Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

9 Top Business Trends (2026)

This is an up-to-date list of key business trends we saw in 2025, along with those that are poised to see continued growth in 2026.

We'll cover the sectors, consumer behavior changes, and tech innovations driving each trend.

Whether you're a scrappy startup or part of a Fortune 500 company, here are the top business trends to know:

1. Generative AI Boosts Business Productivity

Generative AI has businesses paying attention.

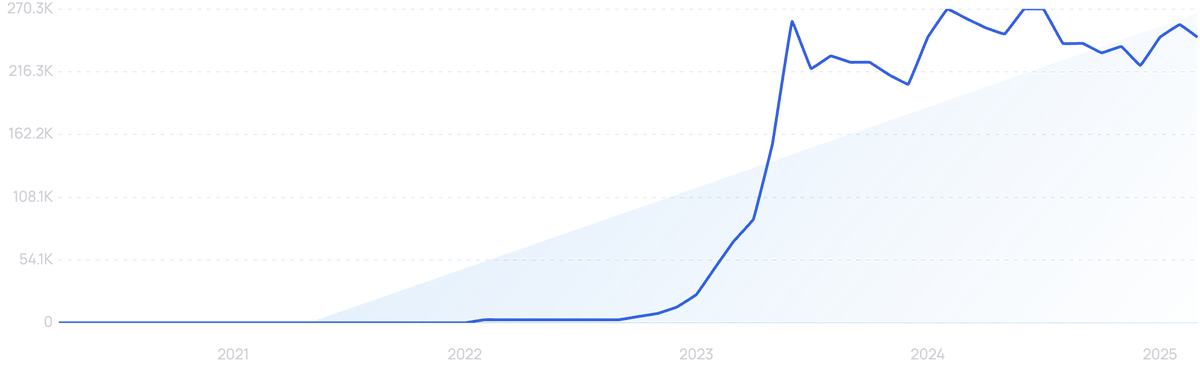

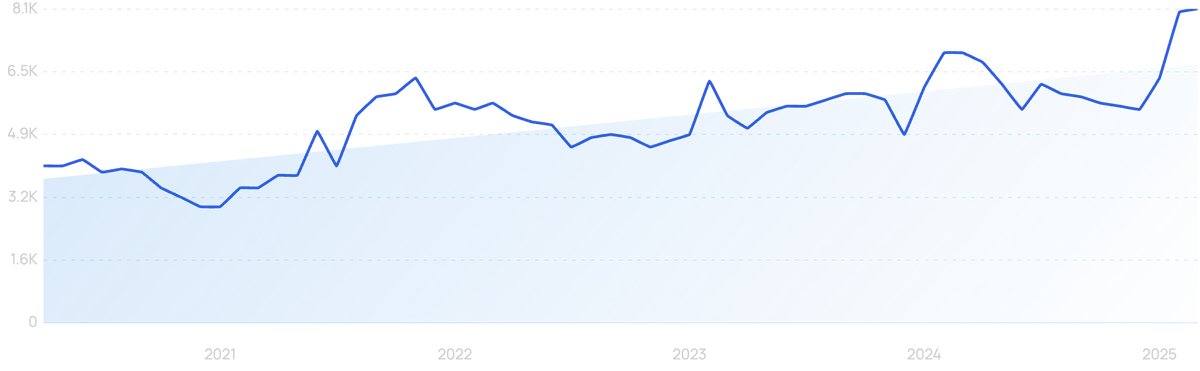

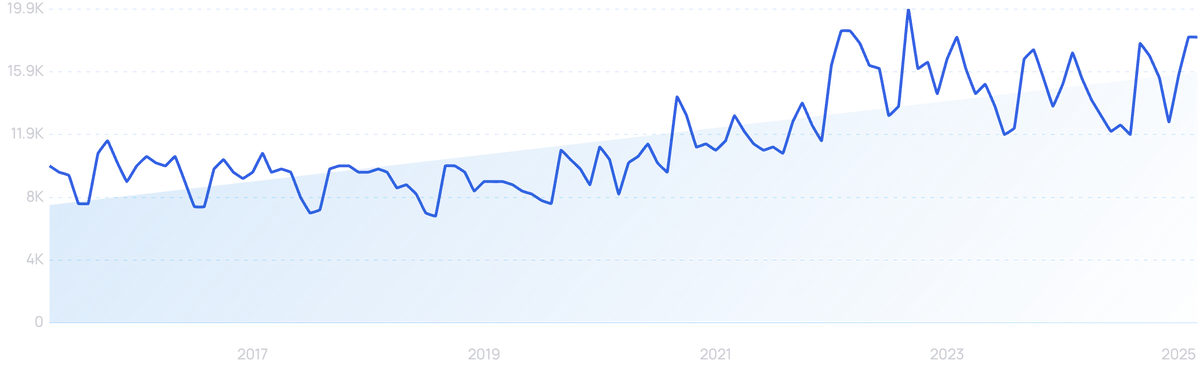

Search volume for “generative AI” has exploded since ChatGPT's launch in late 2022.

According to Visual Capitalist, Generative AI apps are projected to generate more than $10 billion in consumer spending for 2026.

At the same time, a market analysis report from Grand View Research showed that GenAI's market size was USD $22.21 billion in 2025. The report estimates that this will increase by a compound annual growth rate (CAGR) of 40.8% until it reaches $324.68 billion in 2033.

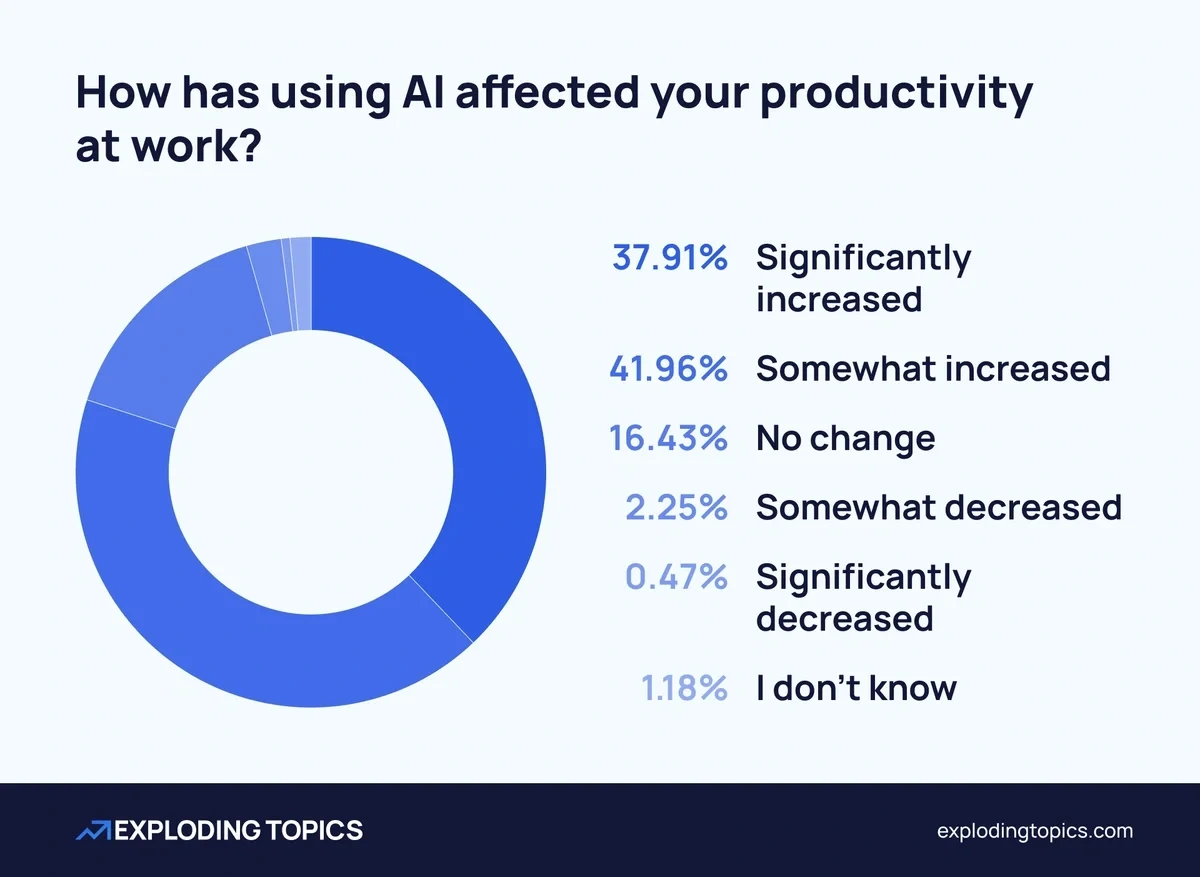

And our own original research on AI in the workplace found that a majority of employees feel that AI has increased their productivity.

Consumers are expecting businesses to capitalize on generative AI applications — nearly 70% of consumers say they believe most businesses will soon be using this technology to improve the customer experience.

Generative AI platforms run on the technology of large language models (LLMs).

LLMs are trained on billions of pages of existing text. As they are trained, LLMs pay attention to contextual relationships between the words and patterns seen in sentences. From there, the LLM can generate content on its own.

For example, the BERT LLM can achieve 85%-90% accuracy in just milliseconds.

And LLMs are only getting better.

🚀 Today's Business Trends

The world of business moves fast. So while this post covers the big-picture trends for the coming year, this table shows what’s catching fire right now. These are real-time topics gaining traction, straight from the Exploding Topics engine.

In the future, AI experts say these models will be able to generate their own training data to self-improve, pull in information from external sources, and operate much more efficiently through an approach called “sparse expert models”.

Boston Consulting Group reports that some expect that generative AI will be able to put out “final draft” content by 2030.

As of now, LLMs are far from perfect, but businesses are already taking advantage of their wide-ranging capabilities.

Businesses are eager to find out how generative AI can improve their bottom line.

They can generate text, translate text between languages, summarize content and rewrite it, categorize content, analyze the sentiment of text, and engage with users in conversational chat.

