Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Top Fintech Trends (2024 & 2025)

You may also like:

Financial technology products and solutions have already become a part of everyday life.

The way consumers log in to bank accounts, pay for goods, and take out loans are all changing dramatically.

Financial institutions are also constantly adapting as they try to predict the needs of consumers, serve their current customers, and prevent fraud.

If you want to see what's coming next in this growing industry, check out our list of the 10 most important fintech industry trends for 2024 and 2025.

1. Growing Interest in Embedded Finance

Embedded finance is the integration of financial services into non-financial websites and apps.

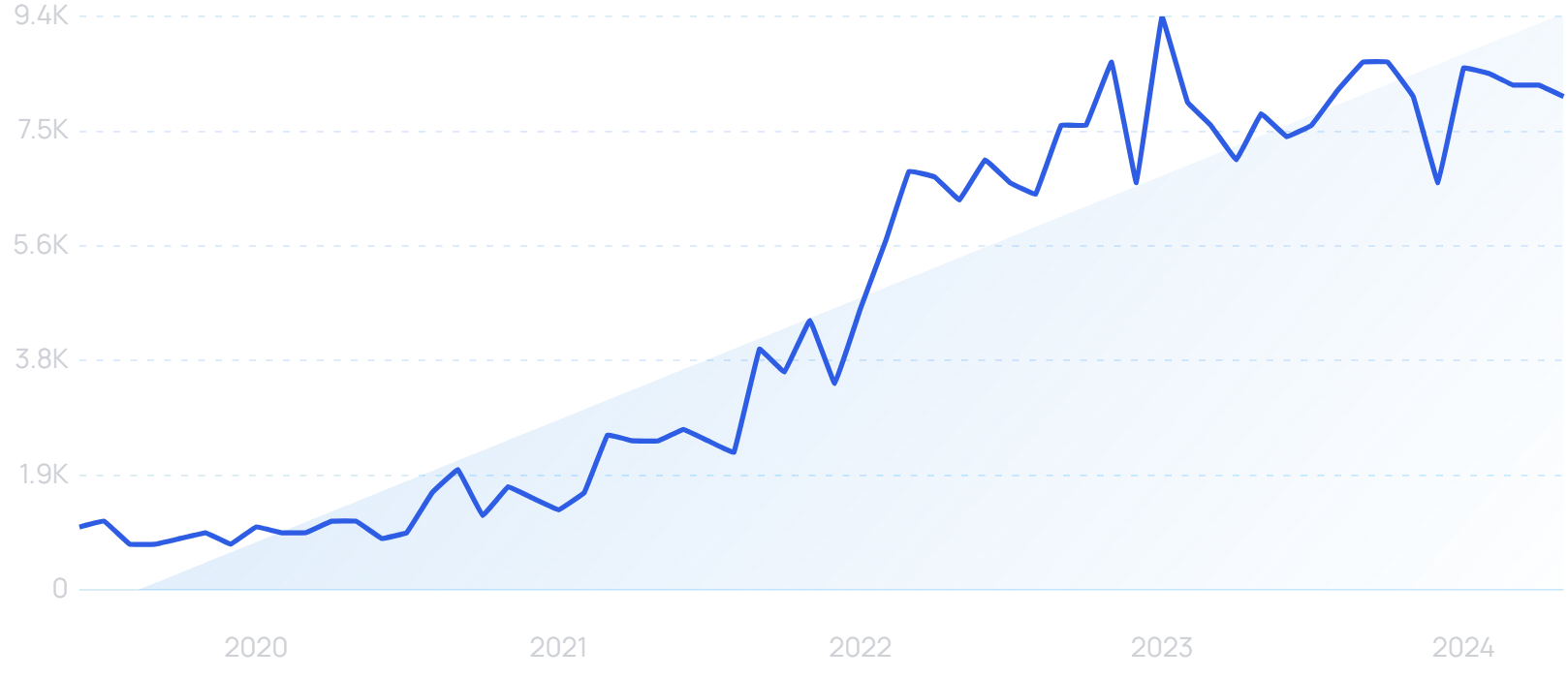

Search volume for “embedded finance” has grown by 682% over the last 5 years.

At a high-level, embedded finance service is driven by a desire for convenience.

A simple example is an eCommerce site offering buy now, pay later (BNPL) options.

Searches for “BNPL” are up 630% over the last 5 years.

Instead of needing to visit a bank to get a loan and spend hours on paperwork, consumers can access credit without leaving the platform they’re on.

Another example is embedded payments. Consumers don’t need to enter their credit card information every time they wish to make a purchase; the information is already there.

The embedded finance market currently sits at $63.2 billion and is predicted to grow to more than $248 billion by 2032.

The most popular embedded finance tool right now is making payments via a digital wallet.

A recent survey found that 49% of Americans have used a digital wallet. Notably, the study also found that 80% of Gen Z use digital wallets on a regular basis.

Statistics show Americans are using embedded finance for payments, loans, credit cards, and investments.

Companies that can jump on this trend early stand to see a positive reaction from their customers.

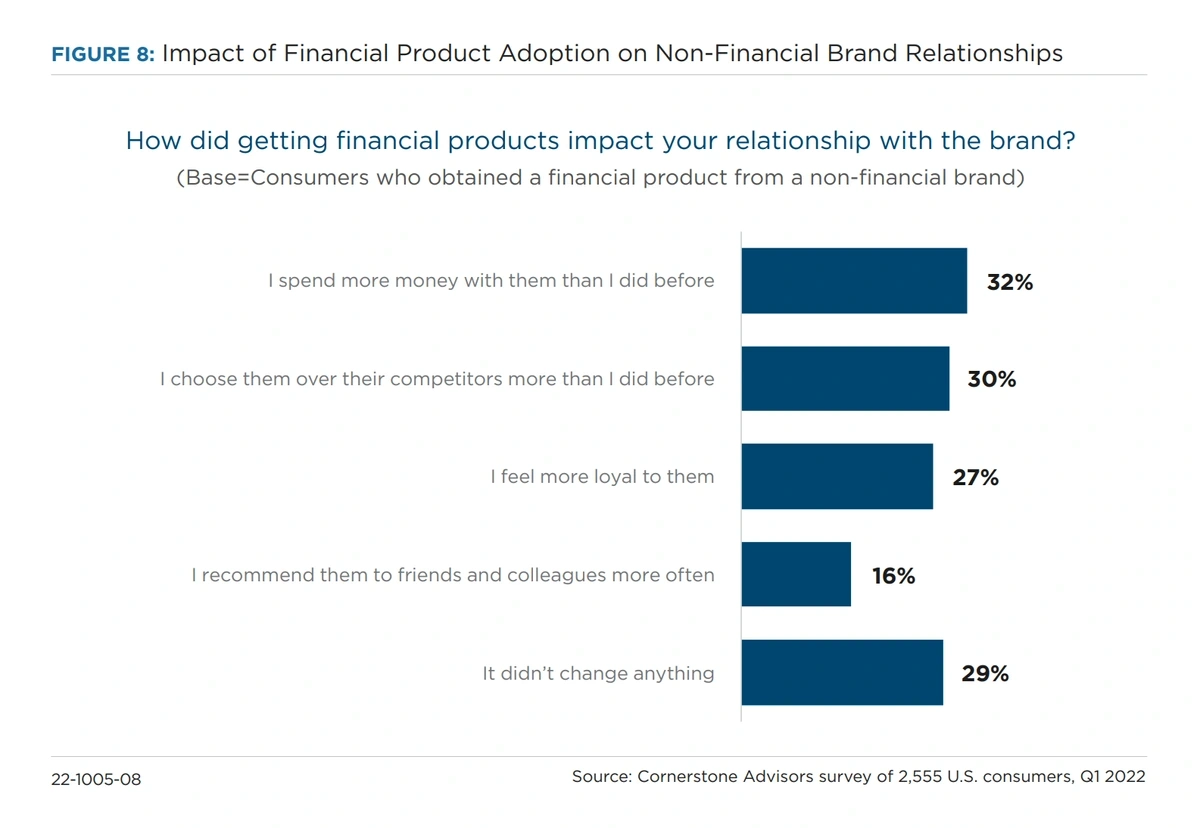

A report from Bond, a fintech software infrastructure company, said one-third of consumers who use a brand’s embedded financial services spend more money with the brand and 30% of them now choose that brand over the competitors more often.

Bond’s report shows that embedded finance options can lead to increased consumer spending and brand loyalty.

Maast (it stands for money-as-a-service) is one fintech company that’s making it simpler for brands to offer banking services under their own brand. Their approach allows brands to run payments, deposits, and loans on the platform.

Maast is a subsidiary of Synovus Bank, which recently bought a 60% stake in Qualpay in order to facilitate its payment technology.

They report their technology can result in a 5x increase in revenue per customer.

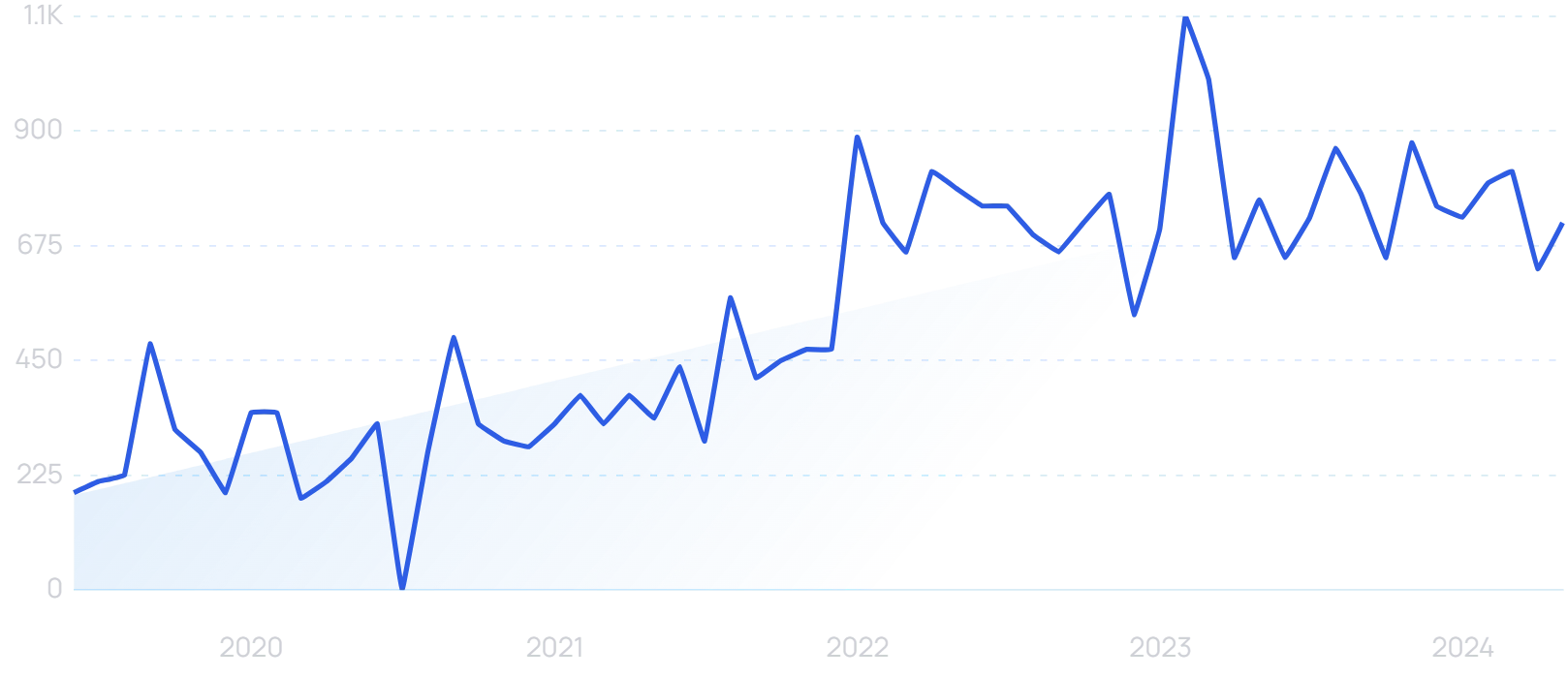

2. Regtech Solutions Provide Accuracy and Efficiency

Financial institutions receive enormous amounts of data on a daily basis. The data is far too complex and cumbersome to comb through manually.

