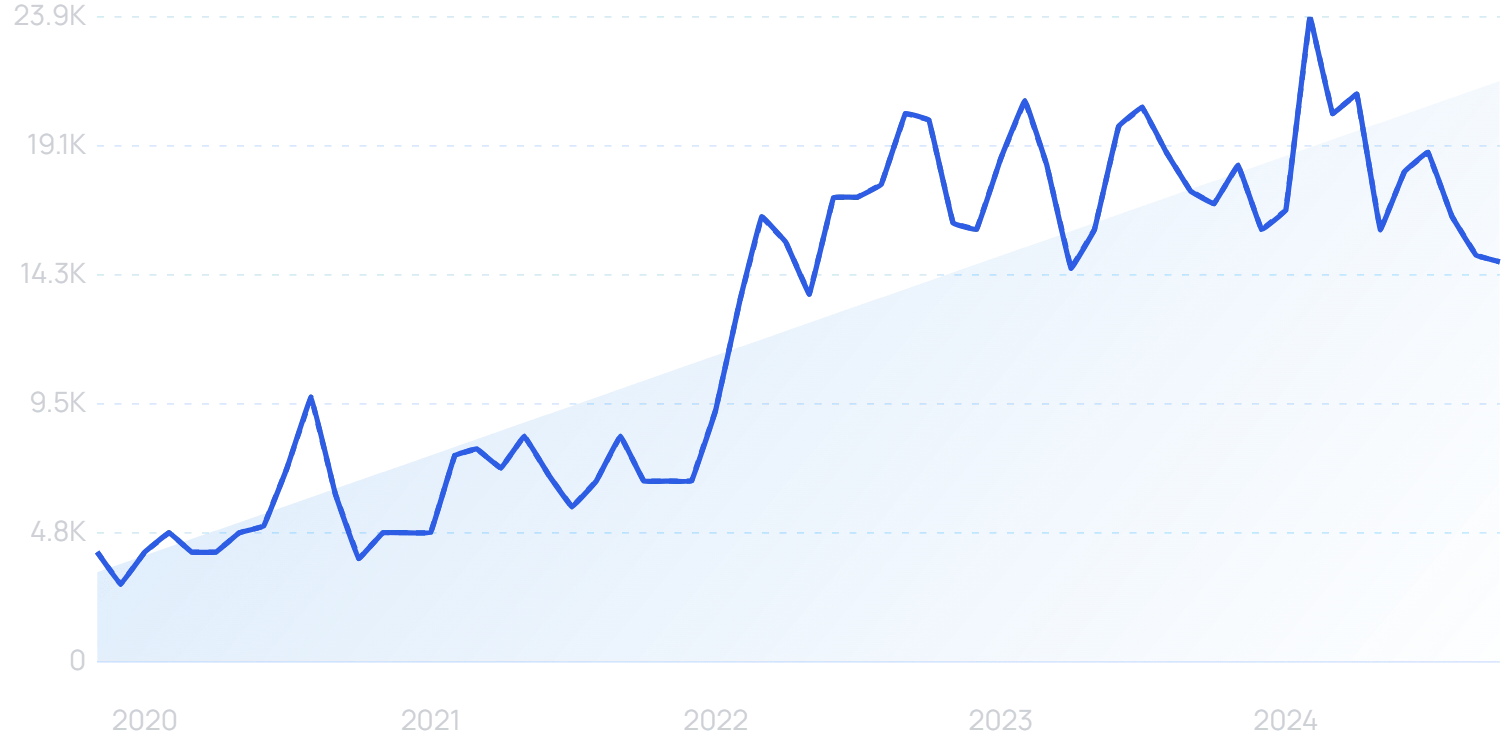

“SurveySparrow” searches are up 195% in the last 5 years.

The company’s founder was inspired by WhatsApp, keeping the tone of the platform’s surveys convenient and conversational.

SurveySparrow says their approach gets a 40% higher completion rate than traditional online surveys.

Pollfish, another mobile-first survey company, stresses that mobile surveys are a much better option than desktop online surveys.

