Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top NFT Trends and Statistics in 2025

NFTs first came into the public consciousness in 2021. But performance has been inconsistent since then, and there are signs the marketing is cooling.

In Exploding Topics Pro, we noticed that NFC trends are generally declining in 2025, and popularity for many trends has peaked.

- 2022: The NFT market hit record highs, then dropped dramatically. It landed with an annual revenue near $2.5 billion.

- 2023: NFT trading volume hit $946 million in January 2023, the highest volume since June 2022 and a large increase over the final three months of 2022.

- 2024: Nike's RTFKT released its final collection ahead of a shutdown of the NFT platform.

- 2025: The NFT market got off to a disappointing start when it went down 24% from $901 million compared to December 2024.

What lies ahead in the NFT space? Take a look at our list of the biggest trends in the NFT space and see what’s changed so far.

NFT Marketplaces

There are more than 100 active NFT marketplaces in 2025. The most popular is OpenSea, which saw 7.8 million visits in September 2025.

| Domain | Visits (September 2025) |

| opensea.io | 7.8M |

| magiceden.io | 2.3M |

| immutable.com | 2.2M |

| axieinfinity.com | 876.4K |

| zora.co | 539K |

| rarible.com | 489.4K |

| tensor.trade | 358.3K |

| objkt.com | 233.1K |

| foundation.app | 180.7K |

| blur.io | 163.4K |

| niftygateway.com | 159.5K |

| element.market | 104.1K |

| superrare.com | 49K |

| solanart.io | 11K |

| looksrare.org | 10.4K |

In the Semrush AI SEO toolkit, our AI visibility research suggests that OpenSea is less commonly mentioned and cited than crypto.com, a more general crypto trading platform with 12.1M monthly visits.

The AI visibility data for the UK also shows that Binance is recommended as an NFT trading platform by ChatGPT. For context, learn how we measure AI visibility.

NFT Statistics

Statistics illustrate continued growth in NFTs, despite ups and downs in the market over the past 4 years.

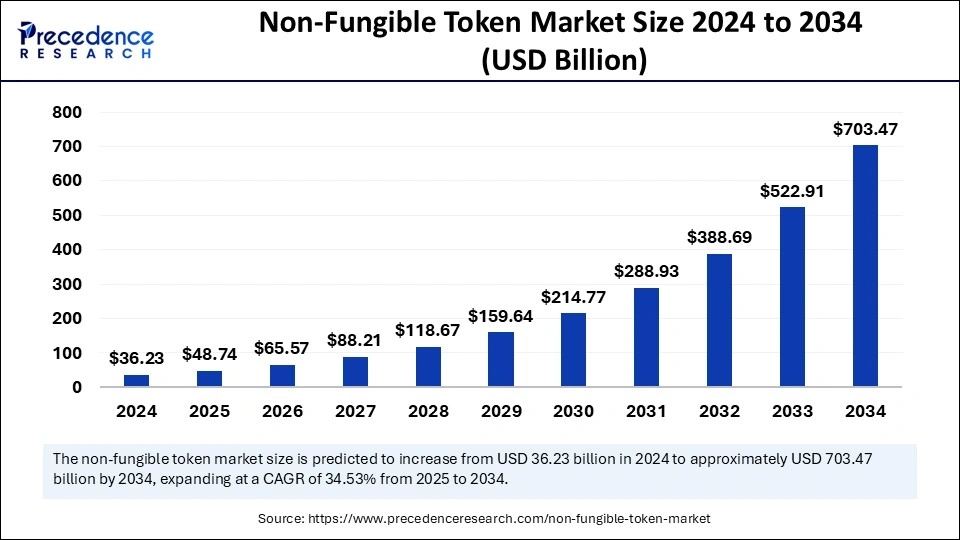

NFT Market Size

The global NFT market is expected to be valued at $49 billion by the end of 2025.

It was valued at approximately $11.3 billion in 2022. This grew to $36 billion in 2024, and it is forecast to grow to a valuation of $703.47 billion by 2034.

Gaming NFTs represent 38% of transactions in 2025.

For gaming NFTs specifically, the market was worth $4.8 billion in 2024.

In 2025, 41% of global NFT transactions take place in the United States.

