Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

49 Soaring Blockchain Companies & Startups (2024)

You may also like:

The global blockchain market is expected to reach a market size of $2.3T by 2032.

Notably, in the US, 75% of IoT technology adopters have or will implement blockchain into their stack.

There are now more than 83 million registered blockchain wallets.

This list presents 49 soaring startups that are making an impact on the blockchain space.

1. Fireblocks

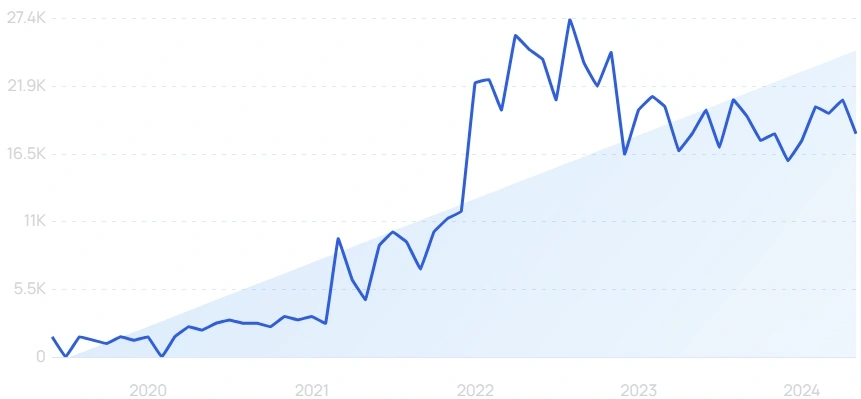

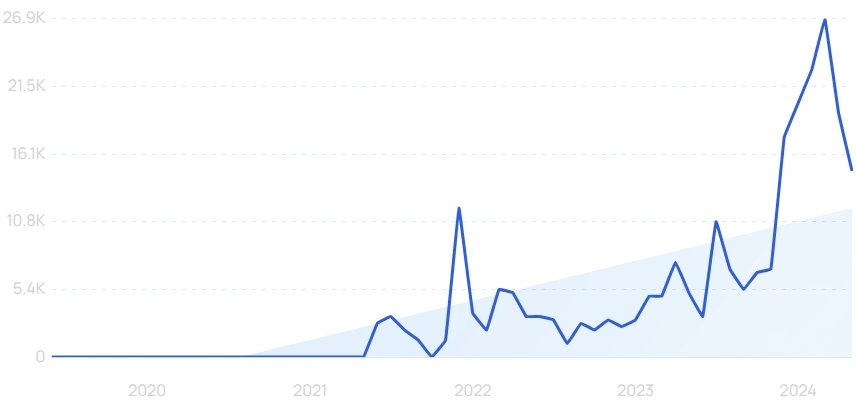

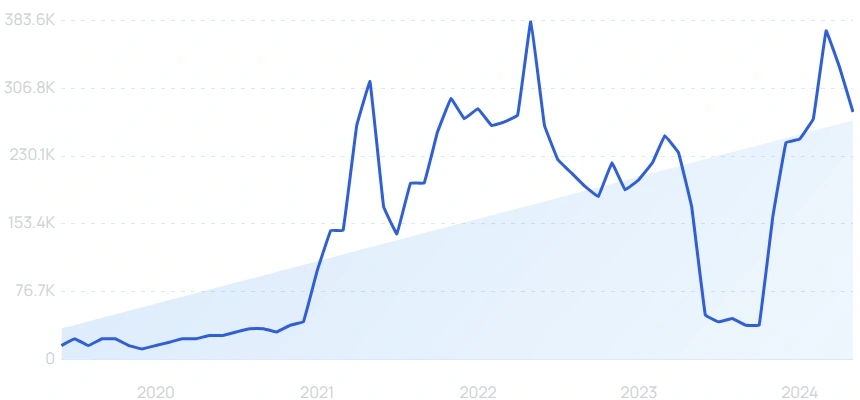

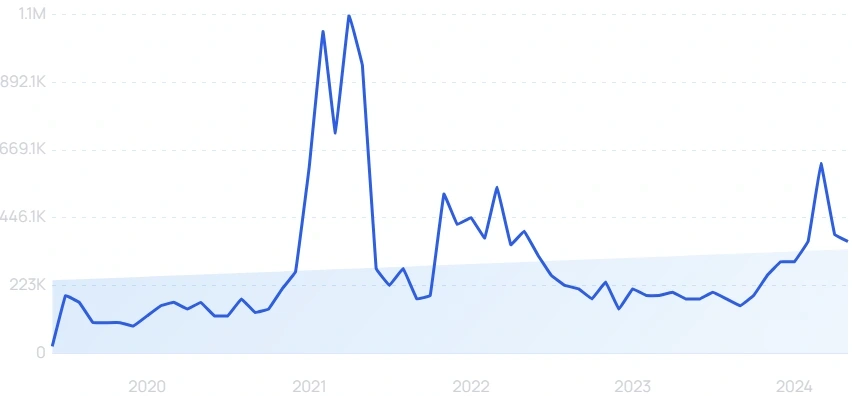

5-year search growth: 1,000%

Search growth status: Regular

Year founded: 2018

Location: New York, NY

Funding: $1B (Series E)

What they do: Fireblocks provides blockchain security solutions to institutions. In particular, they help clients custody cryptocurrencies, manage treasury operations, access decentralized finance and manage their digital asset operations.” Further, Fireblocks has secured more than $2T in crypto assets for their 1,000+ clients.