They say mobile surveys provide a greater reach, especially to consumers in Gen Z, and drive an increased response rate.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

3. The Representative Sample Is Redefined

Market researchers have always been mindful to create their groups of research participants in proportion to the population of the market as a whole.

In other words, they recruit participants who mirror their target audience in terms of gender, age, and location.

In the past few years, there’s been a push to expand what a “representative sample” truly means.

In 2025, more attention is on diversity in the market research space than ever before.

In the US, Gen Z is only marginally majority White. 51% identify as White (non-Hispanic).

And Generation Alpha is expected to be the first “majority minority” generation.

So, failure to get proper BAME representation can leave market research deeply flawed.

ThinkNow, a cultural insights agency, works to mitigate cultural bias in market research.

“ThinkNow” is working to improve the representative sample.

It claims that 98% of its clients increase their audience as a result of ThinkNow’s more representative market research.

Agroni offers a similar service in the UK.

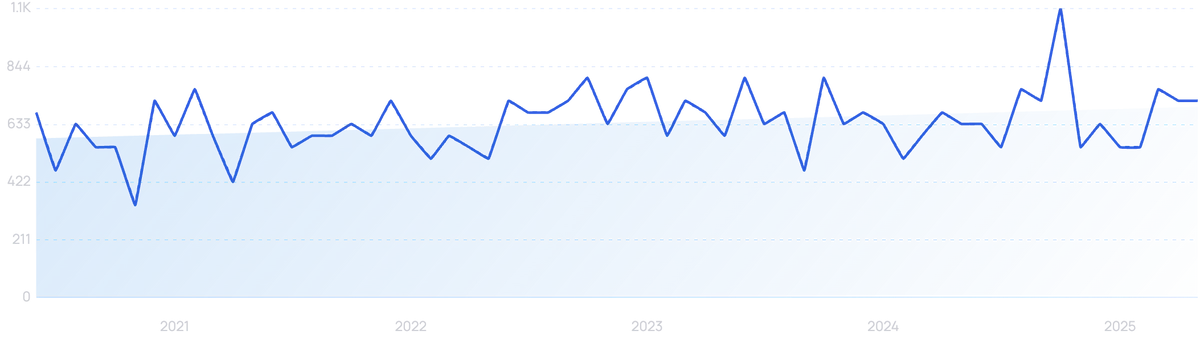

“Agroni” searches over the last 5 years.

Offering market research in more than 10 languages, it has completed over 500,000 quantitative surveys.

Inclusive market research extends beyond ethnicities to include people with physical disabilities, those with intellectual disabilities, and people in LGBTQ+ communities.

It’s not a brand new way of doing things. But it does include several meaningful changes that can drastically improve the quality of the data collected.

For example, researchers are becoming more mindful of the nature of their questions. Are they offensive or dismissive to certain groups of participants? Are they stereotypical or inclusive?

Searches for “diversity” over the past 10 years.

And when brands better understand their audience, they can get better results. 64% of consumers take action after seeing an ad they believe to be diverse or inclusive.

UK laundry company Vanish enjoyed success with its “Vanish: Me, My Autism and I” campaign, looking at how clothes can offer a source of sensory regulation and routine for those with autism. This is exactly the kind of insight that can come from truly representative market research.

4. Video And AI Supercharge Qualitative Research

The classic questionnaire you picture when imagining online and mobile surveys is highly effective for quantitative research. But when looking to gather more than numerical data, video is an effective tool.

