Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Millennial Trends for 2024

You may also like:

More than 72 million people in the United States are Millennials.

If we expect them to follow in the footsteps of previous generations, they should be settling into their careers, getting married, and having children. However, the trends in this report show that the exact opposite is happening.

Millennials are busy traveling, paying off student loans, and turning away from traditional societal norms. What does all of this mean for past and future generations? Keep reading to see seven key trends that will drive the Millennial generation in the coming years.

1. Educated, but not wealthy

Millennials are the most educated generation ever.

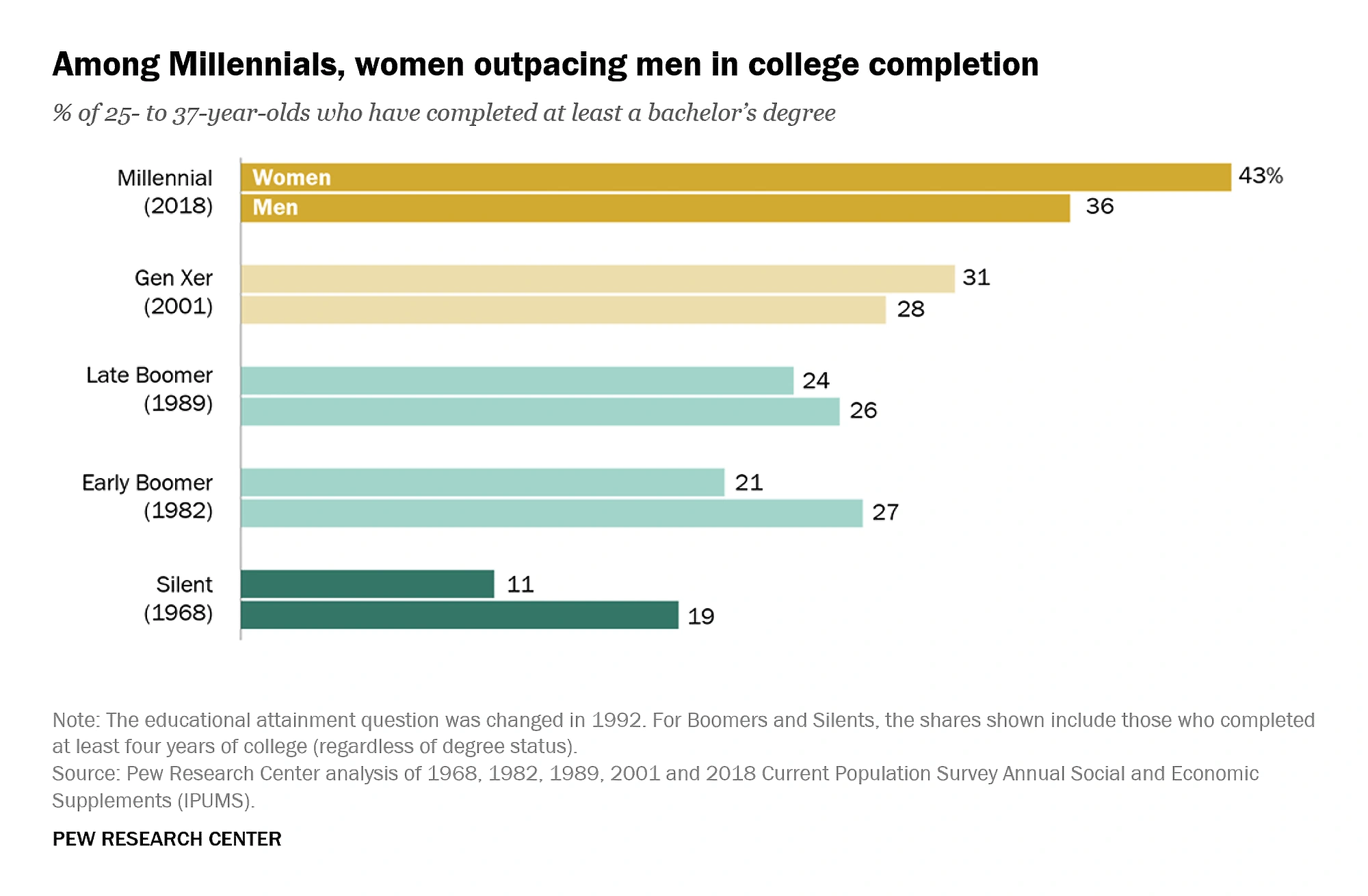

More than one-third of Millennials overall, and two out of five Millennial women, have a college degree.

Female millennials lead all other generations in terms of college education, surpassing Gen Xers by double digits.

Despite all of these educational accomplishments, this generation is “on a much lower trajectory of wealth accumulation than their parents and grandparents,” according to New America.

In fact, the typical Millennial holds 41% less wealth than an adult of the same age in 1989.

In 2020, the US Census Bureau reported the median Millennial household income (pre-tax) was just over $71,000.

Another source, PayScale, reports that “real wages” (wages with inflation factored in) have fallen more than 10% for Millennials between 33 and 40 years old since 2006.

On top of this, the average Millennial’s daily expenses total $208.77 — the highest of any generation.

As the TIAA Institute reports, Millennials have high levels of debt, low levels of savings, and expensive money management choices.

In a 2020 analysis, the organization reported that more than one-third of Millennials would not be able to come up with $2,000 within 30 days of an unexpected emergency.

Financial experts recommend putting at least three months’ worth of expenses into a contingency fund. Searches over the last 5 years have generally been on the up.

One thing to note: this generation did come into adulthood just as the Great Recession was hitting.

For the average Millennial, their family’s wealth dropped 45% in the time immediately following the Recession.

