Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 RegTech Companies & Startups On The Rise In 2024

You may also like:

It’s tough to avoid thousands of regulatory landmines on top of running day-to-day business operations.

From circumventing potential risks to detecting fraud, there are a lot of things to stay on top of.

With the help of regulatory technology solutions, it’s possible to improve, streamline, and automate regulatory processes.

The relatively young RegTech market is valued at $15.8 billion in 2023. As more companies continue to enter this massive space, the industry is projected to reach $85.9 billion by 2032.

In this article, we’ve rounded up some of the hottest RegTech startups that are contributing to the significant growth in this sector.

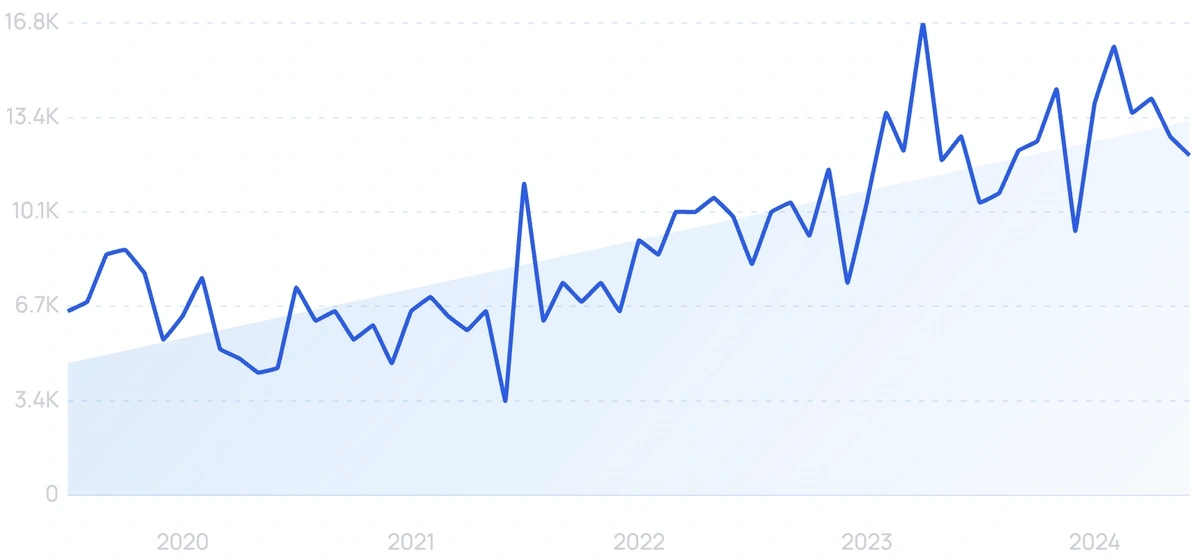

1. Chainalysis

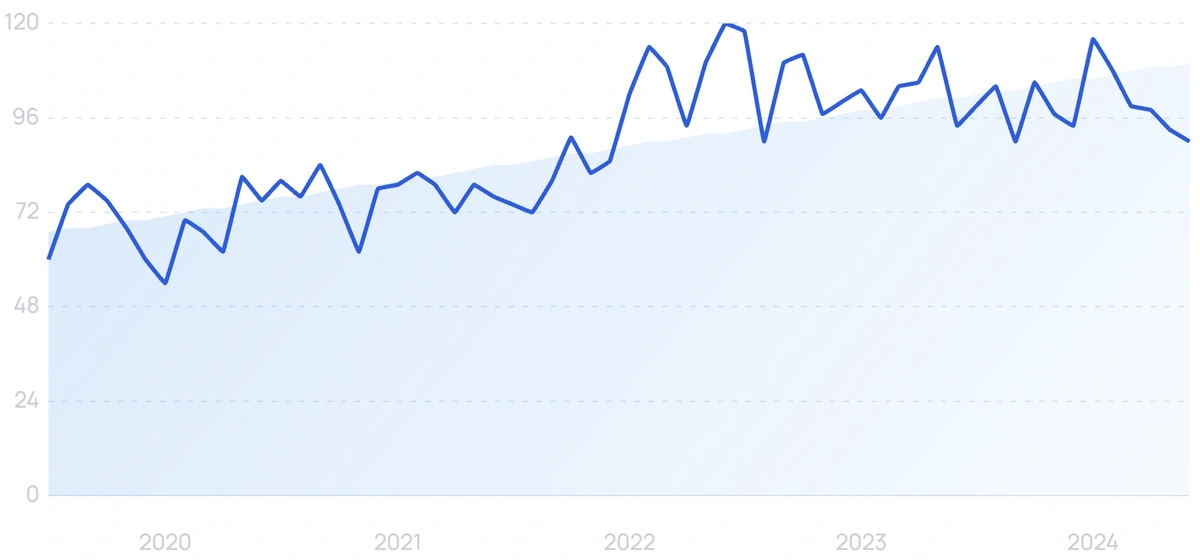

5-year search growth: 150%

Search growth status: Exploding

Year founded: 2014

Location: New York, NY

Funding: $536.6M (Series F)

What they do: Chainalysis is an anti-money laundering (AML) and risk detection solutions provider for blockchains. They offer their cryptocurrency compliance products to crypto companies, financial institutions, and