Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

How To Do Market Research For New Product Development

Market research for new product development can be overwhelming.

It’s easy to get lost in a mountain of market reports with thousands of data points…. yet get no clear insights on which product is best for your brand.

Instead of aimlessly searching for new product ideas and sifting through endless market reports, this post will walk you through a simple step-by-step process that outlines:

- How to quickly find relevant new product ideas.

- Specific data and metrics you need to analyze each product opportunity (and how to find these metrics).

- How to use market research data to assess a product opportunity.

What Is Market Research For New Product Development?

Market research for new product development is the process of evaluating the demand, growth, and gaps in a market for a particular product (typically a physical product sold in a retail setting or direct to consumer).

These insights help you understand which products your target market wants, which ones are most profitable, and the key characteristics customers like and dislike about competitors' products.

With this data, you can more accurately predict which product will perform best for your business.

Types Of Market Research For New Product Development

There are four types of market research typically used for researching and developing products:

- Qualitative research

- Quantitative research

- Primary research

- Secondary research

Quantitative Research

Examples of quantitative data you might collect during the product market research process include:

- Market size and growth rates

- Pricing data

- Sales forecasts

- Website traffic data

- Market share of the top competitors

Quantitative data is helpful for benchmarking and is often the main type of research used to quickly gauge the potential of market opportunities.

Quantitative data can be fact-checked, but accuracy still varies depending on factors like sample size and data collection methods.

Qualitative Research

Qualitative research is data based on subjective opinions.

An example of qualitative data is customer feedback.

This data is helpful for product market research, as you can better understand customer pain points and what they like and dislike about what's already out there.

Some examples of qualitative research methods include:

- Interviews with potential customers

- Customer reviews

- Questionnaires and surveys

- Discussion analysis (monitoring conversations on social media, in forums, etc.)

- Feedback from focus groups

Primary Research

Primary research is data collected by you or your company.

Here are some examples of primary research:

- Results from a survey you conducted

- A report from sales data your team analyzed

- Customer interviews conducted by your team

The advantage of primary market research is that it's proprietary data your company owns. So your competitors won't have access to it. You can also tailor the data to answer your specific questions about the market.

The downside of primary research is that it’s expensive and time-consuming. You'll have to conduct the research, clean the data, and analyze it yourself.

You can hire a market research firm to help, but this will make it even more costly.

Secondary Research

Secondary research is data collected and published by other third-party sources, like an industry publication or government agency.

Here are some examples of secondary research:

- Free and paid market reports published by a source like Grand View Research or MarketResearch.com.

- Statistics published by a source like The U.S. Bureau of Labor Statistics or the U.S. Energy Information Administration.

- Data in the Census Business Builder.

Secondary research is usually cheaper than primary research, so it's great for the early stages of product market research when you're narrowing down your list of product ideas.

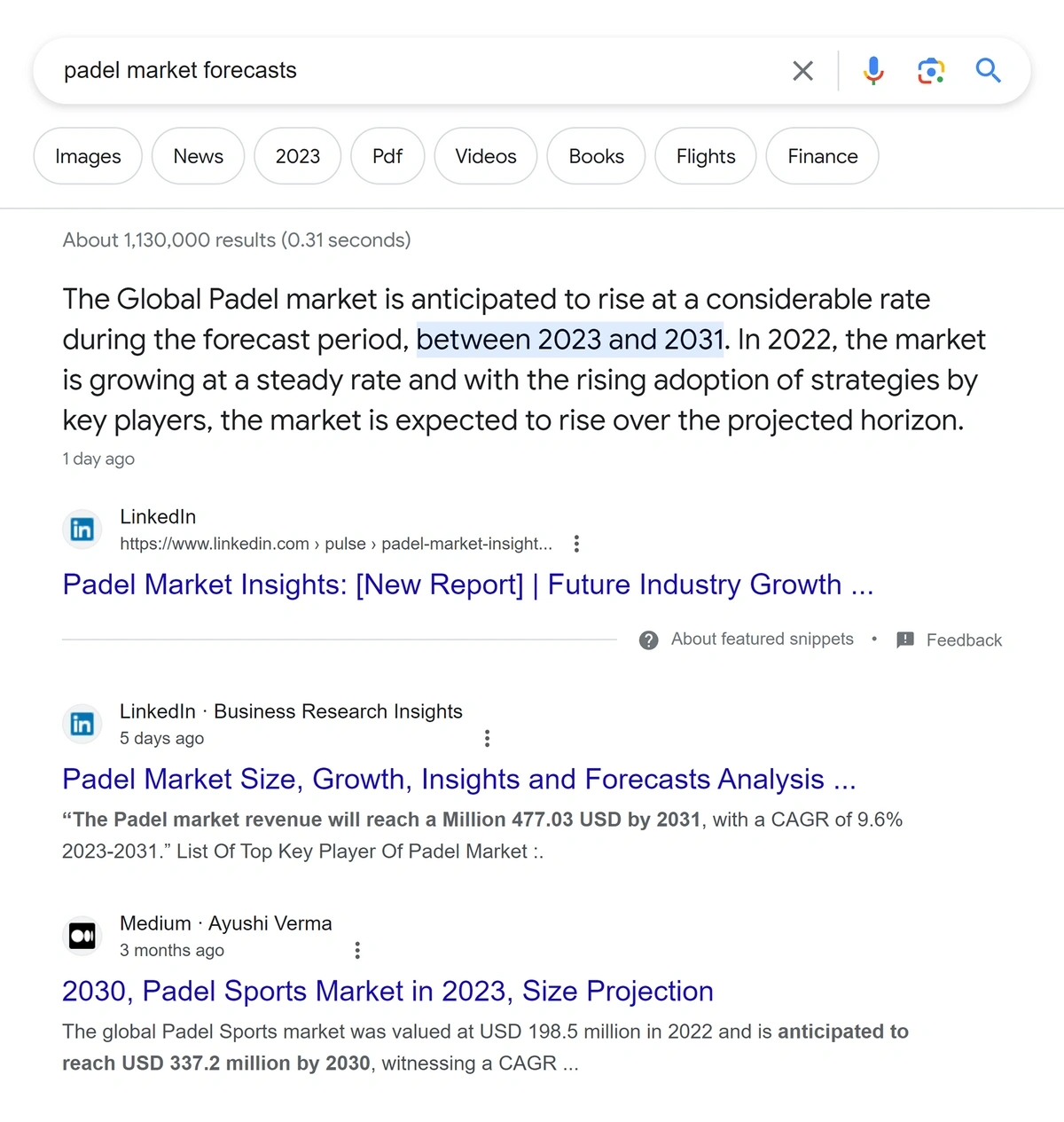

For example, if you're interested in the padel market, search "padel market forecast" to find free industry reports. You can look at statistics like compounding annual growth rate and market size to quickly gauge if the padel market is worth exploring in more detail.

The drawback of secondary research is that the data quality may vary as you can't control data quality.

So research how each provider collects and cleans the data they publish.

Step By Step Process To Conduct Market Research For Product Development

In this step-by-step market research process for new product development, you'll learn how to find, validate, and develop a great product.

Step 1: Research And Identify Trending Products

Many people browse social media and Amazon to find trending product ideas.

But emerging products, by definition, aren't easy to find.

You might spend hours browsing these platforms to find a few promising product ideas. And even the most diligent product researchers might still overlook the best emerging product ideas.

One solution to find great product ideas faster is to use a market research tool.

However, each tool contains different product ideas.

So the tool you choose significantly impacts the product ideas you find.

