Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Booming Wealthtech Companies & Startups In 2024

You may also like:

- 20 Trending Personal Finance Startups

- 19 Thriving Hedge Fund Startups

- 76 Top Fintech Companies & Startups

With the rise of smartphones and finance apps over the last decade, wealthtech has exploded.

Today’s financial consumers expect seamless, smooth research and investing options from their smartphones.

The wealthtech sector has grown tremendously and Allied Market Research projects that this space will balloon to $18.6 billion by 2031.

Check out our list of the top wealthtech startups that are putting financial power in the pockets of people around the globe.

1. OctaFX

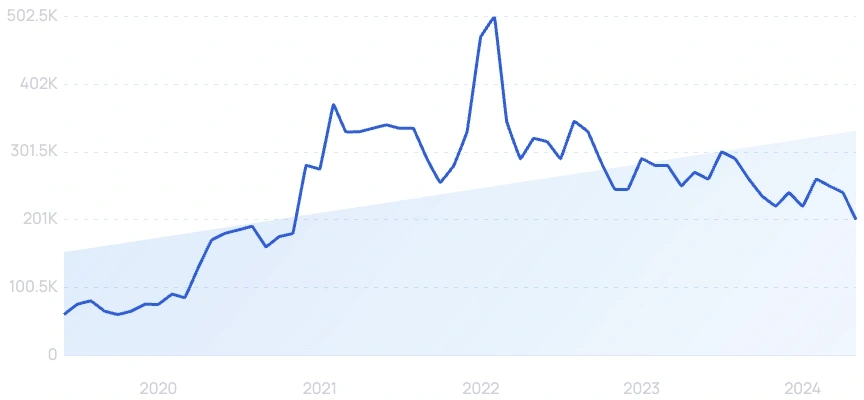

5-year search growth: 233%

Search growth status: Regular

Year founded: 2014

Location: London, England

Funding: Undisclosed

What they do: OctaFX is an online forex and CFD trading broker that provides clients with access to a range of financial markets. The broker offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies, and provides clients with access to powerful trading platforms and a range of educational resources.

OctaFX is known for its transparent and fair trading conditions, low minimum deposit requirement, and excellent customer support, making it a popular choice among traders looking for an accessible and user-friendly online trading experience.

2. Betterment

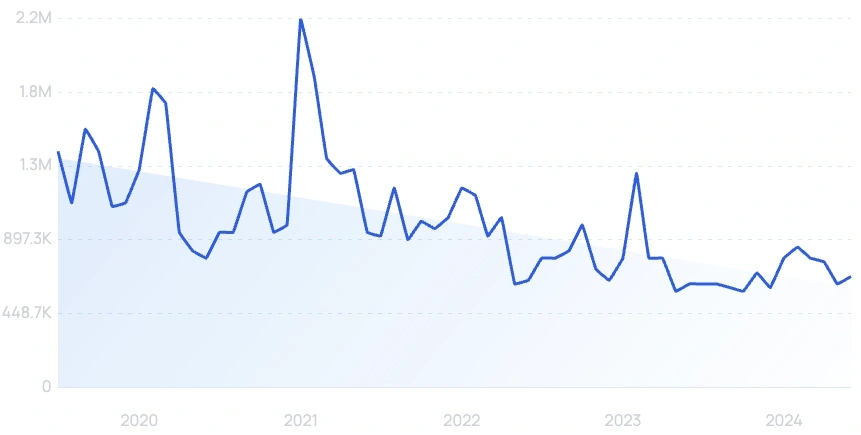

5-year search growth: -28%

Search growth status: Regular

Year founded: 2008

Location: New York, NY

Funding: $435M (Debt Financing)

What they do: Betterment was founded in 2008, making it the oldest on our list of wealthtech startups. With over $21B under management, it’s also one of the largest retirement account companies. That’s because they provide IRA, ROTH, and rollover 401(k) programs in the app.

