Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

9 Top DTC Trends (2024 & 2025)

You may also like:

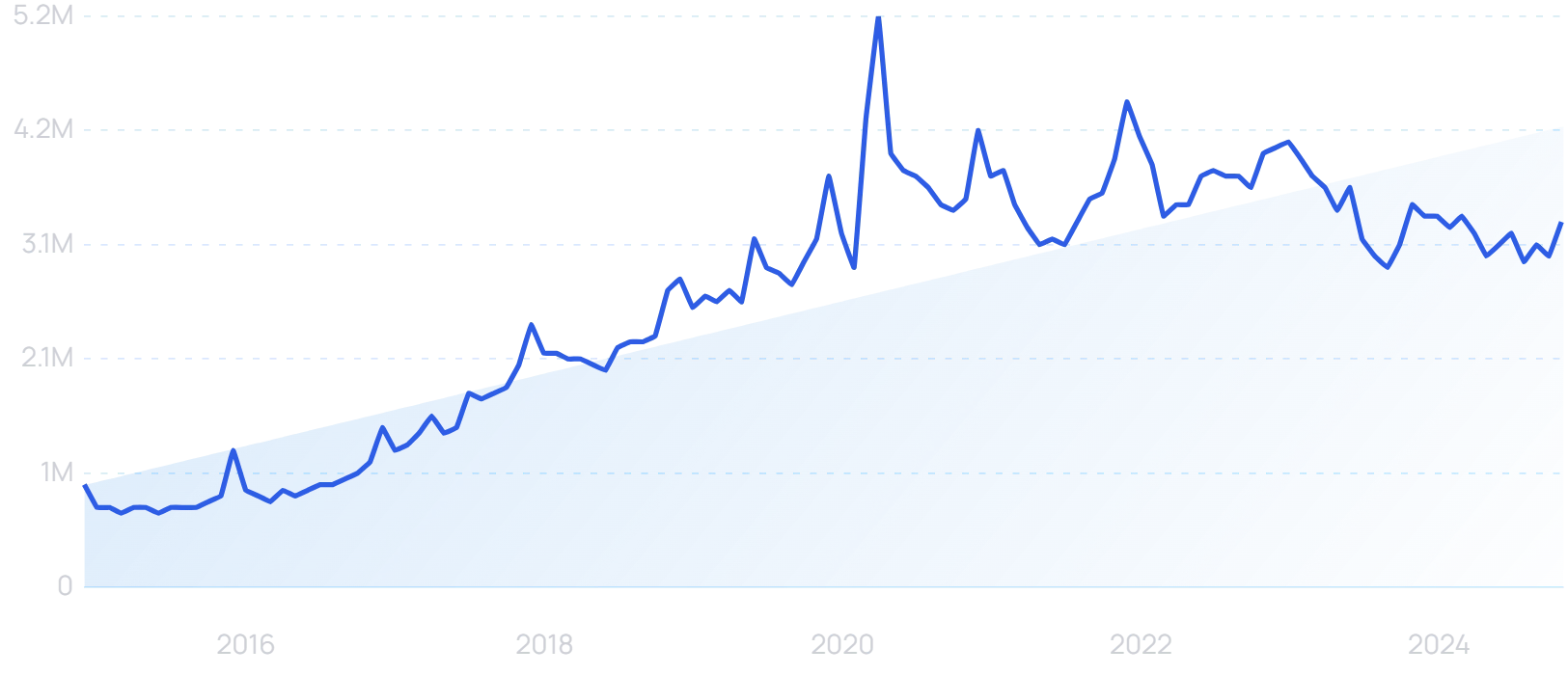

E-commerce sales are set to reach $8 trillion by the end of 2027.

And we're seeing a slew of physical retailers (like Best Buy and Target) rapidly transition towards a DTC model.

Whether you're in the DTC space or want to invest in an E-commerce business, here are the top direct-to-consumer trends right now.

1. Social Media Shopping Goes Mainstream

The old customer experience flow of "see a product on Instagram → click a link in the description → buy the product" is quickly breaking down.

Social shopping is rapidly integrating E-commerce into social media platforms.

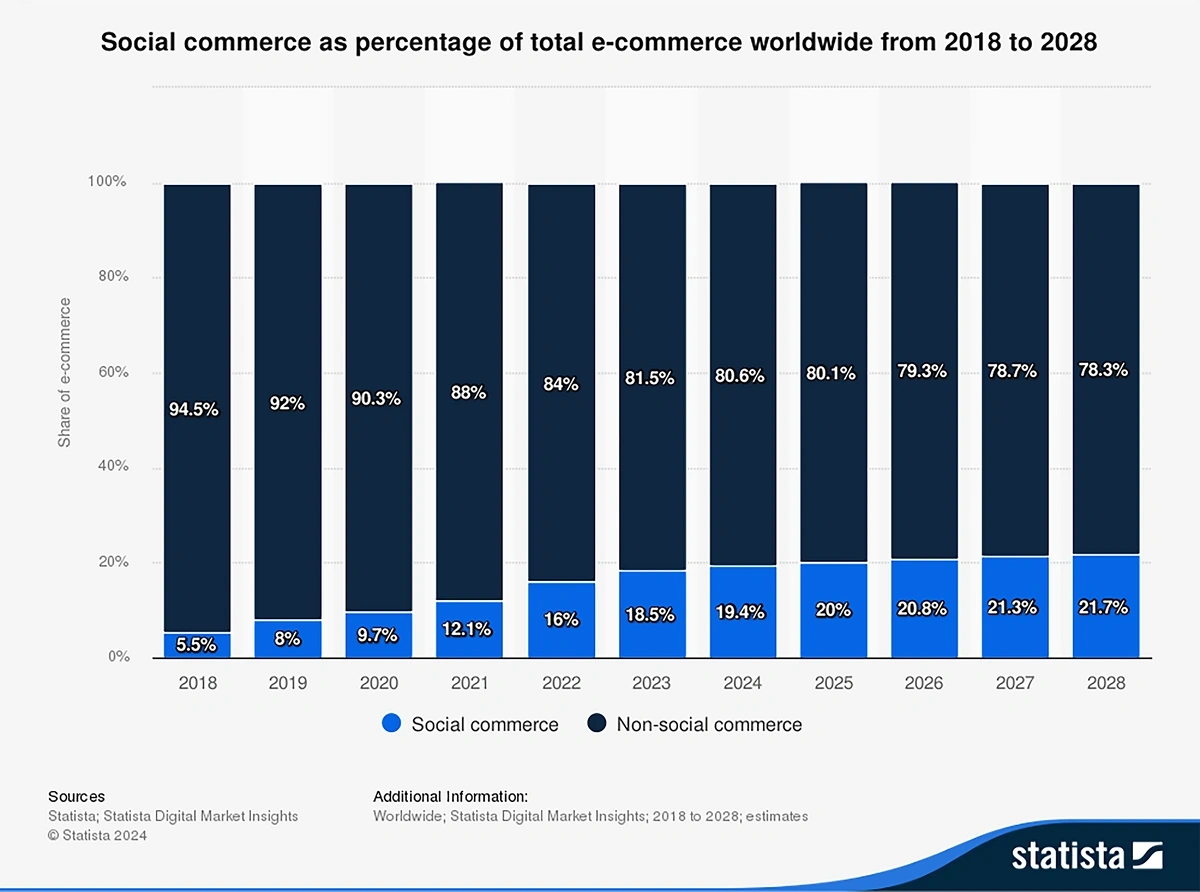

In fact, social commerce now makes up an estimated 19.4% of all E-commerce.

And it's becoming an increasingly common way for members of Gen Z and Gen Alpha to shop online.

With social shopping, consumers can buy items without needing to go through an entire checkout funnel.

Plus, social media platforms get a cut of the action.

Already the home of choice for younger influencers and consumers alike, TikTok has massively capitalized on this trend.