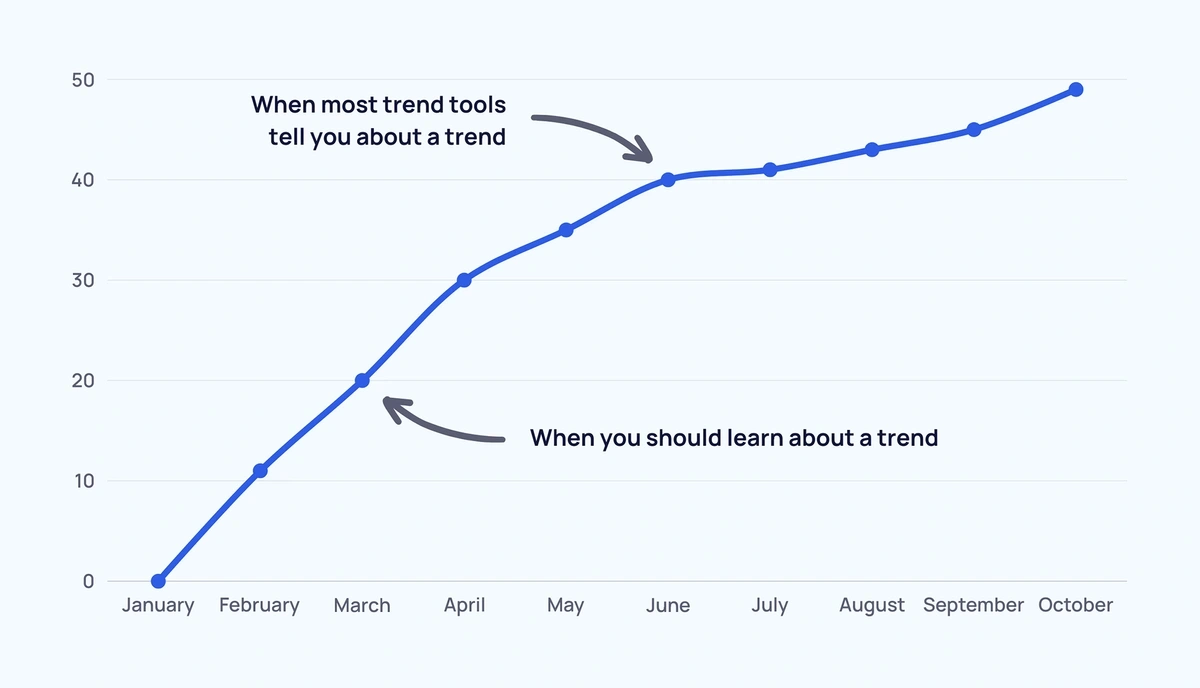

For example, many product research tools only show products that have grown significantly in the past few weeks. These are often fads, and demand may die out when you’re ready to launch your product.

Other product research tools show you products that are currently trending. Yet this isn't helpful if you want to launch a product before demand peaks.

Or, the product research tool might simply overlook the best product ideas. This is common with product research tools relying on human analysts to find product ideas, as even the best analysts may overlook a great product idea.

To solve these problems, we built our own product research tool, Exploding Topics.

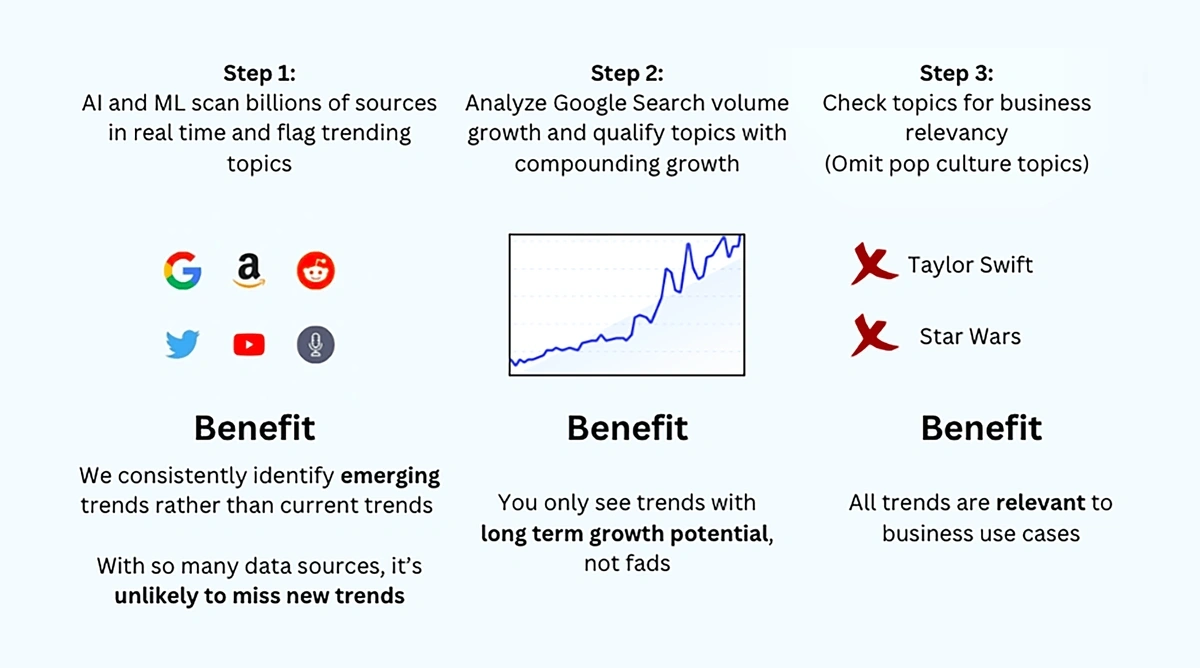

It has a unique trend identification and qualification method that uses AI and ML to scan millions of data points across sources like YouTube, Amazon, Spotify, Google Search, and Reddit. This ensures it consistently spots emerging product ideas. Then, we use Google Search volume data to ensure the topic has a steady compounding growth trajectory.

This process allows Exploding Topics to consistently identify emerging products with long-term growth potential.

It's also easy to use.