agencies. From KYT (know your transactions) to virtual investigation (crypto forensics), the startup offers a range of solutions. Chainalysis has a global reach, with customers spread across 60+ countries.

2. SumSub

Search growth status: Exploding

Year founded: 2015

Location: Limassol, Cyprus

Funding: $37.5M (Series B)

What they do: A Compliance-as-a-Service provider, SumSub helps businesses monitor fraud and verify users when authorizing transactions. The startup provides various services, including KYC, KYB, transaction monitoring, and fraud prevention. Today, SumSub supports over 2,000 clients.

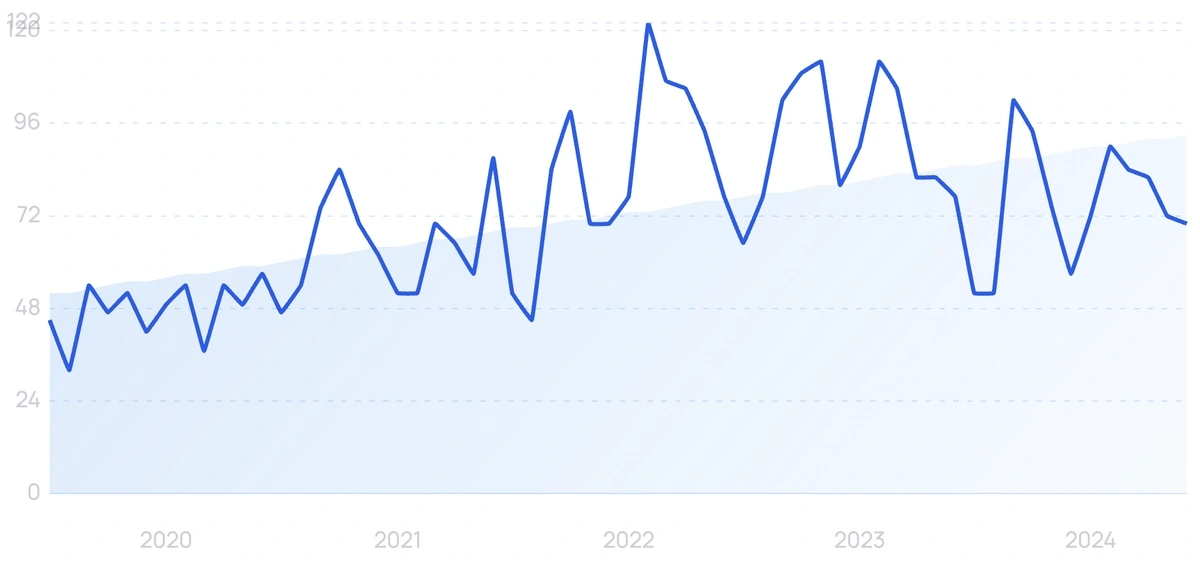

3. Quantexa

5-year search growth: 85%

Search growth status: Regular

Year founded: 2016

Location: London, UK

Funding: $370M (Series E)

What they do: Quantexa helps enterprises with different regulatory compliance domains, including AML, KYC, credit risk, and more. They do this by providing a platform for streamlined data analytics, which, in turn, can potentially help customers make contextual decisions. So far, Quantexa’s solutions have been deployed across more than 70 countries. Their products are specifically catered to banking, insurance, and government organizations.

