Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Trends For The Future of Banking

You may also like:

Banking is changing in ways we have never seen.

Read on to learn more about the most important banking trends happening this year and beyond.

1. AI Transforms Banking

The banking sector could add an extra $340 billion of value per year by using AI to increase productivity, according to McKinsey data.

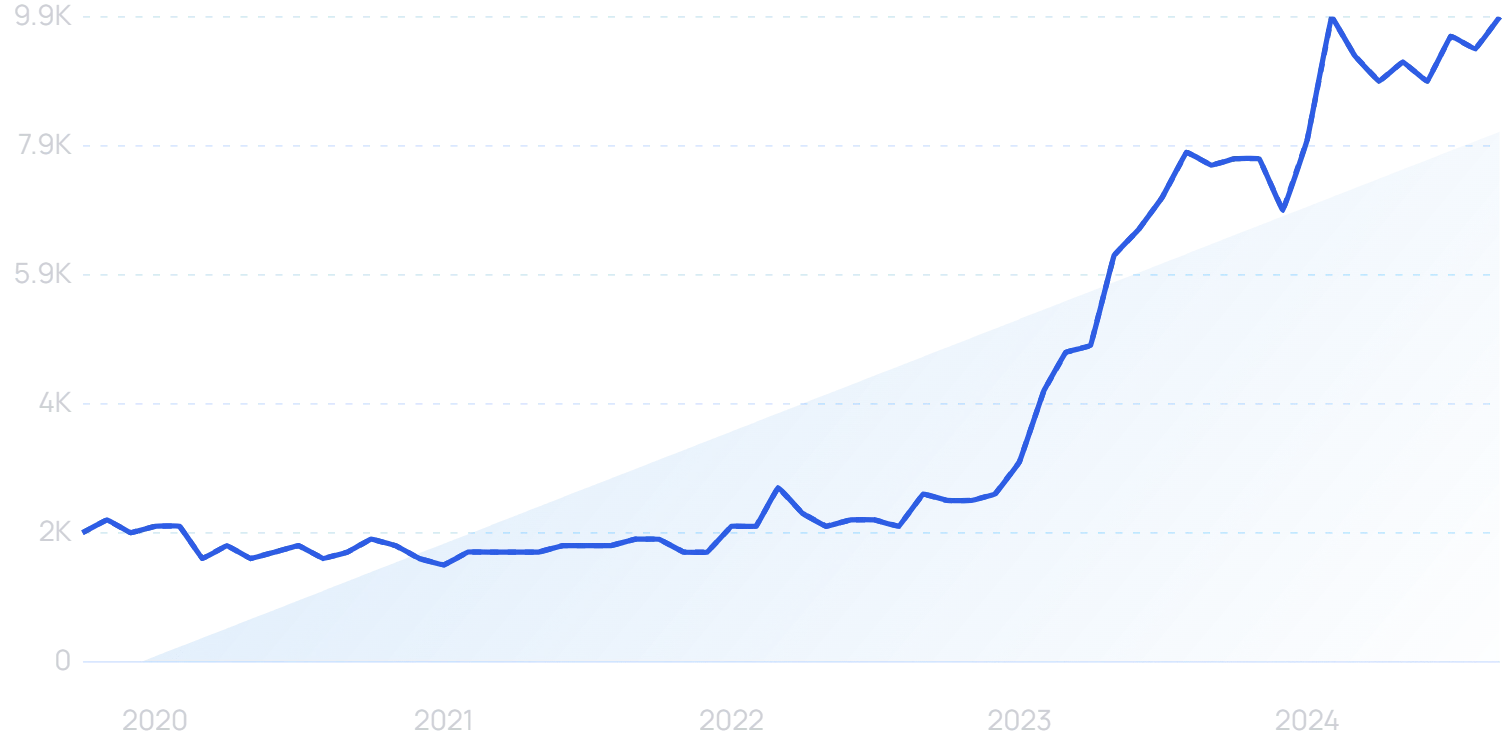

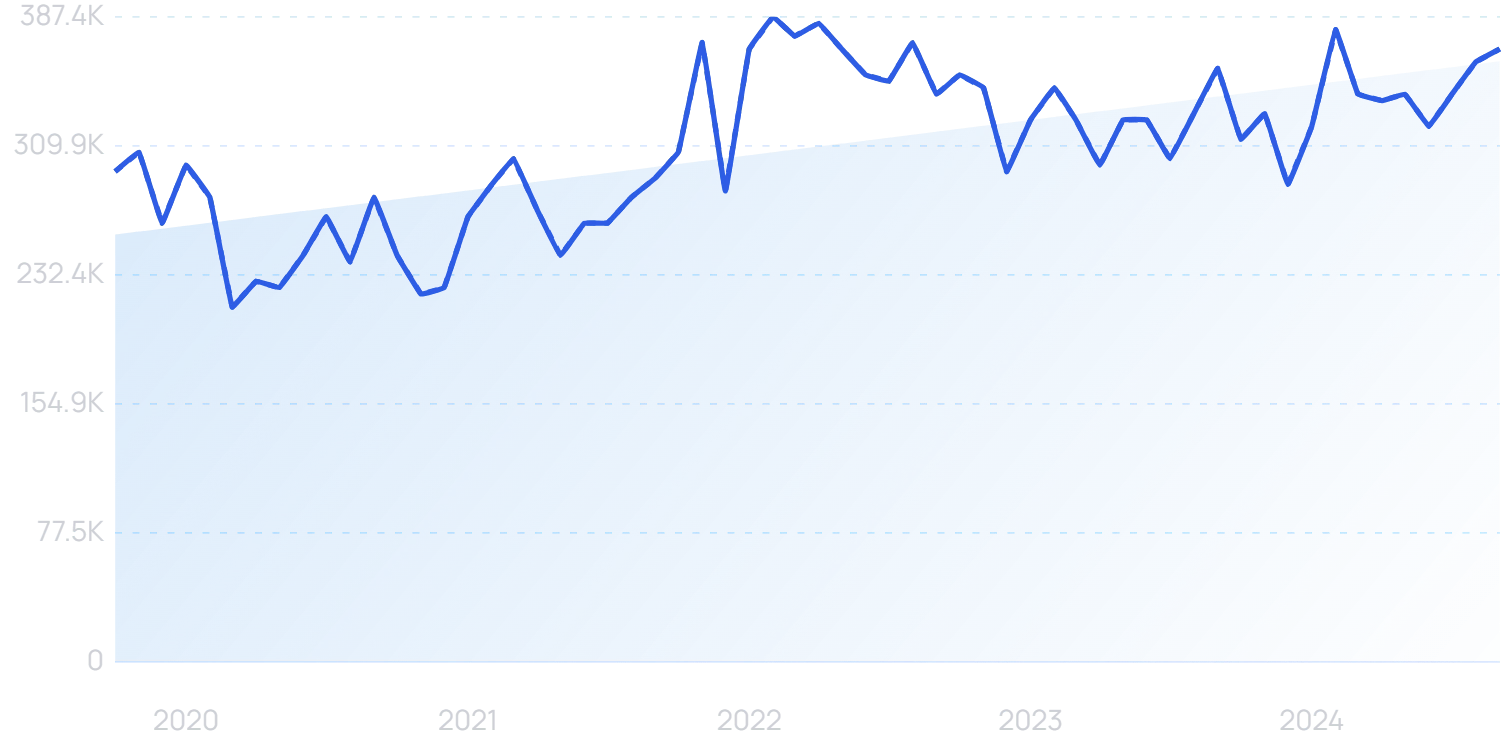

“AI banking” searches are up 343% in 5 years.

Nearly 1 in 10 financial organizations are taking a systemic approach, exploring how AI can be transformative across the entire enterprise.

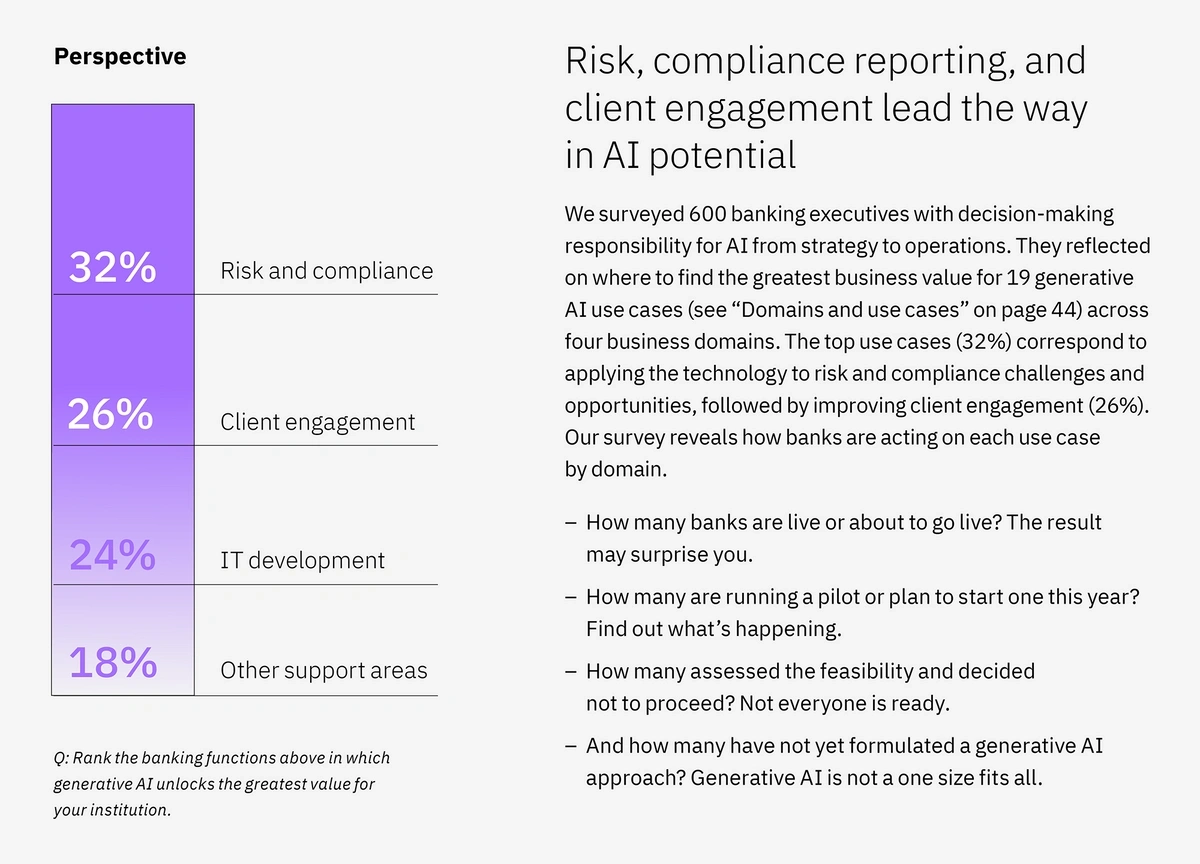

Among those focusing on more isolated pockets where AI can be useful, risk and compliance and customer engagement have emerged as key areas of innovation.

AI can transform risk and compliance within banking.

Use of AI in fraud prevention is part of the risk and compliance picture. But McKinsey explains how generative AI can also be trained to answer questions about regulations, policies and guidelines.

Provenir uses AI for credit risk management.

