Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Major Medtech Trends (2024-2028)

You may also like:

In this report, you'll find 7 trends shaping the future of the medical technology space.

According to Statista, the Medtech market is worth approximately $691.5 billion.

By 2028, the market is expected to reach $23.25 billion, growing at a CAGR of 3.6%.

From telemedicine to 3D bioprinting, let's dive into the list of medtech trends creating new opportunities in this dynamic industry.

1. Growing consumer adoption of telemedicine

COVID-19 caused massive changes in consumer behavior.

And the healthcare space is no exception.

Based on a survey by McKinsey, only 11% of US consumers were using telehealth services in 2019.

Today, thanks largely to COVID-19, that number has grown to 46%.

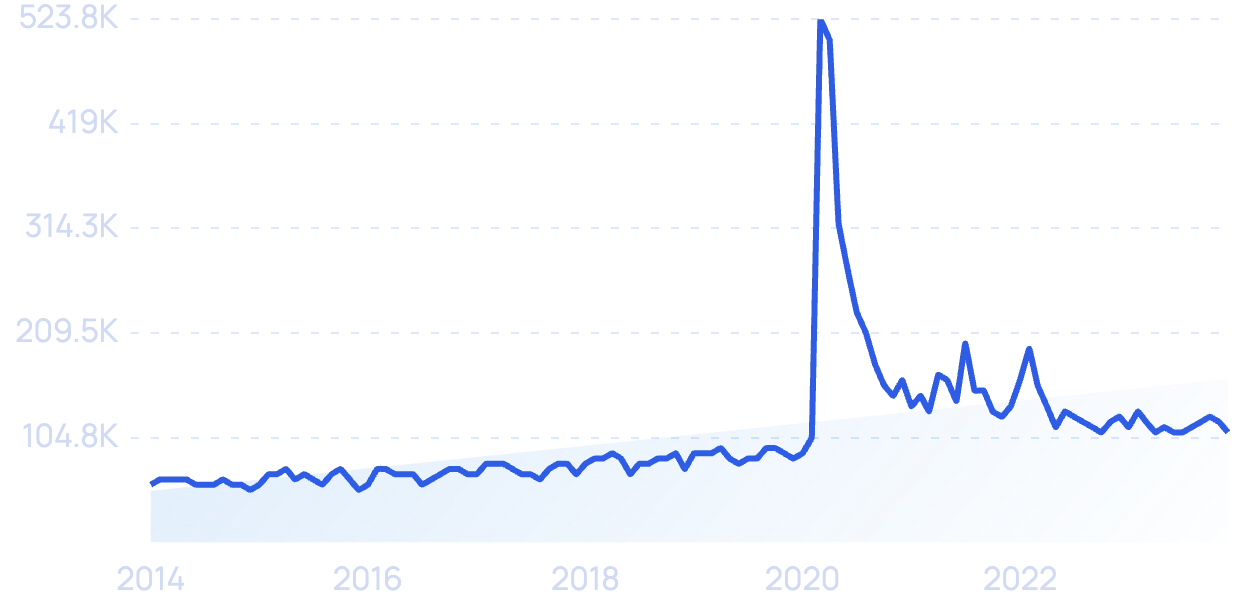

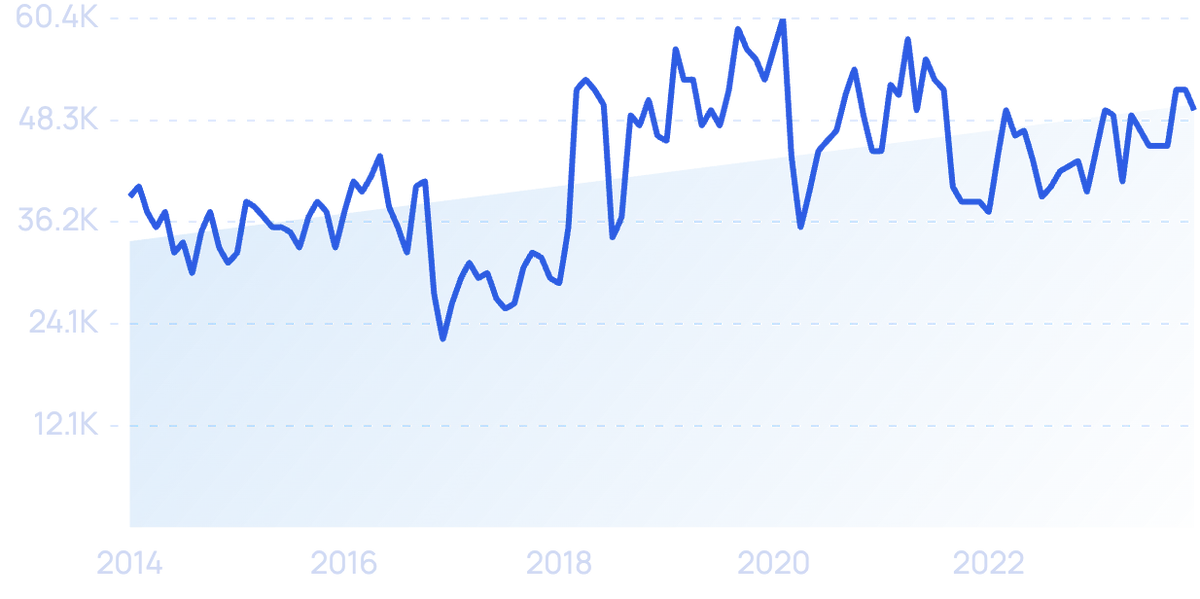

Searches for “telemedicine” spiked in the spring of 2020. But remains above pre-COVID levels (91% growth in 10 years).

And looks like telemedicine is a medtech trend that will continue even as things get back to normal.

In fact, 76% of US consumers report that they are interested in using telehealth in the future as a way to complement in-person visits to the doctor.

With a forecast CAGR of more than 23% from 2020-2026, VCs have been especially interested in the telehealth sector.

According to Mercom Capital, telemedicine startups received close to $1.8 billion in VC funding in 2019.

And in a single 9 month-period of 2020 alone VCs invested $3.2 billion in companies in the telemedicine space.

Companies like Teladoc in the telehealth category have experienced massive revenue growth.

Teladoc is one of many telehealth companies that saw massive growth in 2020 and 2021.

Teladoc reports revenue of nearly $300 million in Q3 2020. Which represents 109% growth compared with Q3 in the previous year.

