Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

8 Important Finance Trends (2024 & 2025)

From crypto to AI, the world of finance is changing faster than ever.

And financial services (like banks, insurance, and money management) are scrambling to keep up.

Many of these new trends come on the back of changing technology. While others are the result of a renewed focus on the customer.

In this report we'll cover the top 8 financial trends to know:

1. Financial Services Leverage Generative AI Solutions

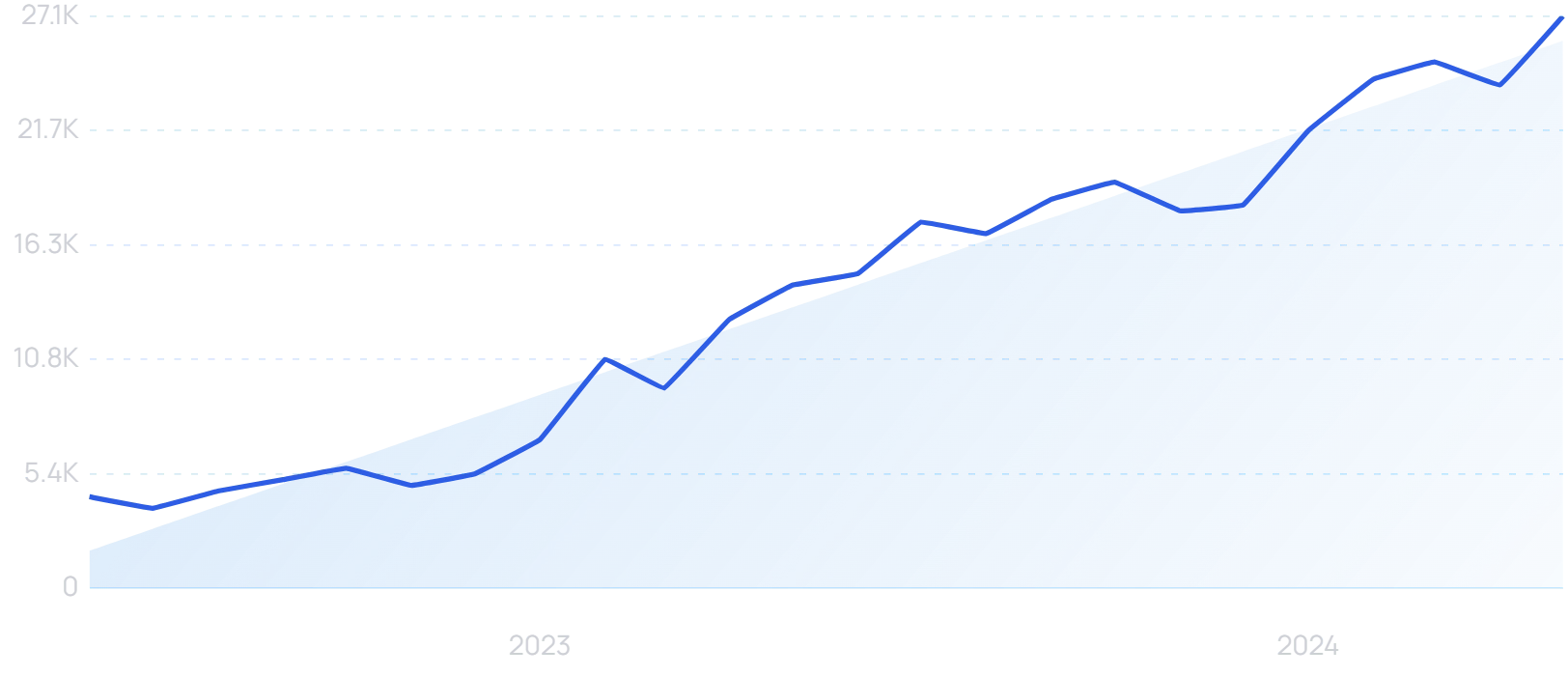

Searches for "AI in finance are up 525% over the past 24 months.

Large language models (including ChatGPT) have the potential to disrupt nearly every industry.

And the financial services space is no exception.

