Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

12 Top Podcasting Industry Trends In 2024

You may also like:

Here are 12 podcasting trends that are shaping the industry this year and beyond.

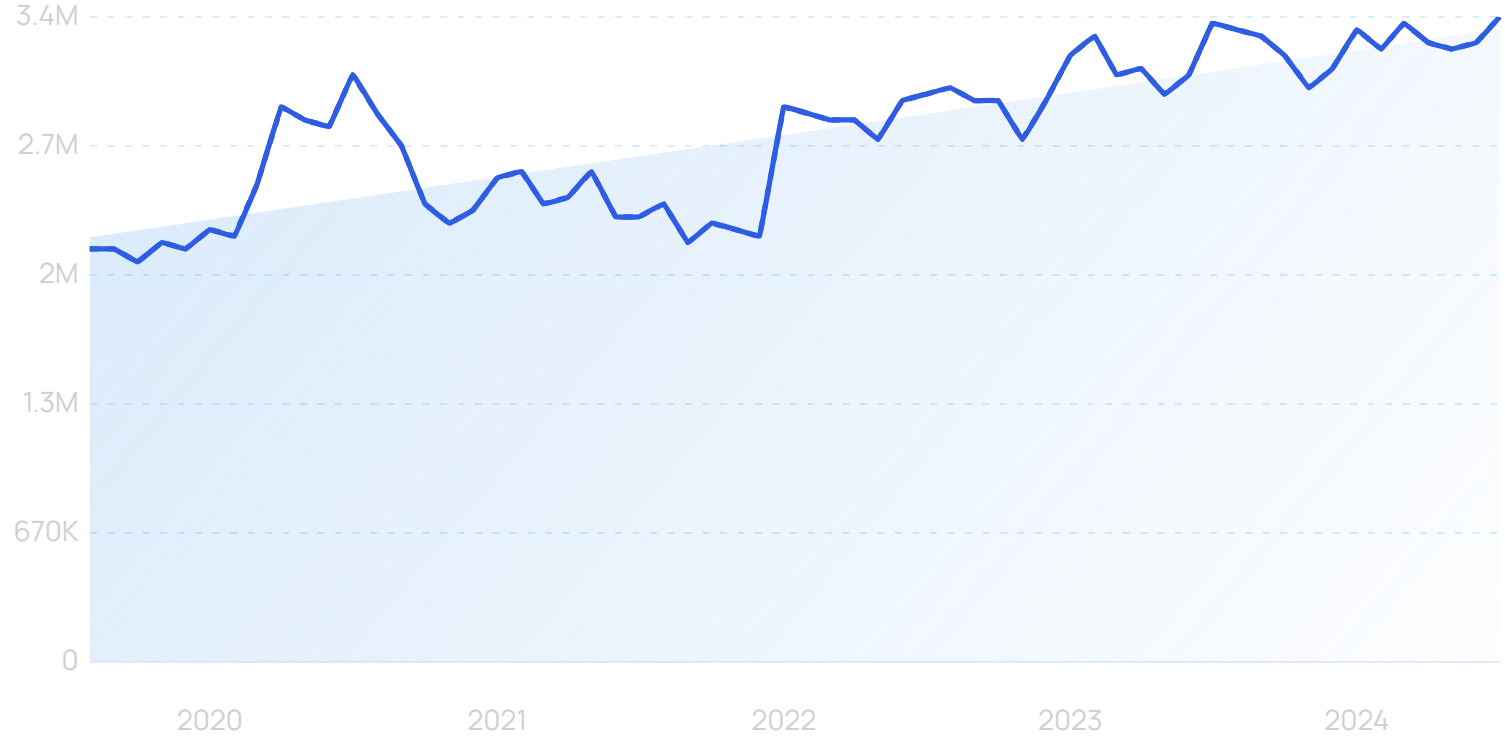

According to the latest count, there are now over 200 million podcast episodes. And at least 3.2 million active shows by the most conservative estimate.

Nearly 7 in 10 Americans aged 12 and over have listened to a podcast before. And almost half (47%) are monthly listeners.

But the podcast industry is still growing...and changing.

Read on to see the major changes on the horizon.

1. Podcasts Embrace Video

In Q1 2024, there was a 39% YoY increase in average daily streams of video podcasts on Spotify globally.

TikTok now has over 1.5 billion monthly active users. And podcasters are increasingly sharing clips on there.

In Q4 2023, the New York Times found that more than half of the 30 most popular podcasts in the US were available in video format. Two years previously, that figure stood at 7.

Joe Rogan was one of the pioneers of video-format podcasting.

This trend has also seen podcasters turn to specialist equipment like podcast cameras.

