Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 7 Cryptocurrency Trends (2025 and Beyond)

The past year has been a wild ride in the cryptocurrency space.

Once ripe with fraud and falling prices, the crypto market surged back in 2024.

The cryptocurrency market is currently at a $3.4 trillion market cap. It surged as high as $3.8 trillion in December 2024.

The rising trend was impacted by the US trade tariffs in Q1 of 2025, causing a short-term decline and high volatility in Bitcoin.

But cryptocurrency appears to be firmly on the rise once again.

In this report, we'll share the biggest trends driving the bull market and influencing investor sentiment.

Plus, we’ll discuss the regulations and environmental concerns that could shake the market in the near future.

Here are the crypto trends happening right now and those that are likely to continue through 2025 and beyond.

1. Bull Market Emerges After Approval of ETFs

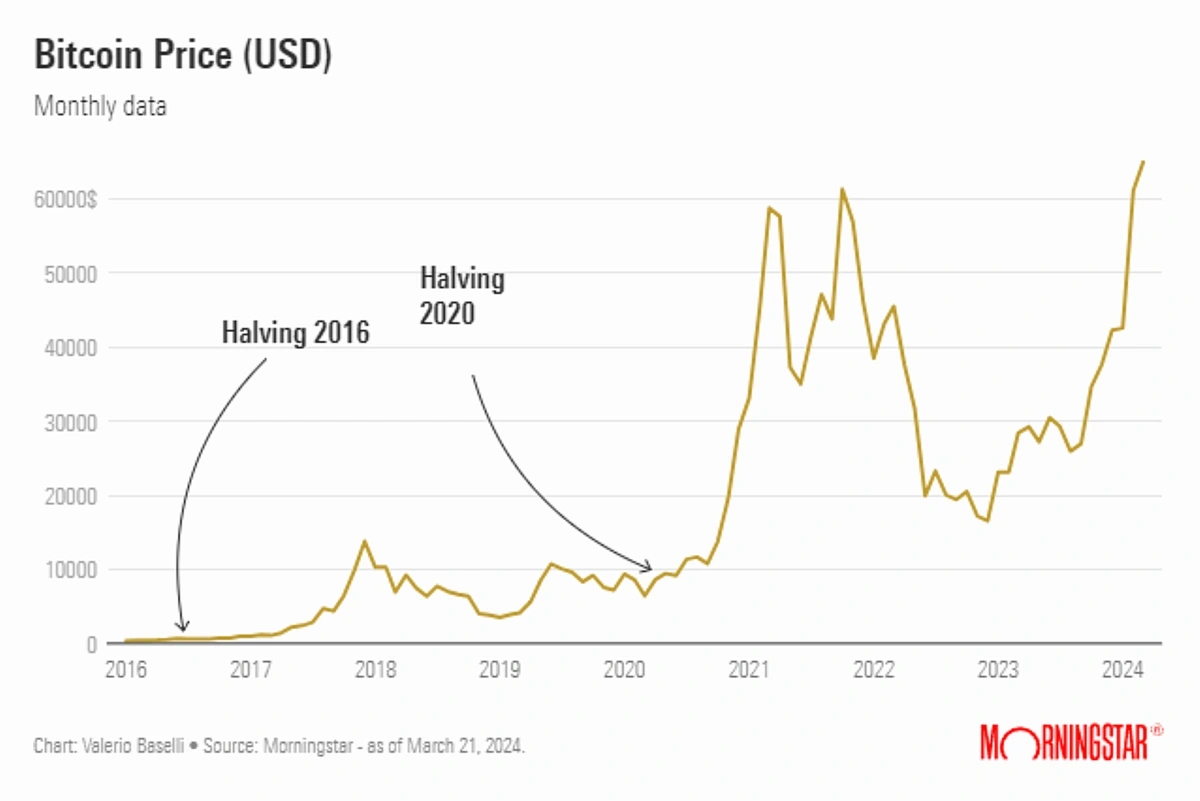

The value of Bitcoin surged 150% coming into 2024.

And many believe this bull run could last well into 2025.

The price of Bitcoin began 2024 at about $44,000 but had grown to nearly $70,000 by late May.

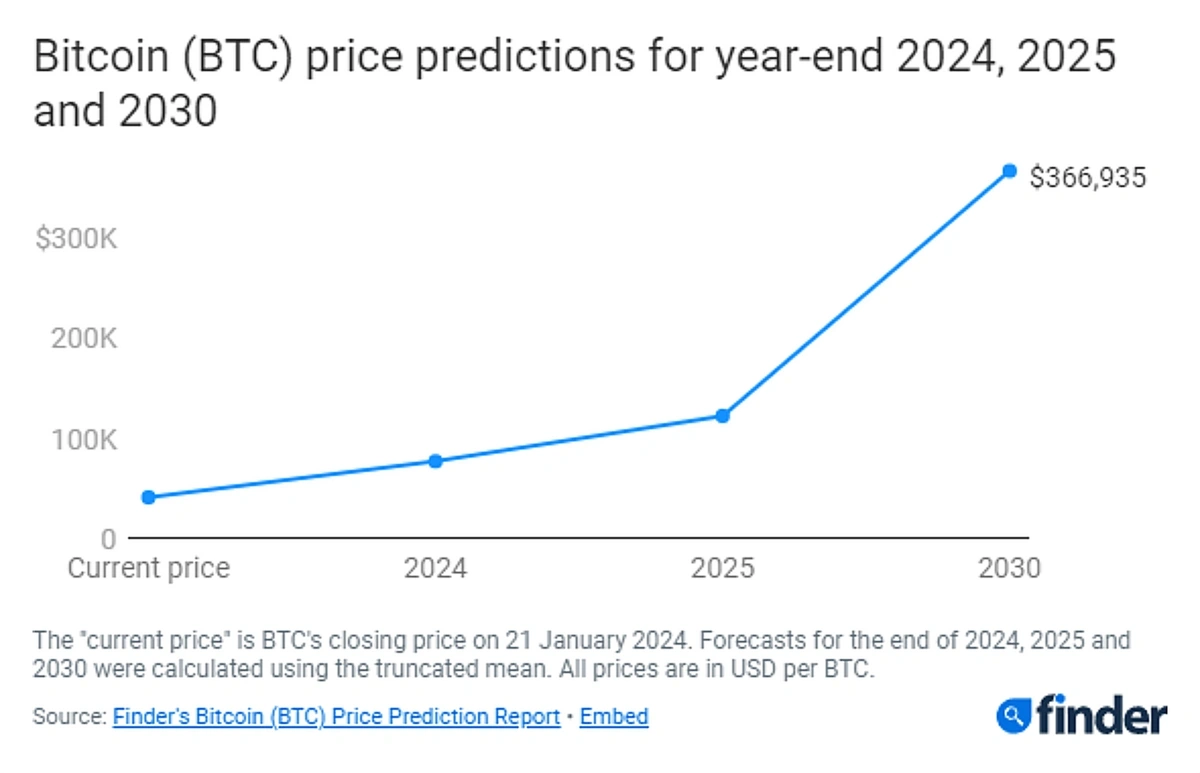

In one survey crypto experts said that Bitcoin could hit $77,000 by the end of 2024 and $123,000 by the end of 2025.

