Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

25 Growing NFT Companies & Startups

Cryptocurrencies are probably the best-known example of blockchain technology. But a new trend in the form of non-fungible tokens (NFTs) are also popular.

The NFT trend first exploded in popularity when it was revealed that someone paid a whopping $69M to buy an NFT created by the artist Beeple.

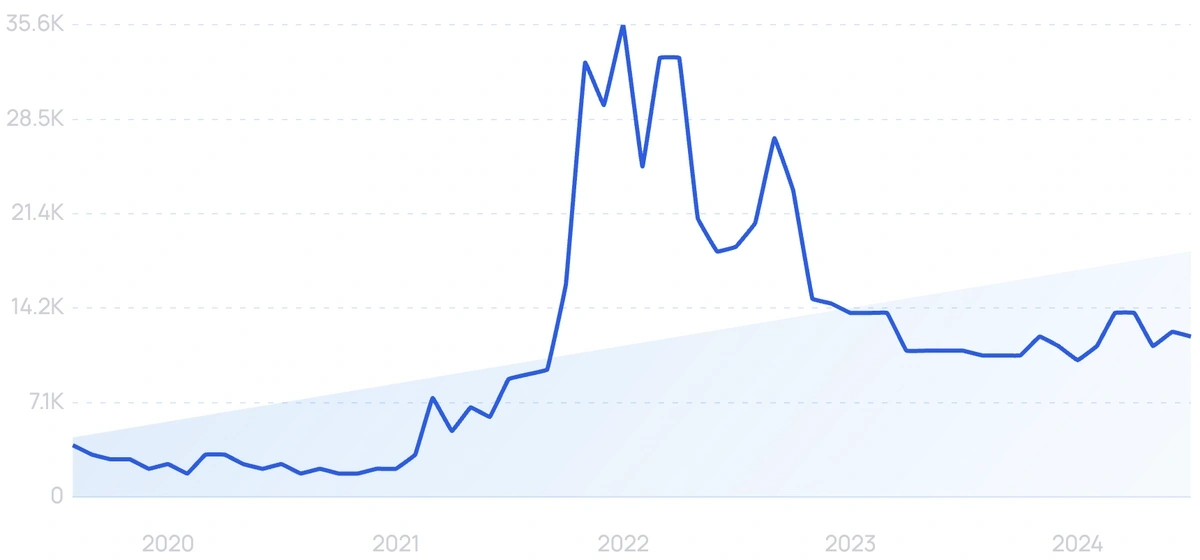

The NFT market cap grew significantly during 2021 and reached a market cap of over $40B. In 2024, however, the NFT market has shrunk and has a cap of about $9.46B.

This list presents 25 growing startups that are making an impact on the NFT space.

1. Element Market

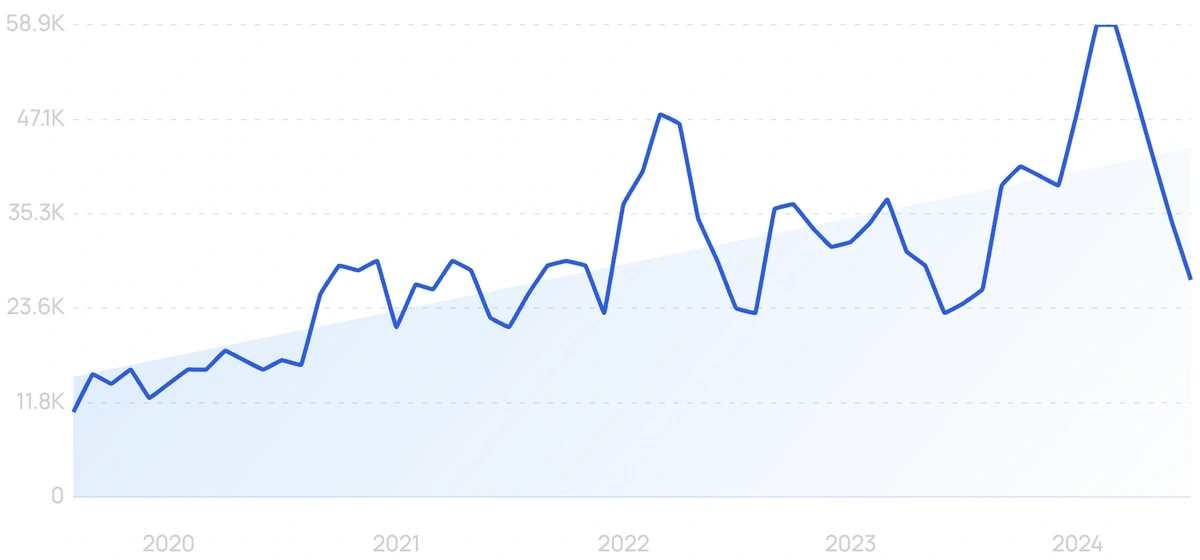

5-year search growth: 171%

Search growth status: Regular

Year founded: 2017

Location: New York, New York

Funding: $11.5M (Early Stage VC)

