Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 11 Retail Trends (2024 & 2025)

You may also like:

In 2024 retail brands need to be able to connect with consumers across multiple channels. And provide them with the personal shopping experiences they crave.

It’s a tall task, but tech solutions (like AI) are making these efforts a bit easier.

In this guide, we'll outline how consumer behavior, emerging technology, and economic conditions are impacting retailers.

Here are the top 11 retail trends you need to know.

1. Retailers Use AI to Boost Sales and Efficiency

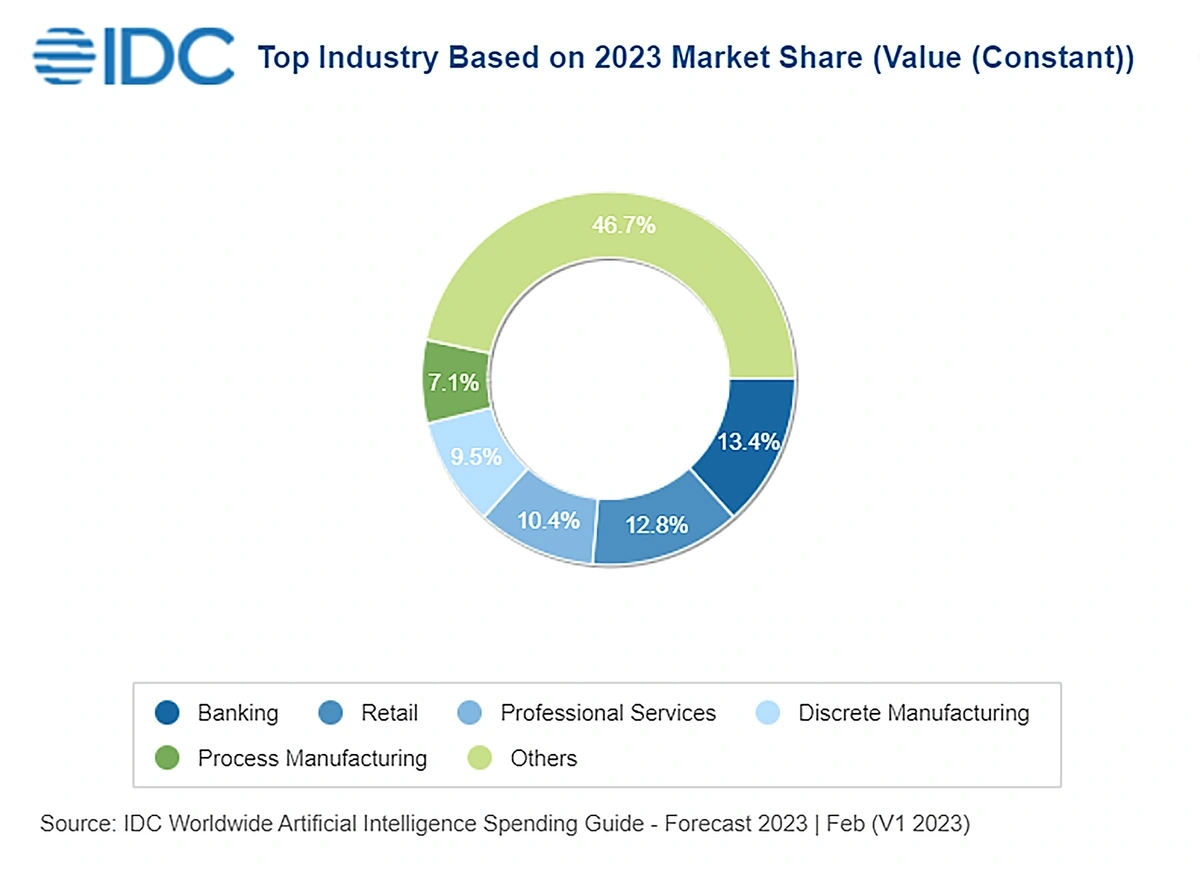

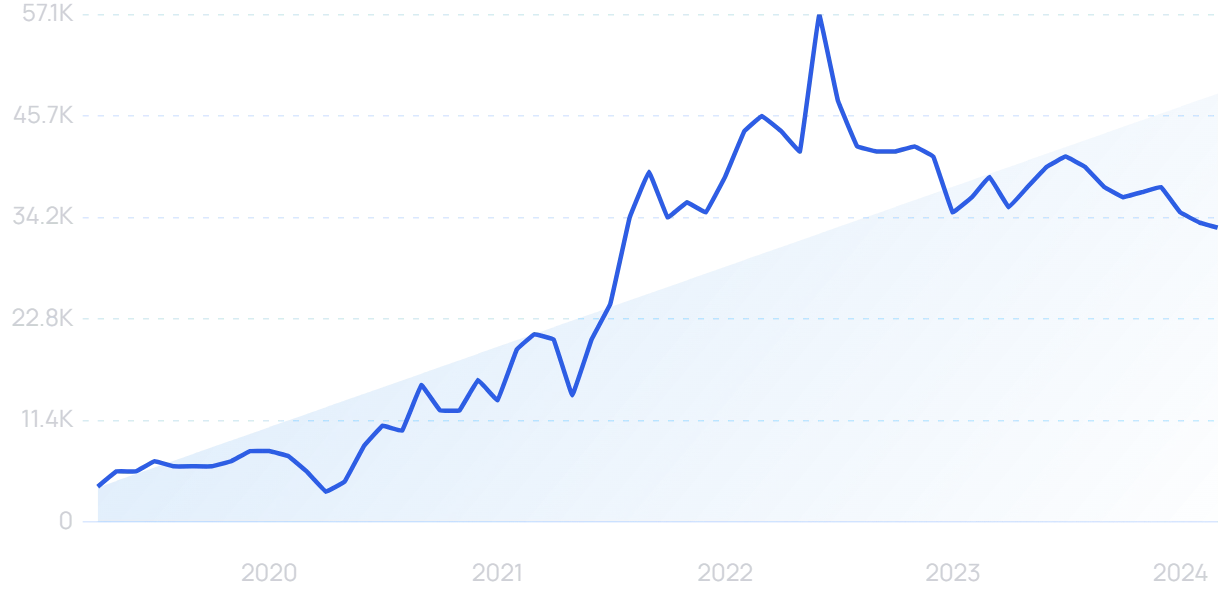

Artificial intelligence and machine learning solutions are impacting nearly every industry, but according to IDC, these technologies are especially prevalent in the retail sector.

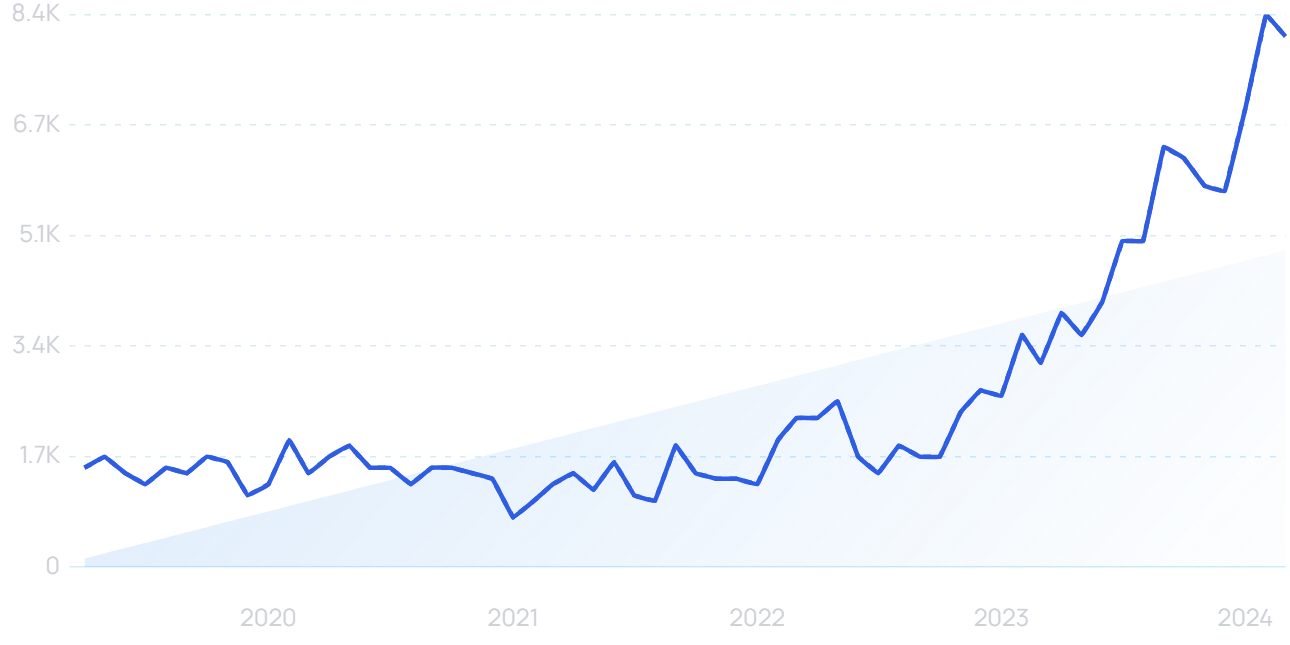

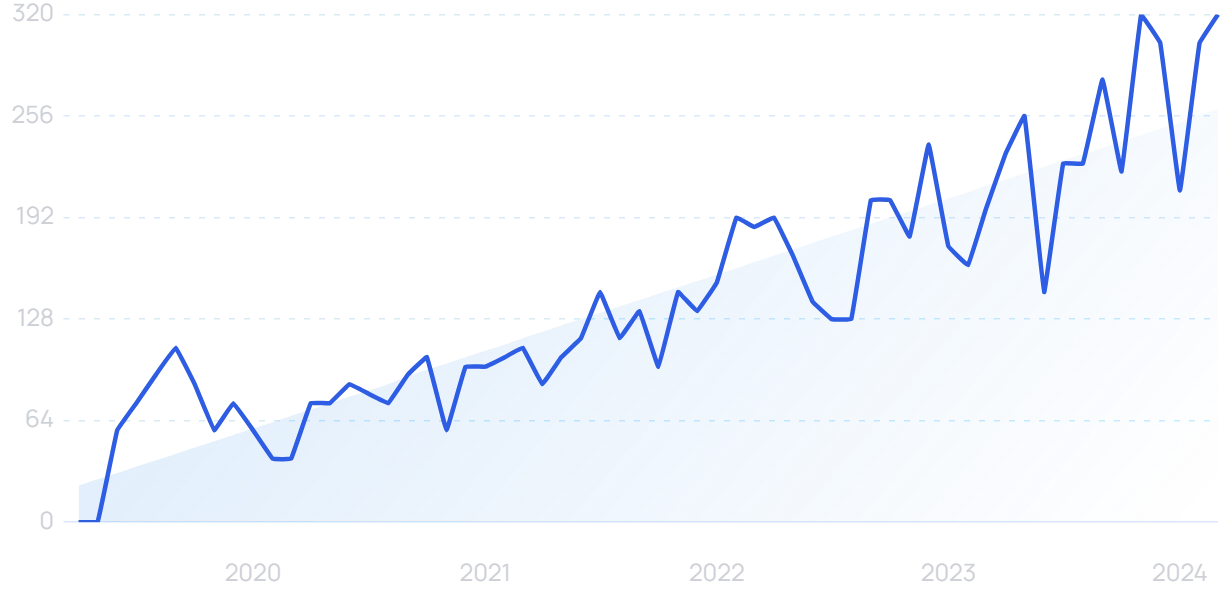

Search volume for “AI in retail” has grown nearly 600% since 2020.

IDC’s data ranks the retail sector as second among all industries when it comes to spending on AI technologies.

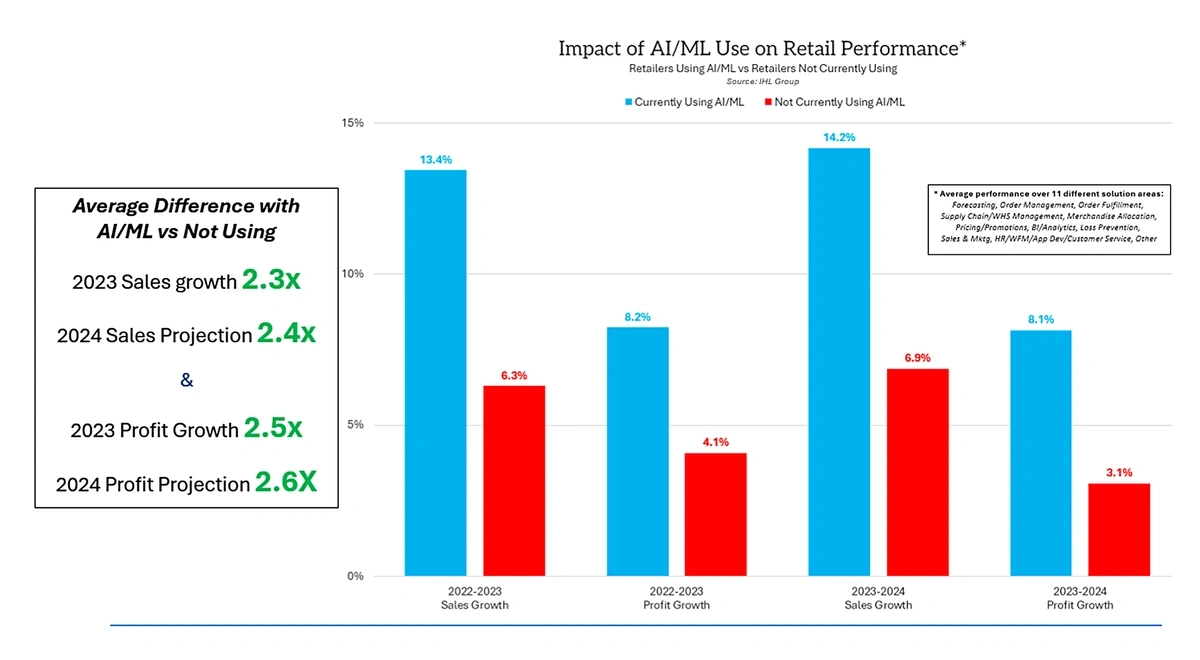

Notably, this increase in AI spending is paying off.