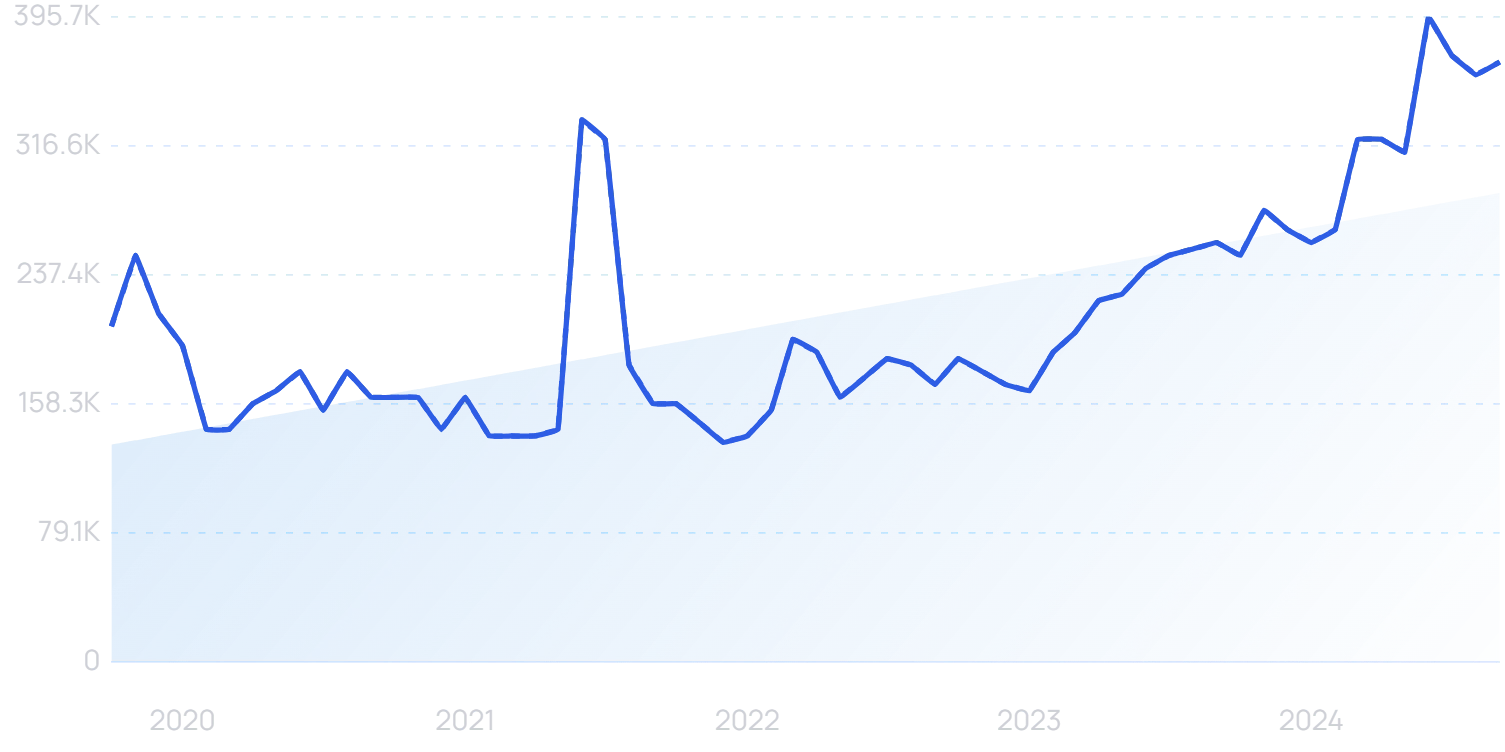

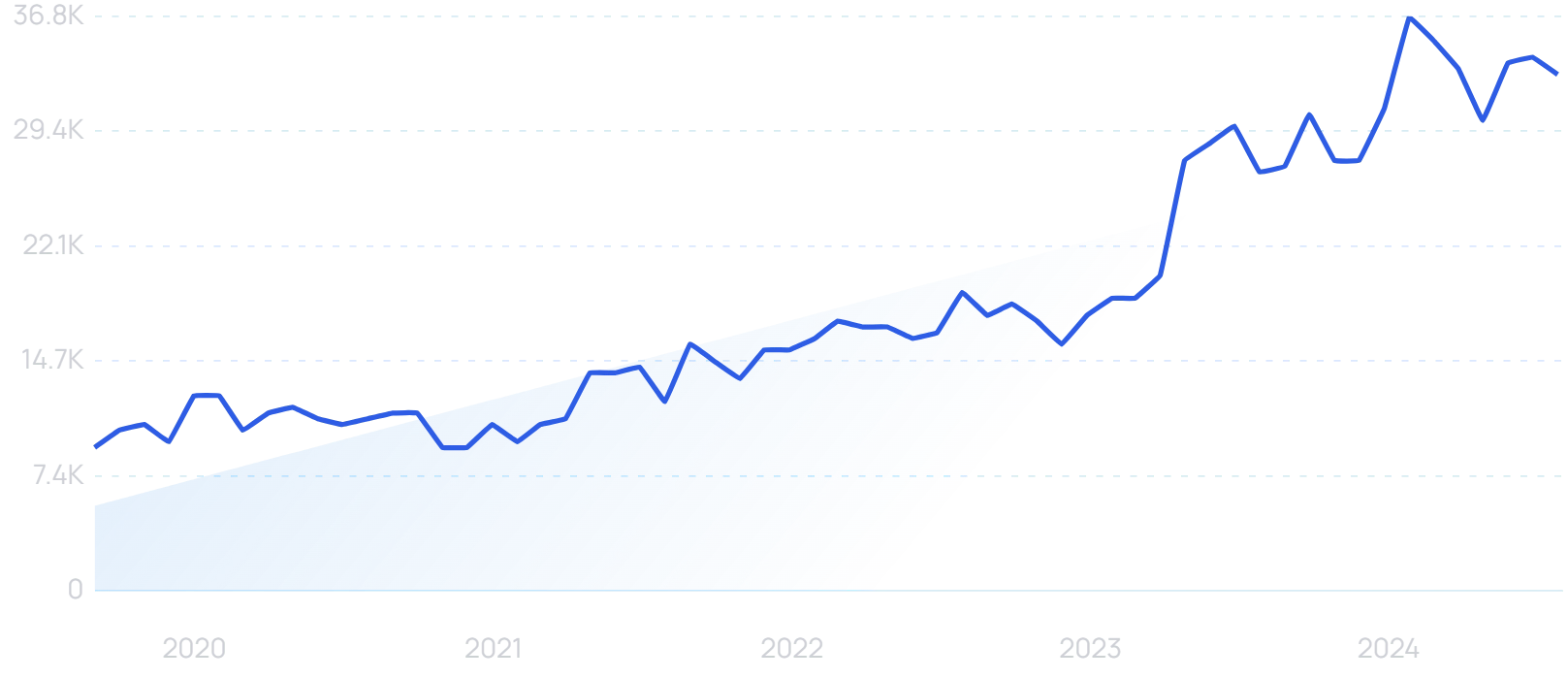

“Provenir” searches are trending steadily upward over time.

Partnering with European neobank TBI, Provenir enabled a 1400% improvement in capacity, with more than 7 million credit applications processed per year.

On the customer engagement front, Boost.AI provides chatbots to banks and other financial institutions.

Searches for “Boost.AI” are up 614% in 5 years.

It boasts a resolution rate greater than 90% for banking inquiries.

AI-focused companies dominate on the live Exploding Topics finance startup directory.

2. NeoBanks Change The Banking Landscape

$6.37 trillion of transaction value will pass through neobanks this year.

Globally, neobanks have more than 1 billion clients. 20 different neobanks have more than 10 million customers each.

So, what is a neobank?

A neobank is a licensed bank that operates completely online.

Neobanks surged to prominence in the early 2020s.

Some examples include Chime, Current, Revolut, Starling and Monzo.

The total value of the neobank market was about $98 billion at the end of 2023.

And some analysts are predicting enormous growth in the future.

The neobank market is expected to be worth about $3.4 trillion by 2032, exhibiting a CAGR of almost 50%.

The largest neobank in North America is Chime.

