Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

12 Important Shopping Trends For 2024

You may also like:

Consumer spending increased in the first half of 2023 after 2022 got off to a slow start. Rising inflation and fears of a recession made many individuals tighten their budgets.

That’s the bad news.

The good news is that the pandemic made retailers more agile than ever. They’re prepared to promote their products via multiple channels and strategies.

Shoppers are showing ever-changing demands. They want faster shopping, faster service, and faster delivery. But, retailers are investing in tech solutions in order to meet these demands.

Here are the top shopping trends that are set to drive sales growth for retailers in 2024 and beyond.

1. Shoppers Buy Directly From Social Platforms

Shopping is quickly becoming a social activity.

Whether that means consumers finding deals through social media or sharing their shopping habits and finds with their friends, there is a definite shift taking place towards social commerce.

A recent study revealed that 47% of shoppers in the United States have made purchases through social media.

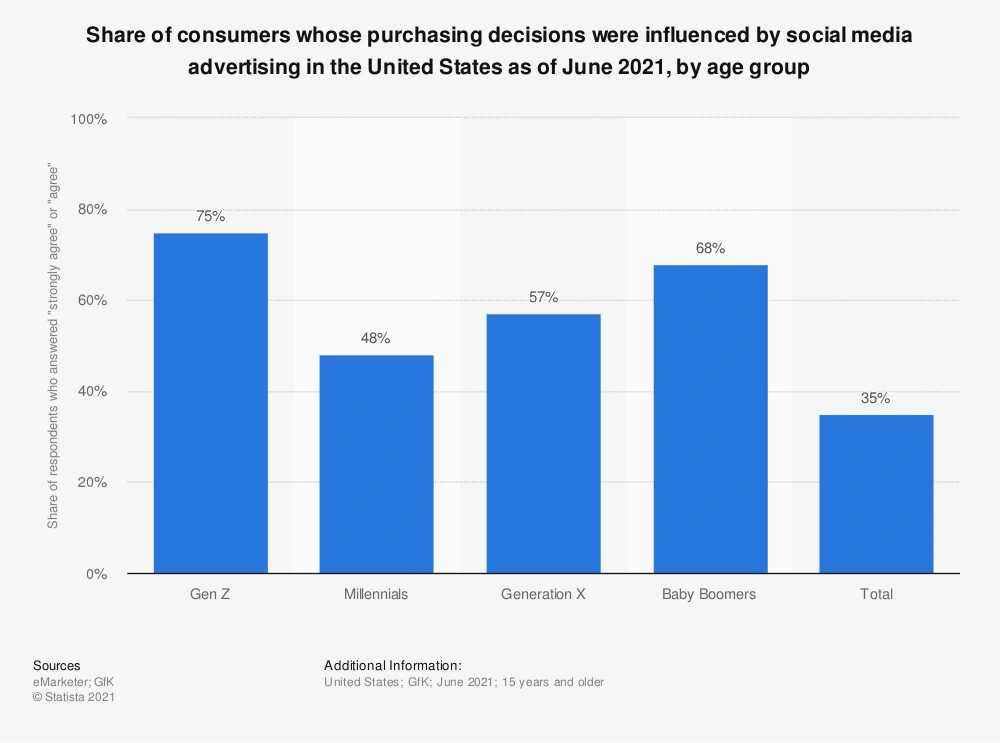

Similarly, Statista found that more than a third of all consumers it surveyed made shopping decisions based on social media ads.

And for Gen Z shoppers, that number jumped to three-quarters.

Shoppers, per age group, whose buying decisions are influenced by social media advertisements.

The world’s largest social media platform is taking advantage of this shift.

Facebook reported in 2021 that its Facebook Marketplace platform now has a billion users. It’s also home to roughly a million shops that sell to 250 million consumers each month.