In addition, companies need to have a thorough understanding of the unprecedented amount of laws and regulations that they must abide by.

That’s where regtech (regulation technology) comes into play.

Regtech solutions use cloud technology, machine learning, and big data analytics in order to identify and prevent risks, as well as to stay in compliance with regulations.

This kind of technology can offer improved efficiency, greater accuracy, and better insights for the entire company.

Juniper Research predicts the regtech industry will experience 200% growth through 2026.

Financial institutions who invest in regtech solutions hope to see the cost savings come through to the bottom line.

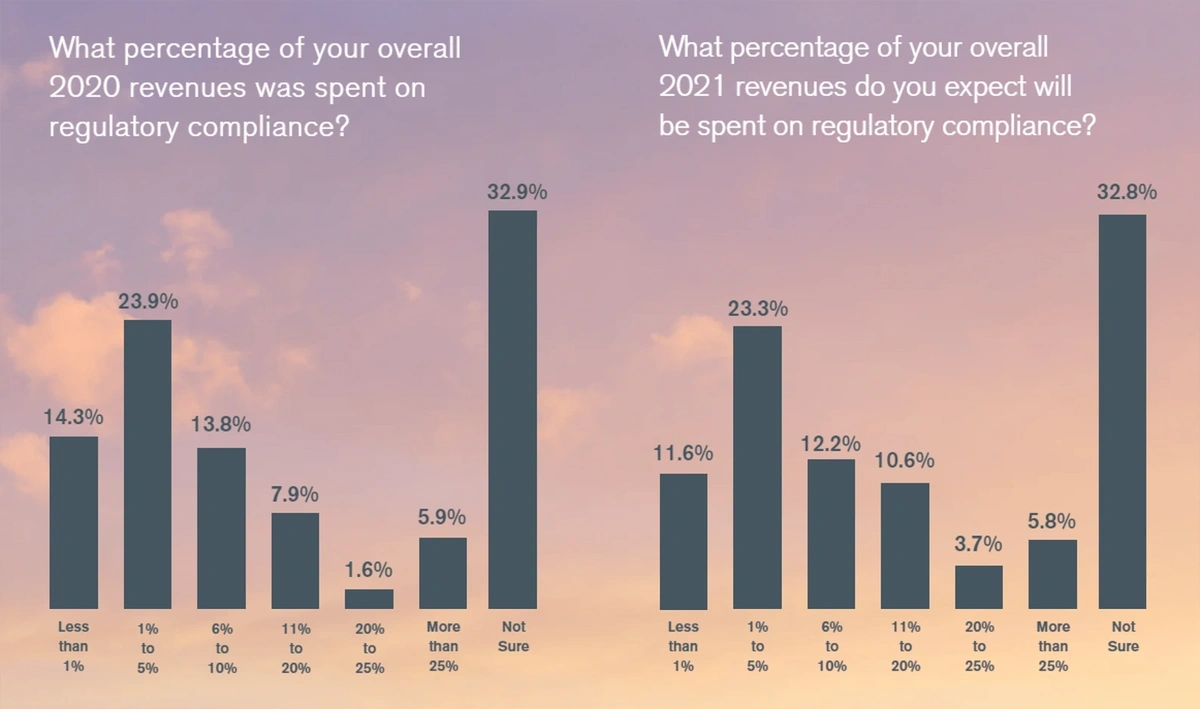

More than 30% of financial institutions spend greater than 5% of their revenue on compliance.

The cost of regulatory compliance is a challenge for most financial institutions.

The global cost of financial crime compliance at financial institutions $85 billion last year.

The same industry study also found that compliance costs increased for 98% of the organizations surveyed.

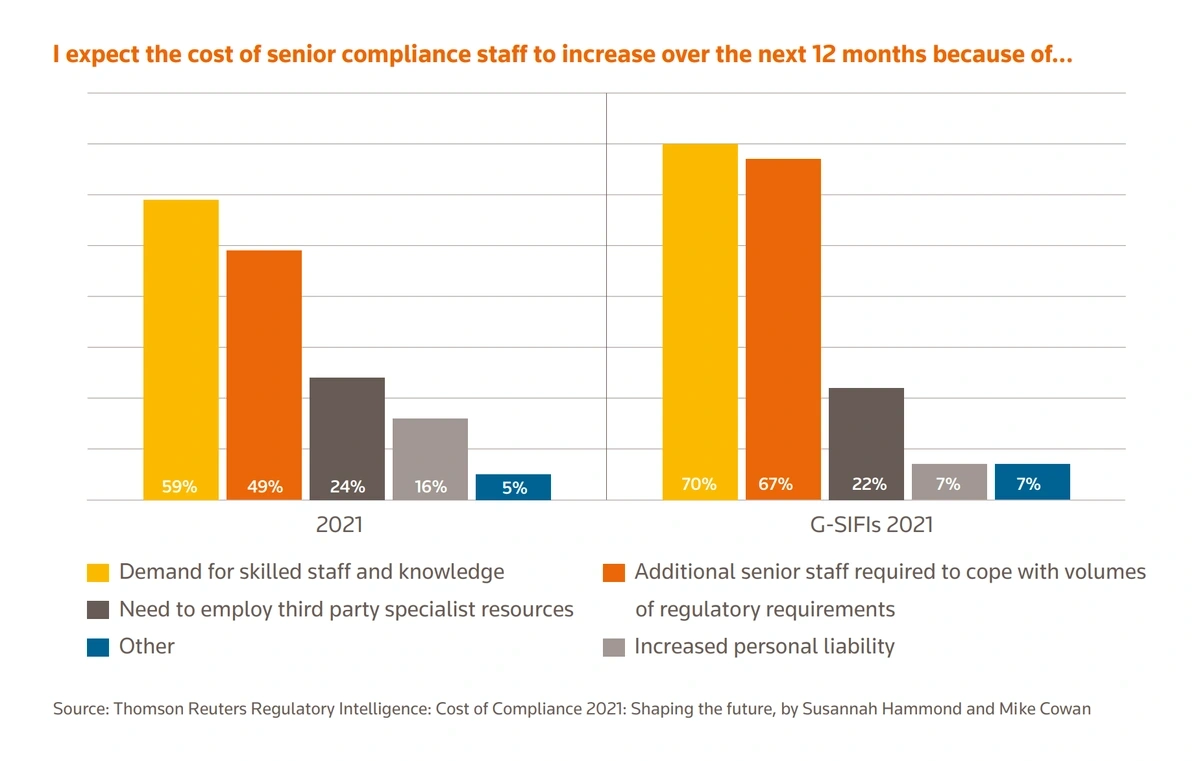

A Thomson Reuters survey showed that 67% of G-SIFI organizations expected to require additional senior staff members just to cope with the volumes of regulatory requirements.

The cost of maintaining a properly trained compliance staff is increasing.

Those companies that fail to ensure proper reporting and compliance face sizable fines.

IJP Morgan was forced to pay $125 million for failing to follow correct compliance controls.

Australian banks ING and CommBank give us one example of how regtech can dramatically impact compliance efforts.

In previous years, these banks were manually mapping their regulatory obligations through a process that took approximately 1,800 hours of human effort.

However, when the banks partnered with Ascent, a regulatory knowledge platform that utilizes AI, they reduced the process to 2.5 minutes.

Search volume for “Ascent” since mid 2019.