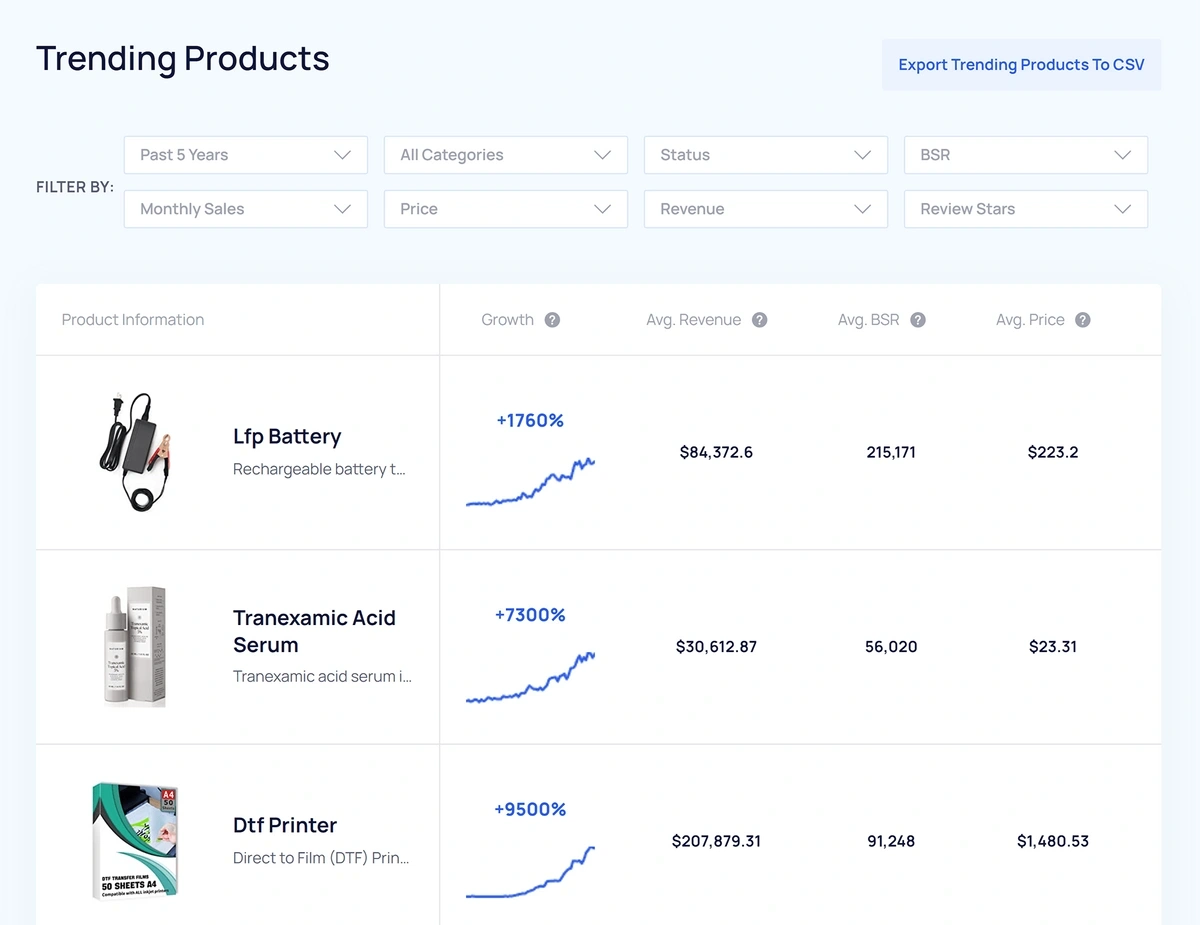

When you open the Trending Products dashboard, you'll see a list of trending products. You can filter the database by category (fitness, fashion, beauty, gaming, pets, etc.), BSR, monthly sales, price, revenue, and reviews.

The graph next to the product information also represents the keyword's Google Search volume trend so that you can gauge its growth trajectory:

When you see a product that interests you, click on it for more details, like a forecast of its growth trend for the coming year.

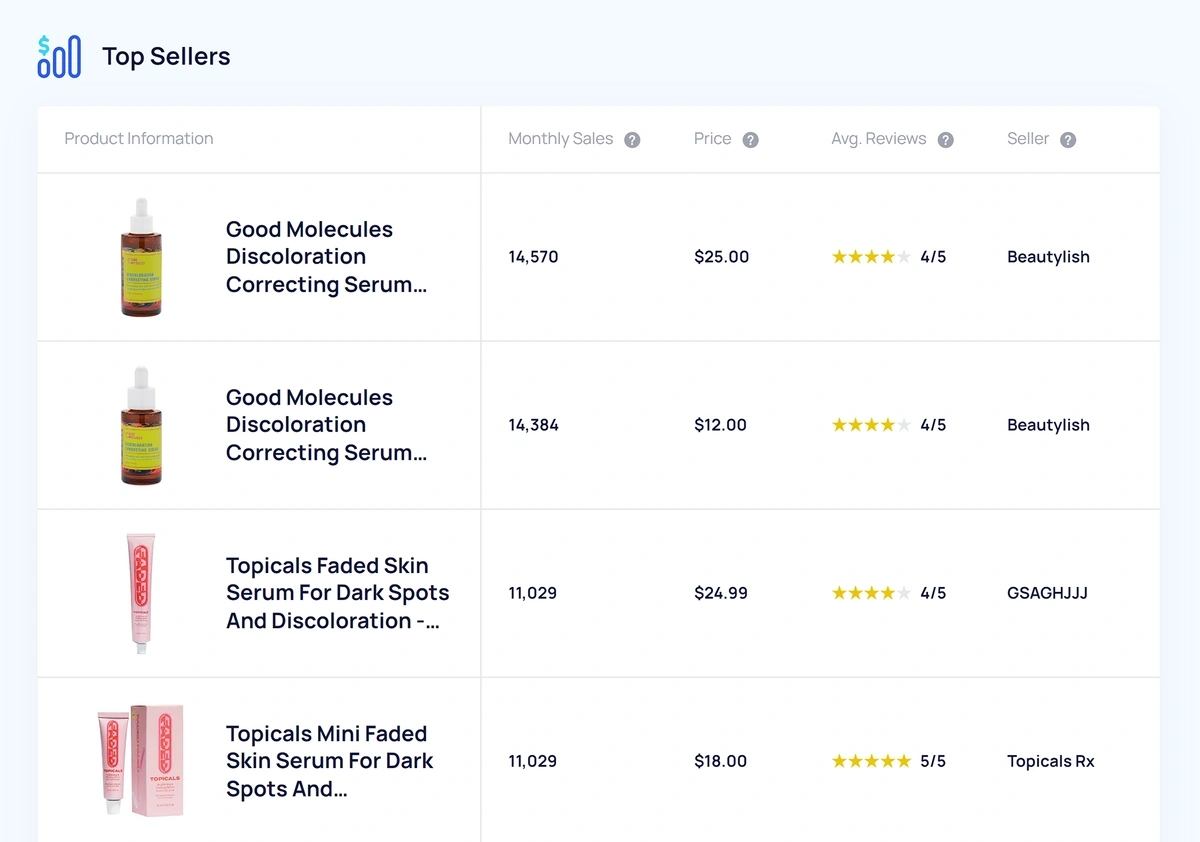

Further down the product page is a list of the Top Sellers for that product on Amazon.

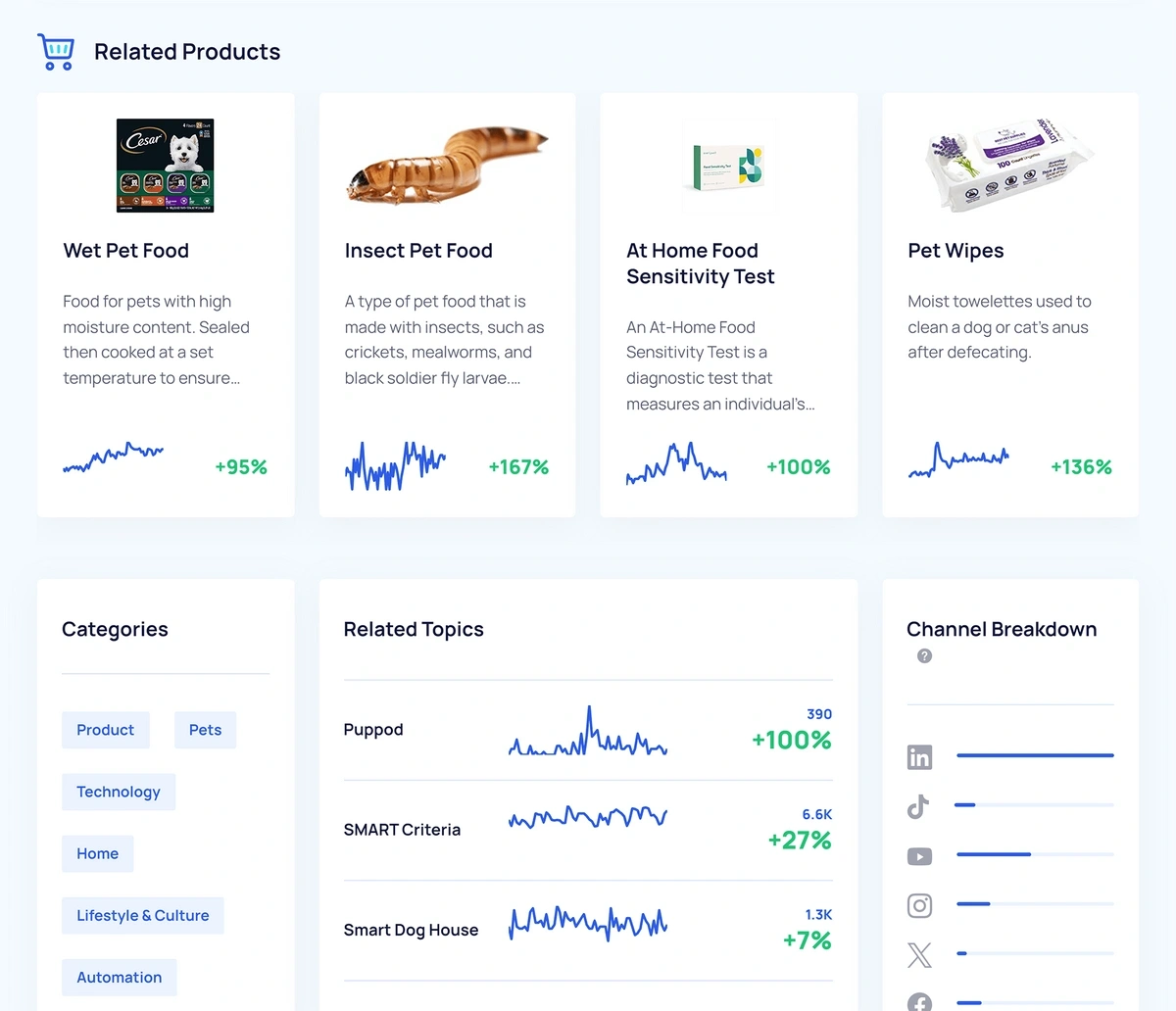

You’ll also see related trending products and topics. You can also click on any of those products for more detailed information.