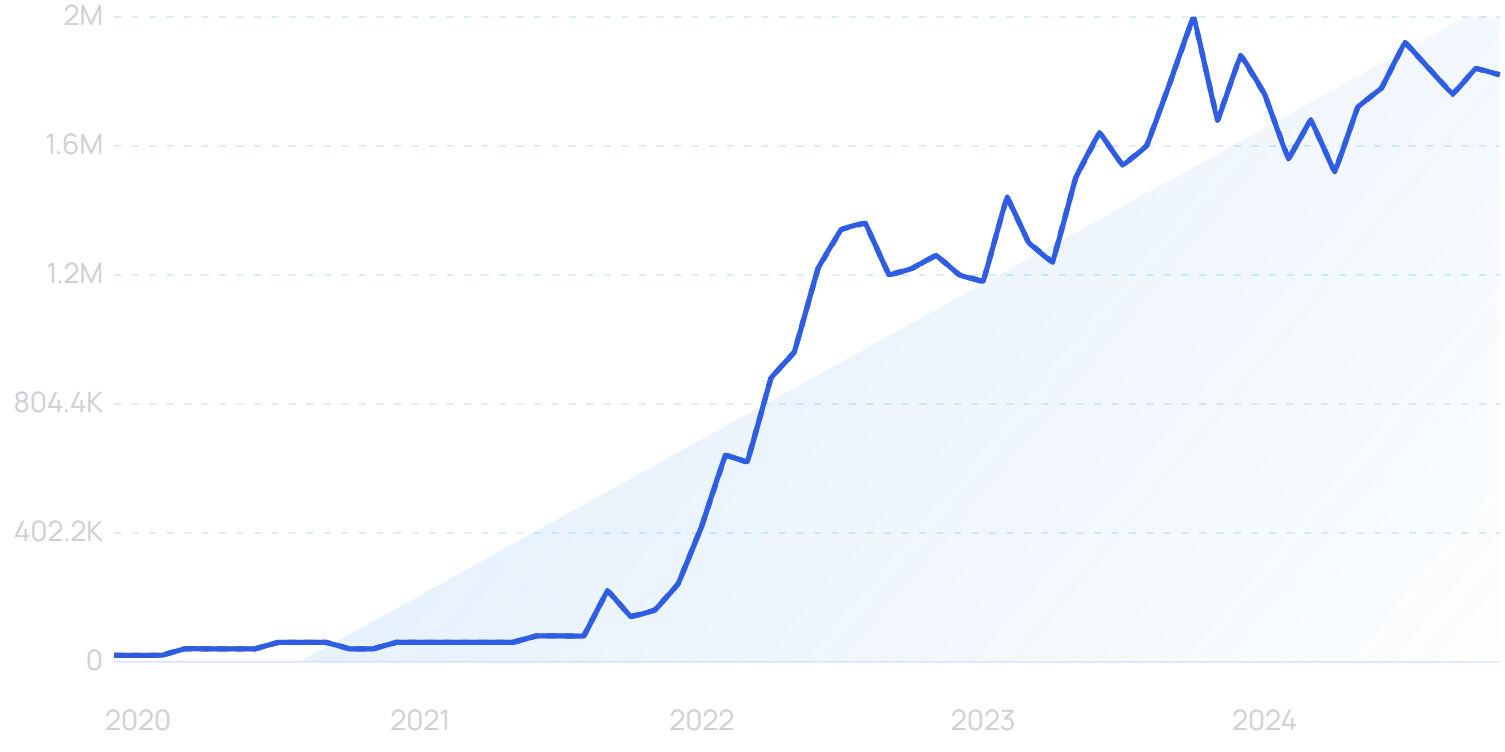

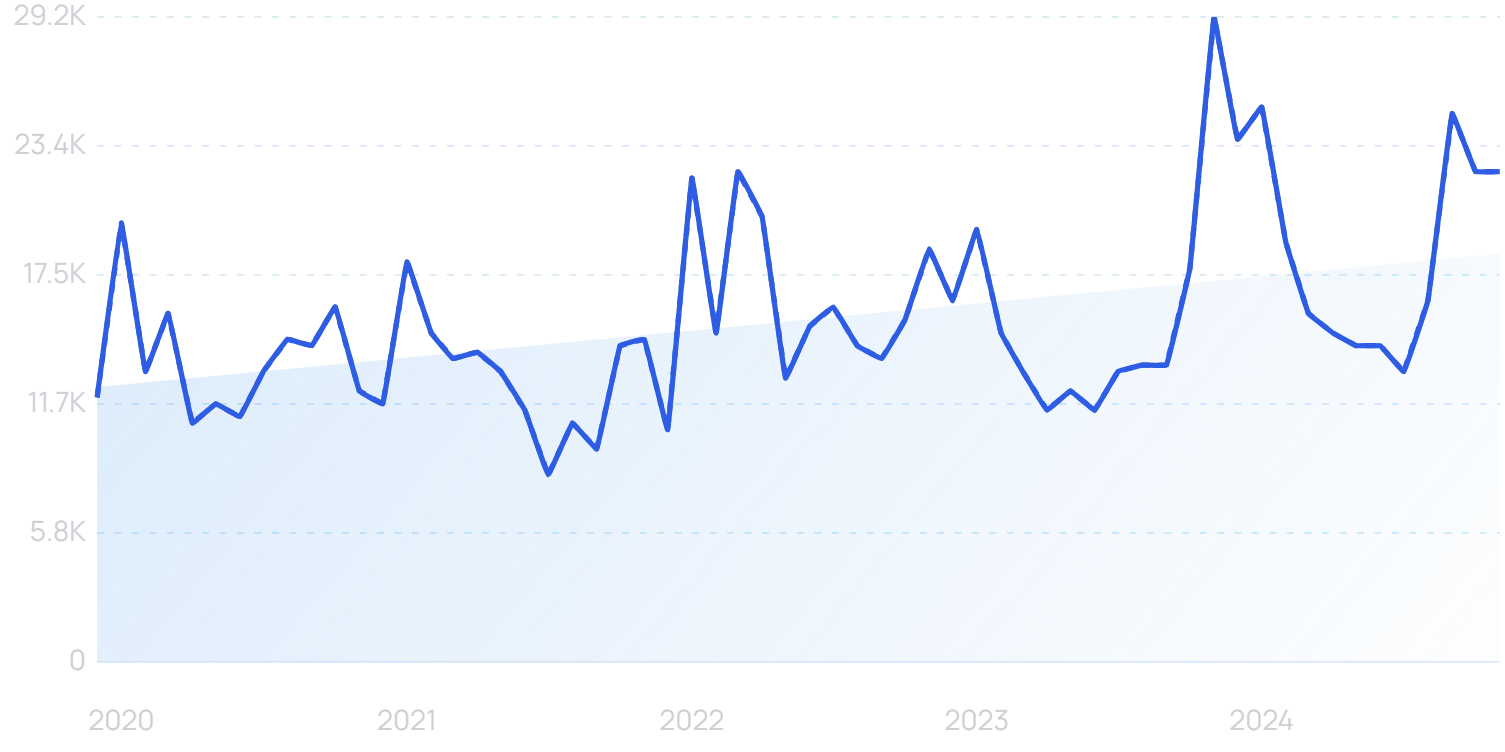

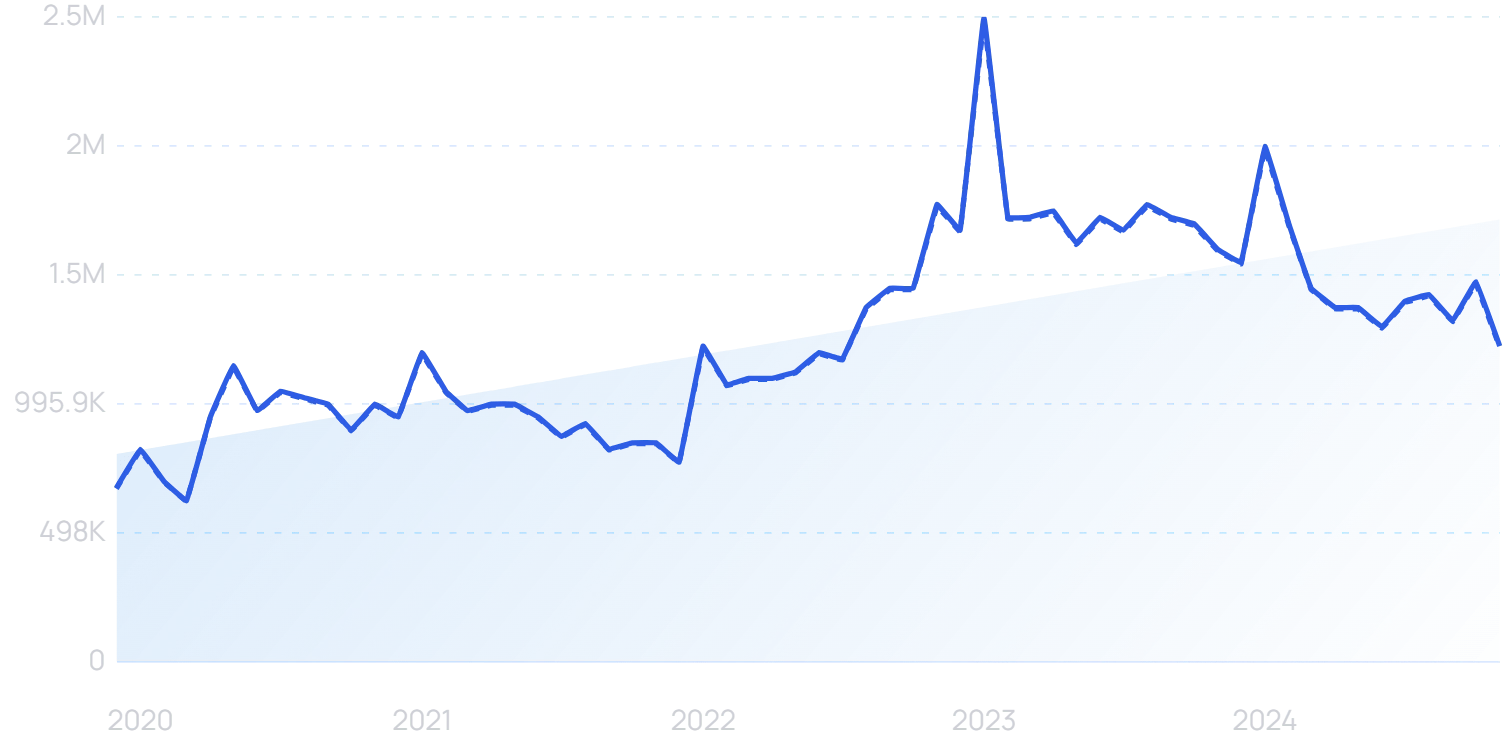

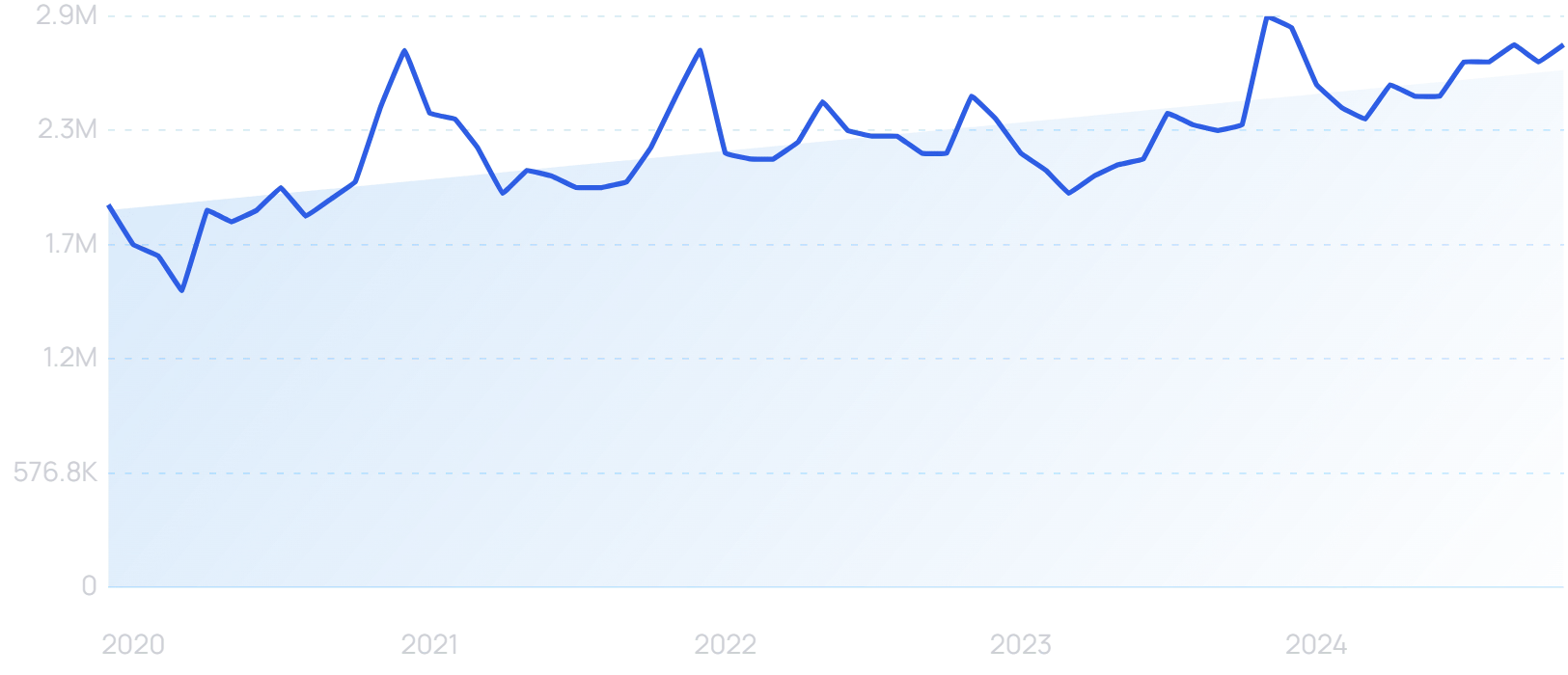

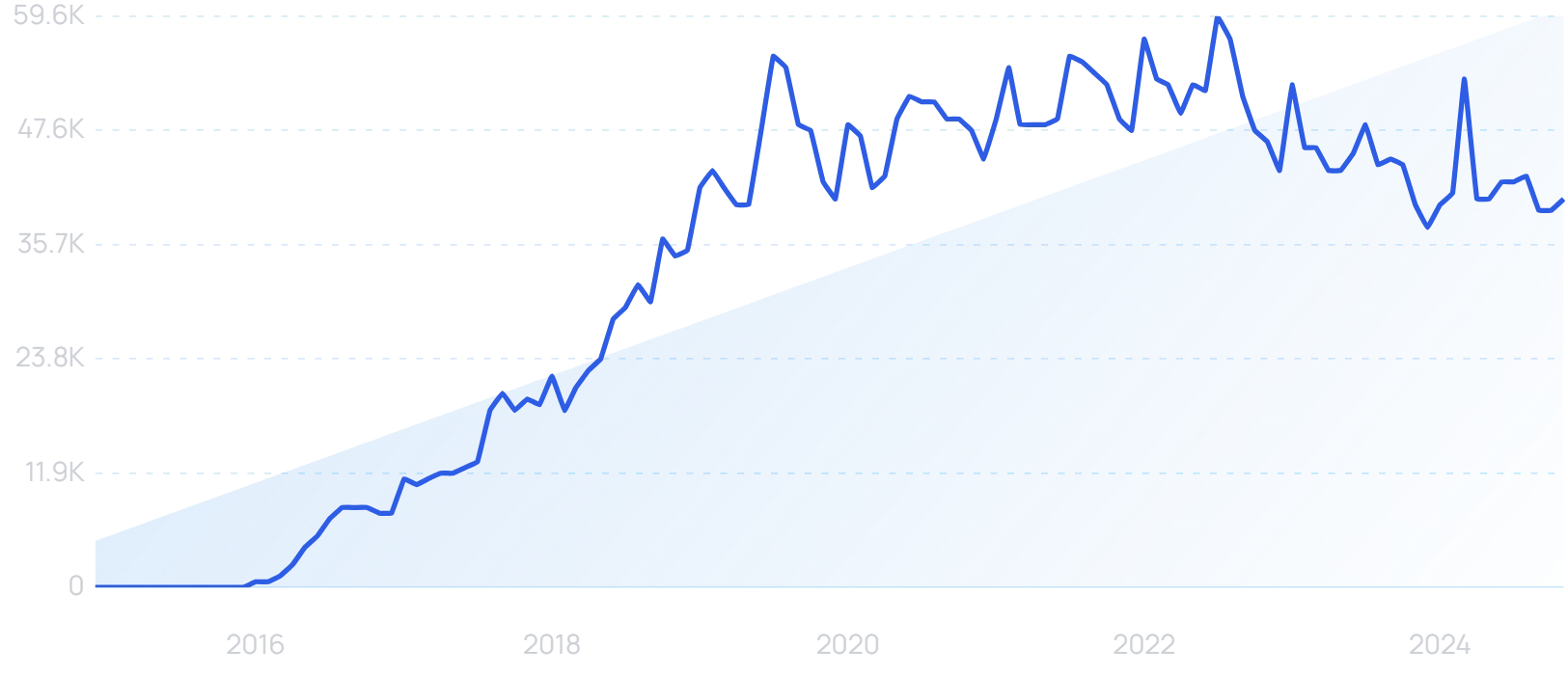

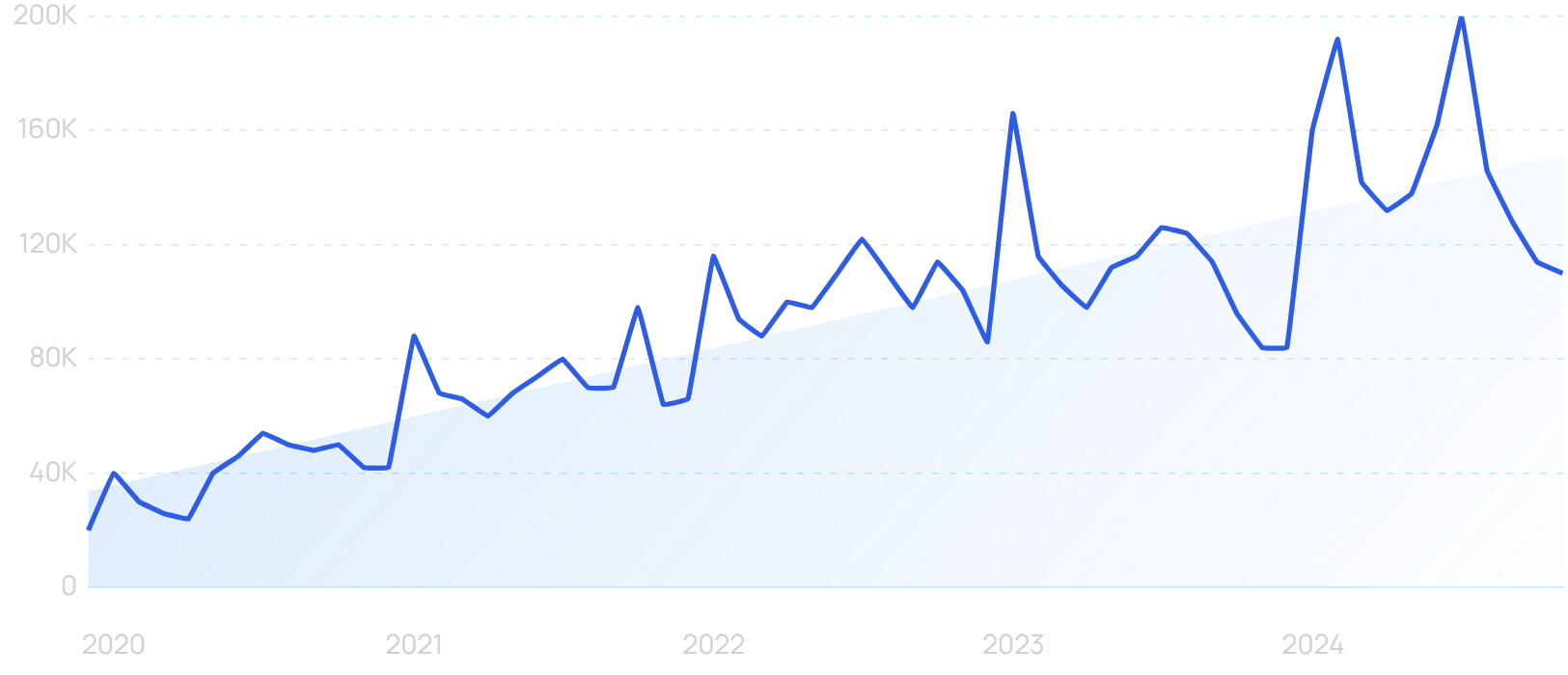

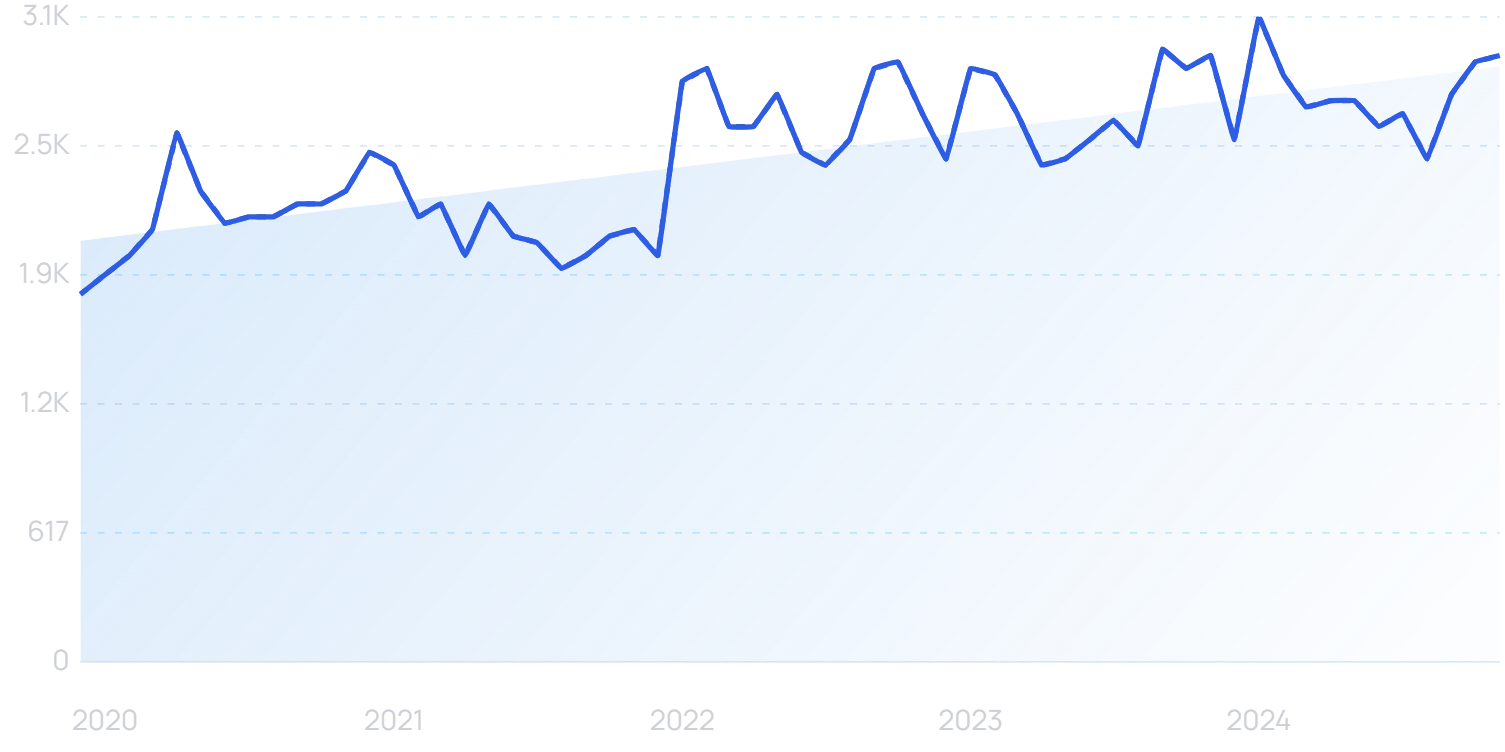

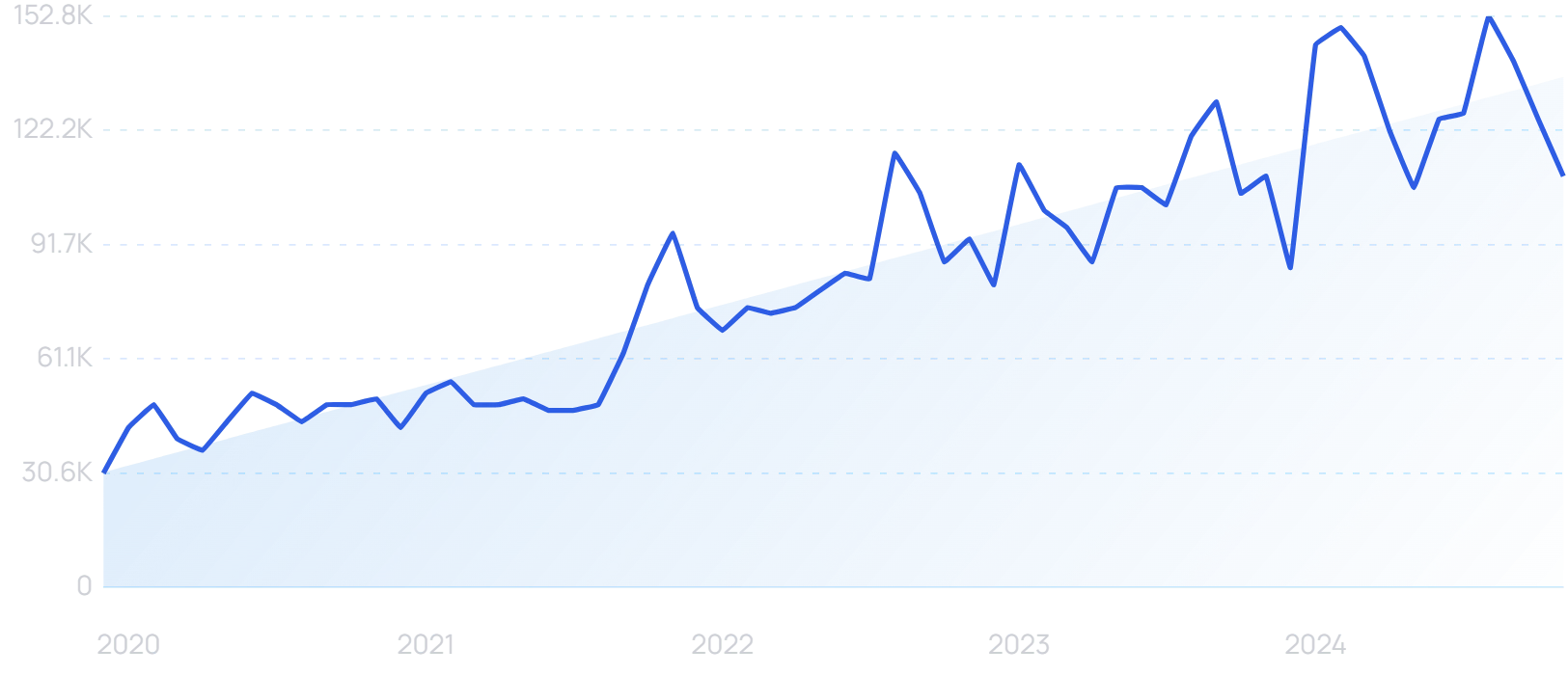

“TikTok Shop” searches have exploded recently.

To date, sales worth more than $11 billion have been made in Southeast Asia through TikTok Shop.

That region has long led the way in social shopping, and it still accounts for 80% of TikTok Shop sales. But the platform has also grossed well over $1 billion combined in the US and UK.

Among daily users of TikTok in the United States, almost 1 in 3 have now bought something through the app.

And TikTok Shop now accounts for more than 66% of total social shopping gross merchandise value, leaving platforms like Instagram Checkout way behind.

Moving forward, social commerce represents an opportunity DTC brands cannot afford to ignore.

2. Influencers Launch Their Own DTC Brands

DTC companies including Casper, Allbirds, Bonobos, and Warby Parker famously used influencer marketing to grow their startups in record time.

And it worked.

This is one of the reasons that influencer marketing became a DTC mainstay: compared to PPC and SEO, influencer marketing resulted in relatively low customer acquisition costs (CAC).

