Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Top Startup Databases (2025)

Startup databases can be used to find new investment opportunities, spot a job opening at an up-and-coming company, or discover a new emerging market. Or maybe you just need a tool for sales prospecting.

Whatever it may be, there is an available database for every use case. But since there are so many available tools, choosing a platform that offers the features you need most can be overwhelming. Startup databases are most commonly used for:

- Finding potential startups to invest in

- Researching high-growth startups that are currently hiring

- Discovering newly launched or trending companies

Each startup database listed below is ranked based on the size of its database, pricing, and available features. Let’s dive in.

1. CB Insights

CB Insights is a market intelligence platform that provides industry reports and a number of investment research tools.

Specifically, their comprehensive startup database tracks private company details and investor activity.

CB Insights has a database of well-established companies along with newer startups. The bulk of the companies listed are in one of these industries:

- Consumer

- Healthcare

- Insurance

- Tech

- Industrial

- Finance

Investing in a CB Insights subscription makes sense if you operate in one of these industries.

You can use the platform to:

- Find new startup investment opportunities

- Discover and track trends for over 160 industries

- Spy on competitor fundraising efforts

- Perform advanced market research

- Fetch real-time data and insights

Pricing

CB Insights has a custom pricing model. You can sign up for a 7-day free trial, but pricing is based on your specific needs. Customers are required to request a demo to see actual pricing for your business.

Who Should Use CB Insights?

VCs, entrepreneurs, and angel investors will benefit most from the CB Insights platform. The collection of emerging tech start-ups and detailed research reports are useful for finding potential investment opportunities.

CB Insights is better for larger VC funds and corporate strategy teams because of the substantial upfront investment and complex predictive analysis tools. If you’re looking to find more under-the-radar startups on a budget, you should check out a different tool on this list.

2. Crunchbase

Crunchbase is a leading platform for data on public and private companies. The database creates detailed company profiles for each startup with information about company funding rounds, estimated revenue ranges, recent company news, and their tech stack.

Crunchbase is particularly useful for finding startups to invest in as venture capital (VC) or private equity (PE) partners. However, the advanced data can be used to research new markets, spy on competitors, and build sales pipelines.

As an investor, you can use your Crunchbase membership to:

- Receive alerts about new funding rounds, mergers, and acquisitions

- Connect with startup founders and integrate outreach with your CRM

- Find competitors and see who other investors are investing in

- Perform market research and track industry trends

Crunchbase also covers nearly every industry. You can explore startup profiles and industry trends in different categories like:

- Advertising

- Artificial Intelligence

- Biotech

- Financial services

- Healthcare

- Real estate

- Software

- Travel

Who Should Use Crunchbase?

Crunchbase is most commonly used by investors, founders, and sales professionals. Because of the wide range of features, it suits larger enterprises and smaller companies or funds.

We'd recommend using Crunchbase as a prospecting and research tool. However, better alternatives exist if spotting new trends or early-stage startups is your primary objective.

Pricing

Crunchbase allows all users to access basic features for free. This includes:

- Company names and profiles

- Company news

- Funding information

Free users are limited to only five accounts per search and a limited number of monthly searches. There is also a 7-day free trial. When it’s time to upgrade, you can opt for a paid plan:

- Starter: $29/month per user, billed annually

- Pro: $49/month per user, billed annually

- Enterprise: custom pricing

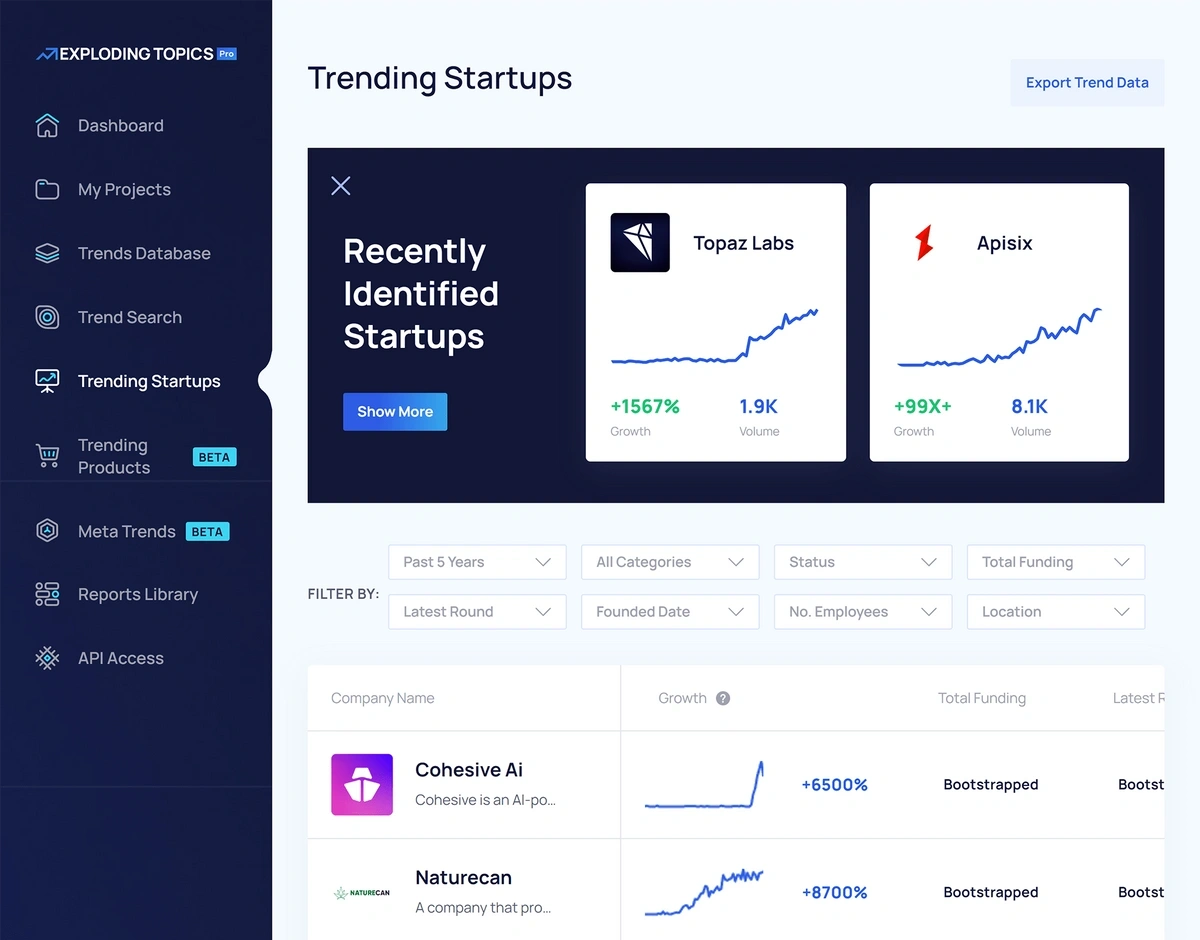

3. Exploding Topics

Exploding Topics is a trend-spotting tool investors, founders, and enterprise strategists use to stay ahead of industry trends. The platform tracks startups based on search growth to help users find under-the-radar companies that might be ready for a VC investment.