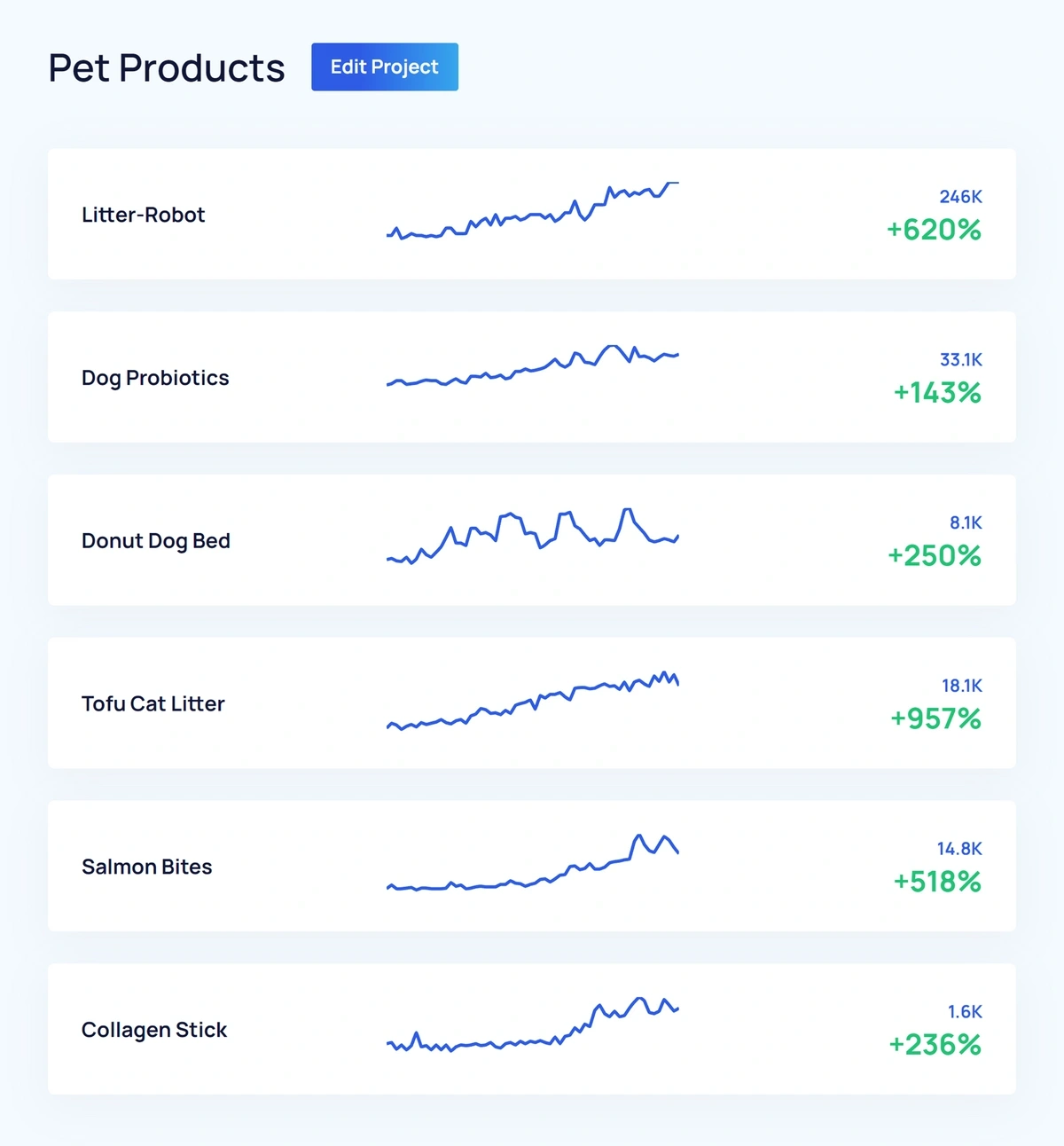

To track a product, click "Track Topic" and add it to a Project.

Projects are folders that live inside the Trend Tracking dashboard, and Exploding Topics updates each topic's growth trend in real time.

This makes it easy to gauge product growth at a glance so that you never have to worry about managing a product idea spreadsheet.

You can try Exploding Topics Pro for $1 to start researching product ideas.

Step 2: Analyze The Market For Each Product Idea

Your product is much more likely to succeed if it’s part of a growing market.

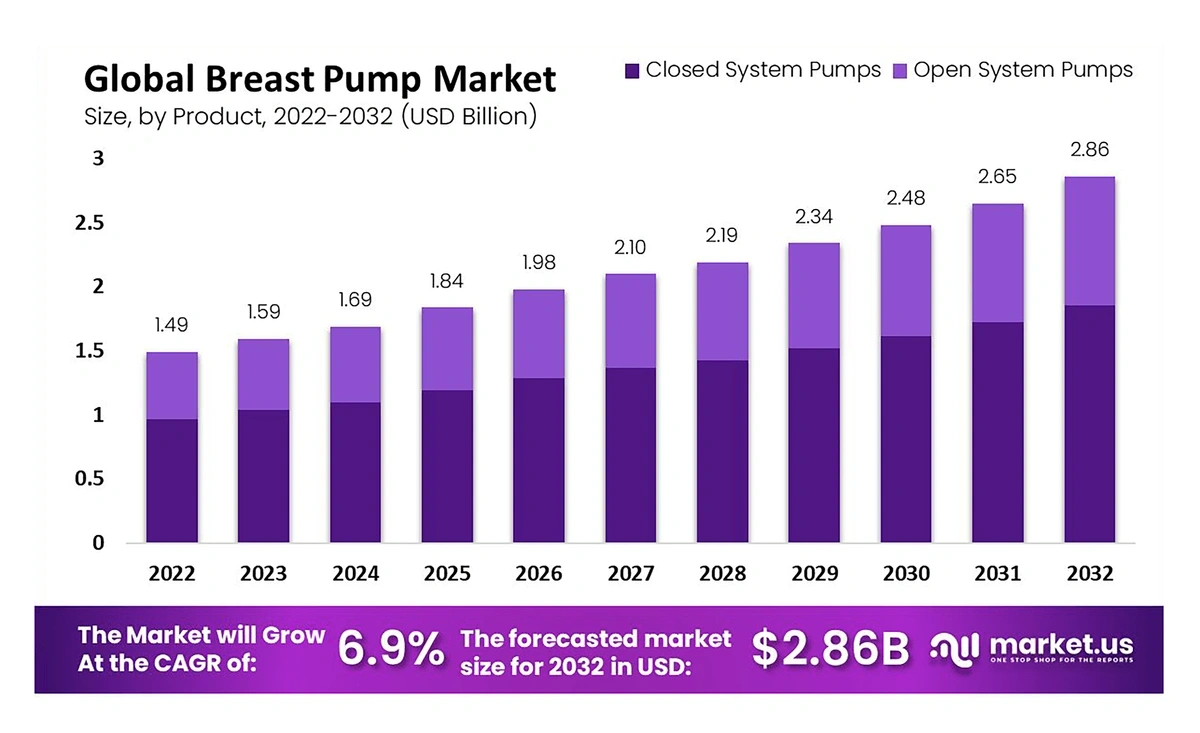

An easy way to quickly analyze a market’s general growth trajectory is to look at a market forecast.