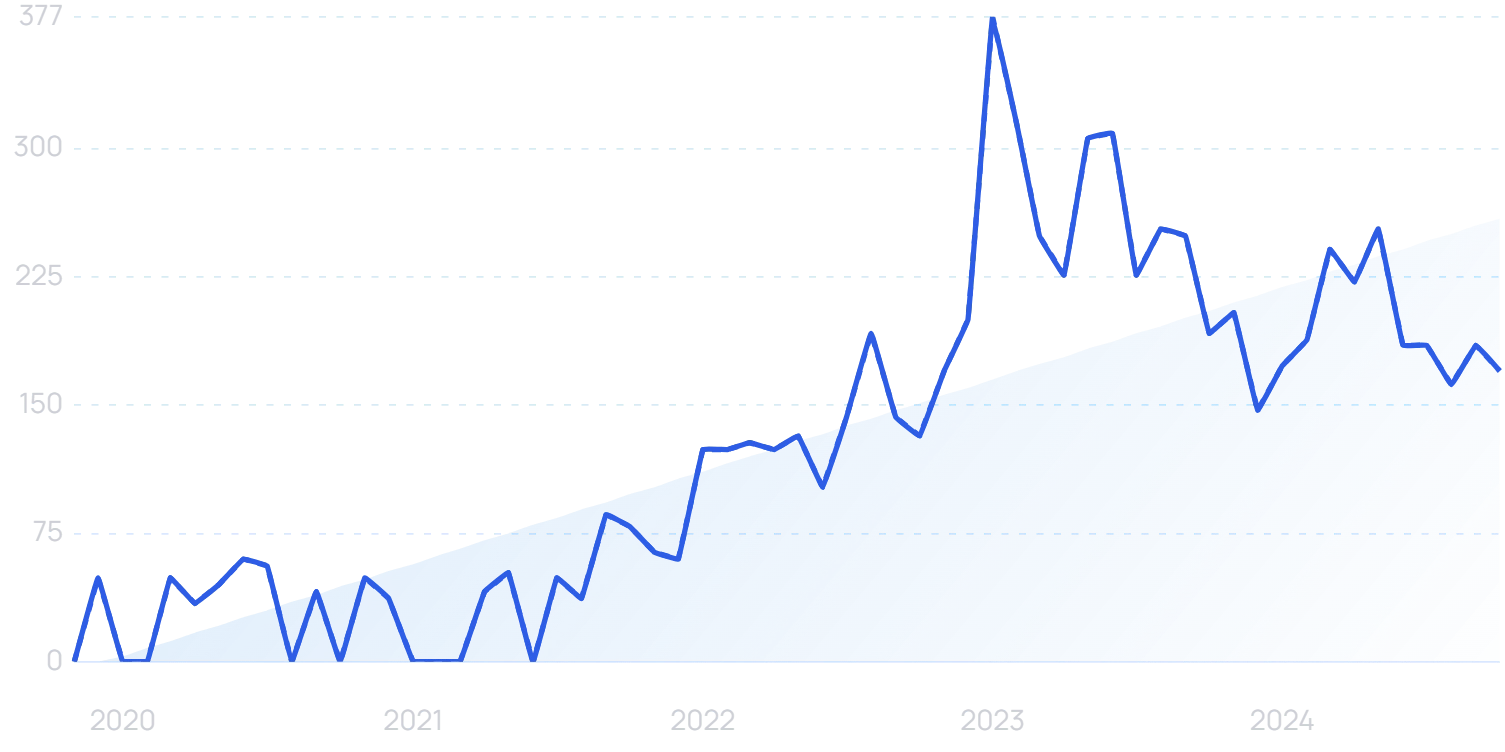

“Remote focus group” searches are up 444% in the last 5 years.

Video is more interactive, more genuine, and provides “unspoken” data like body language, tone, and facial expressions.

A 2023 study from the University of Bath found that in-person focus groups actually worked better with a remote moderator rather than with one physically in the room.

With the moderator only present via video link, participants were “more willing to go beyond their usual role of answering questions and took over the question-asking role”.

Group members also “extended the reach of questions in interesting ways in situations where discussion stalled”.

And similar logic may well extend to entirely remote video focus groups. It keeps participants one step removed from the moderator, and more generally speaking, people have gotten far more comfortable speaking on video in recent times.