When you click on a trending startup, you can view the company profile to learn more. The standard startup profile includes:

- Company name

- Company description

- Founded date

- Total funding

- Latest funding round

- Number of employees

- Location

- Website

- Social platforms (if available)

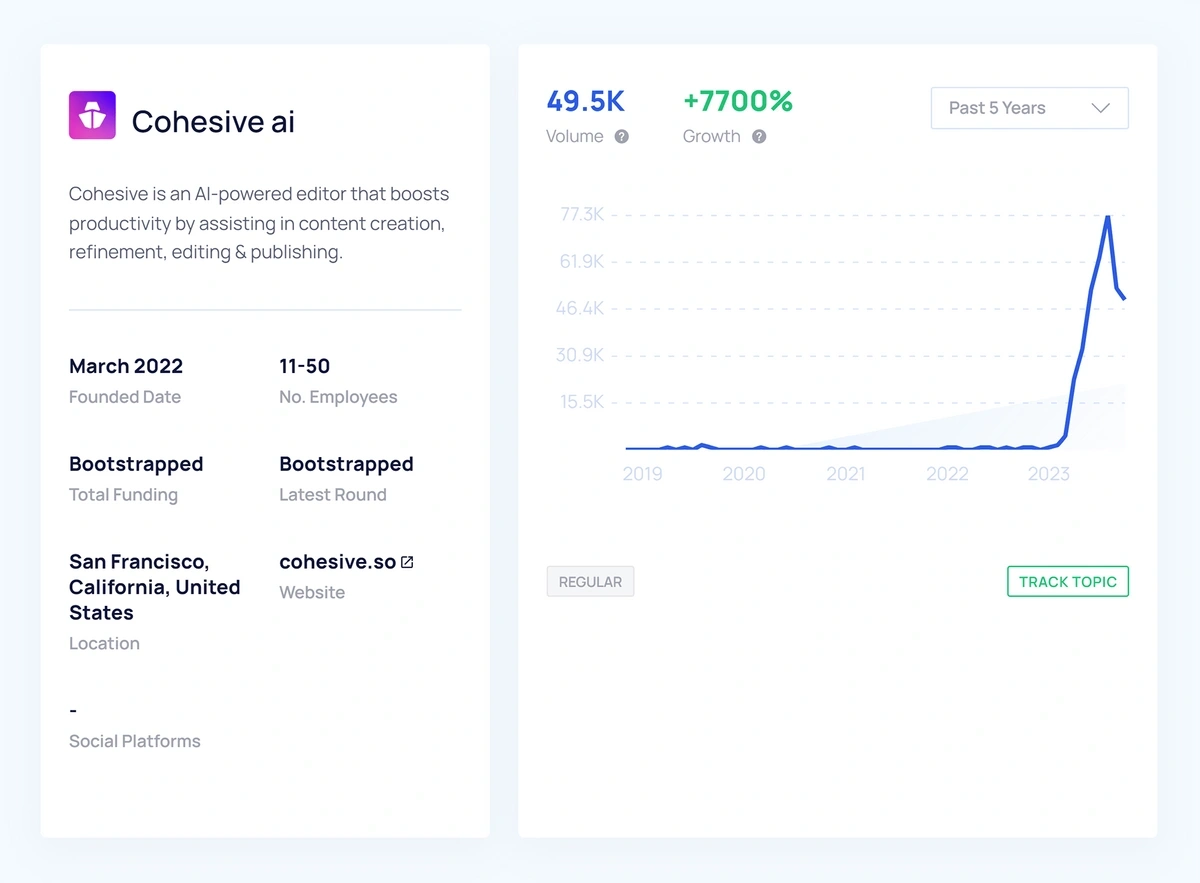

Here’s an example of what you would see if you wanted to learn more about Cohesive AI.