The survey respondents predicted a huge surge in Bitcoin’s value between 2025-2030.

But looking back, the actual Bitcoin peak in 2024 exceeded predictions by a huge margin, reaching $106,140 mid-December.

Bitcoin suffered a pullback in 2025 Q1, caused by the imposition of trade tariffs by the US government and macroeconomic uncertainties.

Yet despite the uncertainties, Bitcoin is showing remarkable resilience, and it's already showing signs of bouncing back in 2025 Q2.

In fact, it has hit new heights, surpassing $111,000.

Two major factors helped to spark this bull market: the approval of spot ETFs and the latest halving event, both of which took place last year.

Brokerages began designing Bitcoin ETFs as early as 2013, but the spot ETF wasn’t approved by the SEC until January 2024.

These funds consist of crypto that’s purchased by the financial firm and then offered as shares to investors. The investors never actually hold any Bitcoin, but the ETF tracks with Bitcoin’s market value.

🚀 What’s Moving in Crypto Right Now

Crypto sentiment can shift in hours, and the next breakout often starts with a spike in curiosity. These are the trending crypto topics right now, based on live data from the Exploding Topics engine.

That’s what’s breaking out now, here’s what we think is coming next.

Demand for crypto has gone up, in part, because these ETFs allow investors to hold a low-cost investment in Bitcoin without operating in a crypto exchange.

This makes crypto more enticing for retail investors but also for wealth management advisors who run 401ks or IRAs.

BlackRock and Fidelity have emerged as the early leaders in the Bitcoin ETF market—Blackrock holds $15 billion in Bitcoin assets and Fidelity has $9 billion.

The latest Bitcoin halving event is the other factor driving up interest in crypto at the moment.

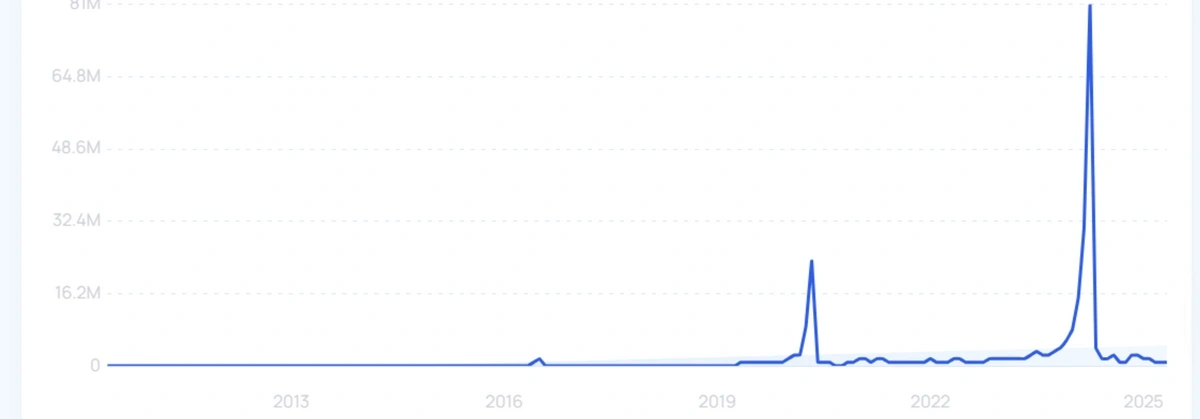

Search interest in “Bitcoin halving” had its biggest spike by far around the time of the last halving event in 2024.

Halving occurs roughly every four years.

The last one happened in April 2024.

On the halving event day, the reward for mining Bitcoin is cut in half. This decreases the rate at which new Bitcoin is mined.

Theoretically, this dip in supply will increase demand.

Previous halving events have been followed by an eventual increase in Bitcoin’s price. However, the increase was not immediate and couldn’t be definitively attributed to the halving.

In the six months following the 2016 and 2020 halvings, there were gains of 51% and 83% respectively.

The previous two halving events positively impacted the value of Bitcoin.

The market has followed a similar pattern following the 2024 halving event. But with many other external factors, such as the re-election of Donald Trump, it’s again hard to attribute the rise entirely to the halving.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

2. The Intersection of AI and Crypto

In recent months, AI has been working its way into the world of cryptocurrency.

AI tokens are cryptocurrencies that are directly related to an AI venture.

Just to name a few examples, AI tokens could be involved in blockchain protocols, decentralized web platforms, and decentralized machine learning platforms.