With a money management fee of .25%, Betterment has helped open up financial planning to everyday smartphone users, allowing a diversified selection of equity and bond choices for different age groups and risk tolerances.

3. Agicap

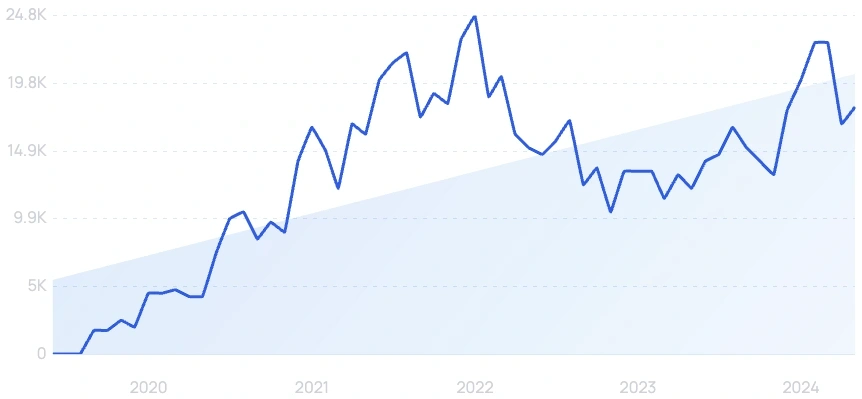

5-year search growth: 1,267%

Search growth status: Regular

Year founded: 2016

Location: Lyon, France

Funding: $118.9M (Series B)

What they do: Agicap is a French fintech company that provides cash flow management software to SMEs. The company's platform helps businesses to easily and accurately forecast, analyze and optimize their cash flows. Agicap strives to assist businesses in saving time and making better financial decisions.

4. Endowus

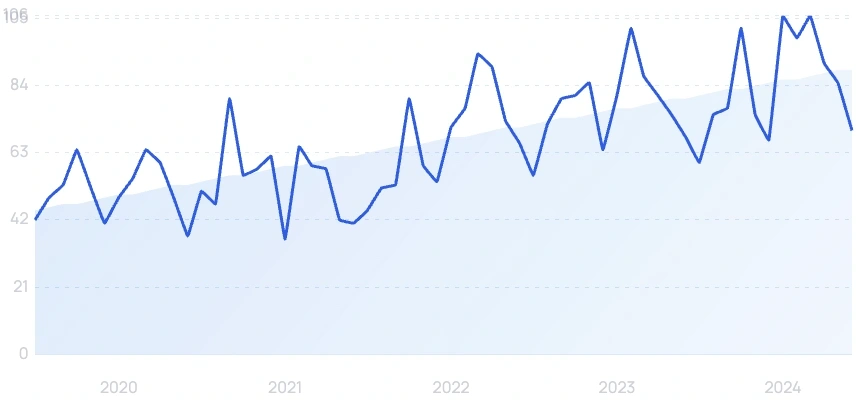

5-year search growth: 7,200%

Search growth status: Regular

Year founded: 2016

Location: Singapore, Singapore

Funding: $79.3M (Series C)

What they do: Endowus is a Singapore-based wealth management platform that serves as a digital advisor for CPF, SRS, and cash savings. This startup operates as an independent, fee-only firm, meaning it is solely paid by its clients and not by product providers.

Investors using the Endowus platform can access over 400 best-in-class funds from 50+ global fund managers. Currently, the company has over $5 billion in group assets.

5. Cadre

5-year search growth: 26%

Search growth status: Regular

Year founded: 2014

Location: New York, NY

Funding: $133.3M (Convertible Note)

What they do: Similar to Fundrise and YieldStreet, Cadre gives mainstream investors the ability to build a customized commercial real estate portfolio. Because real estate is not highly correlated to stocks or bonds, Cadre argues that everyone should have exposure to the real estate asset class in one form or another. With a highly transparent digital platform that provides analytics and clarity on investments and low fees, Cadre’s popularity has skyrocketed as folks look to invest in real estate without the offline paperwork.