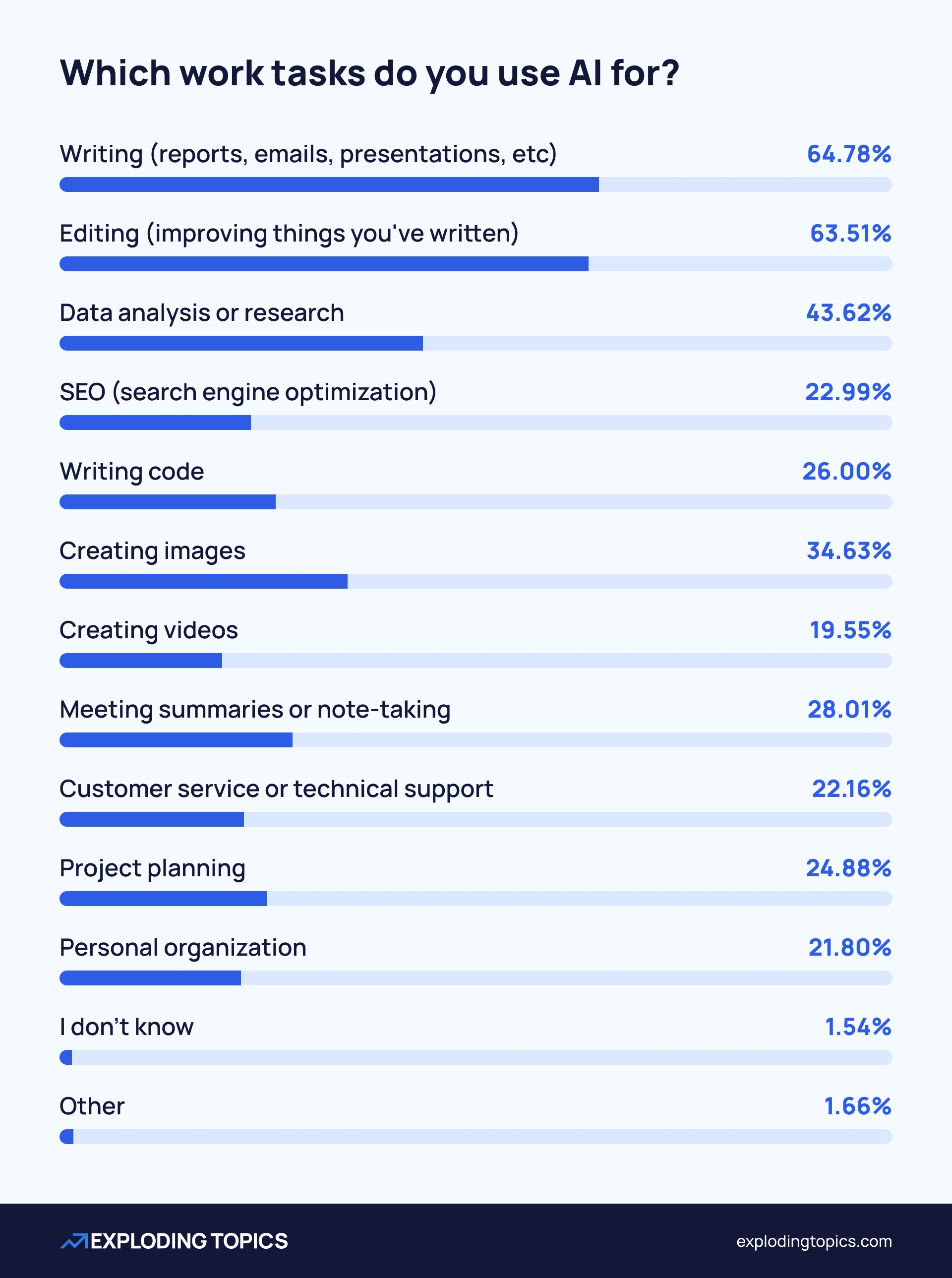

Our own research shows that employees use AI most for writing, editing, and data analysis:

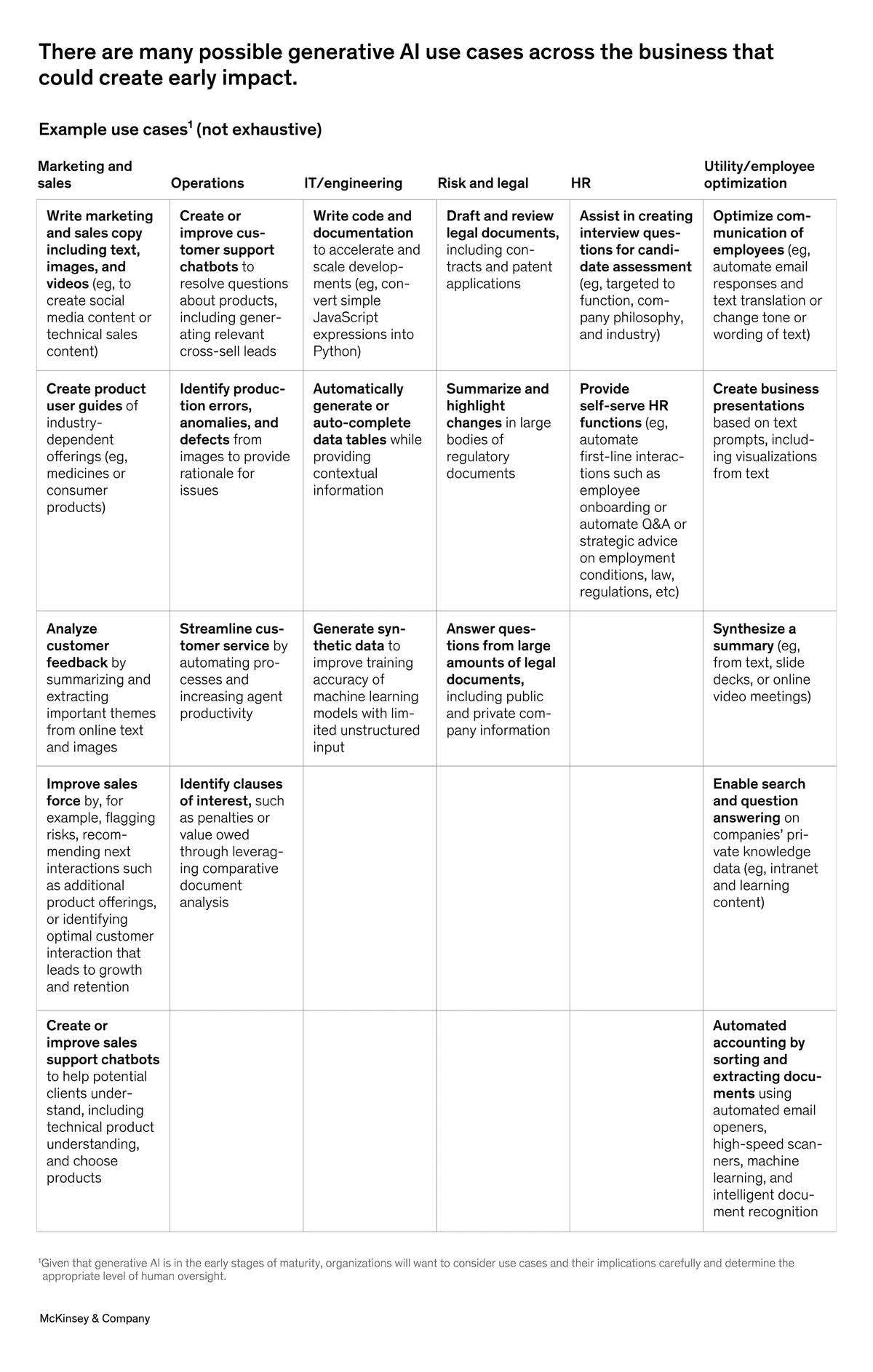

The business applications of generative AI reach nearly every industry.

Accenture reports that LLMs can impact 40% of all working hours. And 98% of global executives believe AI models will play an important role in their organizations within the next 5 years.

Startups in the healthcare industry have already released several promising generative AI technologies.

Syntegra, a 2019 startup based in San Francisco, uses AI to generate synthetic patient data that’s totally realistic but not linked to any certain patient.

Syntegra’s generative AI solution can accelerate the speed of clinical research.

The synthetic data matches the statistical accuracy of the real data, so health systems and research institutions get the data they need while patient privacy remains protected.

It’s also much quicker and oftentimes more economical to get data this way.

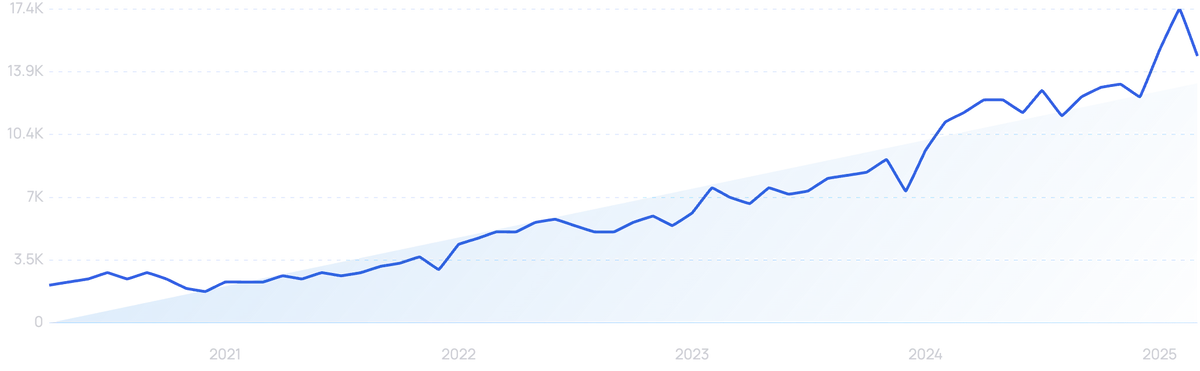

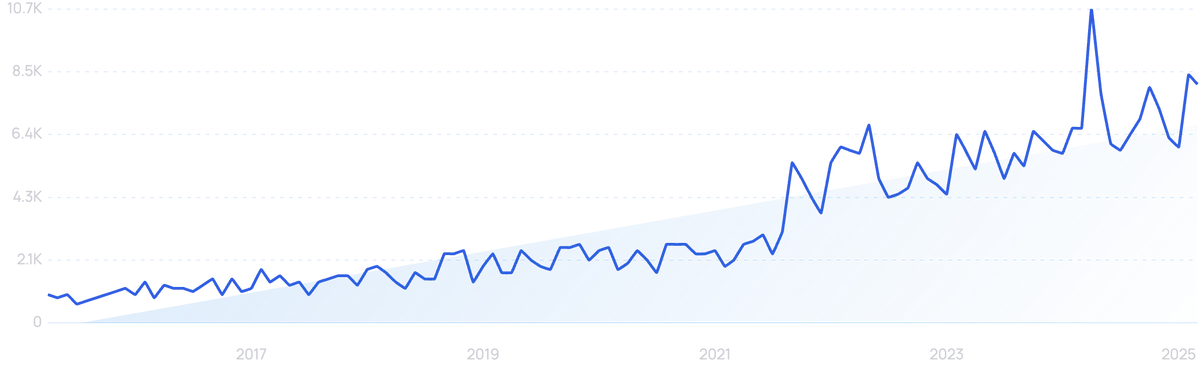

Search volume for “synthetic data” is up 608% in the past 5 years.