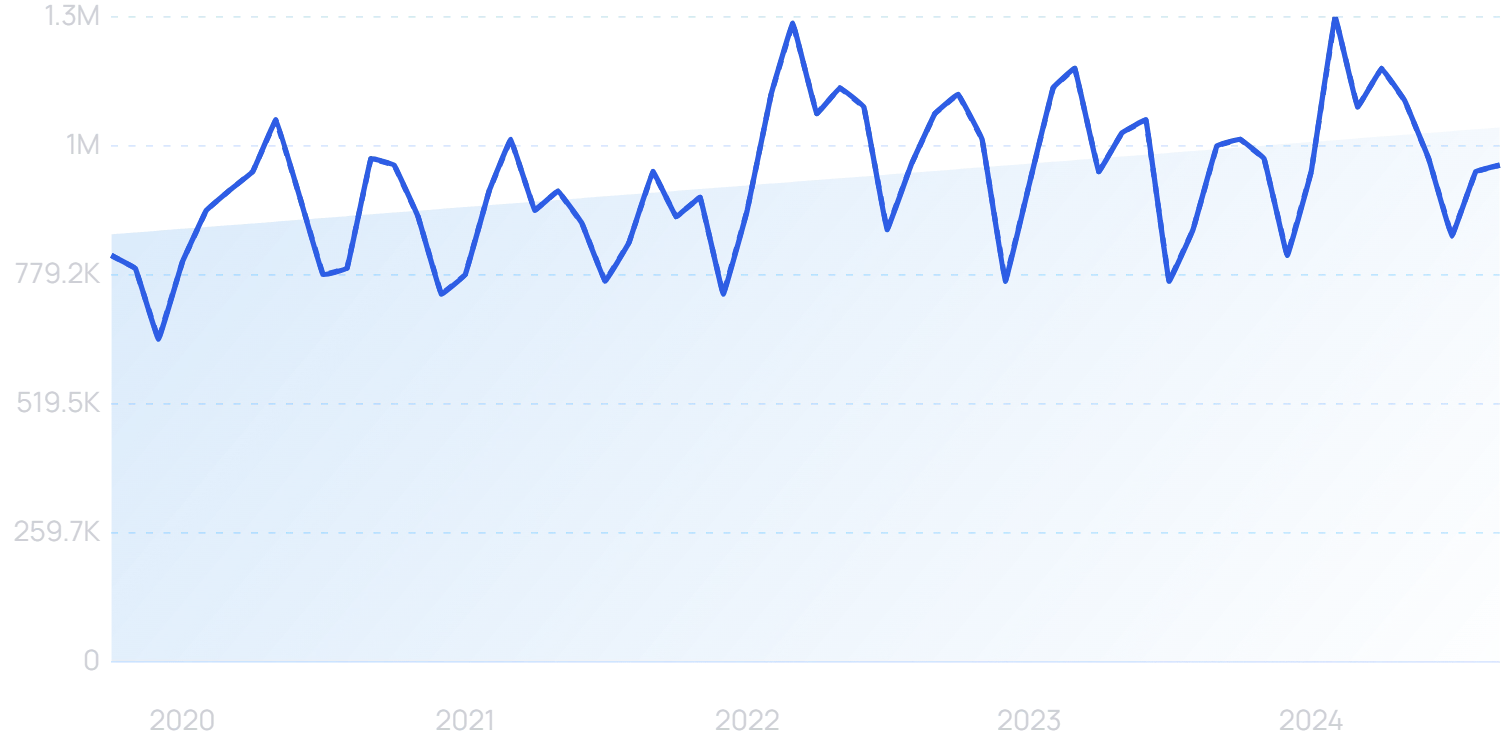

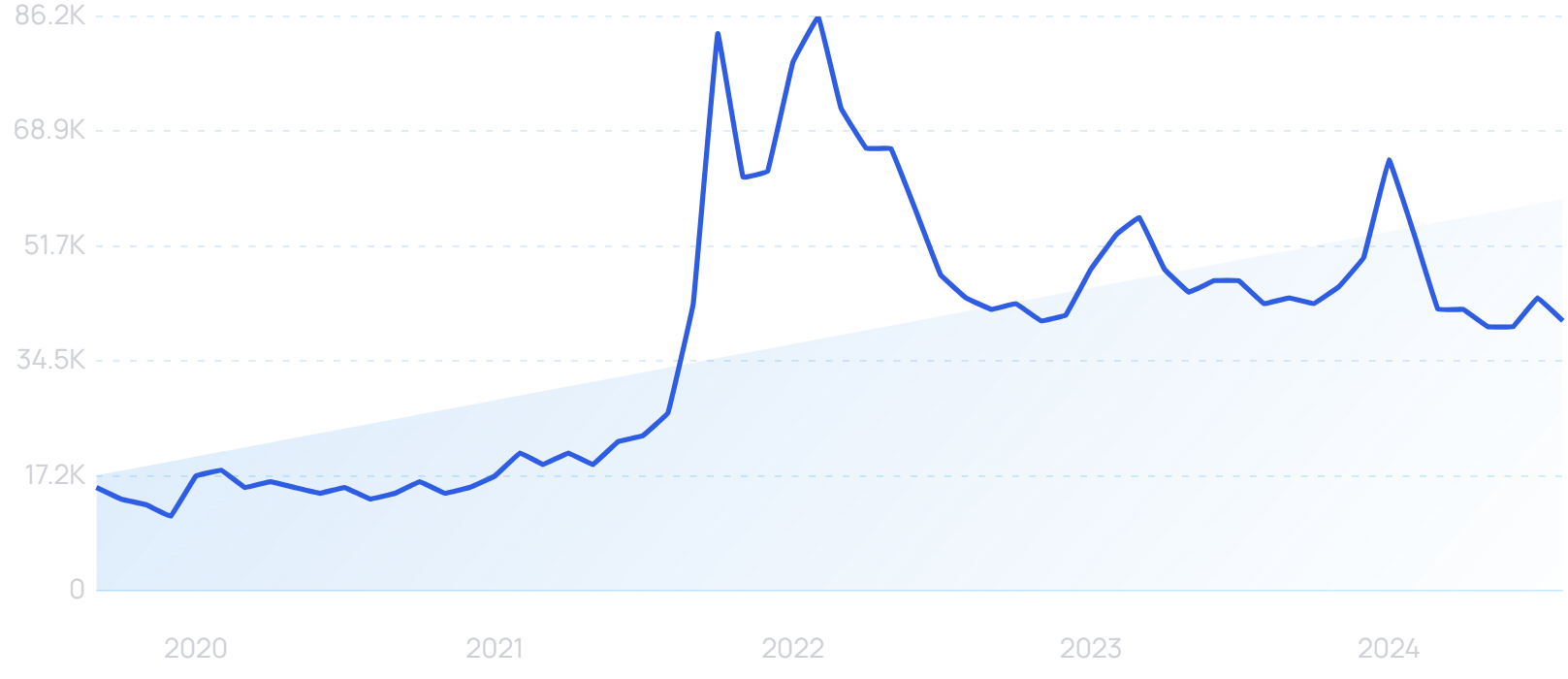

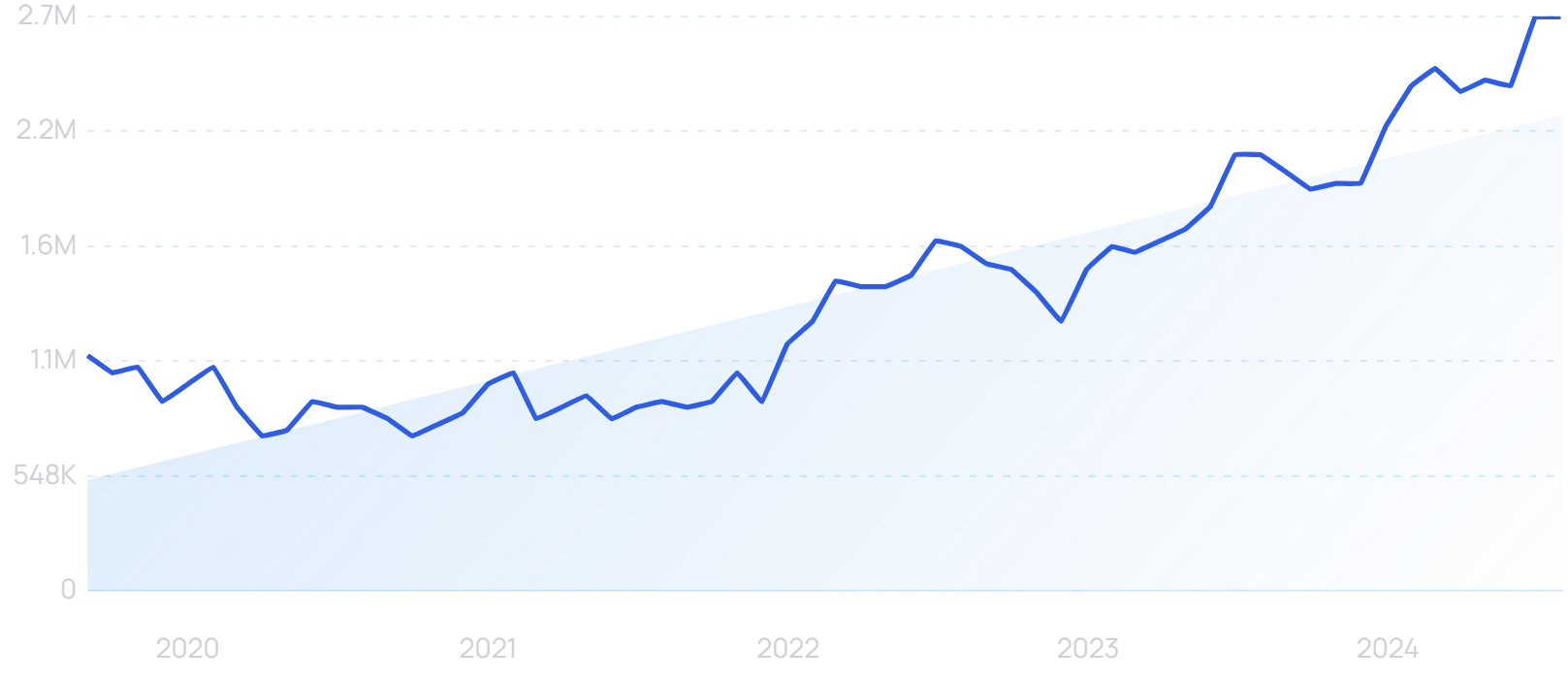

Searches for "Chime" have exploded over the last 5 years.

Chime currently has about 38 million account holders, surpassing every other digital bank in the US. And our wesbite analytics tool shows that it's in the top 10 most-visited banking websites in the US.

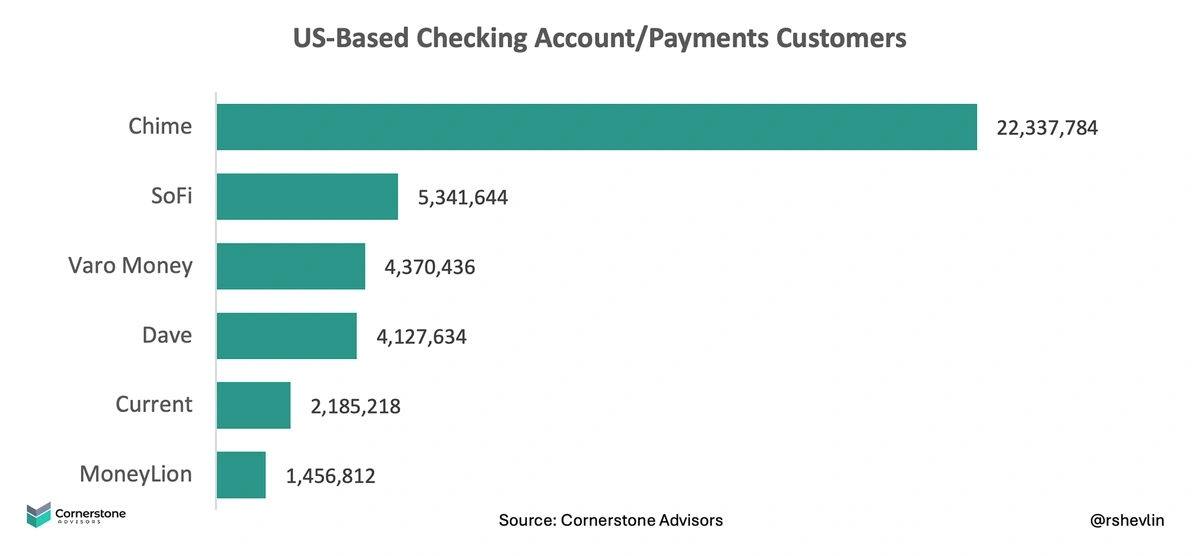

Cornerstone estimates that Chime has more users than SoFi, Dave, MoneyLion and Current combined.

CEO Chris Britt has declared that Chime is “IPO-ready”. It could go public in 2025.

And with Chime’s consumer-friendly policies like no overdraft fees, early direct deposit and a new “earned-wage access” feature allowing access to up to $500 of wages before payday, it is becoming a mainstay in the banking landscape.

Chime’s focus on middle-to-lower-income consumers also produces a lot of customer loyalty.

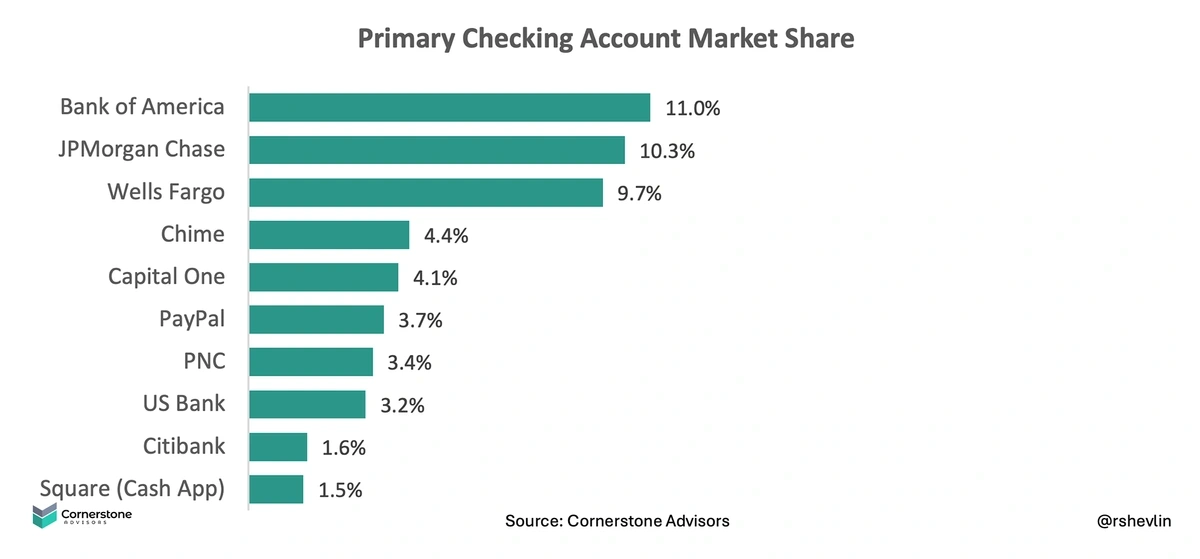

Forbes reports that around half of Chime’s 38 million customers consider the neobank to be its primary bank. That equates to 8.1% of all American adults, and 12.3% of Gen Z.

Chime is right behind established mega-banks like Bank of America and Wells Fargo in terms of primary accounts.

It’s clear that consumers are starting to change their banking preferences.

One survey found that 72% of Gen Z use a neobank as their primary budgeting tool.

It’s no wonder then that a growing number of fintech startups are trying to obtain bank charters in the US.