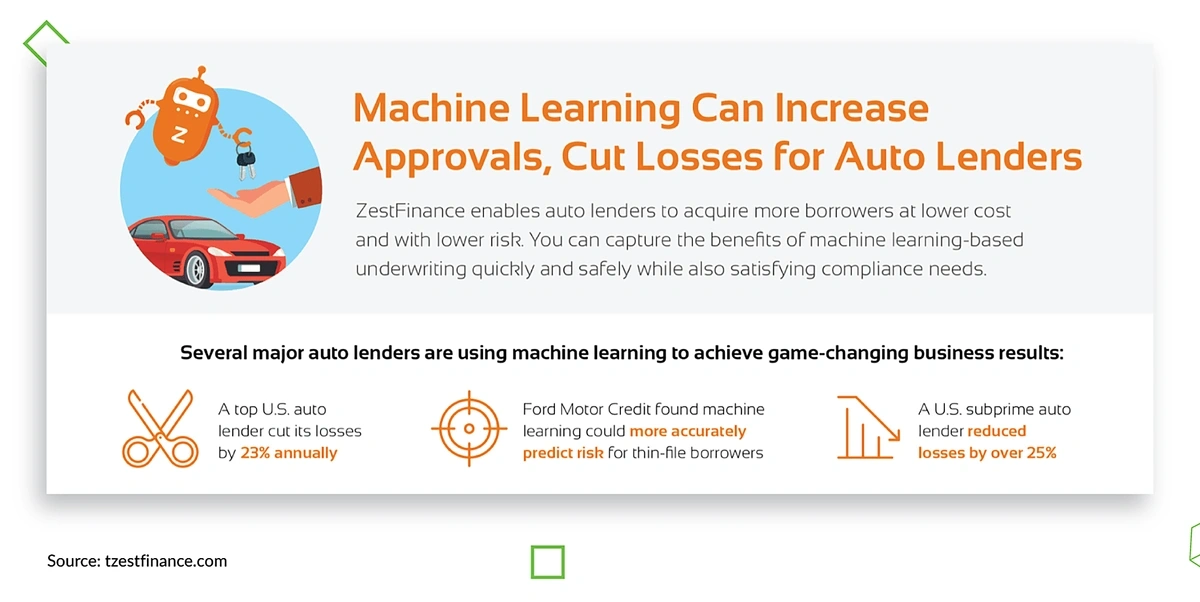

For example, Zest AI reports that AI helped a US auto lender reduce costs by nearly 25%.

While still early, AI looks to be a promising technology for financial services companies.

Other areas that AI could help in the financial services space include:

- Fraud detection: AI is especially adept at spotting patterns. Which makes them it an ideal technology for spotting fraudulent transactions.

- Credit scoring and underwriting: AI can quickly ingest and analyze large amounts of data, which can be used to identify the risk of lending to an individual or business.

- Market analysis: Financial professionals can use tools like Claude and ChatGPT to analyze massive amounts of data to spot market opportunities.

- RegTech: When properly trained, LLMs can help identify and report potential regulatory and compliance issues.

- Knowledge extraction: Large amounts of knowledge and insights are buried inside documents (for example, Form S-1 filings). By uploading these documents to an LLM, users can essentially "chat with" the documents to extract insights.

These use cases for AI in finance aren't theoretical.

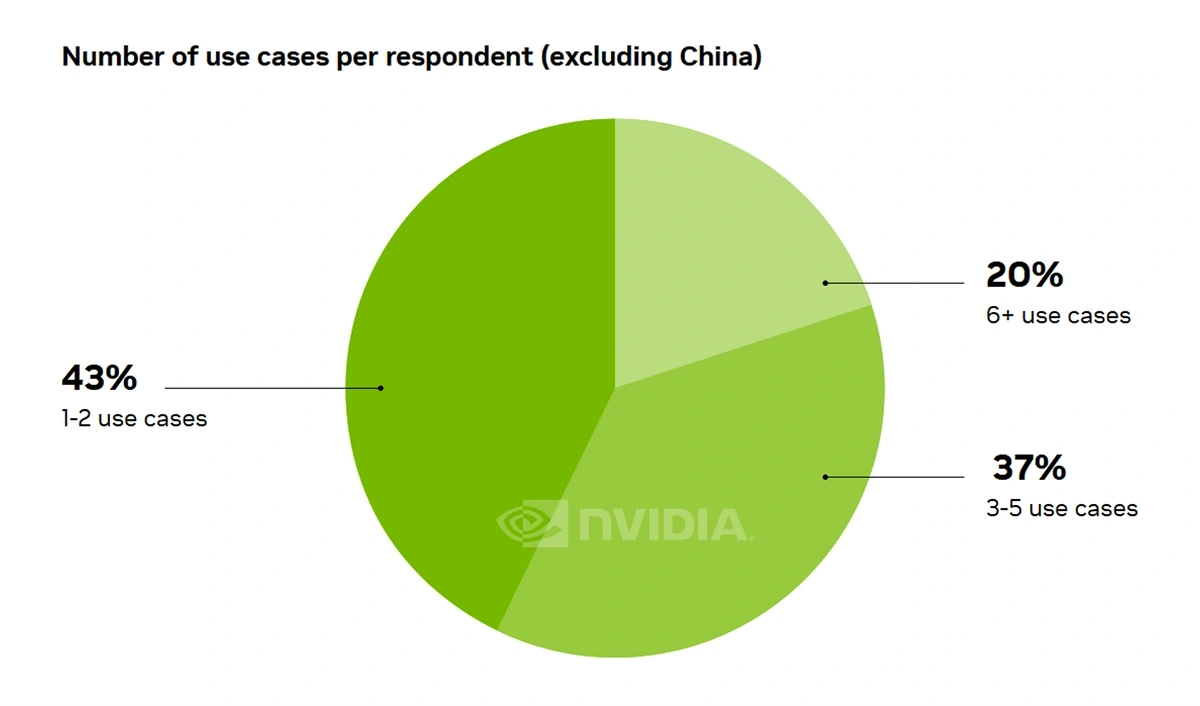

In fact, NVIDIA reports that AI is already being adopted by financial institutions worldwide.