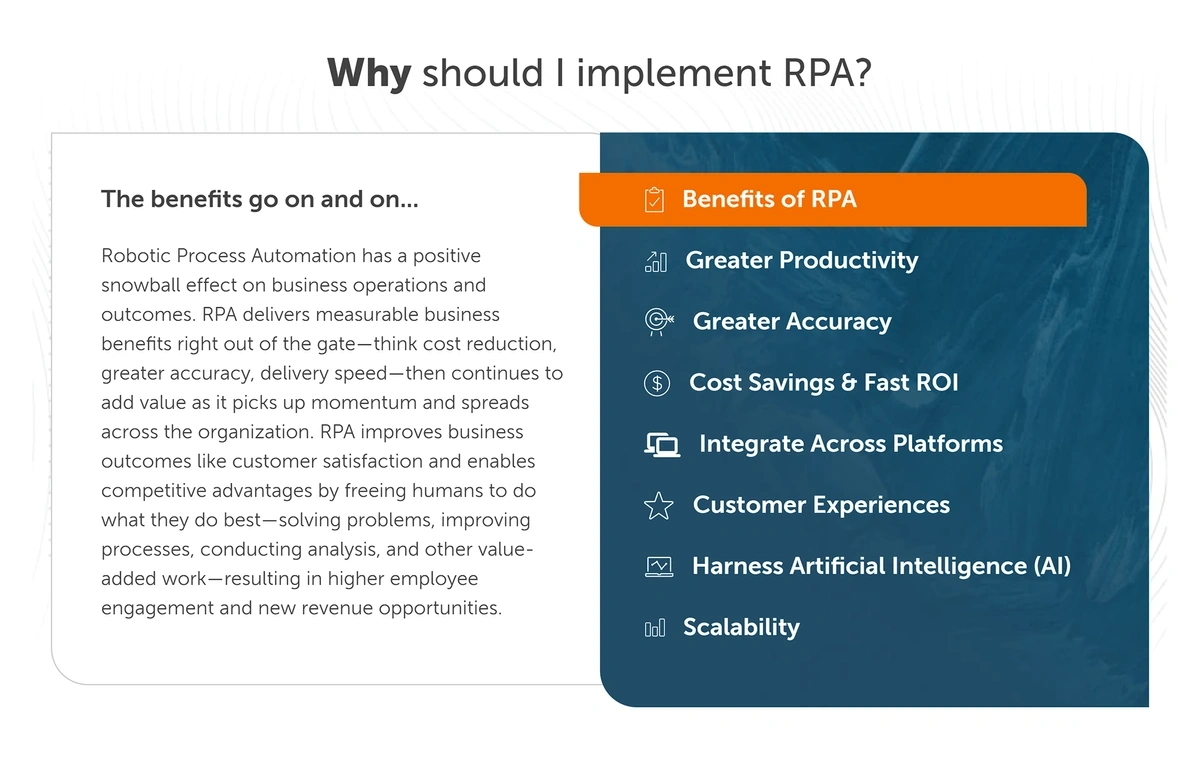

3. Robotic Process Automation Takes Over Mundane Tasks

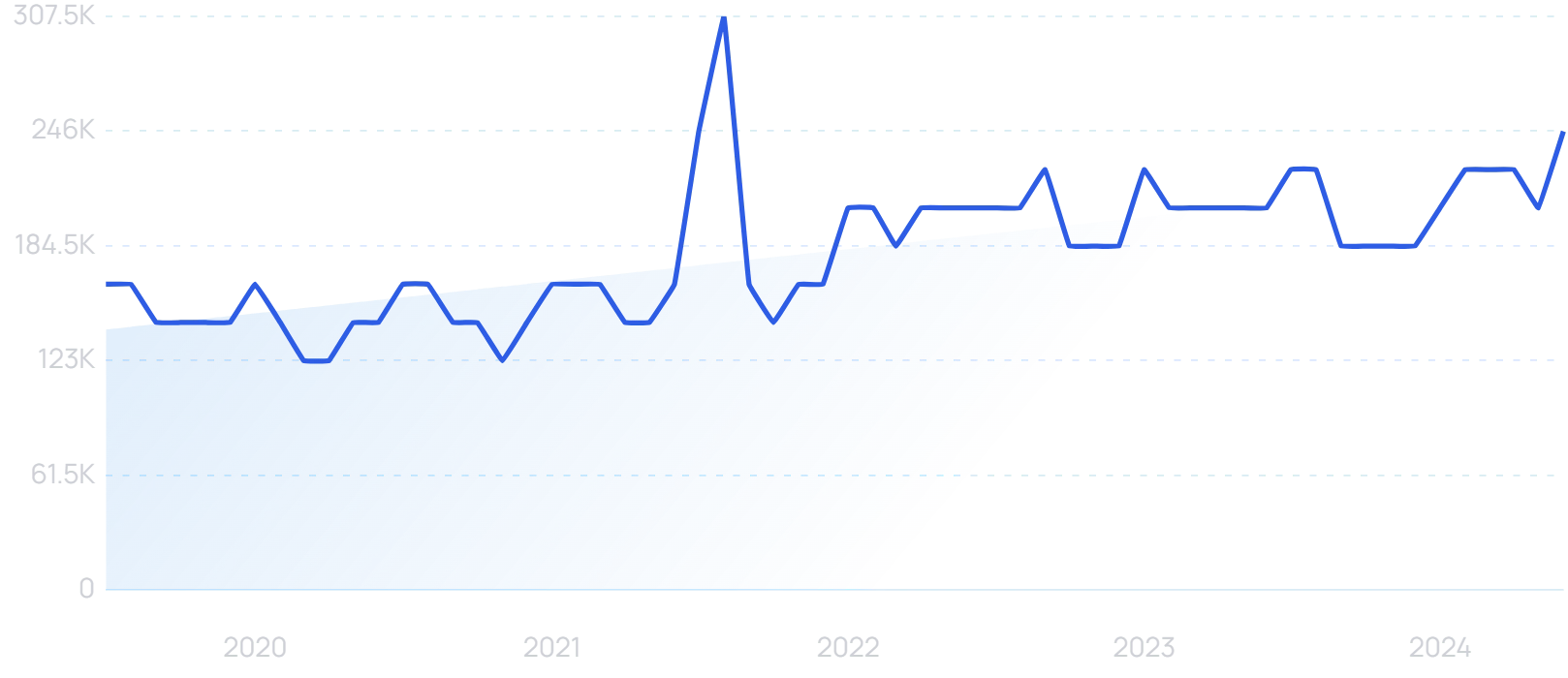

Many financial institutions are turning to robotic process automation (RPA) in an effort to drive down costs and make their teams more efficient.

RPA technology is also referred to as “software robotics.” It’s useful for automating repetitive, rule-based, time-consuming tasks that don’t require human brainpower.

Grand View Research predicts the RPA market will grow at a CAGR of 38.2% by 2030.

Gartner reports that 80% of finance leaders have already implemented RPA solutions in their businesses or have plans to do so.

They’re using the technology to provide insights into customer behavior, analyze invoices, route customer complaints, fight financial crime, and much more.

In 2024, Gartner predicts CFOs who have driven hyper-automation technology adoption and redesigned operational processes will be saving 30% on their organization’s operational costs.

UiPath is one of the most well-respected RPA software companies in the world.

The company has a market cap of over $6 billion.

RPA firm UiPath is now a public company.

In an example of their work, one of the brand’s finance and accounting customers automated 22 processes and saved 80k hours of manual labor as a result.

Automation Anywhere is one company offering RPA-as-a-Service.

Automation Anywhere’s RPA platform is used by a variety of industries.

Patelco, a San Francisco-based credit union, recently used this cloud-native solution to automate a few of their consumer lending, fraud prevention, and contact center operations.

The RPA system was instrumental in driving efficiency as Patelco was experiencing 11% year-over-year growth in its member base.

Patelco saw an 88% decrease in processing time, a 62% efficiency gain, and $39k yearly savings as a result of automating their fraud alerts.

4. Fintech Companies Offer Finance Solutions Along With Green Initiatives

As consumers and corporations start to put more emphasis on environmentally sustainable practices, the fintech industry is capitalizing on the opportunity.

Search volume for “green fintech” is climbing, up 276% in the past 5 years.

Currently, only 8% of fintech founders say they are in the “sustainable fintech” category.

However, investors are flocking to this sector.

Green fintech startups and initiatives span the globe, but the highest concentration of these companies is in Switzerland, Spain, Singapore, and Sweden.

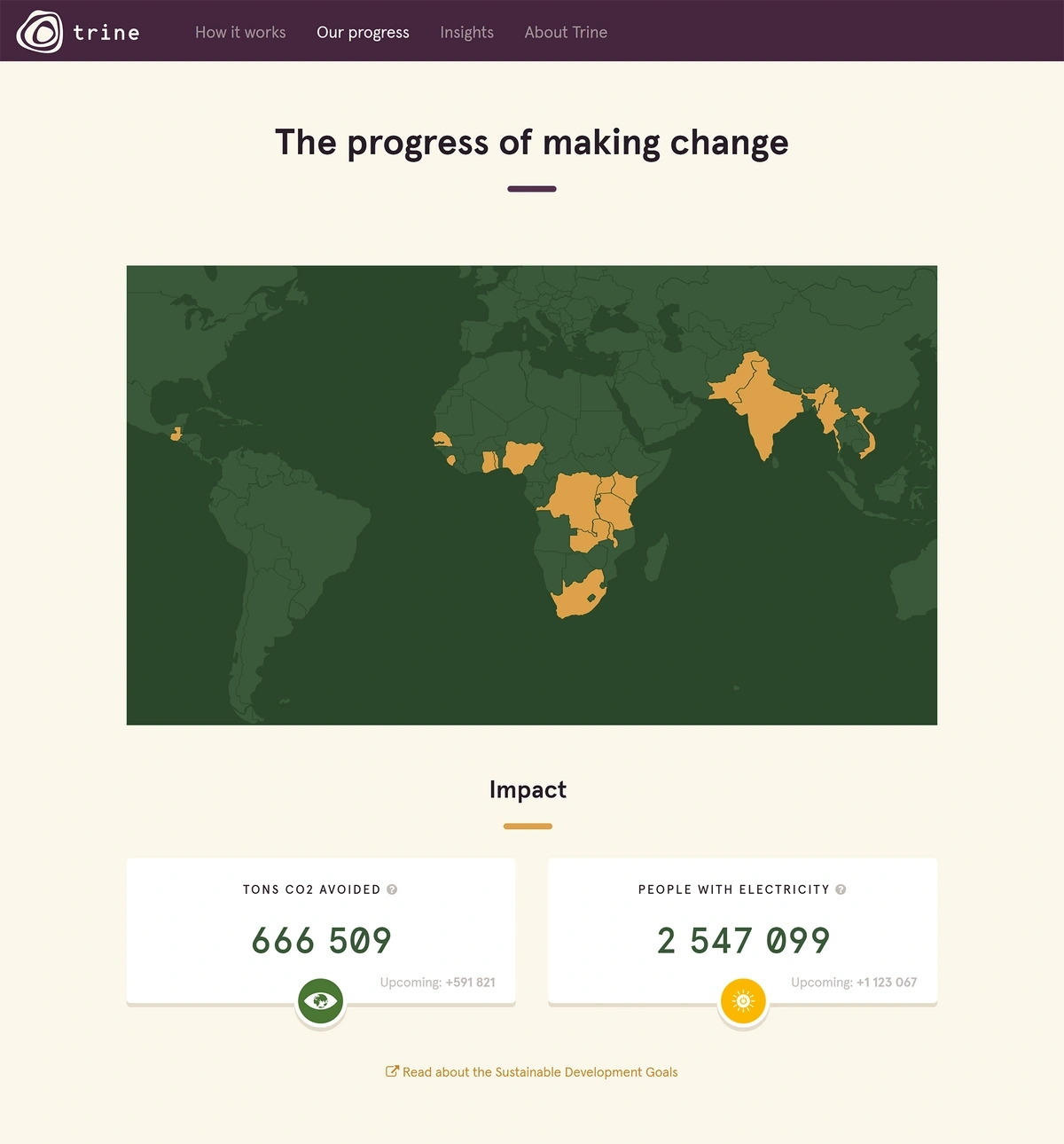

Trine is a Swedish company that loans solar energy companies capital while they supply renewable energy to people in impoverished countries. The process is completed through a peer-to-peer process that’s a lot like GoFundMe.

Trine has facilitated nearly $72 million in funding for solar energy projects, which have provided electricity for more than 2 million people.

Those who invest get back 3-11% interest. The platform has nearly 13,000 current investors.

Green fintech companies are seeing success in the consumer market, as well.

For consumers who want to be mindful of the sustainability of their finances, Commons is one option.

The Commons app invites consumers to aid in "driving the shift to a low-carbon economy".

The app runs on proprietary emissions data and an algorithm that uses personal purchasing data in order to automatically estimate a consumer’s personal carbon footprint in real-time.

Commons curates sustainable brands that eco-concious consumers can purchase from.

The company was recently included in the TIME100 Most Influential Companies of 2022.

Stripe provides one example of a large corporation from the financial sector investing in a green initiative.

Stripe's Stripe Climate works as an an add-on to its payment processing software.

Stripe Climate aims to make it easy for businesses to give a portion of their earnings to carbon removal programs.

Any business using the Stripe platform can direct a portion of their revenue toward carbon-removal initiatives.

Reports show that tens of thousands of businesses are opting-in to the program.

The company itself joined with other large corporations like Alphabet and Meta to commit $1 billion to the carbon-capture market.

They also launched Frontier, an advanced market commitment that will facilitate $925 million of permanent carbon removal by 2040.

5. Buy Now, Pay Later Remains Popular But Many Have Concerns

The BNPL market surged to an estimated value of $386 billion in 2024.

Industry research points to continued growth. A Research and Markets report predicts a CAGR of 32.5% through 2028.

More than half of Americans have used a BNPL service and nearly 40% of those who haven’t used BNPL say they’re at least somewhat likely to use it in the next six months. That’s according to a survey from The Ascent, a personal finance tool from The Motley Fool.

In that same survey, however, 17% of consumers say they are very likely to be late on a BNPL payment in the next year and 18% say they’re likely to do that.

Another survey had found similar results.

A survey from Accrue Savings showed that 28% of Gen Z and 22% of Millennials report that they often spend beyond their means.

The results also showed that 44% of consumers who have used BNPL have already missed a payment.

This could be due to consumers outspending their bank account or simply not understanding the situation they’re in.

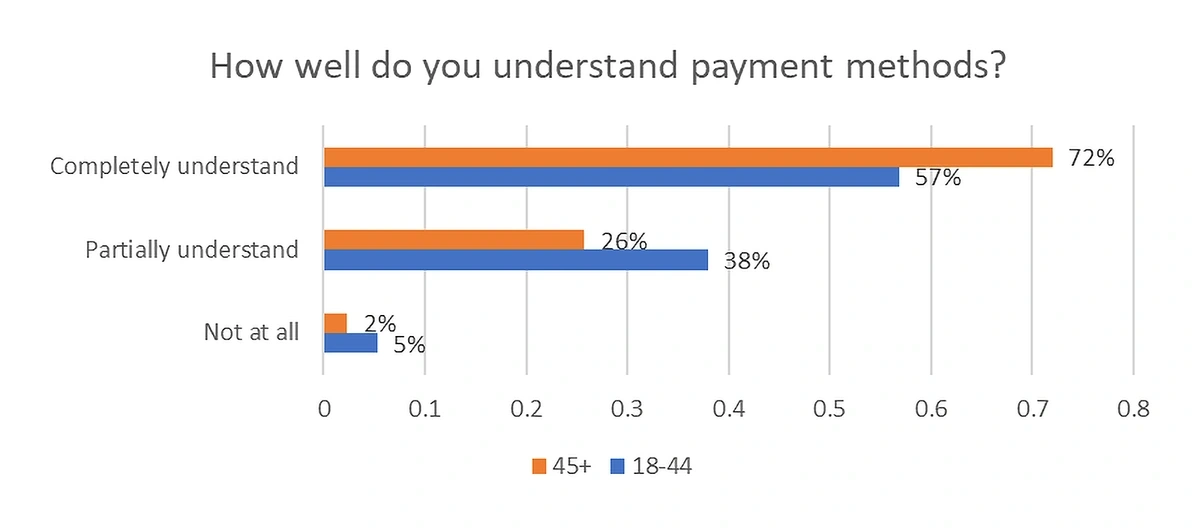

A J.D. Power survey showed that 38% of people between 18 and 44 only “partially understand” payment methods like BNPL and credit cards and 5% said they don’t understand at all.

