Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

19 Thriving Hedge Fund Companies & Startups (2024)

You may also like:

The projected market size for assets under management in U.S. hedge funds is $5.37 trillion by the year 2028. This year alone it's scheduled to hit $4.7 trillion and grow at a CAGR of 3.14%.

With the onset of cryptocurrency hedge funds, hedge fund managers are now creating new investment strategies, investment funds, and hedge fund startups.

We’ve rounded up some of the best hedge fund startups to keep an eye on in 2024.

1. Titan

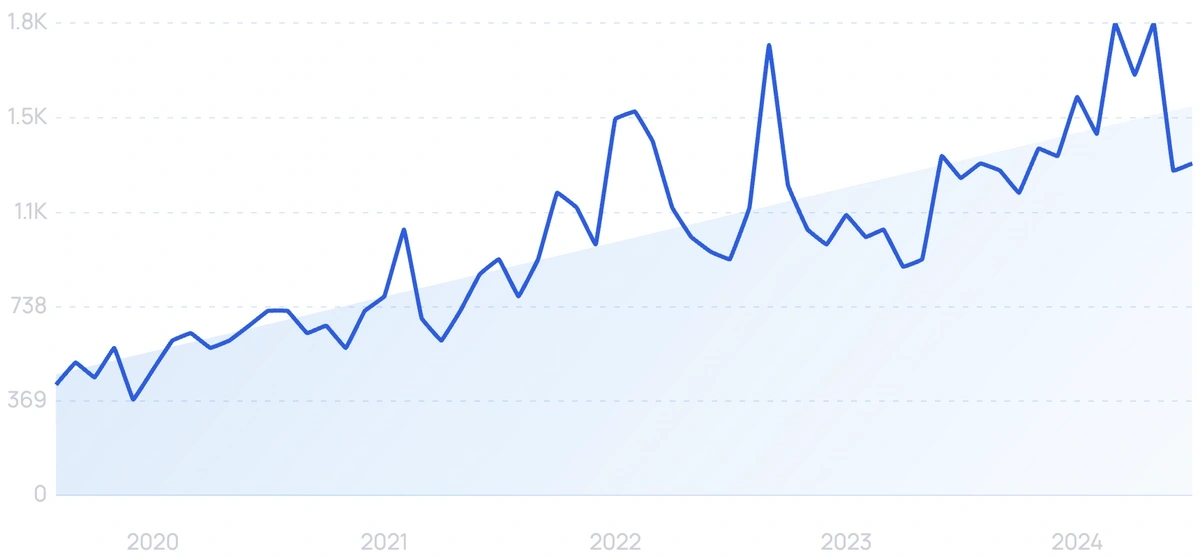

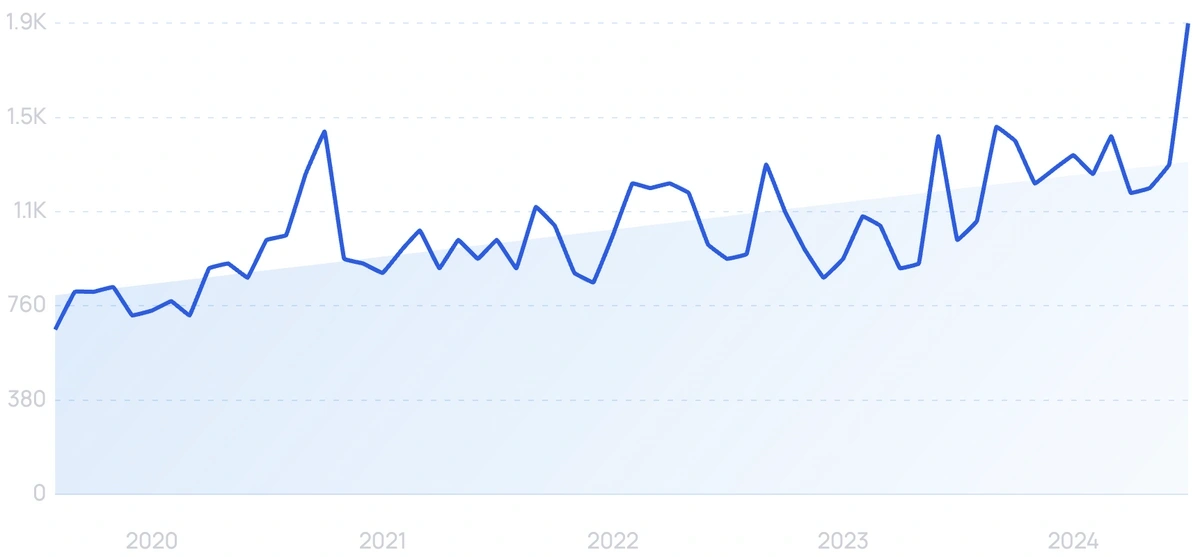

5-year search growth: 116%

Search growth status: Exploding

Year founded: 2018

Location: New York, NY

Funding: $73M (Series B)

