Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 13 Ecommerce Trends (2024 & 2025)

Ecommerce spending across the globe continues to break records.

In fact, Ecommerce sales recently surpassed $1.14 trillion - an all-time high.

Keep reading to learn more about 13 ecommerce trends that are set to impact the industry over the next few years.

1. Augmented Reality Provides an Interactive Shopping Experience

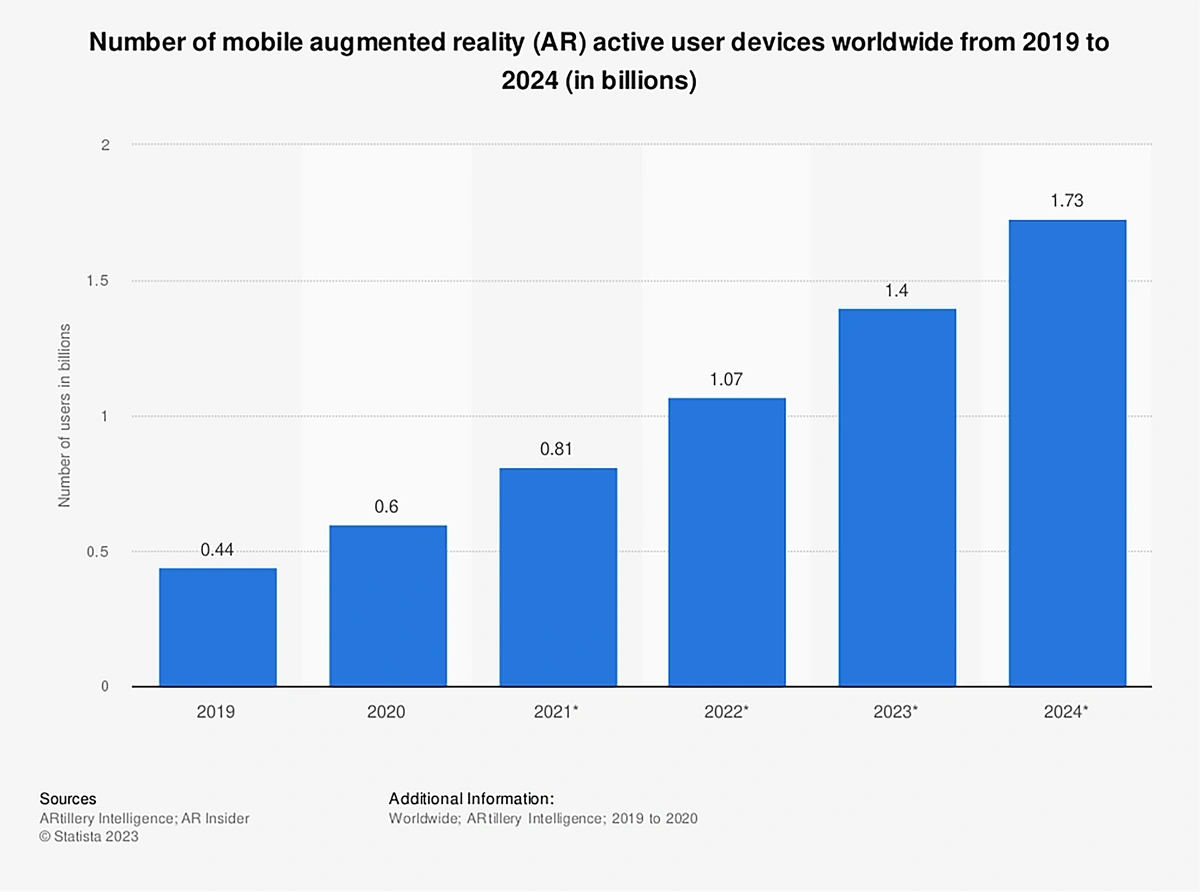

The number of people using augmented reality (AR) is growing quickly.

In total, the number of AR devices worldwide is expected to hit 1.7 billion in 2024.

The number of AR devices across the world continues to climb.

As the global population becomes more comfortable with using AR technology, its adoption and application in ecommerce are growing.

Data shows that more than half of consumers use AR features when shopping.

AR provides an immersive customer journey, making products come to life on smartphones.

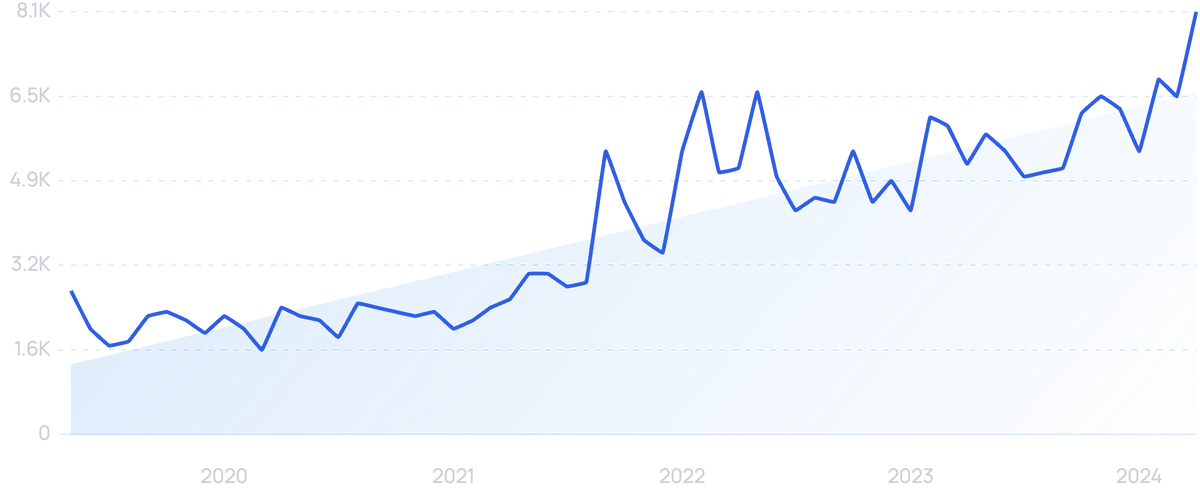

Search volume for “immersive technology” has increased 194% in recent years.

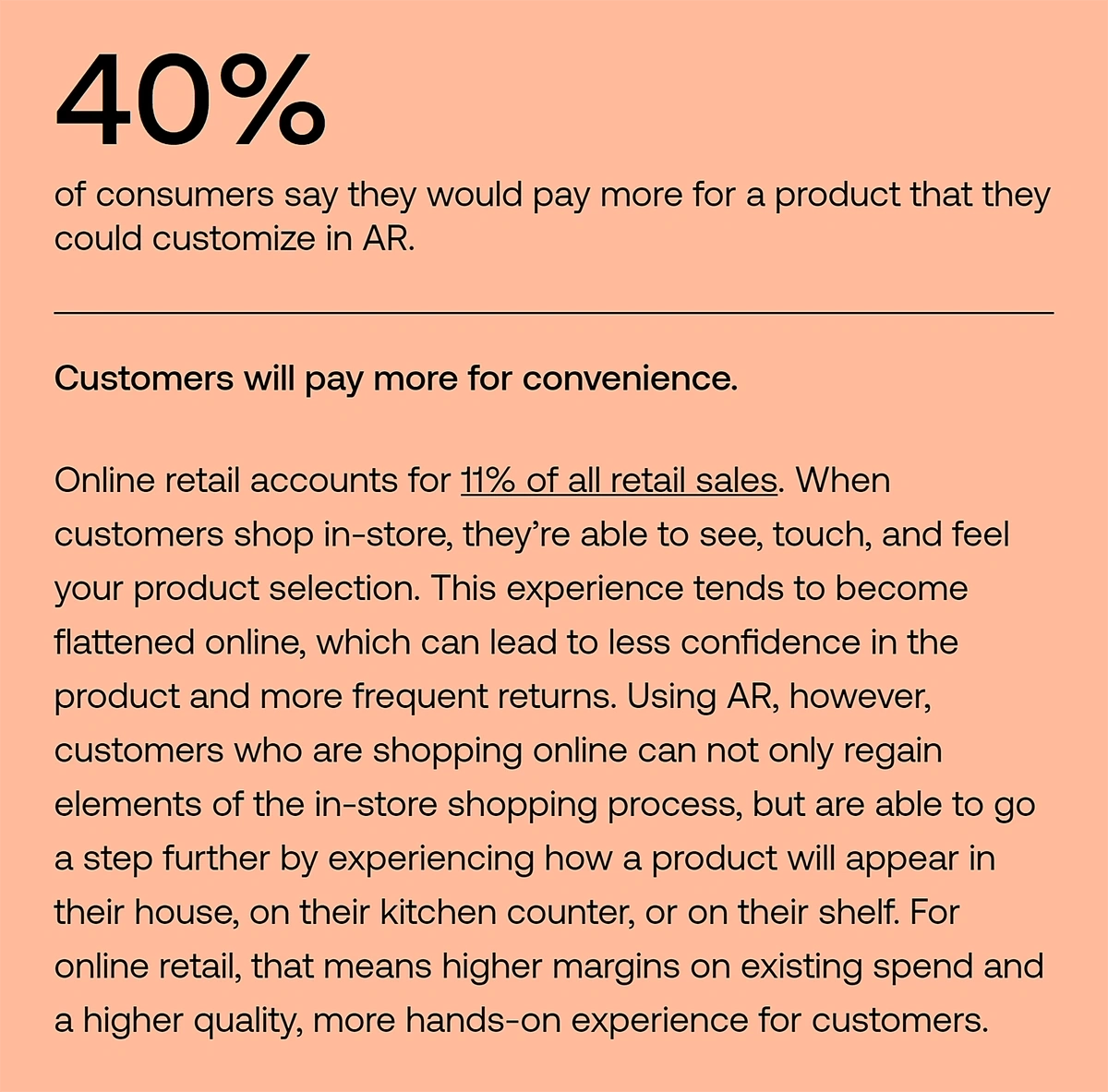

That’s an experience that customers are willing to pay for.

A recent survey reported 55% of consumers say AR makes the shopping experience more exciting and 40% of consumers are willing to pay more for a product if they can use AR to test it out first.

Today’s shoppers are willing to pay more in order to be able to shop with AR features.

AR customer experiences are also a way to capture customer loyalty.

One customer service expert called these immersive experiences “a golden opportunity” to build customer relationships.

Several big names are already seizing the AR opportunity.

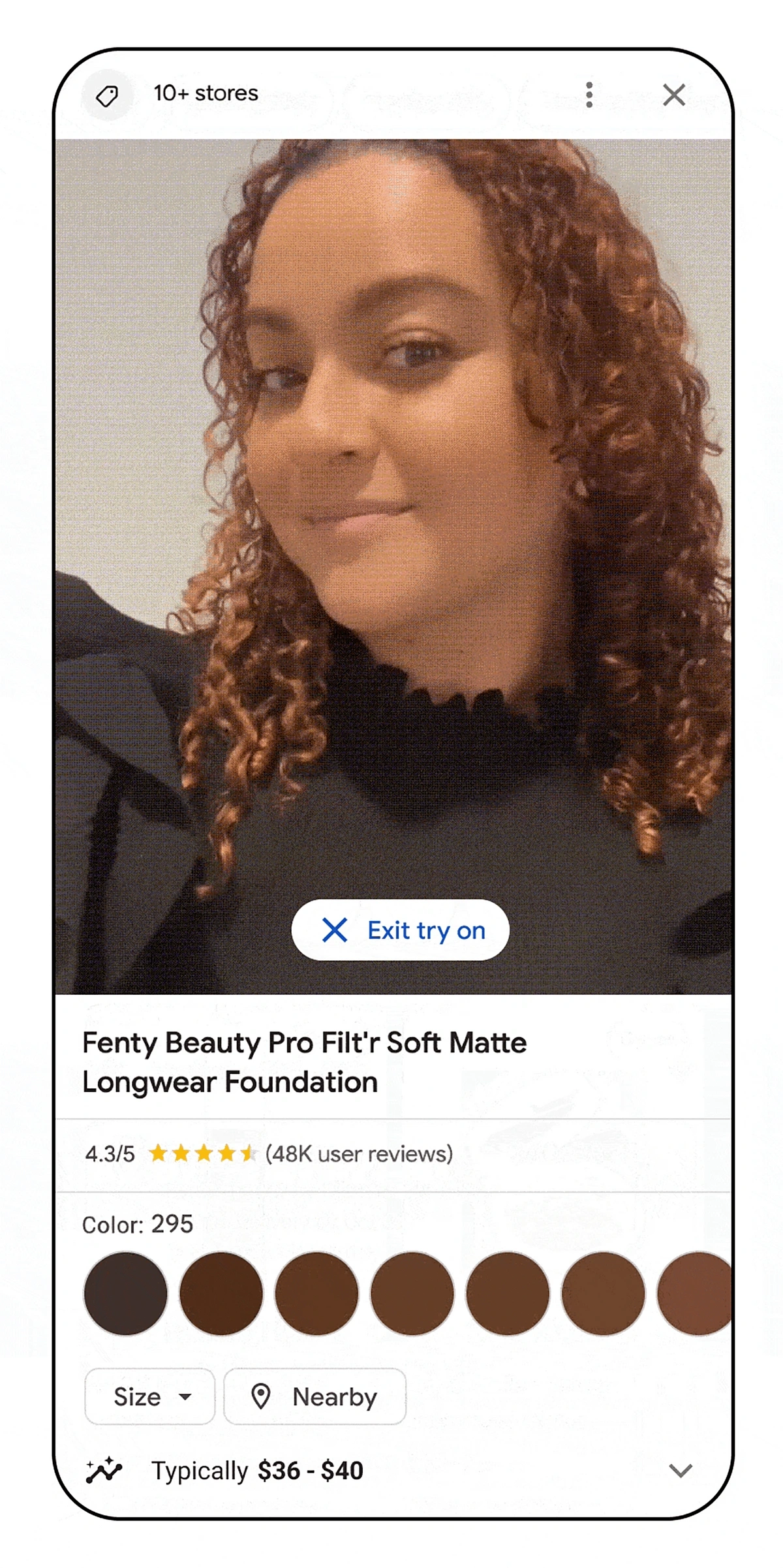

In October 2023, Google announced that ecommerce beauty brands will now be able to build AR-powered ads.

Shoppers can search for a product on Google, select it, and use AR to try it on directly from Google without needing to visit the brand’s site.

Google had previously offered AR features on desktop, but now the full features will be available on mobile browsers.

And, the features now extend to trying on hair color and foundation.

Shoppers can now try on hair color and foundation directly from Google’s shopping page.

Walmart is following suit with AR-powered try-on capabilities on its app.

Customers can try on blush, eye shadow, lipstick, and bronzer.

There are also AR try-on features for fashion brands.

One brand said this feature can make consumers 11x more likely to make a purchase and leads users to spend up to 2.7 times more while shopping.

For example, Bloomingdale’s recently sent customers AR-enabled catalogs. Once a customer scanned the AR-enabled items, they’d be able to see models walking around in the clothing in real life.

This led to a 38% higher customer engagement rate and a 22% increase in conversions.

On average, customers who received the AR-enabled catalogs from Bloomingdale’s explored four looks via AR.

2. AI Automates Ecommerce Marketing

Artificial intelligence is one of the hottest technology trends worldwide, and ecommerce brands are discovering new ways to use it to automate marketing processes.

Data suggests that this trend is here to stay.

The market for AI writing tools alone is projected to reach nearly $6.5 billion by 2030.

The market for AI writing assistants is predicted to grow by a CAGR of more than 26% through 2030.

In addition, the popularity of AI writing tools like Anyword (1 million users) and Copy.ai (380,000 users) is surging.

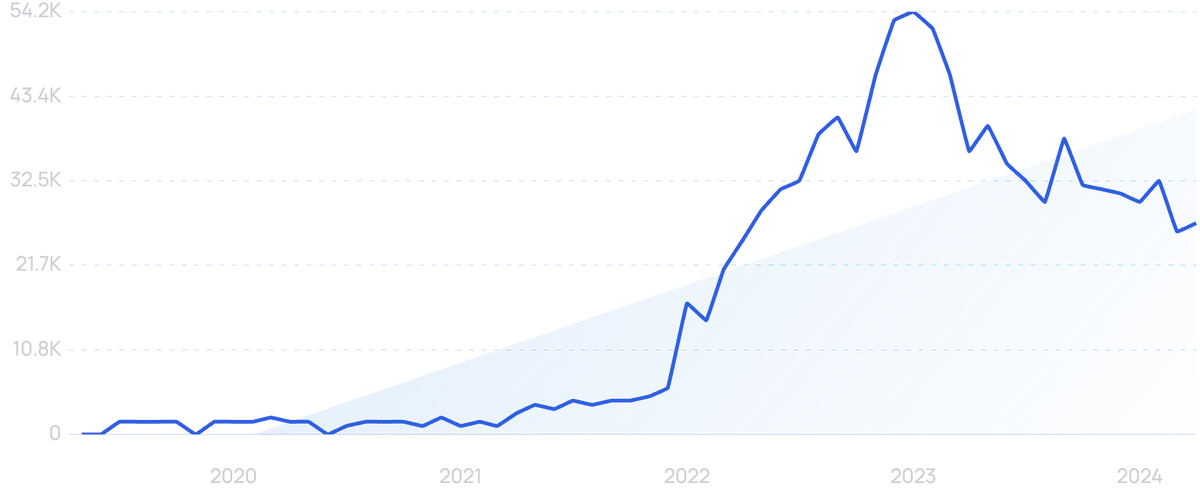

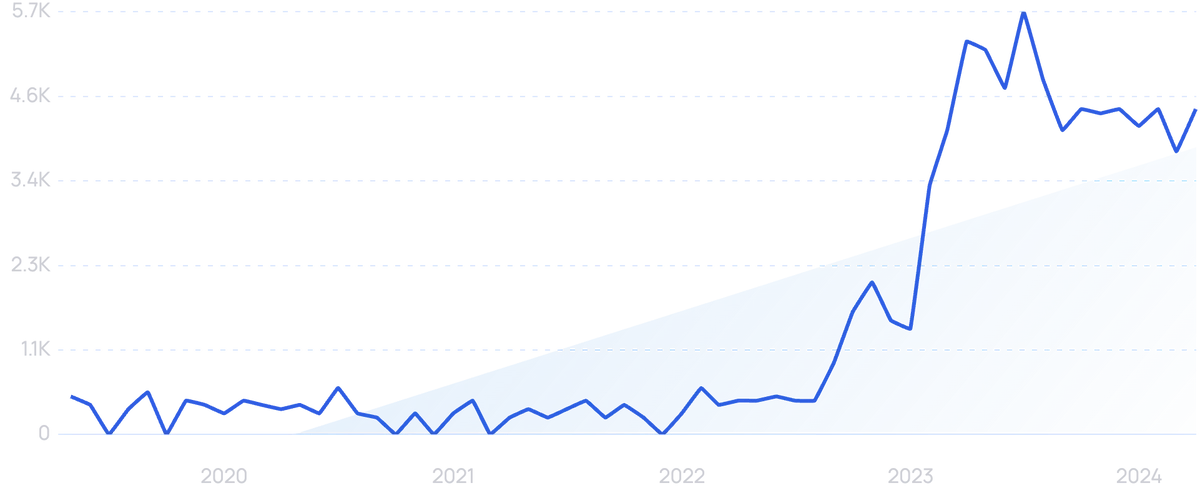

Search volume for “Anyword” is up more than 4,900% since 2019.