This is a slight drop from our 2022 research, when we found Americans represented more than half of all NFT transactions.

15% of US males collect NFTs compared to just 4% of US females.

Respondents in a survey said they collected for investment and as a hobby.

Sources: Precedence Research, GM Insights, Statista

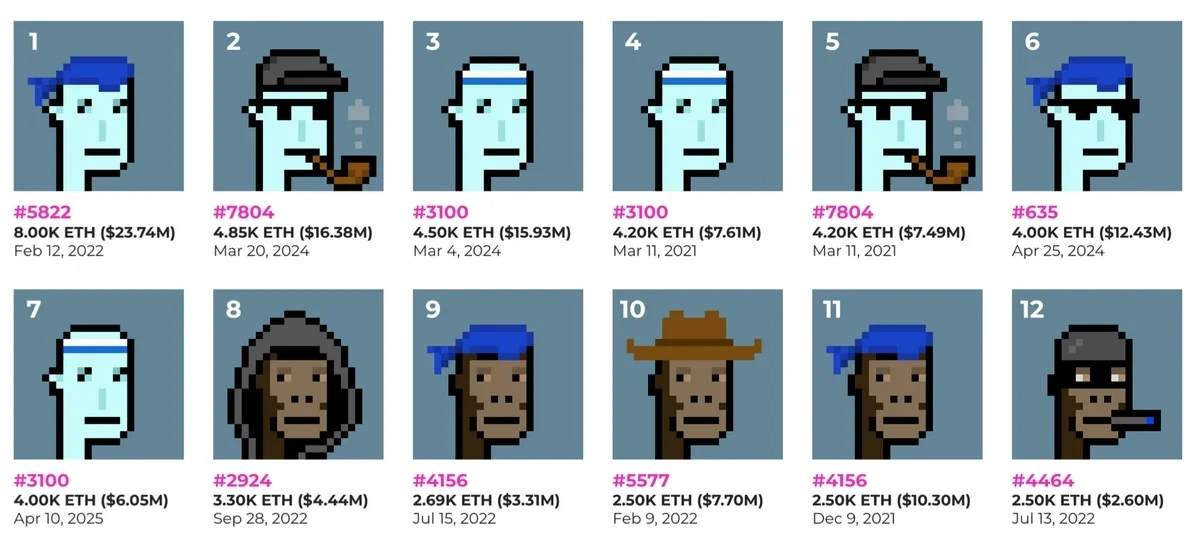

Most Expensive NFTs Ever Sold

The most expensive NFT ever sold is "The Merge" by Pak, a person or group responsible for a number of AI art projects. "The Merge" sold for $91.8 million in December 2021.

"The Merge" was not sold as a single item. It was split among 28,893 individual collectors.

| Artist | NFT | Sold For | Year |

| Pak | The Merge | $91,800,000 | 2021 |

| Beeple | Everydays: The First 5000 Days | $69,000,000 | 2021 |

| Pak & Julian Assange | Clock | $52,700,000 | 2022 |

| Beeple | Human One | $29,000,000 | 2021 |

| Larva Labs | CryptoPunk #5822 | $23,000,000 | 2022 |

| Larva Labs | CryptoPunk #7523 | $11,750,000 | 2021 |

| TPunks | TPunk #3442 | $10,500,000 | 2021 |

| Larva Labs | CryptoPunk #4156 | $10,260,000 | 2021 |

| Larva Labs | CryptoPunk #5577 | $7,700,000 | 2022 |

| Larva Labs | CryptoPunk #3100 | $7,670,000 | 2021 |

| Larva Labs | CryptoPunk #7804 | $7,570,000 | 2021 |

| XCOPY | Right Click and Save As Guy | $7,000,000 | 2018 |

| Dmitri Cherniak | Ringers #109 | $6,930,000 | 2024 |

| Larva Labs | CryptoPunk #8857 | $6,630,000 | 2021 |

| Beeple | Crossroad | $6,600,000 | 2021 |

Half of the top 10 most expensive NFTs were created by CryptoPunks. The collective has an all-time sales volume of $3.8 billion as of October 2025.

Source: NFT Evening, Larva Labs

Recent NFT Trends

In 2025, NFTs have shifted from being associated with brand collectibles to having real-world utility. The increase in AI image generators is also driving new interest in digital art.