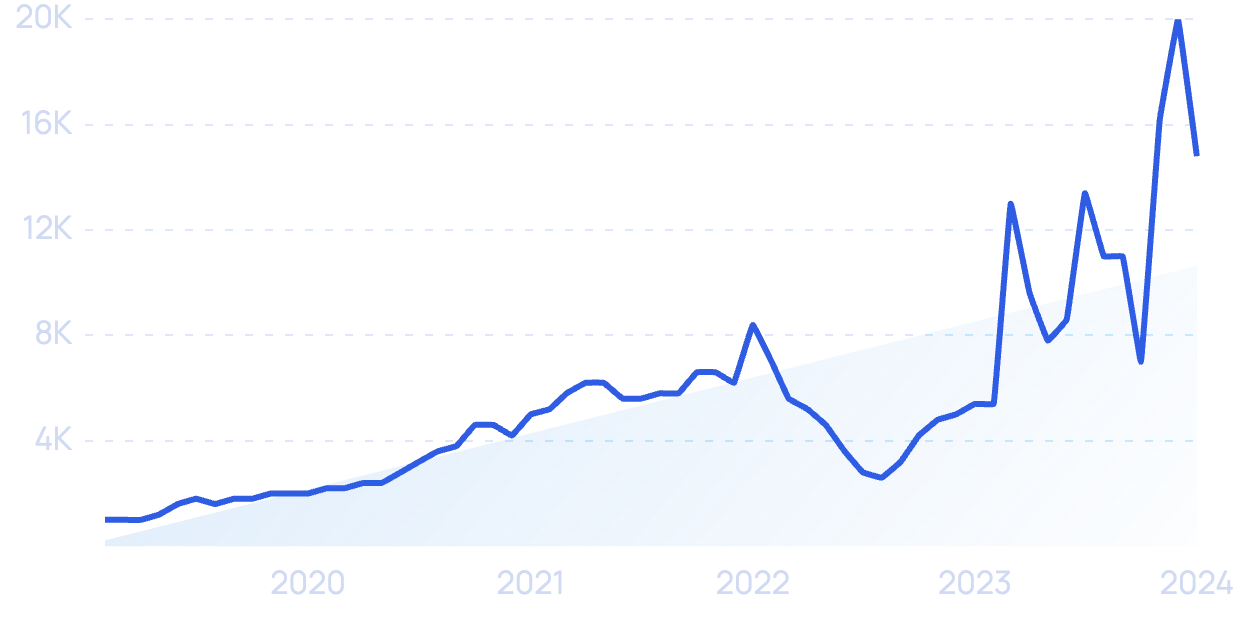

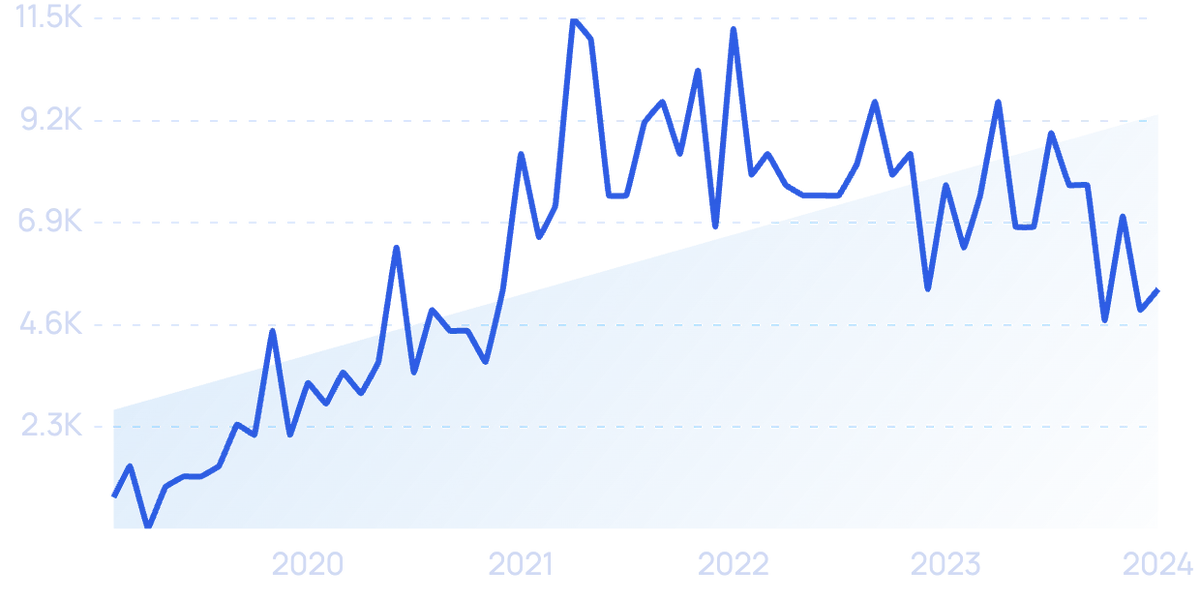

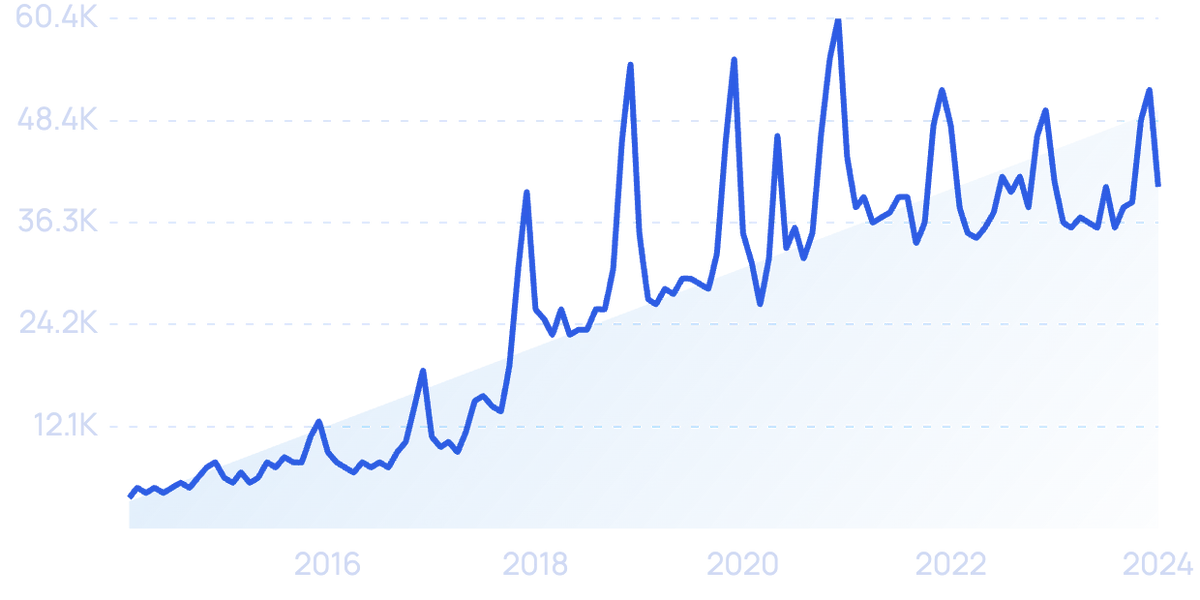

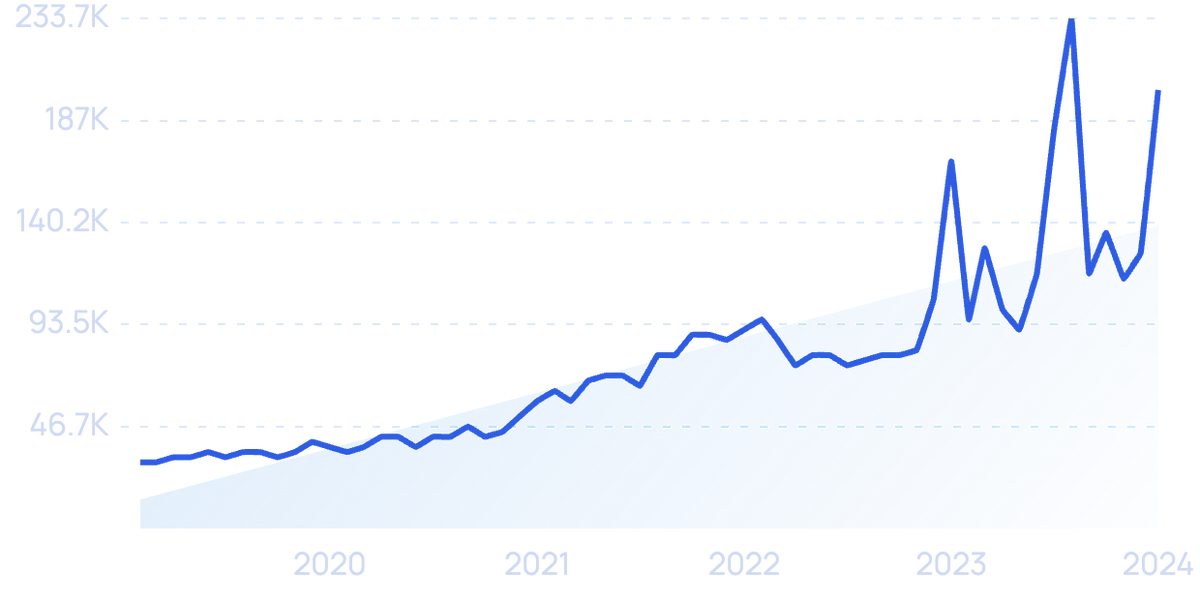

Search interest in “Online Marketplace” has grown by 1,380% over the last 5 years.

For instance, a study done by TikTok found that 80% of the platform’s users who bought something on Black Friday in 2020 found it with the help of TikTok.

In addition, a recent study by Material found that, compared to other social media platforms, TikTok users are twice as likely to make a purchase through the app.

It’s no wonder then, that the popular hashtag #TikTokMadeMeBuyIt has now been viewed over 85 billion times.