What they do: Element Market is a digital asset exchange. What makes the startup special is that it also serves as an aggregator that gathers and provides information on the value transfer of different NFTs.Element Market has held only 1 funding round, which has attracted 3 investors, with one of them being Dragonfly Capital Partners.

2. OneOf

5-year search growth: 47%

Search growth status: Regular

Year founded: 2021

Location: Miami, Florida

Funding: $72M (Seed)

What they do: OneOf is another startup that has played a considerable role in the segmentation of this industry. The company has built a community of music artists and fans to cooperate. With a $0 minting cost, OneOf offers music artists a way to create their digital assets at low prices and minimal environmental damage. Overall, the startup raised more than $72 million in funding.

3. Own the Moment

5-year search growth: 176%

Search growth status: Regular

Year founded: 2021

Location: Tampa Bay, Florida

Funding: $120K (Pre-Seed)

What they do: Own the Moment has developed a set of tools that help users make better investments in the NFT space. The apps can gather data on a specific asset and provide analytics, discussions and forecasting to allow the investor to make a better-informed decision. Own the Moment joined the Techstars Sports Accelerator in June 2021.

Get More Search Traffic

Use trending keywords to create content your audience craves.

4. KnownOrigin

5-year search growth: 175%

Search growth status: Peaked

Year founded: 2018

Location: Manchester, UK

Funding: $4.68M (Series A)

What they do: KnownOrigin is an Ethereum-powered digital art marketplace for trading non-fungible tokens (NFTs). This marketplace is unique because all artwork is created and sold as a single entity. As of 2024, KnownOrigin has over 30,000 unique artwork owners and 75,000+ NFTs sold. In June 2022, eBay acquired KnownOrigin for an undisclosed amount.

5. Mintify

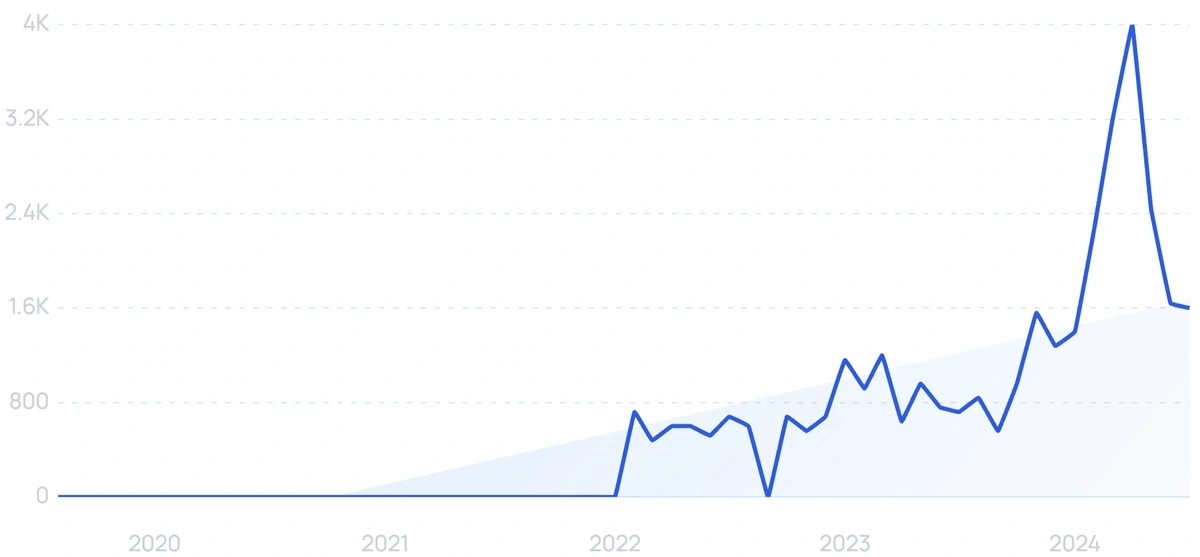

5-year search growth: 3,900%

Search growth status: Peaked

Year founded: 2022

Location: New York, New York

Funding: $5M (Series Unknown)

What they do: Mintify is a multichain aggregator, trading, and analytics platform for NFTs and digital assets. Key features of Mintify include the NFT trading terminal, notifications for upcoming NFT drops, price appraisal models, and more. According to the startup's website, over 100,000 traders have processed 200+ million transactions on the platform.