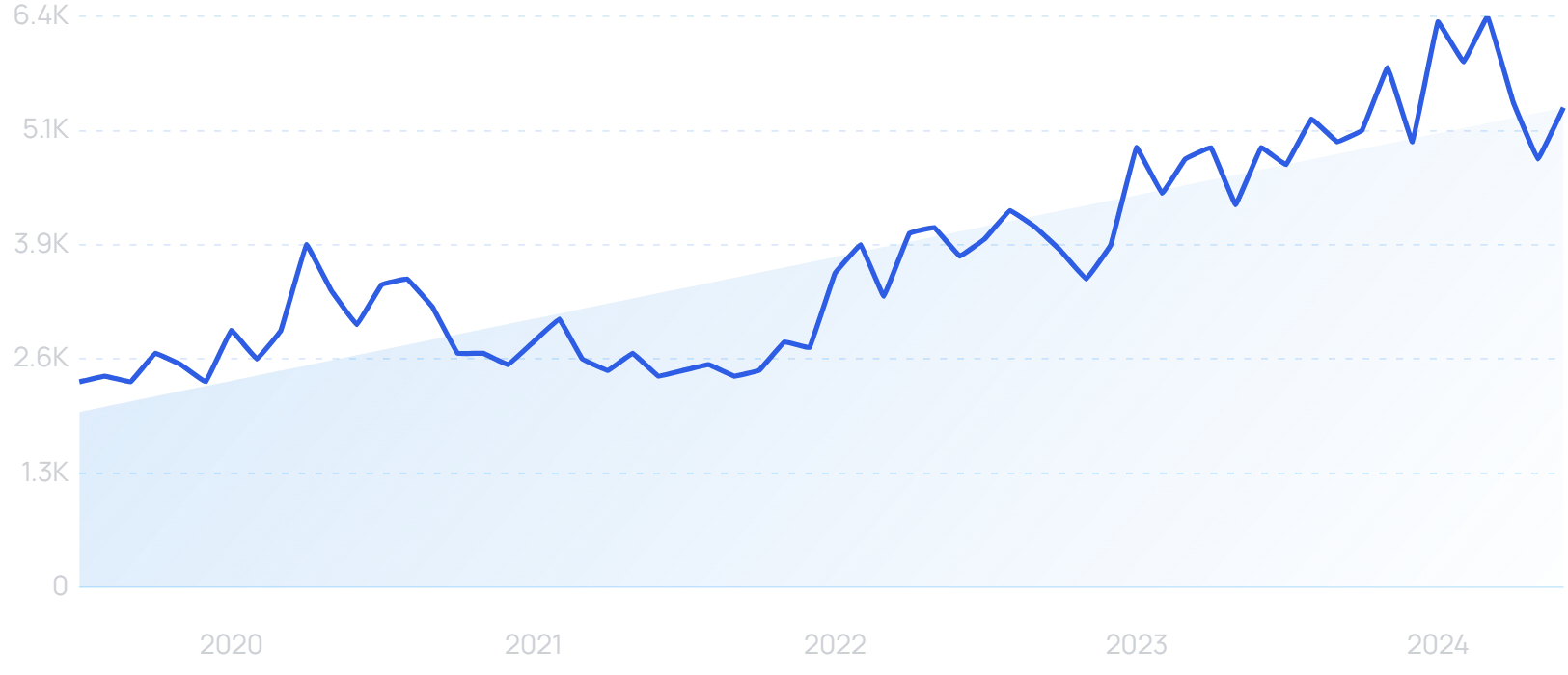

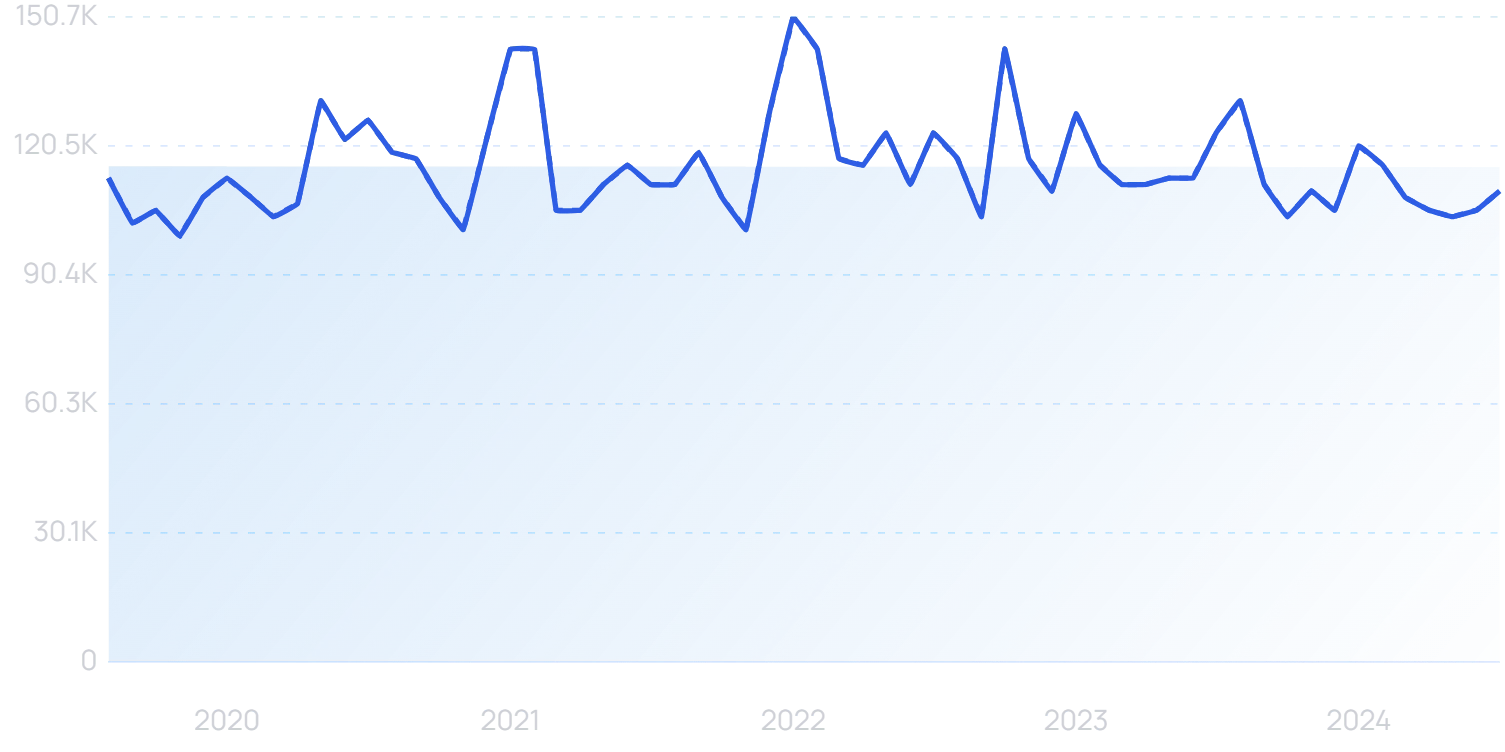

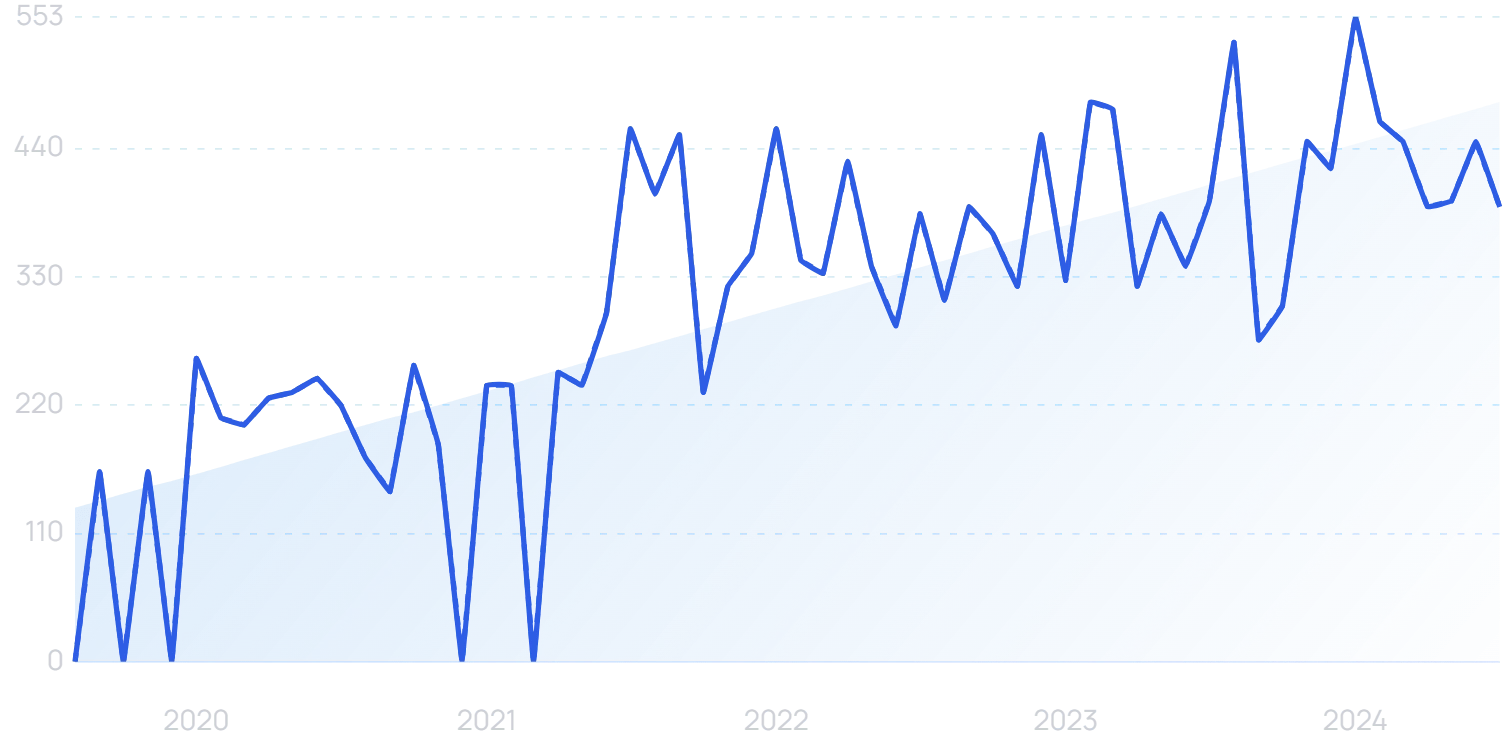

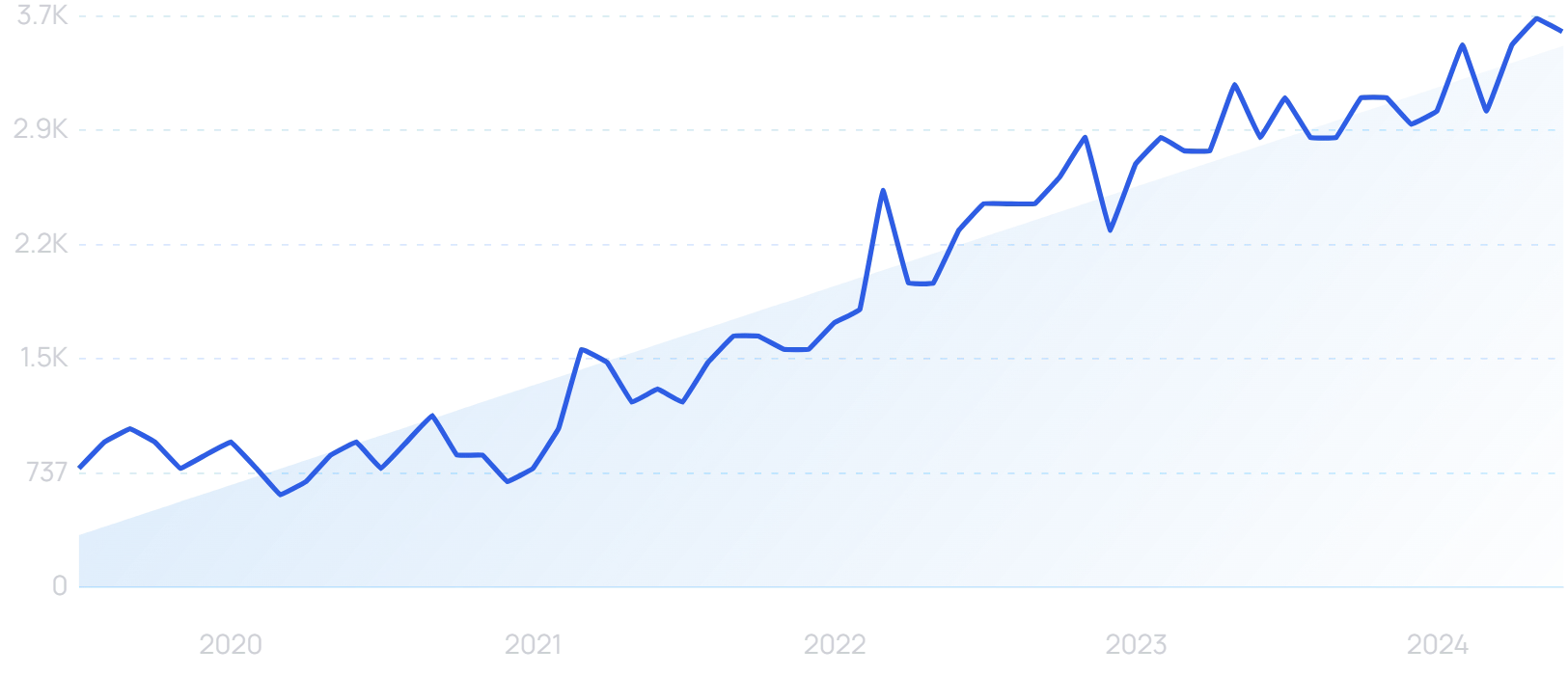

Searches for “podcast camera” are up 117% in 5 years.

OBSBOT specializes exclusively in webcams. It applies AI technology to improve its videography, and boasts users in more than 120 countries.

“OBSBOT” searches have grown by 1217% in 5 years.

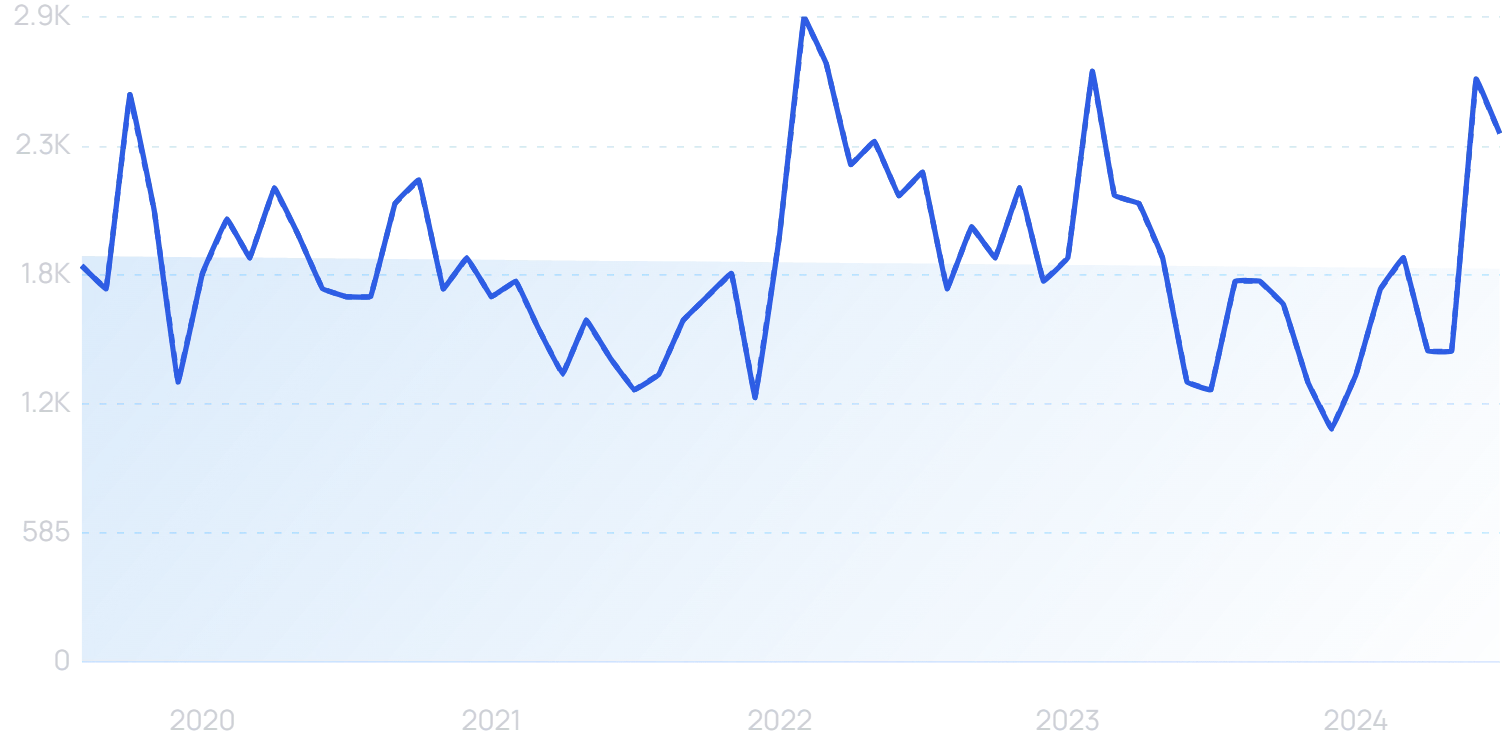

2. Podcast Advertising Picks Up Steam

Podcast ad revenue is expected to grow by 12% in 2024. It’s projected to surpass $2 billion.

And further growth is forecast, with a 10% increase in 2025 and an 8% rise in 2026.

A survey by Edison Research found that among weekly listeners in the US, 46% have purchased a product or service after hearing an ad on a podcast.

Helpfully for advertisers, podcast listeners tend to be more affluent than the average American. 56% have an annual household income of more than $75,000, compared to the 48% national average.

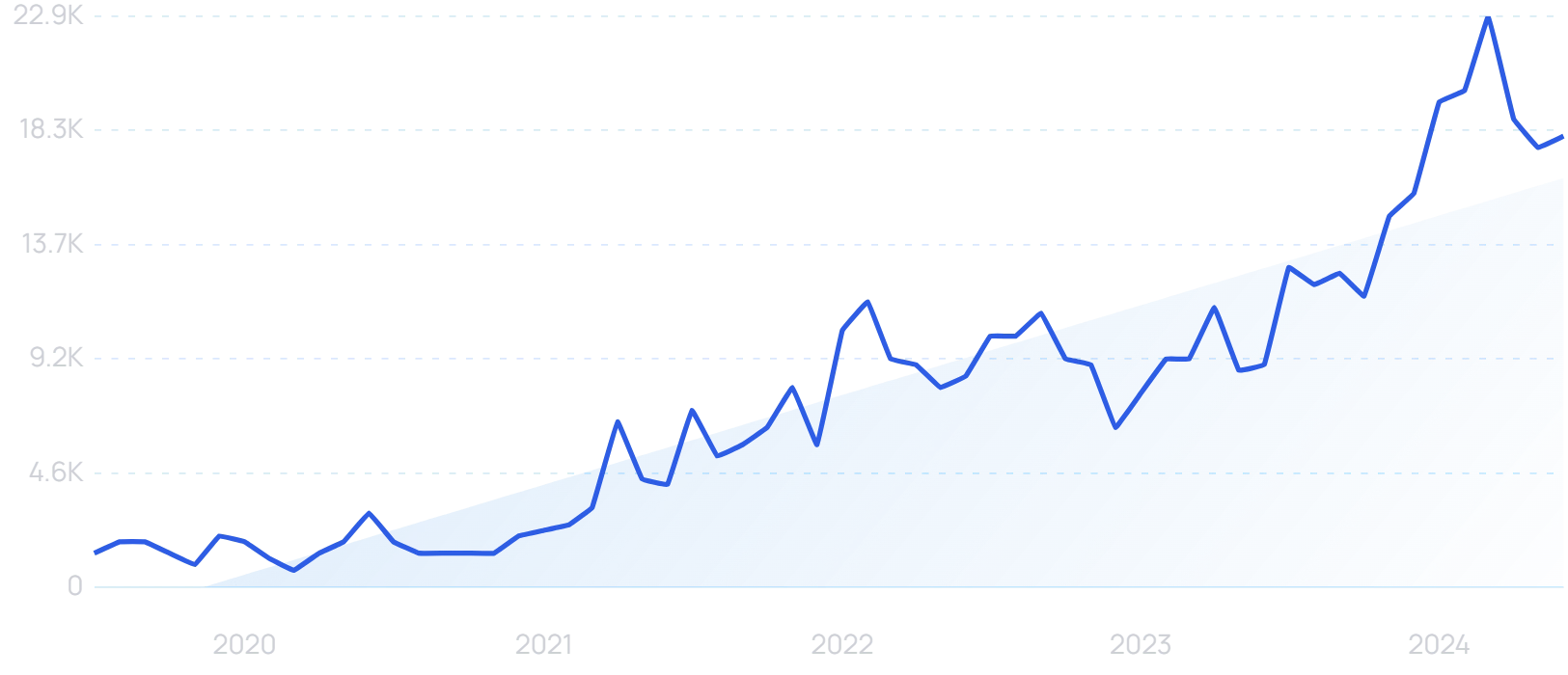

Searches for "podcast advertising" have climbed 3400% in 10 years.