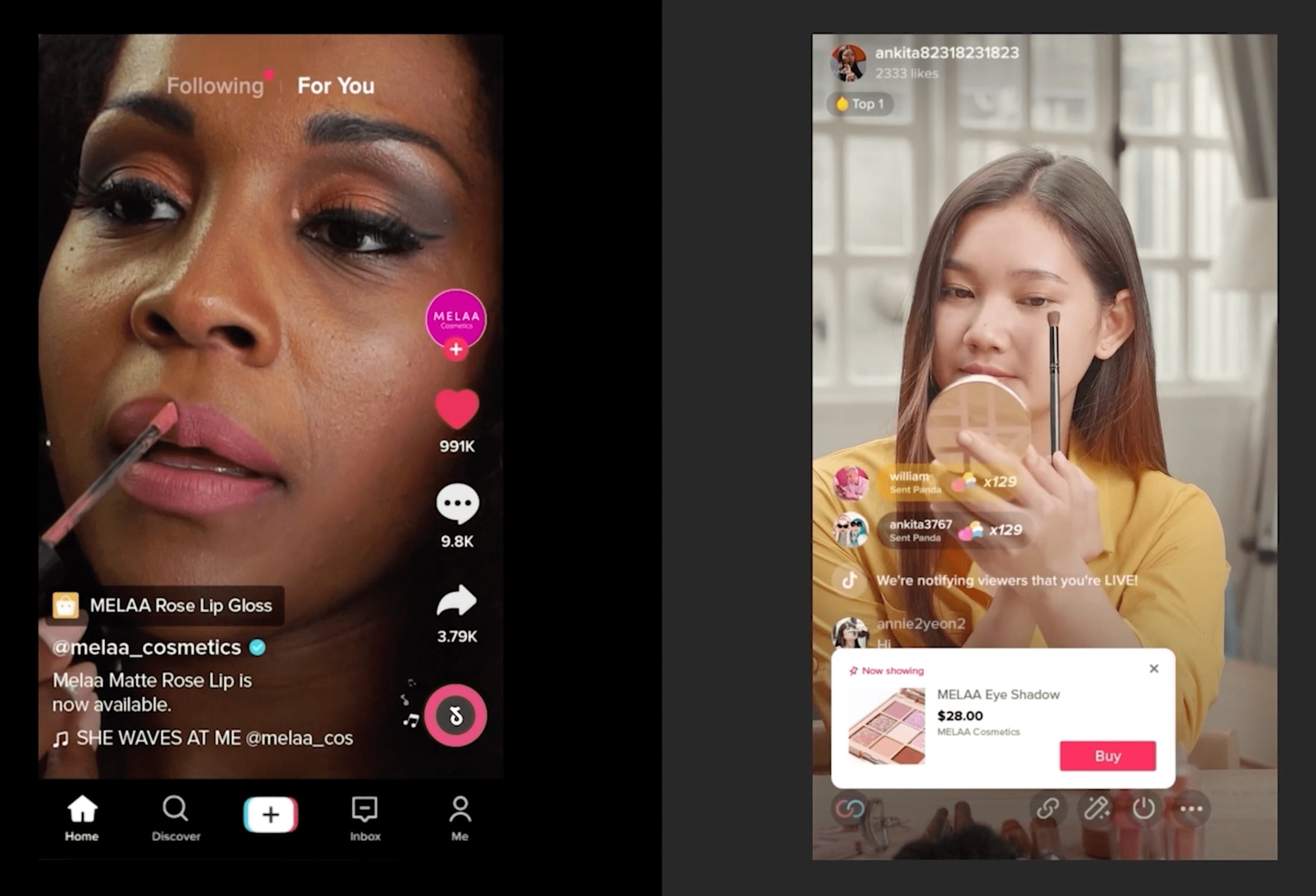

On the back of this success, TikTok has launched TikTok Shopping – a feature that allows merchants to more easily sell products and advertise on the TikTok platform.

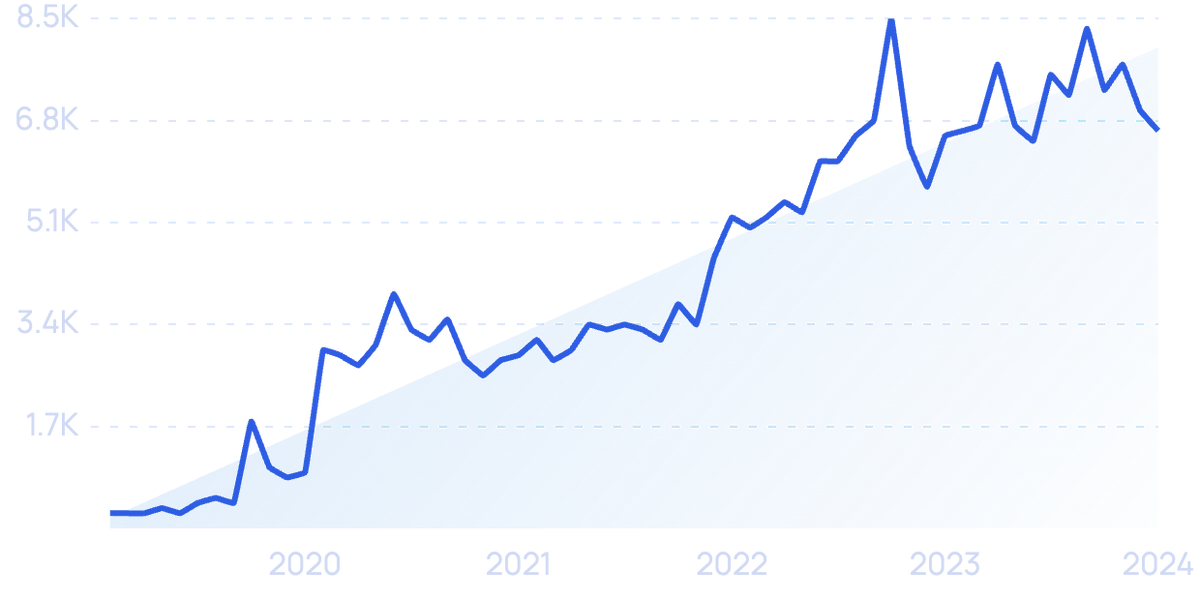

Searches for “TikTok Shopping” have risen by 2,500% over the last 5 years.

To improve outcomes for small merchants, TikTok has partnered with companies like Shopify and has created a TikTok Shopping API that allows merchants to automatically upload product catalogs to TikTok.

An example of TikTok Shopping. Product links appear on the screen when certain brands are mentioned or used.

2. Consumers Continue to Buy Groceries Online

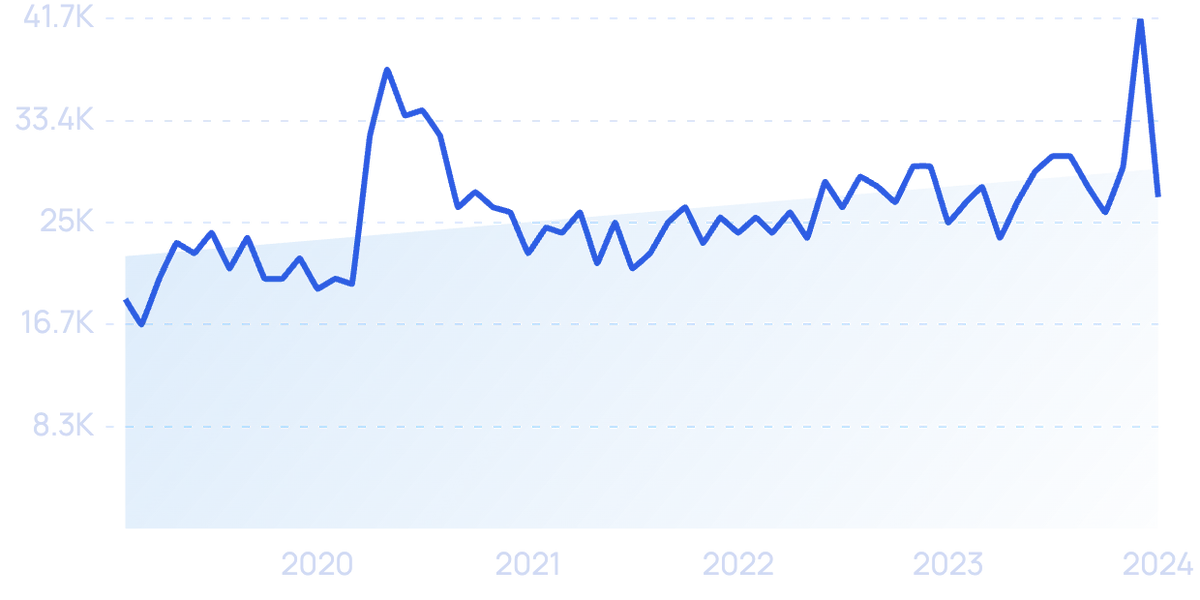

Growth in grocery shopping skyrocketed between 2020 and 2021, with US grocery sales from physical stores jumping from $58.44 billion to $69.97 billion.

As of December 2023, this figure stands at $74.59 billion.

But an even more impressive increase was online grocery sales, which hit $95.82 billion in 2020, a staggering 11% of total grocery sales in the US.

To put this into perspective, over the previous decade from 2010 to 2019, grocery shopping averaged growth of just 1.3% per year, with adjustments for inflation.

What’s more, before 2020, 81% of American consumers hadn’t even tried shopping for groceries online.

