Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

11 Key Martech Trends for 2024-2027

You may also like:

Today you're going to see 11 of the most important martech trends happening in 2024.

(Including many that are set to continue to grow into 2027 and beyond.)

So if you want to see what's coming around the corner in the marketing technology space, you should get a ton of value from this post.

1. New Influencer Marketing Platforms Enter the Marketplace

65% of businesses plan to increase their influencer marketing budget, according to a survey conducted by BigCommerce.

Despite influencer marketing being "the next big thing" in digital marketing, it remains a very labor-intensive process to pull off.

For influencer marketing to work, a brand needs to:

- Find influencers in their space.

- Filter out those with a minimum (or maximum) number of followers.

- Reach out one by one via email or DM.

- Negotiate rates and terms.

- Track the results.

So it's no wonder that a slew of new influencer marketing platforms are entering the market.

These platforms attempt to take a lot of the legwork out of finding and contacting influencers.

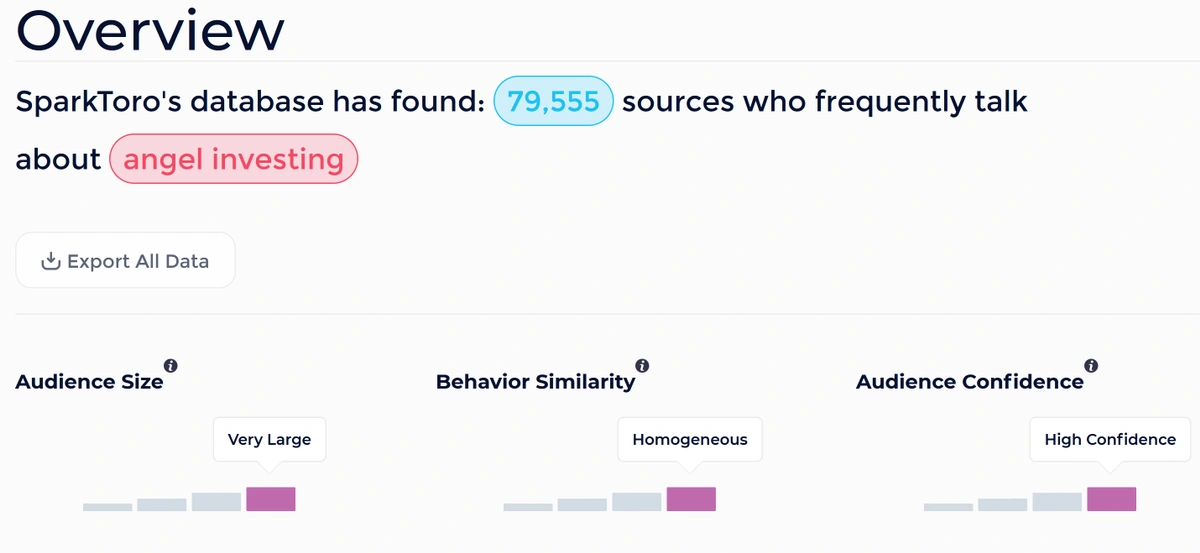

For example, Sparktoro is software designed to help brands quickly identify the exact YouTube channels, podcasts, and personal brands that their audience follows.

Sparktoro's software finds influencers that a specific audience follows.

And Upfluence is more of a database of 3 million+ influencers that users can search and sort through.

Along with email outreach features that allow you to contact influencers within the platform itself.

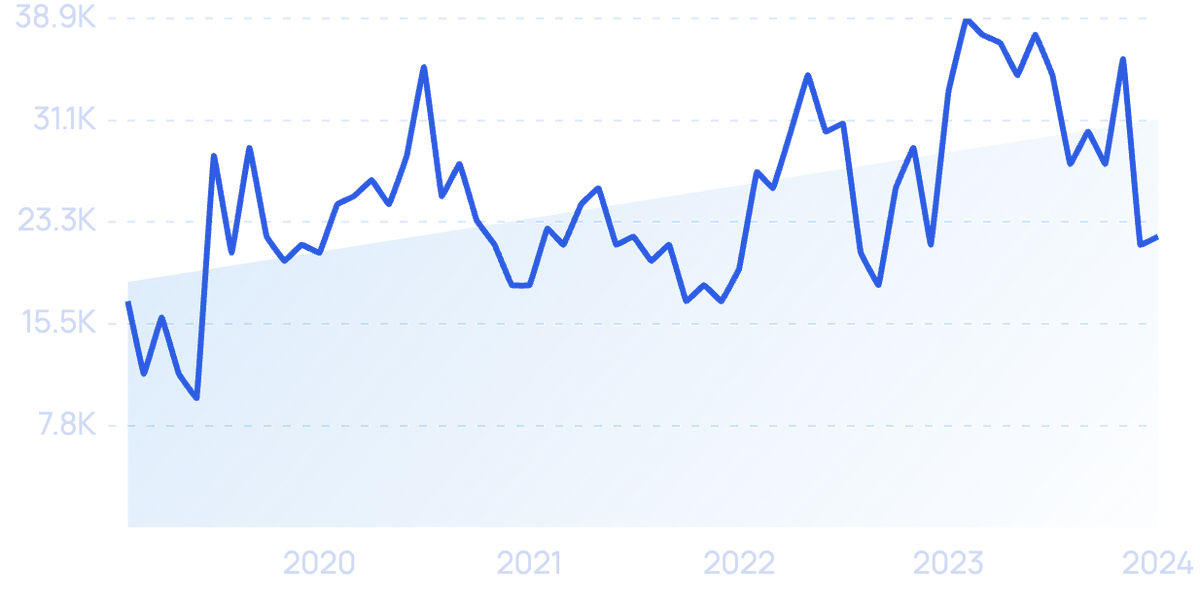

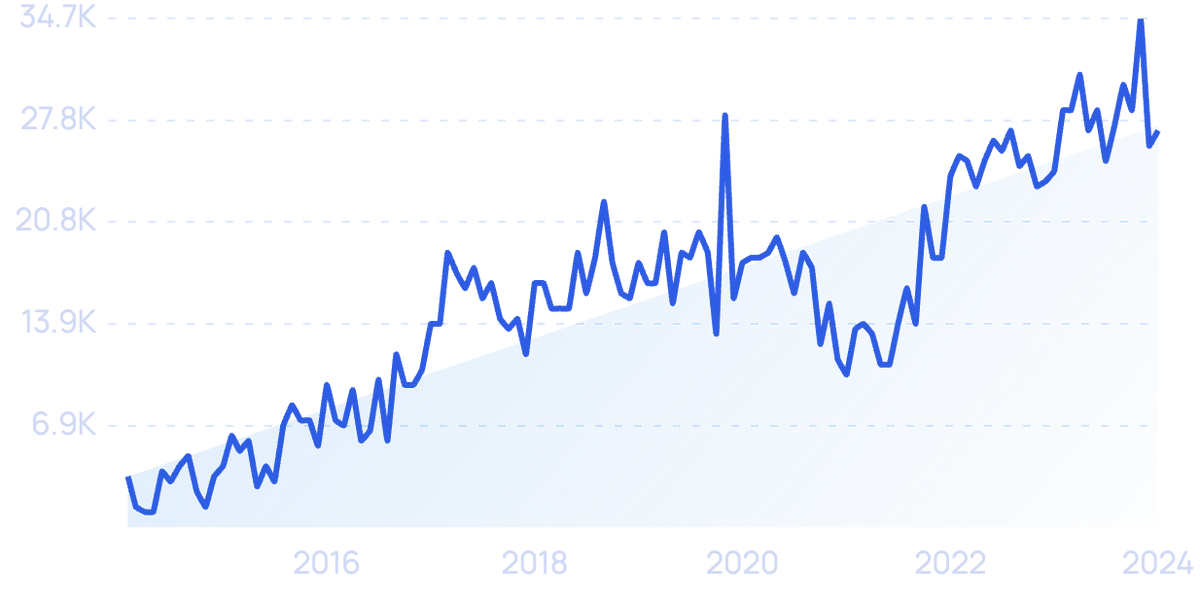

Search growth for "Upfluence" has increased by 108% in 5 years.

2. Chatbots Continue to See Growth

There's been a ton of hype around chatbots over the last few years.