NVIDIA found that financial services teams have already discovered several use cases for AI in their workflows.

And we should expect even more adoption in the future.

In fact, Gartner estimates that 80% of CFOs plan to invest more into AI tools over the next two years.

2. The Finance Industry Embraces Blockchain

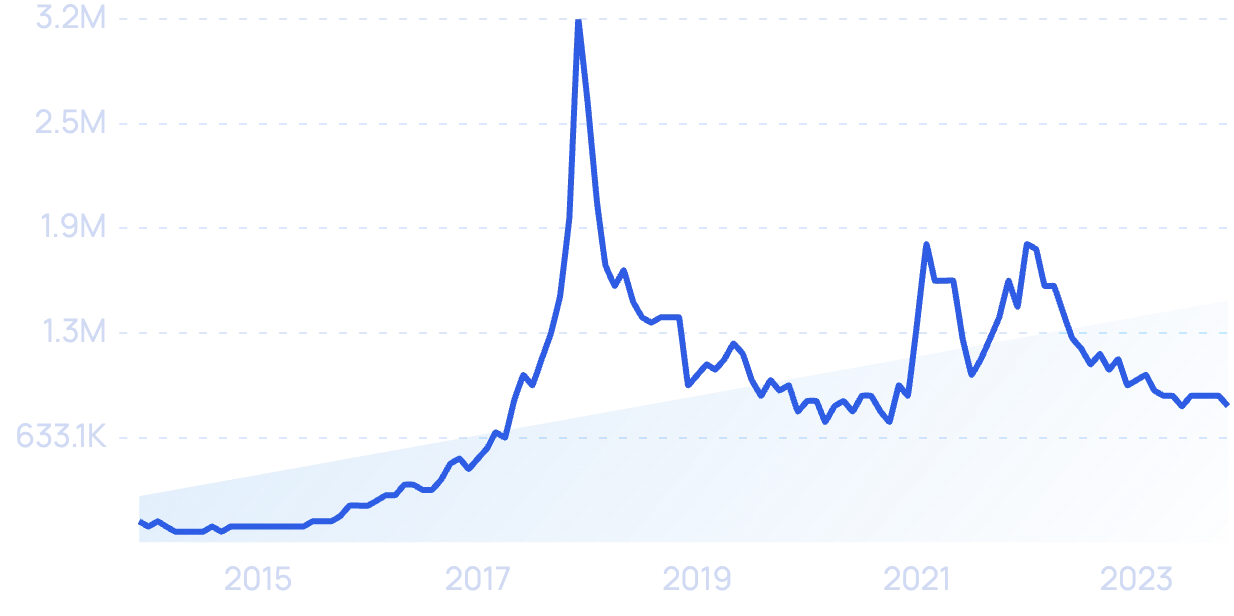

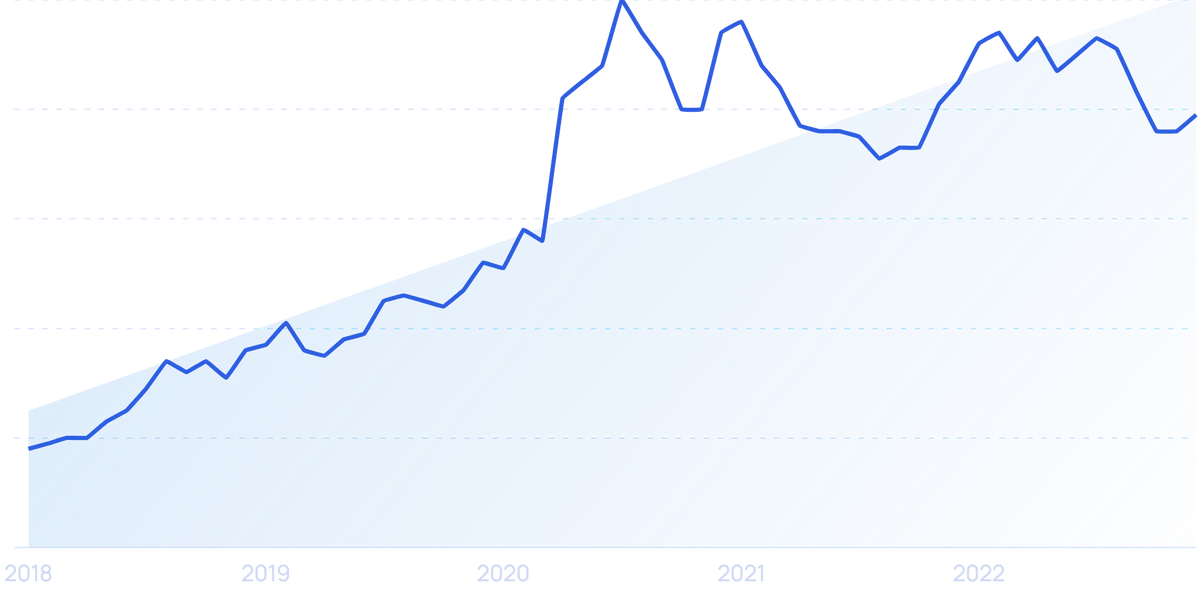

Search interest in “blockchain” has risen by 550% in 10 years.

For years, blockchain technology has been synonymous with cryptocurrency.

However, the technology is starting to become more integrated with existing financial systems.

For example, using blockchain can allow banks to conduct cheaper, more efficient transactions while maintaining tight security.

It can also be used to handle peer-to-peer lending, an industry that could see a growth of up to $150 billion by 2025.

More banks are transitioning to cloud-based banking in 2024, and blockchain will no doubt play a role in this.

