Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Market Trend Analysis: A Simple Step-by-Step Guide

Staying ahead of market trends isn’t about gut feelings or hunches. It’s about identifying key shifts among consumers, and which ones are worth pursuing before they reshape the landscape.

Market trend analysis helps executives and investors spot the next big trends before they peak, giving them a competitive edge in anticipating what’s next.

However, the quality of your market trend analysis process directly determines the value of your insights. Every step – whether it’s the data you rely on, the metrics you choose, or how you interpret your findings – plays a critical role in shaping how these trends will impact your strategy.

In this guide, we'll walk you through a straightforward and effective market trend analysis process that outlines:

- Specific data points to identify

- Quality resources to find data

- How to use the insights you discover to inform your business strategy

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

What is Market Trend Analysis?

Market trend analysis is a data-driven process that executives, investors, entrepreneurs, and other business professionals use to identify and assess market patterns to make informed strategic decisions.

For business leaders, market trend analysis provides insights they need to make sound strategic decisions about new features, product lines, and marketing campaigns to launch (or pivot).

For investors and entrepreneurs, market trend analysis provides insights that guide them toward the most profitable markets and businesses to invest in.

For example, if you’re an investor in the health food market, performing a market trend analysis would help you realize prebiotic soda is an emerging category worth digging into more.

Why is Market Trend Analysis Important?

Here are the four main ways market trend analysis helps business executives, entrepreneurs, and investors make better strategic decisions.

Identify Emerging Trends Early

An effective market trend analysis process helps you identify emerging trends before they mature.

Spotting trends early is useful for investors as early investments often yield a higher ROI. For business leaders and entrepreneurs, this data gives a competitive edge and allows them to identify new product and service opportunities to meet future demand for their customers.

Reduce Investment Risk

Market trend analysis provides insight into market volatility and lets you gauge whether demand increases, decreases, or remains consistent.

This can help you identify the lowest risk opportunities or at least be aware of the risk associated with each investment decision.

Improve Forecasting Accuracy

Launching a new product, service, or marketing campaign requires an accurate estimate of future demand.

Market trend analysis assists your demand calculation by providing an overview of historical consumer interest, which you can use to forecast future demand.

Maintain a Competitive Advantage

Market trend analysis helps businesses maintain a competitive advantage by:

- Uncovering up-and-coming competitors

- Providing insights into why consumers like the new competitors’ products/services

- Providing data on how consumers feel underserved by competitors

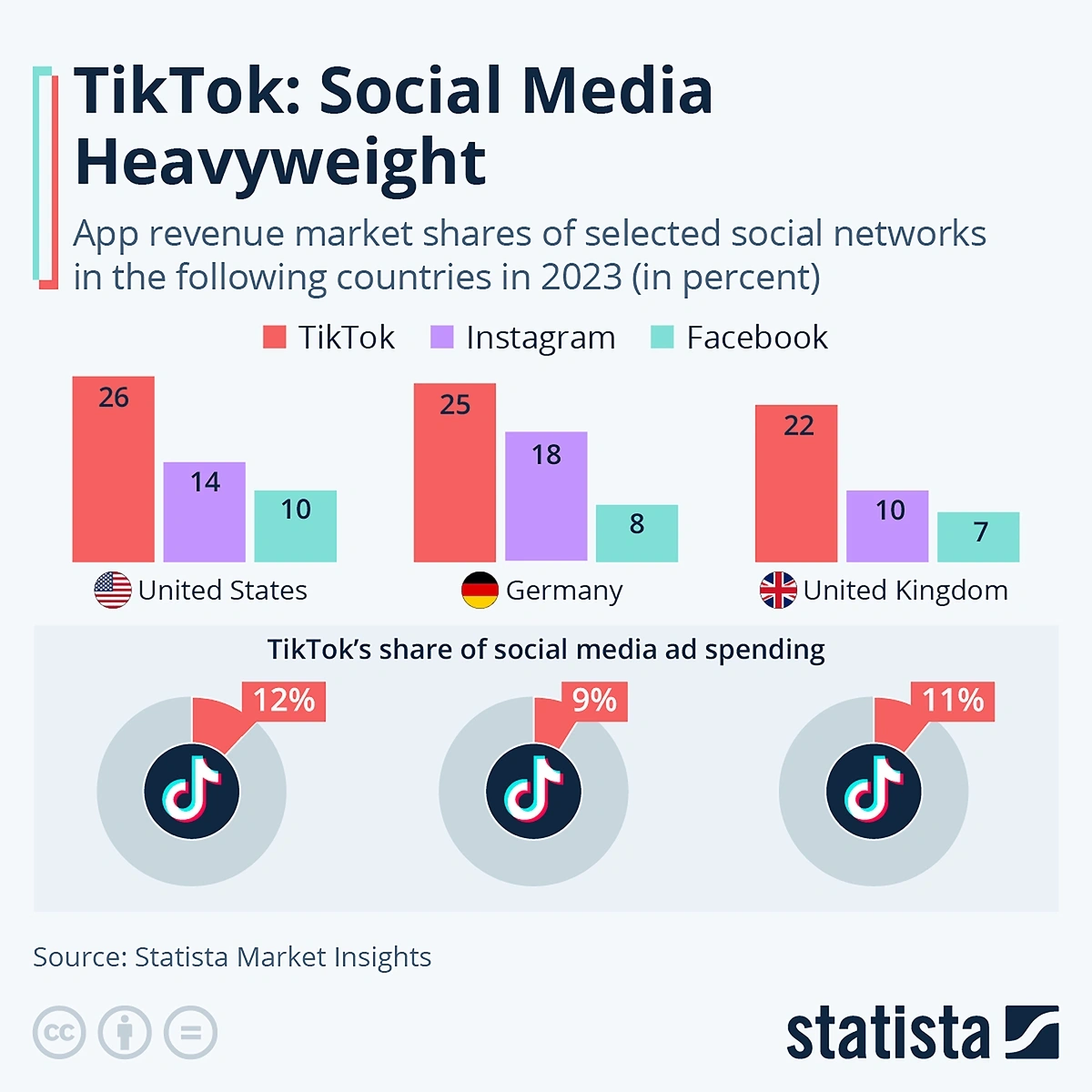

For example, Meta has been losing significant market share to TikTok over the last few years. This is mainly because Meta failed to keep up with consumer demand trends.

If Facebook had identified these market trends earlier and pivoted to implement the aspects of TikTok that users love (short, funny videos), it might have retained this market share.