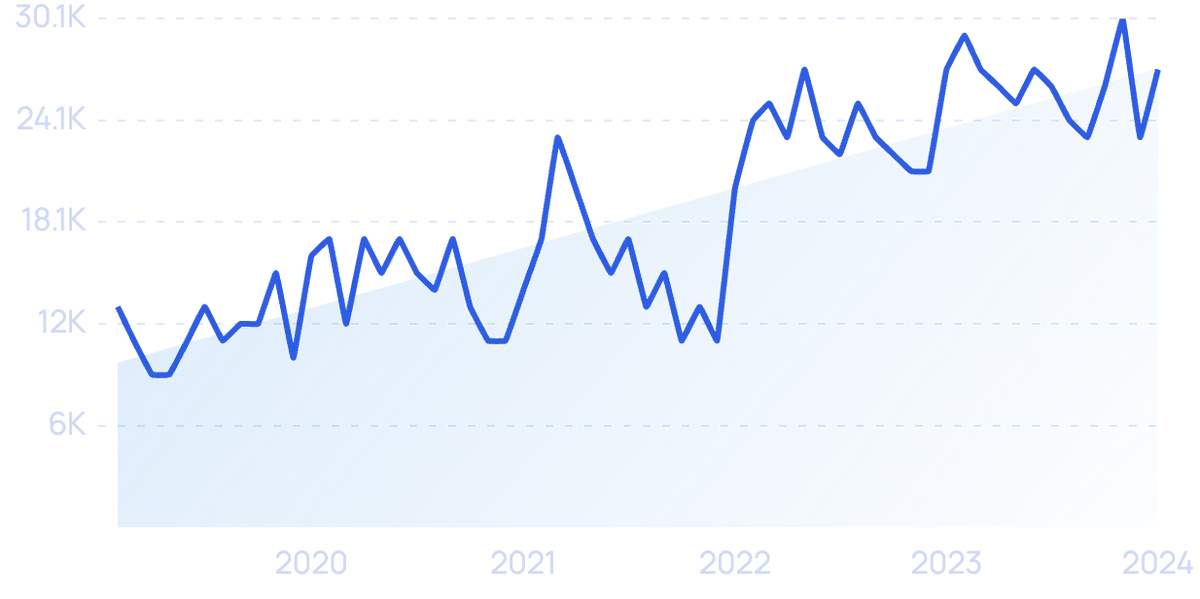

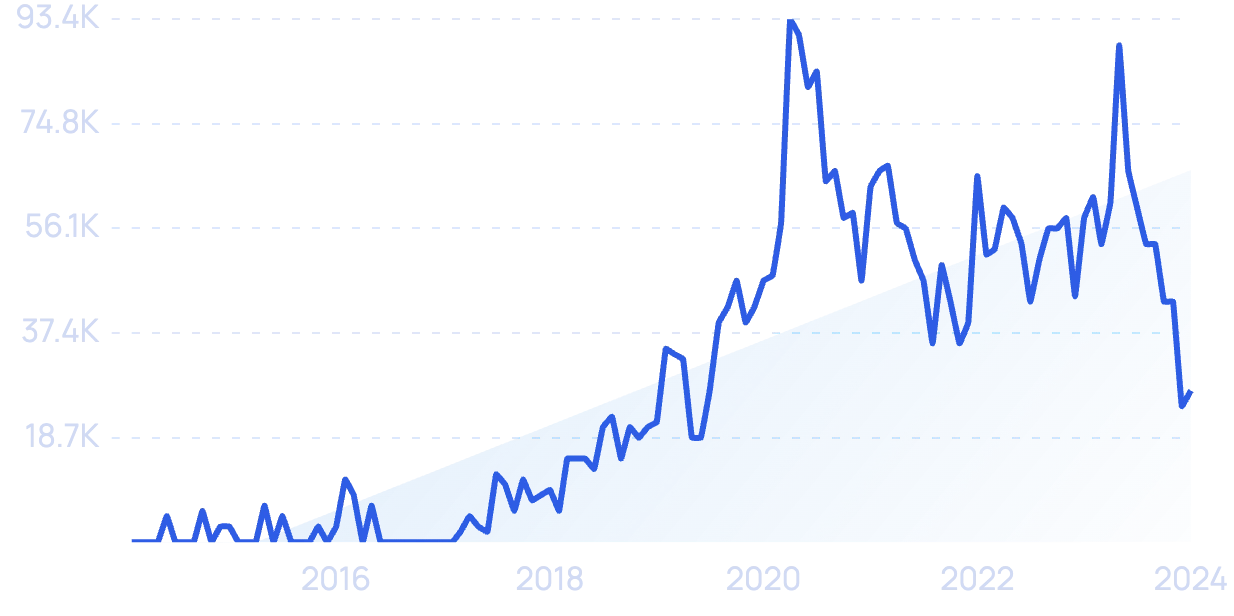

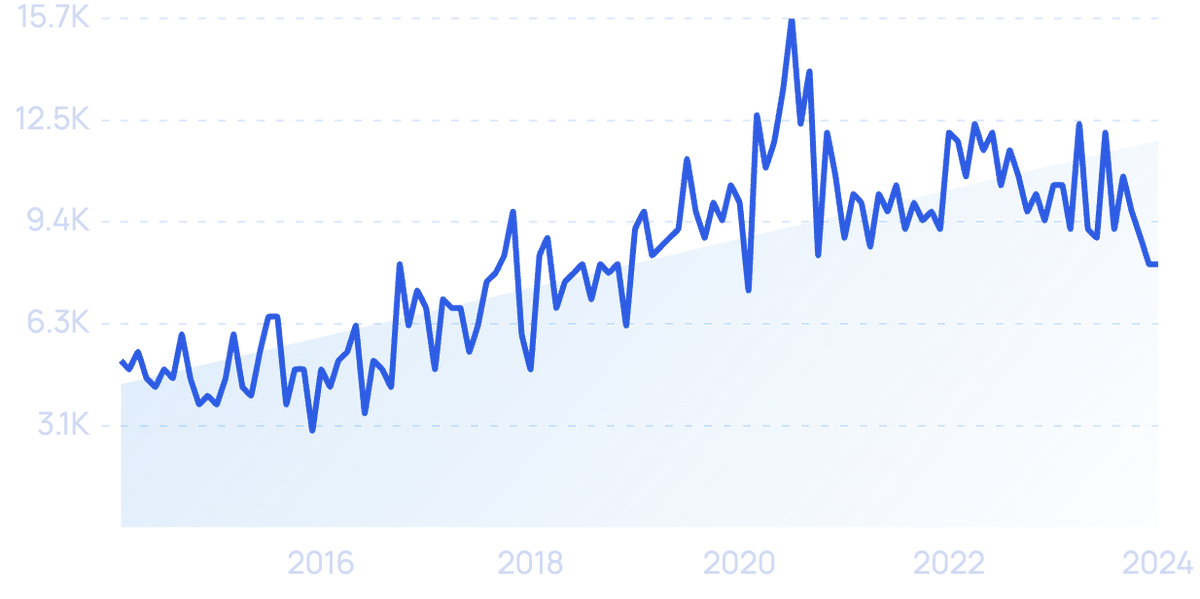

Searches for "chatbot" have increased by 188% in the last decade.

And largely for good reason: a number of chatbot companies are growing rapidly.

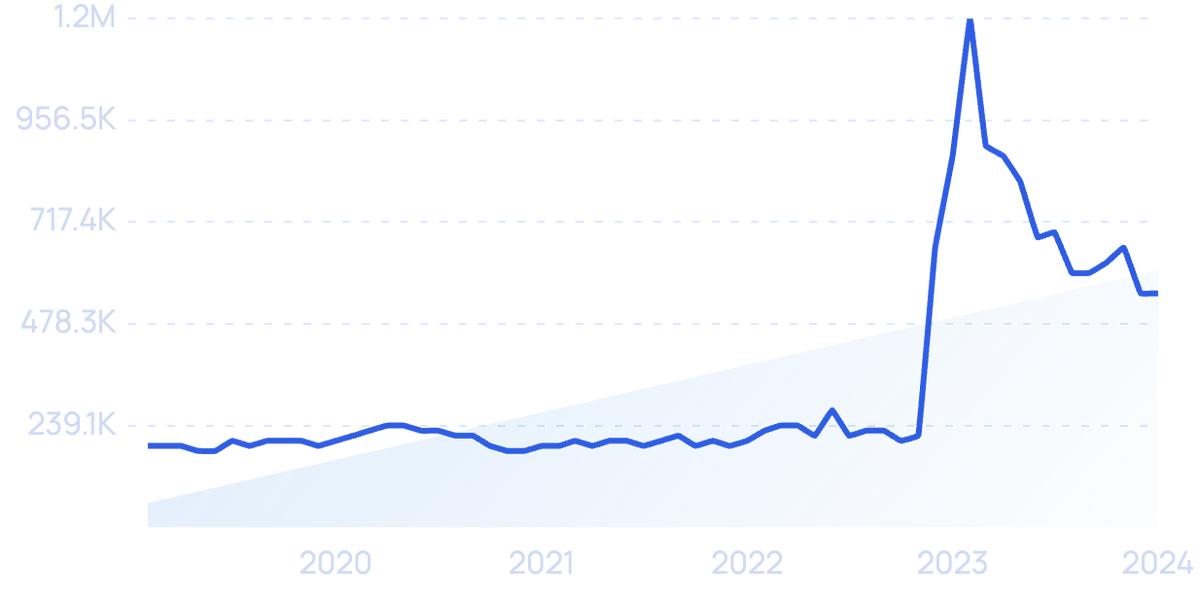

For example, ManyChat.