What they do: As an investment firm, Titan offers capital management services through experienced institutional investors. The company claims to have veteran Wall Street investors, money managers, and fintech experts drive its investment management services. According to their website, Titan works with over 50,000 clients, managing $1B+ in assets and investments.

2. GenesisAI Corporation

Search growth status: Exploding

Year founded: 2018

Location: Boston, MA

Funding: $5.1M (Series A)

What they do: A machine learning protocol, GenesisAI is working towards providing a central marketplace for AI services. The company offers various machine learning AI models to organizations that want to make use of AI tech, such as fintech companies. According to users, GenesisAI models help develop investment models and strategies for hedge funds. In July 2021, GenesisAI raised more than $2.5M in private equity funds.

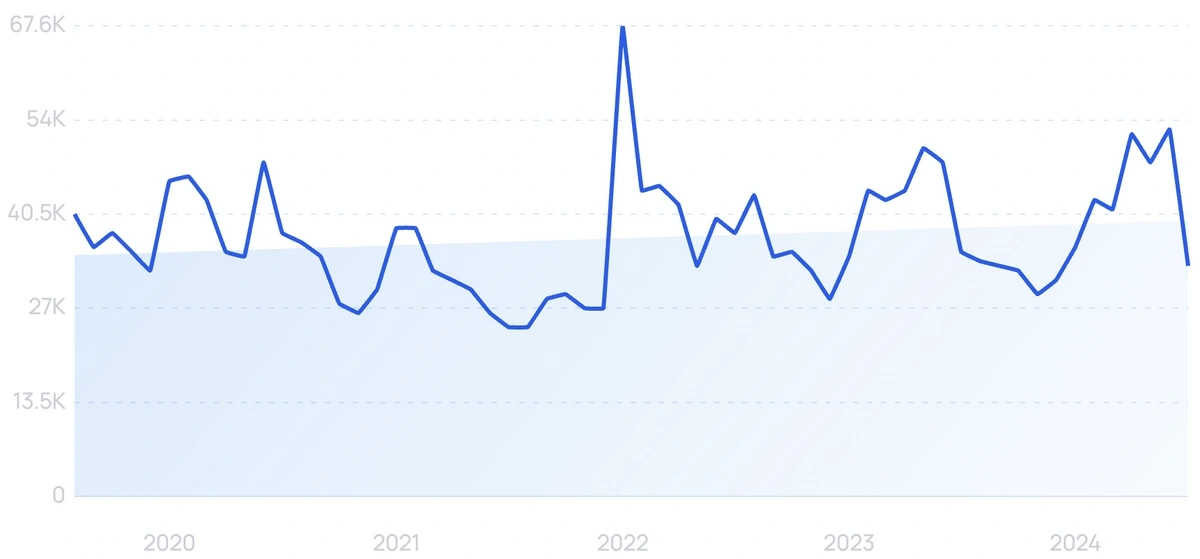

3. Betterment

5-year search growth: 1%

Search growth status: Regular

Year founded: 2008

Location: New York, NY

Funding: $435M (Debt Financing)

What they do: Betterment is an investment company and money management software that provides robo-advising services. The company aims to minimize investment risk and volatility through diversified investing. Their app enables users to track their investments, finances, and taxes to make informed financial decisions. In September 2021, Betterment secured $60M in a Series F funding round.

4. CAIS

5-year search growth: 35%

Search growth status: Exploding

Year founded: 2009

Location: New York, NY

Funding: $406M (Private Equity)

What they do: CAIS is a fintech platform that aims to be the leading hub for alternative investments. As an open marketplace, it allows asset managers, investment advisors, and private equity investors to engage with customers, as well as with one another. The platform’s investment options include hedge funds, structured notes, and private real estate. CAIS announced in November 2020 that the startup received $100M in private equity funding from Reverence Capital Partners.