Generative AI is also proving to be a key technology for software developers.

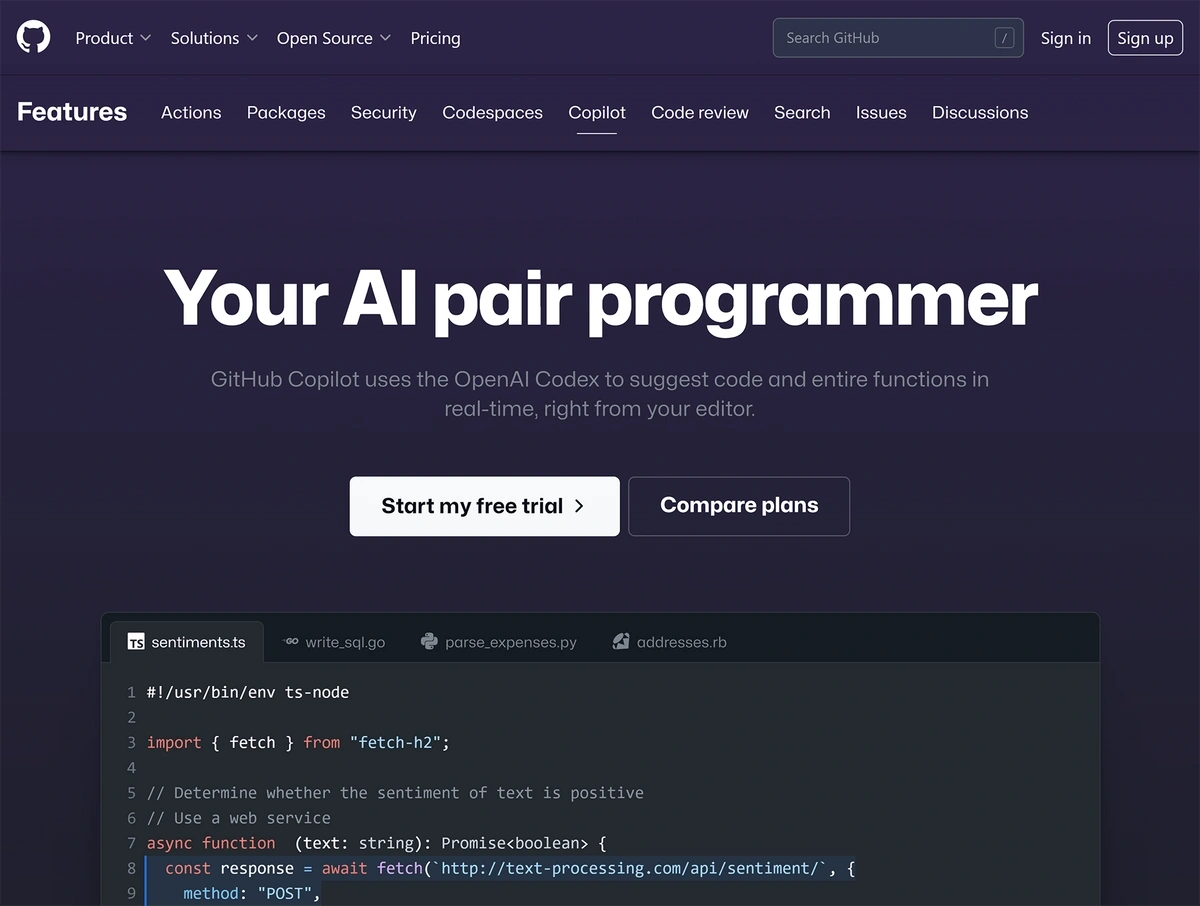

Github’s Copilot is one of the most popular AI solutions available for coding purposes.

GitHub’s Copilot is already used by more than 400 organizations.

The platform takes natural language prompts and suggests code or entire functions to fulfill the prompt. It’s been called autocomplete for software developers.

One Copilot user said that programming tasks that previously took 10 minutes now take just 30 seconds.

In files in which Copilot is used, Github says the AI solution writes 40% of the actual code.

One of the breakout web search trends this year is "cursor AI", growing exponentially since the start of 2025.

The meteoric rise in search volume for Cursor AI began in January 2025

Similar to Github Copilot, Cursor is an AI code editor that helps developers code faster with autocomplete. It can also code complete programs, apps, and scripts for you using modern programming languages and frameworks.

It's also a popular tool in the growing "vibe coding" culture, which is seeing more and more non-developers use AI to build working software tools for them.

Generative AI will soon be used in advertising, too.

Google reports that it plans to implement AI-powered ads in the near future.

Business users will simply upload materials to train the AI model. Then, the model will create new ads from those materials, complete with new text, images, and videos.

Meta has said they’ll introduce a similar AI model for ads on their platforms.

2. E-commerce Growth Persists

The pandemic completely changed the way consumers shop.

E-commerce was already on the rise before COVID-19 hit. But the pandemic helped the e-commerce space take off at an astronomical rate.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

In fact, Shopify reported that e-commerce experienced 10 years’ worth of growth in just three months during the pandemic.

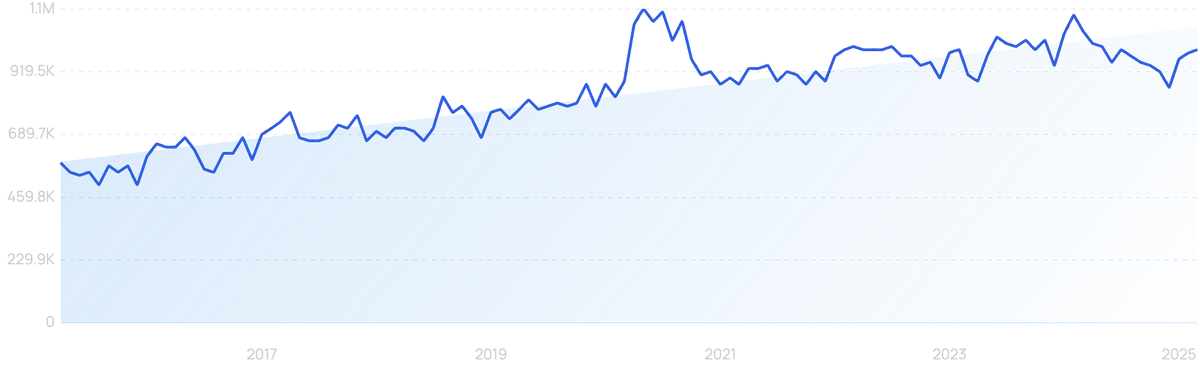

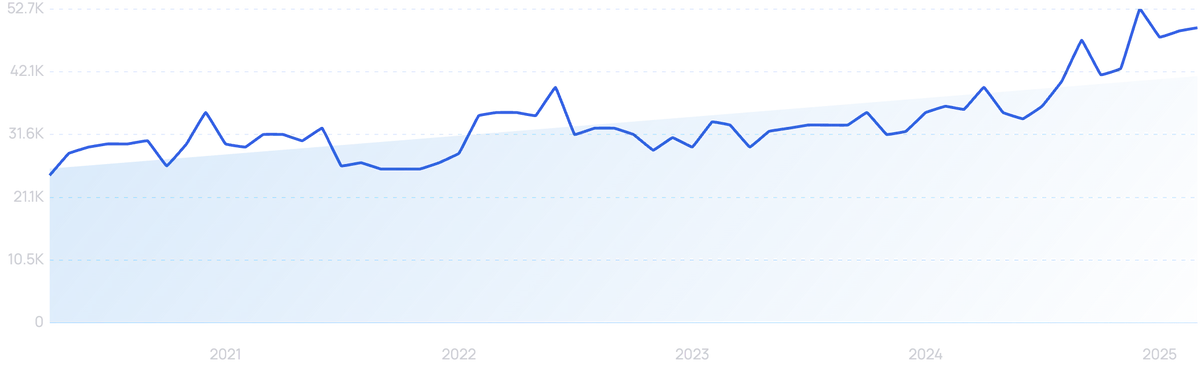

Search volume for “e-commerce” has leveled off but is still up nearly 71%.

Although the growth of e-commerce has slowed post-pandemic, it’s still growing modestly. And businesses continue to adjust their marketing and sales strategies to maximize its impact on the bottom line.

