Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 10 Startup Trends (2024 & 2025)

You may also like:

With rising interest rates and an uncertain economic outlook, the startup world is currently in flux.

However, startups in certain industries (like AI) are thriving.

From venture capital to generative AI, here are the most important startup trends happening right now:

1. VCs Invest Heavily In Generative AI

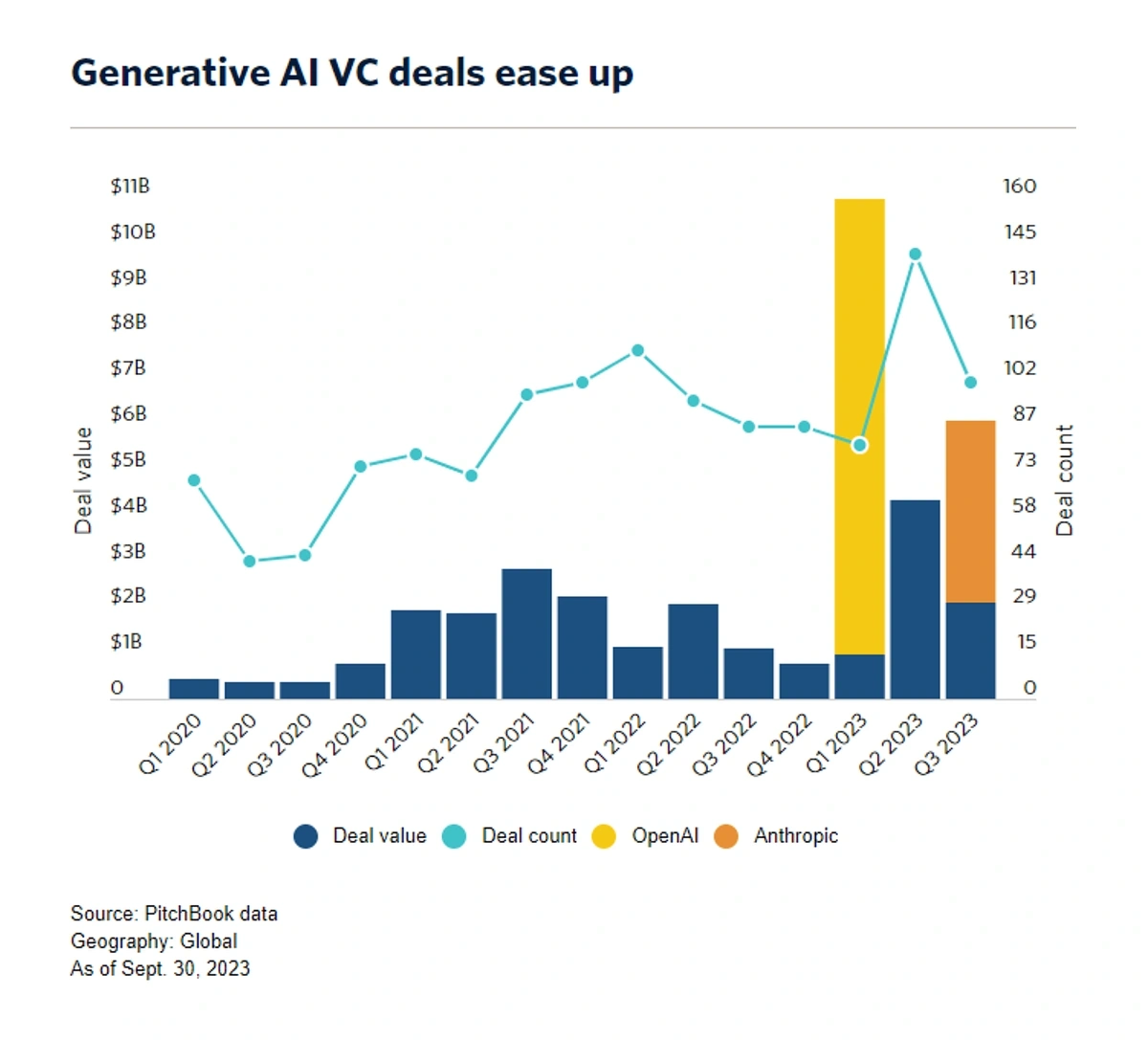

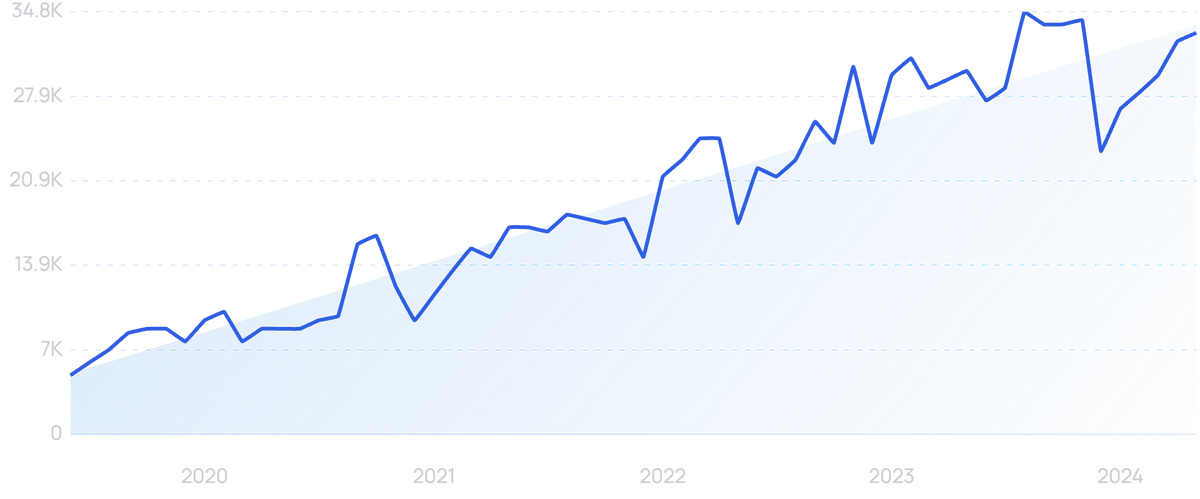

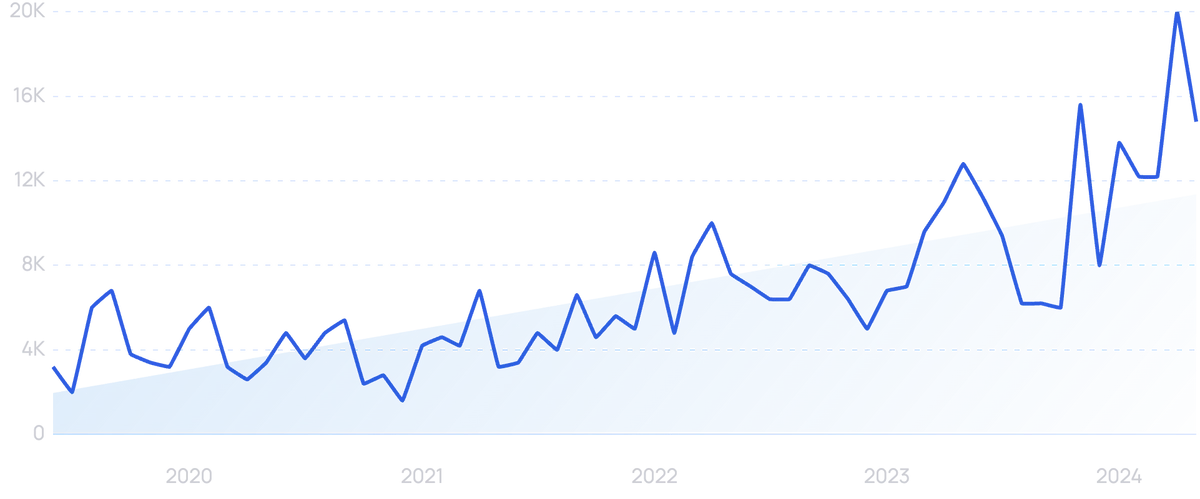

VC funding for generative AI startups has been climbing over the last 3 years.

However, in late 2023 and early 2024, VCs have been making big bets on AI startups.

Here are a few key examples:

- In September 2023 Amazon invested $4 billion in Anthropic, an LLM designed to compete with ChatGPT.

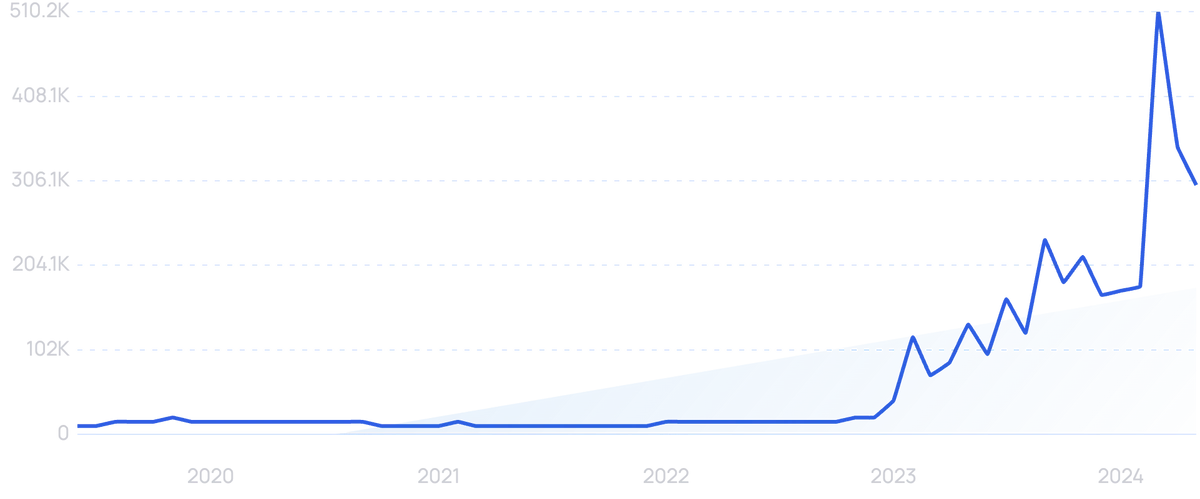

Search volume for “Anthropic” are up more than 2,850% since 2019.

- Inflection, an AI startup looking to develop personal AI systems, raised $1.3 billion.

- Cohere, a company specializing in LLM for enterprises, raised $270 million in a Series C funding round.

- xAI, owned by Elon Musk, is likely to close a $6.5B funding round in June 2024.

Despite this inflow of cash, many are predicting a slowdown in generative AI funding sometime in 2024.

One reason is purely based on the short supply of high-powered chips. The shortage is so severe that black markets are popping up.

Another potential downfall for generative AI startups is uncertain consumer interest.

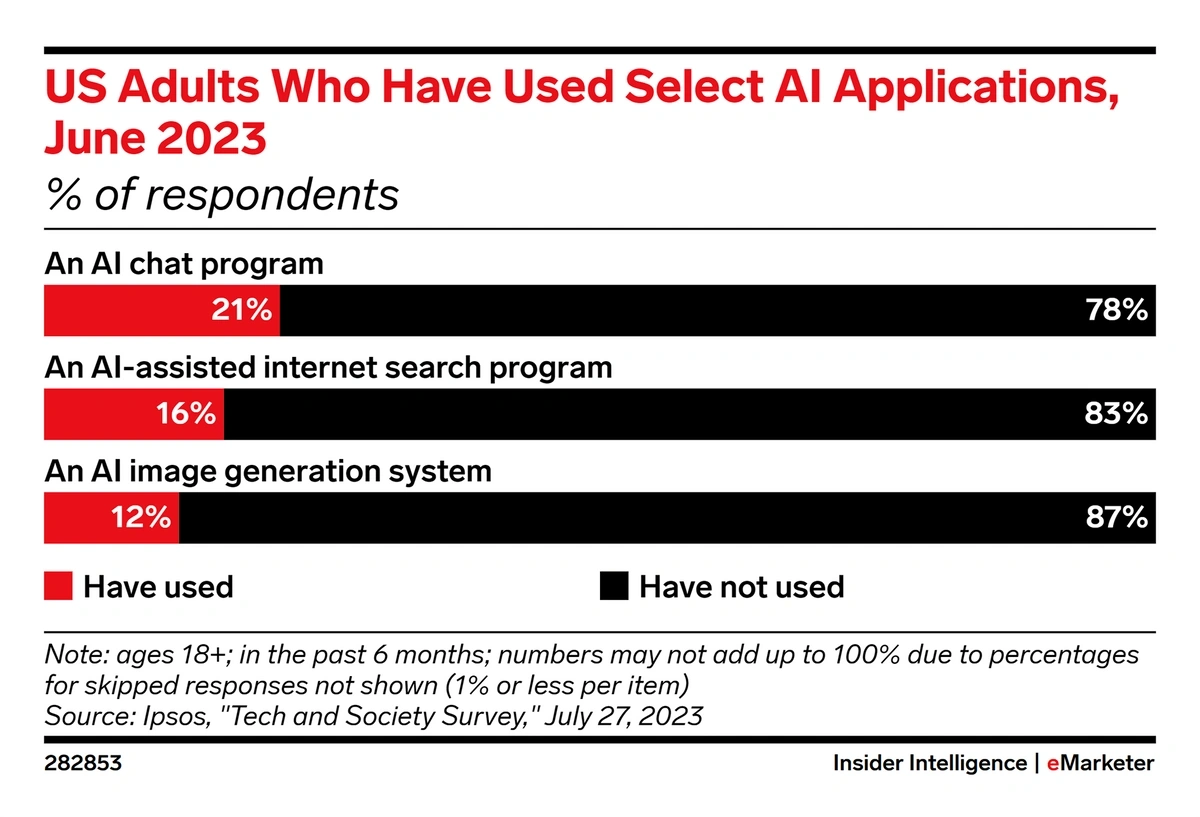

Surveys show just 21% of Americans have used an AI program in the past six months.

