Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

13 Top Technology Trends (2025)

In 2025, the global information technology market is valued at approximately $9.6 trillion, up from $8.9 trillion in 2024.

Much of this rapid growth comes from increased investments in AI, cloud infrastructure, and cybersecurity. All of which we’ll cover in this report.

In addition to exploring the latest tech trends, we’ll also peek around the corner to see what's coming next in this space.

1. The Democratization of AI

AI is by far the biggest trend in the tech space right now.

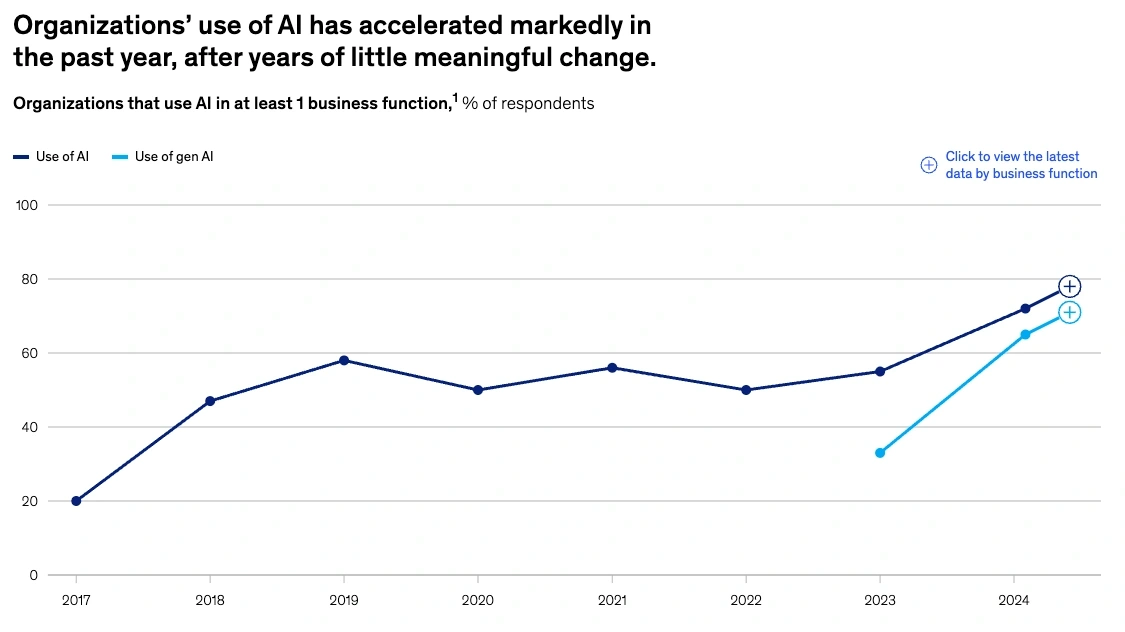

Adoption today is 3.9x higher than it was in 2017.

In fact, 78% of organizations have adopted AI for at least one business function.

AI adoption in enterprises has leveled off recently.

Notably, AI is breaking into finance, healthcare, manufacturing, retail and dozens of other industries.

And, it’s not a technology reserved for large enterprises anymore.

With open-source AI solutions and lower cost and complexity of systems, the democratization of AI is in full swing.

The prime example is OpenAI, the AI non-profit/company behind ChatGPT.