A recent study showed that retailers using AI/ML solutions saw sales grow by 2.3x and profits grow 2.5x that year compared with their competitors who had not adopted the technology.

The study predicted a similar performance for 2024 with a 2.4x growth in sales and 2.6x growth in profits compared to retailers that are not using AI/ML.

Retailers that adopted AI/ML solutions saw much higher growth in 2023.

So exactly how are these AI/ML solutions helping retailers drive growth?

One way is using AI to offer personalized product recommendations.

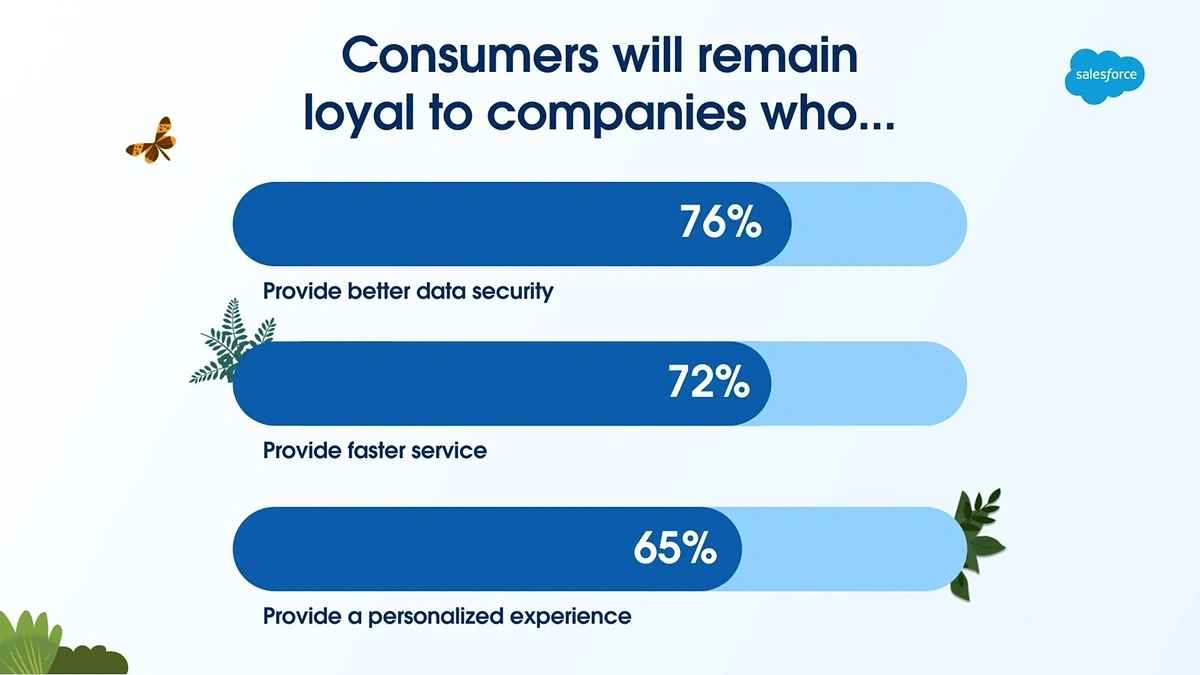

Personalized recommendations are important to customers—65% say they’ll remain loyal to a retailer that offers a more personalized experience and 33% say they’re frustrated by irrelevant product recommendations.

Providing a personalized experience is one of the top three ways companies can encourage customer loyalty.

A Deloitte survey showed that half of retail executives are planning to prioritize this strategy in 2024.

These AI-powered recommendation engines analyze a consumer’s previous behaviors, purchases, and search queries in order to specifically highlight products the consumer is most likely to buy.

It’s no surprise that Amazon is already a leader in this type of technology.

Salesforce reported that a significant amount of sales during Amazon’s Prime Big Deal Days in the fall of 2023 were prompted by AI recommendations.

In both the handbags and active apparel categories, 15% of sales were driven by AI.

Another major way in which retailers are utilizing AI is to increase operational efficiency.

More than 70% of retailers that have adopted AI already say they’ve seen a decrease in operating costs. That’s according to a survey from Nvidia.

AI solutions can be instrumental in preventing retail theft.

These organizations use AI to manage inventory, enhance loss prevention efforts, analyze store analytics, and provide adaptive pricing.

AI is also instrumental in improving supply chains.

The technology can predict surges in demand and guide retailers to optimize inventory in advance of sales and promotions.

Fashion retailer ASOS began using AI to forecast demand in 2023.

Company officials say the technology provides them with “granularity and accuracy” that wasn’t available before they implemented AI.

2. Increasing Consumer Demand for Same-Day Delivery

Speedy shipping continues to be a top priority for retail consumers.

Same-day delivery is moving from a nice-to-have feature to a must-have feature for retailers.

Nearly 70% of customers say the speed of delivery is an important factor when it comes to buying products online.

Nearly 25% like to see next-day shipping availability and 17% want same-day delivery options.

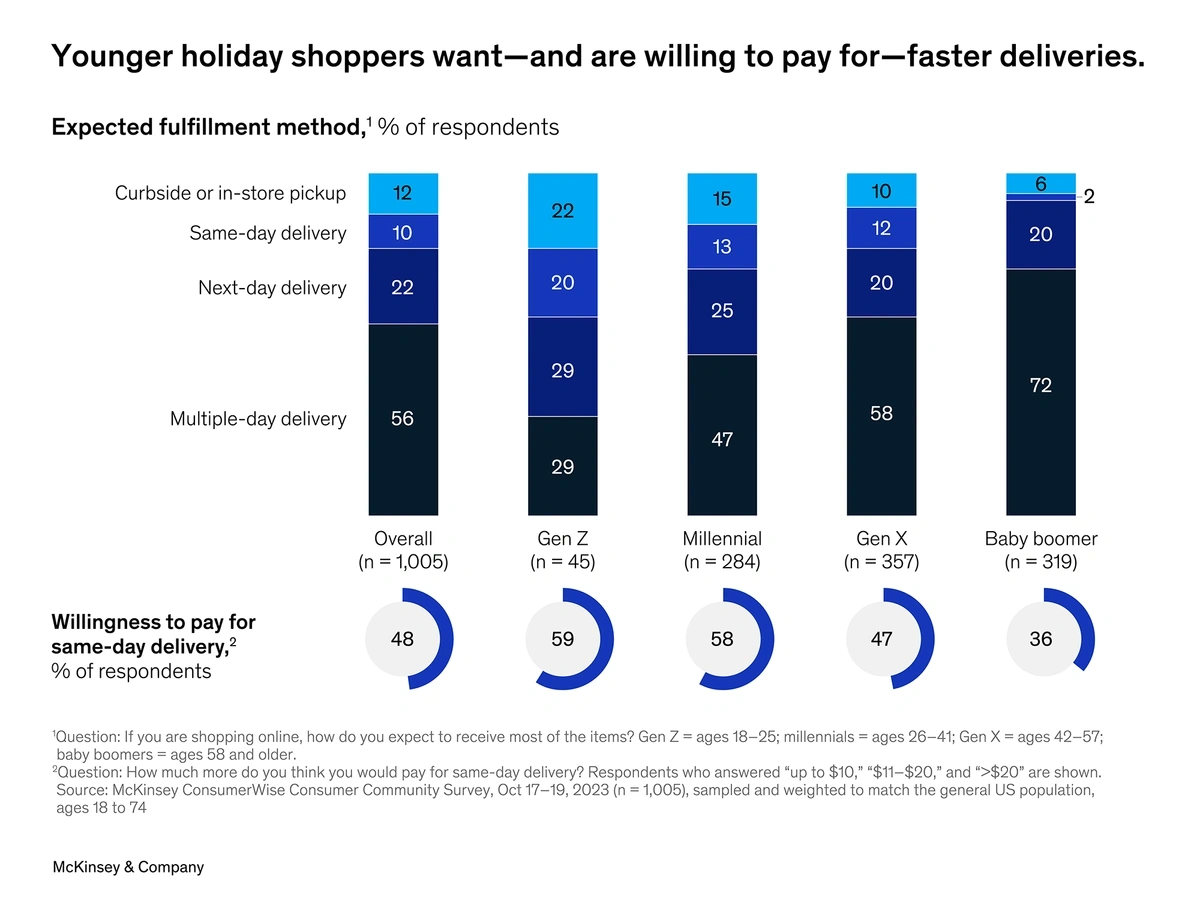

Same-day delivery is most important to young generations, McKinsey reports.

20% of Gen Z expects same-day delivery and nearly 60% of Gen Z is willing to pay for same-day delivery.

More than half of Gen Zers and millennials are willing to pay for same-day delivery.

Some big-box retailers are offering expanded delivery options in hopes of luring customers based on convenience.

In March 2024, Walmart announced they’d start making deliveries to customers’ homes as early as 6 a.m. In the past, their earliest deliveries were scheduled at 8 a.m.

That follows the retailer’s announcement from September 2023 that late-night deliveries would go out as late as 10 p.m. at nearly 4,000 stores.

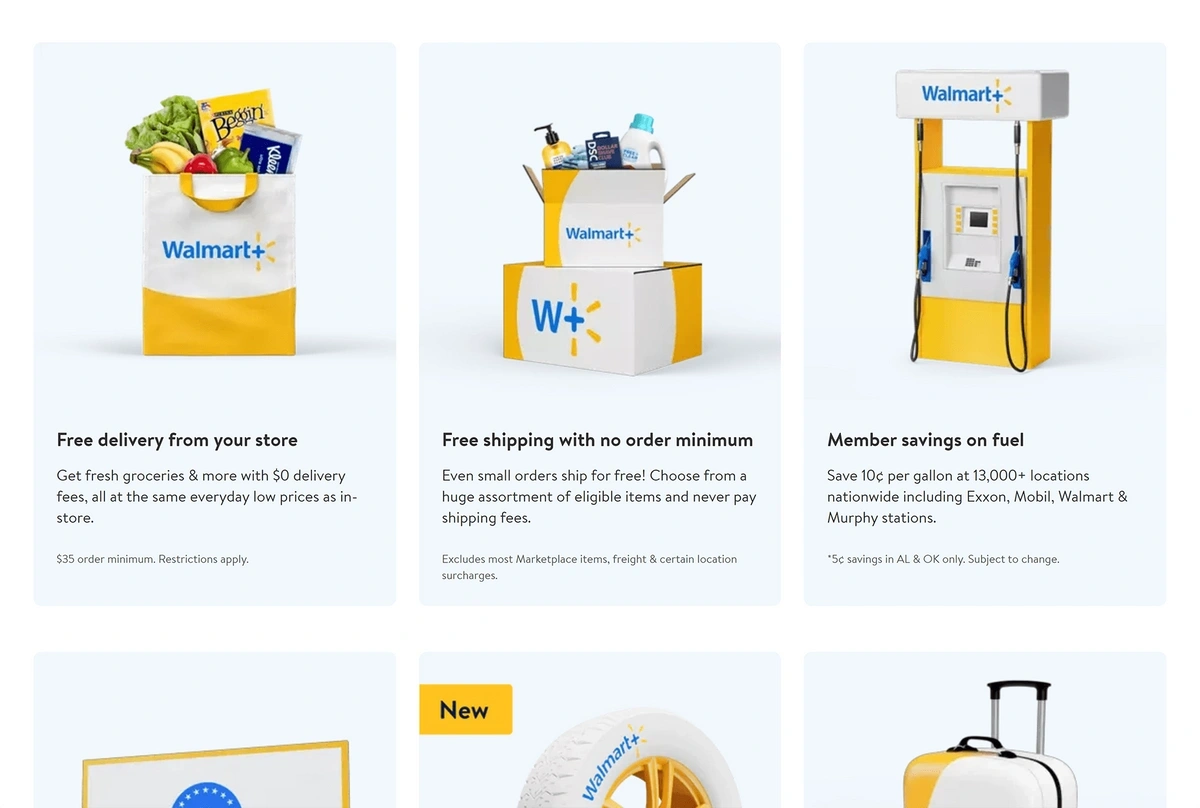

With Walmart+, customers get free home deliveries as early as 6 a.m.