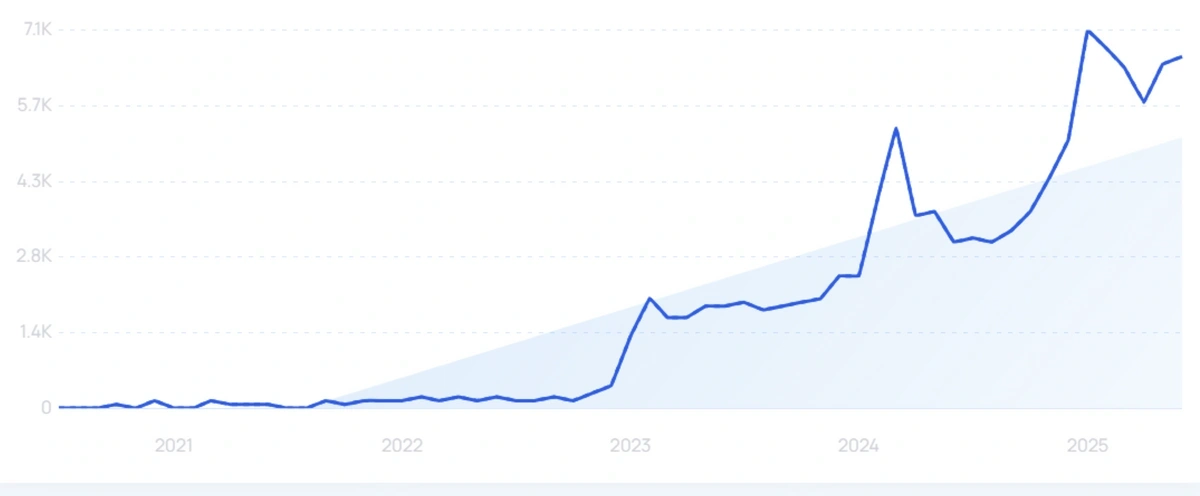

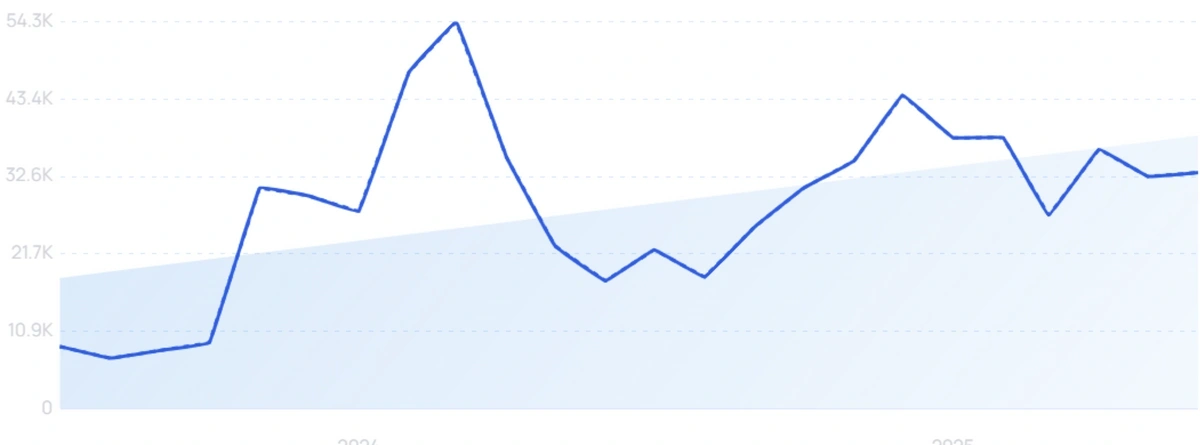

Search volume for “AI tokens” has grown steeply in 2024 and 2025.

And the AI tokens can serve a variety of functions.

Users can use the tokens to pay for services or access data on the platform, and the platform can use the tokens as rewards to pay users.

These tokens can also be used to provide the holders with some level of governance rights.

There are over 200 AI tokens in the crypto space right now.

In April 2023, the combined market value of AI tokens was just $2.7 billion.

Now it’s surpassed $36 billion.

BitTensor is one of the most well-known AI tokens.

“BitTensor” searches are up by 281% in the last 2 years.

It is a decentralized ecosystem of AI models. And its TAO token is used for rewards, staking, governance, and intra-network payments.

TAO’s price has increased by over 17% in the last year.

And it remains the most valuable token in the AI crypto space, with a value of over $425 as of June 2025.

3. Funding, Mergers, and Acquisitions in the Crypto Market

The last few years have been volatile for crypto funding.

2022 was a year of crypto bankruptcies.

But in late 2023, investor confidence returned.

And there has been a steady trend of renewed investment since then. Venture capital investment in crypto startups hit $4.9 billion in Q1 2025, the highest figure in over 2 years.

The quarter’s largest investment, valued at $2 billion, went to Binance. The cryptocurrency exchange has become the go-to place for traders, with a higher daily trading volume than any other platform.

As of May 2025, Binance receives 76.7 million visitors each month.

Among the 445 other deals (up 7.5% quarter-over-quarter), investments focused on early-stage crypto startups.

Investors say funding in the next year will be focused on real-world applications of blockchain and the infrastructure needed to implement these applications.

That includes integration between fintech companies and crypto ecosystems.

“Fintech crypto” searches are up by 113% in the last 2 years.

A spike of IPOs and mergers and acquisitions is also expected for 2025. Total venture funding in crypto this year is projected to pass $18 billion.

4. Changing Regulation of Cryptocurrency and Exchanges

The crypto meltdowns of FTX and others put a direct spotlight on the regulation of the industry.

And, in fact, there wasn’t much regulation at the time.

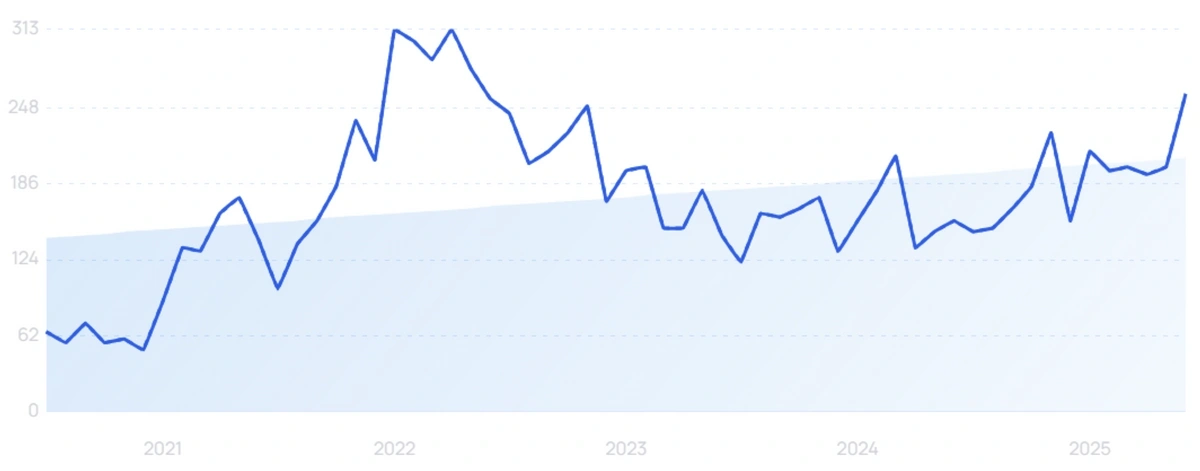

Search volume for “crypto regulation” is up 308% in recent years.

That’s all changed, with governments worldwide getting to grips with crypto regulation. But policies vary massively by country, and the US has favored a more hands-off approach since the re-election of Donald Trump.

The SEC is the nation’s most active regulatory body in the crypto market.

Gary Gensler, the former head of the SEC, was vocal about his support for more regulation in the crypto market, saying it is “rife with fraud and manipulation.”

He oversaw the development of the SEC stance that crypto is a security, functioning much like a stock. That means crypto firms are required to register with the SEC and follow the organization’s disclosure requirements.

In June 2023, the SEC sued Coinbase for not registering as a broker.

The SEC charged Coinbase in June 2023.