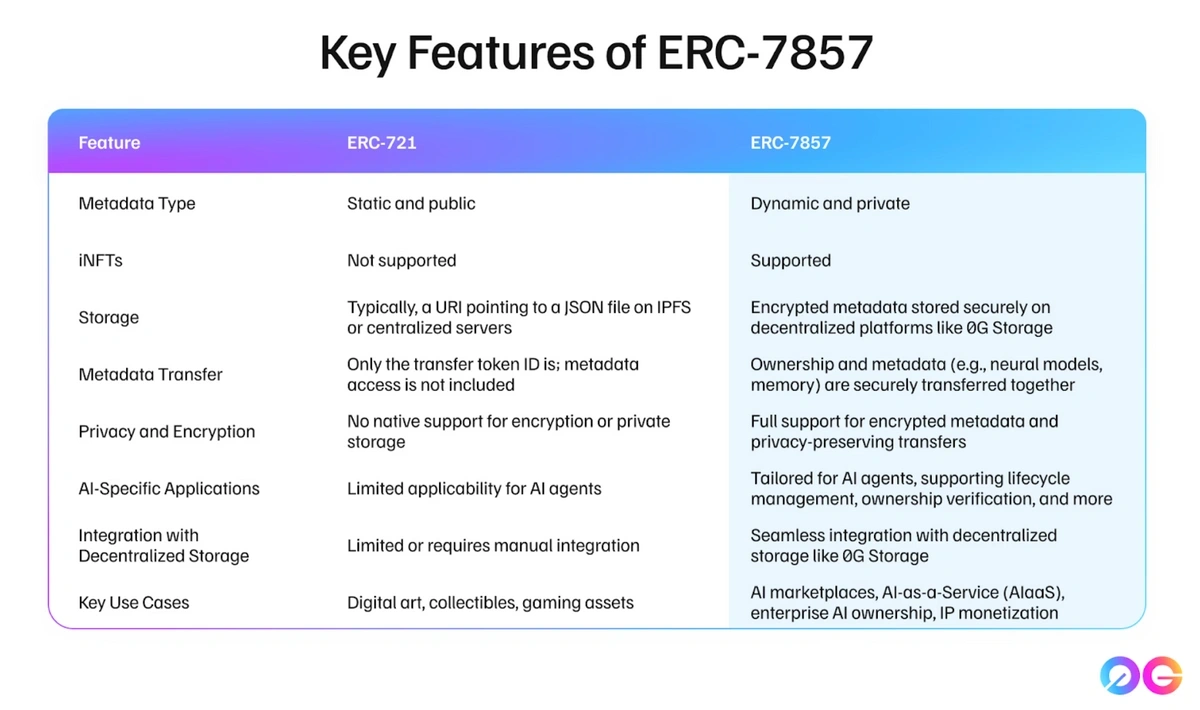

1. AI NFTs (iNFTs) Could Combine NFT with Agents

In January 2025, the 0G Lab announced a new ERC-7857 standard for intelligent NFTs (iNFTs).

iNFTs are a form of NFT AI agents.

If widely adopted, ERC-7857 could significantly impact AI ownership and decentralized technology.

ERC-7857 allows for secure transfer of AI agents, re-encrypting sensitive data for the new owner (0G Labs).

This means we might see new AI marketplaces emerge that give creators more control over earnings.

2. AI Can Generate NFTs

AI is being used to generate images that can be sold as NFTs.