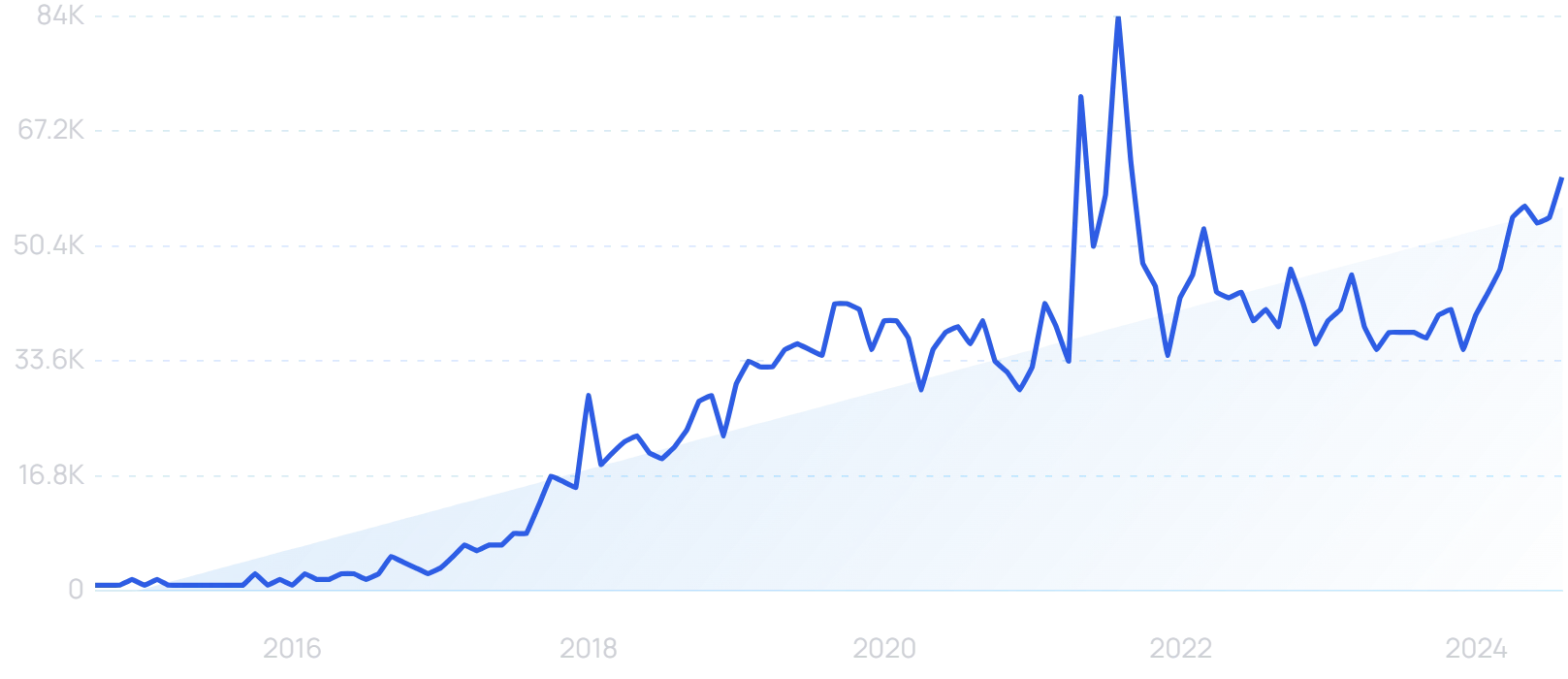

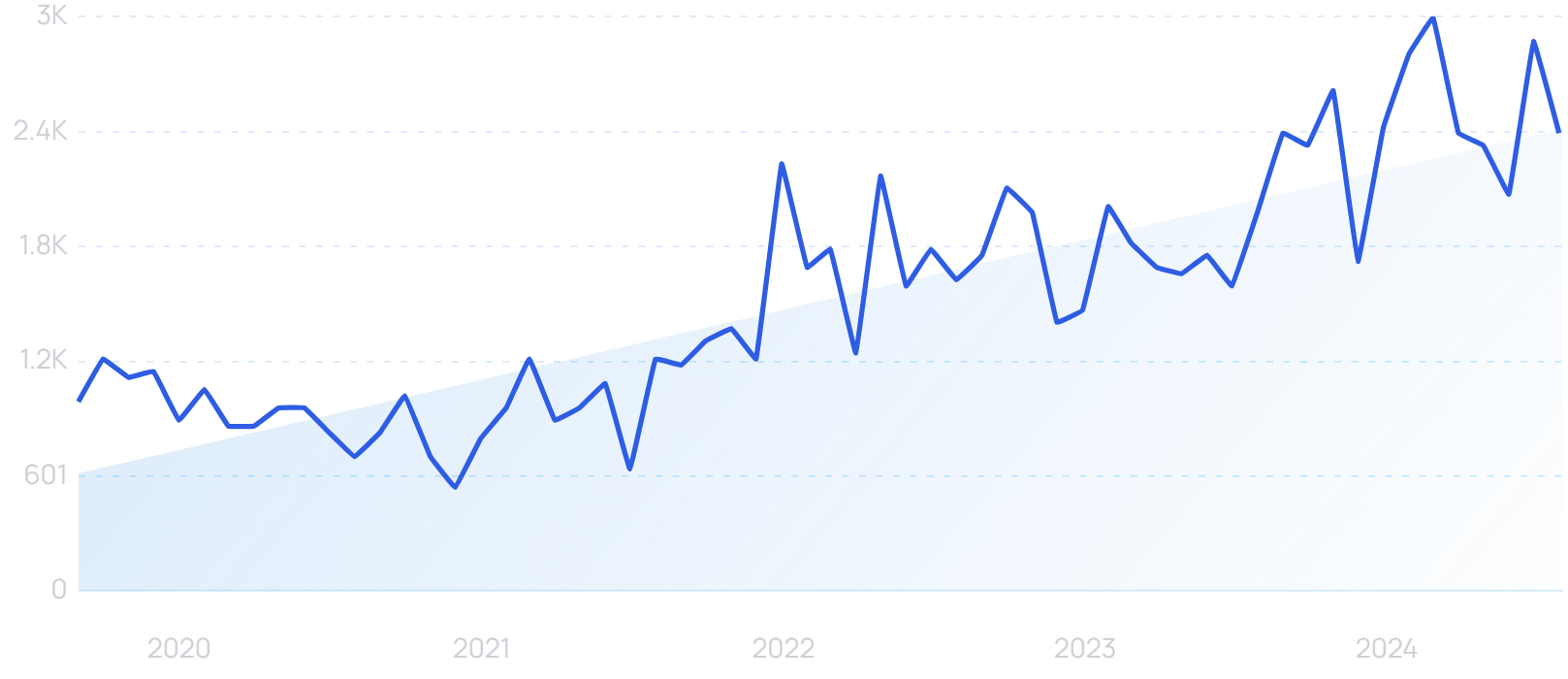

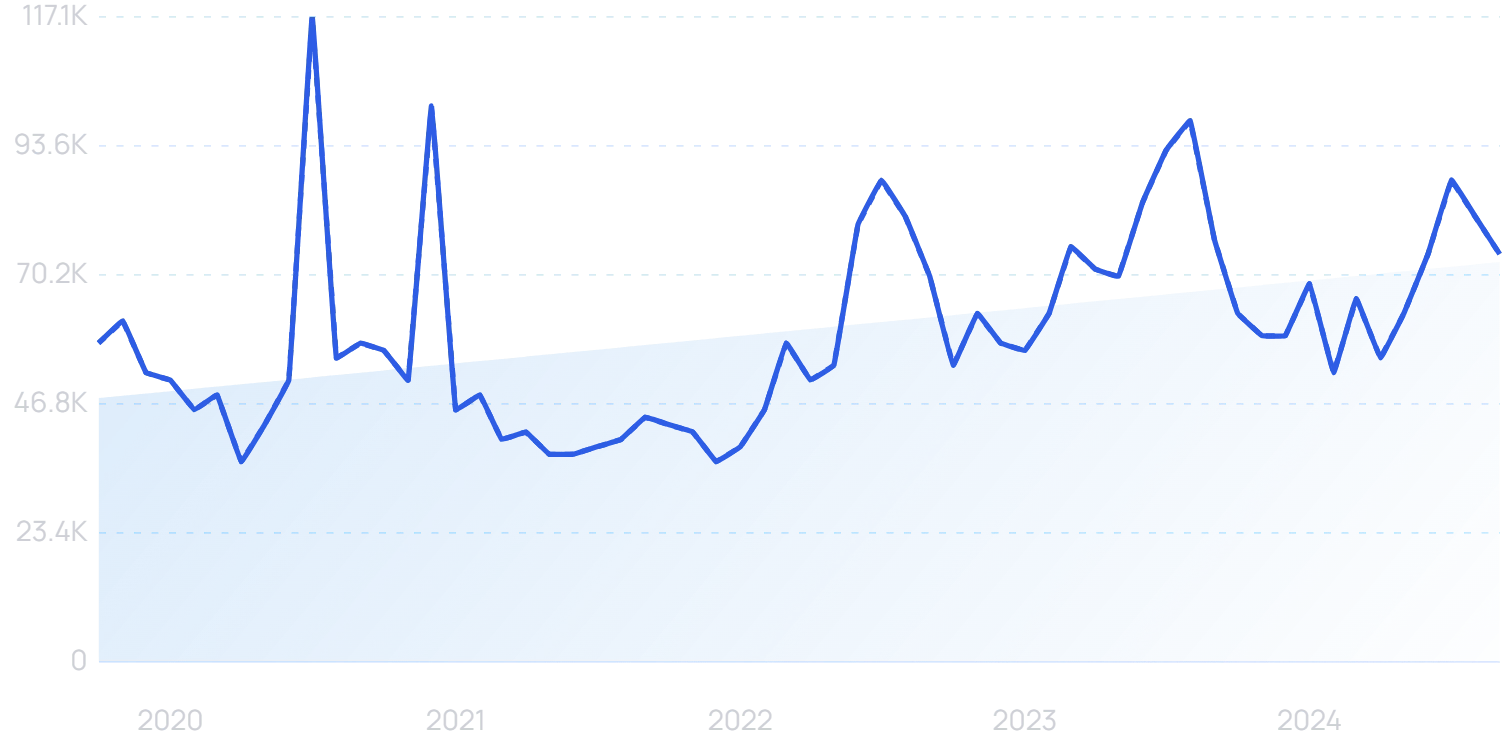

Searches for “fintech" have grown by 2075% over the last decade.

Varo Money was the first fintech to receive a national banking license when the OCC granted it a charter in 2020.

Revolut currently partners with the Community Federal Savings Bank in the US.

But in the UK, after a three-year wait, Revolut finally received a banking license in July.

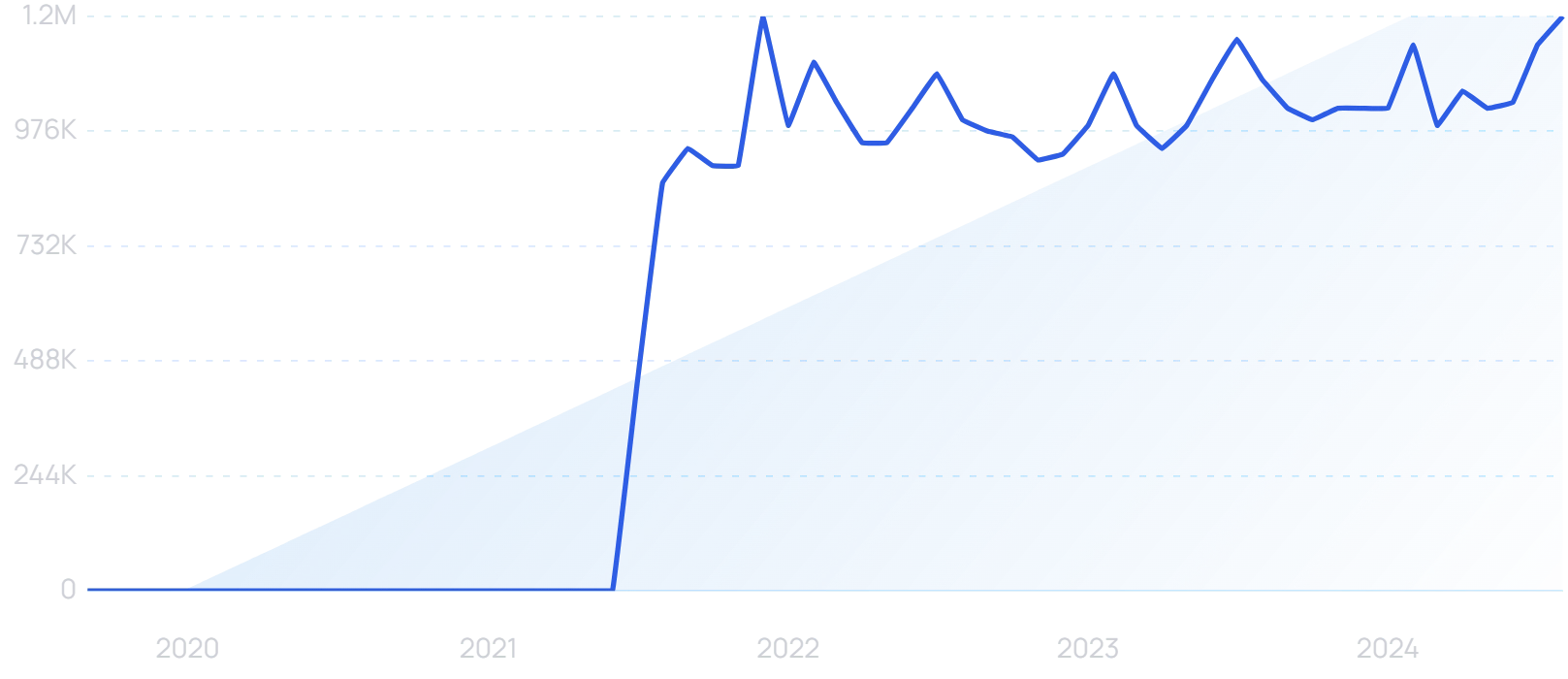

Searches for "Revolut" have grown by 132% over the last 5 years.

It is “likely” that regulators in the US and other countries could be persuaded to follow suit.

3. The US Turns To Open Banking

Open banking – in the simplest terms – basically seeks to make the entire financial infrastructure transparent.

Searches for "Open Banking" have grown by 110% over the last 10 years.

The basic tenets of the concept involve using open APIs to allow third-party developers to build applications and platforms that use banking data.

These applications can allow consumers and businesses to take ownership of their financial data and make payments more seamlessly.

The APIs can be broken down into Data APIs, Transaction APIs and Product APIs.

Data APIs provide read-only access to account information. CreditLadder exemplifies one use-case.

The UK firm allows tenants to report their rent to various credit reporting agencies. Open banking protocols allow CreditLadder to see the rent getting paid on time, which can enhance users’ credit scores.

CreditLadder has reported over $1 billion in rent payments.

Transaction APIs allow payments and fund transfers to be carried out seamlessly. These are known as “Pay By Bank” or account-to-account (A2A) payments.

Uptake in the US has been slow. That’s partly down to the regulatory environment, and partly because of the grip of credit cards on the payments market.

In the UK, 13% of digitally active consumers are already using open banking. That rises to 18% among small businesses.

14.5 million open banking payments were recorded in the UK in January 2024, a 69% YoY growth.

The obvious use case for product APIs is comparison websites.

Again, these are bigger in the UK than the US at present. But Aardy is one example from North America.