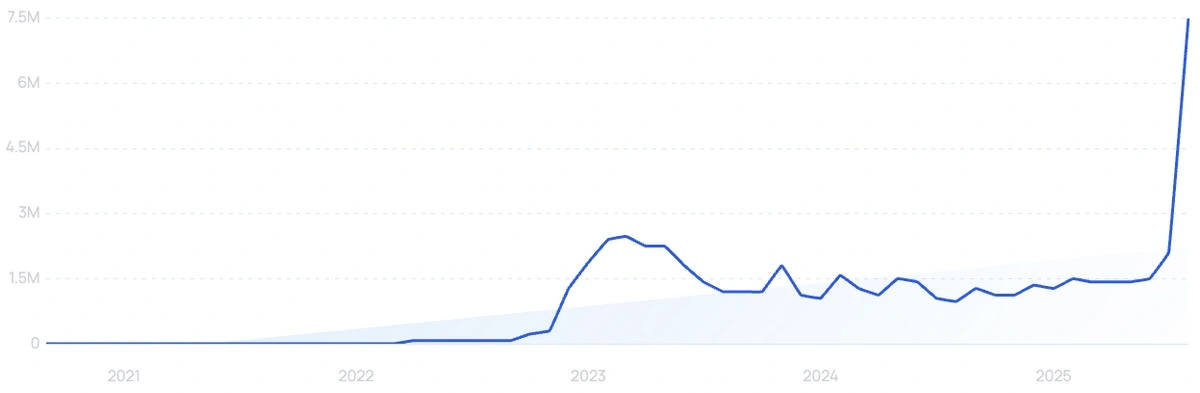

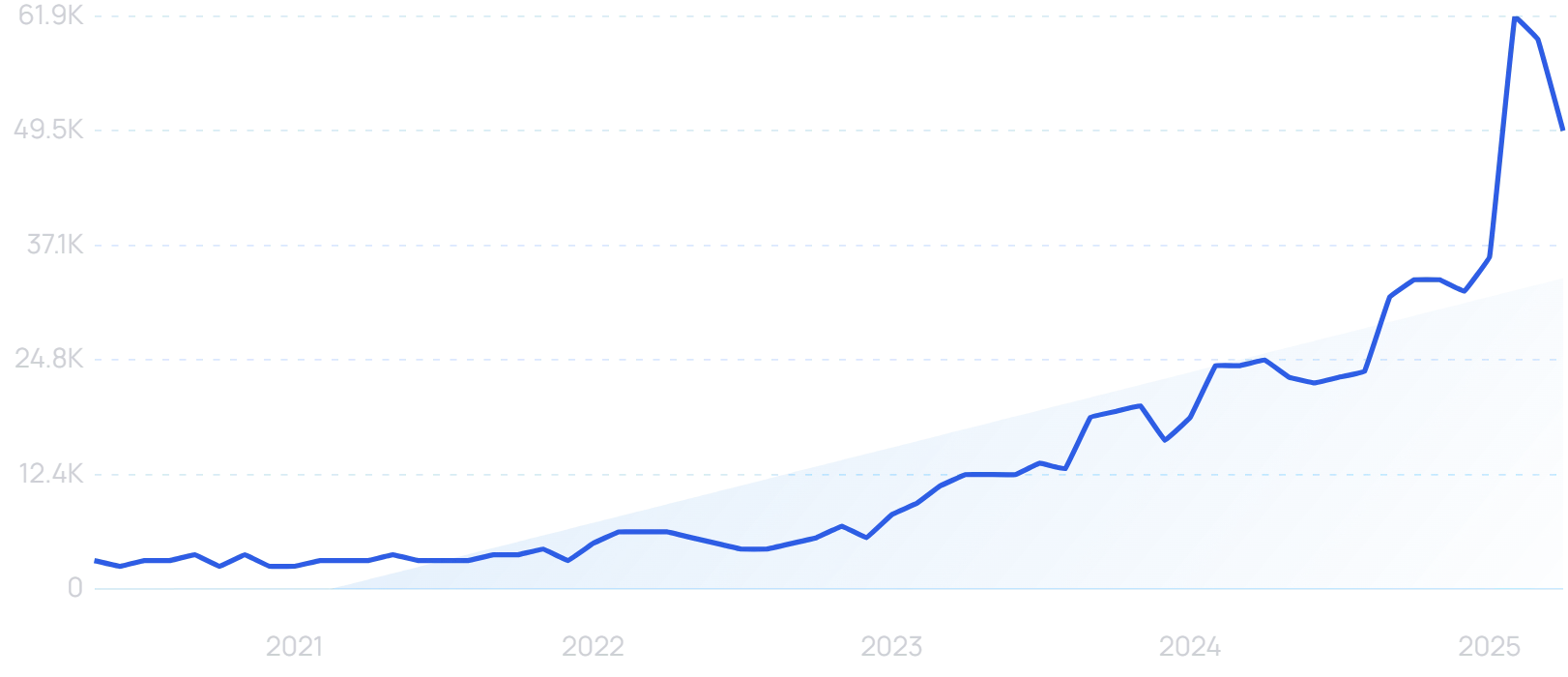

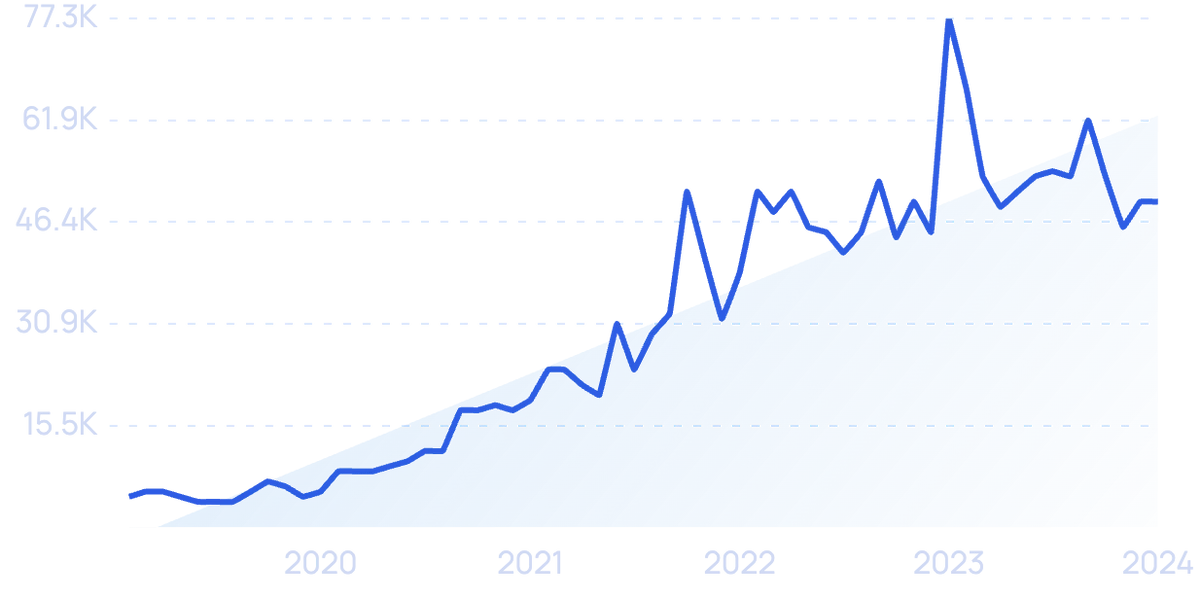

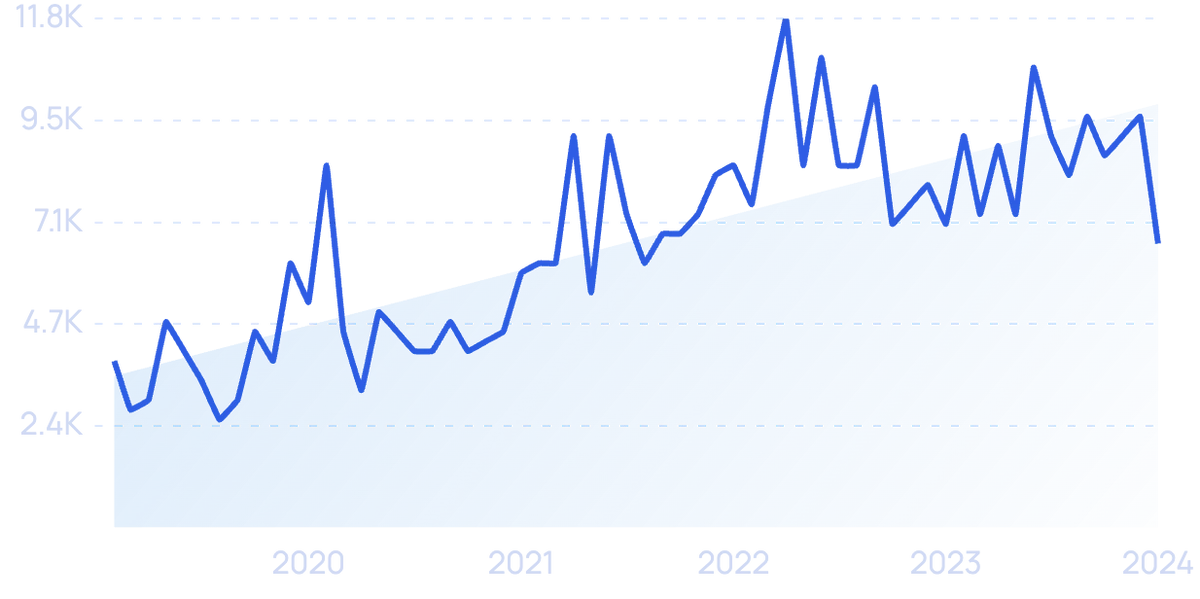

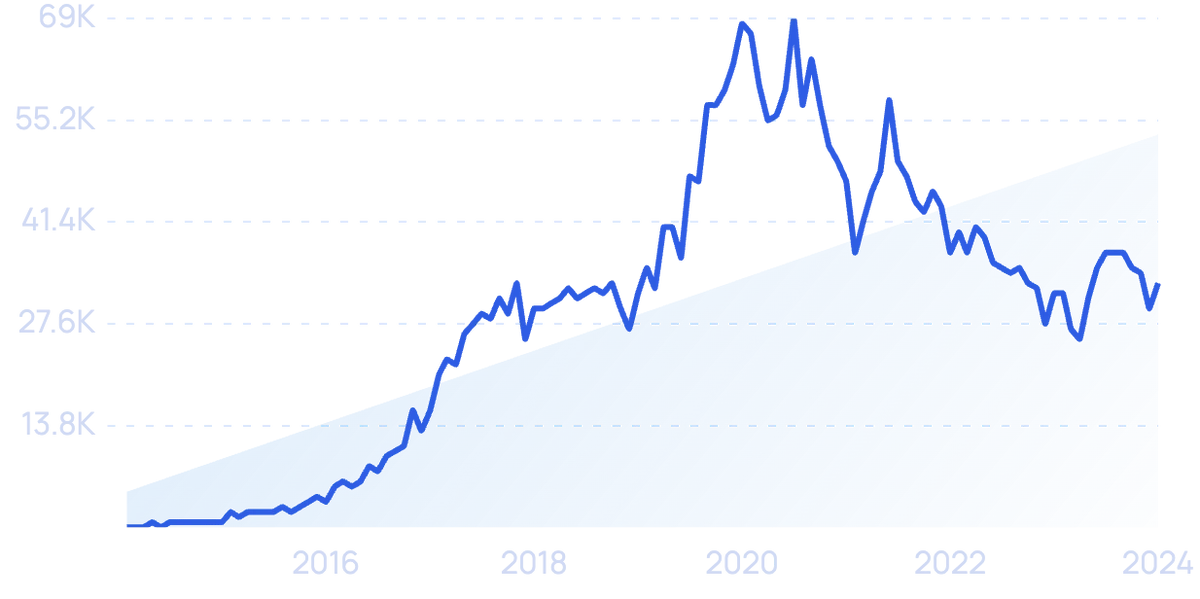

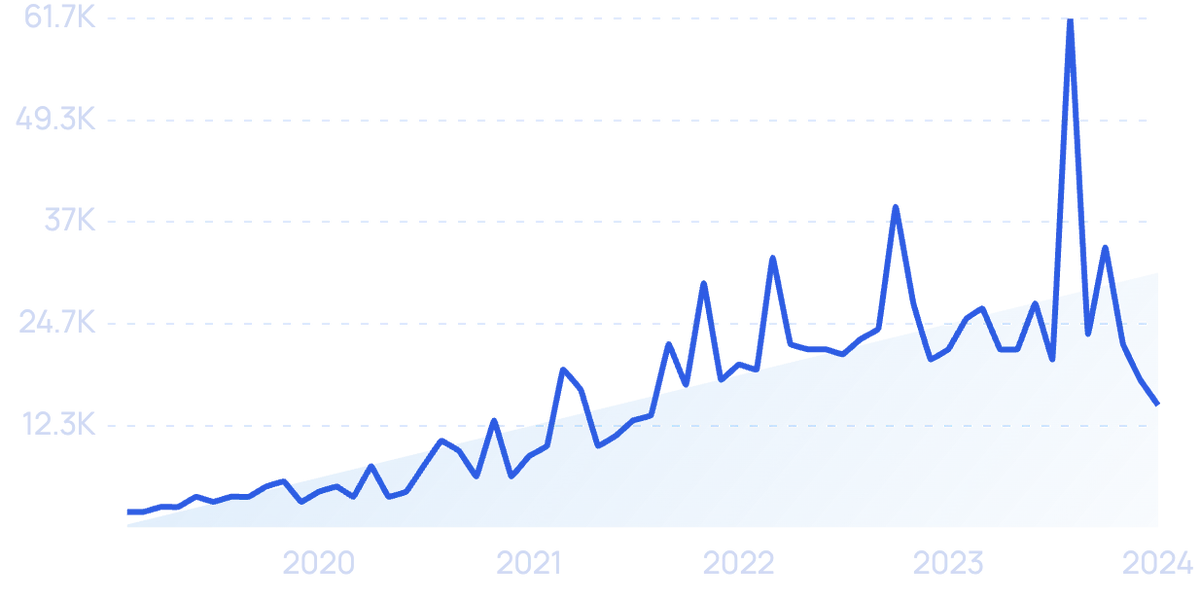

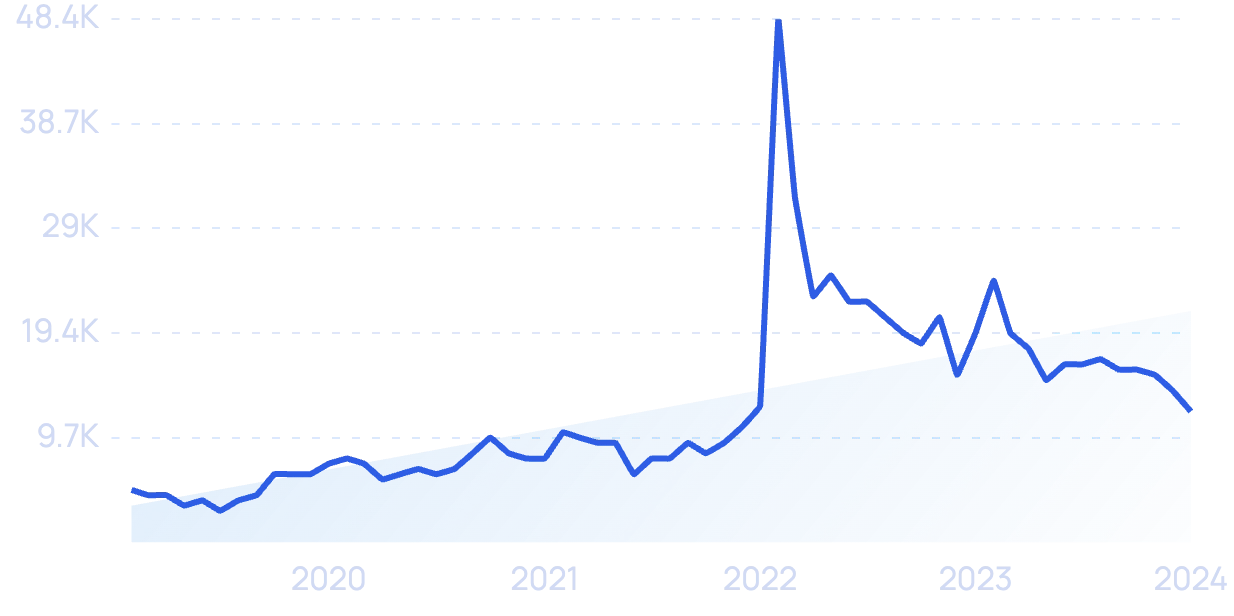

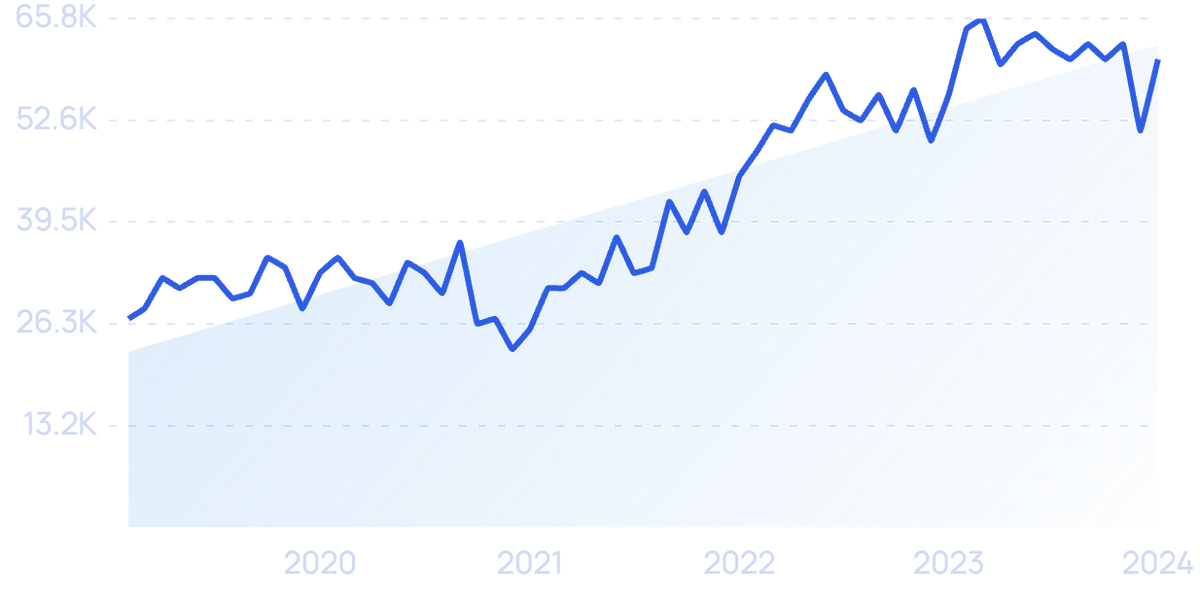

Search volume for “OpenAI” has skyrocketed over the last few years.

It’s currently worth $300 billion, with plans to raise funding at a new valuation of $500 billion.

And, in June 2025, the company hit $10 billion in ARR and $12 billion in annualized revenue. OpenAI expects to reach $125 billion in revenue by 2029.

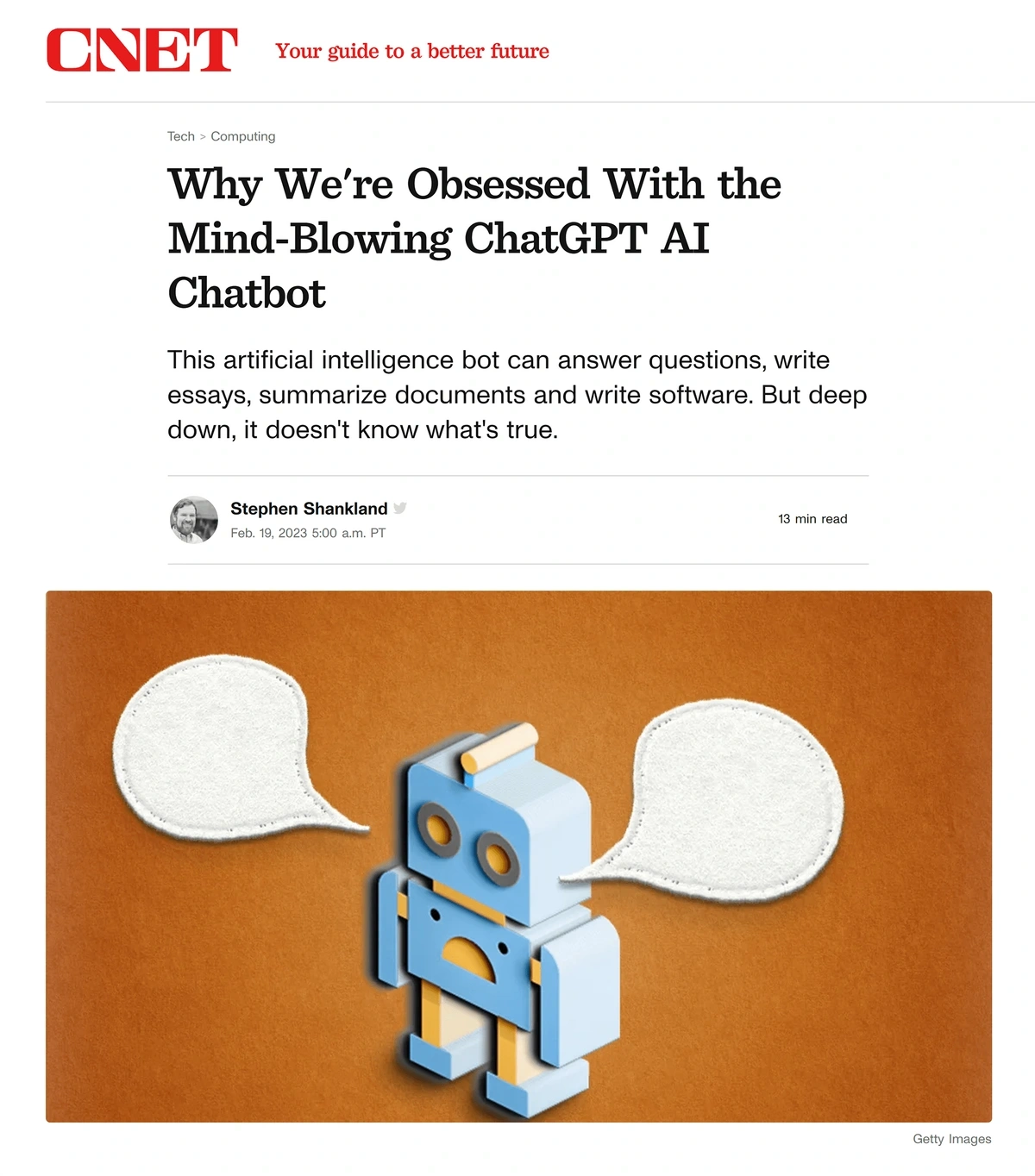

OpenAI’s ChatGPT surprised the world when it was released in November 2022.

The chatbot’s ability to take natural-language prompts and generate conversational text for a wide variety of outcomes made people rethink what was possible with AI.

More than 100 million people used ChatGPT within the first two months of its release.

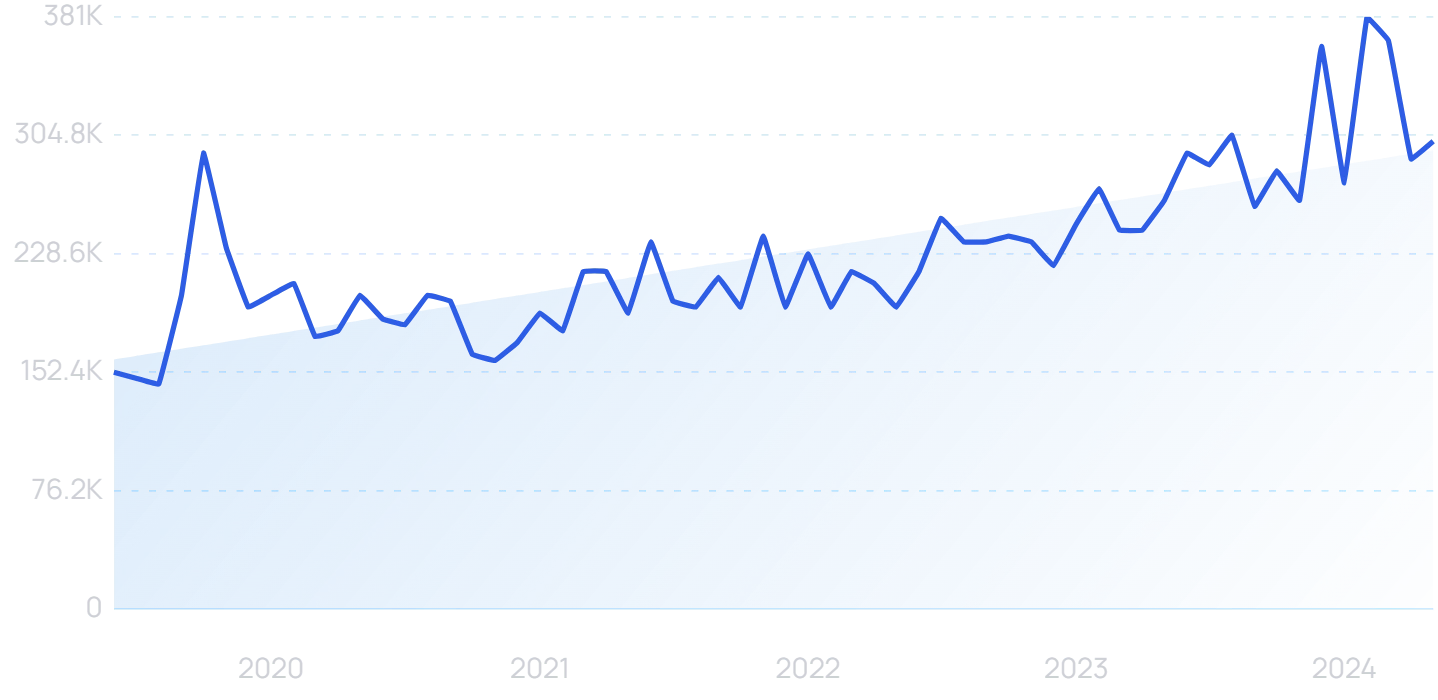

Today, ChatGPT gets 5.2 billion monthly visitors, according to Semrush data.

The release of ChatGPT brought about unprecedented interest.

Following ChatGPT, Google launched its own AI chatbot named Gemini.

Google's Gemini is the company's flagship LLM.

Microsoft also released a Bing chatbot that utilizes OpenAI’s technology.

Even Meta is joining the AI race by focusing on Lllama, an open source LLM.

While still early, LLMs have the potential to revolutionize business operations.

For instance, customer service reps could use it to respond to customer inquiries in seconds.

Companies could use it to create personalized marketing and educational content without needing to hire copywriters.

Developers could use it to write complex code and business leaders can use it to analyze data.

Enterprises are incorporating AI in other ways, as well.

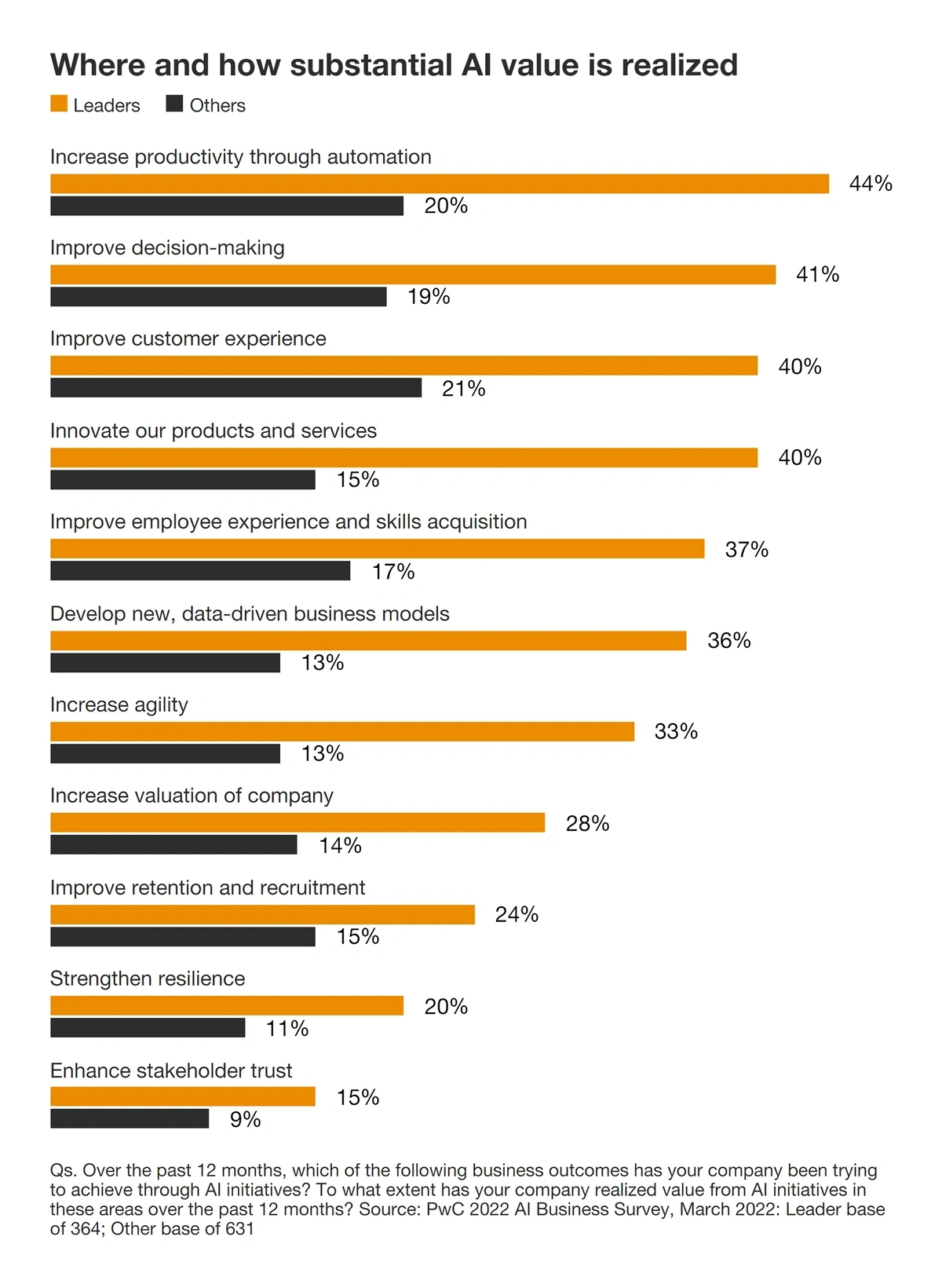

According to a PwC survey, the top goals of business leaders who are adopting AI are increasing productivity through automation, improving decision-making, and boosting the customer experience.

A survey from PwC showed AI is proving most useful in improving productivity, decision-making, and customer service.