Sources like Grand View Research, Globe Newswire, and Market.us usually offer free market reports with forecast data.

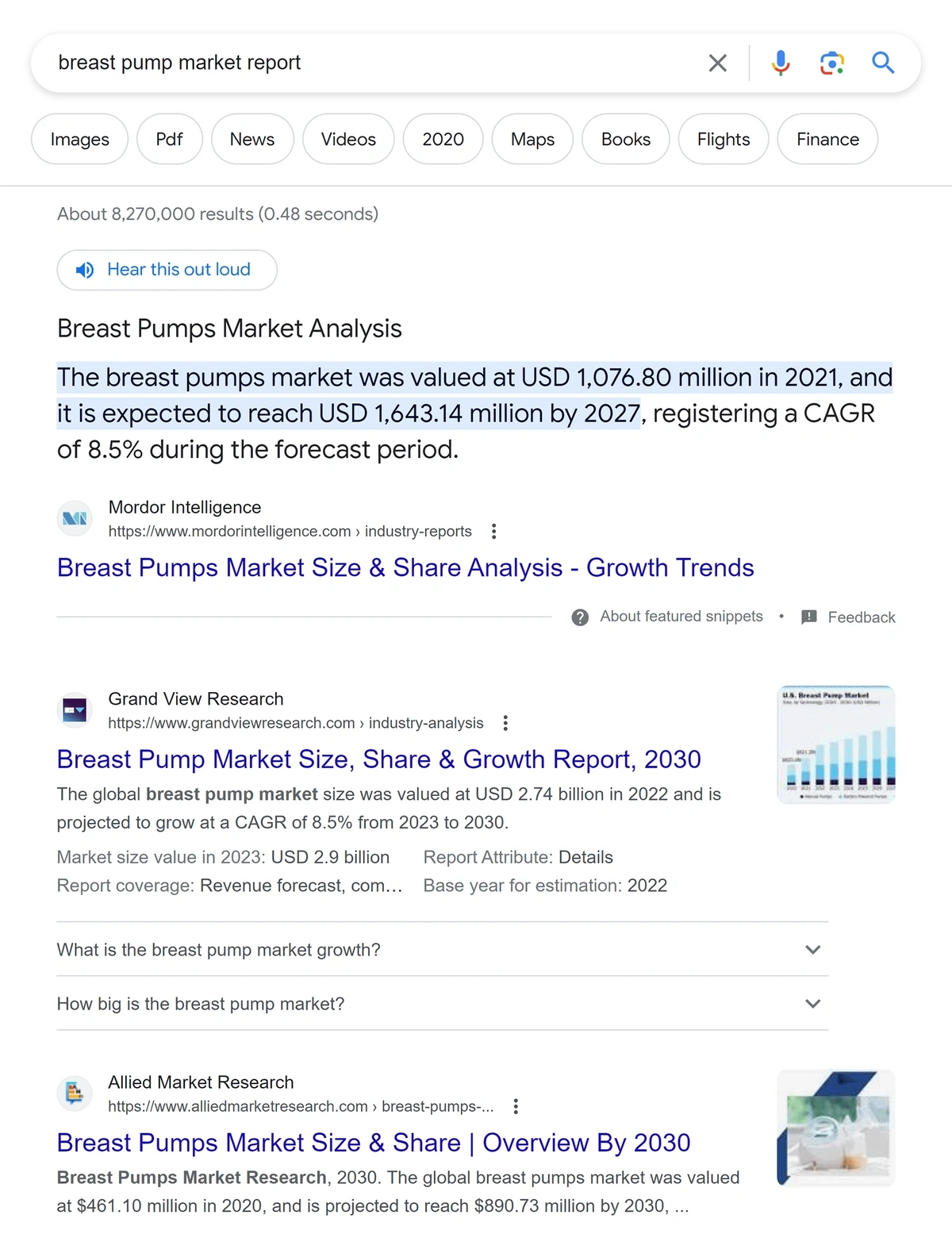

To find these reports, Google the product keyword and "market report:"

Next, identify the brands with the largest market share and analyze their growth trajectory.

If the market leaders are growing rapidly, the market is probably also expanding.

There are two ways to easily gauge a brand's growth.

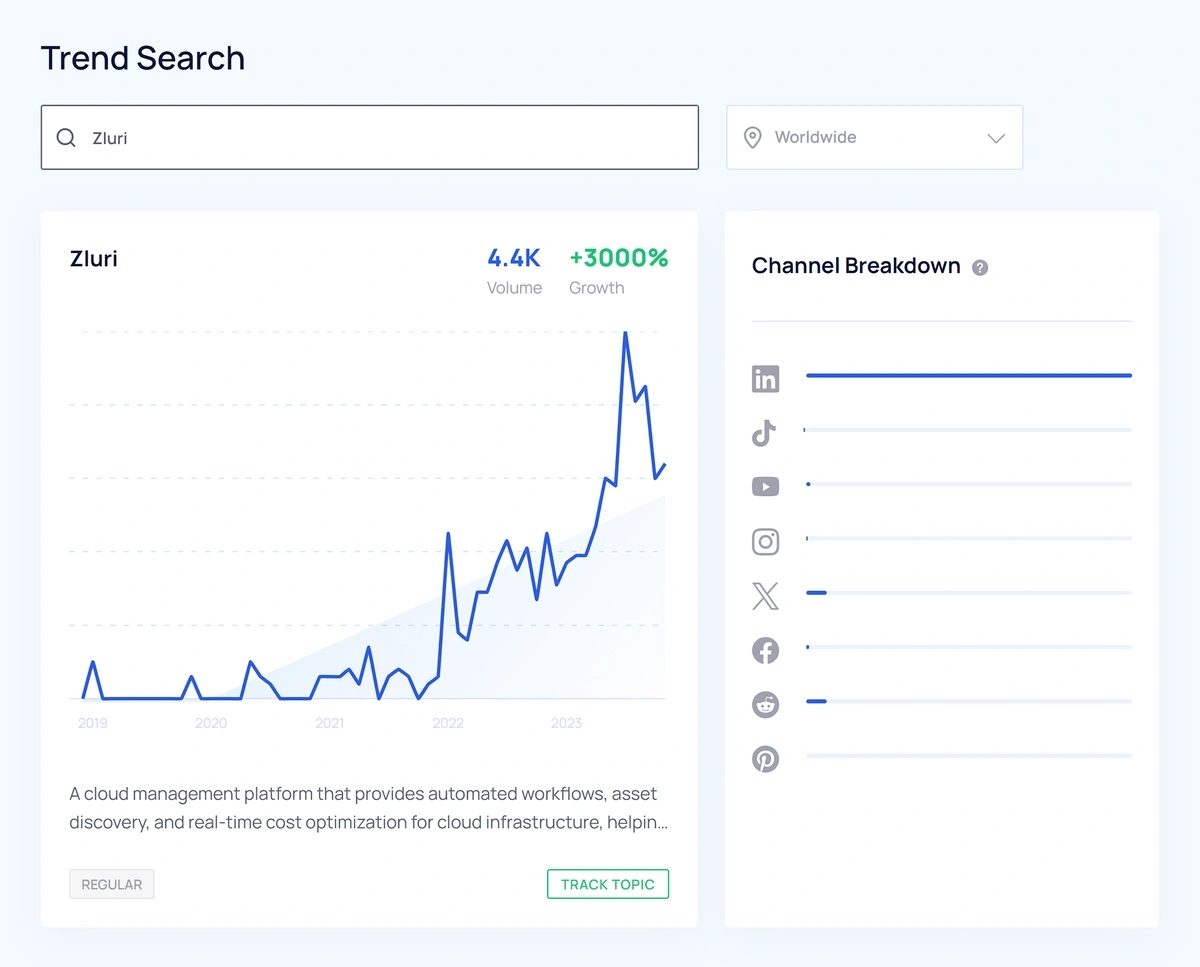

1. Check the brand’s Google Search volume trend.

You can find a brand's Google Search volume trend by typing the brand name into Google Trends or the Trends Search feature in Exploding Topics.