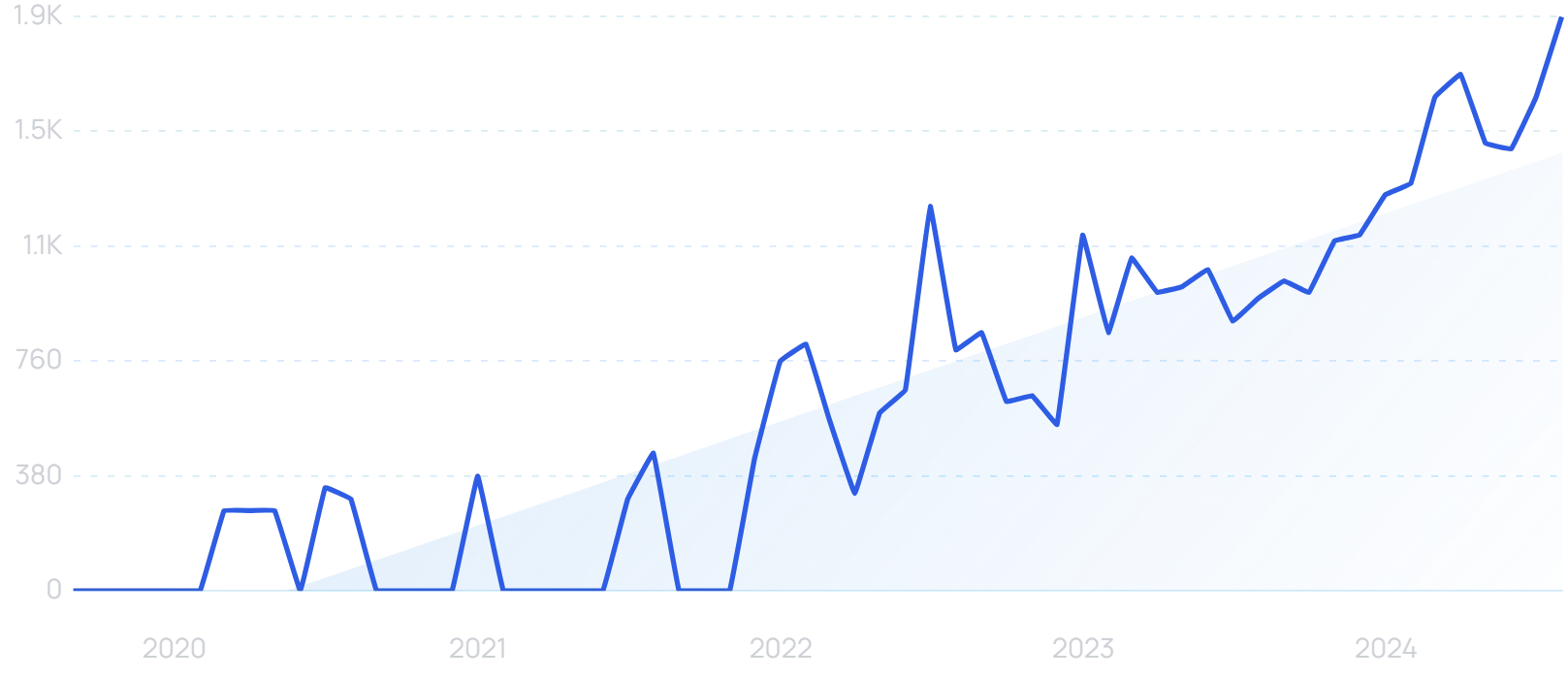

“Aardy”, a US-based travel insurance comparison site, has seen strong recent search growth.

Aardy allows consumers to compare rates from different travel insurance providers.

Using product APIs, third-party aggregators like these can take deals and rates directly from financial institutions, and consumers can purchase straight from the comparison site.

Aardy is a US-based example of a price comparison tool.

The UK and Europe have really taken a lead on open banking. The European Union (EU) took the first steps to making the concept a reality.

The EU passed the Payment Services Directive (PSD2) back in 2015 to encourage competition between payment providers (including nonbanks) on the European continent.

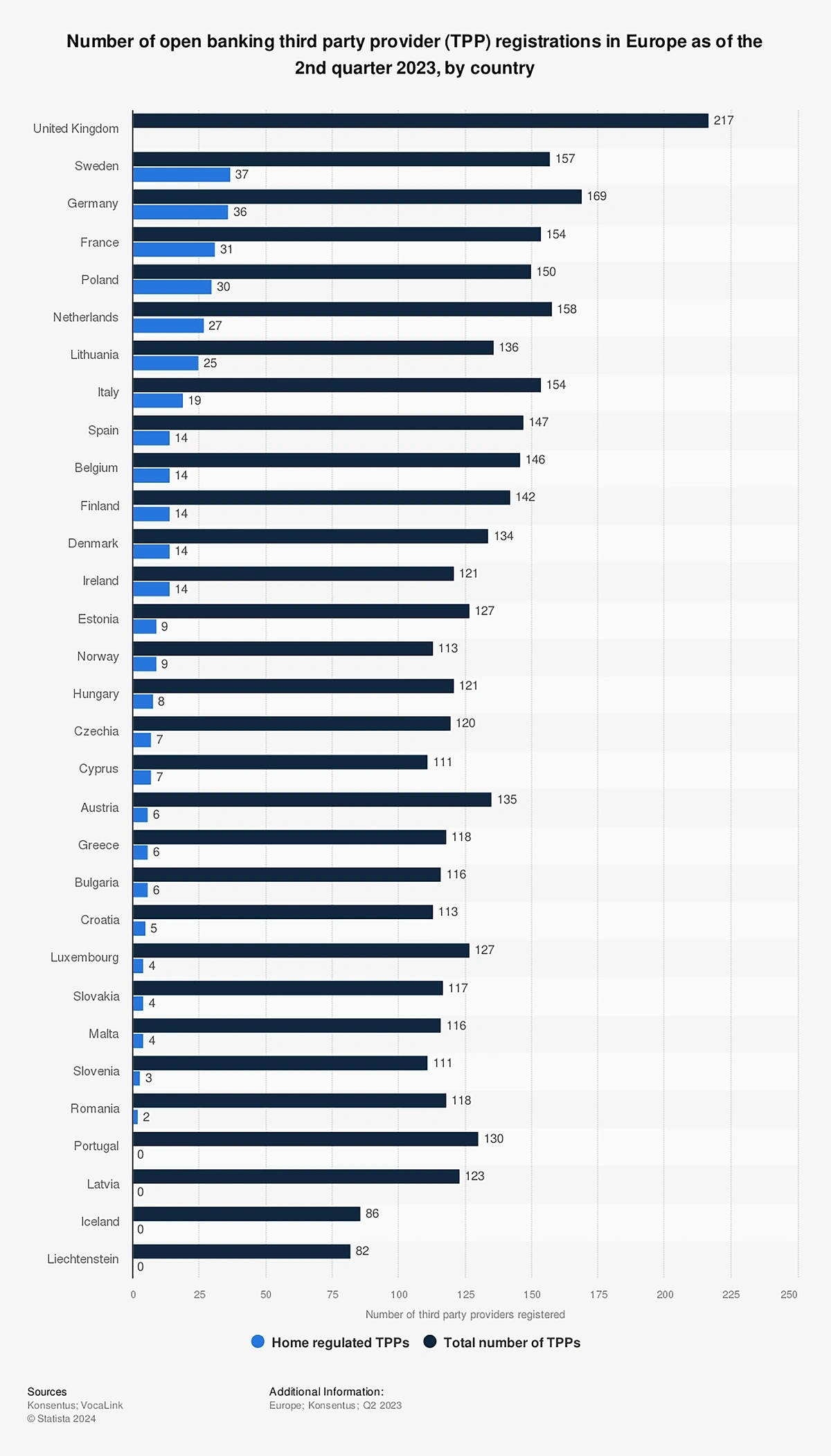

This directive has allowed for a proliferation of third-party providers (TPPs). In the US, these companies are more commonly known as fintechs.

Last year, there were about 4000 open banking TPP registrations in Europe.

Number of TPPs in Europe in Q2 2023.

As the leading financial center in Europe, the UK has the most TPPs operating today.

Meanwhile, the EU has published a PSD3 proposal designed to “remove remaining obstacles” within open banking.

Open banking payments are forecast to increase 479% by 2027.

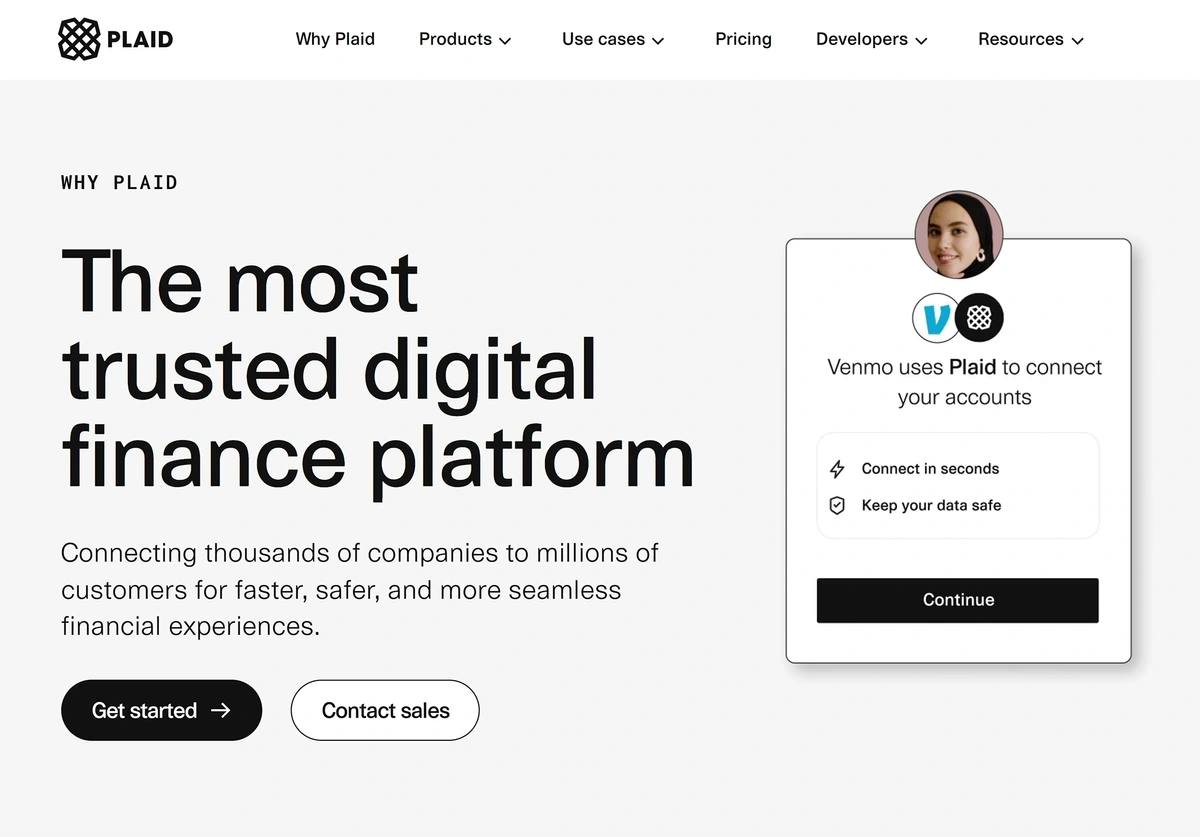

Plaid is basically the face of open banking in the US.

Users can connect their bank accounts to Plaid-powered apps.

Around 1 in 3 Americans with a bank account already use Plaid.