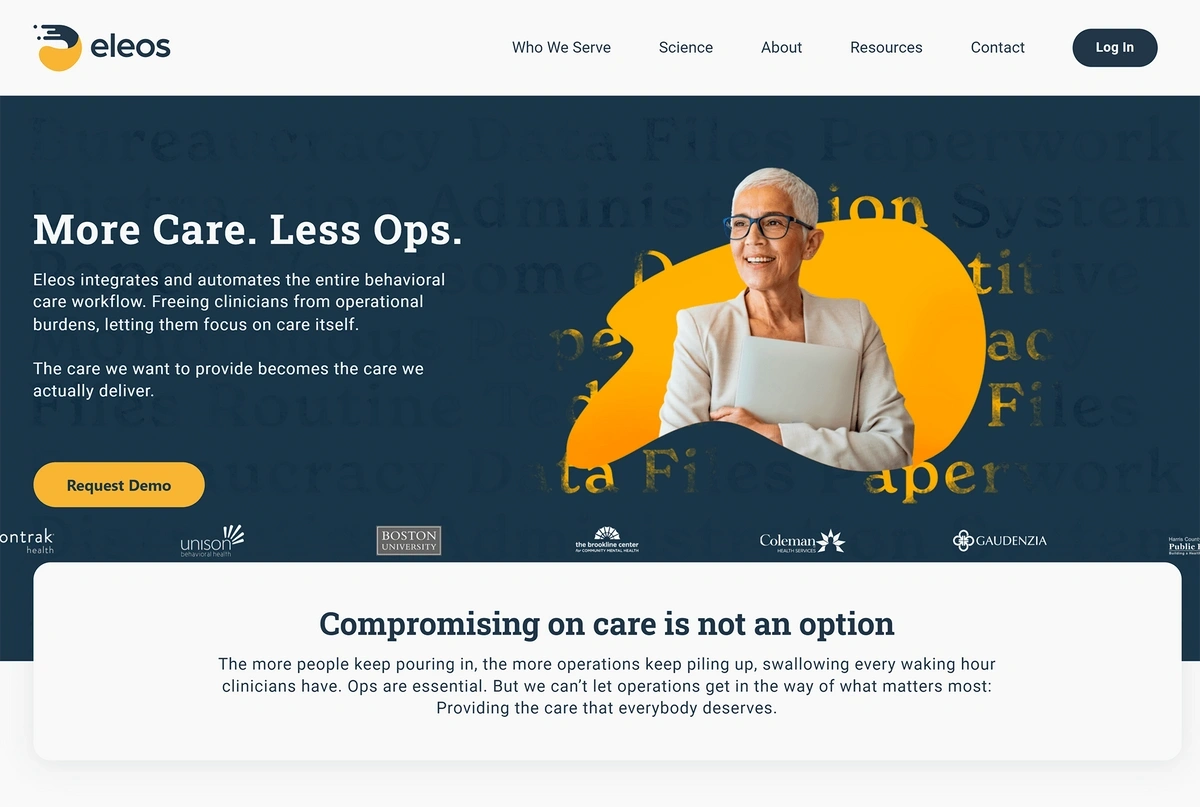

One example of an AI-powered automation platform is Eleos Health. The company offers an AI platform for therapists.

Their CareOps Automation solution is a voice AI platform. It listens in the background of therapy sessions and automatically digitizes all therapy conversations, identifies potential interventions, and produces session summaries instantly.

The company announced has raised a total of $68M to date.

The AI-powered solution from Eleos Health covers the entire therapy care workflow.

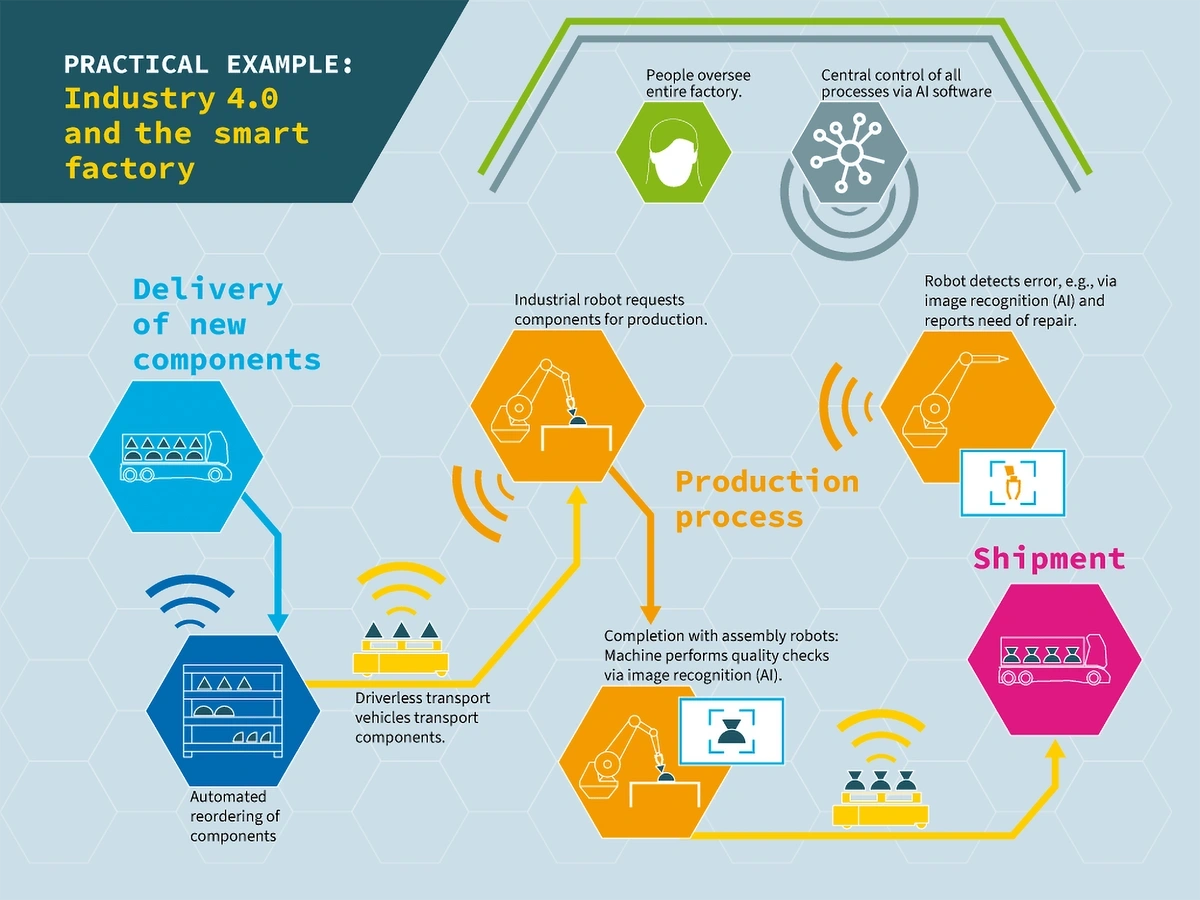

In another example, manufacturing and warehouse operations are finding new and innovative uses for AI.

Warehouse inventory management can be automated through AI’s image-recognition capabilities. The systems can also send alerts when inventory is low and prompt human intervention, as well as account for production or supply chain delays.

In manufacturing plants, AI platforms are part of the “smart factory” trend and these systems can enable predictive maintenance, minimize waste, and improve worker safety.

AI is applied throughout smart factories, from production to ordering to shipment.

2. Tech for Early Disease Detection Advances

Search results for “AI and healthcare” exploded in early 2025.

New tech solutions are focused on identifying diseases earlier on.

This one innovation could help save countless lives.

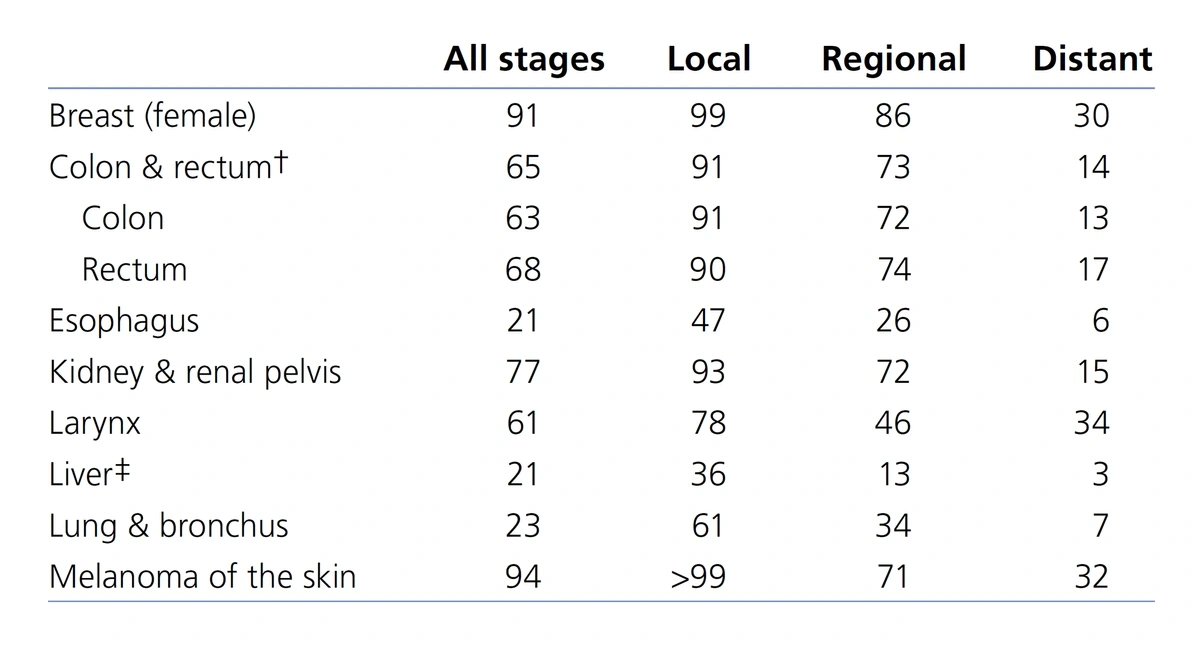

For example, if ovarian cancer is caught while it’s still localized, the five-year survival rate is 93%.

A similar increase in life expectancy is seen for patients with melanoma. There’s a 99% five-year survival rate for localized cancer, but only a 32% survival rate after the cancer has spread.

All types of cancers have higher survival rates when the cancer is localized.

Unfortunately, certain types of cancer, like those that affect the pancreas, lungs, and ovaries, are notoriously difficult to catch early.

In an effort to increase survival rates, researchers and tech industry startups are dedicating an increasing amount of resources to cutting-edge technologies designed to detect cancer cells earlier in development.

Take pancreatic cancer, for example.

A tech startup called Biological Dynamics has developed a lab-on-a-chip test that looks for bio-markers specific to pancreatic cancer. The test is entering human trials now.

So far, the company has raised $125 million in funding and hopes to build on the success of the pancreatic cancer test in order to launch tests for lung cancer and ovarian cancer.

Using AI for early diagnosis is another trend in the health tech space.

Researchers at MIT are using AI models to assess lung cancer risk in patients.

The tool was trained on six years worth of lung scans from patients in the United States and Taiwan. From these scans, the tool learned to identify and categorize patterns.

It’s best at predicting lung cancer that will occur within one year, but is also capable of predicting the disease up to six years in advance.

And it’s not just cancer that tech tools can detect early.

Scientists are leveraging nanotechnology that fits inside a smartphone camera in order to diagnose a wide variety of diseases.

The idea is that this nanotechnology makes phase imaging, an advanced way of viewing cells, available to patients at home.

If this technology makes it through trials, patients will be able to take an image of their saliva or a pinprick of blood at home using phase imaging on their camera and send it directly to their medical provider for analysis.

One at-home medical test that uses smartphone technology that’s already cleared for use is the Minuteful Kidney test from Healthy.io.

The Minuteful Kidney test was developed by Healthy.io.

The test is able to measure a patient’s albumin-to-creatinine ratio (ACR) in order to diagnose chronic kidney disease.

Patients first receive a test kit in the mail and the Minuteful Kidney app provides instructions for collecting a urine sample and dipping a test strip in the urine. After that, the patient takes a photo of the test strip with their smartphone and the app analyzes it.

The app utilizes AI technology and computer vision in order to assess albumin levels. The results are available almost immediately.

The technology has been available in Europe for more than 18 months and more than 540,000 people have already enrolled.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

3. Innovation and Investment in Cleantech Grows

$272 billion was invested in Cleantech companies in 2024.

(That's up 16% YoY)

In fact, clean technology has gained so much momentum that more than 25% of all VC dollars now flow to cleantech companies.

Industry experts suggest that more funding and interest is on the way due, in part, to the Inflation Reduction Act.

The law includes loans, grants, and tax incentives aimed at encouraging the private sector to devote more dollars and time to cleantech.

The leader of Breakthrough Energy Ventures estimates this act will lead to the creation of between 300 and 1,000 new companies.

Many of these companies could be in the green hydrogen industry.

Hydrogen is the most abundant element on Earth and burning it doesn’t release CO2, giving it great potential as a source of green energy.

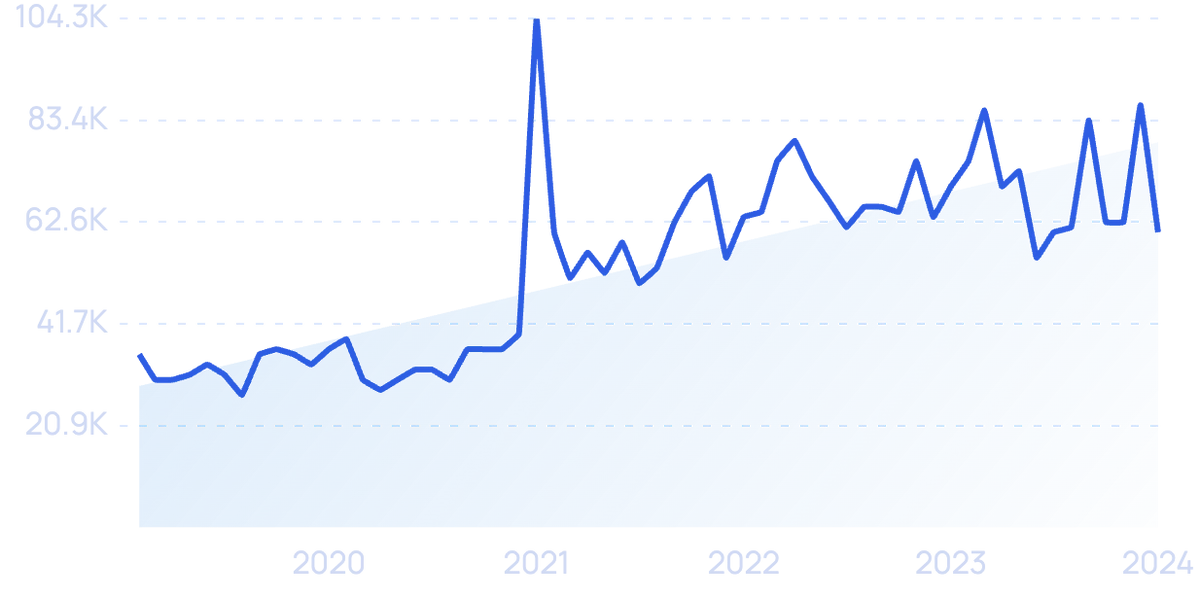

“Green hydrogen” is produced using renewable energy and search volume for the term is up around 1,000% in the past 5 years.

The green hydrogen market is expected to grow at a CAGR of 61% through 2027 and surpass $7 billion in value.

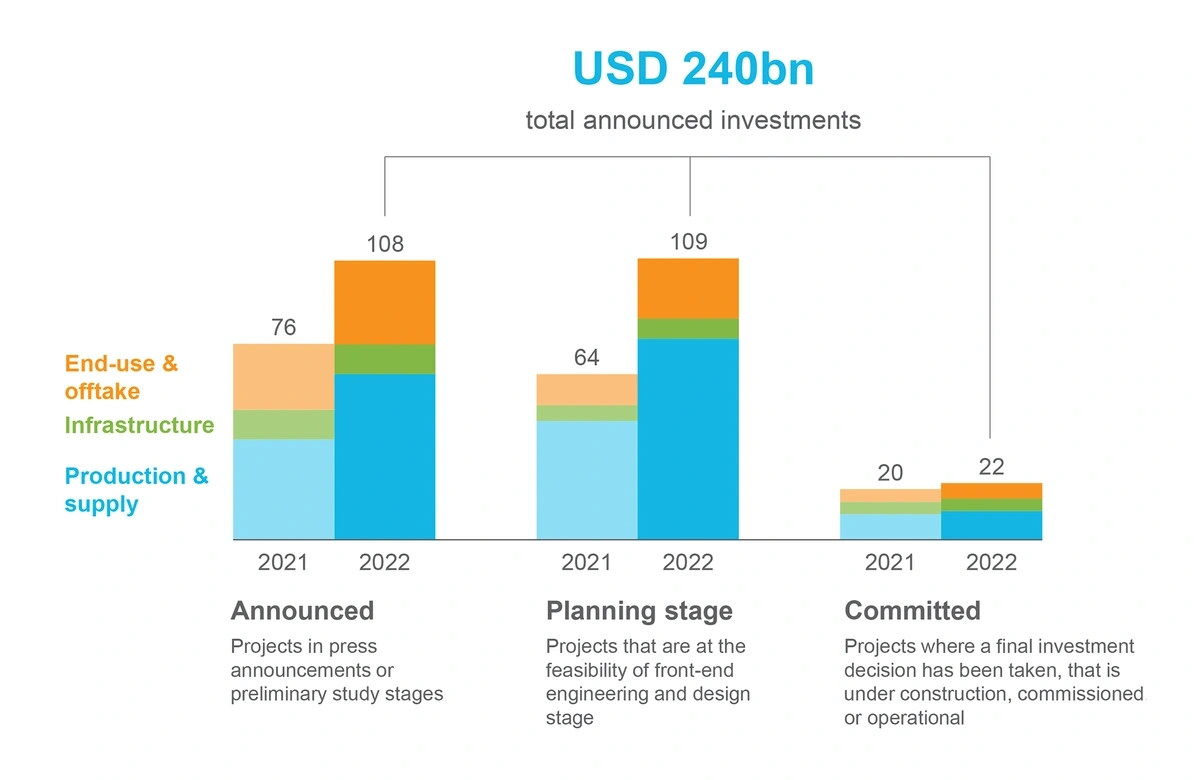

The Hydrogen Council estimates that around $700 billion in hydrogen-focused investments will be needed in order for the world to reach net-zero emissions by 2050.

