Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Top Economic Trends (2024 & 2025)

You may also like:

Trends in the global economy affect everything.

In fact, it could be argued that almost every other trend is dependent on economic conditions.

In a downturn, consumer confidence wanes, retailers struggle, and businesses are forced to deal with uncertainty. And in times of growth, critical infrastructure and innovation can be built out.

With that, here's our list of the top 10 trends impacting the economy right now.

1. Decreasing Inflation and Fed Rate Cuts Could Lead to Soft Landing

Over the past 18 months, predictions regarding the future of the US economy have varied considerably.

Many experts believed the country would land in a recession in 2023 but that didn’t happen.

The latest predictions say inflation will continue to decrease throughout 2024, prompting the Federal Reserve to cut interest rates.

In January 2024, the Fed kept rates locked in where they’ve been since July 2023 — between 5.25% to 5.5%.

That’s because the consumer price index was up 3.1% year-over-year, still higher than the Fed’s preferred rate of 2%.

Sticky inflation was a key headline for the US economy in early 2024.

Some leaders worry that keeping rates high for too long will cause a dramatic decrease in consumer and business spending and borrowing. These two things have the potential to send the country into a recession.

These concerns have prompted the Fed to forecast three quarter-point rate cuts by the end of 2024. That would push rates down to 4.6%.

Predictions show the cuts will most likely start in the summer of 2024.

Rate cuts could put the economy in a “soft landing,” as economists call it.

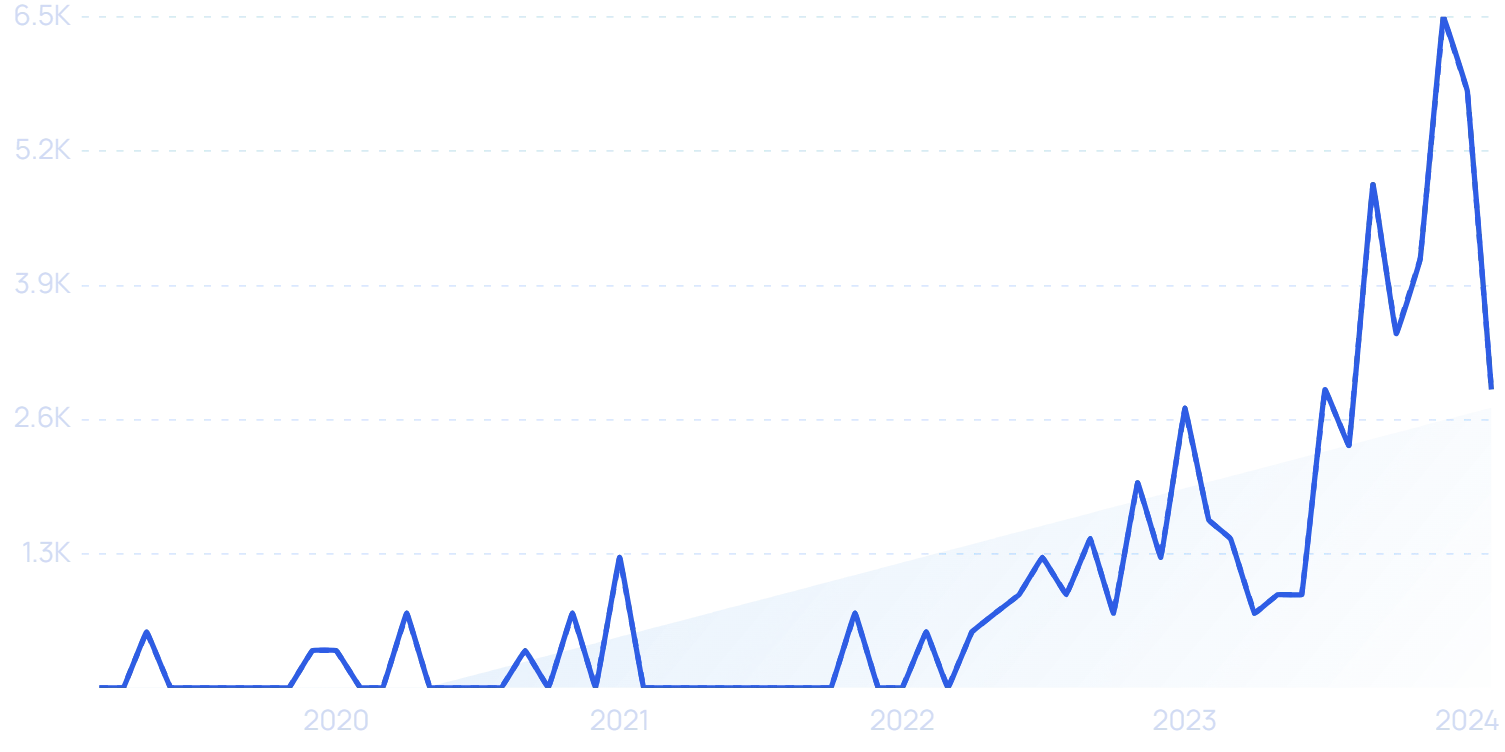

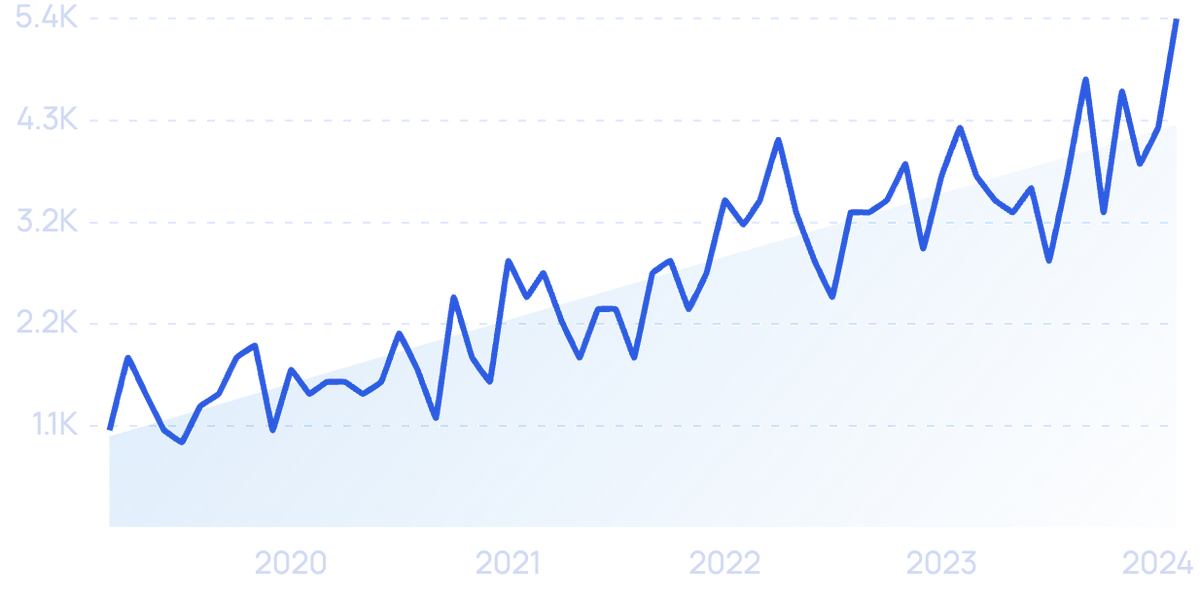

Search interest in the “economy soft landing” has grown more than 6,000% in recent years.

This landing means the economy would see lower inflation, avoid a recession, and slowly grow.

Officials from the International Monetary Fund have slightly increased their predictions for GDP growth in the US in 2024. Early predictions showed just 1.5% annual GDP growth, but their most recent forecasts say the GDP could grow 2.1% in 2024.

Bank of America analysts are a bit less optimistic and predict a 1.4% growth in GDP in 2024.

Analysts from Wells Fargo are most pessimistic, putting total GDP growth at 1.3%.

Wells Fargo predicts a 1.3% increase in GDP.

2. Increasing Consumer Confidence While Keeping an Eye on Debt

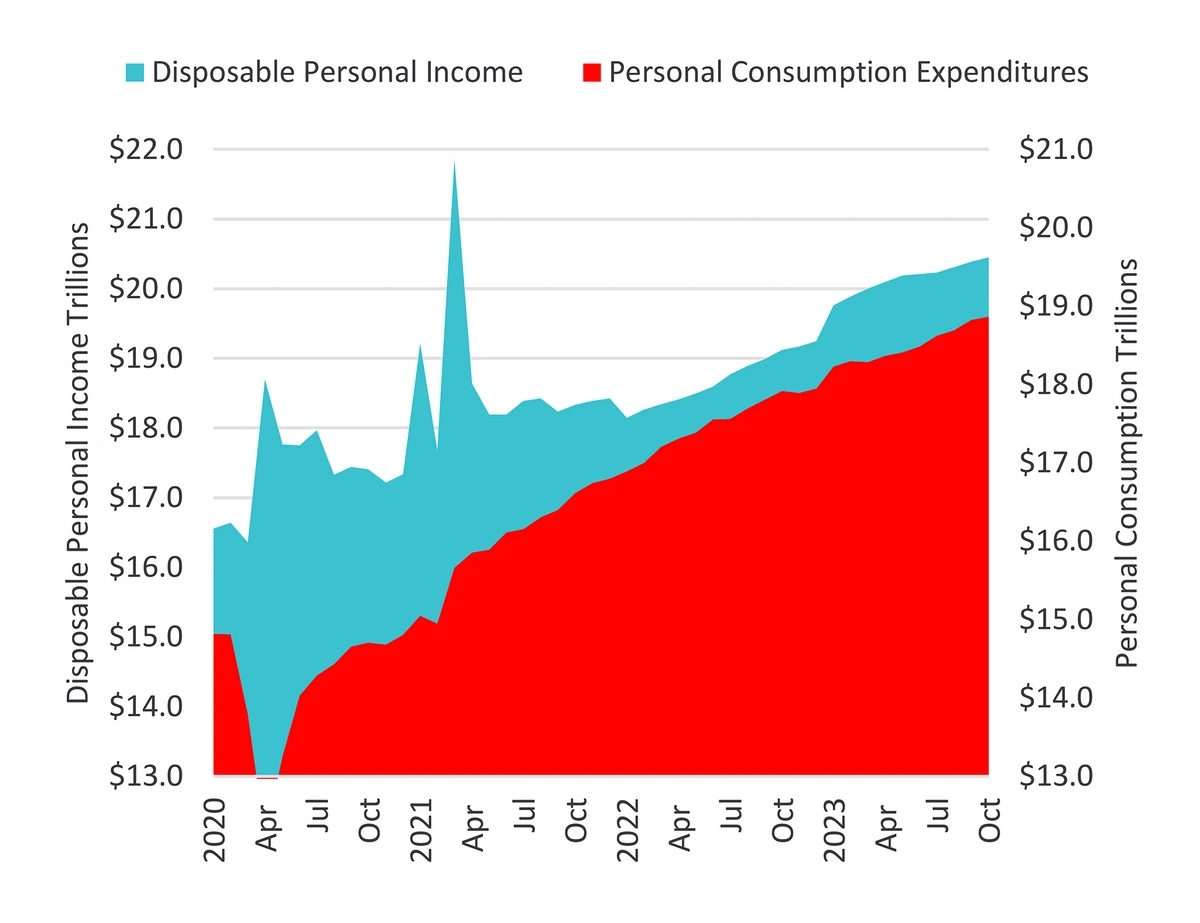

Consumer spending is responsible for more than two-thirds of total economic activity in the United States.

Despite tough conditions in 2023, consumer spending grew 2.5%.

Household income and savings grew in 2023, as well.

Nominal disposable income increased nearly 7% year-over-year in 2023, and consumer net worth was up more than 5%.

In late 2023, the National Retail Federation reported that increased disposable income would lead to strong holiday sales.

Consumers seem to be feeling confident about 2024, as well.

In January 2024, consumer sentiment reached its highest level since July 2021. That’s according to a survey conducted by the University of Michigan.

The same survey reported that more than 40% of consumers predict positive economic conditions for the year ahead.