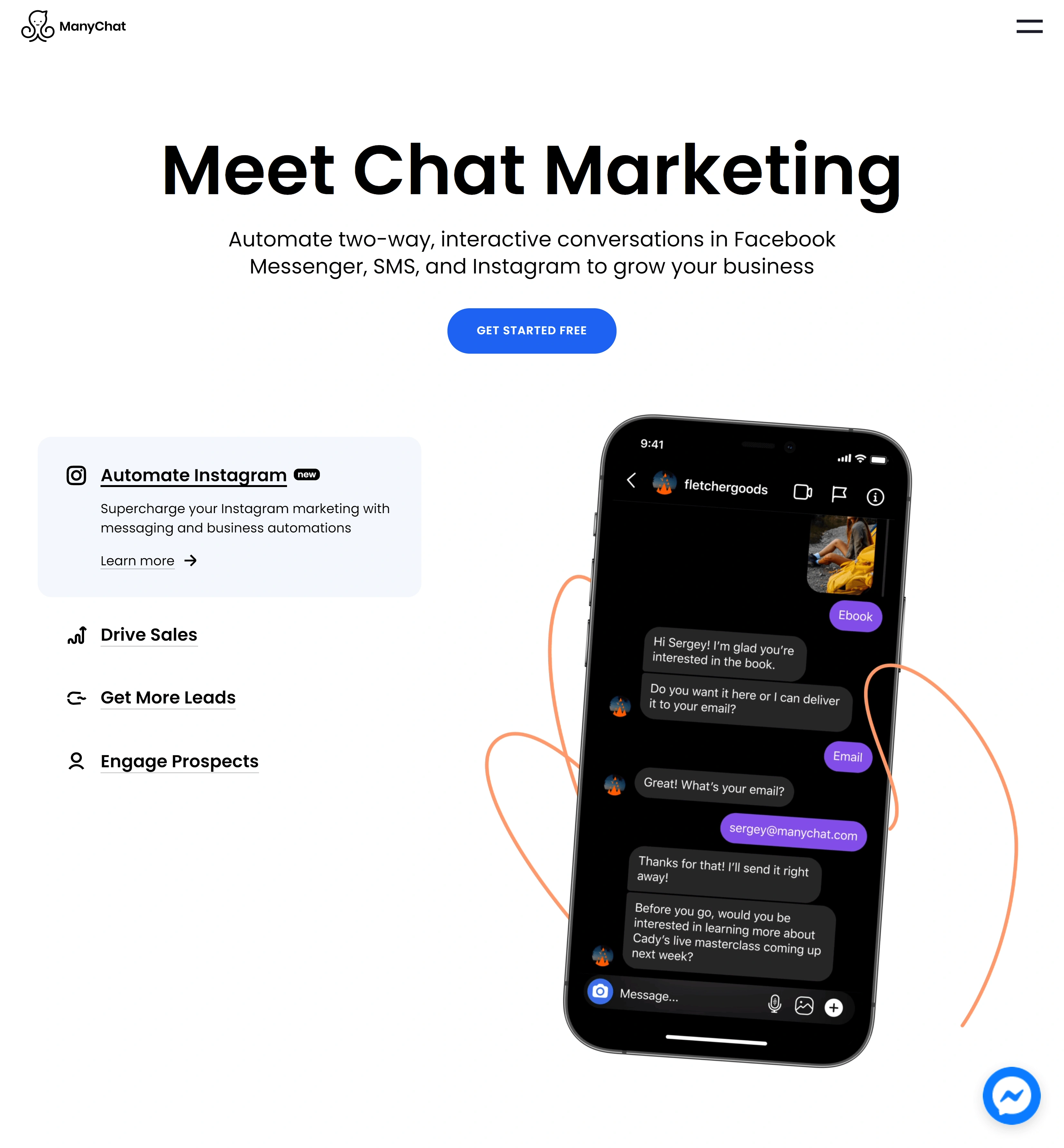

ManyChat is one of many fast-growing chatbot startups.

ManyChat has raised over $23 million to date.

And recently acquired customer attribution tool, Converlytics.

Which suggests that there's still room for growth in this space.

While most chatbots are associated with complicated machine learning/AI capabilities, there's also demand for simple chatbot tools.

An example of an "accessible chatbot" tool is Landbot.

Google searches for "Landbot" have increased over the last 5 years.

Unlike most chatbots, Landbot uses a relatively simple decision-tree system.

According to the company, this makes setting up a chatbot more "intuitive" than its AI-focused competitors.

3. Increased Demand for Social Media Scheduling Tools

Social media scheduling is a martech niche that doesn't get a ton of attention.

That's like because these scheduling tools aren't likely to break the $1 billion mark. Or go public.

Despite that, many social media scheduling tools are growing (in terms of users and revenue) super quickly.

And like many SaaS products, these tools can have potentially high profit margins.

To be clear: this space isn't new.

What's new is that this new batch of scheduling tools has advanced features (like the ability to automatically recycle previous posts).

They also support newer formats, like Instagram Stories.

Many of the brands in this space are geared towards agencies and pros.

Not people just starting out (although they do offer a limited free plan).

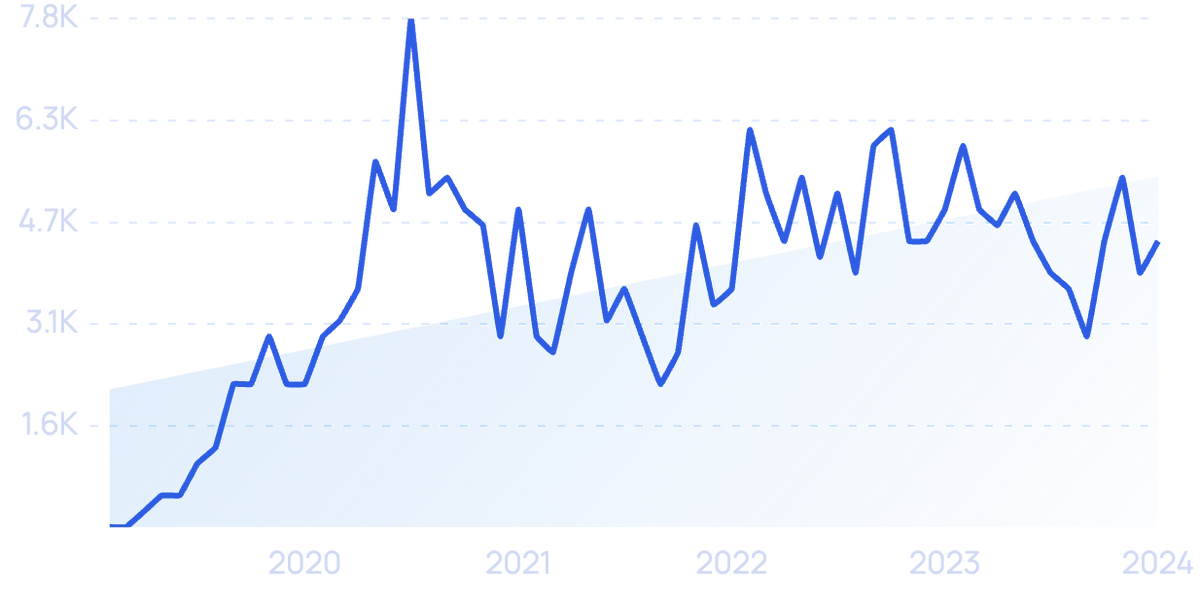

4. Podcast Tech Takes Off

According to Edison Research, 33% of American adults listen to podcasts on a regular basis.

(A number that has been increasing each year.)

And we're starting to see a slew of martech products specifically for podcasts.

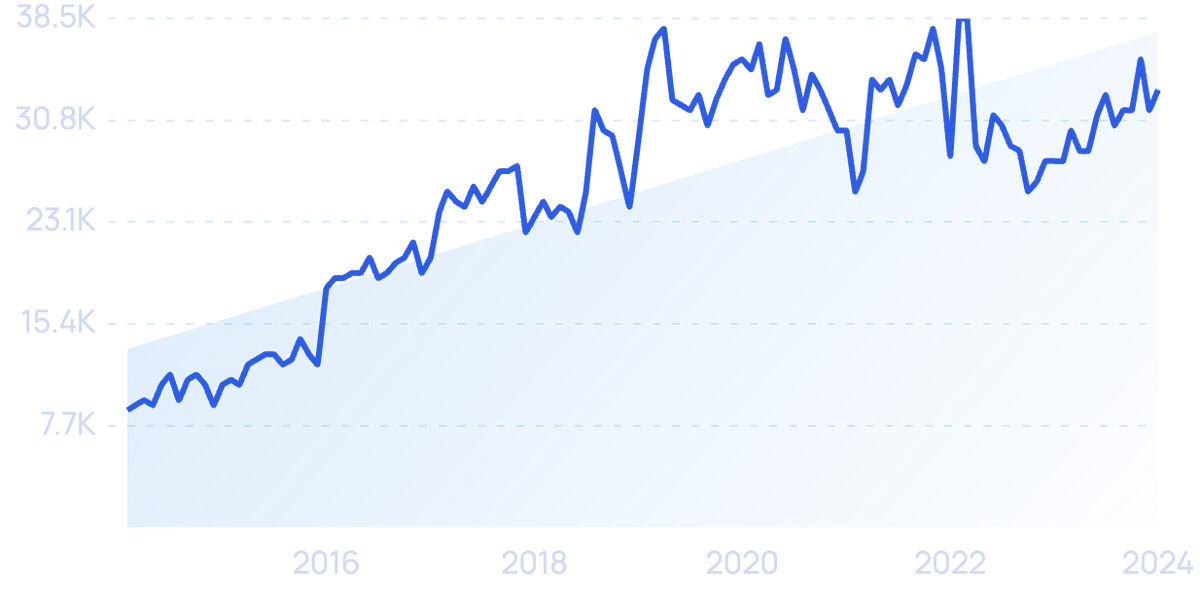

For example, searches for "podcast hosting" have increased over the last five years.