More than three-quarters of Americans have not used an AI-powered platform in the past six months.

Only 31% of US adults say society is ready for widespread use of AI.

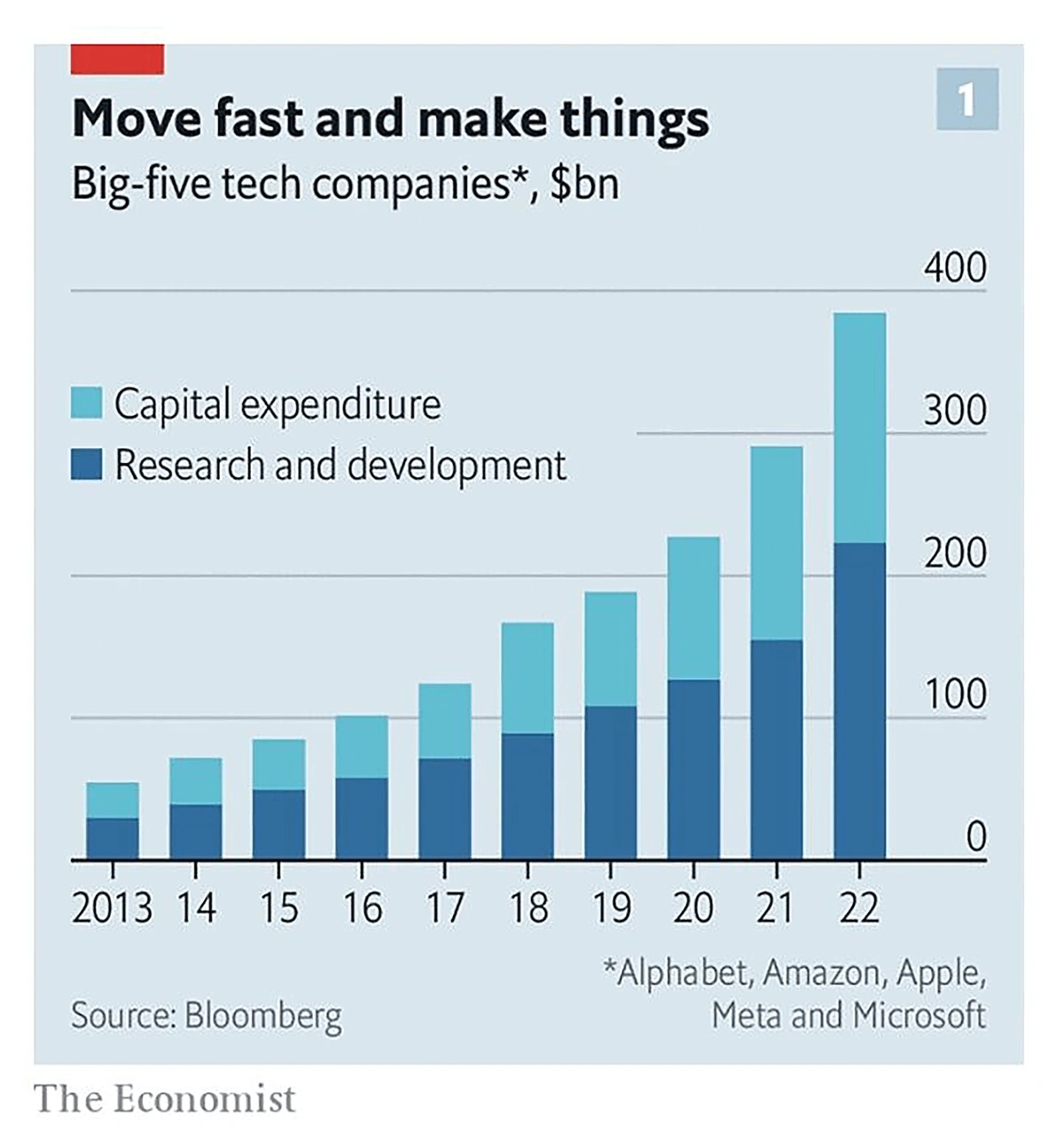

The dominance of well-funded tech giants is another factor to consider.

In 2022 alone, the big five tech companies spent $223 billion on AI research and development and $161 billion in capital spending.

Spending on AI among the Big Five has been climbing steadily since the early 2010s.

2. Agtech Startups Go All In on AI

Today’s agricultural producers are looking to get more out of the land while also protecting it from damage.

That’s where agtech startups come in.

With tools focused on farm data and precision agriculture, these firms are leading the charge for regenerative agriculture.

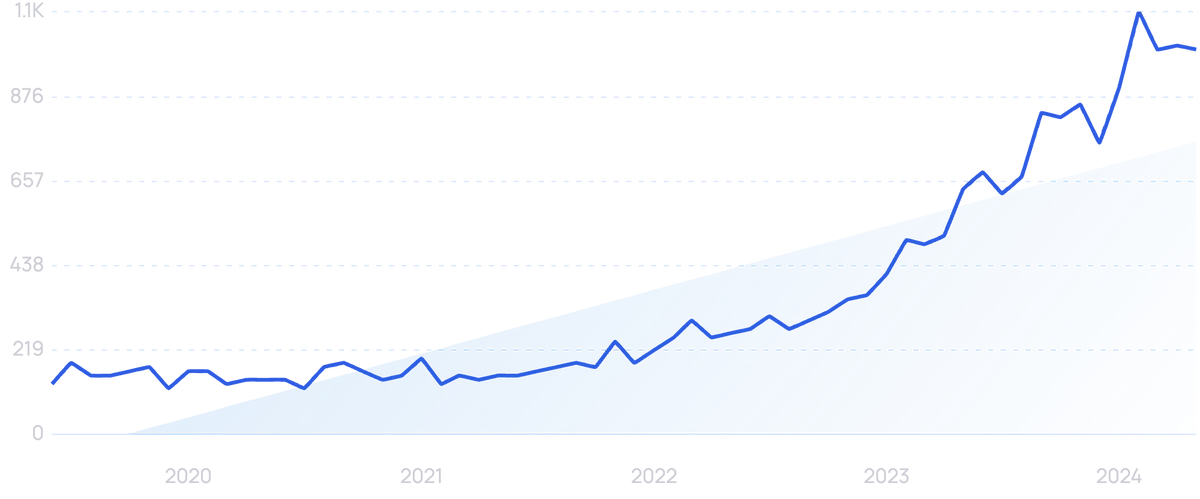

Search interest in “regenerative agriculture” is up nearly 579% over 5 years ago.

There are nearly 300 agtech startups in the US that are focused on AI. That’s out of a total of about 1,400 agtech startups globally.

Search interest in “agriculture AI” is up more than 658% compared to 5 years ago.

GroGuru is a startup using AI to optimize the use of water in agriculture.

Their solutions are currently in use by 300 customers spanning more than 200,000 acres across the United States.

The company is still in the early stages of development with just $4 million in total funding.

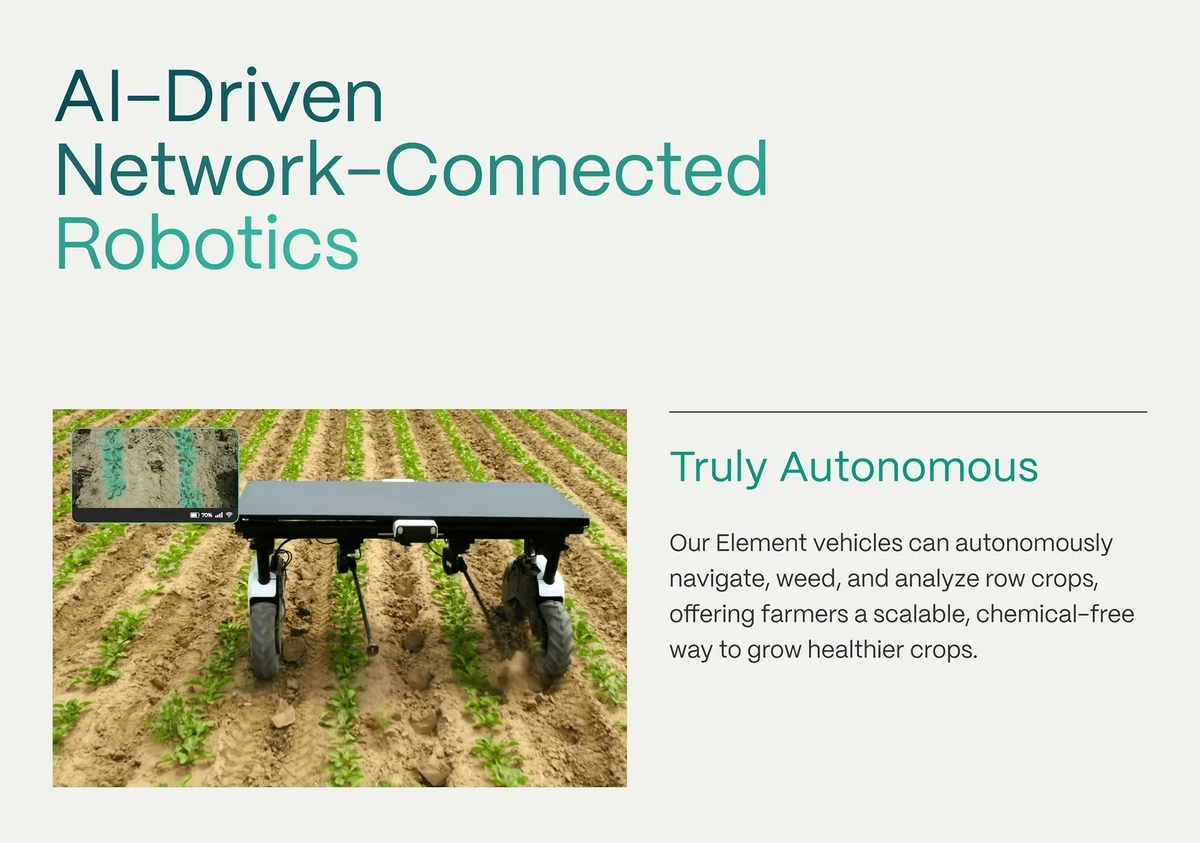

With $16 million in total funding, Aigen is another AI-powered agtech startup.

The company manufactures autonomous robots that roll through fields to eliminate weeds and analyze the crops.

Aigen’s robots independently navigate fields while running on 100% renewable energy.

Their solution has the potential to become a sustainable replacement for the billions of pounds of pesticides that are annually deployed in the agriculture fields.

3. Climate Tech Thrives Amidst Funding Dip

Several climate tech startups have seen massive growth and funding rounds over the last 18 months.