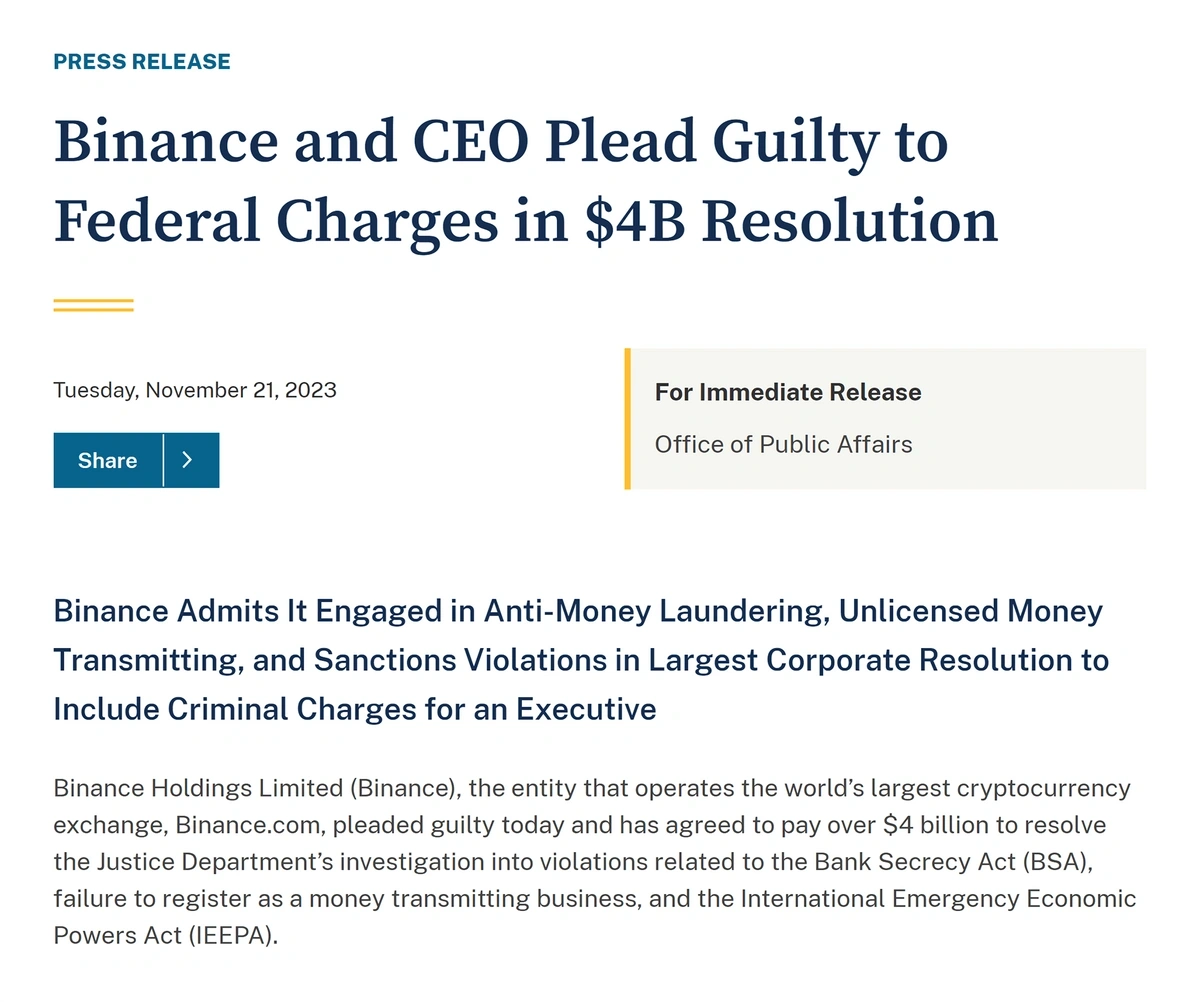

The SEC also sued Binance that month, accusing the crypto exchange of mishandling customer funds.

The company was ordered to pay $4 billion in fines in late 2023.

Binance was charged and ordered to pay $4 billion in financial penalties.

In all, the SEC sued five crypto companies in 2023. It then brought a further 33 enforcement actions in 2024.

But Trump’s administration has been more permissive. In his first week in office, he signed an executive order authorizing a more “light-touch” regulation of the industry.

Meanwhile, the SEC has announced a “Crypto 2.0” taskforce, briefed to create clear, fair rules for the crypto space.

The latest step has been the GENIUS Act, which paves the way for stablecoins to enter further into the mainstream by establishing some clear regulations.

“Stablecoins” searches are up by 900% in the last 5 years.

Under the new rules, issuers of stablecoins must have a reserve of the underlying currency or commodity to which the coin is “tethered” (e.g. USD, gold, etc.).

5. Crypto’s Growing Climate Impact

A lesser-known but potentially pressing trend for the crypto industry is the sector’s energy and climate change implications.

The environmental problems lie within a step of the cryptocurrency mining process called proof of work.

This is a process that requires miners to solve complex mathematical problems via high levels of computing power before they can submit new blocks to the network.

This high-level computing requires an extraordinary amount of energy and water.

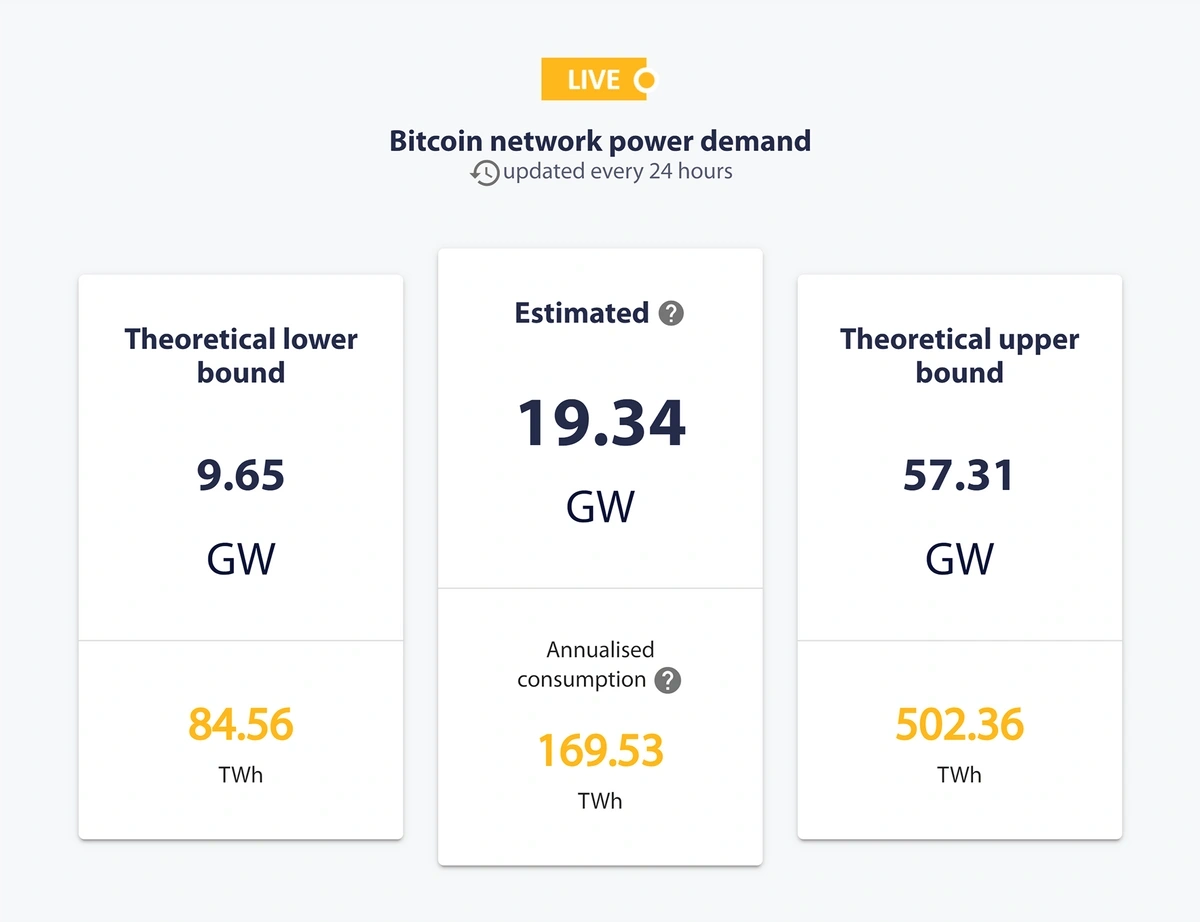

According to the Cambridge Bitcoin Electricity Consumption Index, the production of the cryptocurrency uses about 1174 TWh of electricity per year—more than the total annual electricity usage of the Netherlands.