HSBC and Wells Fargo already use blockchain technology to settle forex trades.

HSBC and Wells Fargo have used blockchain in forex trading.

Paypal, Mastercard, and JP Morgan all allow users to make payments on their networks using blockchain currencies.

This involves cryptocurrency, of course, but it shows banks’ willingness to embrace blockchain.

3. More People Use Personal Finance Apps

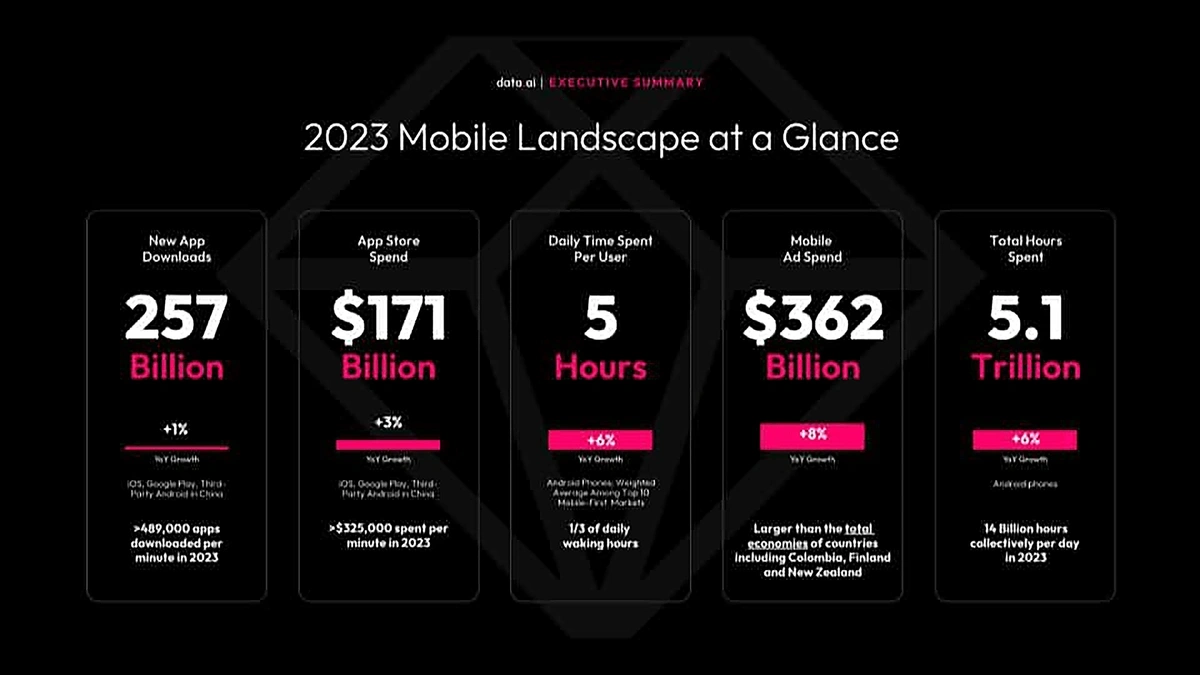

According to one report, 489k personal finance apps are downloaded every second.

That equates to around 250 billion total downloads per year.

Stats around the current popularity of finance mobile apps.

These apps not only help people manage their money, but they offer ways to invest in stocks and crypto.

It’s not just the ability to manage your money remotely that’s attracting people, either. People specifically like having the power to run their financial world (literally) in the palm of their hand.

6 out of 10 users prefer using finance apps over a desktop website.