6. Stash

5-year search growth: -9%

Search growth status: Regular

Year founded: 2015

Location: New York, NY

Funding: $520M (Convertible Note)

What they do: Stash operates as a subscription service (ranging from $1 to $5/month) that provides comprehensive financial advice and the ability to purchase a wide range of equities and custom diversified funds in an easy-to-understand format. Stash’s fluid, seamless user experience, combined with quality descriptions around equities and ETFs, opens up the door for amateur investors to get started.

7. Upgrade

5-year search growth: 75%

Search growth status: Regular

Year founded: 2016

Location: San Francisco, CA

Funding: $587M (Series F)

What they do: Upgrade is a relatively straightforward wealthtech startup, providing clarity around personal loans and a streamlined process for approval. The Upgrade card is their unique value proposition, providing users with 1.5% cashback on all purchases while also allowing customers to pay down the monthly balance at a fixed rate with standard monthly payments. Basically, Upgrade combines the predictability of a loan with the flexibility of a credit card.

8. DriveWealth

5-year search growth: 41%

Search growth status: Regular

Year founded: 2012

Location: Jersey City, NJ

Funding: $550.8M (Series D)

What they do: DriveWealth is a US-based fintech company that provides a technology platform to enable global investment access for retail investors. The company provides APIs and white-label solutions to partners to offer investment services to their customers with features such as fractional share ownership, low-cost trading, and portfolio customization. With its platform, DriveWealth aims to democratize investing by making it affordable and accessible to all.

9. Toggle AI

5-year search growth: 346%

Search growth status: Regular

Year founded: 2019

Location: New York, NY

Funding: $12.8M (Series A)

What they do: Toggle AI is a wealthtech startup that offers a range of AI-powered investment solutions for retail and institutional investors. The platform leverages machine learning algorithms and natural language processing to help investors make informed decisions about their portfolios. Toggle AI also offers personalized investment recommendations based on each investor's risk tolerance and investment goals.

10. Catch

5-year search growth: 64%

Search growth status: Regular

Year founded: 2017

Location: New York, NY

Funding: $18.1M (Series A)

What they do: Catch is attempting to solve the massive problem around benefits for entrepreneurs, freelancers, contractors, and employees. As Catch describes it, they focus on four main areas: taxes, health insurance, retirement, and savings. Automatic withholding is one of their core products, allowing a single payment to the IRS and taking the pain out of accounting for paychecks and projects done over the course of a year. A customized “check-up” allows Catch to make personal recommendations and set users up with the benefit plan most applicable to their unique situation.

11. Vise

5-year search growth: 61%

Search growth status: Regular

Year founded: 2016

Location: New York, NY

Funding: $128M (Series C)

What they do: Vise allows financial advisors to harness AI to build customized, 1:1 portfolios that are unique to every client. Their secret sauce is a portfolio engine that constructs a financial profile and suggests investments based on a client’s situation. After that, Vise helps clients see the reason behind investments with insights and analytics so they understand the “why” behind the AI. How do they do it? Vise integrates with custodians and imports client data, which allows the digital platform to automatically handle the trading and management of assets.

12. Asset-Map

5-year search growth: 76%

Search growth status: Regular

Year founded: 2013

Location: Philadelphia, PA

Funding: $7.6M (Series B)

What they do: Asset-Map is a wealthtech organization that provides financial advisors with an interactive and personalized visualization tool for their clients' financial portfolios. With Asset-Map, advisors can create dynamic financial maps that enable their clients to easily understand and visualize their assets, liabilities, and overall financial health. The platform also allows advisors to identify opportunities for portfolio optimization and growth, while providing a holistic view of their clients' financial plans.