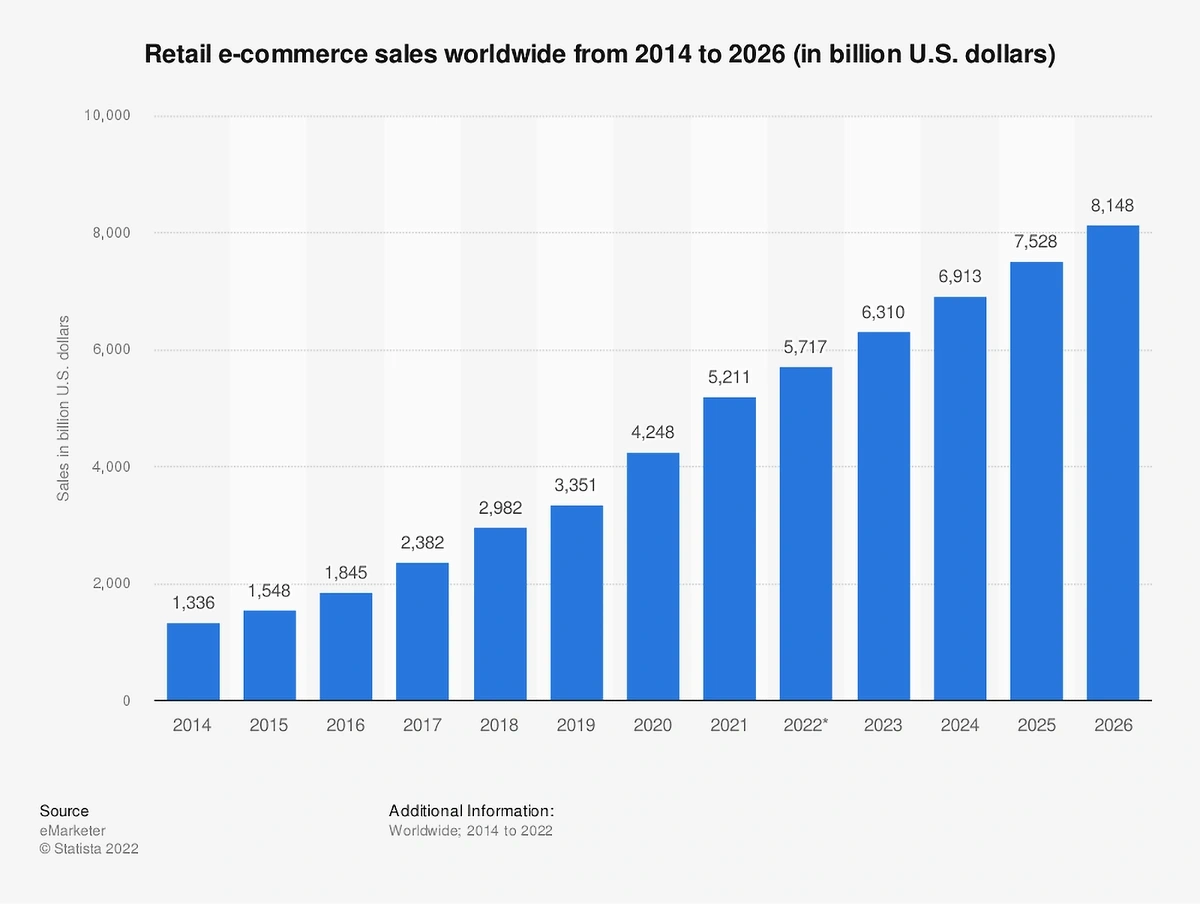

In 2024, global e-commerce sales totaled $6.9 trillion, and that number is expected to grow to $8.1 trillion by 2026.

E-commerce sales continue to grow. Predictions show more than $8.1 billion in sales next year.

E-commerce was responsible for nearly 14% of all retail sales in 2019, but in 2026, e-commerce is expected to account for more than 21% of all retail.

Some specific retail categories, like electronics, home improvement, and home furnishings, have been able to maintain post-pandemic growth.

Take the furniture industry, for example. Shopify estimates that furniture eCommerce generated around $263 billion in revenue in 2025, and will reach more than $280 billion in 2026. This is a category that has seen significant growth since the pandemic as a result of more DIY projects and home fixes.

Shopify's report notes that, by 2030, eCommerce furniture as an industry will be worth close to $338 million dollars, the result of a CAGR of 4.73% over the next 4 years.

Though estimates vary when it comes to how many eCommerce stores exist in North America, most are in the low millions. Red Stag Fulfillment reported 3.5 million eCommerce stores in North America as of April 2025.

Companies are launching new e-commerce opportunities every day.

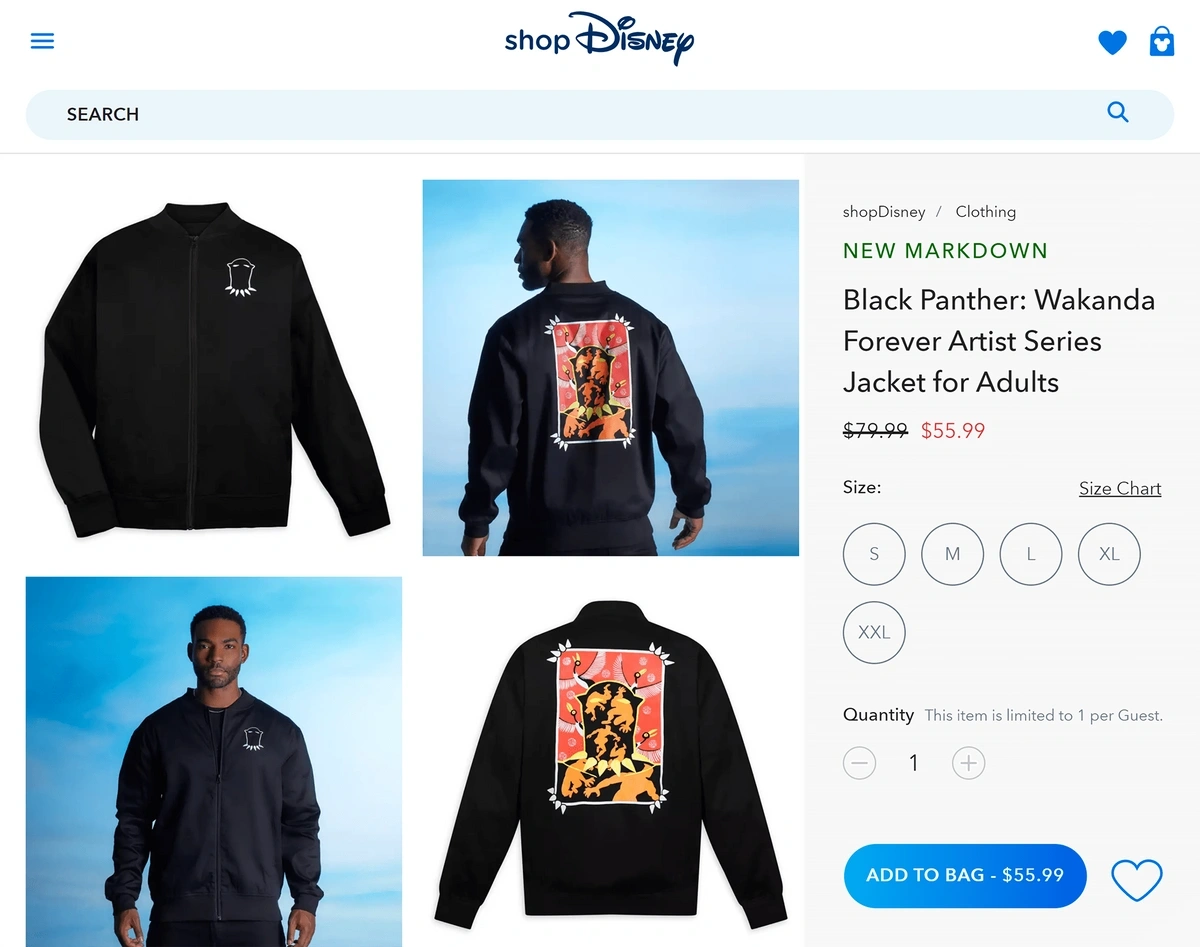

Look at Disney, for example.

The company announced in early 2021 that it would focus on e-commerce and close 60 of its brick-and-mortar stores in North America.

In late 2022, they announced plans to expand the Disney+ platform to include in-app commerce options.

Users can scan a QR code on the detail pages of their favorite shows and movies. That will take them to a specific shopDisney site where they can purchase merchandise that’s available only to Disney+ subscribers.

Exclusive merchandise from Star Wars, Black Panther, Frozen 2, and other Disney titles are available only to Disney+ subscribers.

If you're running an E-commerce business, then try our free E-Commerce Keyword Tool.

3. 5G Vastly Improves Data Collection and AI Capabilities

The development of the 5G mobile network has the potential to radically change business operations.

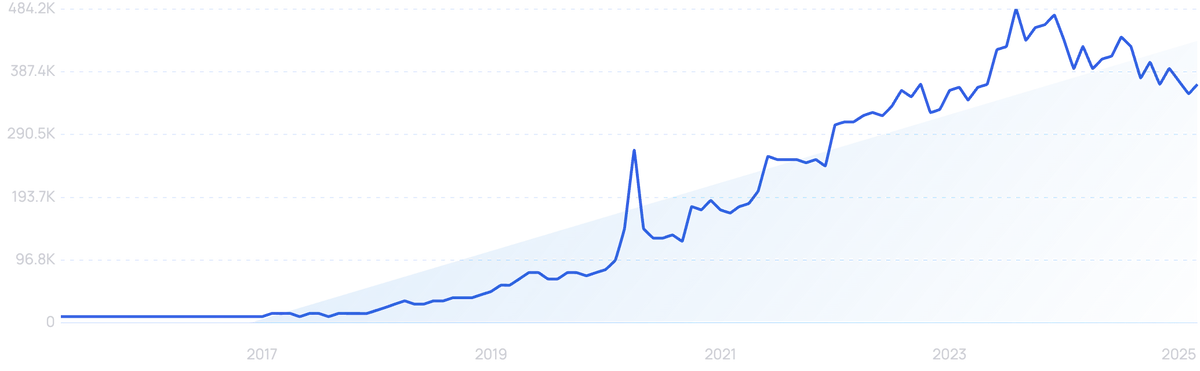

Search interest in “5G” continues to climb, up 3,700% over 10 years.

In simple terms, 5G can deliver higher data speeds, greater reliability, and sub-10ms latency.

Based on the most recent data (2025), the top 3 countries for 5G availability, according to Electroiq, are China (341 cities), USA (279 cities), and South Korea (85 cities).

The 5G market is expected to grow at a CAGR of 59.51% through 2034 to reach a valuation of more than $13,406 billion (over a trillion).

This technology is crucial for businesses that are eager to offer new services and track insights in order to stay ahead of the competition.

For example, the development of the 5G mobile network is driving enhanced data collection and analysis for businesses.

Overall, this means businesses will have more data from more diverse sources at faster speeds. Then, they can put that intelligence to work in real time.

These are the data speeds businesses need in order to utilize AI and automation.

A few possibilities include intelligent data analysis, remote medical control, remote control of traffic lights, and virtual reality monitoring of machinery.

BMW is already testing the capabilities of 5G technology at their factory in Leipzig, Germany.

BMW is utilizing 5G technology to improve factory operations and worker safety.

They are combining 5G and AI in order to locate machines, cars, tools, and parts within the factory in real time. They have an accuracy down to within one centimeter.

In early 2021, T-Mobile deployed its first 5G network in a hospital at the Miami Veterans Affairs Healthcare System.

The network has peak speeds of 1 gigabit per second.

This enables healthcare providers to access data-intensive patient records like X-rays and medical charts from devices anywhere in the hospital.

The 5G network is also critical for medical providers who’ve invested in telemedicine. The high speeds of the 5G network can enable nearly real-time video and remote monitoring of patients.

Searches for “remote patient monitoring” have climbed over 100% in the past 5 years.

Businesses are also leveraging 5G connectivity via the Internet of Things (IoT) in order to improve business operations and launch new services.