And as the US adopts open banking, which will make financial apps even safer, this number will likely increase. And skeptical users who harbored security concerns might be persuaded to take a second look.

Square’s Cash App remains the most popular personal finance app available, and among its list of benefits is a rewards system, which ties into what we discussed above about customer loyalty programs.

Searches for “Cash App” have risen 94% over the last 5 years.

4. More Consumers Get Their Money Professionally Managed

A new kind of wealth manager is quickly becoming the de facto money manager for many consumers: RIA.

A Registered Investment Adviser (RIA) is a firm that is regulated by the Securities and Exchange Commission and specializes in giving financial advice and managing investments.

Compared to typical broker-dealers, RIA’s have what is known as a fiduciary duty to their clients.

This means that they are required to put their client’s interests before their own when making financial decisions.

This kind of high-touch and client-focused model is gaining traction in the US.

According to the latest data, investment advisers manage $114.1 trillion in assets for 61.9 million clients each year.

In addition, there are now just over 32,000 RIAs nationwide.

Even at this growth rate, 47% of RIAs still believe that the industry has a lot of room to grow.

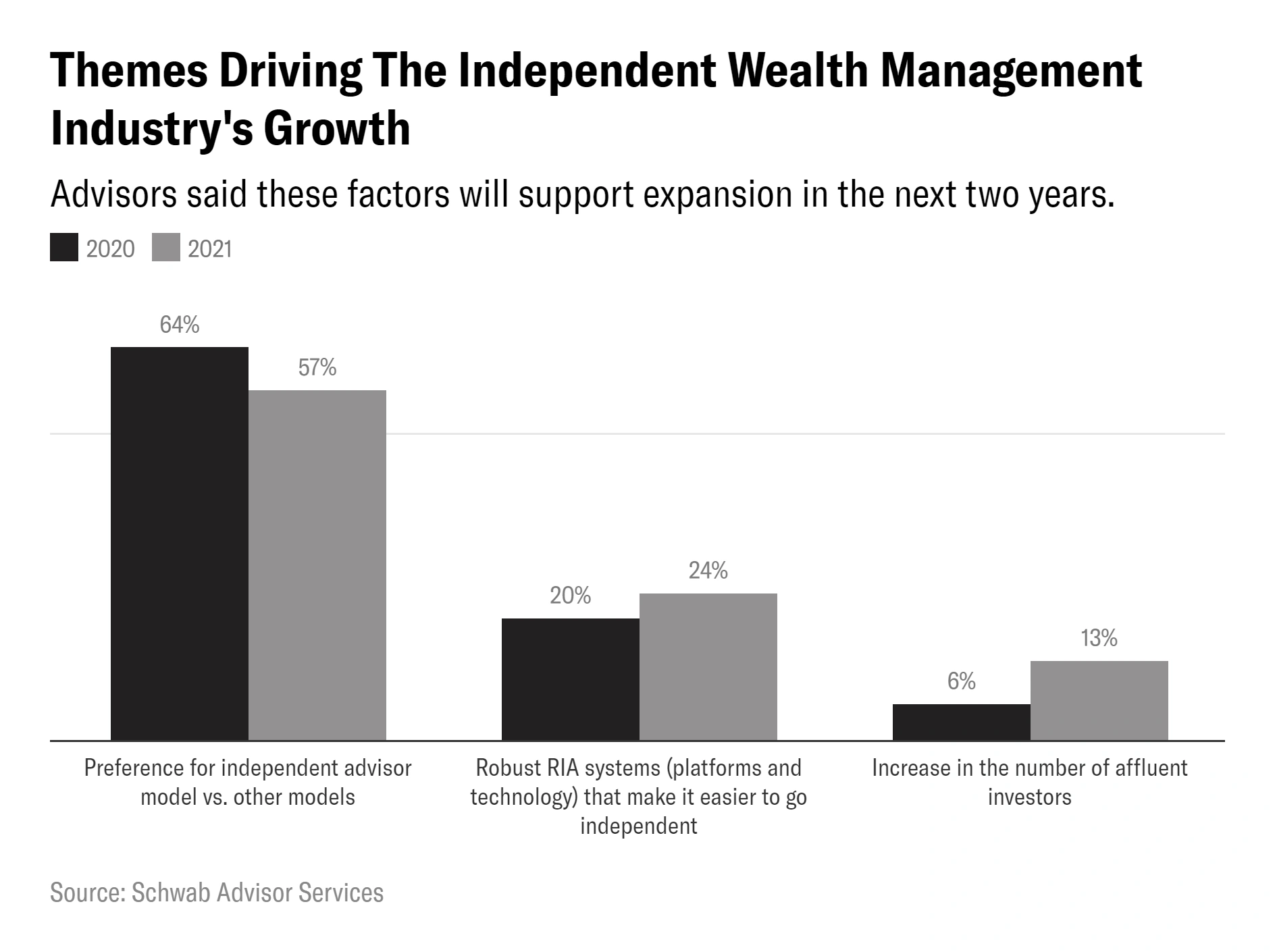

A study by Schwab found that over half of investors prefer to have a fiduciary (an RIA) manage their money compared to any other model.