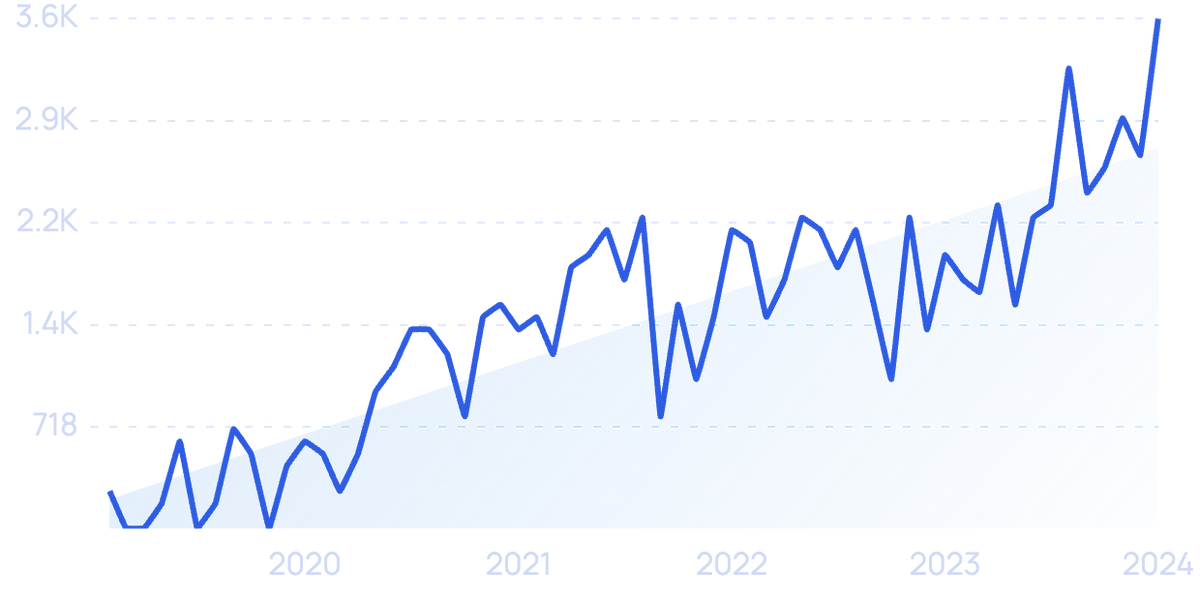

A picture of the rapid growth in online grocery shopping that was spurred by the pandemic.

But by mid-2020, 79% of American grocery buyers reported having made at least one grocery purchase online. By the end of the year, online grocery shopping accounted for more than 7% of all eCommerce sales in the US.

Importantly, this isn’t a trend restricted to the US.

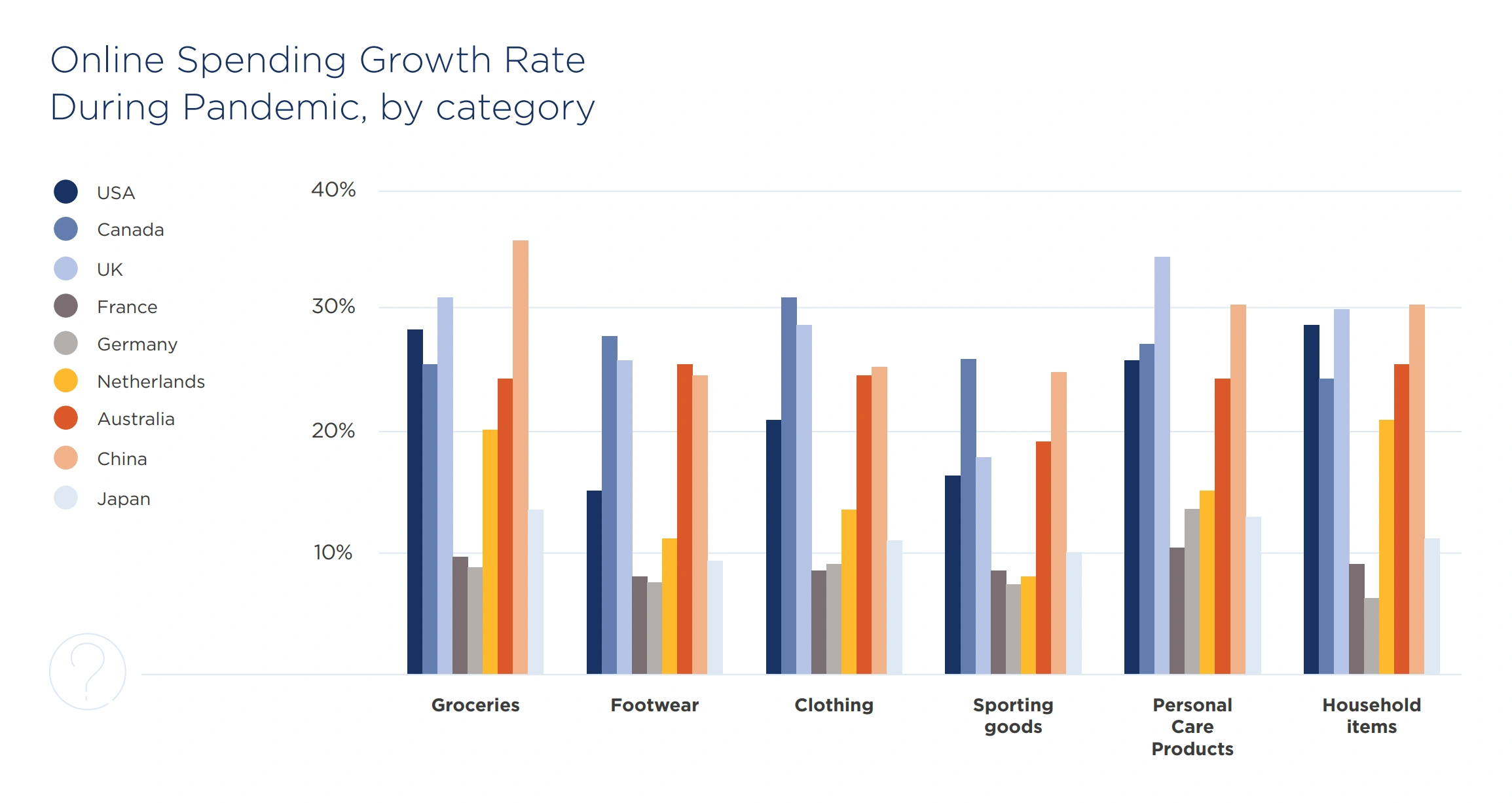

In a study involving 9,542 consumers in 9 countries across the world, Dynata found that before the onset of the pandemic, grocery shopping had the lowest share of online expenditure.

After 2020, online grocery sales surged an average of 23% across the UK, Canada, France, Germany, the Netherlands, Australia, China, and Japan.

Consumers’ interest in online grocery shopping has grown faster than most other products, compared to shopping habits before the pandemic.

Chinese consumers lead grocery spending online. They also added the most number of shoppers, with a Nielsen study indicating that 111 million Chinese consumers bought consumer packaged goods (CPG) for the first time in 2020.

Americans were in second place, with 22 million new online grocery shoppers, followed by South Korea at 922,000 consumers, all making their first digital purchase of groceries in 2020.

According to the Nielsen study that included 12 countries globally, online grocery shopping grew by an average of 40% across these countries, excluding Chile, which was an outlier with an explosive growth rate of 445%.

Most developed countries worldwide added a large number of new online shoppers and experienced increased online sales growth.