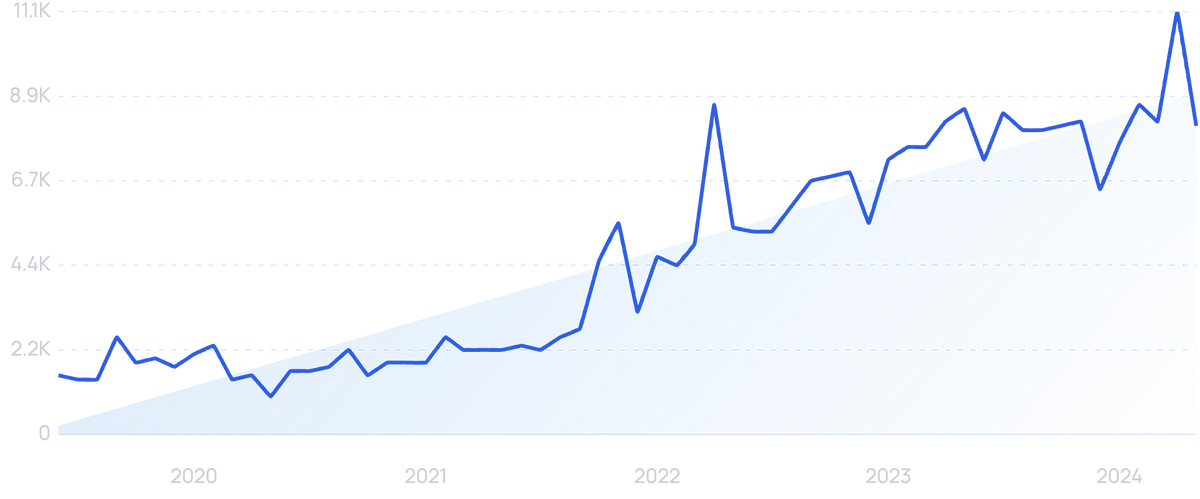

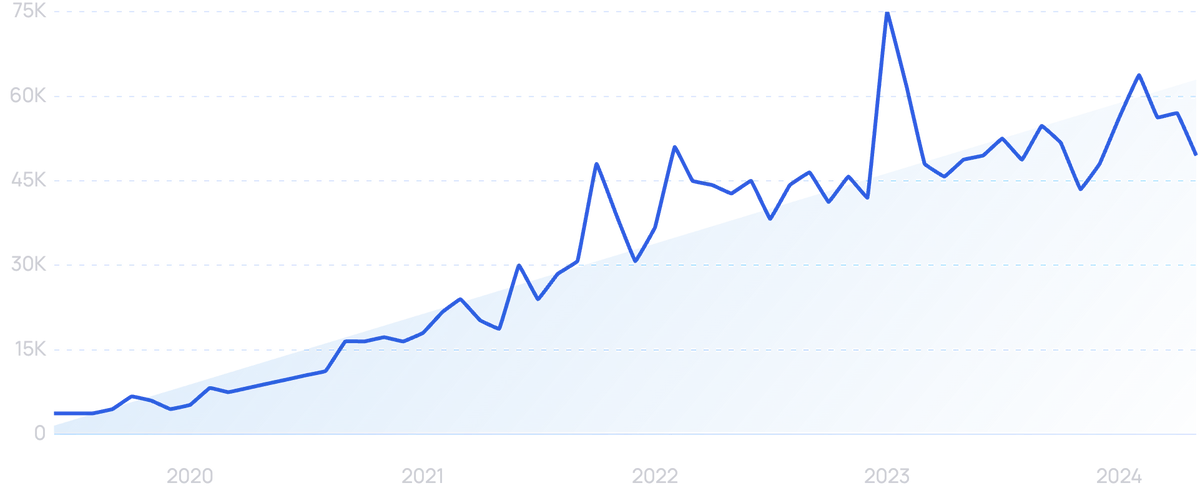

Search volume for “climate tech” is up nearly 421% in 5 years.

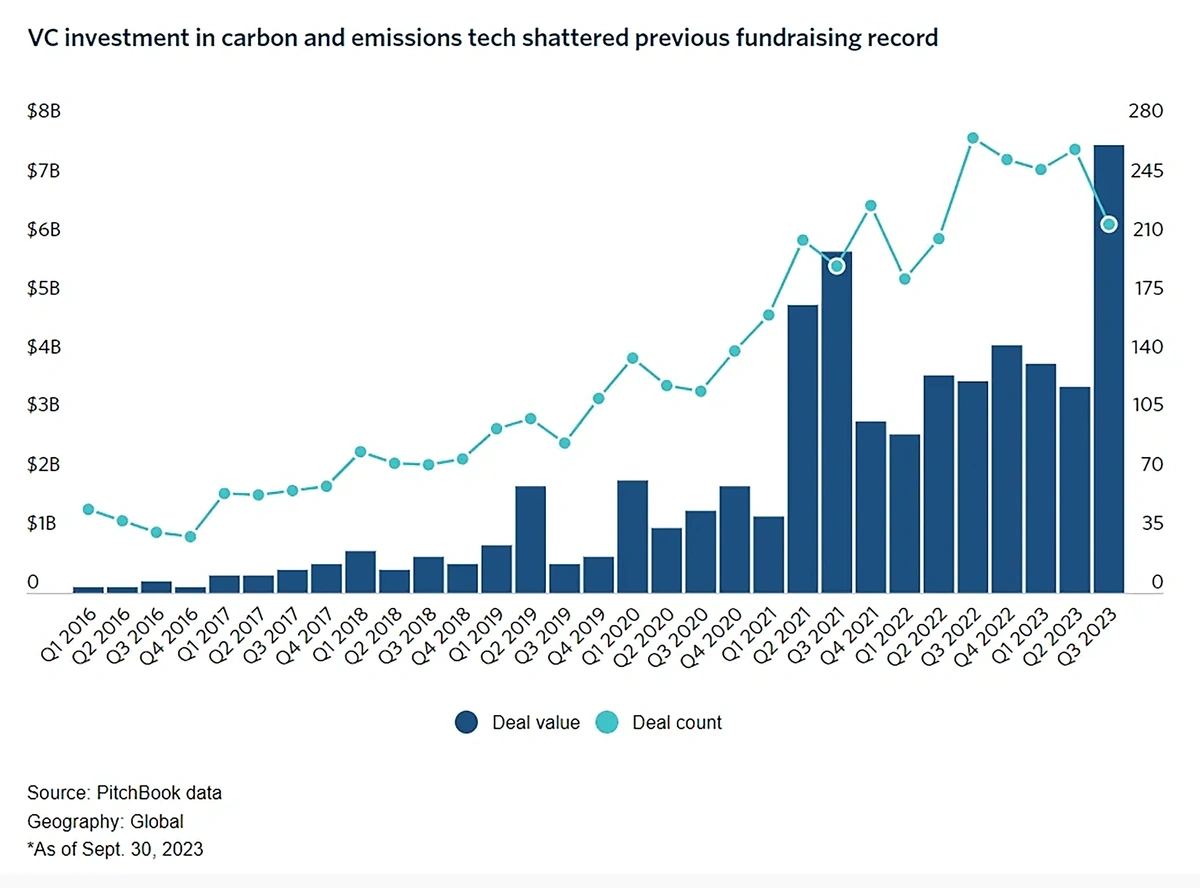

VC investment in startups specializing in carbon and emissions reduction technologies reached a record high — $7.6 billion — in the third quarter of 2023.

Investment in carbon and emissions reduction technology soared in 2023.

Startups in green mining and energy-efficient buildings saw record amounts of funding in quarter three as well. Green mining startups brought in $394.9 million while energy-efficient buildings raised $638.7 million.

However, these record-breaking numbers come as overall investing in climate tech is down.

PwC reported that private equity investment and grant funding in climate tech is down more than 40% year-over-year in 2023.

But, in comparison, private investment across all sectors is down 50% YOY.

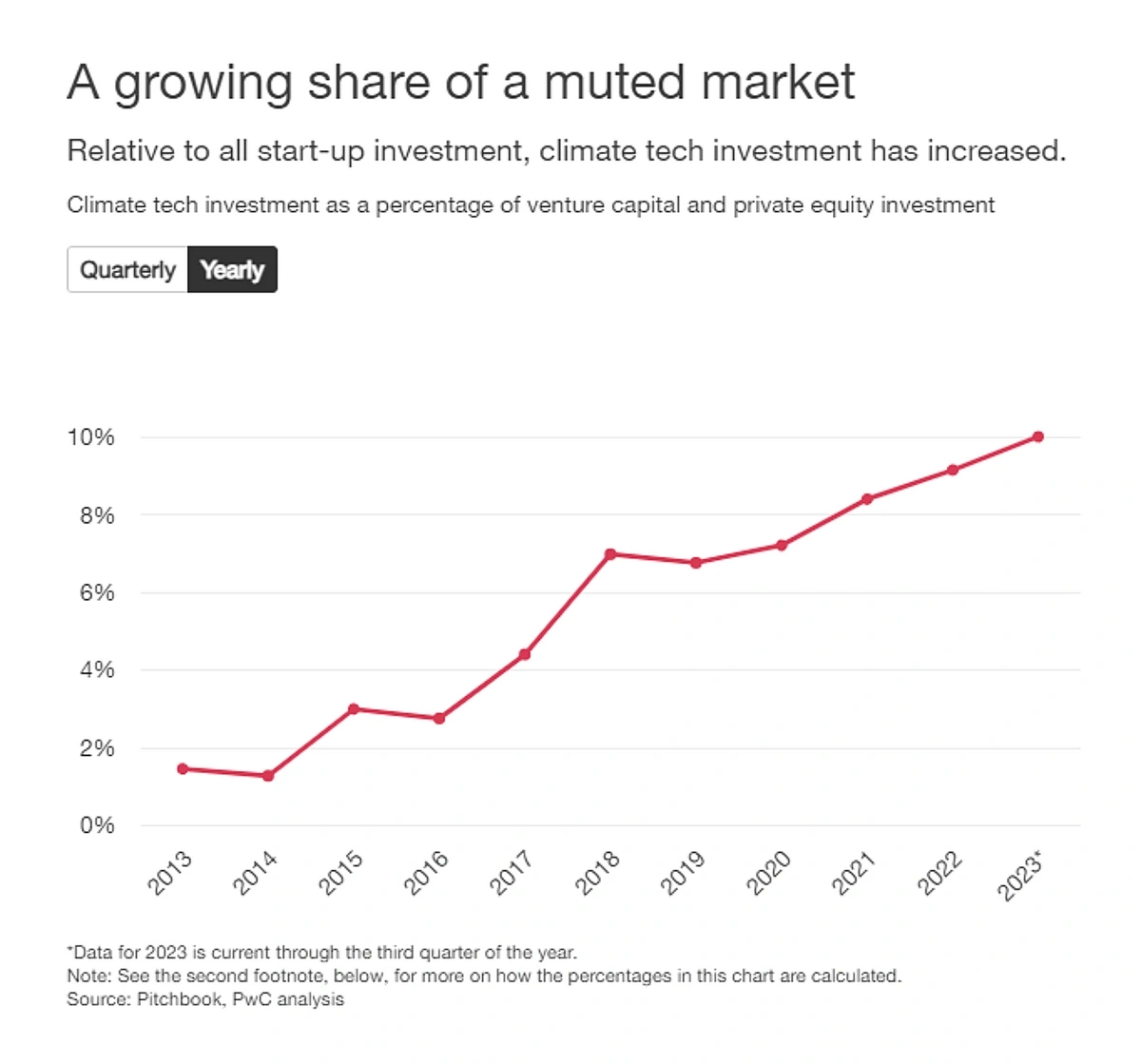

However, the sector is responsible for a growing percentage of private market equity as compared to total startup investments.

In 2023, more than 10% of all startup investments went to climate tech firms. That was up from 7.22% in 2020.

Climate tech’s percentage of total startup investment funds has been climbing for the past 10 years.

As of May 2024, there were well over 100 unicorns in the climate tech space for a total value of $200 billion.

Electric Hydrogen is one of the latest startups to reach unicorn status.

The Massachusetts-based tech company is focused on manufacturing low-energy, cost-efficient electrolyzers that are necessary to split H20 and collect hydrogen.

Search volume for “green hydrogen” has jumped more than 1,220% in the past 5 years.

Electric Hydrogen raised $380 million in a Series C funding round in October 2023, bringing its valuation to $1 billion.

Commonwealth Fusion Systems is another unicorn. The company has raised $2 billion in funding.

Commonwealth Fusion Systems has received funding from Bill Gates, Tiger Global Management, and others.