How To Do a Market Analysis

Whether you’re researching market trends to launch a new business or invest in a startup, here’s a step-by-step process to conducting a market analysis, uncovering trending topics, and using your findings to inform your business strategy.

Step 1: Identify Emerging Competitors, Products, and Industry Terms

Identifying which trends to analyze is arguably the most important task in this process.

That’s because a great analysis of a mediocre market trend can still lead to a dead end.

Most people approach the trend discovery process by reading industry publications, following industry influencers on social media, and browsing free market trend reports.

While this process can work, it's time-consuming. Plus, there's always a chance that you'll overlook the next emerging trend. Before you dive right in, spend some time understanding the market from a zoomed-out perspective with a competitive market analysis.

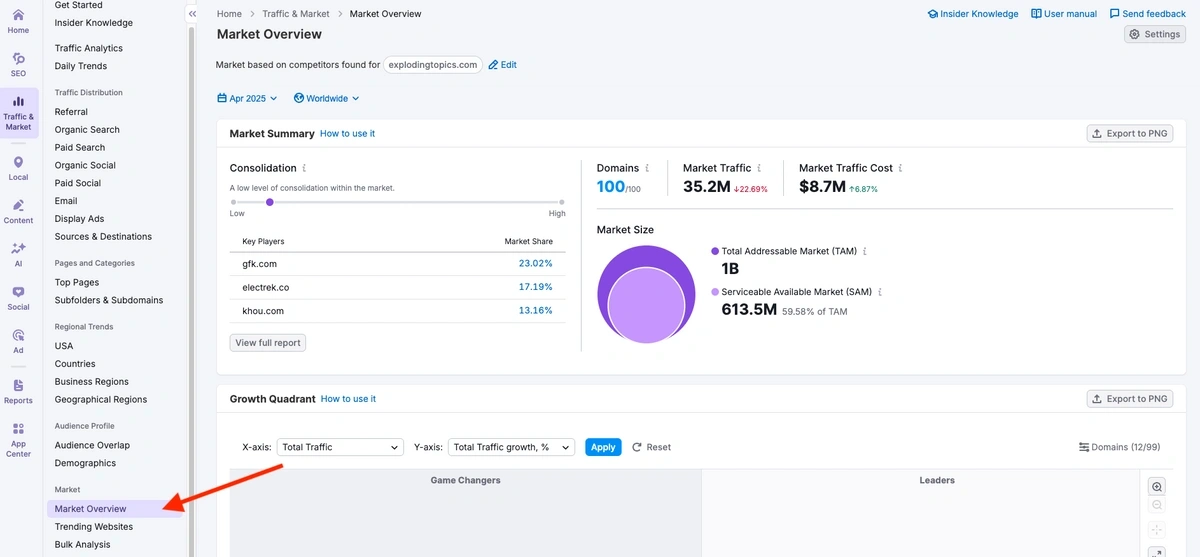

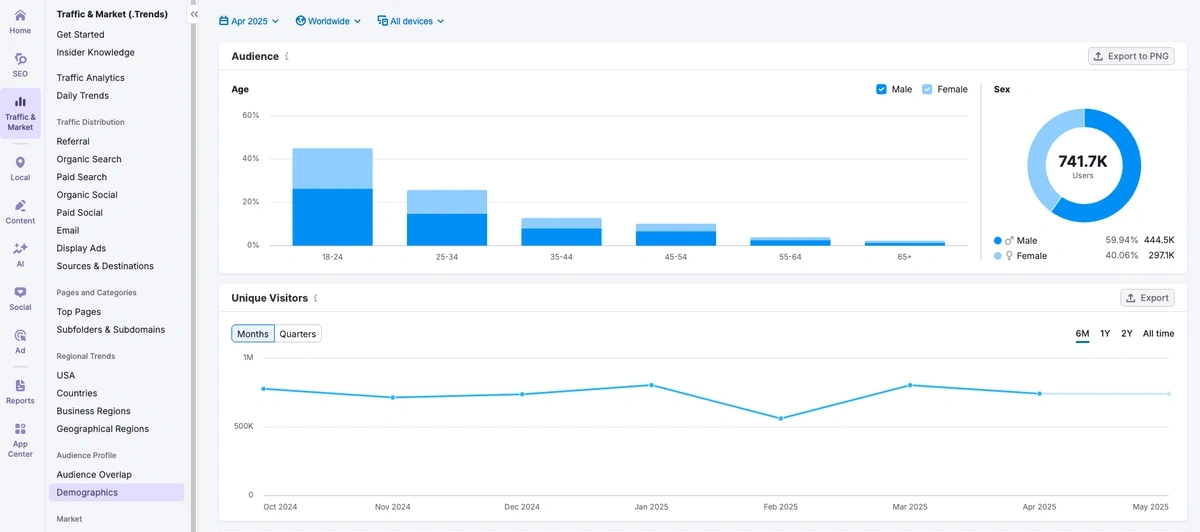

Semrush’s Traffic & Market tool can help you gain a better, data-driven, understanding of your market sector. This tool helps you visualize the overall landscape of your industry by providing data on site traffic, competition, and market size. Here you can start to uncover where it’s worth investing more time digging deeper.

Inside the Semrush dashboard, go to the "Market Overview" tab to view detailed data on your market.

Here, you'll see the “Market Summary” report that estimates the size of your industry, total traffic, top competitors, and more.

Once you generate your report, you’ll have a bird’s eye view of what the market consolidation, market traffic, and market size look like in your space. This market analysis will help you get a better understanding of how your business fits into the larger picture and how competitive the space is.

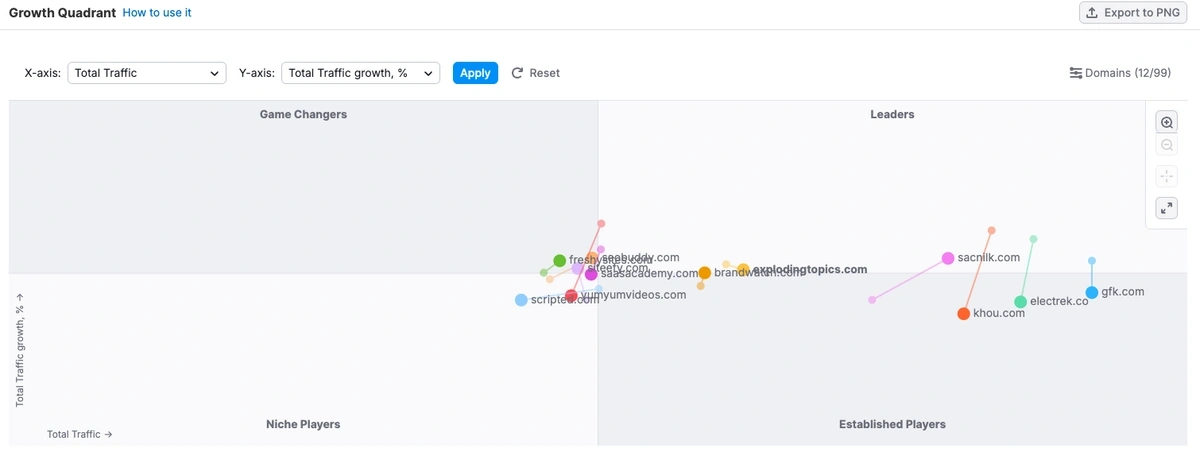

Take your market competitive analysis a step further by looking at the current market leaders.