4. FundApps

5-year search growth: 55%

Search growth status: Regular

Year founded: 2010

Location: London, England

Funding: Undisclosed (Private Equity)

What they do: FundApps is a UK-based regtech startup that provides software solutions for financial compliance management to asset managers and other financial institutions. Their cloud-based platform automates the regulatory compliance process by monitoring regulatory changes, analyzing data, and providing reports to help clients ensure compliance. Founded in 2010, FundApps has grown rapidly and now serves hundreds of clients in over 40 countries.

5. Ascent

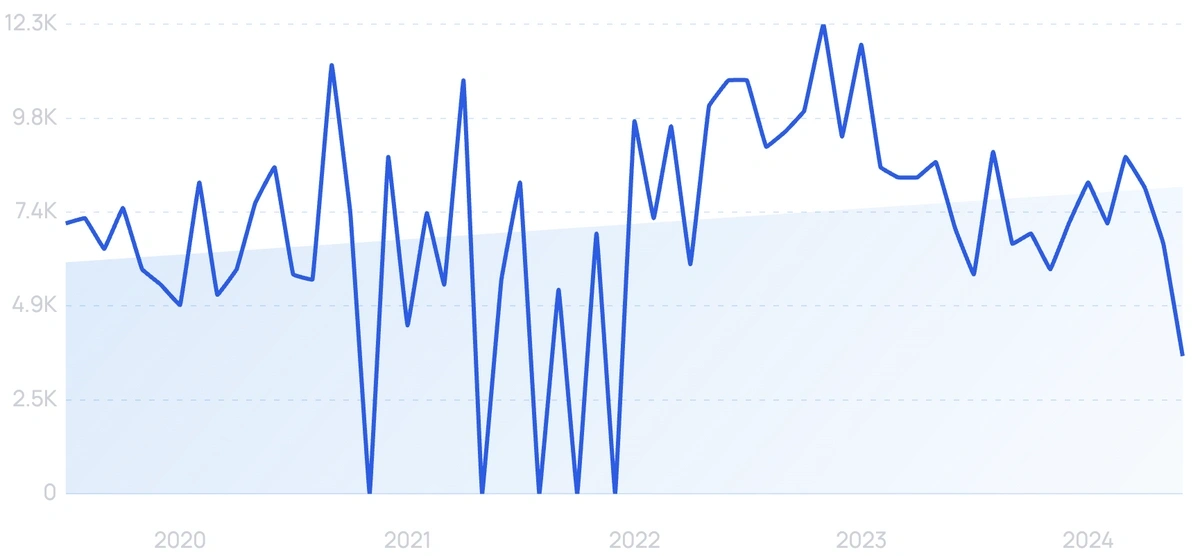

5-year search growth: 7,100%

Search growth status: Regular

Year founded: 2015

Location: Chicago, IL

Funding: $29.4M (Series B)

What they do: Ascent offers cloud-based regulatory compliance software for financial businesses, banks, law firms, and asset management companies. The platform enables users to track internal activities and automate the process of figuring out the legal obligations for their business. It’s estimated that Ascent earns up to $25M in annual revenue.

6. ClauseMatch

5-year search growth: 56%

Search growth status: Regular

Year founded: 2012

Location: London, UK

Funding: $21.1M (Series Unknown)

What they do: A SaaS startup, ClauseMatch is closing a major gap in regulatory compliance tech – smart document management. Through centralized, automated policy and regulatory change solutions, ClauseMatch can help its users take the busy work out of compliance document management. The platform’s features include an online editor, a regulatory portal, AI-enabled content mapping, and more. ClauseMatch has an impressive clientele, with names like Barclays, Cincinnati Financial Corporation, and Revolut.