Fusion energy is at the center of their operations. It’s a specialized type of nuclear energy that produces more energy than typical nuclear sites but does not create nuclear waste or greenhouse gasses.

The company is currently constructing a SPARC facility. According to the company, this will house the first-ever net-energy fusion machine.

In 2025, the company plans to begin building a full-scale fusion power plant.

4. Startups to Provide EV Infrastructure and Support

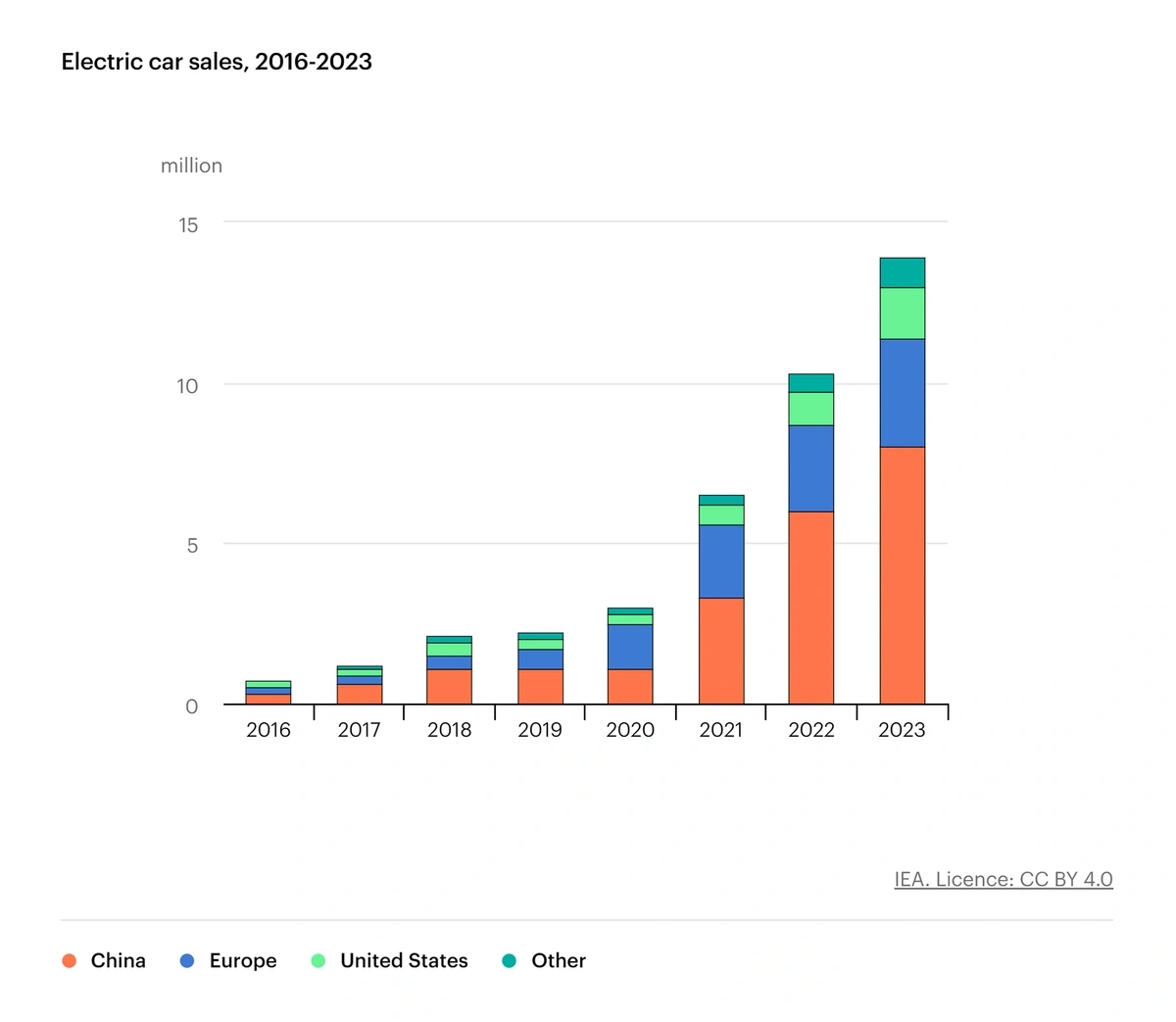

Estimates showed that nearly one in five new cars sold in 2023 were electric. That meant the total units sold was an estimated 14 million+.

The number of electric vehicles sold rose sharply in the early years of this decade.

From Tesla to big-name domestic and foreign automakers, electric vehicles are selling but more slowly than experts predicted.

One reason for the slow roll-out is that the network to support electric cars is lacking.

For instance, reports suggest that New York City alone is 40,000 charging plugs behind demand.

Across the US, there are approximately 130,000 individual charging ports but 145,000 gas stations with multiple pumps.

This lack of infrastructure is proving to be an opportunity for startups.

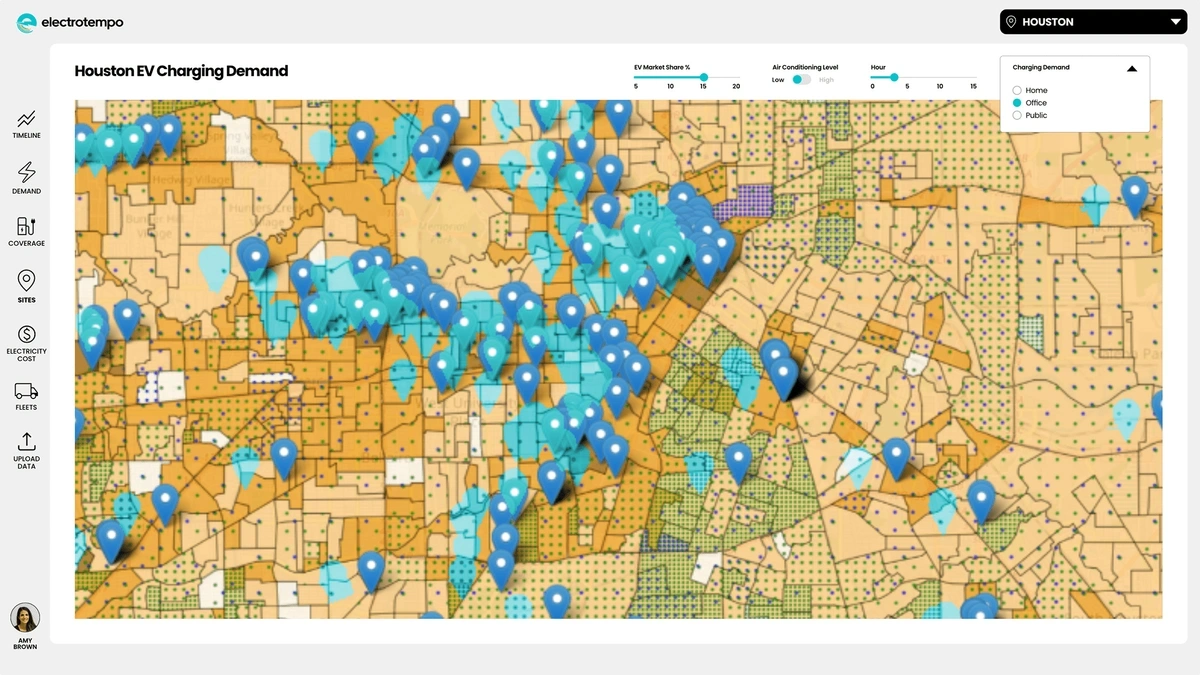

ElectroTempo, a Virginia-based startup, has found its niche in providing software and analytics solutions to predict demand for charging stations and suggest the most cost-effective ways to build out infrastructure.

The company’s most recent funding round closed in August 2023 with $4 million in seed funding.

Software from ElectroTempo can map EV charging demand in any location.

In another example, ItsElectric is a startup that’s installing curbside EV chargers on city streets to provide charging opportunities to drivers who don’t have a garage.

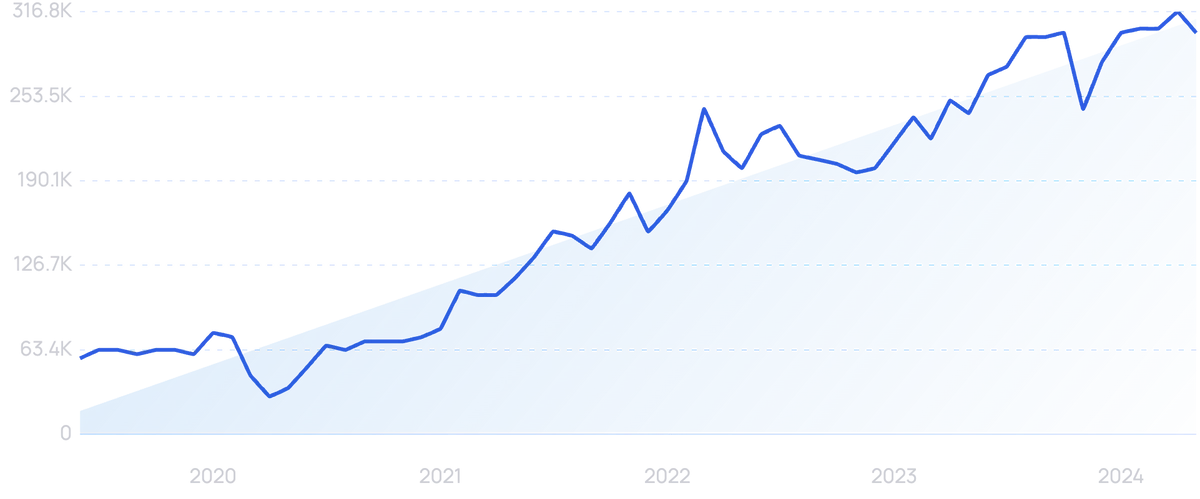

Search interest in “EV charging” has been climbing since 2021.

Instead of going through the process of working with utility providers, ItsElectric partners with owners of residential buildings. The charging stations are located on the sidewalk and pull power from the building’s electricity.

Curbside EV chargers from ItsElectric are operated via the driver’s smartphone.

The company reports that they have orders for hundreds of chargers in various cities.

And, there’s the final step in EV operations: disposing of old batteries.

Estimates show that 12 million tons of batteries will be retired by 2030.

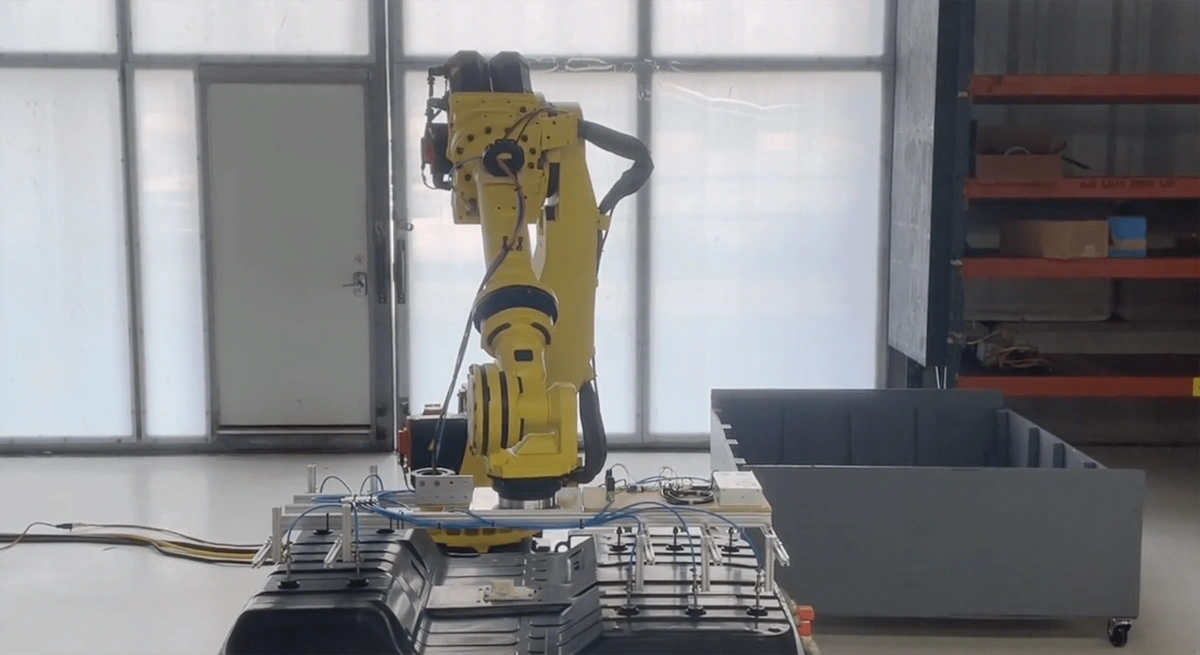

Posh Robotics is one startup that’s looking to put those batteries back to work.