To do this, scroll down to the "Growth Quadrant" chart to view a visual landscape of competitors in the space.

And here’s a pro tip for you: try exporting historical and current data into a CSV so that you can analyze not only who the largest leaders are, but also start to identify emerging brands experiencing the most relative growth.

Now that you’ve identified who the existing leaders and emerging brands are in your category, you can start to delve deeper into what these companies are offering and what that means for your investments or business strategies.

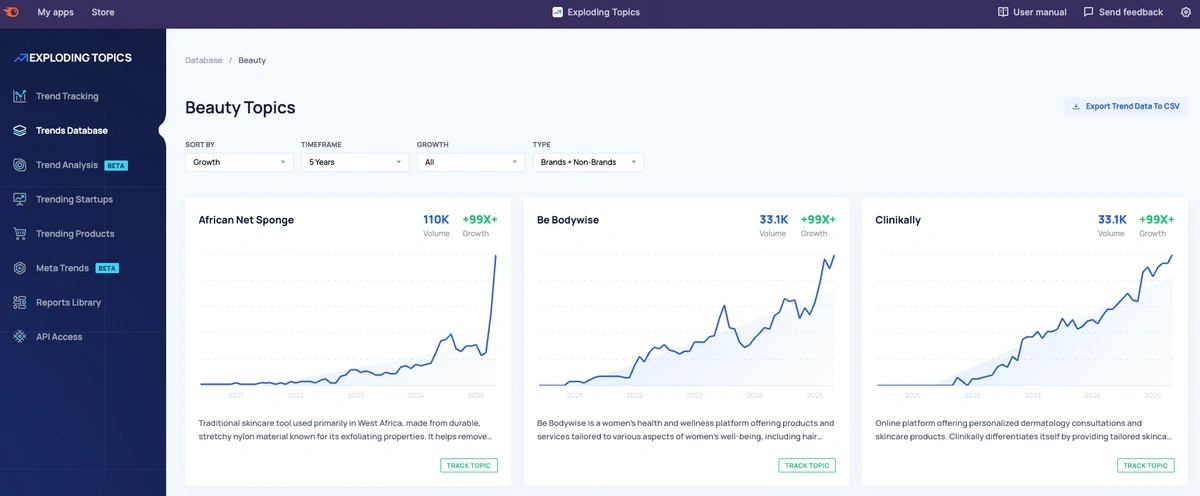

Exploding Topics can help you uncover what topics are breaking through in your category, which you can then use to analyze the competition you just uncovered.

The flagship feature is the Trends Database, a curated selection of 1 million data-backed trends our team manually vetted.

To identify emerging competitors, industry terms, and products, simply sort the Trends Database by one of the 35+ categories (fashion, pets, finance, marketing, CPG, etc.) and then trend status ("exploding," "regular," and "peaked").

After discovering an interesting trend, click "Track Topic" and save it to a custom Project for more in-depth analysis.

We consistently identify under-the-radar trends and don't miss the next big trend.

- Each trend has long-term growth potential.

- Trends are backed by reliable data – not randomly selected by a single person.

- You can use the free Exploding Topics database now to complete this step or try Exploding Topics Pro to access our premium trends and other market analysis features.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

Step 2: Analyze Quantitative Data For Each Trend

It's easy to scan market reports and get lost in endless data without learning anything meaningful about that trend.

So instead of collecting random data, here are the most important quantitative metrics to assess market trends:

- Market size

- Competitor traffic

- Industry funding

- Industry hiring

Below, we'll show you how to collect and use this data to gauge a market's potential.

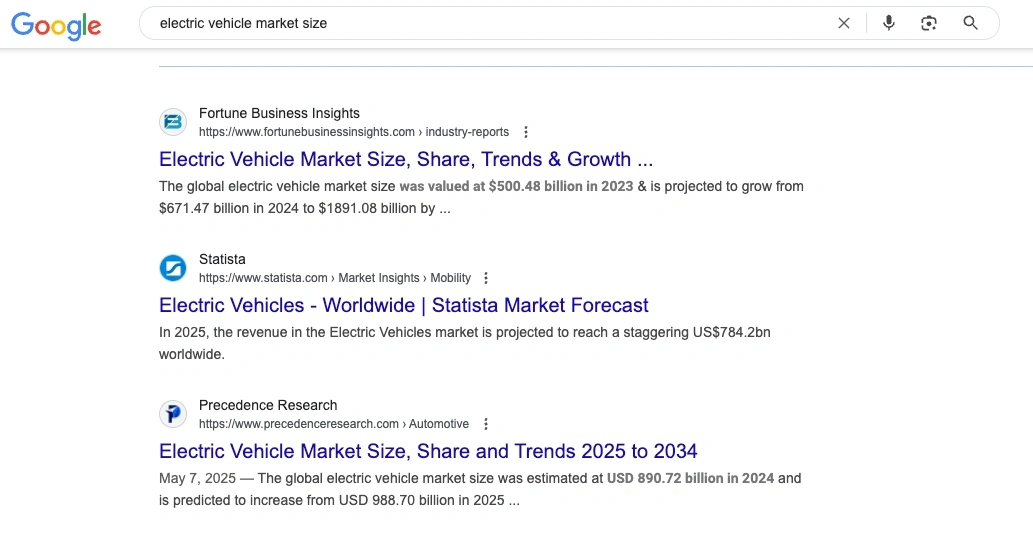

Market Size

In addition to the overall market size data you gather from Semrush’s Traffic & Market tool, you can Google the trend's keyword combined with the words "market report." You’ll usually find a market report from Globe Newswire or Grand View Research that shows its market size and growth trend data. This data can help you analyze a market's maturity and estimate its future growth trend.

If a market has a strong compounding annual growth rate (CAGR), it will likely continue to grow.