4. The Largest Tech Companies Become Banks

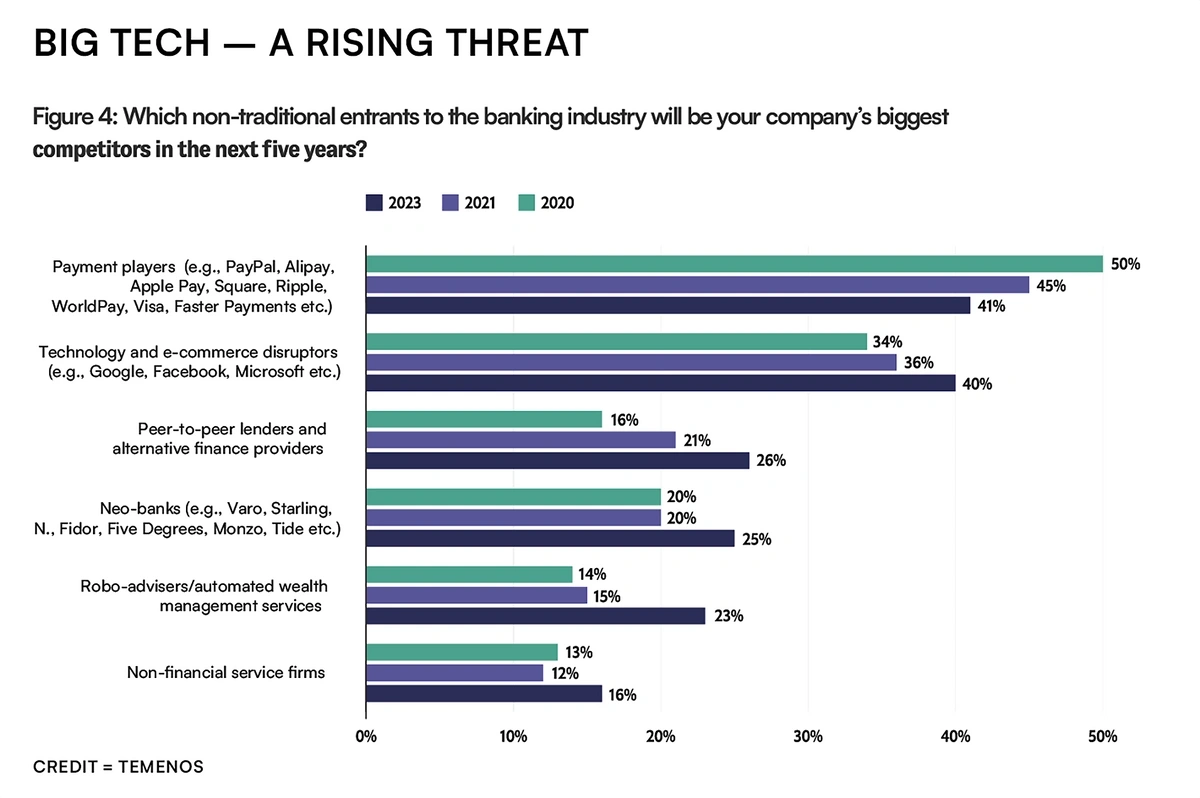

As the tech giants of the world gain more and more steady users, they are beginning to see value in providing financial services to their customers.

The different threats to traditional banks in the US.

Payments seem to be the first step for many big tech companies.

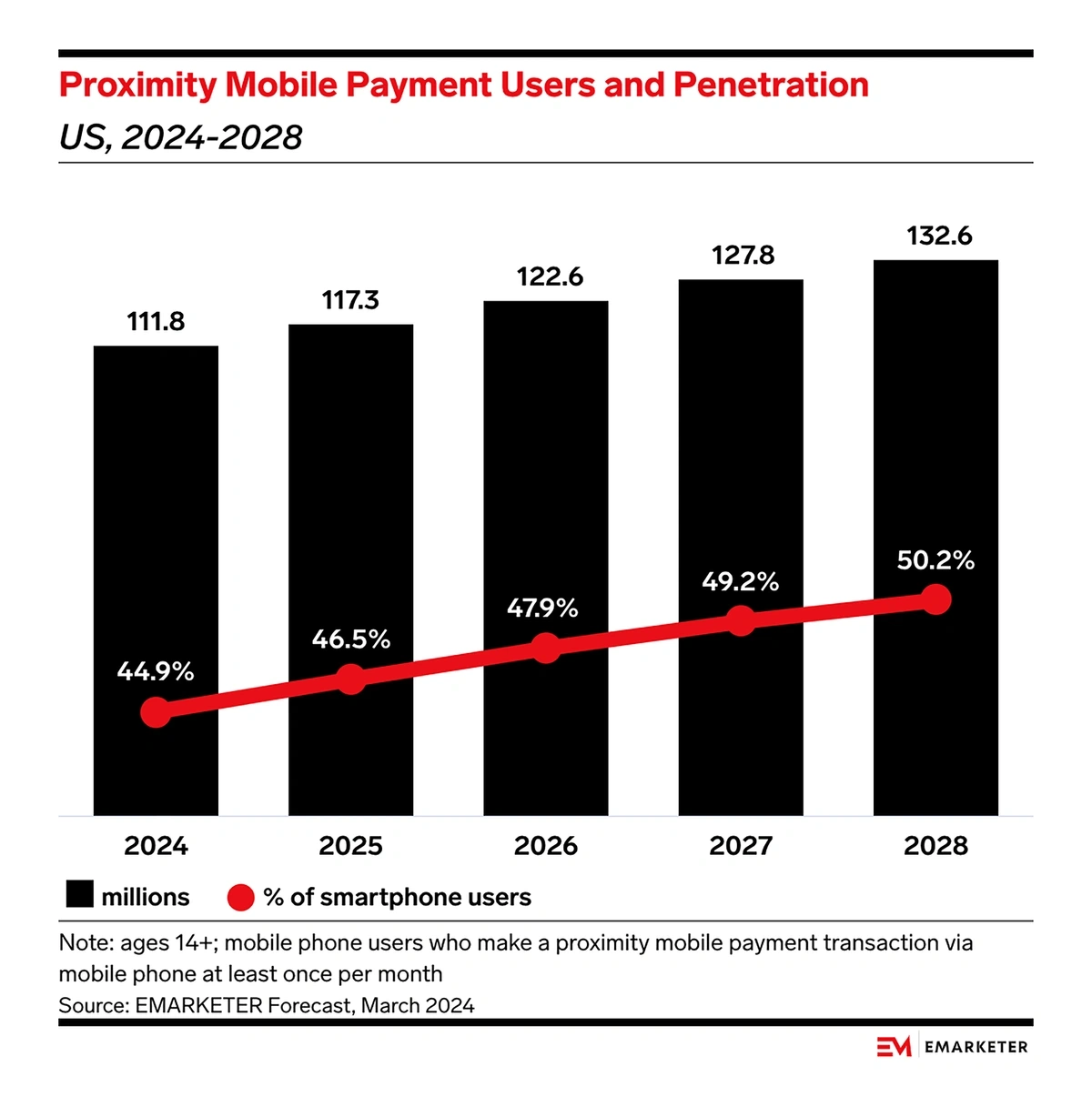

44.9% of US smartphone users aged 14+ already make proximity mobile payments at least once per month.

By 2027, the transaction value of proximity payments is expected to surpass $1 trillion.

As proximity mobile payment adoption increases, companies like Apple and Google see a chance to capture a part of the market.

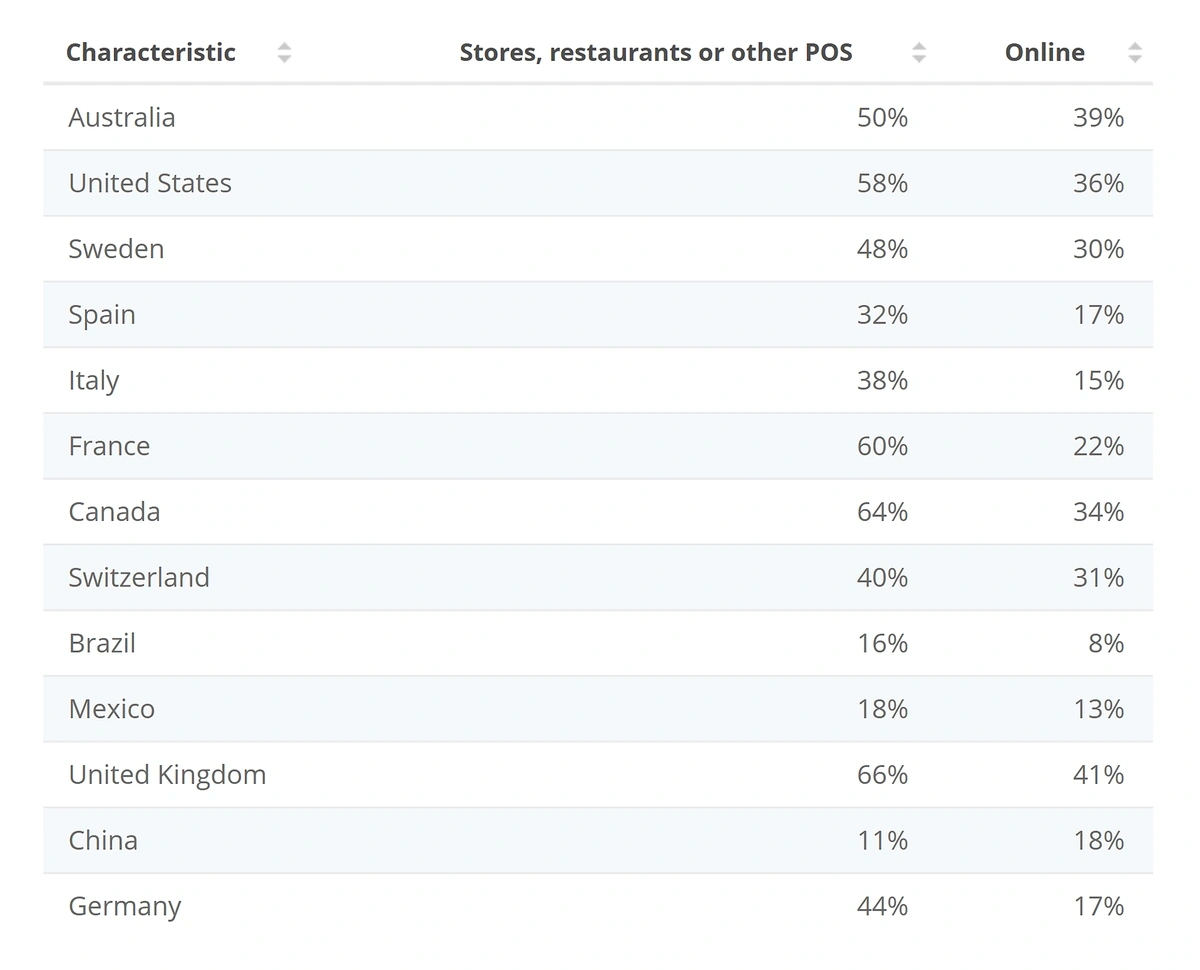

77% of Apple Wallet users will use Apple Pay to make proximity payments this year.

Search interest in "Apple Pay" has risen by 38% over the last 5 years.

Apple gets a small percentage of the transaction fees for every payment made. (Google Pay uses the same model).

But in the natural next step, Apple has launched its own Apple Card, in conjunction with Goldman Sachs.

Users get 2% cashback when using the Apple Card through Apple Pay.

This further cements the fact that tech giants like Apple hope to create their own banking environment, displacing traditional banks and other suppliers of credit.

With Apple Pay reaching 58% penetration for physical transactions within the US, they certainly have the infrastructure to do so.

Apple Pay has reached two-thirds penetration in the UK for POS transactions.

Google is also continuously making upgrades to its Google Pay platform.

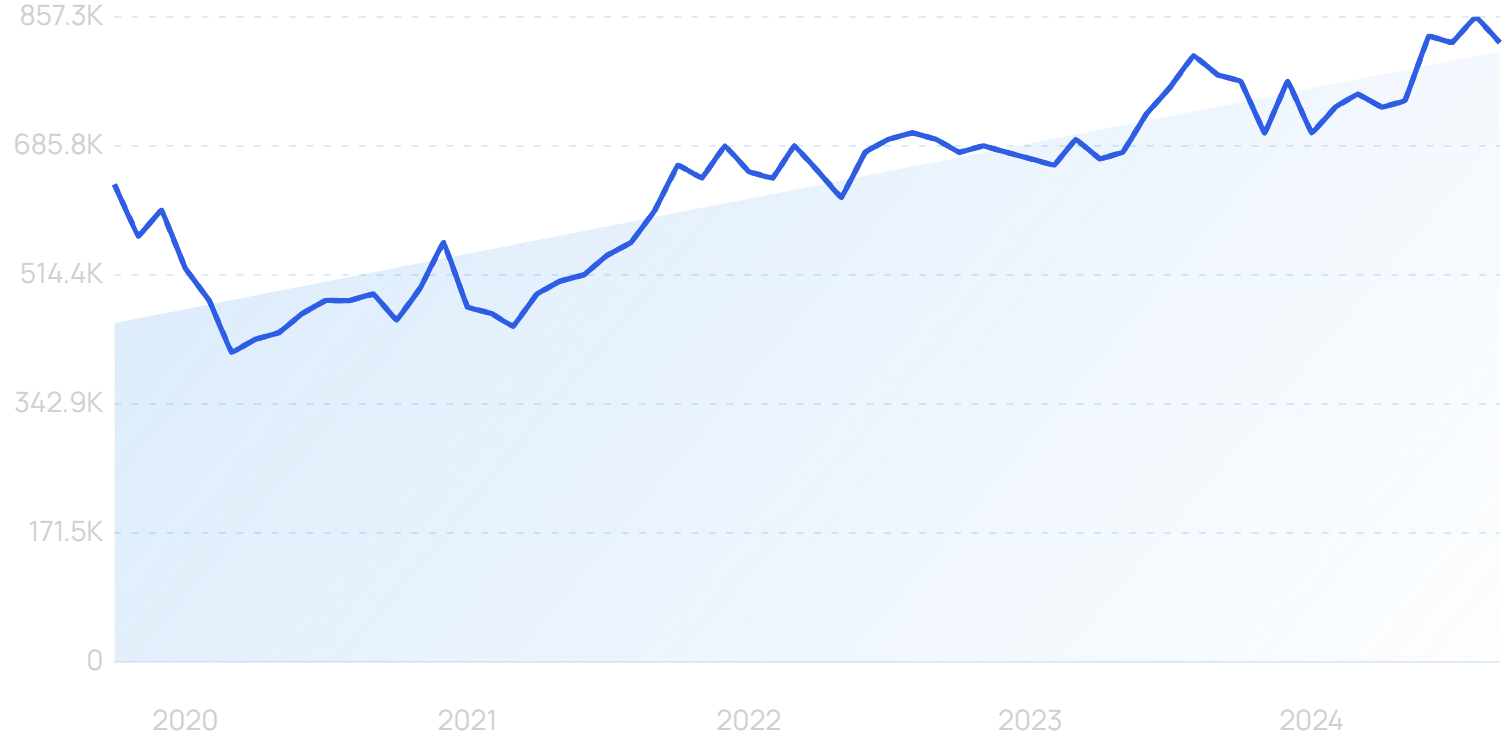

Searches for "Google Pay" have grown by 256% over the last 10 years.