Though it may be more readily associated with its 10,000+ physical locations, Walmart's delivery offerings have helped cement it as an online giant too. The Walmart website gets 527 million monthly visits.

Target, the 16th-most-visited retail website globally, has followed suit by announcing a new Target 360 loyalty program. Free same-day delivery is one perk of membership.

On a broader scale, DoorDash is continuing to position itself as a retail delivery platform.

Company officials said they delivered for just a few dozen retailers three years ago, but they’ve now become a delivery provider for hundreds of retailers.

And very soon, retailers could be delivering products in a whole new way: via drones.

Amazon has been piloting a drone program for a few years now.

The MK30 is Amazon’s latest delivery drone.

Amazon recently expanded the program to include pharmacy orders. These drones are delivering medications to customers in College Station, Texas, in 60 minutes or less.

Walmart is testing a program in Texas, too.

The retailer says that 75% of the Dallas-Fort Worth metro area will be eligible for drone deliveries by the end of 2024.

3. Retailers Attract Shoppers with Entertaining Experiences

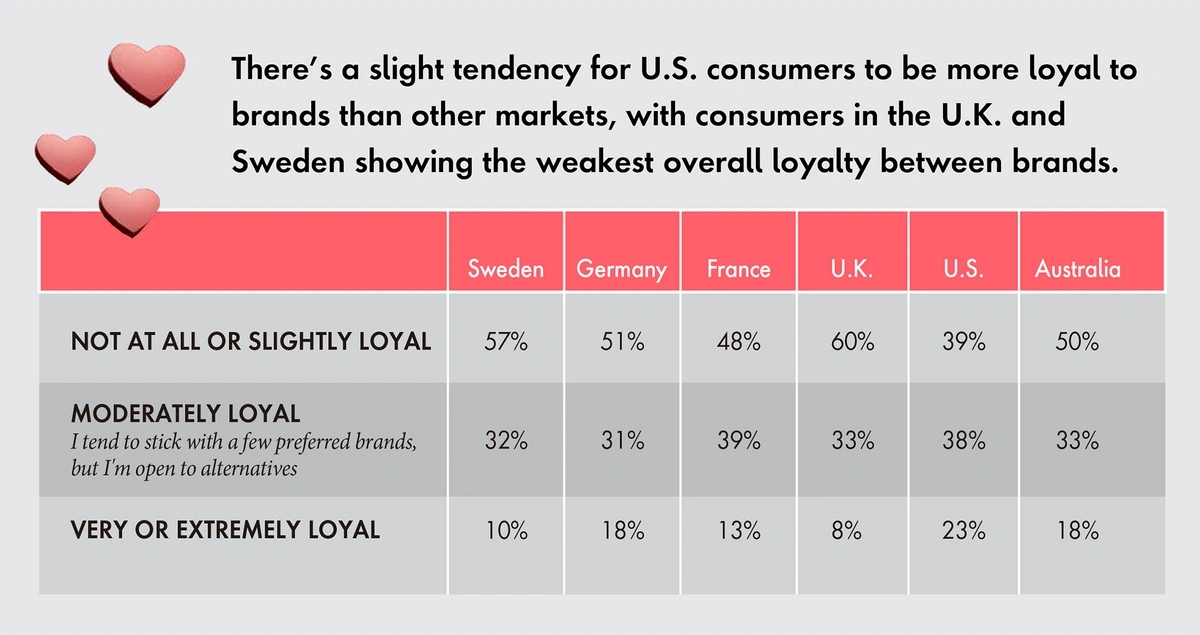

Just 23% of Americans say they’re “very” or “extremely” loyal to brands.

Nearly 40% of U.S. consumers say they are not loyal at all or are only slightly loyal to brands.

But retailers are trying to change that.

One strategy is offering experiential retail, a shopping experience that’s memorable enough to develop customer loyalty.

More than half of consumers say they’ll return to a brand that offers a positive shopping experience online or in-store.

In addition, more than 60% of shoppers say they want brands to give them a multisensory shopping experience.

Aldo, a shoe retailer, leaned into this trend in late 2023 when they hosted a unique pop-up store in New York’s Astor Place.

The pop-up shop celebrated the retailer’s Pillow Walk technology and the structure was fittingly designed like a large pillow.

Aldo’s Pillow Walk popup took over Astor Place in October 2023.

Customers could walk through the entire structure, check out Aldo’s shoes, and enjoy branded cotton candy snacks.

Aldo says they’ll be hosting popups throughout 2024 with the next locations being in other major cities like Chicago and Los Angeles.

Other retail experiences in the summer and fall of 2023 piggybacked on the success of the Barbie movie.

Bloomingdale’s was one retailer.

Along with Barbie-licensed apparel and accessories, Bloomingdale’s used their pop-up experience to promote the in-house brand Aqua.

The pop-up shop also featured complimentary hair styling and special events.

The Barbiecore shopping experience at Bloomingdale’s featured licensed and in-house brands.

4. U.S. Social Commerce Grows But Still Lags Behind China

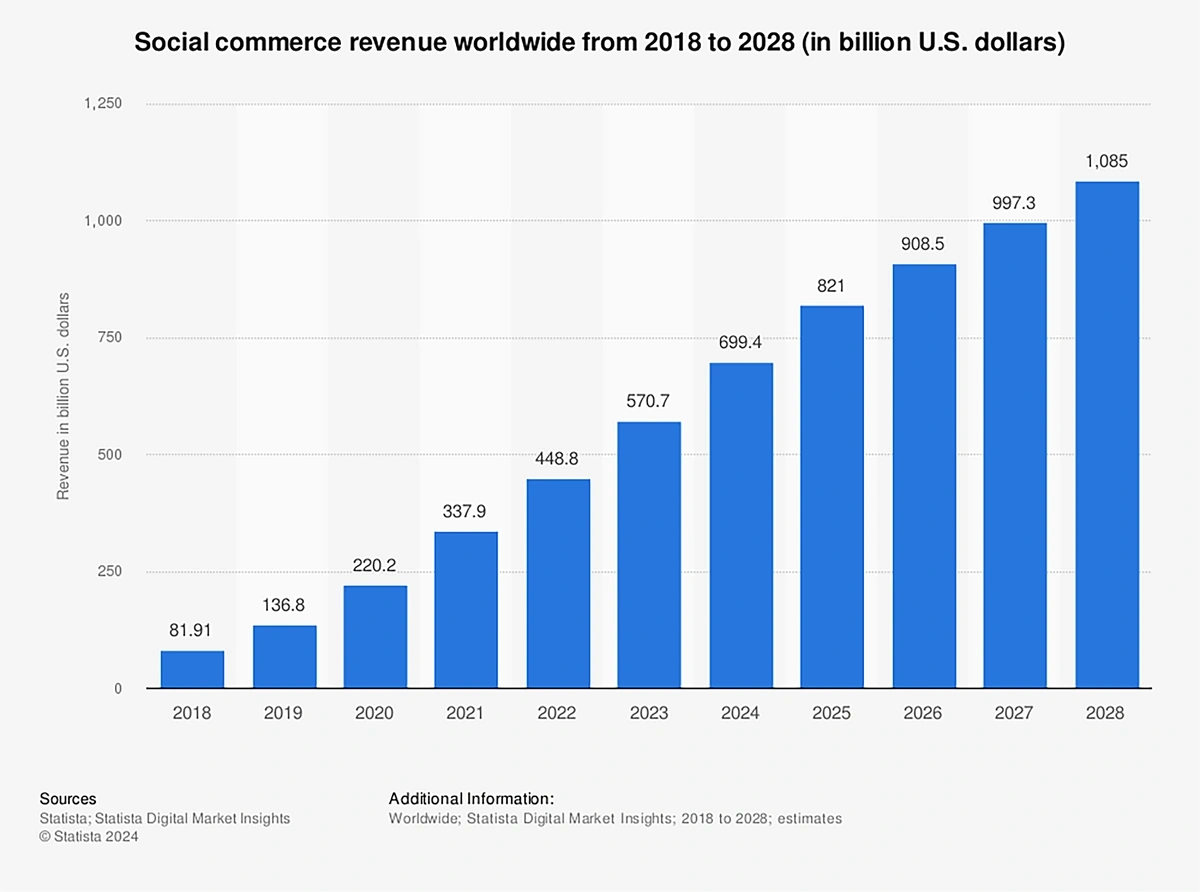

Social commerce revenue around the world amounted to nearly $1 trillion in 2023.

Predictions show the market will continue to grow at a CAGR of more than 30% through 2030.

Social commerce revenue could total more than $6 trillion by 2030.

Social commerce is the clear leader in China, making up more than 46% of all ecommerce in the country.

Worldwide, nearly 60% of individuals have bought a product via social media.

And the amount these individuals are spending on social media continues to increase.

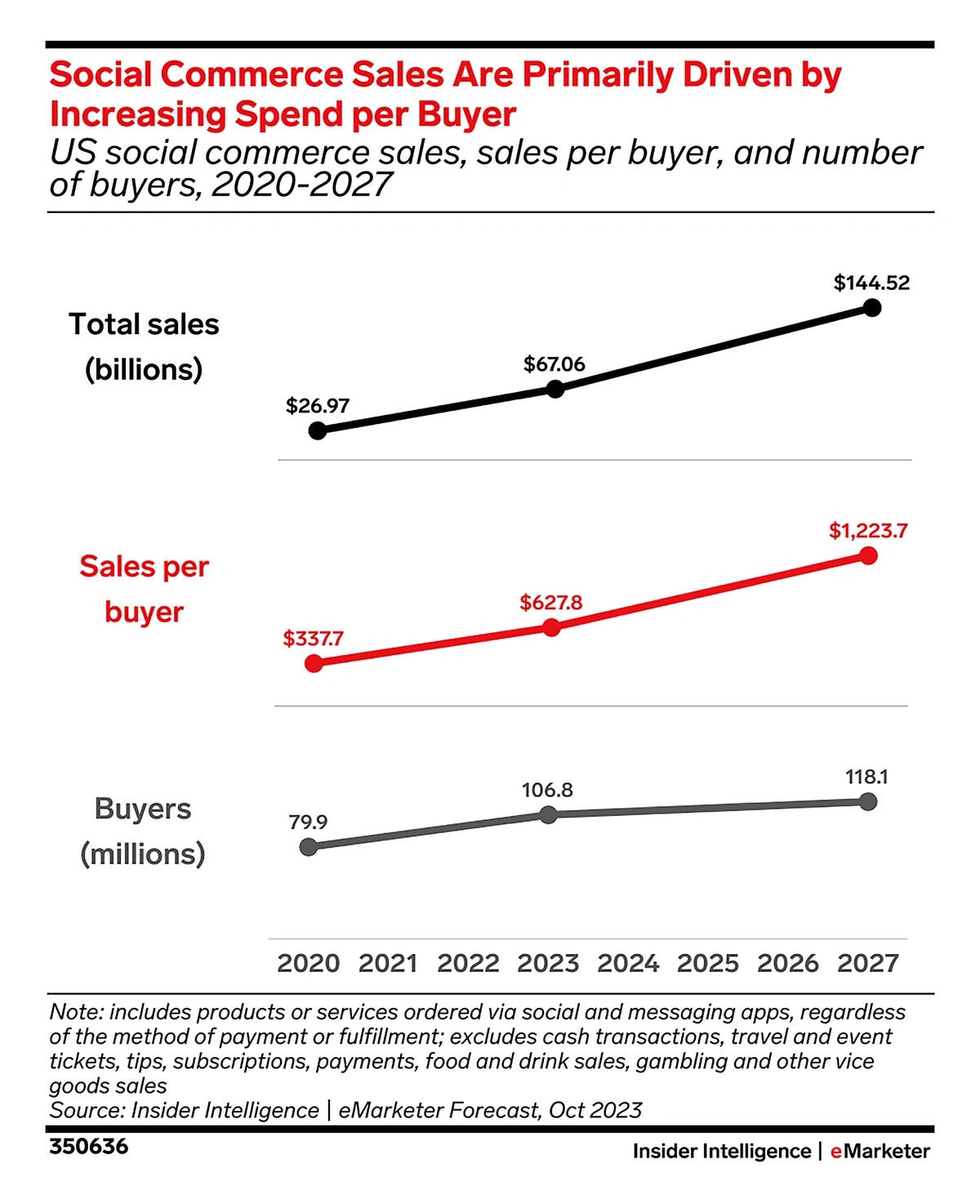

In 2020, the average sales per buyer sat at about $340. By 2027, that number is predicted to grow to more than $1,200.

The number of social media buyers is predicted to grow slowly, but the sales per buyer is set to increase dramatically in the coming years.