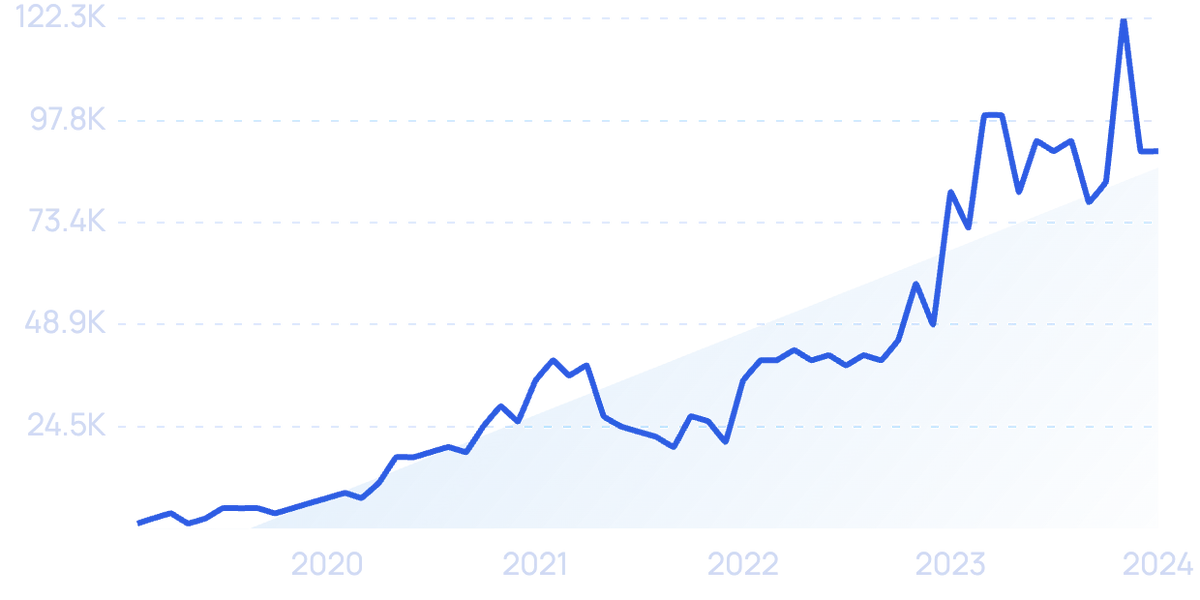

Globally, online grocery shopping is forecast to grow at a compound annual growth rate of 25.3% in the coming years, exceeding $2.1 trillion by 2030.

3. Ecommerce Accelerates Across All Product Categories

Although grocery led the growth curve for online sales in the US, the pandemic accelerated eCommerce growth in several other categories as well.

A lot of spending has been redirected online, with more digital shoppers spending more money on everything from footwear and apparel to household items.

Household items ranked #2 on the growth leaderboard after grocery, increasing 22% globally in 2020.

Clothing and footwear followed closely behind, with an average worldwide sales lift of 19% and 17%, respectively.

Shoppers say that they will continue their online spending in many categories, even after the pandemic, suggesting that a significant fraction of the market share gained by eCommerce platforms is going to be permanent.

Home improvement, meal delivery, and online fitness are three of the biggest eCommerce winners, with 93%, 80%, and 77% of shoppers affirming that they will either increase or maintain their spending in these categories, respectively.

Some of the product categories driving the biggest increases in home improvement are furniture, bedding and mattresses (+61%), landscaping (+58%), and decorative items such as plants and art (+44%).

The pandemic has brought change to the eCommerce landscape, driving demand for online ordering and delivery of products that just weren’t that common before.

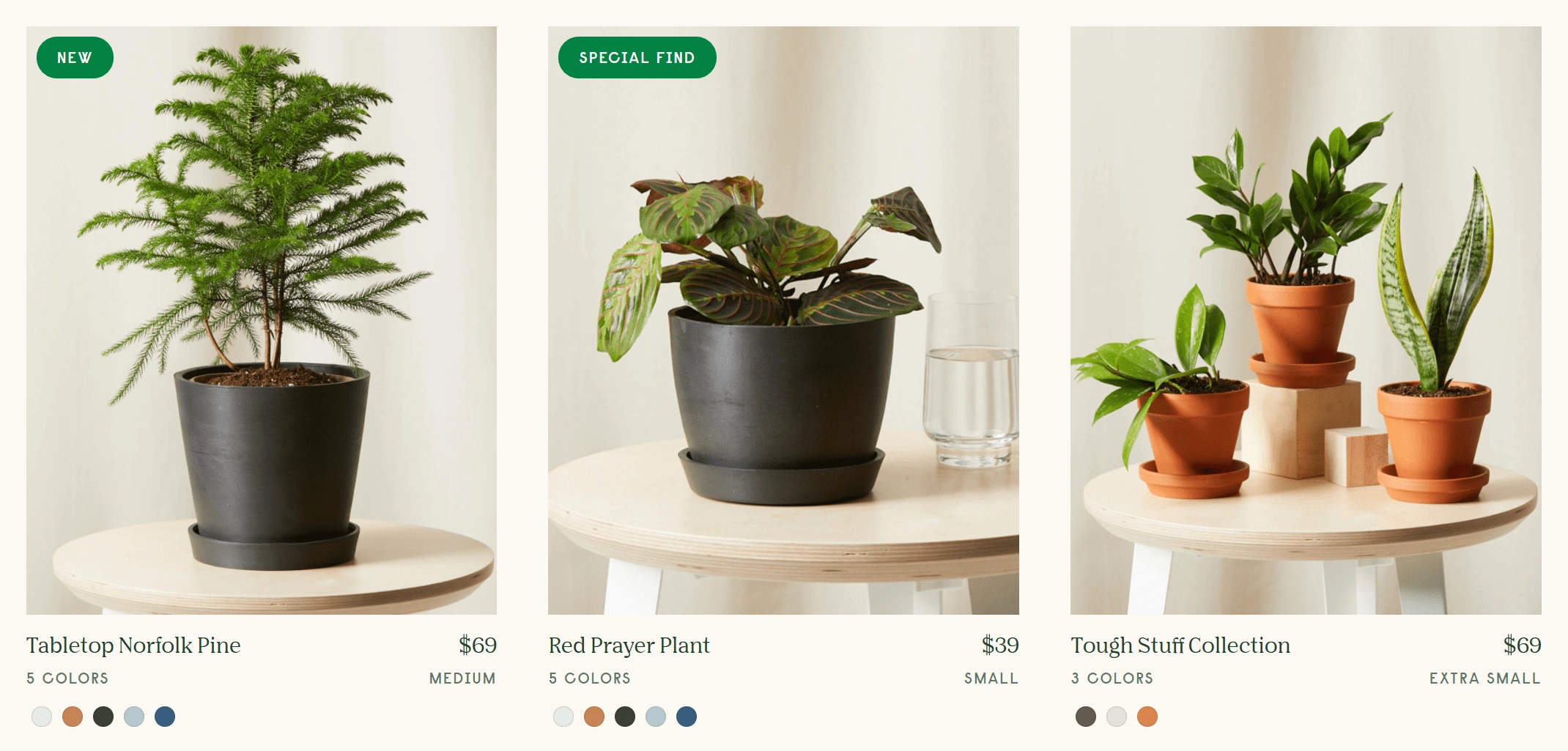

For instance, eCommerce plant delivery company Bloomscape delivers home-ready plants directly to consumers.

In September 2020, Bloomscape’s CEO reported that the company had quadrupled its sales and doubled its workforce compared to 2019.

Example of a plant delivery ecommerce category page.

Such growth is just one example of the new product opportunities brought about by our new digital world.

An Ernst & Young forecast predicts that online sales will accelerate in the coming years. Southeast Asian markets are slated to lead the eCommerce boom with 3X to 4X growth, reaching $363 billion by 2025.

4. Ecommerce Forces Retailers to Adapt

As regions around the world went into lockdown, retail businesses found themselves forced to come up with new ways to serve shoppers through channels other than in-store.

In a study with 11,500 participants across 16 countries, global market research company, Ipsos, found that 65% of consumers had shopped more online than in the previous year.

In the US, 92% of consumers have now made purchases online, including Gen Z, Millennial, Gen X, and Baby Boomer consumers, between 18 and 65 years of age.

More tellingly, 78% of shoppers reported having used channels that were new to most stores such as “buy online, pick up in-store” (BOPIS), and curbside pickup.

Searches for “BOPIS” are up 44% over the last 5 years.

These aren’t just trends restricted to pandemic-induced lockdowns, either; when asked whether they would prefer shopping online or in-store, assuming both options presented zero health risks, 22% said they would continue shopping online, while 39% said they would use both equally.

The new channels also seemed to have quickly gained traction, with 69% of consumers confirming that they will continue using BOPIS and curbside pickup even after the pandemic.

