Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Future of Banking (2024-2032)

You may also like:

Commercial banking in the US is valued at $1.4 trillion.

And technology continues to have a major impact on this industry.

Looking forward to the next 5 years, technology will likely be the heart of this industry’s most significant future-facing trends.

Read this list to find out five ways in which banking will likely change in the future.

1. CBDCs Shift The Banking Ecosystem

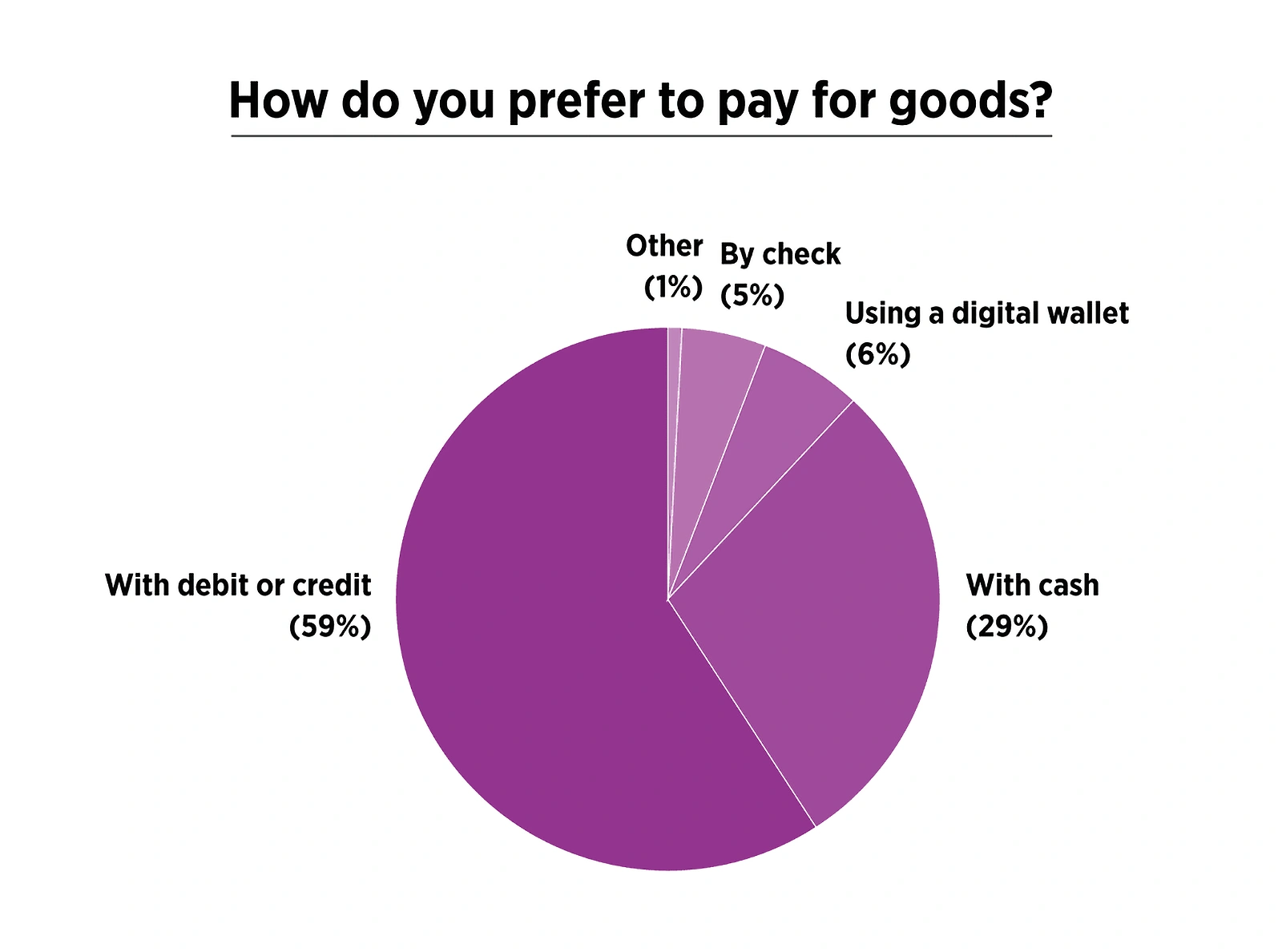

Credit and debit cards have already replaced cash as the preferred payment tool.

Only 29% of American consumers prefer to use cash over a card when paying for a good or service.