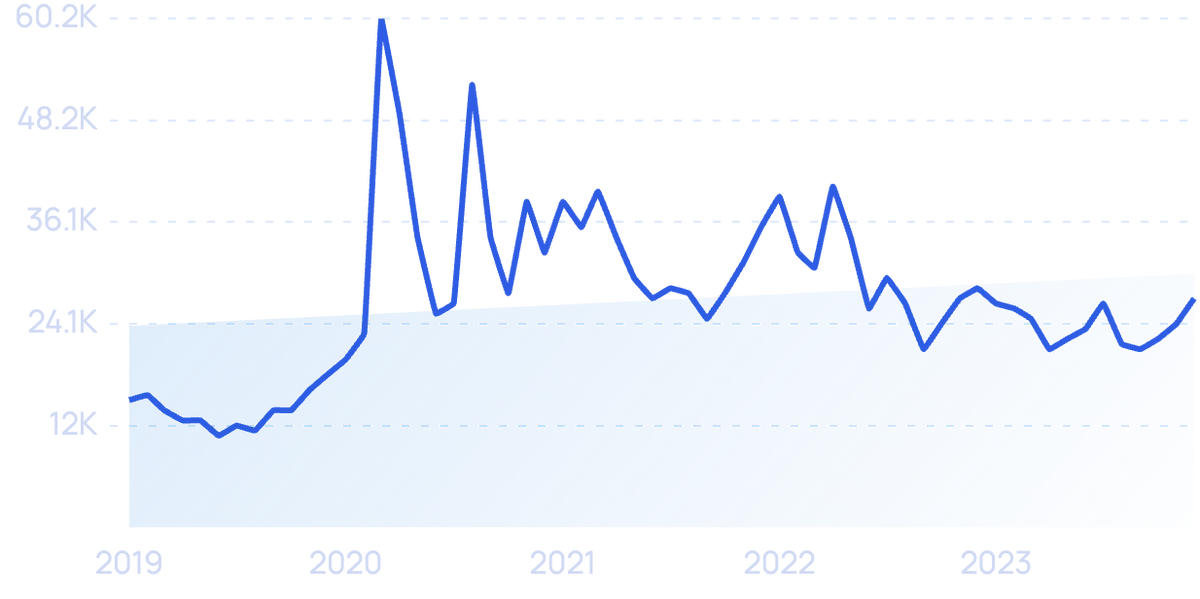

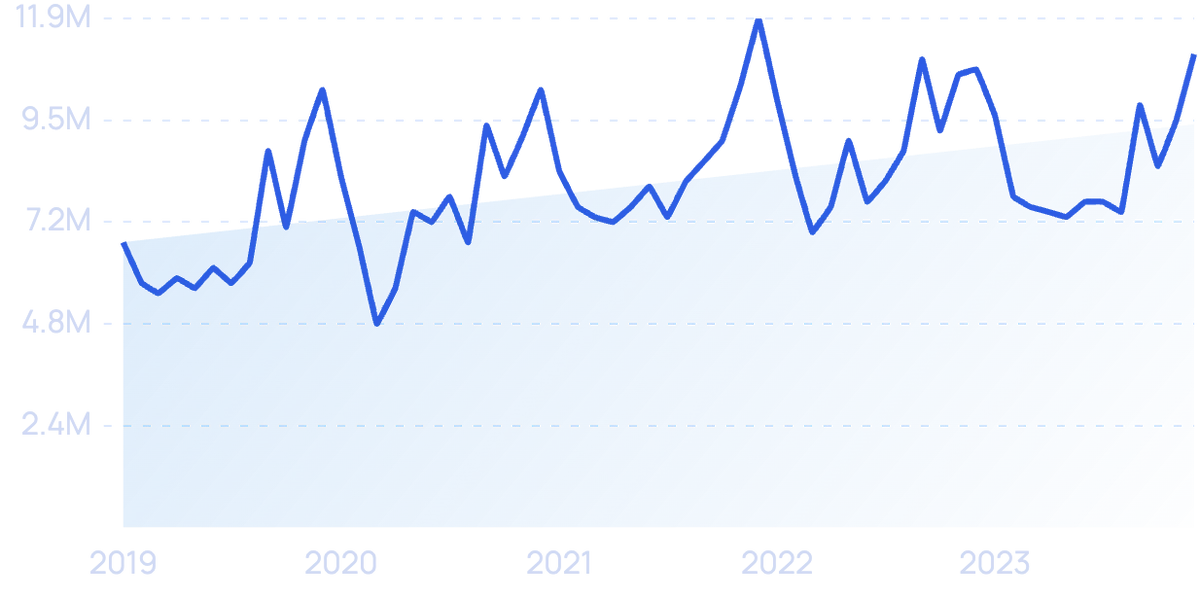

Searches for “Teladoc Health” have increased by 80% over the past 5 years.

2. Artificial intelligence augments healthcare processes

According to CB Insights research, healthcare AI funding reached $3.7 billion in Q3 2020 across 232 deals.