2. Sorare

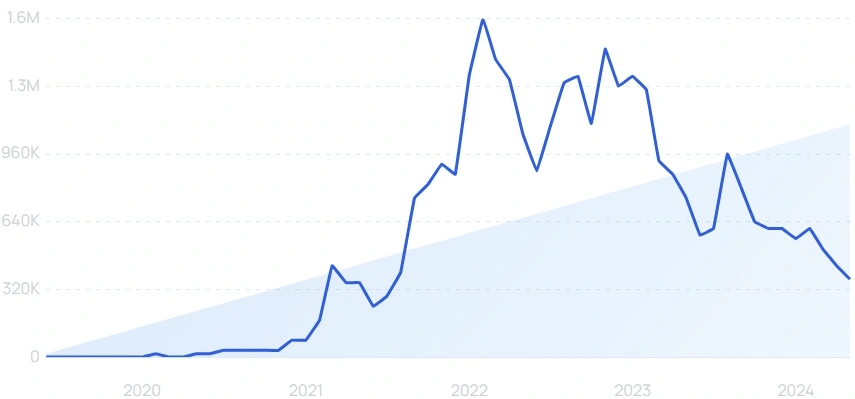

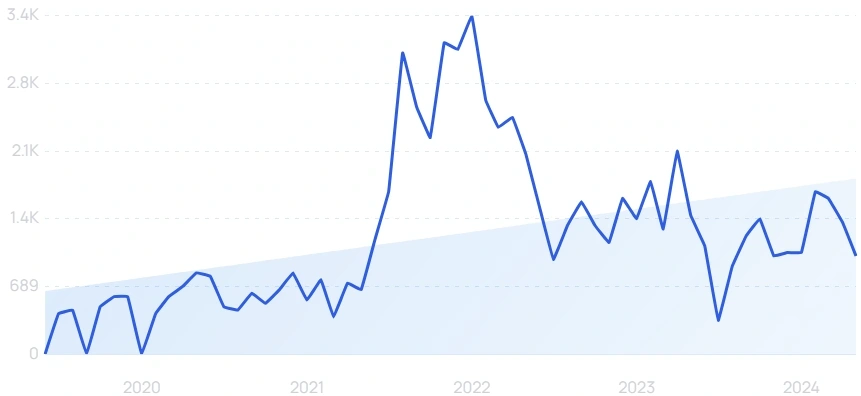

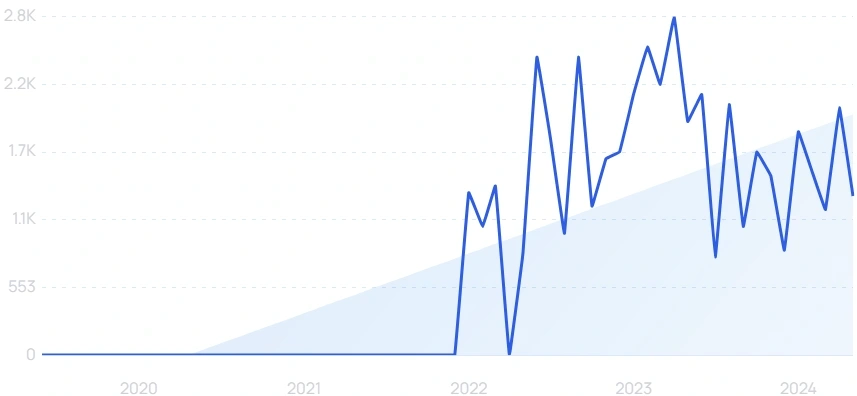

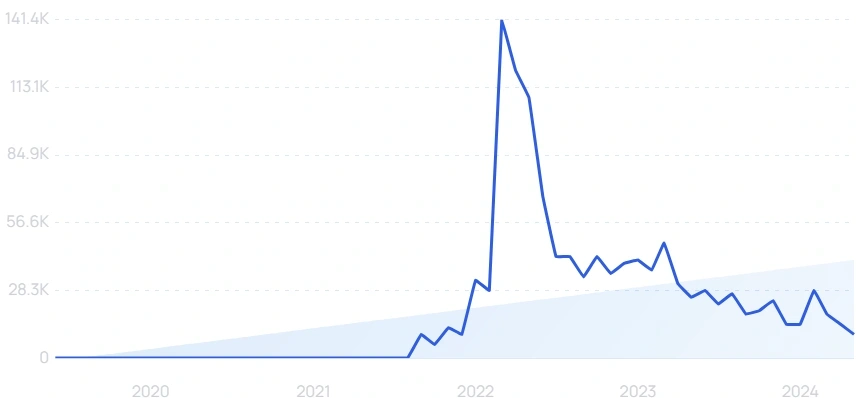

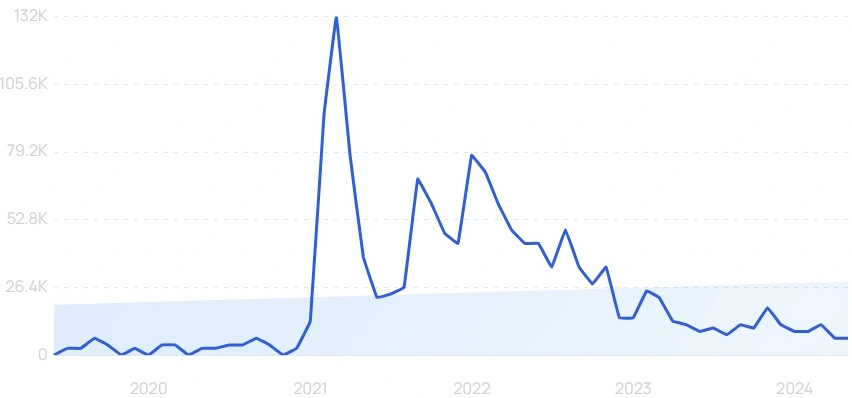

5-year search growth: 2,200%

Search growth status: Peaked

Year founded: 2018

Location: Paris, France

Funding: $739.2M (Series B)

What they do: Sorare is a blockchain-powered fantasy soccer platform. Users can play fantasy soccer by utilizing the platform’s gaming arena. Additionally, the platform also serves as a marketplace for digital player cards where users can buy, sell and trade limited edition digital cards. So far, Sorare is officially licensed to issue cards for 280 soccer clubs.

3. Moonpay

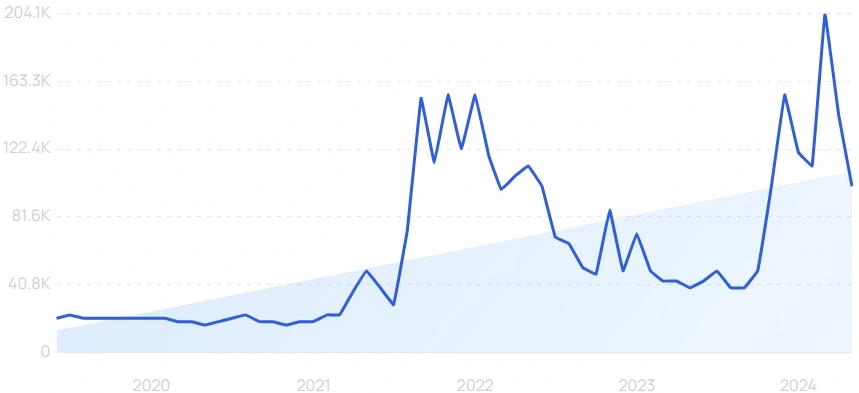

Search growth status: Regular

Year founded: 2018

Location: Miami, FL

Funding: $650.7M (Series A)

What they do: Moonpay provides cryptocurrency sellers and exchanges (e.g. Binance, OpenSea and OKEX) with the technology required to allow everyday consumers to buy and sell cryptocurrency using traditional payment rails (known as On-Ramps and Off-Ramps). According to a late 2021 article, Moonpay has more than 7M customers.