IoT sensors are already in use in manufacturing production lines, supply chain tracking, autonomous vehicles, and more.

IBM is in the testing phase of using IoT to monitor civil infrastructure.

This “next-generation maintenance program” brings together data from sensors, cameras, drones, and wearables to assess the safety and risks associated with roads, bridges, water mains, and other assets.

IBM estimates that this program can help release a $2 trillion backlog of improvements to civil infrastructure.

We expect to see the agribusiness industry rapidly integrate the use of 5G and the IoT into daily operations in the coming years.

Remote sensing and connected devices have the potential to monitor soil conditions, assess harvest readiness, and control pests.

Connected devices are already monitoring livestock.

A “cow-recognition system” from Lely outfits each animal with a transponder attached around its neck.

Lely’s data-driven solution gives farmers the insights they need to efficiently manage livestock.

The sensor collects data regarding animal health, activity, eating, and reproduction.

Although the system doesn’t currently operate on mobile networks, ag business experts say this is one area in which 5G networks will drive efficiency, seamless workflows, and a better-quality end product in the near future.

4. Employees Actively Seek Out Remote and Hybrid Work

At the height of the pandemic, 71% of Americans who had jobs that could be done from home were working exclusively from home.

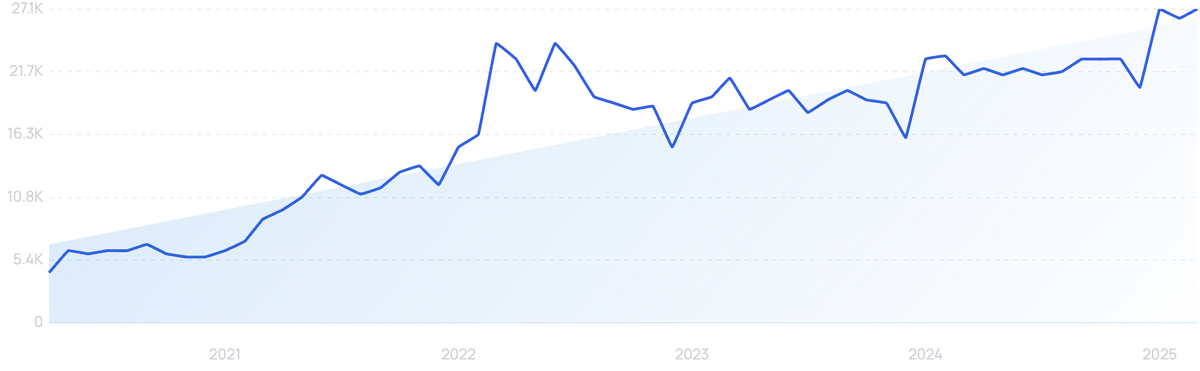

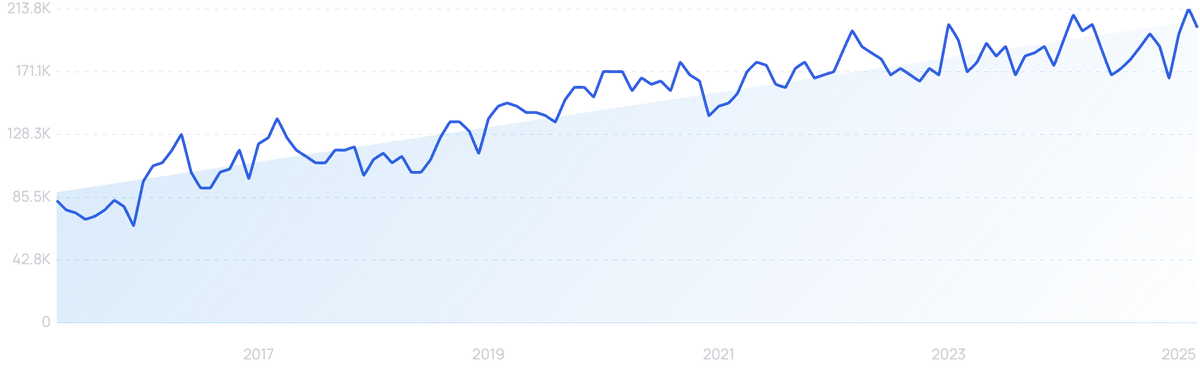

Search volume for “remote work” saw significant gains during the early days of the pandemic and is climbing again.

In fact, the number of people working from home tripled between 2019 and 2021.

More than 3 out of every 4 U.S. workers have a job that is possible to do remotely. 26% of workers are fully remote, while 52% of workers are operating in a hybrid environment. Hybrid environments have grown considerably in recent years as they offer the flexibility of remote work with the team face-to-face time of working in-office.

Search volume for “hybrid work” is up more than 525% in the past 5 years.

Young people with a college degree are the most likely to have access to remote and hybrid work environments.

Research shows that those with a bachelor’s degree or higher are five times more likely to work from home than those with less education.

In recent months, we’ve seen that employees who’ve had the opportunity to work remotely aren’t quick to give in to companies who’d like them back in the office.

A 2022 survey from the Pew Research Center reported that 78% of those who currently work remotely want to continue with that setup in the coming years. That’s up 14% since 2020.

Search volume for “remote hiring” continues to climb, up 345% in 5 years.

More than two-thirds of remote workers say they’d start looking for a new position if their company required them to work in-office full-time, and more than half say they’d rather take a pay cut than give up their workplace flexibility.

In this survey, more than half of respondents said they’d take up to an 11% cut in pay if it meant they could continue with their remote/hybrid work environment.

Employees are continuing to see financial benefits from working remotely.

Those who work from home spend about $432 on things like lunch and coffee, while those who work in the office spend an average of $863 per month.

However, businesses remain leery of the ongoing work-from-home trend.

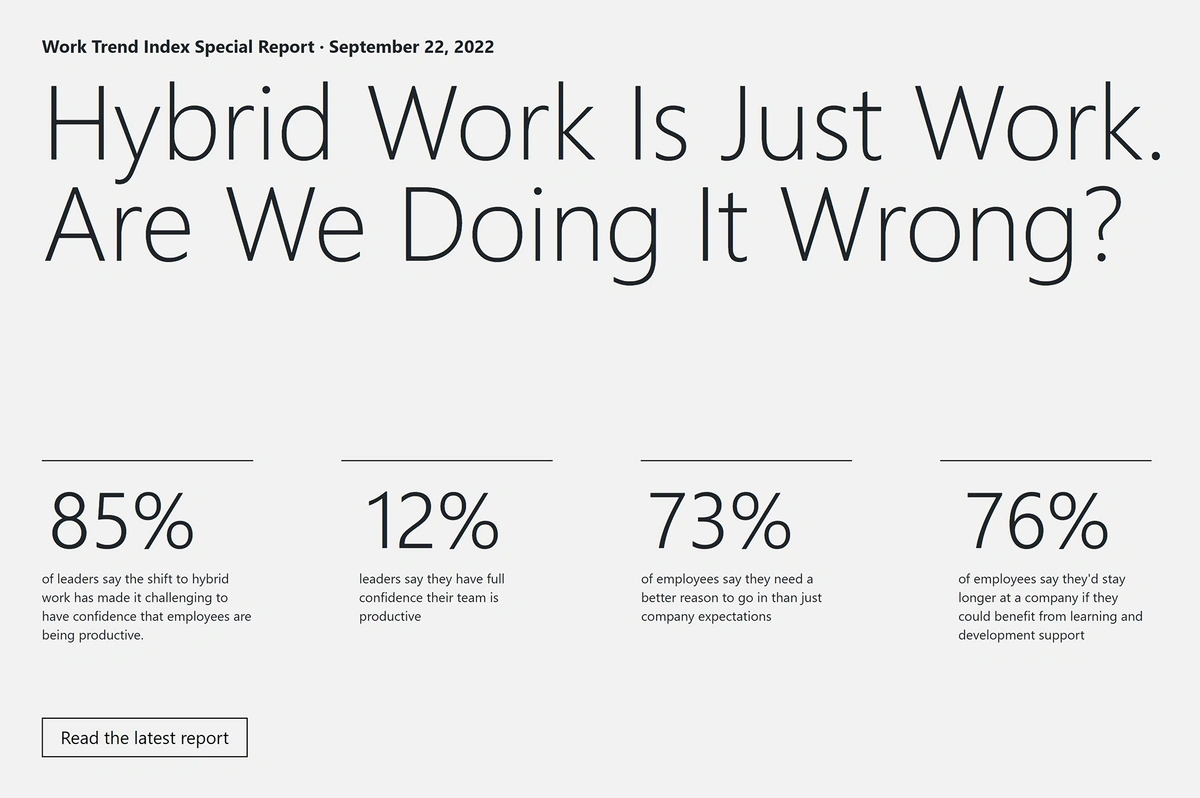

Microsoft’s Work Trend Index reports that 85% of business leaders say it’s challenging to have confidence in employee productivity in a hybrid work environment.

Only 12% of business leaders say they have full confidence in employee productivity.

As this trend persists, we expect to see more companies opting for monitoring technology that will ensure worker productivity.

Many businesses are already utilizing screen monitoring, recording keystrokes, and implementing facial recognition programs that scan workers’ faces several times a day.

Garter reports that the number of large corporations using this type of monitoring technology has more than doubled, reaching 70%, since the pandemic began.

5. Businesses Expand Ads, Communities, and Commerce on Social Media

Running a business without having a social media presence is almost unheard of these days.

The importance of social media in business marketing will likely continue to increase over the coming years.