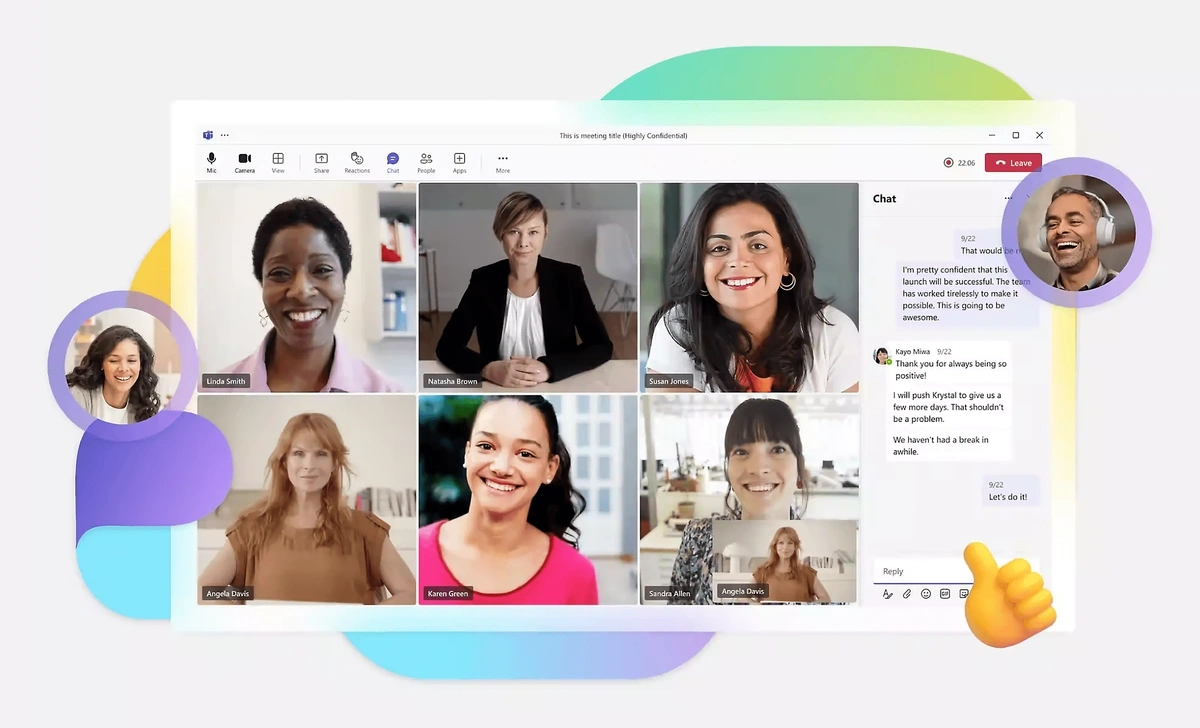

Microsoft Teams has grown to 320 million monthly active users. “Jumping on a call” is part of the daily norm for workers worldwide.

Microsoft Teams has helped normalize speaking on camera.

Medallia’s LivingLens video software offers companies the opportunity to capture 6x more information with video surveys compared to open-ended text responses.

And nearly every industry is taking advantage of video-based market research, from automotive companies to the beverage industry, to healthcare organizations.

In the past, market researchers have been concerned about the scalability of video insights. Manually combing through hours of unedited video footage is nowhere near efficient.

But, in today’s market, video delivers fast results at scale. Dozens of video analytics platforms exist, and they have been supercharged by AI.