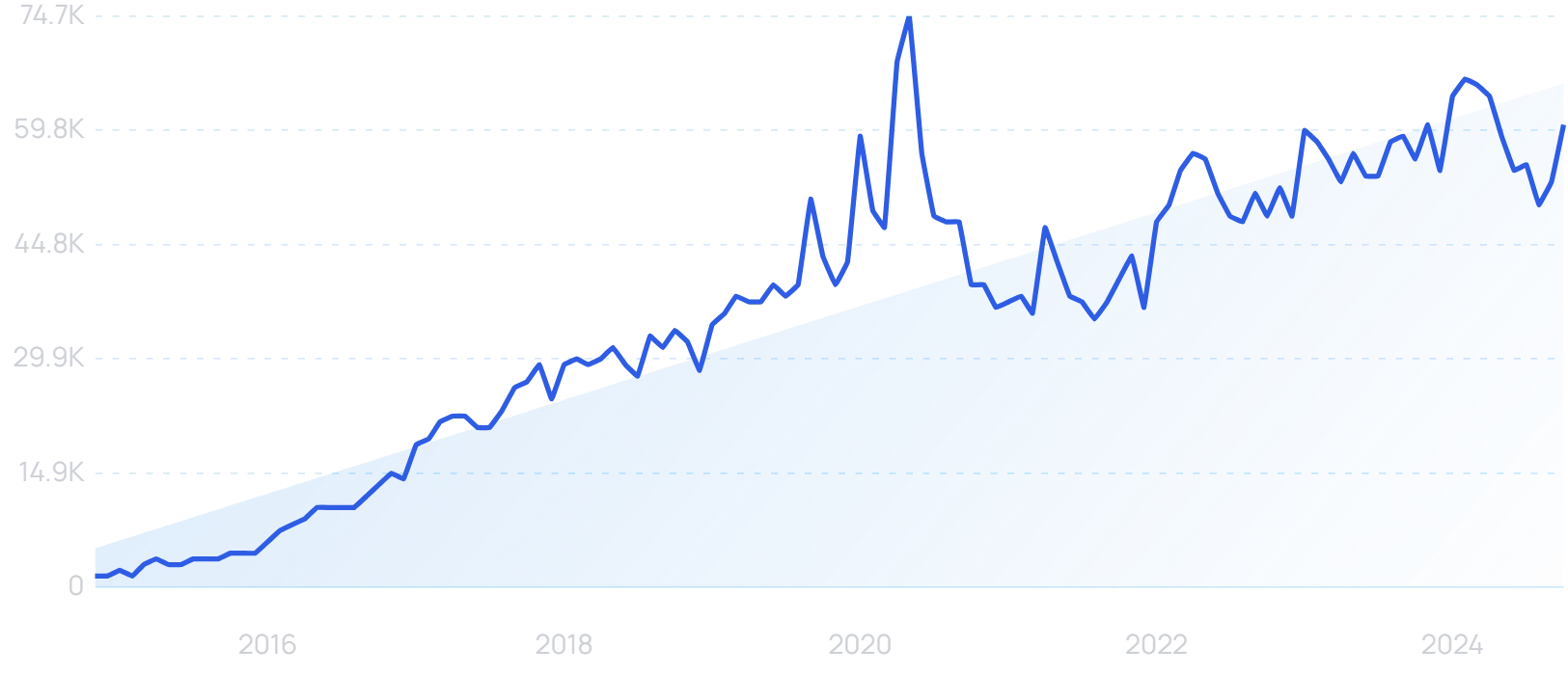

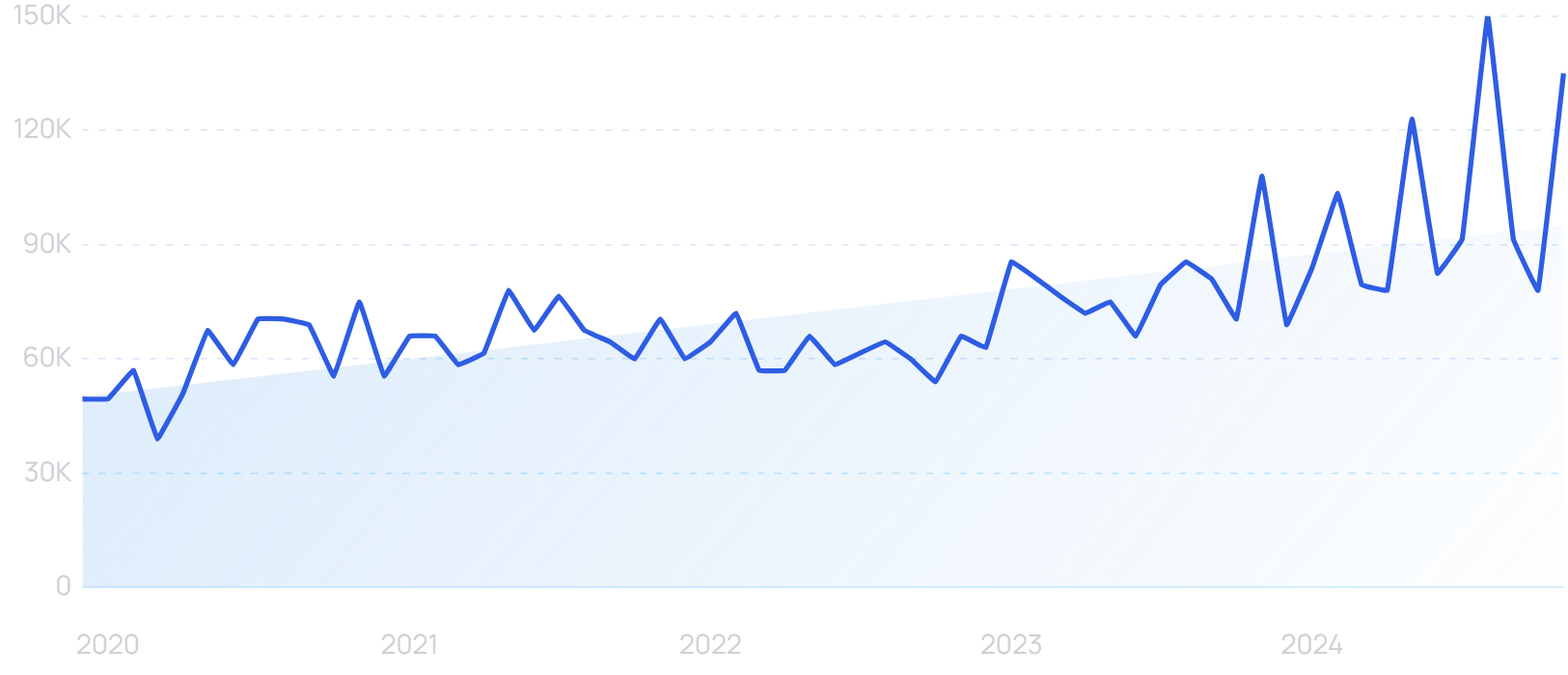

Searches for "influencer marketing" grew 3700% in 10 years alongside the growth in the DTC category as a whole.

But that's rapidly changing.

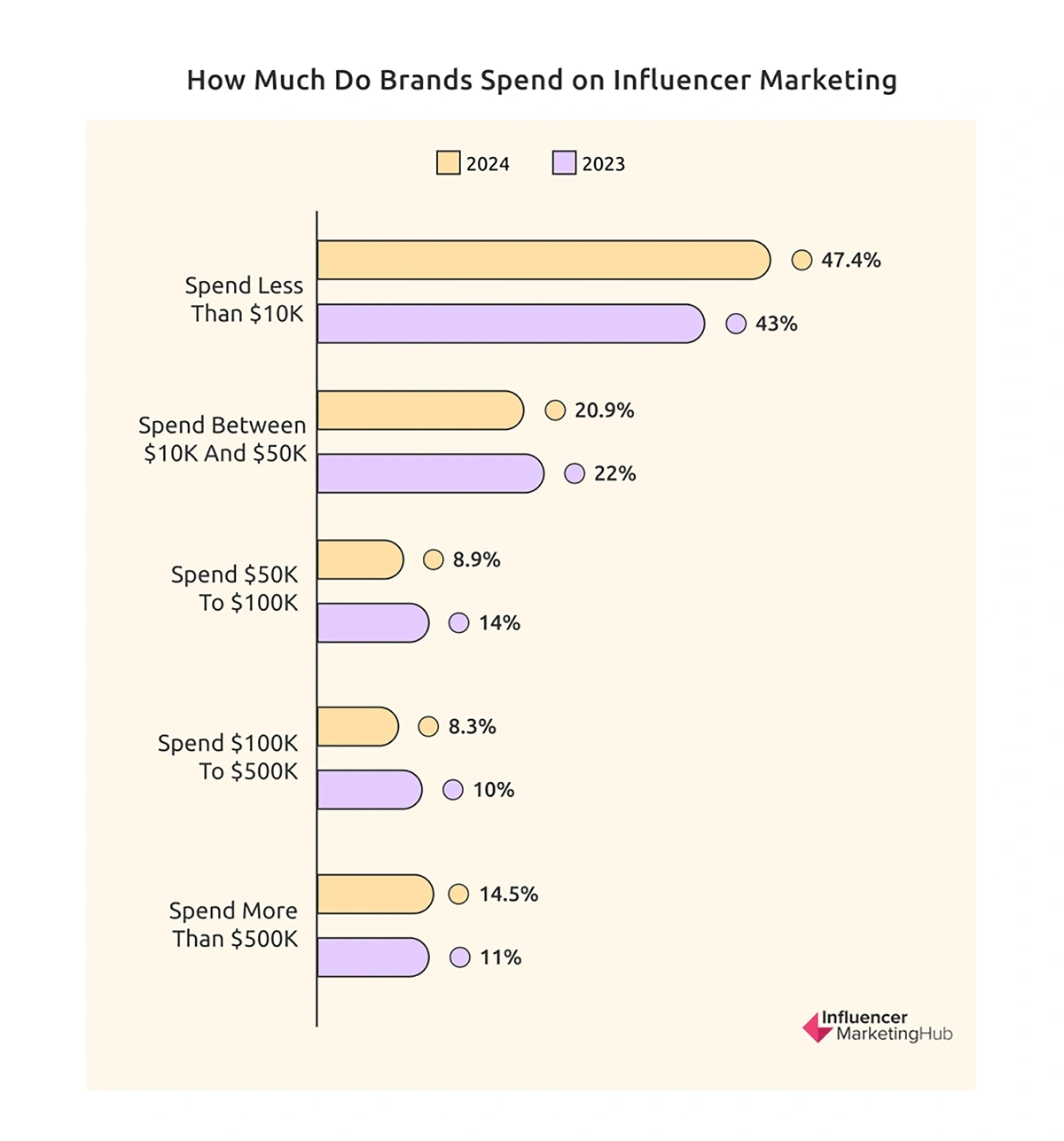

Influencer marketing is getting more expensive. 14.5% of businesses will spend more than $500k on influencers this year, up from 11% in 2023.

At the same time, 47.4% of businesses will spend less than $10k on influencers this year, as some brands exit the influencer space altogether.

There are interesting changes at the top and bottom end of the influencer marketing scale.

And some influencers are eschewing sponsorship deals too. Instead, many are launching their own direct-to-consumer brands.

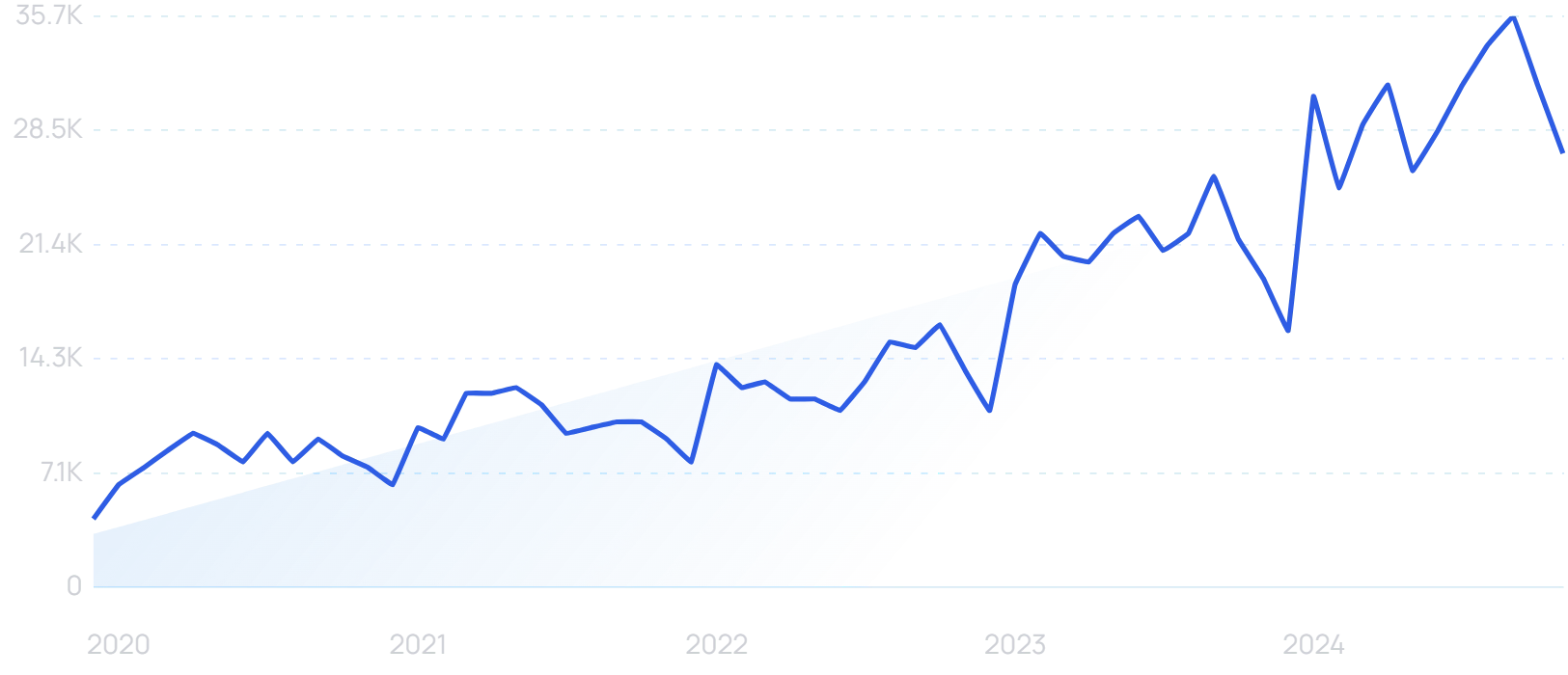

Kylie Jenner's Kylie Cosmetics is probably the most famous example of the "Influencer Entrepreneur" DTC brand.

Kylie Cosmetics took off thanks to the founder's existing social media audience.

But it's far from the only influencer-founded DTC business.

For example, supplement company Truvani was launched by a pair of influencers: Social Trigger's Derek Halpern and "The Food Babe" Vani Hari.

Searches for the DTC supplement brand “Truvani” have risen 567% in the last 5 years.

Both co-founders leveraged their existing audiences (and digital marketing expertise) to help get their DTC supplement brand off the ground.