Nielsen reports that about 75% of the top 50 physical retail brands in the US now offer curbside pickup.

This innovation with new channels and business models hasn’t been confined to essential commodities such as groceries or the food sector.

Even apparel and retail businesses have experimented and found success with non-traditional channels.

5. Ethical Concerns Impact Purchase Decisions

In its benchmark Future Consumer Index study, Ernst & Young surveyed thousands of consumers in 20 countries around the world on attitudes to environmental and social issues.

Of these, 17% of US shoppers reported that they are concerned most about environmental issues, while another 17% said they identify most with social issues.

76% of shoppers indicate that they recycle and reuse packaging and products, and 67% confirm having adopted reusable shopping bags.

And 57% of consumers state that they pay attention to the environmental impact of what they buy.

Consumers also say that they would not shop with businesses that behave socially or environmentally inappropriately. 31% of respondents stating that they would not buy again from such brands, and 24% will also tell their friends and family not to buy from such brands.

Shoppers are also clearly willing to walk the talk, as 55% of the total CPG market growth has come from sustainable sub-brands, even though these form only 16% of the product portfolio of these businesses.

Consumers have demonstrated that they will pay a premium for these products, which cost, on average, 39% more than conventional products.

Accordingly, top businesses across categories from apparel to beauty and retail, are also investing in sustainable practices.

The likes of H&M, Patagonia, REI, and Ikea are all prioritizing products focused on reuse, which has traditionally been a challenging model for brands to fulfill in terms of logistics.

Forrester Research estimates that investment in circular-economy-inspired products and sales models will exceed hundreds of millions, rising into single-digit billions of dollars in 2022.

6. Niche DTC Products Take Off

IRI reports that DTC sales of CPG products are set to increase by 2.5x.

Platforms for manufacturing (Alibaba), logistics (ShipBob), and eCommerce sales (Shopify) have all emerged at the same time. Making it relatively easy to develop, create, sell and ship physical products.

In fact, Shopify announced that transactions on their platform have increased by 109% compared to 2020.

Which is causing the long tail phenomenon that transformed the publishing industry to impact the physical product space.

But it’s not just new tech. Shifts in consumer behavior are also driving this trend.

McKinsey reports that 75% of consumers have changed their shopping behavior over the last year – opening the door for new DTC brands to gain traction.

Examples of DTC brands driving this trend include:

DRMTLGY: DTC skincare startup known for its anti-aging “needle-less serum”. Focuses on the high-end natural cosmetics market (for example, their eye cream costs about $51 vs. $18 at Neutrogena).

Searches for “DRMTLGY" are up 7,300% over the last 5 years.

Secretlab: “Gaming chair manufacturer. The company raised a $7.5 million Series B in 2019. And sales have increased 10x since 2017.

Pretty Litter: Silicon cat litter that changes color based on urine pH levels. Unlike most pet products, Pretty Litter is 100% DTC and subscription-based.

Ekster: RFID-blocking smart wallet brand. The company raised $1 million on Kickstarter (7,000% over its goal).

Femtis: Based in Germany, Femtis is one of many fast-growing “period undearwear” brands.

Femtis’ search growth has increased by 667% over 5 years.

CoBionic: DTC supplement brand that focuses on trending product categories, like chocolate collagen and prebiotics. Company revenue (which includes a line of recipe books) reached $7 million last year.

Examples of fast-growing niche DTC products include:

Wheat straw plates: Plates made from a wheat straw — a byproduct of wheat production. Wheat straw is biodegradable, microwave and freezer-safe, lightweight, sturdy, and FDA-approved. Which is why it’s increasingly used as an alternative to plastic.

Searches for “wheat straw plates” have increased by 1,267% over the last 5 years.

Gaming glasses: Blue light-blocking glasses designed to reduce eye strain during long gaming sessions.

Reusable Q-tips: Silicone versions of the popular cotton swab. One reusable Q-tip brand, Lastswab, raised $772K on a $14K goal on Kickstarter.

Custom keycaps: Custom-made keys designed for mechanical keyboards. Popular with the gaming and anime communities.

Posture correctors: Brace or other wearable device designed to reduce the incidence of slouching.

Makeup fridges: Also known as a “beauty fridge”, makeup fridges extend the shelf life of natural makeup.

Portable blenders: Single-serving, USB-powered blender. One popular portable blender product by Sboly generates an estimated $220K on Amazon per month.

Searches for “portable blender” have grown by 238% in half a decade.

7. Well-being Becomes a Focal Point For Consumers

Possibly one of the few good things to emerge from the pandemic is an increased focus on well-being.

This has found expression in a variety of ways – most notably, as a surge of consumer interest in hygiene, healthy eating, DIY cooking, fitness, and personal care.

Online sales of hand sanitizers exploded 357% during the pandemic, but this hygiene consciousness is likely here to stay.

A Nielsen study of consumers across 17 markets found that 71% of consumers say that health and hygiene will continue to be of heightened importance to them in the coming years.

These priorities are reflected in the sales of multipurpose cleaning agents, as well as kitchen and bathroom cleaning products, which have increased this year by 32% and 29%, respectively.

A Boston Consulting Group study shows that this concern for hygiene isn’t going anywhere.

Even though 79% of consumers are interested in leaving home more often, health concerns are still high, with 65% of shoppers saying they will avoid contact with others in stores even after the pandemic.

Just as many shoppers also expect retailers to continue COVID protocols well into the future.

On the food front, shoppers are increasingly experimenting with DIY cooking, exploring recipes and ingredients that they had not tried before the pandemic.