6. Spores

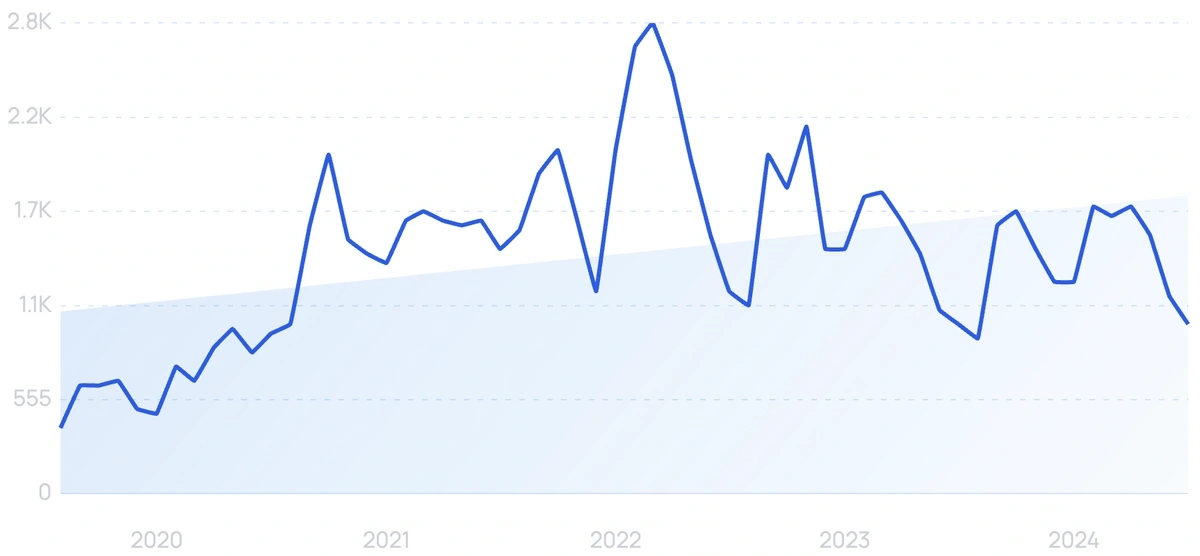

5-year search growth: 39%

Search growth status: Regular

Year founded: 2021

Location: Hanoi, Vietnam

Funding: $2.3M (Seed)

What they do: Spores brands itself as a cross-chain, DeFi-powered NFT ecosystem. Their governing and utility token, $SPO, which currently has a market cap of around $1.4M, gives life to the ecosystem by making it easy to fractionalize, mint, manage, and trade NFTs.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

7. Hello Moon

5-year search growth: 86%

Search growth status: Regular

Year founded: 2021

Location: New York, New York

Funding: Undisclosed

What they do: Hello Moon is an NFT and DeFi token marketplace on the Solana blockchain. The platform provides developers with real-time data feeds to track wallet and on-chain activity. Developers can upgrade to a premium membership to unlock more dev credits, data streams, and better customer support.