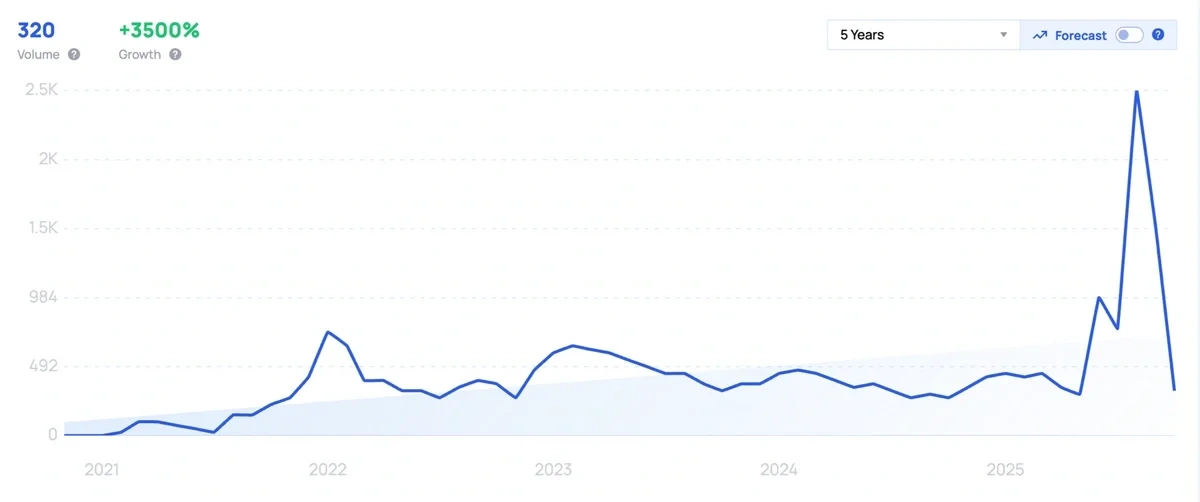

When researching NFT trends in Exploding Topics Pro, we noticed that searches for "AI NFT" spiked in August 2025.

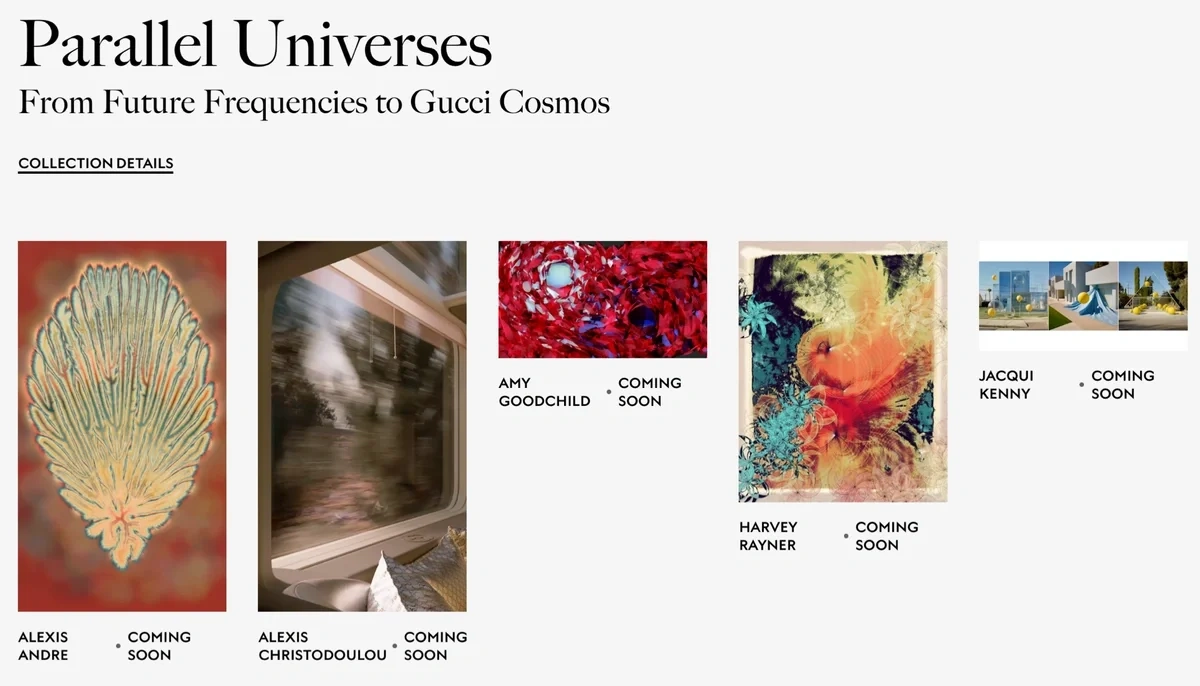

There's related growth in artists who use AI. One example is Claire Silver, who produced a collection of AI art for Gucci with Emi Kusano.

Silver also sells AI-generated art as NFTs on OpenSea.