7. APIsec

5-year search growth: 4,200%

Search growth status: Regular

Year founded: 2017

Location: San Francisco, California

Funding: $2M (Seed Round)

What they do: API security breaches and attacks rose in 2023, accounting for 27% of all cyberattacks. To combat this issue, APIsec offers security testing and vulnerability detection for enterprise companies that want to improve security and meet regulations. The company reached $3.4 million in revenue in 2023.

8. Mindbridge AI

5-year search growth: 54%

Search growth status: Regular

Year founded: 2016

Location: Ottawa, Canada

Funding: $102.3M (Private Equity)

What they do: A FinTech startup, Mindbridge AI offers tools for auditing and analyzing financial data. Their AI-powered solutions are specifically designed for financial institutions, government agencies, auditing firms, and enterprises. According to their website, Mindbridge AI’s data analysis and auditing products are being used by more than 20,000 financial analysts and auditors across the world. The company also made it to the annual Forbes AI 50 list in 2021.

9. 6clicks

5-year search growth: 50%

Search growth status: Regular

Year founded: 2019

Location: Melbourne, Australia

Funding: $34.2M (Series A)

What they do: A risk and compliance management operating system, 6clicks offers a platform designed to tackle different compliance-related problems. Enterprises can use 6click’s assortment of tools to conduct audits, manage policies, automate risk management, and more. On their website, the startup claims that their AI-enabled compliance engine can improve the efficiency of compliance mapping by 14X.

10. CyberGRX

5-year search growth: 14%

Search growth status: Regular

Year founded: 2015

Location: Denver, CO

Funding: $99M (Series D)

What they do: CyberGRX is a cybersecurity startup for enterprises that helps organizations steer clear of third-party risks. It’s a risk management software designed to help enterprises identify, prioritize, assess, and reduce potential cyber risks. CyberGRX was named the best tech startup by The Tech Tribune and one of the best places to work at by Built in Colorado.

11. ThetaRay

5-year search growth: 6%

Search growth status: Regular

Year founded: 2013

Location: Hod Hasharon, Israel

Funding: $169.5M (Series D)

What they do: A threat detection platform, ThetaRay uses automated big data analytics for the finance industry. Their primary offering includes a platform for AML risk management (focused on correspondent banking). They also have a solution to analyze risks associated with cross-border payments. The startup claims that its products can result in a 90% reduction in alerts and a 50% increase in revenue.

12. DataVisor

5-year search growth: -49%

Search growth status: Regular

Year founded: 2013

Location: Mountain View, CA

Funding: $94.5M (Series Unknown)

What they do: DataVisor offers a RegTech platform that uses unsupervised machine learning for risk management. It is designed for the financial, retail, travel, and shipping verticals. DataVisor’s solutions can potentially help protect their customers from digital attacks, fraud, and other online threats. They do this through a robust risk management platform (dOps), combined with a fraud detection system (dVector) and a fraud management platform (dCube). DataVisor was named in the 2020 Gartner Cool Vendor list under the “Identity and Access Management and Fraud Detection” category.