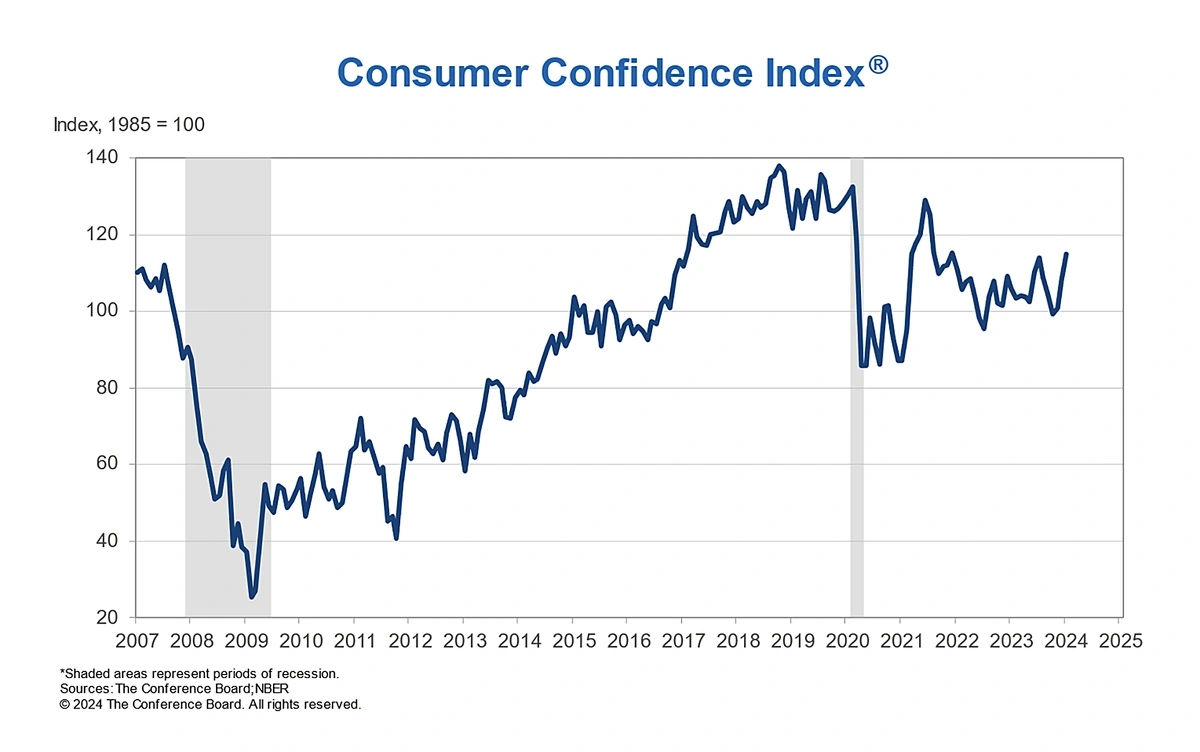

The Conference Board also reported an increase in consumer confidence in early 2024.

The Consumer Confidence Index is rising.

Their survey reported consumer confidence was 114.8 in January 2024. (It’s measured on a scale with a baseline value of 100.)

That was the third straight monthly increase and the highest value since December 2021.

Search volume for “consumer confidence index” shows variable growth over the past 5 years.

However, there’s another issue that financial experts say could have a major impact on consumer spending in the near future: debt.

According to a report from LPL Financial, consumers are seeing increasing debt burdens. This means depleted savings and delinquencies in credit card and auto loan payments.

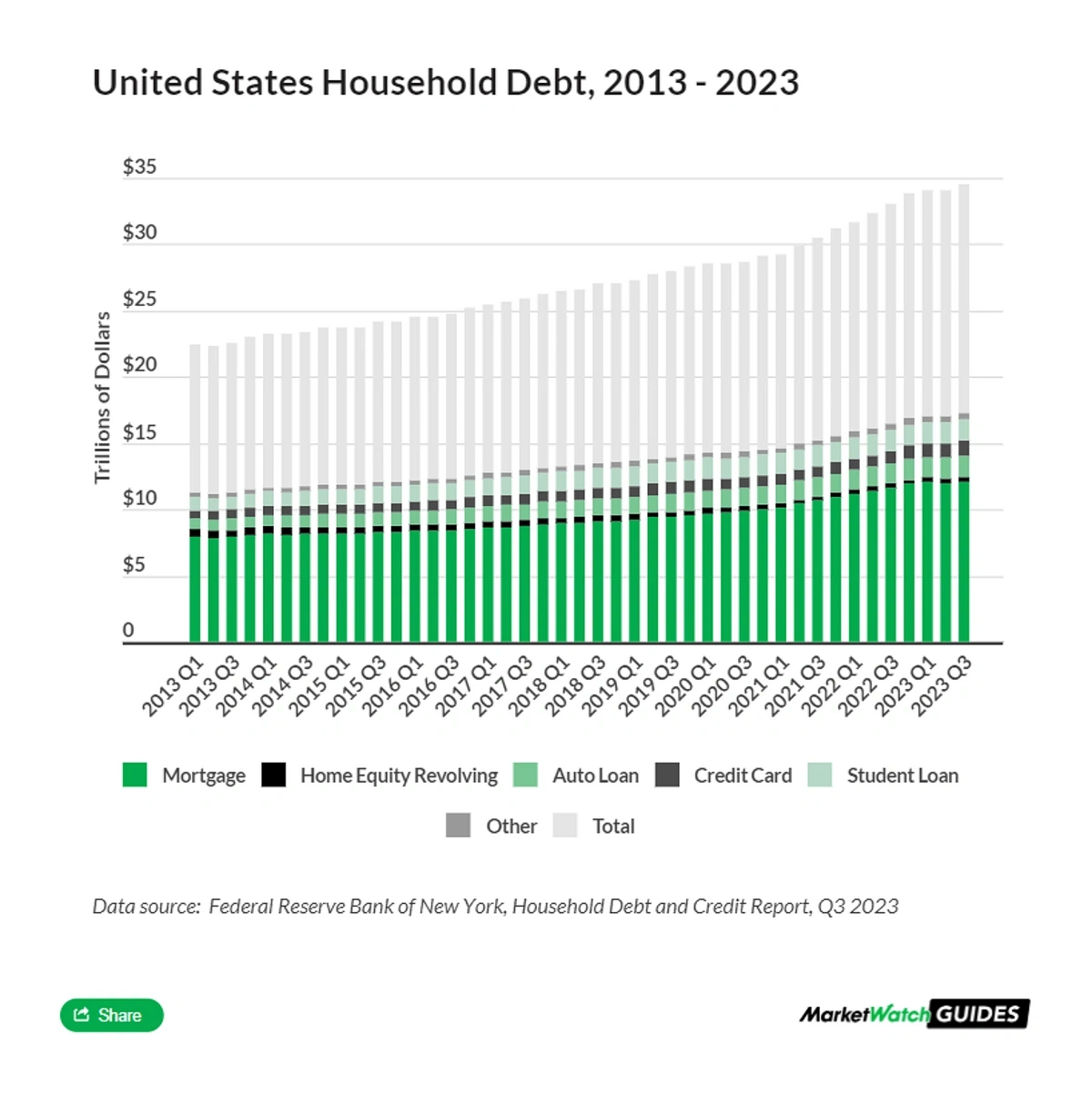

Data from the Federal Reserve Bank of New York shows just how much debt Americans are carrying: a total of $17.3 trillion.

Household debt in the US hit an all-time high in 2023.

Overall, household debt increased 4.8% between November 2022 and November 2023.

And, credit card debt increased by more than 16% during that time.

3. Modest Growth in the Real Estate Sector

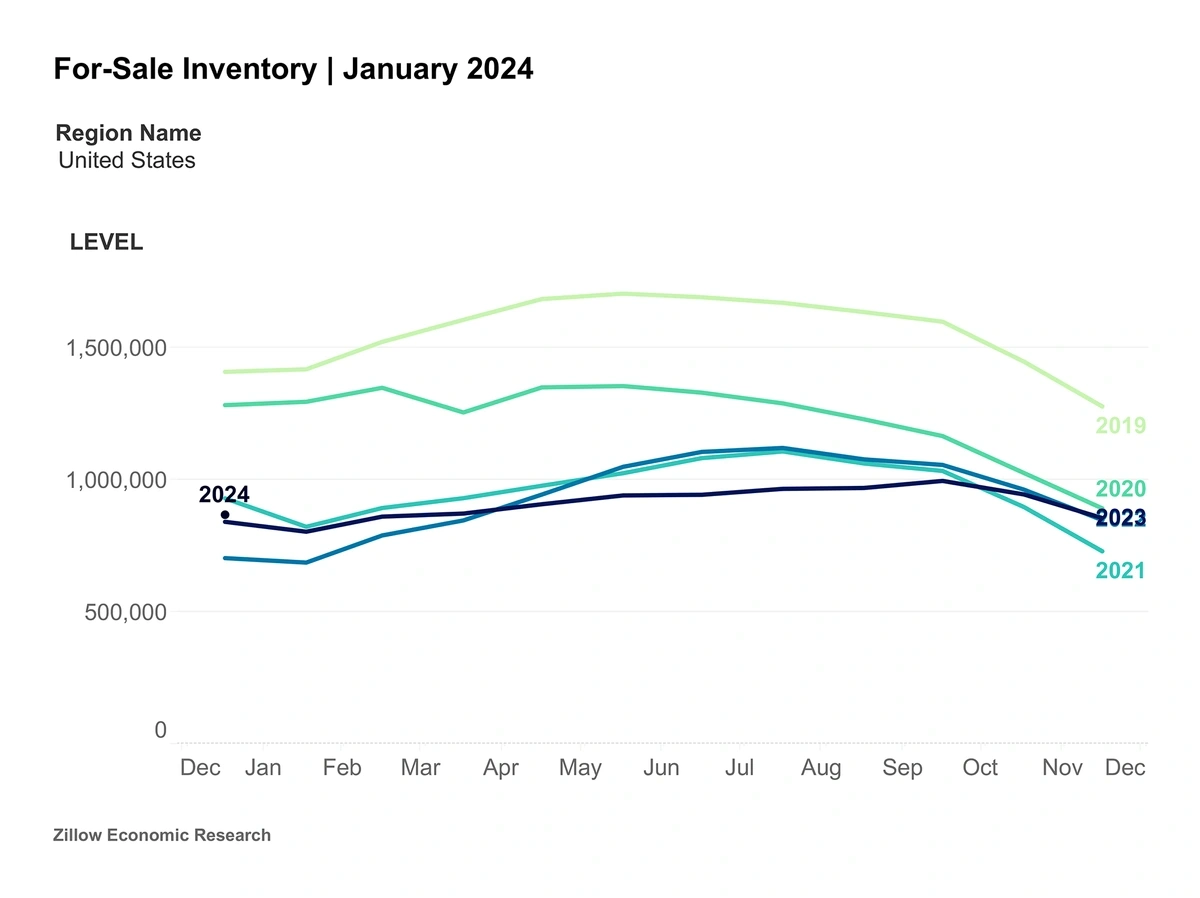

Low inventory and high-interest rates have plagued the real estate sector for the past several months.

If the Federal Reserve does lower rates this summer, more buyers could enter the market for single-family homes.

However, according to Freddie Mac, the decreasing rates won’t be enough to make a major change in the market. They predict homeowners with optimal pre-pandemic mortgage rates will remain in their homes, keeping overall inventory low.

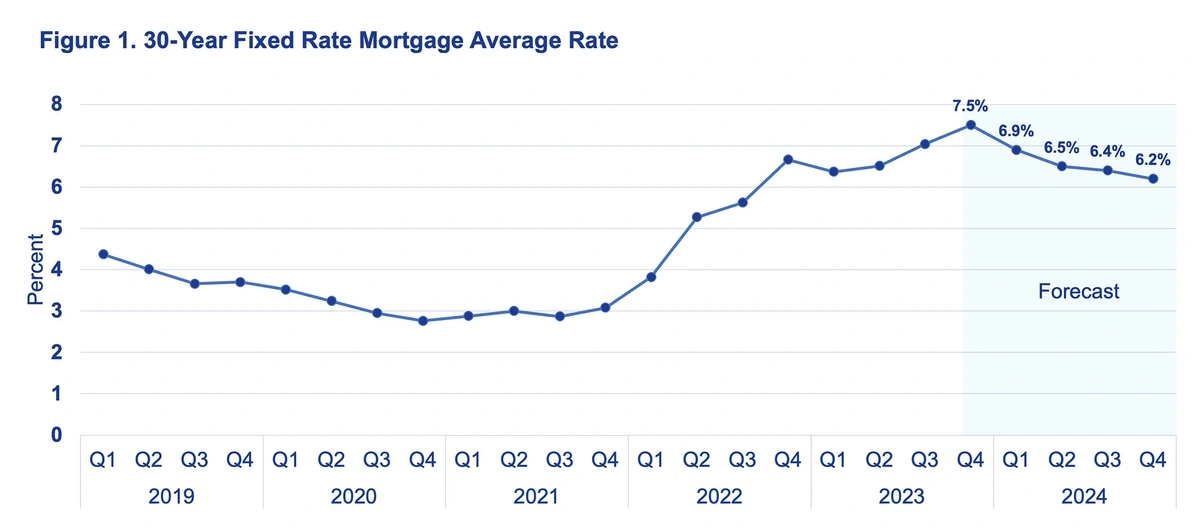

Bright MLS predicts mortgage rates won’t truly dip near 6% until late 2024.

Mortgage rates are expected to drop slowly throughout 2024.

But nearly 90% of current homeowners already have rates under 6%.

For reference, mortgage rates were hovering around 3.2% at the beginning of 2022.

In early 2024, Zillow reported that inventory levels were up a modest 3% year-over-year.

Home inventory in January 2024 was 37.3% lower than pre-pandemic levels for January.

As for prices, the average sale price for an existing home at the end of 2023 was $382,600 — a 4.4% increase year-over-year.

And according to May 2025 Exploding Topics data, Zillow is receiving over 274 million monthly visits.

Freddie Mac predicts a continued increase in home prices. They say prices will increase by 2.8% in 2024 and another 2% in 2025.

Despite this, the National Association of Realtors predicts existing home sales in 2024 will increase 13% year-over-year. By 2025, they say there could be a year-over-year increase of nearly 16%.