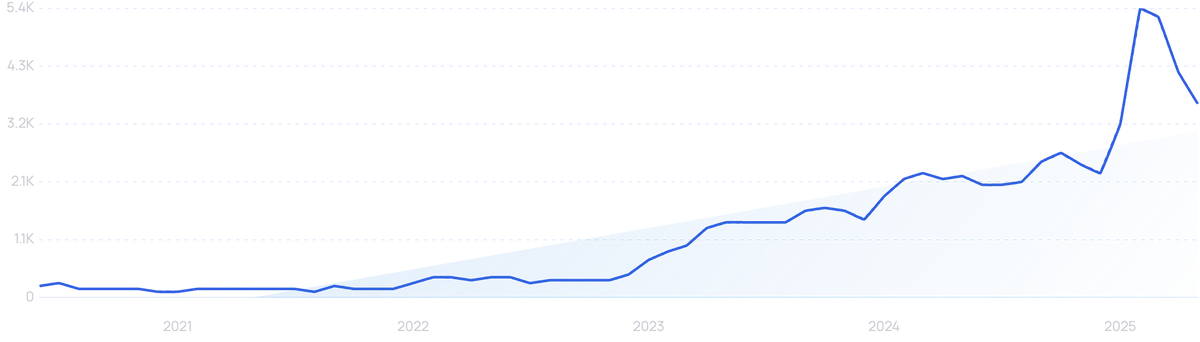

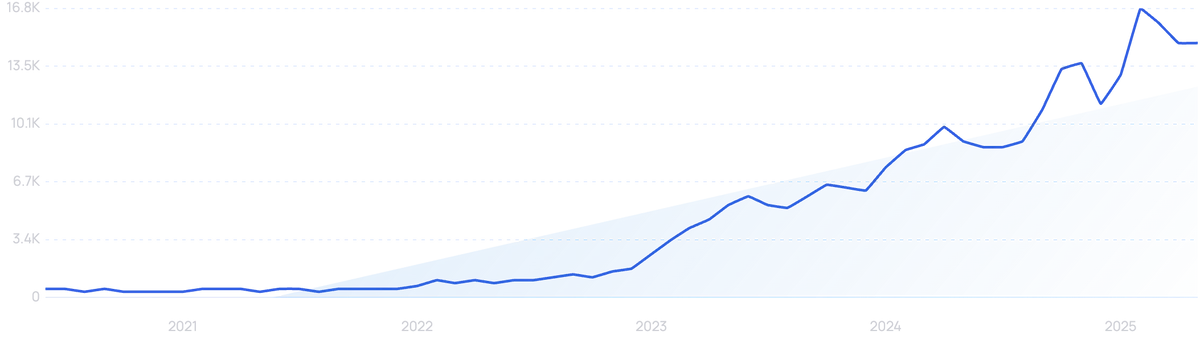

“AI market research” searches are up 1,575% in the last 5 years.

At the simplest level, AI transcription has been a game-changer. It eradicates hours of manual work (with major scope for human error).

Searches for “AI transcription” have exploded.

But the technology is already going further.

Voxpopme uses AI to generate real-time consumer insights and auto-generated summaries from video research.

It claims to make qualitative research 60x faster at 3% of the cost.