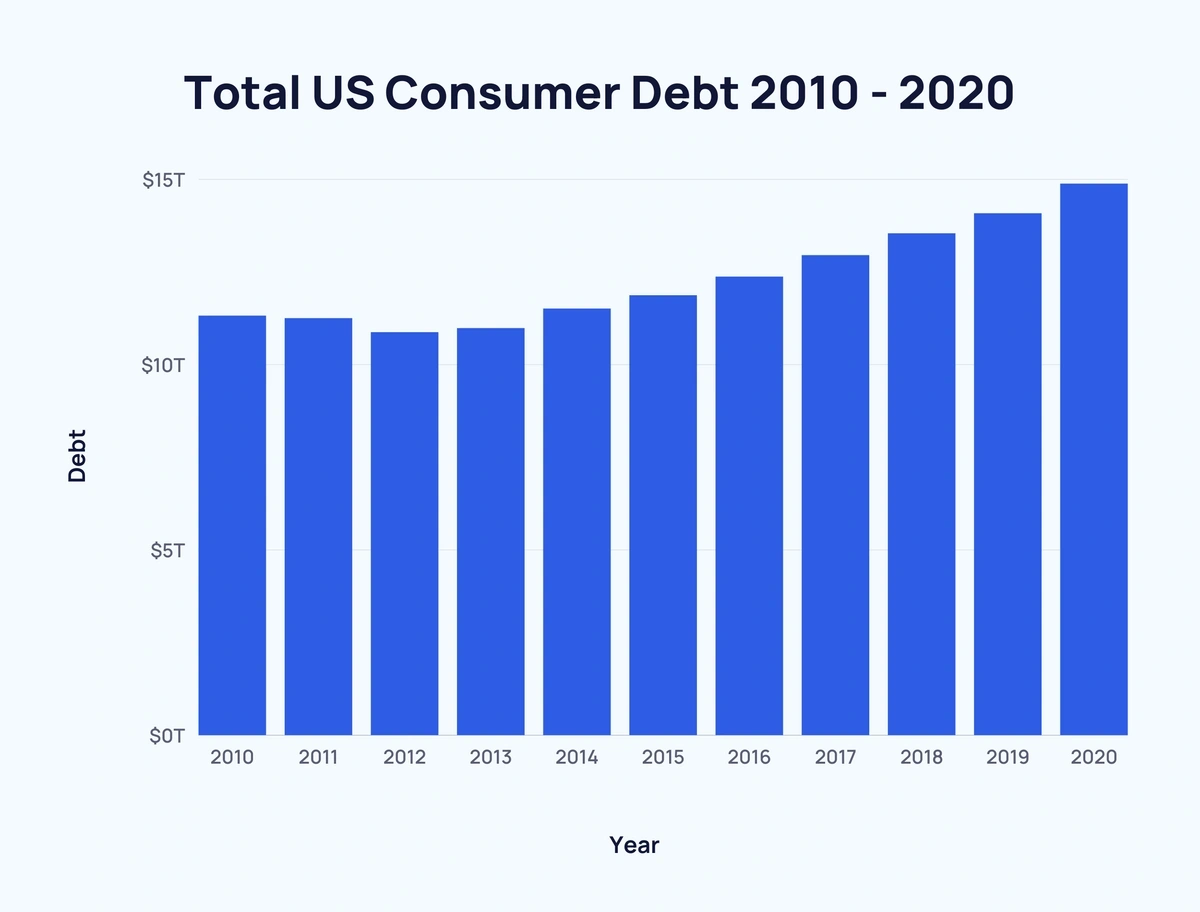

Even worse, this wealth gap continued to widen between 2010 and 2016.

While some experts point to this generation being a “lost generation” in terms of accumulating wealth, others point to Millennials’ education as being one bright spot that may eventually pay off and get them back on track in the future.