You can also click "Track Topic" and add it to a Project to monitor growth.

2. Employee headcount

A company is probably growing if it has steadily increased employee headcount over the past few years.

You can find employee headcount data by typing the brand name into LinkedIn and scrolling down to the bottom of the company page:

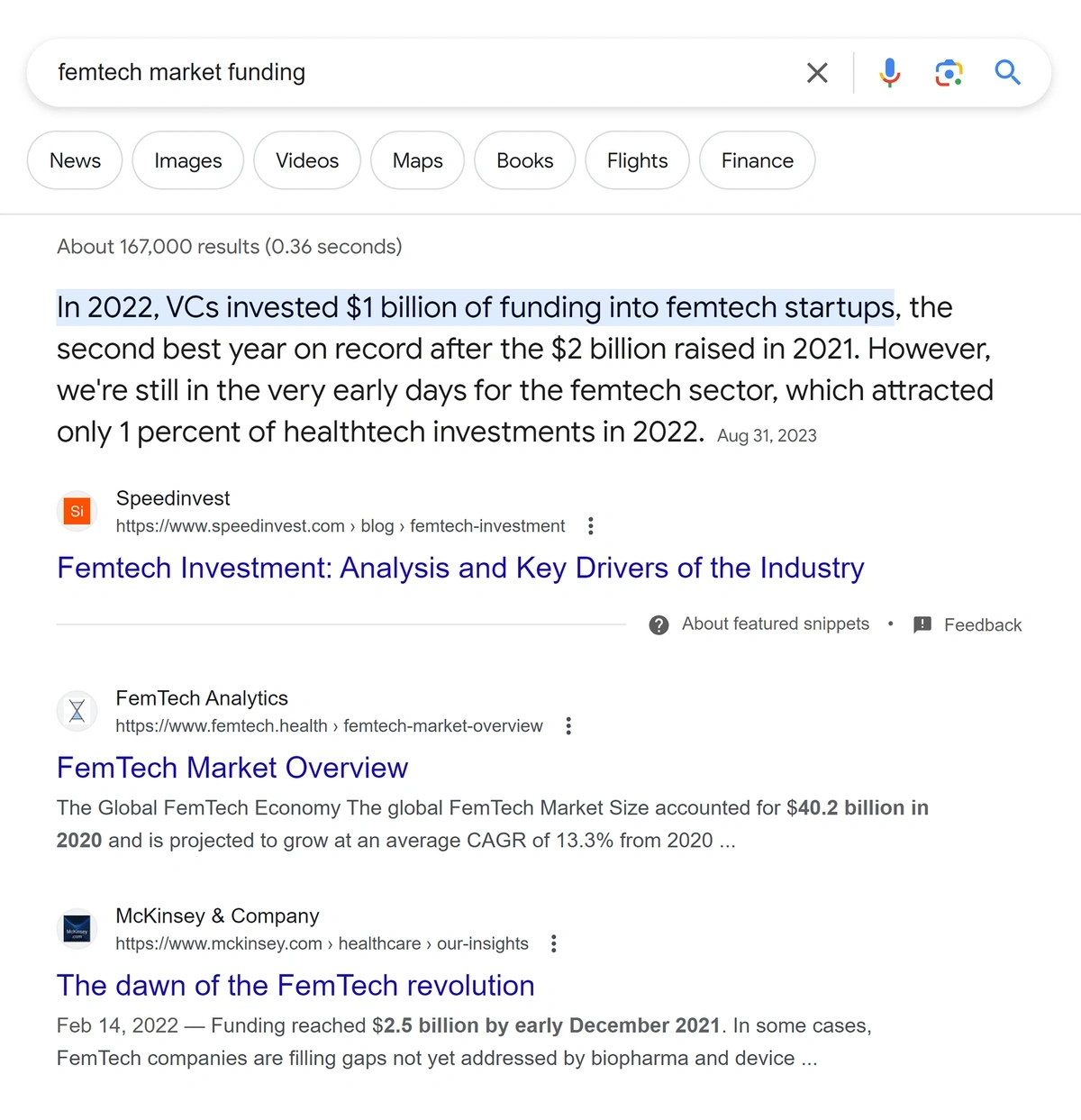

Funding data is also a great indicator of a market's growth trajectory.

Investors spend a lot of time and resources assessing market growth, so a lot of funding activity is a good sign the market is growing.

Paid tools like CB Insights and Pitchbook offer detailed funding data for most industries. You can also search "funding" and the industry name to find press releases, funding reports, and other relevant investment news.

Step 3: Conduct Customer Research

Once you find a trending product in a growing market, the next step is figuring out how to create the best product possible.

First, identify what customers like and dislike about existing products. Then, create a product that incorporates the elements customers like about existing products and solves the pain points they experience.

The easiest way to conduct customer research is to analyze customer reviews.

Amazon is the best resource to find verified reviews. As you're reading through the reviews, make notes on:

- Target Audience Demographics: Who is buying the product? (gender, age, location, etc.).

- Use Case: What problem did they purchase the product to solve?

- Praise: What do they like about the product?

- Pain Points: What do they like about the product?

For example, from the review below, you can tell that customers value soft material, accurate color descriptions, and expensive aesthetics. You can also see that customers want a more durable product.

Reading through reviews can help you better understand your target customers, but most people don't have time to read thousands of customer reviews.

So you can also copy and paste customer reviews into ChatGPT and ask it to extract insights on audience demographics, product use cases, likes, and dislikes.

Here's a prompt you can use to analyze the reviews. (In this screenshot, all of the reviews are pasted in quotes following the prompt):