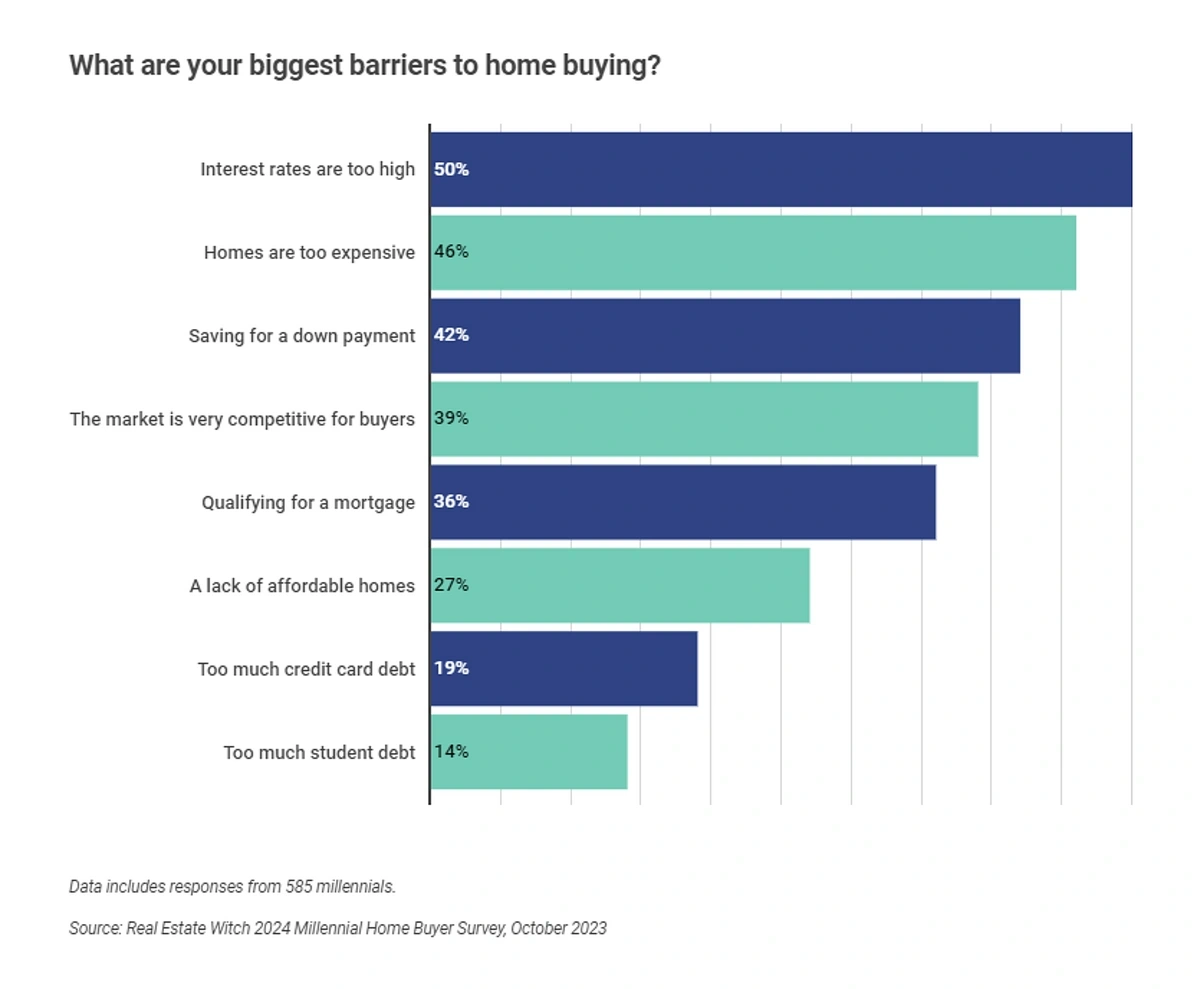

Millennials will drive some of this growth. This generation is proving to be incredibly motivated when it comes to buying a home.

One survey reported that nearly 80% of millennials would take on a mortgage rate above 7% and 30% say they plan to max out their budget when buying a home in 2024.

Price is the biggest barrier for millennials who would like to buy a home.

Another key factor in the real estate sector is the homeownership rates of baby boomers — those between 60 and 78 years old right now.

Members of this generation own more than double the amount of real estate owned by millennials. That’s $19 trillion worth of property.

The rate at which these homeowners leave their homes could drastically impact inventory levels and real estate prices in the years to come.

4. Climate Disasters Threaten Local and Global Economies

The impact of climate change is accelerating.

NOAA’s data shows that Earth’s temperature has risen by 0.14° F per decade since 1880. However, the rate of warming increased to 0.32° F per decade in the years since 1981.

When discussing the effect of climate change on economies, researchers caution it’s already having an adverse impact on a local, national, and global scale.

Climate change has been linked to all sorts of extreme weather events: blizzards, heat waves, hurricanes, wildfires, and others.

And recovering from these weather events takes a toll on the economy.

Since 1980, the US has experienced 376 weather disasters in which overall costs were $1 billion or more. The total cost of all the events is more than $2.655 trillion.

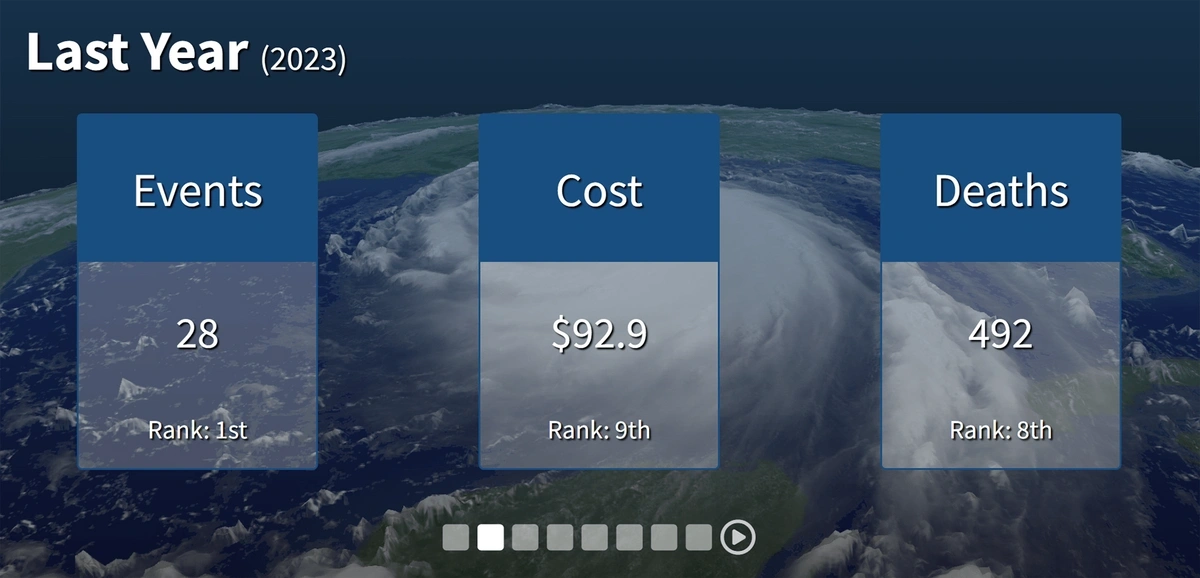

In 2023, there were 28 climate disaster events.

Other estimates say the US has an extreme weather event costing $1 billion or more every three weeks on average.

Many times, these weather events prove to be a financial disaster for homeowners as well as insurance companies.

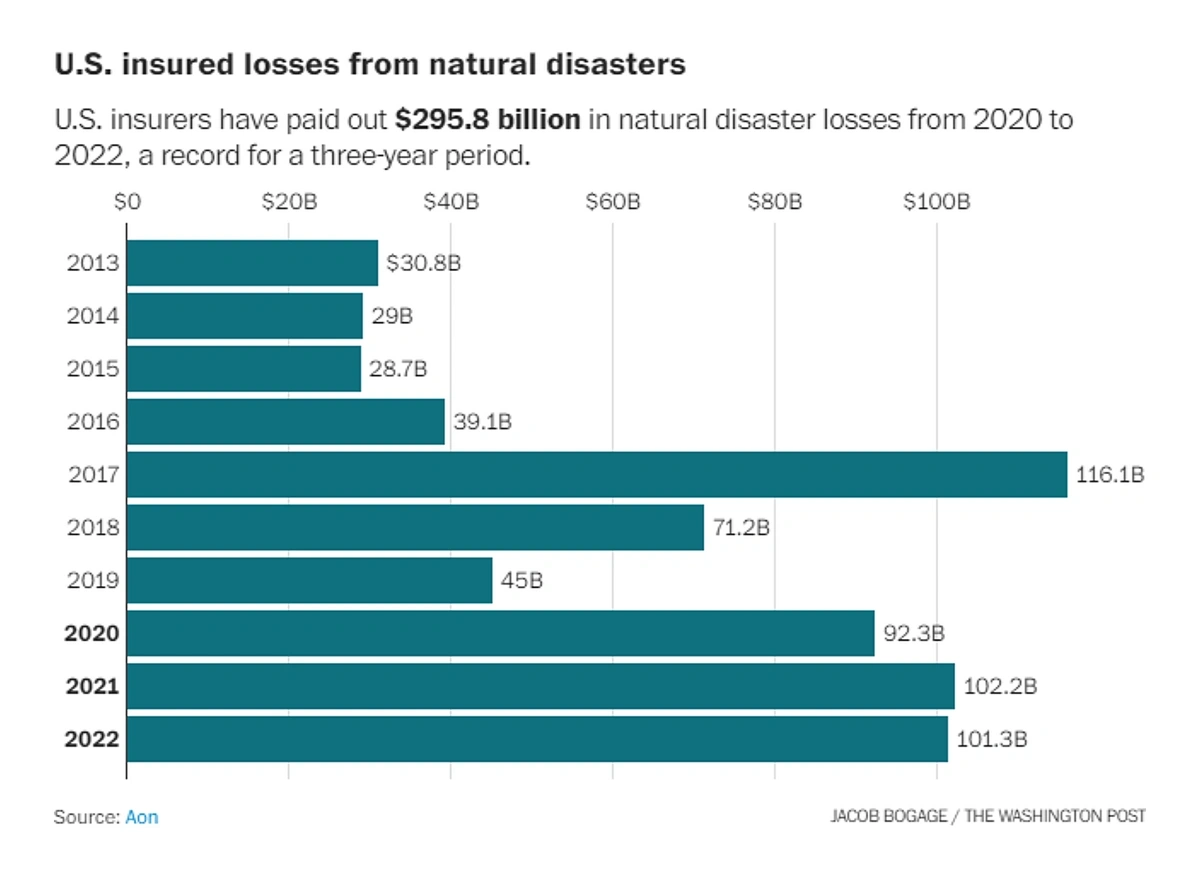

In 2022, the 119 natural disasters resulted in $99 billion in insured losses for homeowners.

From 2020 to 2022, insurers sent out more than $295 billion in claims related to natural disasters.

Natural disasters are costing insurance companies billions of dollars.

The economics are so dire that many insurers are no longer offering coverage in areas that are prone to climate disasters.

Some insurers have said they’re cutting hurricane coverage for property along coastlines and wildfire coverage in California.

Insurers are eliminating some forms of disaster coverage.

For those who can get coverage, home insurance premiums may jump as much as 5.3% per year through 2040 in response to climate change.

Climate change also has the potential to severely impact the GDP of economies across the globe.

A 2022 analysis from S&P Global found that climate change could result in up to 4.5% reduction in global GDP by 2050.

Swiss Re predicts the reduction in total economic value could be 10% by 2050.

In addition, a study found that 63 countries are at risk of having their credit rating cut by 2030 as a result of climate change. By 2100, researchers estimate that 80 countries will have an average downgrade of 2.48 notches.

5. Marketers and Consumers Are Investing in the Creator Economy

The creator economy has blossomed into a $250-billion industry and it’s still growing. Predictions show it could hit $480 billion by 2027.

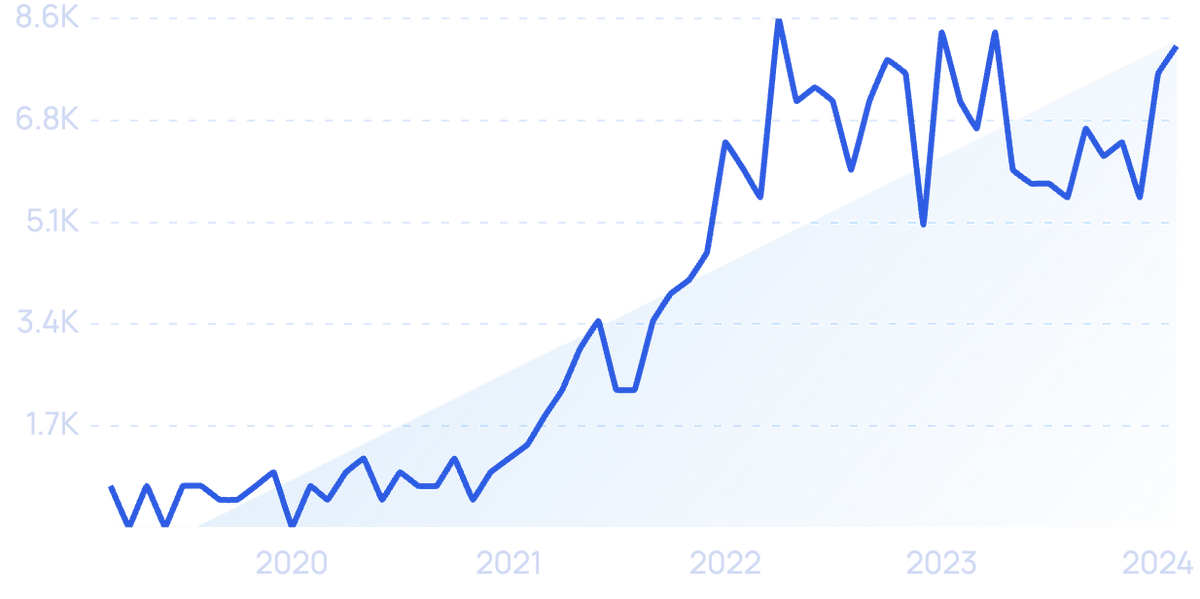

Search interest in the “creator economy” has grown more than 1,067% in the past 5 years.