5. Squarepoint Capital

5-year search growth: 102%

Search growth status: Regular

Year founded: 2014

Location: New York, New York

Funding: Undisclosed

What they do: Squarepoint Capital is a global investment management firm that takes a quantitative finance approach to investing. It's estimated this firm has $126.5 billion in assets under management.

6. Polygon.io

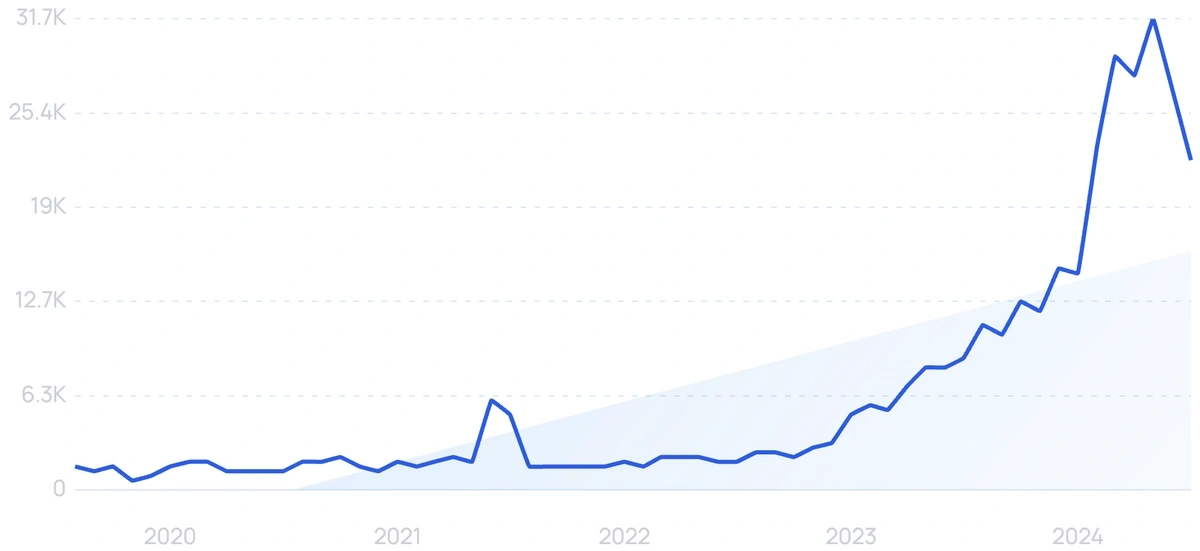

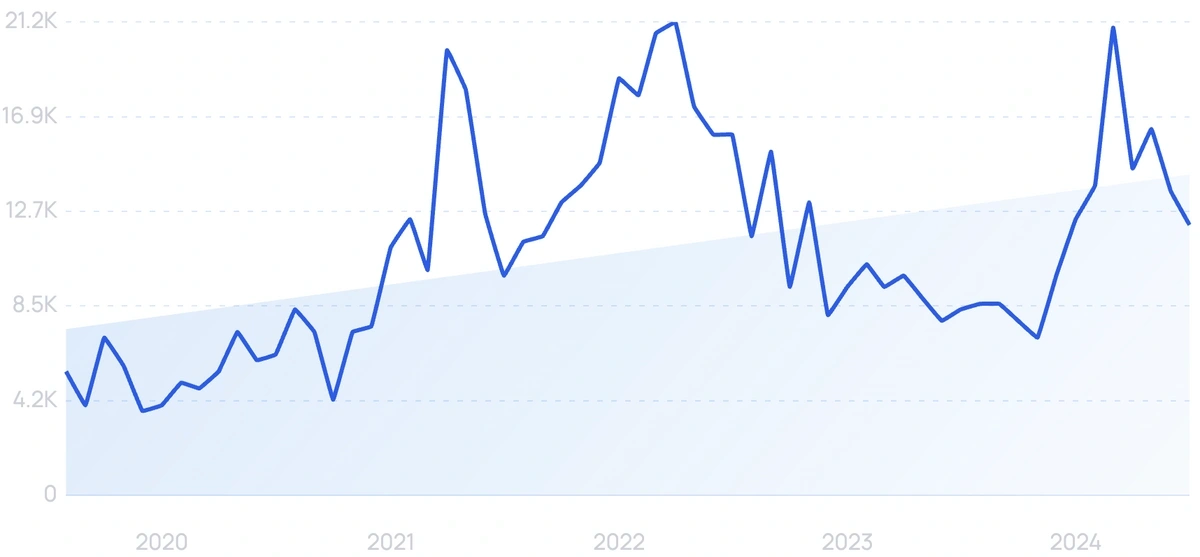

5-year search growth: 9,100%

Search growth status: Regular

Year founded: 2016

Location: Atlanta, Georgia

Funding: $6M (Series A)

What they do: Polygon is a tech startup that provides real-time and historical financial data to developers. This capability enables customers to integrate this data into their applications, primarily serving the financial markets sector. The startup aims to "modernize Wall Street" by making institutional-level data more accessible. In 2023, Polygon ranked #738 in the Inc. 5000.