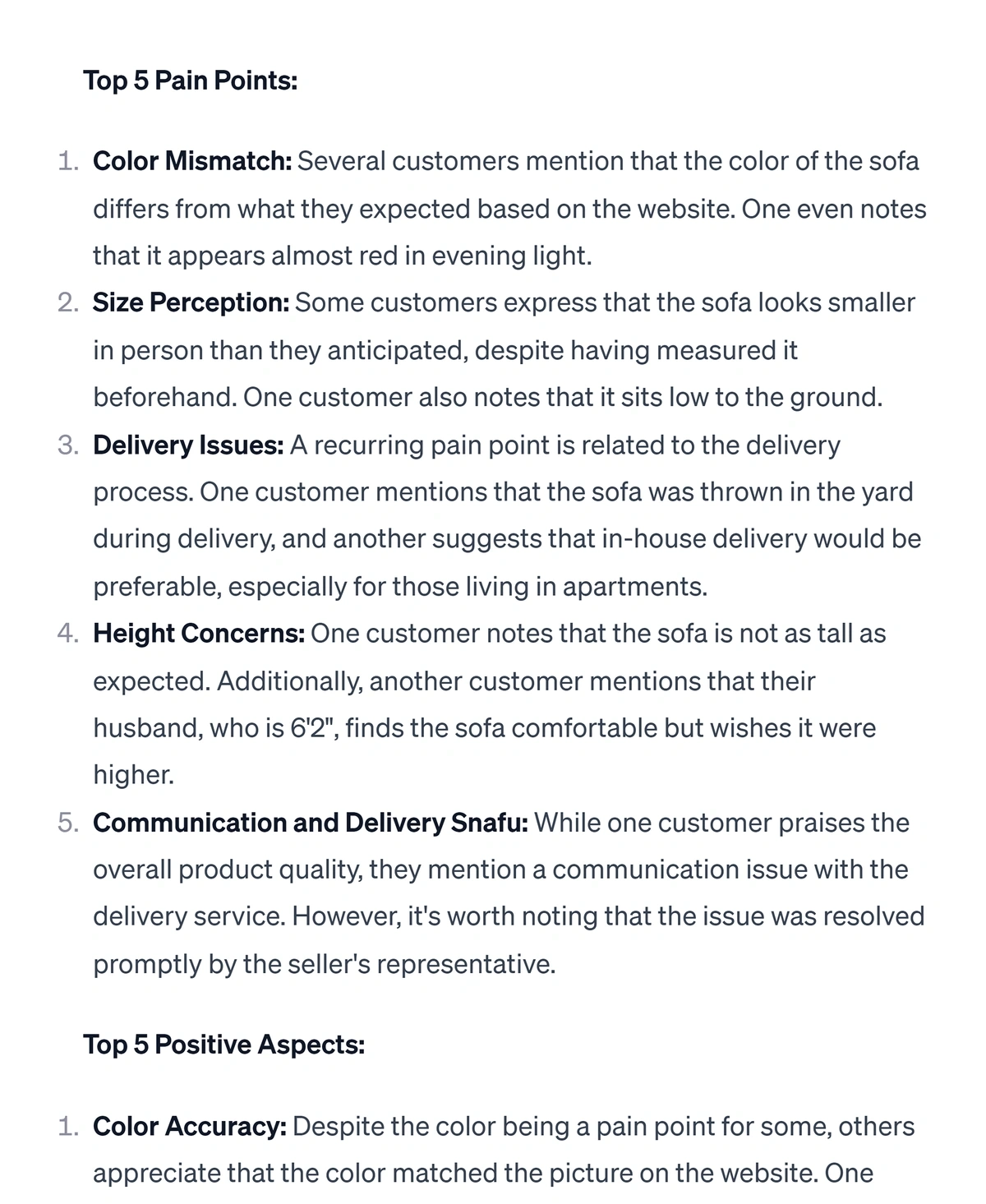

Here’s a snippet of the response it generated:

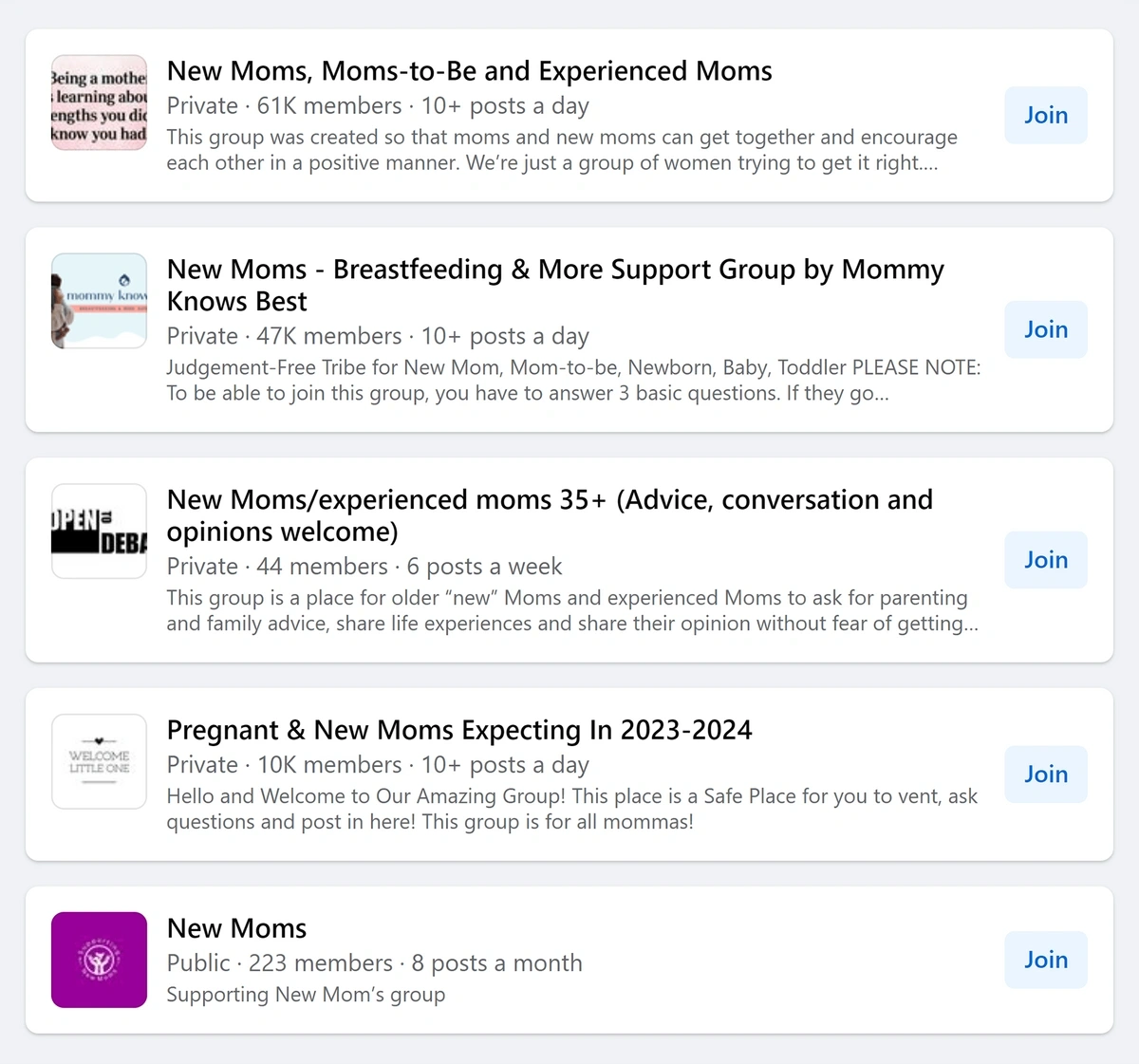

You can also find Reddit or Facebook groups of your target audience.

For example, if you're considering selling infant vitamins, you could join these Facebook groups for moms:

After joining the group, you can ask members about the product you're researching. Here are some specific questions you can ask:

- Why did they purchase the product?

- How did they select the brand they purchased from?

- What do they like/dislike about the product?

You can also ask respondents if they would consider getting on a quick call. One-on-one interviews let you ask more follow-up questions to better understand the audience.

Talking to prospects is also a great way to build up some demand for your product and even recruit a group of beta testers.

If you already have an audience, ask them about your new product idea.

For example, this creator asked her TikTok followers what they thought of her sleepwear product idea.

Then, she documented the product development process and gathered feedback from her followers to craft a product they want.

For example, after designing a few concepts with the manufacturer, she created another video of the initial product designs and asked her audience for feedback.

Her product launch went on to be a major success and she sold out in a matter of hours.

Step 4: Pre-Sell Your Product And Gather Initial Feedback

The best way to validate market demand for your product concept is to see if people will buy it.

So design a few product samples and then run a pre-order sale.

If nobody buys the product, you'll avoid wasting thousands of dollars developing tens or hundreds of products that nobody wants.

And if your pre-order sale is successful, you can use that revenue to fund product development.