Payment preferences among American consumers.

While cash’s popularity has been decreasing, the rise of a government-backed digital currency will likely give it the killing blow.

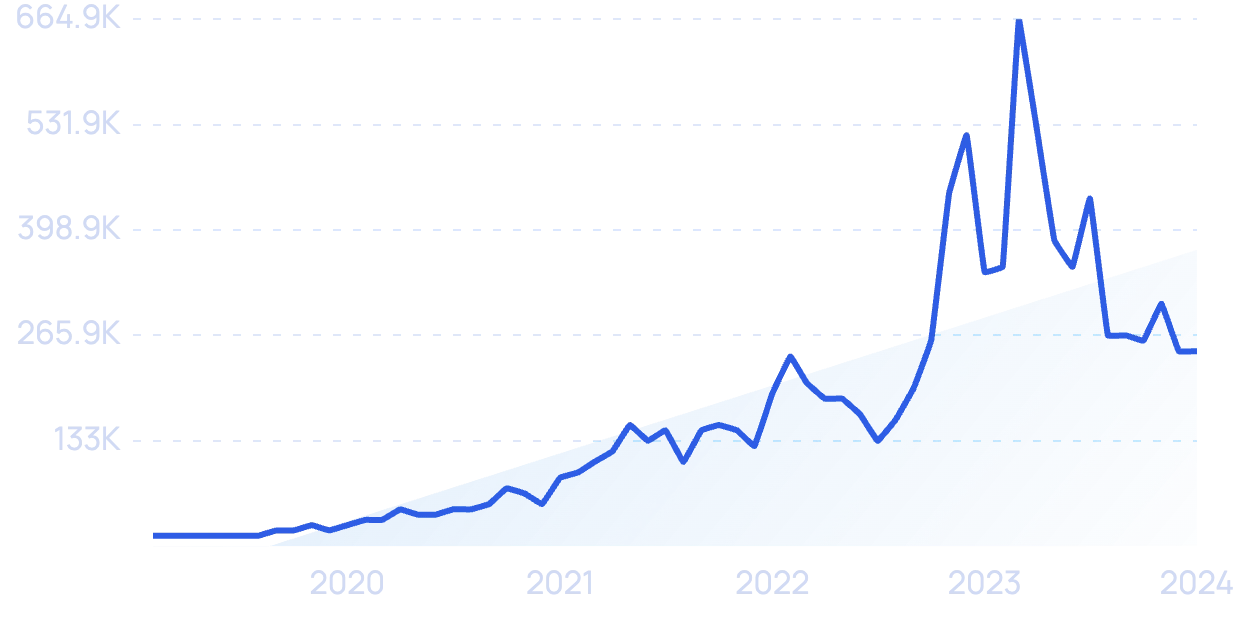

Last year, the US Federal Reserve announced they were looking into the feasibility of issuing a CBDC.