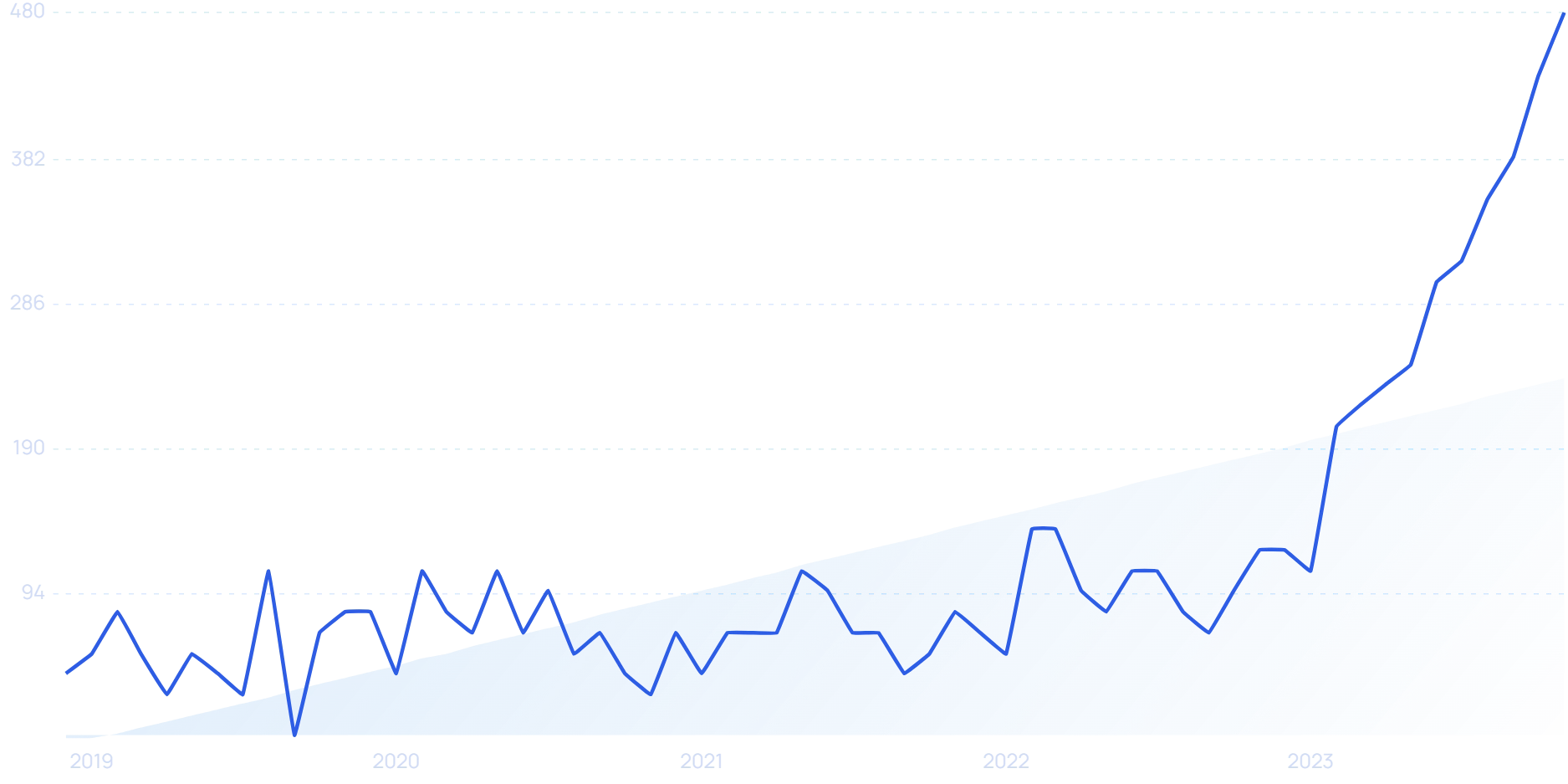

More recently, YouTubers Logan Paul and KSI launched drinks range PRIME.

Logan Paul and KSI have not shied away from placing themselves front and center of PRIME marketing.

The PRIME account on Instagram boasts an engagement rate of 26%, way ahead of the 0.5% benchmark.

In the past, Halpern, Hari, KSI and Paul may have been interested in traditional influencer marketing deals.

But, like many influencers in 2024, they're busy starting (and growing) their own DTC brands.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

3. DTC Gets More Personal With The Help Of AI

81% of consumers prefer companies that offer a personalized experience. That’s no different in the DTC space.

And it just so happens that AI is making personalization at scale more feasible than ever.

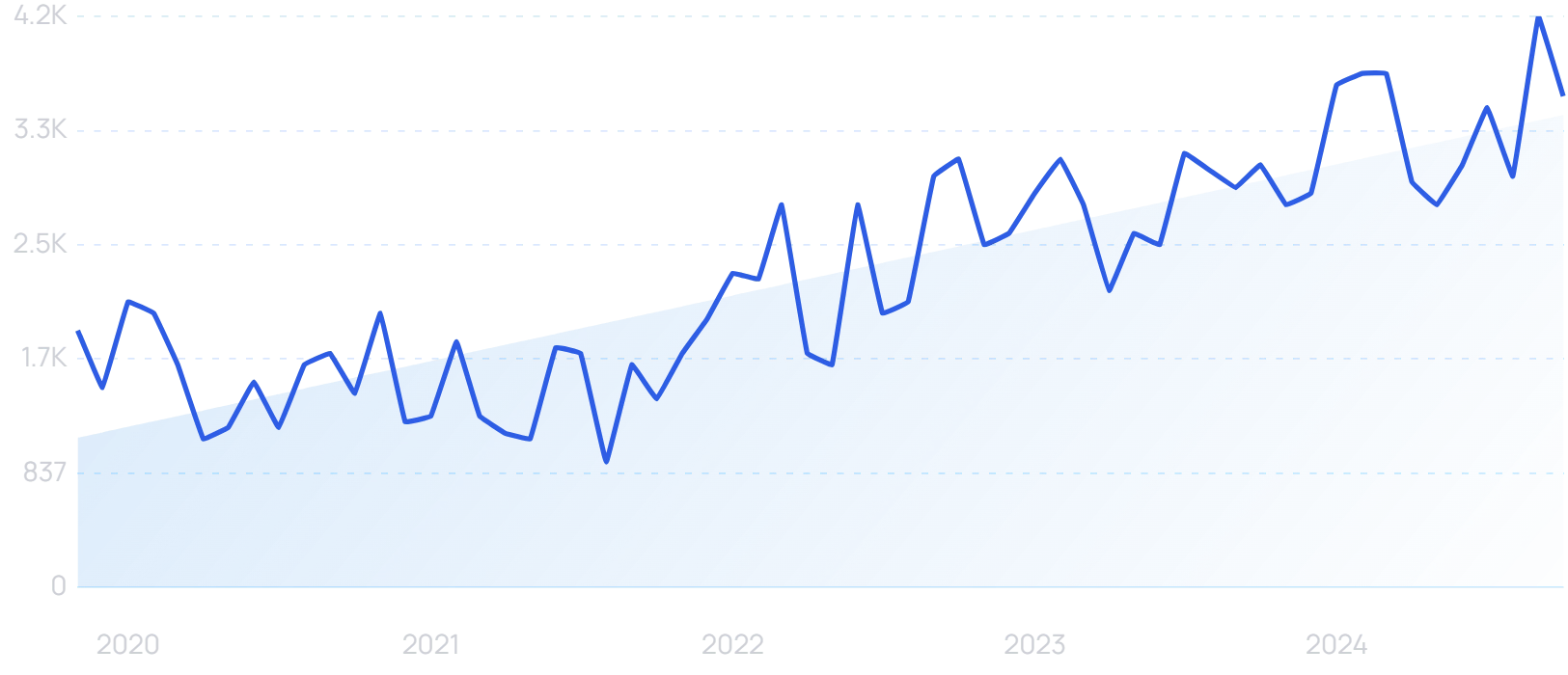

“AI personalization” searches are up 1157% in the last 5 years.

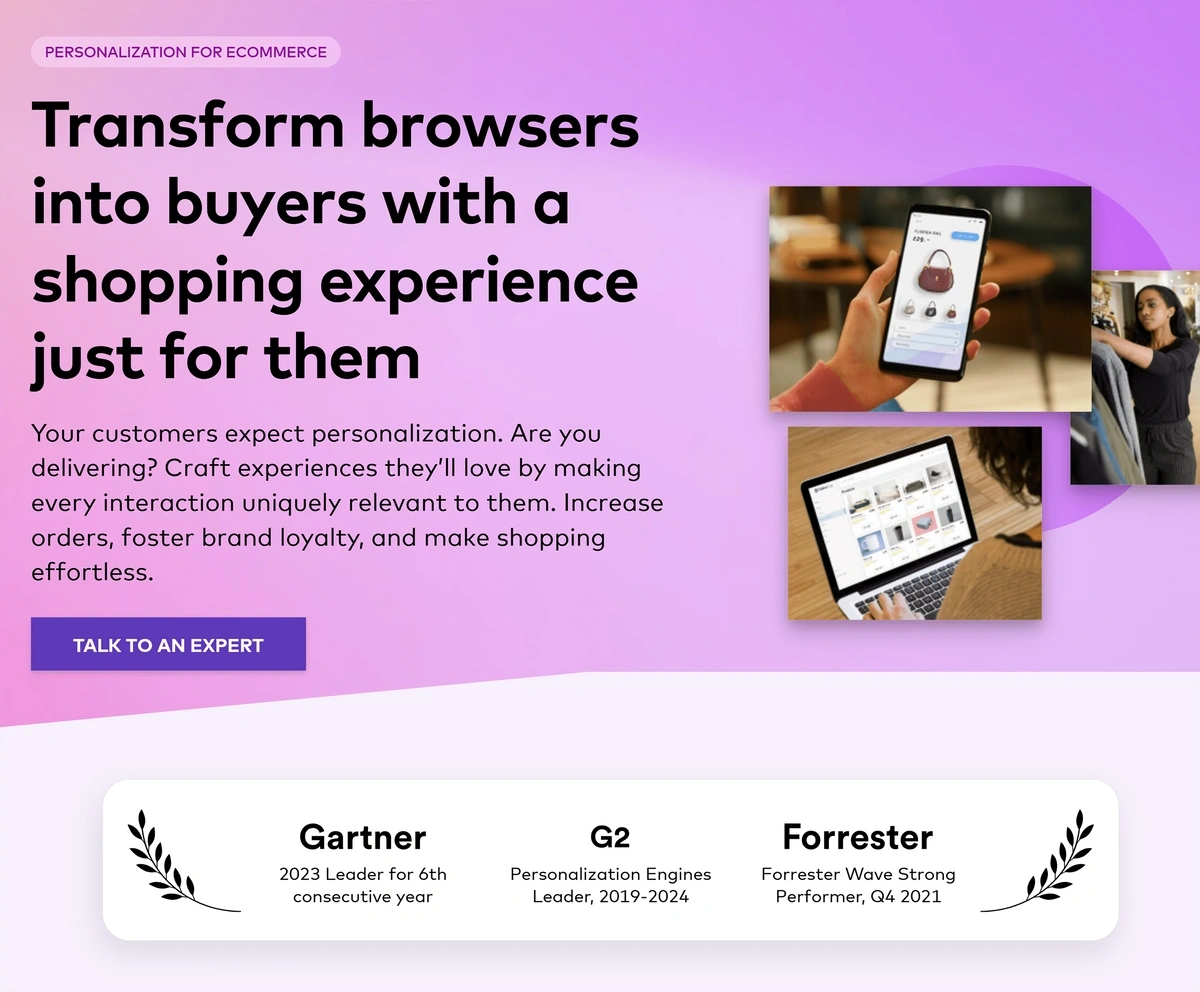

Dynamic Yield is a Mastercard-owned company that uses generative AI to personalize the E-commerce experience for shoppers.

In June, Michael Kors became the first retailer to adopt Dynamic Yield’s “Shopping Muse” technology. It takes consumers’ colloquial language and turns it into tailored suggestions, replicating an in-store shopping experience.

Dynamic Yield’s AI E-commerce offering.

Initial tests showed a 15-20% increase in conversion rate.

And AI is ushering in the era of “hyper personalization”.

“Hyper personalization” searches are up 81% in 5 years.

Attentive has gathered 2 trillion data points to inform its AI model, which has helped to send and receive more than 90 billion personalized email and SMS messages to consumers.

AI Pro and AI Journeys personalize copy, tone, images and even emojis, judging which will resonate best with individual consumers.

It has worked with primarily DTC brands including Fresh Clean Threads and Victoria Beckham Beauty.

Fresh Clean Threads has seen a 50% increase in abandoned cart revenue and a 20% increase in welcome revenue since adopting the hyper-personalization technology.

Meanwhile, AI search is now an important consumer funnel.

Learn how your DTC brand can optimize its E-commerce store for AI search.

4. Food and Beverage DTC Skyrockets

The food and beverage category is the second fastest-growing E-commerce category on the planet.

In fact, according to ECDB, the grocery space grew by around 16.6% last year.

There was a big boost in grocery delivery during COVID.

But the food and beverage DTC space has continued to grow due to a slew of new players in the space.