4. Ape Board

Search growth status: Peaked

Year founded: 2021

Location: Singapore, Singapore

Funding: $1.2M (Seed)

What they do: Ape Board aggregates a user’s DeFi portfolios and displays them in a single portfolio dashboard. The platform is capable of tracking DeFi portfolios on addresses across 42 different blockchains.

5. Eigenlayer

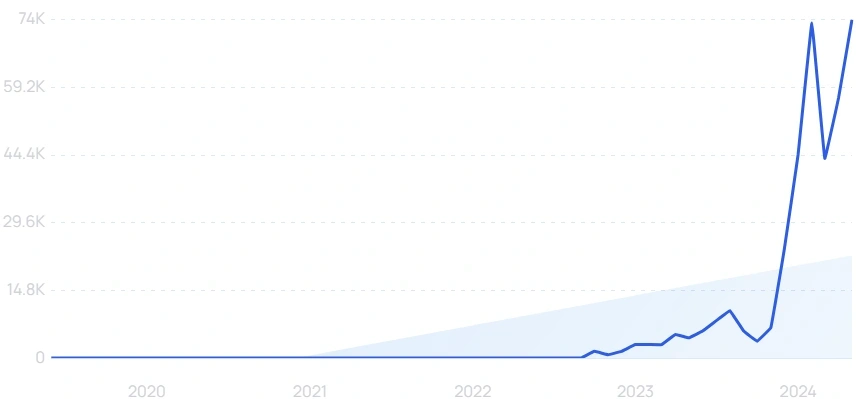

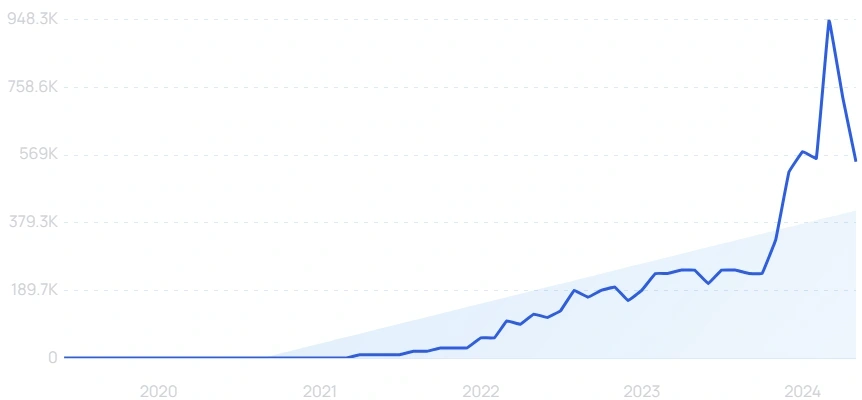

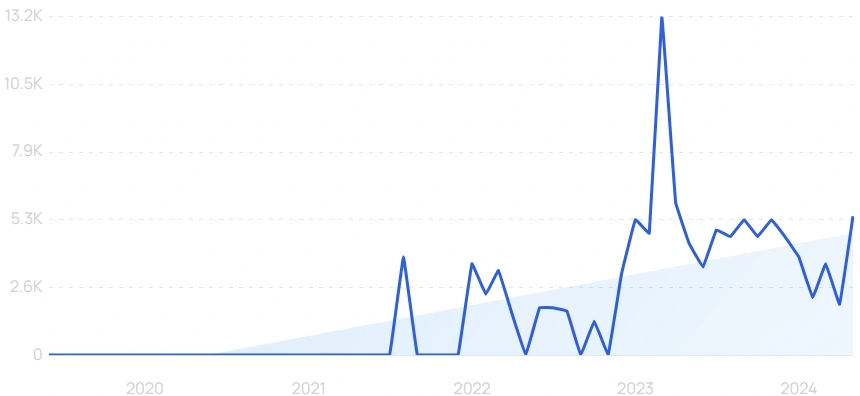

Search growth status: Exploding

Year founded: 2021

Location: Seattle, Washington

Funding: $164.4M (Series B)

What they do: EigenLayer is an Ethereum network protocol that allows for restaking. The startup allows for the reuse of staked ETH to increase blockchain security while reducing the capital costs for protocols to bootstrap their own validator sets. Since launching, the platform has seen $16 billion worth of ether staked.

6. BitQuery

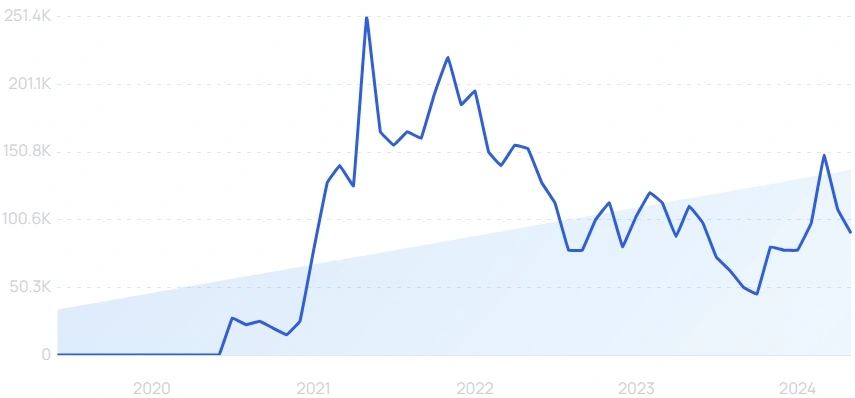

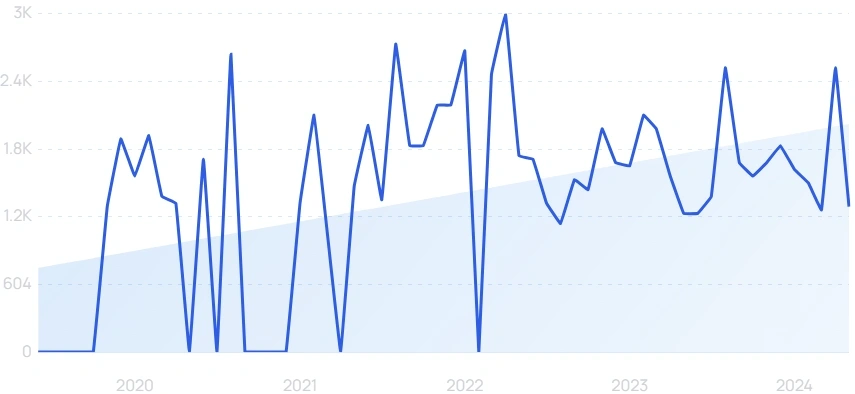

5-year search growth: 7,500%

Search growth status: Regular

Year founded: 2019

Location: New York, New York

Funding: $8.5M (Seed)

What they do: A blockchain data company, Bitquery provides API access for over 40+ blockchain chains and protocols. The company's suite of products includes tools to view cross-chain and real-time blockchain analytics.