13. BondIT

5-year search growth: 107%

Search growth status: Regular

Year founded: 2012

Location: Tel Aviv, Israel

Funding: $32.5M (Series C)

What they do: BondIT is a fintech company that offers a suite of fixed-income portfolio management solutions for financial advisors, wealth managers, and banks. Using its proprietary algorithms, BondIT provides investment recommendations and automated portfolio construction tools to help advisors optimize their clients' portfolios while minimizing risk. The platform also offers advanced analytics and reporting capabilities to help advisors monitor their clients' portfolios and make informed investment decisions.

14. StartEngine

5-year search growth: 14%

Search growth status: Regular

Year founded: 2014

Location: West Hollywood, CA

Funding: $90.8M (Crowdfunding)

What they do: StartEngine aims to open up the word of seed investing to the masses, and so far they’ve raised over $500M on their platform and surpassed 1 million users. In short, StartEngine is opening up a space that’s typically reserved for well-heeled Silicon Valley venture capital firms or professional angel investors.

15. Altruist

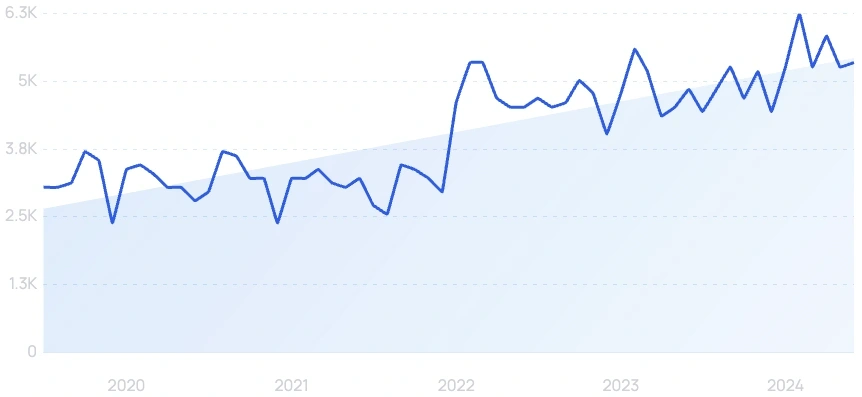

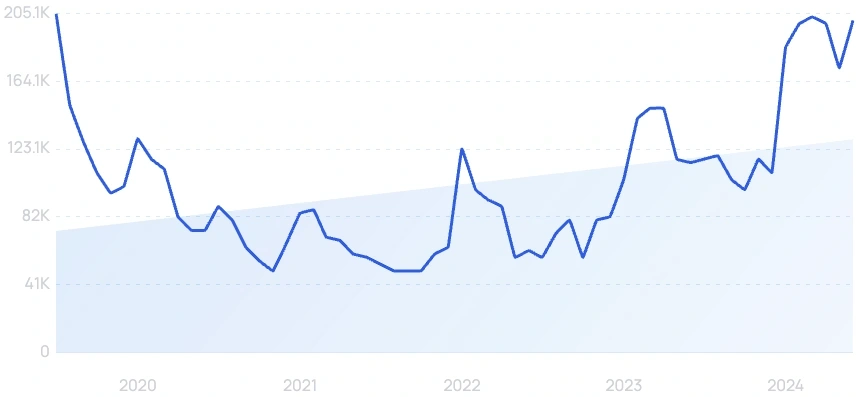

5-year search growth: 184%

Search growth status: Exploding

Year founded: 2018

Location: Culver City, CA

Funding: $449..5M (Series E)

What they do: Altruist is somewhat different from other wealthtech startups on this list, as they provide software to financial advisors (not consumers) that allow a 360-degree view of a client's financial health. Along with access to fractional shares and other tools designed to help manage their client’s portfolio. Compared to many competing options, Altruist’s software is relatively cheap. Which has helped the platform grow quickly.

16. Acorns

5-year search growth: -45%

Search growth status: Peaked

Year founded: 2012

Location: Irvine, CA

Funding: $510M (Series F)

What they do: Acorns is one of the original players in the wealthtech space. The simple idea of allowing users to “round up” transactions to the nearest dollar and invest that money into a diversified fund helped push Acorns into the mainstream. Acorns has branched out into checking accounts, retirement accounts, and funds for kids that allow parents to plan and invest for their children inside a single platform.