The survey showed that people over the age of 45 have a much better understanding of financing than younger consumers.

These statistics offer a glimpse into the reasons why some people view BNPL as a form of predatory lending.

Regulators are starting to take notice.

The Consumer Financial Protection Bureau (CFPB) opened an investigation that was reportedly focused on growing debt, data harvesting, and the regulation of BNPL.

In March 2022, 21 attorneys general began actively encouraging the CFPB to enact “robust consumer protections” in the BNPL industry.

In addition, Experian recently launched a special bureau to facilitate more transparency in the industry.

The Buy Now Pay Later Bureau will work with BNPL providers to collect data on all point-of-sale lending. This includes the number of outstanding BNPL loans, the total of the loans, and the statuses.

However, the threat of increased regulation doesn’t seem to be dissuading the biggest BNPL players from expanding their offerings.

Affirm, one of the leading BNPL providers, went public in January 2021. And currently has a market cap of $10.3 billion.

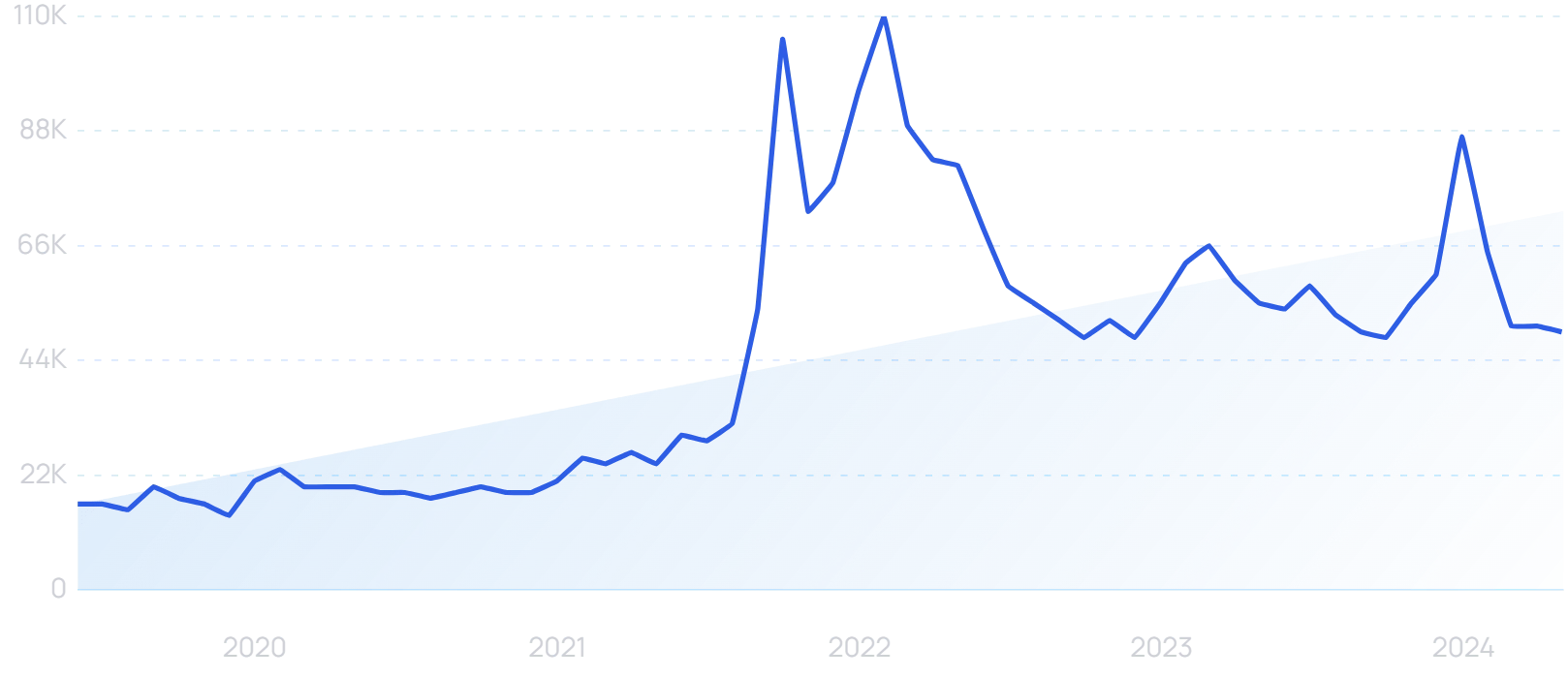

Search volume for “Affirm” continues to grow, up more than 100% in 5 years.

The company has also launched Affirm Debit+. The card links to a bank account like a regular debit card, but consumers have the option to split any purchase over $100 into installments.

6. Financial Institutions Embrace AI

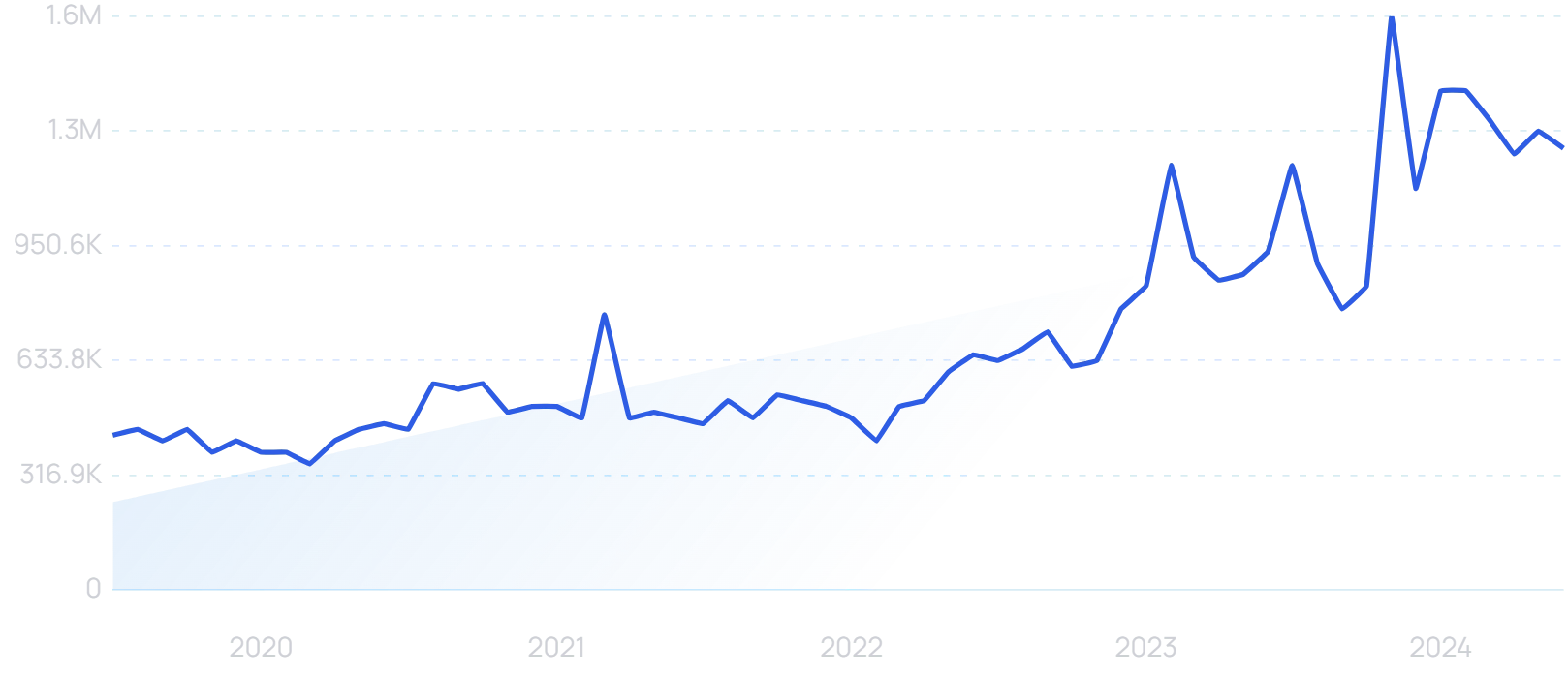

From customer service chatbots to fighting off fraud, the market for AI in the banking industry is growing.