While only 3% of listeners say they listen to “all of the ads” on a podcast, that’s the highest percentage of all media channels. And less than half (46%) “always or often” skip podcast ads.

Almost three in four podcast listeners expect to hear 2-3 ads in a typical episode. So there’s an acceptance that advertising is a part of the medium.

3. Increased Competition Between Podcast Apps

As of June 2024, 34.4% of listeners use Spotify to consume their podcasts, making it the most popular platform.

But it’s closely followed by Apple Podcasts (32.5%), and nine separate platforms achieve over 1 million monthly podcast downloads.

According to a 2024 OFCOM study from the UK, the average podcast listener uses three different platforms.

Services like Pocket Casts, Google Podcasts, Castbox and Overcast are all fighting for a piece of the industry.

But Spotify takes the competition seriously, and has invested heavily - pouring over $1 billion into podcasts.

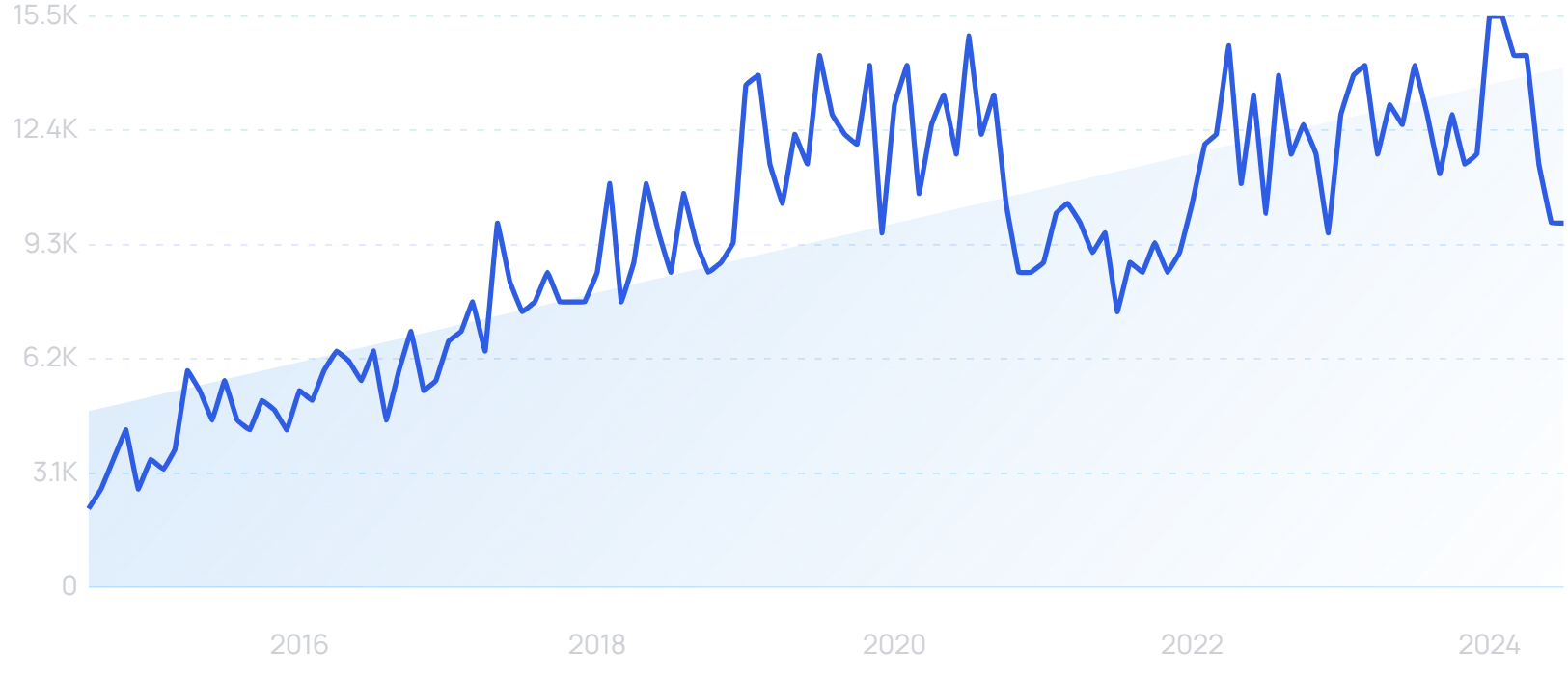

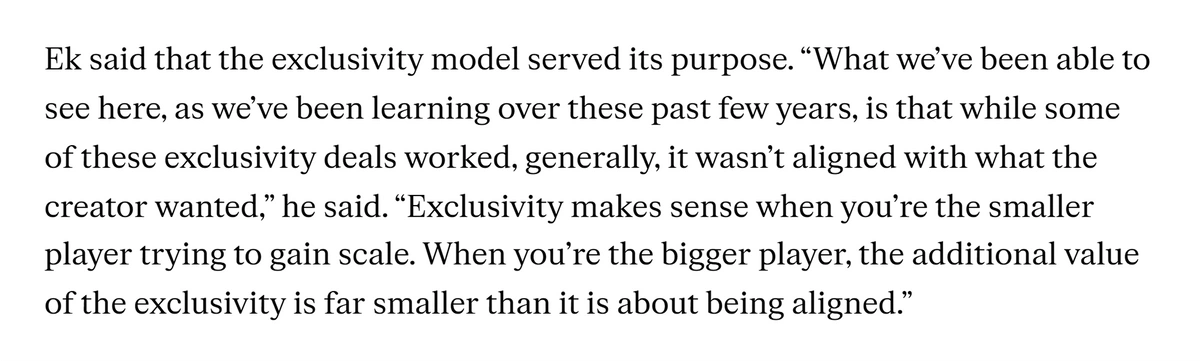

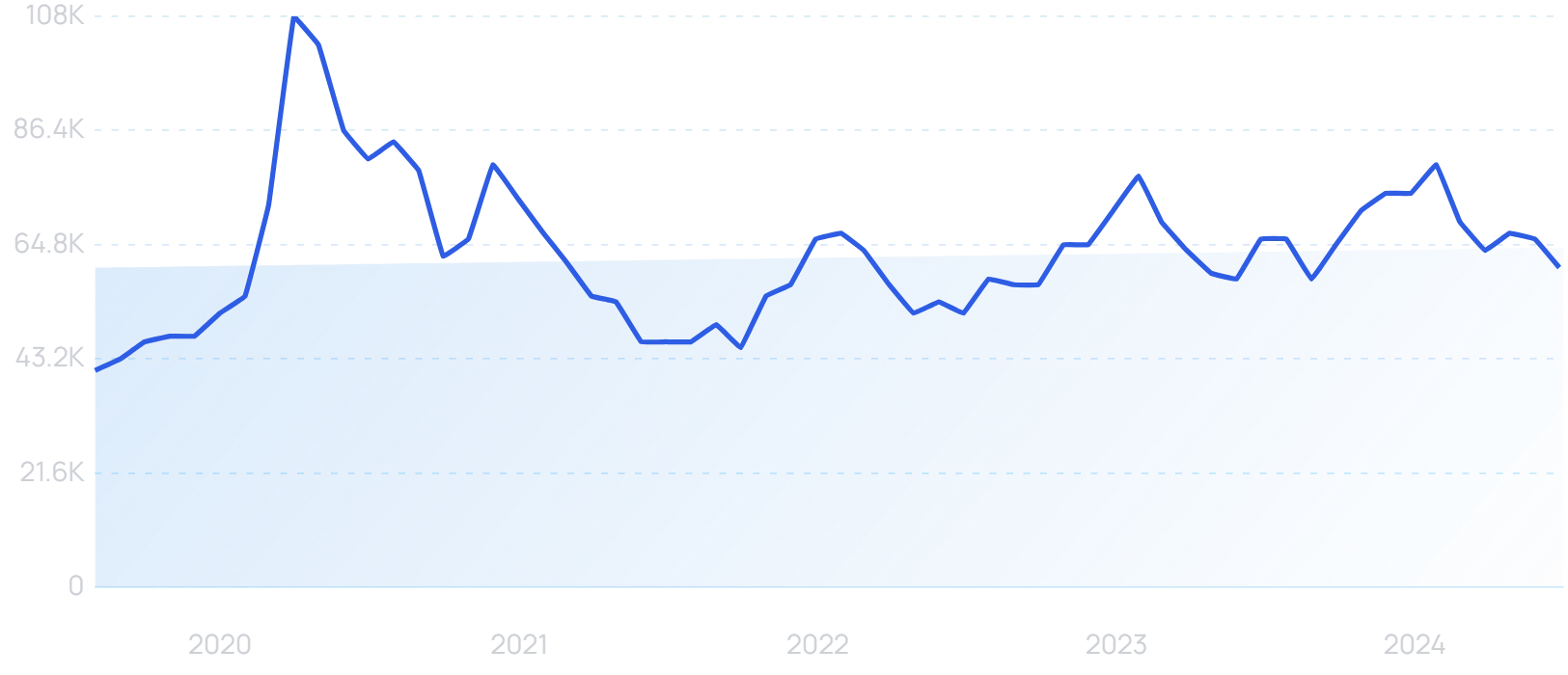

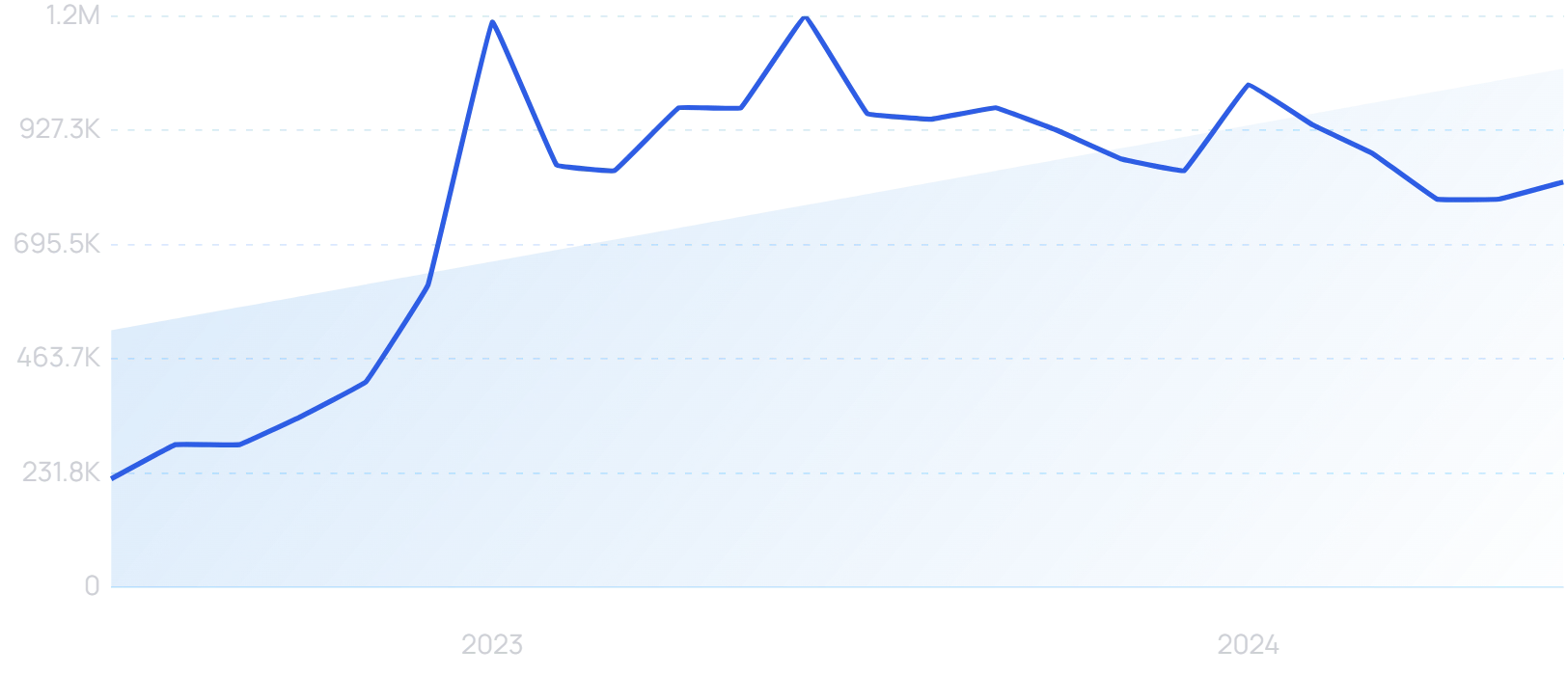

“Spotify podcasts” attracts more than 100,000 searches per month.