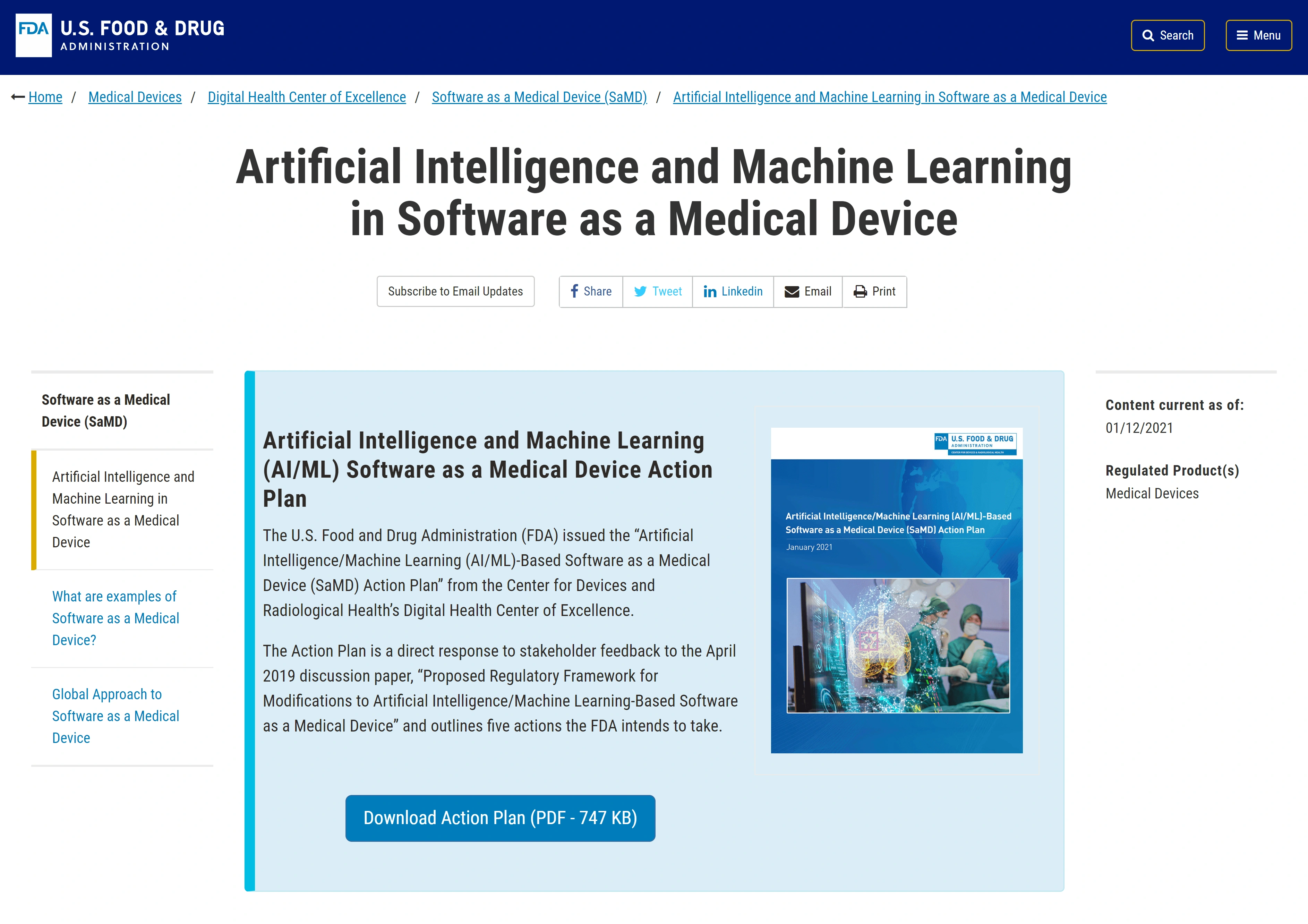

The FDA has largely embraced artificial intelligence.

Specifically, they currently have several ongoing projects designed to develop and update regulatory frameworks specific to AI.

The FDA are updating regulations to reflect advances in AI.

In early 2020, there had been 64 AI/ML-based, FDA-approved medical devices and algorithms.

By mid-2023, this figure had increased to over 500.