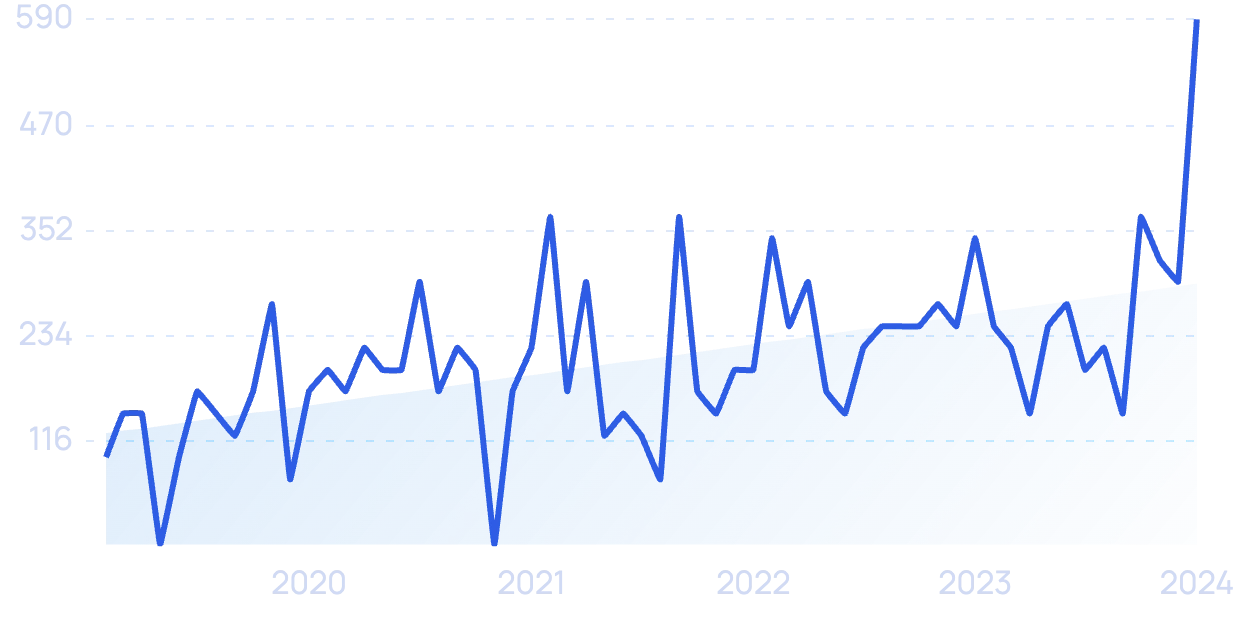

Searches for “CBDC” have grown by 2,566% in the last 5 years.

A CBDC (Central Bank Digital Currency) is basically a “digital Dollar.”