13. Thirdfort

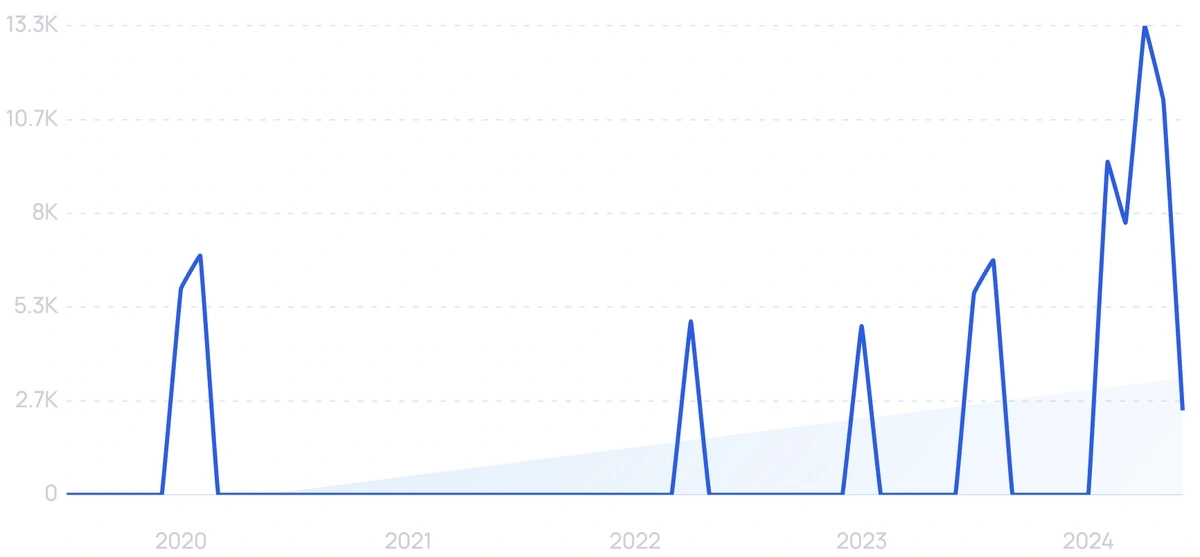

5-year search growth: 8,900%

Search growth status: Exploding

Year founded: 2017

Location: London, England

Funding: $24.7M (Series A)

What they do: Thirdfort is a digital identity verification platform used by lawyers and property professionals to meet compliance regulations. The startup offers tools to verify a client's identity, validate their payment methods, and analyze a client's risk for faster onboarding. In 2024, more than 1,000 businesses use Thirdfort.

14. Evari

5-year search growth: 21%

Search growth status: Regular

Year founded: 2016

Location: Perth, Australia

Funding: Undisclosed

What they do: Evari is a regulatory technology startup that specializes in helping small and medium-sized enterprises navigate complex compliance requirements. Its cloud-based platform offers a suite of solutions for Anti-Money Laundering, Counter-Terrorist Financing, and Know-Your-Customer compliance. By leveraging machine learning and natural language processing, Evari streamlines compliance workflows and automates risk assessments, saving SMEs time and money while reducing their regulatory risk.