Traffic Trends

Traffic trends are going to help you understand how your competition is leading customers to their site, as well as understand the search demand over time for your trending topics.

Understanding how competitors are getting in front of potential customers is going to be key to understanding your larger strategy for breaking into a market or capitalizing on a trend.

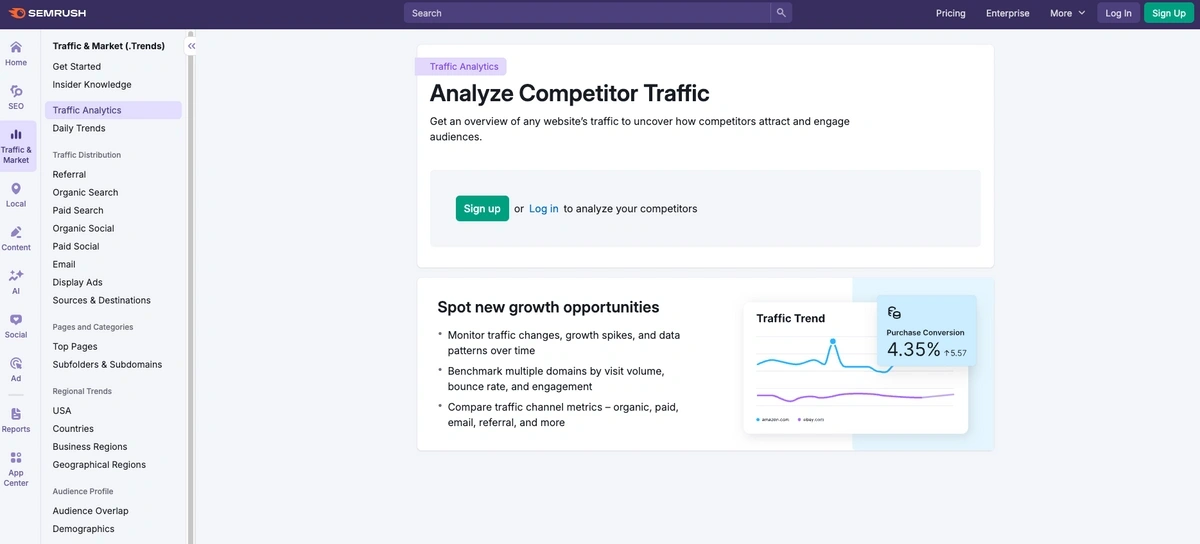

Semrush has a Traffic Analytics tool to help you do just that.

Within the tool, you can enter a competitor you uncovered in your first step. Try analyzing both a large market leader as well as a site that has been experiencing rapid growth based on your analysis.

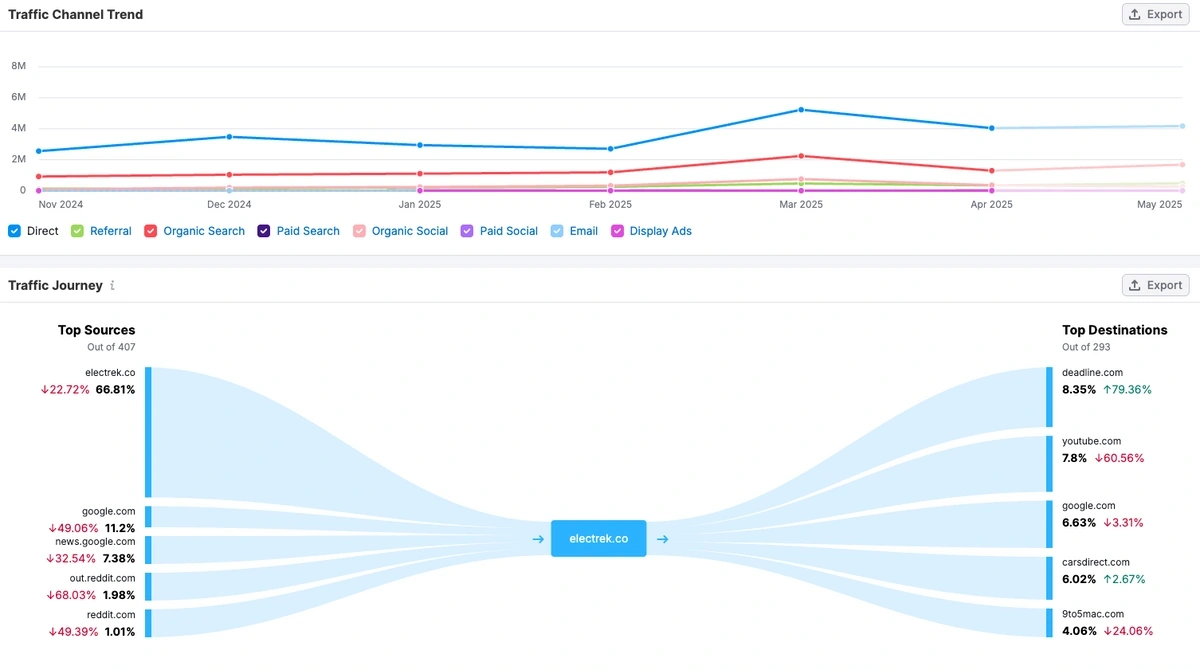

Once the dashboard loads, scroll down until you see the “Traffic Journey” and "Traffic Channel Trend” sections. This is where you can view which marketing channels are driving traffic to your competitors. Using this data, you can understand a little more about their marketing strategy.

If you see:

- Higher Direct Traffic: Your competitor is likely relying on branding and traditional advertising to drive customers

- Higher Organic Search Traffic: A strong SEO strategy is positioning them to capture their audience as they search

- Higher Social Traffic: Social media ads and strategy are driving users from these platforms to your competitor's site

- Higher Email Traffic: There’s an effective email marketing strategy in place that’s driving customers to their site.

Now that you have this data, you can start to see how consumers are searching for trending topics.