To start, the company produces battery packs with the intent of recycling them in the future.

When the batteries are ready to be recycled, Posh automates the process with computer vision and robotic arms, turning a manual and time-intensive process into one that’s quick and safe.

The battery’s components can then be reused for other functions.

The automated disassembly process eliminates human exposure to hazards.

The company brought in $3.8 million in seed funding in June 2022.

5. A New Wave of Drug Discovery Startups

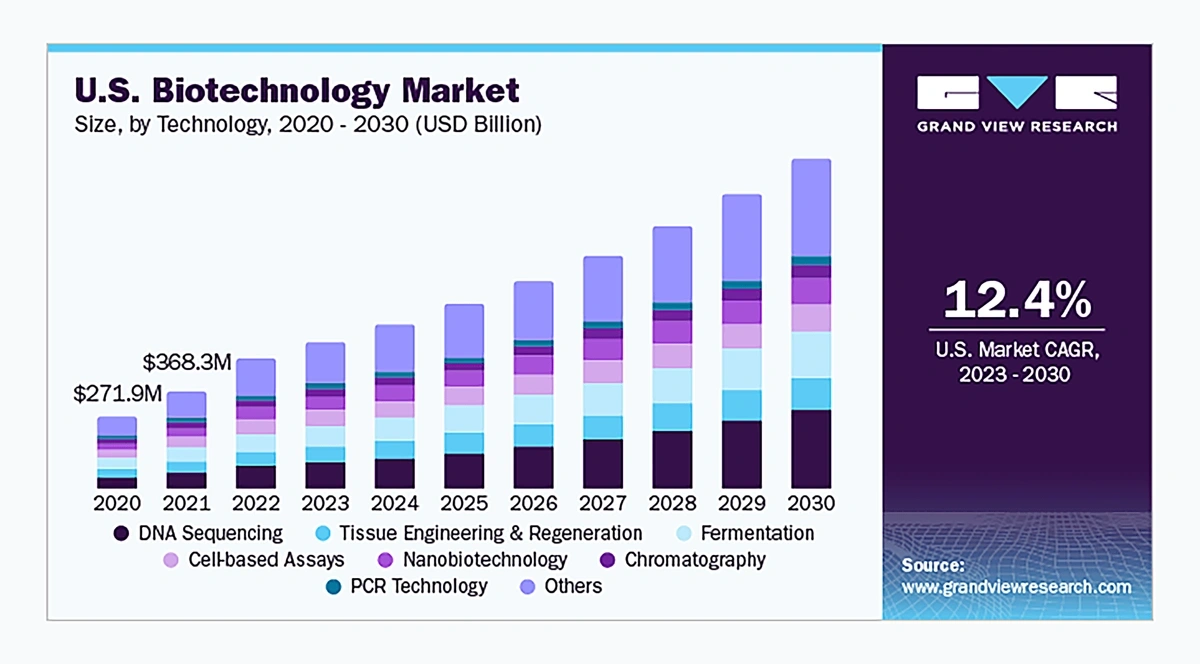

The biotech industry is already valued at $1.55 trillion and it’s expected to grow at a CAGR of nearly 14% through to 2030.

The biotech industry is showing sustained growth.

And that number may grow as biotech startups make more advances in diagnosing, treating, and preventing disease.

Biotech startups are already seeing a lot of interest from investors.

When considering the 130 US-based startups that posted funding rounds of $100 million or more in 2023, biotech startups were responsible for 34 of those rounds.

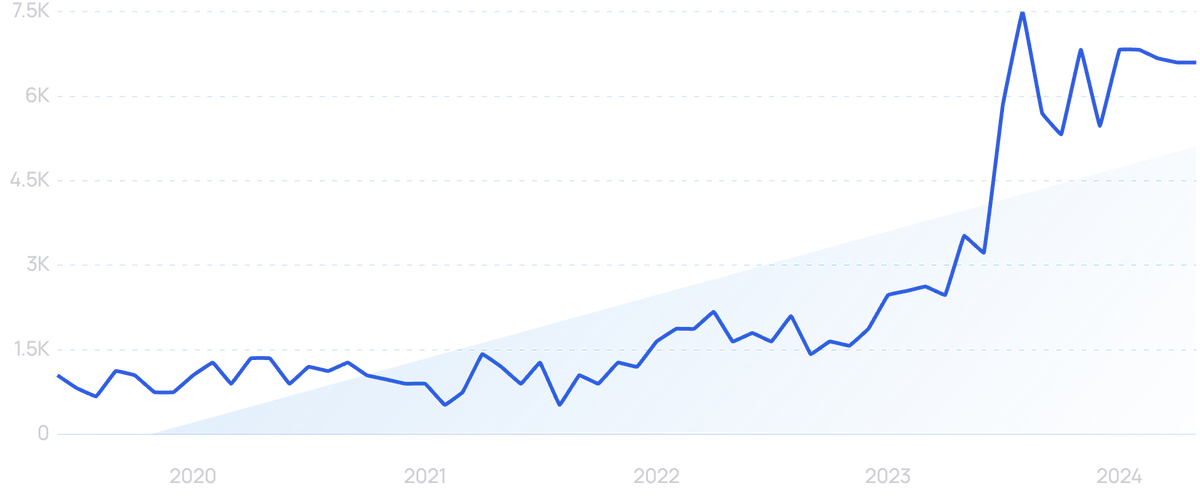

Drug discovery is one area that’s seeing a lot of attention because it incorporates AI/ML technology.

Search interest in “AI drug discovery” has increased 529% since 2019.

One survey reported that 70% of industry respondents who do not currently use AI said they expect the technology to drive a significant or transformative impact in drug discovery in the next five years.

Evozyne, founded in 2020, is one startup aiming to do just that.

The biotech firm has created algorithms that enable the rapid studying of proteins, simulating their evolution over millions of years and identifying new roles in drug development.

Evozyne’s biotech developments are focused on proteins.

Evozyne recently closed a Series B investment round worth $81 million.

One of the most successful startups in the AI biotech space is Genesis Therapeutics.

Genesis Therapeutics has created its own AI platform that specializes in small-molecule drug discovery.

Their technology is centered on using AI to create 3D modeling and molecular simulations.

Genesis’ most recent funding round netted $200 million.

The largest Series C funding round for a biotech company in 2023 came from Generate:Biomedicines.

The $273-million funding round brought the company’s total amount of funding to $700 million.

Generate:Biomedicines says their platform can generate custom protein drugs using a combination of machine learning and bioengineering.

Their first human trial, an antibody therapy for COVID-19 that took just 18 months to develop, began in mid-2023.

The company hopes to have another drug, a medication for severe asthma, in human trials in 2024.

6. Funding for Metaverse Startups Drops

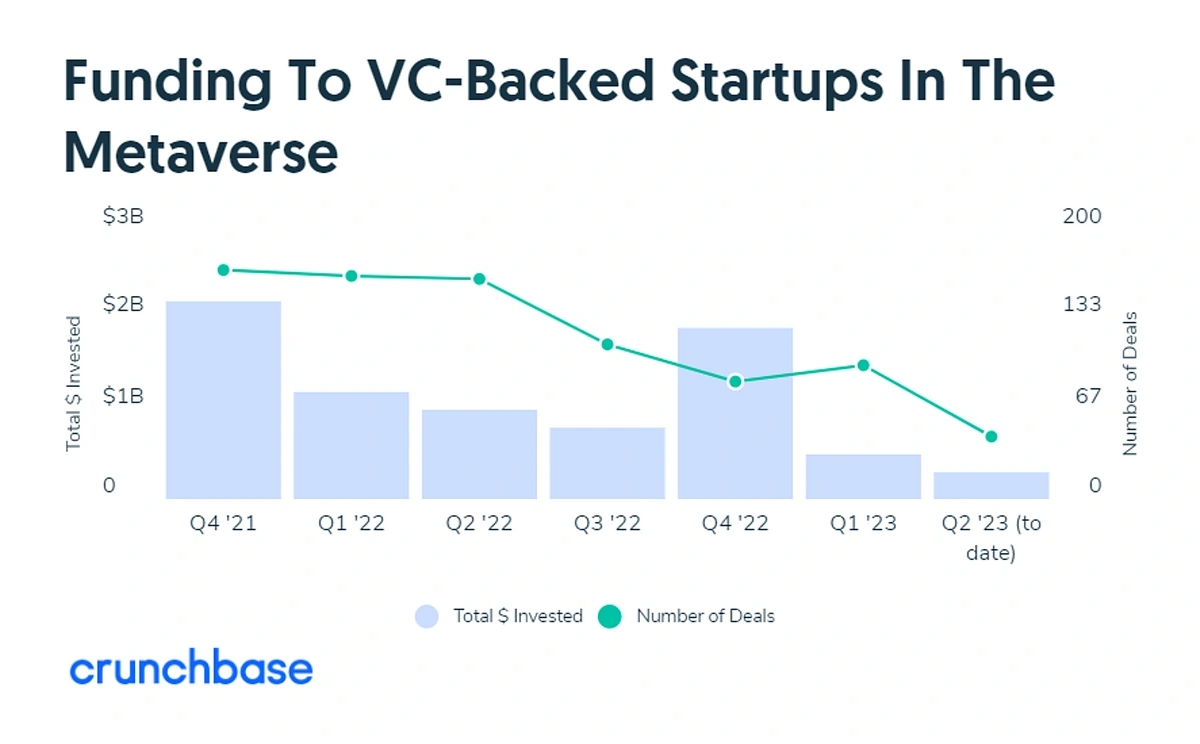

In the final quarter of 2021, startup funding for metaverse companies topped $2 billion.

Fast forward to the second quarter of 2023 and funding plummeted to just $300 million.

Funding for metaverse startups surged in the final months of 2022 but sharply declined in 2023.

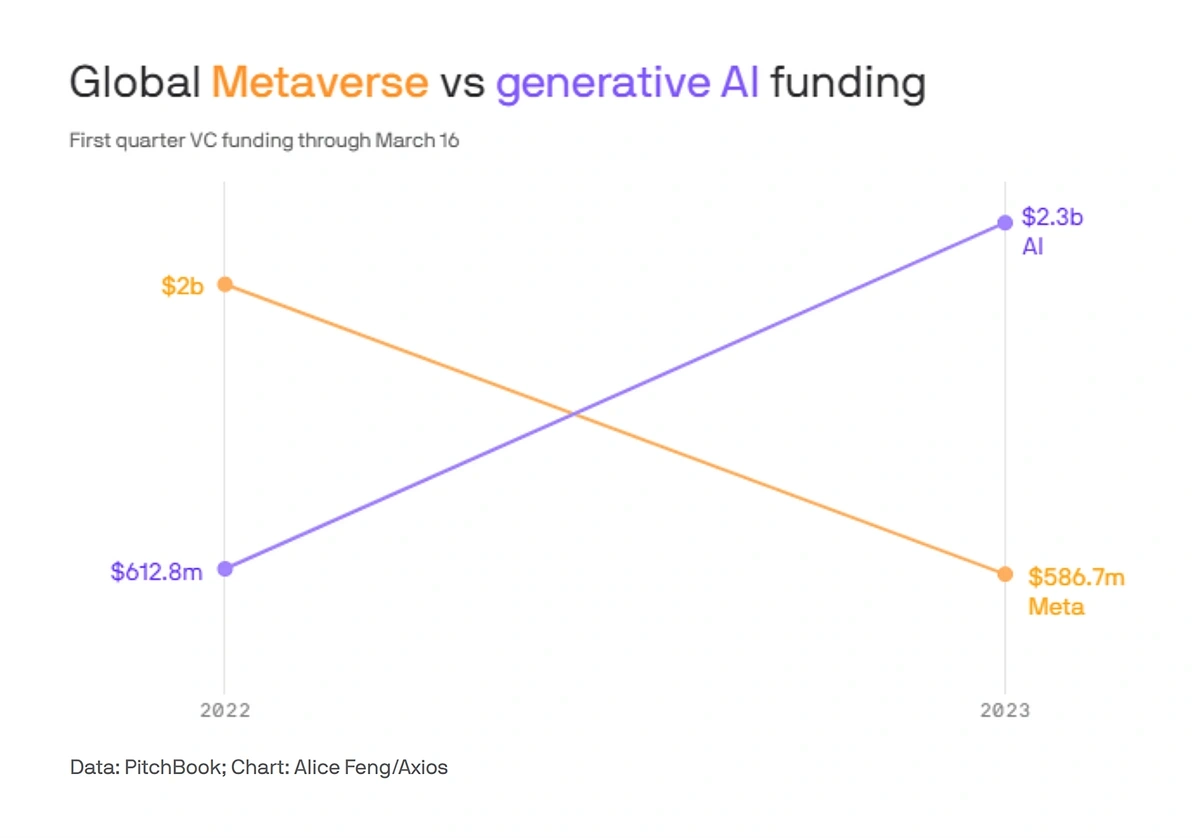

Data shows that funding for metaverse companies has dropped as investors flock to funding generative AI projects.

