Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

6 Important M&A Trends (2024-2026)

You may also like:

Mergers and acquisitions are integral to the development and growth of the global economy.

M&As allow businesses to acquire new technology, make strategic transitions, and offer exits for investors.

Read on to learn about the most important trends influencing the world of M&A.

1. Megadeals Are on The Rise

Megadeals are M&A transactions valued at over $10 billion.

In 2022, there were 2,589 M&A transactions, with a value of around $612.6 billion.

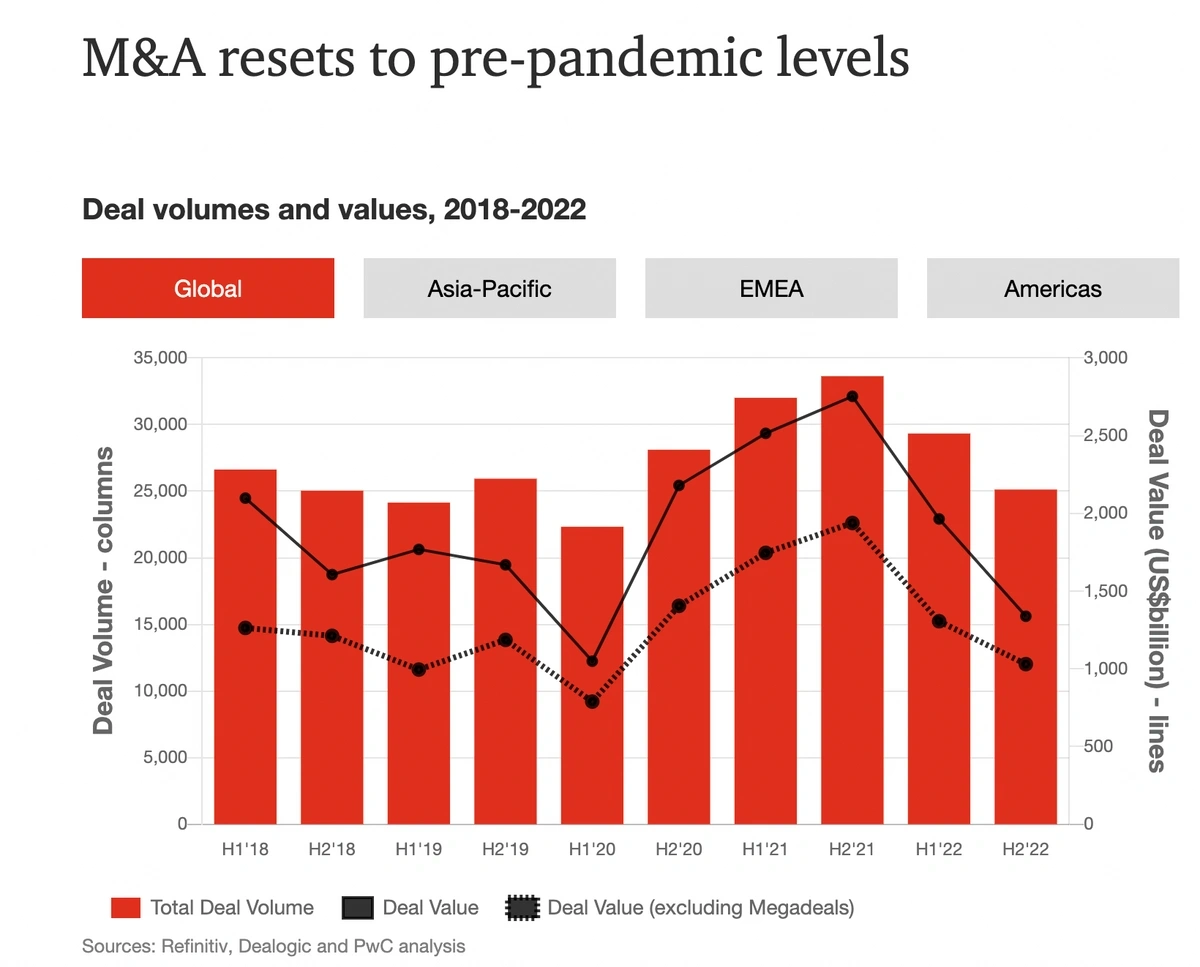

Global deal volume and value per quarter since 2018.

To put the size of the deals into perspective, just look at the first half of 2020.

There were more global deals overall in 2020 (13,275).

But the total value ($921 billion) was around a third of the deals announced in the first half of 2021.

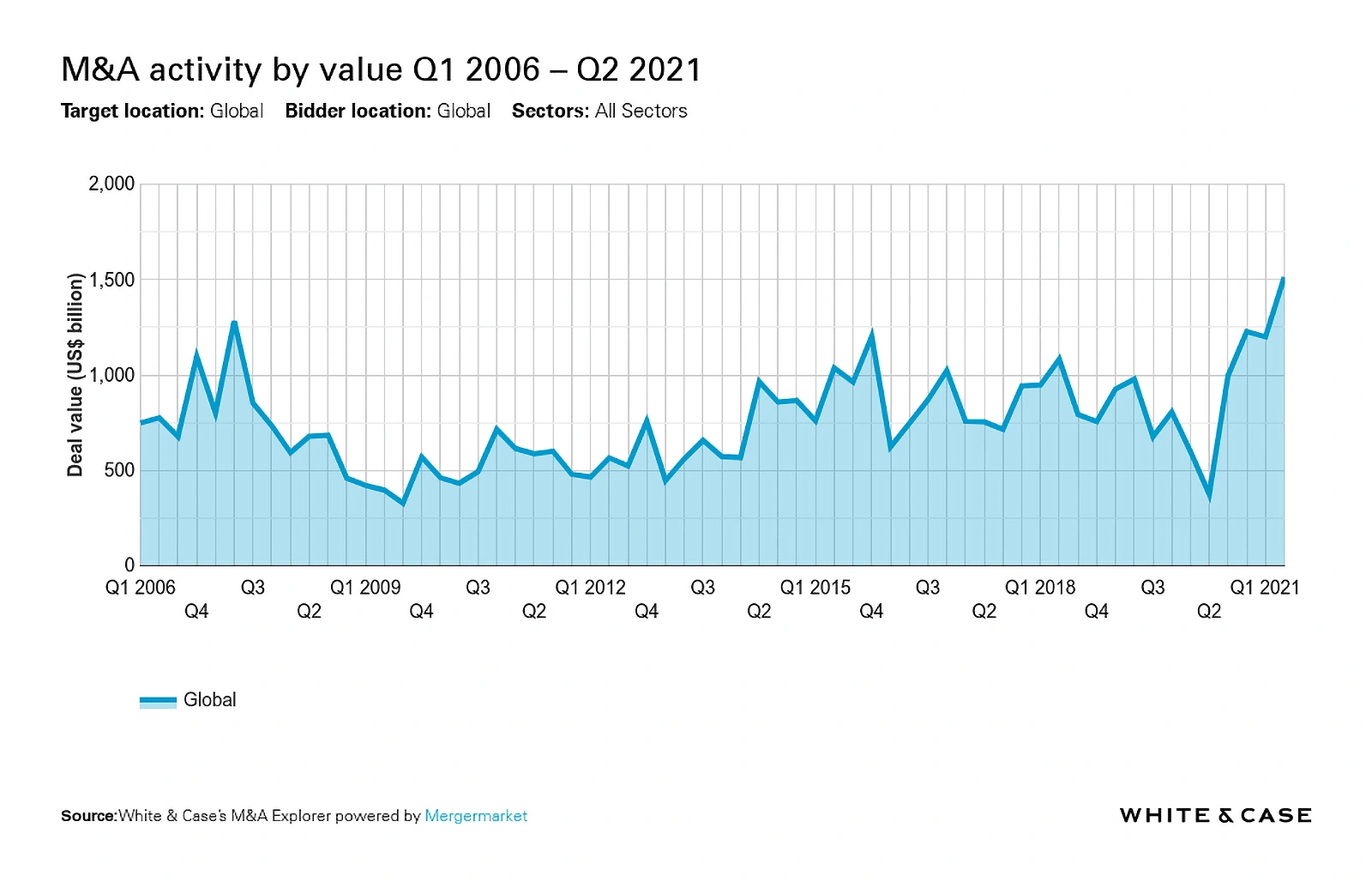

In fact, the first half of 2021’s total deal value was higher than any other first quarter on record (going back to 2006 in their database).