Put another way, a single transaction of Bitcoin uses the same amount of energy as an average US household for nearly 26 days.

Crypto mining is an energy-intensive process.

In addition, United Nations scientists found that 67% of the energy used in crypto mining comes from fossil fuels.

They reported that the carbon emissions from crypto mining alone could push the world beyond climate goals made in the Paris Agreement.

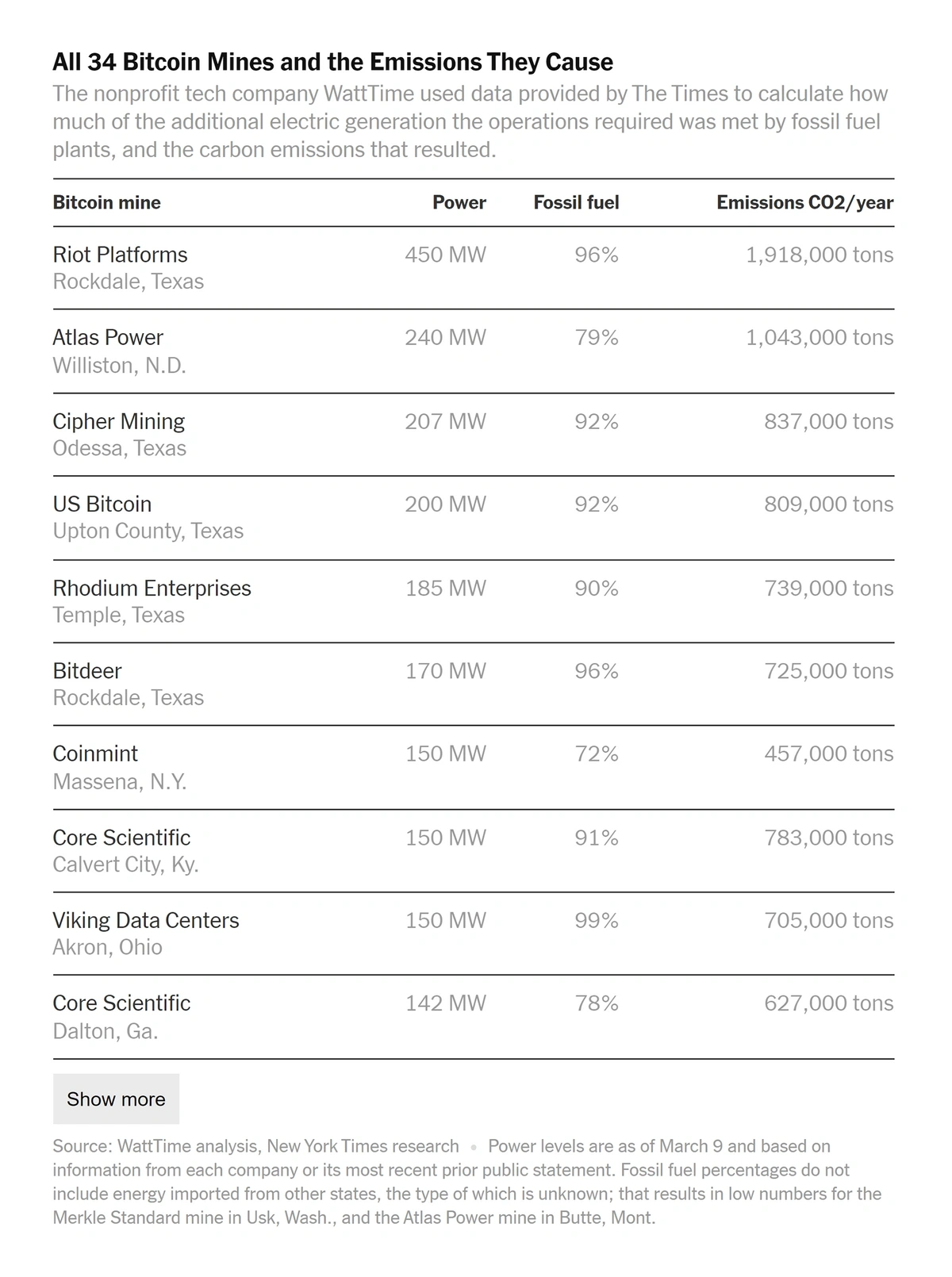

Riot Platform’s mining operation is the largest in the United States.

And it’s not just electricity.

Mining crypto also requires an abundance of water.

In addition to being used for electricity generation, water is used to cool the computer systems and provide the right level of humidity for the machines.

One study found that Bitcoin’s annual water consumption could be as high as 2,237 GL (gigaliters).

That’s equal to the annual amount of water usage in Washington D.C.

In an effort to address climate concerns, Ethereum launched The Merge in 2022, a software upgrade that cut miners’ energy use by 99%.

The upgrade got rid of proof of work and replaced it with proof of stake, a verification method that utilizes cryptocurrency holdings.

However, Bitcoin will likely never switch to a proof-of-stake model.

6. Real-World Assets Turn Digital with Blockchain Technology

Asset tokenization is another trend that takes advantage of the technology behind crypto: blockchain.