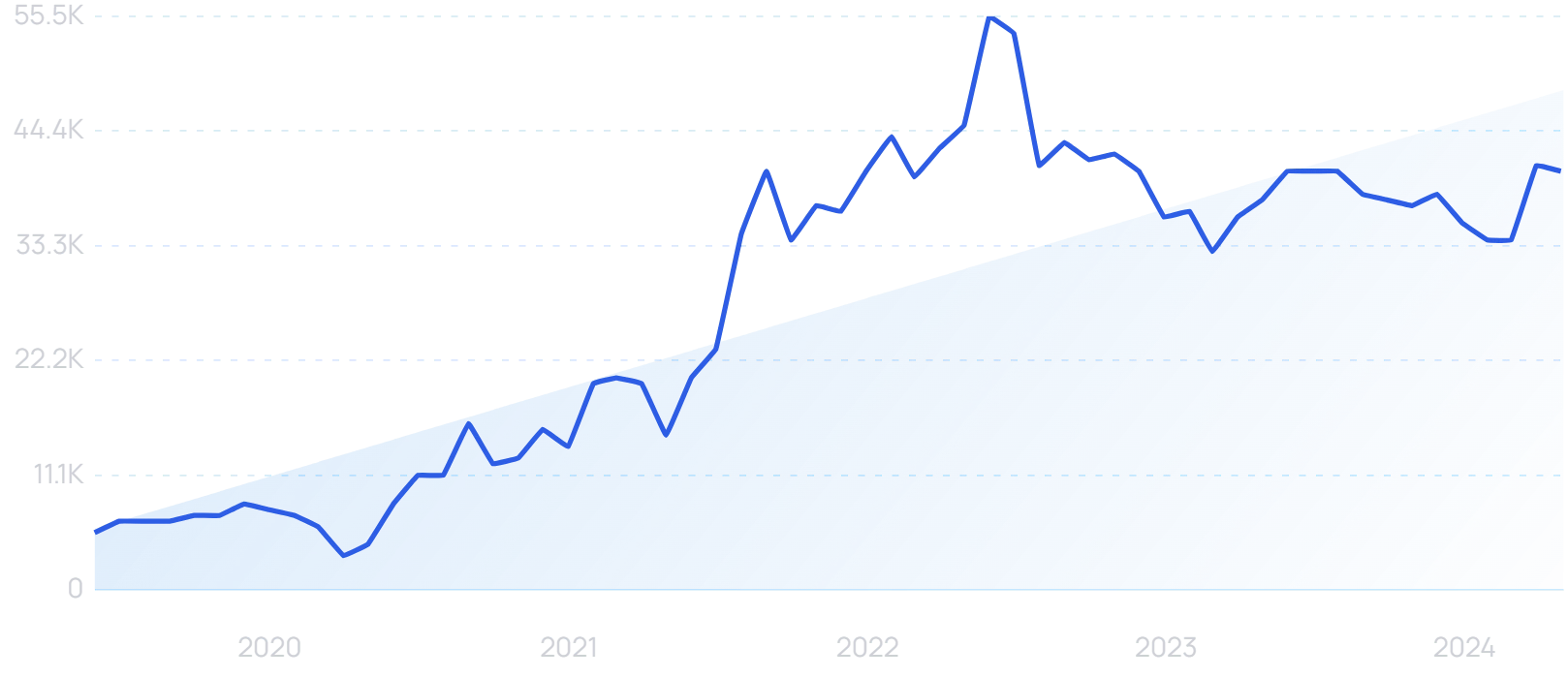

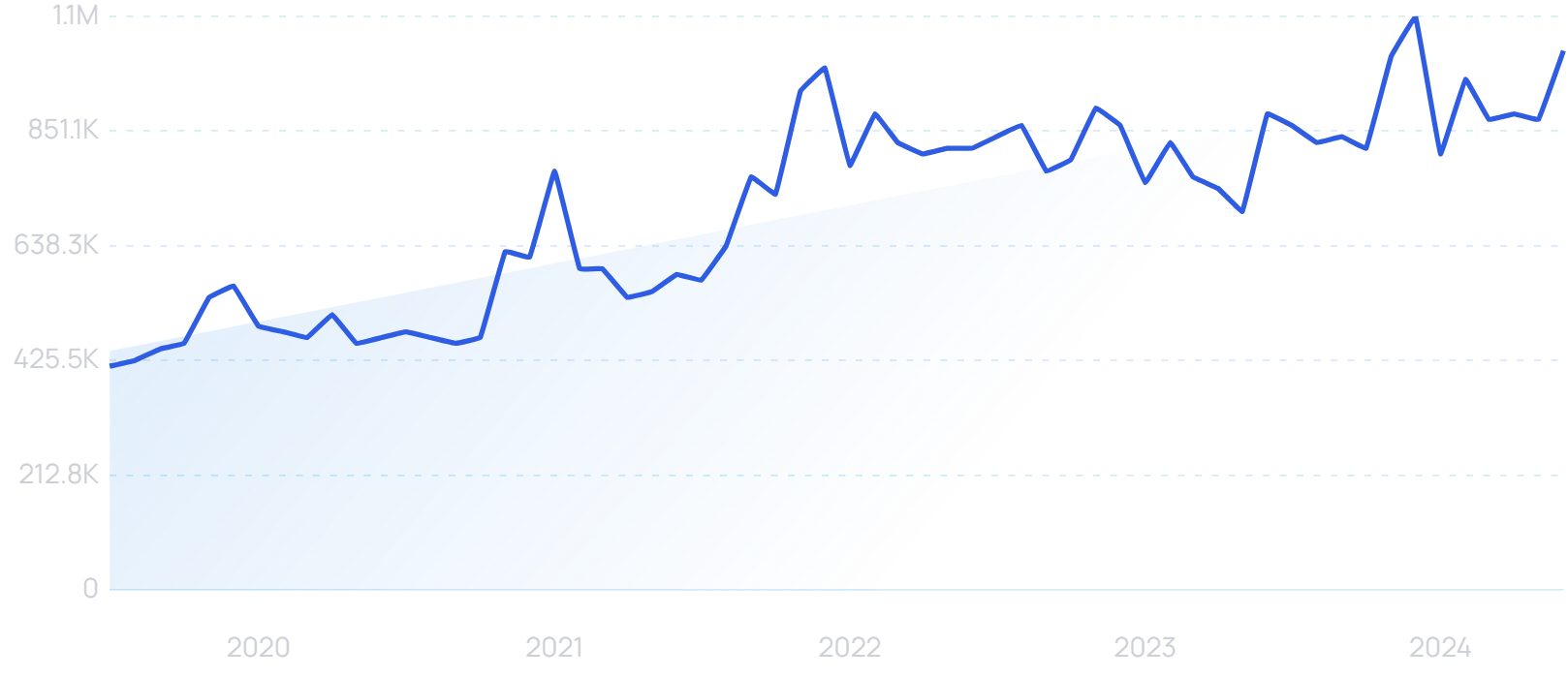

Search volume for “AI in finance” has increased by 764% in 5 years.

OpenText, a company that offers digital transformation platforms, reports that 80% of financial institutions are aware of the benefits that AI can bring to their organization.

Banks across the globe are in the beginning stages of adopting AI solutions.

More than 60% believe that AI will be mainstream in the industry within two years.

About 45% of respondents have already adopted AI technology.

Research firm Autonomous NEXT predicts that AI will decrease operating costs in the financial services industry by 22% by 2030. That’s the equivalent of $1 trillion.

There are three main areas in which AI can benefit the banking industry according to Insider Intelligence: conversational banking and interacting directly with customers, detecting fraud and managing other risks, and underwriting.

Simply automating middle-office tasks has the potential to save North American banks $70 billion by 2025.

Socure is a Nevada-based company that’s using AI for digital identity verification and identity fraud prevention in the banking industry.

Their AI system results in 13x fewer false positives when it comes to fraud detection and up to a 90% reduction in manual reviews of identities.

As for the front office, Accenture reports that banks can see a 2 to 5x increase in the number of customer interactions and transactions by using AI.

The speed and efficiency of AI is a win for both customers and banks.

For example, banks can use AI to better understand customer needs and expectations, predict customer churn, and predict a customer’s likelihood to accept additional offers from the organization.

Gila is a digital customer service platform that’s used by more than 250 banks.

They offer one platform that allows company representatives to interact with customers via chat, voice, video chat, sms, phone, and social.

Plus, their AI solutions provide conversational text and voice-based self-service for customers and customer service reps.

In fact, they’ve already built a library of more than 800 conversational user intents that are ready to be plugged into a bank’s customer service offerings.

Gila’s AI solutions feature CoBrowsing in which bots can navigate, scroll, and point as they interact with live customers.

In March 2022, the company completed a $45 million Series D and reported a $1 billion valuation.

(They've raised $152 million to date).

7. Workers Show Increasing Interest in On-Demand Pay

Many consumers use fintech solutions to pay for goods, but what about the businesses that are paying them? Fintech is changing the payroll status quo too.

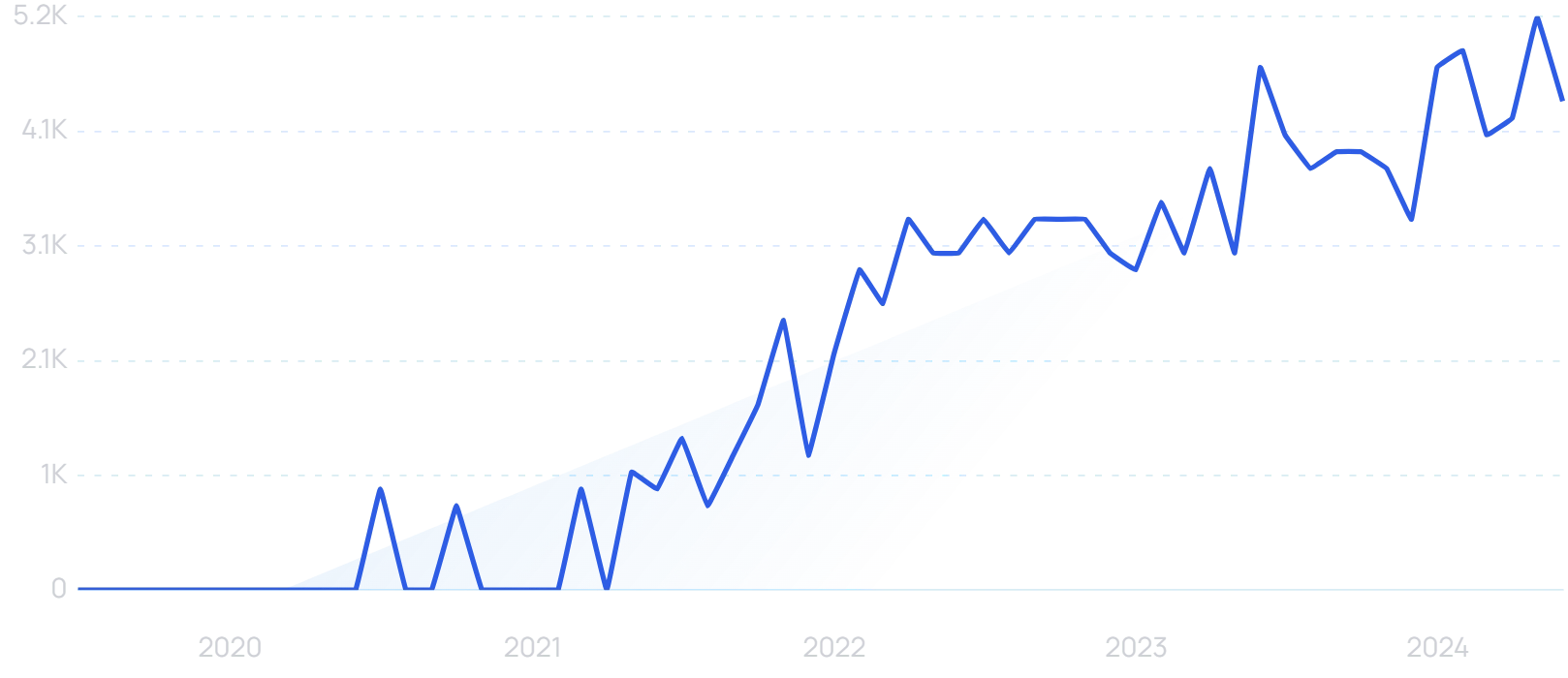

One trend is on-demand pay, also known as earned wage access.