And brands like Anchor.fm (founded by Spotify) are seeing serious growth.

"Anchor.fm" searches are up 2,800% over 5 years (despite a dip since the start of the pandemic).

That said, a podcast needs more than hosting to function.

A professional podcast also needs a high-quality microphone, editing software and more.

In the podcast mic space, the Blue Microphone USB Mic has taken off in this relatively small (but growing) space.

And podcast editing software Descript is looking to become the de-facto software for editing podcast episode audio.

There are also a number of "podcast kits" on Amazon that attempt to deliver all of the equipment someone would need to start a podcast from scratch.

Podcast kits contain the basic equipment needed to start their first podcast.

5. New Software Makes Video More Accessible

According to Animoto, businesses cite expense and lack of time as their two main obstacles to creating video content.

Marketers and CMOs increasingly want to get into video. But technical barriers tend to prevent these campaigns from taking shape.

And a number of SaaS companies have recently launched to help solve those exact problems.

One example of software attempting to make video creation a bit easier is Artgrid.

Largely due to a massive social ads campaign, searches for Artgrid.io have exploded (5,100% growth in 5 years).

Artgrid is a library of tens of thousands of stock video clips that can be used for YouTube videos, Facebook ads, or social video campaigns.

In fact, YouTube itself is attempting to lower the bar for creating professional videos.

Their recently-expanded YouTube Studio has a fairly robust video editing platform.

Searches for video editing tool "YouTube Studio" have increased by more than 682% over the last 5 years.

There's also Viddyoze.

This tool is similar to Artgrid. Except they focus more on stock animations vs real-life footage.

Viddyoze is a video editing tool designed for creating social media video content.

Viddyoze also has editing features built into the platform.

Which, again, is designed to make video creation a bit more accessible.

In this case, by making it so users don't need to learn how to use a separate piece of video editing software (like Adobe After Effects).

6. Email Marketing Software Makes a Comeback

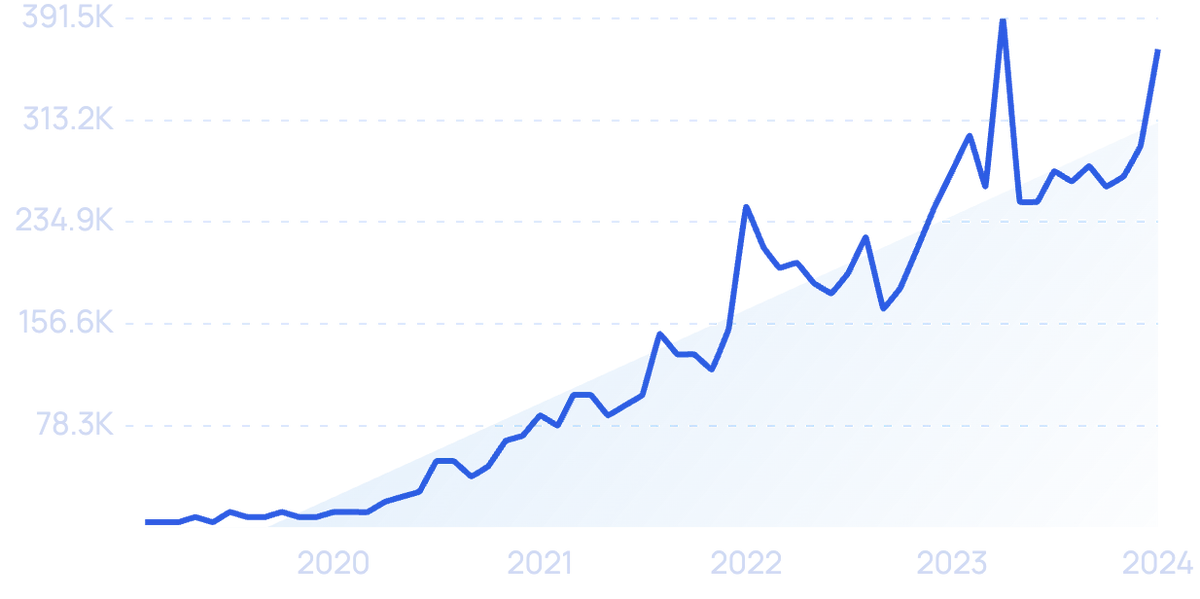

One of the most surprising trends in the marketing technology space is the slew of email service providers (ESPs) seeing rapid growth.

The email service provider industry literally started in the 1990s.

So why is the space growing in 2024?

Largely due to the growing number of niche email service providers entering the market.

Instead of a "one size fits all" tool (like Mailchimp), these niche email marketing platforms tend to focus on one key feature, like newsletter design or simplicity.

For example, Substack separates itself from the Mailchimps of the world by focusing on a relatively niche use case: people who have a list of paid newsletter subscribers.

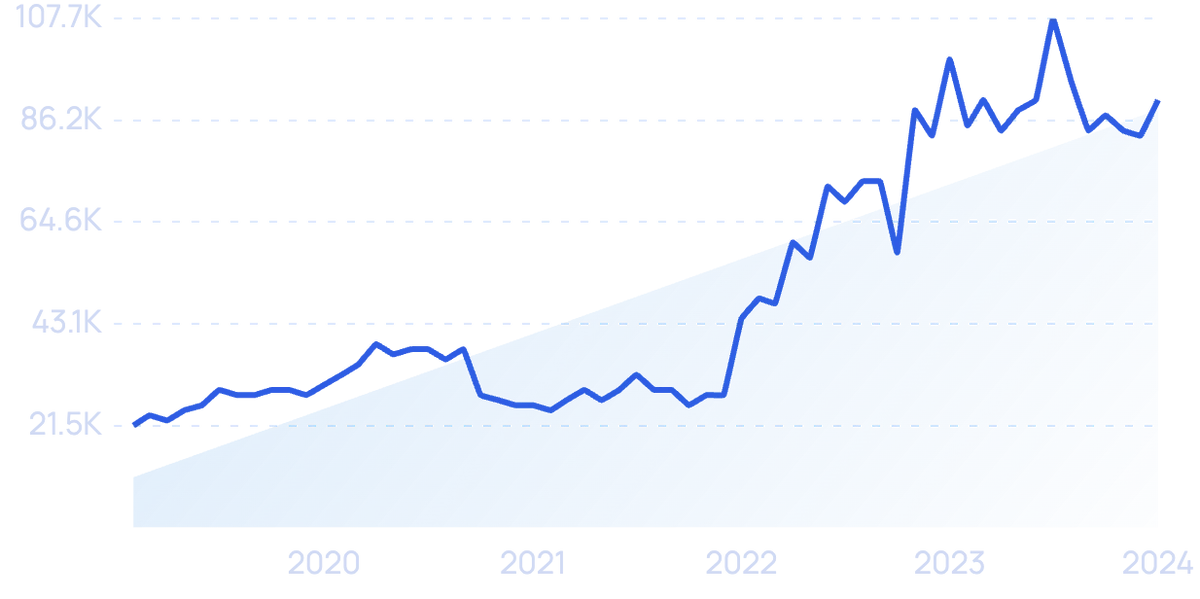

Search growth for Substack has increased by 9300% over the last 5 years.

Substack's pricing model is also unique. Instead of charging a monthly fee, Substack takes a cut of revenue from each customer.

In exchange, users can get started for free. And the platform takes care of sending, billing and other tasks required to run a paid newsletter.