Total deal value by quarter, going back to 2006.

According to Barron’s, there have been 26 of these transactions announced in the first half of 2021. The total value of these deals was $671 billion.

The US claims 15 of these deals and $432.5 billion (about 64%) of the value.

And just like the rest of the world, the US has seen a smaller number of overall deals (down 5% compared to the first half of 2020).

However, the total value of deals in the US grew to $1.29 trillion in the first half of 2021. This is compared to just $316.7 billion in deal value in the first half of 2020.

Four of the five largest deals in the first half of 2021 took place in the US.

White & Case reports that the technology, media, and telecommunications (TMT) sector was the largest global source of deals by sector.

As the technology sector continues to grow and expand to pretty much every other sector, global M&A mega deals may increase substantially.

2. Private Equity Increases Its Share of Global M&A

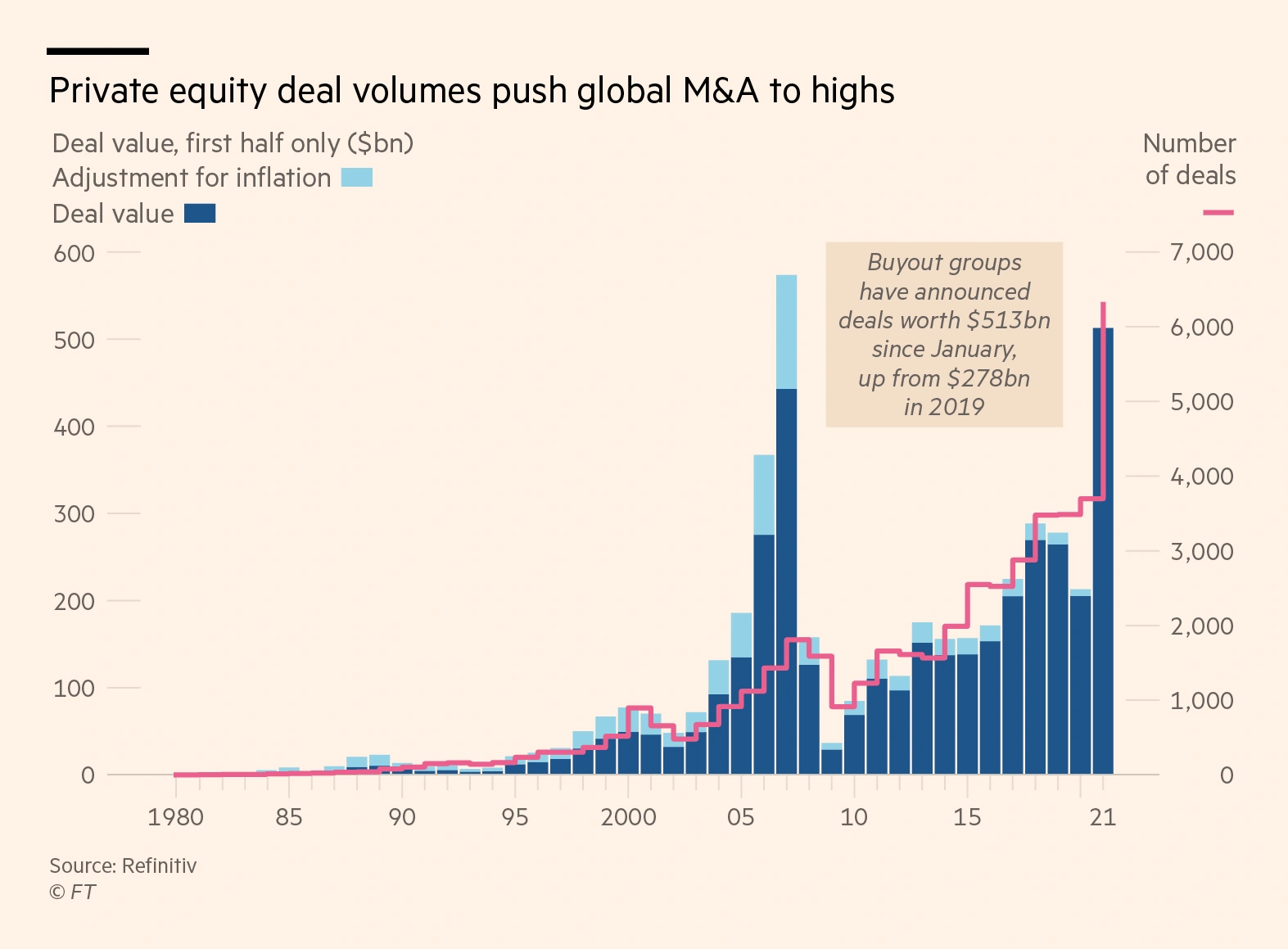

Over the past few decades, private equity (PE) has been taking a larger and larger share of the M&A market.

According to the Financial Times, private equity had its biggest first half in 2021 since 1980.

There were 6,298 PE-backed transactions announced in the first half of 2021 worth about $513 billion.

The total value of deals in the first half of 2021 surpasses every other past year by a wide margin.

And it looks like this isn’t going to slow down any time soon.