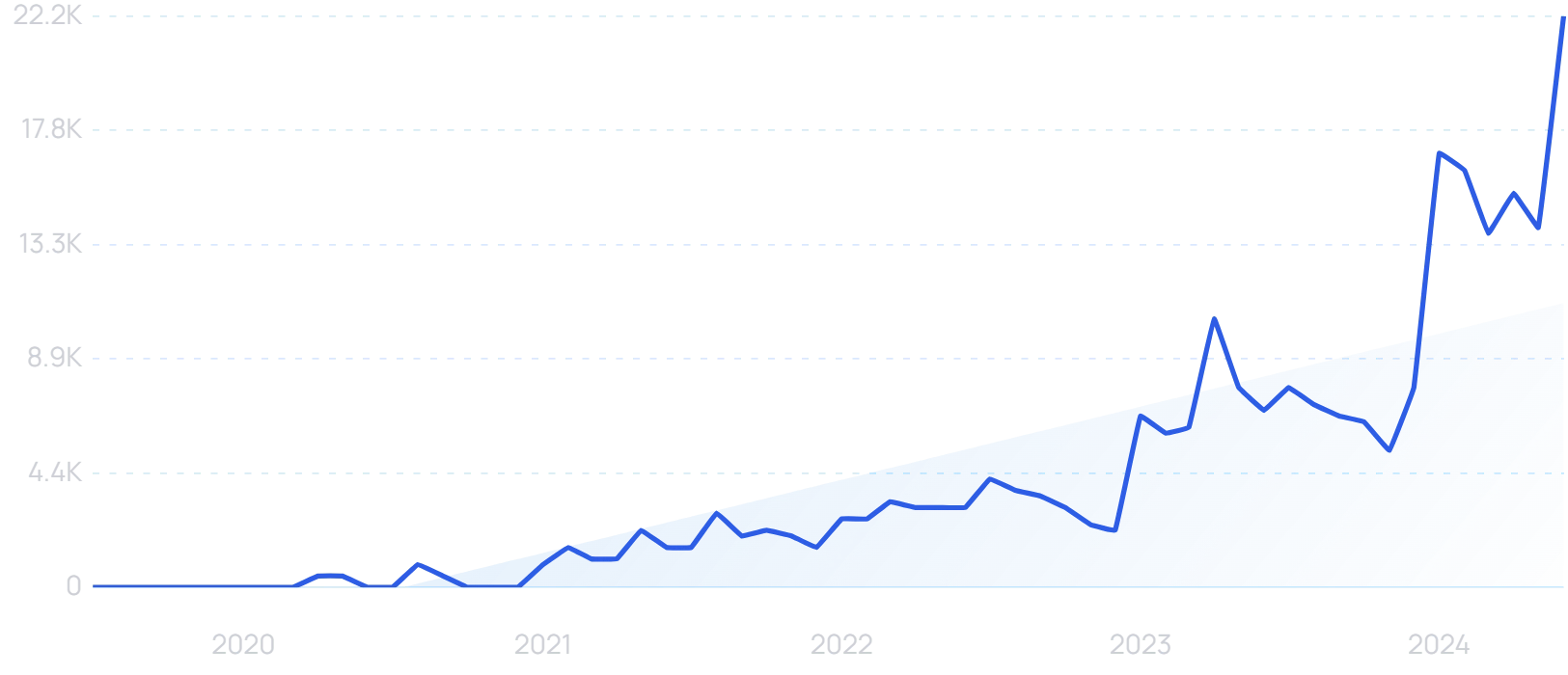

If you used Exploding Topics to identify market trends, you already have search volume trend data. Otherwise, search the trend in Google Trends or Trends Analysis (an Exploding Topics Pro feature) and view its search volume trend.

If you see steady growth, there's a good chance it's a sustainable, long-term trend, whereas spikes and dips indicate that it's either a fad that will die out or a seasonal trend with volatile revenue.

Funding Trends

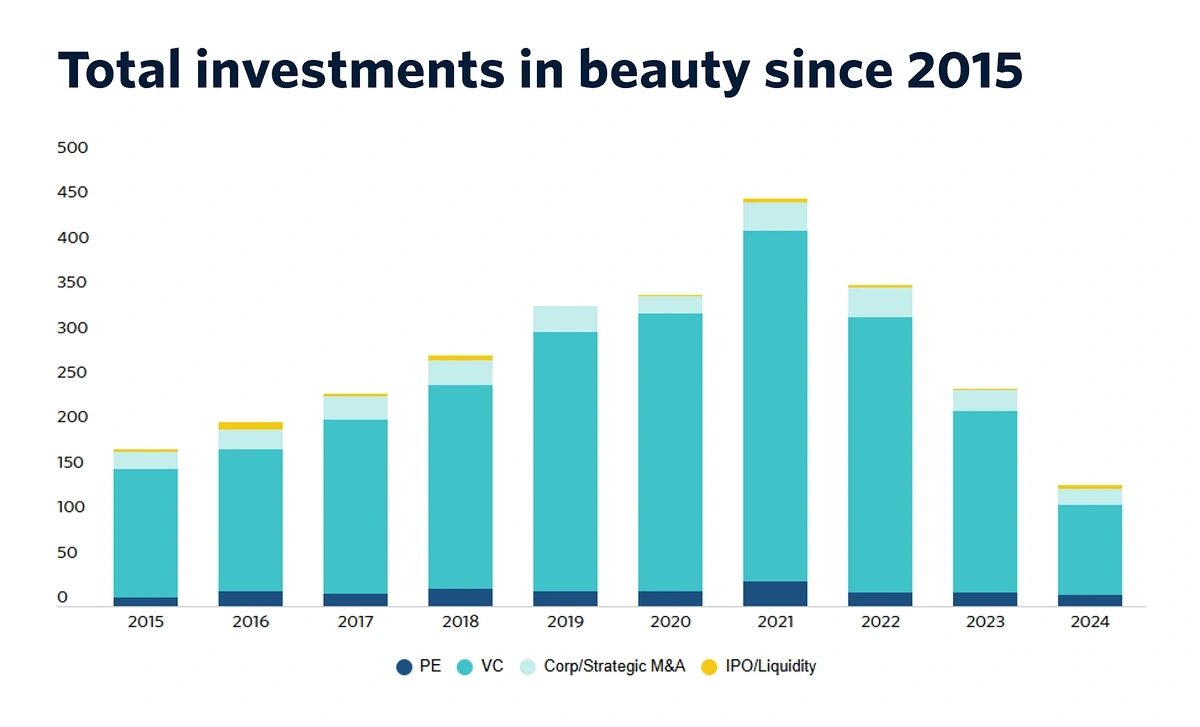

Another good sign that a market is promising is if venture capitalists are pouring money into that market. While venture capitalists aren't always correct in their predictions, they dedicate all their resources to identifying industry trends, so it's still a good benchmark.

A quick Google search of the industry will usually pull up data on VC investment history for that particular trend. For example, a quick search for "VC funding in sustainable beauty" pulled up this data from a Pitchbook blog post:

Databases like Pitchbook and CB Insights are excellent resources for providing funding data.