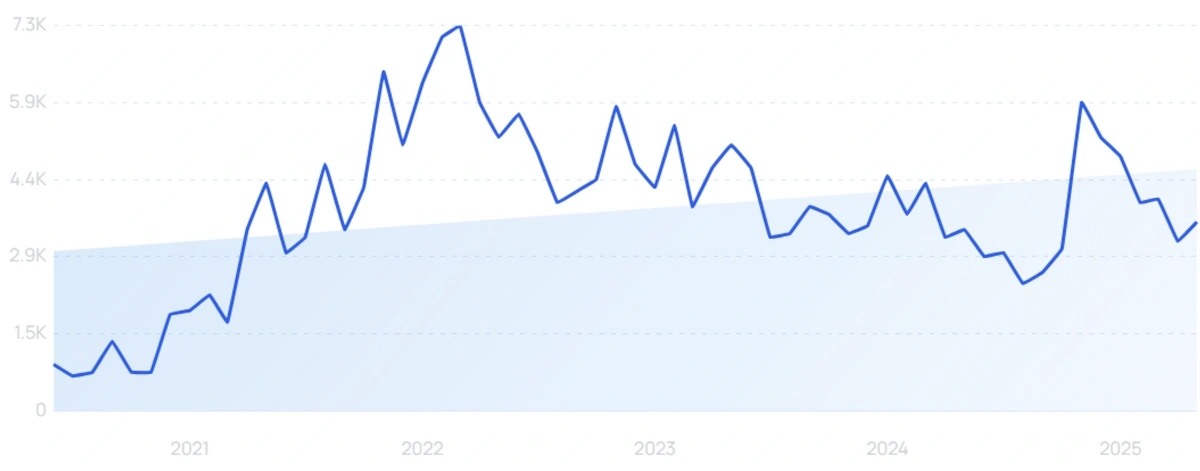

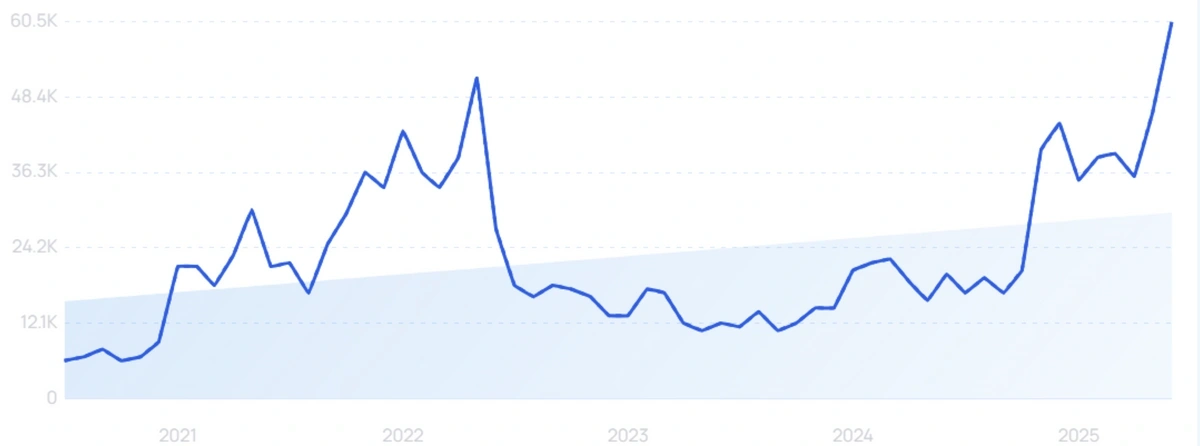

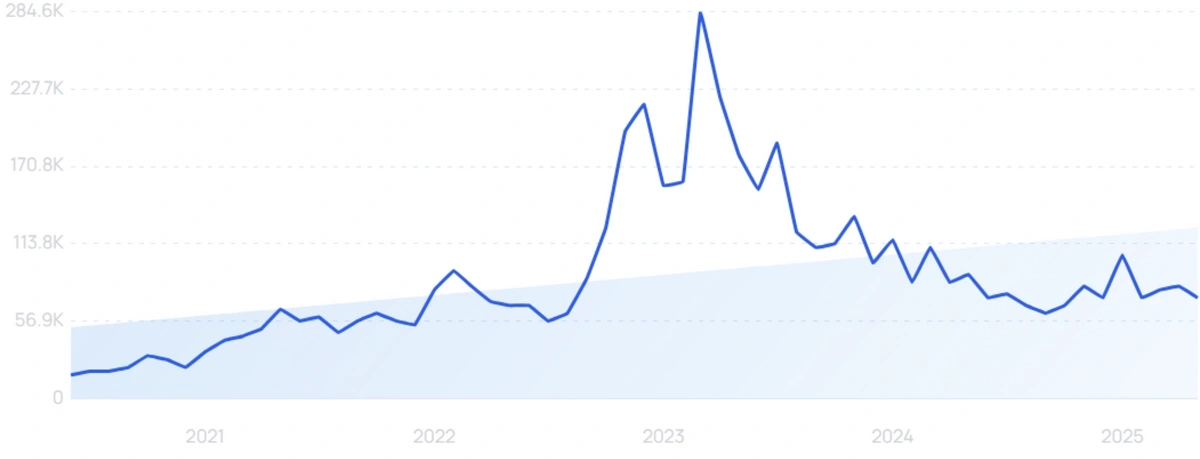

Search volume for “tokenized assets” since 2019.

When a real-world asset (RWA) is tokenized that means there’s a digital representation of it on the blockchain.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

Tokens can represent all kinds of assets like real estate, art, bonds, intellectual property, and more.