2. Focused on a healthy lifestyle

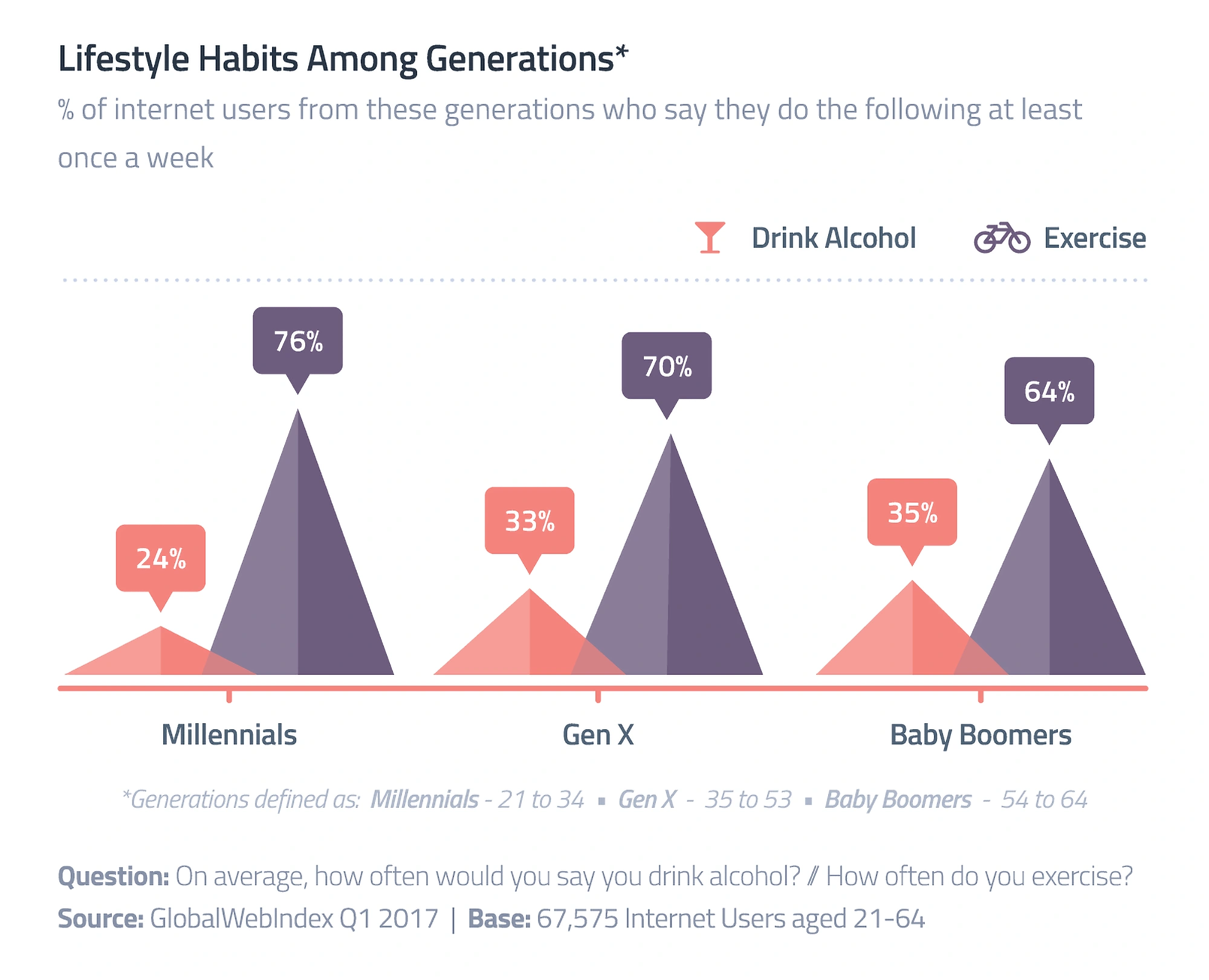

A survey from the Global Web Index gave insight into how Millennials are balancing two critical lifestyle habits: alcohol and exercise.

More than three-quarters of these individuals report working out at least once per week and only 24% reported drinking once per week.

This survey found that Millennials are exercising more and drinking less than the generations that came before them.

In 2018, 33% of health club members were Millennials. That’s compared to 24% from Gen X and 14% from Gen Z.

According to CBInsights, Millennials are flocking toward boutique studio gyms in particular.

They report that Millennials are attracted to the atmosphere and community aspect of these gyms.

This generation is willing to pay for the gym experience they want, too. A 2021 survey reported that nearly 40% of Millennials have been in credit card debt due to fitness and nutrition expenses.

For all their efforts, however, Millennials may not be as healthy as they’d like to be.

Blue Cross Blue Shield Association reports that around age 27, the health of Millennials begins to decline.

3. Paralyzing student loan debt

Experian recently analyzed its database and found that the average Millennial is more than $87,000 in debt.

The company reports that the average student loan debt in this group is $38,877.

Debt is a big problem for Millennials. From 2019 to 2020, the average debt in this generation increased by more than 11%.

The cost of receiving an education at a four-year college has increased by nearly 70% since 1999, according to New America.

Their stats go on to report that with rising costs comes an increase in loans. In that same time period, the number of loans issued for costs associated with higher education has doubled.

Millennial borrowers between the ages of 25 and 34 had more than $500 billion in federal student loan debt at the end of 2021.

In the next age group, people aged 35 to 49, there was $622 billion in unpaid federal student loans.

A Bank of America survey reported that individuals in this generation who carry student loan debt spend 10% of their monthly income on the loans.

Some, however, are simply unable to pay.

One professor and student debt expert says that nearly 30% of Millennials who entered college in 2003 have already defaulted on their loans. She predicted that number would be 38% in 2023.

Some Millennials are putting their hope in student loan forgiveness.

In 2021, more students than ever benefited from the Public Service Loan Forgiveness program.

However, the program still has a long way to go. In the last two months of 2020, only 2.16% of applications were accepted.

That equates to approximately 4,000 claims per month that are accepted, approximately 250,000 that are denied, and 150,000 that are pending.

4. Reluctance to buy a home — for now

Fewer Millennials are buying homes compared to the generations that came before them.

Homeownership in the Millennial generation stands at 61%. For Gen Xers, at a similar time in life, that number was 68% and for Boomers it was 66%.