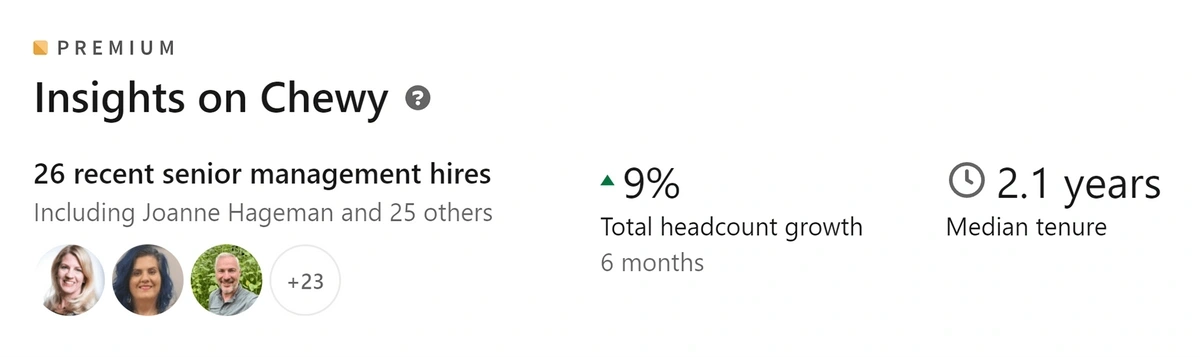

Hiring Trends

Hiring trends also help you gauge the market's general health. If most of the top players in a market are all hiring, there's a good chance that the market is growing.

You can find hiring data by looking at the LinkedIn profiles of the top competitors in the space:

You can also check the specific jobs they’re hiring for by looking at their LinkedIn Jobs and Indeed profiles.

Step 3: Gather Qualitative Secondary Data Around Each Trend

You’ve gathered a lot of quantitative data surrounding the market, competitors, and emerging trends, which provides a general overview of the trend potential. But, there’s still an important piece to your market analysis missing – why is this taking off and what pain points is this solving for customers?

This information helps you understand how to find gaps in the market and provide a solution to unmet consumer demand.

Here are three ways you can collect qualitative data for various trends.

Reading Customer Reviews

Customer reviews help you understand more about the specific pain points that a particular trend solves and general customer enthusiasm for the new product or service.

The trend will likely continue to thrive if it is highly effective at solving a pain point and customers are enthusiastic about it.

You'll also learn more about your target demographic and the ideal customer persona by reading reviews.

To find reviews, you can use Amazon to research D2C products or Capterra or G2 to read B2B reviews.

Once you have a few hundred reviews to analyze, here are a few key things to look for:

- What specific pain points does the product/service solve?

- How did consumers solve the pain point before this product/service existed, and what alternatives did they use?

- What are common customer complaints with the current products/services available?

- The general sentiment around this trend – what kind of tone do they use when reviewing the product?

For example, if you're researching "bamboo baby clothes," you'll see that customers like the product because the fabric is much softer and more flexible.

Other reviewers claimed they purchased bamboo baby clothes to help with their eczema symptoms.

These reviews help you understand why bamboo baby clothes are popular, which is another positive sign that this trend has long-term growth potential.

You can also extract valuable customer demographic insights from reviews like:

- B2C customer persona (age, gender, knowledge level of the pain point, etc.)

- B2B customer persona (position, company size, budget, etc.)

- Parallel interests

- Goals/ambitions

- How they enjoy spending time

- Activities they don't enjoy

All of this information will be useful in informing future marketing efforts, like how to position products and where to advertise online.

Read Industry Forums

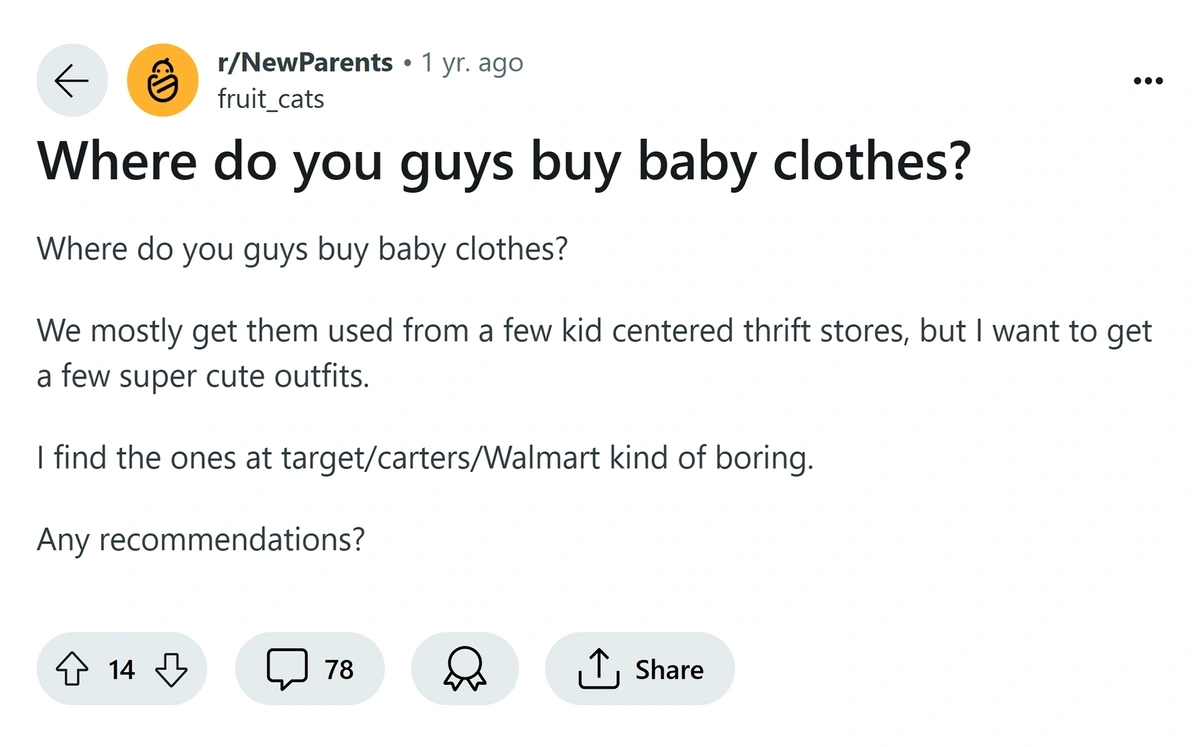

Similar to reviews, industry forums and platforms like Quora and Reddit can provide more detailed discussions on customer pain points around niche trends.

For example, there are several subreddits dedicated to new parents.