Plans for “Google Plex”, which would have been a more direct banking rival, were dropped.

Instead, innovations in Google Pay have focused on partnerships with existing players. For instance, Capital One and American Express cardholders using the digital wallet can now compare rewards at the point of purchase.

But China might show the direction of travel for tech giants in the banking sector.

ECommerce giant Alibaba created Alipay back in 2004.

Searches for "Alipay" have increased by 74% over the last 5 years.

The app (now owned by Ant Group) is the world’s largest payment platform.

Over 100 million daily transactions pass through Alipay.

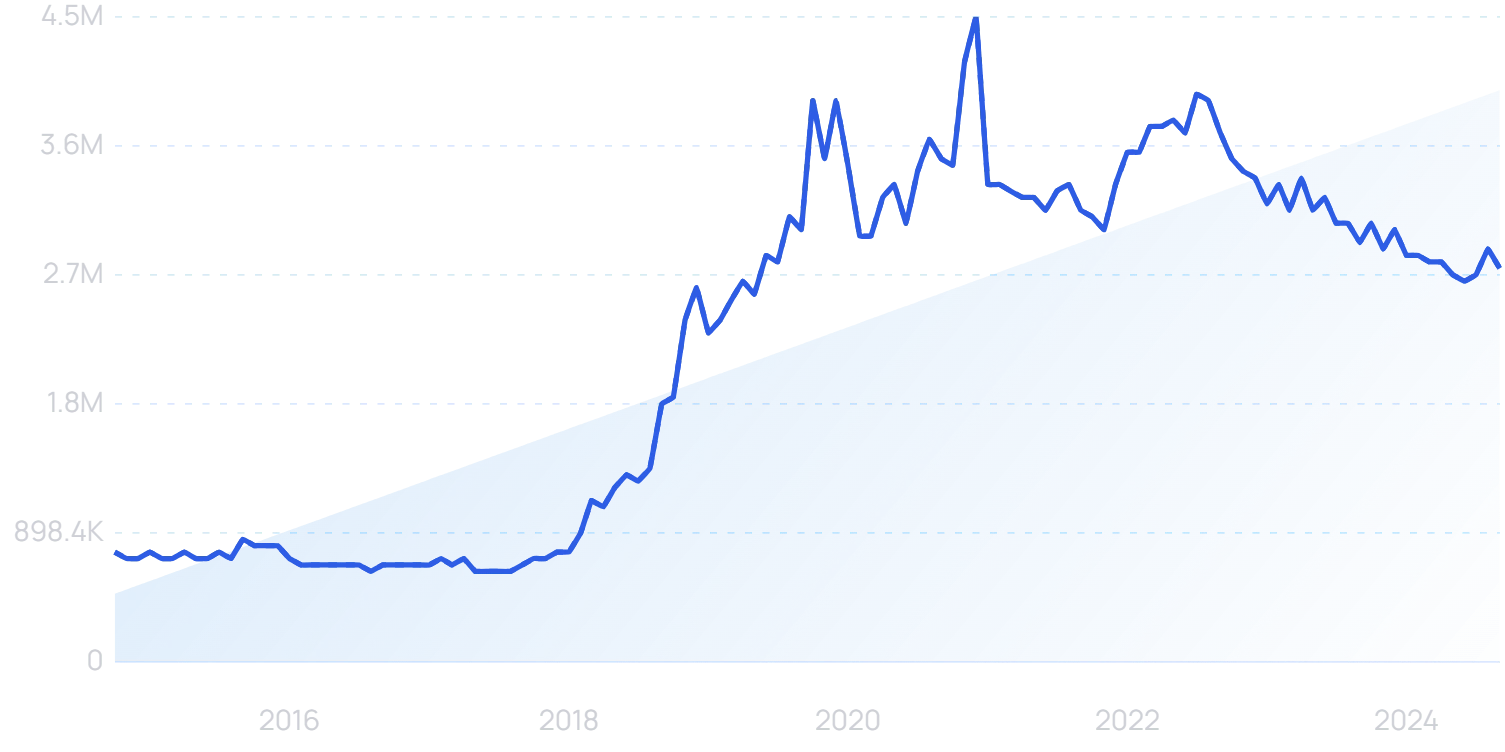

Tencent also has its own powerhouse payment app. Inside the popular WeChat app is something called WeChat Pay.

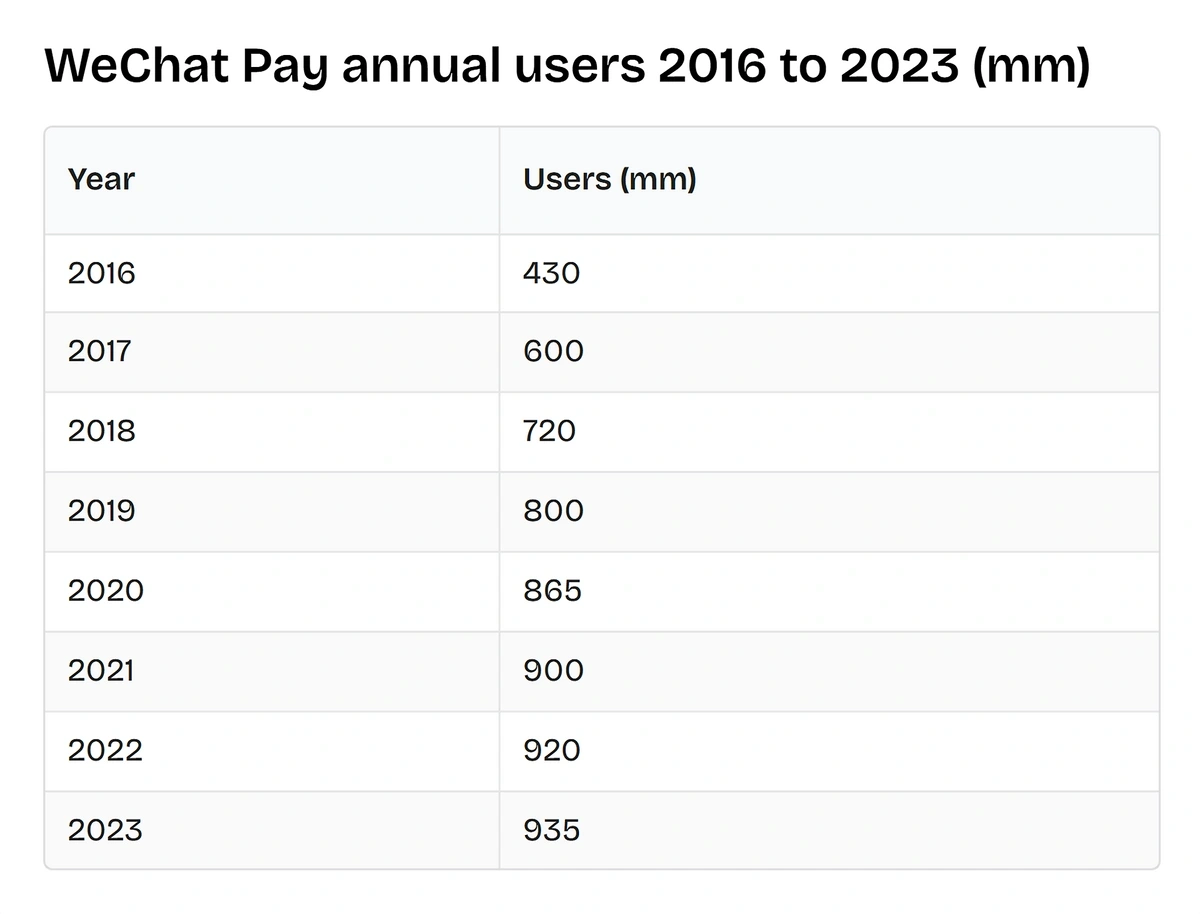

WeChat Pay currently has over 900 million users. That’s more than double the 430 million it had in 2016.

WeChat Pay user numbers by year.

To put this into perspective, WeChat Pay gained more users in the last five years than there are people living in the United States.

From all appearances, the largest Chinese companies are now a mixture of technology companies (social media, eCommerce, etc.), and banks.

And it looks like the US is going through a similar shift.

5. Banks Get Smarter In Financial Crime Crackdown

Banks have lost more than $3 billion due to cyber attacks in the last 20 years.

And nearly a fifth of all cyber incidents occur in the financial sector, with banks the most frequent target.

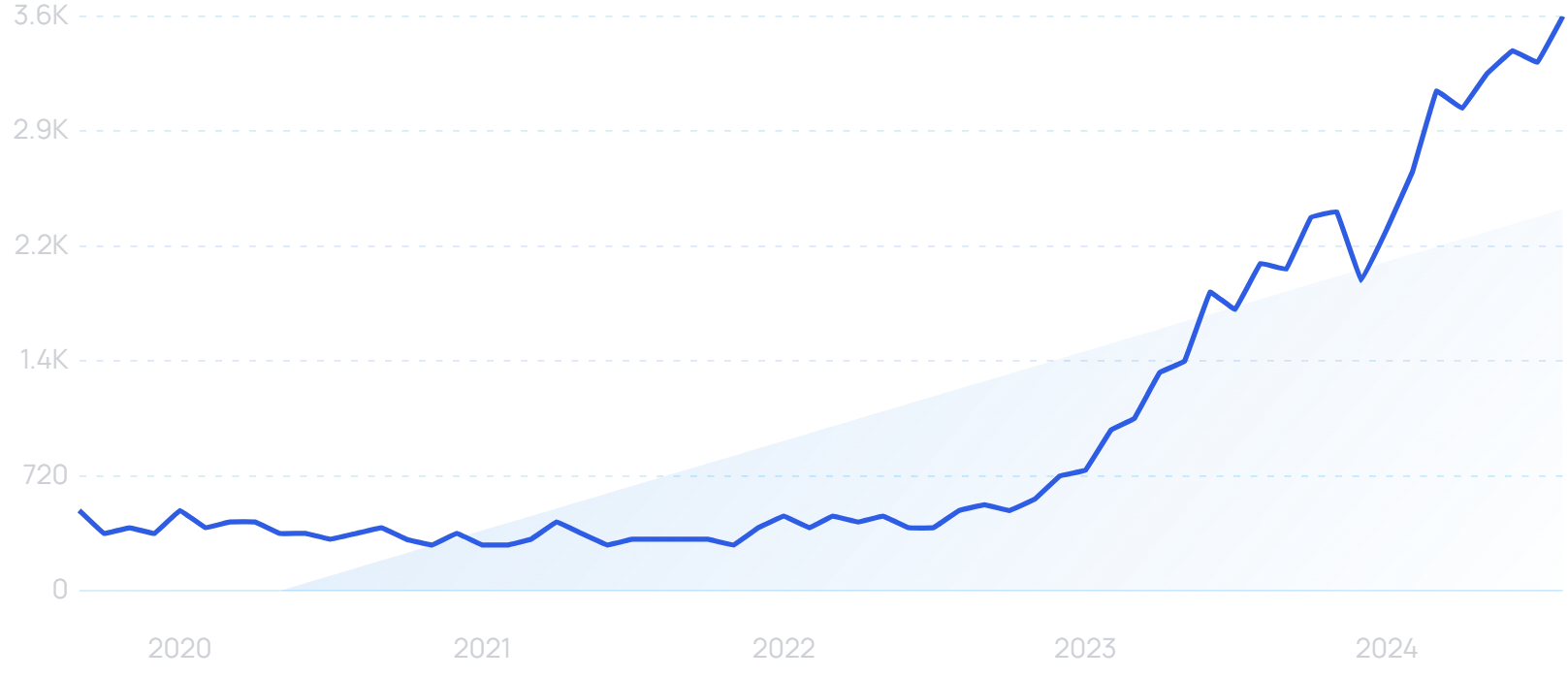

“Banking cybersecurity” searches are up 121% in 5 years.