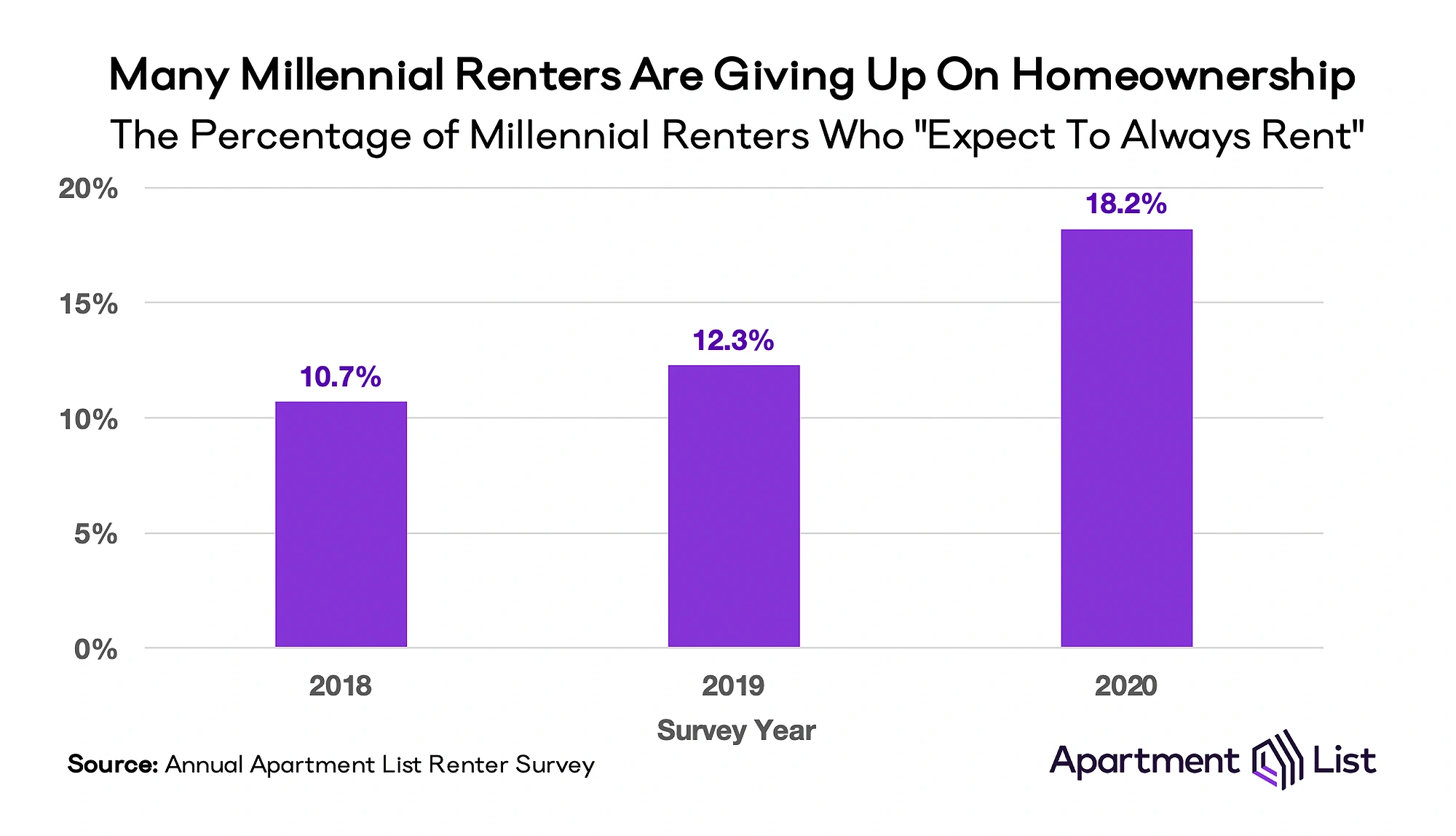

They may never catch up. In 2020, Apartment List reported that the percentage of Millennials who say they plan to never buy a home was up to 18%. That’s a 6% increase from 2019.

The survey from Apartment List reported the main reason Millennials are forgoing homeownership is affordability. Nearly three-quarters of the generation say they simply cannot afford it.

In another survey, 27% of Millennials said student loan debt made them put off buying their own home.

Another reason Millennials aren’t buying homes is that they are living in dense metropolitan areas where renting is the norm. As recently as 2018, 88% of Millennials lived in cities.

Will we see this trend of renting flip to buying once Millennials get a bit older?

One survey says it’s promising. They report a seven-year delay in homeownership in this generation.

In addition, some Millennials are taking a different approach to homeownership: buying a house together with friends.

Attom Data Solutions reports that the number of homes bought by people with different last names increased by more than 770% from 2010 to 2021.

5. Putting off marriage — for good

Millennials and marriage are not a match made in heaven.

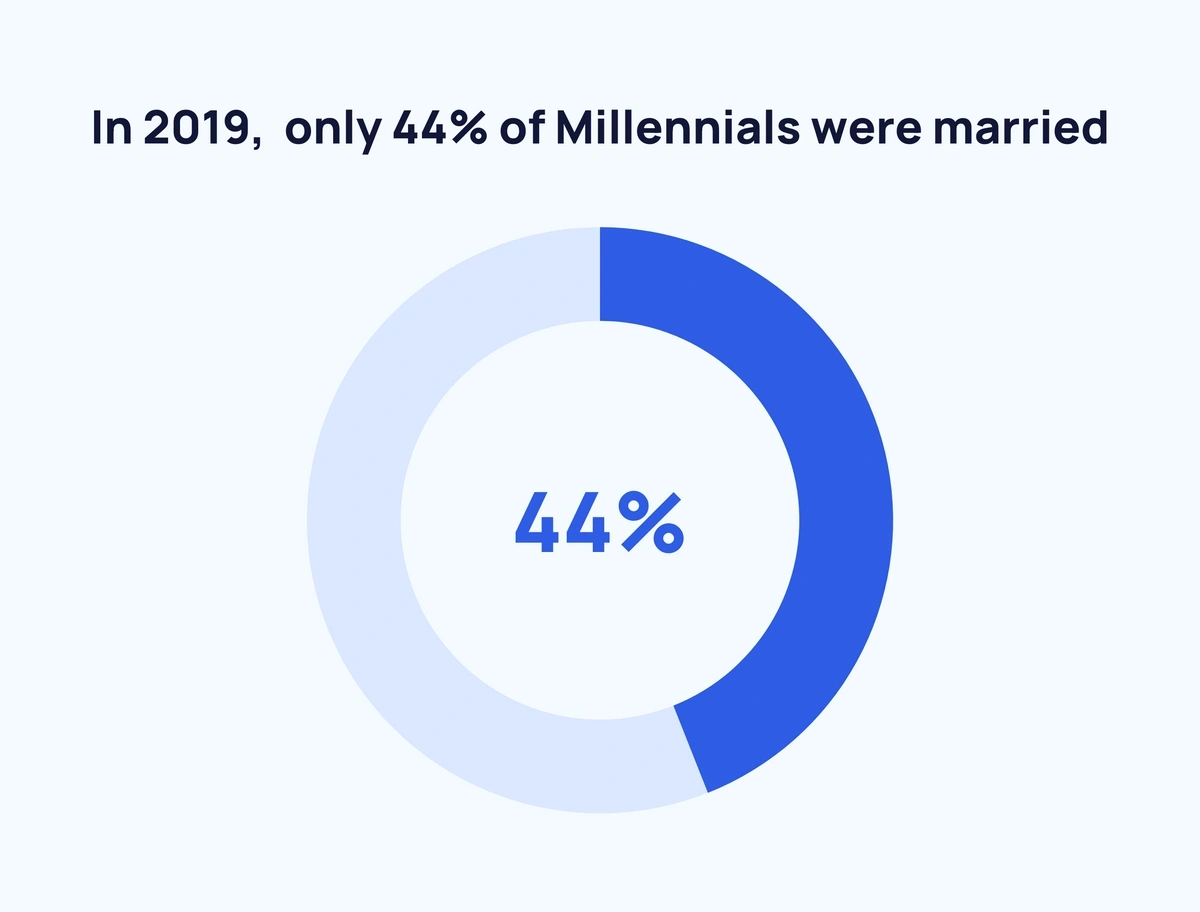

In 2019, data from the Pew Research Center showed that only 44% of Millennials were married.