Beauty and personal care products are responsible for about 25% of social commerce purchases while apparel purchases make up another 24% of the market.

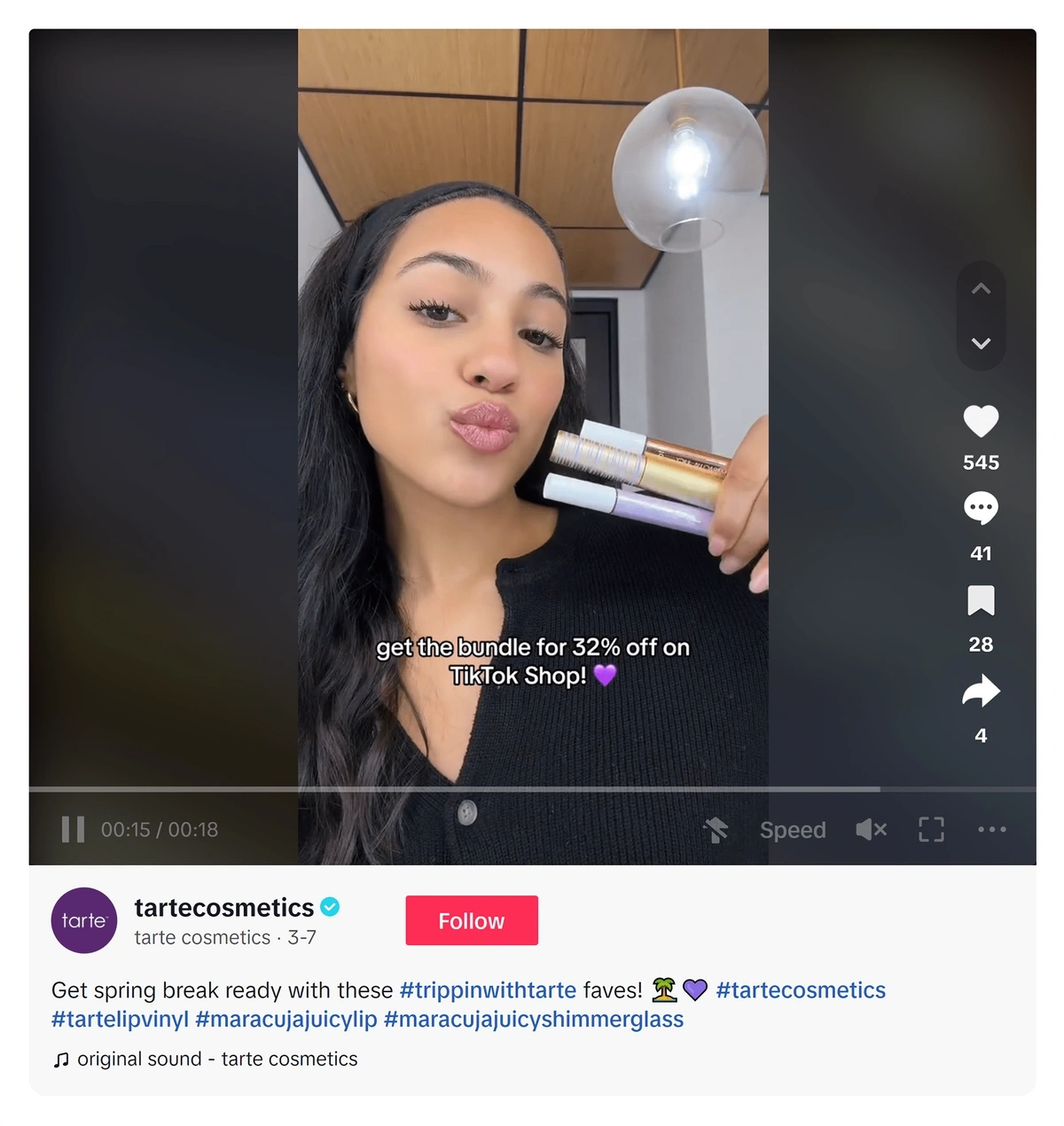

Tarte, which has 1.3 million followers on TikTok, has seen a triple-digit increase in sales of certain products since joining TikTok Shop in mid-2023.

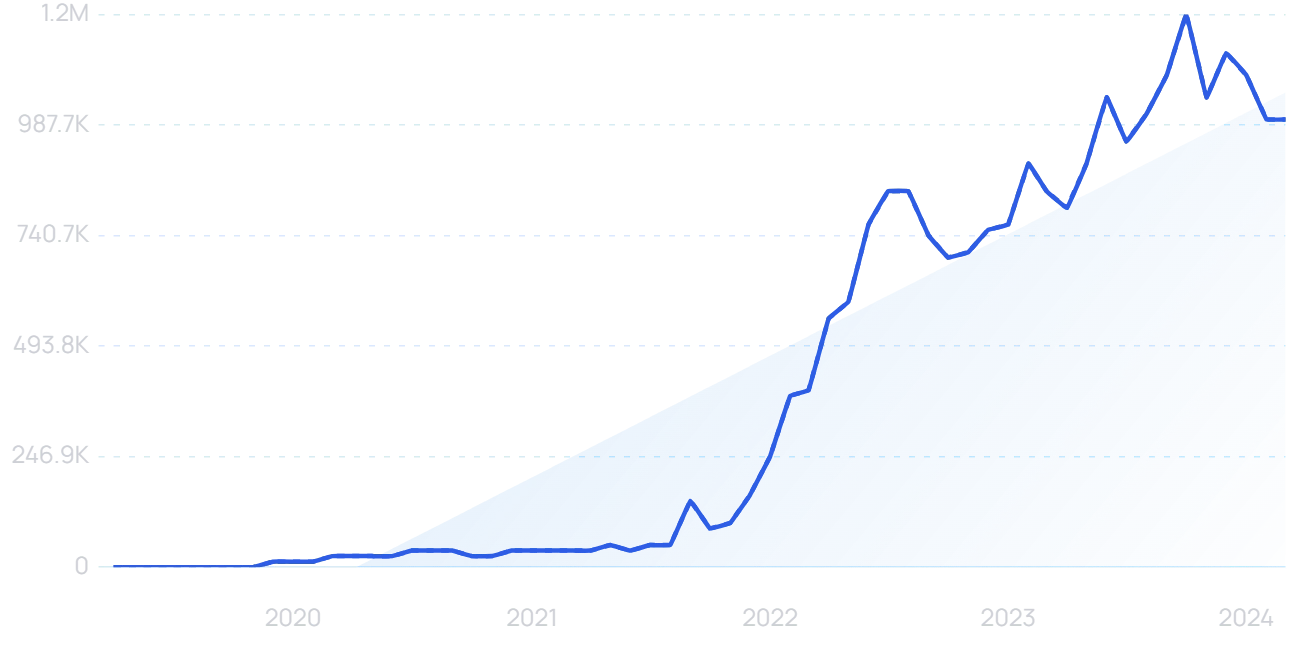

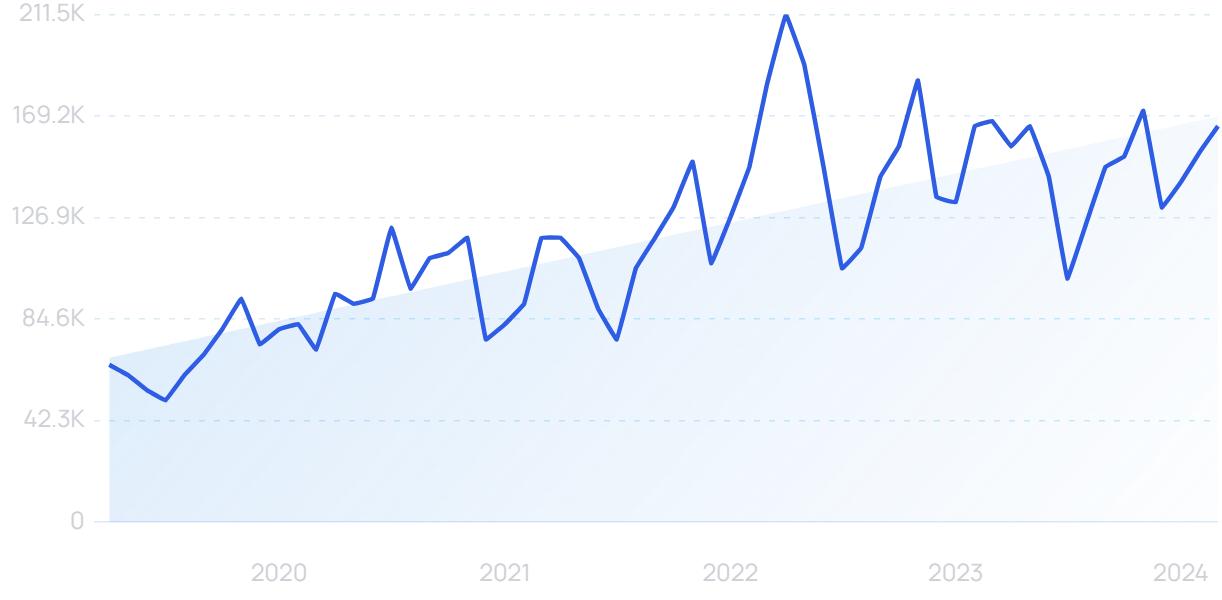

Search interest in “TikTok Shop” jumped in 2023.

The brand has also released product sets that are exclusive to TikTok Shop.

Tarte appeals to social shoppers by offering exclusive product bundles.

Of the nearly 102 million users on TikTok in 2023, 35.3 million became social buyers.

In 2024, TikTok’s user base is predicted to reach nearly 108 million and there could be as many as 40.7 million social buyers.

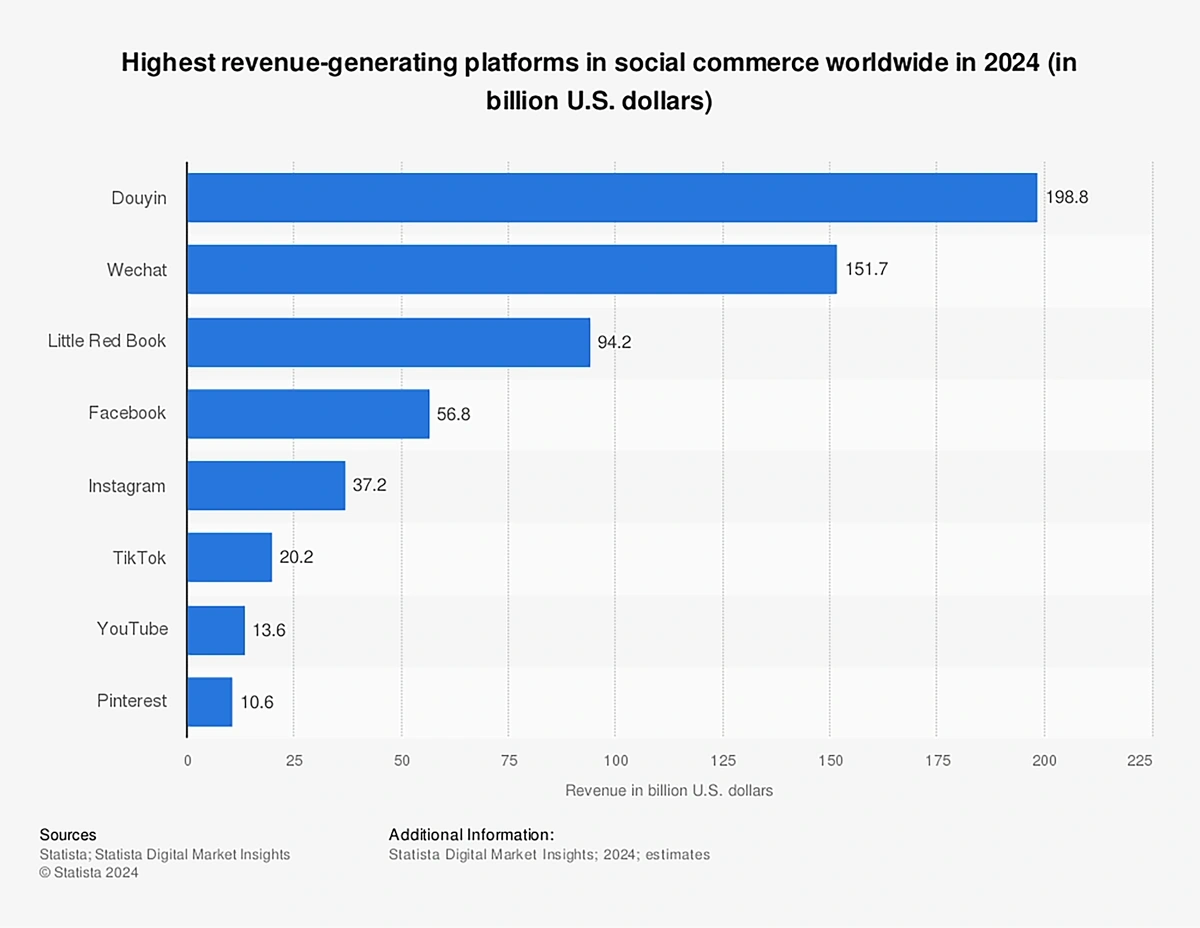

But, the platform is still lagging behind Facebook and Instagram in the social commerce space in the U.S.