Lots of that money went into acquiring exclusive content. But Spotify has pivoted away from that approach, and is now nearing breakeven with the podcasting arm of the business.

Daniel Ek, Spotify MD, explained the company’s changing podcast strategy.

Spotify isn't the only company moving away from exclusive podcasts. Stitcher, which offered exclusive content behind its Premium paywall, has been discontinued altogether.

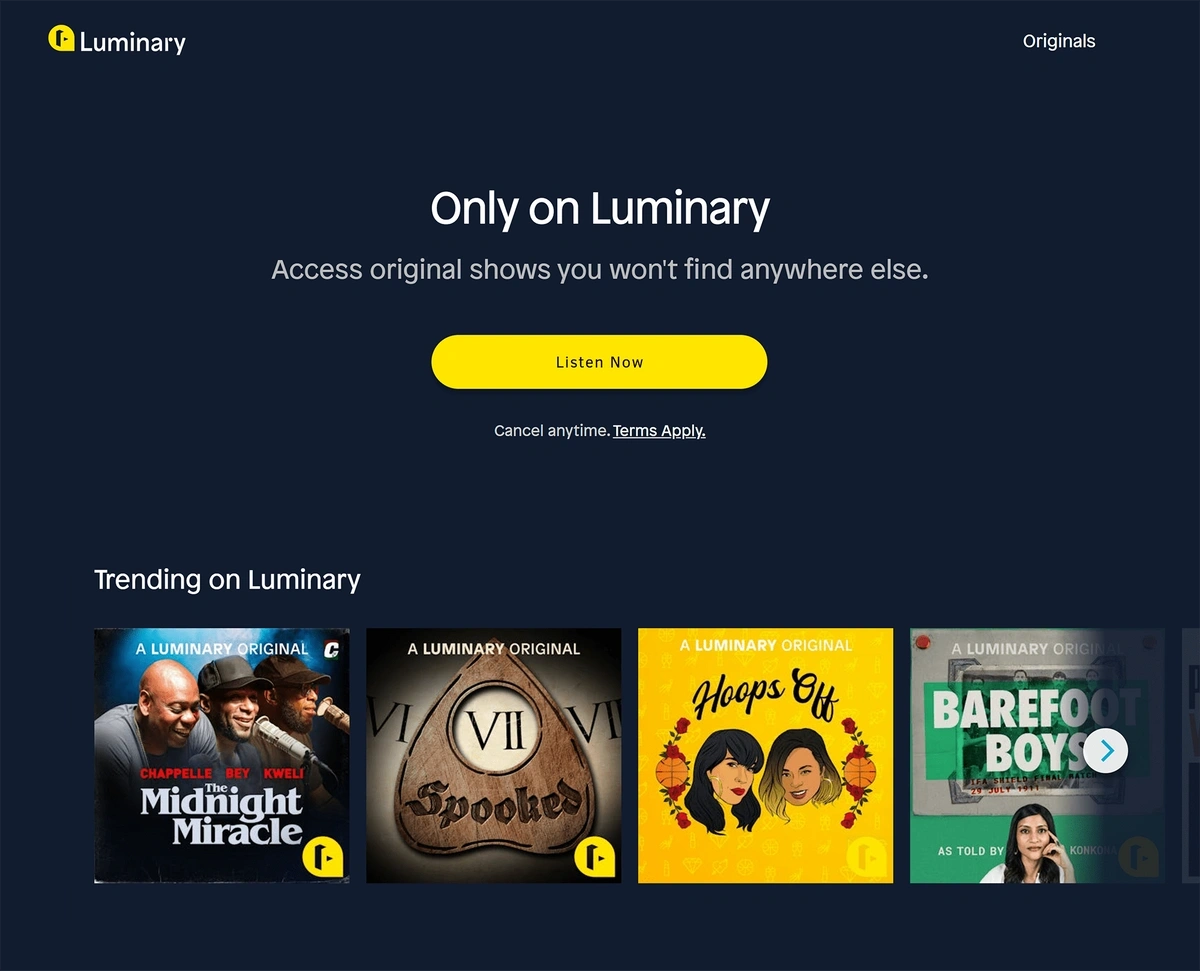

But Luminary still offers original and exclusive content as a major part of its USP in an attempt to stand out from all the app competition. The startup launched in 2019 with $100 million in funding.

Search interest in "Luminary" has grown by 96% in 5 years.

Dave Chappelle and Lena Dunham are among those to have featured on Luminary Originals.

Overcast, another popular podcast player, focuses on advanced features rather than exclusive content.

For example, its trademarked "Smart Speed" feature increases listening speed by eliminating silence during pauses. And Voice Boost is designed to balance the audio.

Amazon is a dark horse in the podcast platform battle.

Amazon acquired podcast startup Wondery in late 2020.

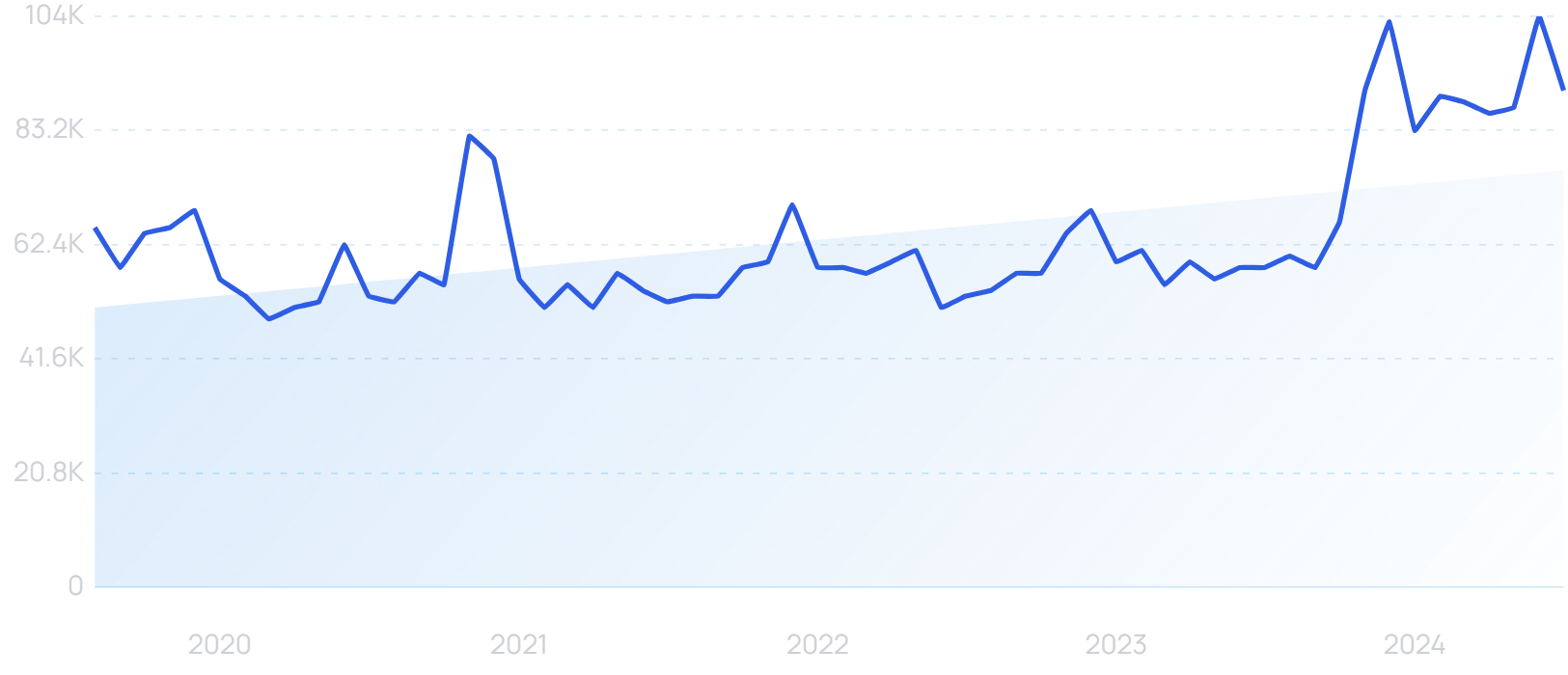

Searches for “Wondery” are up by 44% in 5 years.

The sale was estimated to be worth between $300-$400 million. And instantly made them a player in the podcast market.

4. Podcast Ads Are Getting Easier To Produce And Place

The growth in podcast ads is largely driven by increased podcast consumption worldwide.

That said, podcast advertising is also on the rise due to the fact that the barrier to entry has fallen.

For example, Spotify Advertising lets advertisers create voice ads out of text scripts for free.

And then place those ads on Spotify.

Searches for “voice ads” have increased by 49% in the last 5 years.

In the past, running a single podcast ad was somewhat labor-intensive.

An advertiser had to find relevant podcasts. Reach out to the host or manager. And negotiate a deal.

A fair amount of podcast advertising is still run that way.

However, we're seeing significant growth in podcast ad marketplaces, like Gumball, Podcorn, and LibSyn Ads.

Gumball is one example of a podcast ad marketplace.

These marketplaces are designed to make it easier to find podcast sponsorship opportunities (similar to what's currently happening with the influencer marketing space).

5. Podcasters Find New Ways To Monetize

Podcasters are increasingly on the hunt for new ways of monetizing beyond traditional ads.

For example, Luminary (which we mentioned earlier) has a Netflix model.

Instead of a free platform, Luminary charges users $6.99/month to access content.

And they pay podcast hosts directly to create content for their platform.

List of original podcasts on Luminary.

But podcasters aren’t all relying on being picked up by a big Netflix-like platform. They are taking the subscription model into their own hands.

Patreon now has a dedicated offering for podcasters, which allows creators to sell bonus content to fans alongside regular subscription income.

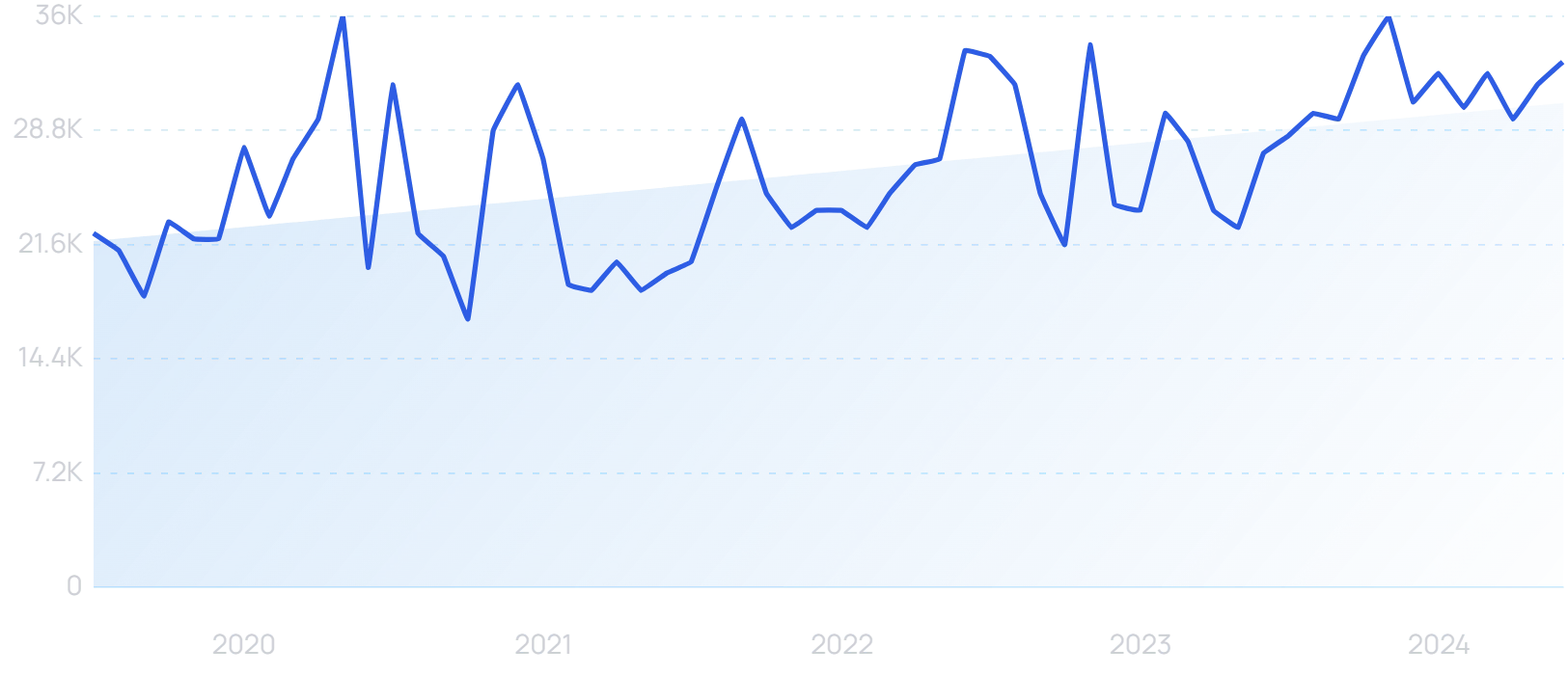

“Patreon” searches are up 48% in 5 years.