For comparison, 61% of Baby Boomers and 53% of Gen Xers were married when they were at the same age as Millennials are now.

Numbers from the 2018 Census show the average age of getting married stands at 29.8 years old for men and 27.8 years old for women — as high as it’s ever been.

More Millennials are living together and having children without being married.

One study from Bowling Green State University found that Millennial women are 53% more likely than Baby Boomers to live with more than one romantic partner during their young adult years.

The study also compared rates of cohabitation five years later. For Boomers, 42% had married their partner. For Millennials, only 22% had married.

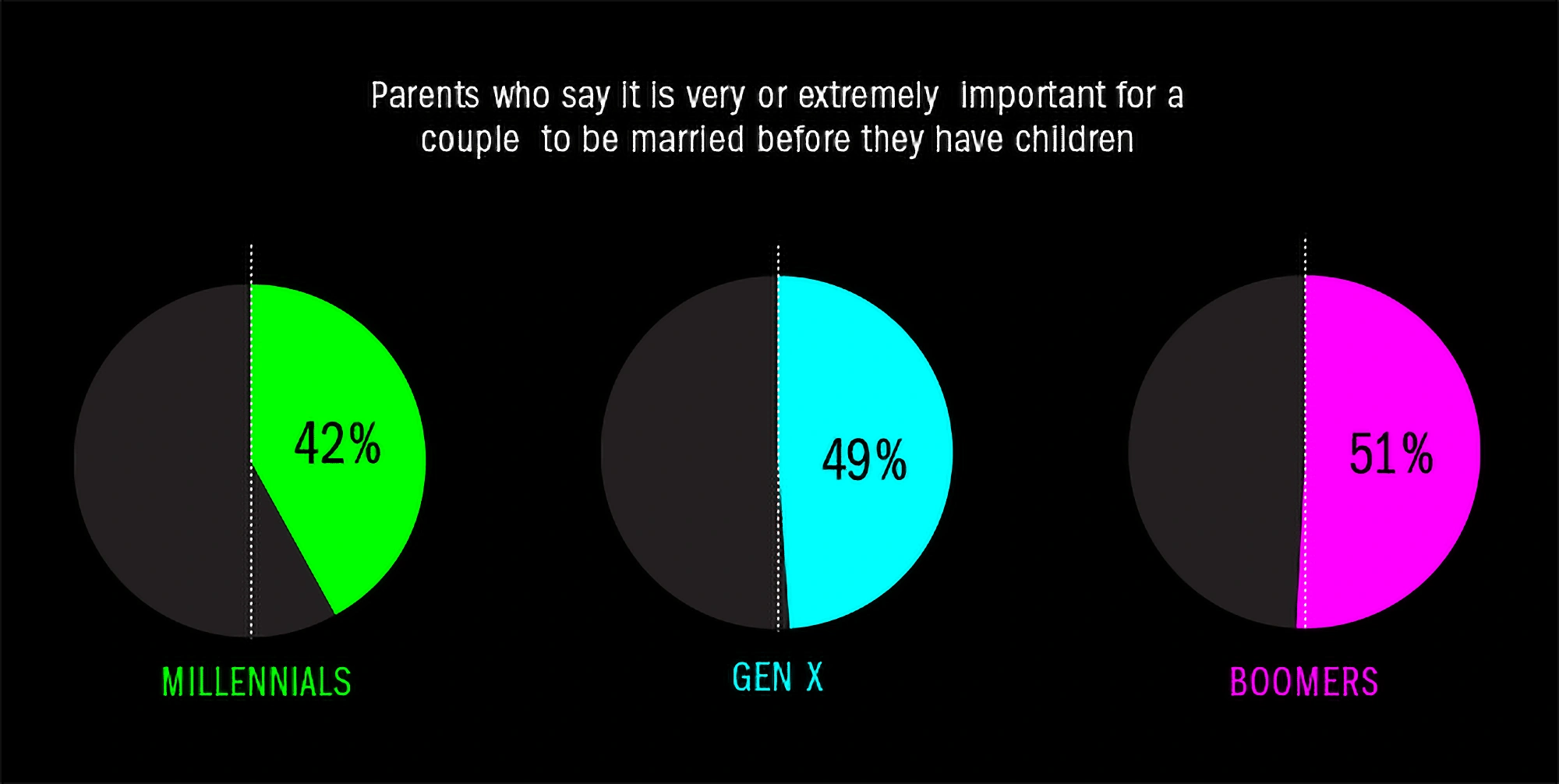

A Time survey recently reported that 42% of Millennials say it’s very or extremely important to be married before having kids. In comparison, nearly half of Gen Xers and Baby Boomers agreed with that statement.

Millennials are less likely than other generations to believe that it’s important to be married before having children.

Data from the CDC shows more than 40% of babies born in 2020 were born to unmarried parents.

However, marriage may go the same way as homeownership with Millennials not completely dismissing the idea, just delaying it.

A 2020 survey from The Knot reported that the majority of Gen Zers and Millennials say they’re expecting to be married in the next two to five years.

6. Millennials aren’t becoming parents

Millennials are also waiting to have children.