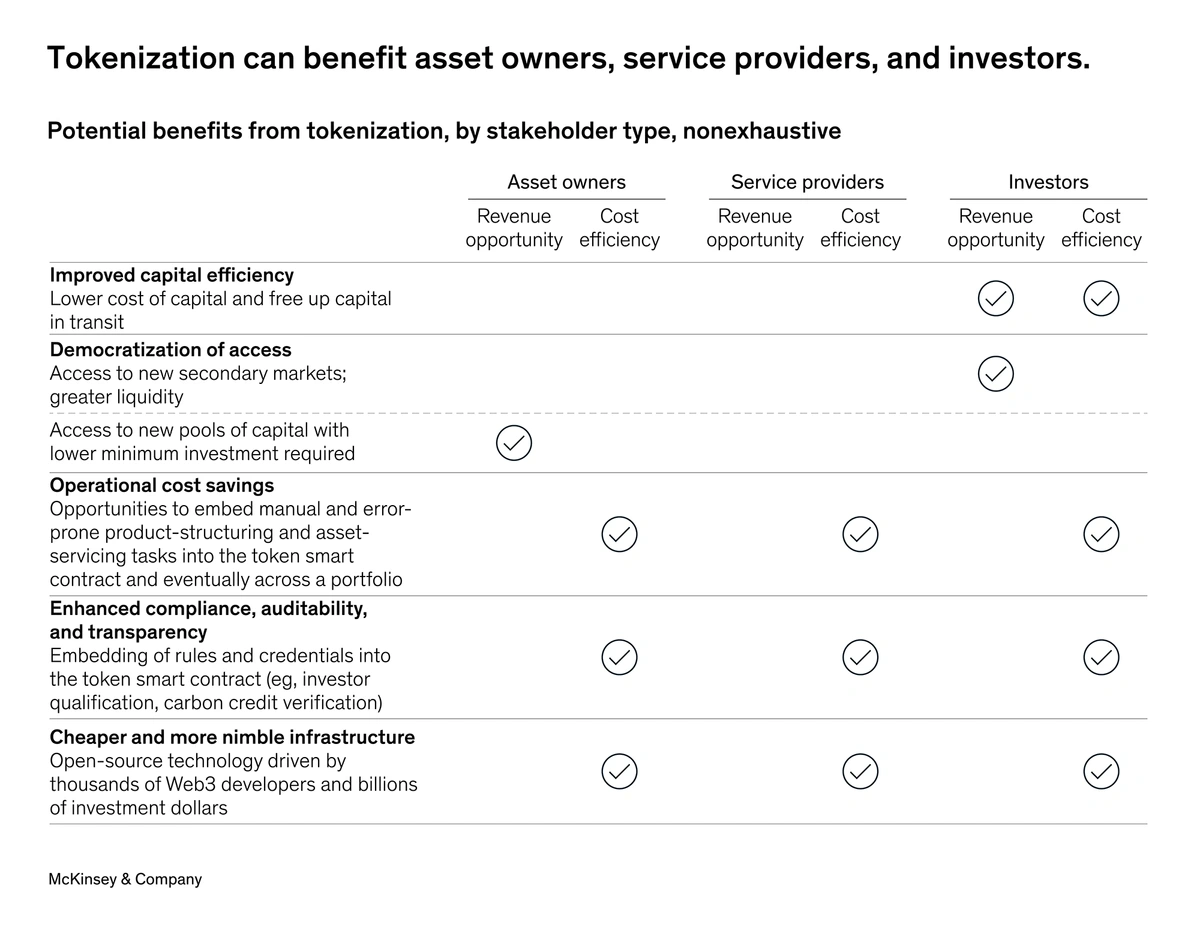

Tokenization can enable the automation of specific actions regarding the asset, provide traceability, enable fractional ownership, and increase liquidity—just to name a few benefits.

Tokenizing an asset enables a host of benefits.

Financial institutions are taking an interest in tokenization.

BlackRock launched its first tokenized asset fund, called BUIDL, in 2024.

The fund utilizes the Ethereum blockchain.

Securitize, a firm specializing in digital asset tokenization, has partnered with BlackRock on the fund.

In its first week, the fund brought in $240 million.

Citigroup is also testing the tokenization of financial assets on a private blockchain.

The bank has said that this will enable clients to transfer their assets on a 24/7 basis and cut processing times down to mere minutes.

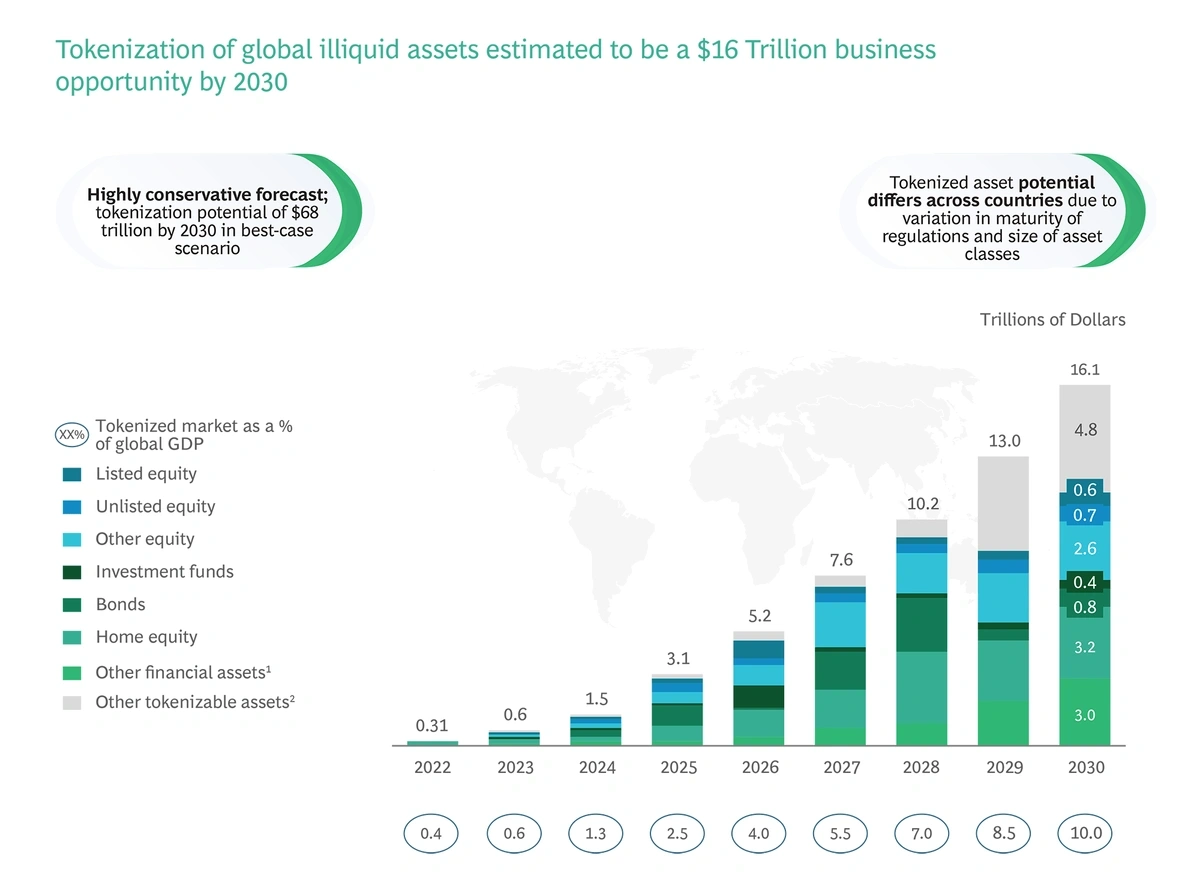

Predictions show that there’s a growing interest in tokenization of assets.

The market was valued at $3.32 billion in 2024 but could reach $12.8 billion by 2032, hitting a CAGR of nearly 20%.

Predictions from Boston Consulting Group are even more optimistic.

Analysts say that up to $16 trillion worth of real-world assets could be tokenized by 2030.

Tokenized assets could represent 10% of global GDP by 2030.

More recently, Deloitte predicted that $4 trillion of real estate alone could be tokenized by 2035, up from $0.3 trillion last year.