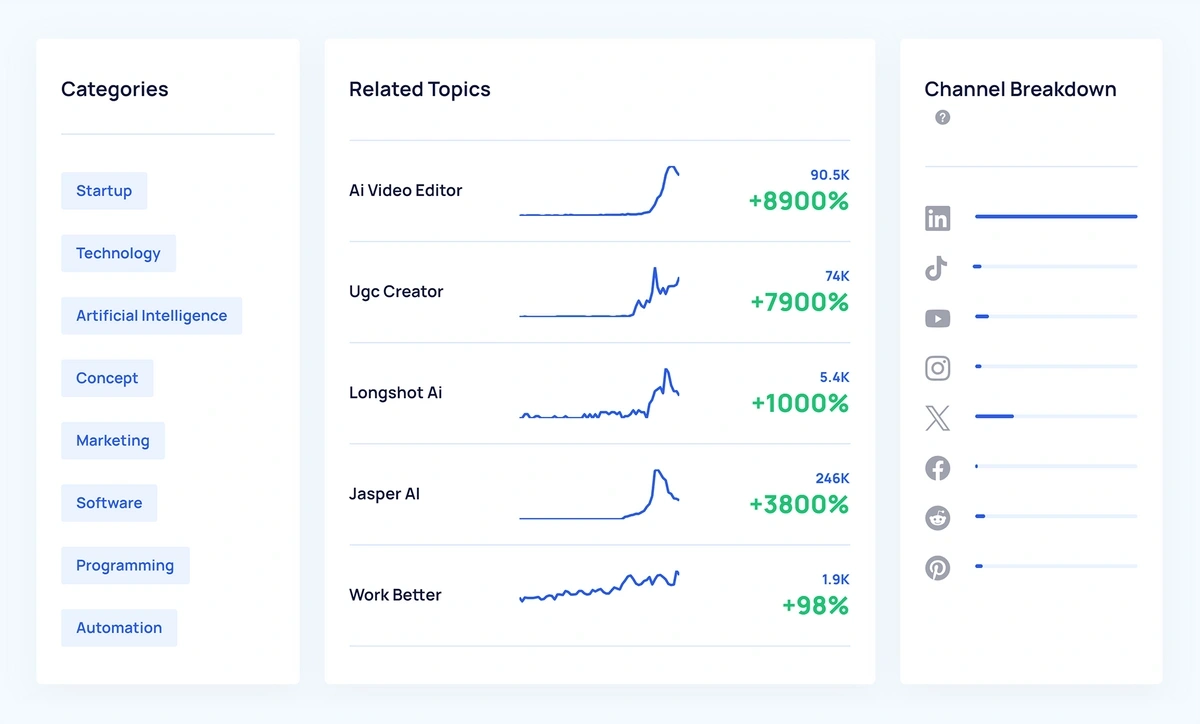

The search growth is based on Google search volume and social media chatter. The newest Exploding Topics feature shows you which channels are showing the most activity related to a topic or startup.

As you can see, LinkedIn is where Cohesive AI is generating the most buzz. If you want to keep an eye on this startup, click “Track Topic” and add it to a new Project.