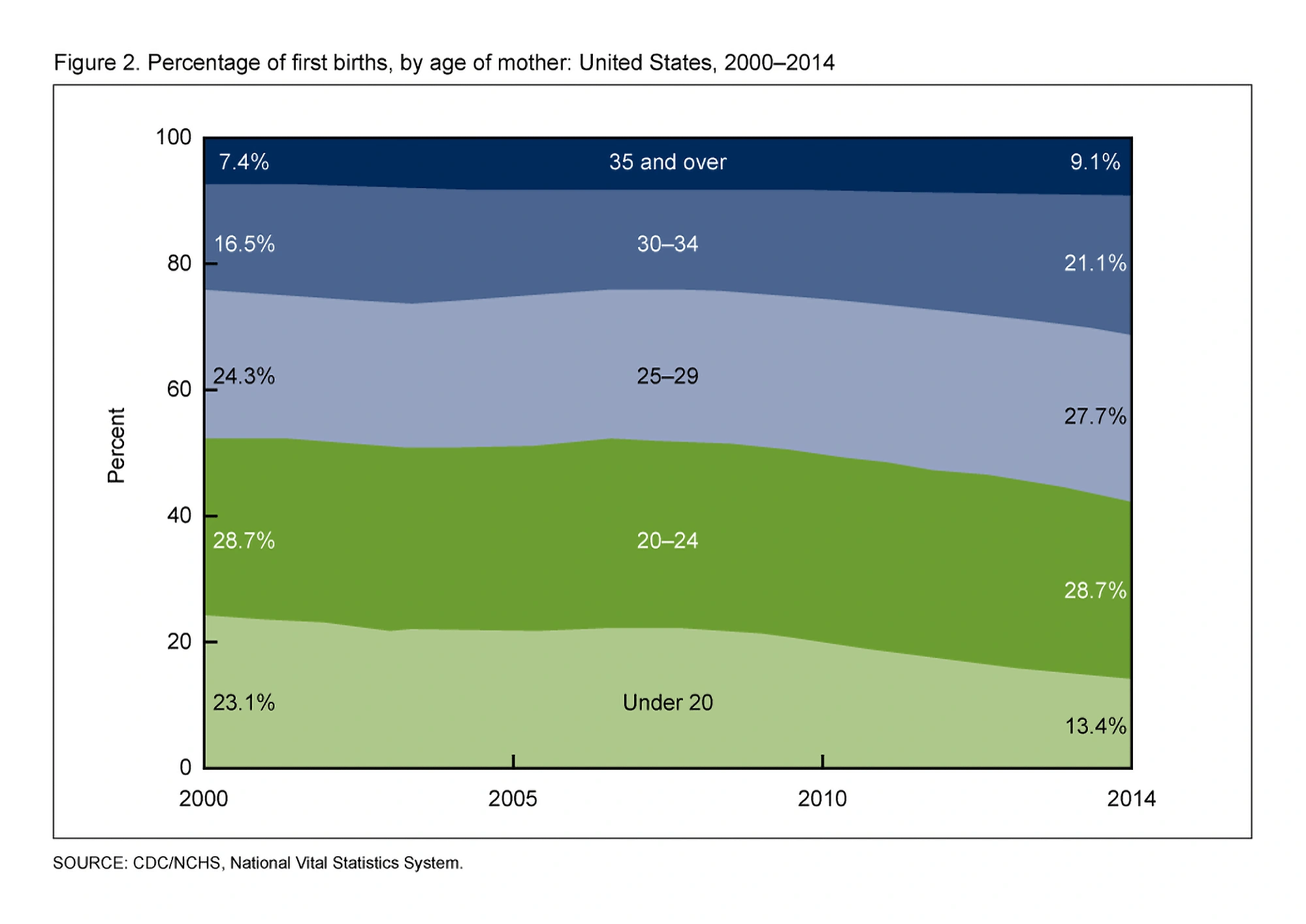

Data from the National Vital Statistics System shows that the average age of a woman when she had her first child increased from 24.9 years old to 26.3 years old between 2000 and 2014.

This trend hinges on a variety of factors.

One professor analyzed data from the US Census and found that waiting to have children increased a woman’s earnings. Women who had their first child at 30 years old were making $16,000 less than women who waited until they were 35.

This analysis is echoed in a 2020 survey by SoFi and Modern Fertility.

Their data shows 60% of people who haven’t had children are delaying because they don’t have enough money saved.

Interestingly, 32% said they are still young and have plenty of time in the future.