7. Global Officials Explore Central Bank Digital Currency (CBDC)

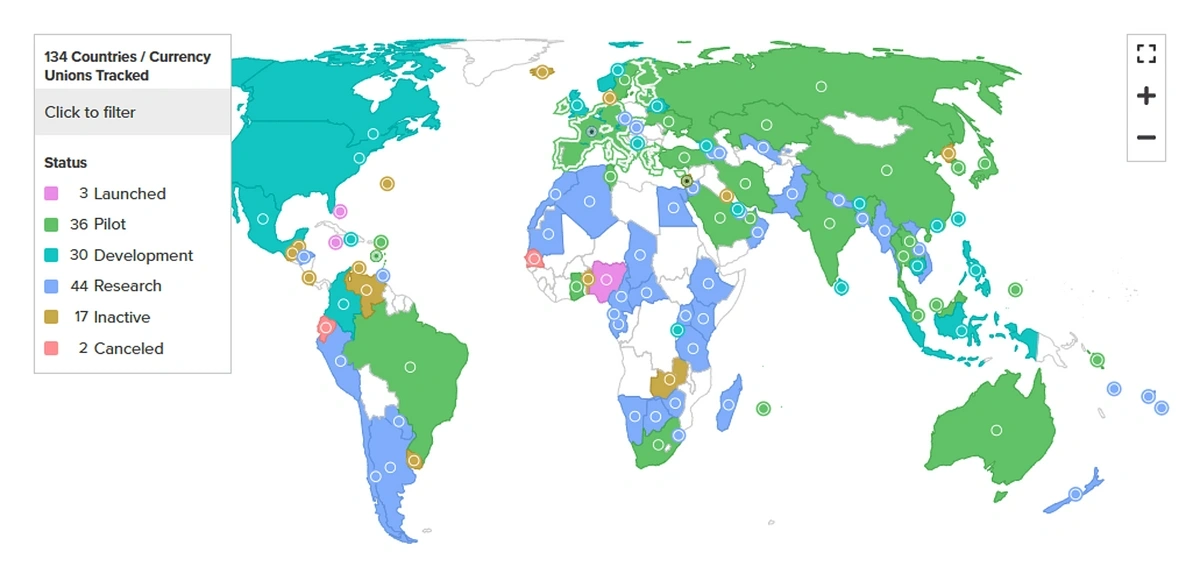

Banking systems across the world are in the process of developing their own digital currency, referred to as Central Bank Digital Currency (CBDC).

Search volume for “CBDC” over the last 5 years.

According to the Brookings Institution, this would create a virtual currency that is centralized and managed by central banks as opposed to decentralized blockchains.

There is hope that this type of currency would offer the benefits of crypto without the risk.

Digital currencies are currently being developed or tested in 132 countries, which amounts to 98% of the world’s GDP.

Many countries in Europe are piloting CBDCs.

CBDCs are already fully operational in Jamaica, Nigeria, and the Bahamas.

China is piloting the largest CBDC trial in the world.

The digital yuan, called e-CNY, is being tested in 260 million wallets across 29 pilot areas.

It’s already accepted on the Beijing public transport system.

By 2030, the Bank of International Settlements says 15 retail CBDCs (those used by consumers and businesses) and 9 wholesale CBDCs (those used by banks) will be operational.

The Bank for International Settlements says that more CBDCs are coming soon.

To connect various CBDC, the bank messaging network SWIFT is planning to launch a network of CBDC platforms in the next year or two.

The goal of the network is to enable the cross-border use of various CBDCs and enable banks to continue to use their existing infrastructure to manage transactions.

The organization has already tested its network with 38 banks and financial platforms.

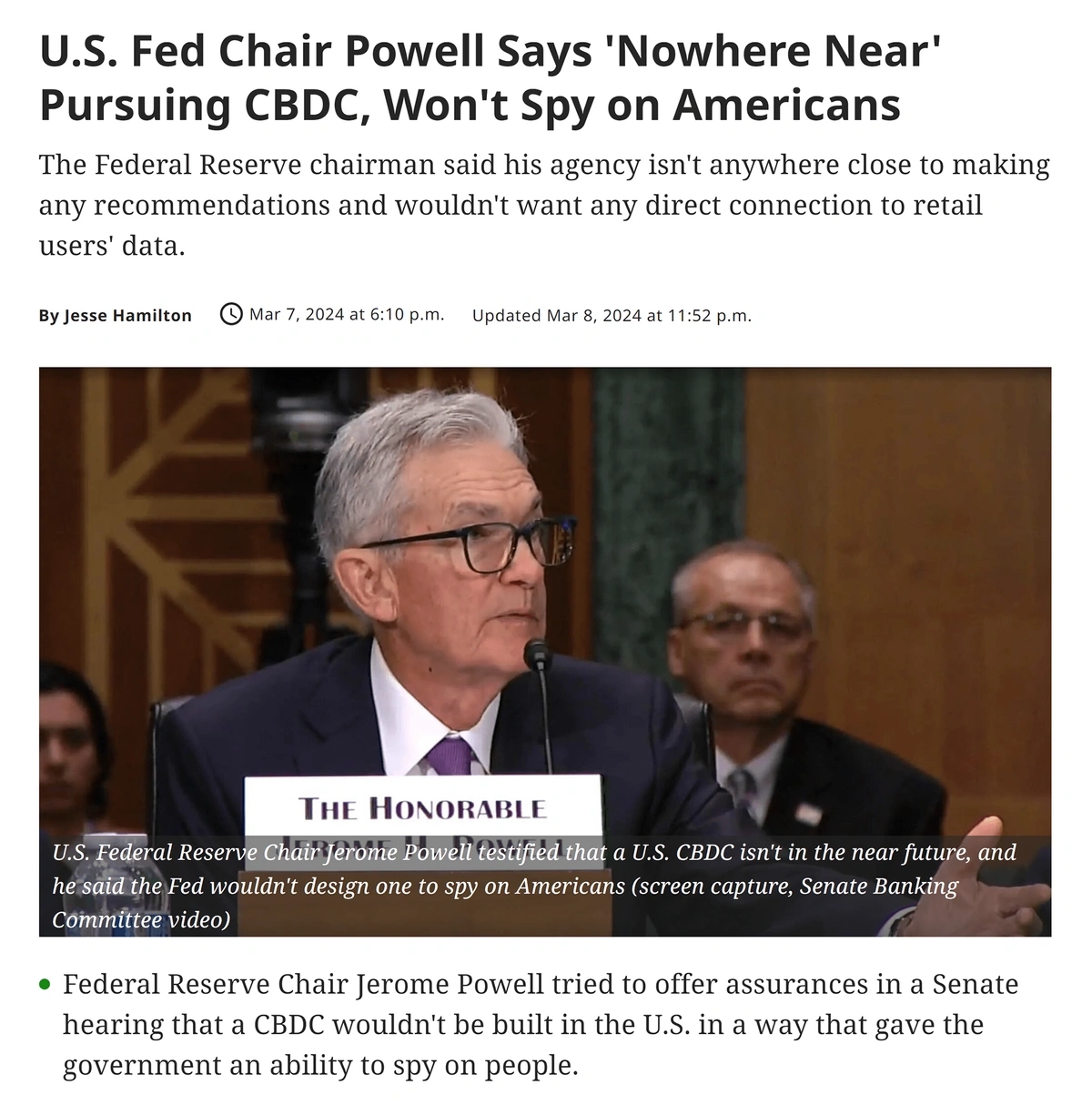

Despite growing global interest, officials in the United States say they have no plans to develop CBDC.

The Fed has said that any CBDC would be subject to congressional approval.

U.S. consumers have been vocal about their privacy concerns regarding CBDC.

In addition, bank officials worry that digital currency could negatively impact the cost and availability of credit, set up commercial banks for possible failure, and decrease the stability of the financial system as a whole.

Conclusion

That concludes our list of the top seven crypto trends to watch right now.

The cryptocurrency market has been almost completely unpredictable over the last several years. The bull market has been in control for the past few months, giving investors and crypto enthusiasts hope for a record-setting future.

But with increasing regulation and climate impacts, it seems nearly inevitable that crypto’s future will be just as uncertain as its past.

You may also like:

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more