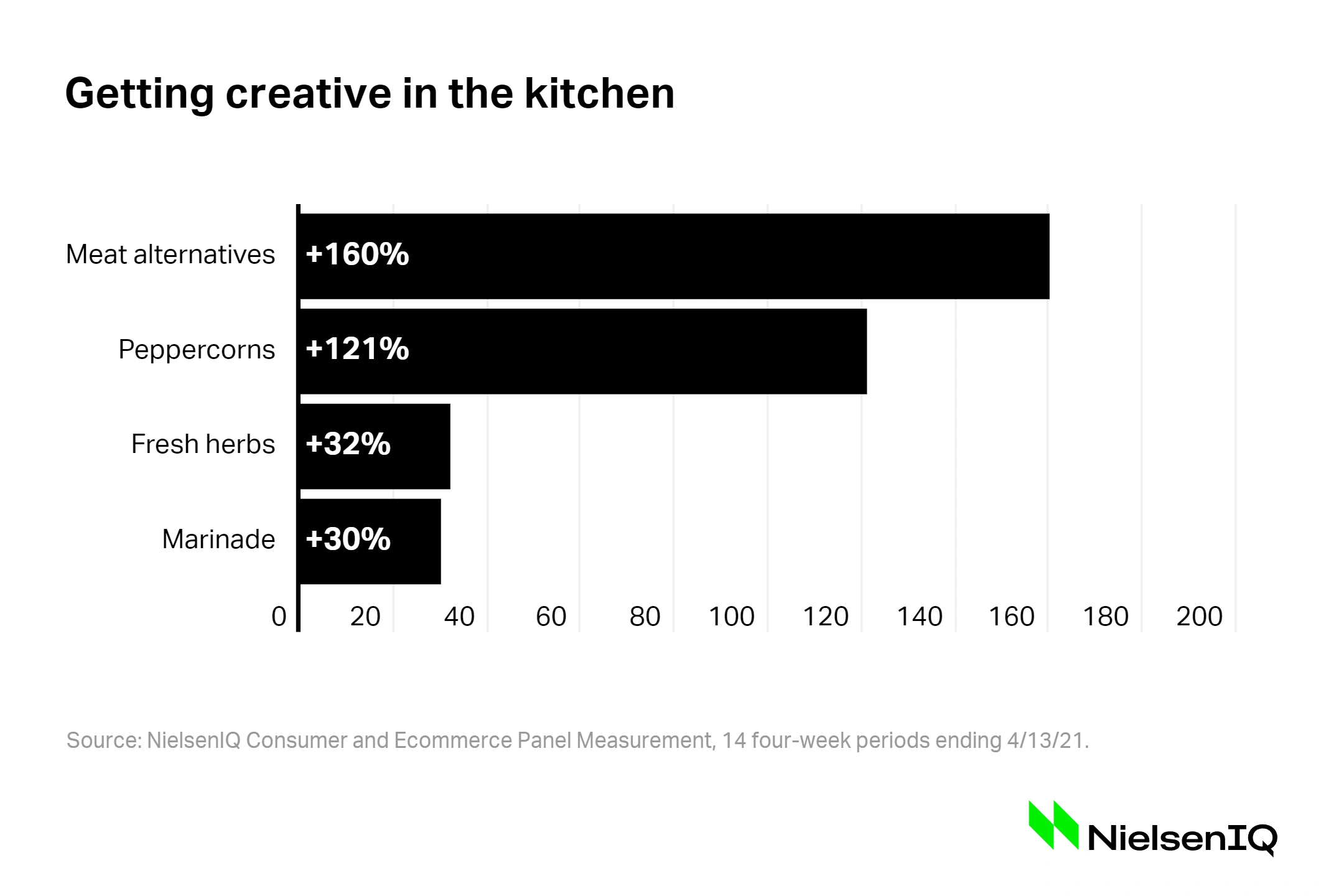

In ingredients, shopping for meat alternatives has grown 160%, while peppercorns, fresh herbs, and marinades have increased 121%, 32%, and 30%, respectively.

Consumer eating habits have changed during the pandemic.

Search interest in “Plant-Based” has grown by 336% in 5 years.

Frozen foods also saw a big jump in sales of 23%, with consumers buying $66 billion worth of frozen foods in 2020.

The quest for healthy options also led to seafood sales skyrocketing by 59%, generating more than $16.6 billion in revenue in one year.

Fitness and personal care are just as important, with shoppers from Canada to China driving growth rates of sporting goods up by 26% since the onset of the pandemic.

While overall sales of beauty products dropped by 24% during the pandemic, some categories saw triple-digit sales growth online, with nail grooming and hair removal products exploding by 144% and 158%, each.

By the beginning of 2021, increased online shopping for personal care and beauty products reversed the growth slump, ending 2020 with a 16% increase in sales.

Shoppers in the UK are the biggest spenders in this category, driving the growth of 35% in online personal care sales.

8. Chatbots prove to be helpful to shoppers and efficient for retailers

Over the next few years, retail industry experts suggest that fewer shoppers will actually talk with humans as they shop.

Instead, they’ll participate in what’s called “conversational commerce”.

Chatbots and smart speakers are the most common examples of conversational commerce today.

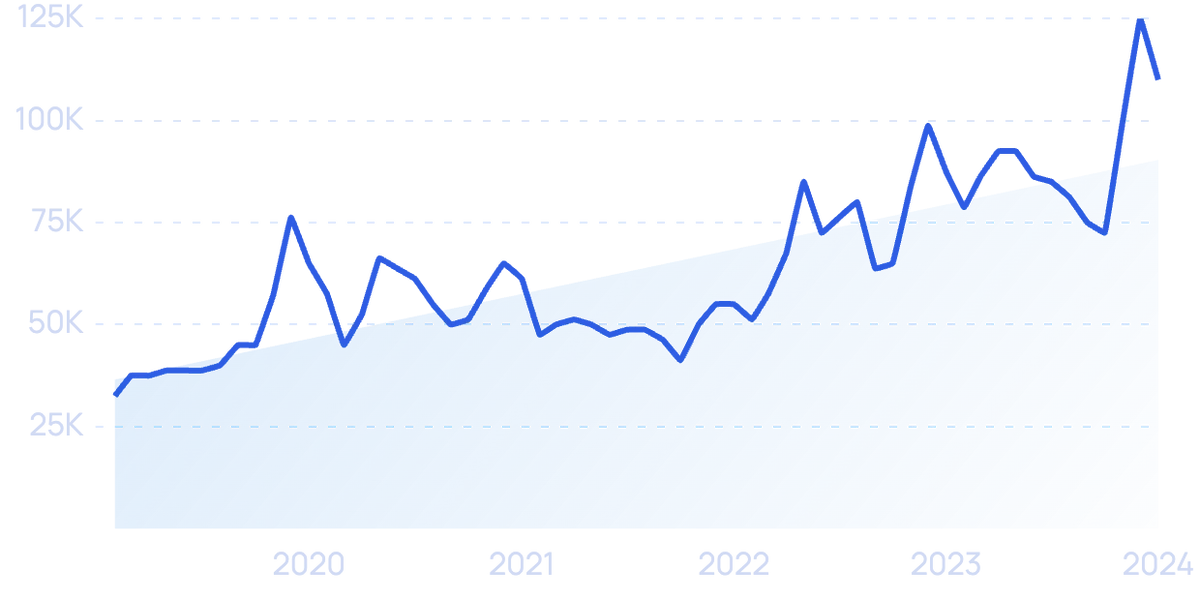

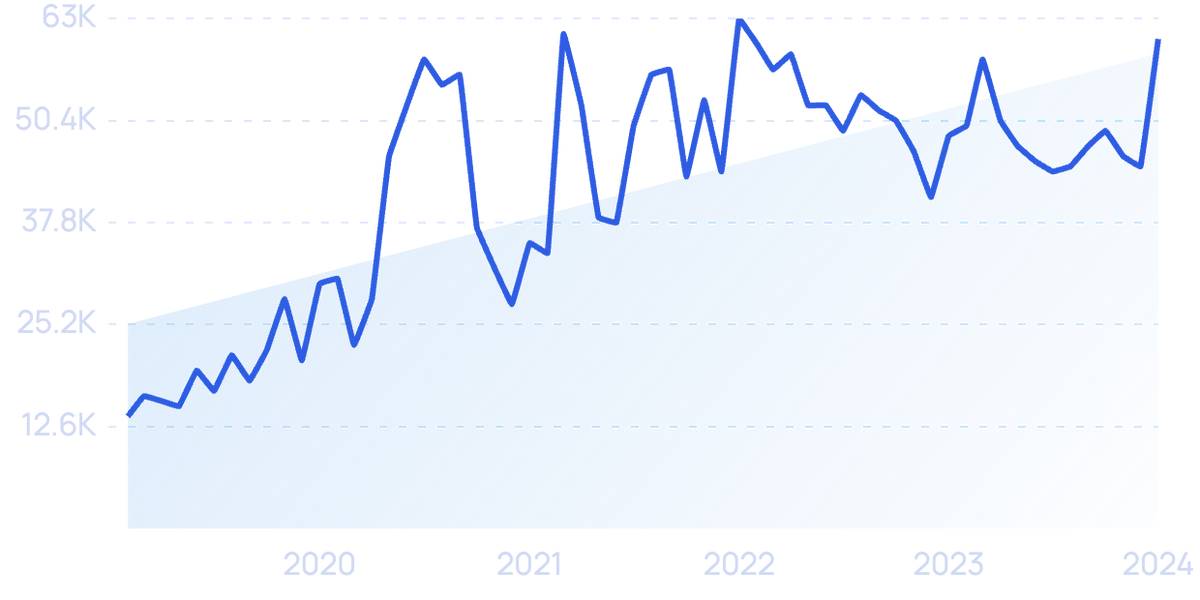

Search interest for “chatbot” is growing rapidly.

Data from the National Retail Federation shows that shoppers' interactions with chatbots are on the rise.

Between 2018 and 2020, there was a 40% increase in the percentage of US customers who interacted with chatbots on a daily basis, the organization said.

Many shoppers prefer this way of communication: 64% of consumers would rather message a business than call.