Ecommerce marketers are using AI writing tools to generate copy for product descriptions, ad copy, social media content, and blog posts.

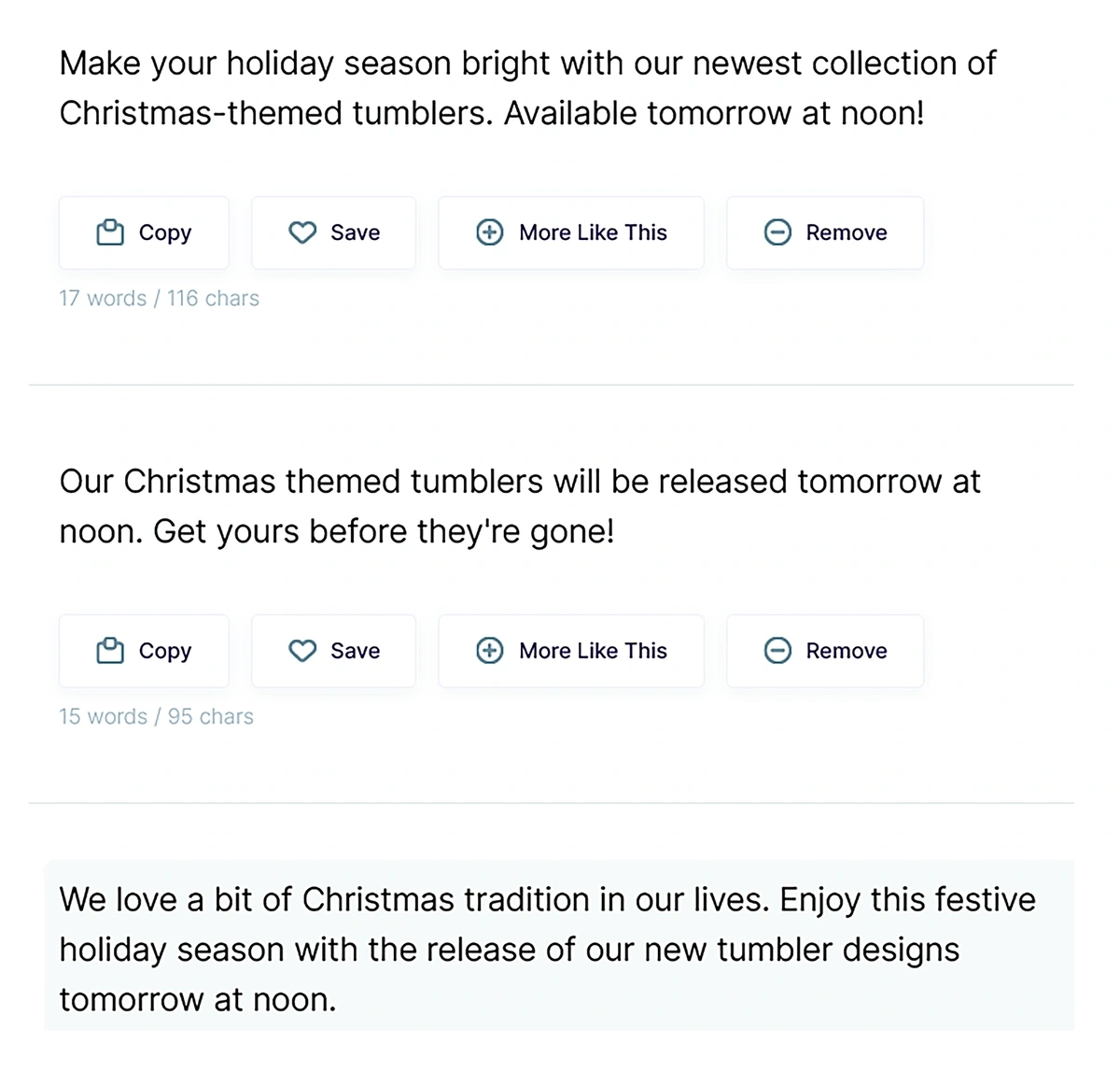

Here's an example of a social media caption generated through Chat.ai

Ecommerce marketers provide a bit of information about their social media posts and the AI platform produces several social media captions.

AI writing tools aren’t perfect, so a human still has to edit and adjust the copy. Still, these tools save ecommerce businesses thousands of dollars because they no longer have to hire copywriters to create content from scratch.

AI is also transforming product visuals.

A recent survey found that more than 40% of brands find it challenging to deal with the high costs of managing and producing product visuals.

60% of brands surveyed said they plan to invest in AI to automate the creation of product visuals.

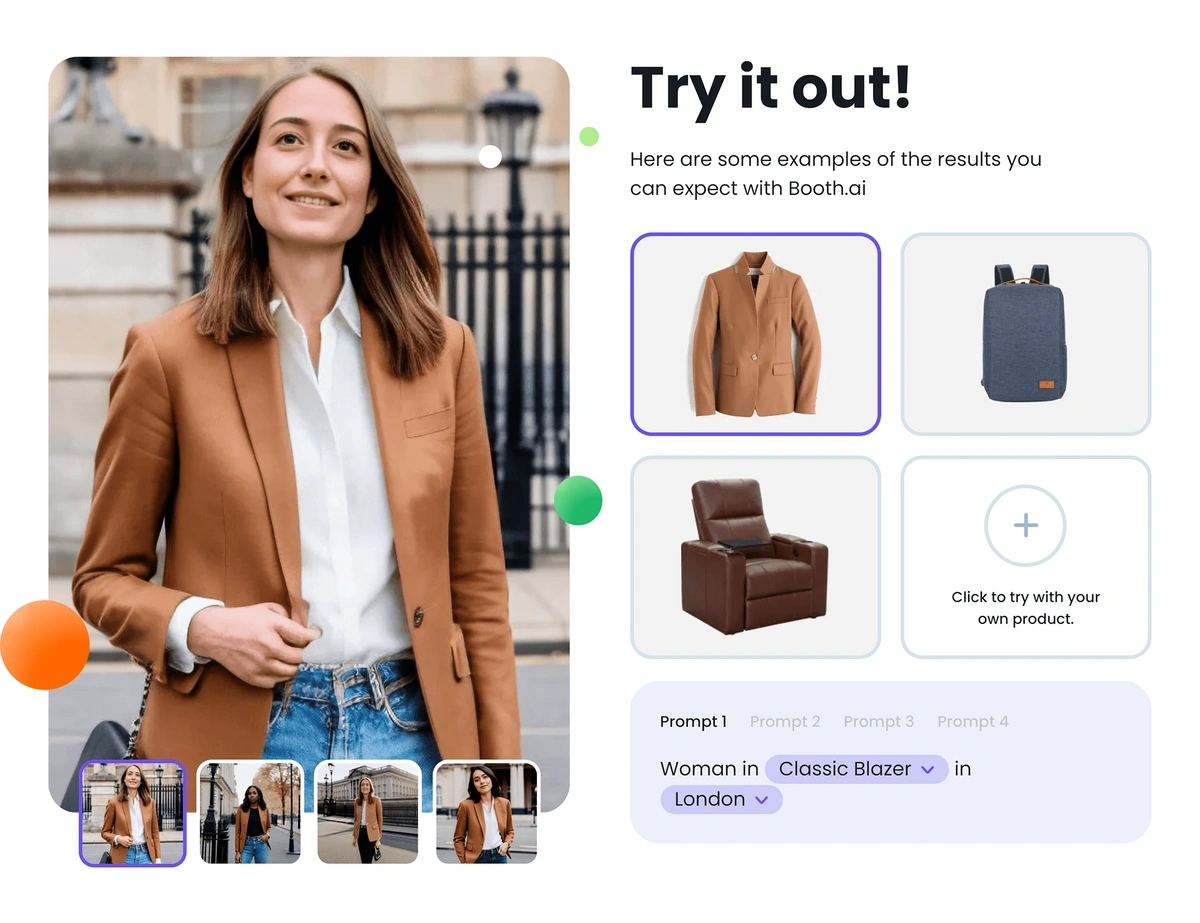

Tools like Booth AI are becoming increasingly popular for generating product photos.

Search volume for “Booth AI” spiked in late 2022.

For example, Booth AI can change the scene or swap the models in a product photo. The tool can also take flat images of clothing or shoes and put them on an AI-generated model.

Booth AI enables marketers to swap out the backgrounds and models in their product photography.

Marketers can use these AI tools to dramatically cut expenses involved with running a photoshoot, like set design, lighting, and professional photographers. Because it saves so much time, it can also lead to faster product debuts.

Ecommerce brands of all sizes are already taking advantage of AI tools like this.

For example, Levi's recently partnered with LaLaLand.ai, a startup that builds customized AI fashion models. Levi's aim is to use AI to incorporate a more diverse set of models into their product photography.

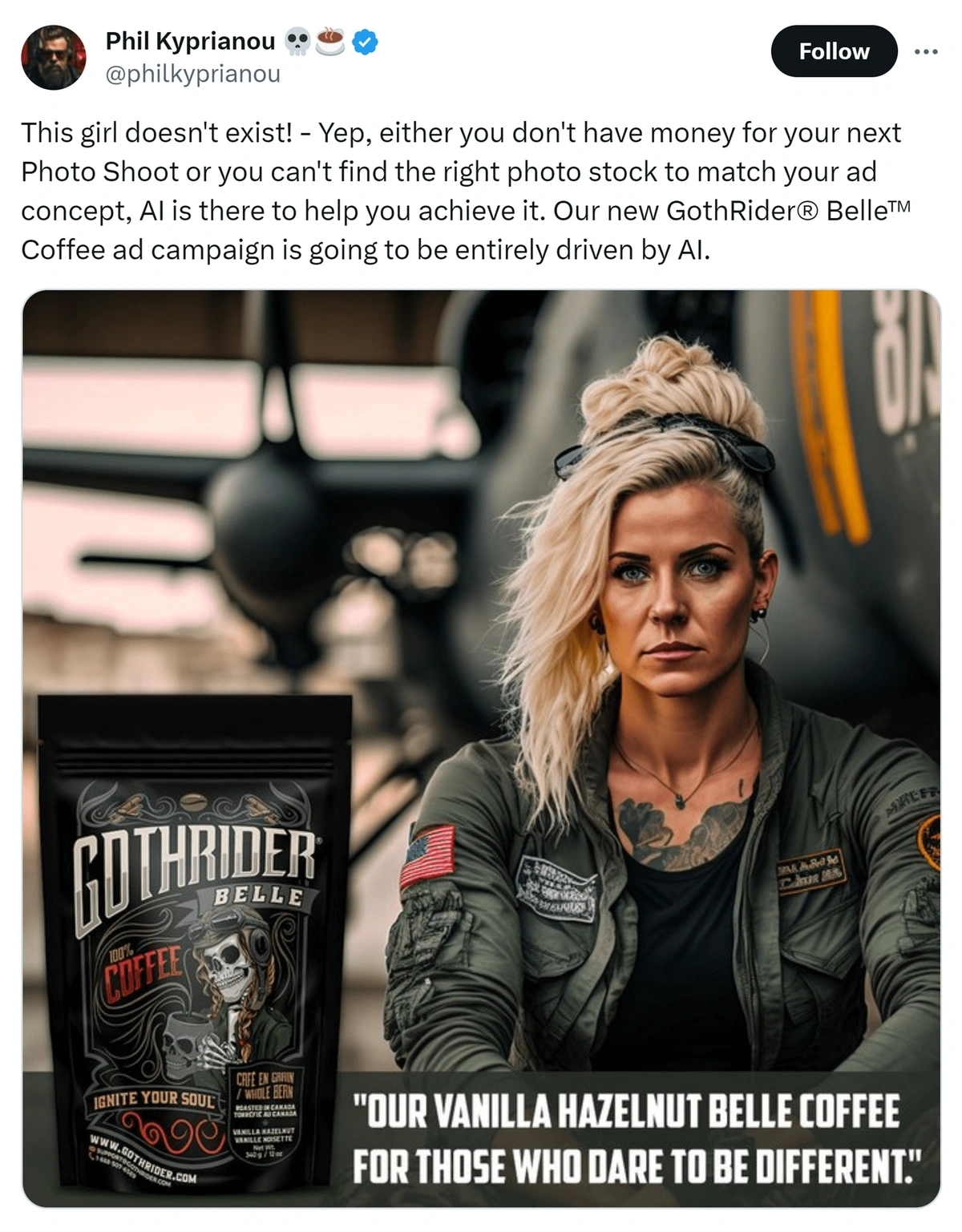

A much smaller brand, Gothrider Coffee, is using an AI-generated model as the star of a new ad campaign.

The founder of Gothrider Coffee posted his AI-generated ad to X.

As well as helping to generate marketing materials, AI presents new avenues for E-commerce discovery. Check out our guide on how to optimize your E-commerce store for AI search.

3. Surging Revenue in Social Commerce

Social commerce has grown tremendously in recent years. And the coming months are predicted to follow the same trend.

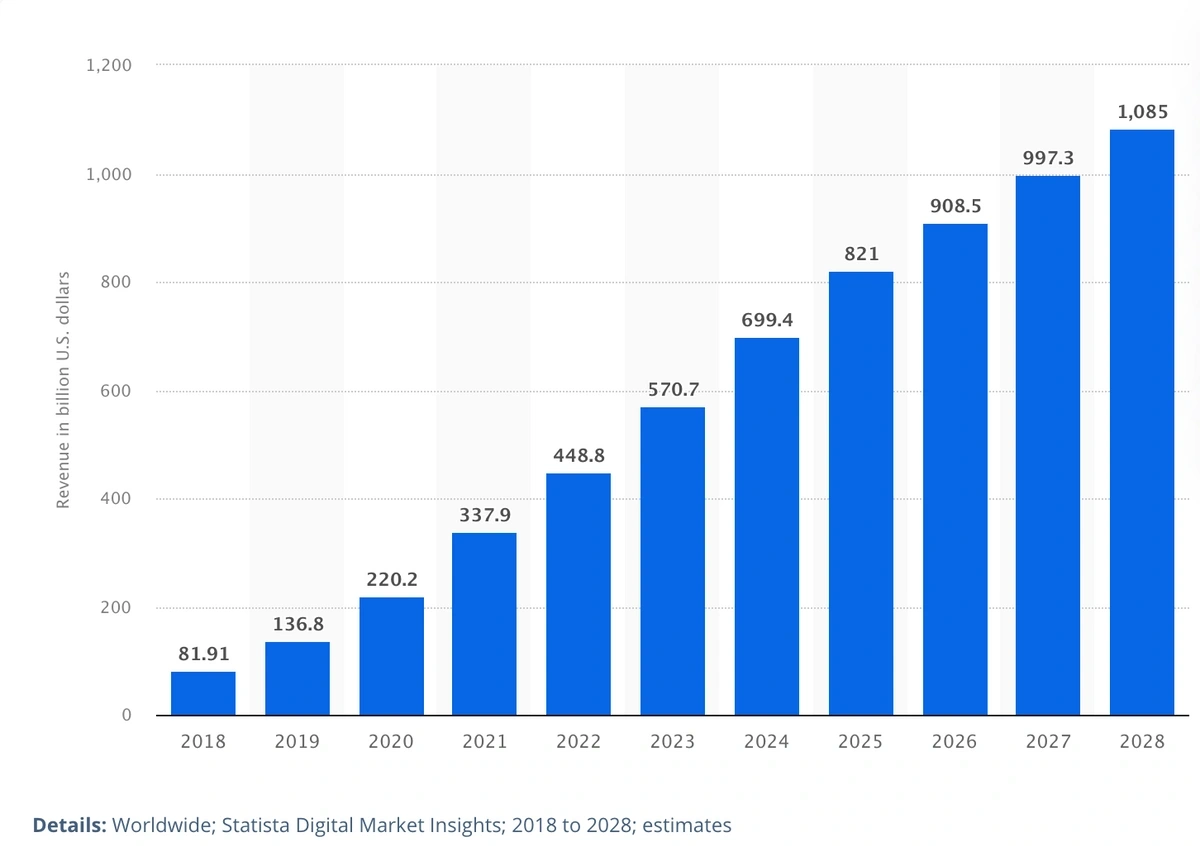

Last year, social commerce generated about $570.7 billion in revenue, and forecasters predict the market will expand to over $1.085 trillion by 2028.

Revenue from social commerce could reach as high as $1.1 trillion by 2028.

Those sales are currently coming from more than 106 million buyers, but that number could grow to 118 million buyers by 2027, according to Insider Intelligence.

Insider Intelligence also reports that the dollar amount of sales per buyer is expected to double between 2023 and 2027.