Facebook’s 2024 social commerce revenue is predicted to hit $56.8 billion and Instagram’s social commerce revenue could top $37 billion.

TikTok comes in behind these two leaders at $20.2 billion.

Taking a look at the global landscape, these three platforms are dwarfed by Chinese giants like Douyin, Wechat, and Little Red Book.

Chinese company Douyiun is the clear leader in social commerce revenue.

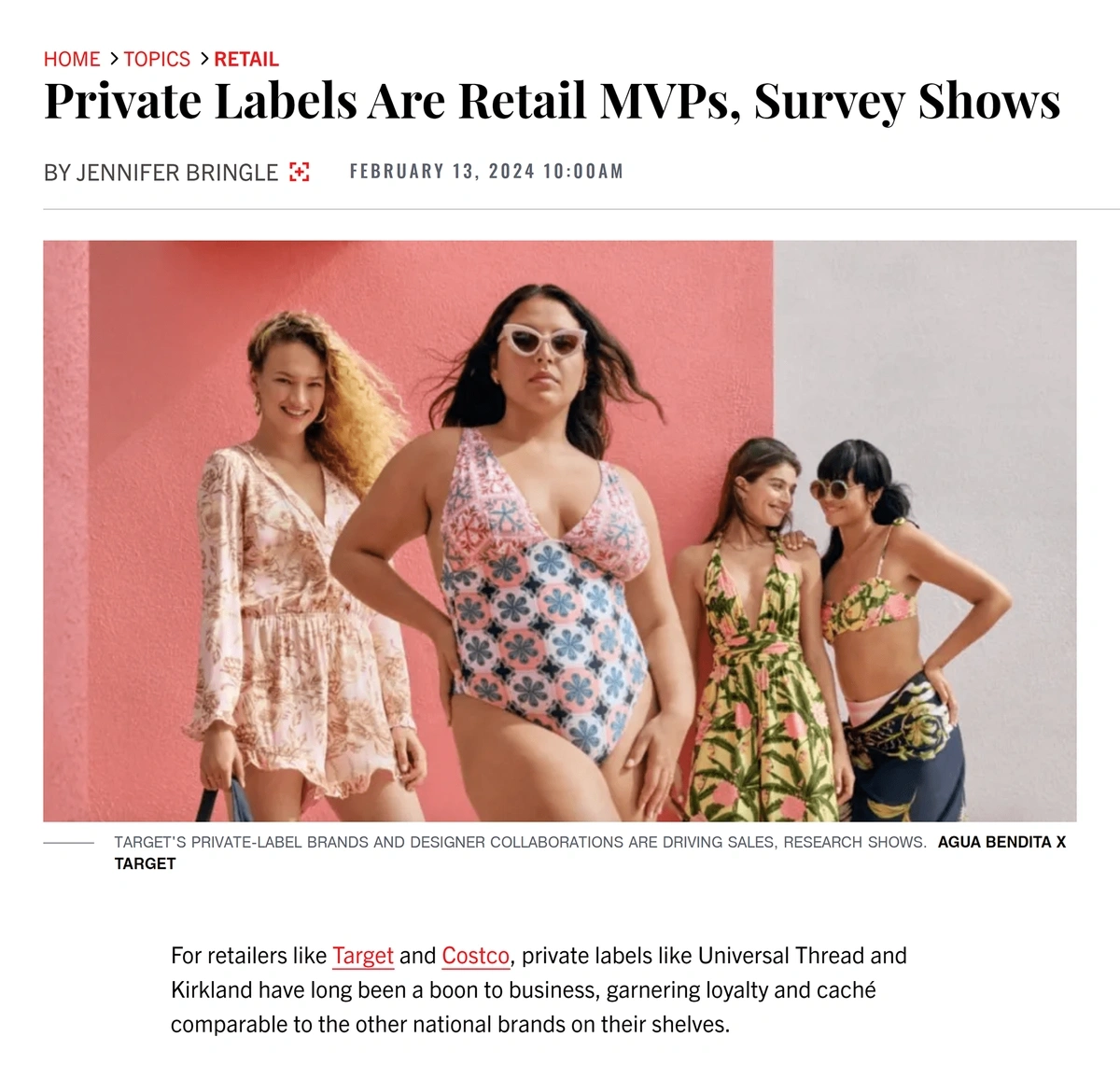

5. Private Labels Drive Record Revenue

Far from the low-quality generics of years past, private labels and store brands are poised to move to the forefront of retail sales in the coming years.

Surveys show that 36% of shoppers actively seek out private label brands.

Consumer surveys show that private labels are gaining traction in the retail sector.

Nearly 65% of consumers have purchased a private label product within the past six months.

The majority of those, 71% of consumers, had made private label purchases in the food and beverage category, but 48% have purchased private label beauty products and 41% have purchased private label fashion items.

In the consumer packaged goods (CPG) sector, private label products are now responsible for more than 20% of all unit sales.

Some grocery retailers are pushing even harder on their private label products.

At Aldi, Trader Joe’s, and Costco, private labels make up more than 50% of the total product count.

Albertsons has also invested heavily in private label development and marketing in recent months.

In 2023, the grocer announced plans to consolidate a few of their private brands under a new name: Signature Select.

The lineup features more than 8,000 products.

Albertsons private label portfolio now features nine brands.

Company officials say the grocer’s private labels are valued at $16.5 billion.

Another retailer that’s found success with private labels is Target.

With more than 45 private labels, the retailer has garnered a cheap-chic perception from consumers and developed brands that offer everything from premium luggage to value-priced home organization pieces.

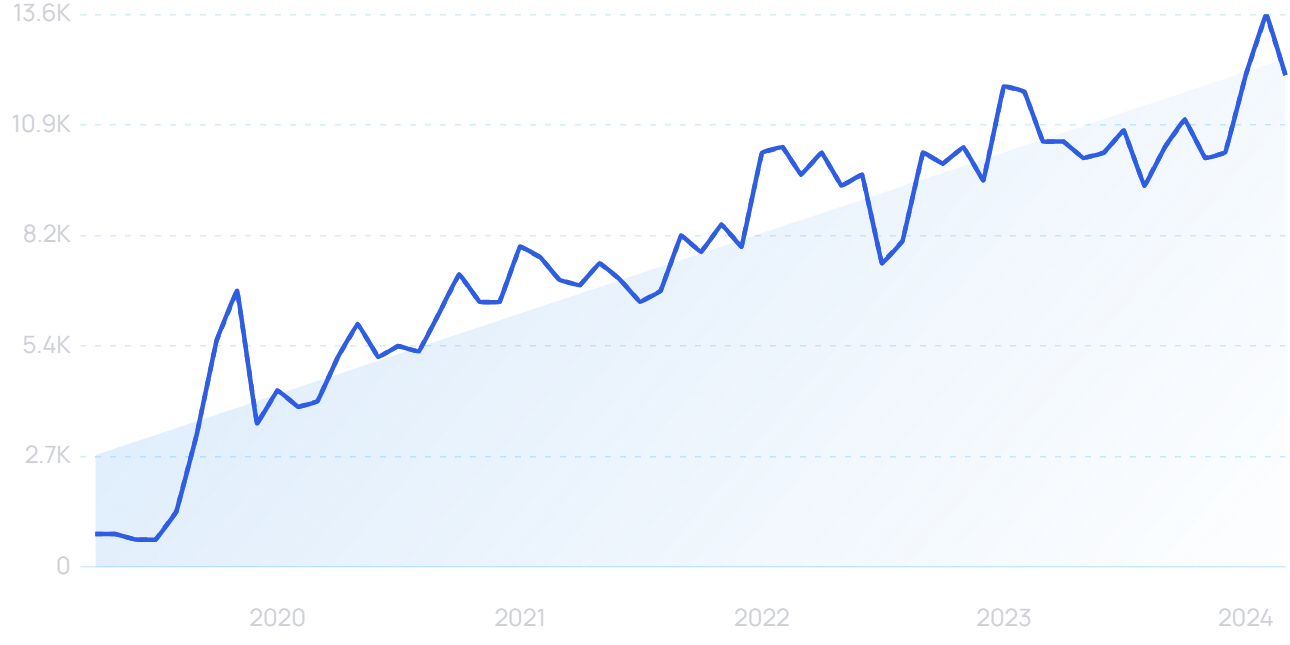

Search interest for one of Target’s brands “Good and Gather” is up more than 1,300% in the past five years.

And, the private labels keep coming.

In March 2024, Target announced a new value-based brand called Dealworthy.

Target’s newest private label brand Dealworthy will be featured in the apparel, electronics, beauty, and home categories.

In all, Target’s private labels surpass $30 billion in annual revenue.

6. Resale Becomes Fashion’s Biggest Trend

Financial woes and sustainability concerns are leading retail consumers to shop resale marketplaces more frequently than ever before.

The founder of Recurate, a platform that helps brands build their own resale marketplaces, says that the resale market is growing 11x faster than regular retail.

Nearly 75% of consumers around the world say they shop resale.

And, the number of brands offering branded resale platforms grew 3.4x from 2022 to 2023.

That means the global market could be worth as much as $350 billion by 2027 according to ThredUp, a fashion resale marketplace. They predict $70 billion of that would come from the U.S.

Clothing and shoes were the top resale categories of 2023.

Nearly one-third of U.S. consumers have purchased secondhand clothing in the past 12 months.

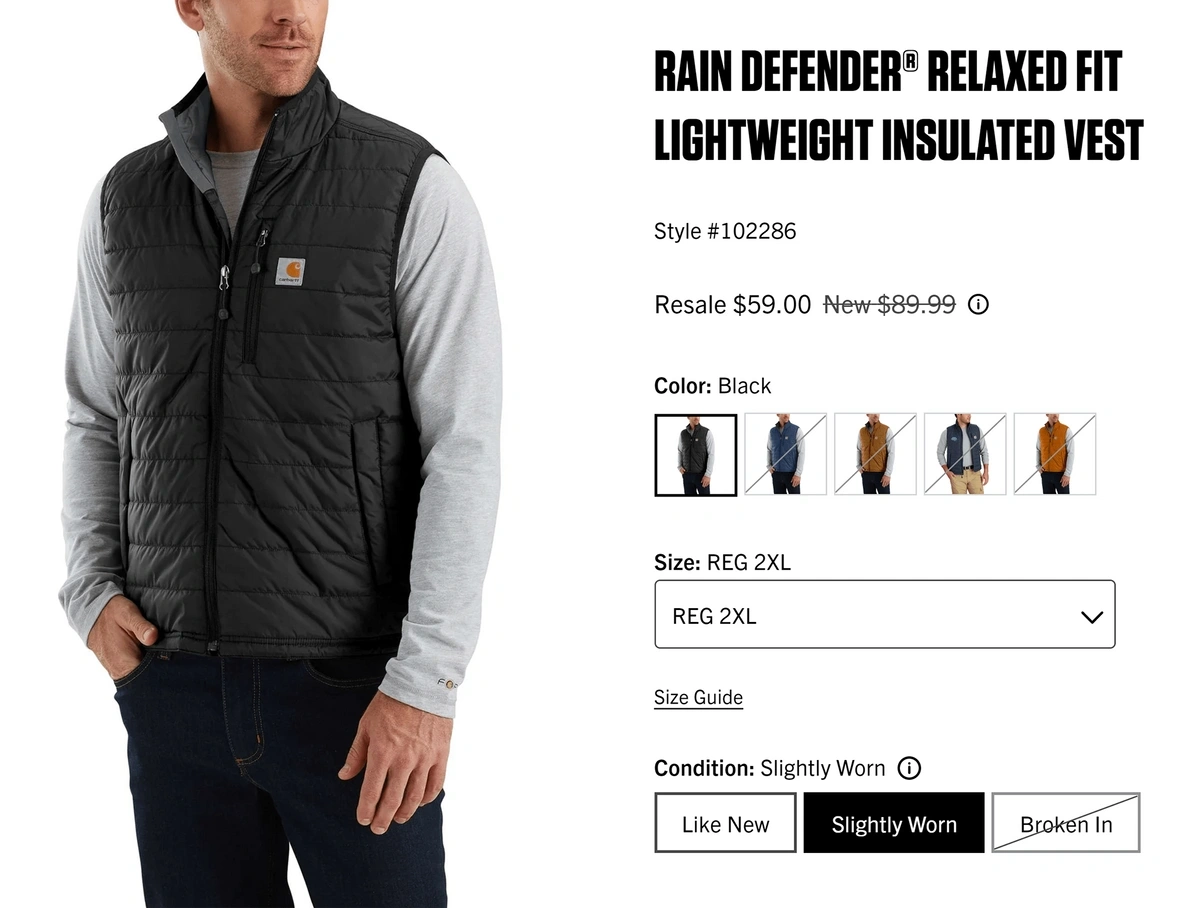

Carhartt, famous for their durable jackets, is one of the latest fashion retailers to offer resale options.