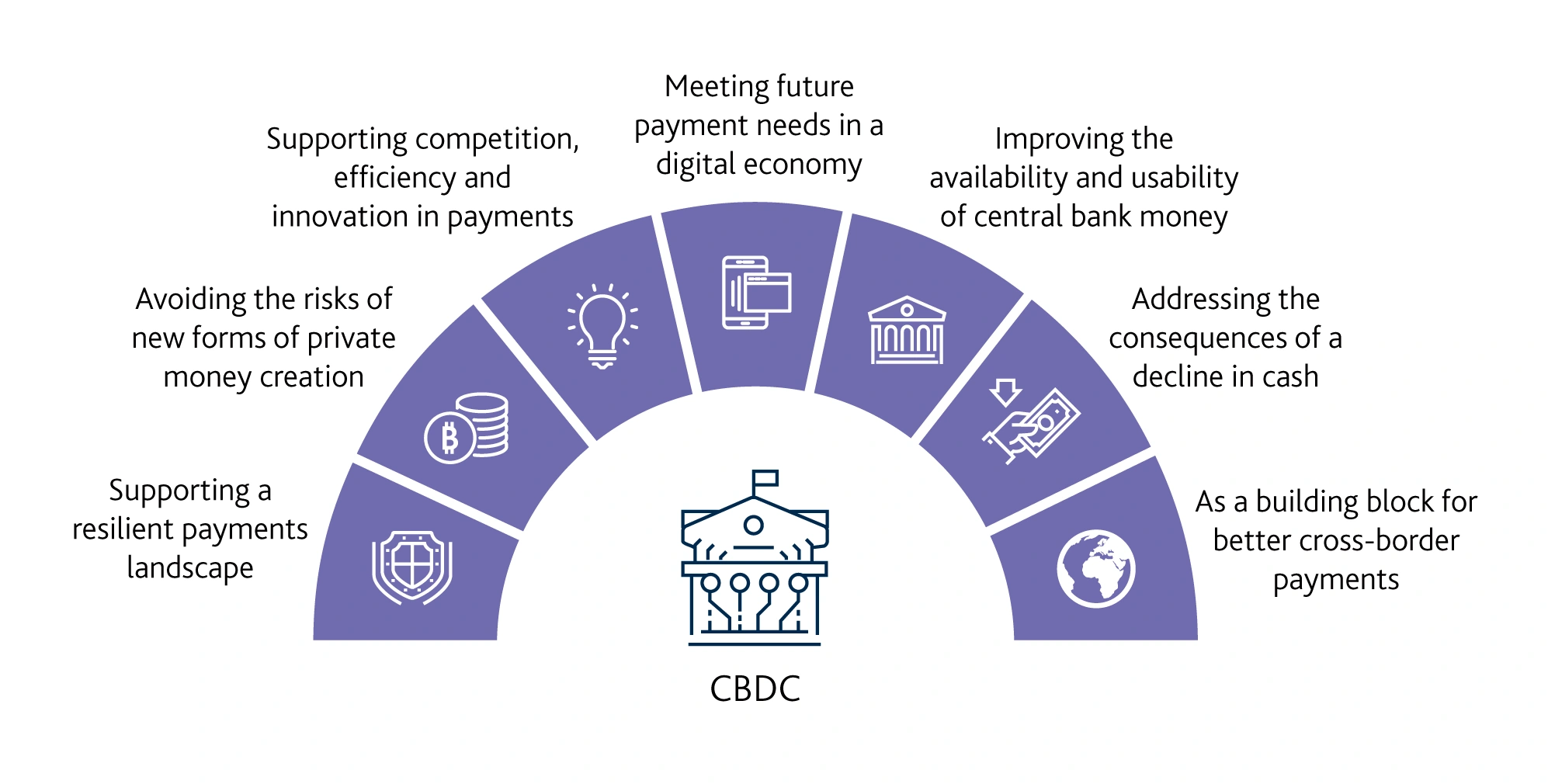

Some governments are advocating CBDCs because they are seen as a tool to better maintain monetary and financial stability.

Potential advantages to using CBDCs.

Based on these trends, some aggressive estimates predict that cash will become entirely obsolete, especially among developed nations.

But CBDC’s most significant impact would be the death of the commercial bank.

Under a system reliant on CBDCs, people work directly with the Central Bank.

All financial services are carried through the Central Bank (people open an account with the Central Bank, and all their transfers go through this account).

This means that the Central Bank has more control over its monetary policy because it can directly influence how much money is supplied to the market.

As we can see, this system will eliminate the need for commercial banks that currently serve as middlemen between the Central Bank and the customers.

Another significant change with using CBDCs would be the potential loss of privacy.