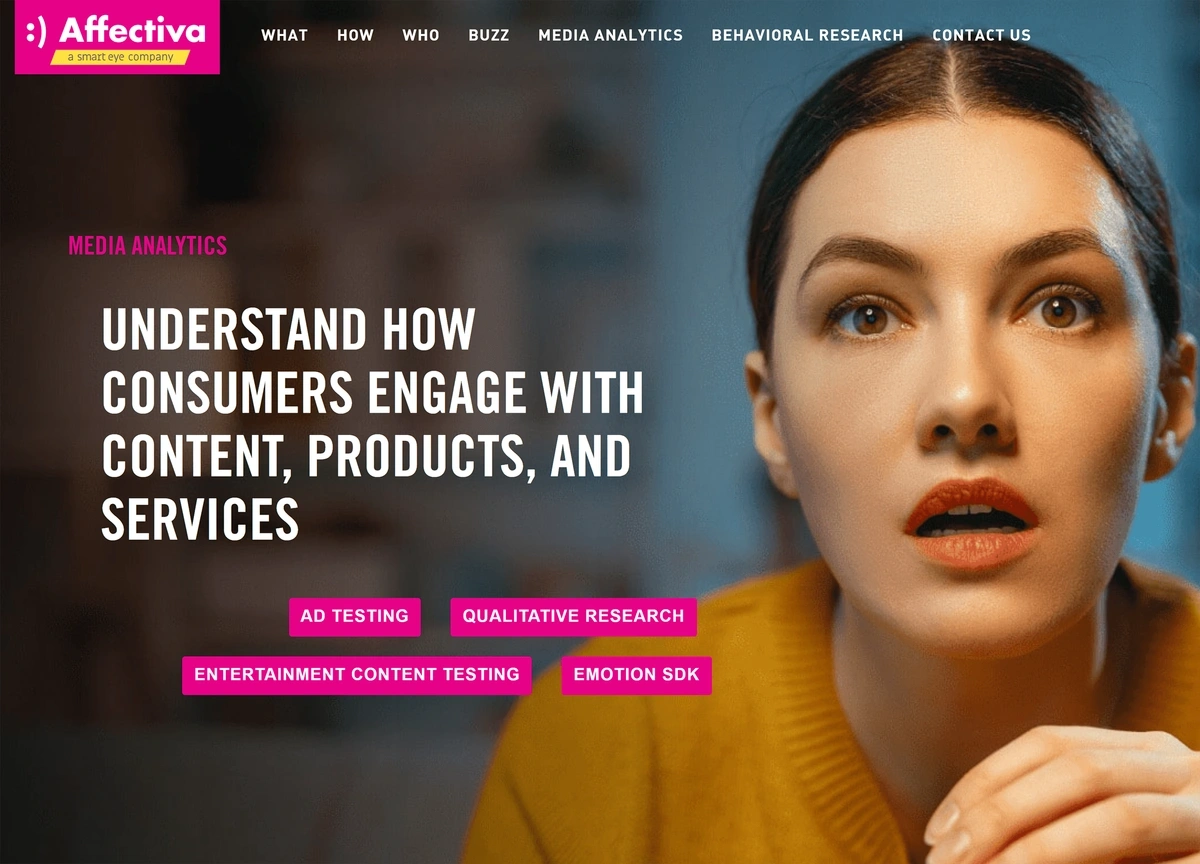

And Affectiva’s technology can “detect nuanced human emotions, complex cognitive states, activities, interactions, and objects people use”.

Affectiva uses AI to assess human expressions.

It recently announced a three-year renewal of its partnership with market research giant Kantar.