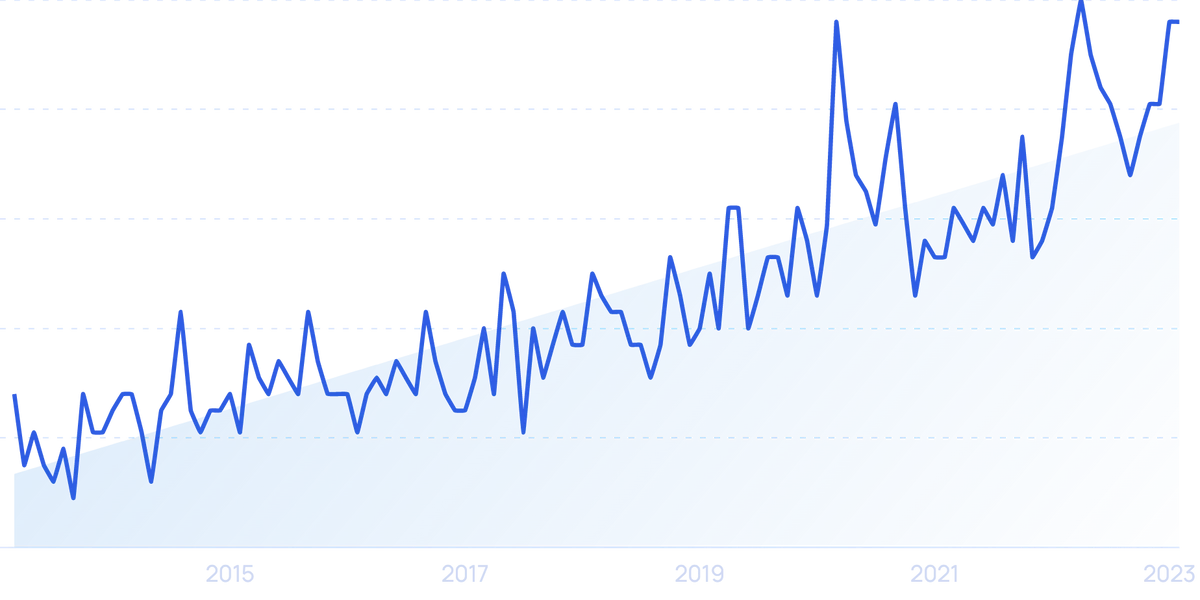

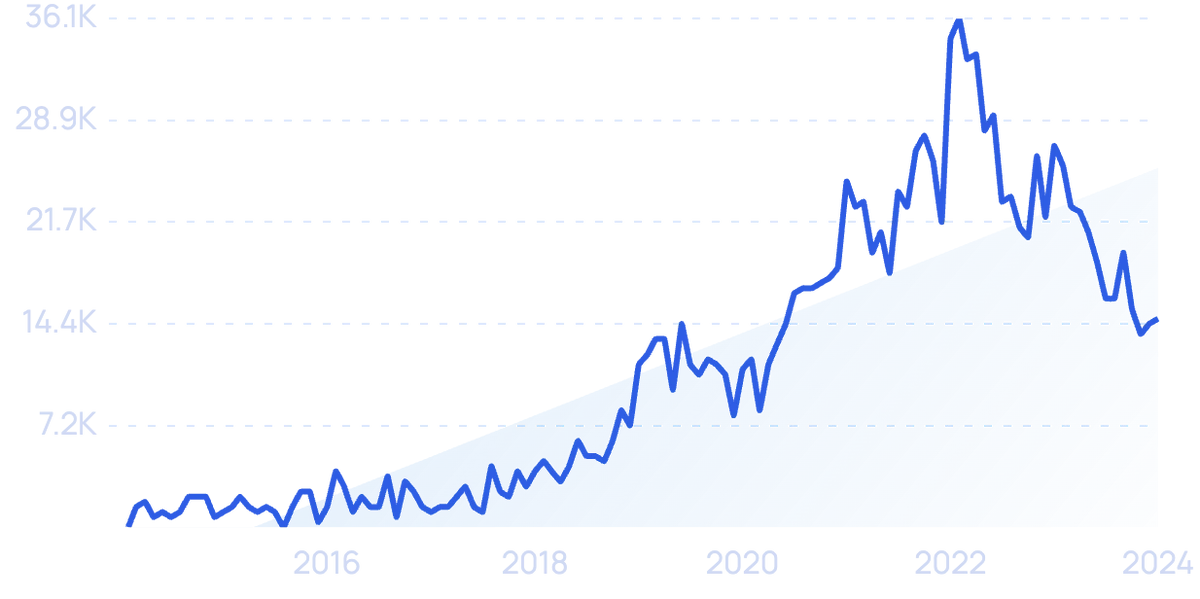

As women delay having children, fertility treatments are on the rise. Searches for the company “Modern Fertility” surged in the past 5 years.

In a study by the Guttmacher Institute, 33% of women in the US said that the pandemic would likely delay their decision to have children.

Many Millennials seem set on their decision to remain childless.

A Pew Research Center survey found that 44% of non-parents between the ages of 18 and 49 years old say “It is not too or not at all likely that I will have children someday”. That was a 7% increase over 2018.

7. Driven by wanderlust

Many Millennials are prioritizing experiences like traveling instead of traditional expectations like getting married and having kids.

One survey found that nearly 50% of Millennials would rather spend money to travel than to buy a home.