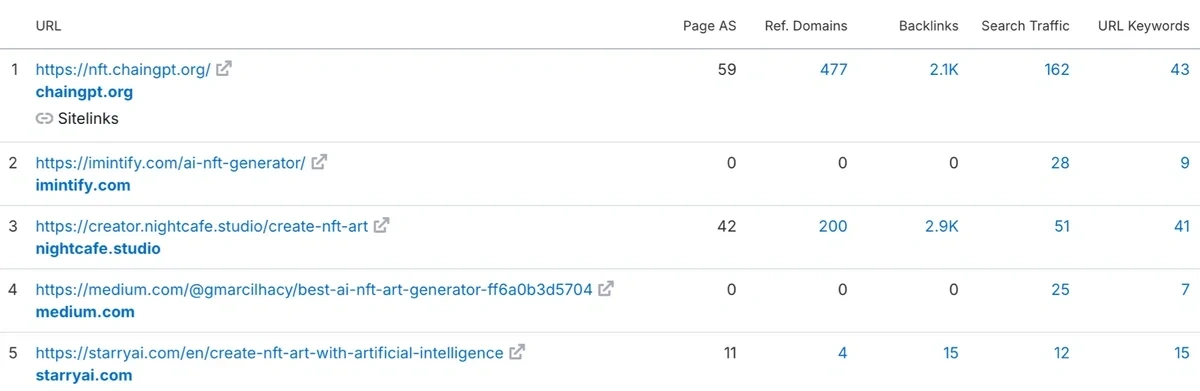

Additionally, more and more AI NFT generator websites have started surfacing on the web.

Data from Semrush for the keyword 'ai nft generator' displays mixed results with both strong and weak domains ranking.

3. NFTs See Growth Among Gamers

Gaming is a major growth area for NFTs.

Gaming market size for NFTs is expected to reach $44.1 billion by 2034.

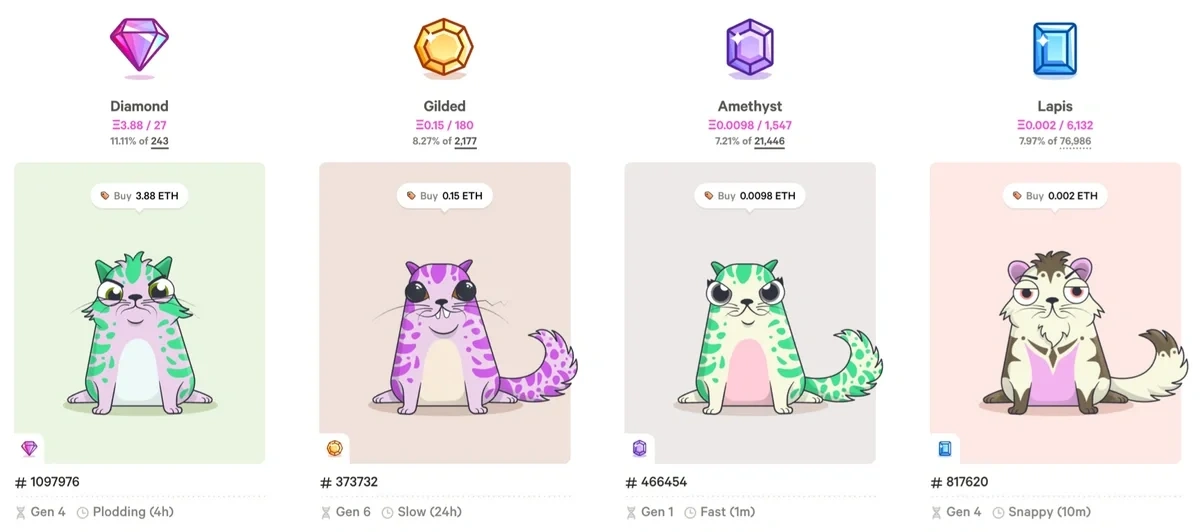

One of the first and most famous examples is CryptoKitties, a blockchain-based game where players collect, buy, and sell cat NFTs.

NFTs are also used for digital trading cards, virtual land ownership, skins, and in-game weapons.

3. Brands Are Moving to Phygital Experiences

While many brands entered the NFT market to produce collectibles in 2021-2023, the landscape has shifted towards luxury brands.