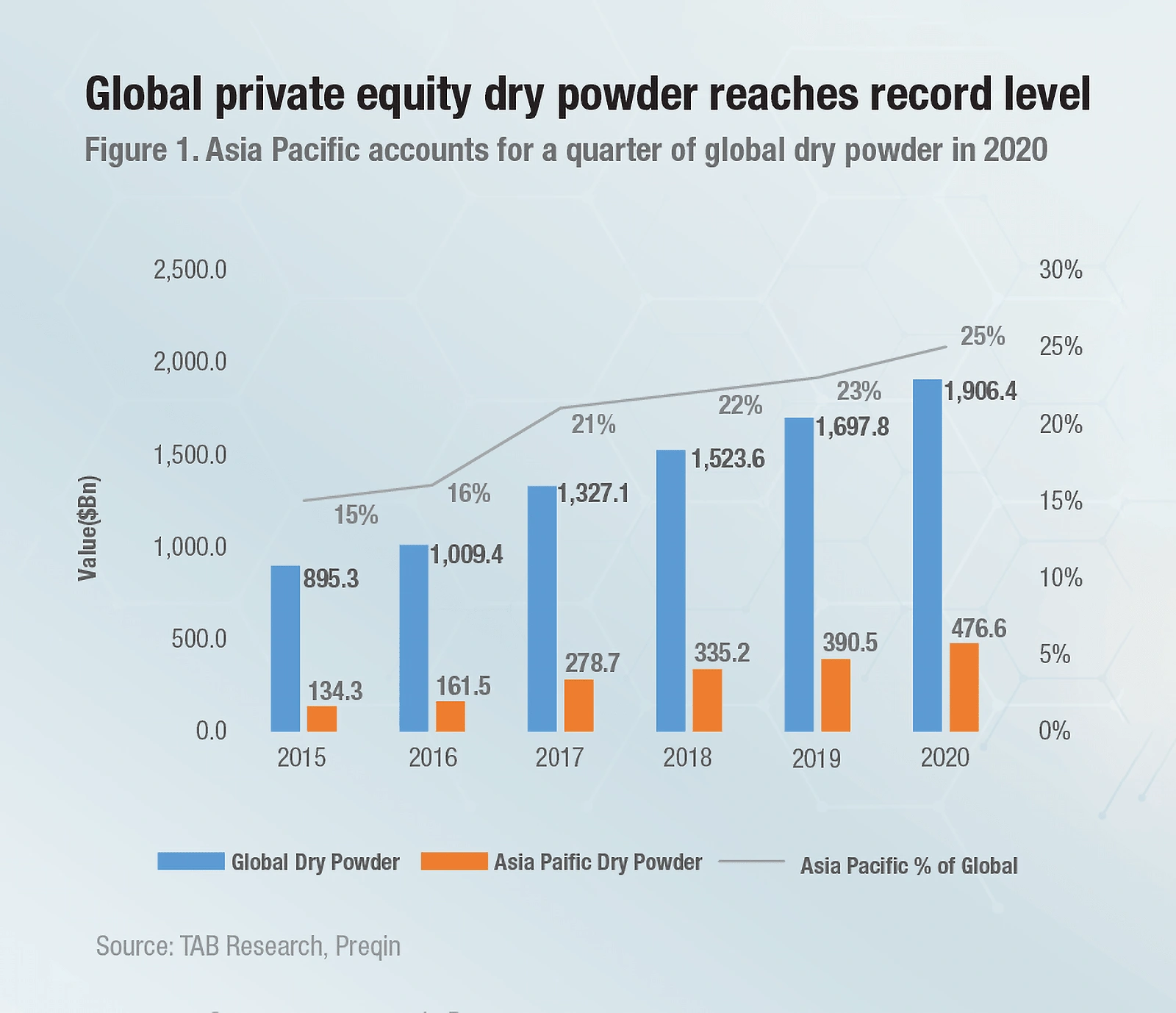

Global PE dry powder has been growing for years, driven by increased growth in the Asian Pacific.

It’s estimated that the first half of 2021 added an extra trillion to PE dry powder, bringing the total to $3 trillion.

US PE dry powder sat at roughly $150 billion as of mid-2021.

The Blackstone Group is the world’s largest private equity firm based on assets under management.

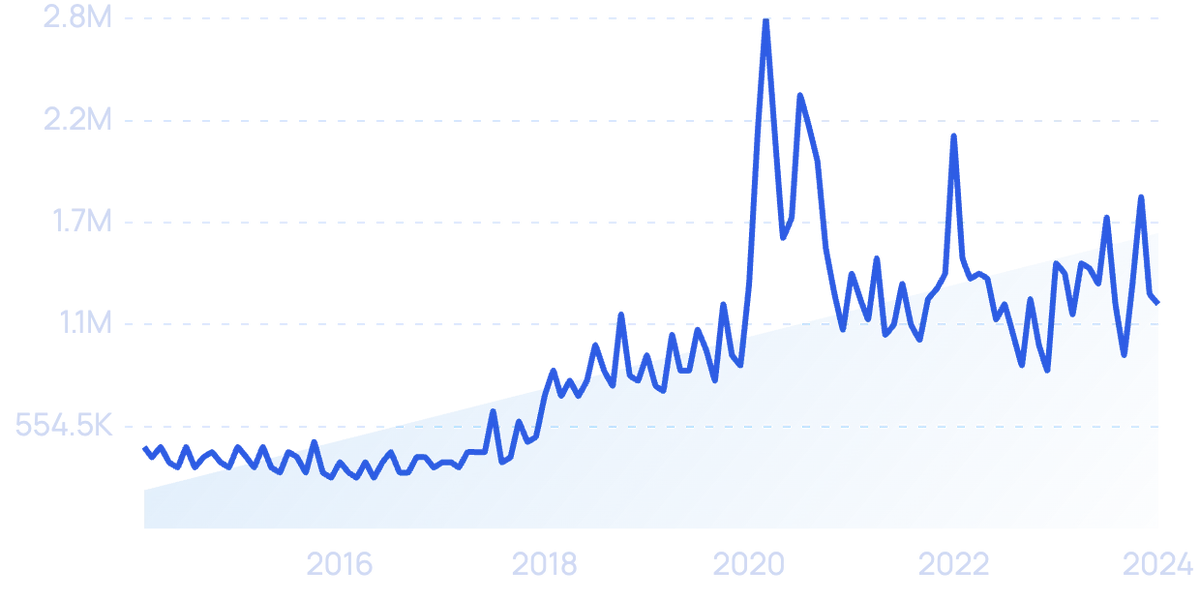

Search interest in "The Blackstone Group" has increased by 40% over the last 10 years.

As of July 2021, Blackstone reported $223.6 billion in private equity AUM. This is 21% higher than 2020’s mid-year number.

Bain Capital – another large US PE firm – has shifted its focus to the early-stage startups

It started Bain Capital Ventures back in 2001 but has recently ramped up its AUM in 2021. It raised $1.3 billion in the first half of 2021, bringing its AUM to $6.7 billion.

3. Industry Rollups Offer New Ways for Acquirers to Create Value

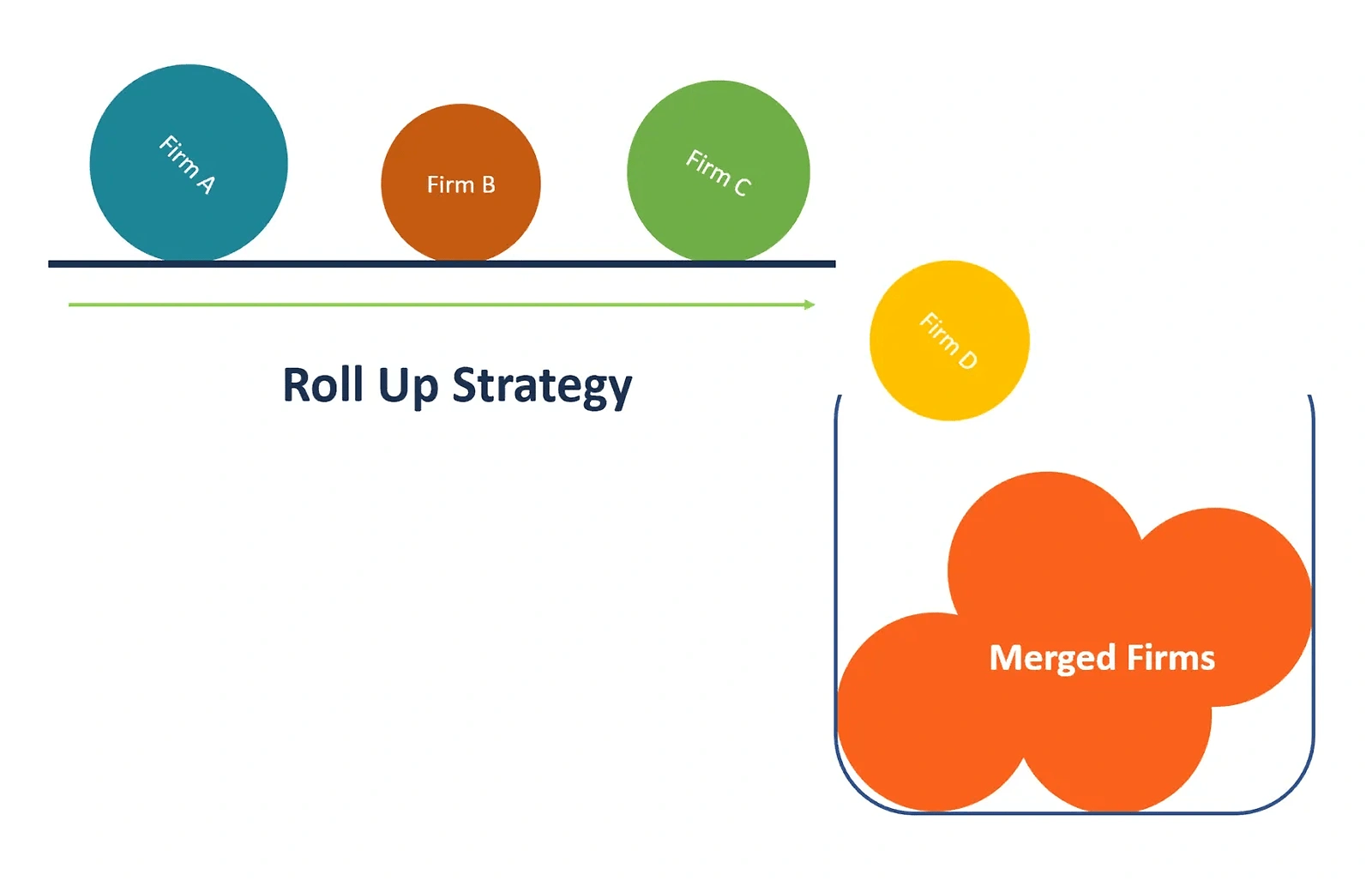

One M&A strategy that has become popular in recent years is the industry rollup.