7. SumZero

5-year search growth: 186%

Search growth status: Exploding

Year founded: 2008

Location: New York, NY

Funding: $1M (Seed)

What they do: SumZero is an online community for professional investors and capital partners. Users can find peer-reviewed investment research and buy-side ideas to invest in hedge funds. SumZero runs on a post-or-pay method. Users can either pay for, or post, unique hedge funds and asset management research to gain access. In 2020, Alpha Sigma Capital partnered with SumZero to offer cryptocurrency research on the platform.

8. Pantera Capital

5-year search growth: 118%

Search growth status: Regular

Year founded: 2003

Location: Menlo Park, California

Funding: Undisclosed

What they do: Pantera Capital is an investment fund focused on blockchain technology, digital currencies, and crypto assets. Currently, the firm manages over $4.2 billion in assets across multiple crypto funds, including 100+ blockchain companies and 110+ early-stage token investments.

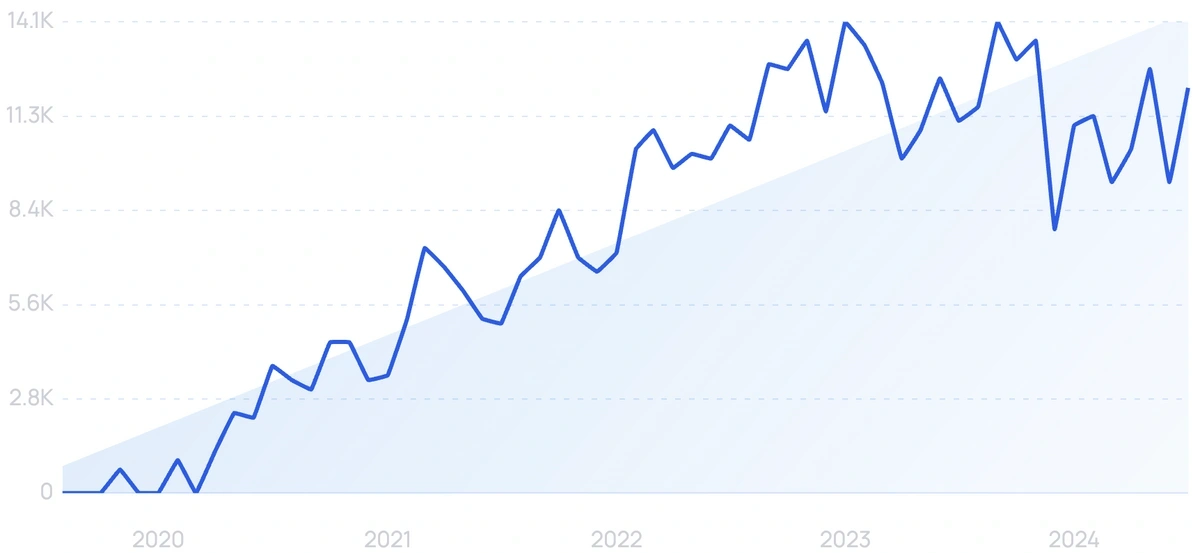

9. Preqin

5-year search growth: 245%

Search growth status: Exploding

Year founded: 2003

Location: London, United Kingdom

Funding: Undisclosed

What they do: Preqin provides data, analytics, and insights for the alternative assets industry. The platform covers alternative asset classes such as private equity, venture capital, hedge funds, private debt, and more. In total, Preqin can track performance data for over 53,300 funds. In July 2024, Blackrock acquired the startup for $3.2 billion.

10. Allocator

5-year search growth: 25%

Search growth status: Regular

Year founded: 2013

Location: London, England

Funding: Undisclosed (Seed)

What they do: Allocator provides integrated data and software solutions to the alternative investments industry. The startup collects and validates data reported by General Partners (GPs) using a proprietary data technology platform. The company works with some of the top limited partners globally and aims to make information more accessible between fund managers and investors.