They report that 680 large-scale hydrogen projects had been announced as of May 2022 — an increase of 160 projects compared to 2021.

About 10% of hydrogen projects have reached the final investment decision.

In addition, the US Department of Energy announced $47 million in available funding for clean hydrogen technologies in early 2023.

Plug Power is one of the largest companies producing hydrogen fuel cell systems in the United States.

The company opened a hydrogen fuel cell manufacturing plant in Slingerlands, New York, in 2022.

On the heels of new partnerships with TC Energy and Nikola, the company’s stock price is up nearly 30% as of 2023.

Non-US investments in hydrogen are also on the rise.

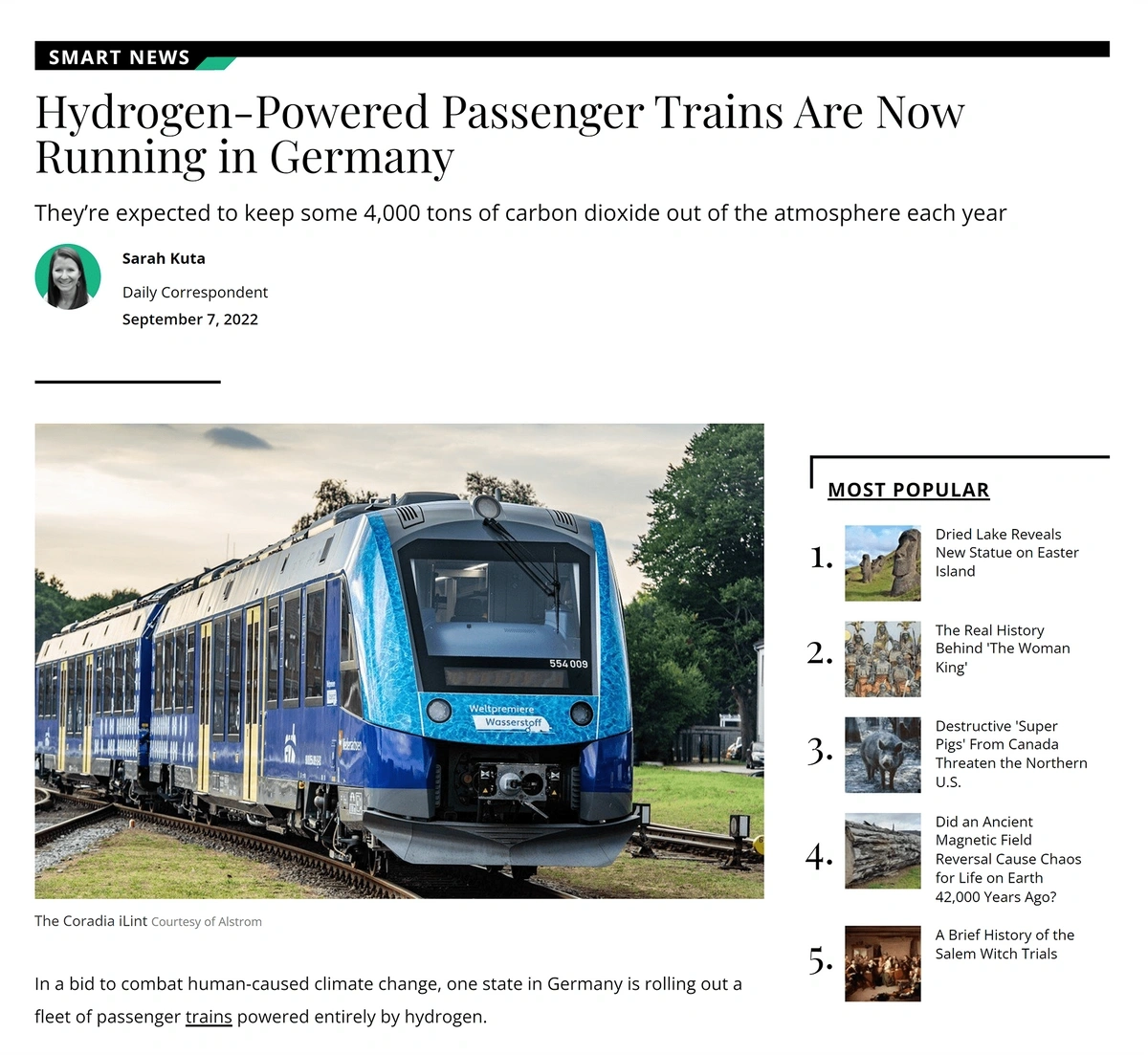

A hydrogen-powered passenger train debuted in Germany in September 2022. The train can run more than 600 miles without having to refuel and the top speed is 86 miles per hour.

Cleantech is powering passenger trains in Germany.

Germany plans to transition 2,500 to 3,000 of its trains to hydrogen fuel in the coming years.

But, while green initiatives — like planting trees and switching to hydrogen-powered vehicles — can reduce carbon emissions over time, many experts believe the impact of these efforts alone will be too little too late.

According to the Brookings Institution, global greenhouse gas emissions hit 58 gigatons in 2022. That’s the largest amount ever recorded.

It’s well-documented that carbon emissions are one of the largest drivers of modern climate change.

In order to directly eliminate some of these emissions, cleantech leaders are using what’s known as carbon capture technology to make immediate progress toward reducing and even reversing emissions.

Searches for “carbon capture and storage” are up 71% over the last 5 years.

The process involves working with super-emitters — like power plants and concrete manufacturing facilities — to capture carbon molecules when they would normally be released into the air.

Carbon capture can effectively remove up to 90% of emissions from the air released at power plants and industrial facilities.

From there, carbon capture companies isolate and extract the carbon through a variety of chemical processes before reselling it or depositing it deep into the earth, where it can be transformed back into stone.

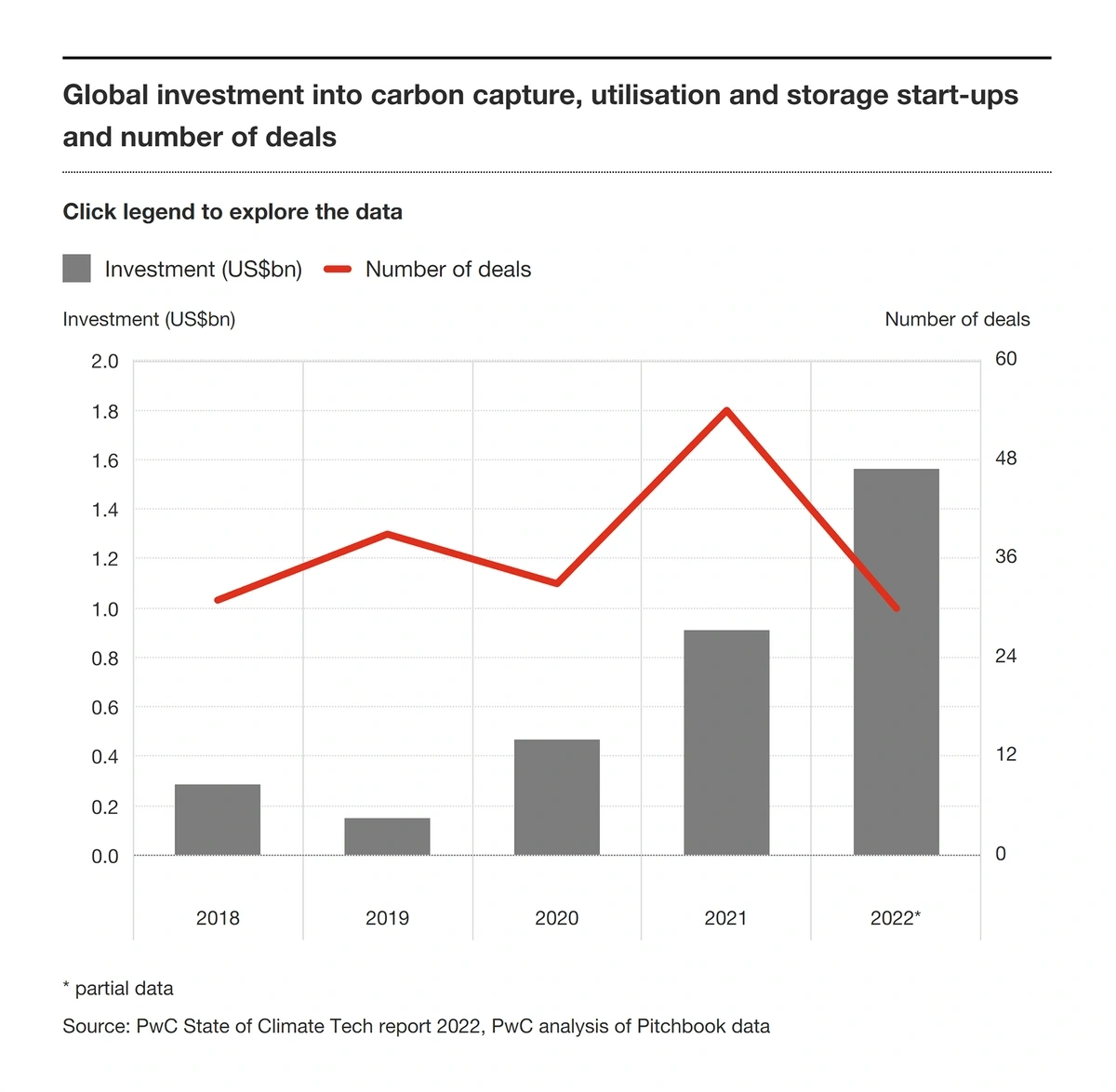

PwC reports that funding for carbon capture technology in the first three quarters of 2022 was nearly double that of total funding for 2021.

In 2022 there were fewer venture deals but larger average deal sizes.

4. Cyber Threats Grow More Advanced

From attacks on random consumers to government-sponsored cyber warfare, cybercrime is a persistent and growing threat.

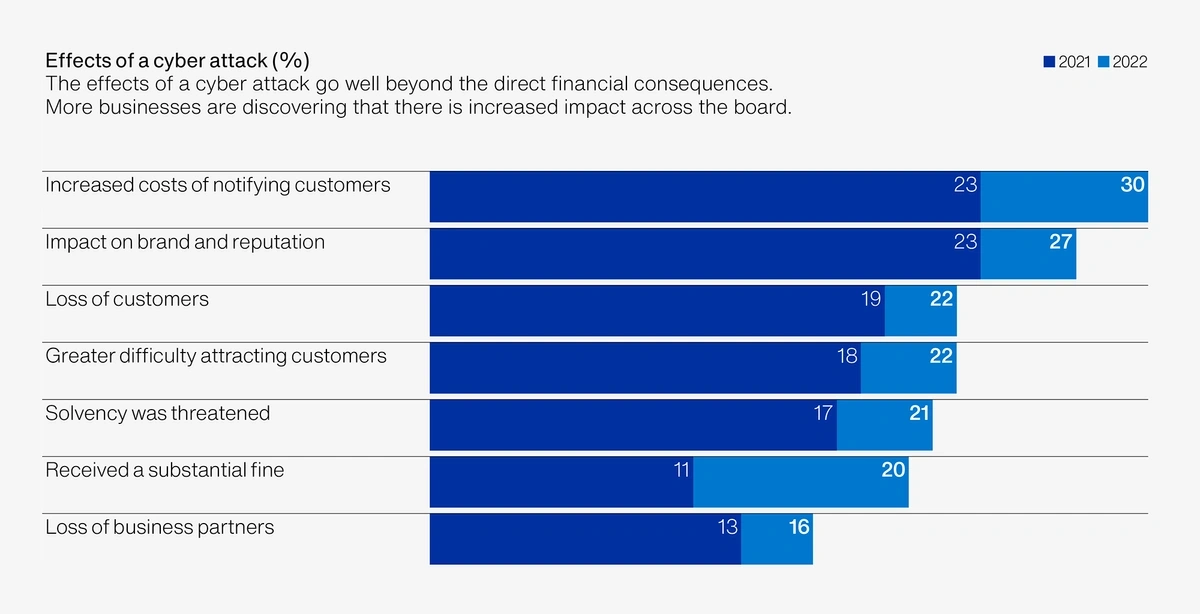

A 2022 global survey from Hiscox showed 43% of companies reported a cyber attack.

The most alarming statistic from that report was the fact that 20% of attacked organizations said the cost of the damage threatened their solvency.

The impact of cyberattacks is growing across the board.

Some predictions show that a single data breach was expected to cost an average of $5 million in 2023.

IBM’s research says it’s even higher: $9.44 million.

In fact, virtual crime has become so prevalent the $155 billion cybersecurity industry is expected to swell to $376 billion by 2029.

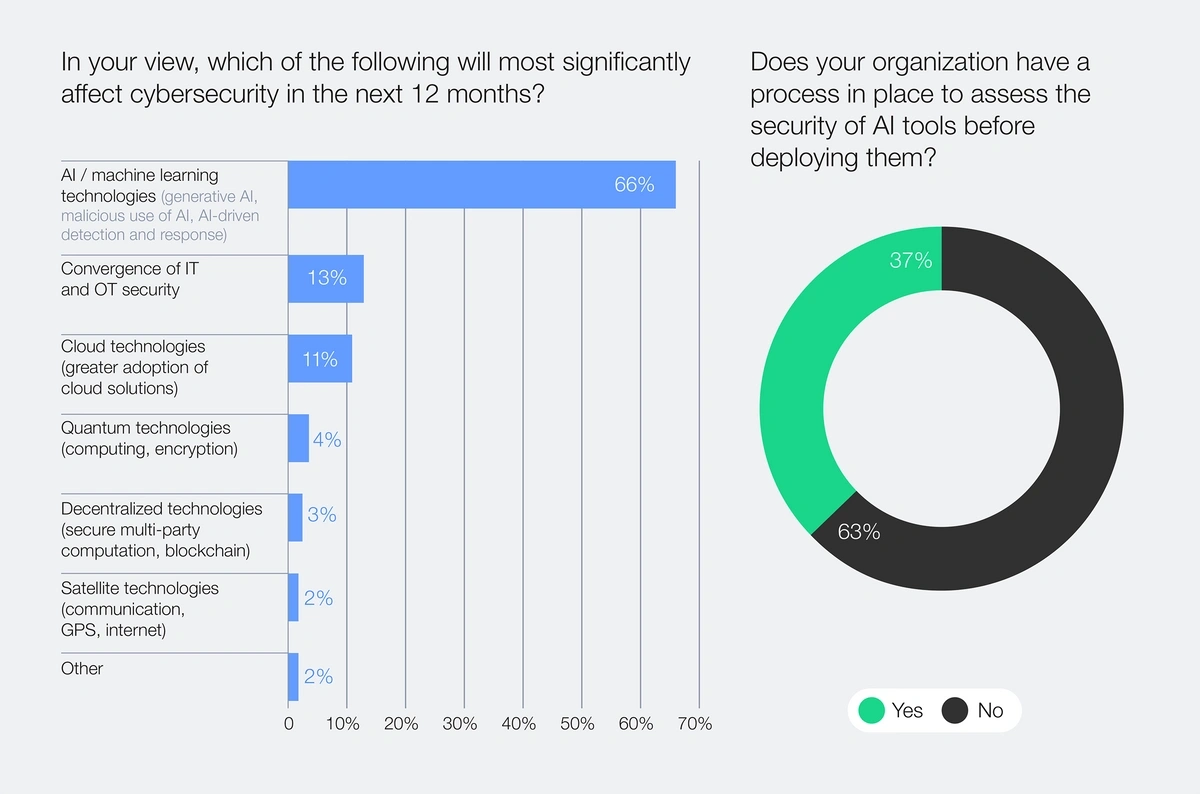

In a survey, 66% of the organizations rated AI as having the greatest impact on cybersecurity in 2025 and beyond.

The same research also discovered that 63% of the surveyed organizations think they lack reliable processes to evaluate security of AI tools before adoption.

Organizations anticipate AI tech to have a big impact on cybersecurity

Deepfake attacks are one of the most sophisticated ways hackers are gaining access to businesses.