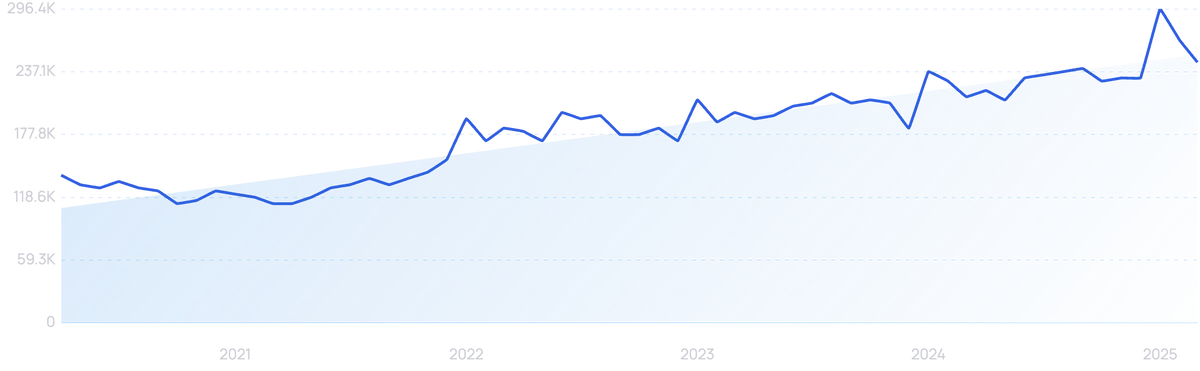

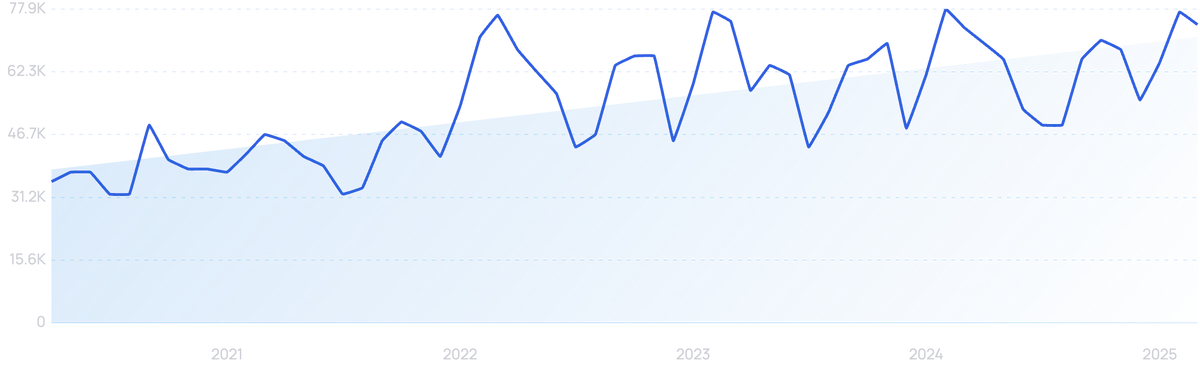

Search volume for “social media marketing” continues to climb, up 141% in the past 10 years.

Estimates showed 5.66 billion users currently on social media as of October 2025, equating to 68.7% of the global population.

More than half of CMOs say they’ll be increasing their spending on social media ads in the coming years.

TikTok ads are one marketing strategy that's increasingly used by businesses in nearly all industries.

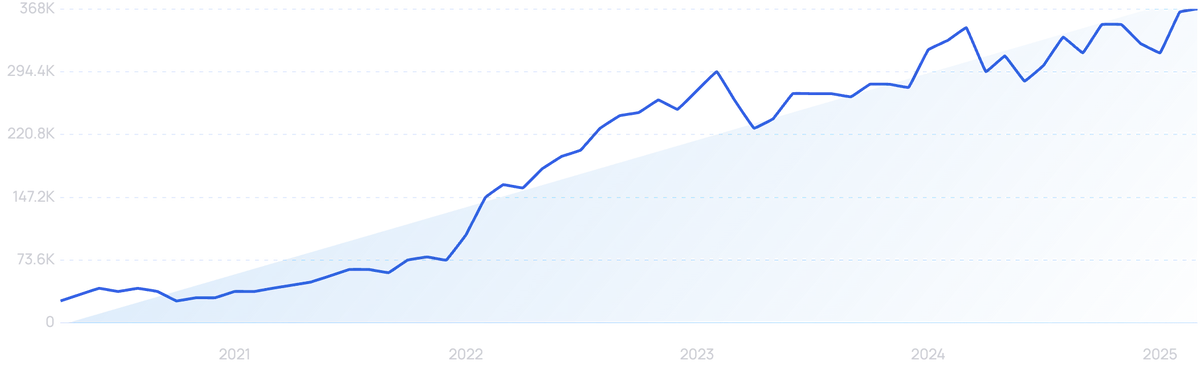

Searches for “TikTok ads” have climbed 1,329% over 5 years.

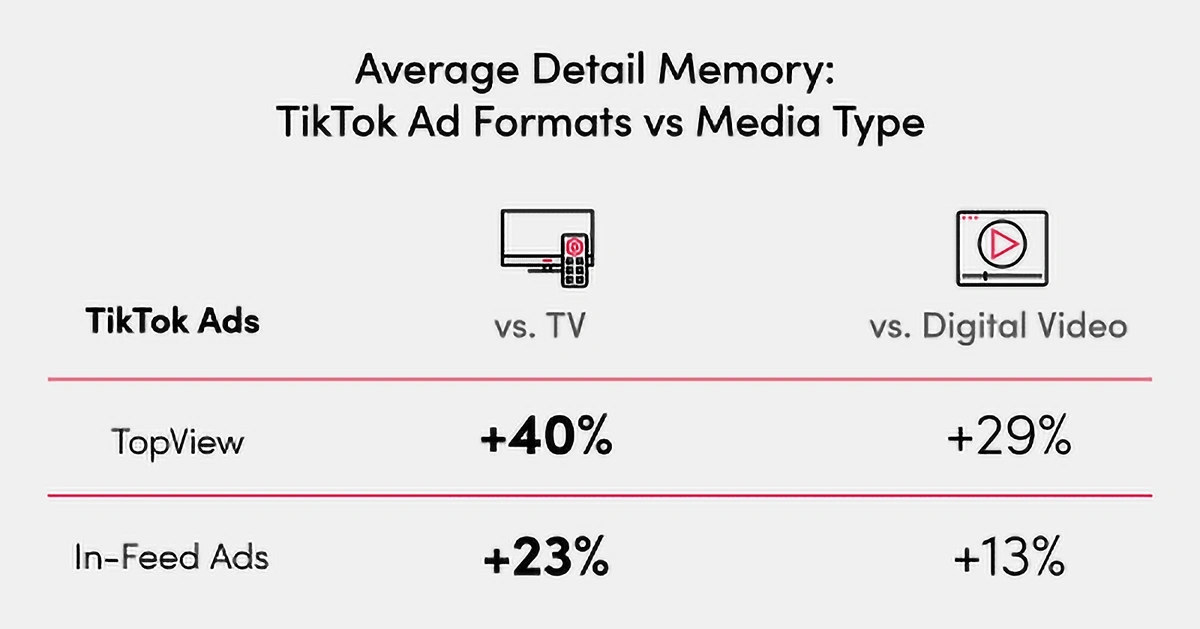

A study found that in-feed TikTok ads are 23% more memorable than TV ads and 13% more memorable compared to other types of digital video.

TikTok ads are consistently more memorable than other types of ads.

In the coming years, we expect to see businesses go beyond ads to focus on building communities as part of their overall social media strategy.

Nearly 80% of people say that the most important group they belong to operates online.

According to one source, companies that use micro-influencers see a 60% higher engagement rate than they see with more popular influencers.

The conversion rate is better, too: 1.46% for micro-influencers compared to 0.61% for influencers with 21k followers or more.

In an effort to increase engagement and sales, brands are likely to invest in social commerce in the coming months.

Search volume for “social commerce” is up more than 82% over 5 years.

Social commerce is a popular concept in China, where 14.3% of total online retail sales were made through social commerce in 2021 and that figure was expected to reach 17.1% by the end of 2025.

It's estimated that social commerce sales accounted for 8.8% of total eCommerce sales in the US in 2025.

6. Companies Focus on Sustainability

According to a Ceres release from late 2025, at least two-thirds of US consumers say they’re willing to pay more for sustainable products, and 62% of consumers are willing to change their shopping habits in order to reduce their environmental impact.

Globally, reports show that 89% of people have changed their purchasing habits to become more sustainable in the past five years.

Businesses are responding to this consumer demand by paying special attention to their ESG processes.

A 2022 survey found that nearly 80% of retailers who’ve dedicated resources to improving sustainability believe their efforts have resulted in increased customer loyalty.

The degree of profitability has been contested over the years, but numbers from late 2025 show a profitability rate of 21%.

Another business buzzword related to ESG initiatives is the circular economy.

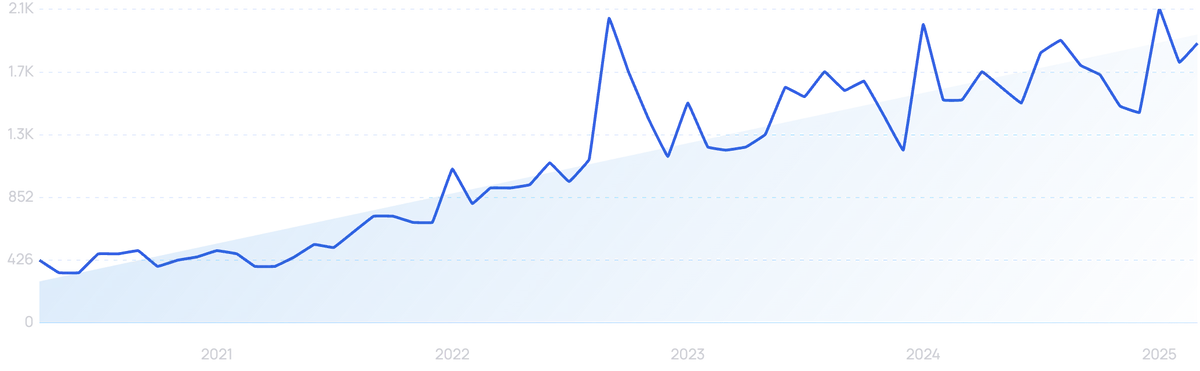

Search volume for “circular economy” is climbing, up 111% since 2020.

Environmental activists refer to the way the world operates now as a linear economy — businesses take materials from the earth and customers eventually throw them out as waste.

In contrast, a circular economy focuses on keeping materials and products in use for as long as possible.

The World Economic Forum reports that if businesses invest in reusing and recycling there could be savings of $1 trillion per year.