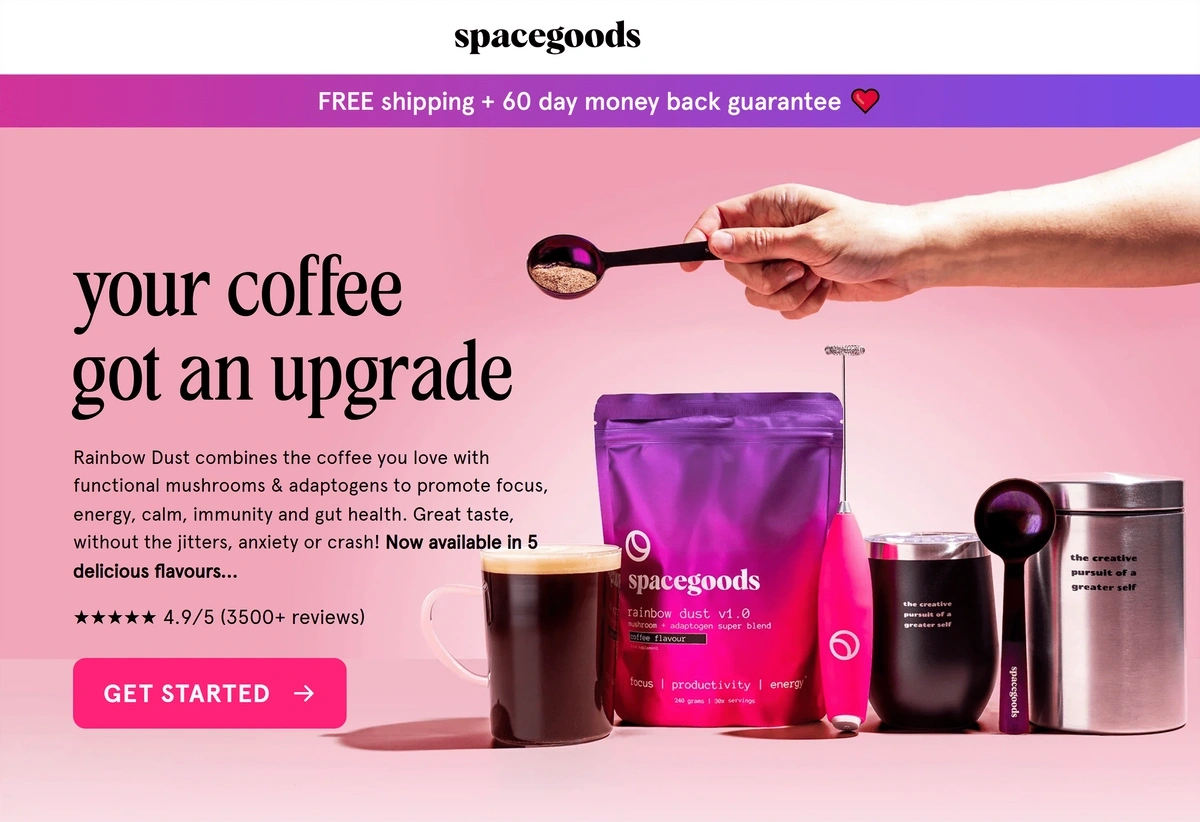

For example, Spacegoods has enjoyed a rapid rise to prominence.

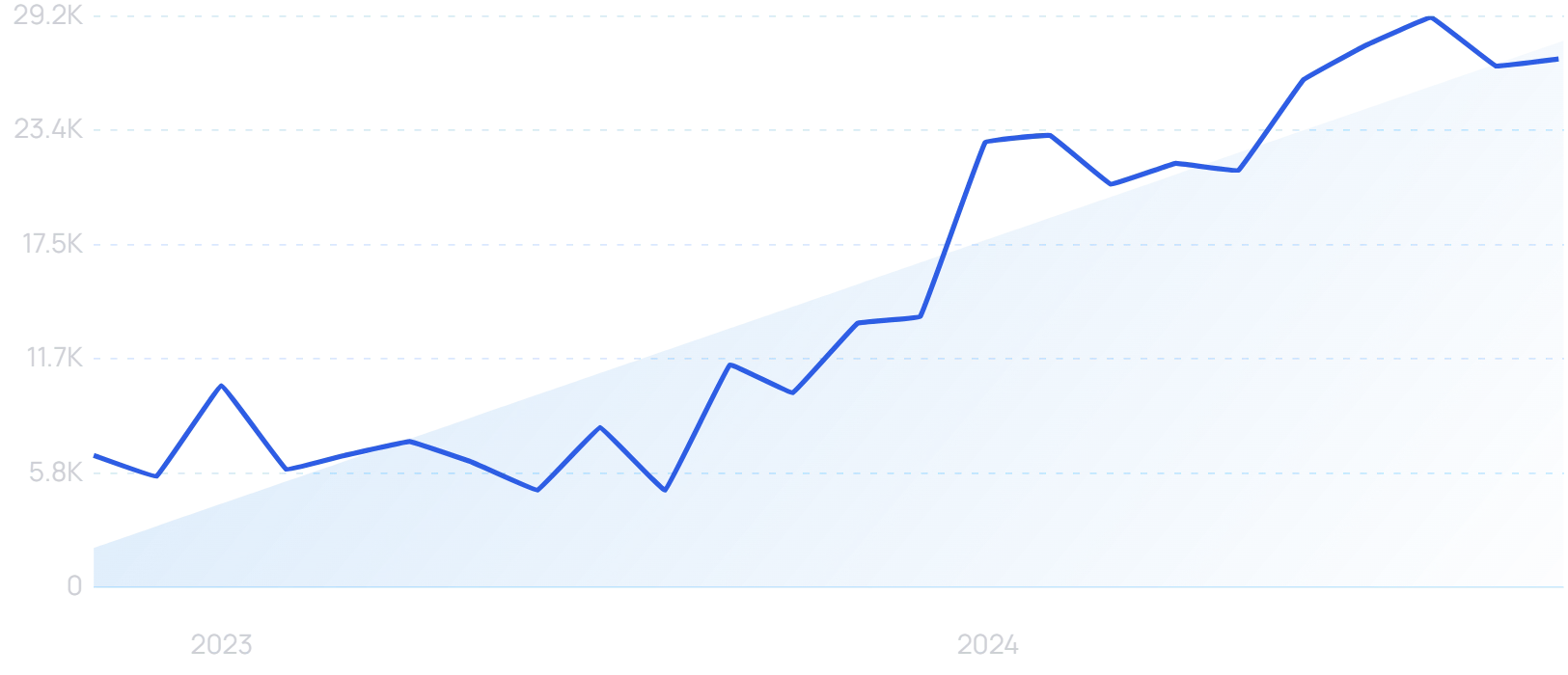

“Spacegoods” searches are up 426% in the last 2 years.

Founded in 2021, its adaptogenetic mushroom blends can be added to coffee, and are designed to bring wellness benefits.

Spacegoods sells calming products for night-time and energy boosters for the day.

Meanwhile, some brands founded pre-pandemic have settled into sustainable growth.

Kettle & Fire is a bone broth brand creating products suitable for the keto diet.

Search growth for “Kettle & Fire” has increased by 76% in 5 years.

It turned over $3 million in its first year, and has continued to grow.

The DTC food market is projected to be worth over $195 billion by 2031.

5. Competition Within Categories Heats Up

Not long ago, selling mattresses online was completely novel.

Flash forward to today, and there are dozens of DTC mattress companies — including Saatva and NectarSleep — fighting for market share.

“Saatva” searches are up 148% in the past 5 years.

It's the same story with the eyewear space.

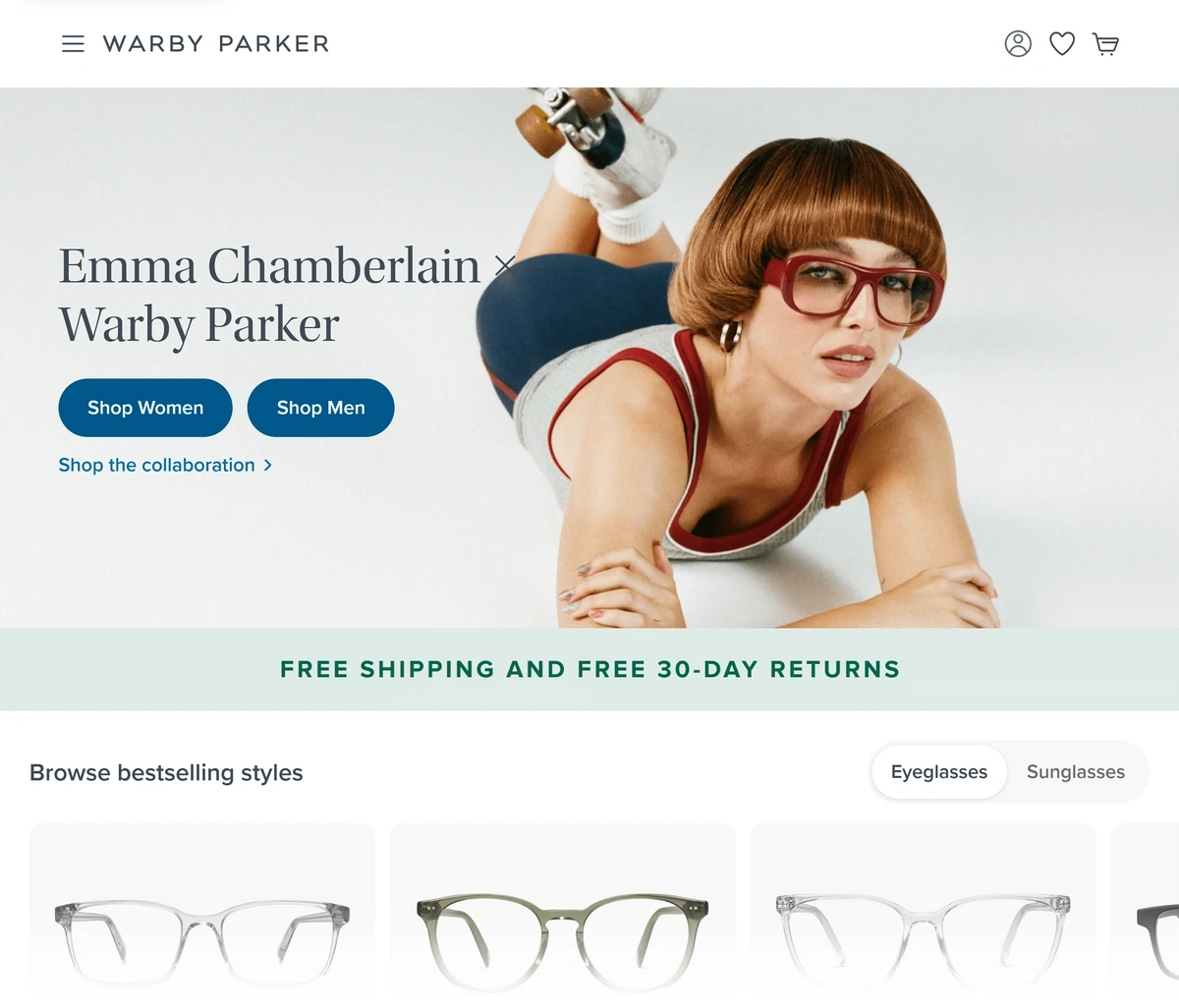

Warby Parker had a brief first-mover advantage.

Along with Dollar Shave Club, Warby Parker became one of the highest-profile DTC startups in the US. But they too are seeing new competitors emerge.

But they're now competing against emerging competitors, like Lensabl.

Part of the reason for this increased competition within DTC categories is that it's significantly easier to launch and grow a DTC company than even a few years ago.

Platforms like Shopify make setting up an E-commerce site relatively quick and easy.

And services like ShipBob can take care of shipping, logistics, and returns.

“ShipBob” searches are up 64% in 5 years.

Following a deal with the fast-growing TikTok Shop, ShipBob recorded revenues of around $500 million last year.

With the rise of dropshipping, sellers don’t even need to keep inventory themselves.