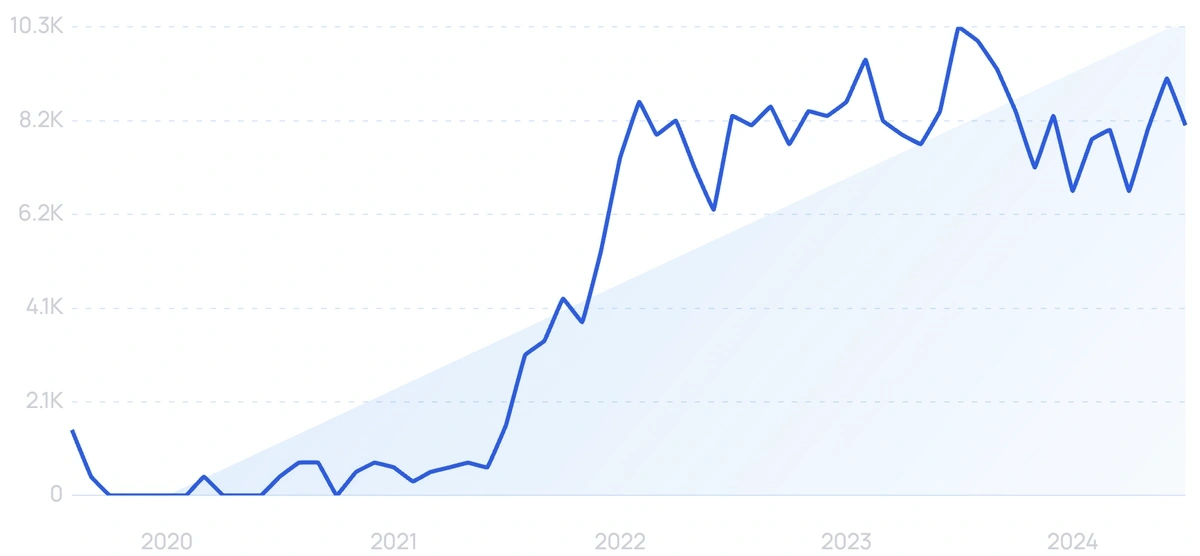

8. Autograph

5-year search growth: 6,950%

Search growth status: Regular

Year founded: 2021

Location: Santa Monica, California

Funding: $205M (Series B)

What they do: Autograph, co-founded by NFL legend Tom Brady, is an NFT platform that helps celebrities create and sell NFTs to fans. The start has worked with some of the biggest names in sports, including Tiger Woods, Derek Jeter, Wayne Gretzky, Tony Hawk, Naomi Osaka, and Usain Bolt. As of May 2024, the company has raised over $200 million.

9. Ternoa

5-year search growth: 1,200%

Search growth status: Peaked

Year founded: 2013

Location: Biarritz, France

Funding: $7.3M (Seed)

What they do: Ternoa has developed its own blockchain. They plan to use it to build something they call a Time Capsule non-fungible tokens. The idea is that Time Capsules will make it possible for users to encrypt, store and transfer data in a faster and more secure way. According to its roadmap, the startup started mining its first Time Capsules in August 2021.

10. Exchange.art

5-year search growth: 32%

Search growth status: Regular

Year founded: 2021

Location: London, England

Funding: $3.2M (Seed)

What they do: Exchange is a digital art marketplace on the Solana blockchain. Artists can create art and use the platform to mint and sell their creations as NFTs. The startup has facilitated over $21 million in art sales from more than 16,000 creators.

11. Only1

5-year search growth: 8%

Search growth status: Peaked

Year founded: 2021

Location: Hong Kong, Hong Kong

Funding: $4.3M (Seed)

What they do: Only1 is a social platform that uses tokens as a means of engagement and rewards. Creators can use the platform to post their content (which other users then purchase.) This allows creators to monetize their name and their followers. Only1’s smooth transfers are partly due to the fact that their system is built on the Solana blockchain.