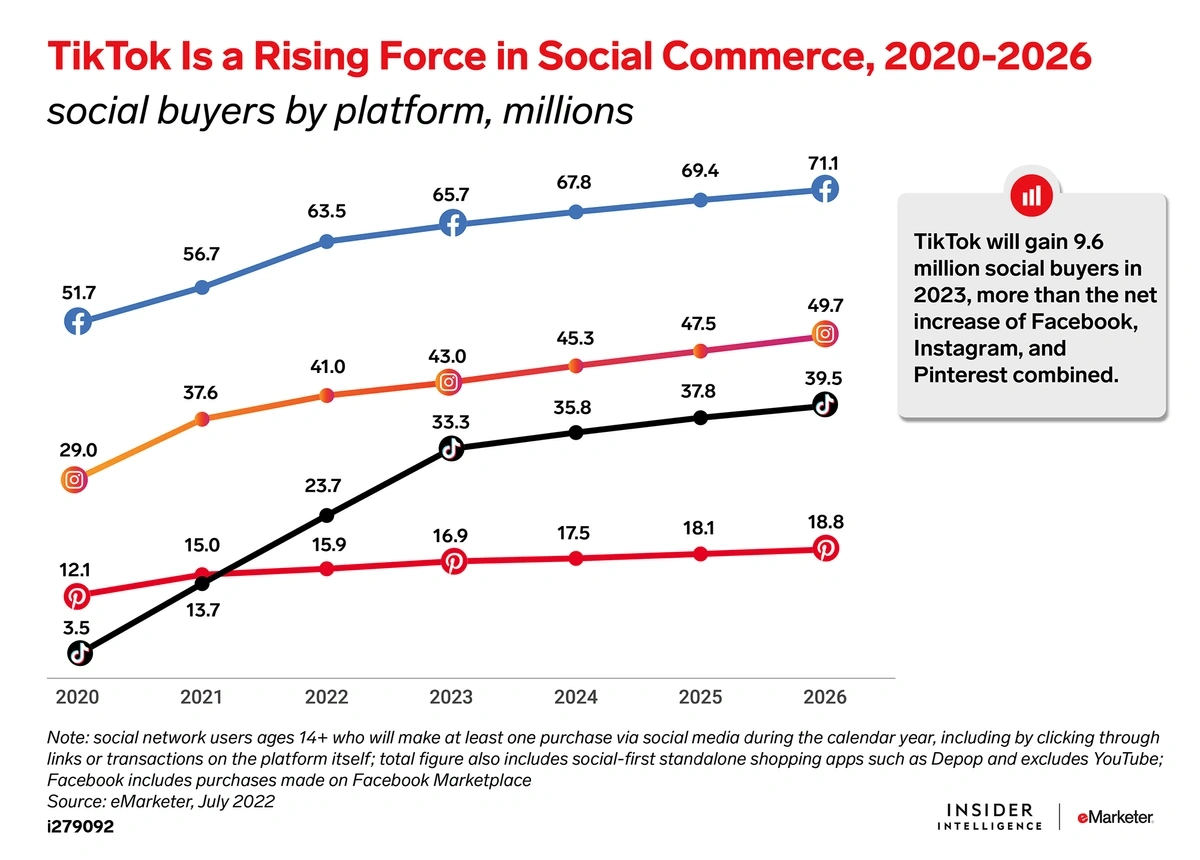

Facebook currently dominates social commerce.

The platform is expected to see 67.8 million buyers in 2024 while Instagram is predicted to see 45.3 million buyers and TikTok is predicted to see 35.8 million.

While Facebook and Instagram have stepped back from social shopping, TikTok is more focused on ecommerce than ever before.

Research shows that 15.8 million new social buyers will flock to TikTok by the end of 2026.

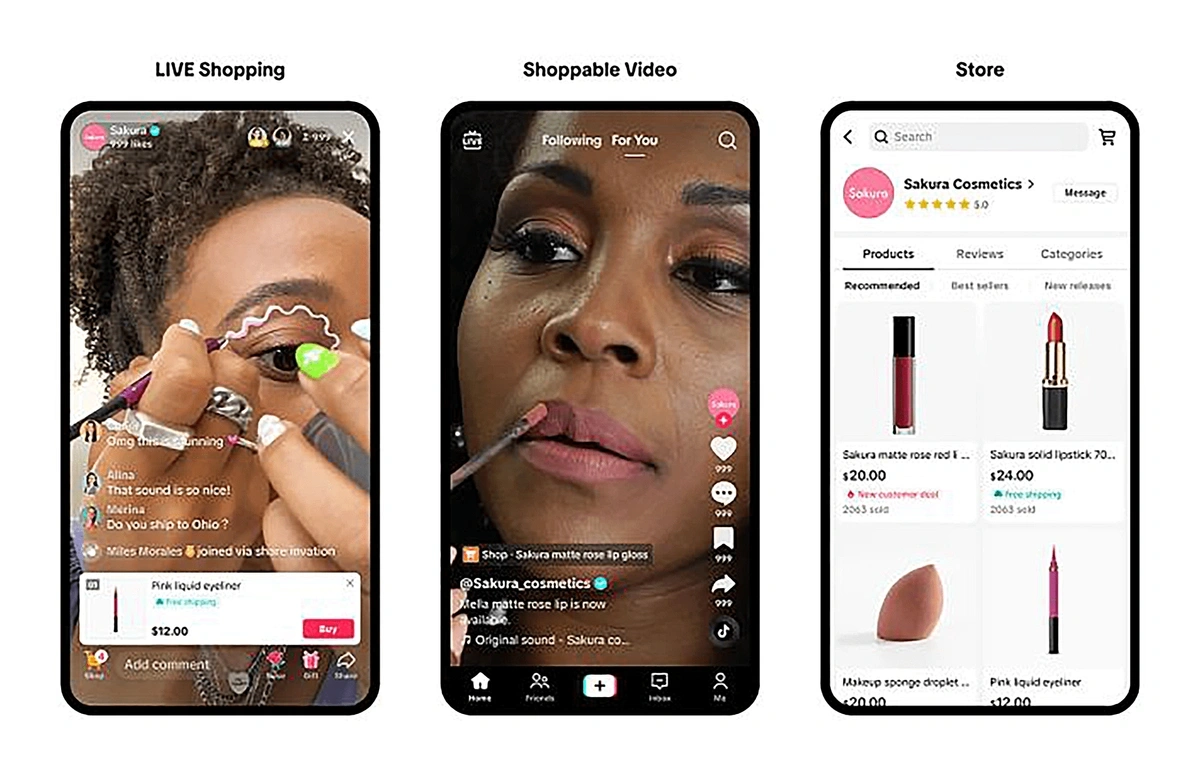

The platform released TikTok Shop capabilities to everyone in the US in September 2023.

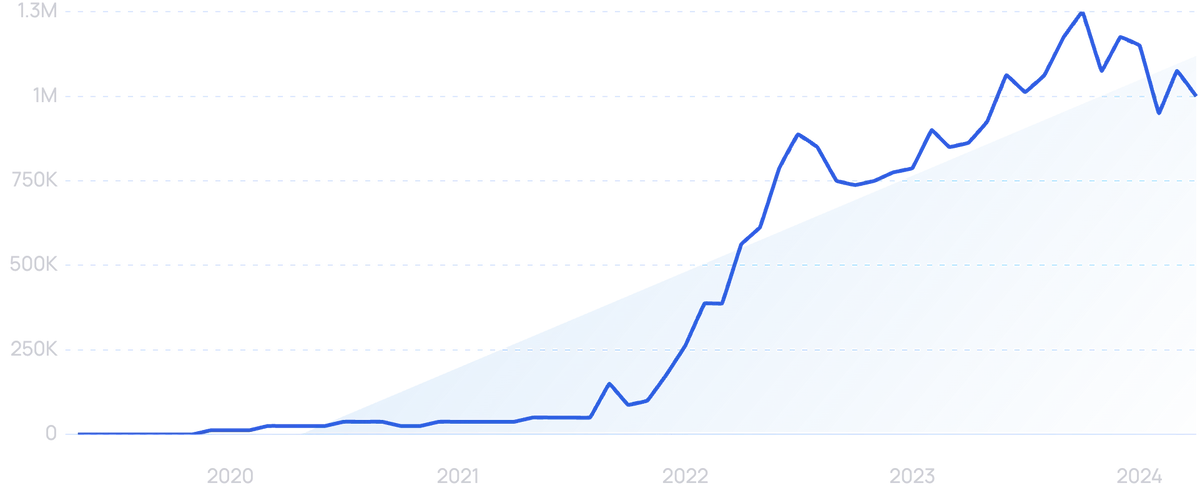

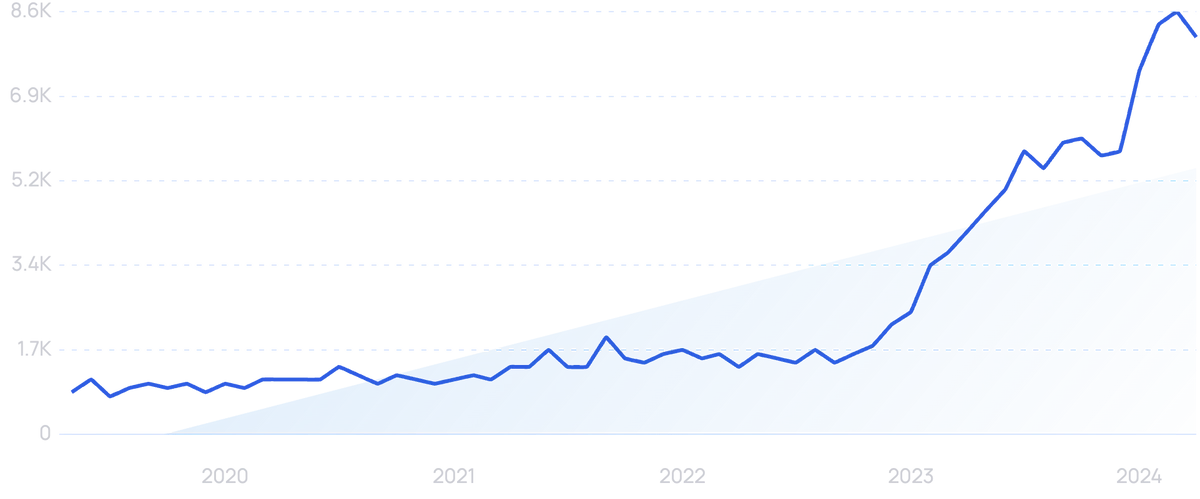

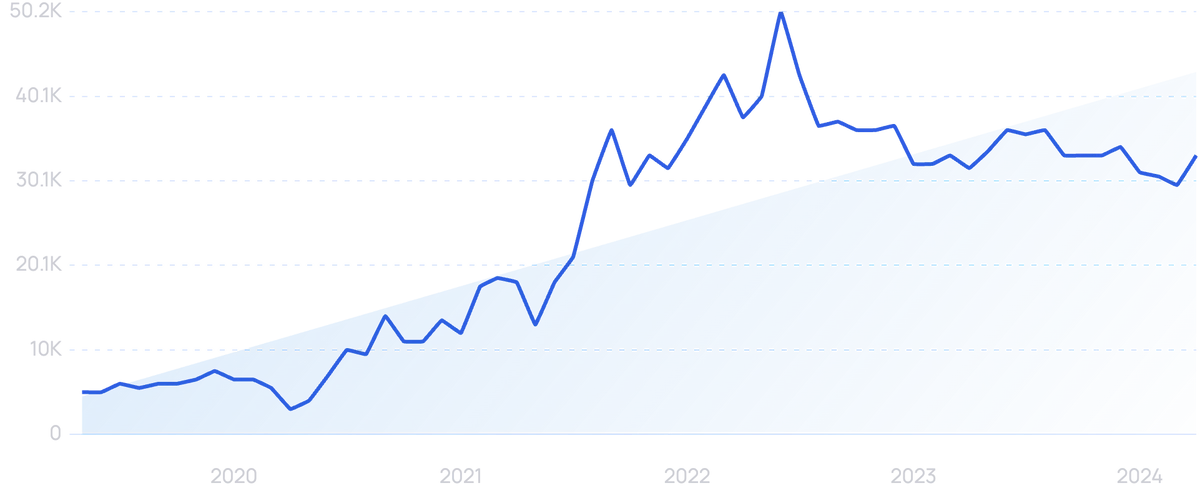

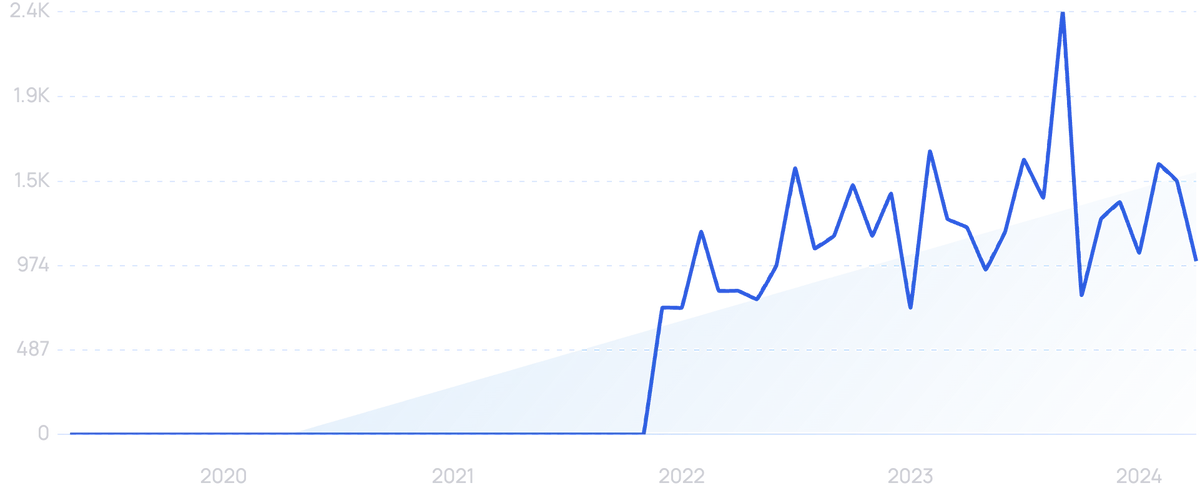

Search interest in “TikTok Shop” has grown exponentially since 2022.

That means users can purchase products directly from TikTok videos or the platform’s “shop” tab.

TikTok users have multiple ways to shop.

TikTok executives predicted that their global ecommerce sales would top $20 billion in 2023. Total sales were just $4.4 billion in 2022.

Even Pinterest, a bit of a dark-horse platform when it comes to ecommerce sales, is seeing growth.

In May 2023, the platform launched a partnership with Amazon that’s aimed at making it easier to shop on Pinterest.

In the third quarter of 2023, Pinterest reported a 6% year-over-year increase in sales to jump to a total of $708 million.

4. AI Enhances the Customer Experience

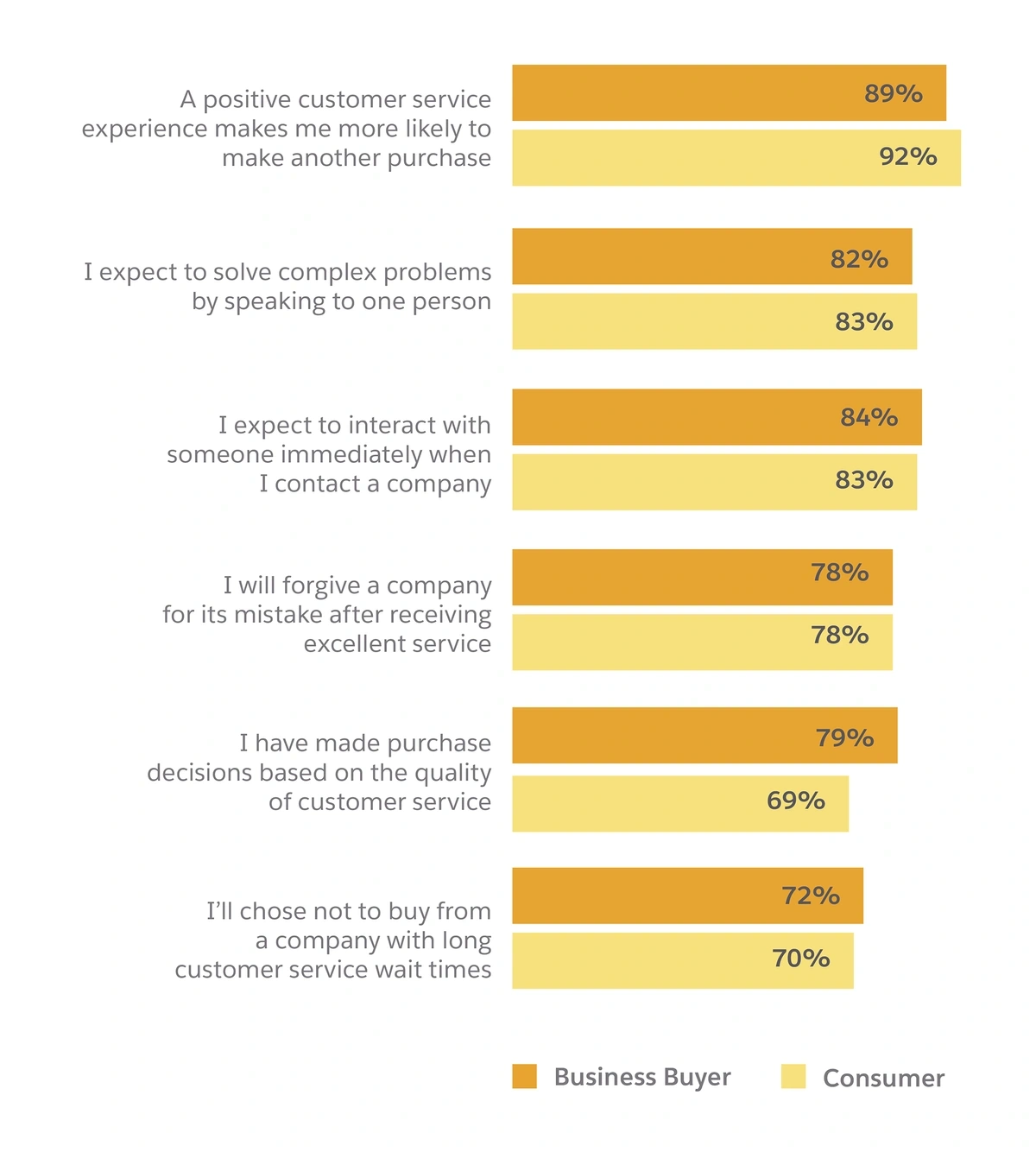

A recent study showed that 92% of consumers are more likely to make another purchase after a positive customer experience. And, nearly 80% of consumers have made buying decisions based on the brand’s level of customer service.

Survey results show the importance of good customer service.

On the other hand, 40% of consumers say they’ll stop buying from a brand if they receive poor customer service.

Recent innovations in AI are allowing ecommerce businesses to provide better online experiences for customers while simultaneously cutting the cost of customer support.

Search interest in “AI customer service” has jumped more than 840% in recent years.

Gartner predicts that the use of AI-powered tools will lead to a 20% to 30% reduction in a brand's customer service and support staff by 2026.

One tool that’s becoming popular with ecommerce retailers is AI-powered chatbots.

Chatbots enable brands to automate customer support requests, which speeds up the process for consumers.

While chatbots aren't a new concept to ecommerce, many companies and consumers have been hesitant to use them because their capabilities have been somewhat limited.