They launched a resale pilot called “Carhartt Reworked” in early 2023 and started accepting trade-in items at 35 of their stores in July.

In early 2024, Carhartt also began accepting mail-in trade-ins.

Carhartt Reworked offers items that are like new, slightly worn, or broken in.

The backend of their program is run by Trove, a resale-as-a-service company based in California.

Trove operates more than 20 branded resale platforms like those from Patagonia, Lululemon, and Elieen Fisher.

The company’s business grew 50% year-over-year in the fourth quarter of 2023.

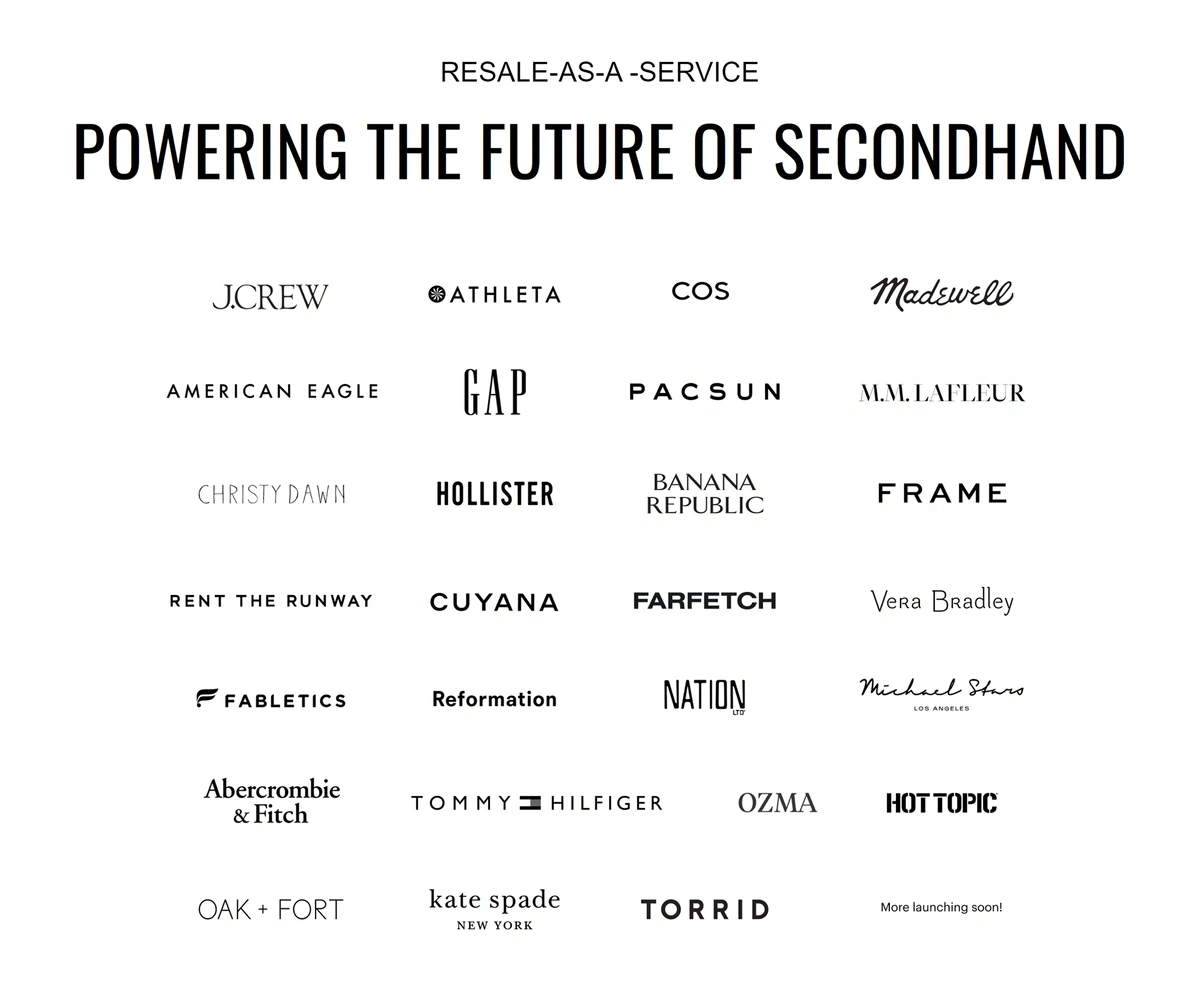

ThredUP, which operates their own online resale site, is another leader in the resale-as-a-service market.

The company added 11 brands in Q2 of 2023 alone and now operates more than 50 branded resale platforms.

ThredUP works with a variety of high-profile brands.

ThredUP’s revenue increased 8% year-over-year in Q2 of 2023.

But it’s not just online resale that’s booming. Resale shops with physical locations are growing too.

The Winmark Corporation operates several secondhand retail stores like Once Upon a Child, Play It Again Sports, and Music Go Round. In total, they have 1,300 franchised stores.

The company brings in more than $39 million per year in net income.

Across the country there are approximately 25,000 second hand stores bringing in a total of $15 billion per year.

The National Association of Resale Professionals say that revenue could double this year.

7. The Shifting Role of Brick-and-Mortar Locations

The prevalence of in-person shopping has been in flux in recent years.

Before the pandemic, the popularity of ecommerce was already growing and brick-and-mortar stores were already closing at alarming rates. The term “retail apocalypse” was used as early as 2010.

Thousands of brick-and-mortar stores have closed in recent years.

More than 9,300 major retail stores closed in 2019 and another 12,000 locations shut down in 2020.

Predictions show that 23,500 of the nation’s brick-and-mortar retail locations will close by 2026.

The role of physical retail locations is in jeopardy, but does that mean there’s no future for brick-and-mortar?

Not necessarily.

A recent survey found that 61% of Gen Z, a generation with a combined total of $360 billion in disposable income, are more likely to shop at a brick-and-mortar store than online.

Gen Z is more likely to shop in-store versus online.

The Pew Research Center took a look at adults of all ages and found that 57% of adults prefer buying in-person versus online.

And, in 2022, there were more store openings than store closings for the first year since 2016.

Revenue at many in-person retailers is picking up too.

Ecommerce is responsible for just 15% of total retail sales.

And, revenue at malls grew 11% in 2022.

JCPenney is one mall retailer that’s investing in its physical stores.

JCPenney plans to modernize its stores in 2024 and 2025.

The company plans to spend more than $1 billion by the end of 2025 in order to boost business.

A major part of that plan is remodeling its stores, a move that’s desperately needed as traffic at JCPenney stores is down 24% year-over-year.

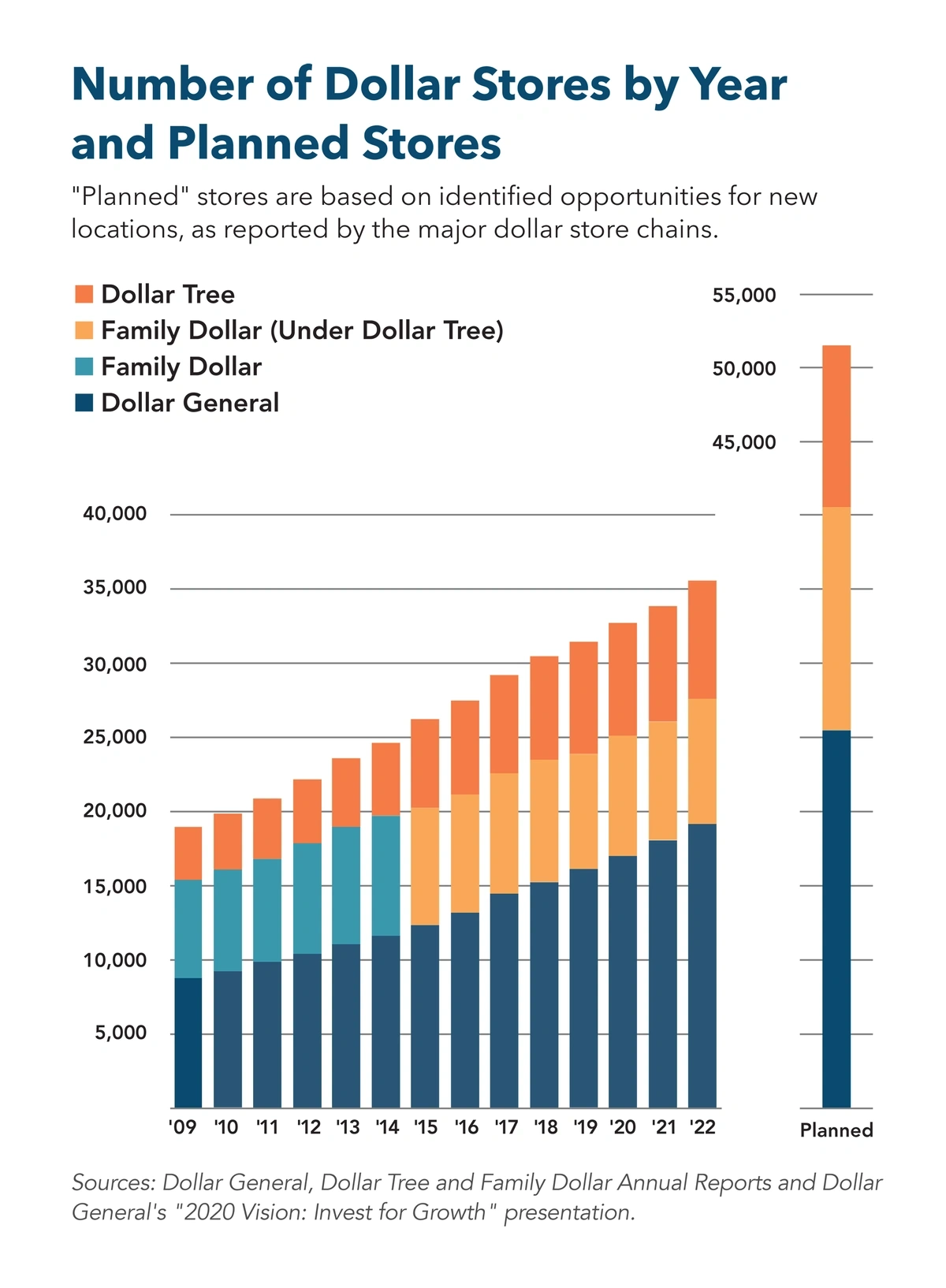

On the other hand, dollar stores are seeing growth in both traffic and revenue.

In 2021, almost 50% of all new retail openings were openings of chain dollar stores.

Combined, Dollar General and Dollar Tree operate more than 34,000 stores in the U.S.

More than 50,000 new dollar stores are in the works.

With those numbers, there are 6x more dollar stores than Walmarts in America.

Traffic at these stores is surging.

Dollar Tree brought in 4.3 million new customers from September 2022-2023.