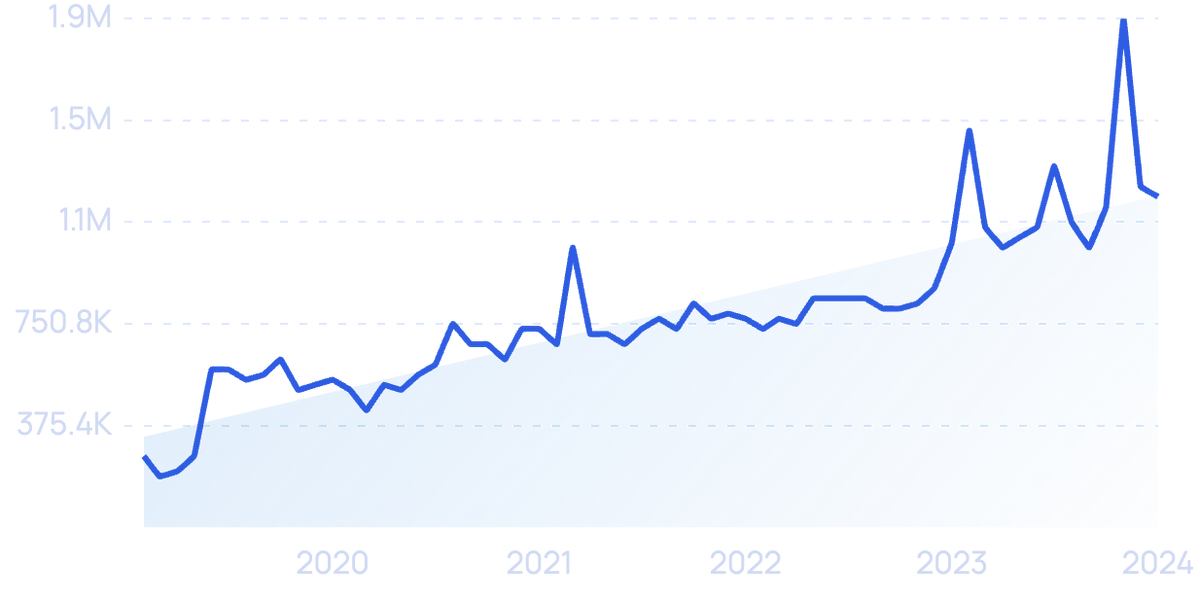

And searches for 'deepfake' are at an all-time high since the past 2 years.

Search interest in “deepfake” is up nearly 364% over the past 5 years.

In a recent survey from VMware, 66% of participating IT leaders said they’d experienced a deepfake-related attack within the past 12 months. That’s an increase of 13% since 2021.

Deepfake technology utilizes AI/deep learning to create convincing videos, images, and audio of fake events and people.

The technology has been around for a few years, and it’s getting better and better for hackers.

A type of machine learning technology called generative adversarial networks is making the deepfake models nearly impossible to detect.

Plus, the emergence of 5G networks is making it easier to manipulate videos in real time.

Deepfakes are especially useful to cyber criminals who commit BEC (business email compromise) scams.

Manipulating face-to-face verification methods with deepfakes is another possibility for cyber criminals.

Identifying deepfakes and other incoming threats is very much a defensive game for organizations. Security professionals are always one step behind attackers.

However, cybersecurity pros are using AI and other advanced technology solutions in order to detect and stop attacks as early as possible.

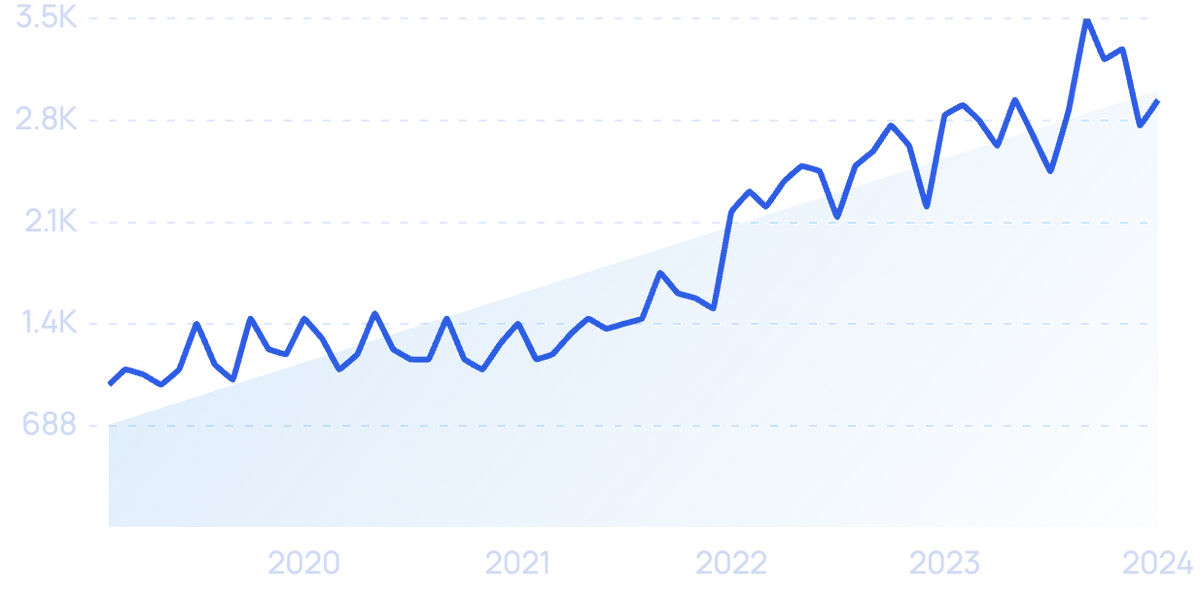

Searches for “cybersecurity technology” have increased more than 200% in the past 5 years.

A recent report from IBM found that organizations that use AI cybersecurity tools and automation extensively save $2.22 million compared to those who don’t use these solutions.

Not only can AI tools recognize attacks before human operators, but they can also be configured to stop the attack and alert IT personnel before the breach gets out of control.

Deep Instinct is a cybersecurity company powered by deep learning.

Deep Instinct uses AI-powered cybersecurity in order to prevent 99% of threats before they’re executed.

The solution can scan millions of files per day and detect threats in less than 20 milliseconds.

Since its founding in 2015, the company has raised more than $321 million in funding from firms like BlackRock and Chrysalis Investments.

Search interest in “Deep Instinct” has grown more than 71% since 2019.

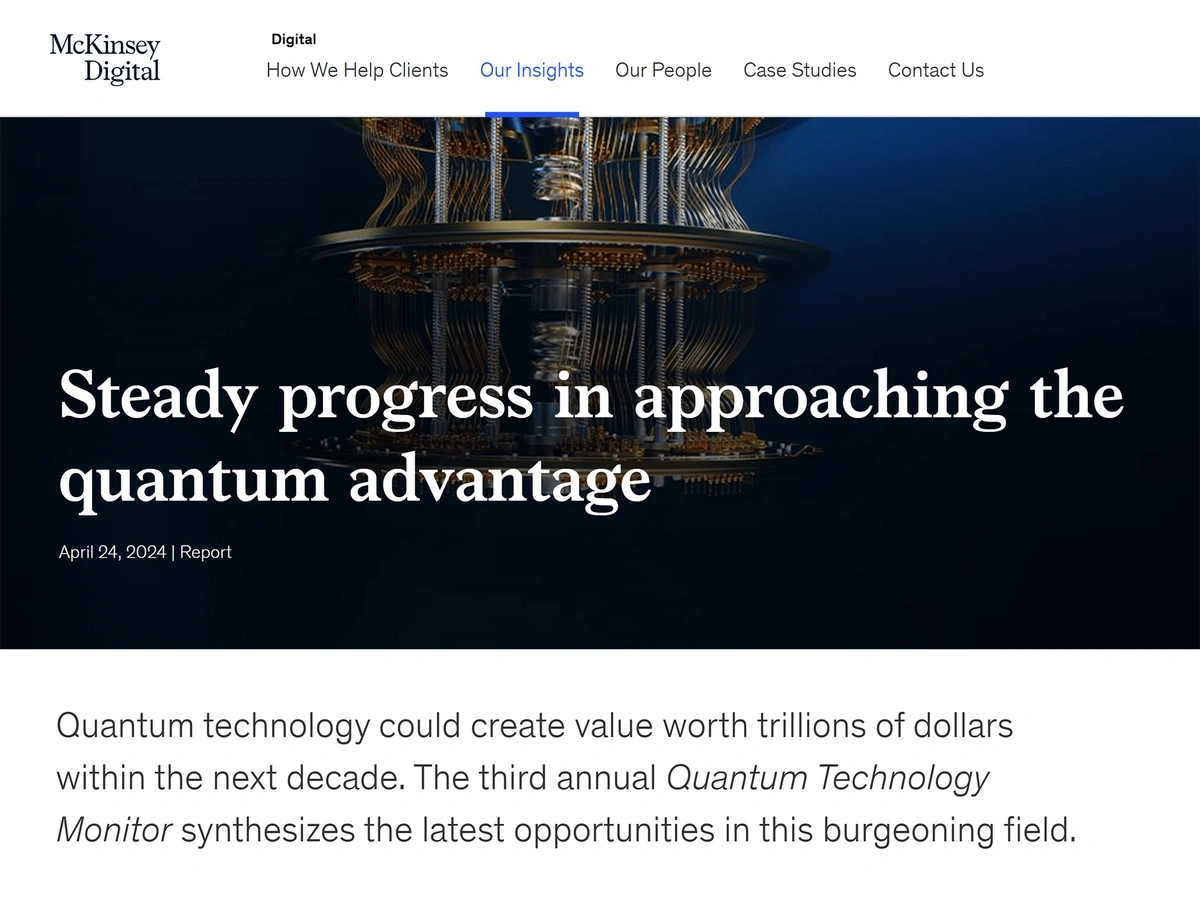

5. Quantum Computing Moves Toward Real-World Application

Quantum computing has been a topic of discussion since the 1980s.

Fast forward to 2025, and the world is finally close to achieving real-world applications for this type of computing.

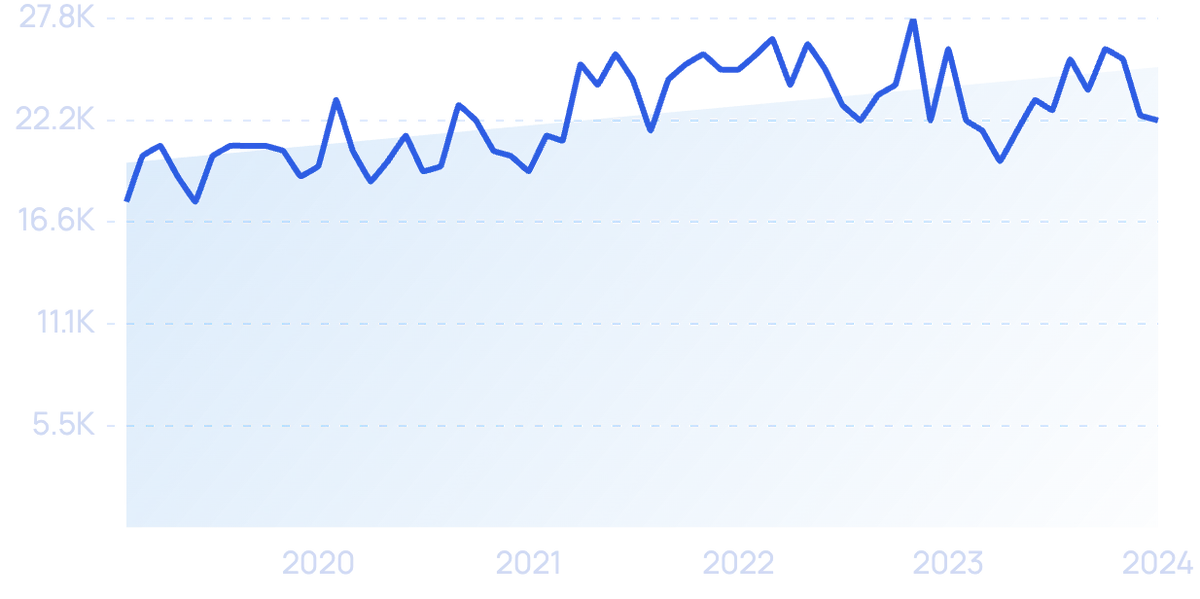

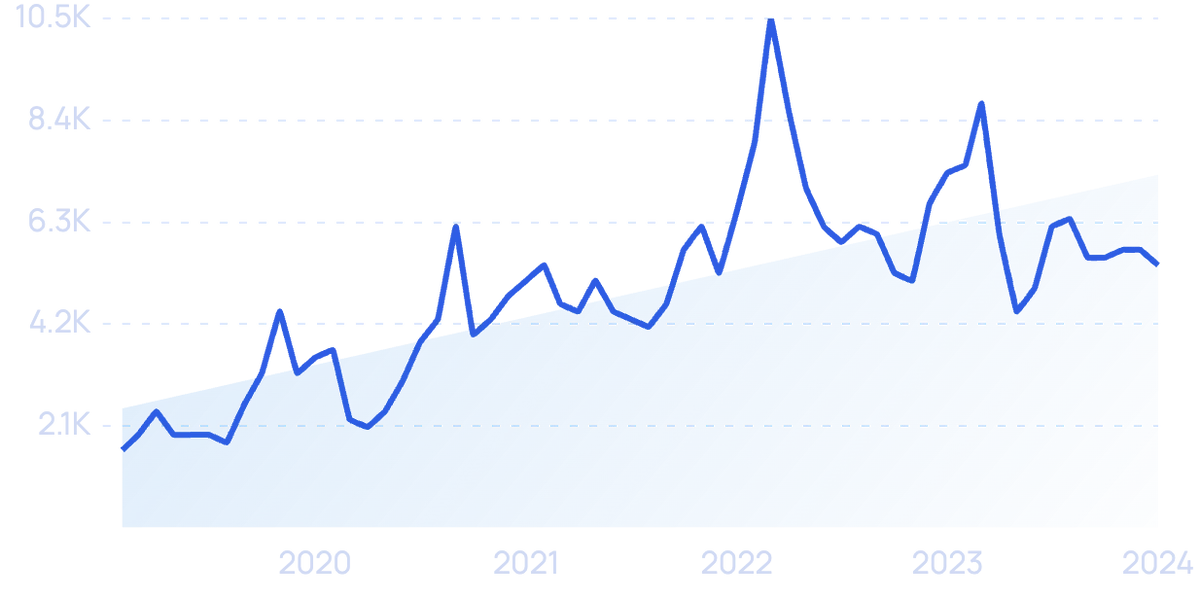

Search volume for “quantum computing” is increasing.

Traditional computers we know today operate on binary code (either 0 or 1). Quantum computers use qubits, which allows a piece of data to exist in two states at the same time (both 0 and 1).

All of this technology boils down to an increased speed of computation.

Complex calculations done by today’s computers might take millions of years, but they can be solved in minutes with quantum computing.

Technological and financial issues have plagued the industry, but momentum has been building in recent months.

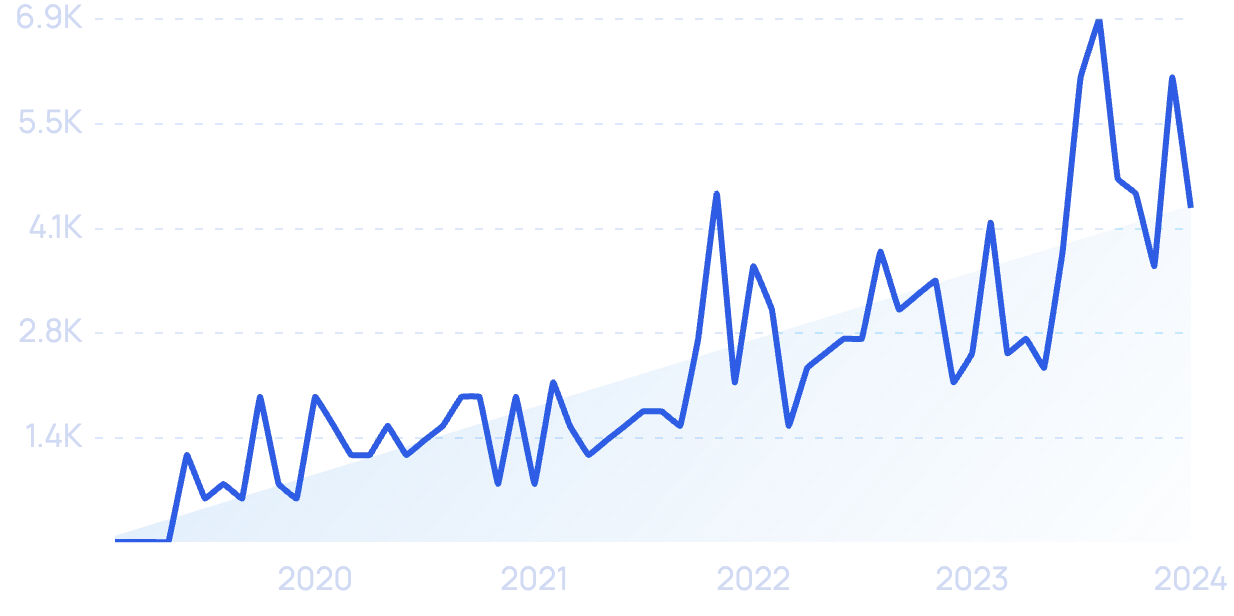

In fact, $1.7B was invested in the quantum computing startups last year.

Financial investments in quantum computing are increasing.

So far, the leader in the race to quanxtum computing appears to be IBM.

Osprey, IBM’s quantum computer, was unveiled in November 2022 and boasts 433 qubits.

IBM is developing quantum processors as well as a quantum mainframe.

The company says they’ll have a computer with 4,000 qubits by 2025.

However, tech experts say quantum computers need millions of qubits to be fully functional. Many expect that to come to fruition by 2027.

Alphabet has been operating a quantum computing division for the past six years and, in March 2022, announced it would become a standalone company called Sandbox AQ.

They received “nine figure” funding in 2022 and had raised another $500 million by February 2023.

Although projects from IBM and Alphabet show promise, other lesser-known companies are creating competition and raising large amounts of funding in the space.

For example, Origin Quantum, a Chinese company, raised $148.2 million in 2022, the largest amount of the quantum computing industry for the year.

Q-CTRL was launched as Australia’s first VC-backed quantum tech company in 2017.