17. Wahed Invest

5-year search growth: 23%

Search growth status: Peaked

Year founded: 2015

Location: New York, NY

Funding: $90M (Series B)

What they do: Before Wahed, the Islamic investor didn’t have many options to turn to when it came to finding investments that were in line with Islam. Wahed Invest is centered around “Halal investing”. The Shari’ah board screens companies for a litany of criteria that are in line with Islam, and then allows the investor to select companies or a diversified fund of halal investments.

18. Wealthfront

5-year search growth: -2%

Search growth status: Exploding

Year founded: 2008

Location: Palo Alto, CA

Funding: $274.2M (Convertible Note)

What they do: Wealthfront is another of the “old guard” of wealthtech, providing a digital bank for smartphone-native users. Innovative features (like categories) can help users break up their accounts for different purposes, including saving for a house or paying off debt. Automating finances and optimizing for savings and investment with low fee diversified funds are other popular features inside of Wealthfront.

More recently, the wealthtech company has been looking into a potential sale. Banks and various acquisition companies have taken an extreme interest in the company. While no final verdict has been decided, the sale of the company could be $1.5B or higher.

19. YieldStreet

5-year search growth: -30%

Search growth status: Peaked

Year founded: 2015

Location: New York, NY

Funding: $728.5M (Debt Financing)

What they do: If someone wanted to invest in alternative assets with low correlation to the stock market, usually you’d be out of luck unless you were an accredited investor. Enter YieldStreet. YieldStreet opens up other asset classes like fine art, commercial real estate, Marine Finance and more up to normal, everyday investors. In their most recent funding round, YieldStreet raised $50M which they plan to use to enhance their technology, grow sales, and expand marketing to wider audiences.

20. Gemini

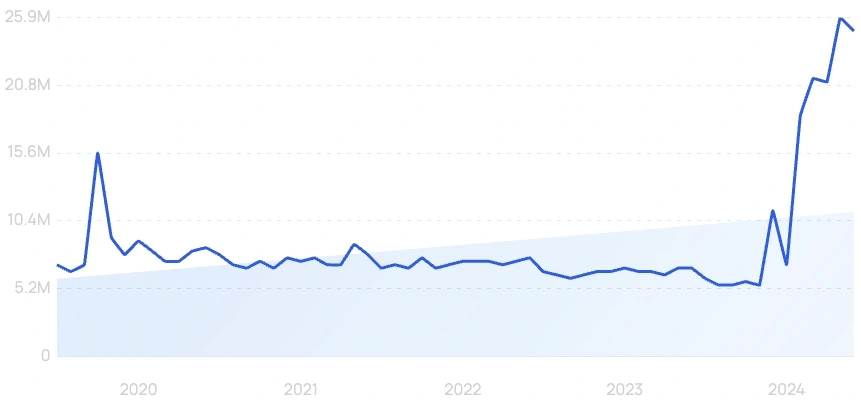

5-year search growth: 256%

Search growth status: Exploding

Year founded: 2014

Location: New York, NY

Funding: $423.9M (Series Unknown)

What they do: Gemini began with the need for a transparent, easy-to-use cryptocurrency exchange along with integrations to the banks most commonly used across the United States. Led by the Winklevoss twins of Facebook fame, Gemini is a complete platform for buying, storing, and earning interest in cryptocurrency.

Today, Gemini has over $86 million in cryptocurrency volume traded and $9 billion in total assets. The success of the platform means that Gemini is now custodian for many crypto exchanges across the world, and features rigorous security that allows peace of mind to their users who hold crypto on Gemini.

Conclusion

Expect to hear more big things coming out of these wealthtech startups, as the millennial cohort continues to control more and more of the economy.

What’s similar about all of these innovative money management startups? They’re smooth, intuitive for the digitally native consumer, and feature sleek branding and a great user experience while being mobile-friendly.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more