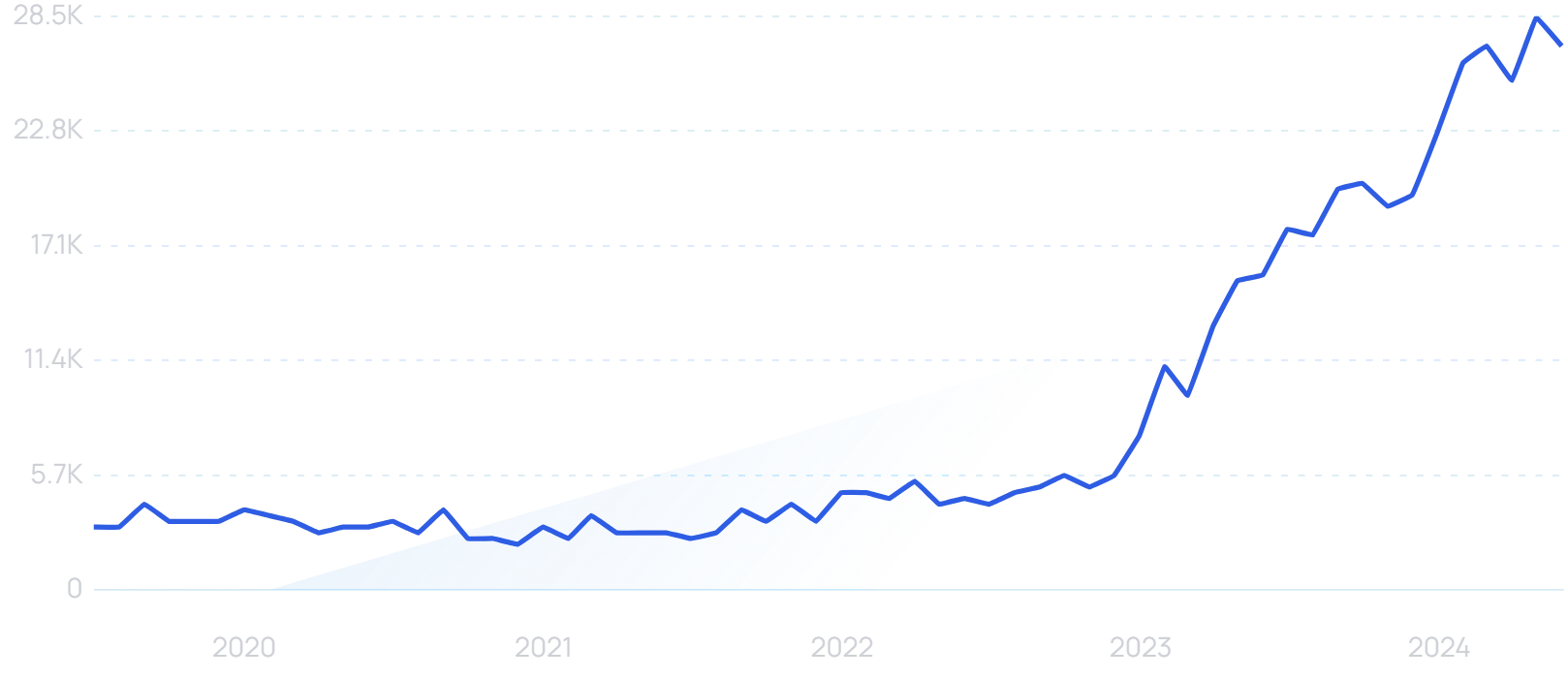

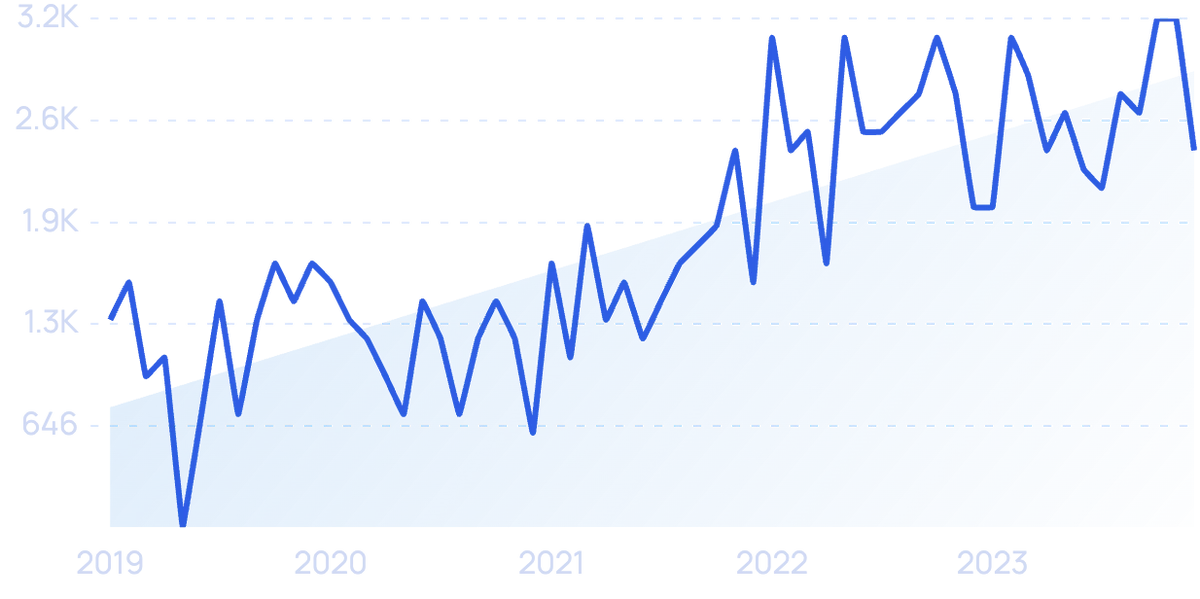

Search volume for “earned wage access” is skyrocketing, up more than 2,800% in 5 years.

Businesses of all sizes now have access to cloud-based solutions where employees can log in on an app, check their payroll balance, and withdraw money at any time.

Employees seem to be increasingly interested in earned wage access programs.

In fact, one survey found that 21% of Americans want access to wages as they earn them.

On-demand access to wages is especially important to employees experiencing financial stress.

In one survey of working individuals in the US and the UK, 35% of people have been in a financially stressful situation in the previous year in which they were not able to pay an expense between pay periods.

The same survey reported that roughly 20% of people would be likely to use an on-demand pay option if it were available to them. About 5-10% of people are extremely likely to do so.

Nearly 80% of workers say that they would take a job with an employer that provides on-demand pay over an employer that does not. That’s according to ADP.

Workers also report that access to on-demand pay would increase their loyalty to their employer.

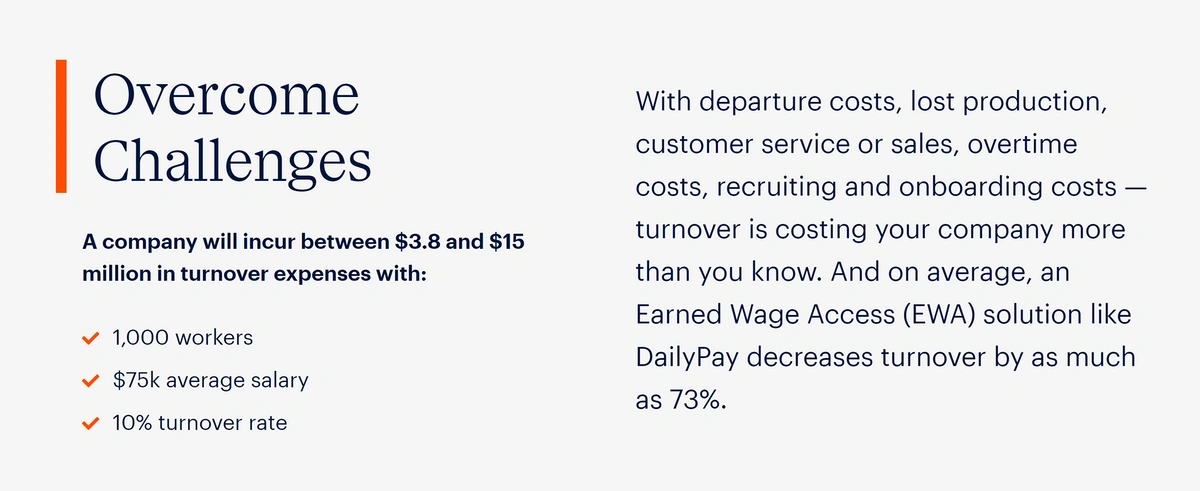

In fact, employees with earned wage access are likely to stay with their employer. One company reports that their on-demand pay solution decreases turnover by up to 73%.

For a company with a 10% turnover rate, expenses can be in the millions.

DailyPay is the earned wage access provider for 80% of the Fortune 200 companies that utilize this type of technology.

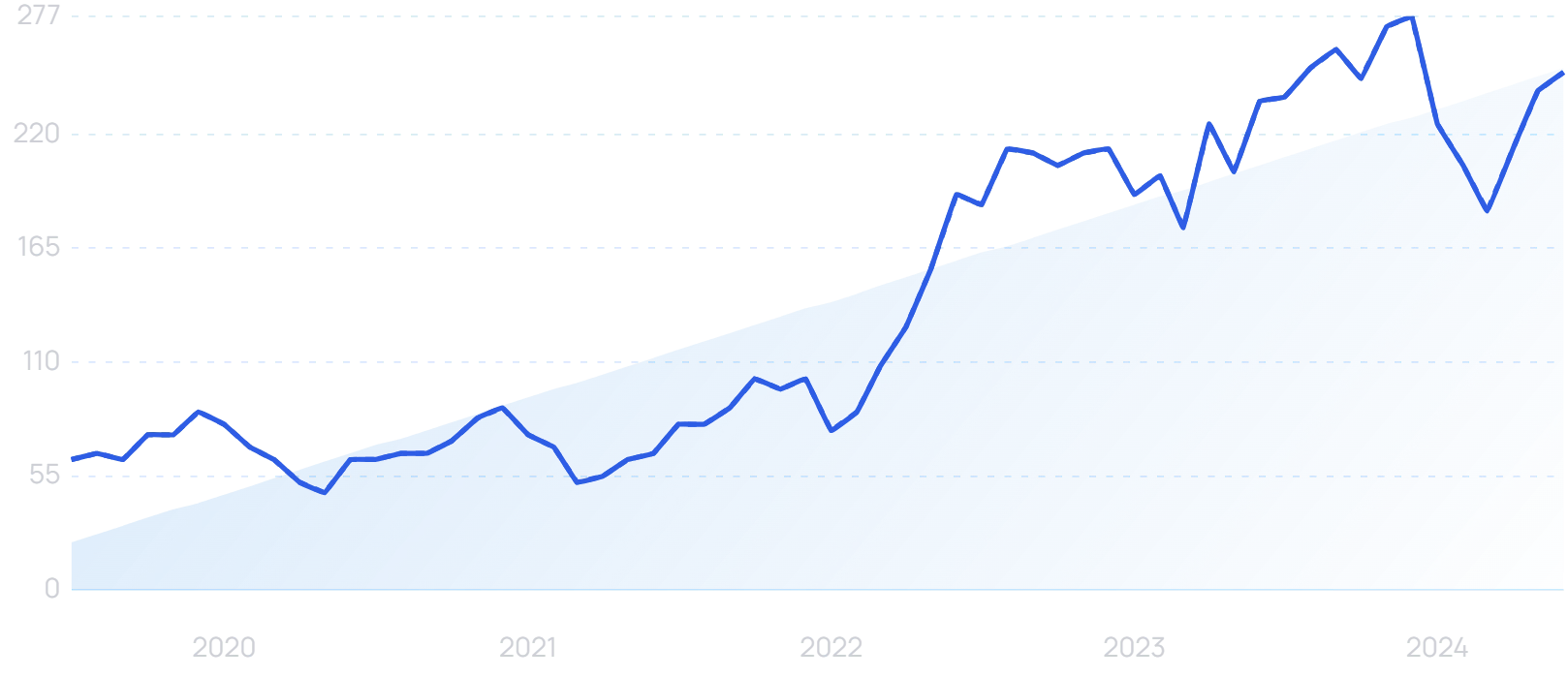

Search volume for “DailyPay” is up 291% in the past 5 years.

The company manages more than $2 billion in earnings and says that employees save $1,250 annually by using their service.

DailyPay provides an on-demand payment solution for big-name companies like Six Flags, Dollar Tree, and McDonald’s.

Even with all of the interest in on-demand pay, there’s also a bit of controversy associated with this trend.

Because many of the on-demand payroll solutions charge fees to the workers, these fintech companies have been compared to payday lending.

For example, DailyPay charges users $2.99 to receive their earned, but unpaid, income.

8. Cybercriminals Utilize New Tactics

Cybersecurity threats are on the rise in the financial sector.

Search volume for “banking cybersecurity” is on the rise, showing an 82% increase over 5 years.

Over the last 3 years, the banking industry experienced a nearly 2x increase in ransomware attacks.