12. Collab.Land

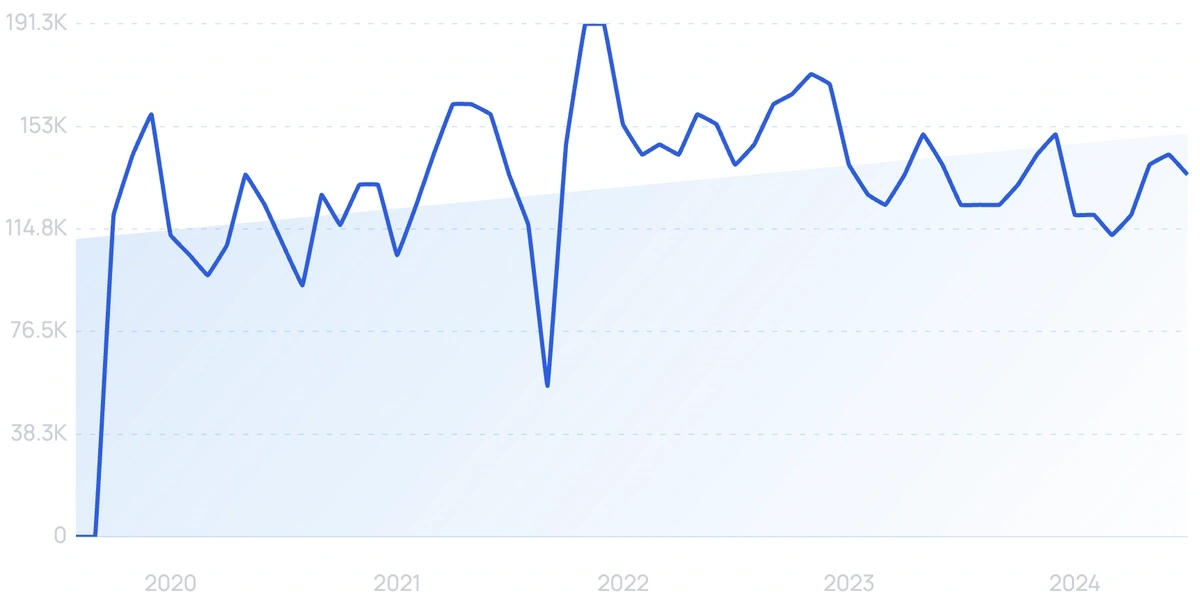

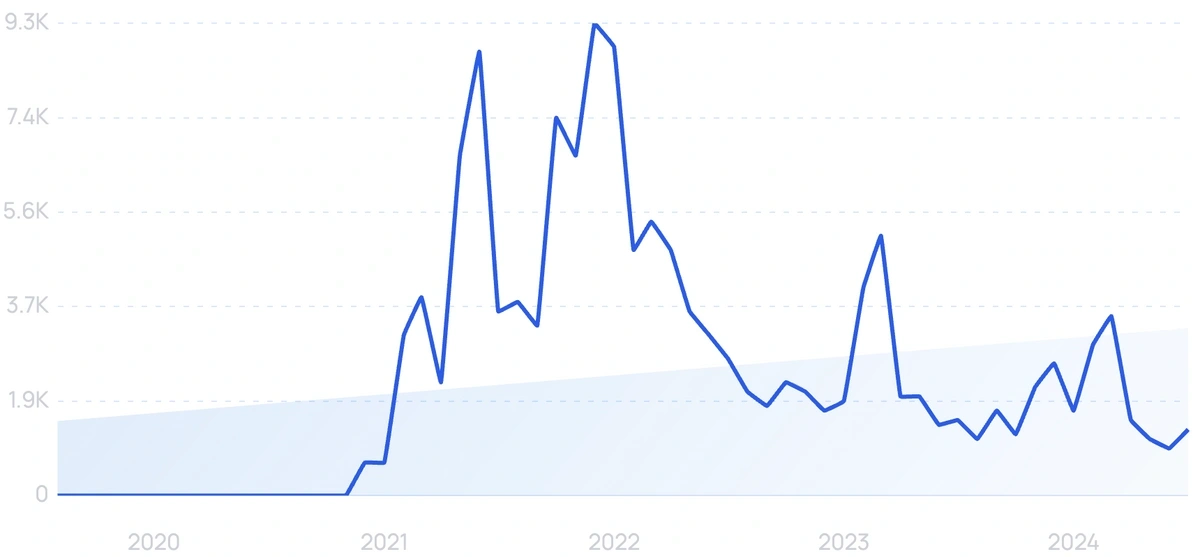

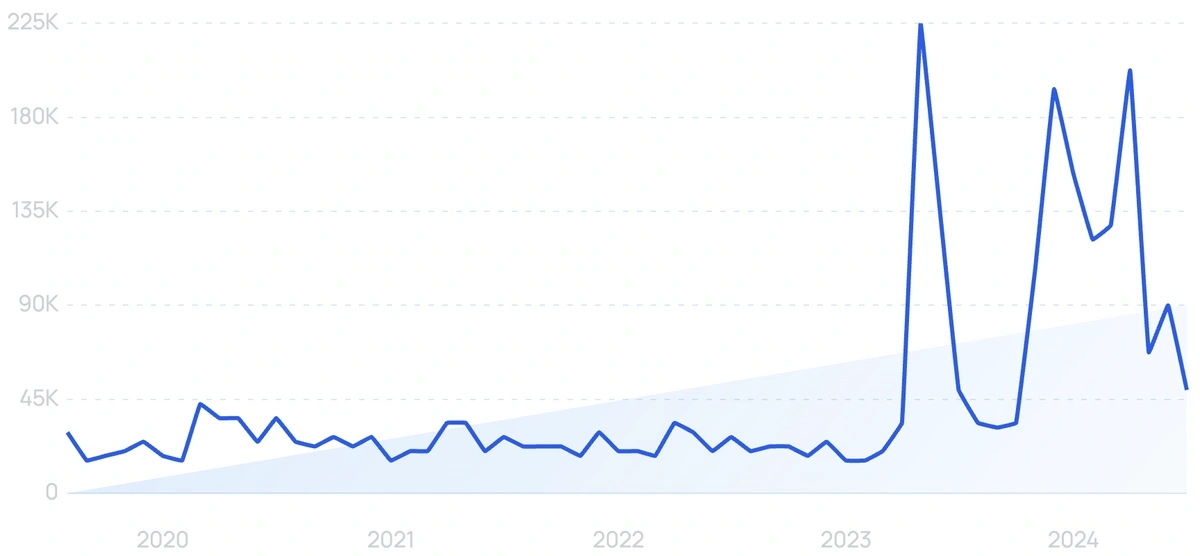

5-year search growth: 9,300%

Search growth status: Exploding

Year founded: 2020

Location: Chicago, Illinois

Funding: Undisclosed

What they do: Collab.Land is a management tool for tokenized projects, primarily NFT communities. It requires each member to own the required token(s) to join and participate in a community with continuous checks. The platform also easily integrates with Discord and Telegram. Today, more than 40,000 communities and 3.5 million wallets are linked to Collab.Land.

13. Art Blocks

5-year search growth: 12%

Search growth status: Regular

Year founded: 2021

Location: Marfa, Texas

Funding: $6M (Seed)

What they do: Art Blocks is an NFT marketplace and platform focused on generative art. Artists write code that produces unique, on-demand artworks when collectors mint NFTs on the platform. Unlike other NFT platforms, Art Blocks generates on-demand, one-of-a-kind digital art based on an artist's algorithm. As of April 2024, the startup has processed over 270,000 transactions for a total of $1.46 billion in sales.

14. Zerion

5-year search growth: 2,450%

Search growth status: Peaked

Year founded: 2016

Location: San Francisco, California

Funding: $33M (Series B)

What they do: Zerion is a non-custodial cryptocurrency wallet for NFT and DeFi portfolio management. Currently, Zerion supports 10+ networks, including Ethereum, Polygon, Binance Smart Chain, Solana, and more. Today, the company supports over 300,000 monthly active users.