7. Pastel Network

Search growth status: Regular

Year founded: 2018

Location: New York, New York

Funding: $5M (Seed)

What they do: Pastel Network is a peer-to-peer decentralized platform that allows users to register, trade, and collect digital assets. The startup has an estimated yearly revenue of $1.3M.

8. Zerion

Search growth status: Regular

Year founded: 2016

Location: San Francisco, California

Funding: $33M (Series B)

What they do: Zerion has built a digital marketplace that allows users to invest in multiple DeFi projects. The marketplace offers convenience by allowing users to get data on DeFi projects, trade them and track their portfolio, all under a single platform. The marketplace supports over 60 DeFi projects and has over 220,000 monthly active users.

9. Bitget

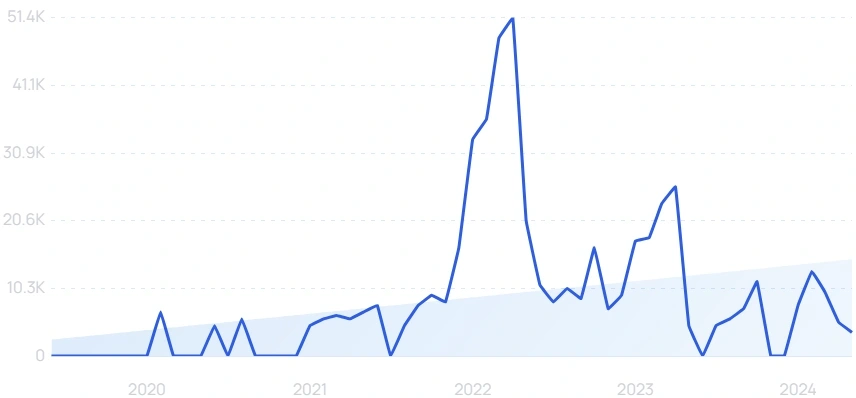

5-year search growth: 5,700%

Search growth status: Regular

Year founded: 2018

Location: Singapore, Singapore

Funding: $20M (Undisclosed)

What they do: Bitget is a cryptocurrency exchange and trading platform that offers users access to over 750 cryptocurrencies.

10. Fumbi

Search growth status: Peaked

Year founded: 2018

Location: Bratislava, Slovakia

Funding: $1.6M (Series Unknown)

What they do: Fumbi is a cryptocurrency trading platform that replaces collective investment schemes and allows users to own their cryptocurrencies directly. The startup has over 115,000 users and trades 34 cryptocurrencies.

11. Ledger

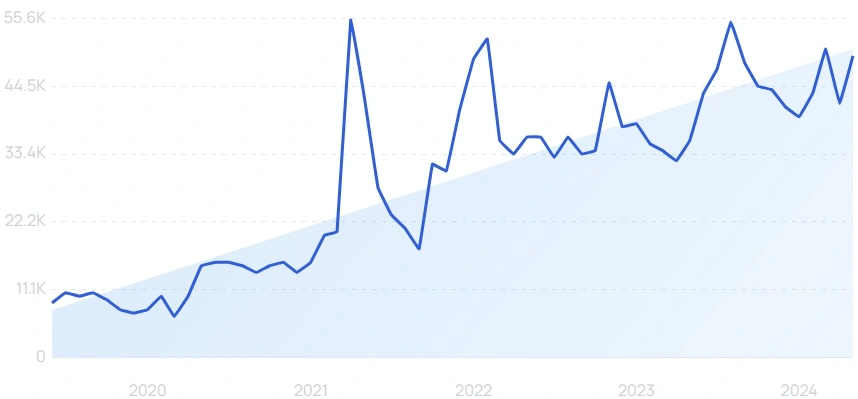

5-year search growth: 31%

Search growth status: Regular

Year founded: 2014

Location: Paris, France

Funding: $577M (Series C)

What they do: Ledger is a hardware crypto wallet company that stores private crypto keys offline for increased security. The company's three wallet options, the Ledger Nano S Plus, Ledger Nano X, and Ledger Stax, use a proprietary operating system and secure chip to provide cold storage for over 5,500 coins and tokens. Users can also download the Ledger Live mobile app to manage their cryptocurrencies in one place. The startup currently supports more than 6 million users.

12. Blockdaemon

Search growth status: Peaked

Year founded: 2017

Location: Los Angeles, California

Funding: $431.3M (Series Unknown)

What they do: Blockdaemon is a node management tool allowing businesses to manage their blockchain applications. Blockdaemon currently supports over 60 blockchain networks.

13. Paybis

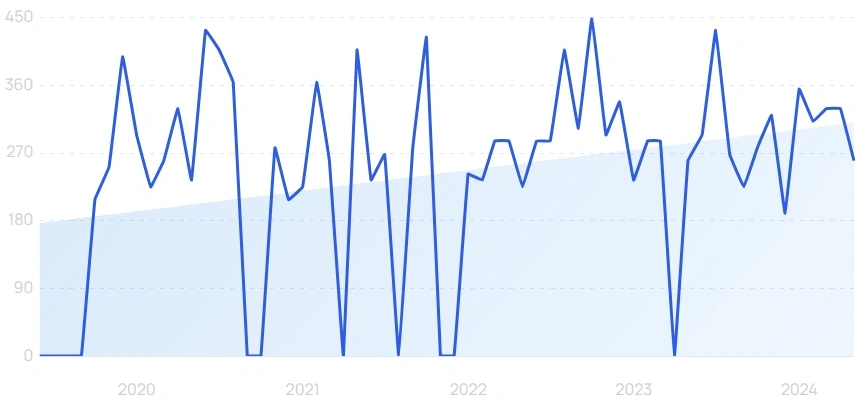

5-year search growth: 456%

Search growth status: Exploding

Year founded: 2014

Location: Glasgow, United Kingdom

Funding: Undisclosed

What they do: Paybis is a crypto exchange and virtual wallet application. The platform supports over 80 cryptocurrencies and 48 fiat currencies, allowing users to purchase and send cryptocurrencies to external wallets instantly. As of February 2024, the Paybis team estimates they've processed over $2 billion in total volume.