In 2025, Gucci continued to auction NFTs through its Art Space project.

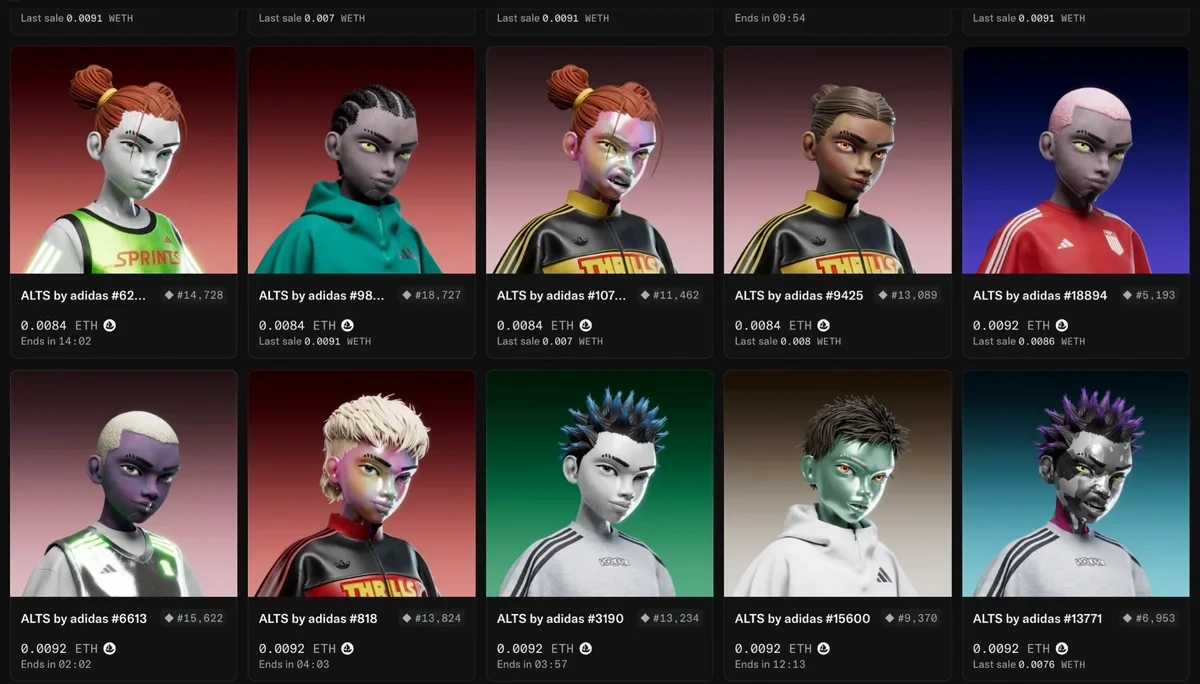

Also in 2025, Adidas launched its own ALTS by Adidas collection of digital avatars.

There are 20,066 NFTs in the Alts by Adidas collection, with a market cap of approximately $745,000. Buyers can purchase an avatar to unlock physical merchandise and exclusive event invitations.

But in 2025, many of the brands that pioneered NFTs are no longer prioritizing web3 technology.

One example is Nike, who acquired RTFKT and released its own virtual sneakers. The items were released in the CryptoKicks and CloneX collections.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

There was a brief outage in April 2025 that left 30,000 Nike NFT images inaccessible.

Nike has now closed RTFKT. It also closed its Nikeland game on Roblox in 2024.

Nike's move follows the closure of the NFT platform Rally in 2023 that left some NFT collectors without access to the items they had paid for. And Starbucks also closed down its NFT project, Odyssey.

What's Next for NFTs in 2026?

For NFTs, the market may be down overall, but new use cases for NFTs may push valuations back up.

That’s certainly true for the real estate industry and others who are looking to capitalize on NFTs for luxury brand marketing. Even though many brands have discontinued their NFT platforms, the projected growth for NFTs suggests that a second wave of interest may be on its way.

As NFTs continue to evolve, Exploding Topics Pro provides unique insights and forecasts into the future of NFT market trends.

Try Exploding Topics free for 7 days to research the changing market yourself.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more