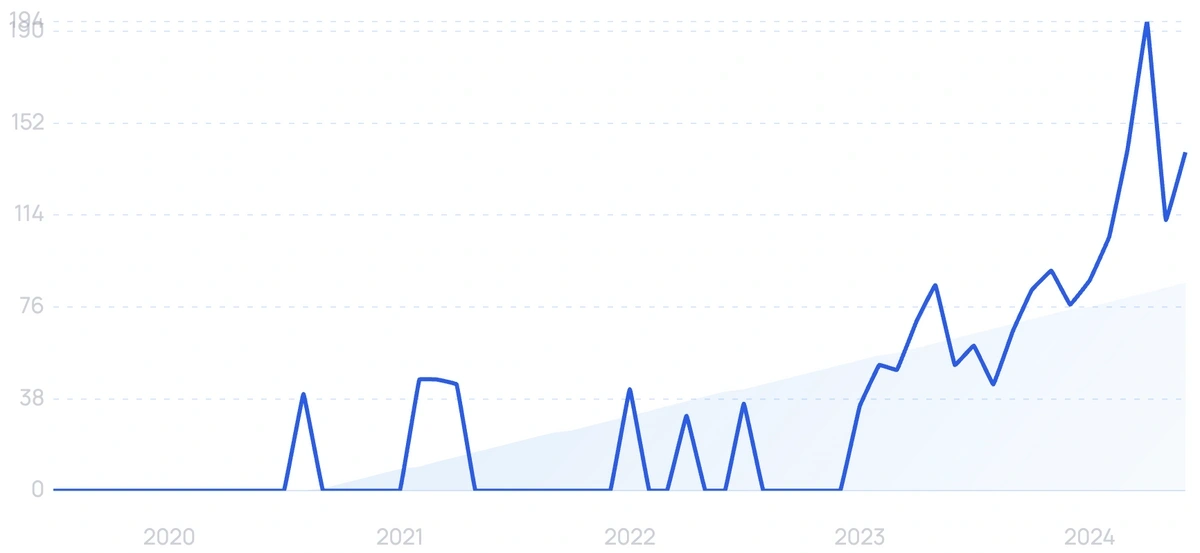

15. Hawk:AI

5-year search growth: 1,900%

Search growth status: Exploding

Year founded: 2018

Location: Munich, Germany

Funding: $27M (Series B)

What they do: A real-time transaction monitoring platform, Hawk:AI helps finance companies detect and avoid criminal activities (fraud and money laundering). In a nutshell, their core product is designed to help their customers improve their financial compliance processes. Hawk:AI earns around $99.9K in monthly revenue (or about $1.2M ARR).

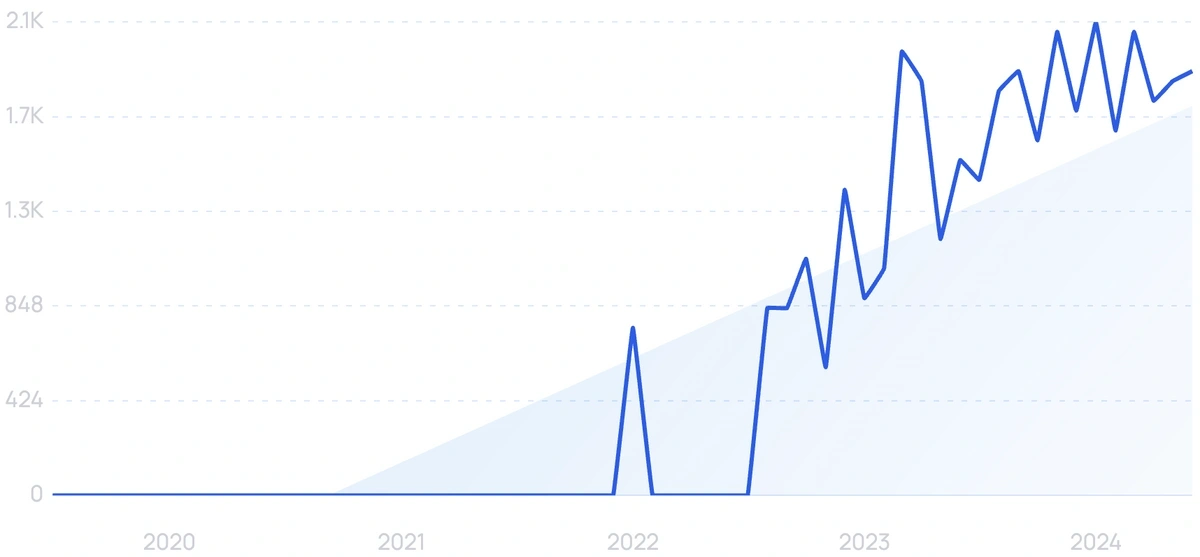

16. Corlytics

5-year search growth: 1,700%

Search growth status: Regular

Year founded: 2013

Location: Dublin, Ireland

Funding: $26.2M (Series Unknown)

What they do: Corlytics is a provider of regulatory risk intelligence solutions. Their platform is designed to help businesses stay up-to-date with the latest regulatory compliance changes. For this purpose, they offer a regulation library, an analytics tool, and a regulation monitoring platform. In 2018, Corlytics won the MEDICI Top 21 RegTech award. They were also one of the startups awarded the Disruptive Technologies Innovation Fund by the Irish government in 2019.

17. ComplyAdvantage

5-year search growth: 77%

Search growth status: Regular

Year founded: 2014

Location: London, UK

Funding: $108.2M (Series C)

What they do: ComplyAdvantage is a London-based FinTech startup that offers AML compliance solutions to financial institutions. From customer screening and monitoring to media insights, the platform offers solutions designed to help finance companies stay compliant. The startup has scaled to over 200 employees who work together to serve over 500 customers.