Company leaders are focused on overcoming the industry’s challenges associated with hardware error and instability through quantum control infrastructure software.

Search volume for “Q-CTRL” is up 2,200% in the past 5 years.

The company closed a $27.4 million Series B funding round in early 2023.

Q-CTRL already has contracts with more than 8,000 users. That includes the US government and Australian defense agencies, as well as companies like IBM, IonQ, and others.

As companies race to develop this new technology, leaders in several industries are anticipating the potential impact of quantum computing. That impact could be huge for a number of sectors.

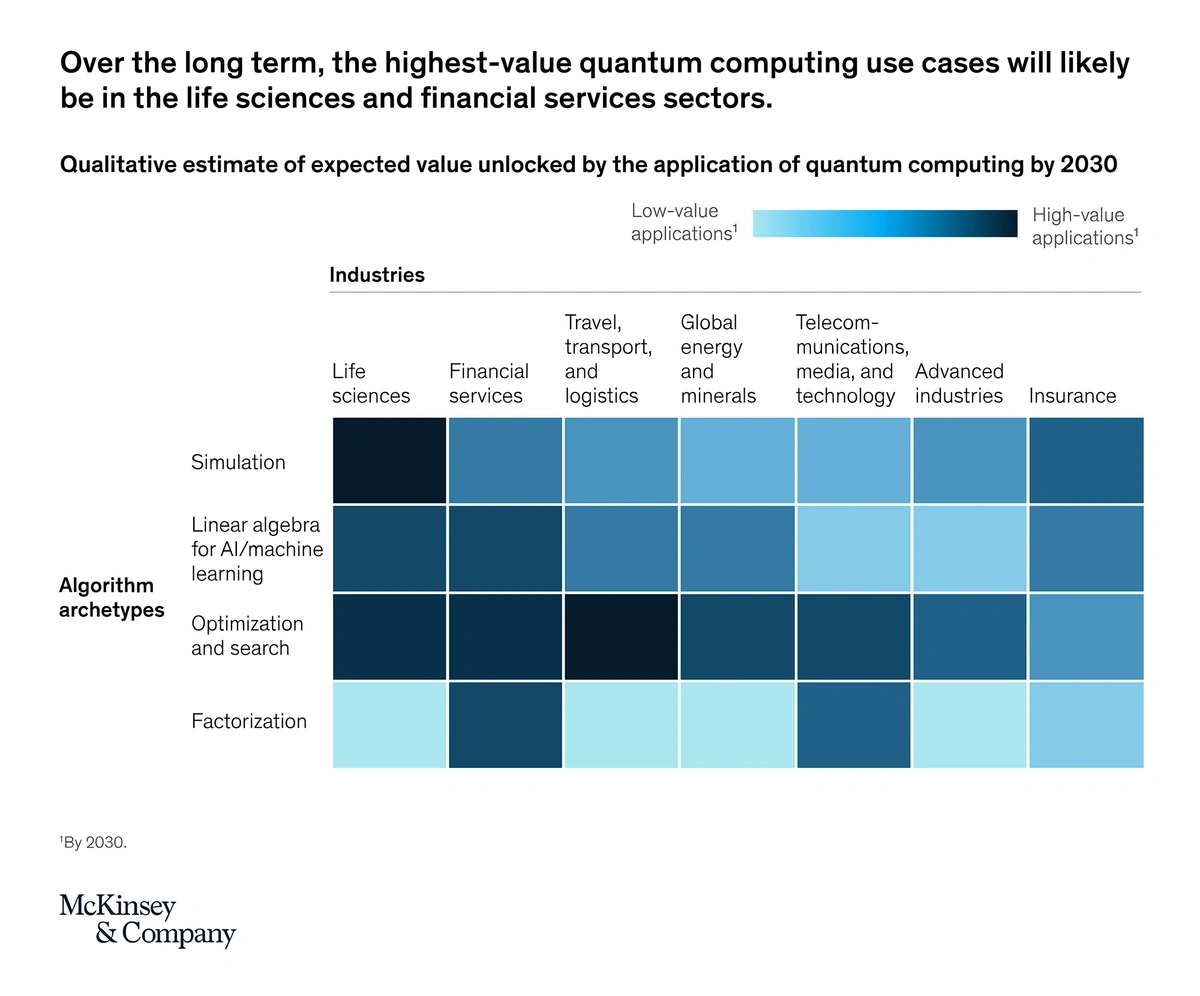

A report from McKinsey says quantum computing will provide the highest value in the life sciences and financial sectors.

A variety of industries stand to benefit from quantum computing applications.

Up to $700 billion in value may be realized by 2035, according to McKinsey.

In the life sciences industry, quantum computing could be valuable in simulating chemical processes, optimizing pharmaceutical designs, and advancing the development of personalized medical treatment through genomics.

In the financial sector, quantum computing could drastically reduce market risks, improve fraud detection, and speed up customer onboarding.

Quantum computing could have various consumer-facing impacts, as well.

Take electric vehicle charging, for instance.

It takes an average of 10 hours to fully recharge an electric car at home. Even the fastest charging speeds still take 20 minutes.

With quantum technology, charging time could potentially be cut down to just three minutes at home and a few seconds at high-speed charging stations.

6. Enterprise and Public Use of IoT Expands

Despite ongoing chip shortages, the number of global IoT connections is expected to grow to 27 billion by 2025.

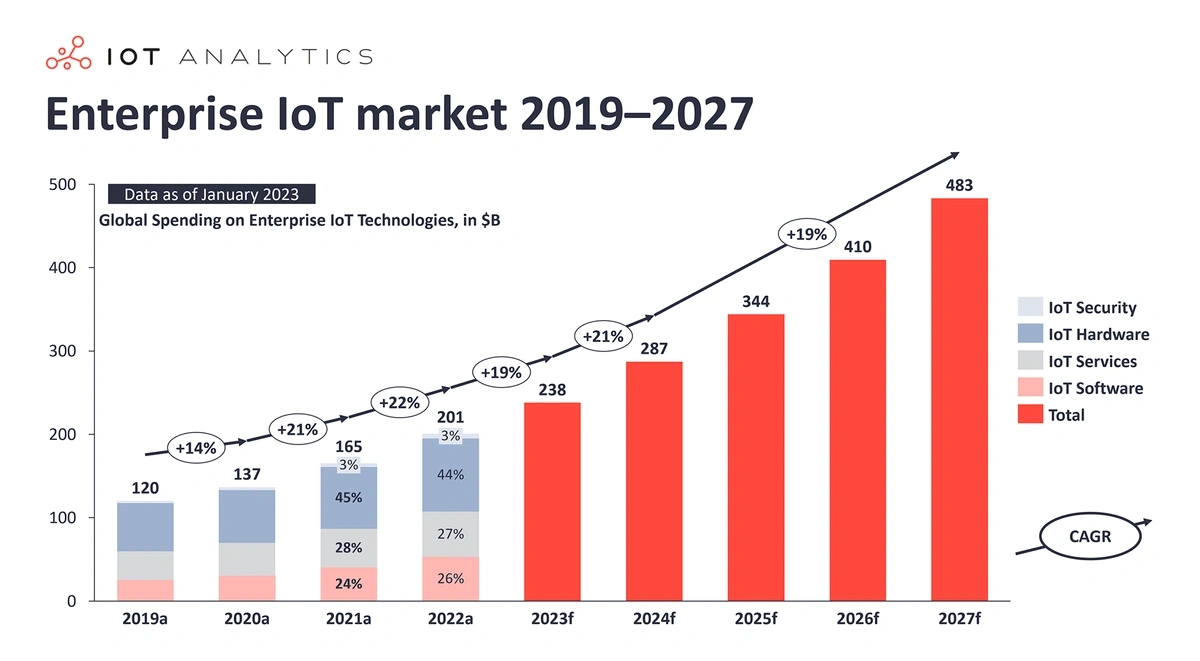

With the advancement of 5G networks and relief on the horizon for semiconductor manufacturing, some estimate the enterprise IoT market could grow to $483 billion by 2027.

The enterprise IoT market is expected to grow at a CAGR of nearly 20% through 2027.

Business leaders from a variety of industries are adopting and expanding their use of IoT technology in order to improve connectivity and data collection.

In a 2022 survey from IEEE, IoT was ranked as one of the top five most impactful technologies of 2023.

Businesses are seeing relatively quick ROI on their IoT projects. More than 60% say they’re reaching financial payback in just three years.

Manufacturing is one industry that’s investing in IoT (nicknamed the “industrial internet of things” or IIoT) as part of an effort to create smart factories.

Search interest in “IIoT” is growing.

In the United States, 35% of manufacturers are already collecting and using data through IoT devices.

For instance, sensors on machinery gather data from the machines, store it wirelessly, and a machine-learning platform runs through the data to analyze it and assess if human intervention is needed.

This process can be used to improve efficiency, reduce waste, and predict maintenance needs.

IoT devices are also powering smart cities.

Sensors collect data from things like electric meters, trash cans, traffic signals, and more. That data is then utilized to make the cities more efficient and make the citizens safer.

When the University of Idaho partnered with Nordsense, a smart trash can company, they outfitted 58 concrete trash cans with IoT sensors.

Because these sensors monitored trash levels and altered the waste management team when a bin needed to be emptied, the team cut their working hours and fuel consumption by 50%.

7. Ambient Computing Enables Nearly Invisible Tech

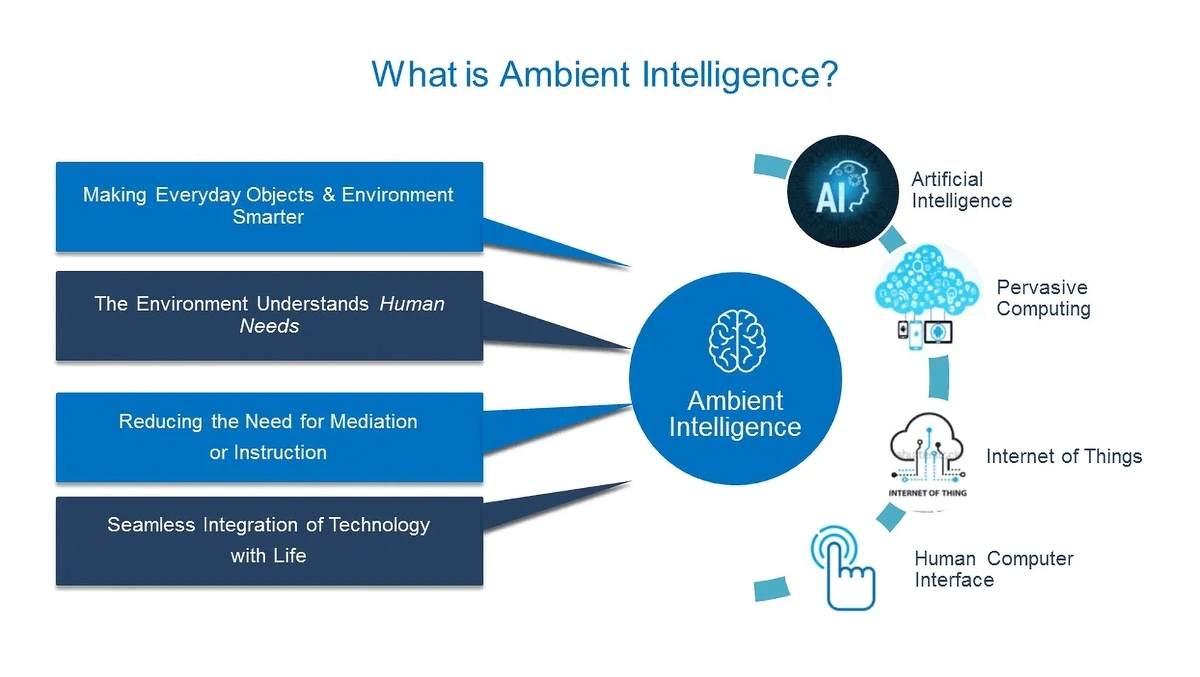

Ambient computing is a concept that builds on IoT and promises a future of nearly invisible technology.

Here’s why: with ambient computing, an AI-driven network of devices and software runs in the background (all around us) with little to no human intervention required.

Ambient computing uses both AI and machine learning to interpret data gathered from physical devices, like smart thermometers and smart watches, and make decisions on their own.

All of this technology comes together to create devices that can interact with both individuals and other devices.

Ambient computing is able to understand user context and take action depending on those preferences.

With the potential to transform how we interact with everything from coffee makers to freight trucks, it comes as no surprise the ambient intelligence industry is expected to grow at an impressive 32% CAGR through 2028 to reach a total value of $225 billion.

Ambient computing is still a young technology, but use cases are already being seen in both consumer-focused and business-focused solutions.

Voice assistants and smartphone-controlled thermostats are great examples of ambient computing, but this technology has the potential to become even more invisible.

Ecobee’s smart thermostats learn the routines of homeowners, recognize when nobody is home, and automatically adjust the temperature.

For example, a person getting off a flight could be automatically alerted that their bags are ready at a specific carousel. After their bags were picked up, they’d receive another notification that their rideshare was ready at a specific location. While they were in the car, a coffee would be automatically ordered from the nearest Starbucks and they’d be automatically checked into their hotel.

In another possibility, homeowners may no longer need garage door openers. Instead, the owner’s smartphone will communicate the location to a device in the home, which will open the garage door for them as they approach.

In factories, ambient computing is being used to monitor and schedule maintenance on machines.

When the IoT device recognizes the machine needs servicing, it links up with the software that schedules maintenance and inputs that machine on the schedule.

In retail, sensors on shelves could automatically order new inventory when stock is running low.

However, as this technology progresses, privacy and security concerns will be top of mind.

8. Adoption of Robotic Process Automation Continues to Grow

As the lines between artificial intelligence and machine learning continue to blur, businesses are finding an increasing number of ways to integrate automation into their processes.

And one of the emerging technologies executives are most excited about is robotic process automation (RPA).

Search demand for “robotic process automation” is up 4,700% over 10 years.

RPA involves training software programs to perform or execute mundane, repetitive tasks.

Forecasts predict the RPA market to grow to $25 billion by 2030 with a CAGR of nearly 36%.

In 2022, RPA software revenue reached nearly $10B last year — a nearly 2x increase from 2021.

Surveys report that one-fifth of businesses are currently employing RPA.

One of the main reasons enterprises are adopting RPA is because a tight labor market means that businesses need to maximize employee efficiency and productivity.

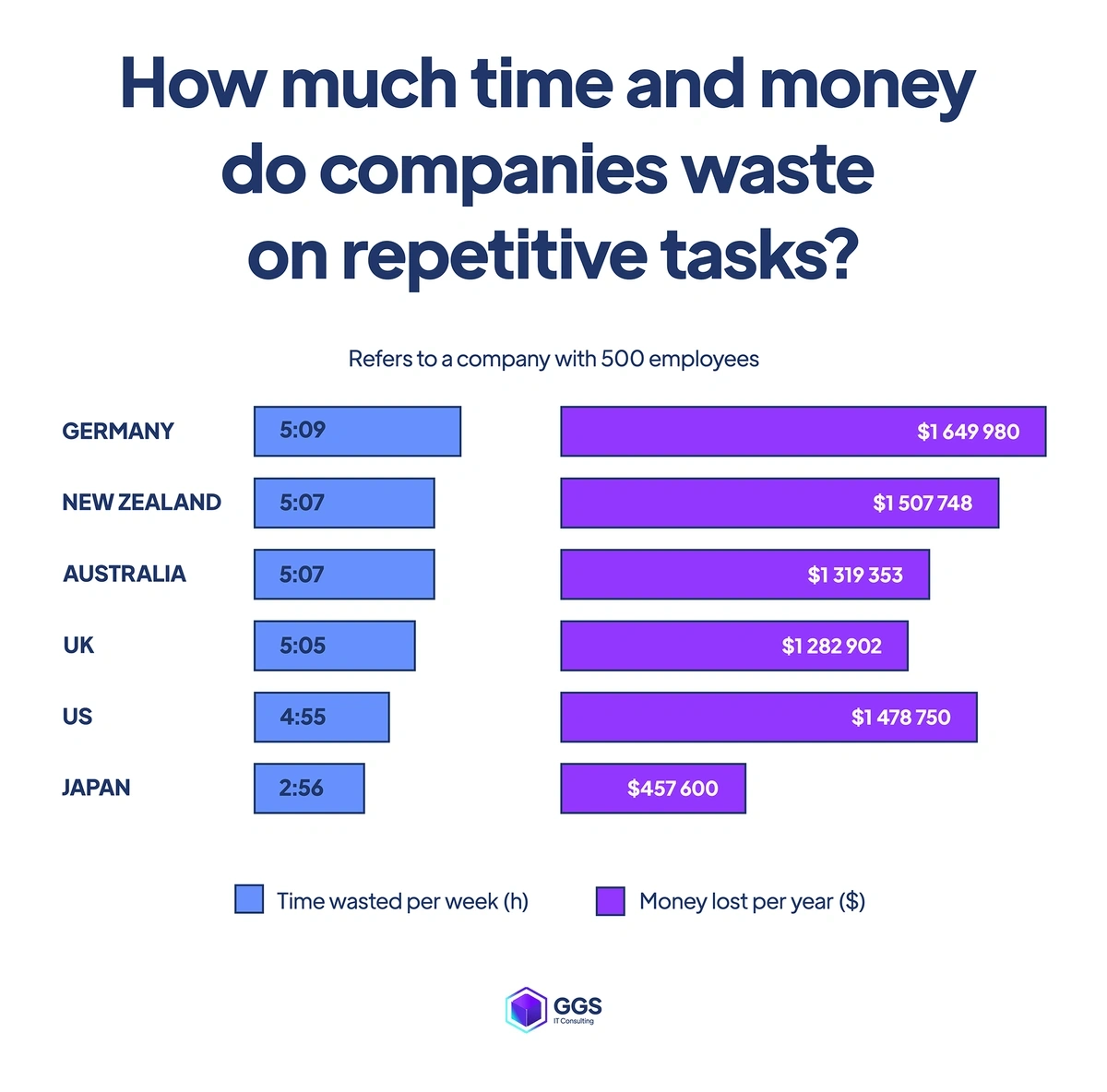

Data shows that the average company in the US with 500 employees loses more than $1.4 million each year due to time wasted on repetitive tasks.