The trends that are driving RIA growth.

Overall, it seems that the growth of the RIA industry is leading more Americans to consider letting a professional manage their money.

5. Loyalty Programs Drive Repeat Business

We’re seeing an uptick in loyalty programs in the finance world.

Loyalty programs have long been a popular way to keep customers coming back, but they’re usually offered in retail and the food industry.

Now, loyalty programs are practically mandatory, even in the financial services industry. Many believe that they’re only going to get bigger, better, and more competitive.

Most customers, (80% of millennials and 68% of non-millennials) would be willing to sign up for a premium loyalty program offered by their favorite brands.

Repeat customers spend at least 33% more than new customers.

And more than 80% of millennials and almost 75% of baby boomers like to get rewards simply for engaging with their favorite brands, whether or not they make a purchase.

A good example of this is CitiBank’s “thankyou” rewards program, which lets customers earn points by simply using their mobile apps or ATMs.

A survey conducted by McKinsey & Company showed that consumers who belong to paid loyalty programs are 62% more likely to spend more money on that brand.

Interestingly, when it comes to free loyalty programs, that number is only 30%.

Banks are losing the “tender wars” to companies like PayPal and programs like Buy Now, Pay Later. Offering a good loyalty program may be one of their few remaining options to bring consumers back.

6. Banks Further Embrace the Cloud

Banks were already gravitating towards the cloud pre-pandemic, but the pandemic really sped things up.

The banking industry's move to the cloud provides just that.

Market research company IDC estimates that global spending on cloud services will surpass $1.3 trillion by 2025, just a year or so away.

Banks and credit unions will be a part of that, with heavy hitters like JPMorgan Chase and Arvest Bank already converting part of their core systems to a cloud-native platform.

Jim Marous of The Financial Brand believes that cloud banking is the future, citing the fact that IBM has developed cloud solutions specifically for the financial industry.

Microsoft introduced its own offering last year with Microsoft Cloud for Financial Services.

Another survey, this one conducted by Harris Poll and Google Cloud, showed that, of the 1,300 financial services leaders polled, 83% of them were using the cloud as part of their primary infrastructure.

MANTL is one of the companies that is focused on the cloud banking market.

Search interest in “MANTL” over the last 10 years.

The company basically helps traditional banks expand into the digital market.

MANTL does this by developing products that allow banks to automate back-office functions, set up an online presence, and onboard customers digitally.

Overall, the company boasts that its customers can expect to receive four times more account applications with a digital offering powered by MANTL.

Artificial intelligence plays a big role in the adoption of cloud services. Not only does AI provide chatbots, but it can also analyze transactions, monitor suspicious activity, and perform other tasks just as well if not better than human counterparts.

Investing in AI would generally cost more than banks would be willing to consider, but if AI was packaged with cloud services, that would become a very appealing offer.

7. Banks (Mostly) Move Past Overdraft Fees

Overdraft fees have long been a thorn in the side of bank customers everywhere.

They’re known for not only being excessive but also having a tendency to snowball and reach absurd amounts.

According to the Consumer Finance Protection Bureau, overdraft and non-sufficient revenue dropped from $15.47 billion in 2019 to only $5 billion last year.

Of course, that doesn’t mean that banks will just up and get rid of them (though Ally Financial did just that last year and Capital One followed suit in January), but multiple institutions are implementing new features designed to help customers avoid fees at all costs.

Bank of America added a feature called Balance Connect, which allows users to automatically transfer money to and from accounts to prevent possible overdraft fees.

There’s still a fee of $12 per transfer, but that’s less than the usual overdraft fee. Plus, there’s less chance of it compounding as dramatically.

PNC is offering a new feature called Low Cash Mode that will let customers change the order in which transactions are processed in order to avoid overdrafts.

JPMorgan Chase is giving customers more opportunities to restore overdraft balances before they get charged a fee. They’re also letting customers access direct deposited paychecks two days early.

There are two major factors in banks suddenly looking to eliminate or lessen overdraft fees:

One, everyone is doing it, and no bank wants to be the last one charging overdraft fees. In an age where consumers want loyalty programs, going the opposite direction is a good way to go out of business.

Two, with the release of the CFPB report mentioned above, the agency announced its intentions to begin zeroing in on banks that have, as Director Rohit Chopra puts it, “become hooked on overdraft fees to feed their profit model”.