The process typically involves one holding company that goes on an acquisition spree, buying up several different companies in the same industry.

How a rollup acquisition strategy works.

Rollups allow a holding company to combine resources and share operating costs required to run multiple companies in the same industry.

Industry roll-ups are especially prevalent in lower and middle-market M&A activity.

Although there were some mega-deals announced in the last several years, 68.7% of all transactions were under $100 million in 2020.

In a market like this, industry roll-ups are a major way for acquirers to add value. They can create economies of scale and value the whole greater than the sum of the parts.

It’s no surprise then that 62% of PE firms that were actively looking to acquire in 2021 said they were pursuing a rollup strategy.

Because of this, rollups are on the rise in the fragmented eCommerce industry.

Thrasio, a company founded in 2018, has sought to consolidate the eCommerce market.

In their first two years, Thrasio acquired more than 125 Amazon brands.

And in 2020 Thrasio was the fastest company to ever reach a valuation of $1 billion.

This has kicked off a trend in the Amazon third-party seller market.

Close to a billion dollars was raised by firms and funds looking to acquire Amazon eCommerce brands in 2020. And $2.5 billion was raised in just the first four months of 2021 to acquire Amazon brands.

One of the other largest companies executing this strategy is The Hut Group.

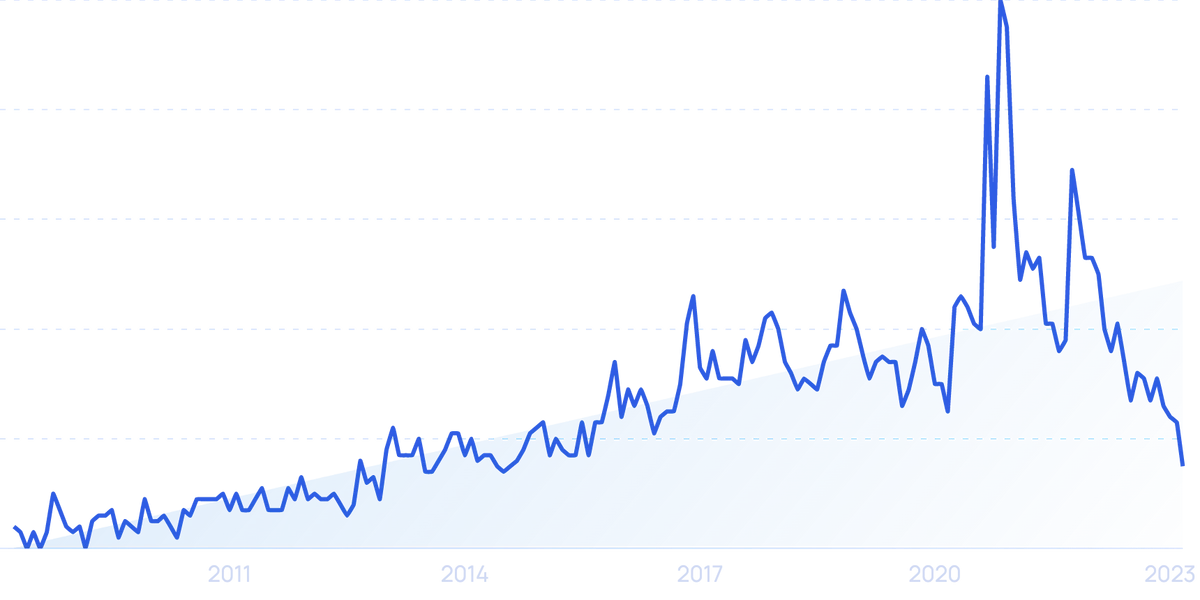

Searches for "The Hut Group" have grown by 1,050% over the last 15 years.

The Hut Group was founded back in 2004 in Manchester, England.

Since then it has acquired multiple eCommerce brands (mostly in the health and beauty sector.)

The Hut Group now has 300 websites through which it sells direct-to-consumer products.

As eCommerce rollups became more popular in 2020, The Hut Group went public at a $7 billion valuation – the largest IPO in the UK since 2015.

And this trend should only increase as the Amazon third-party seller market grows.