The top Patreon creator is a podcast - Matt and Shane’s Secret Podcast - and boasts over 92,000 paid subscribers.

6. Live Podcasting Continues To Grow

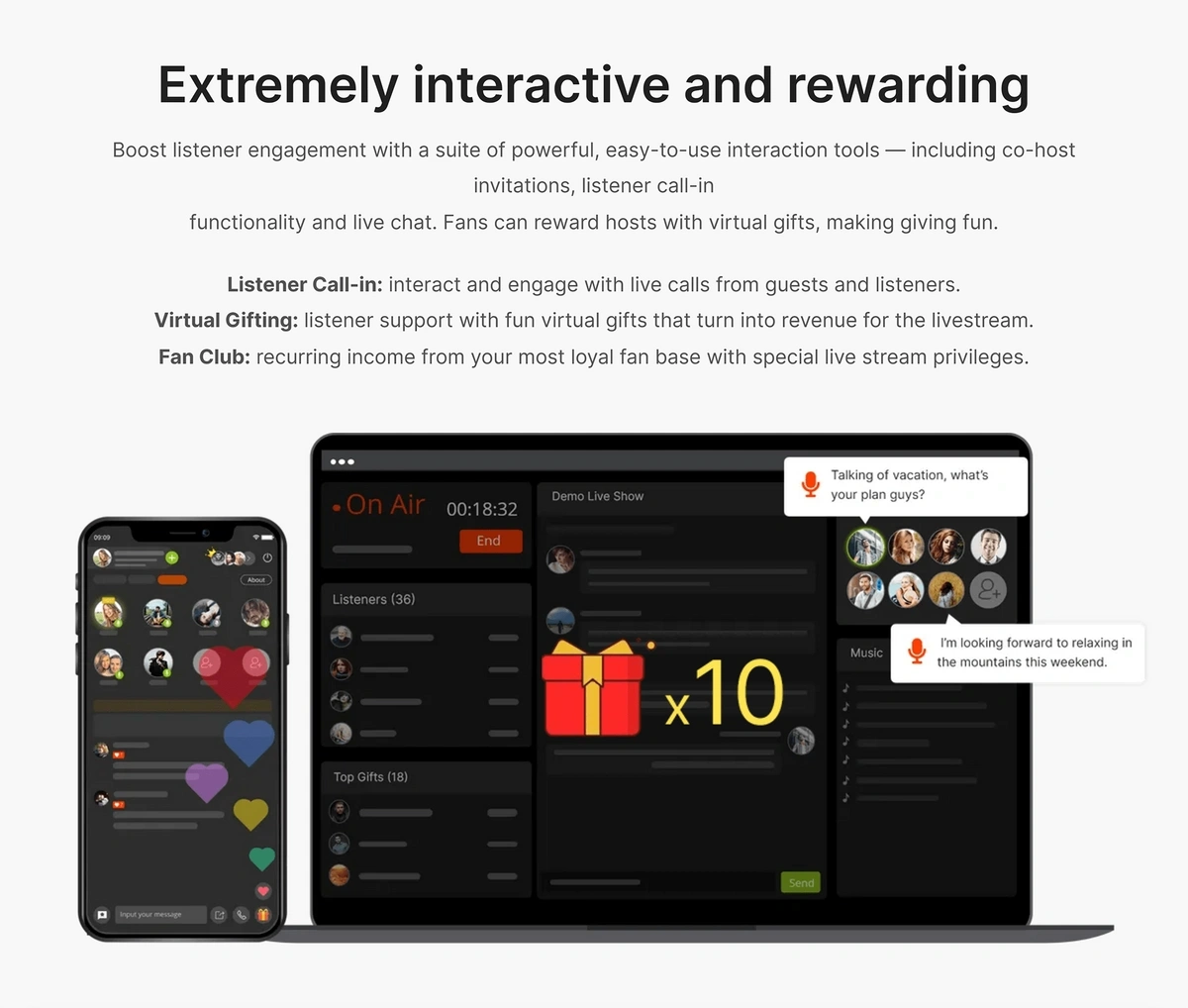

The podcasting community has seen an increase in hosts that want to do live recordings, with 1 in 10 now opting for a live broadcast.

Live broadcasts can boost audience engagement and create a new source of revenue.

Platforms like Podbean offer an array of tools specifically geared to live podcasting. Including “virtual gifts” that convert to real revenue.

Podbean offers creators an extensive live podcast toolkit.

These live episodes can be in the form of interviews and Q&A sessions, contests, phone-in debates, and live coverage of events.

Popular live broadcasting options include YouTube Live, Facebook Live, Twitch and Zoom.

These are combined with dedicated streaming tools like StreamYard, Ecamm Live and Riverside.

Searches for "Riverside streaming" have grown steadily since the company was founded in 2020.

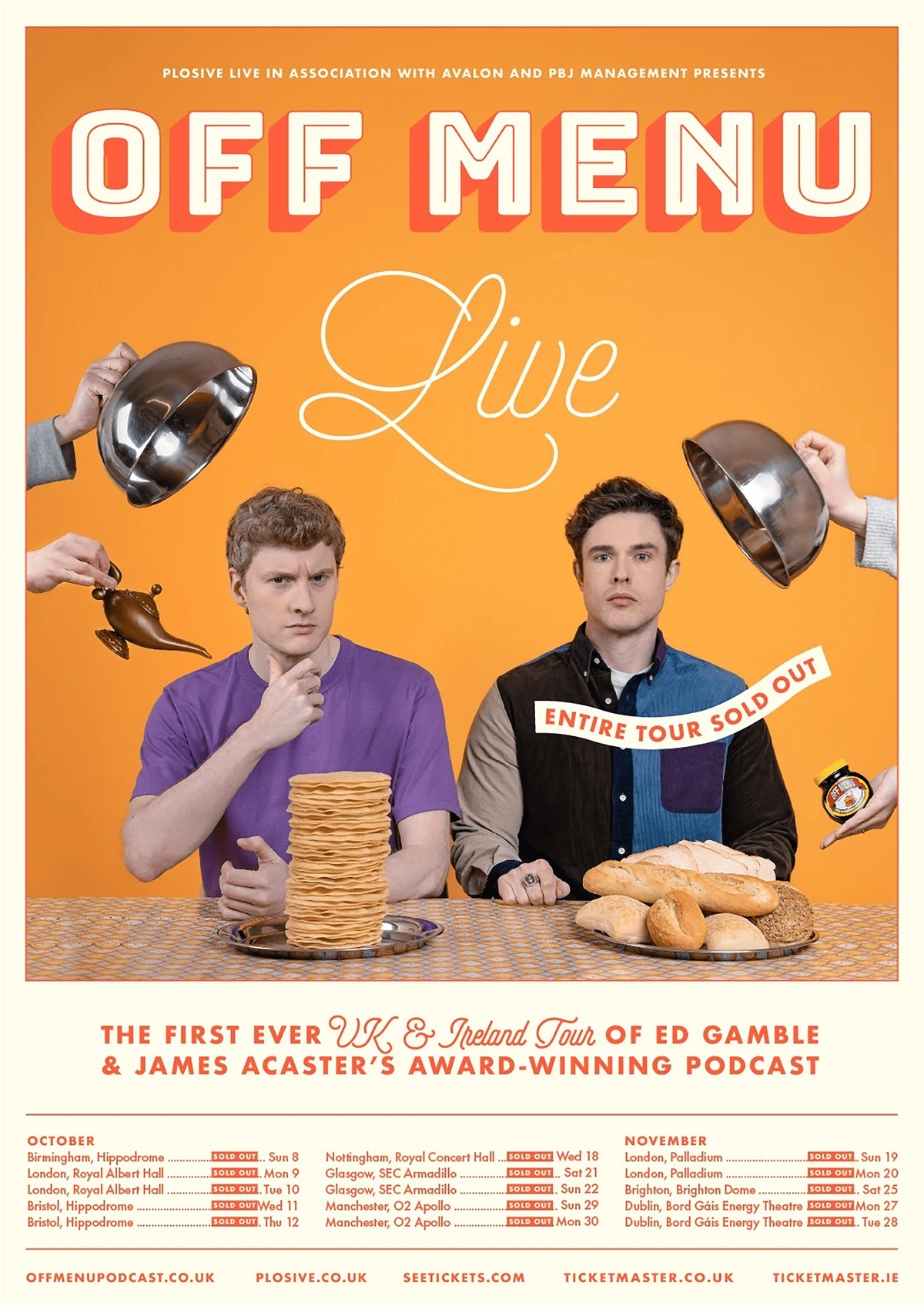

And some of the most successful podcasts are now hosting live in-person events too.

Spotify says that 88% of ticketed Ringer events have sold out, sometimes in as little as 12 minutes. And 90% of events in 2024 have secured sponsors.

In the UK, the ‘Off Menu’ podcast with comedians James Acaster and Ed Gamble sold out the Royal Albert Hall in London across multiple nights.

Example of a live podcast event.

7. Podcasters Tap Into New Growth Strategies

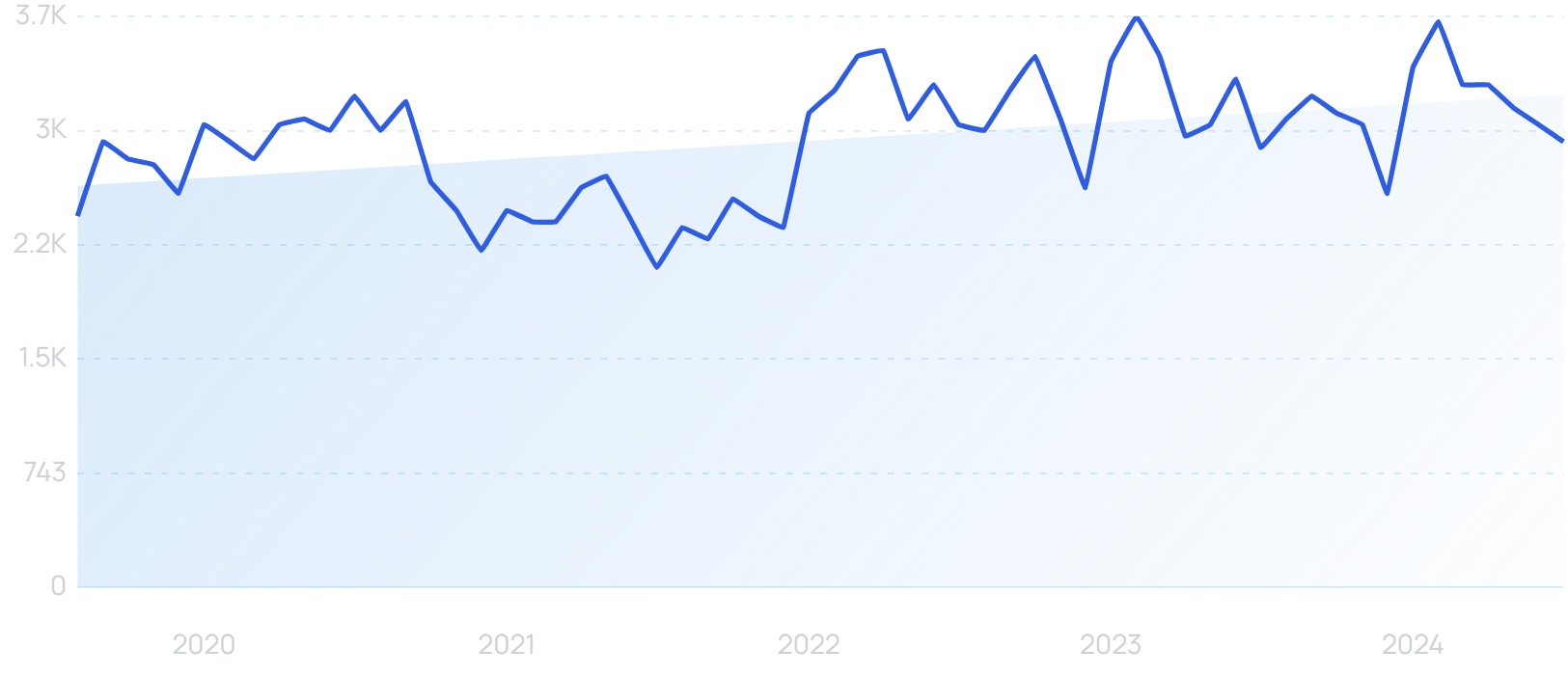

Podcast listening is on the rise.