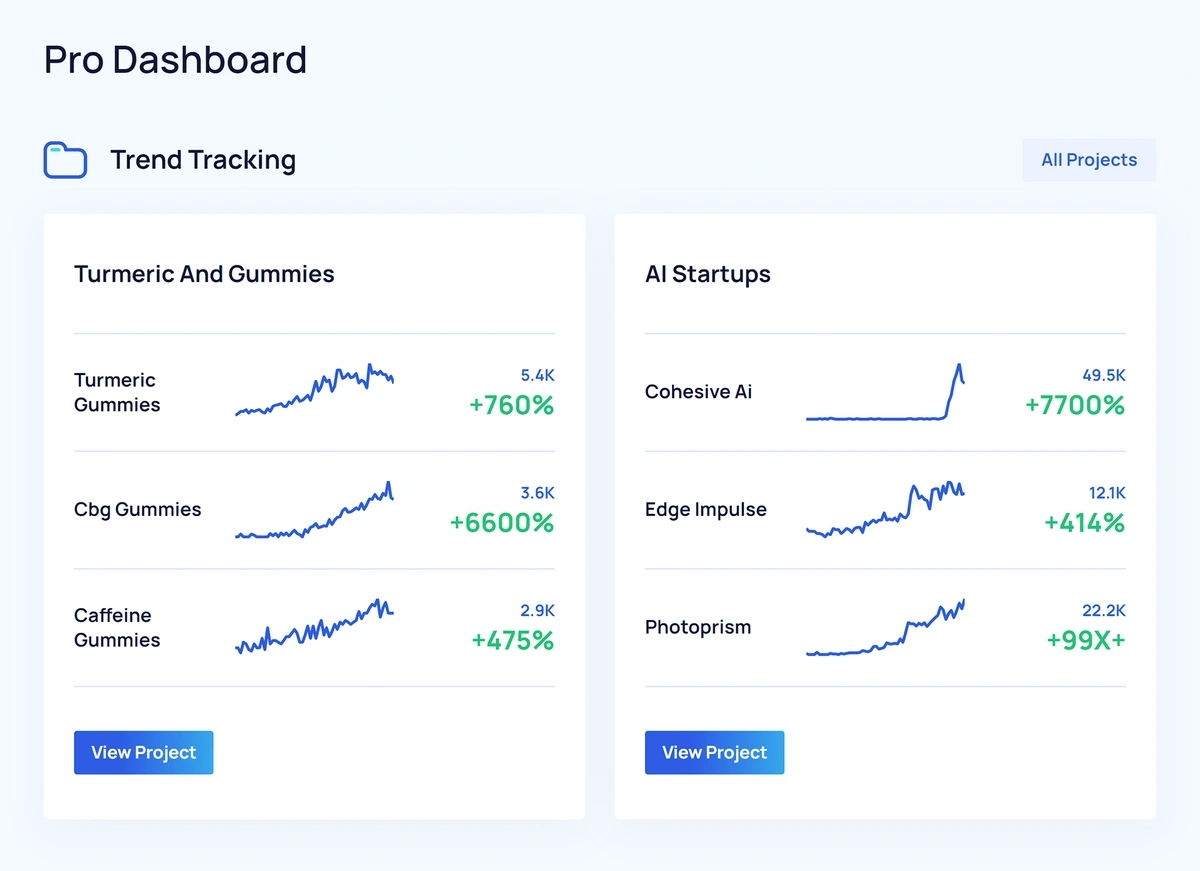

After creating a new project, your Pro dashboard will look like this.