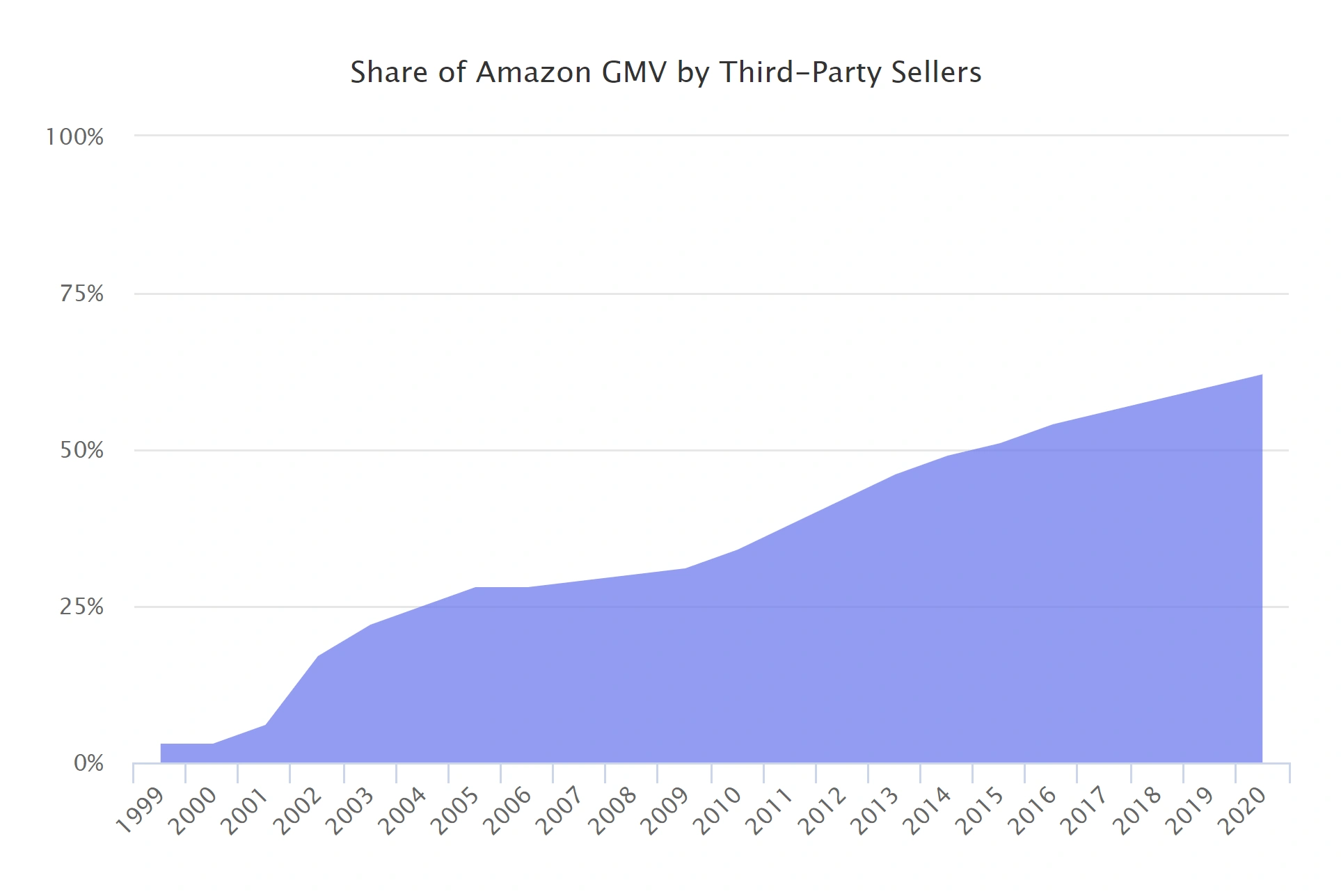

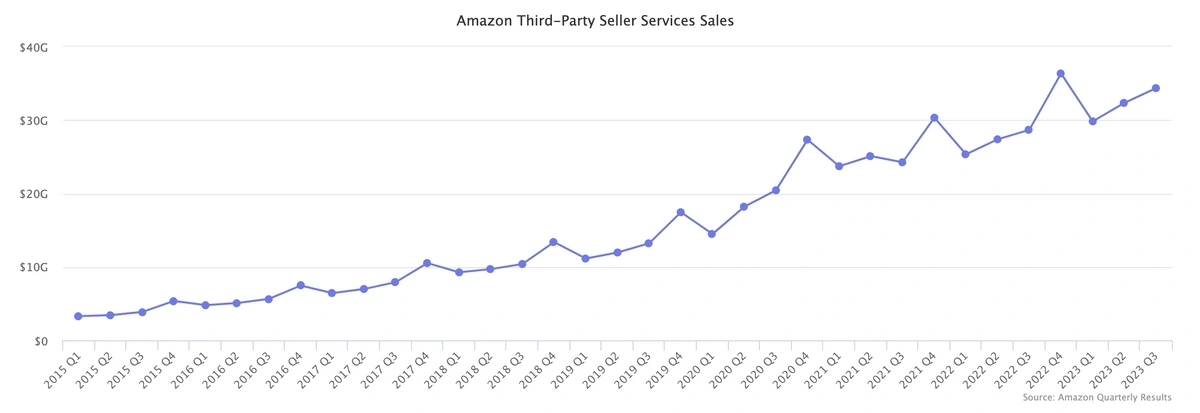

Third-party sellers drove most of Amazon’s gross merchandise volume (GMV) growth in 2020.

In 2020, Amazon third-party sellers’ share of total Amazon GMV increased to 62%, up from about 50% five years ago in 2015.

Amazon third-party sellers’ share of Amazon GMV had increased from 3% in 1999 to 62% by the end of 2020.

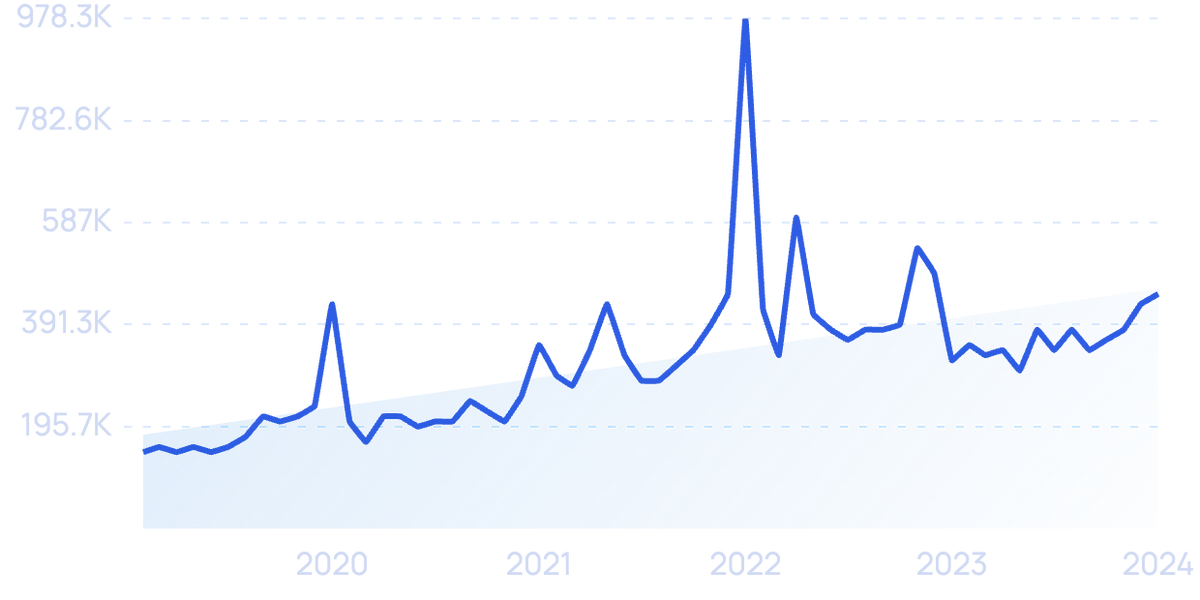

And Amazon's third-party sales in Q3 2023 increased by over 150% compared to Q1 2020.

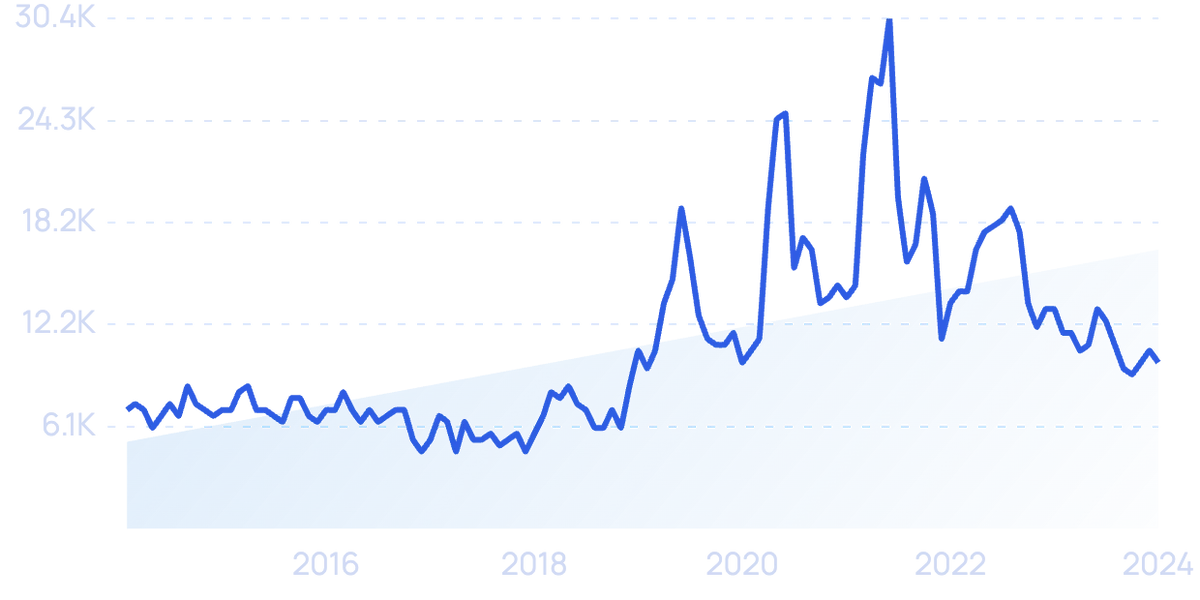

Amazon third-party sales per quarter.

4. Venture-Backed Companies are Increasingly Driven by M&A

The venture capital market is currently experiencing more M&A activity than ever before.

Acquisitions by large tech companies are becoming a major way for venture capitalists and other investors to exit their positions in startups.

And VC-backed companies are buying other VC-backed companies at an unprecedented rate.