11. Inbestme

5-year search growth: 5,900%

Search growth status: Exploding

Year founded: 2013

Location: Barcelona, Spain

Funding: $5.7M (Equity Crowdfunding)

What they do: Inbestme is an automated portfolio manager and wealth management startup. The platform provides personalized investment plans using index funds, ETFs, and pension plans. Currently, the startup supports over 3,400 customer accounts and $95M in assets under management.

12. CapShift

Search growth status: Exploding

Year founded: 2018

Location: West Newton, MA

Funding: $9.6M (Series Unknown)

What they do: CapShift is an investment firm that offers investment solutions to small and medium-sized businesses. Its goal is to provide capital investments based on a business’s values, goals, and objectives. The firm’s services include investment research, partnerships, sourcing, and reporting. In July 2024, CapShift raised $2.6 million in a venture round.

13. Polychain

5-year search growth: 50%

Search growth status: Regular

Year founded: 2016

Location: San Francisco, CA

Funding: $10M (Seed)

What they do: Polychain Capital is an investment firm that focuses on the blockchain asset class and cryptocurrency investments. The company participates in hedge funds and venture capital investments, investing in companies like Tezos and Kik Messenger.

They utilize mathematical properties in their processes, such as game-theoretic equilibrium and cryptographic verification. Currently, Polychain has $6.6B in assets under management (AUM).

14. Delphia

5-year search growth: -32%

Search growth status: Peaked

Year founded: 2018

Location: Toronto, Canada

Funding: $79.5M (Series A)

What they do: Delphia is building an algorithm that chooses stocks for investors. It aims to be a single investment strategy any user can utilize to improve their investments. According to their website, their process works by collecting users’ data, making improved predictions based on that data, adjusting investments, and improving their algorithm. In 2019, Delphia raised $15.4M from Black Jays Investments and 10 other investors.

15. Syfe

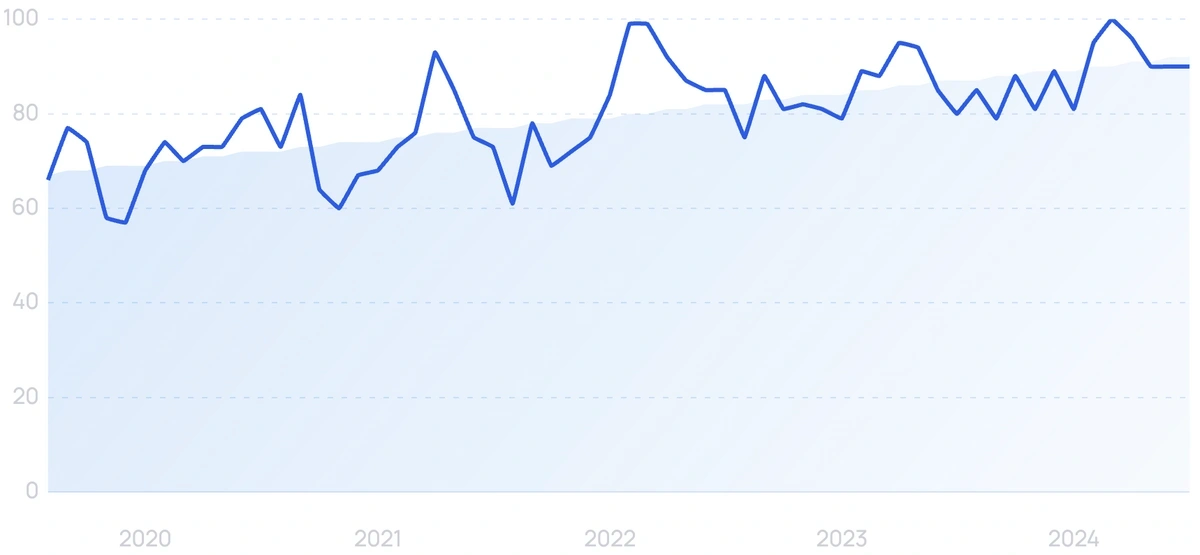

5-year search growth: 450%

Search growth status: Regular

Year founded: 2017

Location: Singapore, Singapore

Funding: $51.9M (Series B)

What they do: Syfe is an investment platform that lets users invest in managed portfolios and individual stocks. The startup provides curated, risk-managed portfolios managed by wealth experts, as well as investment solutions to earn higher returns on idle cash. Syfe currently has over 100,000 investors using their platform.