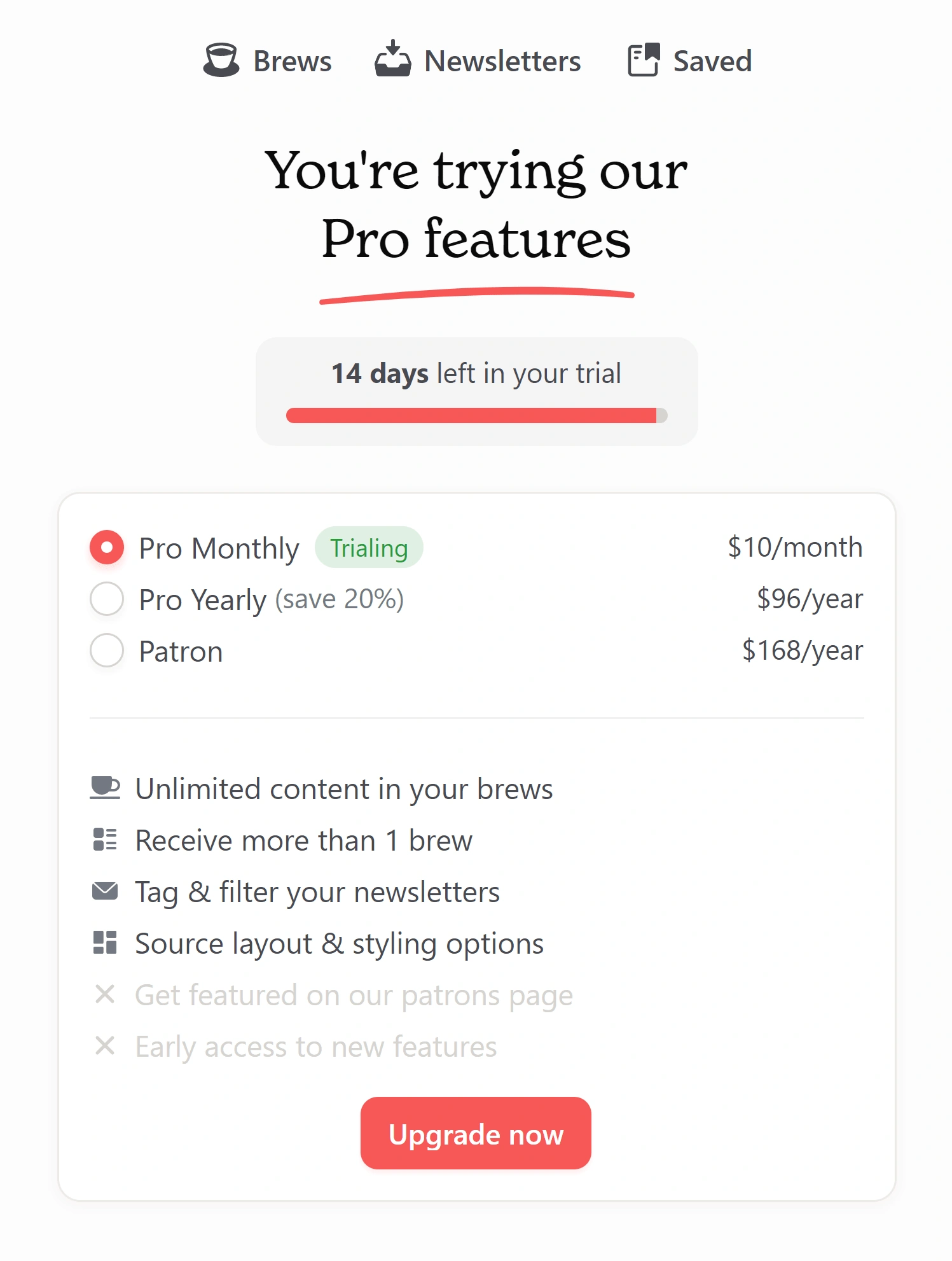

Mailbrew is another email tool that's a bit different than Substack.

Mailbrew is essential “Twitter (and everything else) over email”.

Searches for “Mailbrew” are up 500% in 5 years.

Users pay $5 per month to receive the top tweets from people they follow.

But they get all of this content in email newsletter format.

You can also receive the latest YouTube videos from specific channels, the top threads in particular subreddits and so on.

And all of this can be personalized to your specific needs in terms of frequency and format.

Mailbrew has had rapid growth, with shoutouts from several big names in the space.

And you can even see examples of people actively pointing followers to Mailbrew’s paid service, to get them to subscribe for email updates of their tweets.

SendFox is a traditional ESP that focused on content creators (like YouTubers) who often neglect email promotion.

“SendFox” searches are up 1,700% over a 5-year span.

Over the next decade, content creators will likely consolidate their audiences on a property they own: email.

And their success will no longer be subject to platform algorithms, but instead, be more reliant on email deliverability.

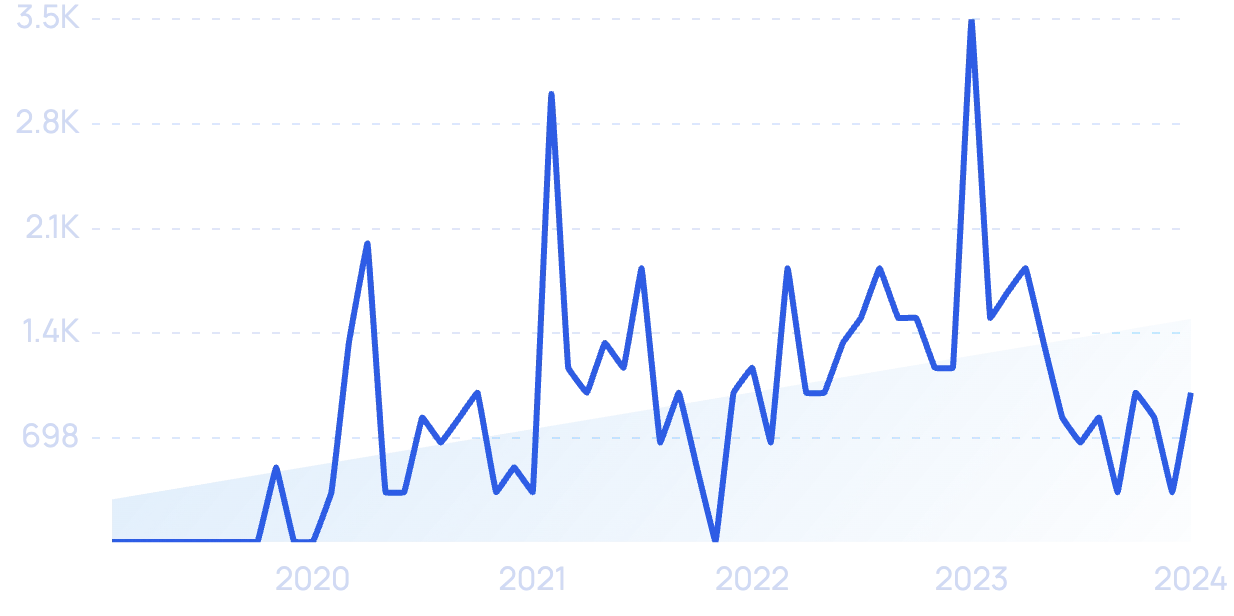

We're even seeing specialized email service tools moving to the forefront in the paid advertising space too.

Email ads have long been the Wild West of paid acquisition.

But this is set to change as companies like Paved bring Facebook-level demographic targeting and automation to email.

Paved is a marketplace that connects newsletters and advertisers.

Paved’s marketplace allows advertisers to automatically reach predefined user profiles across many separate newsletters all at once.

When combined with email’s reach and engagement, this format of ad deliverability could begin to outperform other channels.

Email is coming back to front and center stage.

Both are for businesses looking to reclaim their own audience.

And to cut through the noise to reach new audiences with more effective advertising.

7. Ad Campaign Automation Becomes The Norm

As digital transformation takes hold, more and more businesses are advertising online for the first time.

And at the same time, automated advertising campaign management is changing the face of online ads.

Specifically, things like automated bidding and programmatic ads mean that certain aspects of running an ad campaign can be handled with AI.

Search volume for the term "programmatic ads" is up 680% over 10 years.

To be clear: a human still needs to manage the campaign.

And to develop ad creatives, write copy, and calculate ROI.

But a good chunk of ad management, from split testing to finding the right target audience on Facebook, is becoming automated.

8. Brands Double Down On Personalization

According to HubSpot, personalization is the #1 way that marketers improve their email marketing performance.

That's because, when done right, personalization can dramatically improve the customer experience. Increase conversions. And more.