Losing time to repetitive tasks costs businesses more than a million dollars annually.

RPA solutions can also save time and money when it comes to low-value, mundane tasks done within a business.

For instance, when RPA is at work copying and pasting information from a document to a database the process goes faster and the results have a higher rate of accuracy than when humans perform the task.

Estimates show that RPA can increase workplace capacity by as much as 50%.

Not to mention that high-value human talent can be applied to another task.

RPA can also be used to extract data from websites, book appointments, collect information from customers, monitor compliance, and onboard employees — just to name a few tasks.

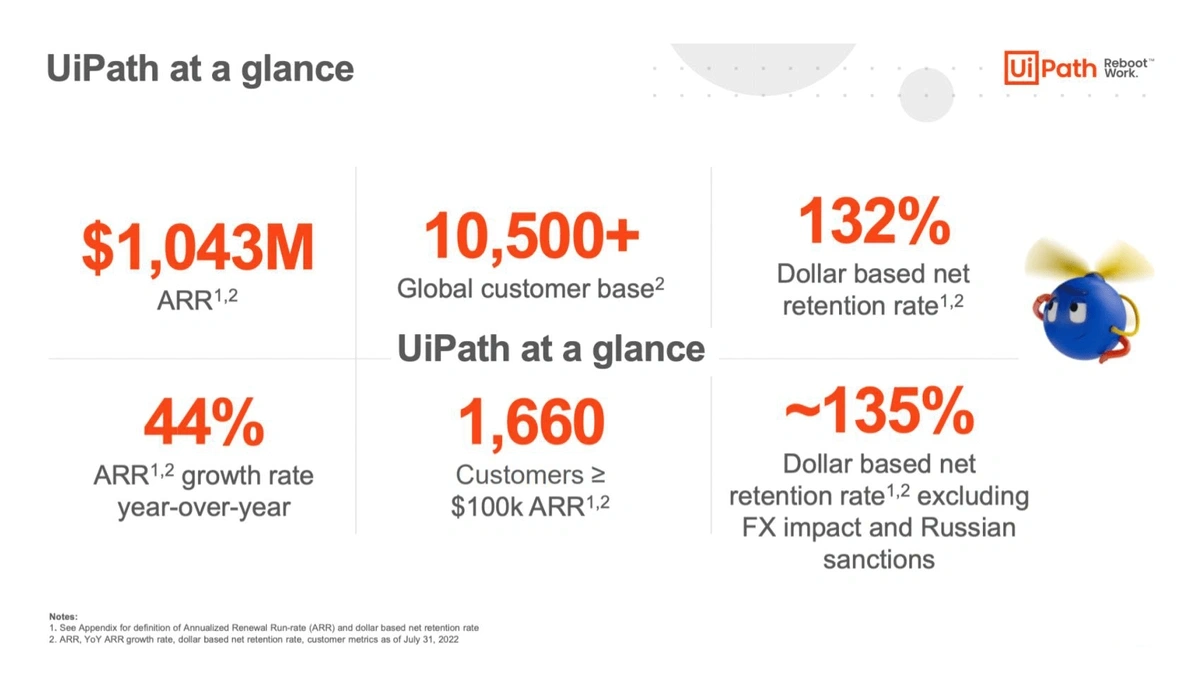

As far as RPA vendors, UiPath is the clear market leader.

The company recently surpassed $1 billion in ARR and currently serves more than 10,500 customers around the globe.

UiPath has successfully marketed its RPA solutions as integral to a business’ digital transformation.

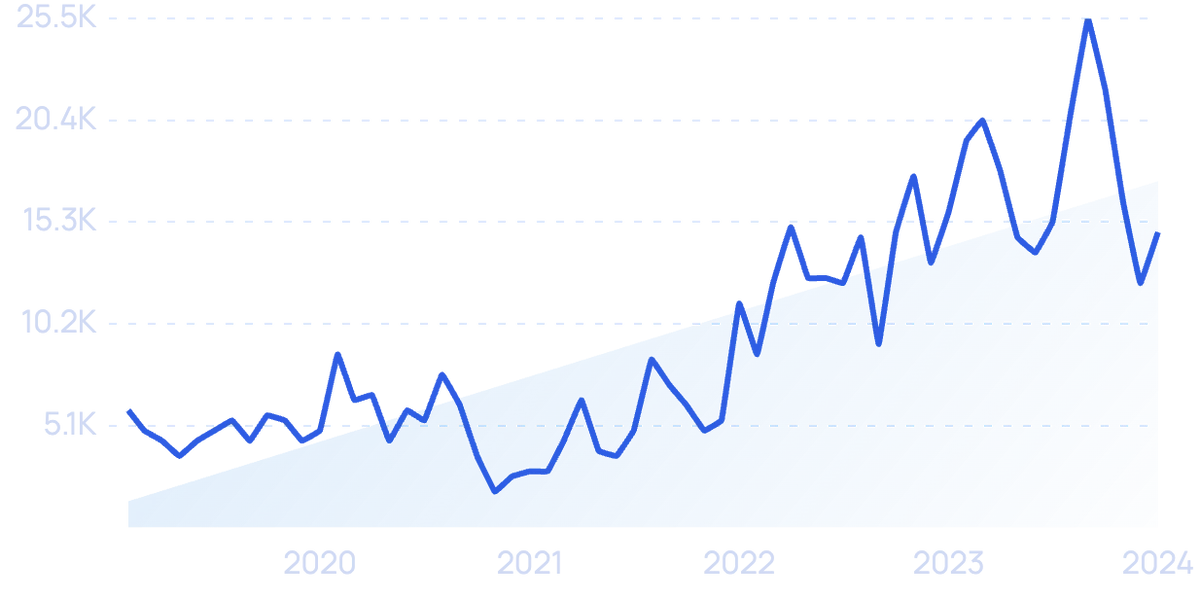

9. FemTech Looks to Reform Traditional Women’s Healthcare

The FemTech sector — defined as tech related to fertility, menstruation, pregnancy, and other women’s health topics — is poised for huge growth in the coming years.

Search interest in “FemTech” has increased more than 700% in the past 5 years.

Predictions show its value could shoot up from $51 billion in 2021 to $103 billion by 2030.

An analysis by McKinsey points out several ways surging investment and growth in FemTech is trickling down to consumer products.

Virtual clinics are providing telemedicine solutions that allow women across economic classes to access quality care. Trackers and wearables are providing women with the data they need to better assess their health. Startups are bringing more attention to cultural populations (LGBTQ+ and Black women, for example) that are often marginalized in traditional care settings.

The sector saw its first-ever unicorn in 2021: Maven Clinic.

Search volume for “Maven Clinic” is up more than 152% since 2019.

The company created a digital health platform to provide medical care specifically to women and families. They’ve treated more than 15 million patients so far.

In November 2022, they closed a $90 million Series E round to bring their total funding to nearly $300 million.

Maven Clinic’s digital platform offers comprehensive care for women.

One of the most popular science-backed FemTech trackers today is breathe ilo.

Here’s how it works.

A woman breathes into the breathe ilo device for 60 seconds and the device measures the CO2 levels in her breath. The data is sent to a smartphone app, which utilizes a self-learning algorithm to predict the woman’s ovulation. (CO2 levels are highest in the first phase of a woman’s menstrual cycle)

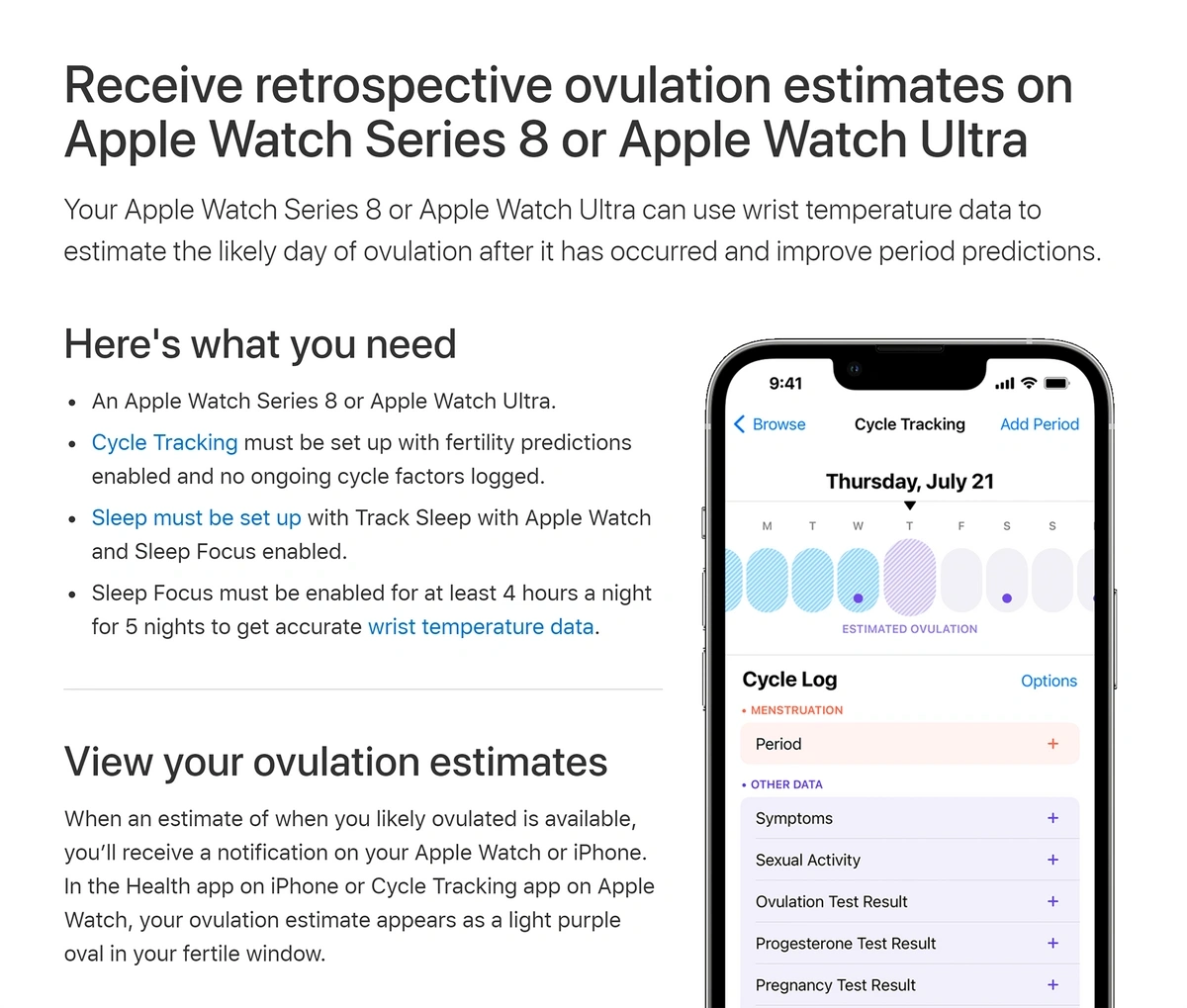

Other tech companies, like Apple and Samsung, are looking to capitalize on FemTech without creating stand-alone devices.

For instance, the Apple Watch Series 8 tracks body temperature via two wrist sensors. The Health app displays the results and ovulation predictions.

Apple’s latest smartwatch tracks women’s temperatures as they sleep and uses that data to predict the days in which a woman is most fertile.

Samsung partnered with Natural Cycles to add ovulation tracking to its Galaxy Watch 5. The temperature tracking tech from Samsung will be combined with an ovulation-predicting algorithm from Natural Cycles.

The feature will roll out to 32 markets in mid-2023.

10. Wearable Devices Get Sleeker & Smarter

The market for wearables continues to trend upward.

Up until recently, many wearables were focused on sleep tracking and step counting.

In recent years, however, we’ve seen a variety of devices launched with features that go far beyond these basic functions.

A few tech companies offer smart rings with built-in near-field communication technology.

These rings enable wearers to make payments, unlock smart-key doors, and share data with the swipe of their fingers.

For instance, McLear’s RingPay acts as a contactless payment device, allowing users to swipe their ring in the same way they swipe a contactless card. There’s no need for any kind of interface or app.

Another example comes from the smart ring brand Cnick. They’ve created the Tesla key ring.

Search volume for “Tesla ring” has climbed more than 240% in the past 5 years.

Owners can lock, unlock, and start their vehicle by simply taping their knuckle.

The ring can also be used for contactless payments.

Cnick’s rings are waterproof and never need to be charged.

There’s also increasing consumer demand for tech wearables that are embedded in clothing, referred to as e-textiles.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

In one example, the Nadi X yoga pants use sensors and stretch bands to analyze and provide feedback on the owner’s posture.

For long-distance runners, Sensoria socks could potentially help prevent injuries.

Sensoria’s smart socks track a variety of data points for walkers and runners.

These smart socks have textile sensors running through them that not only record basic measurements like step count and distance, but also track cadence, foot landing, and the impact generated with each step.

When paired with the mobile app, runners get real-time audio cues to correct problems that may lead to injuries.

And even babies are wearing smart clothes.

The Owlet dream sock fits snuggly on a baby’s foot and monitors heart rate, oxygen level, movement, and wakings.

The Owlet dream sock allows parents to monitor their baby’s data from an app.

11. Extended Reality Expands Beyond Entertainment

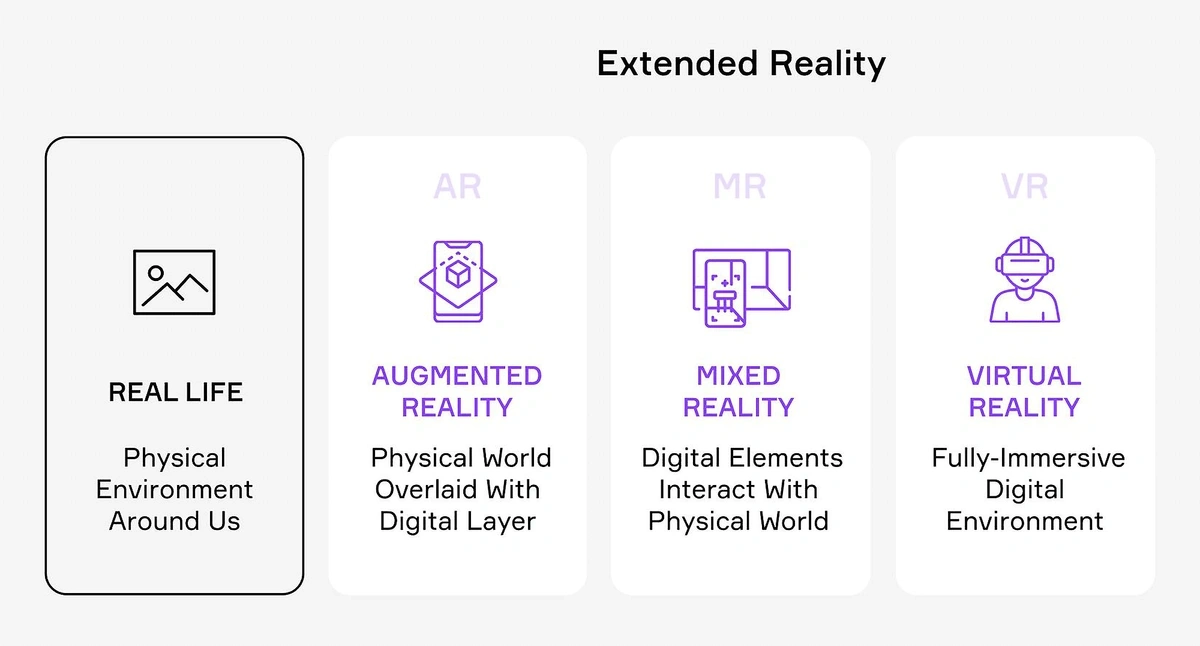

As the lines blur between mixed reality, augmented reality, and virtual reality, the term “extended reality”’ has become an umbrella term designed to encompass all of the above and more.

Search volume for “extended reality” is up more than 150% since 2019.

In the next few years, extended reality has potential applications in everything from the metaverse to virtual concerts.

The concept of extended reality includes AR, MR, and VR applications.

For starters, there are multiple B2B use cases where extended reality could drive serious innovation.

One, in particular, is the medical field.

In just one application, extended reality is being used to train both new and existing surgeons.

This technology could prove highly useful in helping surgeons understand the intricacies of new, innovative surgeries they may not have learned about in school or previous positions.

A study in Clinical Orthopaedics and Related Research found that VR training significantly increased the accuracy of surgery and the rate of completion of surgery.

Another study showed VR training improved surgical performance by up to 230%.

The automotive and manufacturing industries are two other sectors in which extended reality is expected to make an impact in the coming years.

VR training is helping automotive manufacturing employees practice assemblies and prevent errors.

The technicians in these industries are required to perform highly intricate processes and machine work.

Because of that, extended reality technology can be used to provide an up-close, first-person view of those processes in a safe environment where mistakes can easily be remedied.