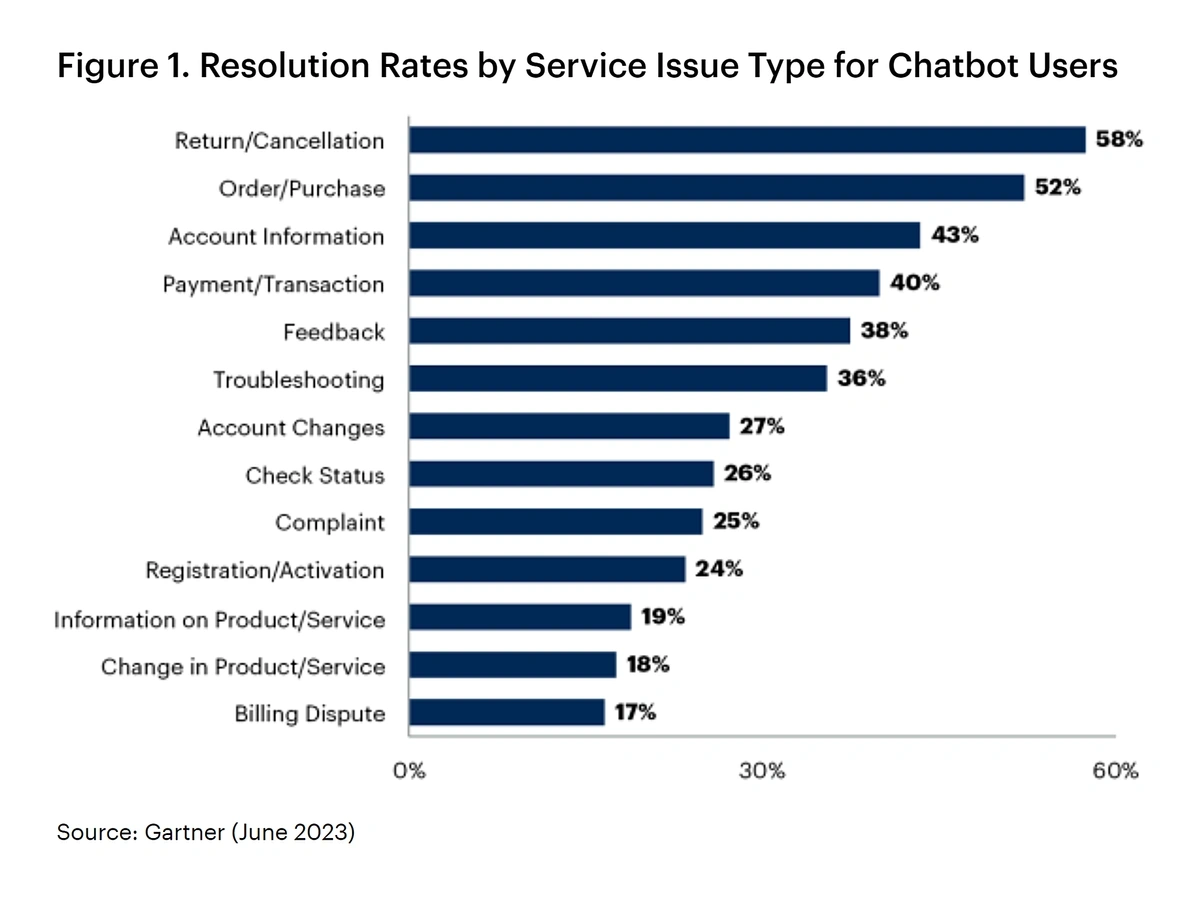

The success of chatbots varies widely based on the type of customer service issue they’re tackling.

For instance, chatbots resolve nearly 60% of return or order cancellation issues, but only 17% of billing issues.

Chatbots are most likely to be effective when the customer’s issue has to do with a specific order.

However, today’s AI is advancing at a rapid pace.

Many chatbot platforms offer no-code versions, meaning users can build their brand’s chatbot with a simple drag-and-drop interface.

In addition, the machine learning that powers chatbots is getting smarter when it comes to deciphering user intent.

This means customers get answers faster, without needing to involve human agents.

It also opens up the opportunity for upselling and cross-selling.

Predictions show that the billion-dollar chatbot market is set to grow even more in the coming years.

The market was valued at $4.7 billion in 2022 and is expected to surpass $15.5 billion by 2028.

As well as retailer-specific chatbots, OpenAI is on a mission to let consumers buy directly from general-purpose AI interfaces like ChatGPT.

Its Agentic Commerce Protocol is designed to eventually allow any chatbot to purchase from any retailer on behalf of users.

Here are a few other examples of how ecommerce companies are using AI to provide a better customer experience:

- AI writing assistants generate replies for human agents to use in answering customer support tickets

- AI provides product recommendations that are most aligned with the customer's interests and purchasing history

- AI and machine learning automate inventory management to ensure the data displayed to customers is always accurate

- AI assists with translating both website content and customer support tickets to help ecommerce brands better serve international customers

- AI sentiment analysis tools analyze reviews and identify the most common customer complaints

5. Ecommerce Influencer Marketing Continues to Grow and Change

The influencer marketing industry has more than doubled since 2019.

A survey by The Influencer Marketing Hub shows that 51% of the companies contributing to the growing influencer market are ecommerce brands.

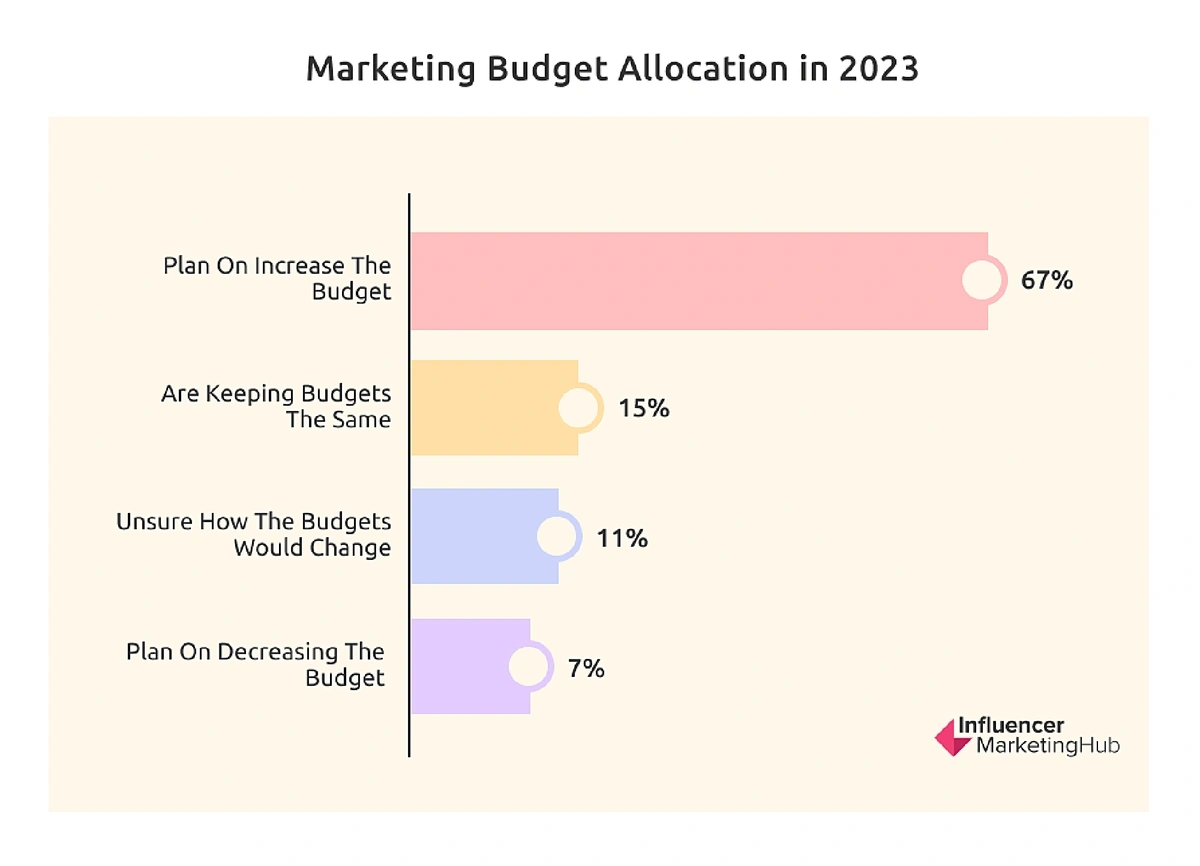

Additionally, about 67% of brands intended to increase their influencer marketing spend in 2023.

Nearly 70% of marketers planned to increase their budget for influencer marketing.

While influencer marketing isn't a new trend in 2024, the ways ecommerce brands leverage this strategy are changing.

In recent years, some influencer campaigns have begun to feel similar to traditional ads.

For example, a post may be overly scripted and the influencer may appear unnatural.

This is having dire consequences for ecommerce brands.

One survey found that more than half of respondents simply scroll past influencer posts.

Even worse, the survey reported that nearly 30% of respondents hate influencers and say they’re untrustworthy.

Another survey reported that only 10% of consumers actually trust influencer content.

Because of this, brands have had to shift their strategies toward publicizing authentic content from users and limiting their partnerships to organic influencers.

Survey results show that brands with authentic content have the potential to fare better than brands that use influencers.

The trend is so strong that “de-influencing” (where social media users discourage viewers from buying a product) has become a hot hashtag on TikTok with nearly 935 million views.

In order to build trust, some brands are going through a trial period with an influencer before they begin a campaign. The idea behind this strategy is that the brand’s product can become part of the influencer’s life. That way, when they rep the product, it’s natural and part of their story instead of being a supplemental product.

Research from Stanford has also shown that engagement goes up when influencers include friends in their sponsored posts. This simple act was so impactful that it negated the negative response that the followers would’ve had to the influencer’s ad-like post.

Stanford researchers found that influencers who include images of friends in their posts get more engagement.

For successful brand/influencer partnerships, the returns can be massive.

“Good” results, as one expert says, are when an influencer drives 4%-15% of a brand’s sales. However, influencers have been known to drive up to 25% of a brand’s sales.

6. Rising Consumer Demand for Sustainable Products and Packaging

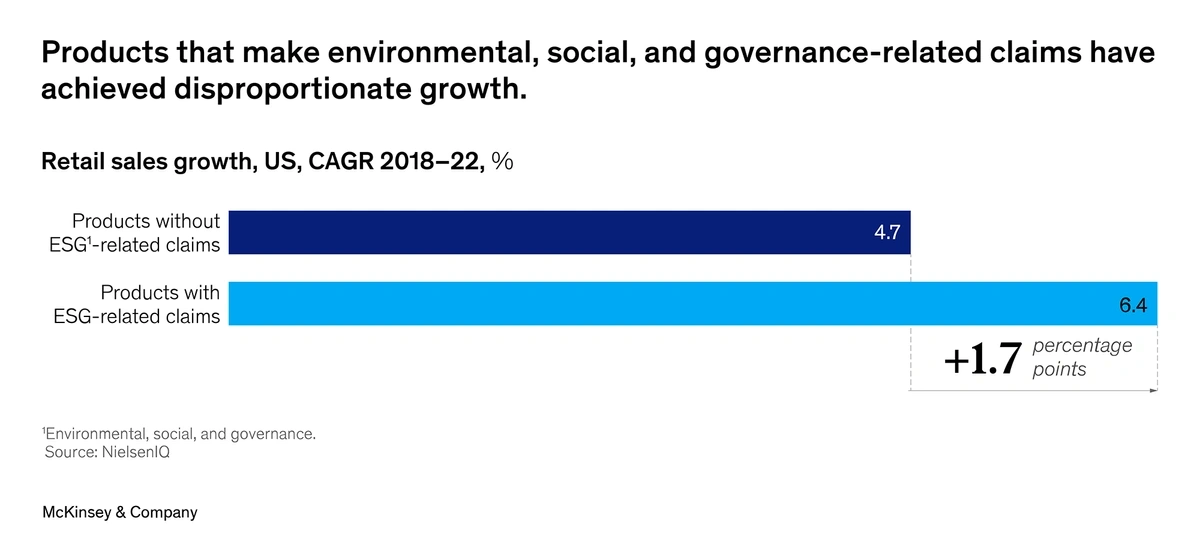

A recent survey published by NielsenIQ and McKinsey shows that consumers are willing to pay more for products with ESG (environmental, social, and governance) claims.

In fact, the survey found that brands making ESG claims saw 8% higher cumulative growth over the past five years than brands that do not make ESG claims.

Products with ESG claims have shown a 1.7% higher CAGR over the past four years than products without ESG claims.

Consumer surveys show that interest in sustainable products is rising.

A 2023 survey of American consumers showed that 74% of people want to purchase sustainable products, and 68% of consumers are willing to pay more for sustainably sourced products.

There are also plenty of examples of brands that have grown exponentially by leveraging sustainability as a unique positioning strategy. Here are just a few of them:

- Alohas: a sustainable footwear company operating on a pre-order business model

- Earth Breeze: a brand of laundry detergent that delivers dehydrated detergent sheets in a compostable cardboard sleeve

- Pela Case: a tech accessories company that manufacturers its products from compostable materials

- Saltair: a skincare company focused on sustainable sourcing of ingredients and plastic-free packaging

Search interest in “Alohas” has increased 1,150% in the past 5 years.

Sustainable packaging is also an important trend for ecommerce brands.

Data shows that the amount of shipping and delivery cardboard packaging used in the United States in just four months could pave a mile-wide road from New York City to Los Angeles and back.

Some of the packaging is recycled but up to 31% of it isn’t.

Not only is this bad for the environment, it’s bad for brands.

A 2023 survey reported that 82% of consumers are willing to pay more for sustainable packaging and 63% say they’re less likely to buy products if they’re packaged in a way that’s harmful to the environment.

More than three-quarters of consumers say they’ll pay more for products that are packaged sustainably.

Returnity is a company that’s working to reduce ecommerce packaging waste.

Returnity is focused on reducing packaging waste.

They offer reusable mailer bags and boxes that can each be used more than 40 times.

The brand has already worked with big brands like New Balance, Rent the Runway, and Estee Lauder.

So far, the brand has raised $3.1 million in funding.

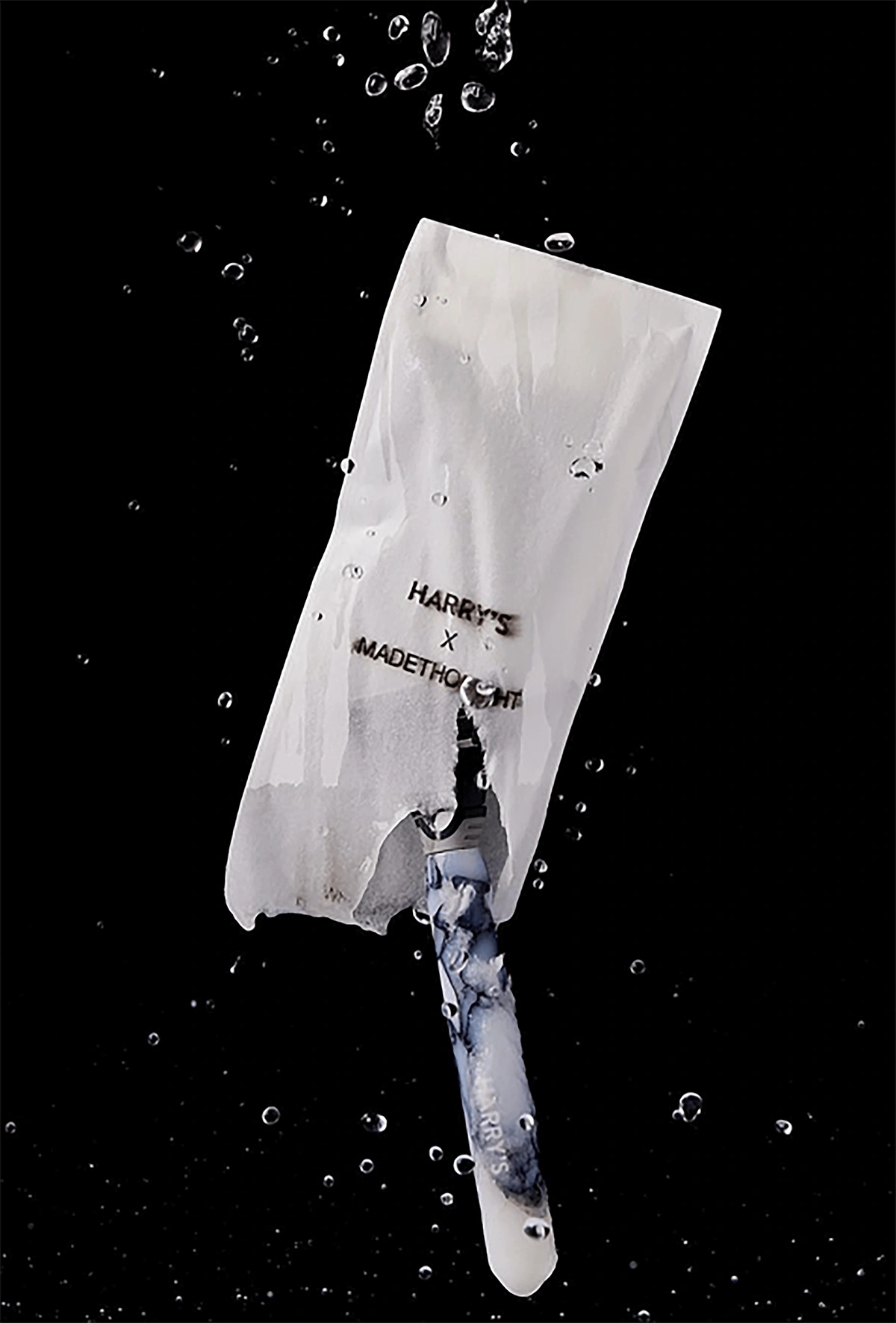

Other ecommerce brands are switching to cardboard and plastic alternatives like water-soluble packaging, mushroom-based packaging, and seaweed-based packaging.

Harry’s packaged their razors in water-soluble pouches that totally dissolve in water, safely going down the drain.

7. Consumers Expect Convenient Payment Options

Today’s consumers are all about convenience.

By offering the payment options consumers want, ecommerce brands can boost their sales.

In fact, nearly 60% of consumers say that the availability of convenient payment options is an essential factor when making an ecommerce purchase.

And, one survey showed that 65% of Gen Zers will abandon an online purchase if the payment option they want isn’t available. That number jumps to nearly 80% when considering Millennial consumers.

Consumers, especially younger generations, are demanding more payment options when making a purchase online.