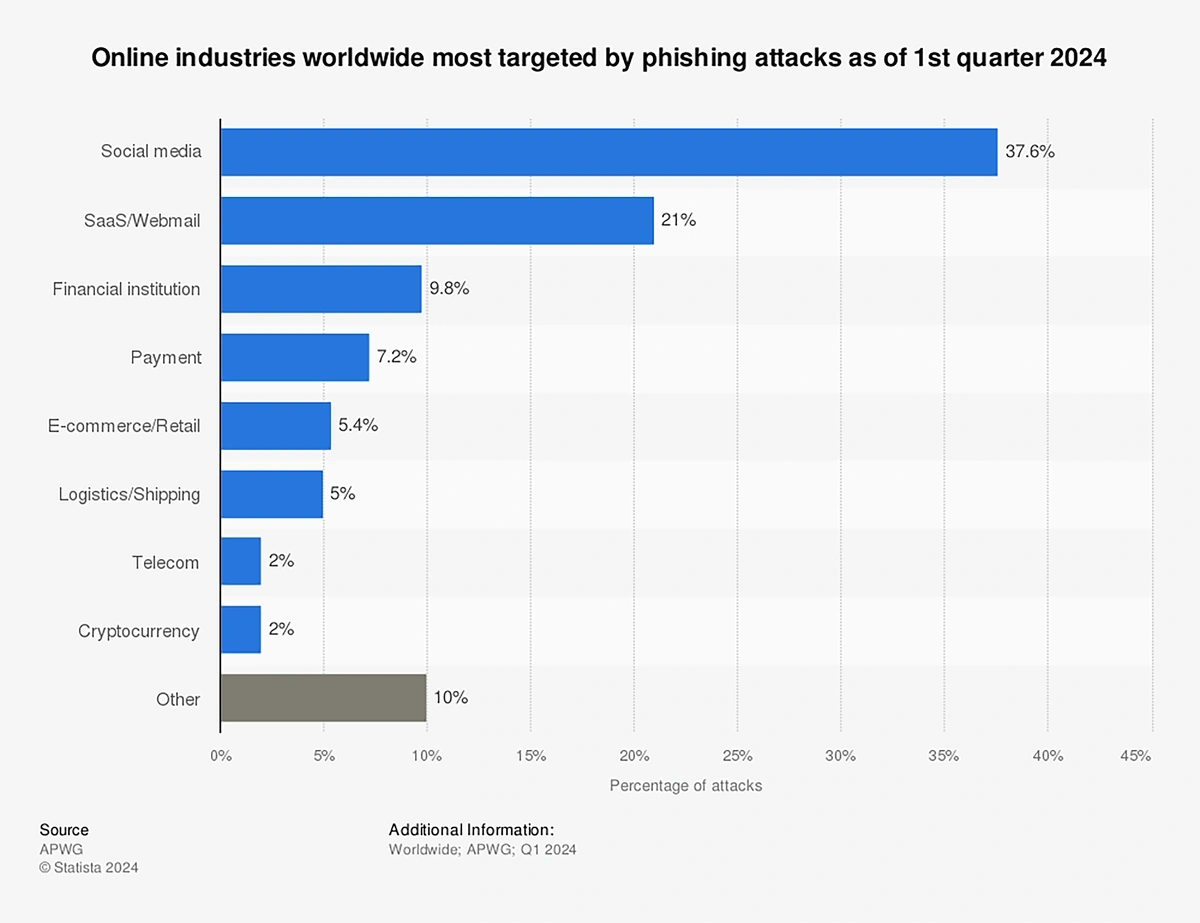

Notably, phishing attacks are regularly targeting financial institutions.

In 2024, 17% of all phishing attacks were aimed at finance and payment services.

One study discovered that finance and payment providers were some of the primary targets of phishing.

Cybersecurity threats and attacks are costing the industry millions of dollars.

Every data breach in a financial firm costs the firm roughly $4.2 million, according to a survey of IT professionals working in the financial sector.

Cybercriminals targeting the financial industry are constantly developing new tactics to get around security.

One of the most convincing tactics is using “deep fake” techniques. This involves using AI and machine learning in order to generate a person’s likeness in both image and voice.

Search volume for “deep fake” is up 186% in the past 5 years.

One major incident involving this type of strategy happened when criminals used deep fake technologies to mimic the voice of an executive of an energy firm and requested a transfer of $243,000.

Using a fake voice, the caller spoke with the CEO of the company and claimed the transfer was urgent, needing to be made within the hour. The money was deposited in a Hungarian bank account, then moved to Mexico, and never seen again.

A similar crime happened to a bank in Hong Kong. A bank employee spoke to a man he believed worked at another company, a person whom he had spoken to on the phone on a prior occasion. This deep fake attack resulted in the employee transferring $35 million.

Voice phishing, called vishing, is an AI-enabled scamming technique.

Another cybercriminal tactic focused on banks is a Trojan called Fakecalls. This has been used with customers of South Korean banks.

Fakecalls appears to be a mobile app from a popular bank. However, once the user calls customer support, the Trojan can break the connection and open up a fake call screen. Everything appears normal, but hackers can then control the phone call.

In many instances, the hackers will get on the call and pretend to be the bank employee and gain access to confidential information from the caller.

One of the latest ways today’s cybercriminals look to attack banks is by infiltrating the AI and machine learning systems the banks are using.

An AI expert says, “The vulnerabilities of AI and complex analytic systems are significant and very widely overlooked by many of the organizations employing them”.

Because machine learning is a fairly new technology, the security tools that banks need to protect their systems aren’t up to speed yet. And the hackers may be winning the race.

9. Biometrics Adoption Accelerates

Federal Reserve Chairman Jerome Powell has said that cyberattacks are the number-one risk to the global financial system.

With such a bold threat looming over the industry, fintech companies are deploying a host of new security options.

Passwordless authentication is one security measure that IT leaders are pushing.

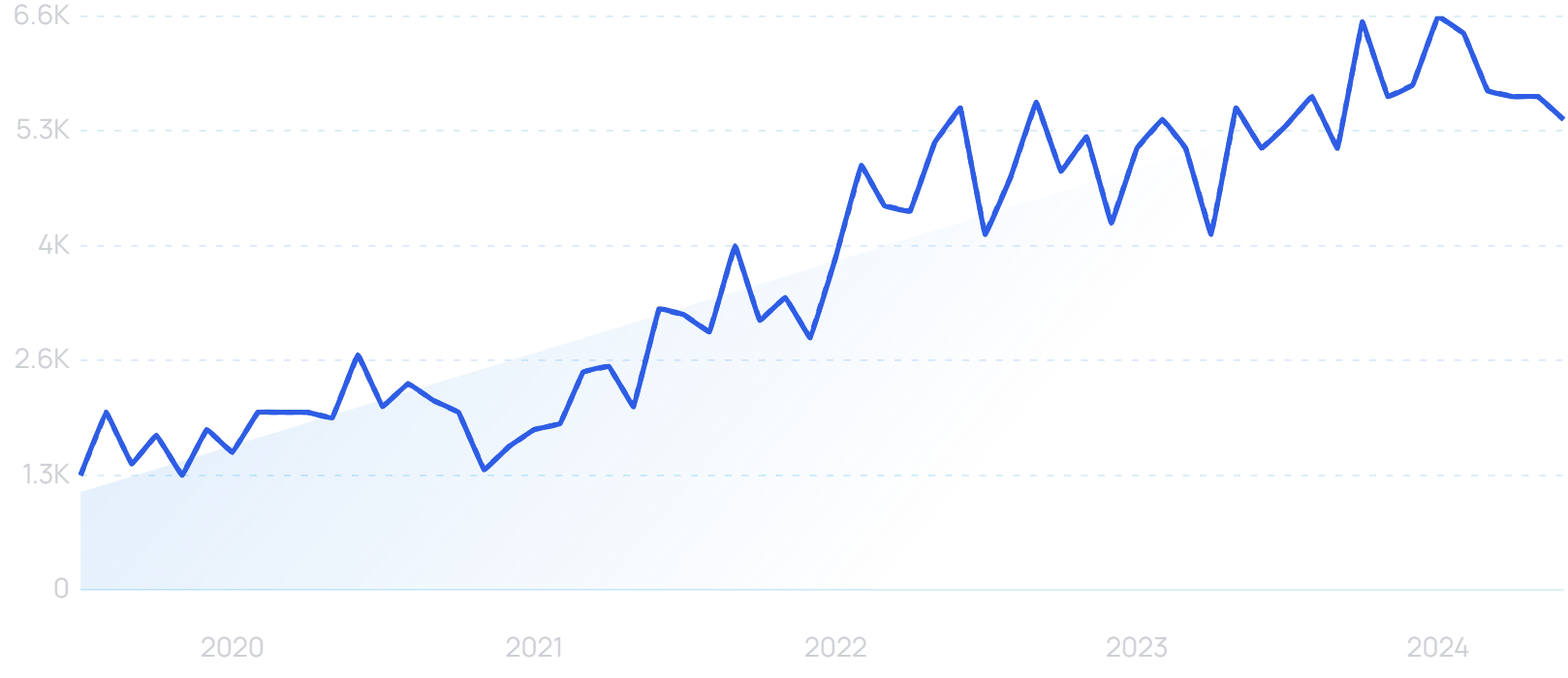

Search volume for “passwordless authentication” continues to grow.

In fact, nearly 90% of security leaders say this solution provides the highest level of security. That’s according to a survey commissioned by HYPR, a company that offers a multi-factor authentication platform.

A relatively simple login method that doesn’t use passwords is sending users a push notification that provides an authentication code.

A more sophisticated method is biometrics.

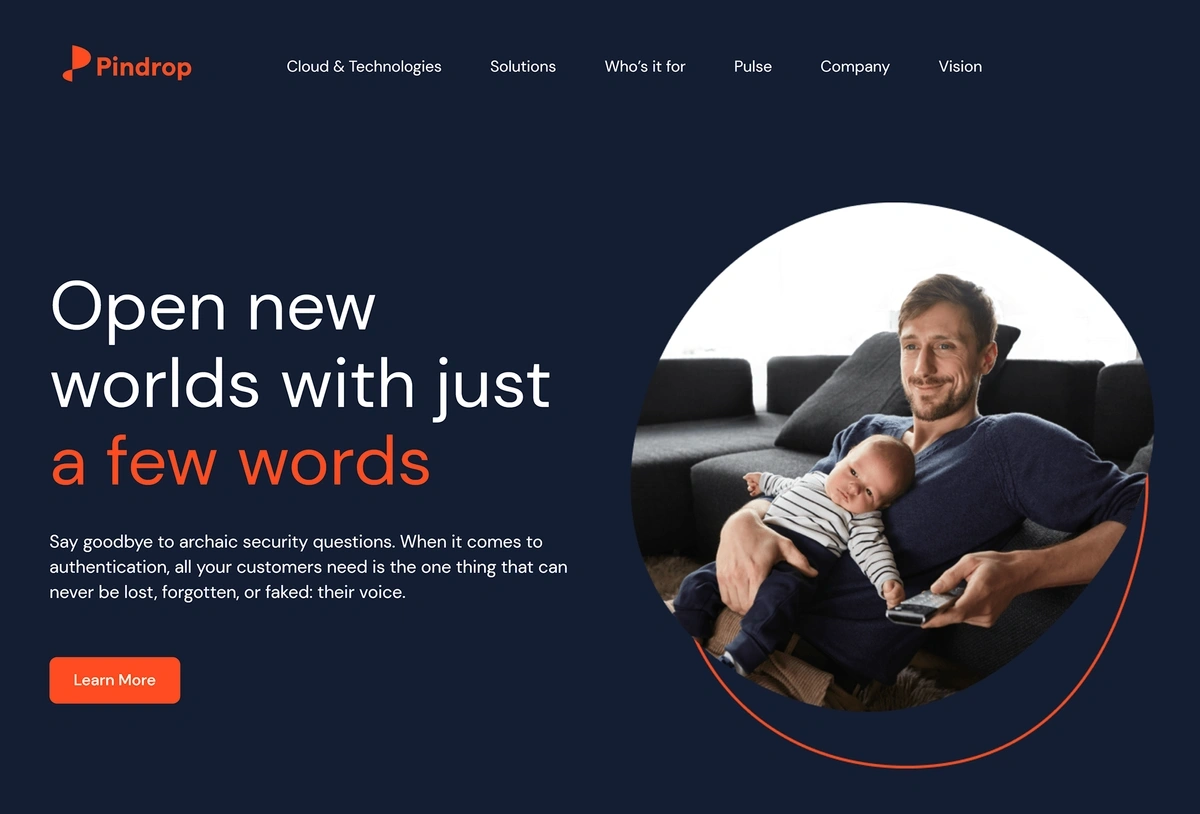

Voiceprint, a biometric technology that makes a user’s voice their password, is an example of a company operating in this space.

Today’s voiceprint technology can analyze 1,000 micro-characteristics in a person’s voice to verify their identity at login.

The First National Bank of Omaha recently implemented a voiceprint platform from Pindrop.

Within a year, the bank saved 2.5 million minutes in customer service call handling times and reduced fraudulent account takeovers by 50%.