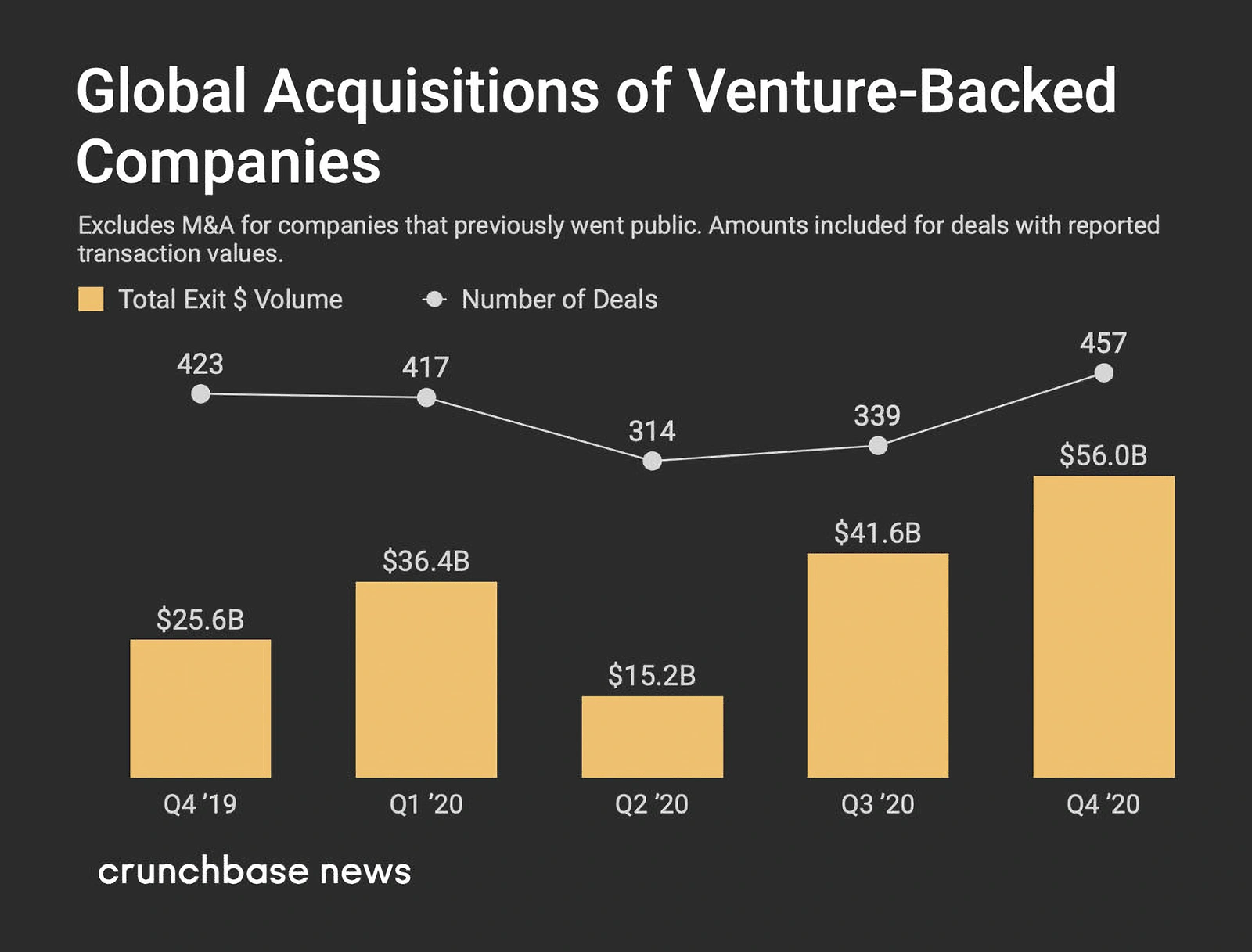

In 2020, there were more than 1,500 venture-backed private companies that were acquired by 1,300 acquirers. The total deal value was just under $150 billion.

Total VC-backed M&A deal value and the number of deals per quarter.

The majority of this $150 billion in transaction value came from just a few transactions.

In 2020, there were 41 of these companies that were acquired for $1 billion or more – totaling $104 billion in deal value (roughly 70% of total VC-backed deals).

Tech giants Apple, Microsoft, and Cisco were responsible for a large chunk of these acquisitions.

According to Apple CEO Tim Cook, the company has acquired more than 100 companies since 2015.

List of Apple’s largest acquisitions.

Microsoft acquired 13 companies in 2013, 8 in 2020, and acquired 14 in 2021.

Searches for "MSFT" – Microsoft’s stock ticker – in the last 10 years are up.

According to Crunchbase, Microsoft has acquired a whopping 254 companies since its inception.

And Cisco has completed 238 acquisitions since it was started in 1984.

Additionally, Cisco has made several acquisitions of successful startups such as Epsagon and Socio.

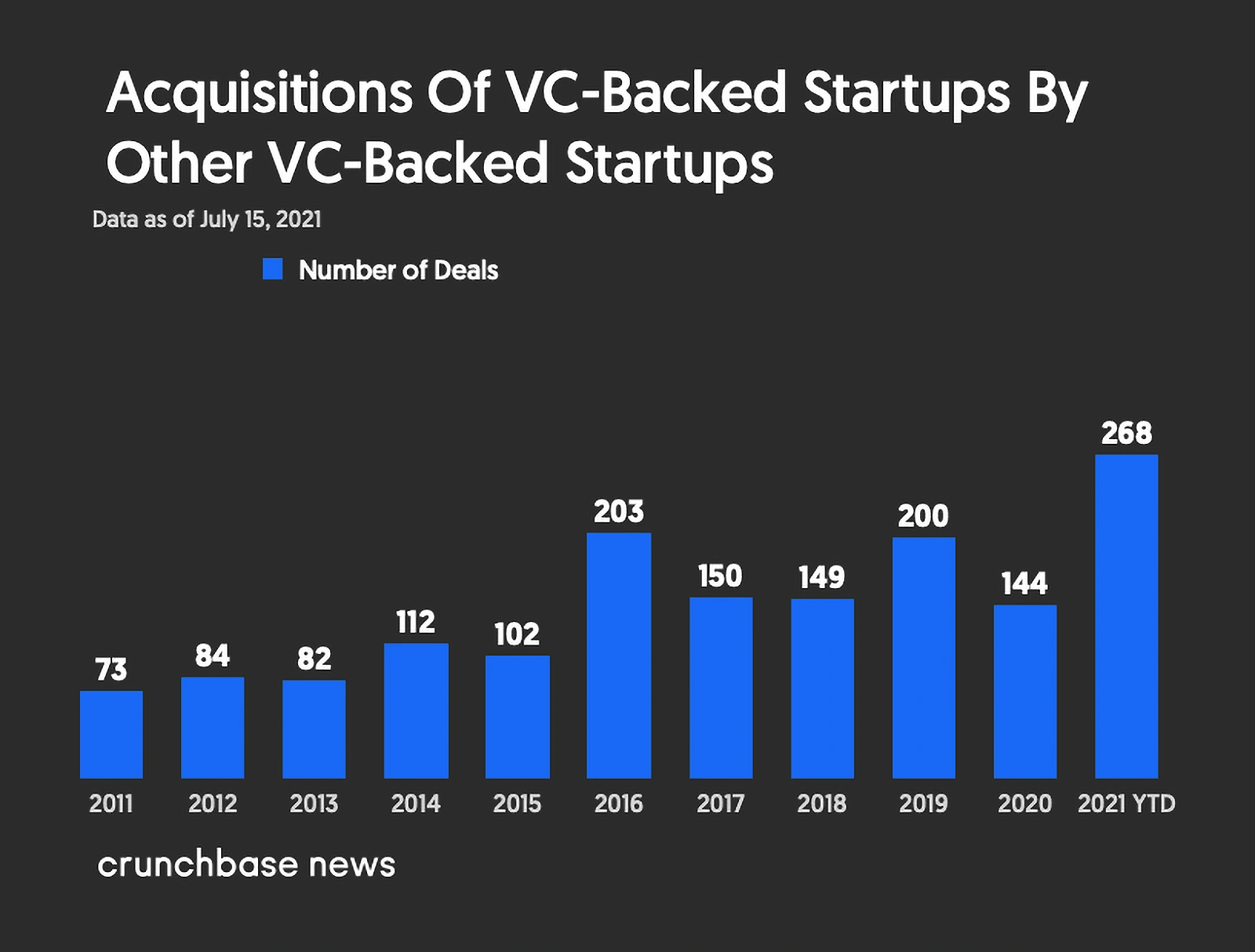

In addition to large corporations, 2021 has seen a record number of VC-backed firms being acquired by other VC-backed firms.