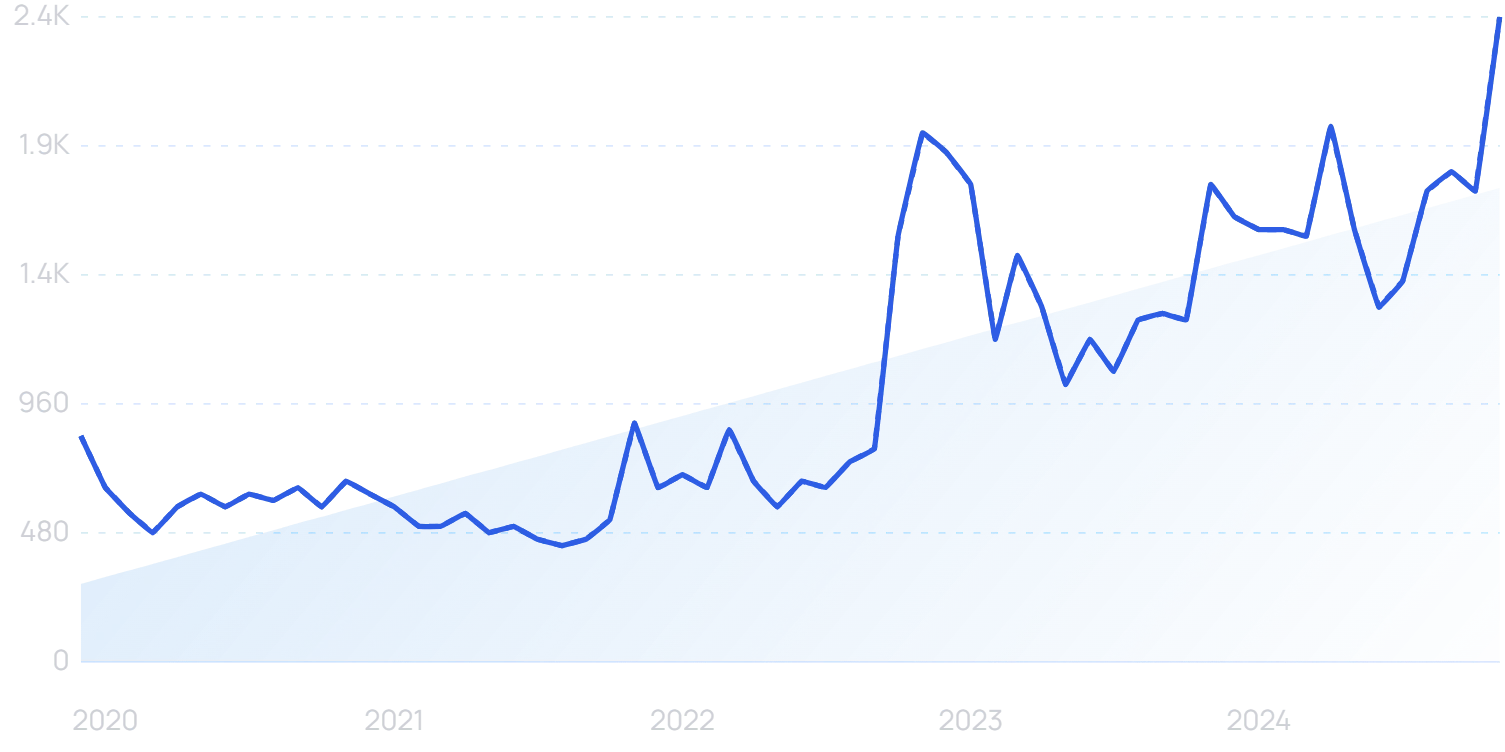

Searches for “dropshipping” are up 960% in the last 10 years.

All of this lowers the barrier to entry for anyone who wants to compete with a DTC company that's gaining traction in a space.

Semrush is one way DTC businesses can gain an edge in this ever-expanding sea of potential competitors.

“Semrush” searches are up 156% in the last 5 years.

A comprehensive suite of features includes five bespoke competitor analysis tools:

- Traffic Analytics - Allows businesses to benchmark their own daily and weekly traffic against competitors within the relevant industry.

- Organic Research - Lets users find valuable keywords that rivals are (and aren’t) ranking for in organic search.

- Advertising Research - Enables businesses to analyze competitors’ ads and gain a better understanding of the paid search landscape within their niche.

- Social Media Tracker - Offers an overview of audience preferences and ways to boost engagement, as well as analysis of social activity from other brands in the industry.

- Map Rank Tracker - Provides accurate tracking of Google Maps rankings for users’ own businesses and those of their competitors.

Try Semrush for free and take its powerful tools for a test drive.

6. DTC Brands Offer Flexible Payment Methods

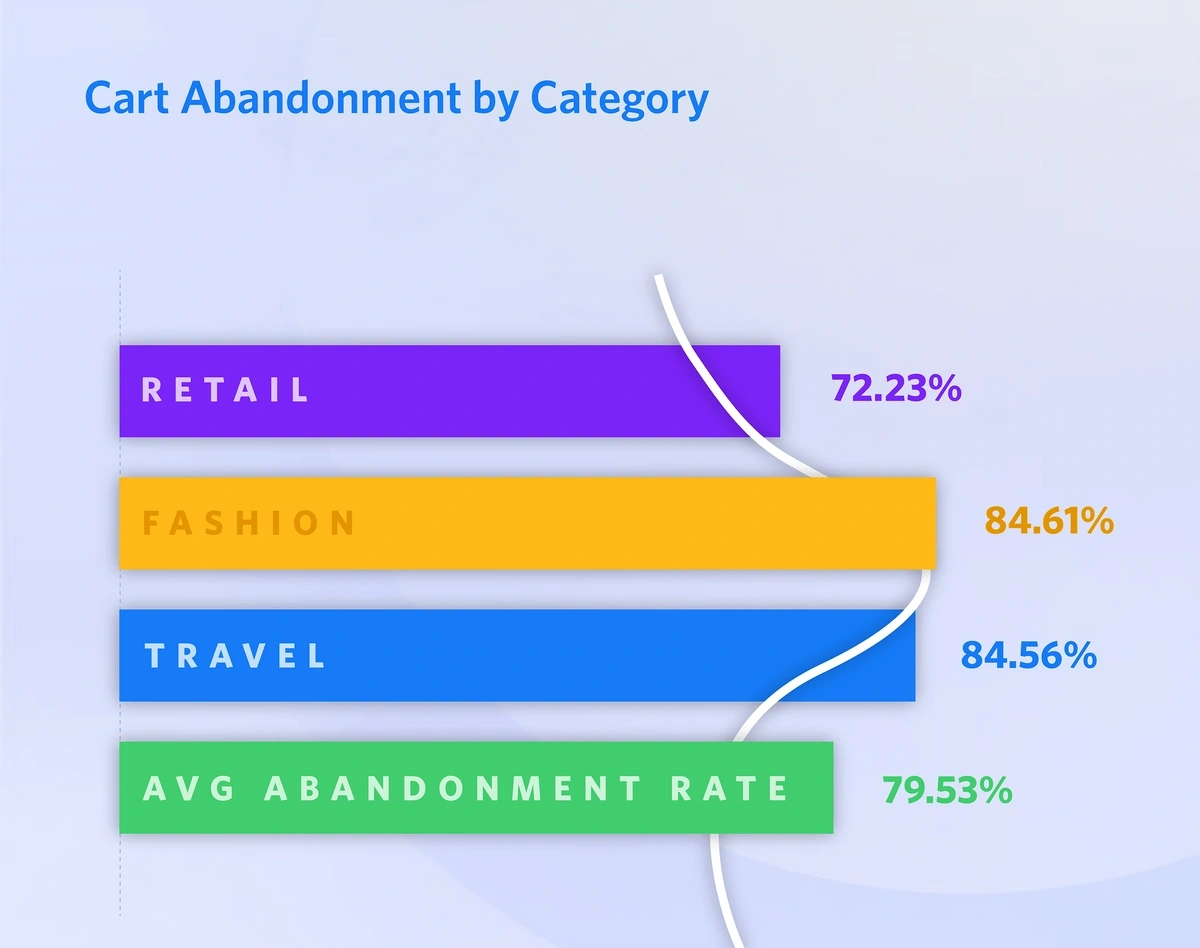

With shopping cart abandonment rates hovering close to 80%, many E-commerce platforms are loading up their carts with payment options, like Apple Pay and Google Wallet.

SaleCycle data on cart abandonment rates across various E-commerce sectors.

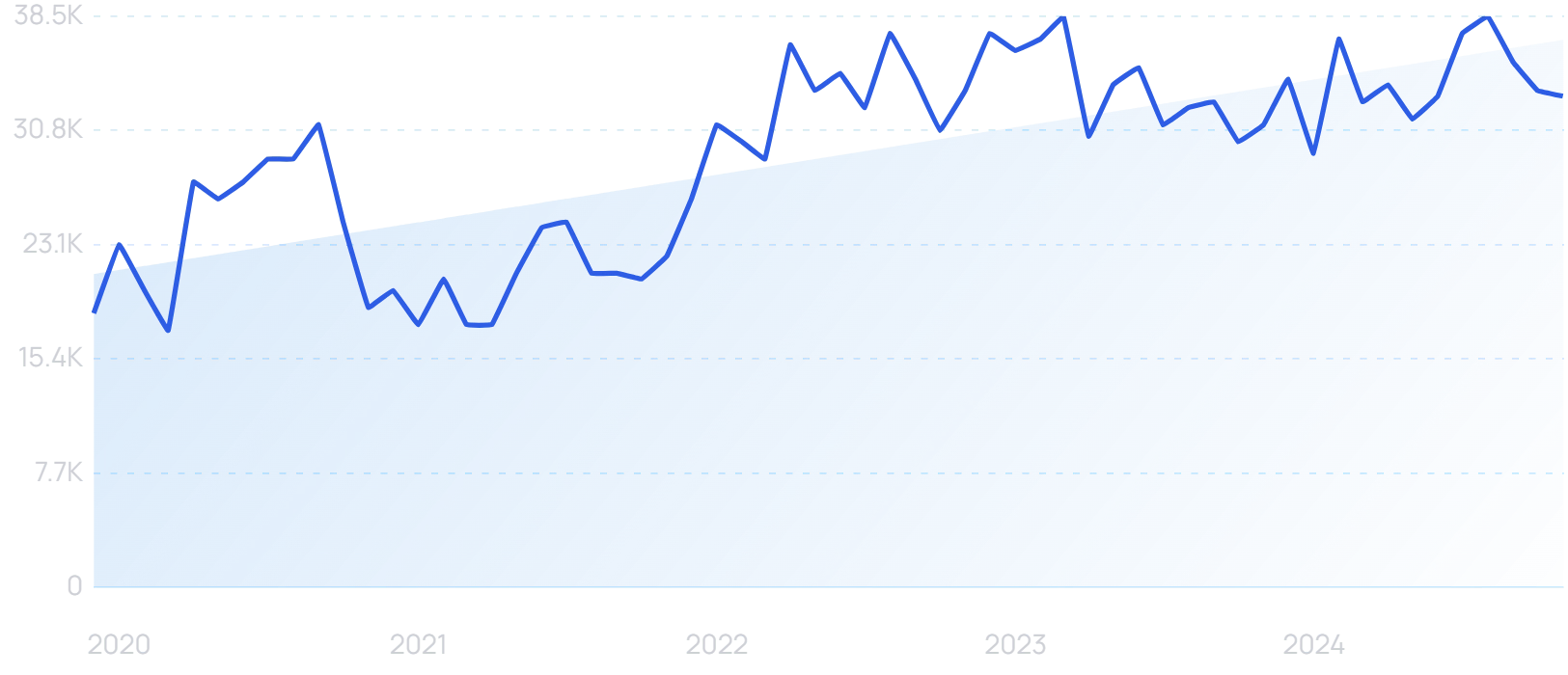

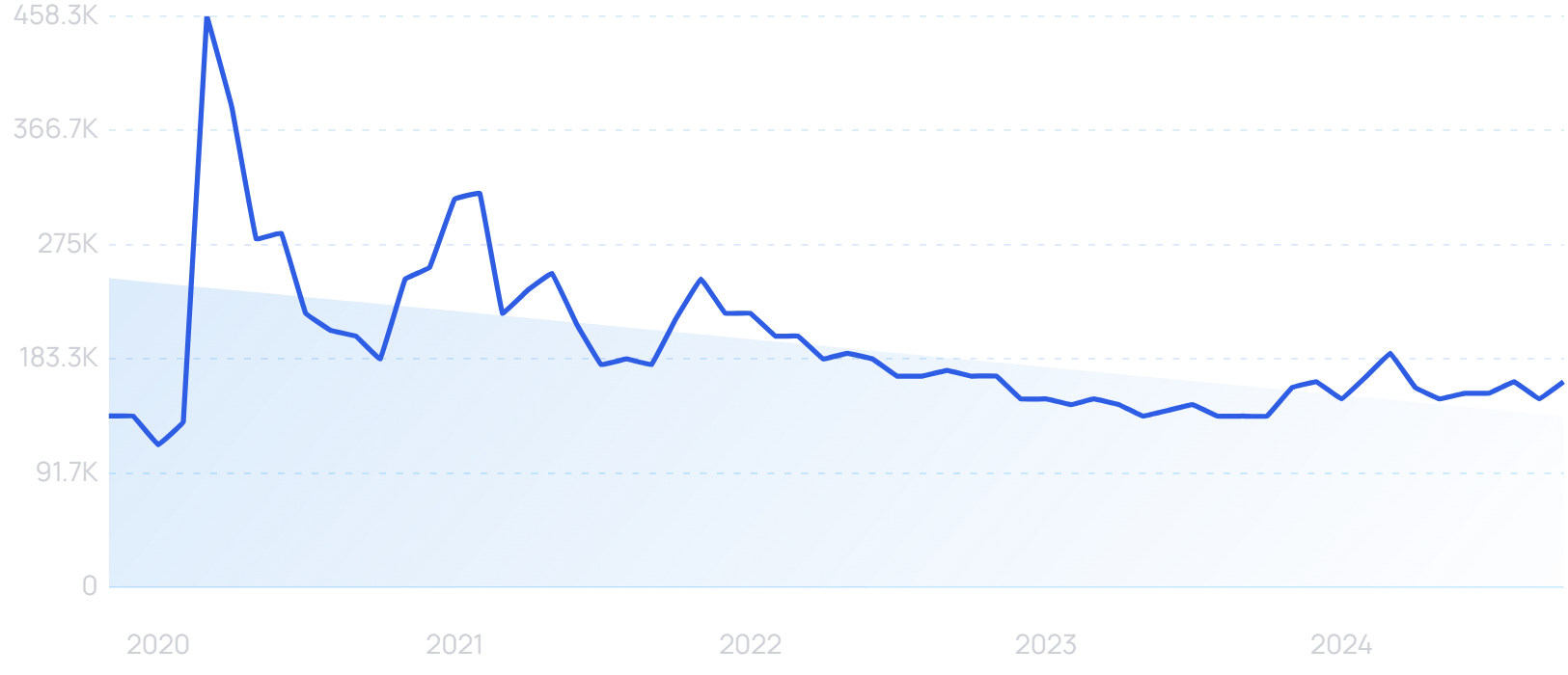

And while the "buy now, pay later" (BNPL) bubble appears at first glance to have somewhat burst since the pandemic, many businesses are convinced it is here to stay.