16. Romano Capital

Search growth status: Peaked

Year founded: 2003

Location: Vancouver, WA

Funding: Undisclosed

What they do: Specializing in real estate investments, Romano Capital aims to provide various alternative investment opportunities. Their investments range from land and commercial developments to housing units. Customers can invest in diversified perpetual evergreen investment funds or project-based offerings, based on their interests. In October 2020, Romano Capital raised $650M.

17. Axoni

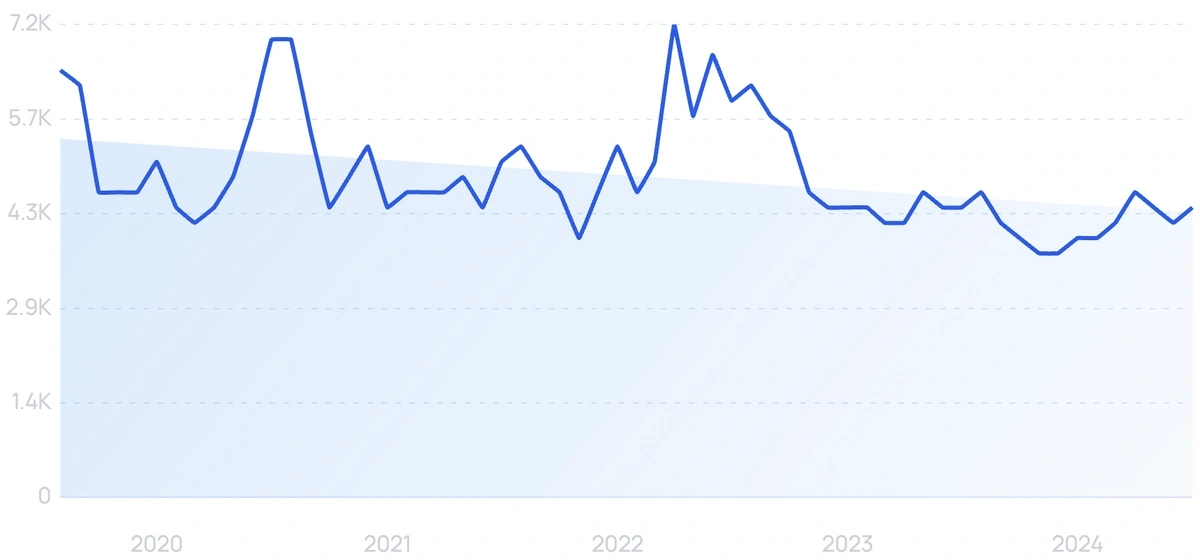

5-year search growth: -67%

Search growth status: Peaked

Year founded: 2013

Location: New York, NY

Funding: $109.8M (Series Unknown)

What they do: Based on a blockchain infrastructure, Axoni offers network and infrastructure services for hedge funds and financial services companies. The company claims that its infrastructure can synchronize information across fund markets in real-time. Enterprise customers are also offered workflow automation for complex ledger deployments. In 2019, Axoni was listed in the Forbes Fintech 50 list.

18. Damex (Digital Asset Management EXperience)

5-year search growth: 40%

Search growth status: Peaked

Year founded: 2017

Location: Gibraltar, Gibraltar

Funding: $1.7M (Equity Crowdfunding)

What they do: As a digital asset servicing firm, Damex assists with crypto payments and asset tokenization. The company aims to provide a payment gateway that will enable online businesses to accept cryptocurrencies. Damex also offers an OTC platform, cross-border settlements, and smart contract management. According to their website, the startup works with over 350 merchants worldwide, with over $1B traded since 2019.

19. Divina Capital

Search growth status: Peaked

Year founded: 2020

Location: Amsterdam, The Netherlands

Funding: $425K (Seed)

What they do: As a collective investment fund, Divina Capital offers hedge fund investment opportunities for individuals and corporations. Their offerings are designed for institutional investors, corporations, and customers who need independent asset managers. The fund offers various participation classes depending on how much a customer wants to invest.

Conclusion

That concludes our list of the top hedge fund startups going strong in 2024.

The advent of AI and machine learning has paved the way for unique early-stage hedge fund startups. Furthermore, with blockchain technology and cryptocurrencies taking off, we’re beginning to see diverse startups in the industry.

As new investment opportunities and asset classes develop, the hedge fund industry should continue to adapt, leading to unique hedge fund startups.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more