Up to 200 million people work as part of the creator economy and 4% of them bring in more than $100,000 per year.

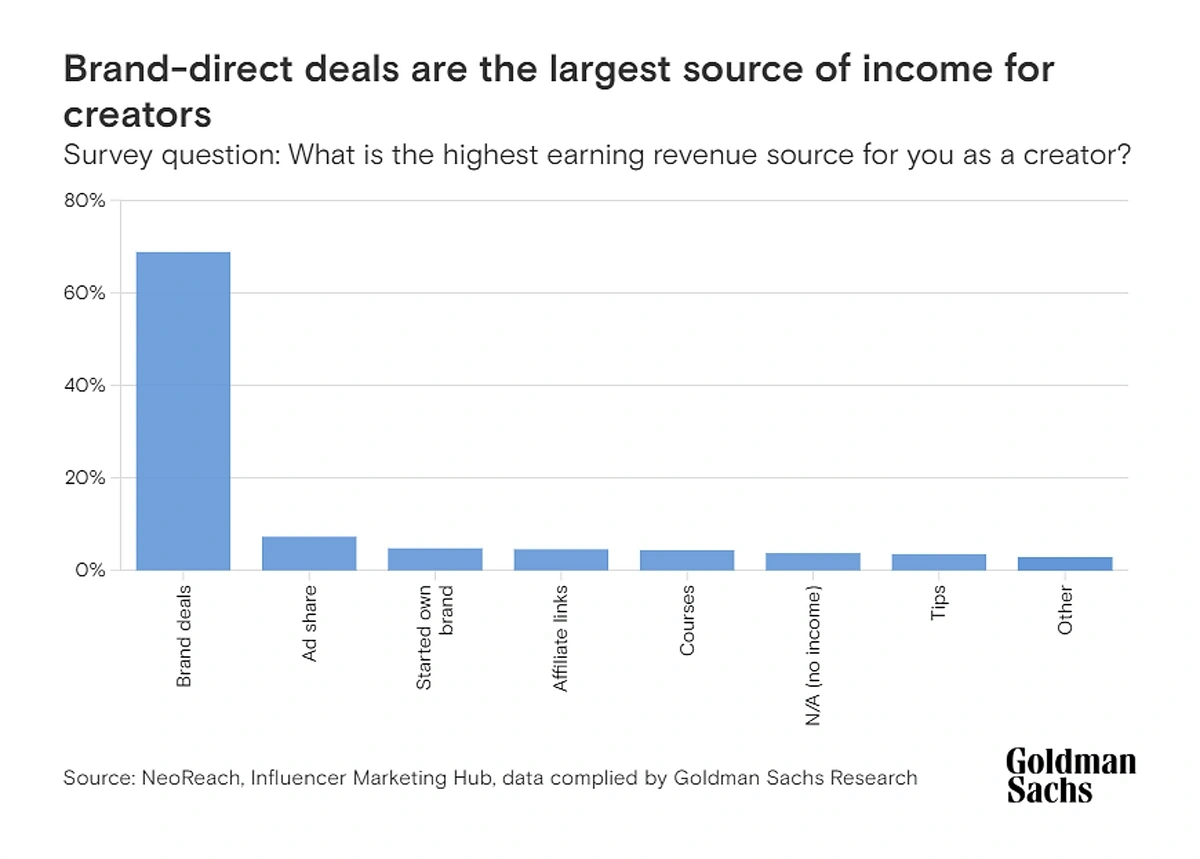

Much of the creator economy revolves around brands’ marketing dollars.

Nearly 70% of creator income comes from deals with brands.

The large majority of creator income flows from brands.

The role of creators in marketing is predicted to soar in 2024.

More than 40% of marketers plan to increase their spending on creator content.

In return, creators are driving quite a bit of revenue for these brands.

More than half of Gen Zers have bought an item after watching an influencer review the product on social media.

Total sales on social media were nearly $27 billion in 2020 and are predicted to grow to $144.52 billion by 2027.

One of the most popular platforms for content creators is YouTube.

The platform’s creative ecosystem reportedly contributed $35 billion to the US economy in 2022 and represented the equivalent of 390,000 full-time jobs. That’s according to Oxford Economics.

The Sorry Girls, aka Kelsey, Becky, Rachel, and Rochelle, tackle all sorts of design and crafting DIYs on their YouTube channel.

The creator economy has become so ubiquitous that dozens of creator-themed products have hit retail shelves.

The beauty sector is the best evidence of this trend.

40% of the top 100 creator brands are in the beauty sector. Their combined annual revenue is $1.5 billion.

In late 2023, TikTok influencer Anna Paul launched Paullie, an affordable skincare brand.

The brand reportedly had a six-figure waitlist prior to launching.

Anna Paul has more than 7 million followers on TikTok.

On the other hand, 8% of creator brands are based in the food and drink sector.

Mr. Beast, a viral YouTuber, launched a brand of snacks in 2022 and estimates show the brand pulls in $500 million in revenue annually.

6. Signs that the Labor Shortage May Not Improve

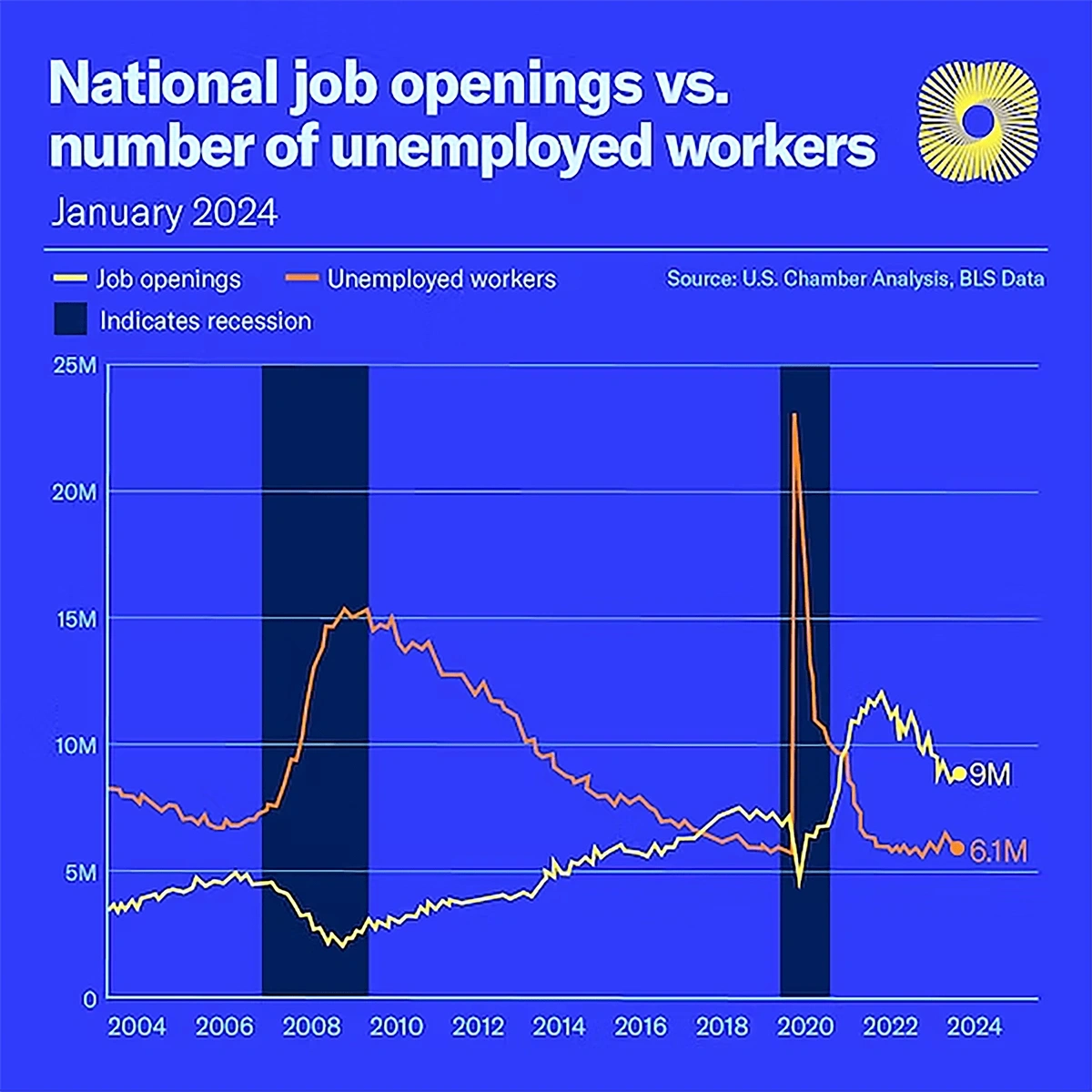

According to the US Chamber of Commerce, there are about 9.5 million jobs open in the United States but only 6.5 million available workers.

As of January 2024, approximately 6 million workers were available for employment.

The labor force participation rate, a statistic that shows the share of the population ages 16 and above who are working or seeking employment, sat at just 62.5% in January 2024.

The BLS predicts the rate to be down to 60.4% in 2032.

The labor shortage is already threatening operations and productivity in several sectors of the economy.

The construction industry alone needs to attract half a million new workers in 2024 to keep up with demand.

In the coming years, the medical field is projected to be short of nearly 200,000 nurses and 124,000 physicians.

More than 50% of tech leaders say they’re experiencing a shortage of job candidates, especially those with advanced skills in areas like AI, ML, and automation.

One contributing factor to the labor shortage is a lack of child care.

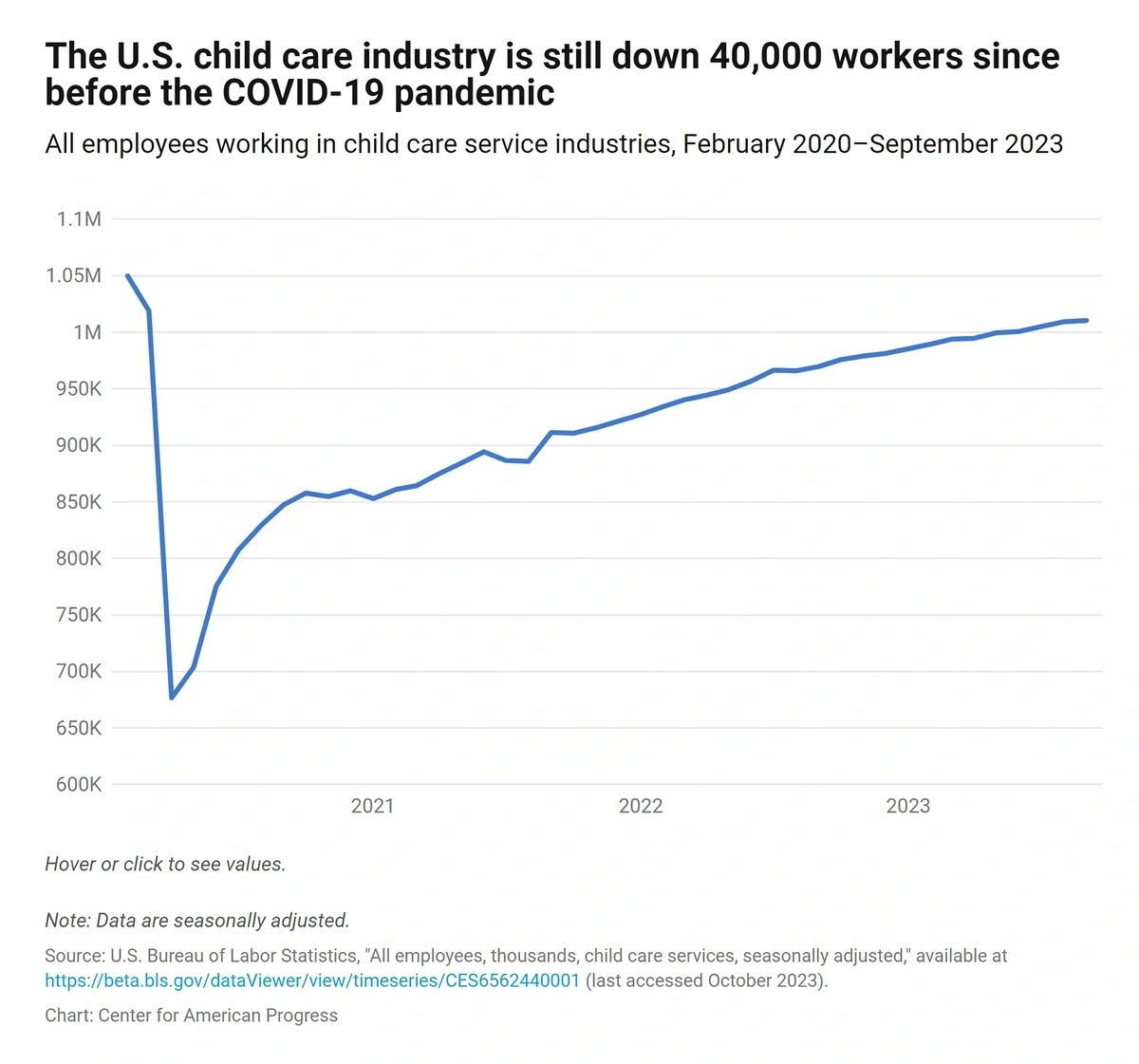

The childcare sector lost hundreds of thousands of jobs during the pandemic and nearly 40,000 of them have not been reestablished.