5. Market Research Moves In-House

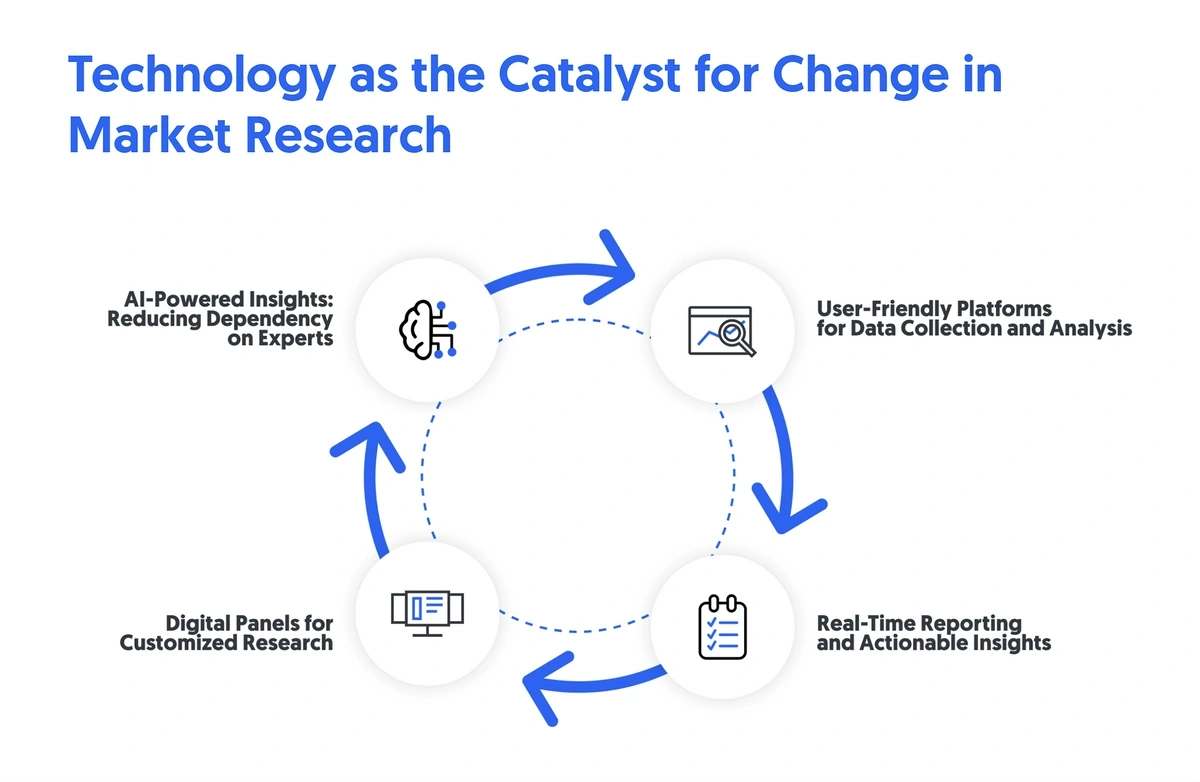

As the technology improves and the costs come down, the case for moving market research in-house gets stronger.

Traditional market research agencies face a challenge to keep offering genuine value.

With user-friendly tools like Semrush available on enterprise plans, businesses are increasingly capable of fulfilling their market research needs without the need for traditional external agencies.

Two-thirds of large multinationals have already established in-house marketing agencies. And a fifth of all brands are considering doing the same.

And with the DTC trend continuing to grow, companies increasingly have simple access to valuable data about the demographics of their consumers.

“DTC” searches are up 194% in the last 5 years. As businesses sell directly to consumers, they unlock a potential treasure trove of customer data.

Companies that are investing in in-house research see it as a way to keep their efforts customer-centric and use new technologies to empower their brand.

In essence, brands want more transparency, more control, and a streamlined process for market research.

Investors are taking notice of this trend.

Research platform Strella recently raised a $4 million seed round for its AI-powered customer research tool, which it says can help brands generate insights 10x faster and at half the cost.

Strella raised $4 million before it even launched publicly.

The company has already signed up the likes of Duolingo, Spanx, and Square.

6. Social Listening Gives Insights In Real-Time

Social media platforms are full of conversations, interactions, likes, and dislikes that are relevant to brands.

Each of these interactions is a window into the preferences and attitudes of a company’s target audience.

Social listening (sometimes called social media listening) involves gathering historical and real-time data from social media. Like other market research methods, this data can inform decisions and inspire new offerings.

“Social listening” searches are up 51% in the last 5 years.

Statistics show that 5.85 billion people worldwide will be using social media by 2027.

Better yet, 68% of people say they post on social media in order to share “who they are and what they care about”.

This means businesses that invest in social media research methods essentially have access to their target audience in real-time.

Those that can effectively monitor social media and make sense of the data will get a wealth of valuable information: customers’ likes and dislikes, how they use products, what trends they’re interested in, and much more.