Pindrop reports that their platform is in use at 8 of the top 10 banks and credit unions in the US, as well as at 11 of the largest insurers in the country.

Pindrop provides protection against data leakage, social engineering, and phishing.

Voiceprint companies ensure that they can identify users in as little as half a second, but many banking leaders are concerned that deep fake technology may override this kind of security soon.

Other authentication methods go beyond the login to monitor for fraud throughout the user’s session.

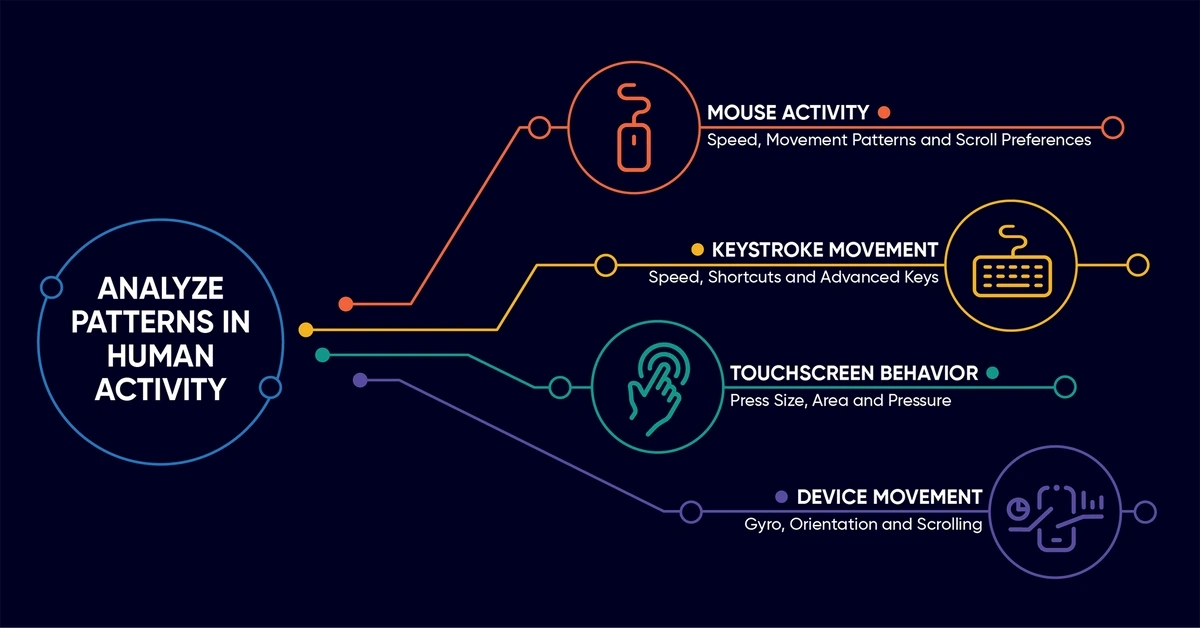

Behavioral biometrics analyze a user’s physical and cognitive behavior to determine if fraud is occurring.

These machine learning platforms look at everything from mouse activity to touchscreen behavior to keystrokes. The technology can recognize legitimate and criminal behavior, even from users it’s never seen before.

Behavioral biometrics platforms analyze human activity to detect fraud and identity theft.

In one example, a top-five credit card issuer adopted a behavioral biometrics platform and saw an increase in their fraud detection by 90%, plus a 12x ROI achieved by accepting more applications, decreasing costs, and reducing fraud.

10. Neobanks Appeal to Young Consumers

FICO reports that many young US consumers consider digital banks, like Venmo and Chime, as their primary checking account provider instead of traditional banks.

The report goes on to say that the number of young consumers who are choosing fintech options over traditional banks has doubled since 2020.

Only 25% of Gen Z use a big bank as their primary checking provider.

These digital-only banks are referred to as neobanks or challenger banks and they’re gaining popularity.

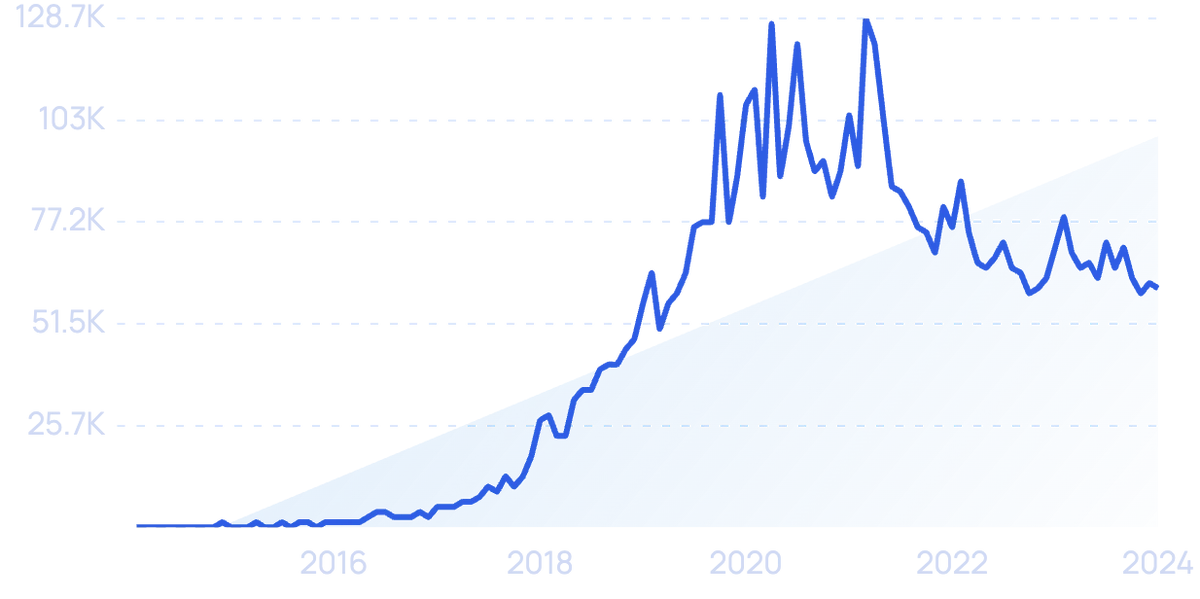

Search volume for “neobank” are up 2x since 2019.

As for customers, Bloomberg reports that there are 80 million neobank customers in North America and Europe. That number is expected to go as high as 224 million by 2026.

Plus, neobanks’ revenue is expected to grow 580% in those years.

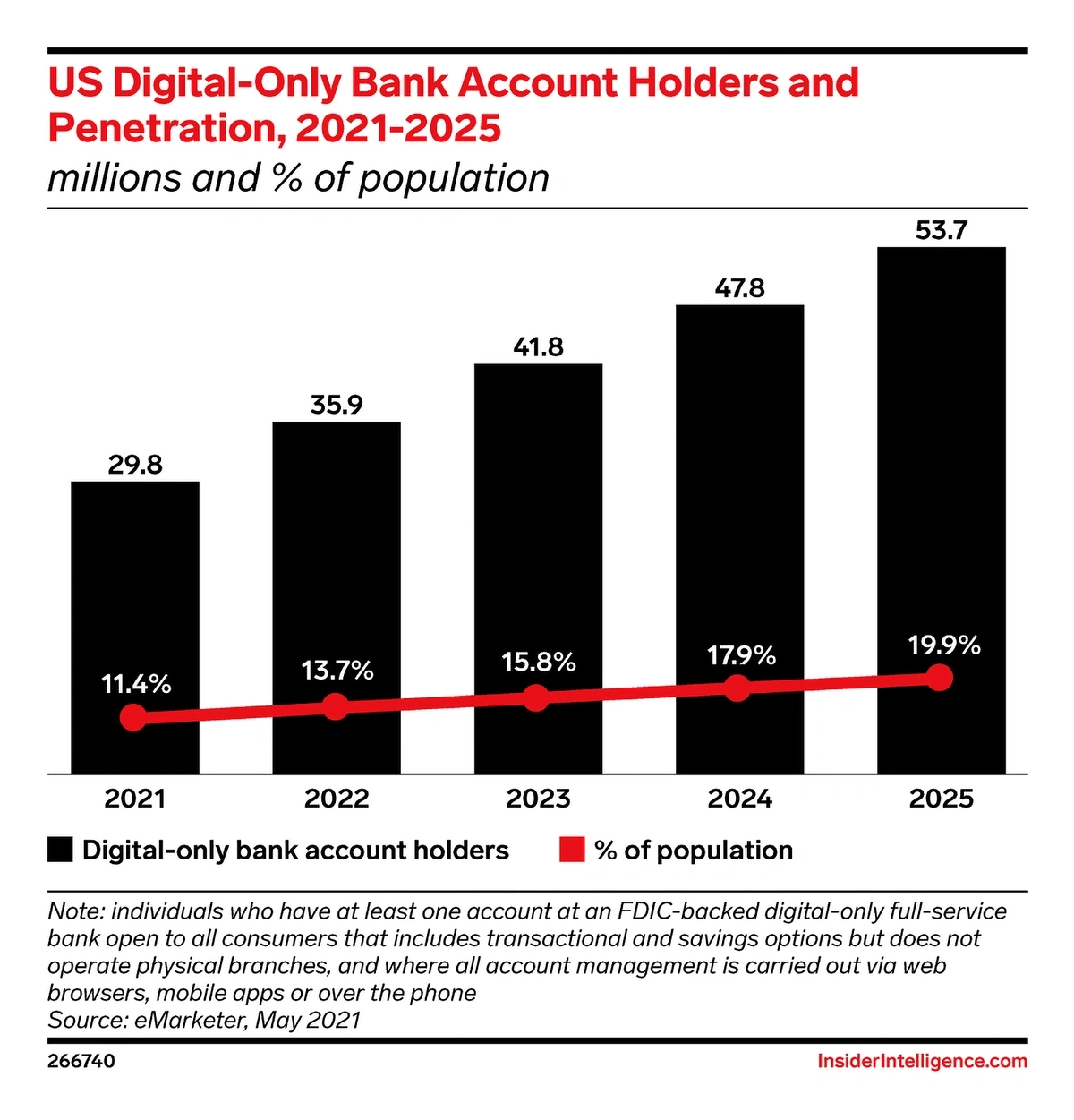

In the US alone, Insider Intelligence predicts 53.7 million people will have a neobank account by 2025.

Insider Intelligence predicts nearly 20% of the US population will have an account at a neobank by 2025.

Young consumers are drawn to the seamless digital experience they get with these banks.

They enjoy bot-powered customer service, social media integrations, and the lack of cumbersome infrastructure.

They can make an account on the neobank’s app and be using their account via a digital wallet almost immediately.

With more than 12 million customers and a 58.6% market share, Chime is the largest neobank in the United States.

Search volume for “Chime Bank” has increased 4,600% in the past 10 years.

The bank offers several features that appeal to young people like no account fees, no monthly balance requirements, automatic savings, and the ability to open an account in just two minutes.

Chime offers checking and savings accounts, as well as a credit card.

However, Chime has been the subject of increasing neobank regulation in the United States.

The California Department of Financial Protection and Innovation took Chime to court because they believed the company was erroneously calling itself a bank.

Chime does not have a banking license. The company’s banking services are provided by The Bancorp Bank and Stride Bank.

Regulators won the suit. Chime was required to remove “bank” from all of its marketing materials, and the company is now required to state that it is a fintech company that partners with a bank to provide services.

In addition to increasing regulation, some finance industry experts warn the business models of many neobanks may not survive the test of time. They’re too reliant on interchange fees, experts say.

Strategy consultants Simon, Kucher & Partners say that less than 5% of neobanks are breaking even.

Conclusion

That wraps up our list of 10 trends in the fintech space to watch right now.

In this new digital-first world, financial services of all kinds are scrambling to adapt.

The financial institutions that will succeed appear to be those that are willing to use technology to achieve efficiency gains, avoid security missteps, and adapt to changing sentiments in consumer preferences.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more