Based on Deloitte's European study with MedTech Europe, the economic impact of AI applications in healthcare can be quantified as €200 billion in annual savings (including opportunity costs) for the European healthcare system.

There are multiple types of AI applications in healthcare, including:

- Robotics

- Personalized apps

- Labs

- Monitoring

- Data analysis

- Virtual health assistance

- Wearables

However, medical diagnostics in particular may have the most potential for AI tech.

In fact, there are already commercial applications available today.

According to an IDTechEx report, image recognition AI technology in medical diagnostics will be worth more than $3 billion by 2030.

One of the companies utilizing artificial intelligence in medical diagnostics is Qlarity Imaging.

Its QuantX product helps radiologists reduce false diagnoses when diagnosing breast cancer.

QuantX has been featured in the ranking of best inventions by Time magazine.

3. Medical robots continue to gain traction

According to a Verified Market Research report, the worldwide market size of medical robots is expected to reach $35.05 billion by 2030.

Surgical robots are by far the leading category among robotics used in healthcare.

And demand for surgical robot technology has seen immense growth in the last few years.

Investments in robotic surgery companies have been one of the key drivers of VC funding increase in the medical devices category.

(That’s despite a significant decrease in the number of elective surgeries completed due to the pandemic.)

Moreover, many experts claim the use of robotic technology is especially useful during COVID-19 as it helps to decrease human-to-human physical contact.

Some of the notable surgical robotic developments include AquaBeam, which is an ultrasound-guided surgical robot developed by PROCEPT BioRobotics.

The AquaBeam surgical robot.

The company raised $77 million in venture funding.

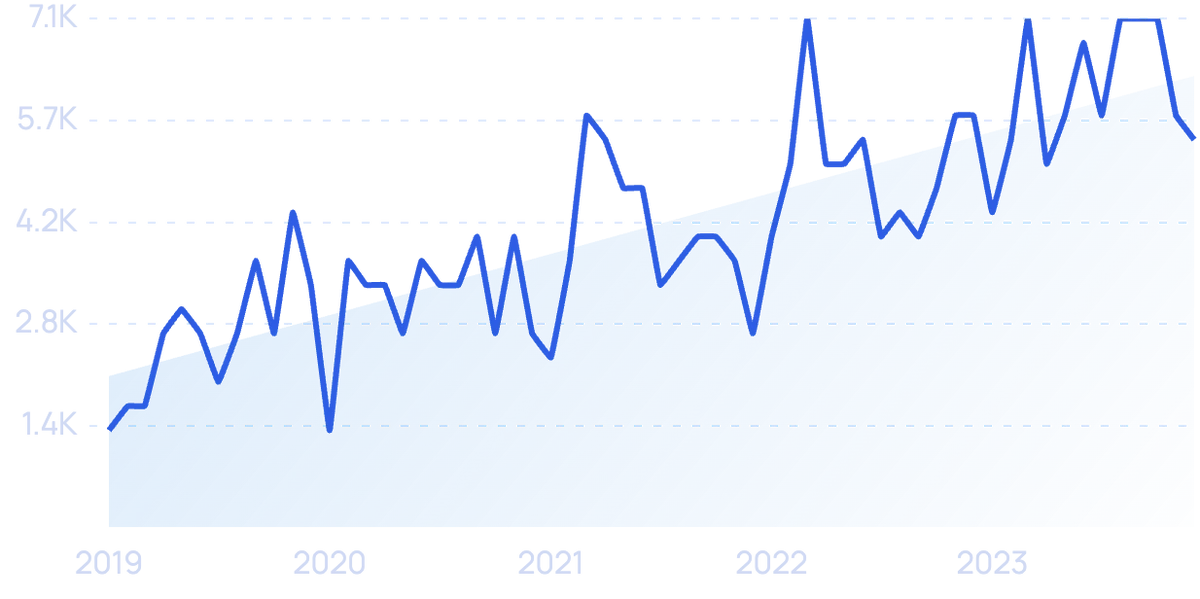

Searches for "robot-assisted surgery" have increased over the last 5 years.