A digital currency is easily traced, meaning that there will be no way for users to transact anonymously.

Therefore, Central Banks would have complete control over the currency and could easily monitor any user’s activity.

As of Q1 2024, 11 countries have already launched CBDCs.

More importantly, 21 countries, including major economies such as China, Sweden, South Africa, and Russia, are piloting their own CBDC programs.

2. Human-less Banking

Walking into a bank in the future might be drastically different, mainly because the customer might be the only human inside the building.

Through AI and robotics, the banks of the future will be able to operate without any human assistance.

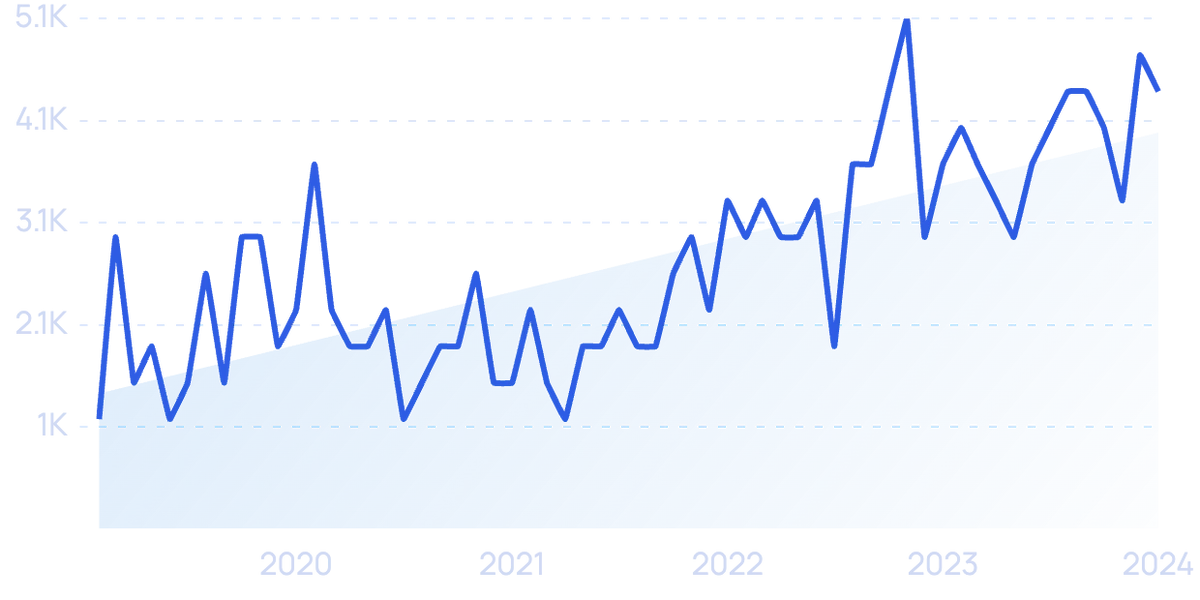

Searches for “banking automation” have grown by 183% in the last 12 months.

65% of banking executives believe that zero-human banking will become a reality in the future.

And some banks are already testing human-less banks.