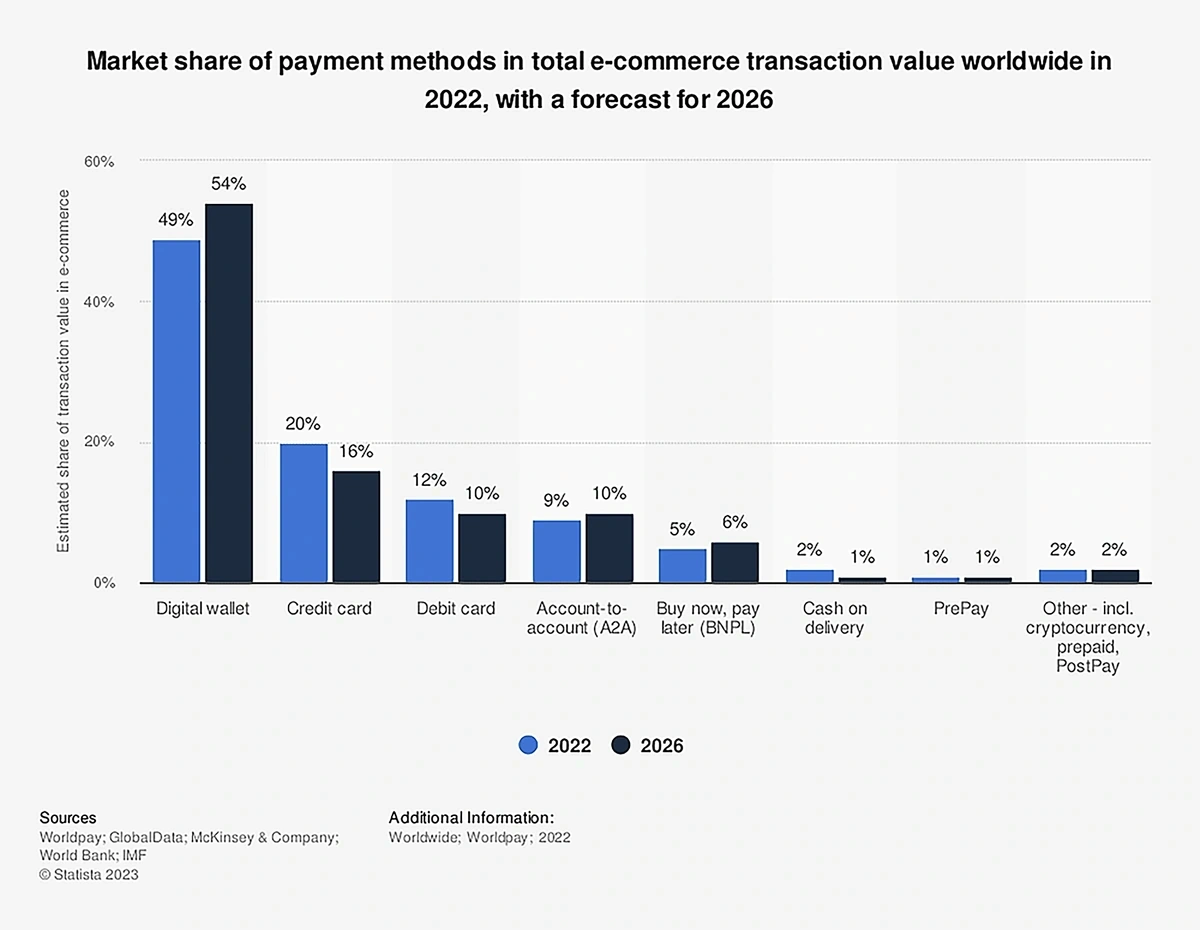

Digital wallets like Apple Pay, Shopify Pay, and Google Pay are firmly cemented in the ecommerce payment space.

Data from Statista shows that 49% of global ecommerce transactions in 2022 occurred through digital wallets, and that number is expected to grow to 54% by 2026.

The majority of ecommerce payments are completed with digital wallets.

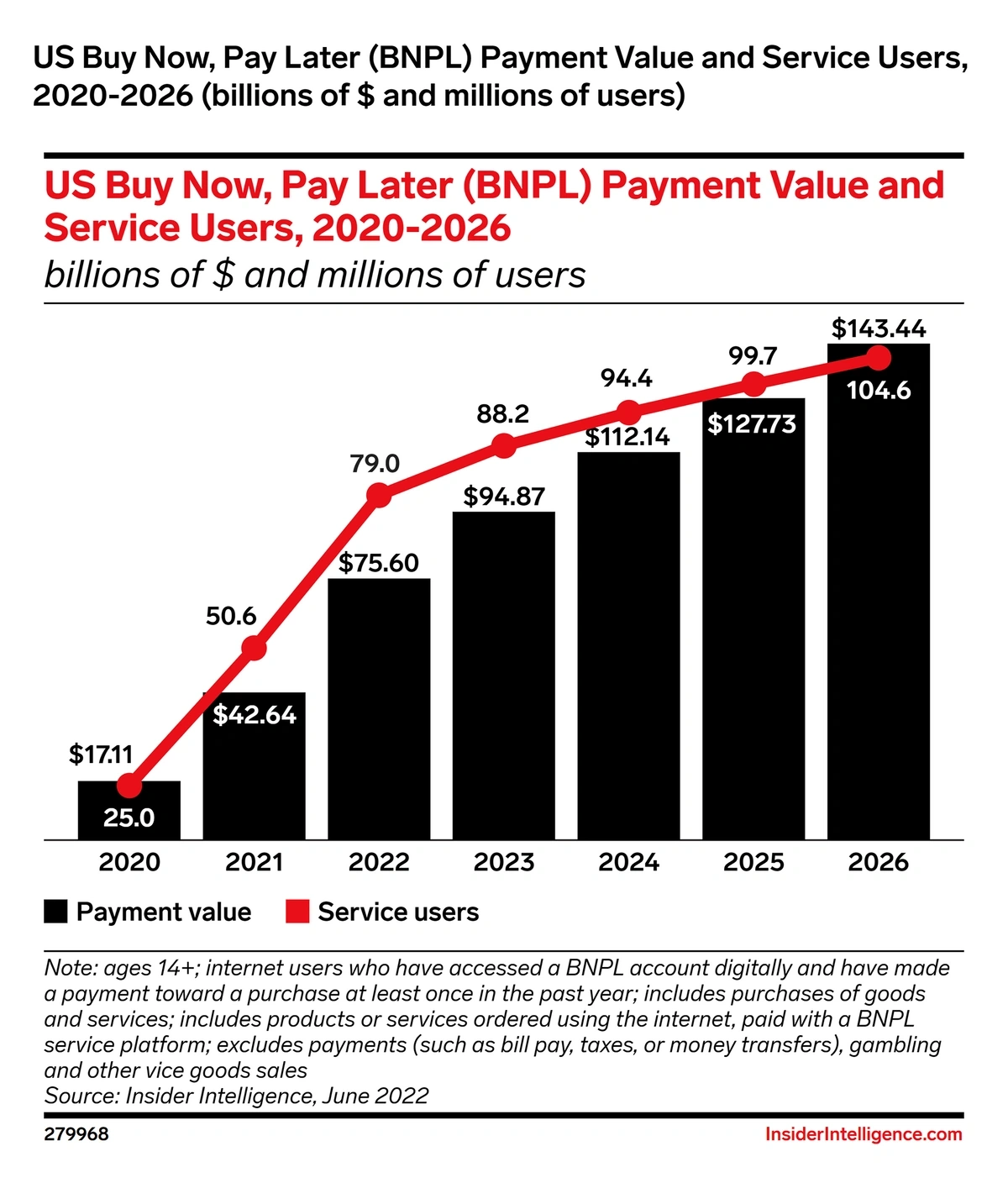

Buy Now, Pay Later (BNPL) options are also multiplying.

Search volume for “BNPL” has jumped more than 560% in the past 5 years.

BNPL providers like Klarna and Affirm have been around for a while, but new services like Apple Pay Later have recently debuted.

Apple’s offering is built directly into the Apple Wallet, allowing users to take out zero-interest loans up to $1,000.

The number of people using BNPL was predicted to represent more than 40% of online consumers in 2023 — a record-high number.

The total spending via BNPL could reach nearly $95 billion by the end of 2024.

BNPL spending is predicted to hit $143 billion by 2026.

In addition, crypto is gaining popularity as an ecommerce payment method.

Paypal, Shopify, Overstock.com, and Newegg are just a few online retailers that have already started accepting crypto payments.

Fees associated with processing crypto payments are lower than credit card processing. And, processing is faster.

Overall, global crypto payments are predicted to reach $11.43 billion by 2025.

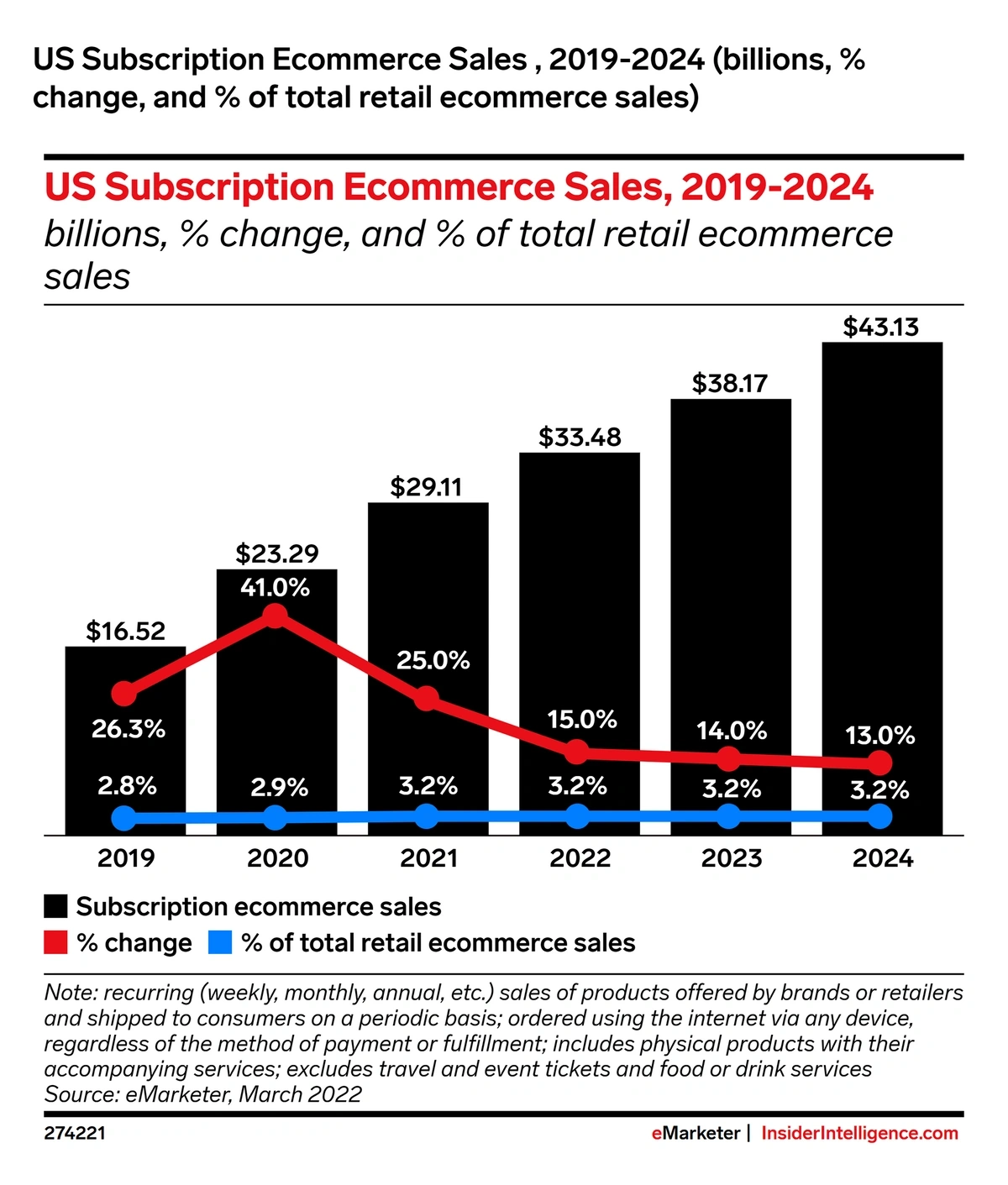

8. Ecommerce Subscription Market Grows Despite Economic Pressure

In the United States, ecommerce subscriptions are expected to top $43 billion in 2024.

Subscription sales are predicted to grow 13% between 2023 and 2024.

Subscriptions involving home goods and beauty products have the highest retention rate.

In the home goods category, 51% of consumers are still subscribed after 12 months. For the beauty category, that number drops to 36%.

Home goods subscriptions post the highest retention rates while food and beverage subscriptions have the highest lifetime customer value.

In 2022, the home goods category saw a 14% year-over-year increase in monthly recurring revenue (MRR). That was double the average increase of subscription MRR across all categories.

But, in post-pandemic times, many consumers are cutting back on discretionary spending. Some of them are feeling “subscription fatigue” and are scaling back on their subscriptions.

One report said churn rates for B2C subscriptions average 6% — close to double pre-pandemic rates.

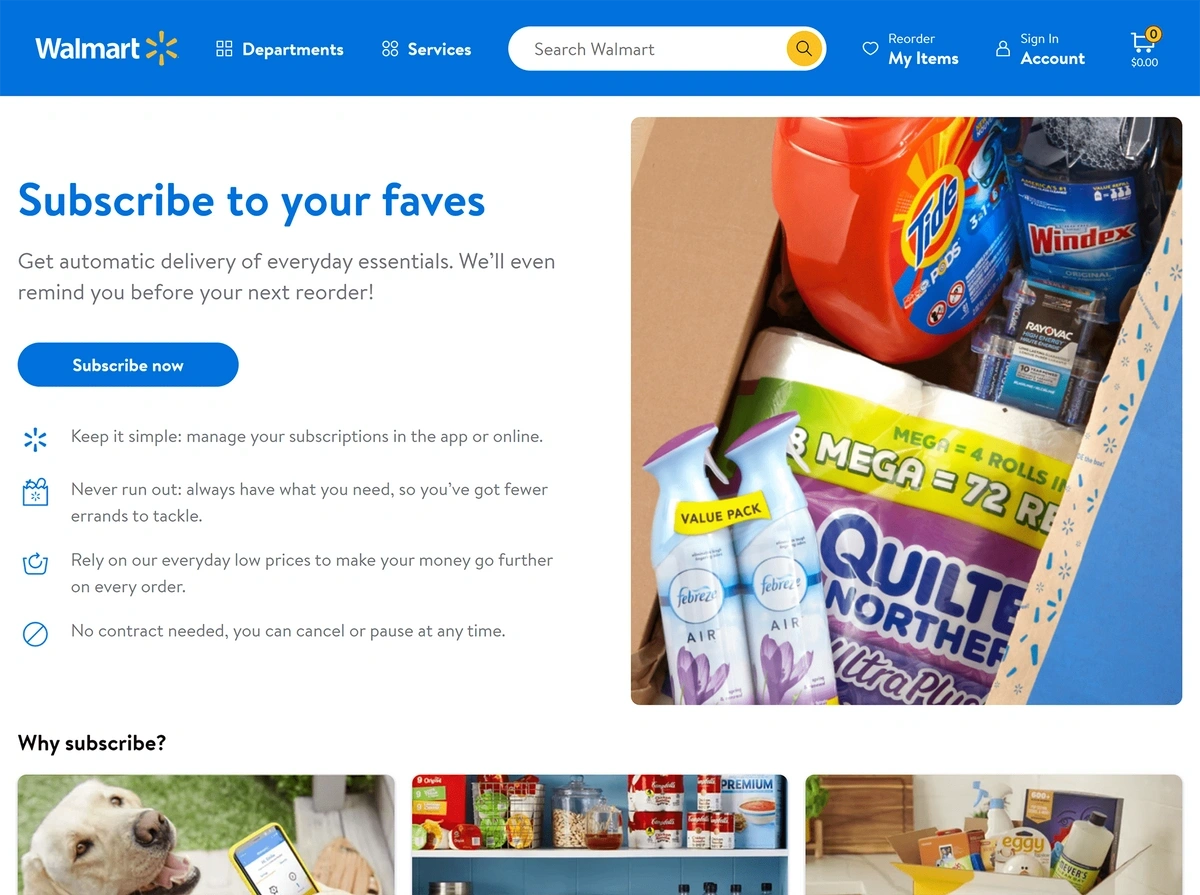

Replenishment subscriptions are one way to fight the “fatigue” and encourage customers to stick with their scheduled auto-ship purchases.

Convenience is key to replenishment subscriptions, and it turns out that most customers are willing to continue paying for their essentials to be delivered directly to their doorsteps.

In fact, Walmart recognized this demand and launched replenishment subscriptions in September 2023.

The subscriptions are available for a wide variety of Walmart’s products like pet food, diapers, paper towels, and other consumables.

Walmart’s auto-ship program offers free shipping on all Walmart+ orders and non-member orders over $35.

Vitable, an Australian vitamin brand, is another great example of a relatively new company successfully leveraging the ecommerce subscription model.

It recently announced that revenue increased at a 280% CAGR between 2020 and 2022.

Search interest in “Vitable” has increased nearly 725% in recent years.

Another example of a brand leveraging the subscription model is Butternut Box. This UK-based pet food subscription service delivers fresh dog food directly to the consumer’s door once every few weeks.

The pandemic helped the brand earn new customers in 2020, but it has remained a popular solution for pet owners and raised over $354 million in a 2023 funding round.

Search volume for “Butternut Box” has been steadily rising over the past few years.

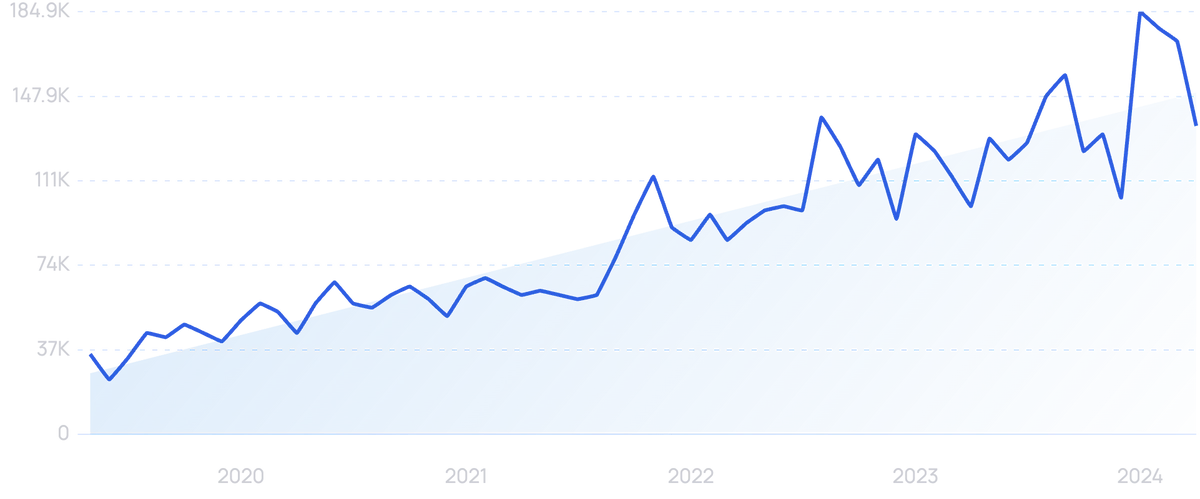

9. Mobile Commerce Drives Nearly Half of All Ecommerce Sales

By the end of 2023, it’s estimated that mobile commerce will be responsible for 43% of total retail ecommerce sales. That’s a slight increase over 2022 when mobile commerce accounted for 41.8% of sales.