Many of which have active discussions about baby clothes:

This subreddit alone is everything you need to track the current market for baby clothes (including clothes made from bamboo fabric), as it discusses what people like and dislike about the major brands in the space.

You can also join these discussions and get members' feedback on new product ideas.

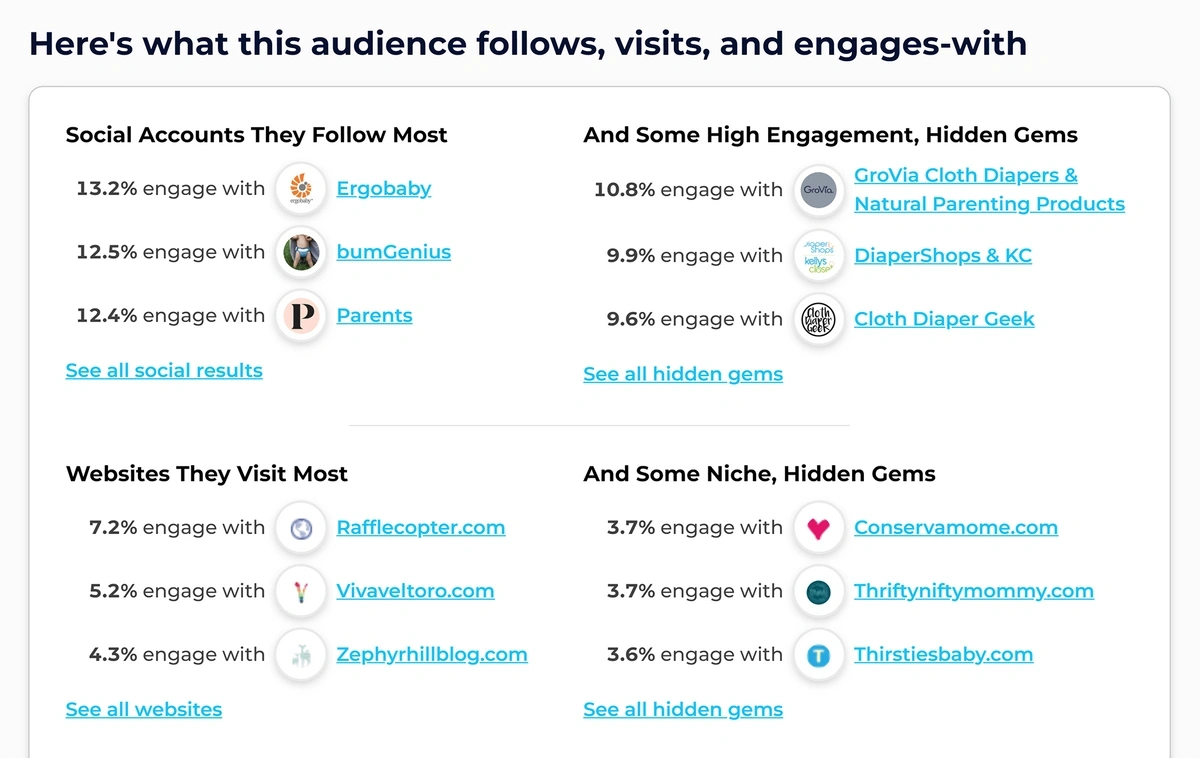

If you're struggling to find industry forums, you can use a tool like SparkToro to help you. Just type in the trend keyword, and it will show you the websites people searching that keyword frequently visit:

Social Listening

You can also gather plenty of qualitative data and competitive insights by simply listening to what customers say on social media.

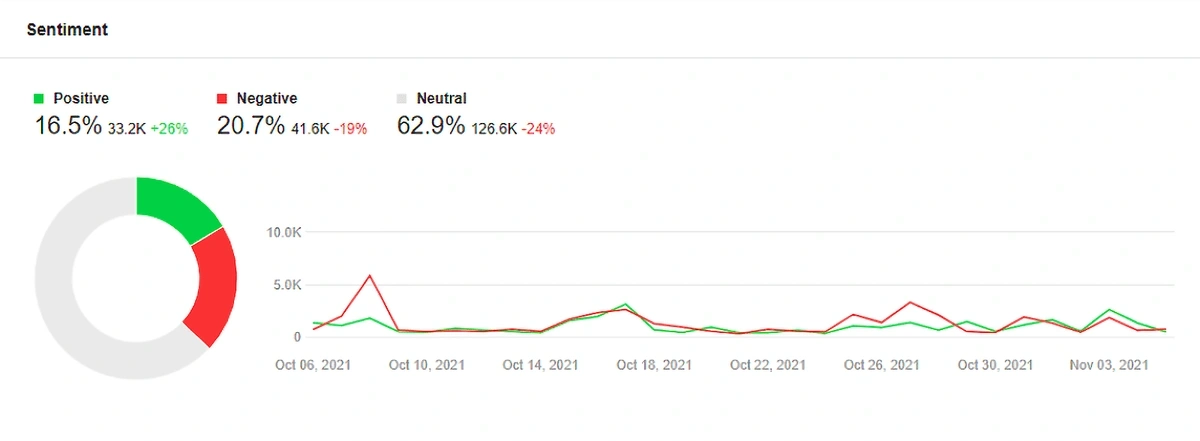

For example, you can use a social listening tool like Brand24 or Awario to track competitor brand mentions on social media. Most social listening tools also offer sentiment analysis, which can help you understand how potential customers feel about a particular trend.

Here’s the sentiment analysis trend from Awario of Starbucks:

If you notice that most people have a negative outlook on most of the top brands in the space, that's a negative sign that the trend you're tracking might not be short-term and on its way out.

However, it could also mean that there is an unmet demand that you can capitalize on.

Step 4: Conduct Primary Research and Talk to Your Target Market

The secondary market research we did above is great for narrowing down the market trends you're considering, but it's important to also do primary research and talk to your customers before launching a product or service to understand where the gaps in the market exist.

If you’re not sure who your target market is or want to get a quantitative gut check on the qualitative research you’ve conducted, conduct a target market analysis using Semrush's Audience Profile feature.

Within the tool, you can enter up to 5 competitors' websites and uncover details on the audience’s age, gender, location, employment status, education, and social media platform use.

This data allows you to gather the info you need to make informed strategic decisions on how and where to market your products and services, as well as provide a great starting point for your primary research.