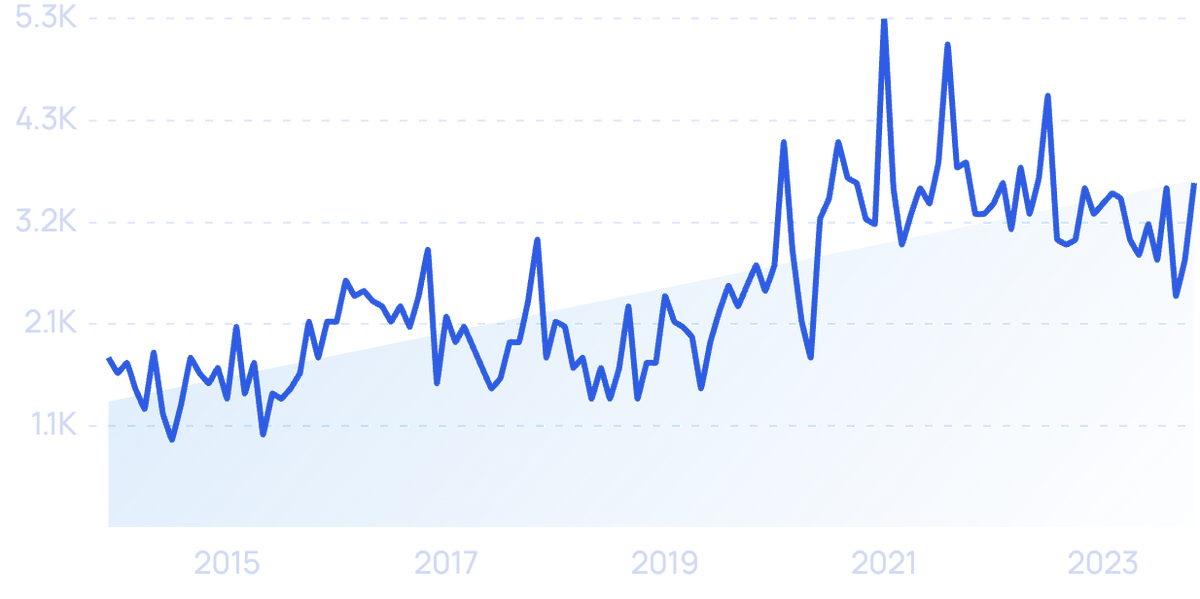

8. More Non-Tech People Get into Crypto

As of June 2024, total cryptocurrency market capitalization is around $2.7 trillion.

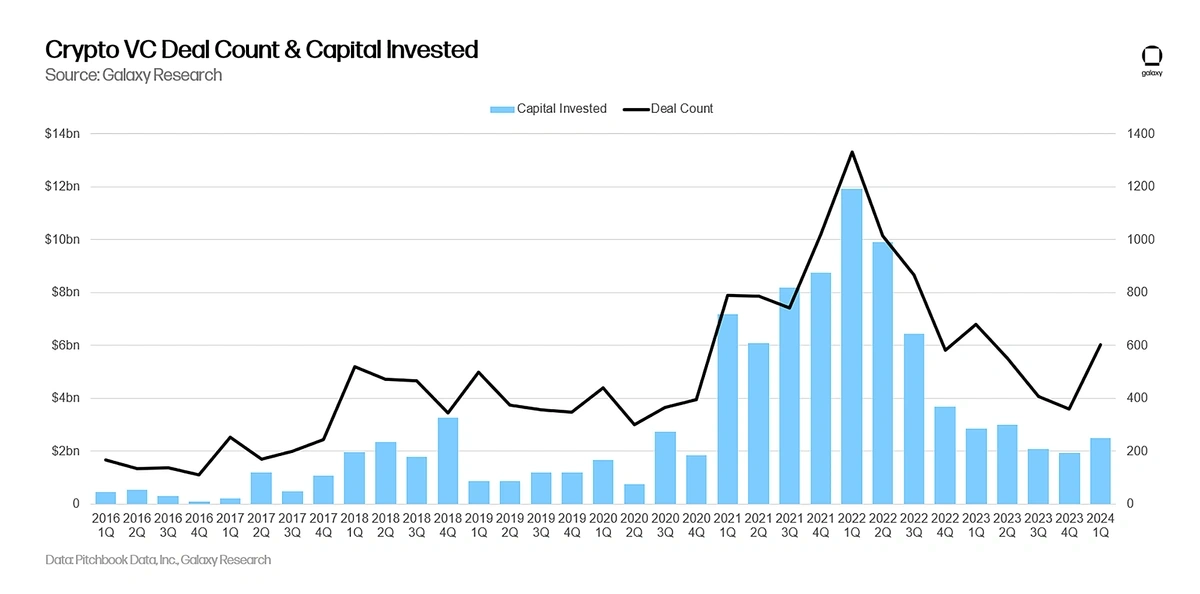

Thanks largely to a bull market that saw bitcoin hit an all-time high, VCs have increased investment in blockchain companies.

In fact, Galaxy reports the number VC deals in the crypto space has increased by 69% compared to the previous quarter.

Venture capital firms have invested $2.49B in crypto startups in the last quarter alone.