Funding for metaverse startups has decreased while funding for generative AI projects has increased.

Despite this, predictions show the total value of the metaverse market could grow by a CAGR of 48% through 2030 to land at $1.3 trillion.

Some startups are betting on this growth projection and entering the market despite funding challenges.

Take Futureverse, for example.

The company, formed in 2022, closed a $54-million Series A funding round in mid-2023.

Futureverse’s platform is broadly applicable to the metaverse. It uses AI to generate all sorts of metaverse content like music, characters, and animations.

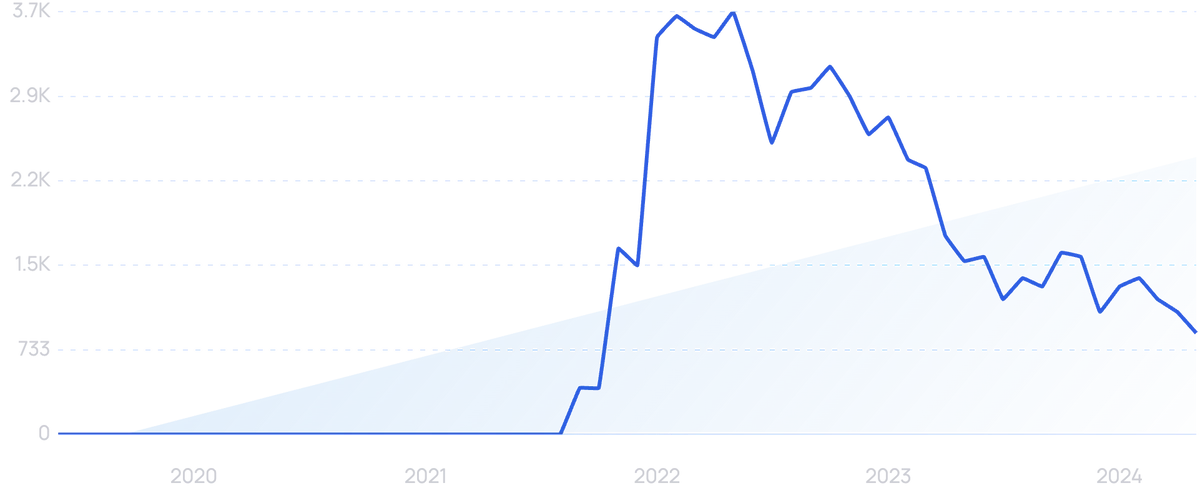

Search volume for “metaverse marketing” has been up and down since 2022.

They’ve already launched AI League, an AI-powered soccer game available on Android and Apple devices.

The players in AI League feature custom wearables and AI skills.

In another example, Geeiq is a metaverse digital metrics and intelligence startup.

Geeiq’s platform is especially relevant for businesses that need data intelligence from Roblox.

The company has already partnered with big names in fashion like Ralph Lauren, Gucci, and Tommy Hilfiger.

In September 2023, Geeiq completed an $8.2 million Series A funding round.

The future of metaverse startups remains unknown and tech experts are split on their predictions, too.

In a survey from the Pew Research Center, 54% of tech insiders say they expect the metaverse to be a refined platform that’s truly immersive by 2040. However, 46% of respondents said this will not happen by 2040.

7. Satellite Startups Dominate Space Tech

Like many other startup sectors, investments in space tech have been impacted by the current economic downturn.

However, total investment in the second quarter of 2023 totaled $818 million. That was double that of the first quarter. The median deal size also doubled during that time.

And big funding rounds came in for three growth-stage companies:

- Ursa Major: The startup is solely focused on building rocket engines and raised $100 million in a Series D funding round.

- Constanellis Aerospace: The startup hopes to go to the moon in 2024 and raised $78.9 million in a Series A funding round to support that goal.

- Astranis: The satellite-building startup raised $200 million to bring its valuation to $1.6 billion.

Search interest in “Astranis” has jumped nearly 363% in the past 5 years.

Industry experts say satellite imagery startups seem to be the sure bet of this sector as investors see them as safe and demand is relatively predictable.

Deloitte reports that the amount of data moving between Earth and space will total 500 exabytes by 2030. That’s a 14x increase over 2020.

Deloitte notes that challenges associated with space tech have diminished significantly in recent years.

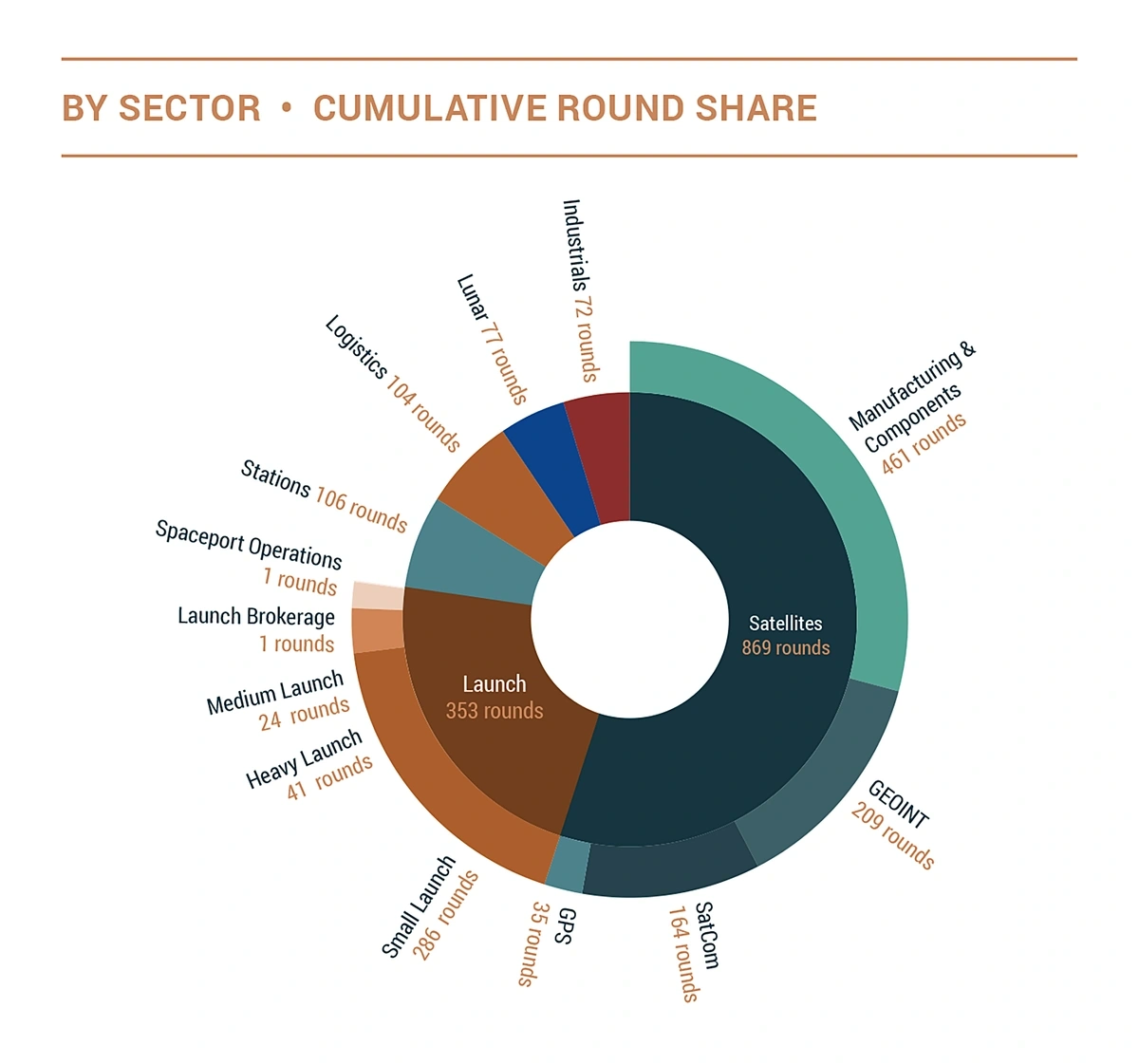

Investment data backs up predictions regarding the importance of satellite technology.

In the past two years, investment in satellite-focused companies has amounted to nearly 30% more capital than investment in launch-oriented firms.

Investments in the satellite sector are growing faster than investments in the launch sector.

Pixxel is a satellite startup that’s building space satellites so powerful they can identify the tree species present in a forest.

In fact, the company says its satellites are 10 times more powerful than traditional satellites that are currently deployed in orbit.

The startup has raised $71 million to date, including a $36 million in a Series B funding round in June 2023 that was led by Google.

There’s also Seattle-based Starfish Space, a startup that aims to provide satellite maintenance at a reasonable price.

Starfish Space is focused on finding a way to repair satellites in space.

The company’s first major objective is to dock two commercial satellites in orbit.

However, their first mission nearly ended in catastrophe. A glitch caused their spacecraft to go tumbling through space but engineers on the ground were able to pull it back under control.

Still, Starfish has garnered about $22 million in funding and was recently tapped by NASA to investigate the possibility of using Starfish technology to inspect space debris up close.

8. Startups Focus on Specific Use Cases for Drones

Crunchbase reports that seed and venture funding to drone-related startups eclipsed $1.51 billion in the first seven months of 2023.

That number is on track to surpass 2022 when the annual equity funding hit $1.6 billion.

Drone startups specialize in everything from light displays to defense weaponry and surveillance to the delivery of goods.

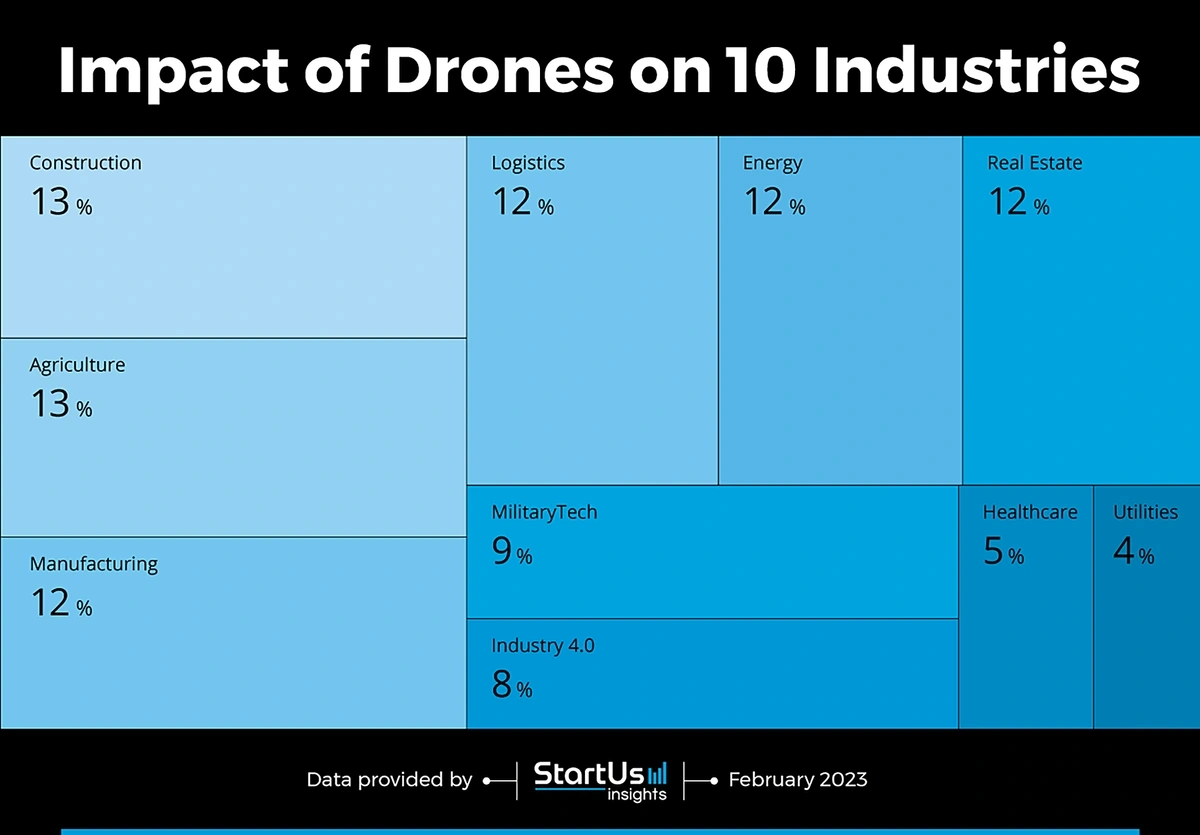

The use of drones is expanding to a variety of industries.