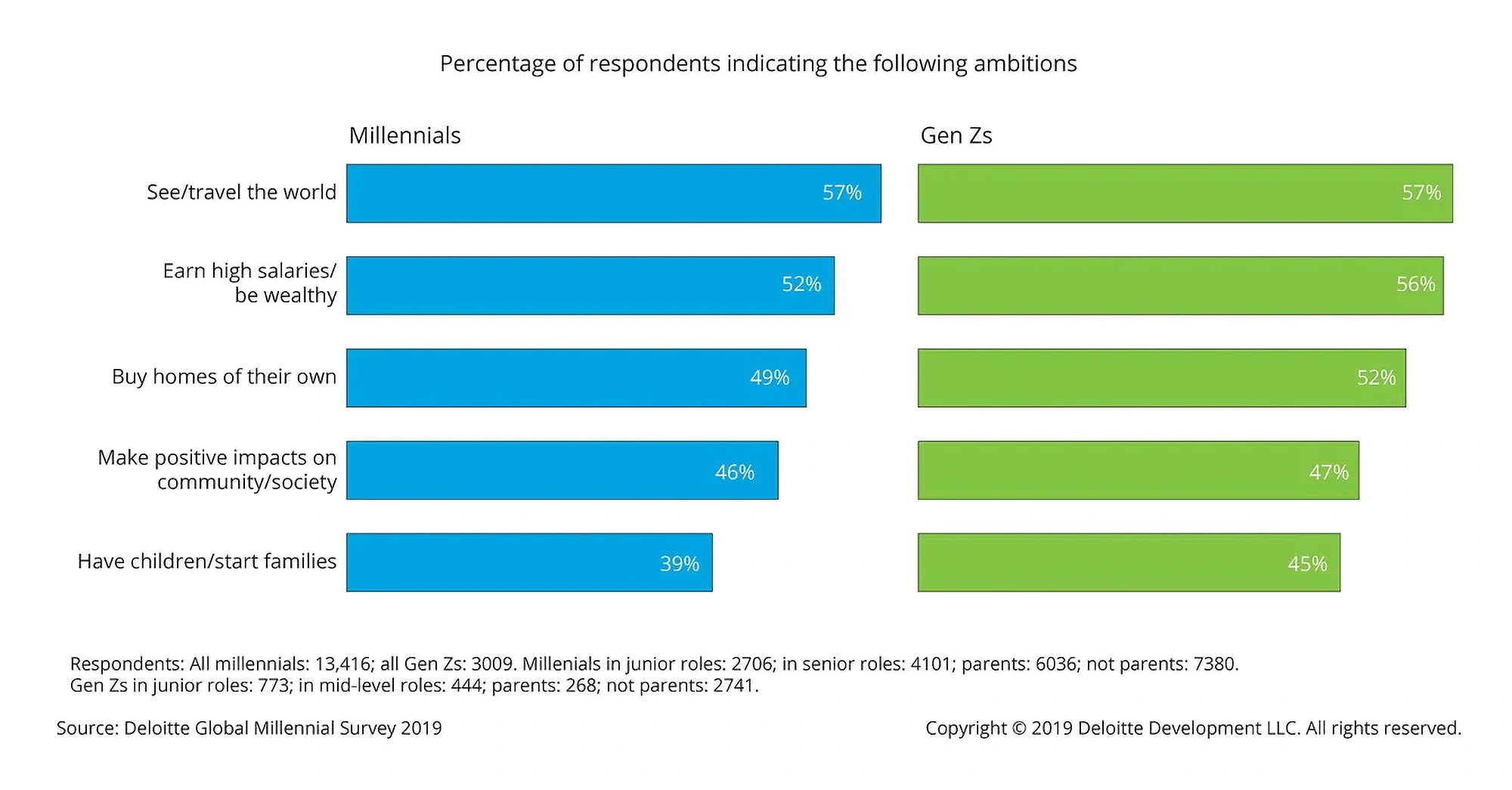

Deloitte recently reported that “traveling the world” was the top priority of 57% of Millennials. In comparison, only 39% listed starting a family as a priority.

For Millennials, surveys report that traveling is a higher priority than buying homes, having kids, and making an impact in society.

On average, Millennials say they take 5.6 trips per year.

One example of this dedication to traveling is Cait Flanders, a Millennial who turned to minimalism and wrote about it on her blog and later, in a book.

Cait put herself on a “shopping ban” for an entire year. However, she never gave up traveling. In fact, she spent $10k on travel during that year.

In her book The Year of Less, Cait Flanders describes giving up books, clothes, and shopping, but she continued to travel at least once each month.

Millennials aren’t just staying local, either. One travel site ranked the top Millennial travel destinations and they’re all over the world: Portugal, Indonesia, Italy, France, and Myanmar, just to name a few.

While the pandemic may have held Millennials back for a while, they are driving post-pandemic travel.

A TripAdvisor survey found that individuals from this generation are leading a surge in luxury travel, in particular.

They were much more likely to consider international air travel, take a cruise, and increase their travel spending.

Some Millennials are taking travel one step further and are choosing to live and work abroad.

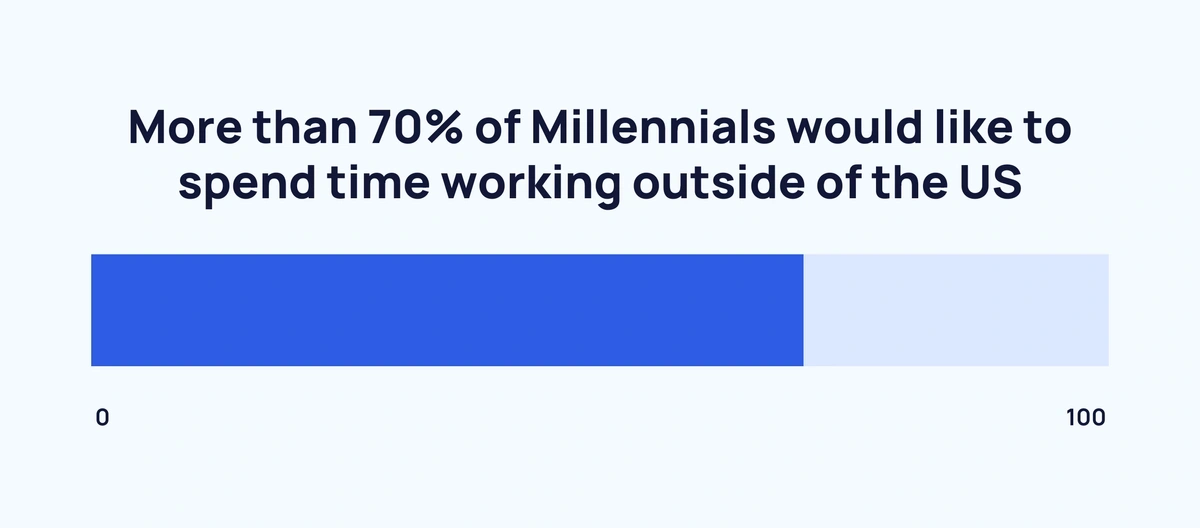

Over 7 in 10 Millennials would like to spend time working outside of the US, according to a PricewaterhouseCoopers poll.

Companies that can offer these globetrotting experiences are benefiting from the Millennial workforce.

“You’ve got to look outside your little box, and what better way to do that than to expand internationally, giving your folks that are working an opportunity to do that? They’ll come back with new ideas and new ways of doing things that we may never see here,” said one business owner.

Conclusion

That wraps up the top seven trends we see impacting Millennials as we move deeper into 2024.

Through these trends, we can see that this generation is making their own way in life, charting a path that differs widely from the path their parents took. Financial woes are one of the main reasons, but changing societal expectations and uncertain times like the Great Recession and the COVID pandemic are driving the trends of this generation, too.

As Millennials age into mid-life, we’ll need to keep a close watch to see how their maturity and experience has affected their choices going forward.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more