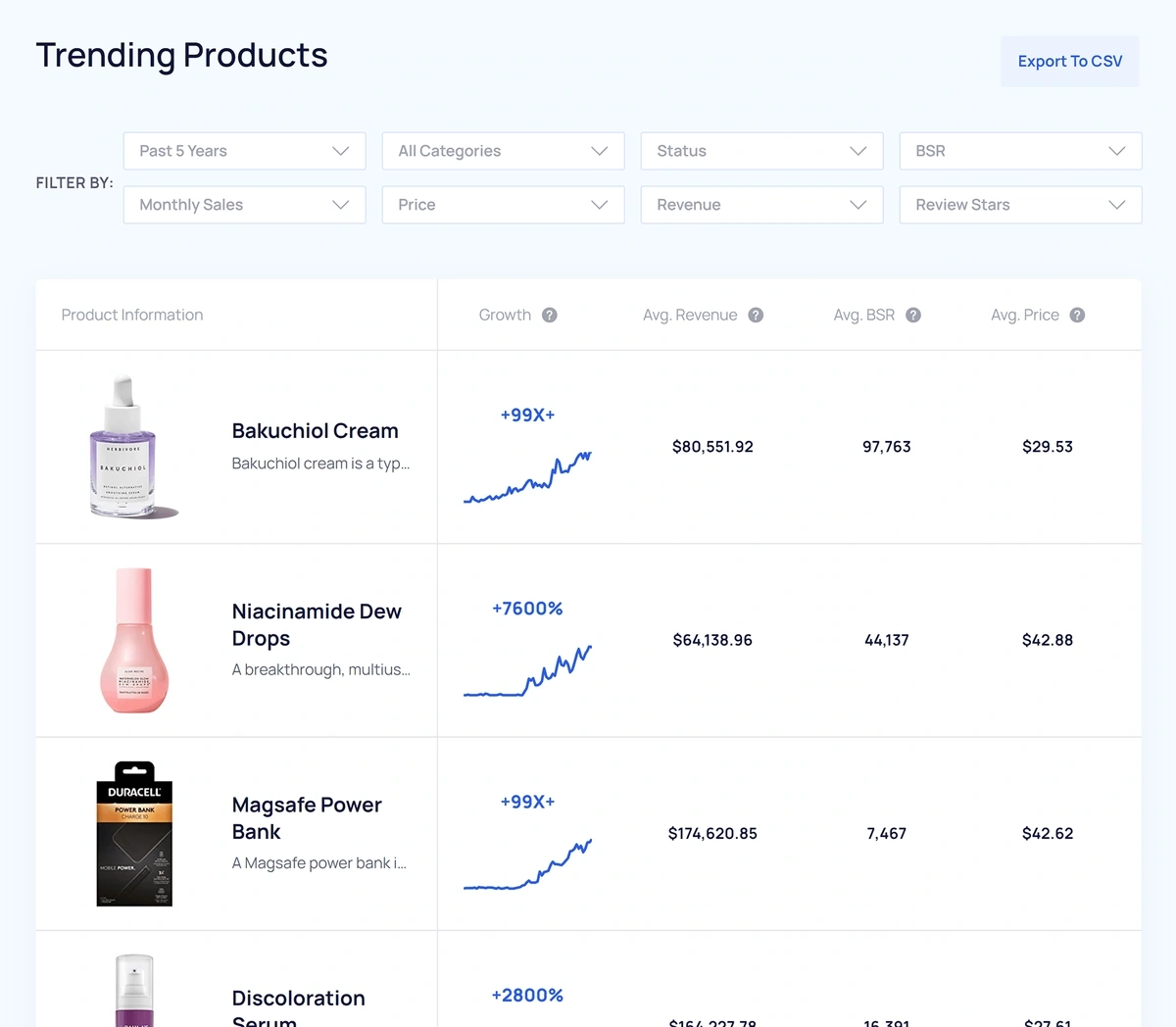

You can use Exploding Topics as much more than just a traditional startup database. It can also be used to find trending topics and products. The Trending Products tool includes a number of relevant Amazon sales data: average revenue, BSR (best seller ranking), price, average sales, etc.

This sales data can be helpful when looking for trending DTC startups and product categories.

Exploding Topics also sends out weekly reports to Pro members.

These weekly reports include eight curated companies, products, and topics sent directly to your inbox. Pro members can access previous reports in their Exploding Topics pro dashboard.

You can also dig deeper into specific startups or product categories using the Semrush Traffic & Market Toolkit. There are various tools available to analyze a company's traffic, competitive landscape, and past performance.

Who Should Use Exploding Topics?

Entrepreneurs and investors get the most use out of the Exploding Topics platform. You can estimate the future growth of a product, company, or topic based on the Exploding Topics data. It’s ideal for finding early-stage startups that are brand new or just starting to gain traction.

Pricing

You can use Exploding Topics for free to get started. Free users get limited access to the database. But to access more features, you can sign up for a 7-day trial for $1.

After the trial ends, you can choose from three pricing plans:

- Entrepreneur: $39/mo for 1 user seat, billed annually

- Investor: $99/mo for 4 user seats, billed annually

- Business: $249/mo for 10 user seats, billed annually

4. PitchBook

PitchBook is a market intelligence platform used by venture capital and private equity professionals to find potential startups to invest in.

The PitchBook platform is much more than just a startup database. Investors and founders can use the platform to:

- Connect with other industry professionals, fund managers, founders, and investors

- Raise capital for a startup

- Source investment deals

- View previous investments, mergers, and acquisition (M&A) deals

- Export detailed public and private company financials

One of the downsides to PitchBook is the steep learning curve and significant upfront investment required to get started.

It's available as a desktop app and mobile app. Plus, you can download an Excel or Chrome plugin to export and import data faster.