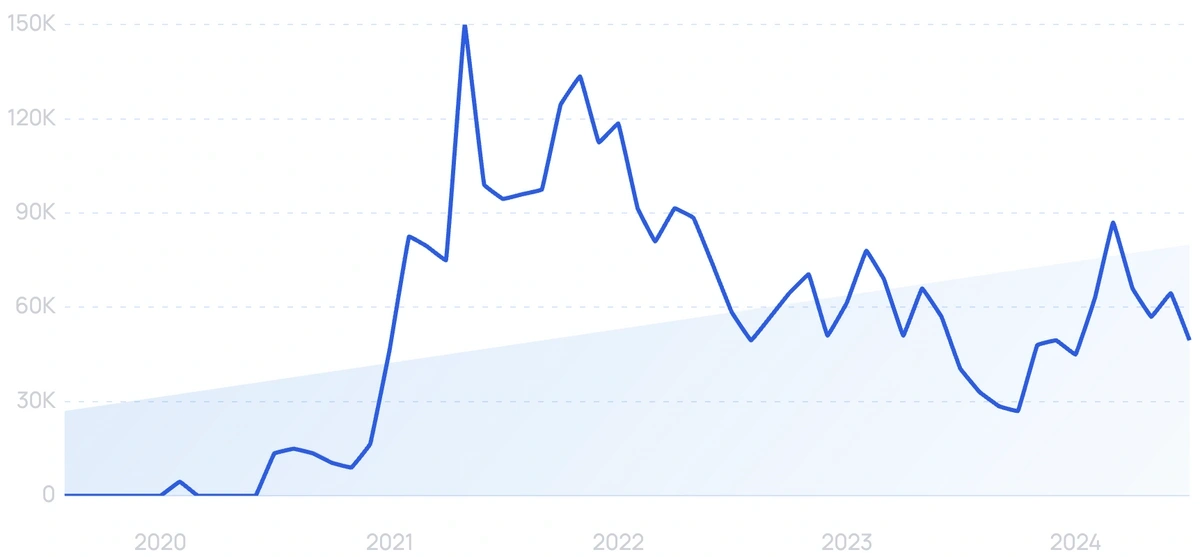

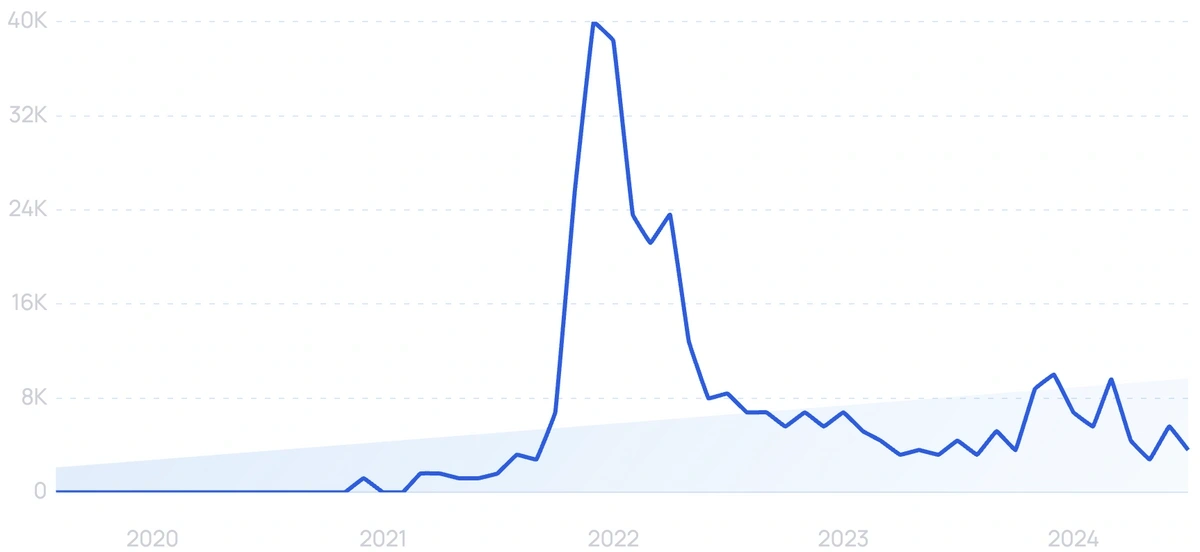

15. Dapper Labs

5-year search growth: 1,200%

Search growth status: Peaked

Year founded: 2018

Location: Vancouver, Canada

Funding: $612.5M (Series Unknown)

What they do: Dapper Labs uses blockchain to deliver experiences and products to millions of people around the world. The startup brands itself as “THE” NFT company because it has been part of some of the most successful NFT projects, such as NBA Top Shot, CryptoKitties, and UFC on Flow. Perhaps this is one of the reasons that, according to PitchBook, Dapper Labs is one of the most heavily funded companies operating in this sector.

16. Milady

5-year search growth: 204%

Search growth status: Regular

Year founded: 2023

Location: Undisclosed

Funding: $5M (Seed)

What they do: Milady Maker is a popular NFT collection with more than 10,000 available NFTs. The NFT collection is also linked to the Milady Meme Coin (LADYS), which secured a $5 million seed round investment from DWF Labs in June 2024. The current market cap of the Milady NFT is 50,588 ETH (floor price of 5.07 ETH).

17. Charged Particles

5-year search growth: 16%

Search growth status: Regular

Year founded: 2019

Location: Ontario, Canada

Funding: $1M (Seed)

What they do: Charged Particles, as their name suggests, is a system that charges NFTs by making it possible for them to contain multiple ERC-20 Tokens. This allows owners to monetize their assets by earning interest in the stored tokens. The startup has already attracted the interest of big crypto players such as CoinGecko and Moonwhale.