4. Heightened interest in digital therapeutics

According to Digital Therapeutics Alliances, “digital therapeutics (DTx) deliver evidence-based therapeutic interventions to patients that are driven by high-quality software programs to prevent, manage, or treat a broad spectrum of physical, mental, and behavioral conditions".

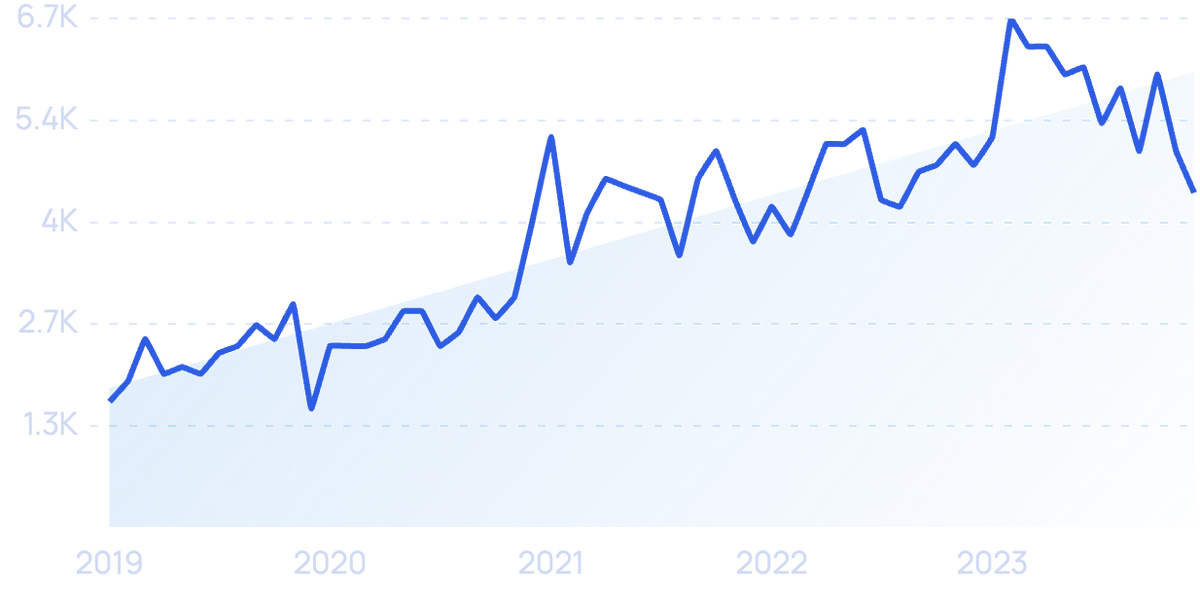

Search interest in "digital therapeutics" has grown by 167% over the past 5 years.

Thanks to new technical developments and increased consumer adoption of digital health products, DTx (as a part of the broader digital medicine category) has been featured in a recent edition of Scientific American's top 10 emerging technologies.

Global VC DTx funding has grown by 4x since 2017 to approximately $1.2 billion in 2022.

In total, the DTx space has a forecast CAGR of 31.6% during 2021-2026 and a market size of close to $17.7 billion in 2027.

In a survey of medtech leaders by Deloitte, 63% of respondents agreed that digital therapeutics will have a major impact on the industry over the next 10 years.

One of the notable players in this sector is Boston-based startup Pear Therapeutics.

Pear Therapeutics has raised a total disclosed funding amount of $409 million.

Its current product portfolio offers applications focused on treating chronic insomnia and helping with substance abuse.

5. More virtual reality healthcare applications

Virtual reality (VR) technology can benefit the healthcare industry in a number of ways, including:

- Medical training

- Patient treatment

- Medical marketing

- Disease awareness

According to a Verified Market Research report, the VR healthcare market was valued at $2.14 billion in 2019.

And is forecast to reach $33.72 billion by 2027.

VR startups in the healthcare category have attracted attention from major players.