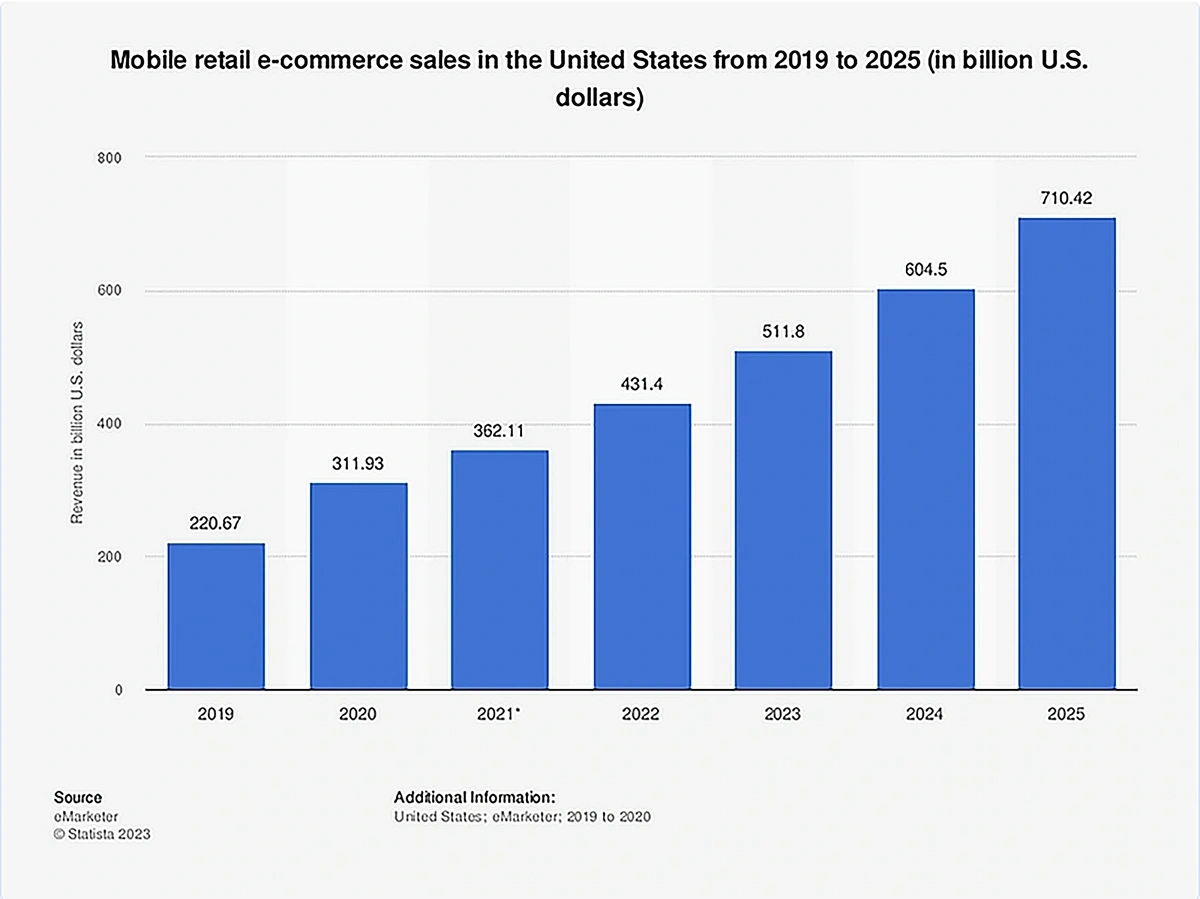

Total sales in this segment are predicted to exceed $710 billion by 2025.

Mobile commerce is predicted to drive more than $710 billion in sales in 2025.

Apps are the preferred method of mobile shopping.

One marketing firm found that 90% of consumers in the US have multiple shopping apps on their smartphones — 13% of those surveyed had 10 or more shopping apps.

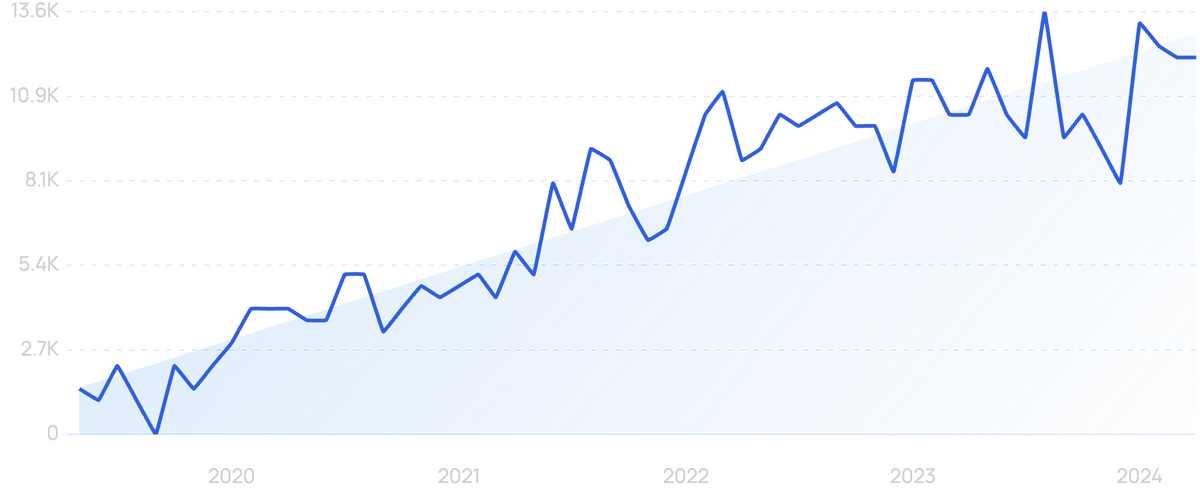

Consumers are spending an increasing amount of time on these shopping apps, too.

Data suggested that by the end of 2023, global consumers would spend more than 50 billion hours on Android shopping apps. That’s a 42% increase over 2020.

The amount of time consumers spend on shopping apps has increased dramatically since 2020.

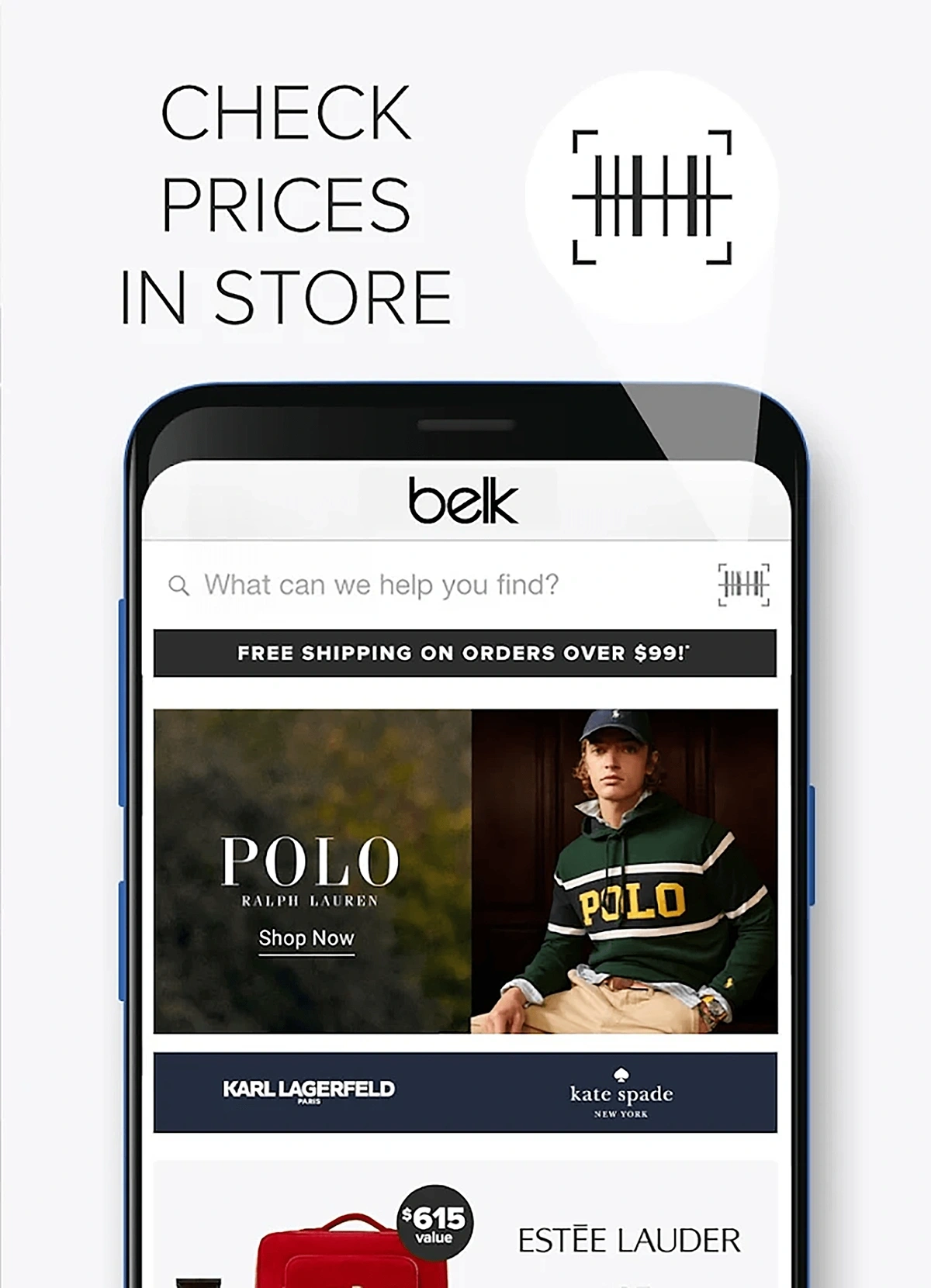

And consumers aren’t just using their smartphones to shop when they’re at home. They’re also using mobile devices while they’re shopping in-store.

Nearly three-quarters of consumers are likely to use their device in-store to do things like use a retailer’s app, scan QR codes, text to join a loyalty program, and read product reviews.

According to PwC, using a retailer’s app or website to find a product and then locate it in the store is particularly appealing to more than 40% of consumers.

In one set of rankings put out by a mobile app development company, the Belk app was rated as the top retailer shopping app.

The Belk app reminds customers of deals, coupons, and rewards.

The app has more than 1 million downloads in the Google Play store and an average rating of 4.4.

Belk uses a behavioral targeting strategy that sends personalized push notifications to shoppers, and the brand utilizes an in-app messaging center to boost engagement.

10. Brands Attract Customers with AI-Powered Personalization Tools

In today’s competitive ecommerce marketplace, brands need a way to capture consumer attention and hold their loyalty.

Personalization is one way to do this.

By playing into the specific needs and wants of each customer, ecommerce brands can deliver a tailored shopping experience that drives revenue.

A survey from Zendesk echoes this.

Nearly 80% of leaders say deep personalization leads to better customer retention and 66% say it leads to lower customer acquisition costs.

And nearly 60% of consumers want brands to collect data and use it to personalize their experiences.

The majority of customers want brands to use relevant data to personalize the shopping experience.

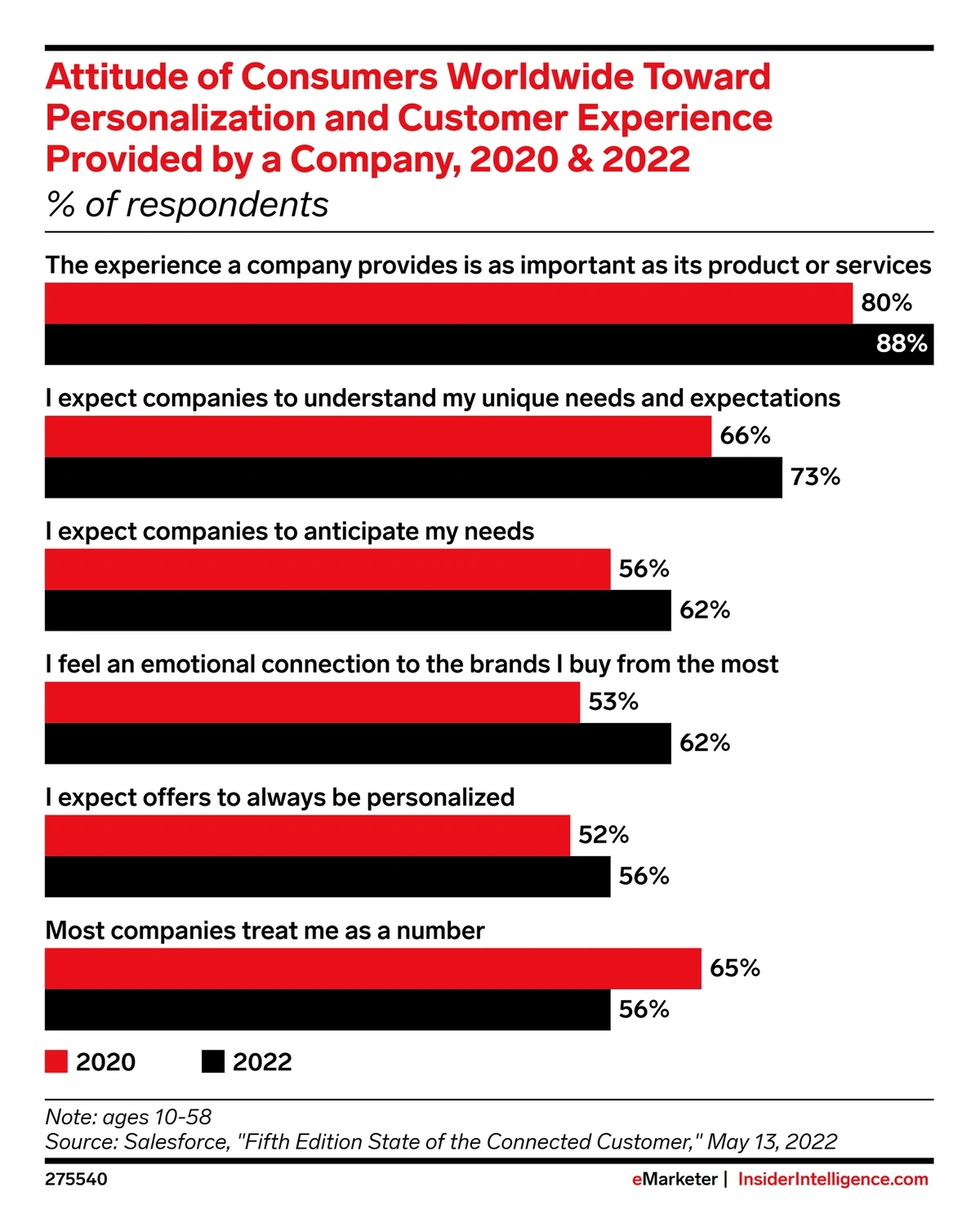

In the past two years, there’s been a growing demand for brands to understand the expectations of each customer and to anticipate their needs.

In 2020, 56% of consumers wanted companies to anticipate their needs. That number rose six points to land at 62% in 2022.

Consumers want personalized offers and a personalized experience when interacting with a brand.

Retailers are recognizing this gap and many plan to invest in personalization technology in the coming years.

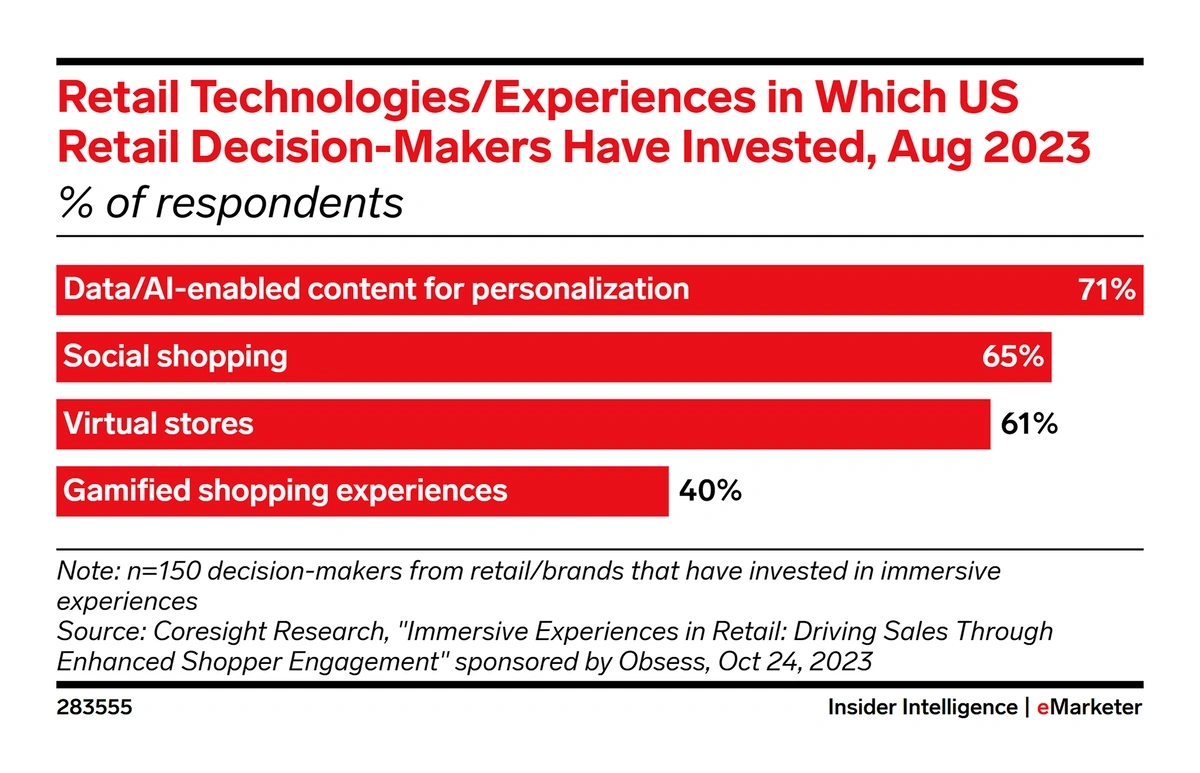

One of the main technologies they’re using is AI.

In one survey, 71% of brands that have invested in immersive customer experiences said they’re focusing on AI tools for personalization.

And they’re already seeing results. More than 60% saw increases in CTR, time on site, and Net Promoter Scores.

Improving personalization by using AI technology is the most popular way that brands are creating immersive experiences.