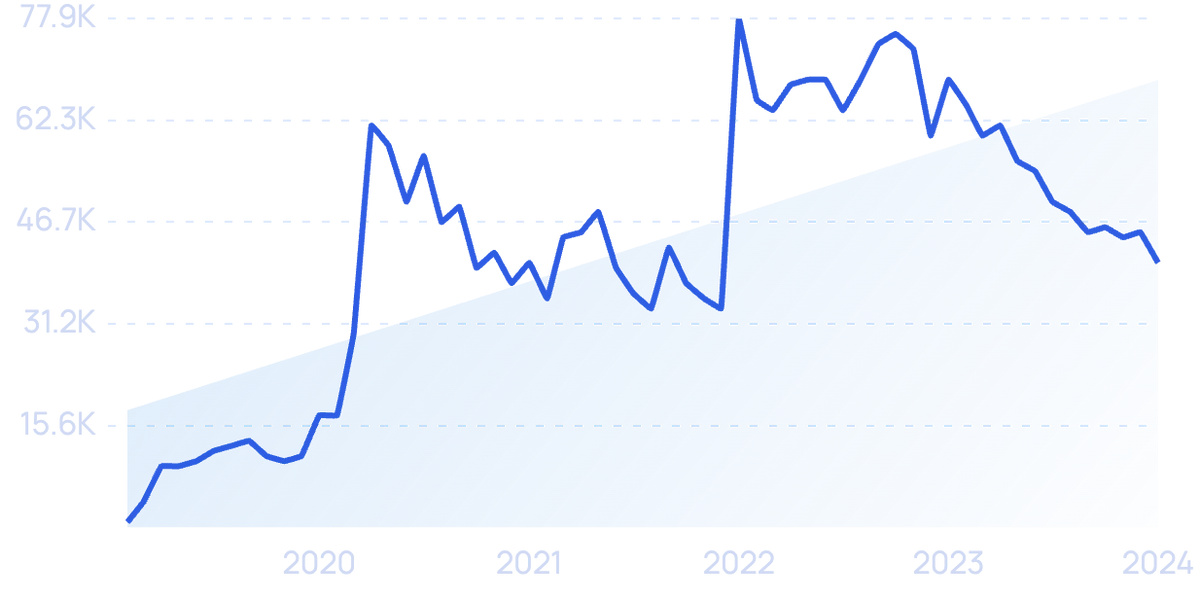

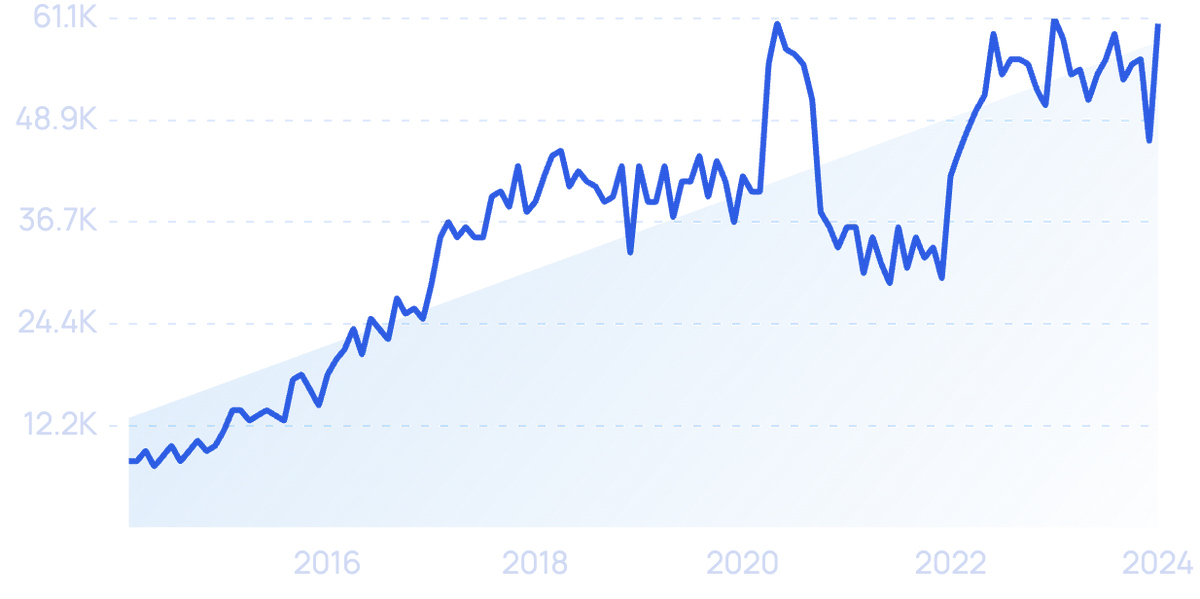

In fact, searches for "marketing automation" have been increasing over the last 5 years.

And show no signs of slowing down.

"Marketing automation" remains a hot topic in the marketing world.

The early days of personalization were dominated by bulky, complicated software suites, like Ontraport.

Today, many more accessible SaaS products have added personalization features.

For example, the popular ESP ConvertKit has a number of basic personalization options.

But its price point, branding, and ease of use make it clear that ConvertKit is geared towards single-person businesses over enterprise customers.

ConvertKit's search growth over 5 years is up 113%.

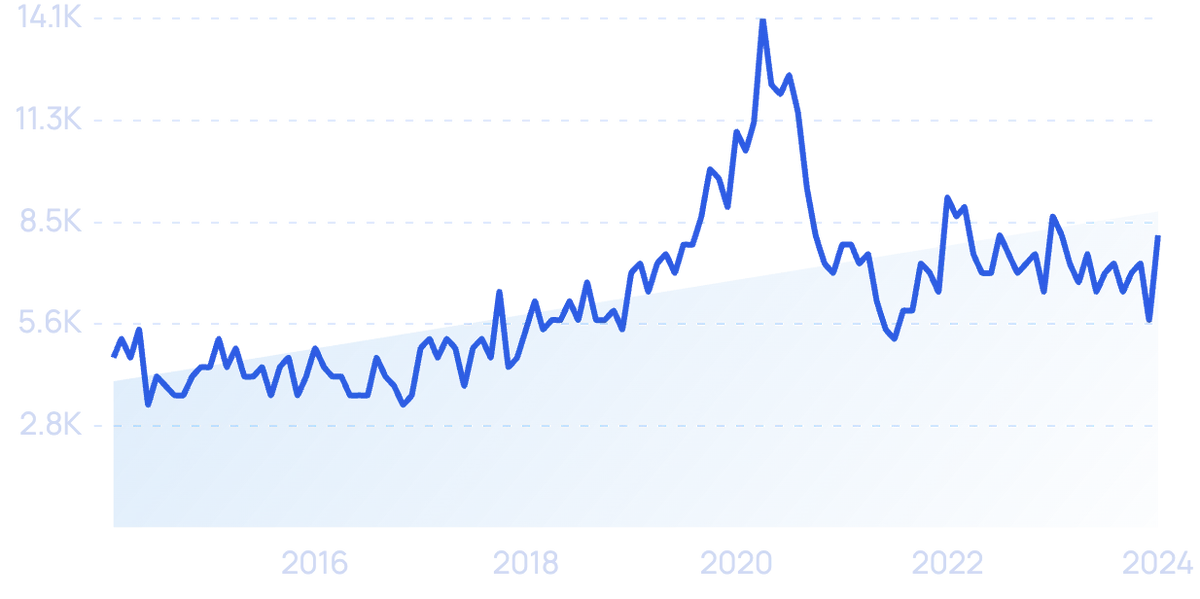

9. Demand For SEO Software Continues to Grow

As email service providers, SEO software is far from a brand new category.

Despite that, space continues to see steady growth.

For example, Ahrefs is slowly becoming one of the market leaders in the space (based on search volume growth and purported revenue numbers).

Interest in SEO software suite "Ahrefs" is steadily increasing (320% in 5 years).

Mangools is in the same category as Ahrefs.

However, Mangools is largely competing on price rather than trying to replicate the features of a full-blown SEO and content marketing platform.

Mangools is going after a market comprised of folks that only need limited features.

Either way, both of these tools represent a growing interest in search engine optimization as a whole. Especially for SEO martech that serves a specific niche.

A great example of this kind of niche SEO tool demand is "Shopify SEO".

Searches for "Shopify SEO" are rising (186% in 5 years).

While those searches don't all represent the demand for tools that people want to add to their current martech stack (some of these searches are people looking for information).

But it does show that marketing leaders are increasingly seeking out niche tools that are designed specifically for their needs (this is also known as "vertical SaS").