Job numbers in the childcare industry are way off the pre-pandemic trajectory.

That means that many working parents can’t find childcare or can’t afford it.

For example, half of all children under the age of 5 in Missouri live in a “child care desert”, a location in which there are 3+ young children for every spot at a licensed child care site or there are no slots available at all.

In addition, wages haven’t kept up with expenses for many workers.

When considering inflation, workers in many areas are earning less than they were in 2000.

Other employees left their jobs and started their own businesses or stayed home to take care of loved ones.

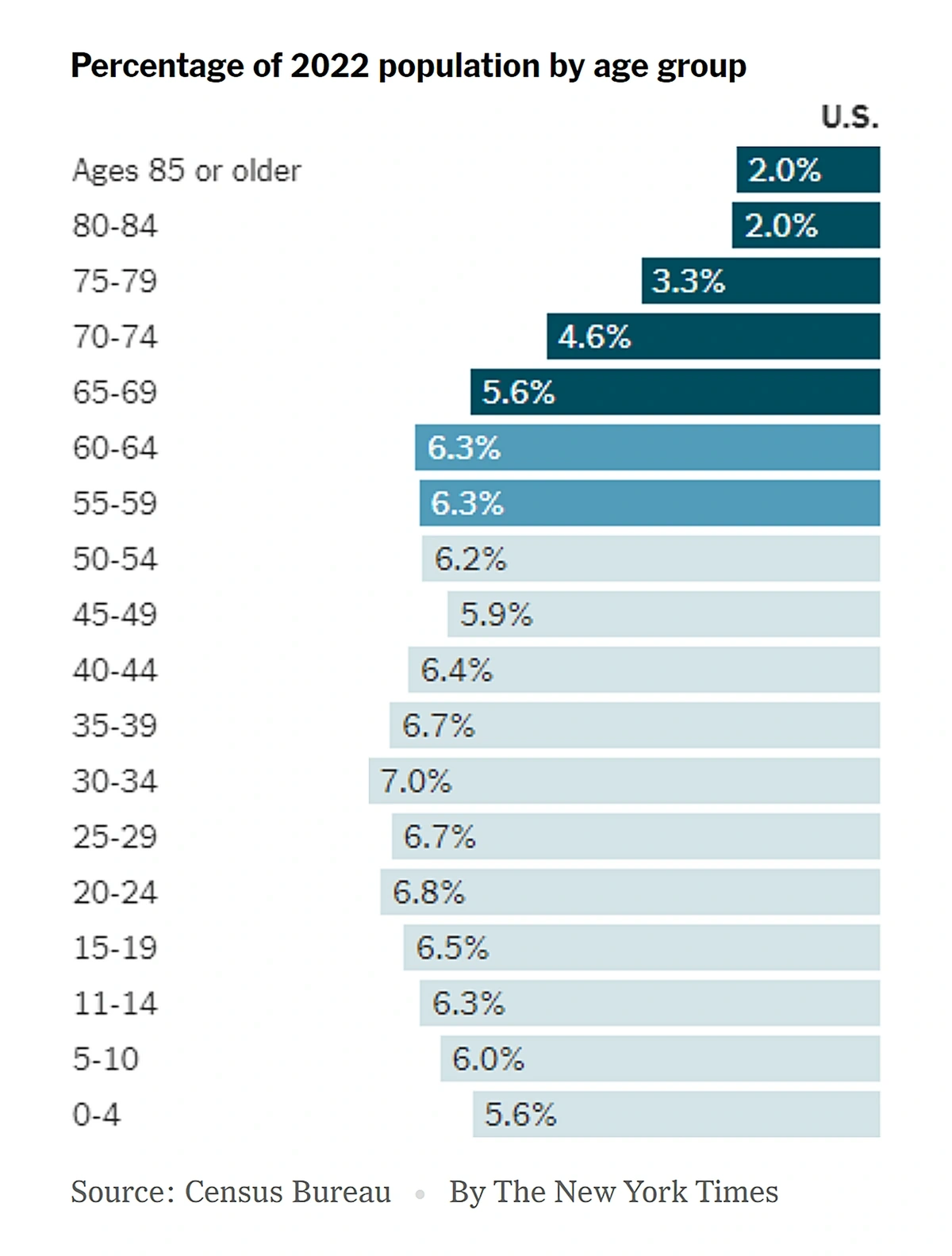

Census data reveals that the labor shortage is likely to get worse in the coming years.

Approximately 10,000 baby boomers turn 65 years old every day and by 2030, every individual in that generation—one in five Americans—will be eligible for retirement.

A large portion of the current workforce is near retirement age.

7. Business Investment Flows into Green Energy

Climate change mitigation efforts have the potential to dramatically affect the economy in the next few years.

Investments are needed in infrastructure and supply chains, just to name a few areas.

Climate change is already impacting global trade and supply routes.

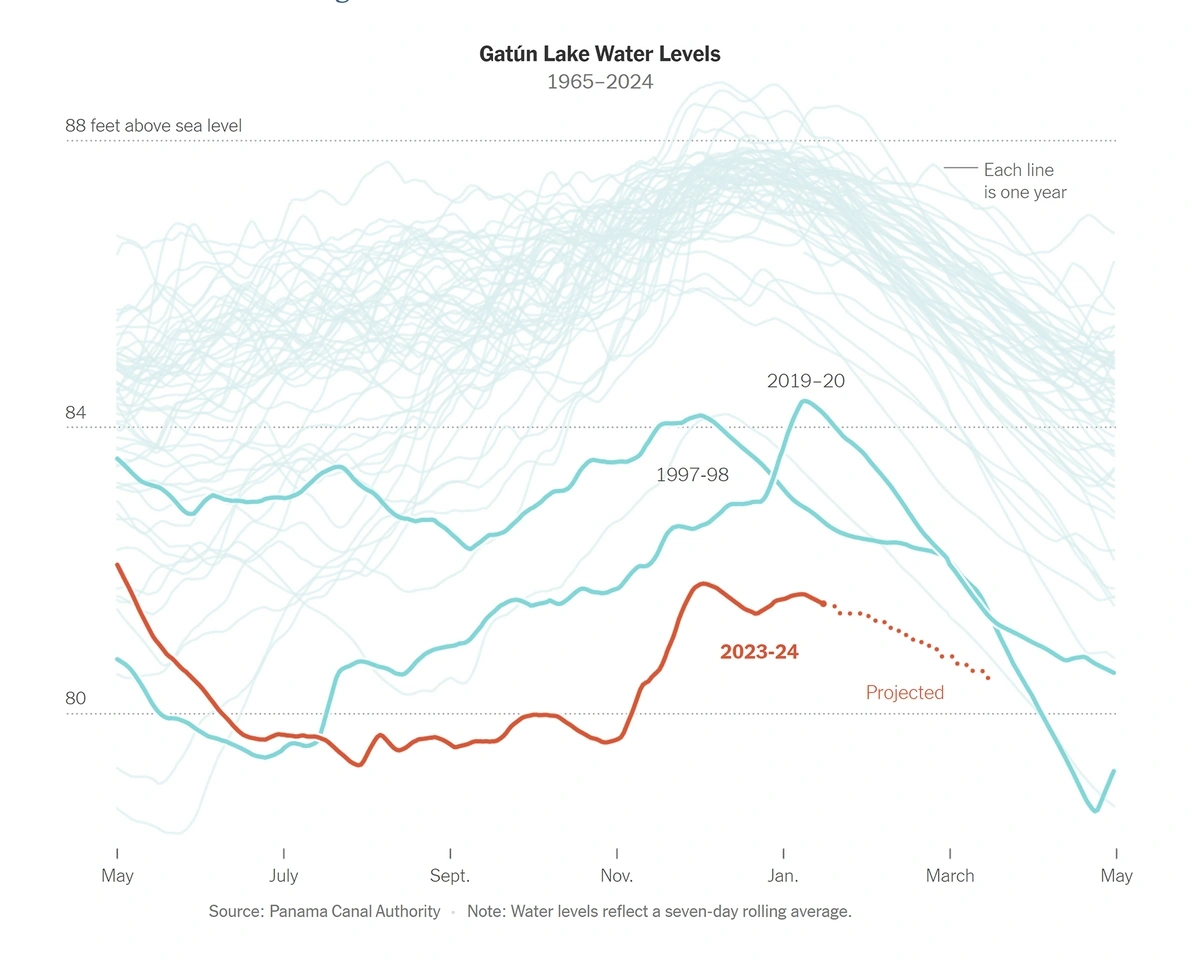

A severe drought in Central America is causing a decrease in ship traffic on the Panama Canal.

The lake that supplies the water for the Panama Canal is at record-low levels.

Traffic in early 2024 was down almost 40% compared to 2023.

Considering that the Panama Canal is utilized in 5% of all seaborne trade and 46% of container traffic between Asia and the East Coast of the US, the impact is substantial.

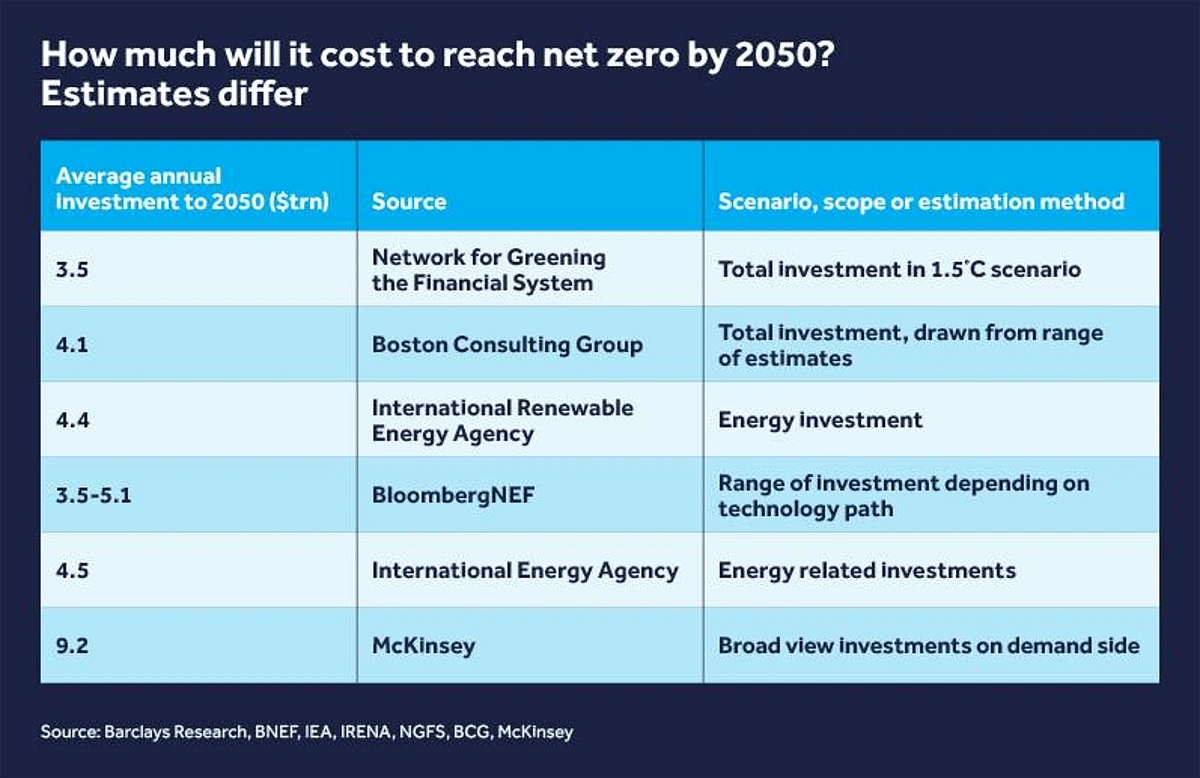

In the coming years, trillions of dollars in economic investment are likely to be needed in order to avoid climate-related problems and halt rising temperatures.

Barclays reports the transition to green energy could total up to $300 trillion over the next 25 years.

The most conservative estimates show an annual investment of $3.5 trillion per year.

The global economy is currently investing approximately $1.4 trillion per year.

Although these estimates may seem lofty, the International Monetary Fund points out that climate-related investments of today will benefit the economy in the future.

Their research suggests that reaching net zero could boost global GDP by 7%.