8. Balancing Personalized Experiences with Privacy Concerns

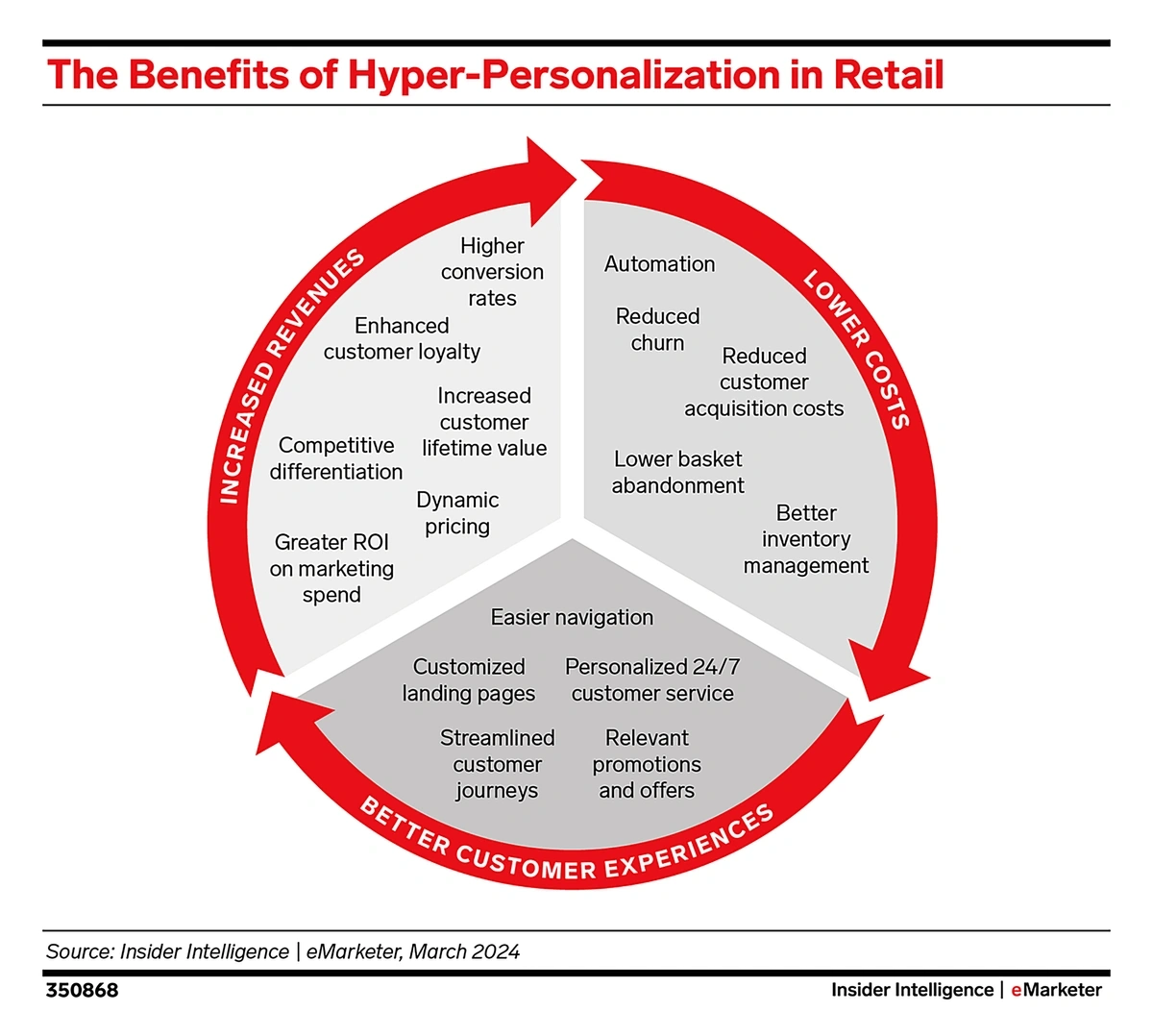

90% of retailers say hyper-personalization is a must-have capability in today’s retail landscape.

In addition, 90% of retailers believe that hyper-personalized offers will take the place of store-wide sales events within the next three years.

This type of personalization goes beyond special discounts and offers, too.

It encompasses tailored shopping experiences and personalized customer service.

Today’s shoppers expect retail brands to give them what they want exactly when they want it. This boils down to understanding and predicting the customers’ wants and needs.

In fact, more than one-quarter of Gen Zers and millennials in the U.S. say they can envision a time in the future where they won’t even have to shop—AI will do it for them.

Retailers aren’t at that level yet, but personalized marketing is already impacting costs and revenue for brands.

Hyper-personalization improves the customer experience and increases revenue.

McKinsey reports that personalization can cut customer acquisition costs in half and boost revenue by as much as 15%.

But personalization at scale isn’t easy to achieve.

Many retailers are turning to AI/ML solutions to improve the speed and agility of their strategies.

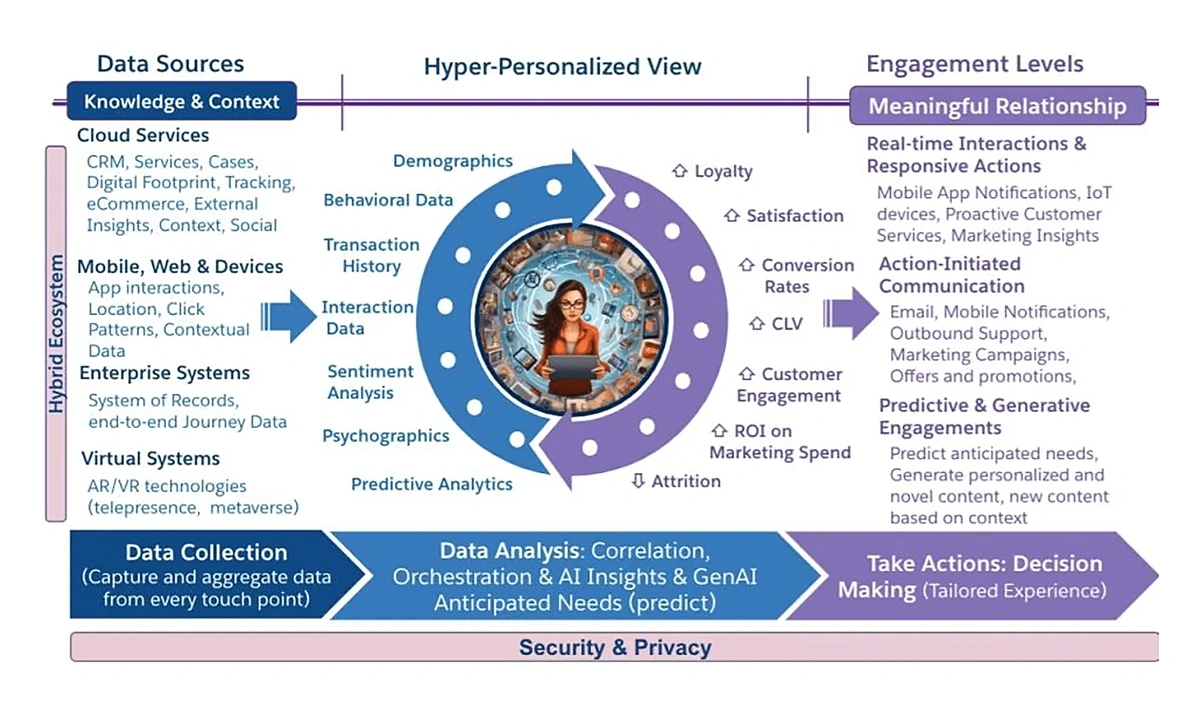

Data feeds the AI/ML systems that produce hyper-personalized experiences for retail consumers.

In a survey conducted by BCG, nearly 70% of CMOs said they’re looking into using generative AI for personalization.

And many of the fastest-growing brands in our marketing startups directory are concerned with AI personalization.

At the same time, consumers are concerned about the data that’s feeding those AI/ML solutions.

79% of consumers across the world are concerned with data privacy.

Search interest in “data privacy tools” has increased more than 5,000% in recent years.

There’s strong reasoning behind that fear—an IBM report listed the retail and wholesale industry as the fifth-most targeted industry by cybercriminals.

Beyond privacy, some consumers think personalization has simply gone too far—46% think it’s “creepy” when they see promotions related to a website or app they’ve visited within the past two minutes.

9. Consumers Demand Sustainable Practices

KPMG reports that 72% of consumer and retail company CEOs say they’ve been facing increased demands for ESG reporting and transparency.

Research from Deloitte echoes those feelings.

Their research shows that retail executives face pressure from customers, board members, and regulators.

The sustainability-oriented attitudes of consumers can make or break a brand.

An analysis from McKinsey showed that consumer products with ESG-related claims on the label grew 6.4% over the course of five years while products without these types of claims grew only 4.7%

In addition, having more than one ESG claim on the label resulted in 2x greater growth than products with just one ESG claim.

McKinsey’s analysis looked at retail products over the course of five years.

ESG concerns are especially prevalent among younger generations like Gen Zers.

A survey from EY found that 31% of Gen Z consumers have stopped purchasing from a brand or bought less from that brand because they believe it's not doing enough for the environment.

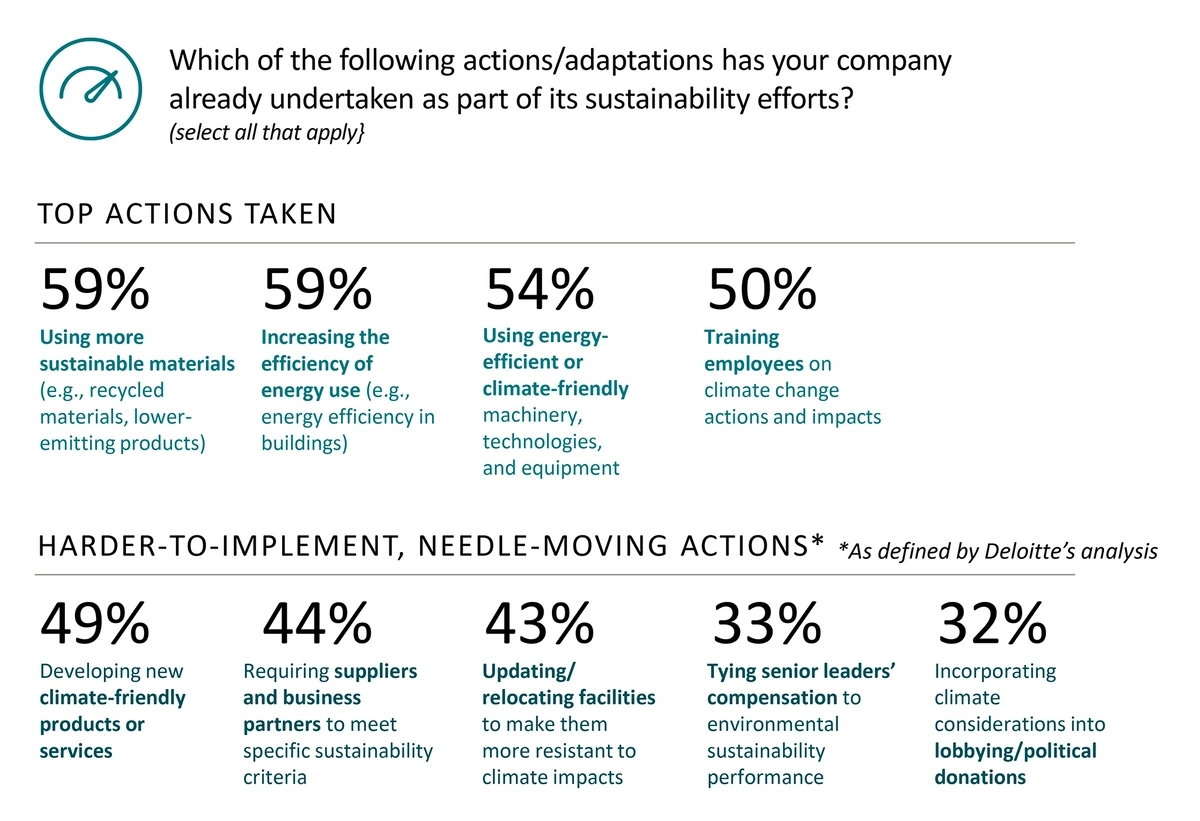

In the face of demands from consumers and regulators, Deloitte reports that 65% of brands have begun using more sustainable materials and 62% have invested in efficient energy usage.

Less than half of retail brands have invested in “needle-moving actions” according to Deloitte.

However, many brands are forgoing more serious actions like holding senior leaders accountable for sustainability goals.

For example, only 43% of brands are requiring suppliers to meet sustainability criteria but the retail supply chain accounts for 25% of greenhouse gas emissions worldwide.

Ship It Zero, an organization advocating for zero-emissions shipping by 2030, recently released a shipping report card that assessed major retailers.

IKEA was the clear winner with 89/100 points.

The company reduced its climate footprint by 12% year-over-year in 2023.

Fashion retailers, especially those considered fast-fashion retailers, have been heavily criticized for their emissions and the situation is predicted to get worse.

Search volume for “fast fashion” is up more than 150% since 2020.

By 2030, the fashion industry’s emissions are predicted to increase by 50%.