One example of personalization in action comes from Saks Fifth Avenue.

The company’s CMO reports that brand communication to customers is tailored using 250 data points including historical shopping data and predictive attributes.

Tapestry, the parent company of Coach and Kate Spade, is using AI to personalize content throughout the shopping journey.

Everything from website banners to landing pages to CTA buttons are personalized using an AI-powered word bank and automated decision-making technology.

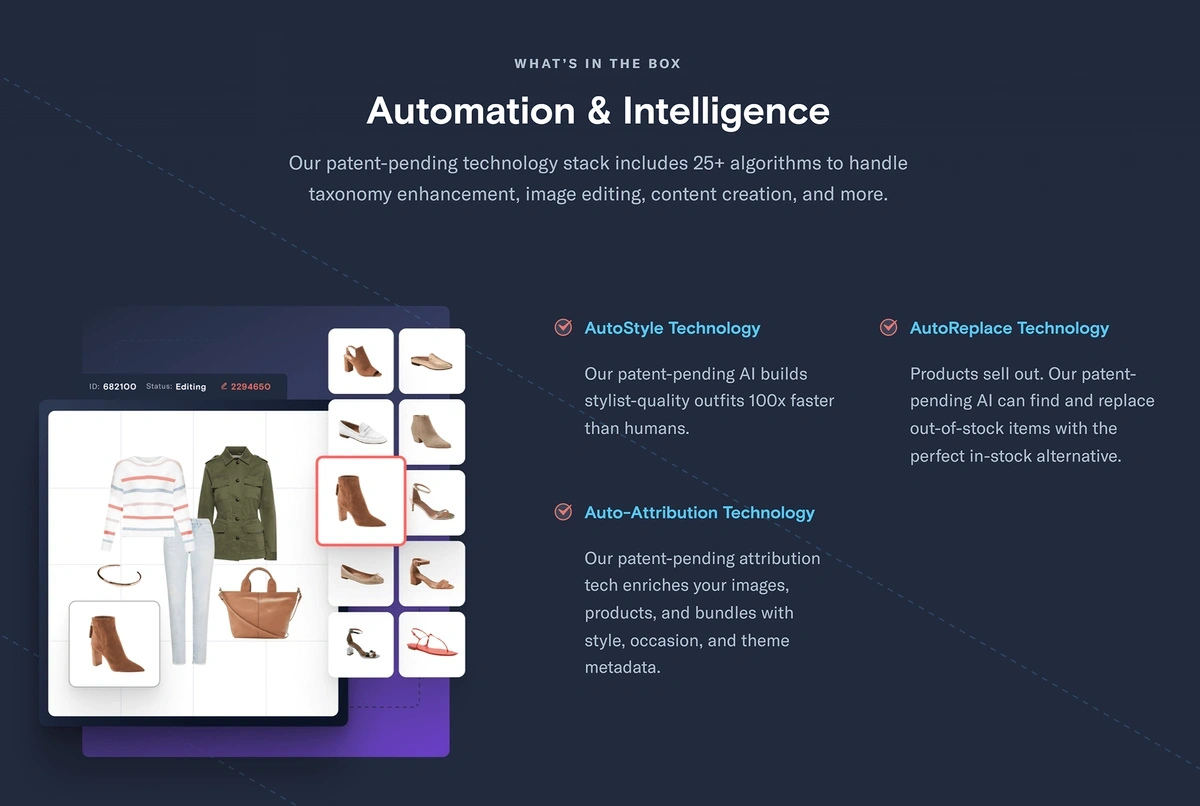

On a broader scale, Stylitics is an ecommerce solution that uses AI to showcase personalized product recommendations for fashion brands.

Stylitics’ technology builds personalized outfits for each ecommerce customer.

In a Stylitics-commissioned study, Forrester found that automation from the Stylitics platform can result in a 563% return on investment and a 15% increase in conversion rates.

11. Retailers Continue to Invest in Quick Commerce

Consumer demand is fueling the growth of quick commerce, the concept of providing hyper-fast delivery of ecommerce goods.

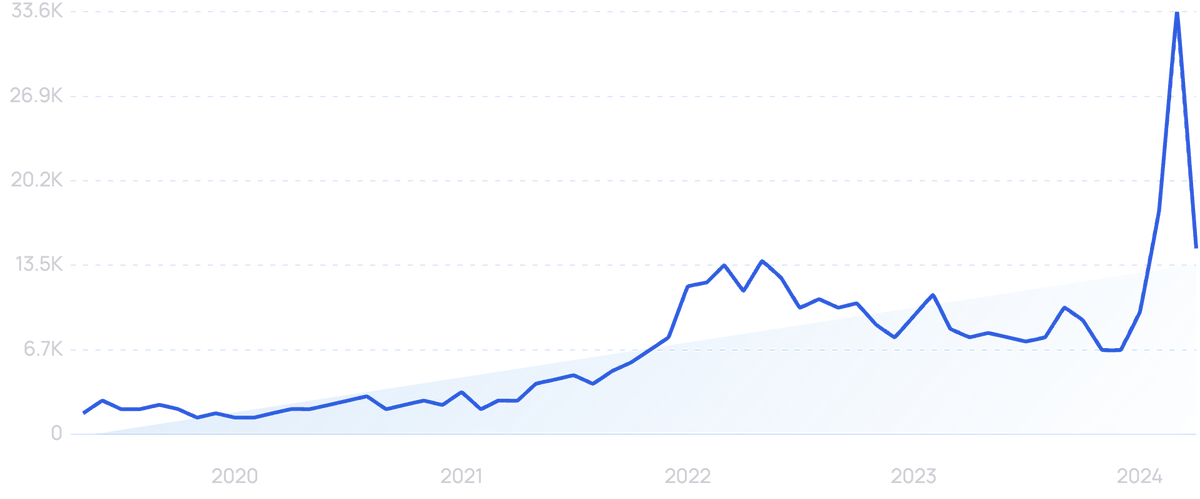

Search interest in “quick commerce” jumped in 2022.

In April 2023, the average time between placing an order and final delivery was four days. That’s compared to 5.6 days just one year earlier.

But for many consumers, that’s not fast enough.

A recent survey found that 86% of consumers consider items that arrive in two days or less as “fast delivery.” And, more than 60% of consumers will switch retailers if the items arrive outside of that timeframe.

The survey also found that 55% of consumers are willing to pay $5 for same-day delivery.

Data shows there are approximately 50 million quick commerce users (a 19% penetration rate) in the United States market as of 2023, but predictions show that number could soar as high as 66 million by 2027.

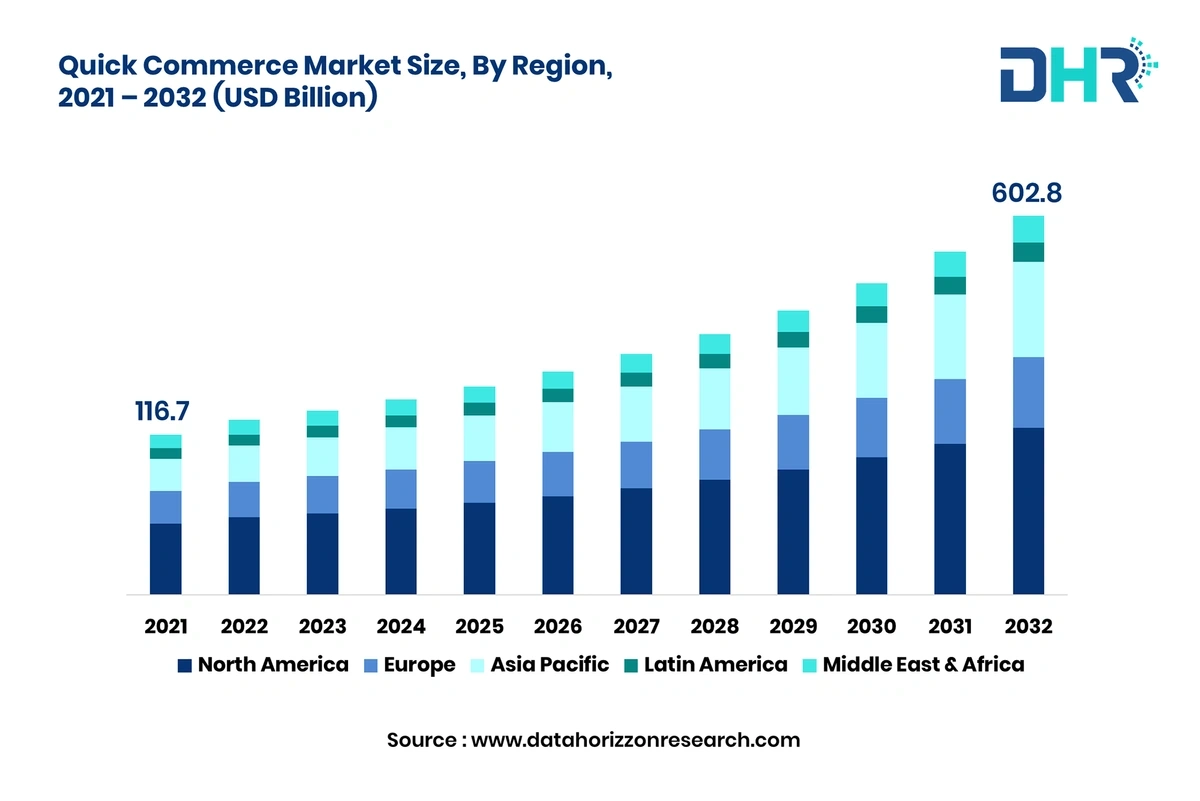

Overall, the quick commerce market (defined as the delivery of any type of goods within 30 minutes), is predicted to grow at a CAGR of 16.4% through 2032 when it could be valued at as much as $603 billion.

The quick commerce market is growing across the world.

In order to maximize profits and efficiency, brands have begun operating dark stores. These stores are closed off to in-person shoppers and instead, they serve as fulfillment centers for local ecommerce orders.

This trend first became popular with grocery delivery during the pandemic, but now, it’s expanded to include a wide variety of ecommerce goods.

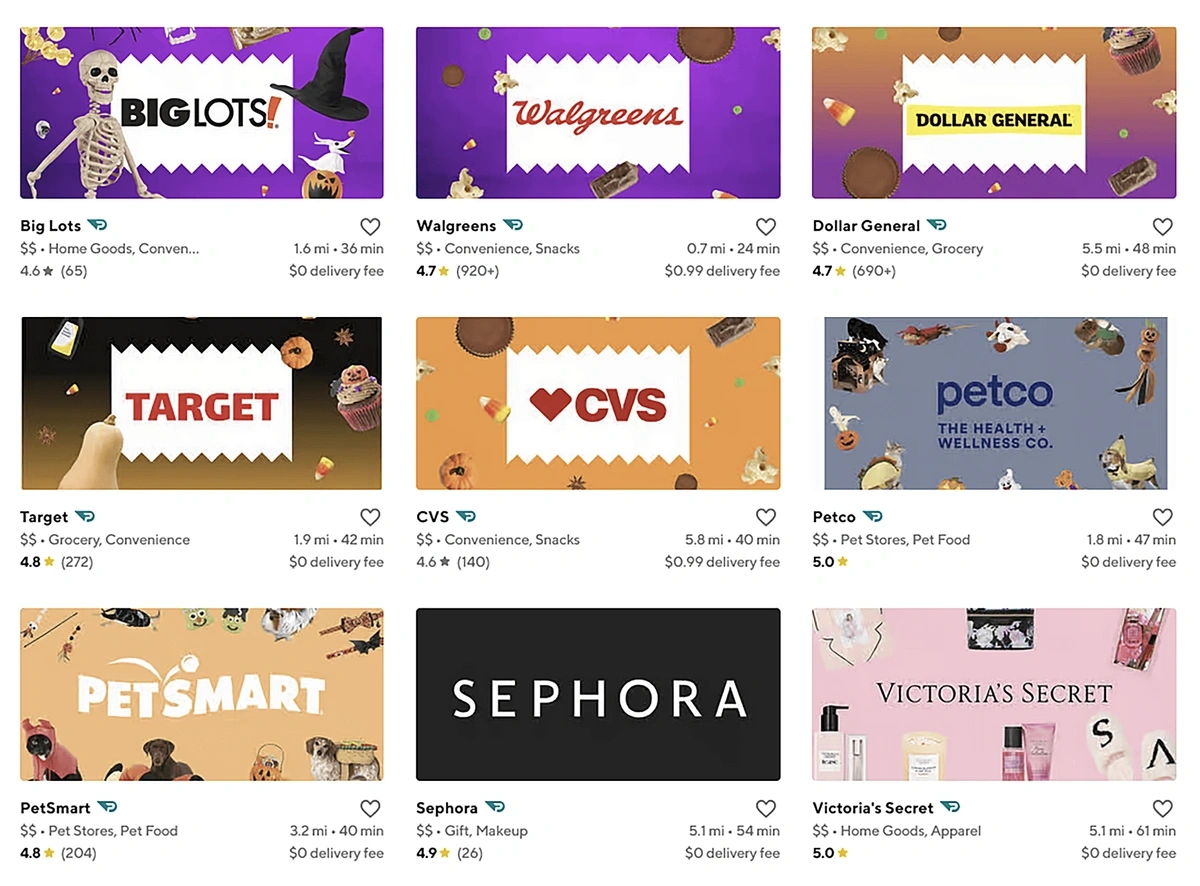

DoorDash is a delivery service that’s become well known for restaurant and grocery deliveries, but the brand recently launched partnerships with Dick’s Sporting Goods and Big Lots in late 2022. Then, in March 2023, the company announced additional ecommerce partnerships with Lush Cosmetics, Party City, and Victoria’s Secret.

DoorDash has recently announced partnerships with several ecommerce retailers.

Amazon is all in on quick commerce, as well.

The Wall Street Journal reports that the ecommerce giant is investing resources and dedicating facilities to ensuring the delivery of goods in less than 24 hours.

This includes building more than 100 “same-day sites” in the next several years. These sites are located near large cities and house 100,000 of Amazon’s most popular products.

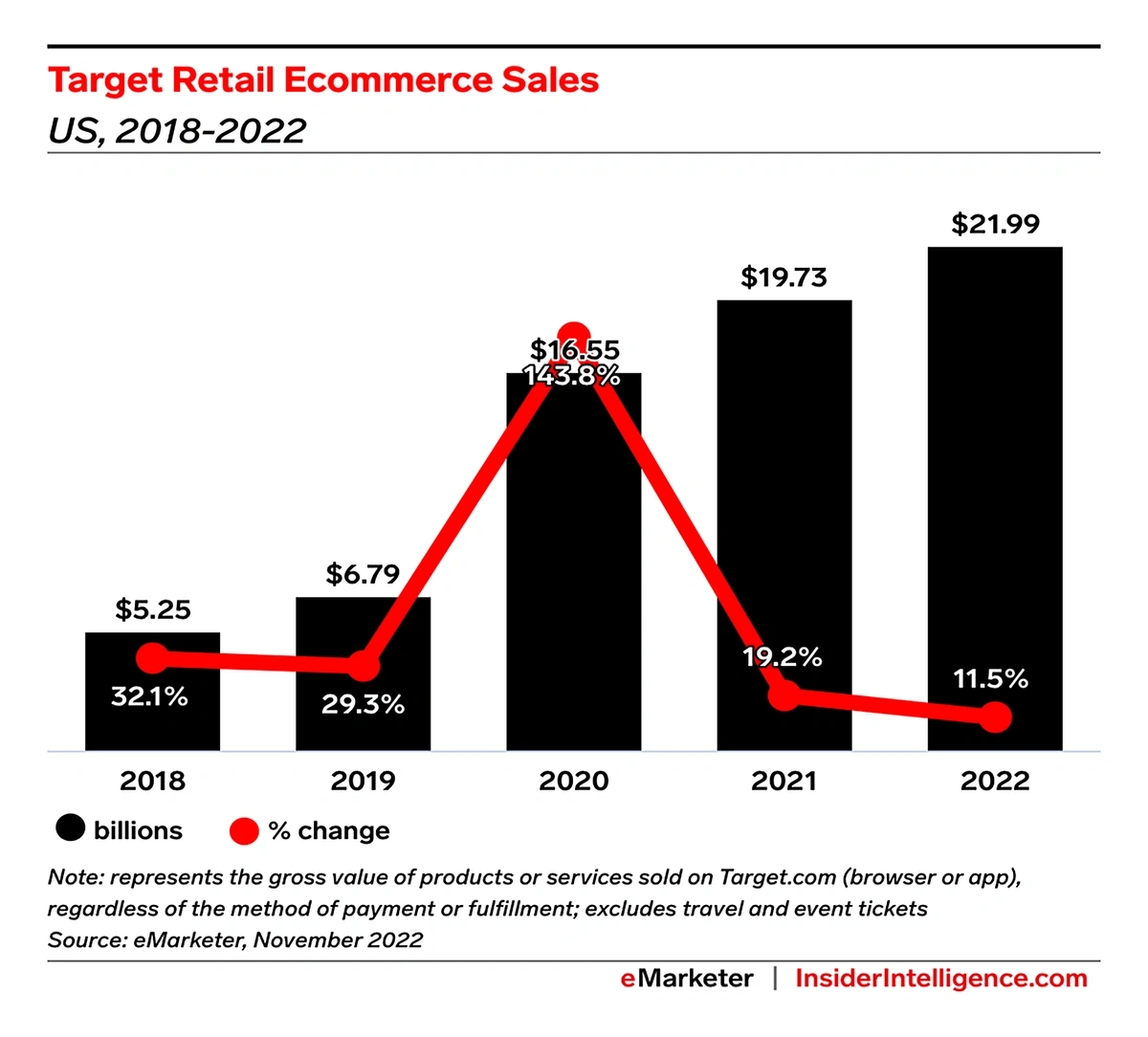

There’s also Target.

The brand is pouring $100 million into its “stores as hubs” strategy in which store employees pick and pack nearly 97% of all ecommerce orders.

As part of the strategy, Target also plans to build 15 new sortation facilities by the end of 2026.

Target delivered nearly $22 billion in ecommerce goods in 2022.

And, in September 2023, Walmart announced it would be expanding the hours of its express delivery service until 10 pm.

The quick commerce model seems to be attractive to fashion retailers, as well.

Need It For Tonight is a London-based startup that guarantees fashion items ordered on their app will be delivered within 90 minutes. Customers pay a flat fee of about $10 per delivery.

Need It For Tonight orders are delivered via bike courier.

In Australia, the peer-to-peer fashion marketplace Designerex is partnering with Uber to provide two-hour deliveries.

12. Consumers Opt for Second-Hand Ecommerce

As sustainability weighs on the minds of consumers and inflation squeezes their budgets, second-hand ecommerce is becoming more popular than ever before.

Resale ecommerce produced $77 billion in sales in 2022.