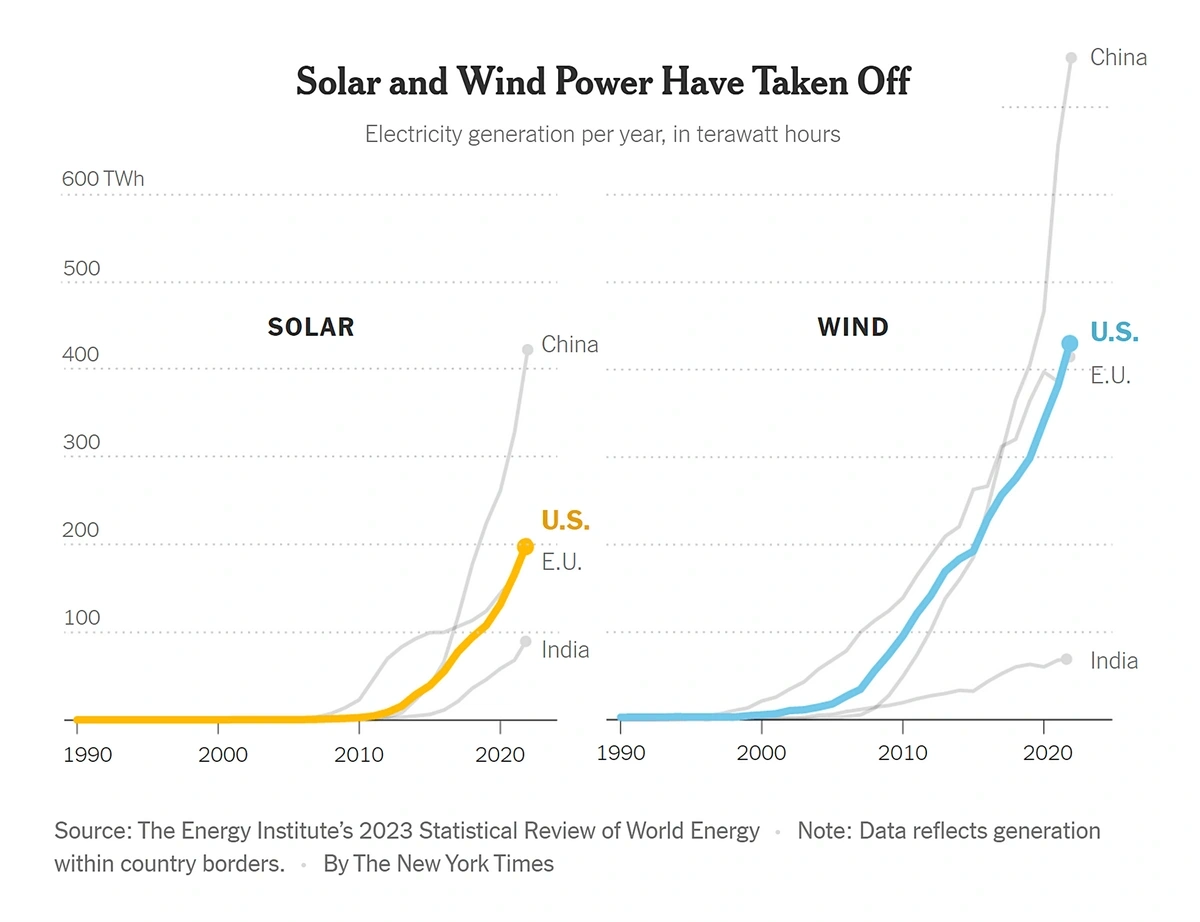

Investment efforts to boost green energy hit record levels in 2023.

The number of solar panel installations has soared as prices for the panels have dropped—35% more capacity was installed in Q3 2023 versus 2022.

Global wind energy alone is now capable of powering nearly 80 million homes.

Solar and wind power are two of the most popular green energy sources.

In the first three months of 2023, investors poured more than $358 billion into renewable energy. That was 22% higher than the same time period in 2022.

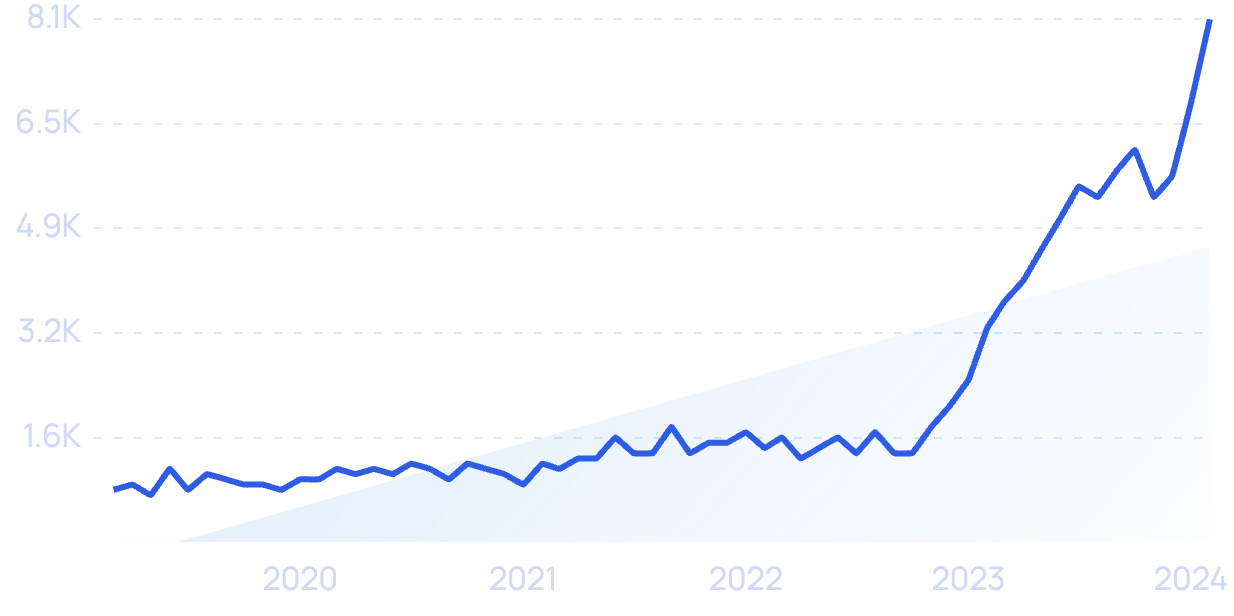

Search volume for “green energy investment” is up more than 425% in recent years.

Even more investment is predicted in the near future and experts say that’ll put renewable energy production ahead of fossil fuels by 2025.

8. The Accelerating Impact of Generative AI

According to a report from Bank of America, the economic impact of generative AI will be similar to the widespread economic impacts spurred by the invention of steam engines and electricity in previous generations.

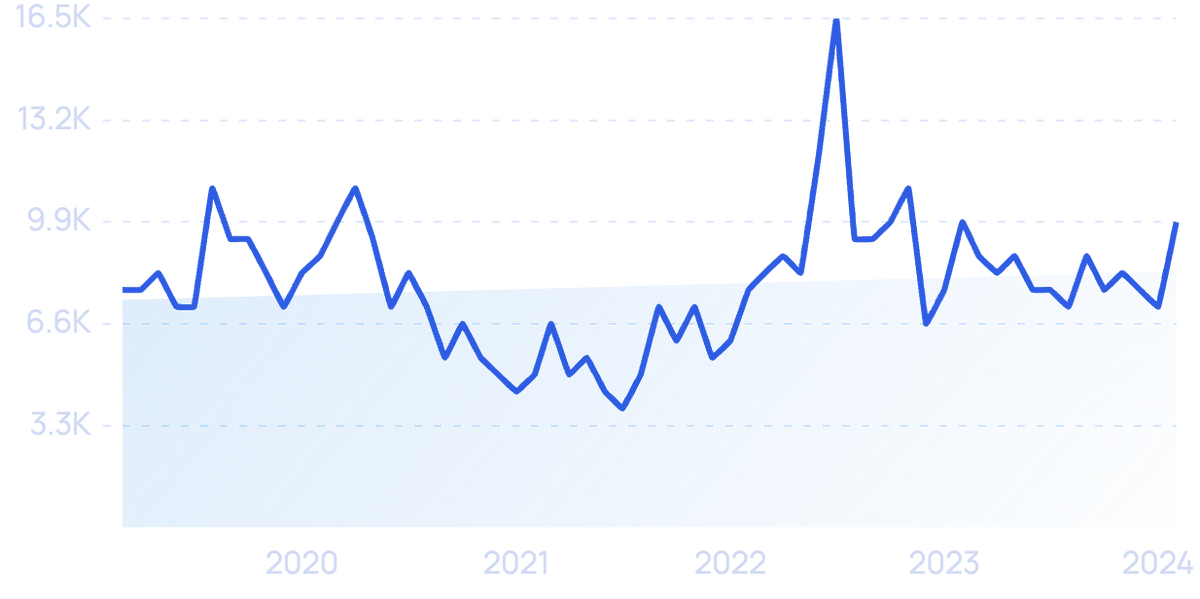

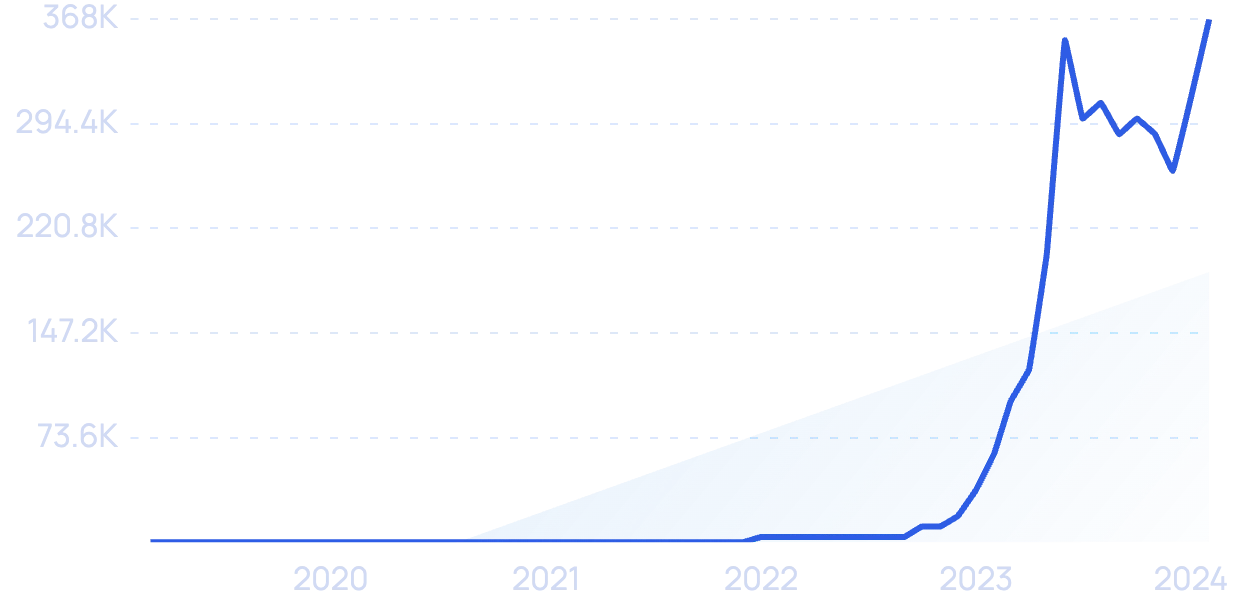

Search volume for “generative AI” grew rapidly in late 2022.

Bank of America estimates that AI could pump $15.7 trillion into the global economy by 2030.

PwC predicts that China and the US will see the bulk of this influx. China could see a 26% increase in GDP and the US could see a 14.5% boost by 2030.

One way in which generative AI will impact the economy is through the labor market.