In the United States alone, there are more than 1,300 drone startups.

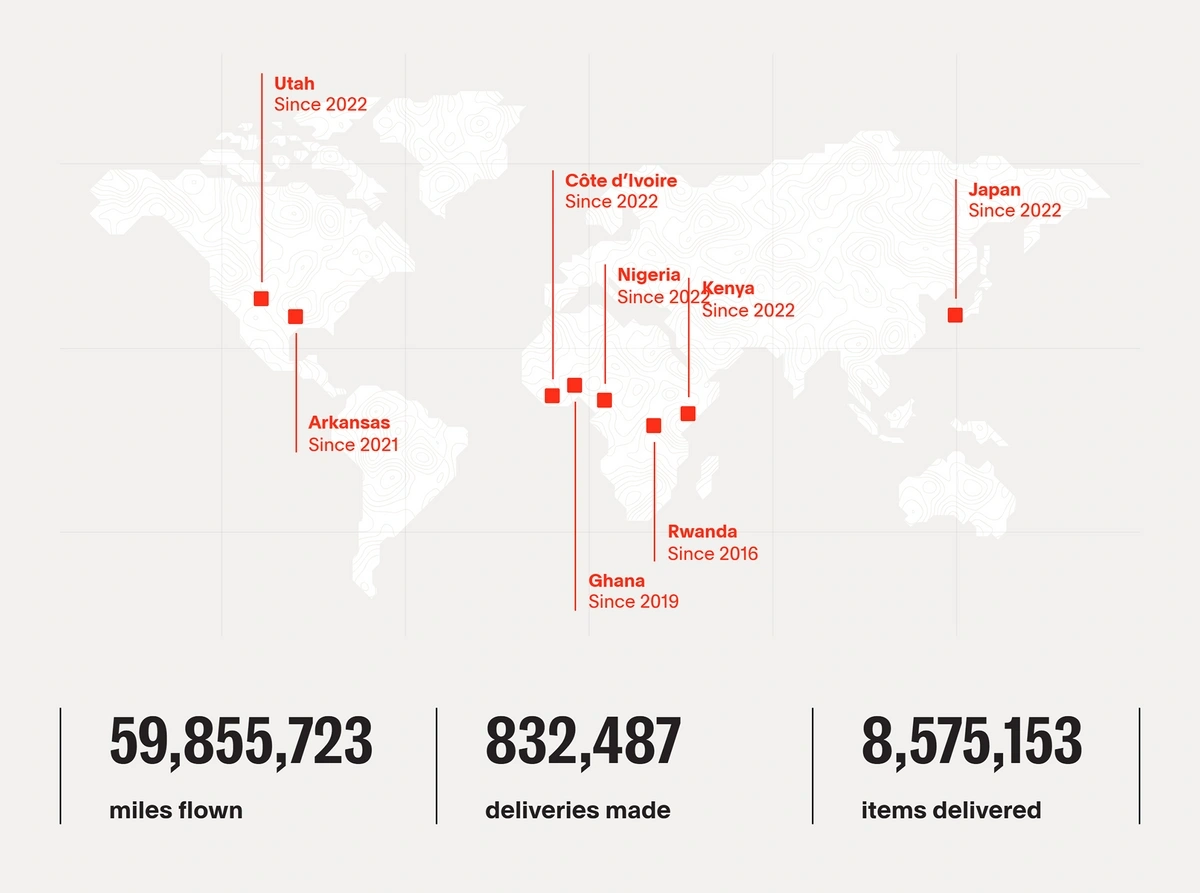

Zipline is one of the most successful.

The startup offers fulfillment and drone delivery to organizations and to residential homes. Their service delivers consumer healthcare products, restaurant orders, grocery items, and urgent public health products.

So far, they’re operational in seven countries and have already flown 59 million miles.

Zipline has drone delivery systems on three continents.

In August 2023, the company raised $330 million and was valued at more than $4 billion — the highest valuation of any drone delivery company in the world.

Zipline is also expanding deliveries in the US.

A Seattle-based pizza restaurant, a medical courier service, and GNC recently announced they would partner with Zipline for deliveries.

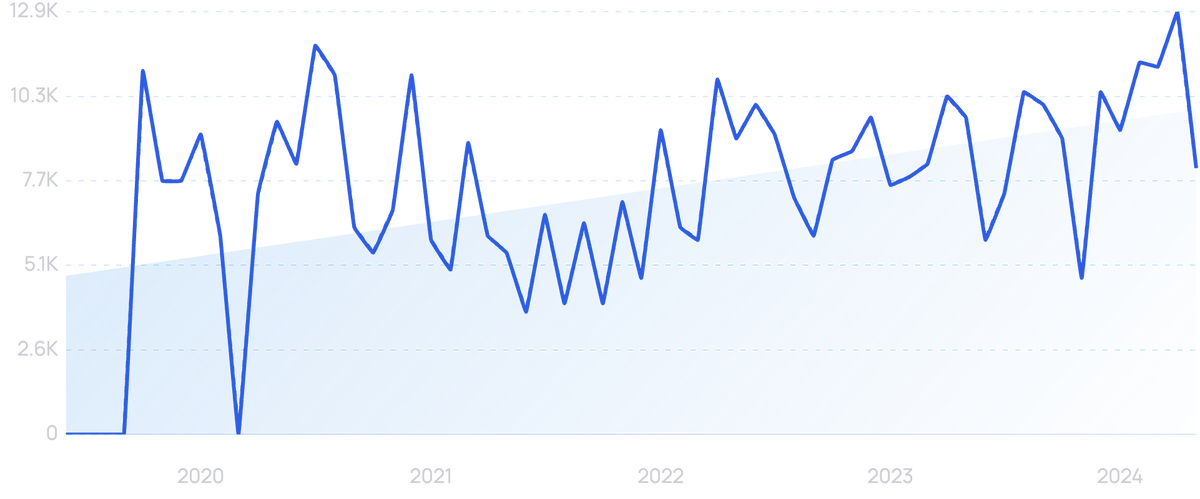

Skydio is another billion-dollar drone startup.

In the past 5 years, the search volume for “Skydio drones” has grown 6,200%.

Valued at $2.2 billion, the firm closed a $230 Series E funding round in early 2023.

That valuation is double what it was just two years ago and the company has reported 30x growth since 2020.

As the largest drone manufacturer in the United States, Skydio builds drones for a mix of functions — government, consumer, and enterprise. The drones perform a variety of tasks such as bridge inspection, battlefield surveillance, search and rescue, power plant inspection, and more.

Startups are also developing drones for indoor use, especially for the purpose of tracking warehouse inventory.

Verity is one such startup that’s seen recent success with investors.

The firm raised $43 million in 2023.

Its small, nimble drones are flying in 16 IKEA warehouses across Europe.

Verity’s drones track warehouse inventory.

9. Shining a Spotlight on Diversity in Startup Funding

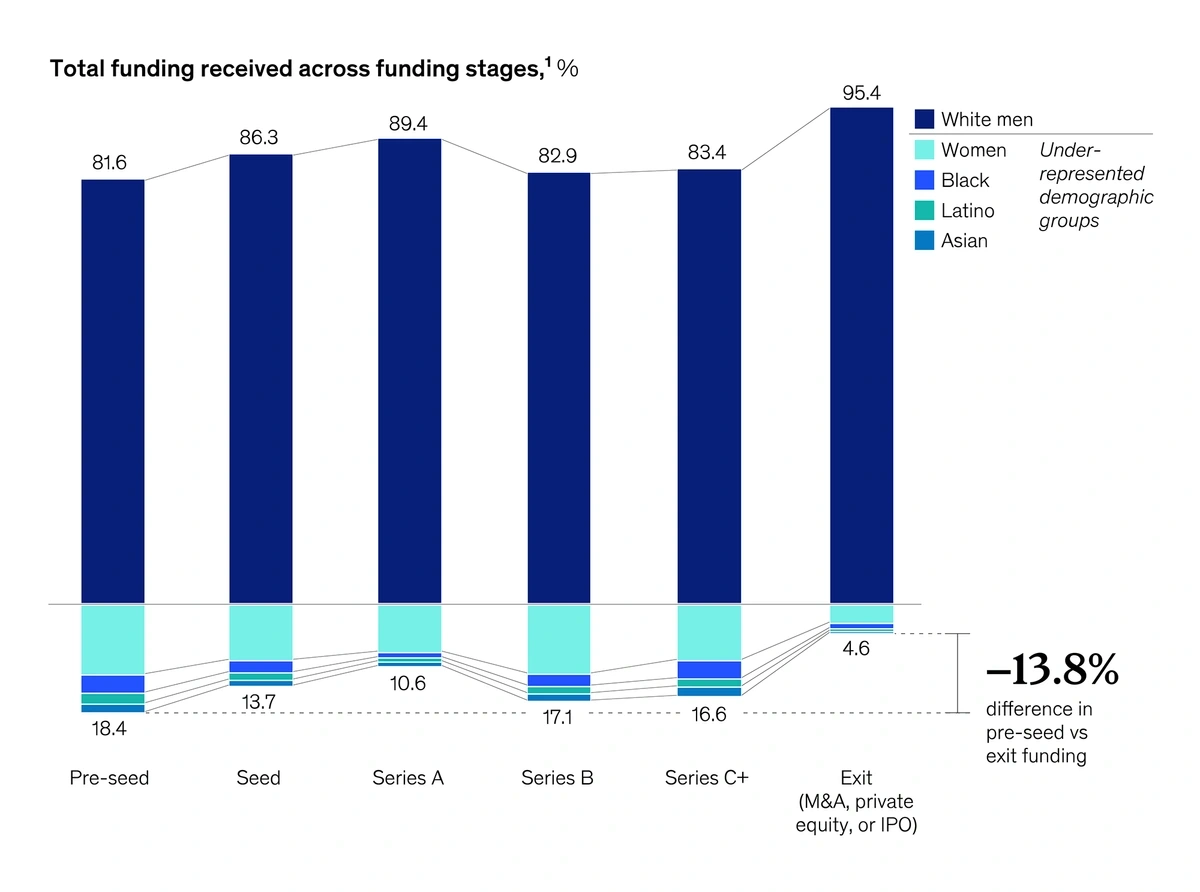

Funding for startups headed by Blacks, Latinos, women, and other minorities is remarkably low. But some in the investing space are hoping to change that.

McKinsey research shows the average startup led by white males receives more than $210 million in total funding while the average startup led by minority founders garners $91.1 million, just 43% of the funding given to startups led by white males.

Startups founded by underrepresented demographic groups receive dramatically less funding than businesses founded by white men.

In particular, startups led by Latinos are impacted by a lack of private equity and venture capital.

Even though Latinos in the startup community represent a combined value of $2.6 trillion, Lainto entrepreneurs receive less than 1% of total invested capital.