14. Klaytn

Search growth status: Peaked

Year founded: 2019

Location: Seoul, South Korea

Funding: $90M (Initial Coin Offering)

What they do: Klaytn is a blockchain platform developed by Ground X, the blockchain subsidiary of South Korean internet company Kakao. It aims to provide a user-friendly blockchain experience for both developers and end-users by offering high-performance, scalability, and reliability. Klaytn focuses on promoting the mass adoption of blockchain technology by enabling businesses to build and deploy decentralized applications (DApps) with ease.

15. OpenOcean

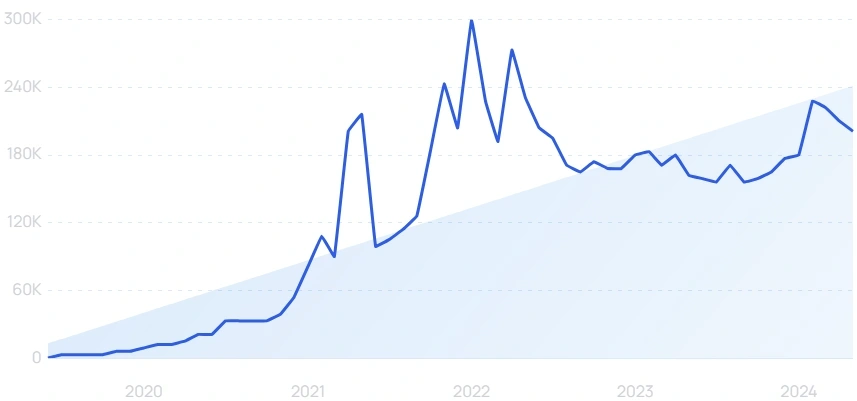

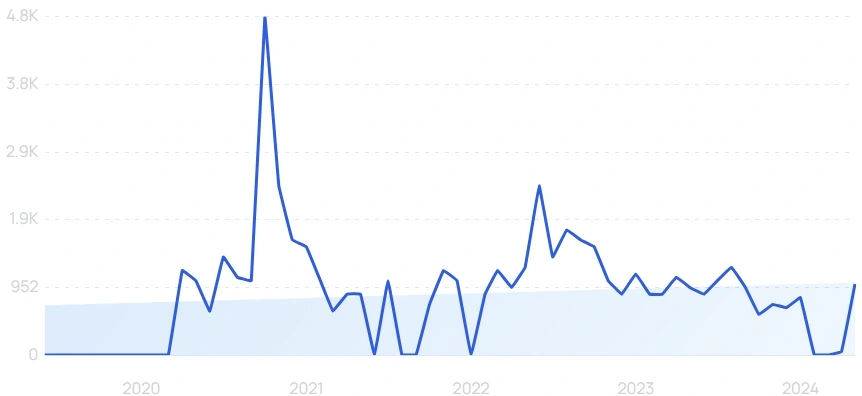

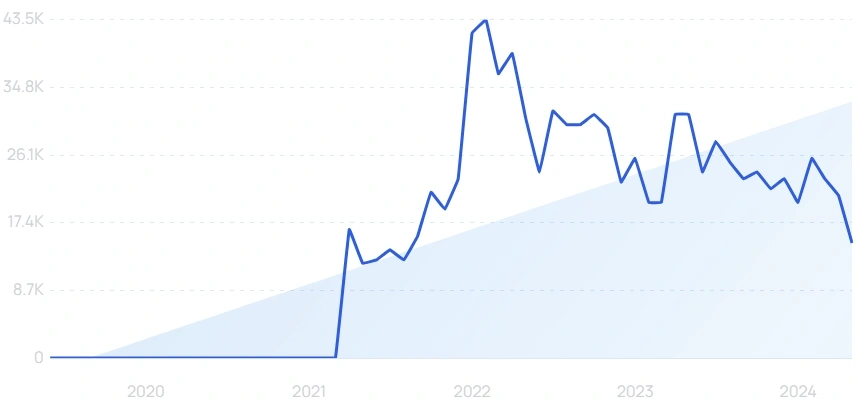

5-year search growth: 2,900%

Search growth status: Regular

Year founded: 2019

Location: Singapore, Singapore

Funding: $2M (Seed)

What they do: OpenOcean aggregates price information of multiple decentralized exchanges and compares them to prices offered by centralized exchanges. The startup aggregates DEXes on Etherum, Binance Smart Chain, Tron and Ontology.

16. Synapse Network

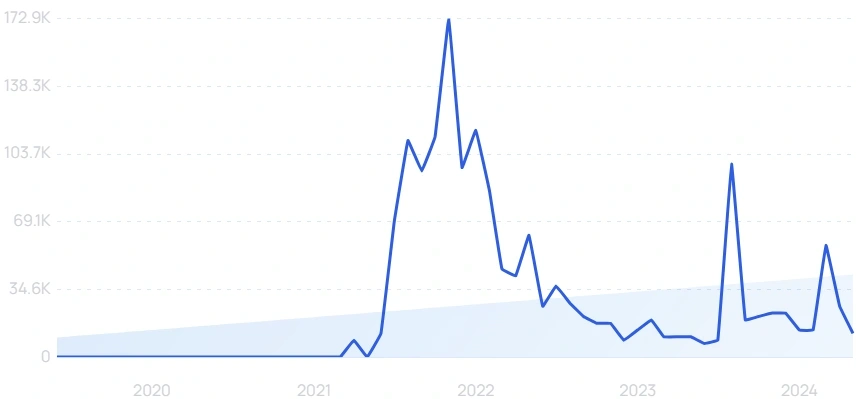

5-year search growth: 2,800%

Search growth status: Peaked

Year founded: 2021

Location: London, England

Funding: $50.7M (Series B)

What they do: Synapse Network is a cross-chain investment ecosystem. It opens the way for small investors to invest in promising startups in their earliest development phases. Investing through Synapse Network is facilitated by $SNP, the system’s native token.

17. bitsika

5-year search growth: 2,000%

Search growth status: Peaked

Year founded: 2018

Location: New Castle, DE

Funding: $185K (Convertible Note)

What they do: bitsika has created a payment application facilitating instant money transfers and digital currency trading. According to Pitchbook, the company is looking to close their Series A funding soon.