The China Construction Bank has already launched a personless bank branch where everything is run by humanoid robots.

China Construction Bank’s robot.

The entire in-person banking journey will change.

Instead of going to a bank and receiving services from a human, customers will now use a number of integrated technologies.

For example, if somebody wants to apply for a loan, they just need to click on a button.

Then, an AI-powered robot will go through the individual’s financial history and records. Based on this, the robot shows which loans the customer qualifies for.

Then, after the loan is approved, the money automatically appears in the customer’s bank account.

3. One Platform To Rule Them All

FinTech is unbundling financial services, meaning that each new startup offers a single (or just a few) financial service(s).

Investment platforms like Robinhood allow users to invest for free. Money-sending services like TransferWise have made it cheaper than banks to transfer money. Virtual banks such as Chime offer fee-free mobile banking services.

Examples of popular finance apps.

Customers need to log into a different platform each time they want to access a particular financial service.

And this is what is driving demand for platforms that aggregate people’s financial information.

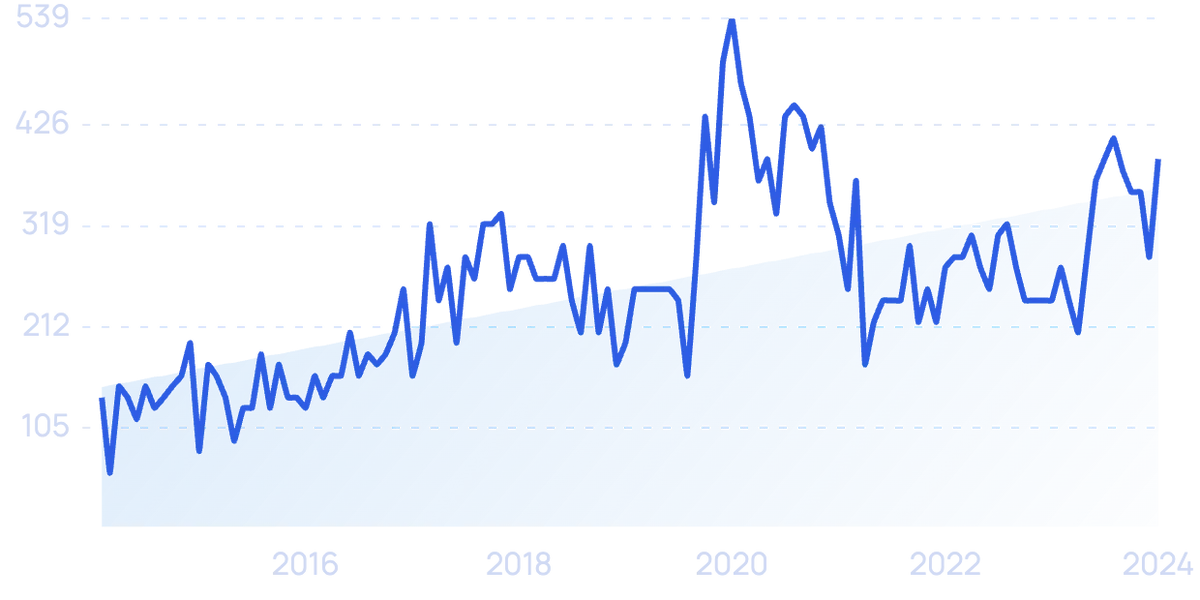

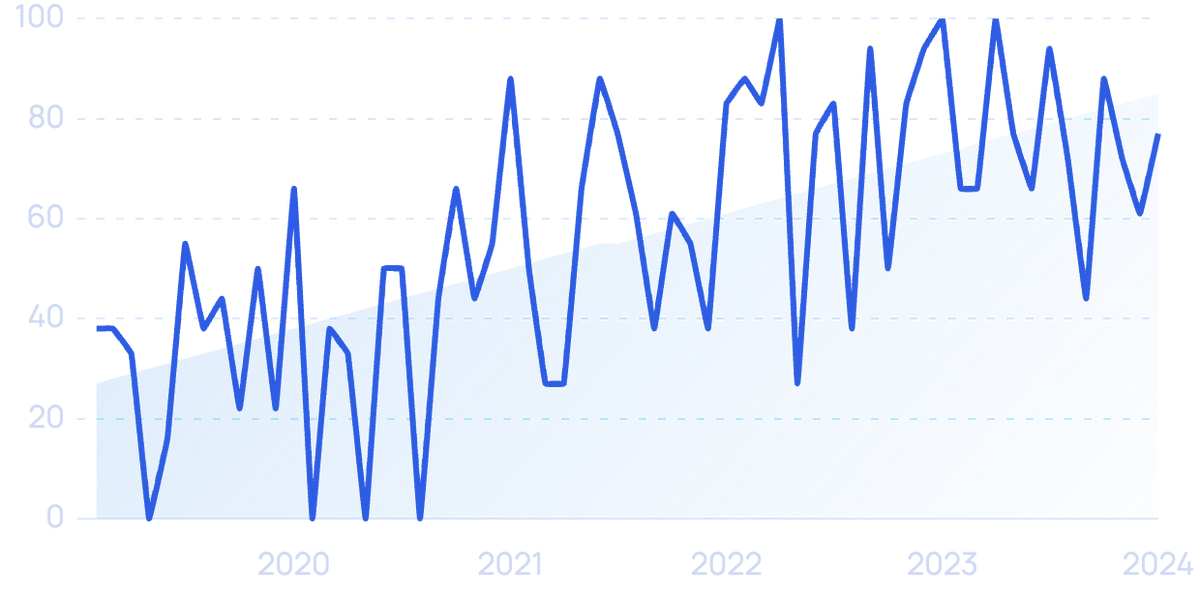

Searches for “financial aggregator” have grown in the last 5 years.

And these aggregators will give rise to super apps.