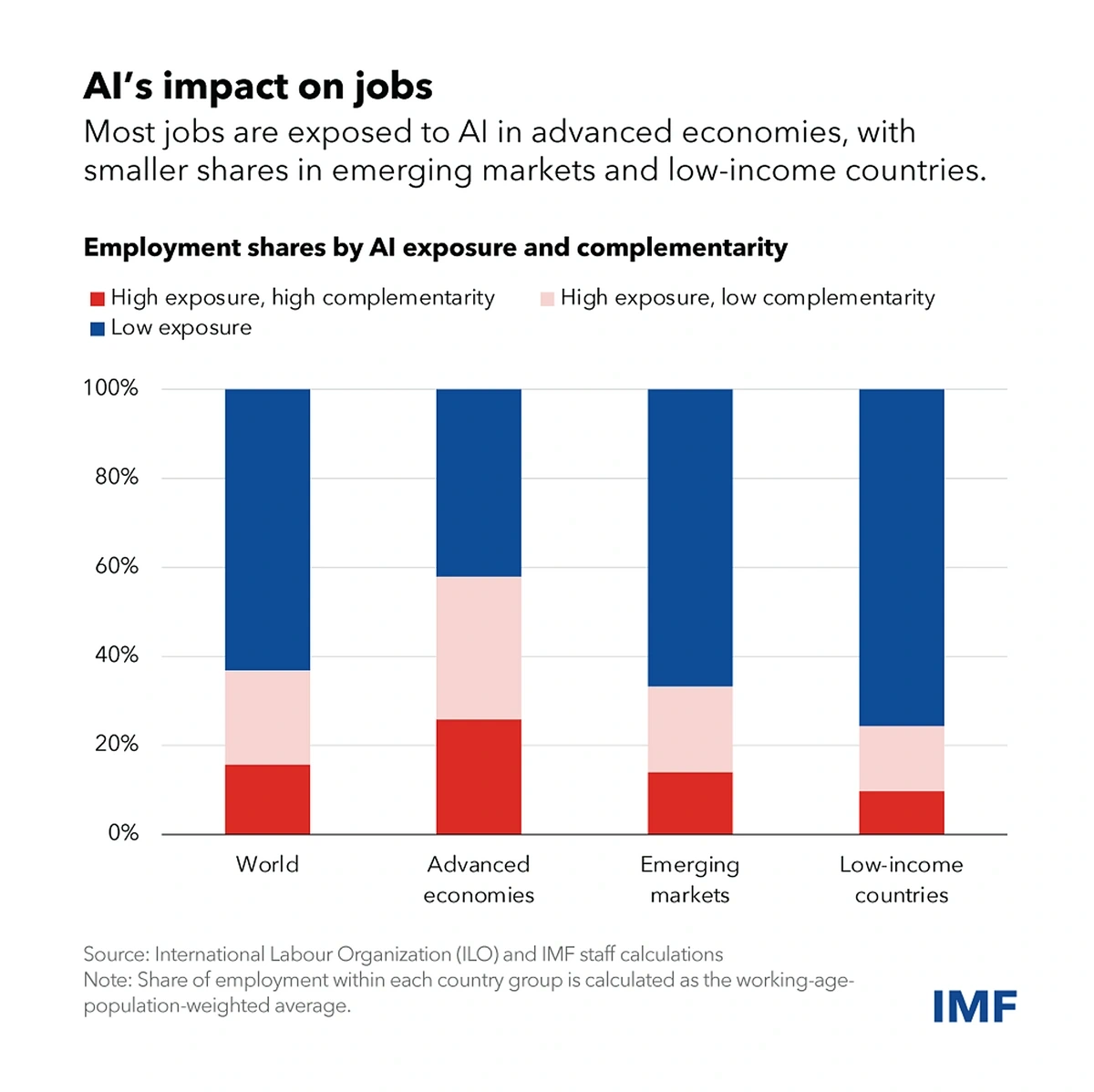

Up to 40% of jobs across the globe will be impacted by generative AI according to The International Monetary Fund. They say that number jumps to 60% of jobs when considering only advanced economies.

Research from the IMF suggests AI will impact more than half of all jobs in advanced economies.

The IMF predicts that automation and AI will improve productivity and efficiency, thereby increasing business profits.

Generative AI stands to provide the most benefit (75% of the overall value of AI) in four sectors according to McKinsey analysts: marketing and sales, software engineering, customer operations, and research and development.

Search interest in “customer service AI” is up more than 900% in recent years.

For example, they say AI in the CPG industry, which invests heavily in marketing and customer operations, could deliver up to $660 billion in value annually.

9. Amplified Geopolitical Tensions Threaten GDP Growth

In January 2024, The Brookings Institution reported that rising geopolitical tensions were the most important risk to the global economy.

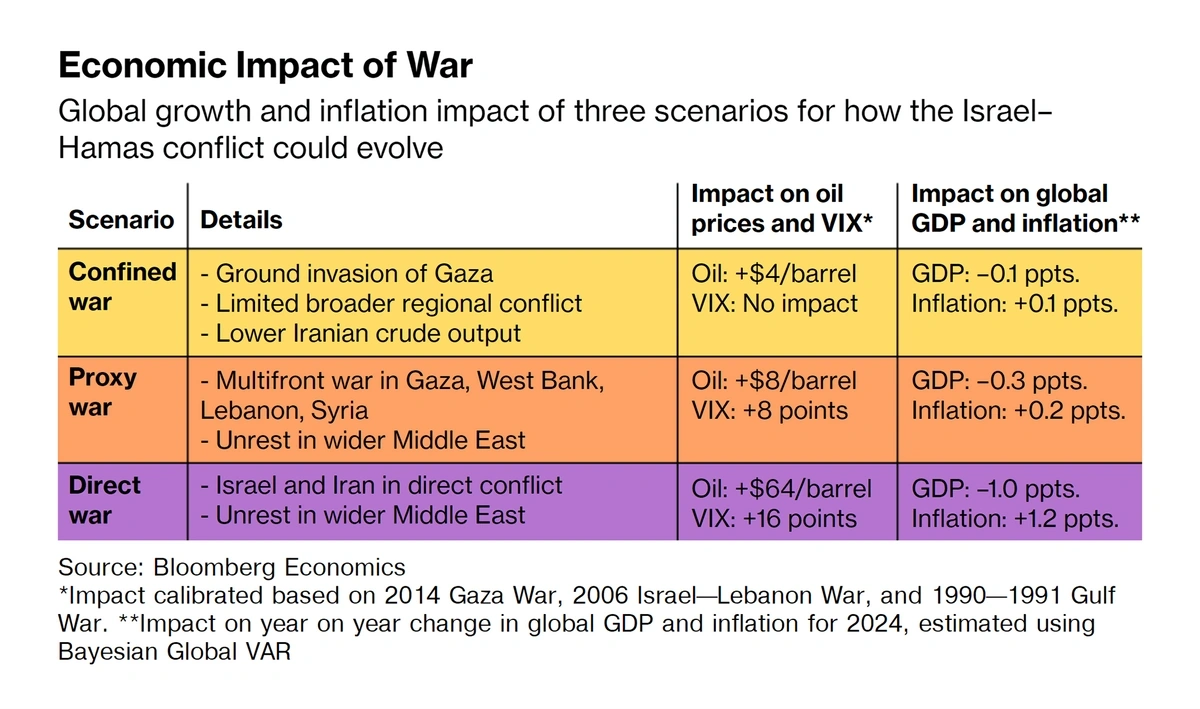

An expansion of the Israel-Hamas conflict could hamper GDP global growth and send inflation soaring again.

Future GDP and inflation metrics depend on the severity of the conflict.

Bloomberg Economics’ model shows that this could mean global inflation would sit at nearly 7% in 2024.

This conflict, along with the war in Eastern Europe, has already stirred up economic uncertainty in the minds of investors.

Merrill Lynch advisors say that conflicts like this can result in a 5% to 10% drop in the S&P 500 but recovery is usually quick.

Not surprisingly travel and leisure stocks are likely to be some of the worst performers during times of conflict, whereas stocks associated with defense spending usually surge.

For example, shares of TransDigm Group, a company that manufactures parts for military aircraft, are up 32% in recent months.

Recent global conflicts have led to a dramatic uptick in the defense and aerospace sectors of the U.S. economy. Production is up 17.5% in recent months.

These conflicts are also threatening to shake energy markets, slow global trade, and increased deglobalization.

For example, The Brookings Institution has predicted a baseline price of oil at $81 a barrel in 2024. However, they warn that escalating tensions in the Middle East could push that price up as much as 30%.

One EY analyst has said that an expansion of the war could push oil prices to $150 per barrel.

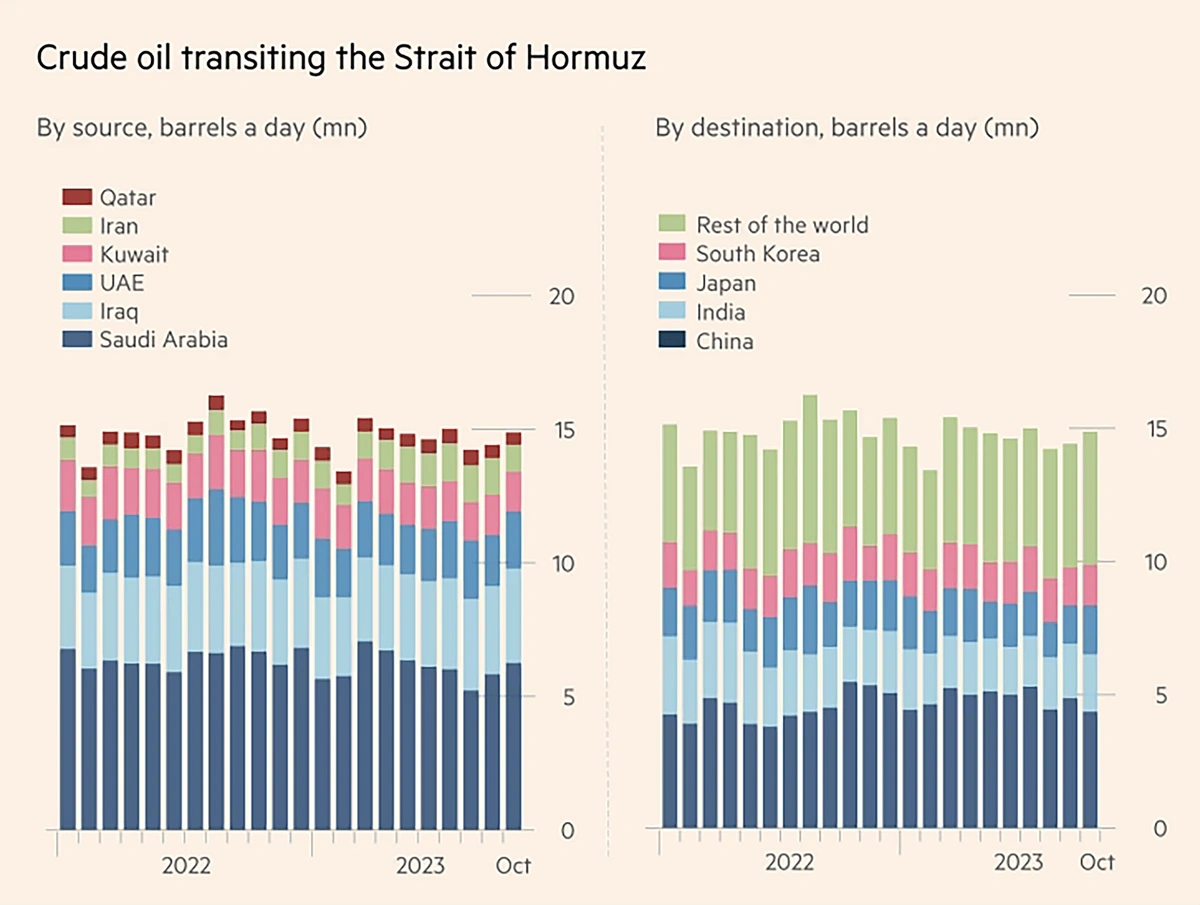

In addition, if conflicts in the Middle East spread, key trading routes like the Strait of Hormuz could be impacted.

Nearly 20% of the world’s oil supply is shipped through that waterway.

Approximately 5.5 million barrels of oil per day originating in Iraq, Kuwait, and Qatar depend on the Strait of Hormuz — there’s no other way to ship the oil out.

Conflicts in the Red Sea also have the potential to rattle global economies.

Approximately 15% of all seaborne trade travels through the Red Sea.

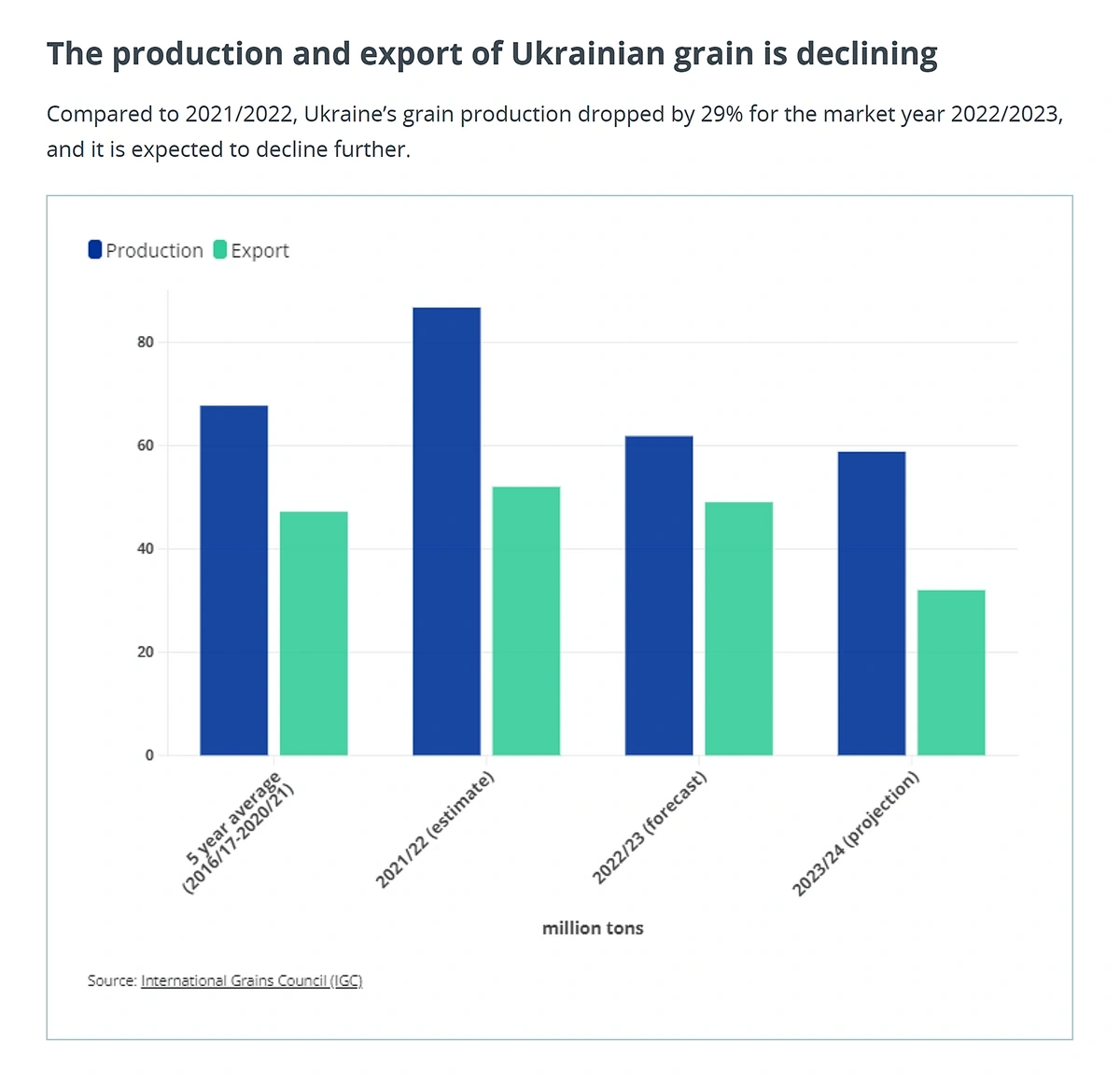

The conflict in Ukraine is also having a dramatic effect on food supplies in developing countries.