As was the case with the acquisition of British startup Digital Surgery by medtech giant Medtronic back in February 2020.

Oxford VR is another example of a growing VR startup.

The company is focused on mental health applications for VR. And they have raised $17.7 million.

6. Use of biometric devices and wearables is growing

Products like the Apple Watch, which is still growing, helped create initial awareness of ongoing health tracking.

And largely led to the mass adoption of wearable technology.

Searches for “Apple Watch” are still on the rise (66% in 10 years).

Today, a growing number of medtech companies are creating a slew of devices to track metrics ranging from physical activity to women’s health.

All of which form the Internet of Medical Things (IoMT).

Search growth of "IoMT" has grown 300% over a 5-year span.

According to a Jabil Digital Health Survey Report, 52% of digital healthcare decision-makers are developing or plan to develop wearable devices.

Interest in launching wearable products should come as no surprise.

The wearable tech industry is projected to see a CAGR of over 25% from 2020-2027 (based on Research and Markets report findings).

The same report estimates the wearable market will reach upwards of $60.4 billion by 2027.

One of the innovators in biometric wearables include Oura.

Oura is a fast-growing medtech startup focused on the consumer market.

Oura's flagship product is a wearable health tracking product in the form of a small ring that tracks sleep and activity levels.

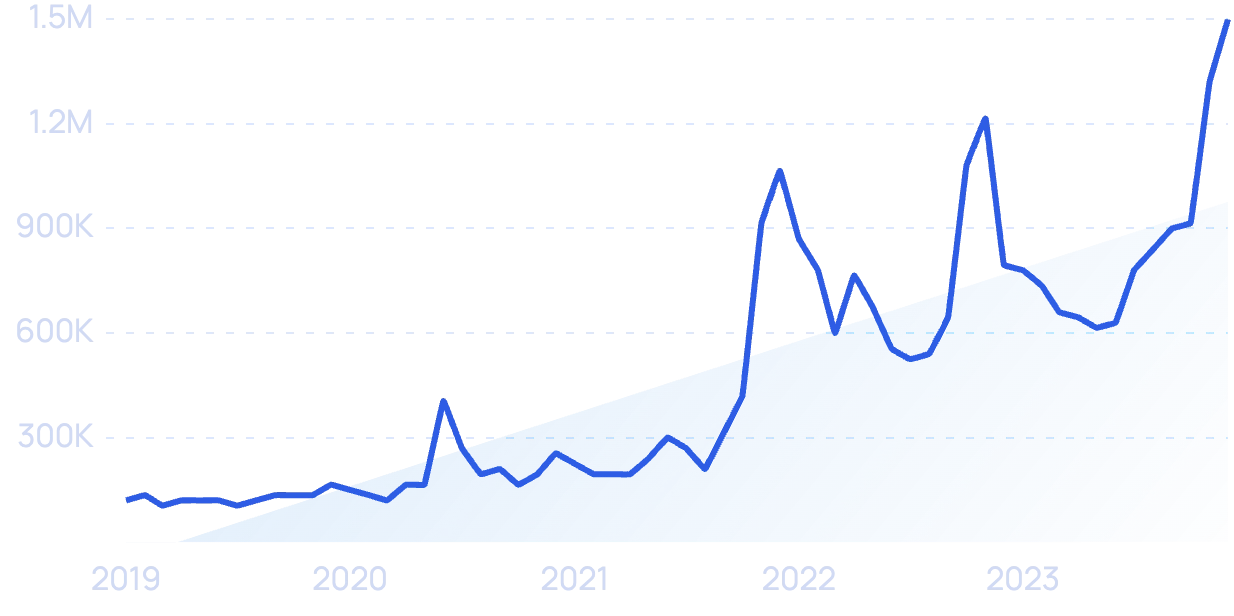

Search interest in the "Oura ring" has grown by over 1,150% over the last 5 years.

Oura raised $28 million during Series B.