Over half of the venture-backed acquisitions by private acquirers in the first half of 2021 were made by other venture-backed companies.

Acquisitions of VC-backed startups by other VC-backed startups were the highest on record in 2021.

If you’re skeptical about the growing role of M&A in the startup landscape, just ask MicroAcquire.

Its founder, Andrew Gazdecki, said the platform is seeing about 300-400 new acquirers join the platform every day.

MicroAcquire is a marketplace for startup acquisitions. It has more than 200,000 buyers on the platform and has raised $5 million in recent funding.

Private equity is also dipping its toe into the startup market.

About 20% of venture-backed companies were bought by a private equity firm in 2020, compared to just over 2% 20 years ago.

And traditional PE firms like Bain Capital have injected more and more money into funds focused on early-stage companies.

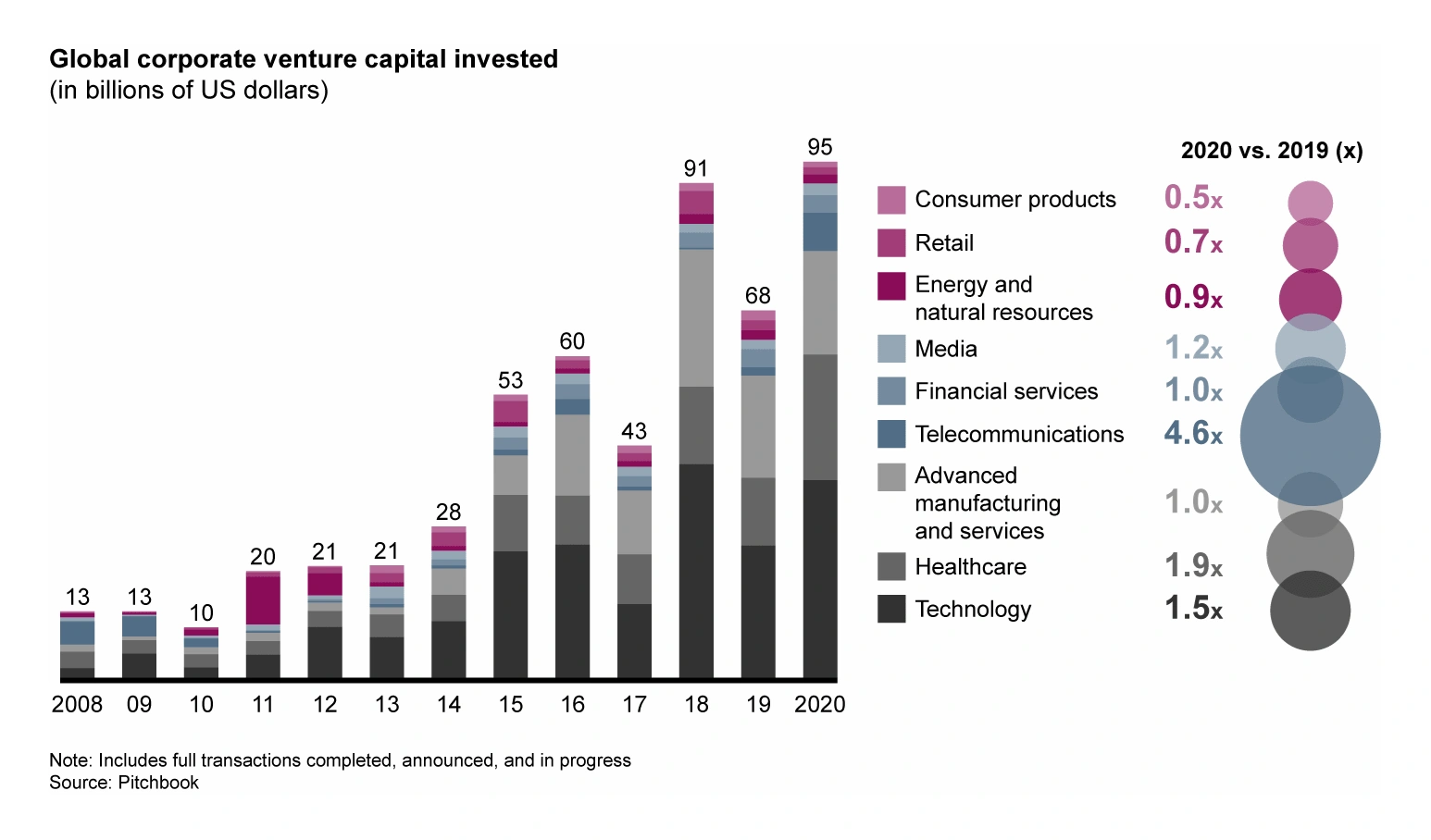

This plays into a growing trend known as “corporate venture capital”.

Instead of engaging in a strategic merger or acquisition, a corporation typically develops an arm of the company that engages in VC-like activities.

This may involve participating in funding rounds, joint ventures with startups, and entire acquisitions of smaller start-ups.

Corporate VC deal value rose to a record $95 billion in 2020. Technology and healthcare led the way, taking in $60 billion in corporate venture capital.

Plug and Play says the total value of deals is even higher, placing it at $120 billion for 2020.