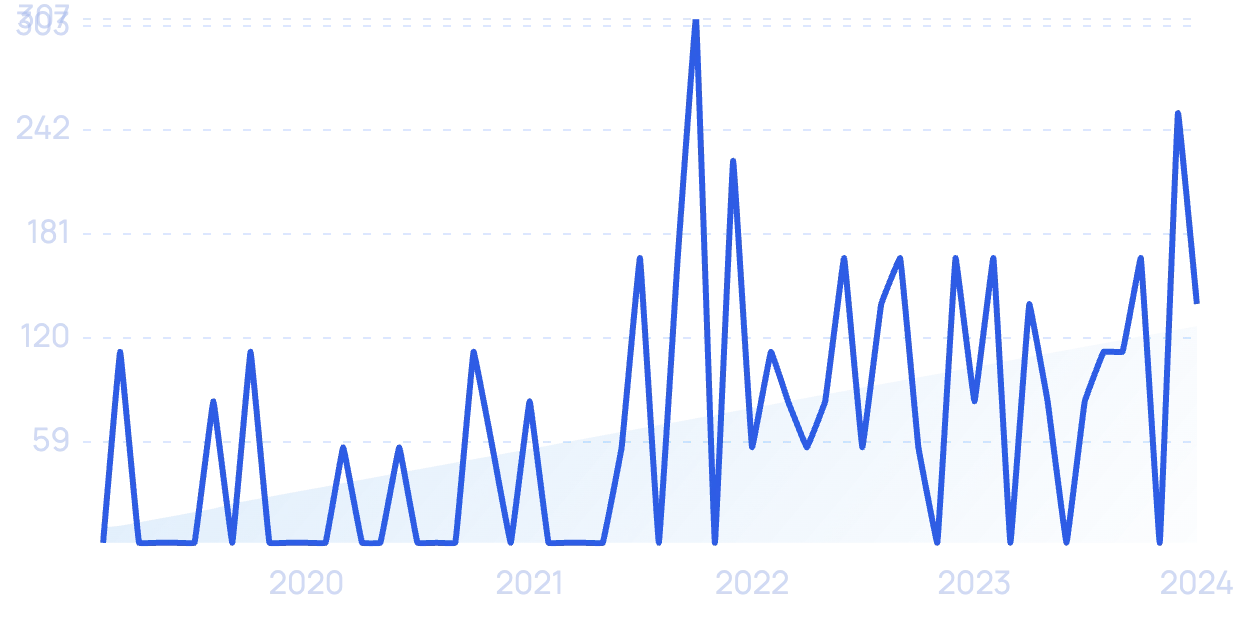

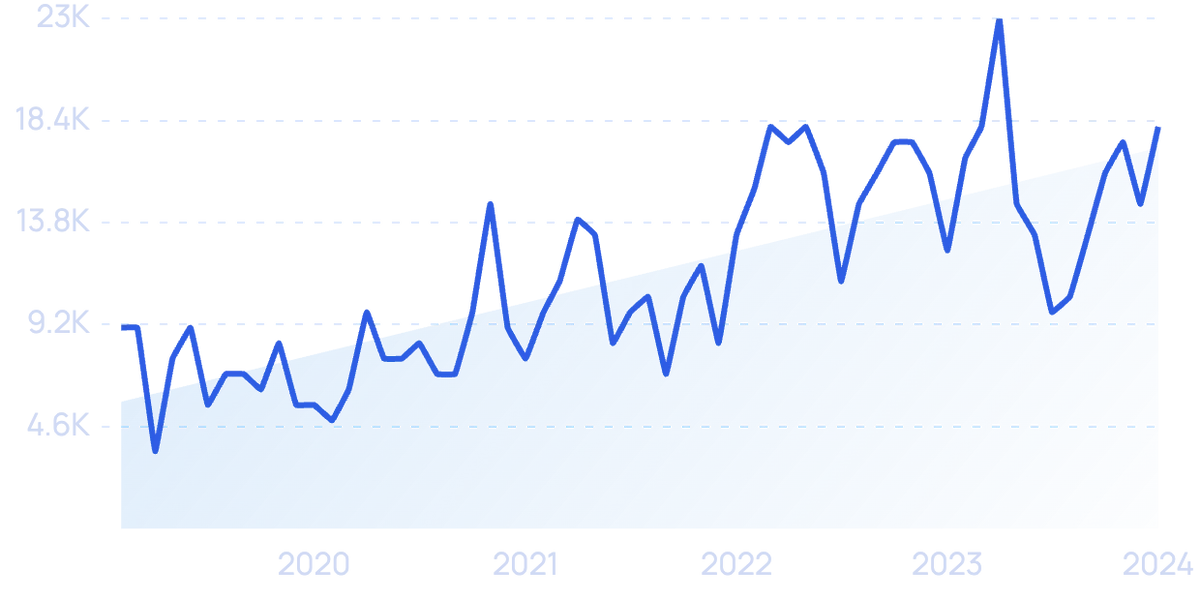

Searches for “finance super app” over the last 5 years.

Financial super apps are ecosystems that enable users to access a wide variety of financial services under a single and unified platform.

Instead of having to log into several apps, users will be able to sign into one super app, which pulls all these different services and lets customers maneuver everything from a “central hub”.

To illustrate, WeChat, a Chinese application, is an example of a popular super app. WeChat allows users to message friends, buy groceries, call a cab, book a doctor’s appointment, and more. All of this is done within one unified platform.

And thus, by 2030, we might see a financial app that aggregates all financial services into one. Basically, we might see a WeChat for financial services.

4. Legacy Banks Embrace Personalization

Using technology to provide hyper-personalized products/services will be critical to the survival of traditional financial institutions.

Searches for “hyper-personalization” have grown by 300% in the last 5 years.

72% of consumers view personalization as “highly important” for their banking experience.