Searches for “Buy Now, Pay Later” spiked massively in the pandemic, but have since stabilized above pre-pandemic levels.

In Indonesia, tech giant GoTo (a merger of ride-hailing firm Gojek and E-commerce brand Tokopedia) recently launched a BNPL offering as part of its partnership with TikTok.

The video-sharing app previously struck a similar deal in Malaysia with Atome. And with TikTok one of the biggest current drivers of DTC trends, we can assume BNPL isn’t going anywhere just yet.

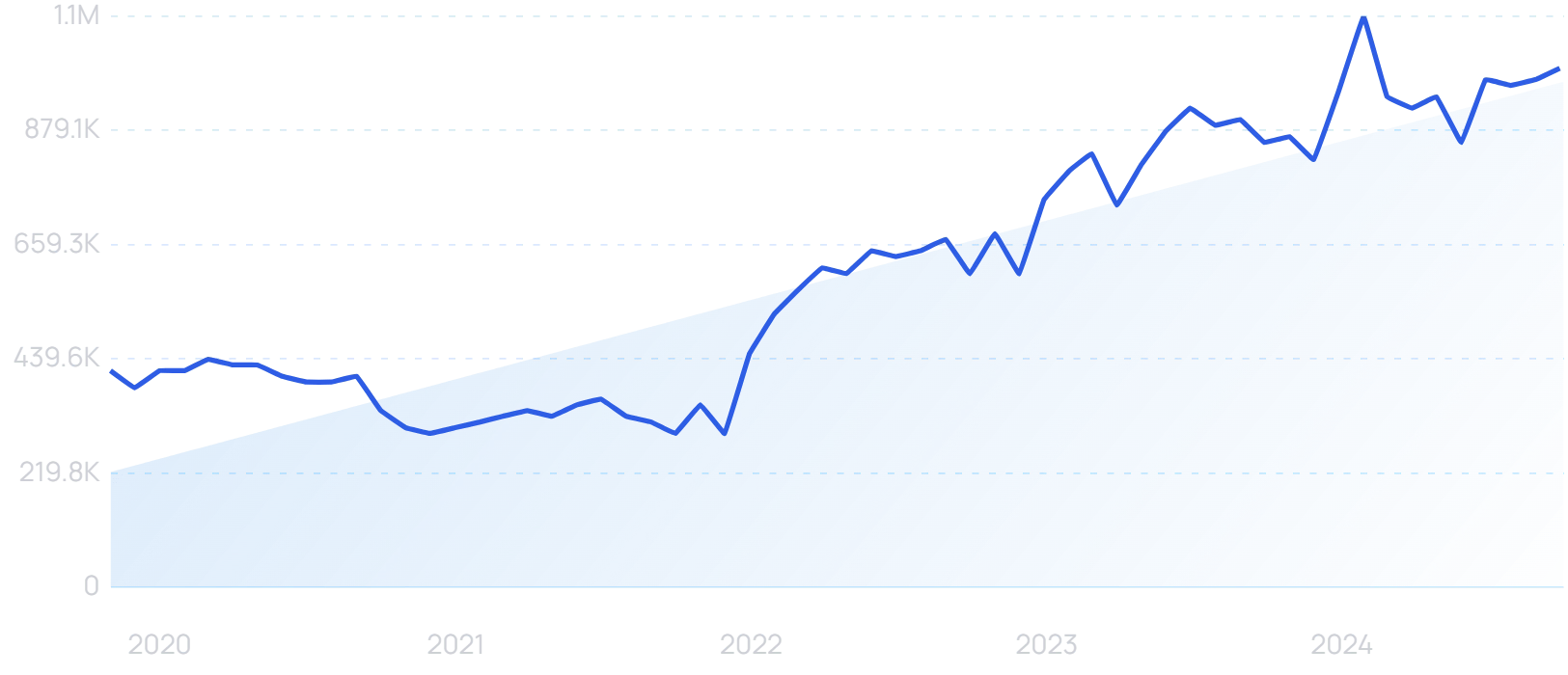

Swedish company Klarna, a leader in the BNPL space, continues to see search growth.

“Klarna” searches are up 80% in the last 5 years.

Last year, Klarna reported gross profits of 11.7 billion SEK, around $1.16 billion. It recently filed for an IPO on the New York Stock Exchange.

7. DTC Tackles New Categories

Mattresses and eyewear might get all of the attention.

But we're seeing a number of companies launching DTC brands in totally new categories.

For example, breast pumps.

Breast pump DTC company Haakaa has seen rapid growth due to:

- A highly-regarded product

- Intimate knowledge of their target demographic

- Highly-effective influencer marketing

But also because they were one of the first breast pump brands to focus on DTC over retail.

Searches for “Haakaa” saw rapid initial growth.

Athletic Brewing is part of the food and beverage DTC explosion. But it’s also an example of a brand that has found a very specific niche: non-alcoholic beer.

Searches for “Athletic Brewing” are up 408% in 5 years.

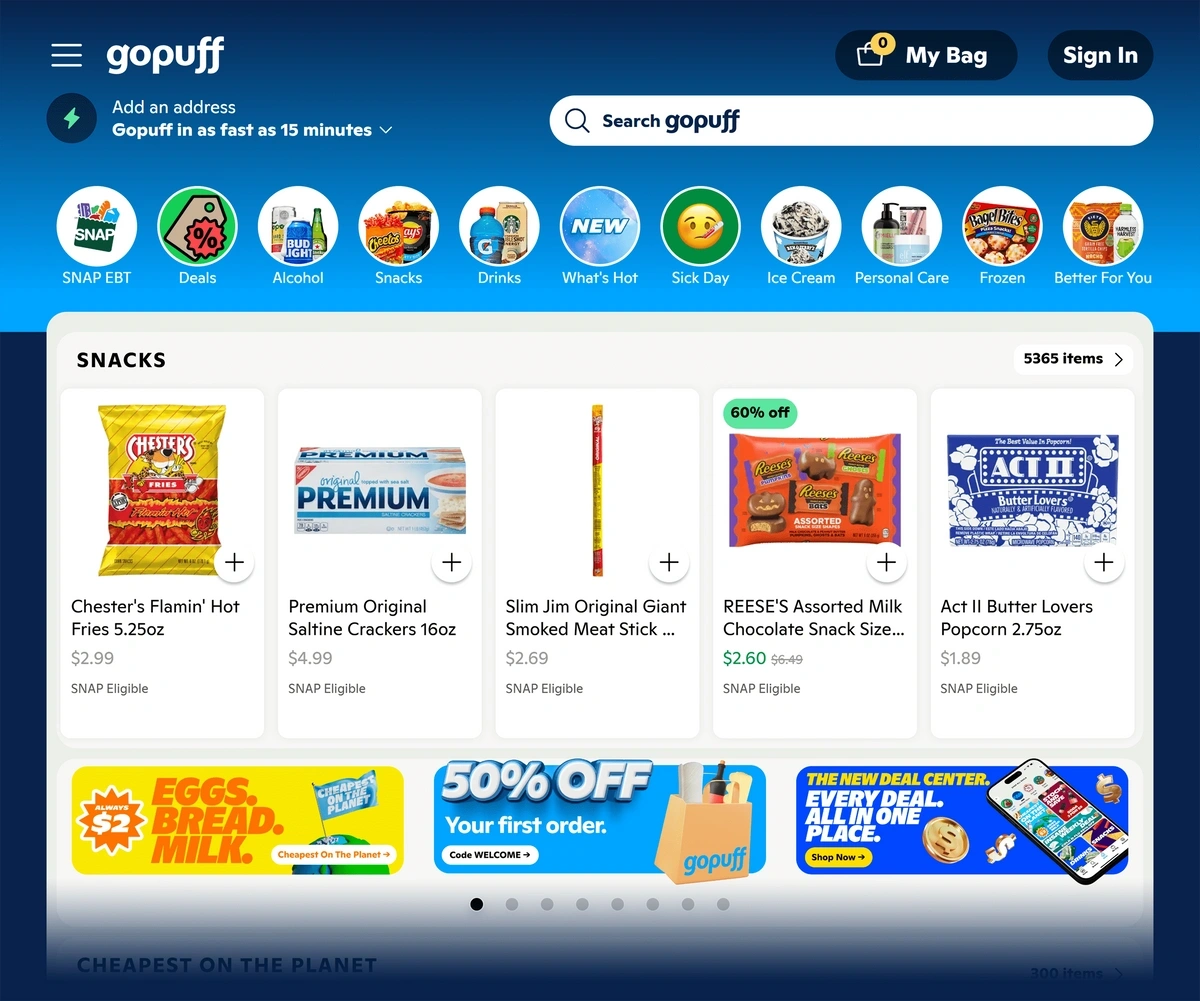

Convenience stores are another category getting disrupted by the DTC model.

Gopuff offers consumers 30-minute delivery on items that you'd normally buy at a brick-and-mortar store: snacks, cold drinks, and cleaning supplies.

Homepage for the snack delivery company, Gopuff.

Last year, Gopuff had about 1.8 million active users. The app has been downloaded more than 20 million times.

If you want to explore potential niches for your E-commerce business, then check out our free E-commerce Keyword Tool.

8. The DTC Fitness Space Continues to Grow

$10 billion in annual revenue transferred from gyms to at-home exercise solutions during the pandemic.

And this trend is continuing post-Covid.

For example, in Q3 2024, Peloton subscription revenue increased by 2.4% to $424.7 million.

The home fitness giant enjoys just 1.2% average monthly subscription churn.

This probably comes as little surprise given that the Peloton bike hardware retails for $1,445 from the get-go. The treadmill costs $2,995 and the rower sets you back $3,295.

Numerous DTC fitness startups are attempting to recreate Peloton’s successful “hardware + software + subscription content” model.

This means creating a “device for X” and adding a recurring revenue model via live classes.

FightCamp is effectively Peloton for boxing.

FightCamp is part of the “Peloton for X” trend.

The product itself (retailing for $999) is a smart punching bag that connects to an app for tracking punches.

FightCamp is also heavily monetized with a monthly subscription model. The product requires a $39/mo membership to use.

Punchlab and Liteboxer are also startups in the “Peloton for boxing” space.

Meanwhile, CLMBR is Peloton for rock climbing.

Its “2.0” machine, launched last year following a fresh round of funding, promises to work out 86% of muscles.

Having enjoyed some success in the US, it recently passed compliance standards to fulfil orders in the UK and Europe.

Tempo is for strength training.

Searches for “Tempo Studio” are up 54% in 5 years.

It uses AI and a mounted camera to offer personalized guidance.

The Tempo Studio Pro.

Tonal is another player in this space. After a $250 million Series E round in March 2021, it raised another $130 million last year.

Mirror raised $74.8 million in VC funding before being acquired by Lululemon in July 2020 for $500 million. The Peloton for equipment-free workouts has now been rebranded as Lululemon Studio.

“Lululemon Studio” searches are up 214% in 5 years.

9. DTC Brands Go All-In With Subscription Pricing

Speaking of subscription pricing, the subscription market is growing 18% year-over-year.

This probably explains why a growing number of DTC brands are adopting the SaaS model of monthly recurring subscription pricing.

That includes DTC companies in very specific niches, like pet supply brand Chewy.

Searches for “Chewy” are up 321% in the last 10 years.

Chewy “Autoship” customers get 5% off base prices and priority access when supply is running low.

And this model is certainly not limited to pet supplies. E-commerce giant Amazon has a similar offering.

Amazon's "Subscribe & Save" feature is the subscription model applied to specific products on the site.

So while many DTC brands will continue to offer one-off purchases, expect more of them to offer subscriptions as an option.

Or as the only way to buy.

There's also the "monthly box" niche that's continuing to see growth.

Unlike Autoship or Subscribe and Save, a subscription isn't something tacked on to boost revenue.

The entire business model is based on it.

Butternut Box, another DTC pet supplies company, provides a helpful illustration.

“Butternut Box” searches are up 308% in 5 years.

Unlike with Chewy, dog food from Butternut Box can only be purchased on a subscription basis. Sales almost doubled last year amid international expansion.

Keep Pace With The Latest DTC Trends

There you have it: 9 important trends impacting the direct-to-consumer space right now.

Although demand for DTC was trending upward prior to COVID, the pandemic accelerated growth in the space.

We can expect more growth, major changes, and plenty of new products in the near future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more