18. Mercado Bitcoin

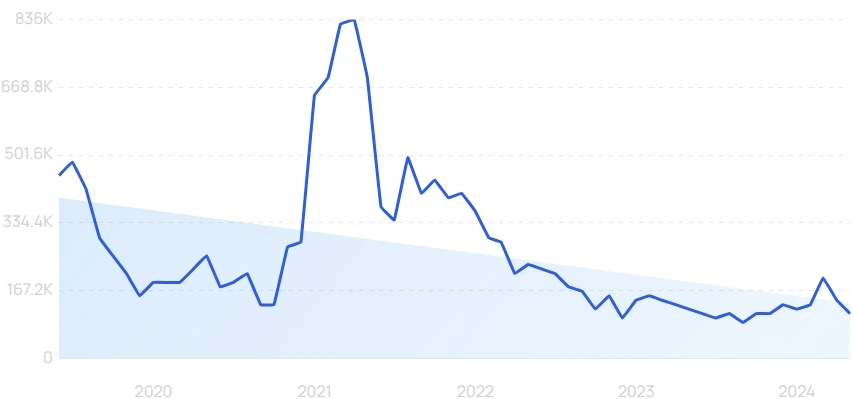

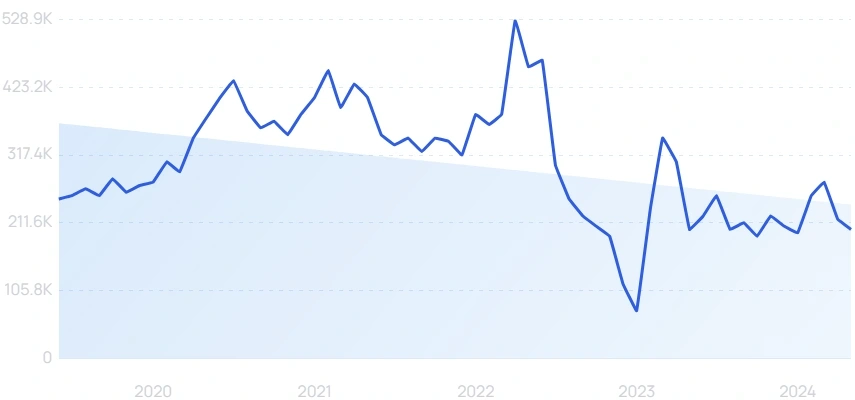

5-year search growth: -76%

Search growth status: Peaked

Year founded: 2013

Location: Sao Paulo, Brazil

Funding: $288M (Series C)

What they do: Mercado Bitcoin allows investors to trade multi-category crypto-assets by providing a comprehensive crypto exchange platform. The venture reduces market confusion by listing only assets with real value and scalable prospects. Mercado Bitcoin got a lot of media attention when it announced that it earned $200M in funding from SoftBank Group.

19. Texture Capital

5-year search growth: 4,700%

Search growth status: Regular

Year founded: 2019

Location: New York, New York

Funding: Undisclosed

What they do: Texture Capital works to improve the capital-raising journey for private companies through security tokenization. The startup’s executive team are seasoned financial industry experts who have previously held roles at ITG, Liquidnet and Societe Generale.

20. Matrixport

5-year search growth: 1,000%

Search growth status: Peaked

Year founded: 2019

Location: Singapore, Singapore

Funding: $138M (Series C)

What they do: Matrixport is a trading platform where customers can buy, sell, and leverage crypto assets. This startup also operates as a custodian for institutional clients by offering offline global deployment, mandatory two-factor authentication, and high-level encryption measures. Today, Matrixport supports more than 500 institutions globally and holds $10 billion in assets under management.

21. Airtm

5-year search growth: 229%

Search growth status: Regular

Year founded: 2015

Location: Mexico City, Mexico

Funding: $24.7M (Series Unknown)

What they do: Airtm is a digital dollar wallet and peer-to-peer payment platform. Users can store, send, receive, and exchange currencies in more than 190 countries using 400+ payment methods, including local bank accounts, cryptocurrencies, digital wallets, and gift cards. The digital wallet service allows users to store their currency as USDC, which is pegged to the US dollar and maintains its value. Airtm has more than 700,000 total users.

22. Amara Finance

5-year search growth: 314%

Search growth status: Regular

Year founded: 2021

Location: Boston, MA

Funding: $1M (Seed)

What they do: Amara Finance helps connect popular cryptocurrencies to digital assets. The startup’s point of differentiation is that it allows such a connection to happen at a very low-friction value transmission. 8 investors fund the New York-based venture over 1 funding round.

23. World Coin

5-year search growth: 39%

Search growth status: Regular

Year founded: 2019

Location: Berlin, Germany

Funding: $125M (Initial Coin Offering)

What they do: Worldcoin is building a device that gives out cryptocurrency to people across the globe. The “catch” is that, for a person to receive their crypto, they have to let the device scan their eyeballs. When asked about their goal, the Sam Altman-backed startup says they want to build a universal income system that pays everybody who signs up. According to the startup, their eye-scanning device is just a way to ensure that people do not sign up multiple times.

24. Terawulf

5-year search growth: 5,400%

Search growth status: Regular

Year founded: 2021

Location: Easton, Maryland

Funding: $305.1M (Post-IPO Equity)

What they do: TeraWulf operates a crypto mining farm in Maryland. Because more than 90% of their energy comes from zero-carbon sources, the startup can mine Bitcoin while having a minimal damaging impact on the environment 25.

25. Interlay

5-year search growth: 39%

Search growth status: Peaked

Year founded: 2019

Location: London, England

Funding: $9.5M (Series Unknown)

What they do: Interlay provides a tool that allows users to invest their Bitcoin into different DeFi projects. Interlay is built as a parachain Polkadot that can be used across multiple blockchains.

26. Zeeve

5-year search growth: 4,600%

Search growth status: Regular

Year founded: 2020

Location: Santa Monica, California

Funding: $3.7M (Undisclosed)

What they do: Zeeve is a blockchain infrastructure and rollups automation platform used by startups, enterprises, and Web3 developers. This startup is like having an in-house DevOps and Cloud team to deploy, monitor, and manage blockchain nodes and networks in one place. In 2024, Zeeve supports 27,000+ users and 40+ enterprise clients.