But so is the level of competition.

There are well over 3 million podcasts now, compared to only 550k in 2018.

This is why podcasters are increasingly on the lookout for new ways to get their shows in front of new listeners.

Searches for “podcast marketing” are up by 17% in the last 5 years.

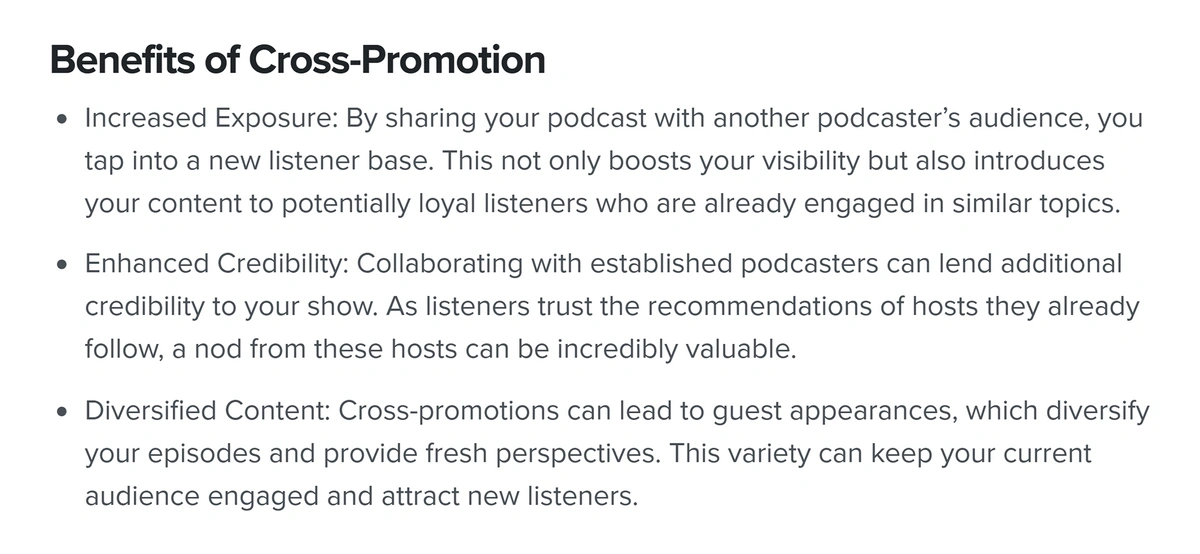

One new strategy that more podcasters are tapping into is cross-promotion.

Across all industries (not just podcasts), cross-promotion has been found to increase acquisition by an average of 23%.

And it’s increasingly being recommended and executed within the world of podcasting.

Podcasting platform “Ausha” espouses the benefits of cross-promotion.

An example of this trend is podcast swaps.

Podcast swaps are when two hosts take turns interviewing each other.

Then, each host simultaneously delivers the episode to their audiences.

Podcast swaps help new listeners discover shows in their niche they may not have discovered on their own.

This cross-pollination tactic has resulted in notable boosts in downloads and new subscribers. One case study saw a 21% month-over-month increase in downloads.

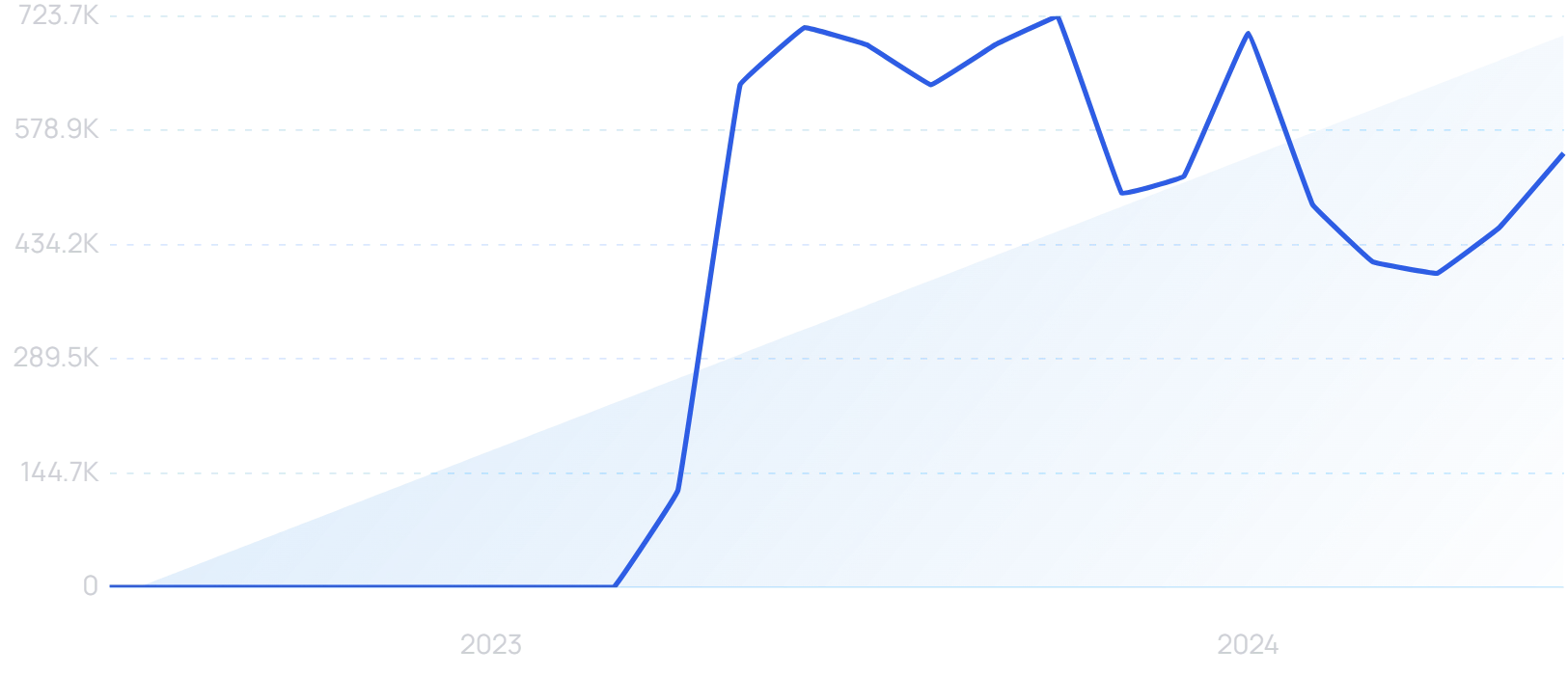

We're also seeing podcasters distribute their podcast content on social media using tools like Opus Clip.

AI podcast clip generator “Opus Clip” has increased in search popularity by 8200% over the last 2 years.

Opus Clip is used by over 5 million creators. It harnesses AI technology to extract compelling video clips for platforms like TikTok and YouTube Shorts.

Opus Clip uses AI to automatically reframe footage for various aspect ratios.

8. Podcast Listeners Crave Learning

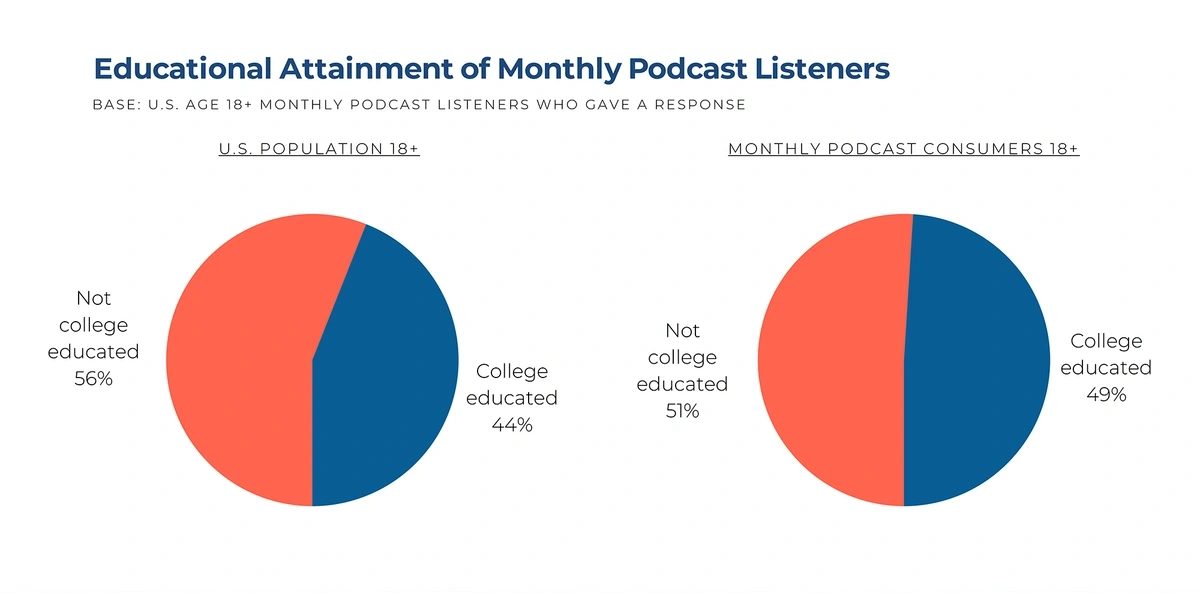

Research shows that podcast audiences are educated and affluent: two demographic features that many advertisers crave.

As for the age range, it’s more diverse than ever before. Among weekly podcast listeners, those aged 55 and older actually have the longest mean listening time, tuning in for an average of just over 8 hours a week.

And 49% of monthly podcast consumers aged 18 and older are college-educated.

Podcast listeners are among the highest sought-after demographics in the US.

Knowing that, it should come as no surprise that many podcast listeners want to use podcasts as a way to learn, stay informed, and gain inspiration.

55% of podcast consumers listen in order to learn, second only to entertainment. For those aged 50 and up, education is the number one reason for listening.

For example, Andreessen Horowitz-funded startup Knowable is essentially "MasterClass for audio".

And they currently have a library of courses focused on learning new skills, including public speaking, marketing, and finance.

Searches for “Knowable” have increased by 26% over the last 5 years.

9. Listeners Use Podcast Content In New Ways

We know that entertainment and learning are the top two overall reasons for listening to podcasts.

However, we're also seeing audio content being used in completely new ways, especially by the younger generations. Which is creating entirely new podcast categories.

For example, listeners are increasingly turning to podcasts as a means of distraction from menial tasks they are performing at the same time, such as household chores.

70% of US podcast listeners aged 18-29 use podcasts “to have something to listen to while doing something else”. That’s compared to just half of that age group who listen in order to learn.

ADHD podcasts are a rapidly growing niche primarily designed to inform people about the realities of living with the condition, along with “hacks” to make things easier. But they’re also created in a way that is mindful of shortening attention spans.