Many economically vulnerable countries are dependent on Ukraine for its wheat exports.

For example, 80% of grain imported by East Africa has historically come from Russia and Ukraine.

Due to the war, Ukrainian grain production has fallen by nearly 30%.

Decreases in grain exports from Ukraine are threatening the food supply of many Asian and African countries.

10. Generation-Specific Economic Challenges Persist

Some of America’s oldest and youngest adults are now facing unique financial pressures. These pressures are set to impact consumer spending, healthcare costs, and other nationwide economic markers in the coming years.

Take the baby boomers, for example.

In order to live comfortably throughout retirement, the Federal Reserve says the average person needs a total of $967,000 in savings.

But more than 40% of baby boomers have no retirement savings and only 58% of them even have a retirement account.

If they have one, the average savings in a baby boomer’s retirement account is just $289,000.

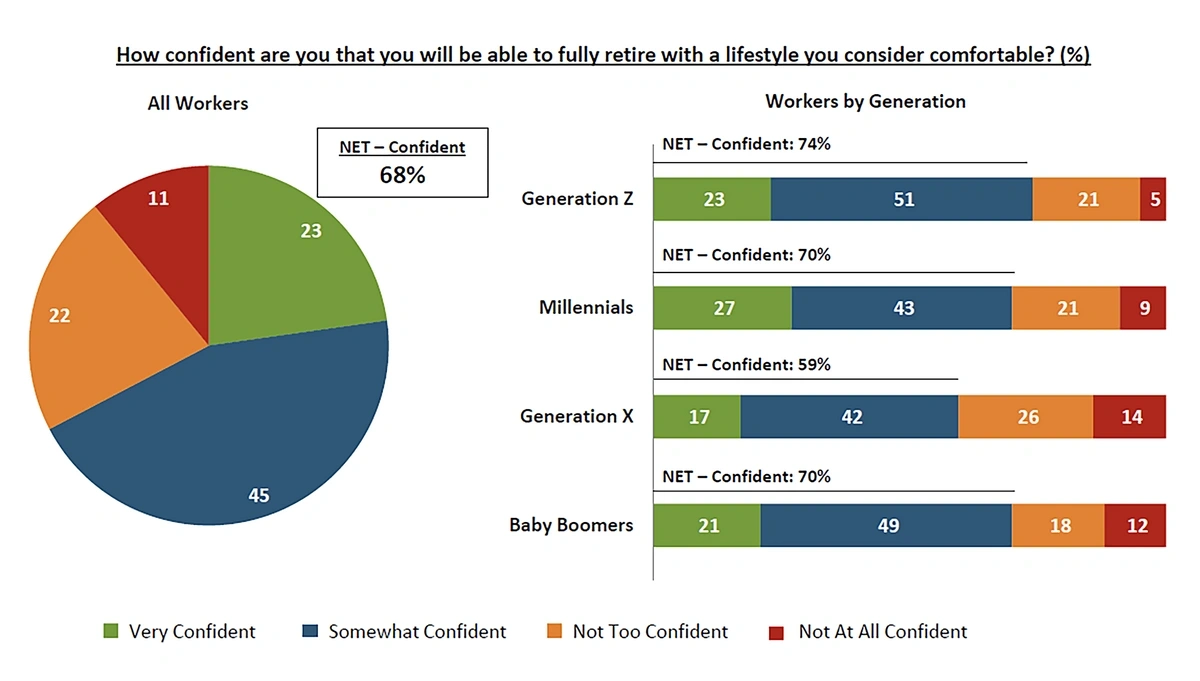

70% of baby boomers say they’re confident that they’ll be able to retire comfortably.

Increasing medical expenses are set to compound this problem.

Fidelity estimates each boomer will amass $157,500 in health care expenses in retirement.

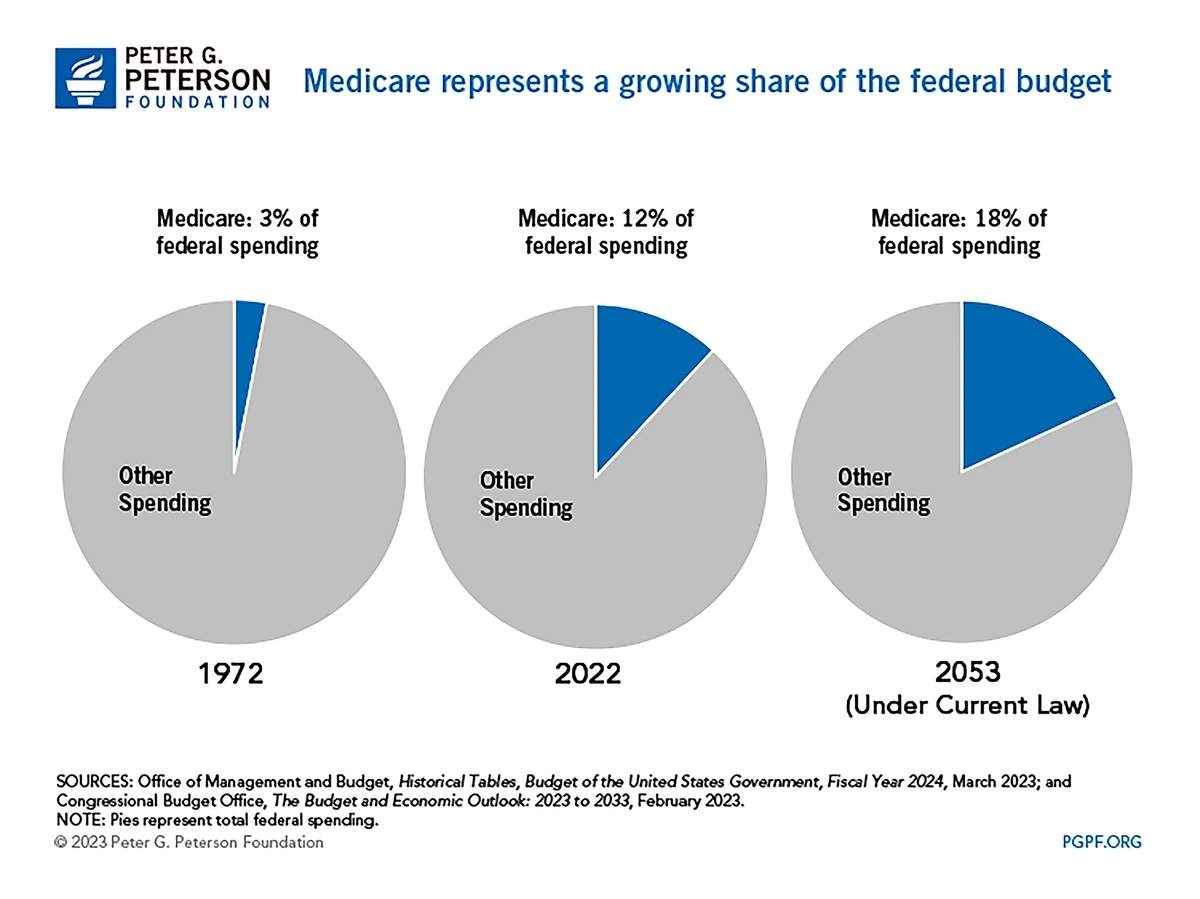

Because of Medicare, these healthcare expenses will also be felt by the federal government and taxpayers.

Medicare is expanding to encompass a larger portion of the federal budget.

Medicare expenses are forecasted to grow about 8% annually between 2025 and 2029.

At the other end of the spectrum is Generation Z. (This includes individuals who are 12-27 years old right now, but economic data focuses on the population aged 18-27.)

More than 50% of Gen Zers are worried about not having enough money.

A survey from Bank of America showed that more than one-third of Gen Z experienced financial hardships in 2023.

Bank of America’s survey revealed the financial concerns and opportunities for Gen Z.

Even for those Gen Zers who haven’t experienced financial hardships, budgets are tight and consumer spending is down.

In the face of inflation, nearly three-fourths Gen Zers are now spending less on essentials like gas and groceries and plan to keep those spending habits for at least a year.

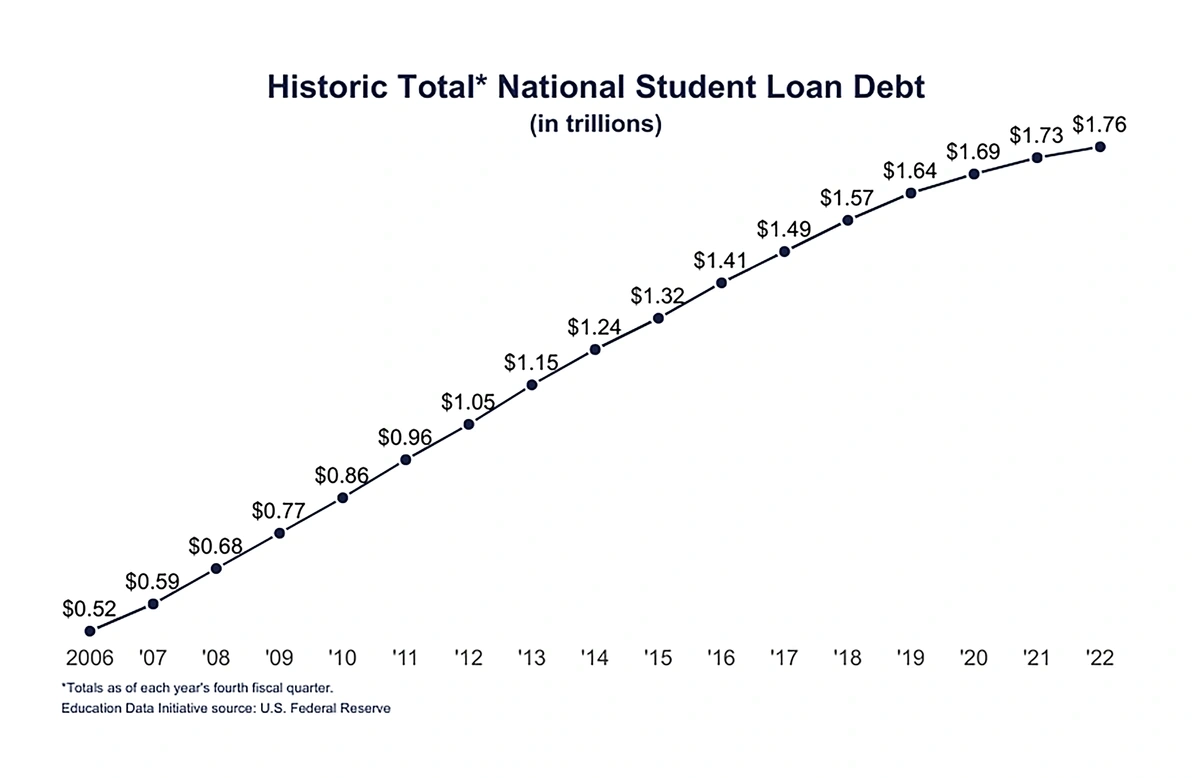

Student debt is one factor that’s weighing heavily on Gen Z.

More than 7 million Gen Zers already have student debt and nearly half of 2024 college graduates say they’ll graduate with debt.

Student loan debt in the U.S. totals more than $1.76 trillion.

Most individuals graduate with $20,000 or less in student debt, but 7% of Americans owe in excess of $100,000.

Many Gen Zers say this debt is one thing that’s holding them back from buying a home.

40% of Gen Zers don’t have the financial resources to save for a down payment. And, their rising debt-to-income ratio is high, a key metric that lessens their chance of getting approved for a mortgage and getting a reasonable mortgage rate.

Conclusion

That’s all for the top economic trends to watch in 2024 and beyond.

Sticky inflation, labor shortages, and environmental concerns have definitely changed the global economic outlook. There are a number of trends that have been disrupted, but other trends that have accelerated in the face of uncertainty.

We will continue to watch and see how businesses and governments react to armed conflicts, trade disruptions, and slow GDP growth. Look for consumer resilience and attitudes to possibly shift in response.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more