In a move that should signify that crypto is, in fact, getting even bigger, US President Joe Biden signed a bill that requires all crypto exchanges to be reported to the IRS.

This sort of oversight wouldn’t be necessary if cryptocurrencies weren’t poised to become even more popular.

Bitcoin and Ethereum ETFs have now hit the New York Stock Exchange in October, allowing traders to invest in a more conventional way.

Instead of buying crypto, they’re instead able to invest in companies that have a financial stake in crypto. So, they’re still susceptible to its volatile nature, they’re just inserting a middleman.

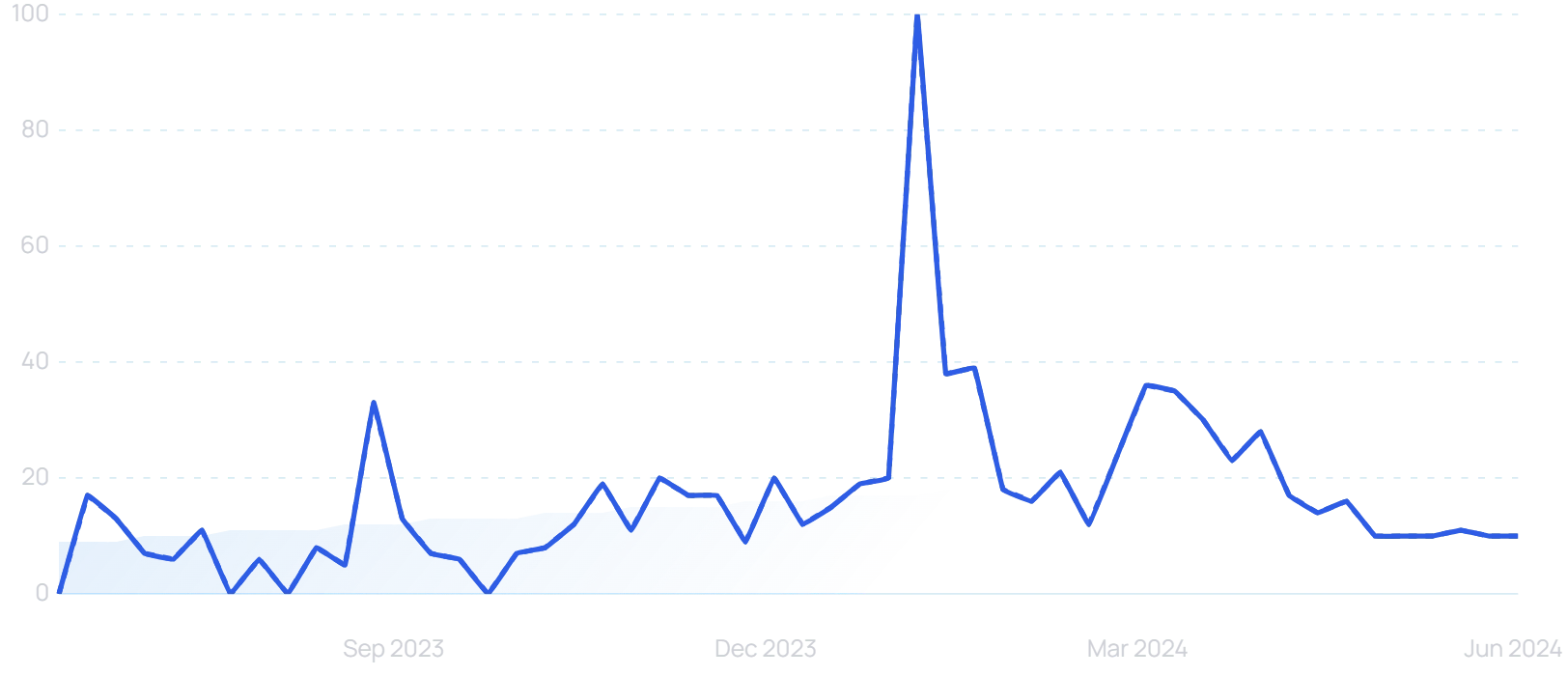

Search interest in “grayscale bitcoin trust” are up 900% YoY.

Interest in cryptocurrency isn’t limited to the private sector, either.

The El Salvador government now demands that all of its local merchants accept Bitcoin as legal tender.

This prompted other Central American countries, like Honduras and Guatemala, to begin looking into central bank digital currencies.

This also had an impact on the US, where 27% of Americans polled answered in favor of adopting Bitcoin.

While some countries, namely China, are strongly opposed to cryptocurrency, the vast majority are considering how they can bring crypto into the fold.

Conclusion

Things are definitely moving away from traditional financial practices.

Unsurprisingly, everything is going digital.

Financial services are looking at the cloud and the blockchain, customers are looking at mobile banking, and everyone is looking at crypto. It’s an exciting time to be in the financial services industry.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more