27. Solana

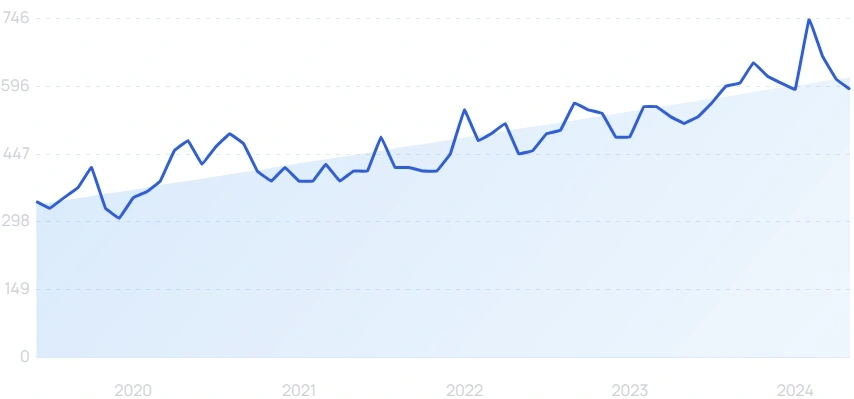

Search growth status: Exploding

Year founded: 2017

Location: San Francisco, California

Funding: $319.5M (Undisclosed)

What they do: Solana is a blockchain platform and cryptocurrency (SOL) available for trading. The platform supports decentralized applications and offers scalability for developers while keeping transaction fees low and transaction processing speeds high. It can process up to 65,000 transactions per second with average transaction fees of around $0.00064, much cheaper and faster than alternatives like Bitcoin and Ethereum.

Today, Solana is the 5th most valuable cryptocurrency, with a market cap of over $77.8 billion.

28. GoSats

5-year search growth: 4,000%

Search growth status: Peaked

Year founded: 2019

Location: Singapore, Singapore

Funding: $4.8M (Seed)

What they do: GoSats is a cashback/credit card reward company based in India. Similar to US-based Fold, they reward users with Bitcoin instead of miles or points. The GoSats app currently has more than 100,000 customers.

29. Yuga Labs

Search growth status: Peaked

Year founded: 2021

Location: Miami, FL

Funding: $450M (Seed)

What they do: Upon their launch in 2021, Yuga Labs was the team behind the wildly famous Bored Ape Yacht Club NFT collection. Over the past year, they’ve grown into an NFT marketing powerhouse, acquiring the industry-leading Crypto Punks project while expanding into everything from merchandise to metaverse gaming.

30. Argo

5-year search growth: 41%

Search growth status: Regular

Year founded: 2021

Location: Beverly Hills, CA

Funding: Undisclosed

What they do: Similar to NFT music companies, Argo helps content producers monetize their short films and TV episodes by cutting out the middlemen. In particular, they compensate creators through a direct ad revenue-sharing model while also allowing them to monetize their audiences via NFT sales (which may or may not be the only way to gain access to a creator’s video content).

31. Finnt

5-year search growth: 6,600%

Search growth status: Exploding

Year founded: 2021

Location: Miami, FL

Funding: $3.5M (Seed)

What they do: Finnt helps investors get their loved ones involved in decentralized finance investing. In particular, it allows users to link multiple wallets to a central wallet so more savvy investors can get their children, spouse, parents, or relatives to participate without each person having to go through the technologically advanced process of setting up and managing a DeFi wallet.

32. Paxful

5-year search growth: -19%

Search growth status: Peaked

Year founded: 2015

Location: Wilmington, Delaware

Funding: Undisclosed

What they do: Paxful is a peer-to-peer platform for buying, selling, and trading digital currencies. This startup provides a Bitcoin and crypto wallet app that allows users to trade cryptocurrencies with over 350 payment methods. Paxful has a global presence, with over 12 million users from 150+ countries.

33. Soon

5-year search growth: 72%

Search growth status: Regular

Year founded: 2017

Location: Salt Lake City, Utah

Funding: $1.5M (Pre-Seed)

What they do: Soon uses automated trading to help users offset the impact of inflation on their idle cash savings. In particular, they directly debit users’ checking accounts on an automated basis (determined by the user), invest those funds, then redeposit investment gains back into the user’s debit account (allowing them to spend their gains). Further, they raised $1M in their first angel round (which was oversubscribed).

34. OnScale

5-year search growth: -7%

Search growth status: Peaked

Year founded: 2021

Location: New York, NY

Funding: $23M (Series A)

What they do: Designed to serve high net worth creators, OnScale provides combines big banking services (cash flow mgmt., tax write-offs, etc.) with crypto rails so users can easily convert their traditional income into crypto, and their crypto income into disposable income.

35. Zengo

Search growth status: Regular

Year founded: 2018

Location: New York, New York

Funding: $24M (Series A)

What they do: Zengo is an all-in-one self-custodial cryptocurrency platform. The Zengo wallet supports 120+ different digital assets, including Bitcoin and other currencies. This startup has become popular in the crypto community because it is the only self-custodial wallet with no private key vulnerability. Instead, it's powered by Multiparty Computation (MPC) technology, making it virtually unhackable.

36. Tether

5-year search growth: 1,725%

Search growth status: Exploding

Year founded: 2014

Location: Seattle, Washington

Funding: Undisclosed (Seed)

What they do: Tether (USDT) is a stablecoin cryptocurrency with a value pegged to the US dollar on a 1:1 ratio. All Tether tokens are built on numerous blockchains, including Algorand, Bitcoin, Ethereum, Solana, and more. Currently, Tether is the third most valuable cryptocurrency, with a market cap above $111.8 billion.

37. Aleo

5-year search growth: 13%

Search growth status: Regular

Year founded: 2019

Location: Reno, NV

Funding: $298M (Series B)

What they do: Aleo brands itself as the “Ultimate toolkit for building private applications.” While most work in the blockchain space is made public for transparency's sake, Aleo allows developers to rapidly create, test and deploy dApps while keeping their work (the underlying code) private. Their GitHub has 33 repositories (a hallmark of developer activity) with four of those being updated multiple times per day.

38. Dapper Labs

5-year search growth: 400%

Search growth status: Peaked

Year founded: 2017

Location: Vancouver, Canada

Funding: $612.5M (Series D)

What they do: Dapper Labs is involved in both NFT production, NFT custody, and blockchain gaming. In particular, they’re the company behind high-profile NFT projects like CryptoKitties, NBA Top Shot and UFC Strike. Their most popular project, NBA Top Shot, ranks among the top 2,200 websites in the US.

39. Flashbots

5-year search growth: 3,300%

Search growth status: Peaked

Year founded: 2020

Location: Cayman Islands

Funding: $60M (Series B)

What they do: Flashbots provides education and bot creation tools surrounding the highly complex Miner Extractable Value (MEV) process inherent to most Proof of Stake blockchains. To date, over $675M in MEV has been extracted by Ethereum miners.

40. Yield Guild Games

5-year search growth: 600%

Search growth status: Peaked

Year founded: 2020

Location: Quezon, Philippines

Funding: $36.2M (Initial Coin Offering)

What they do: YGG acts as both a facilitator and middleman between, blockchain gamers and investors. In situations where playing a blockchain game requires hundreds if not a thousand dollars or more in upfront capital, guilds like YGG lower (and in some cases eliminate) that barrier by providing gamers with the capital/resources they need to play the game. As one of the more popular guilds, they have 176K Twitter followers and over 100K average monthly website visitors (per SimilarWeb).