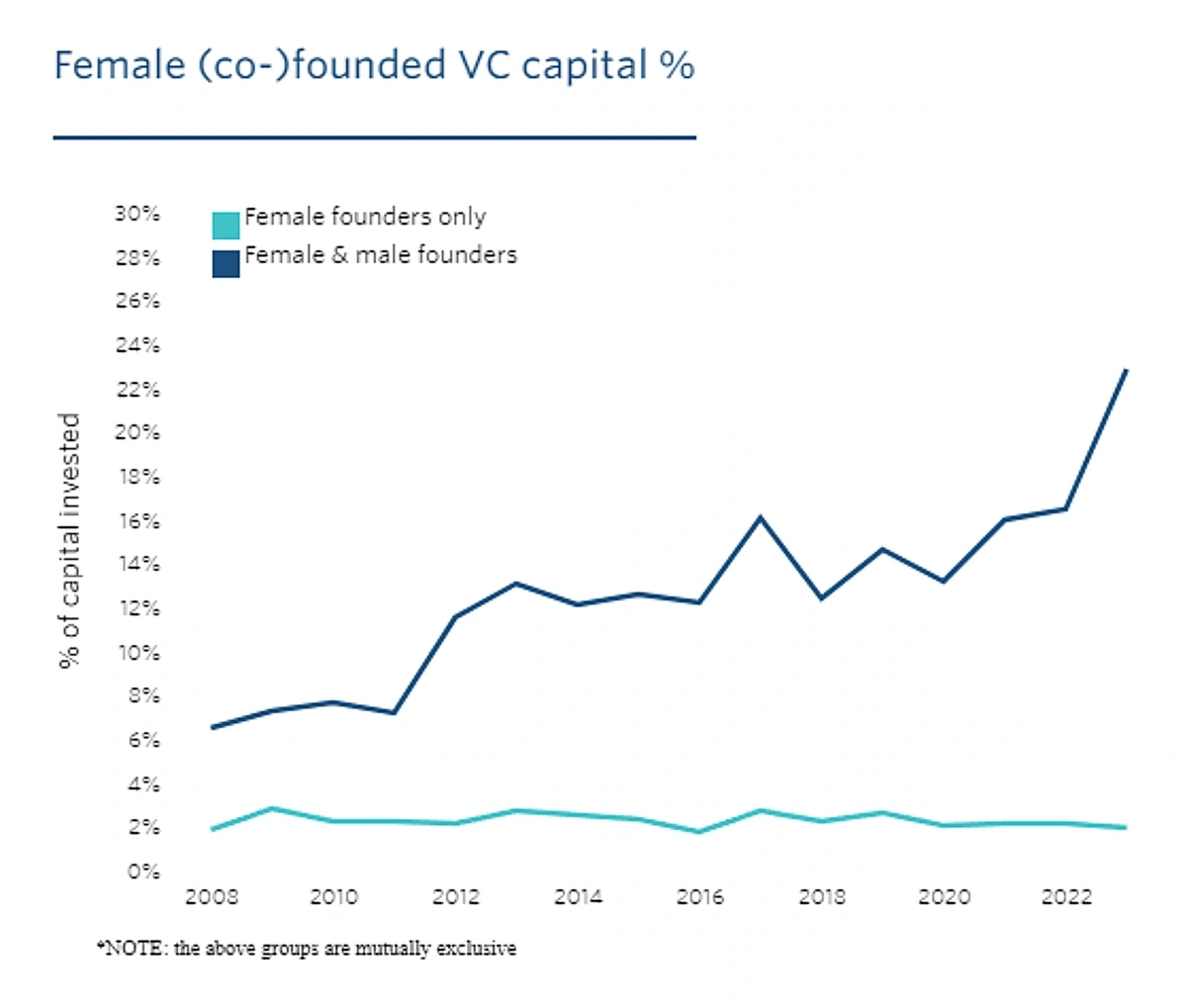

The data is similar when looking at female-led startups.

Pitchbook reports that startups founded by women accounted for just 2.1% of total capital invested in venture capital-backed startups.

More VC capital is invested in startups that have both female and male founders than in startups led only by females.

In 2022, that amounted to $4.3 billion in 926 deals.

However, most of the money marked as going to “diverse founders” is going to white women.

Research from BBG Ventures found that 79% of “diverse founders” seed funding went to white women.

Change does appear to be on the horizon.

In October 2023, California passed a law requiring VC firms to report data regarding the diversity of the startups they’re funding.

The law goes into effect in 2025.

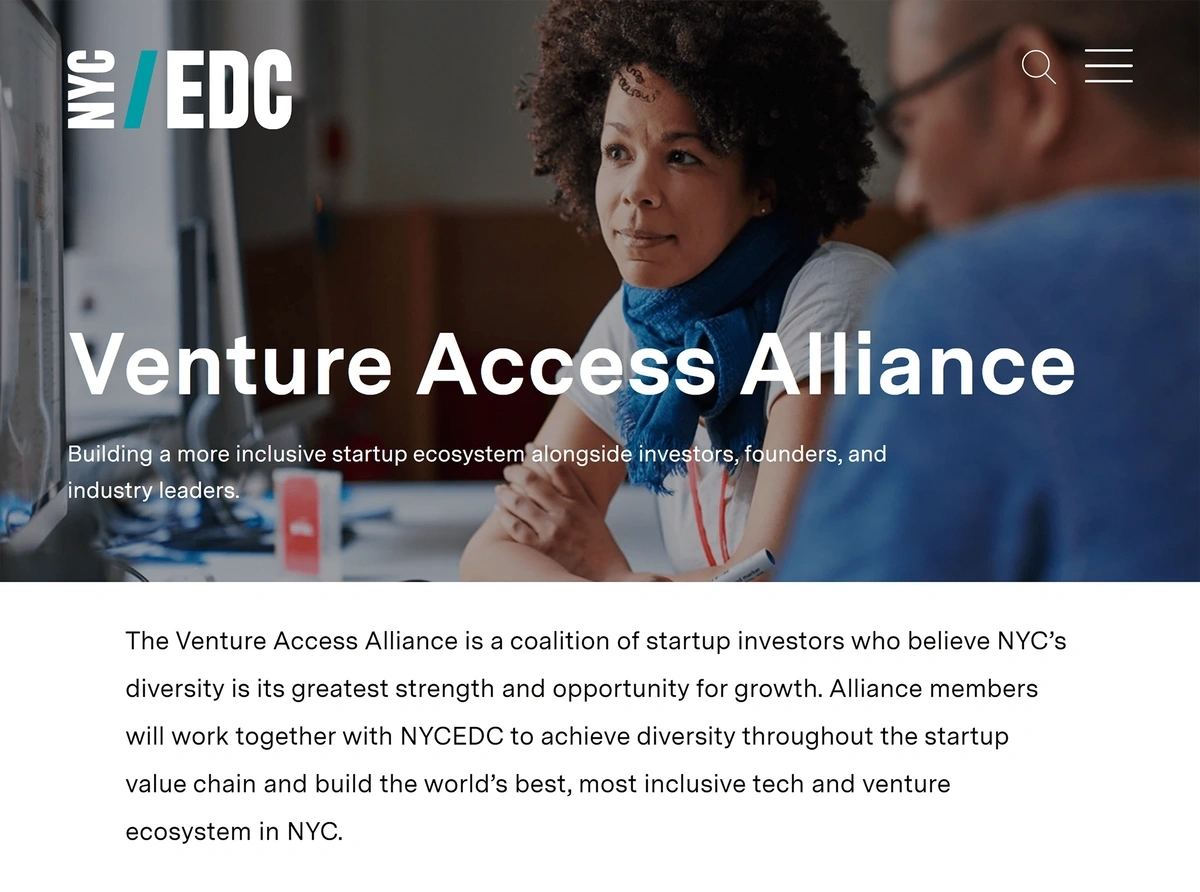

On the other side of the country, the New York City Economic Development Corporation is launching the Venture Access Alliance — a group of 70 investors committed to funding startups with diverse leadership.

New York City’s Venture Access Alliance is dedicated to incorporating diversity into venture investments.

Change is coming overseas, as well.

Unconventional Ventures is a firm recently launched in the Nordics region. They’re looking to invest in diverse startups in healthtech, food tech, fintech, and sustainable fashion.

The firm just wrapped up its second close on a $32 million fund.

10. Startups Hunt for Alternative Financing Sources

With the uncertainty surrounding the current economy, startups in need of funding are increasingly turning toward unconventional methods.

Non-dilutive funding is becoming a popular option.

This type of funding includes options like loans, grants, and government subsidies. And startups don’t have to give up any of their ownership to secure the funds.

For example, many states and metro areas offer non-dilutive startup funding to spur economic development.

Alabama Launchpad is one such program that offers up to $150,000 in non-dilutive funding through four startup competitions per year.

Alabama Launchpad hosts four startup competitions per year.

So far, the organization has funded 117 startups with $6.2 million.

On the other hand, some startups, especially growth-stage startups, are using venture debt as a way to supplement their financing.

Although venture debt took a huge hit when Silicon Valley Bank went under, demand is still there.

One private credit marketplace that grants venture debt deals up to $20 million says they’re handling 4x as many startups in 2023 as compared to 2022.

Venture debt has become a popular financing option for startups.

Simple agreements for future equity (SAFE) rounds are also becoming a valuable tool for startups.

SAFE funding doesn’t require a startup to settle on a valuation. Instead, the price is fixed in a future equity round.

This has become especially relevant in recent months as valuations have been under pressure.

Many firms believe SAFE funding is the best kind of deal for early-stage funding rounds.

One AI firm focused on the construction agency, Togal.AI, raised $5 million in a SAFE round in March 2023.

There’s also been an increase in crowdfunding for startups.

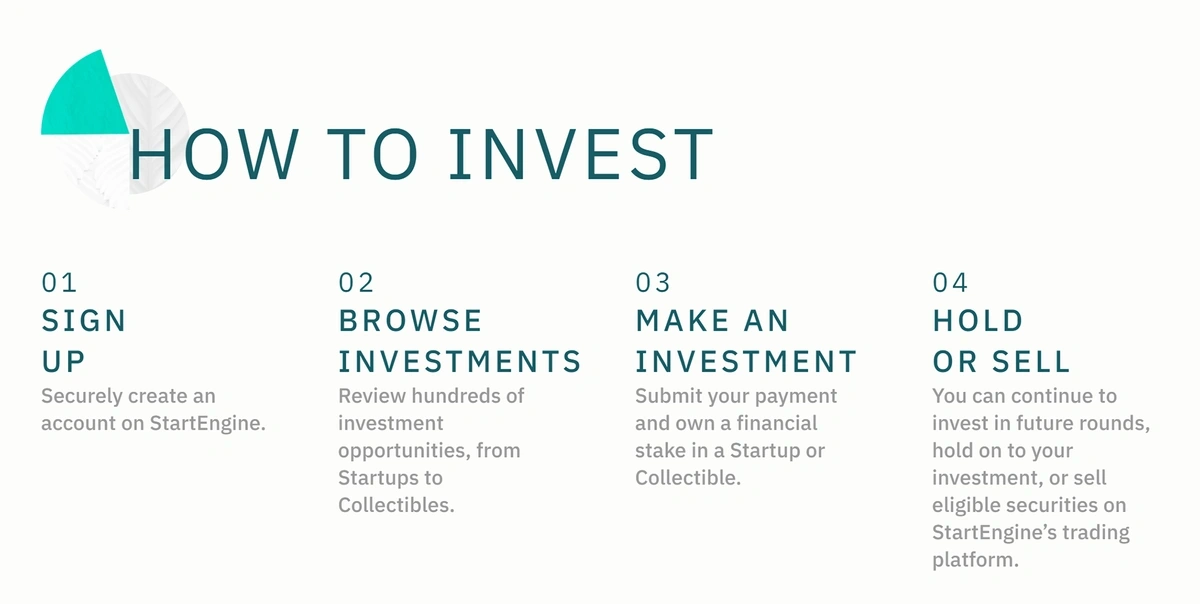

StartEngine is a crowdfunding platform that allows anyone to invest in startups.

Everyday investors have put more than $1 billion into startups via the StartEngine platform.

In 2023, StartEngine itself was valued at $1.32 billion.

During the year, it also acquired another investment crowdfunding platform called SeedInvest.

Timeplast, a startup that’s developed a type of plastic that completely dissolves in water, has raised $4.3 million on StartEngine.

Legion M, a film and television startup, has raised more than $3.5 million on the platform.

Investors can get started with Legion M for just $39.60.

Conclusion

There you have it: the 10 biggest startup trends for 2024 and beyond.

It’s clear that tech startups in the AI space are the most popular right now. But if interest in AI wanes in the coming months, that could change.

Still, tech startups in other sectors like agriculture, space, and climate have the potential to make big moves in the near future.

Either way, new technologies and disruptive ideas continue to spur massive changes in the startup world.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more