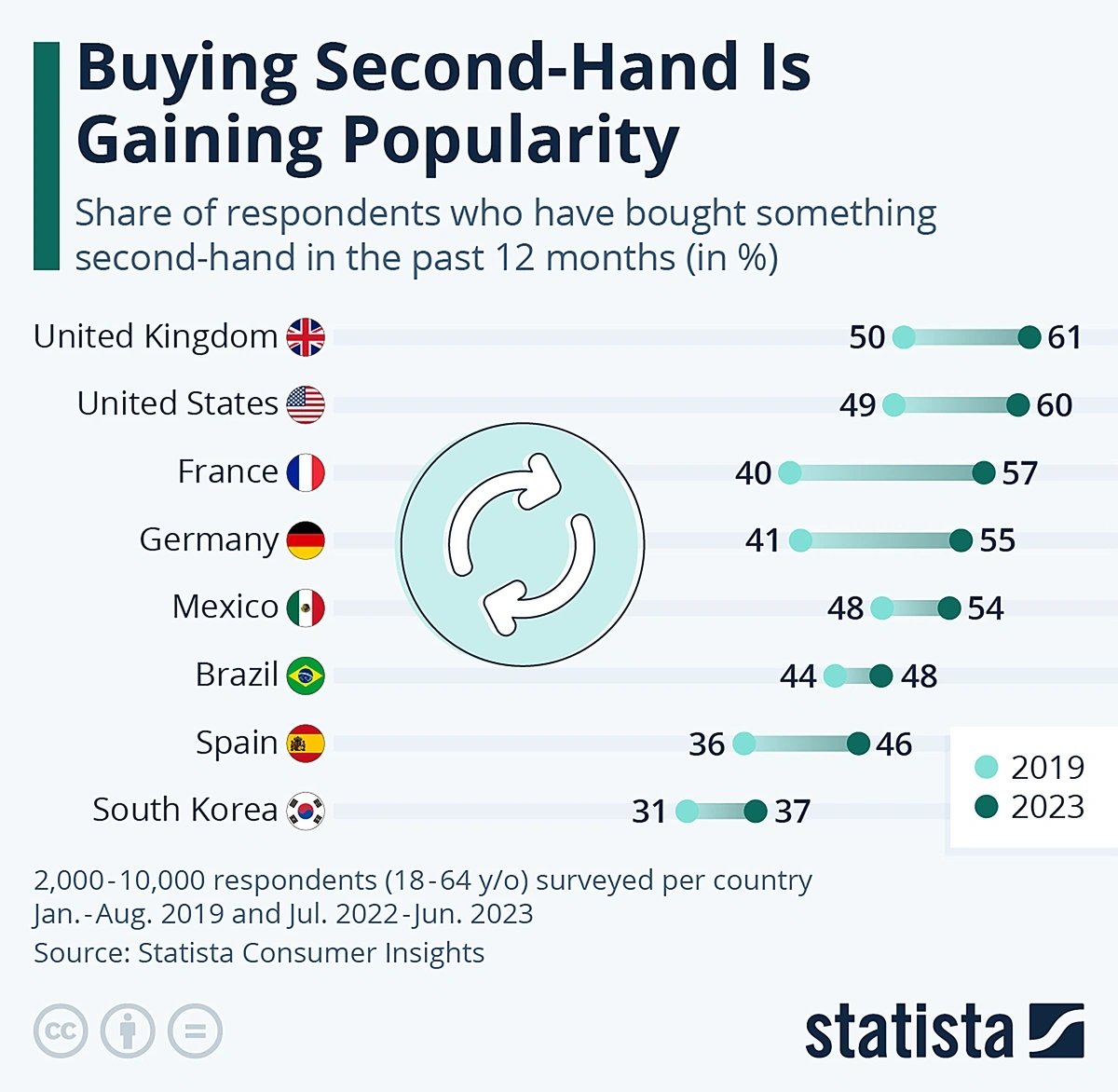

Surveys show 60% of Americans made a second-hand purchase between June 2022 and June 2023. That was an 11% increase over the previous 12 months.

The United States and the United Kingdom have the highest participation rates in second-hand commerce.

The total value of the ecommerce resale market is predicted to cross the $100 billion threshold by 2026.

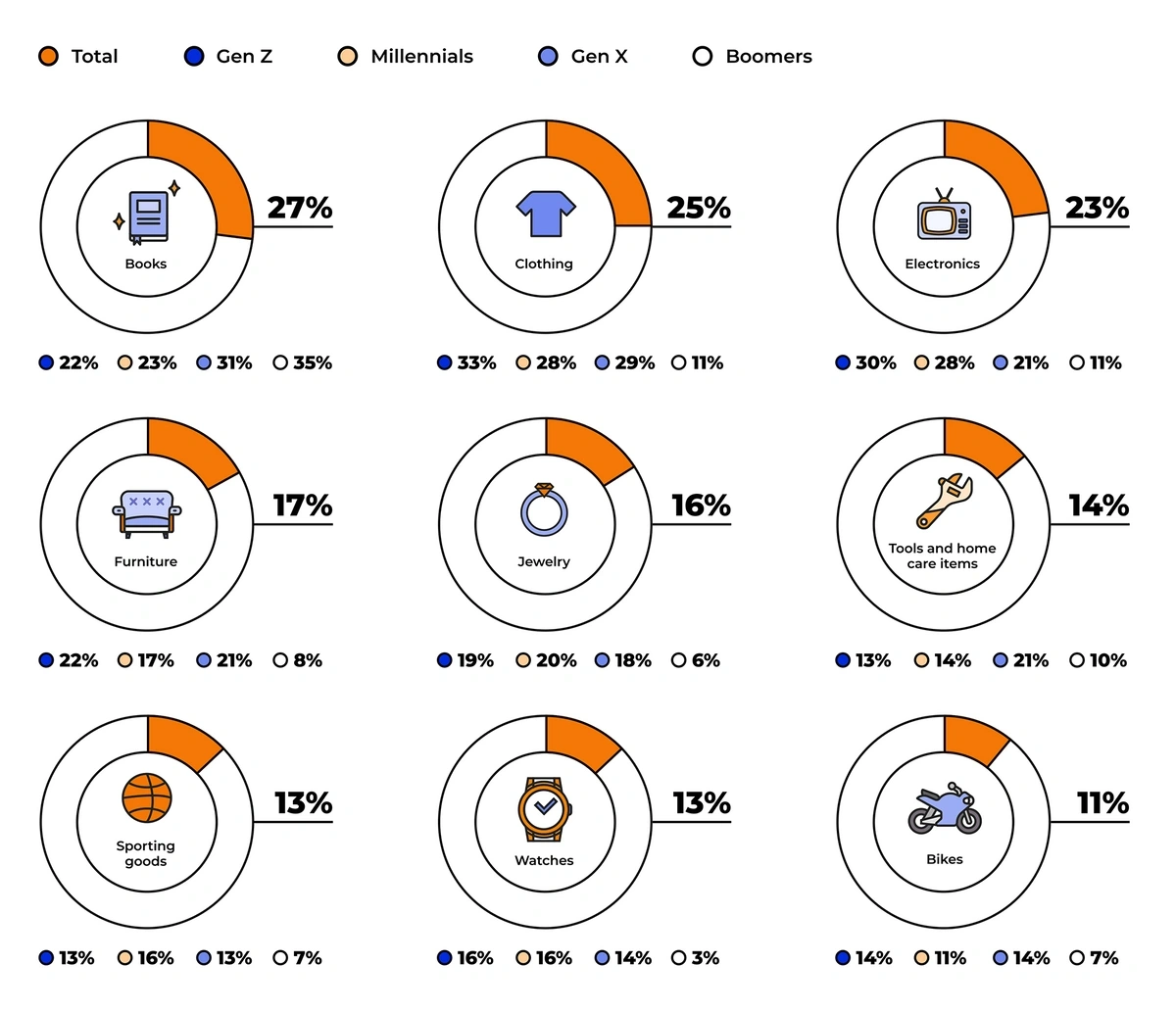

While books are the most popular segment of online resale, second-hand fashion in the United States has grown into a $12-billion-dollar sector in the past few years.

In one survey, an average of 27% of respondents had purchased used books online while 25% had purchased used clothing.

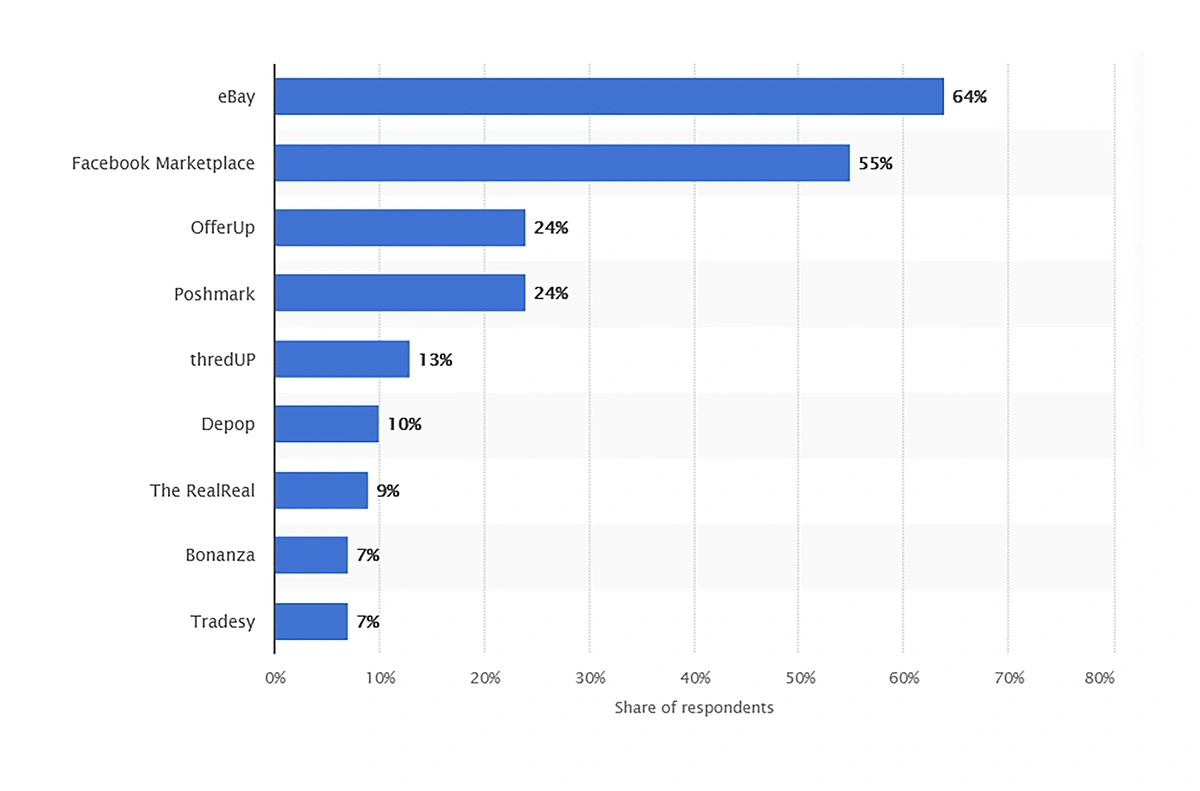

In 2022, six of the top nine online resale platforms were fashion-focused.

Poshmark, ThredUp, and Depop were the most popular fashion resale platforms.

ThredUp continues to grow.

In the second quarter of 2023, the resale platform processed 1.8 million orders and reported an 8% increase in revenue year-over-year.

Most fashion resale platforms are strictly online. However, Goodwill is a popular resale brand with hundreds of physical stores, and the brand is just now jumping into resale ecommerce.

Several Goodwill locations are adopting technology that allows them to efficiently sell donated items online.

In some cases, Goodwill workers simply feed clothing into intelligent machines that are able to photograph the item, price it, and post it online at GoodwillFinds. The machines can possess one piece of clothing every seven seconds.

GoodwillFinds lists second-hand items in several categories like video games, musical instruments, and collectibles.

13. TikTok and Investors Beton Live Shopping

Live shopping is an ecommerce trend that’s been huge in China in recent years.

In 2022, livestream shopping brought in more than $500 billion in sales in China. That was eight times more than in 2019.

It’s a trend that many ecommerce experts in the United States have been watching, but it’s been a slow build so far.

As of August 2023, just 5% of US adults reported using livestream shopping regularly. An additional 9% say they’ve used this method of shopping before but don’t use it regularly.

Livestream shopping interest in the United States remains low for now.

But some ecommerce platforms aren’t discouraged by these numbers. Many are still investing in livestream shopping options.

TikTok is one example.

The social platform is offering sales commissions (covering the costs of coupons and free shipping) for creators that utilize live shopping.

In 2025, a total of 760,000 live streams generated over 1.6 billion views during the 4-day TikTok Shop Black Friday event.

Search interest in “TikTok live shopping” has increased more than 1,000% in recent years.

Many brands utilize TikTok to host live shopping events, but other brands are building their own livestream shopping platforms.

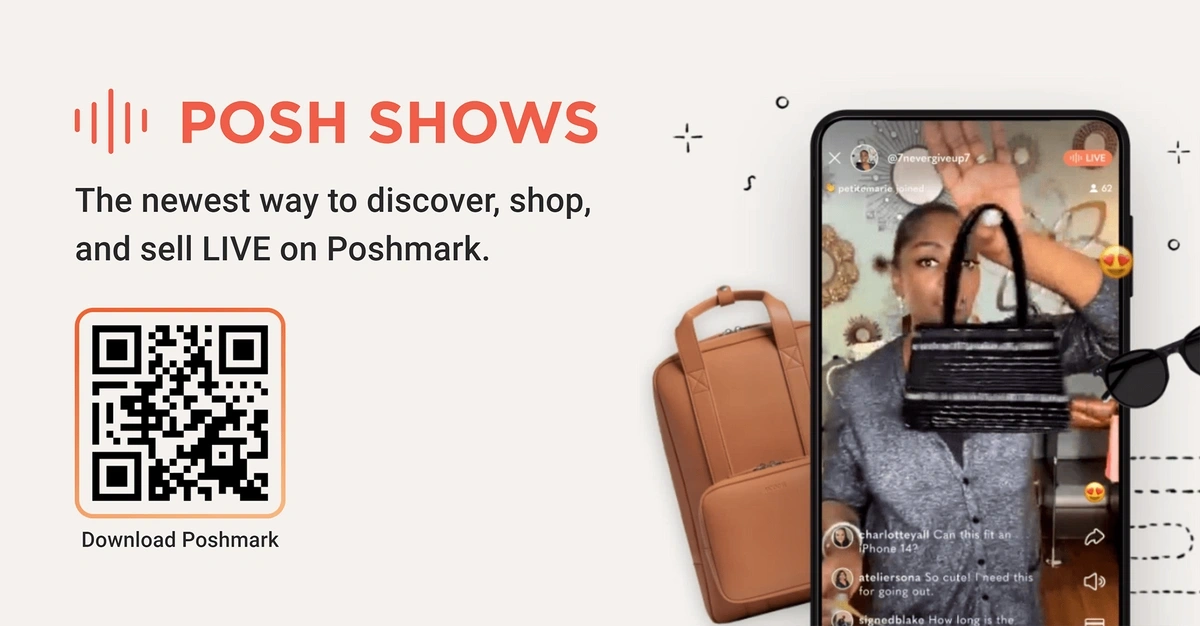

Poshmark, a peer-to-peer marketplace, has Posh Shows. This feature allows users to livestream their items and auction them off.

The platform released live shopping capabilities as a beta feature in early 2023. More than 100,000 users have already hosted a Posh Show and there’s a waitlist of users wanting to try it.

Posh Shows allow sellers to connect with their audience in real time.

Here’s another sign that livestream shopping will gain popularity in the coming years: investors are flocking to the market.

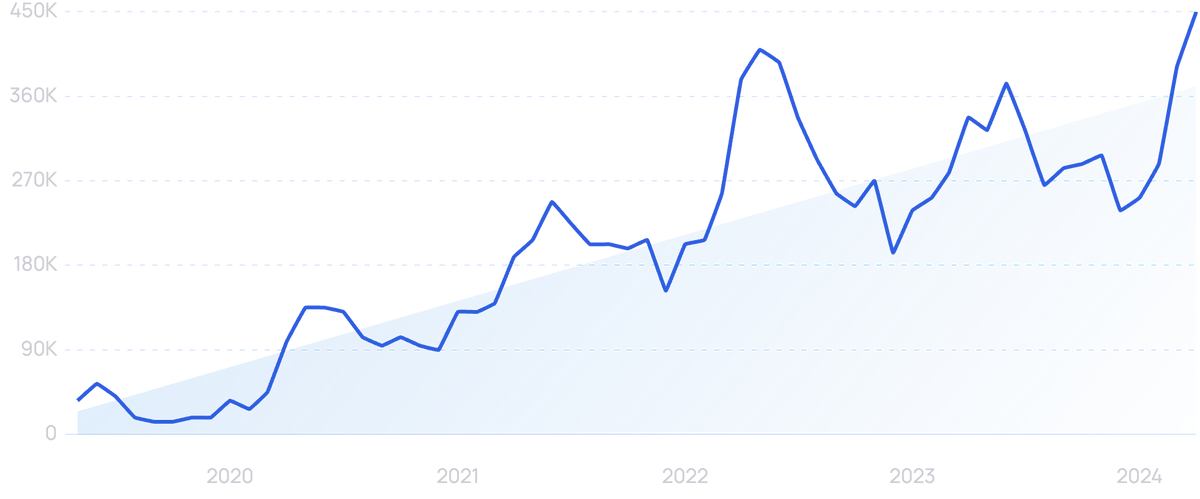

In 2020, $36 million was invested in livestream ecommerce companies. In 2022, investments were up to $380 million.

Whatnot is one of the companies that has received millions in funding. Their most recent funding round netted $260 million.

The company’s overall valuation has reached $3.7 billion and revenue grew 3x year-over-year in the first half of 2022.

Whatnot shoppers can participate in livestream shopping in a variety of product categories.

In October 2023, another livestream shopping startup, Supergreat, closed. Whatnot is reportedly set to acquire nearly all the staff members.

Conclusion

That wraps up the top 13 trends we expect to impact ecommerce over the next two years.

Despite looming uncertainties and economic challenges around the world, ecommerce spending continues to grow at an unprecedented pace. Shoppers have more choices than ever before. That means retailers must craft innovative strategies to gain the attention of consumers and build loyalty among current customers.

Some ecommerce brands are already building immersive customer experiences by taking advantage of AI tools and AR technology. Others are betting on social media and mobile commerce. But whatever marketing strategy they use, smart brands must incorporate the values that are most important to today’s consumers, like authenticity and sustainability.

Find out how Exploding Topics can support your e-commerce business today.

You may also like:

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more