41. Chainalysis

Search growth status: Exploding

Year founded: 2014

Location: New York, New York

Funding: $536.6M (Series F)

What they do: Chainalysis wants to bring some law and accountability to the wild west world of blockchain. The startup has developed an investigation, compliance and risk-management tool that helps solve crypto criminal cases. Chainalysis has managed to sell its tool to companies in over 70 countries.

42. Bitpanda

5-year search growth: 1,550%

Search growth status: Regular

Year founded: 2014

Location: Vienna, Austria

Funding: $554M (Series C)

What they do: Similar to what Robinhood has done in the US, Bitpanda allows European retail investors to buy and sell stocks, cryptocurrency and precious metals with as few barriers to entry as possible (their minimum to get started is just one euro). According to their About page, they have more than 730 team members and 3.5M users.

43. Rocket Dollar

5-year search growth: 4,200%

Search growth status: Regular

Year founded: 2018

Location: Austin, TX

Funding: $13.5M (Series A)

What they do: In what is a growing financial services trend, Rocket Dollar allows investors to buy and hold alternative assets (including cryptocurrency) in tax-free and tax-deferred retirement accounts. Their services range from $15 to $30 per month with one-time setup fees ranging from $360 to $600.

44. Anchorage Digital

5-year search growth: 5,100%

Search growth status: Regular

Year founded: 2017

Location: San Francisco, CA

Funding: $487M (Series D)

What they do: Similar to Fireblocks, Anchorage provides advanced blockchain security solutions to banks and institutions. In particular, they help clients avoid the dangers involved in cold storage while allowing safe access to decentralized borrowing and lending protocols (among other services). Per their website, they currently allow clients to custody 91 different cryptocurrencies.

45. Coinme

5-year search growth: 46%

Search growth status: Peaked

Year founded: 2014

Location: Seattle, WA

Funding: $30.6M (Seed)

What they do: In what originally started as a network of Bitcoin ATMs made possible via partnerships with CoinStar and MoneyGram, Coinme recently launched an app that allows users to buy and sell cryptocurrency (including the option to pay via Mastercard and Visa). Nationwide, their ATMs can be found in 15,000+ locations.

46. Coin Metrics

5-year search growth: 500%

Search growth status: Peaked

Year founded: 2017

Location: Boston, MA

Funding: $66.1M (Series Unknown)

What they do: Coin Metrics is a cryptocurrency data analysis company focused on providing financial intelligence to institutions. In particular, their services enable clients to better understand, value and use cryptocurrency networks. Their 15+ investment backers include high-profile names like Goldman Sachs and Fidelity.

47. ZenLedger

5-year search growth: 600%

Search growth status: Peaked

Year founded: 2017

Location: Bellevue, WA

Funding: $25.9M (Series B)

What they do: ZenLedger provides both retail investors and their CPAs with a suite of tax software designed to keep an accurate record of transactions and taxes owed (a massive pain point in the world of retail crypto investing). Their software supports 400+ centralized exchanges and 100+ decentralized finance exchanges.

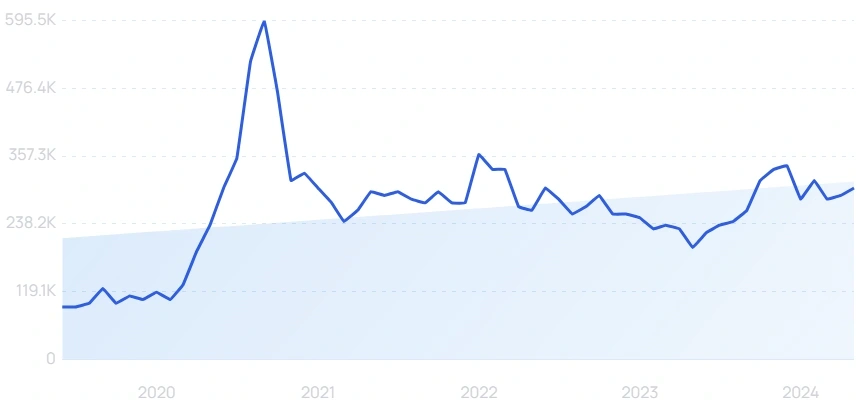

48. TaxBit

5-year search growth: 500%

Search growth status: Peaked

Year founded: 2017

Location: Draper, UT

Funding: $253.4M (Series B)

What they do: Similar to ZenLedger, TaxBit provides a retail-oriented SaaS platform that automates the tax tracking and reporting process, including helping enterprise clients track their user’s activity while providing accurate 1099s. Between Sep. of 2021 and March 2022, their website traffic quadrupled from 200K monthly visitors to 800K (per SimilarWeb).

49. Fold

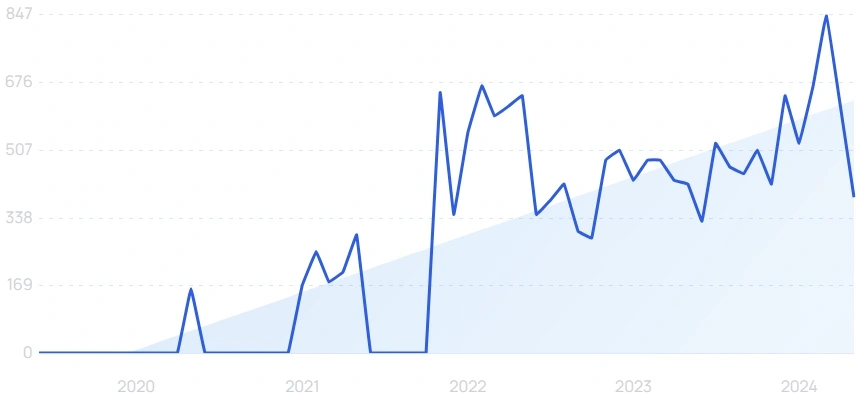

5-year search growth: 228%

Search growth status: Exploding

Year founded: 2014

Location: Atlanta, GA

Funding: $16.3M (Series A)

What they do: Fold provides US consumers with a Bitcoin rewards debit card, allowing customers to choose between flat-rate rewards or the chance to win up to 100x rewards via their “Spin to Win” in-app game. To date, they’ve rewarded users with 166+ Bitcoin, worth more than $7.6M.

Conclusion

So there it is—our list of 49 small blockchain startups looking to impact the crypto industry significantly.

These ventures utilize blockchain technology to offer faster digital asset trading, move money securely, and mine cryptocurrencies.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more