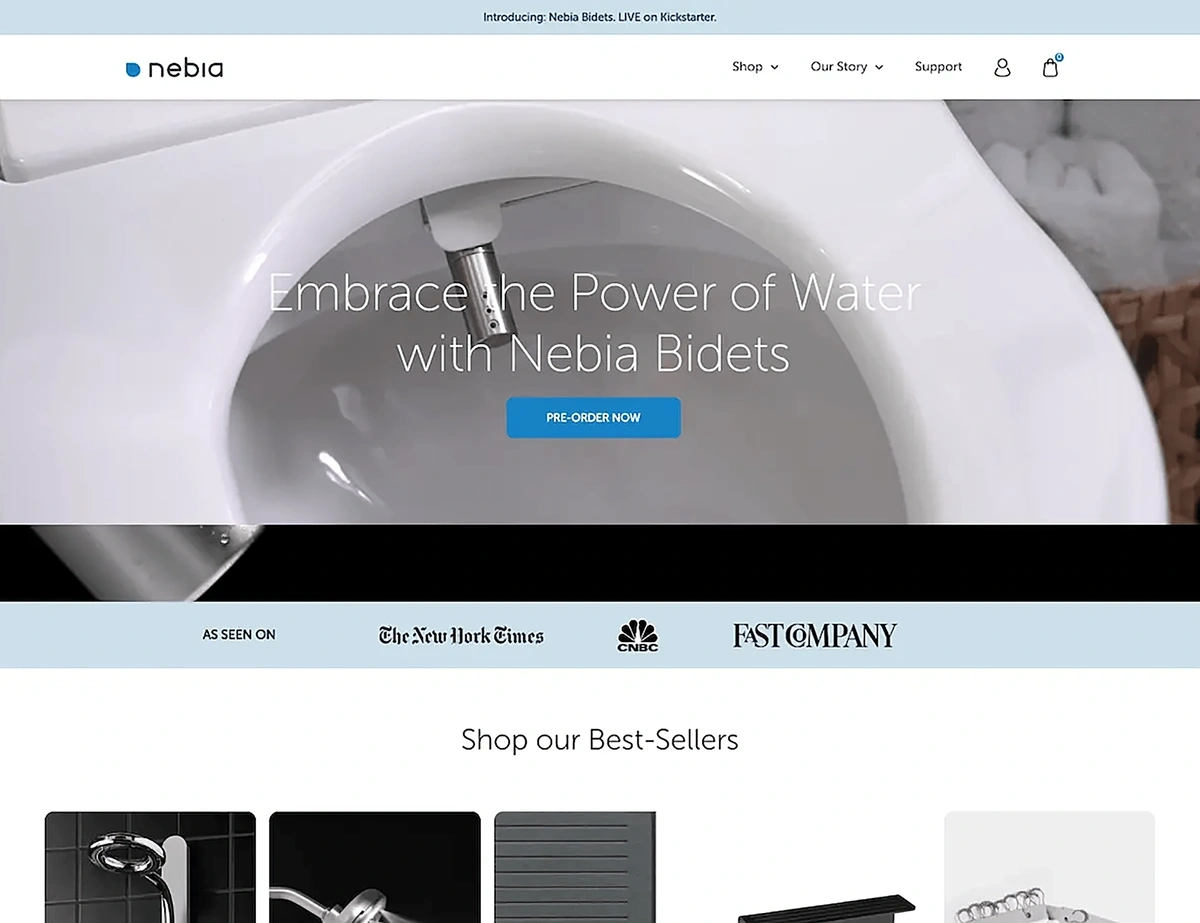

For example, Nebia ran a pre-order sale for its bidets to validate the product concept.

There are a few different ways you can generate pre-orders.

If you already have an audience, you can create a social media post or email your list and announce the pre-order sale.

This post is a great example of a pre-order sale video. The influencer explains how the product works, its benefits, and how it solves common pain points.

If you don't have an audience, you can work with an influencer to create a pre-order video for you.

You can also run Facebook or Instagram ads to a landing page to generate pre-orders. Facebook has a step-by-step guide explaining how to set up and run ads for pre-order sales.

Another option is to run a pre-order sale on Kickstarter.

Nebia is a great example of an ecommerce brand that validated its product idea on Kickstarter.

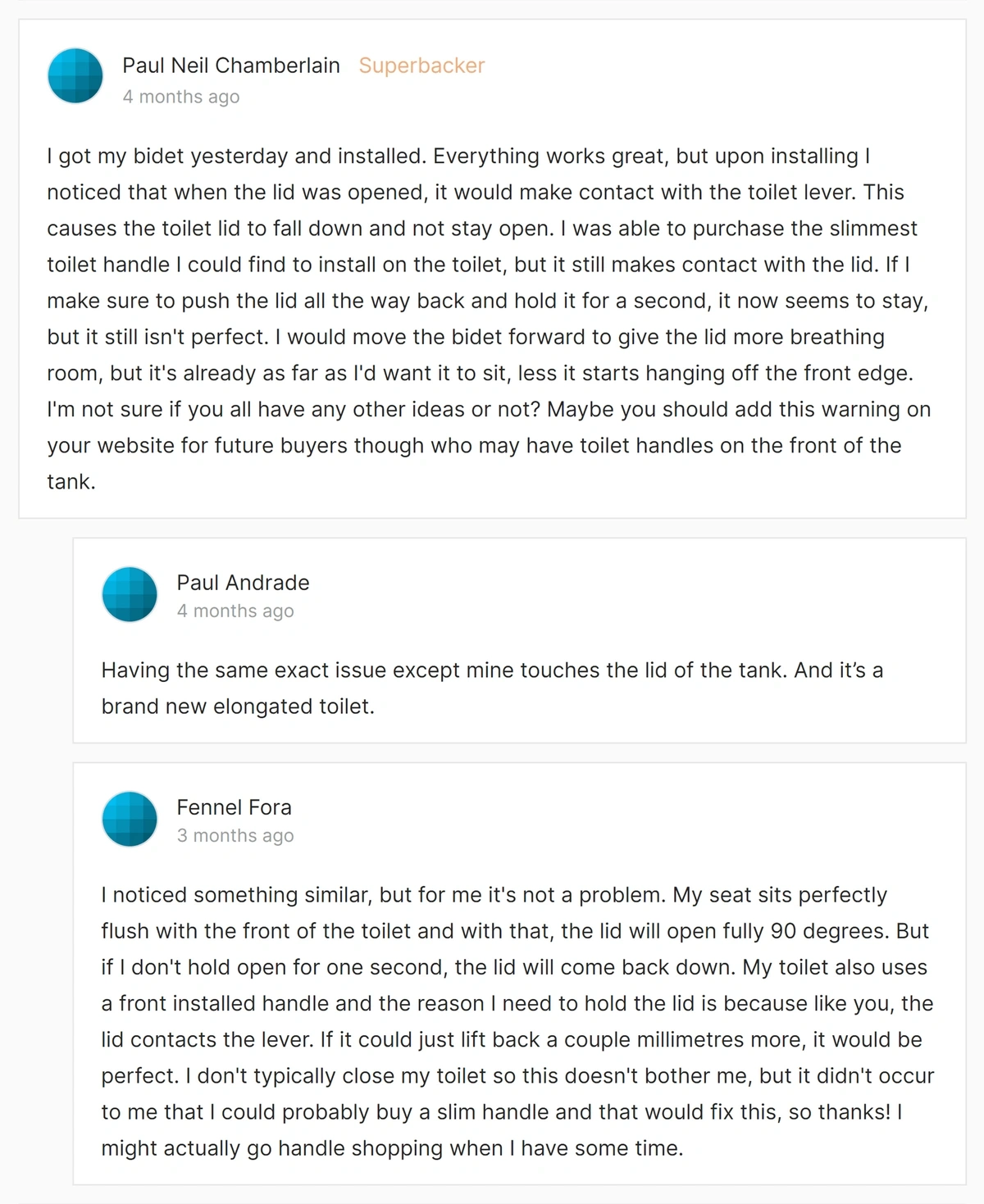

The Kickstarter community will also give you initial feedback on the product before you launch it to the public. Kickstarter users also know they're beta testers, so they tend to be more forgiving if the initial product concept isn't perfect.

You can also ask some Kickstarter buyers to record video reviews of the product for your public product launch.

Step 5: Launch Your New Product And Gather Feedback

After launching your product, gather feedback from your audience to continue iterating on the original product.

If you have a social media following, you can ask your audience what they like and dislike about the product.

You can also email your list offering a discount or coupon to complete a product survey.

Survey tools like Pollfish and SurveyMonkey make it easy to create and send a product survey.

In the survey, ask specific questions about the product. For example, if you’re selling athletic clothing, you could ask them to rate the product fit, material quality, durability, style, color, and other specific factors.

If you leave the questions too open ended, people will give you generic feedback that might not be very helpful for improving the product.

Start The New Product Market Research Process Today

A solid product market research process takes the guesswork out of product launches by giving you the data you need to identify and design the best product for your audience.

It will also give you more confidence on launch day, as you'll have solid evidence of strong demand for your product.

To get started with the first step of the product market research process, use Exploding Topics to browse thousands of emerging trending products today.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more