When technicians are able to practice assembly processes before stepping onto the actual line, human error and injuries can be prevented.

Extended reality is even being used to train automotive students.

Maryland’s Vehicles for Change program is a virtual-first training program that aims to ease the mechanic labor shortage and, at the same time, provide job options for former prisoners.

The program is expected to expand to 20 new sites by 2028.

The United States military is also using extended reality for training purposes.

With this technology, military leaders can set up training operations that are too dangerous or costly to set up in the real world. It also has the benefit of reducing wear and tear on critical pieces of equipment like aircraft.

In April 2022, the Army reiterated the military’s interest in extended reality technology when officials requested new technologies from public industries as part of the Technologies for Mission Rehearsal and Training project.

It seems that current extended reality technology isn't quite as advanced as the military would like.

The Army announced a $21.88 billion contract with Microsoft to acquire 120,000 HoloLens-like headsets, but the timeline was pushed back in late 2021 and the headsets are currently going through another series of redesigns.

The Army’s extended reality headsets are specifically called IVAS: integrated visual augmentation system.

12. Edge Computing Transforms How Enterprises Use Data

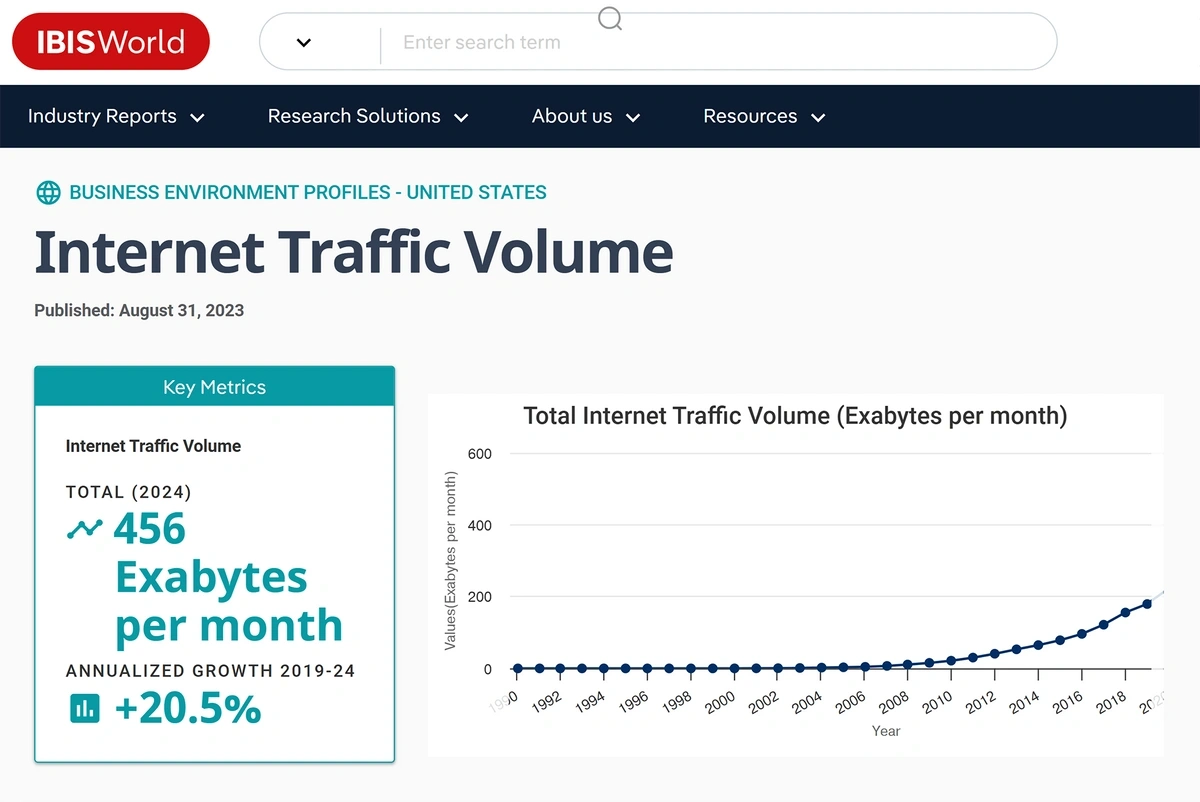

In 2018, global data centers processed approximately 155 exabytes of data per month. In 2023, that number had skyrocketed to 374 exabytes.

According to estimates, total amount of data transferred via the internet reached 456 exabytes per month in 2024.

As the world is becoming increasingly digital — and 5G technology enables larger data transfers at faster speeds — IT infrastructure is requiring more processing power than ever.

In particular, growth in data-intensive technologies like personal and enterprise use of IoT, remote health monitoring, and remote work is expected to continue pushing global data processing requirements to record highs.

To aid in the processing of all that data, companies are pouring more of their budgets into edge computing.

Search volume for “edge computing” is up nearly 150% in the past 5 years.

In 2023, it’s estimated that more than half of all new enterprise IT infrastructure will utilize edge computing.

With a focus on speed and network distribution, edge computing is designed to improve response times and save bandwidth by moving processing power physically closer to the source of data.

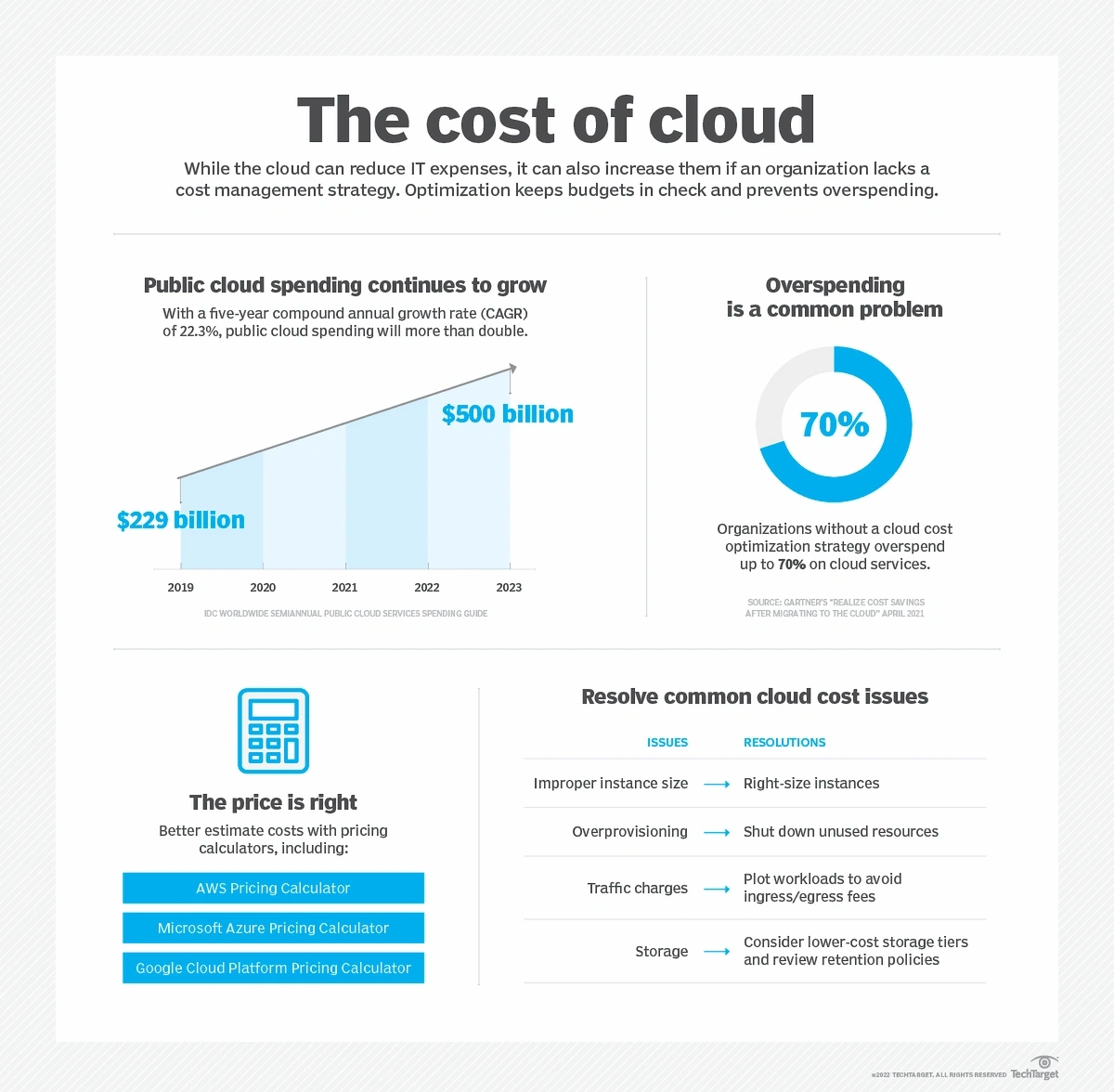

Cloud computing has been one popular way businesses have attempted to deal with massive amounts of data and increasing technology needs.

However, cloud computing is both expensive and resource-intensive. This is especially true for companies dealing with large amounts of data because many cloud storage services base their fees on usage.

The cost of cloud services continues to be a pain point for IT.

Because of this, corporations are looking at ways to reduce their dependence on cloud computing by moving to edge computing instead.

By leaning more heavily on the edge, and in particular its ability to reduce bandwidth transmissions, companies will be able to reduce their cloud computing bill while providing a faster user experience to end-users.

Edge computing also decreases latency because data isn’t being sent back and forth between the cloud and devices. This provides enterprises with the opportunity to analyze data faster and make quicker decisions.

In fact, 45% of IT professionals say this is the biggest advantage of running workloads on the edge.

The lower latency achieved by edge computing allows enterprise leaders to make real-time decisions.

Growing reliance on AI is also fueling the growth of edge computing.

To reach its full potential AI/ML systems will need to become more data-driven. And that means more analysis and computation needs to happen at the edge.

Search volume for “edge AI” is up more than 800% in recent years.

Self-driving cars are a great example of edge AI in the real world.

The car’s sensors collect data and take action in the blink of an eye without ever sending that data to the cloud.

In another example, edge AI enables security cameras to process data and run real-time algorithms to detect suspicious activity and take action immediately.

13. More Developers and Non-Developers Use Low/No Code Tools

Given the constant release of new and exciting technologies, it’s easy to assume tech companies are rolling out new products and services as fast as they can.

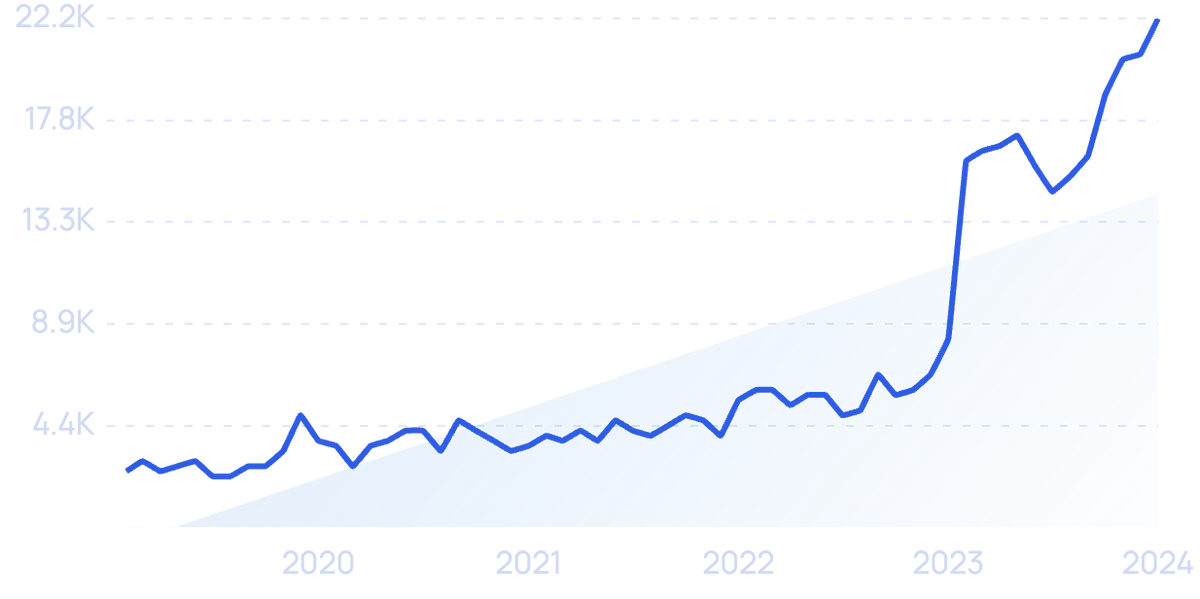

In reality, however, there’s a serious shortage of developers.

IDC predicts the shortage will reach nearly 4 million unfilled positions in 2025.

In a 2023 survey from Infragistics, more than 37% of respondents said they expect to continue having trouble hiring developers in 2023.

Developer shortages are prompting companies to invest in low-code now-code platforms.

With a persistent and growing shortage of talent, creating solutions that allow developers to work more efficiently has become critical for companies that want to move initiatives forward and outpace their competition.

Fortunately, that’s precisely what low-code and no-code (LCNC) software programs can do.

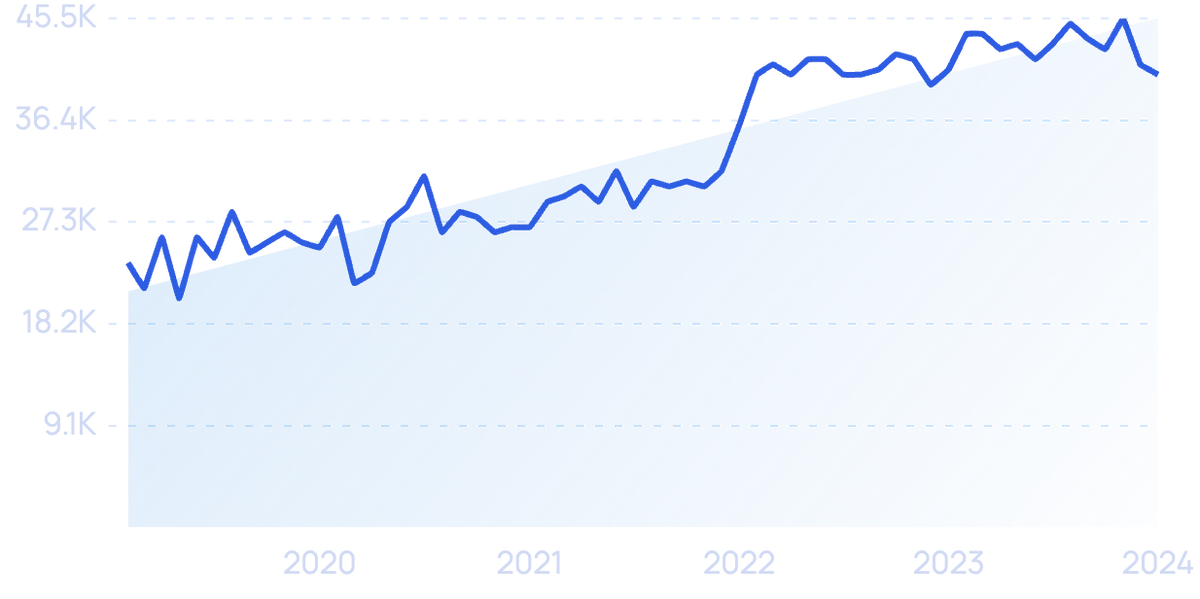

Search volume for “low code” continues to grow.

By combining visual models with AI-powered tools, software developers who use LCNC are able to skip, or at least expedite, the time-consuming process of writing thousands of lines of code from scratch.

This dramatically streamlines the coding process and speeds up the development of software.

And it’s not just full-time software developers that benefit from these new tools.

Because LCNC solutions are meant to be user-friendly by design, an increasing number of non-developers are able to build software programs too.

These non-IT employees are being called “citizen developers.” Gartner predicts that large enterprises will soon have four times the amount of citizen developers as compared to professional developers.

The Infragistics survey showed more than 76% of organizations are already utilizing LCNC.

Further proof that adoption is soaring is the growth of the low-code market. It was expected to jump to $27 billion in 2023, a 20% increase over 2022.

At the core of LCNC solutions are what’s known as low-code application platforms (LCAPs).

These platforms are component-based and offer pre-defined templates.

Mendix was the leader in the 2023 Gartner Magic Quadrant analysis for low-code platforms.

Search volume for “Mendix” is up more than 120% since 2019.

Their platform is used by more than 4,000 enterprises worldwide.

Since being acquired by Siemens in 2018, Mendix’s ARR has grown more than 300%.

The Mendrix platform provides visual, model-driven app development.

With an increasing shortage of software developers and an increasing number of people successfully building applications using LCNC, it's safe to assume these platforms and their use among enterprises will continue to advance at a blistering pace.

As evidence of this, Gartner estimated that LCAPs would account for $10 billion of the LCNC market in 2023 and $12.3 million in 2024.

Conclusion

That wraps up our list of the top 13 technology trends impacting enterprises and consumers right now.

From labor shortages to a computer chip crisis, companies across the globe have faced a variety of challenges over the last two years.

Despite these challenges, however, the technology sector continues to grow and adapt to new demands.

With a focus on solving today’s most pressing problems and a seemingly infinite pool of cash available to the companies that succeed, it’s unlikely the tech industry will slow down anytime soon.

Instead, the technology trends we’ve outlined above are set to play a large role in molding our future.

You may also like:

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more