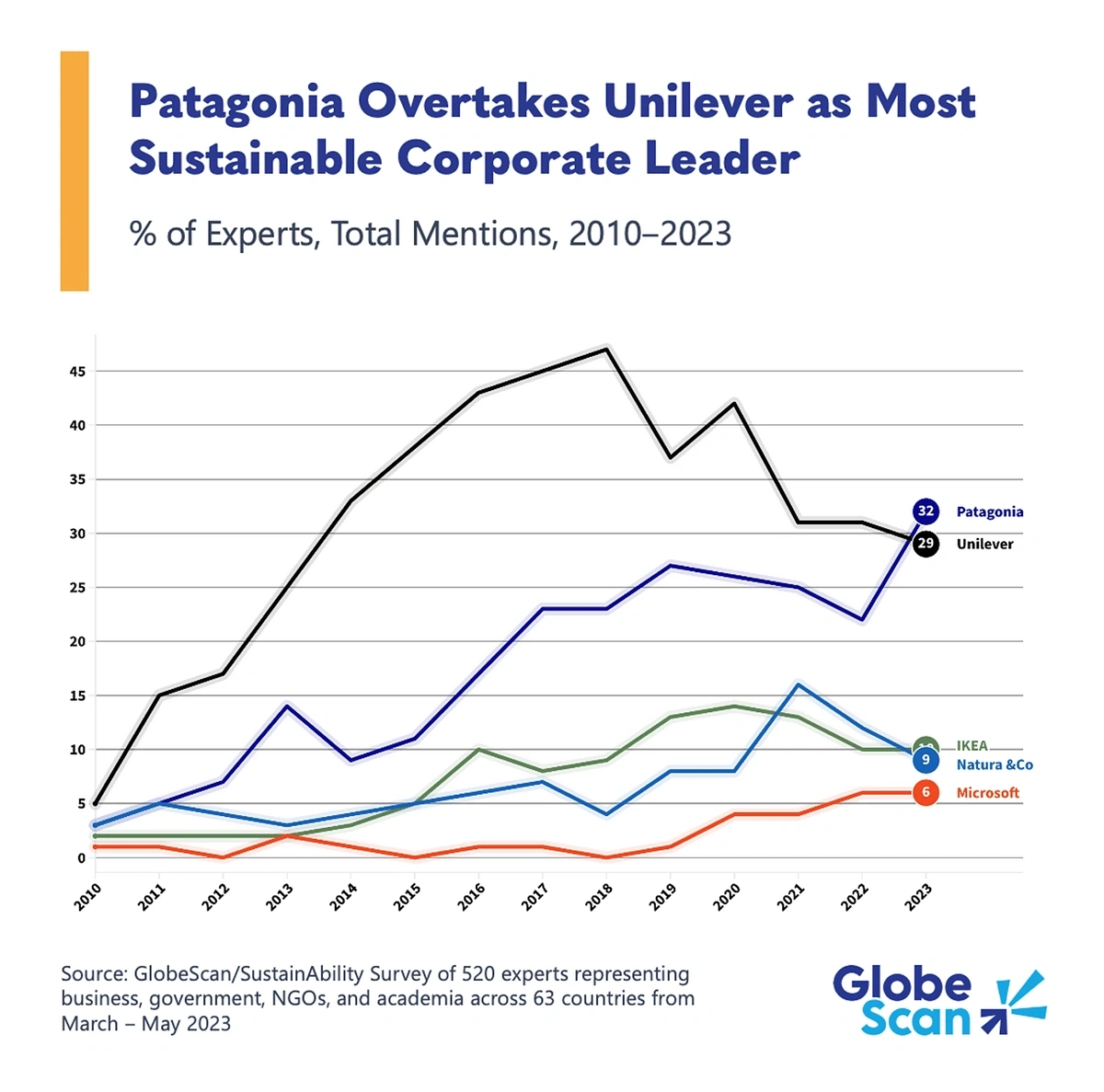

Companies like Patagonia are long-standing champions of sustainable fashion, but a few other notable brands have joined them in the past year.

Patagonia is consistently ranked as the most sustainable fashion retailer.

Gucci’s Denim Project will be released in 2024. The lineup features clothing made with 74% regeneratively grown cotton and 26% post-consumer recycled fibers.

There’s also Girlfriend Collective, a sustainable brand of activewear.

Their products are made from a blend of organic cotton and several types of recycled materials like water bottles, fishing nets, and fabric scraps.

The brand also launched their own resale site in the summer of 2023.

The Girlfriend Collective announced they’d be opening a secondhand marketplace in 2023.

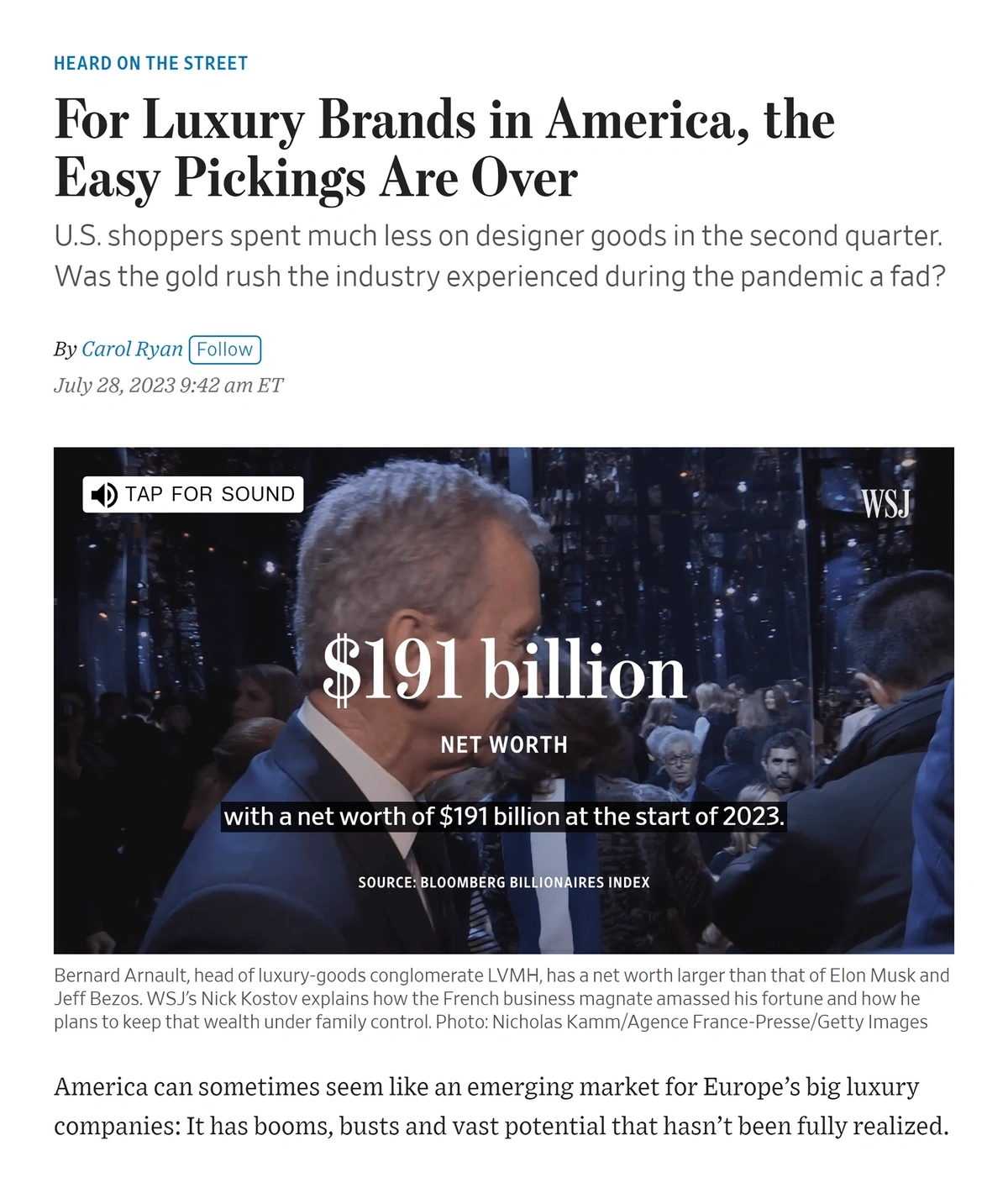

10. Luxury Segment Faces Declining Sales

The luxury goods market proved to be resilient during the pandemic, but experts say this may be the year it slams back to reality.

During the past three years, sales of luxury goods were up 20% on average.

But in 2024, estimates show the market will grow just 4%-6%, barely enough to cover the rising costs of doing business.

The growth of the luxury goods market is set to stall in 2024.

Spending on luxury goods was down 15% year-over-year in November 2023.

Luxury fashion retailer Burberry reported revenue was down 7% year-over-year in December 2023.

Kering, the luxury conglomerate that owns Gucci, Yves Saint Laurent, and others, reported a sales drop of 23% in mid-2023.

Luxury brands saw steep declines in sales in 2023.

Demand and sales of luxury watches are down as well.

The Bloomberg Subdial Watch Index has dropped 30% since 2022.

This loss of revenue is putting some luxury retailers in the red.

Hudson’s Bay Co., which owns brands like Saks Fifth Avenue, was reportedly months behind on vendor payments in late 2023. The company sold $340 million worth of real estate in order to stay afloat.

There is an exception to this downturn, however.

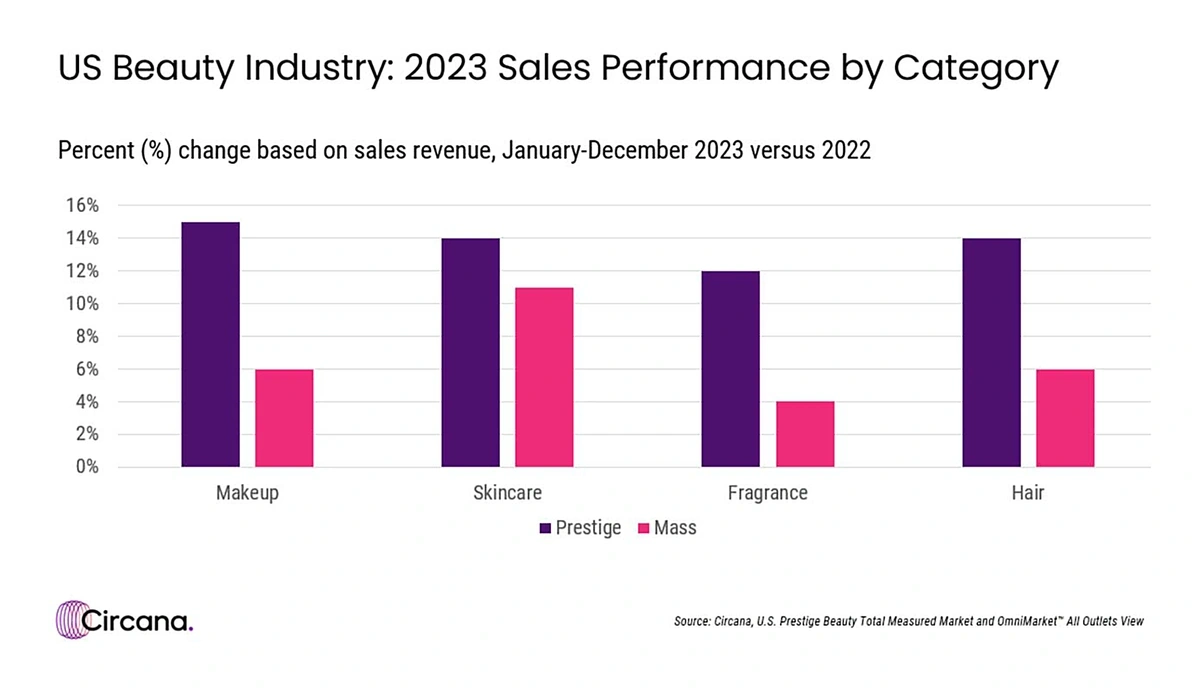

Many luxury beauty brands are continuing to see increased demand and sales.

For example, prestige brands saw gains across product categories in 2023. Makeup sales rose 15%, skincare sales were up 14%, and fragrance sales were up 12%.

All of these gains were substantially higher than gains for mass market brands.

Revenue from luxury beauty brands grew substantially in 2023.

11. Making the Checkout Process More Convenient

In today’s marketplace, any type of friction at checkout can lead to customer frustration and lost sales.

One way retailers are looking to appease customers is by offering a variety of payment options.

This obviously means contactless payment options—more than half of Americans want to tap to pay or use their mobile wallet.

But for consumers who either don’t want to use a credit card or have reached their credit limit, buy now pay later (BNPL) options are a must-have checkout option.

Search volume for “BNPL” remains high.

46% of shoppers in the U.S. have used BNPL and many of them, especially consumers under the age of 40, are now relying on this payment method.

Nearly 30% of these younger shoppers say they’d abandon a purchase if they couldn’t use a BNPL payment option.

This trend has been gaining momentum online for the past few years, but now it’s also working its way into physical stores.

In December 2023, Affirm announced its BNPL service would be available at self-checkout kiosks in Walmart stores.

Other retailers are reimagining the entire self-checkout process in order to lessen frustration among customers.

RFID tags are one way retailers are doing it.

RFID tags can track merchandise within the store and enable an easier checkout process for customers.

This process begins with retailers attaching an RFID tag to every price tag. This means consumers don’t need to scan each individual barcode at checkout.

Instead, they simply place the items into a bin and the computer scans the RFID tags. The prices then automatically register on the self-checkout screen.

Fashion retailer Uniqlo has enabled RFID checkout at all 47 of their stores in the United States.

They credit this new system with reducing customer wait times by 50%.

Amazon is also using an RFID-powered checkout for their apparel and softlines merchandise at their Just Walk Out stores.

RFID speeds up the checkout process at Amazon stores.

Customers can simply carry their items through the exit gate. On their way out, they tap their credit card and the gate reads the RFID tags on their items. They’re automatically charged as they walk out.

Amazon piloted the program in 2023 at stadium stores in Climate Pledge Arena and in Lumen Field in Seattle.

Conclusion

That's it for this report on the top retail trends set to impact the industry in the next few years.

Many retailers are leveraging innovations like AI to improve the way they communicate with their customers and understand their preferences. But those preferences are undergoing major shifts. Sustainability, convenience, and memorable experiences are now some of the most important factors for shoppers.

The industry is also seeing dramatic changes in consumer spending. As economic hardships continue to impact shoppers, private labels are likely to stay popular and the luxury market is likely to face at least a subtle downturn.

Stay tuned into the retail landscape to see how these trends impact brands of all sizes moving forward.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more