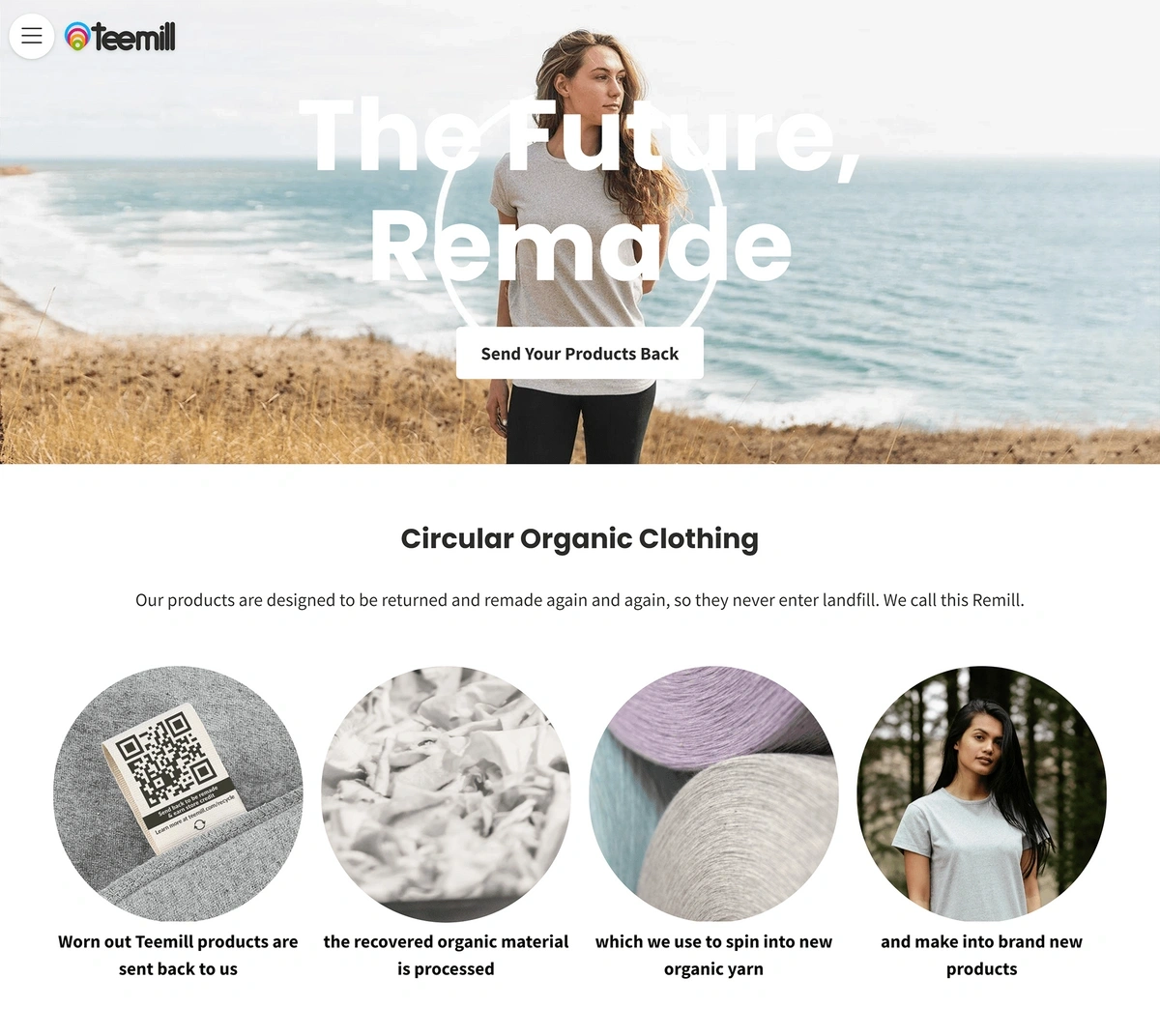

One business example of the circular economy is found in Teemill, a fashion business from the UK.

The company offers B2B print-on-demand services for t-shirts with distinctly sustainable business practices.

Any business owner can log in to the Teemill site, design t-shirts, and set up a store.

When a customer orders a shirt, Teemill prints it and drop-ships it to the customer directly.

Every tee includes a QR code on the tag so that customers can return the shirt to Teemill. The company then recovers the organic material from the shirt and uses it to spin new yarn.

Teemill’s products are designed to be returned to them and recycled in order to make new clothing.

7. Businesses Experiment With Immersive Technologies

As businesses look to engage customers in cutting-edge ways, immersive technologies like augmented reality (AR), virtual reality (VR), and mixed reality (MR) are setting a new standard.

Search interest in “immersive technology” has grown by 744% over the past decade.

Big tech is already investing heavily in various types of immersive technologies with the hope that widespread business adoption is coming soon.

Despite having laid off about 1,500 employees (10%) from its Reality Labs in early 2026, Meta still has an estimated 13,500 employees in that department. The most recent numbers estimate that Apple has 3,000 employees dedicated to immersive technology, although they did recently walk back their plans for a Vision Pro revamp in order to focus on a product that will more directly compete with Meta's efforts.

The immersive technology market (including AR/VR/MR) was valued at nearly $40.88 billion in 2024. It’s expected to swell to more than $169.8 billion by 2030.

Consumers are showing increasing interest, too.

AV/VR-headset sales increased by an estimated 39.2% in 2025.

And, more than 50% of consumers are willing to use AR/VR to assess products.

In one study involving a make-up retailer, consumers who utilized AR to try on lipsticks sampled nearly 2x more lipsticks than in-store customers.

The study also found that customers who used AR browsed for longer and viewed more products than those who didn’t use the technology.

Those who used AR were nearly 20% more likely to make a purchase than those who didn’t.

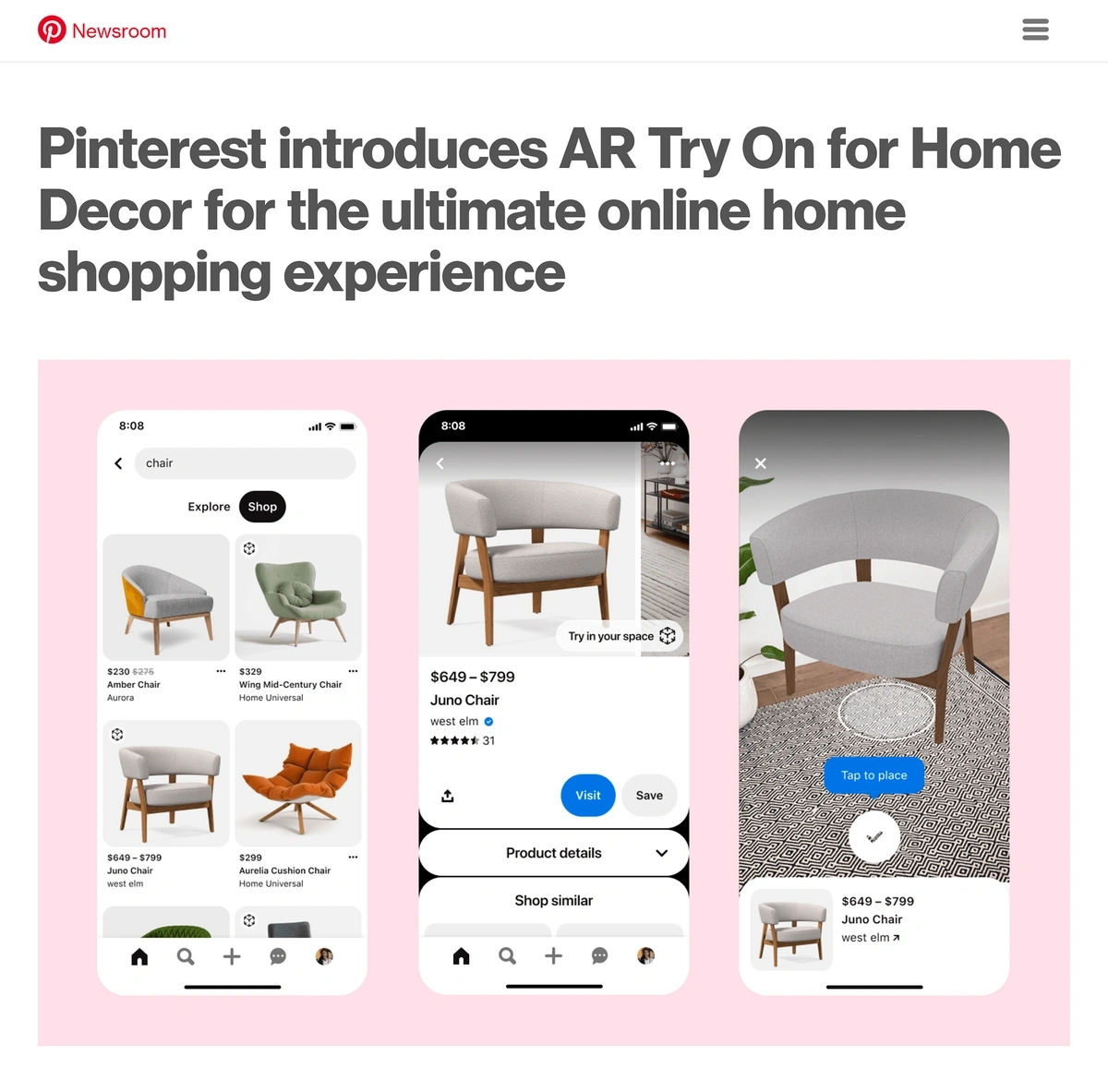

In early 2022, Pinterest launched new AR capabilities on its platform.

Pinterest’s AR capabilities now provide consumers with the ability to try furniture, lipstick, and eye shadow in their own space.

The “Try On for Home Decor” tool allows users to stage their home virtually with furnishings from a variety of retailers via the Pinterest Lens camera.

The brand reports that consumers are 5x more likely to buy items when using this feature than when using standard pins.

Some businesses are going further into immersive technologies and investing in the metaverse.

Gartner predicts the metaverse will be a gathering spot for employees soon.

Instead of video conferencing, employees will engage, collaborate, and connect as avatars in the metaverse, they say.

A Statista report anticipates 21.2% of employees will use the metaverse this year, with that number rising up to 39.7% in 2030.