Who Should Use PitchBook?

The PitchBook platform is ideal for investors, fund managers, M&A executives, and founders because of the advanced funding data. Investors can find public and private company financials and review past deals. If having too much information is a concern, there are better options available.

Pricing

PitchBook keeps pricing private because it’s customizable according to what you need from the platform. But you should be prepared to pay a hefty membership fee of around $12,000/year for 1 seat. The high price is why larger investment funds mostly use this tool.

5. Tracxn

Tracxn is a market research platform and a private startup database. This market intelligence tool is used for tracking startups and private companies in technology sectors and emerging industries.

This tool is most used for:

- Sourcing new investment opportunities

- Tracking trending startups and finding new ones

- Staying up to date on new funding rounds and acquisitions

- Performing in-depth company due diligence

- Managing investment deals and monitoring your portfolio

The feature that sets Tracxn apart from other startup databases is its quarterly reports. They publish over 1,000 reports every quarter, covering 2,500+ sectors in detail. These reports cover:

- Funding & investment trends

- Recent unicorn updates

- Business model leaderboards

- Competitive landscape analysis

It’s used as much more than just a simple startup database: Tracxn also tracks 1,800 different trending topics.

Who Should Use Tracxn?

Tracxn is most commonly used by venture capitalists, private equity professionals, corporate development teams, angel investors, and startup founders. This is because it can effectively be used to build VC funding analysis and identify emerging sectors for potential investments.

The platform can also be a way to find new, trending startups using the Soonicorn Rating feature. The Soonicorn Rating is given to fast-growing startups with unicorn potential.

Tracxn is also useful for journalists because of its data visualization service. Because of the pricing and advanced features, we recommend Tracxn to larger teams instead of solo investors.

Pricing

Tracxn is not cheap, and pricing is based on your team size. The pricing is customizable for each enterprise. Each seat gets more affordable as your team gets larger. Some of the available pricing plans include:

- Small team plan: Three users for $1,100 per month, billed annually

- Medium team plan: Seven users for $2,200 per month, billed annually

- Large team plan: 25 users for $7,150 per month, billed annually

- Corporate plan: Custom-pricing; demo required

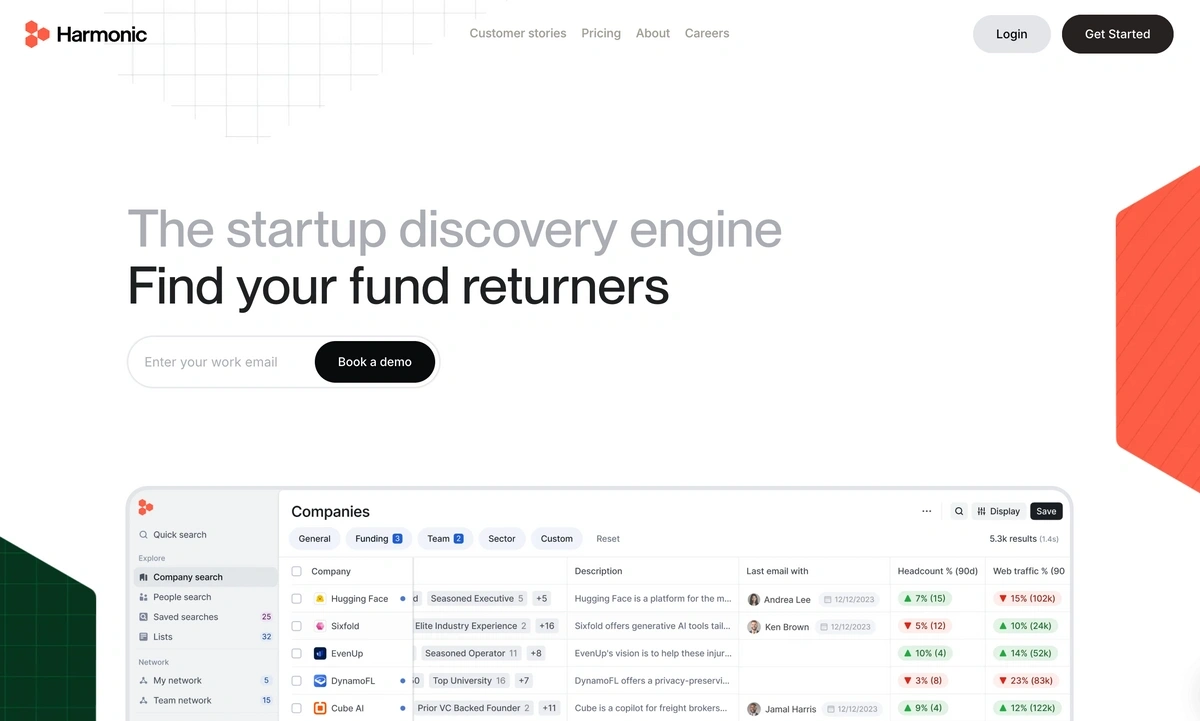

6. Harmonic.ai

Harmonic is an AI-powered startup database built specifically for early-stage venture capital investors looking to discover new investment opportunities.

The platform uses machine learning and proprietary web scraping to track millions of companies in real-time, while providing deep insights into high-growth startups. It allows users to filter companies based on:

- Industry and business model

- Funding stage and investor signals

- Hiring velocity and job titles

- Leadership’s past experiences

- Headcount totals and growth

- Founder background and location

- Team size, growth rate, and more

You can also use Scout, Harmonic’s AI agent that can performance advanced startup searches to find companies that match your descriptions. It can also automatically monitor your saved filters and notifies you of new companies that match your criteria.

Who Should Use Harmonic?

Harmonic is a solid tool for early stage VCs, individual investors, and sales teams. It makes the research process easier while offering different data points that are hard to find in other platforms, particularly information about stealth startups or founder data. However, you should look elsewhere if you need more advanced financial data.

Pricing

Harmonic offers custom pricing only with enterprise plans, API access, and bulk data options.

7. VentureRadar

VentureRadar is a search and discovery platform with over 280,000 companies. Besides finding new startups and ranking them, the platform tracks recent venture funding rounds and industry news.

All users can browse the database for free and search the featured discovery lists for newly added startups. Some of the notable features include:

- Advanced search filters

- Similar companies lists

- Email alerts

- Exporting search results to CSV

- Company Rankings

- Company Profiles

VentureRadar crawls more than 5 million websites per month to discover new startups and related news. They use a proprietary algorithm to score each startup on a scale of 1-1000 based on profile views, social proof, etc.

Users can perform a search, and it provides results like the Google search engine. You can use VentureRadar to:

- Find, research, and track new companies

- Submit your startup for improved visibility to customers and investors

- Build a sales pipeline

- Track venture funding news

- Stay up to date on the latest market insights and trends

Who Should Use VentureRadar?

VentureRadar is a valuable tool for business professionals, investors, and founders. Business professionals can use it to build out their sales pipeline.

Founders can use the database to submit their startups and connect with investors or partners. And investors can find under-the-radar startups to invest in.

It’s a good starter tool. However, it lacks more advanced features like CRM integrations and trend tracking. Other tools are more suited to managing larger pipelines.

Pricing

VentureRadar is free to use in a limited capacity. Free plans can export up to 10 monthly records and perform 5 daily searches. You can upgrade to one of two plans:

- Business: $99/mo per user for unlimited use

- On-Demand: $150 for 5 weeks; unlimited use for one-off projects

Conclusion

If you currently use news outlets and social media platforms to find new startups, there are better alternatives like Exploding Topics or one of the startup databases mentioned above.

Getting access to the right database can make it easier to find investments, source previous funding details, and connect with other investors or founders.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Anthony is a Content Writer at Exploding Topics. Before joining the team, Anthony spent over four years managing content strat... Read more