5. Borders Are Becoming Irrelevant to M&A Activity

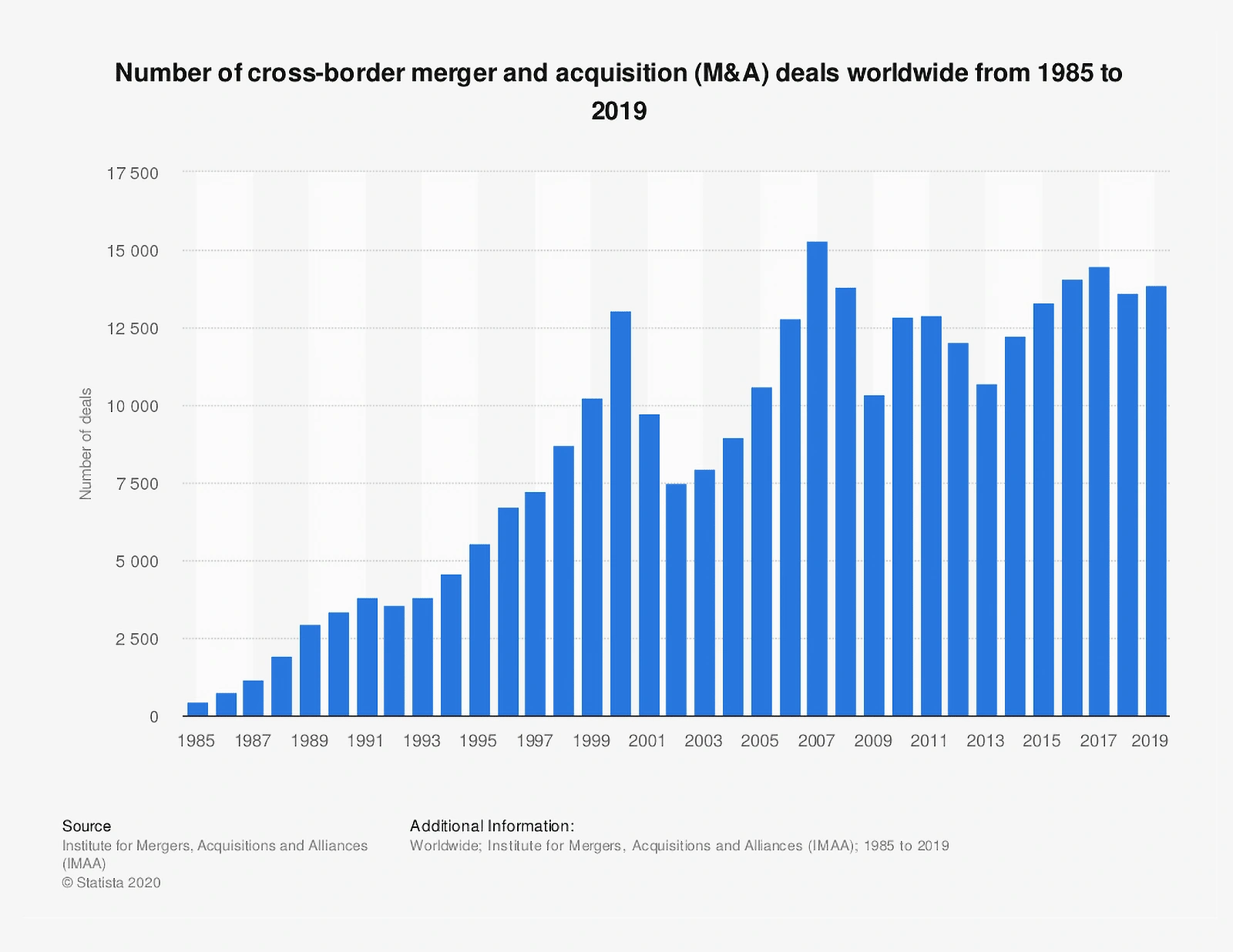

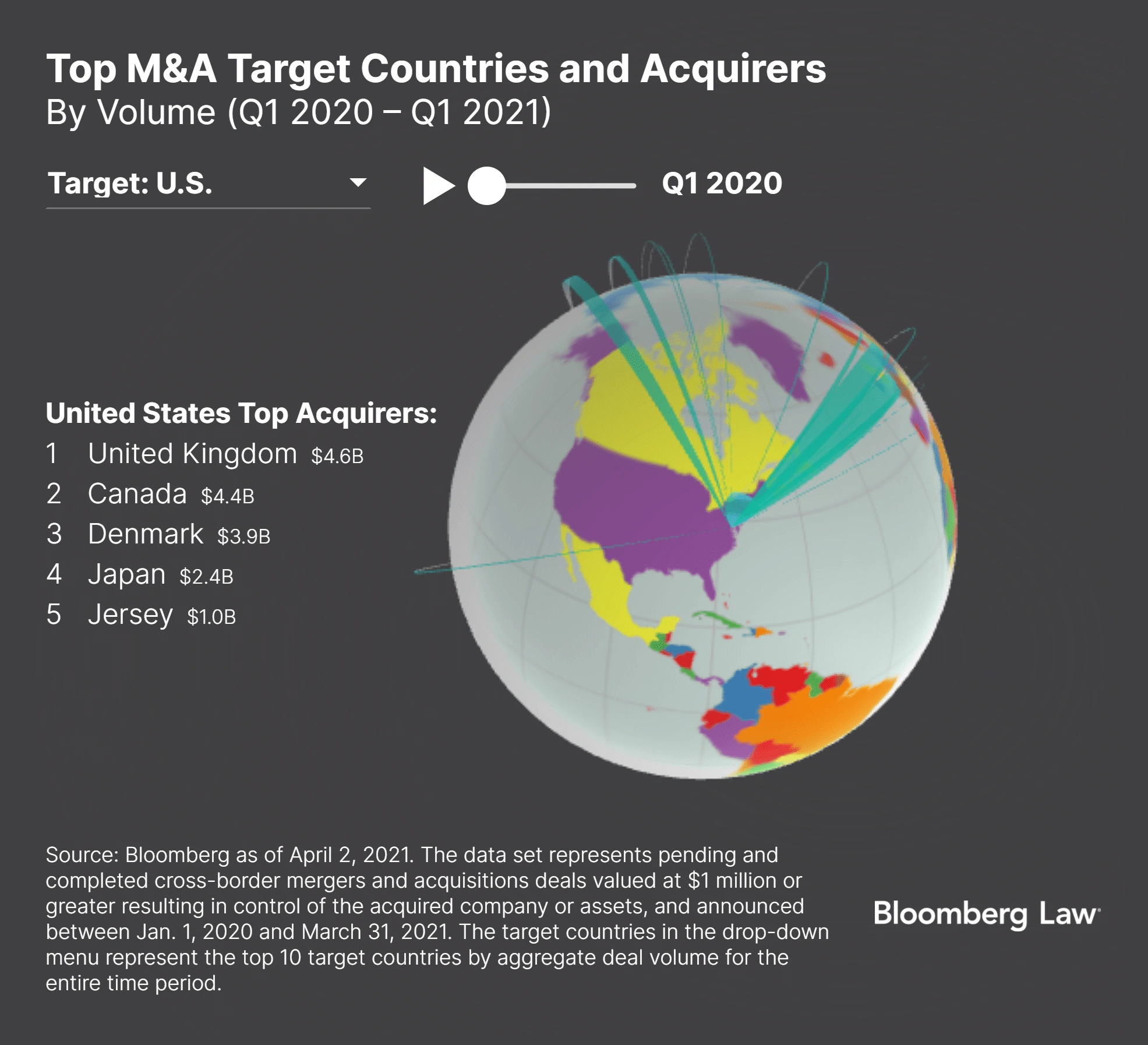

As the global economy becomes more connected, cross-border M&A is becoming a larger part of business around the world.

Cross-border M&A is somewhat cyclical but has risen quite a lot over the last 35 years.

Cross-border M&A has risen from a few hundred deals in 1985 to about 13,900 in 2019.

The global pandemic in 2020 put a slight damper on cross-border deals, but volume rebounded in 2021.

Cross-border deal volume in the first quarter of 2021 grew by 78% compared to the first quarter of 2020.

There were 922 deals in Q1 2021 valued at a total of $358.1 billion.

In fact, the first quarter’s cross-border volume made up over 40% of all global M&A transactions.

Canada was the largest acquirer of US companies in the first quarter – completing deals worth $37.3 billion.

6. Governments Increase Scrutiny of Deals

As deal sizes and total value explode, many expect the government to begin cracking down on large deals and industry consolidation.

In July of 2021, President Biden signed an executive order into action that urged the Federal Trade Commission (FTC) to address prior “bad mergers” allowed under previous administrations, among other things.

In addition, Lina Kahn was appointed head of the FTC last year. She reportedly pledged to block more mergers that the FTC believes violate antitrust laws.

The FTC undertook more enforcement actions in 2020 than it has in any other year since 2001.

In 2020, the Department of Justice’s Antitrust department sued to block Visa’s attempted $5.3 billion acquisition of payment technology company Plaid – causing the two to abandon the deal in January 2021.

Search interest in "Plaid" has grown by 207% over the last 5 years.

In addition, the FTC has filed actions to block five major hospital acquisitions in 2021.

In 2021, the US Justice Department sued to block a massive $30 billion merger between two of the “big three” insurance brokers – Aon and Willis Towers Watson.

And it’s not just the US government either.

The European Commission recently expanded its jurisdiction when reviewing cross-border deals in the EU.

And in August the Commission announced that it was reviewing a small $1 billion deal between two US companies – Facebook and the startup Kustomer.

In January of 2020, the UK government enhanced its ability to intervene in mergers based on a public policy basis.

As more M&A activity goes on and more industries consolidate, expect more antitrust enforcement to disrupt the hot merger market.

Conclusion

That’s all for the top mergers and acquisitions trends worth tracking over the 2-3 years.

Overall, the level of M&A activity is on an uptick across every industry and around the globe. The value of the deals is becoming larger, and the antitrust scrutiny is becoming stronger.

As these trends progress, the outcomes will likely get more surprising.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more