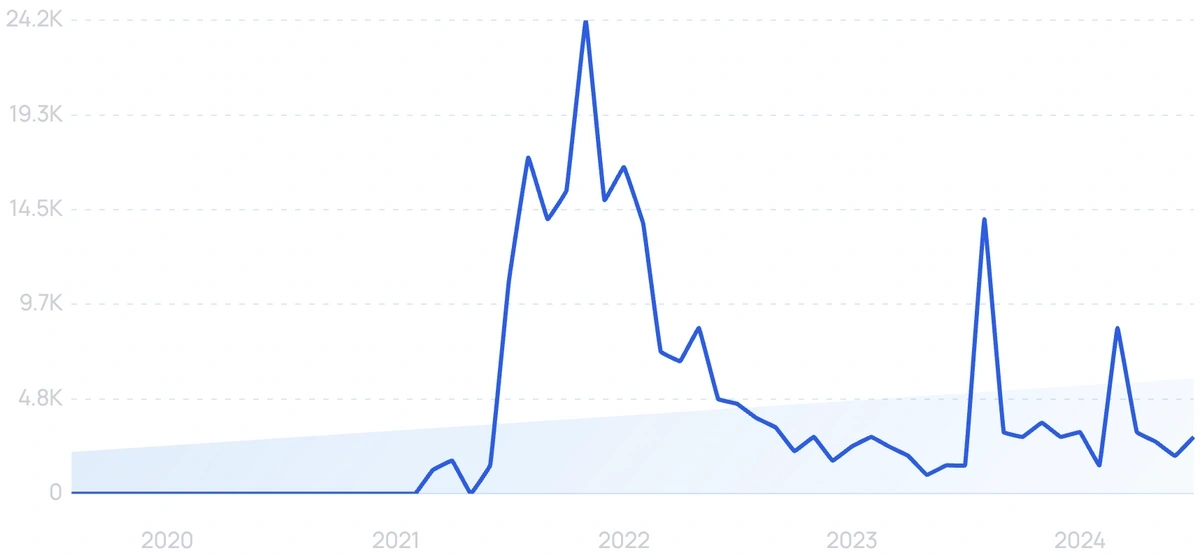

18. Yield Guild Games

5-year search growth: 1,300%

Search growth status: Peaked

Year founded: 2020

Location: Quezon, Philippines

Funding: $36.2M (Initial Coin Offering)

What they do: Yield Guild is a decentralized autonomous organization (DEO) whose mission is to develop the largest virtual world economy. It aims to achieve its mission by gathering a community of play-to-earn gamers who play to earn and collect token rewards. Yield Guild’s vision has attracted funds from over 40 investors over 2 funding rounds.

19. BitsCrunch

5-year search growth: 900%

Search growth status: Peaked

Year founded: 2021

Location: Munich, Germany

Funding: $10.6M (Series A)

What they do: BitsCrunch is an AI-powered blockchain analytics startup that provides NFT and digital asset data. The platform utilizes AI and ML algorithms to detect fraud and other forensic data for investment decisions and risk assessments. BitsCrunch token BCUT currently has a market cap of $20 million.

20. Animoca Brands

5-year search growth: 190%

Search growth status: Peaked

Year founded: 2014

Location: Cyberport, Hong Kong

Funding: $843.6M (Corporate Round)

What they do: Animoca Brands is a blockchain, digital entertainment, and gamification startup. The startup develops games that incorporate NFTs to give players ownership of in-game assets. Not only does Animoca Brands develop their own products, but they have also made various investments into top NFT platforms like OpenSea.

21. CryptoSlam

5-year search growth: 500%

Search growth status: Peaked

Year founded: 2018

Location: Overland Park, Kansas

Funding: $9M (Seed)

What they do: CryptoSlam is an aggregating platform that gathers sales volume data of NFTs and displays them in a centralized list. The startup currently aggregates data from 20+ blockchains. As of May 2024, total NFT sales volume on the platform surpassed $64.1 billion.

22. ConsenSys

5-year search growth: -16%

Search growth status: Peaked

Year founded: 2014

Location: Brooklyn, New York

Funding: $726.7M (Secondary Market)

What they do: ConsenSys is a software engineering company specializing in building blockchain-powered infrastructures. The company has worked on multiple NFT projects, where they have built token launches and complete marketplaces—and everything in between. The startup’s success has attracted funding from global powerhouses such as MasterCard, JPMorgan Chase, and UBS, to name a few.

23. Legends Of Crypto

5-year search growth: 1,800%

Search growth status: Peaked

Year founded: 2021

Location: Amsterdam, Netherlands

Funding: Undisclosed

What they do: Legends of Crypto is a token-powered card game where players can win different collectibles. These items can then be traded for cryptocurrency. The startup is currently pre-revenue and is testing its beta with a private number of users.

24. Unisat

5-year search growth: 89%

Search growth status: Peaked

Year founded: 2023

Location: Hong Kong, Hong Kong

Funding: Undisclosed (Seed)

What they do: UniSat is an open-source crypto wallet used to store, mint, and transfer Bitcoin NFTs. The non-custodial wallet also provides a a platform to trade Ordinals, Atomicals, BRC-20 and ARC-20 assets. In April 2024, the company announced they've reached 1 million weekly active users.

25. Vulcan Forged

5-year search growth: 900%

Search growth status: Peaked

Year founded: 2020

Location: Athens, Greece

Funding: $8M (Undisclosed)

What they do: Vulcan Forged is another gaming platform that lets players earn digital assets. Instead of focusing on building only one game, the startup has over 10 games with different themes. This system has been working quite well as it has allowed Vulcan Forged to amass over 200,000 users across their 15 games and decentralized applications.

Conclusion

This concludes our list of fast-growing startups utilizing blockchain technology to make access and usage of NFTs easier and more mainstream.

As can be seen from our list, startups competing in this sector are building the infrastructure, marketplaces, protocols, and applications that are set to make NFTs a part of the future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more