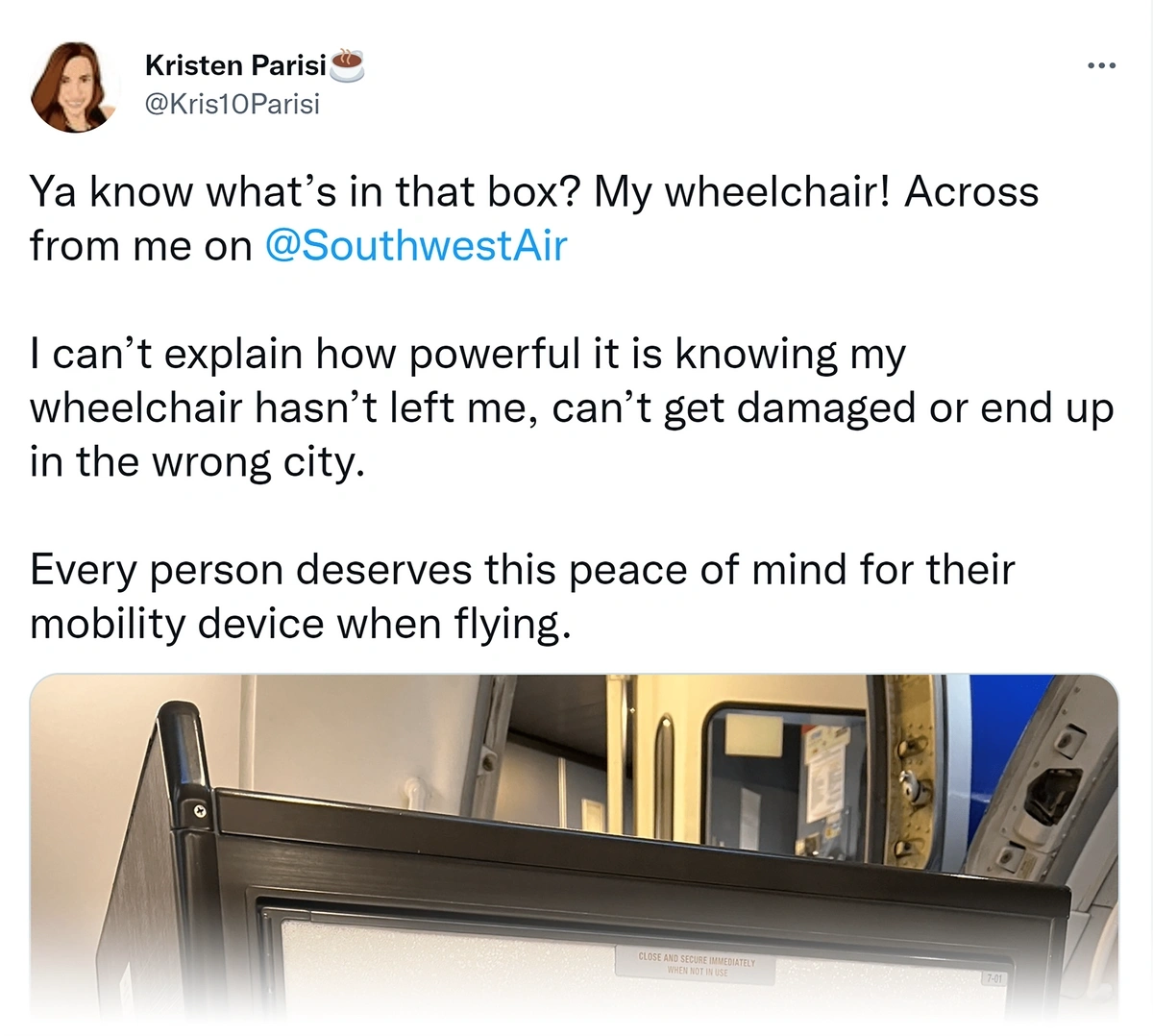

Social media listening captures customer sentiment in real time, like this X post directed at Southwest Airlines.

With a variety of social media listening platforms and price points, this type of market research method is available to businesses of any size.

The “Brand Monitoring” app available through the Semrush marketplace allows users to track the mentions of their own brand, and those of competitors, across social media and elsewhere on the web.

After a free trial, Semrush users can access the app for as little as $59 a month.

Talkwalker is another example of a dedicated social listening platform.

More than 2,500 companies worldwide use Talkwalker.

The Talkwalker platform crawls nearly 150 million websites and 30 social networks across 239 countries and regions.

Businesses should take note, though, that one of the drawbacks of social media market research is the incidence of skewed results caused by unrepresentative samples and herd mentality.

People on social media skew young, act impulsively, and are largely swayed by other users. Which means the data isn’t always 100% accurate.

Key Takeaways: Market Research Trends

The market research trends that lie ahead on the horizon show us that social media, smartphones, and DIY data research should dominate the market in the near future.

Customer needs are constantly changing, and that means market research will always be key to any successful organization.

The brands that can quickly and effectively anticipate customer wants and needs are the brands that will be able to surpass the competition and never look back.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more