10. SMS marketing goes mainstream

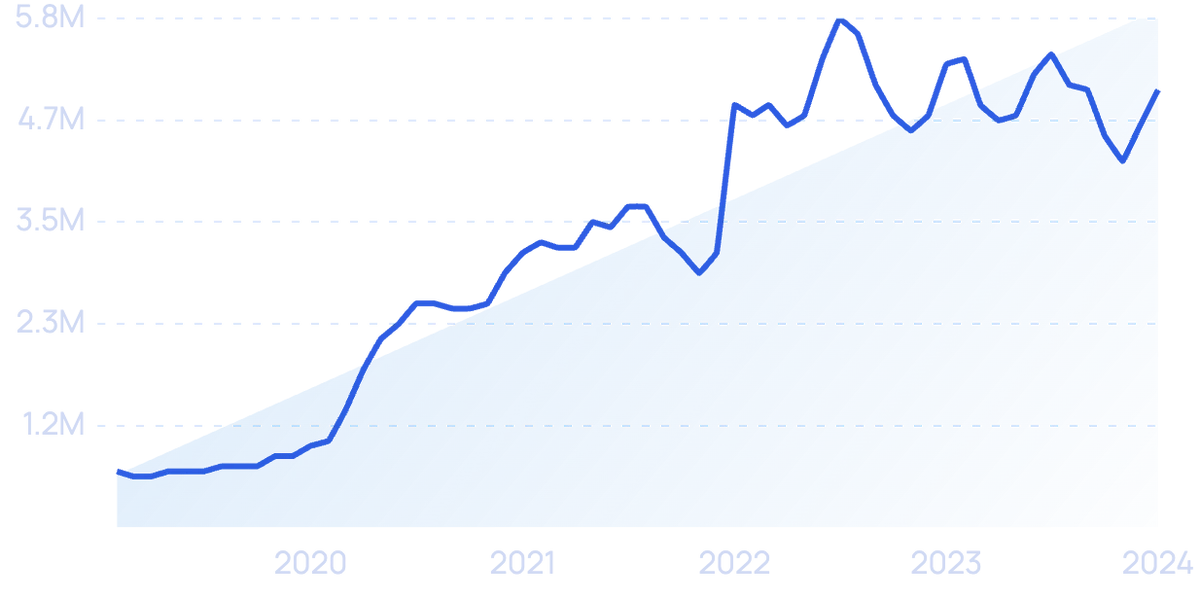

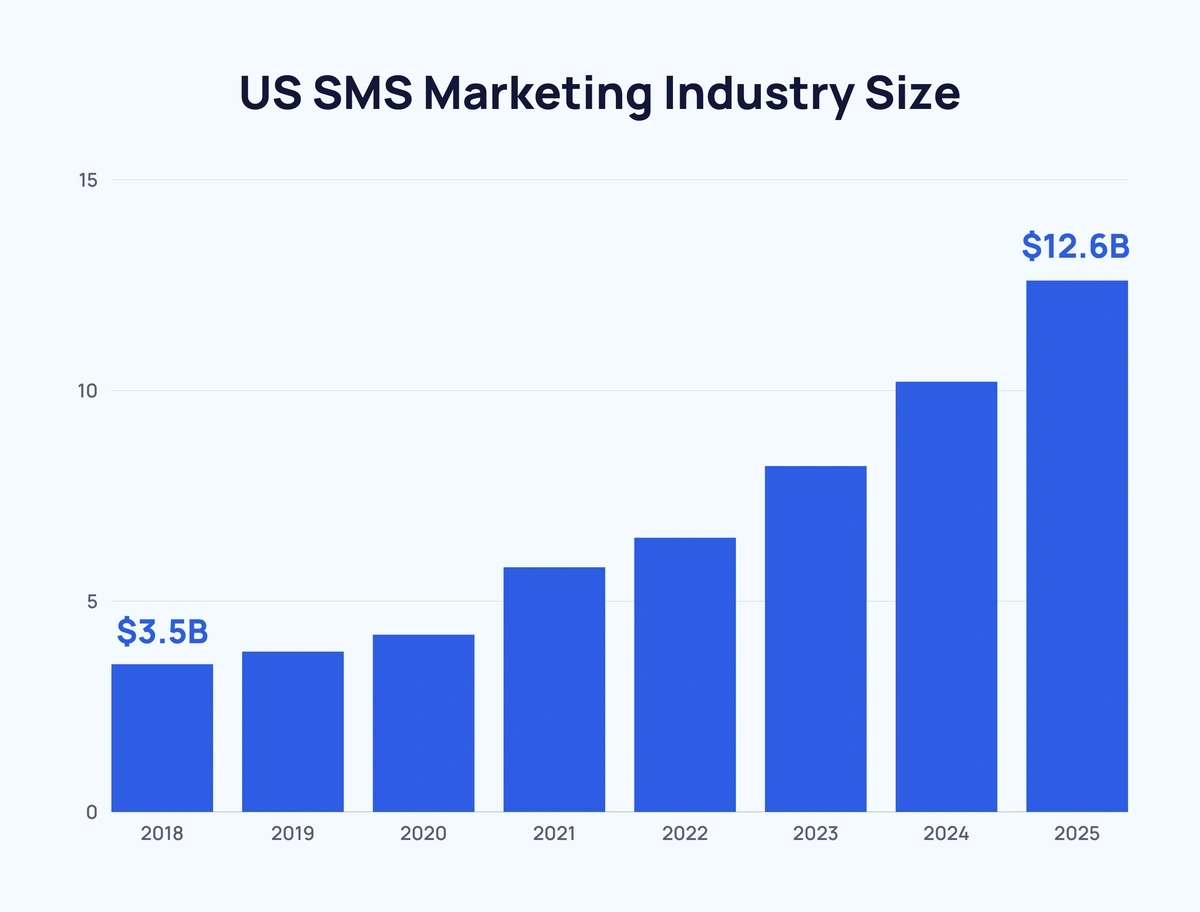

The US SMS marketing industry is forecast to grow to $12.6 billion in 2025, up from $5 billion in 2020 (CAGR of around 20%).

Chart of the SMS marketing industry's growth.

According to Gartner, as of 2016, the average SMS text message open rate was as high as 98%.

That’s 4 times the average open rate of emails, which is 21.33%.

This is why a growing number of companies are adding SMS tools to their marketing stack.

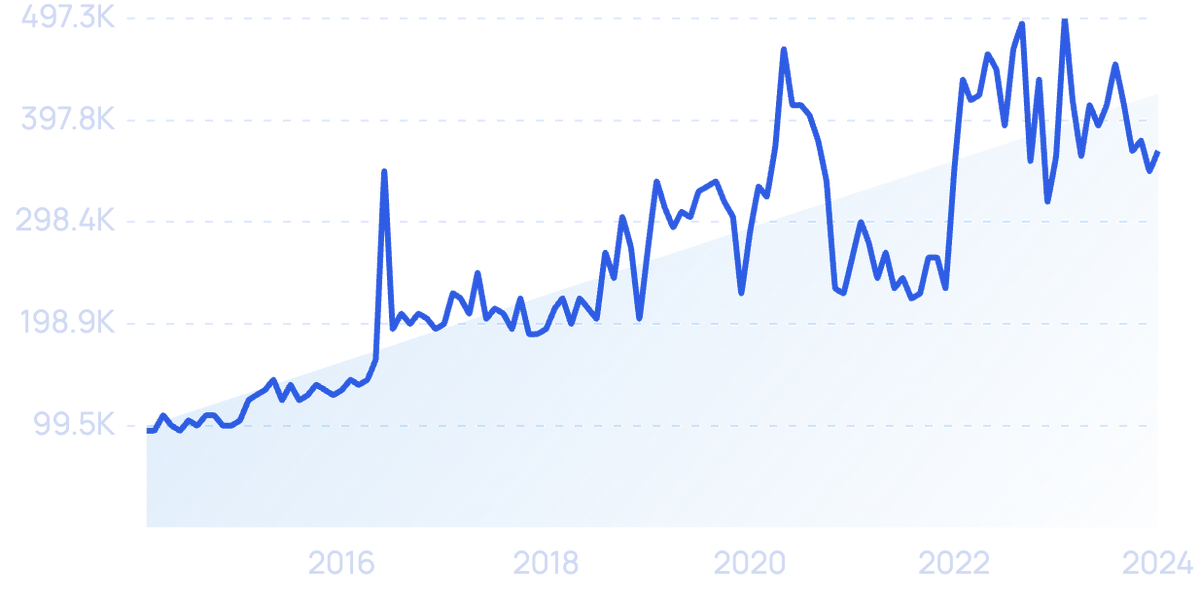

One of the leaders in SMS marketing is Twilio.

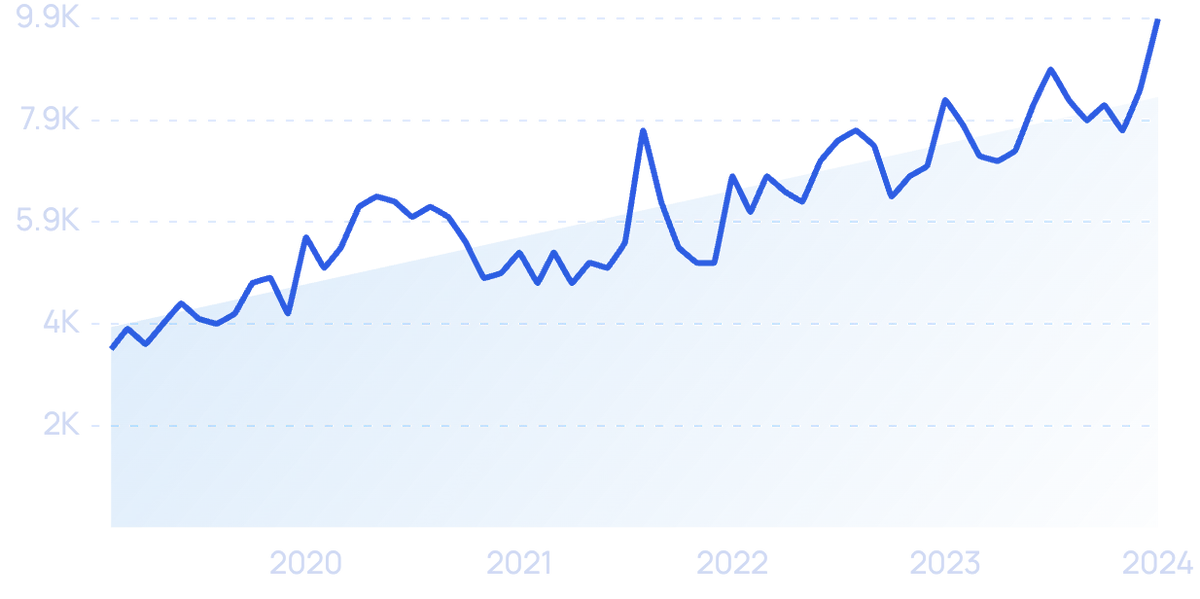

Searches for "Twilio" have increased by 289% over 10 years.