18. Behavox

5-year search growth: 10%

Search growth status: Peaked

Year founded: 2014

Location: London, UK

Funding: $121.4M (Series Unknown)

What they do: An award-winning company, Behavox offers a collection of risk and compliance-related solutions for enterprises. They employ artificial intelligence and machine learning to help identify internal threats, problematic employee behavior, and market misconduct. They also offer a platform for archiving organizational data in one place. Forbes named Behavox as one of the most innovative fintech companies in 2021.

19. NorthRow

5-year search growth: 37%

Search growth status: Regular

Year founded: 2010

Location: Abingdon, UK

Funding: $6.7M (Convertible Note)

What they do: NorthRow enables companies in the finance, payments, hospitality, and property/real-estate verticals with their AML compliance programs. The startup’s key investors include Maven Capital Partners, Angel CoFund, and Mercia Asset Management, among others. With NorthRow’s platform, businesses can not only manage a compliant customer onboarding experience but also monitor regulatory risks and manage customer remediation.

20. Tessian

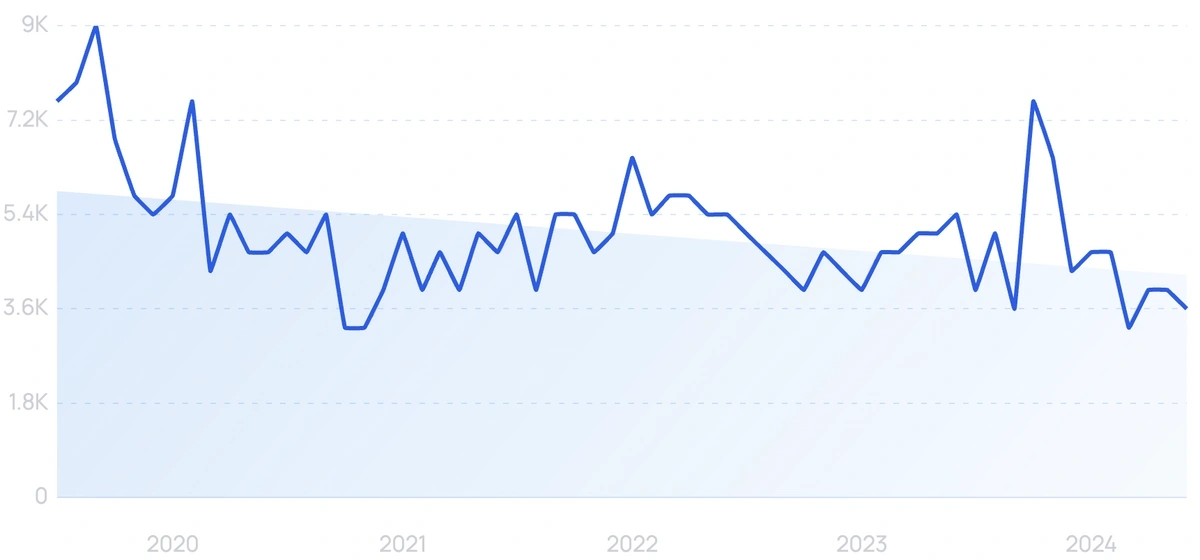

5-year search growth: -52%

Search growth status: Peaked

Year founded: 2013

Location: London, UK

Funding: $132.6M (Series C)

What they do: Tessian helps businesses reduce compliance risks associated with potential human error on email. Their “human layer security” platform is designed to avoid phishing attacks, accidental data leakages, and other compromises. Leading enterprises like Evercore, Hill Dickinson, and Gubra use Tessian’s platform to streamline their email compliance processes.

Conclusion

That wraps up our list of the rising regulatory technology startups to follow in 2024.

These ventures are helping businesses navigate the tricky waters of regulatory compliance with cutting-edge tech like artificial intelligence and machine learning.

As globalization continues, the need for smart compliance solutions will only increase.

This indicates that the RegTech market has a lucrative future ahead.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more