But as fraud gets smarter, so must the banks.

60% of financial service industry professionals say that their organization has either already implemented AI for fraud prevention or else plans to do so within the next 18 months.

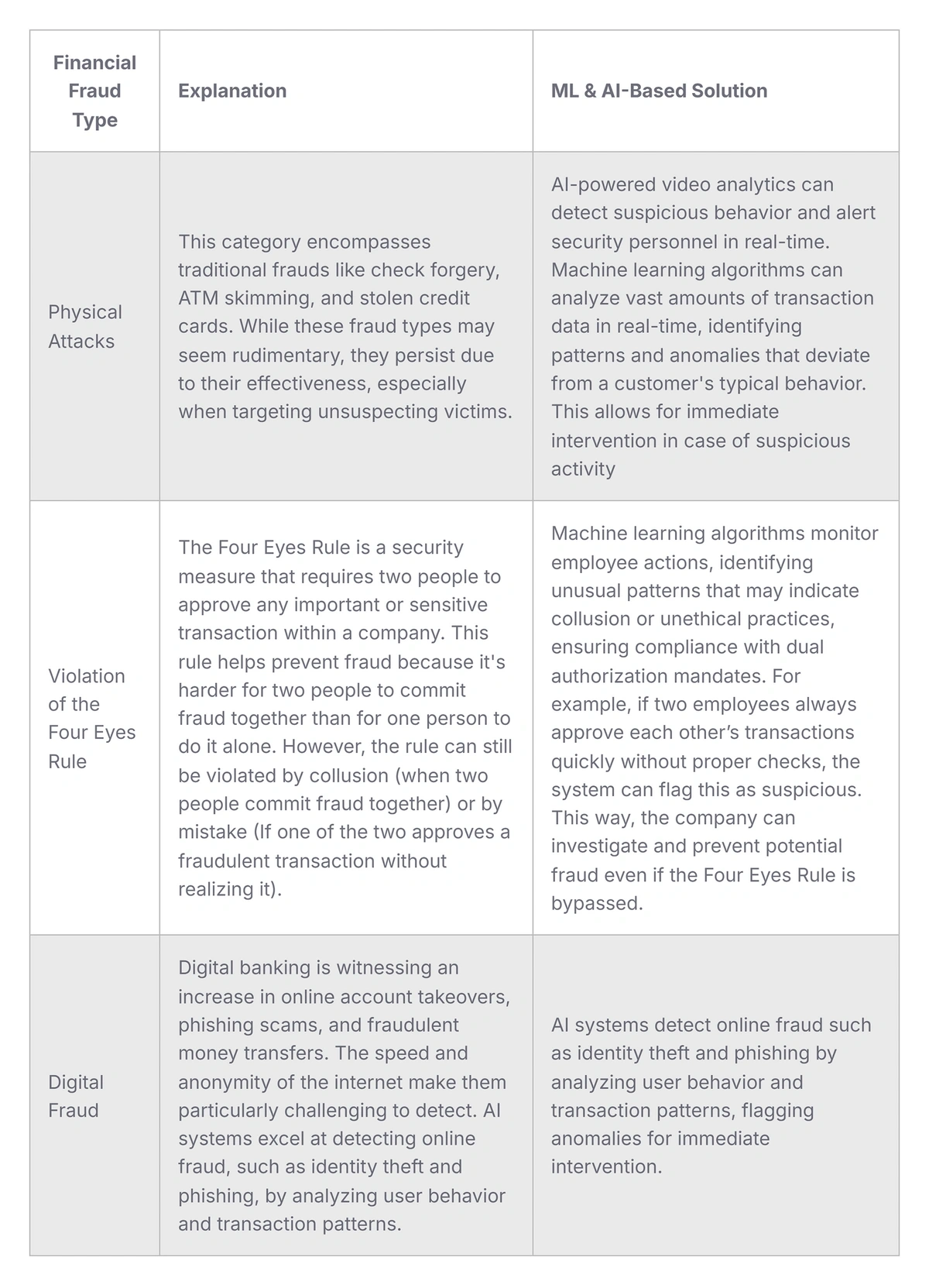

AI can help combat everything from more “traditional” fraud to sophisticated cyber attacks.

AI has a variety of fraud prevention applications for banks.

With the average cost of a data breach in the financial sector now $4.88 million, this is more important than ever. Organizations that adopt AI and automation extensively save an average of $2.22 million.

But not all solutions have to be especially high-tech. Cybersecurity training can be a hugely effective way for banks to protect themselves.

“Cybersecurity training” searches are up 260% in 5 years.

CybeReady runs simulations to ensure employees know how to guard against things like phishing attacks.

It may seem simple. But it boasts a 5x increase in resilience to cyber attacks, and reduces the pool of “high-risk” employees by 80%.

CybeReady is used by institutions like Westamerica Bank, ING and Raiffeisen Bank.

6. Banks Face Competition From An Increasingly Digital Payments Marketplace

A bank's role in the payments ecosystem is changing faster than ever before.

Obviously, the vast majority of businesses and consumers hold their fiat currency in a bank account somewhere. And the largest banks still control a lot of the financial plumbing.

But as more spending shifts into the digital environment, other providers and companies are becoming essential to the payment marketplace.

By 2027, Bain & Company predicts that emerging providers could capture 10% of banking revenues from small and medium business transactions worldwide.

The flip side of this, however, is that the overall payments market is growing, and that presents opportunities for banks.

For example, the same report forecasts a 6% annual growth rate for wholesale payment revenues, reaching $645 billion in the next three years.

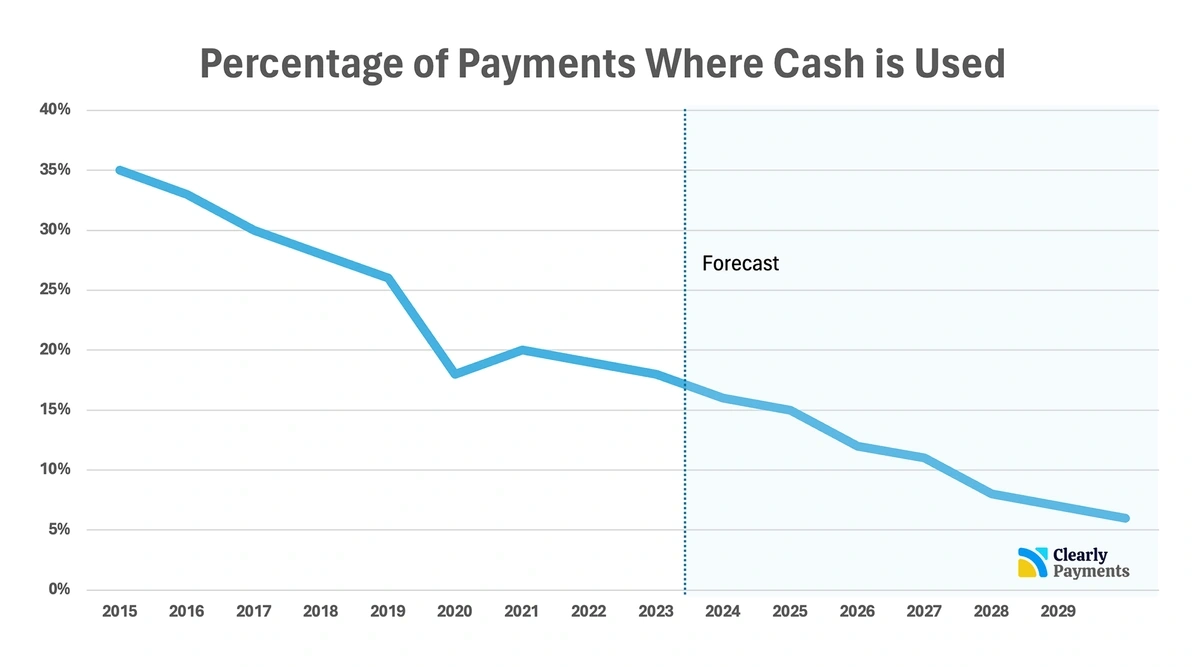

Obviously, fewer and fewer payments are being made by checks, cash, and money orders.

“Cashless” has seen 588% search growth over the last 15 years.

In North America, just 16% of payments are now made with cash.

The decline of cash payments is expected to continue.

This wedges banks further out of the payments ecosystem, making way for many new competitors.

Just look at how many non-bank companies are deeply embedded in the chain of payment processing.

The different levels of the payments ecosystem.

Meanwhile, eCommerce will account for 20.1% of all retail sales this year. That’s up from 18.8% in 2021.

All of this has led to an increased share of spend by mobile or digital wallets.

Spending from digital wallets already makes up about 30% of total POS transaction value. It’s the single biggest payment source ahead of credit cards, debit cards and cash.

And digital wallets are expected to account for half of all POS transactions by 2027.

Banks will have to adapt if they hope to capture a similar portion of consumers’ and businesses’ wallets in the future.

7. Fintech Partnerships With Banks Create Value

As much as banks and fintechs face off, it is becoming even more common for them to team up.

The two parties are now seeing that partnerships are more beneficial than competition or disruption.

Banks can use fintech products and offerings to become more efficient or acquire customers. And fintech companies typically require banks’ cheap sources of financing (deposits) and lending expertise.

Banks have an average of 9.4 fintech partners.

And 70% of banking executives view partnerships with fintech as at least a moderate driver of growth for the next few years.

Creating new products and services, increasing deposit account volume and reducing operational expenses were ranked as the top three reasons for partnering with fintech.

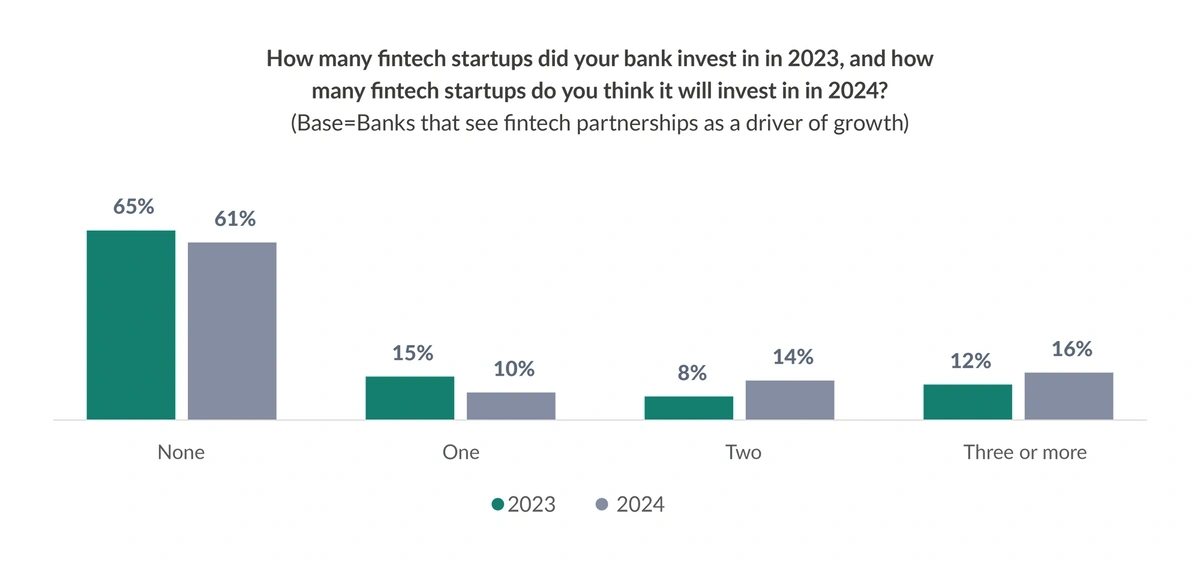

As well as partnering with fintech, banks are also investing in it.

J.P. Morgan and American Express invested in the most recent $425 million funding round for Plaid, embracing open banking.

And 40% of banks which view fintech as a driver of growth intend to make 1 or more investment in 2024.

The number of banks with an intention to invest in fintech is rising.

This relationship also goes both ways.

Many banks are in relationships with multiple fintechs and other startups, helping them navigate the tricky global financial system.

Partner banks, as they are known, have grown steadily in recent years.

Some of the largest banks in America see value in these partnerships. And many more will likely follow their lead in the future.

Fintech partnerships with the largest banks in the US.

As banks and fintechs start to see more value from their combined operations, expect more partnerships and acquisitions to occur.

Conclusion

That’s all for the top banking trends impacting the financial world right now.

Overall, technology is transforming how financial services work. And almost everyone is angling for a spot.

Whether it’s one of the world’s largest tech companies or a fintech startup, the merging of technology with banking is driving this industry forward.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more