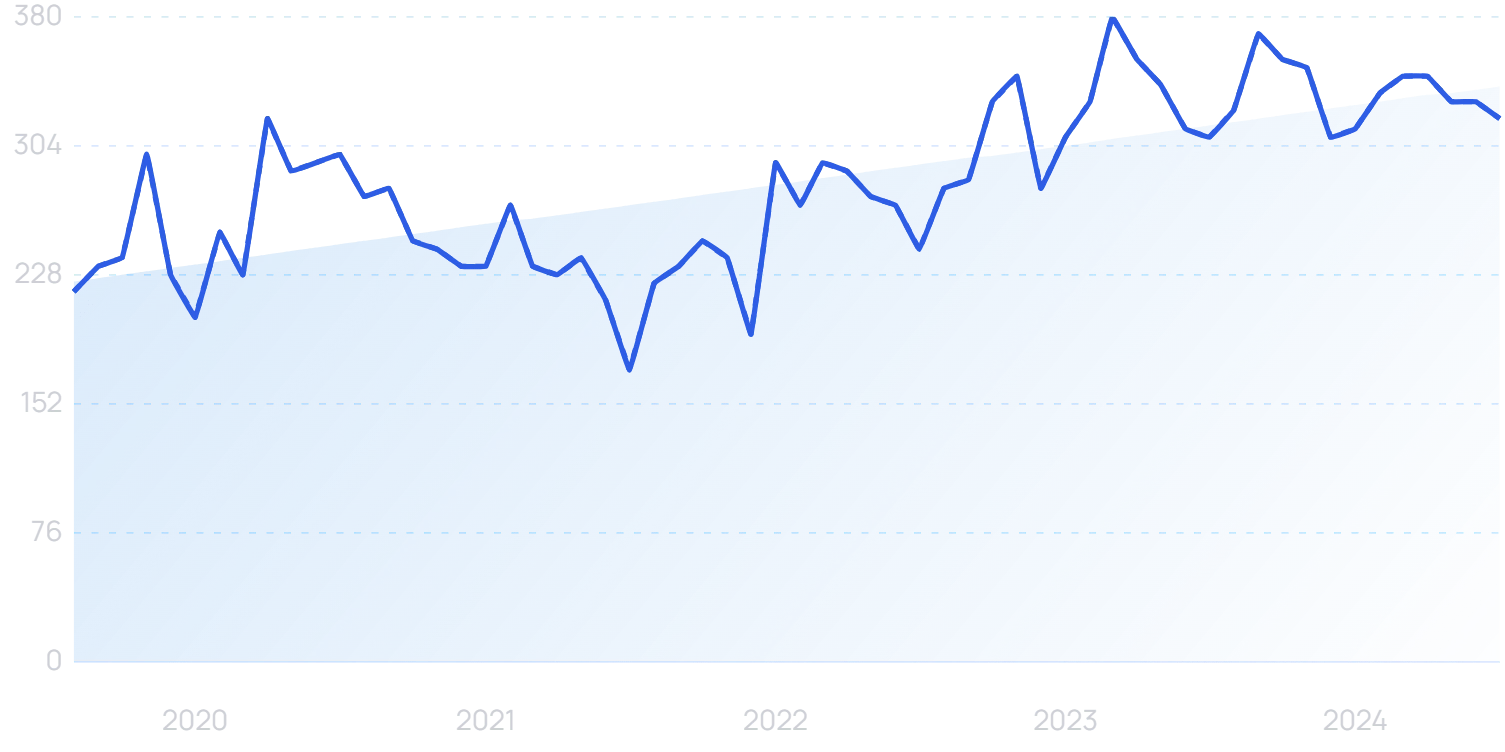

Searches for “ADHD podcast” are up 367% in 5 years.

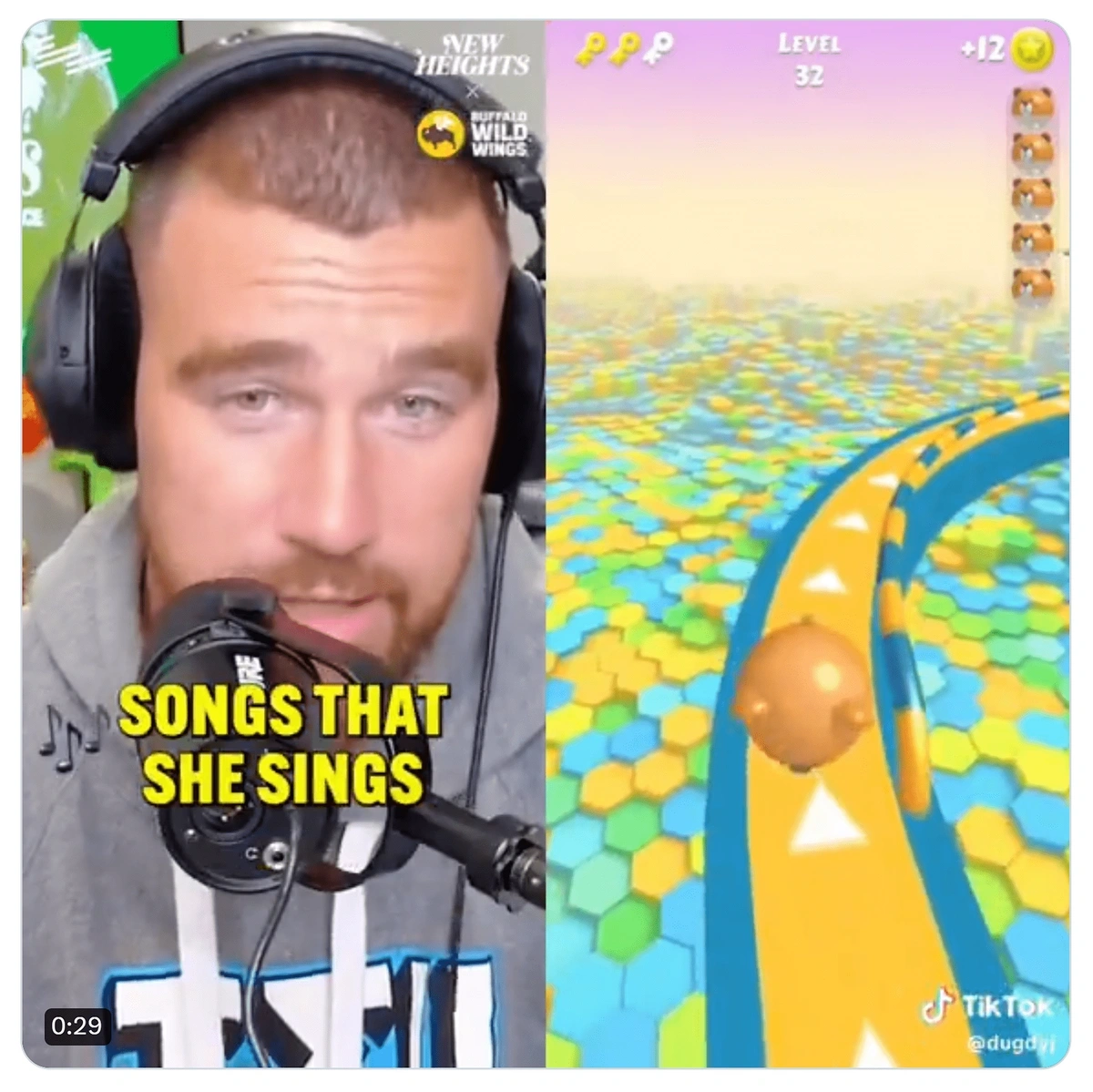

Podcast snippets uploaded to TikTok are sometimes presented alongside a split-screen clip of something deliberately inane: “sludge content”.

It could be ASMR content or a video game playthrough.

"What TikTok is doing with these videos is allowing people to have distractions on the same screen ... [and therefore] have people stay on the same screen for an extended period of time,” explains Saif Shahin, an assistant professor of digital culture at Tilburg University in the Netherlands.

Problematically, makers of “sludge content” aren’t always the creators or owners of either clip. For example, this was not posted by the wildly successful New Heights Podcast - but there’s no denying that users are finding the format engaging.

10. Creators Tap Into Professional Podcasting Tools

Like any mature industry, podcasting is developing a set of tools specific to the medium.

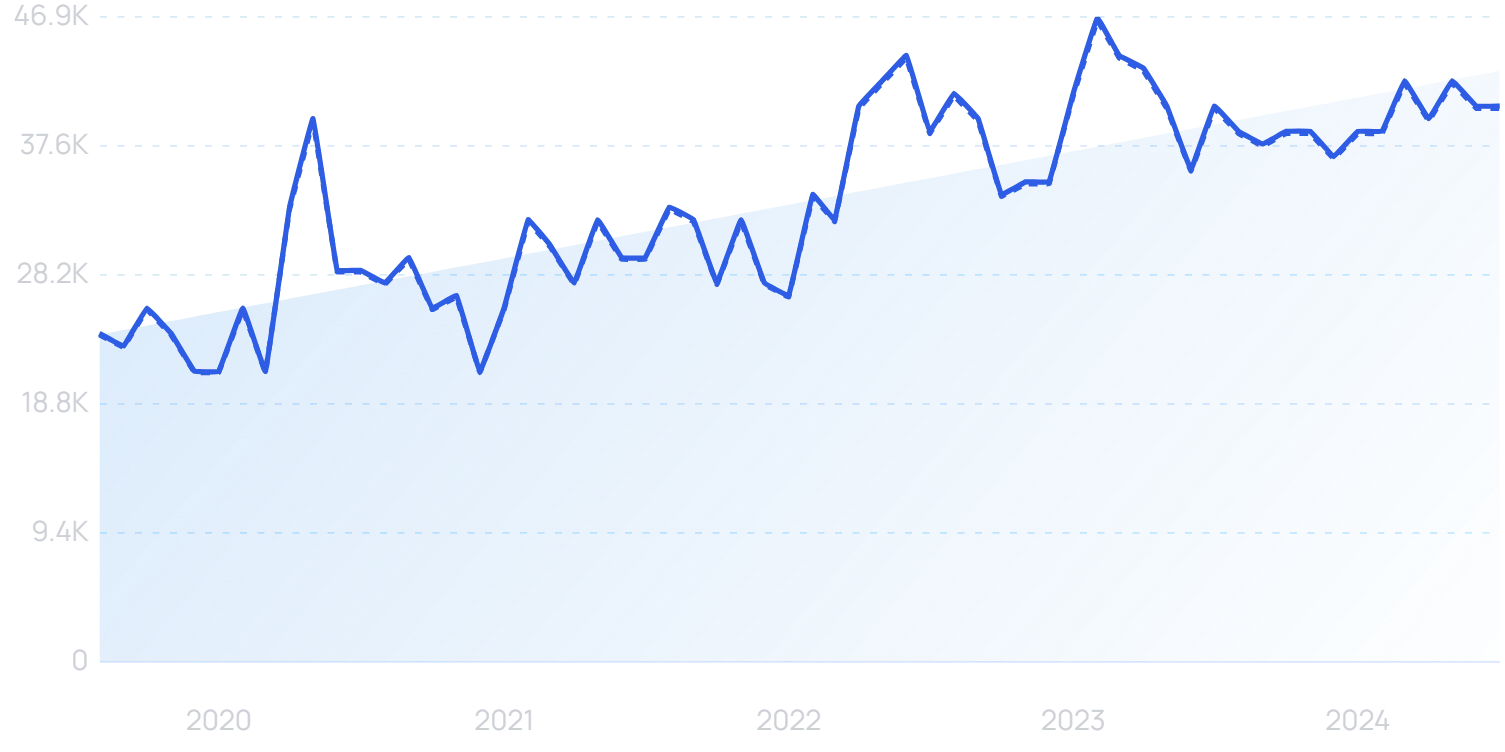

For example, searches for the term "podcast microphone" have increased significantly over the last five years.

Searches for “podcast microphone” have increased by 47% over the last 5 years.

Dozens of podcast microphones, like Shure, Neat King Bee, and the Rode Procaster, are now competing to meet surging demand.

We’re also seeing a number of podcast-first audio editing software products enter the market.