Which marked it as the largest VC deal for a biometric wearable in Q1 2020.

7. Additive manufacturing and 3D bioprinting gain steam

Additive manufacturing (commonly referred to as “3D printing”) of medical devices was valued at $1.1 billion in 2019 and is estimated to reach close to $4 billion by 2027.

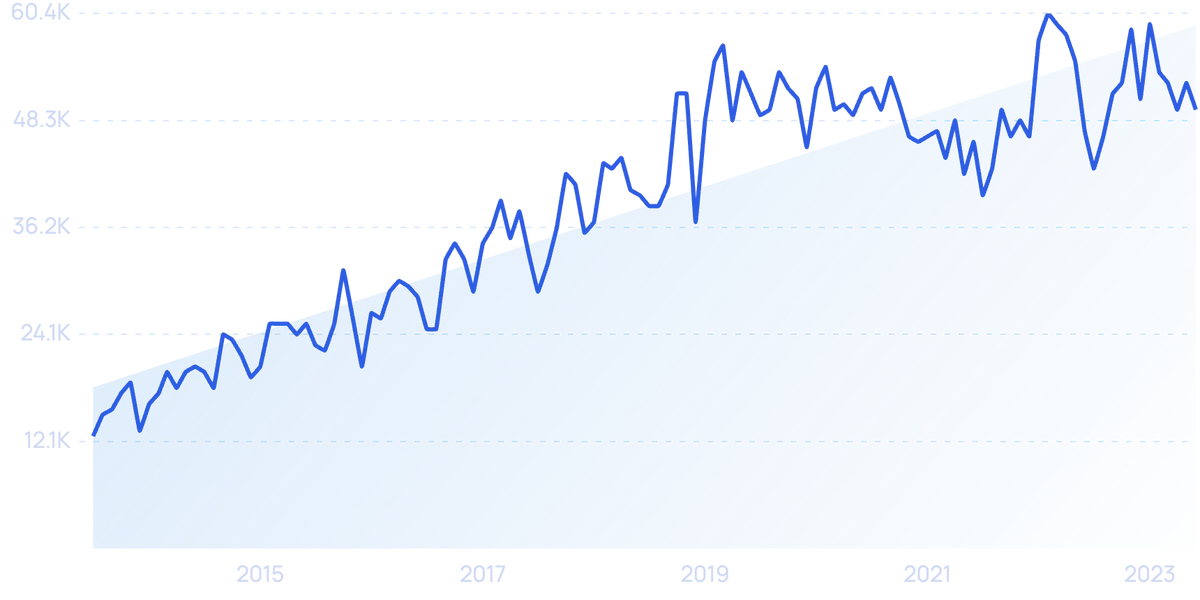

Search volume for “additive manufacturing” has shown consistent positive growth (207%) over the last 10 years.

This growth is largely driven by technological advances in the area of 3D printing.

There are multiple use cases of 3D printing in the medical field (including manufacturing of surgical instruments, prosthetics, implants, and tissue engineering products).

However, 3D printing is commonly used for rapid prototyping.

In fact, nearly all of the 50 leading medical device companies currently use 3D printing technology to quickly create prototypes.

Amid the COVID-19 pandemic, 3D printing saw a wave of increased demand in the healthcare space.

Mostly due to supply chain disruptions and the need to produce greater numbers of PPE, testing, and medical devices to combat COVID-19.

Another concept that is gaining growth in market size is 3D bioprinting.

3D bioprinting is similar to regular 3D printing, but it’s specifically designed to print biological materials.

One of the pioneers in this field is Vancouver-based startup Aspect Biosystems.

Aspect Biosystems focuses on 3D bioprinting of human tissues.

The medtech startup raised $24 million of disclosed funding in 2020.

Conclusion

We hope you learned something new from this list of 7 medical technology trends for 2024-2028.

The pandemic boosted consumer adoption of many innovative technologies and highlighted the importance of adaptability in the medical space. So we can expect to see even more medtech innovation in 2024 and beyond.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more