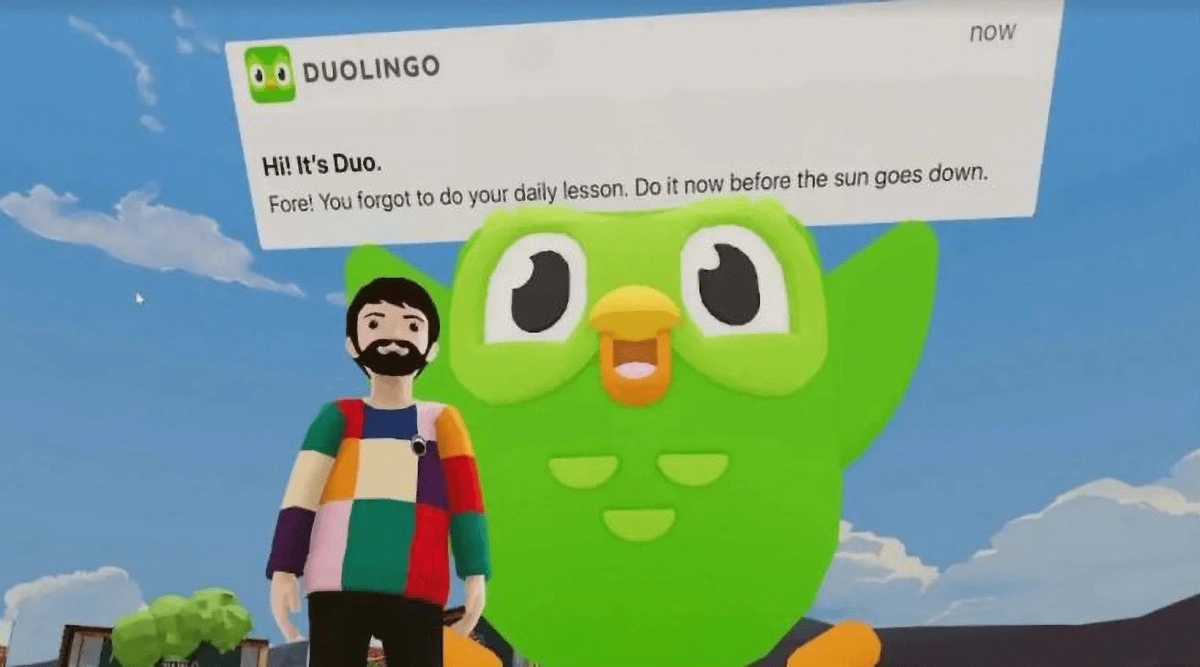

In another example, Duolingo’s mascot, an owl named Duo, led the company’s metaverse debut in the Duolingo Game Hub in late 2022.

Duolingo’s presence in the metaverse was launched in honor of the 10th anniversary of the company.

In just a few weeks, the metaverse destination received more than 9 million visits, and players spent a total of 41 million minutes playing Duolingo games.

The brand had a metaverse presence in Roblox as well as in Decentraland.

And although peak VC funding for AR/VR technologies seems to have happened in 2021-22, more than $750 million went to those efforts in 2024.

8. Innovation Impacts Last-Mile Delivery

Nearly all businesses suffered supply chain disruptions due to the pandemic.

An Electroiq survey found that 94% of companies experienced a negative impact on their revenue due to supply chain disruptions.

The same study found that supply chain disruptions brought on by climate change have impacted 63% of companies.

Last-mile delivery is one supply chain component that’s receiving a lot of attention from businesses.

Search interest in “last mile” is up around 100% in 5 years.

In the past, the last mile has been inefficient, costly, unreliable, and unable to flex with changing demands.

In fact, this component alone accounts for 53% of shipping costs.

But as consumers demand faster shipping times, businesses cannot afford to have sub-par last-mile delivery solutions.

In May 2022, nearly one-third of consumers bought retail items online and had them delivered on the same day.

Nearly 80% of consumers say they’re more likely to make a purchase if they can get delivery in two days or less.

41% of consumers are willing to pay more for same-day delivery, and 23% are willing to pay more for delivery within 3 hours. That said, 86% of consumers consider a delivery fast if it occurs within 2 days.

Research and Markets reports that the global drone delivery market could be worth $5.56 billion by 2030, achieving a CAGR of 49% over the next eight years.

In June 2022, a few companies were given clearance from the FAA to begin drone deliveries.

This includes Amazon, Wing, and Flytrex.

Wing, a company owned by Alphabet, tested its drones in Virginia and Texas.

They’ve made more than 250,000 total deliveries during the test period.

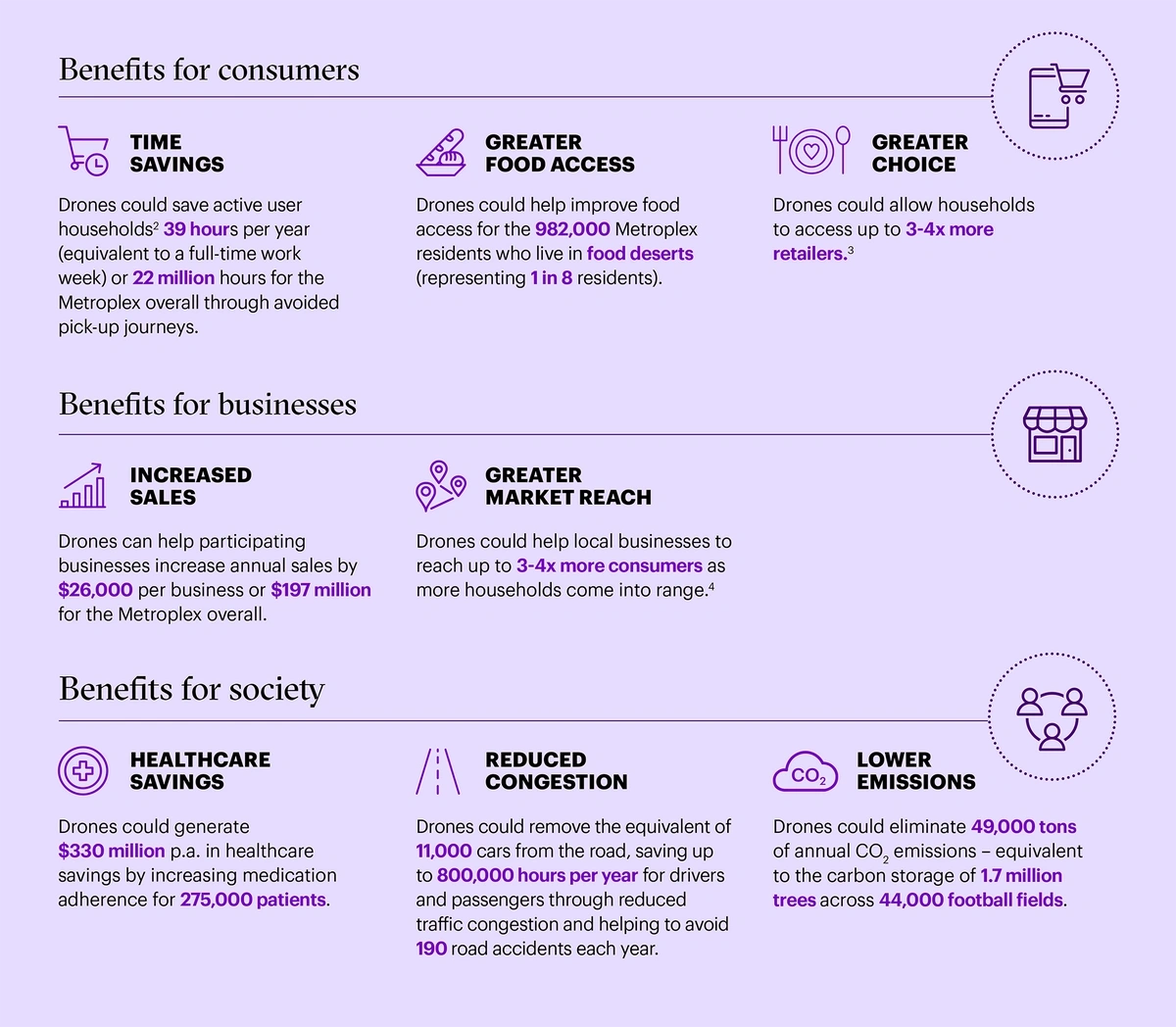

Statistics from an impact report focused on Wing’s potential in Dallas, Texas, show that drone delivery could drive $26,000 in revenue gains for businesses per year. That would potentially boost annual revenue in the Dallas Metroplex by $197 million.

Accenture’s impact study found numerous benefits to drone delivery in Dallas.

LogiNext is a New Jersey-based company that offers AI solutions in order to help businesses improve last-mile operations.

Their SaaS solution features automated route optimization, intelligent capacity utilization, and predictive analysis for delivery ETA.

The company’s platform supports more than 500 million orders each year.

9. Improved Customer Experience and Cost Savings Through AI

In 2025, customers have more purchasing options than ever. That means businesses must work even harder (and smarter) to attract and retain customers.

70% of organizations say customer service is directly connected to the performance of their business and 63% of them are prioritizing the customer experience.

And the customers? 52% of them will consider switching to a competitor if they have a single negative experience.

One critical way businesses are improving customer service is through the use of artificial intelligence (AI) solutions.

Gartner reports that customer service budgets are directly increasing spending on tech solutions.

Technology is anticipated to see a 7.8% boost in spending in 2026, totaling $5.6 trillion, up from $5.2 trillion in 2025.

Salesforce reports that the number of customer service leaders using AI has increased by 88% since 2020. Currently, 56% of CX leaders say they’re exploring new AI vendors and tools.

AI solutions have the potential to drastically increase the efficiency of customer service operations, reduce spending, and boost overall customer satisfaction.

According to Gartner, agentic AI will resolve up to 80% of customer service issues on its own by 2029.

And although AI might be reducing costs by up to 30% for companies, 3 out of 4 customers still want some kind of human interaction in service situations.

In one example, Camping World launched an AI system from IBM to handle the company’s customer contact center.

The solution incorporates a virtual customer care agent named Arvee and the dynamic routing of incoming calls.

The virtual agent is connected to other customer platforms at Camping World, so it can find customer information automatically and address customer questions more efficiently.

Camping World says customer engagement increased 40% and call wait times decreased to just 33 seconds after implementing the AI solution.

Forethought is one of the leading AI startups in the customer service sector.

Forethought’s AI solution offers support via chat, email, help desk, and social media.

In 2021, they completed a $65 million Series C funding round, grew their ARR by 5x, and tripled their customer base.

The company recently worked with online retailer Uncommon Goods to improve its customer service during the holiday season.

The AI system provided customers with a robust self-service portal and automatically tagged inquiries with relevant information that agents could use.

As a result, the company now has a 49% deflection rate via email, a 46% deflection rate via chat, and a 47% self-serve rate.

The overall cost savings came to $18,000 per month.

Key Takeaways

That concludes our list of important business trends that will impact various sectors in 2026.

The business world continues to invest heavily in social media and tech solutions. As these trends continue to develop, we expect to see increased funding and product development.

However, businesses will have to keep a sharp eye on consumer sentiment regarding environmental and corporate responsibility if they want to continue to attract new customers.

Companies that stay on top of key trends and innovate based on these trends are poised to come out on top.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more