There are two popular methods to execute primary research:

- Survey potential customer

- Interview potential customers

Surveying Potential Customers

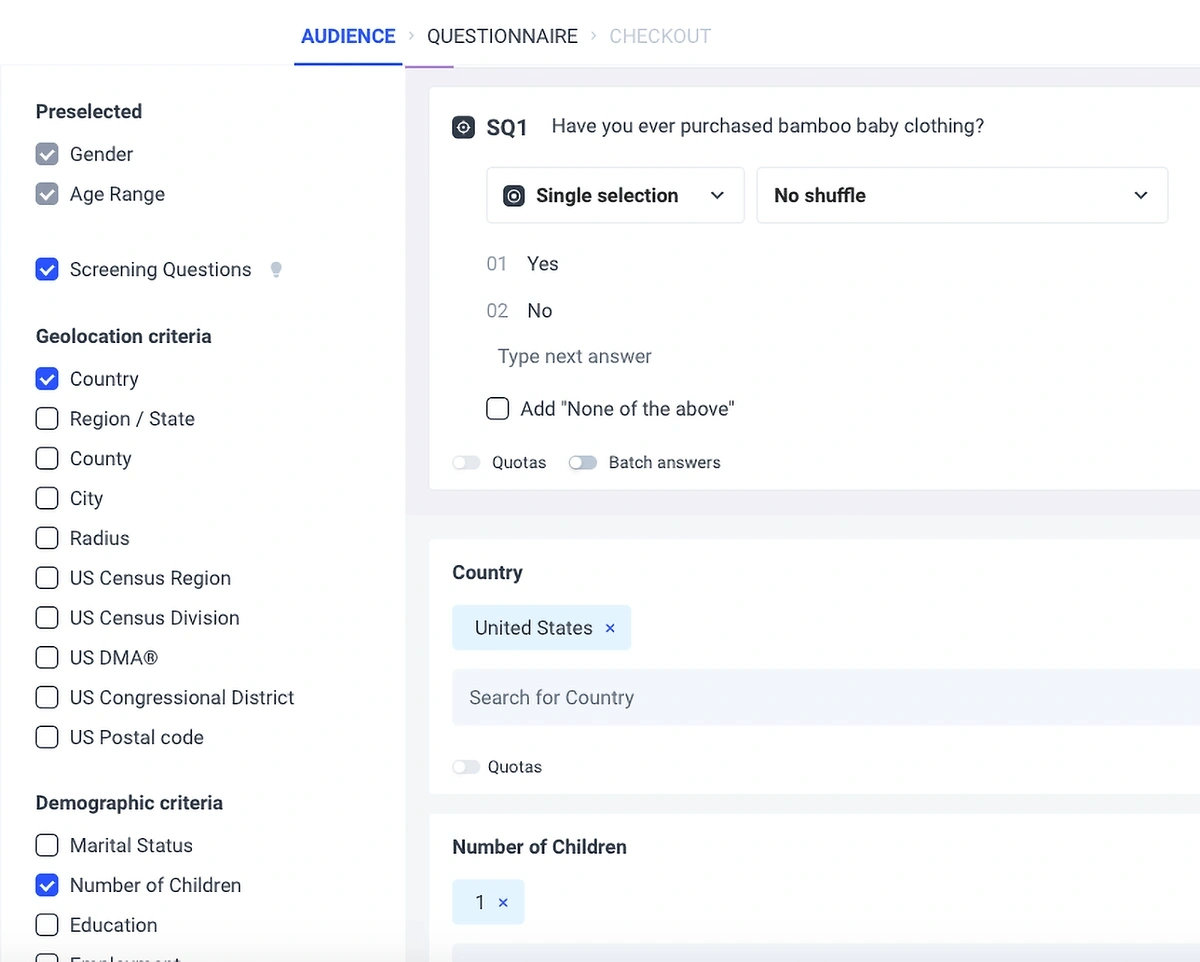

If you already have an audience, you can survey your existing email list to gauge their feelings about a particular trend.

However, if you don't have an audience in the market you're analyzing, there are plenty of survey tools like SurveyMonkey and Pollfish that allow you to run a survey to a specific audience.

For example, if you're analyzing the bamboo baby clothing market, you could use one of those survey tools to run a survey to an audience of parents with children under four years old. To get even more specific, you could add a screening question like "Have you ever bought bamboo baby clothing?"

Pricing is usually about $1 per response, making it relatively cost-effective.

Interviewing Customers

Perhaps the best way to assess market demand and learn what customers want is to talk to them one-on-one. Live conversations usually reveal golden insights often missed with other market research methods, as you can ask follow-up questions to get to the root of any pain point.

For example, if you're marketing bamboo baby clothing, you might discover on customer research calls that most users received it as a gift from friends or parents.

That insight means that you should probably adjust your marketing messaging from targeting just new parents to also targeting friends and grandparents who provide more detailed insights.

To conduct customer interviews, you can use a tool like Discuss.io, which records the customer research calls, creates auto-generated clips based on keywords (like "gifts"), and even provides sentiment analysis.

If you're doing B2B customer research, you can find people to interview through a service like Respondent.

Step 5: Create a Beta Offer Around That Trend

By now, you've thoroughly analyzed the market trend from a data perspective. Still, the only way to assess whether or not this trend is worth investing in is to see if customers will buy it.

So create a beta offer and see if people buy it.

Most companies make the mistake of developing a product or service before selling it, only to discover that it's not quite the solution their target demographic actually wants.

To prevent you from making this costly error, create a landing page advertising the offer and see if you can get people to pay real money for the product.

For example, Carry is a platform designed to help freelancers create solo 401ks. Before launching, they created a landing page to see if enough business owners would sign up for it:

The founder only started building the product after enough people joined.

Even if you're planning to launch an ecommerce product, you can still create a landing page and offer pre-orders before building the product.

If people purchase the product, you can create it and send it to that initial beta group.

If your target audience doesn't buy, you just saved yourself from spending thousands, if not millions, on a market trend that doesn't resonate with your audience.

Start The Market Trend Analysis Process Today

A key difference between unicorn companies and legacy companies overtaken by unicorns is their ability to accurately identify, analyze, and swiftly take action on the right market trends.

However, many companies fail to identify the right trends early enough.

So to help you solve this problem, we built Exploding Topics.

It executes the trend discovery process for you by analyzing billions of webpages and extracting the most promising trends. Then, a human analyst manually vets each topic for relevancy before adding it to the Trends Database.

By using the Trends Database, you can find relevant emerging trends in a matter of seconds rather than spending hours reading industry publications, scrolling X, and combing other data sources for potential trends. Which can really help with the trend analysis process.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Angela Skane is a freelance writer at Exploding Topics. Throughout her career, she has produced over 100 content marketing cam... Read more