The company offers a full cloud communications platform, including not only API-based SMS marketing functions but also email, phone calls, chatbots, and more.

Twilio also owns 2FA app Authy and recently acquired Segment, a customer data platform.

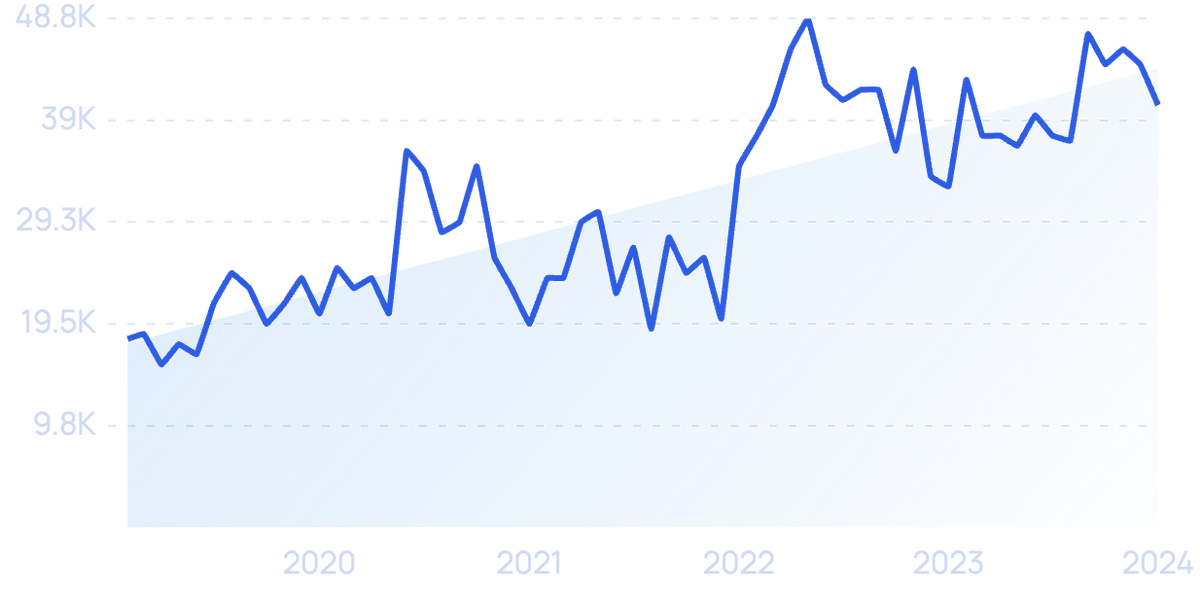

An emerging competitor is Netherlands-based MessageBird, which also supports voice, WhatsApp, and other platforms.

MessageBird raised a $200 million Series C in 2020, giving it a $3 billion valuation. The company is backed by Spark Capital, Accel, Y Combinator and others.

MessageBird’s search interest over the last 5 years has increased by 124%.

Bandwidth is another major player.

Founded in 1999, Bandwidth didn’t start off as a rocketship like Twilio and MessageBird. But its customers now include Google, Microsoft, and Zoom. The company has a market cap of $620 billion as of this writing.

Vonage was also founded decades ago, in 2001. It boasts customers like Domino’s, DHL, and Allstate. And has a market cap of over $5 billion.

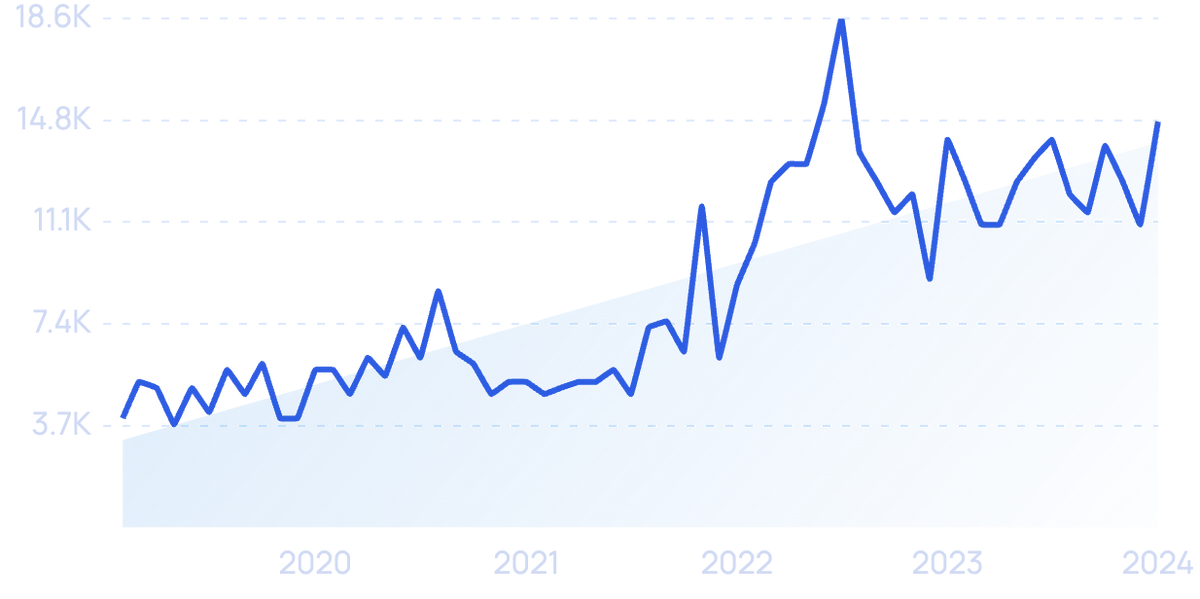

Another all-purpose cloud communications platform is Telnyx. Its service is used by Slack, Philips, and Talkdesk.

Searches for "Telnyx" are growing consistently (up 272% in 5 years).

Other services focus more strongly on SMS and other mobile messaging.

Like OpenMarket, which supports RCS: a new SMS protocol for Android devices. (The company is owned by Amdocs, an $10 billion market cap communications multinational.)

Or Tatango, with customers including Sony Music, Ace Hardware, and TBS.

As well as SimpleTexting, SlickText, VoxDirect, Amazon Pinpoint, EZ Texting, Avochato, Textlocal, TextAnywhere, and Text Marketer.

And some SMS services are built for specific purposes or industries.

Yotpo, Attentive, and Emotive are made for eCommerce sites.

Yotpo raised $75 million in 2020 and has raised $436 million to date.

While Attentive has raised total funding to $863 million.

Emotive is the smallest of the three: its recent round of funding brought its total to $78.2 million.

Postscript and SMS Live are more specifically for Shopify stores. Postscript has raised over $100 million.

SMSDrift works only with Saleforce’s Pardot.

RunGopher, ManyChat, and Mobile Monkey specialize in interactive chatbots (including on Facebook Messenger).

And Textline is for customer service and sales teams. Its customers include Lyft, Farmers Insurance Group, and Tuft & Needle.

Searches for "Textline" over the past 10 years.

While not strictly for marketing purposes, Textel and Red Oxygen are also interesting corporate SMS services.

Textel is geared toward contact centers and has raised $5 million in funding.

While Red Oxygen is designed for organizations’ internal communications. It’s used by Yamaha, Siemens, and Hyatt.

11. More Single-Feature Martech Products Launch

According to data from The Chief Marketing Technologist, the number of martech products has increased by 67.2% since 2017.

This is largely due to no-code and low-code solutions allowing people to launch marketing SaaS products more quickly than ever before.

And due to increasing consumer demand for marketing software that does one thing super well.

For example, Canva (which is valued at $40 billion), has stood out thanks to accessibility and ease of use.

Canva has grown largely thanks to its focus on a single feature (creating social media images.)

Other martech companies that are growing thanks to a relatively simple approach include:

AgencyAnalytics generates client reports for agencies.

Influence Grid is a tool for finding influencers on TikTok.

And Wavve turns podcast episodes into audio clips for sharing on Twitter.

This doesn’t even include the thousands of developers who are rushing to get their apps added to Shopify’s burgeoning app store.

Searches for “Shopify apps” have risen 662% over 10 years.

Conclusion

That's it for our list of important trends in the marketing technology space.

From automation to podcast editing, the martech space is one of the fastest-moving on the planet.

The pandemic pushed digital transformation into the limelight. And forced marketing teams to quickly change up their marketing strategy for a new age.

Hopefully, this post helped you see what's coming next in the world of martech.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more