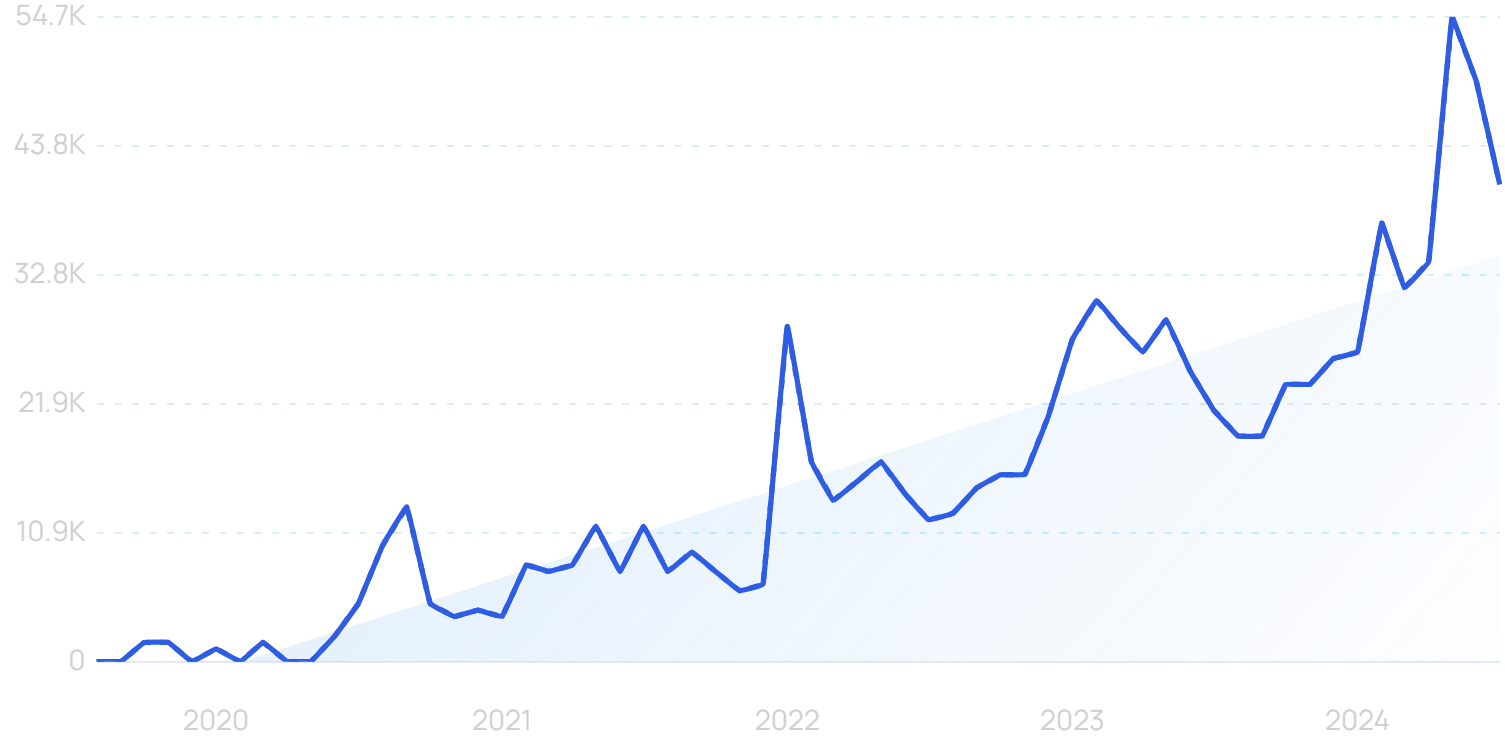

A leader in that space is Descript, which combines transcription and audio editing into a single platform.

“Descript” has seen search growth of 1350% over a 5-year span.

Descript’s “AI voices” feature allows podcasters to edit their episode using the text-based transcription.

The tool translates those changes into audio using an AI-powered tool that simulates the speaker’s actual voice.

Descript's "AI voices" feature designed for editing podcast episodes.

Podcast hosting is another growing subcategory in this space.

Buzzsprout and Podbean are leaders in this field, but there are also emerging platforms like Castos.

Searches for “Castos” are up 67% over the last 5 years.

Castos’ USP is an unlimited number of podcasts, episodes and downloads on all plans. Premium subscriptions instead offer other additional features like advanced analytics or unlimited transcripts.

While specialized podcast products are cropping up left and right, there are also a growing number of “all in one” solutions for pro podcasters.

These combine podcast hosting, editing, transcription, and show-note pages.

One of the fastest-growing companies in this space is PodCastle.

Searches for “PodCastle” are up 7300% in the last 5 years.

The platform offers tools for every stage of the podcasting lifecycle. Episodes can be recorded, edited and published through PodCastle.

Podcastle brands itself as a one-stop shop for podcasting.

Other growing subcategories in the podcast-specific products and services space include podcast SEO and podcast editors.

11. Emergence of Podfluencers

63% of people trust their favorite podcast host more than their favorite social media influencer.

And 45% of Millennial and Gen Z listeners will trust what they hear in an ad more because of their trusted relationship with the host.

Spotify has dubbed these emerging influential hosts “podfluencers”.

At a time when nearly 90% of people say they mistrust “traditional” influencers, this voice of relative authority is significant.

It opens up avenues for podcasters to advertise third-party products. But there are also opportunities in podcast-branded merchandise.

Printify allows creators to easily create branded products.

“Printify” searches are up 274% in the last 2 years.

Printify has a specific page dedicated to podcast creators. It has more than 90 print providers worldwide, offering more than 900 customizable products.

12. Podcasting goes global

There are an estimated 129.9 million podcast listeners in the US. But that’s far from the only audience ripe to be reached.

For instance, Western Europe has 111.3 million listeners of its own. And with 22 countries on the continent boasting “high” or “very high” English proficiency, there’s a significant market for US creators to reach.

In the UK, 55% of podcasts streamed among listeners aged 18-24 originate in another country. That rises to 62% among those aged 13-17.

And more than 1 in 5 podcasts globally attract at least half of their audience from overseas.

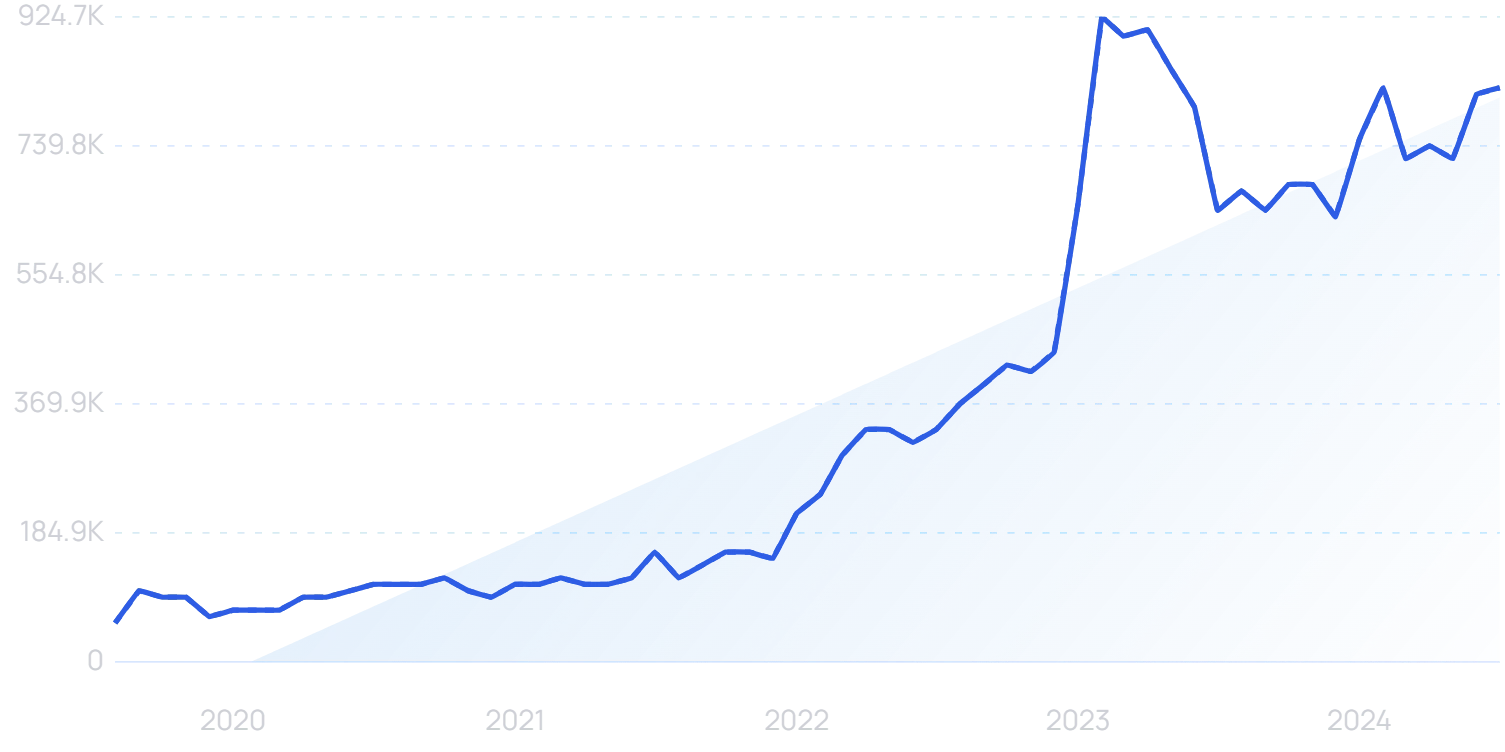

Spotify is even attempting to eliminate the language barrier by running an AI translation pilot.

Dax Shepard and Steven Bartlett have been involved in an initial Spotify translation pilot.

The technology translates podcasts into different languages, but retains the podcast host’s voice.

Rask AI is one of the companies offering translation services like these.

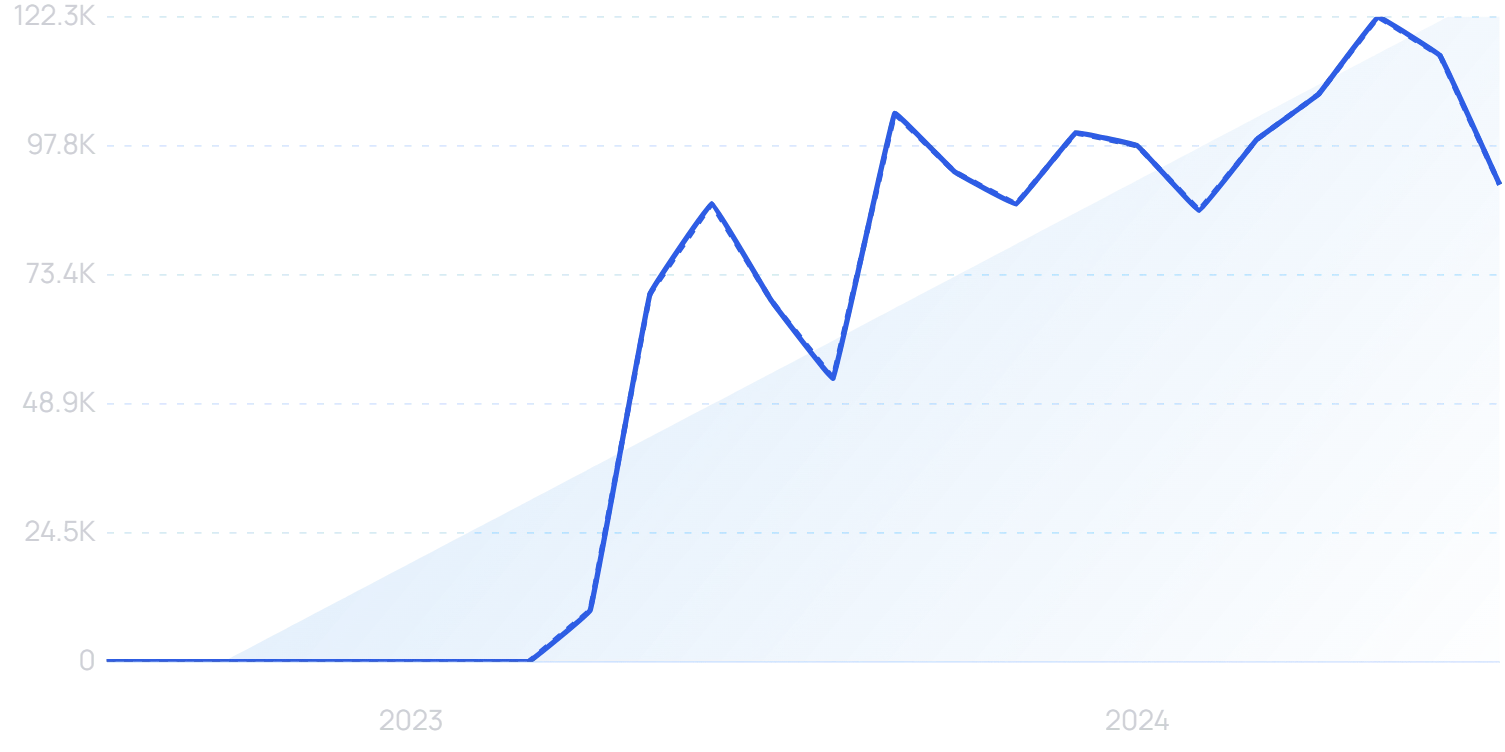

Searches for “Rask AI” are up 7600% in 2 years.

It had already passed $1 million in annual recurring revenue within 150 days of launch, and it now claims over 2 million users.

Conclusion

I hope you enjoyed our list of the 12 key podcast trends for 2024.

From tools to new platforms, the podcasting space is ever-changing.

And thanks to large investments in the space, we can expect more trends to take hold in the near future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more