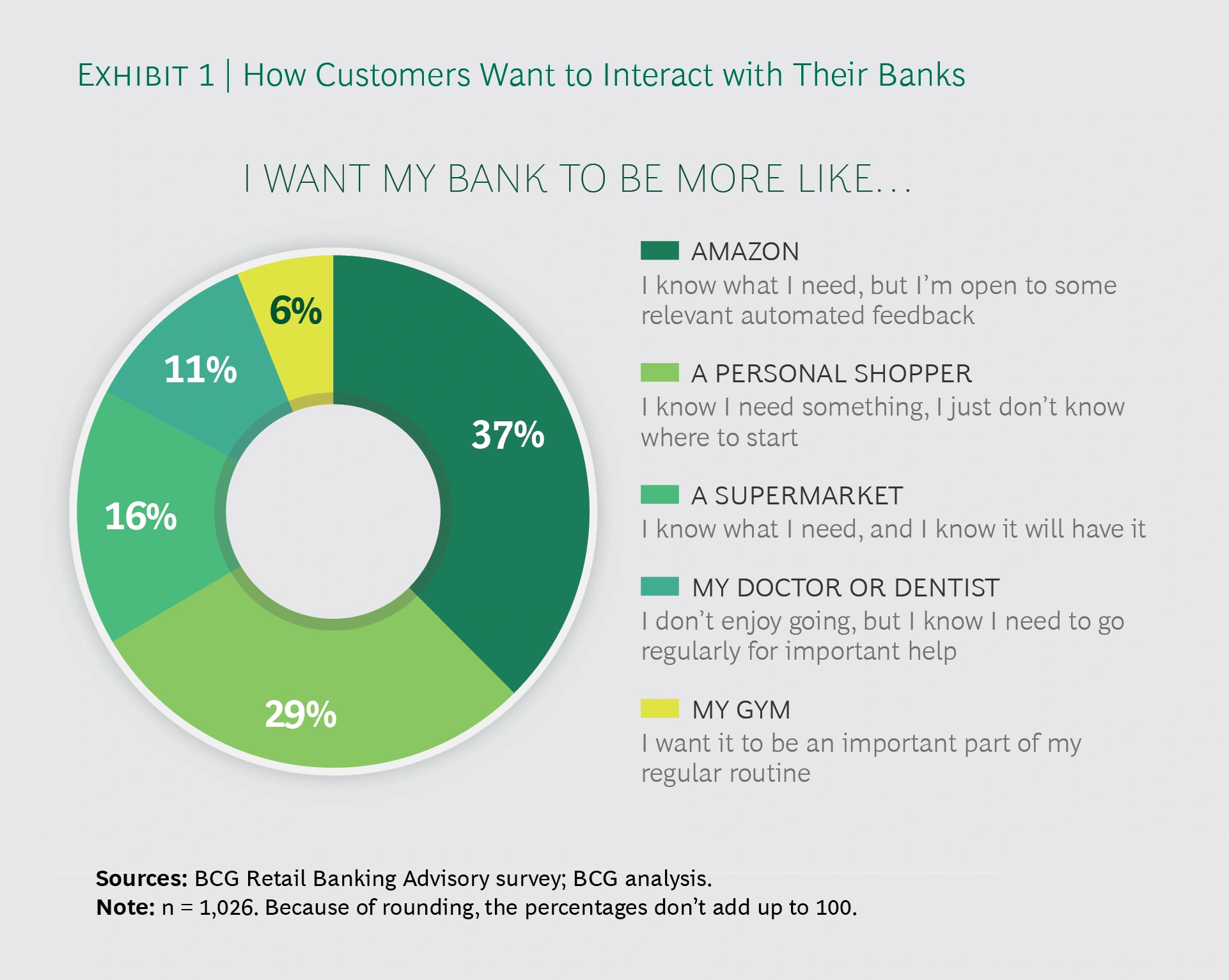

How customers want to interact with their bank.

Some financial institutions have already started to embrace personalization.

The Bank of Ireland recently announced its plans to become the “Netflix of Banking”.

“Netflix of Banking” refers to an initiative to implement AI and data science to better understand its customers' preferences and make more precise product/service recommendations based on that information.

As personalization becomes more advanced and common, dealing with a financial institution should feel like “working with a close friend”.

Länsförsäkringar, a Swedish bank, is trying to launch a Personal Finance Management solution that uses data to analyze their customers’ spending habits in real-time.

Then, they will use this information to provide on-the-spot finance tips.

Banks will continue to pursue this concept mainly because it makes sense financially.

Some estimates claim that for every $100 billion in assets, a bank can increase its revenue by as much as $300 million.

In other words, a bank with $500 billion in assets can potentially increase its revenue by $1.5 billion through personalization initiatives.

5. Payment Supporting Wearables

Paying will become much more convenient once smart wearable devices support payment systems.

In fact, 60% of financial organizations are expected to make wearables a standard payment method by 2030.

Smartwatches are a type of wearable technology that will become a critical payment tool.

Contactless payment via a smartwatch.

Companies like Google have already embedded payment capabilities in their smartwatches.

Smart glasses are also a type of wearable tech that will likely support payment systems.

Searches for “pay by glasses” have grown by 100% in the last 5 years.

Some predict that there will be two ways how this will work:

One, users look into a QR code that serves as a payment receipt, and the smart glasses will automatically scan your eyes to ensure you are authorizing this payment.

Two, the person has to say the word “pay”, and the smart glasses will recognize the voice to make sure it's the right person authorizing the process.

Other wearables that have the capability to become payment tools include bracelets and rings.

Searches for “pay by ring” have grown by 100% in the last 5 years.

Startups like McLear have already developed rings with contactless payment capabilities.

Contactless payment via a McLear ring.

And payment by wearables will likely become the major catalyst for why physical cards (and cash) will see a drastic decrease in their utilization.

Conclusion

This completes our dive into the future of banking.

Technology is the primary driver of the most significant changes in this industry.

In fact, technology and how well it is implemented, will likely be what makes or breaks a lot of players in this industry.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more