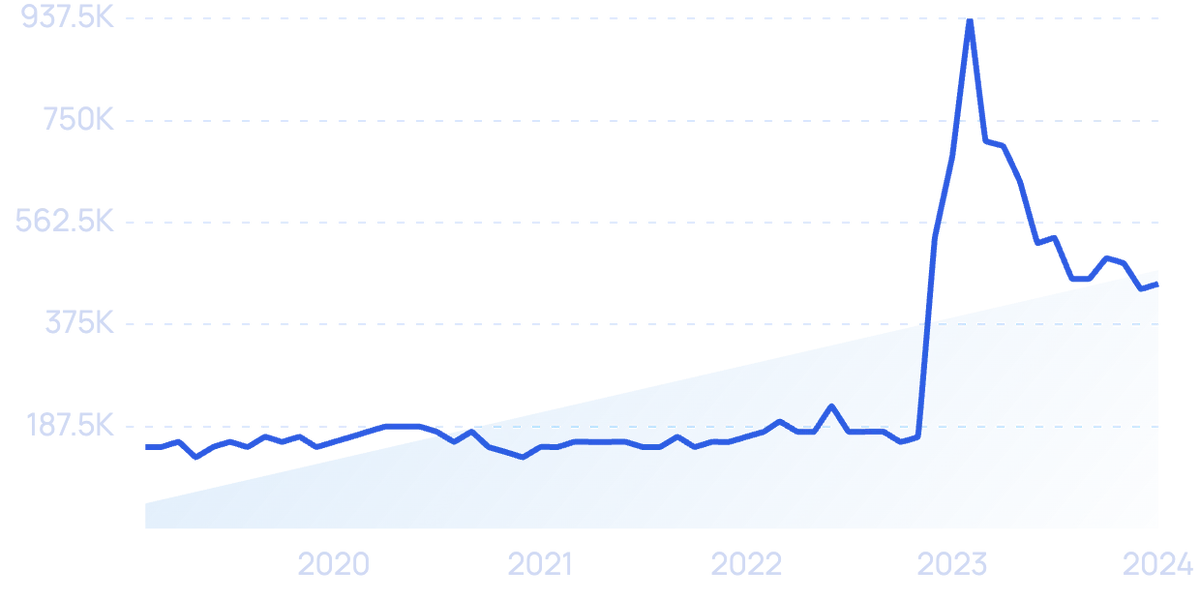

Market reports prove there’s a lot of interest in chatbots and conversational commerce.

The chatbot market is expected to grow at a CAGR of nearly 35% through 2026, reaching a total value of more than $102 billion that year.

Retailers are using AI-powered chatbots to help shoppers determine specific needs and preferences, and they’re also funneling shoppers to specific products online.

Chatbots are becoming an essential part of the shopping experience for many consumers.

One research firm predicted that retail sales from chatbots could reach $112 billion by the end of 2023, and retailers could save $439 billion a year in customer service savings.

Kusmi Tea was one online retailer that faced a surge of orders in 2020, and the brand used chatbots to maximize sales.

Their chatbot uses conversational AI to answer 25 of shoppers' most frequently asked questions.

The brand reported 8,500 conversations with customers and a 94% automation rate.

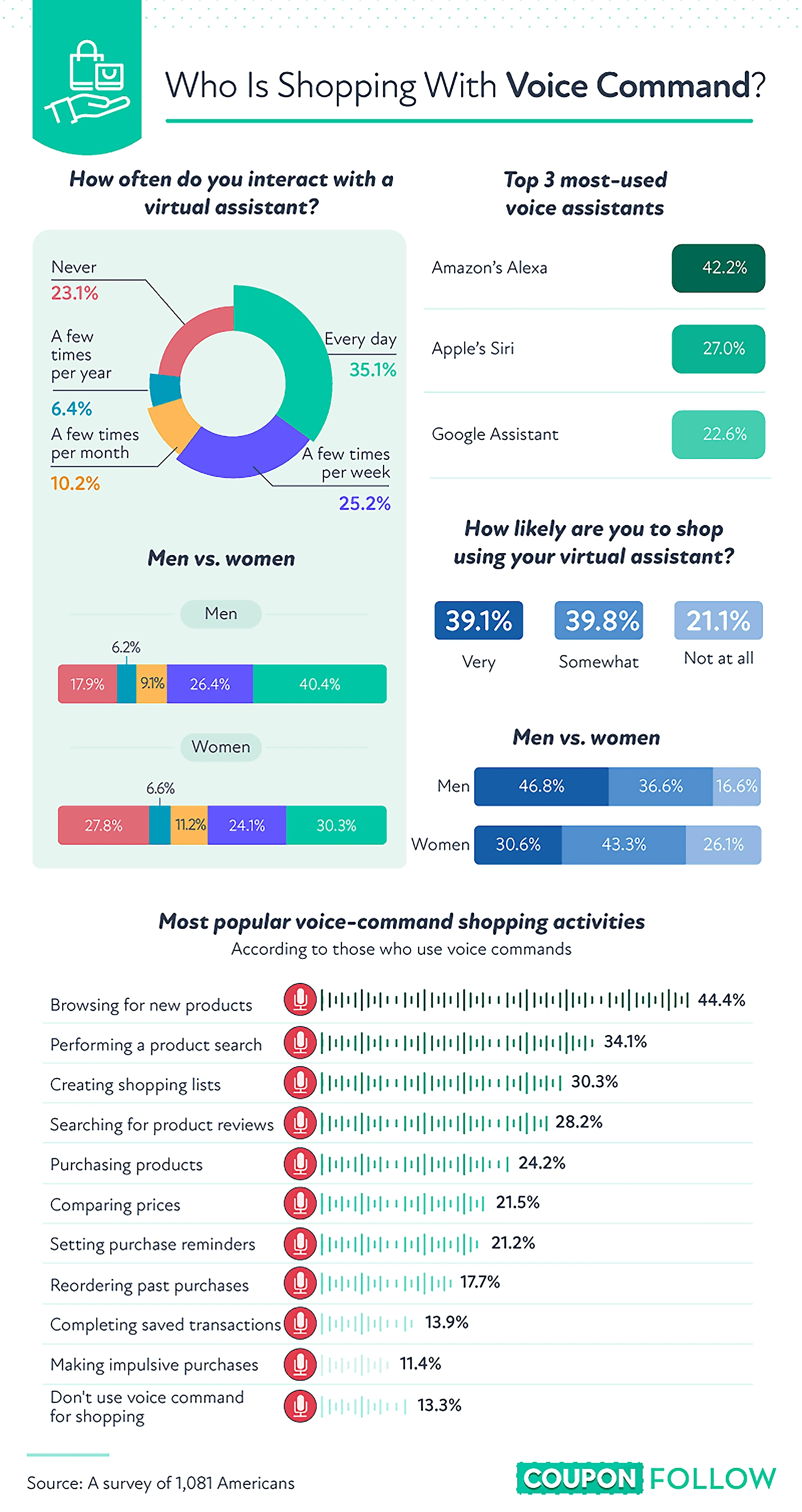

9. Shopping via voice gains popularity

Another important part of conversational commerce is voice shopping via smart speakers or smartphones.

There were more than 4.2 billion voice assistant devices in 2020, but in 2024, that number is expected to jump to 8.4 billion.

For many individuals, these smart speakers provide an easy way to shop.

Search interest in the “smart speaker” has increased 1,017% over the past 10 years.

A 2021 survey found that nearly 40% of smart speaker owners are very or somewhat likely to consult their assistant when shopping. They’re doing everything from browsing for new products to creating shopping lists to actually purchasing goods.

Shopping by voice is more popular among men than women.

Voicebot.ai reports that, as of 2021, 45.2 million shoppers had used voice to order a product at least once. That represented a 120% jump from 2018.

Globally, voice shopping is driving billions of dollars in ecommerce revenue.

In 2021, $4.6 billion in purchases were made via voice assistants. In 2023, experts predict that amount to jump to $19.4 billion — that’s a 400% increase.

Shoppers with Amazon’s Echo device can purchase anything from Amazon.com, Whole Foods Market, or Amazon Fresh with their voice. The device also prompts shoppers to reorder items and refill prescriptions through Amazon Pharmacy.

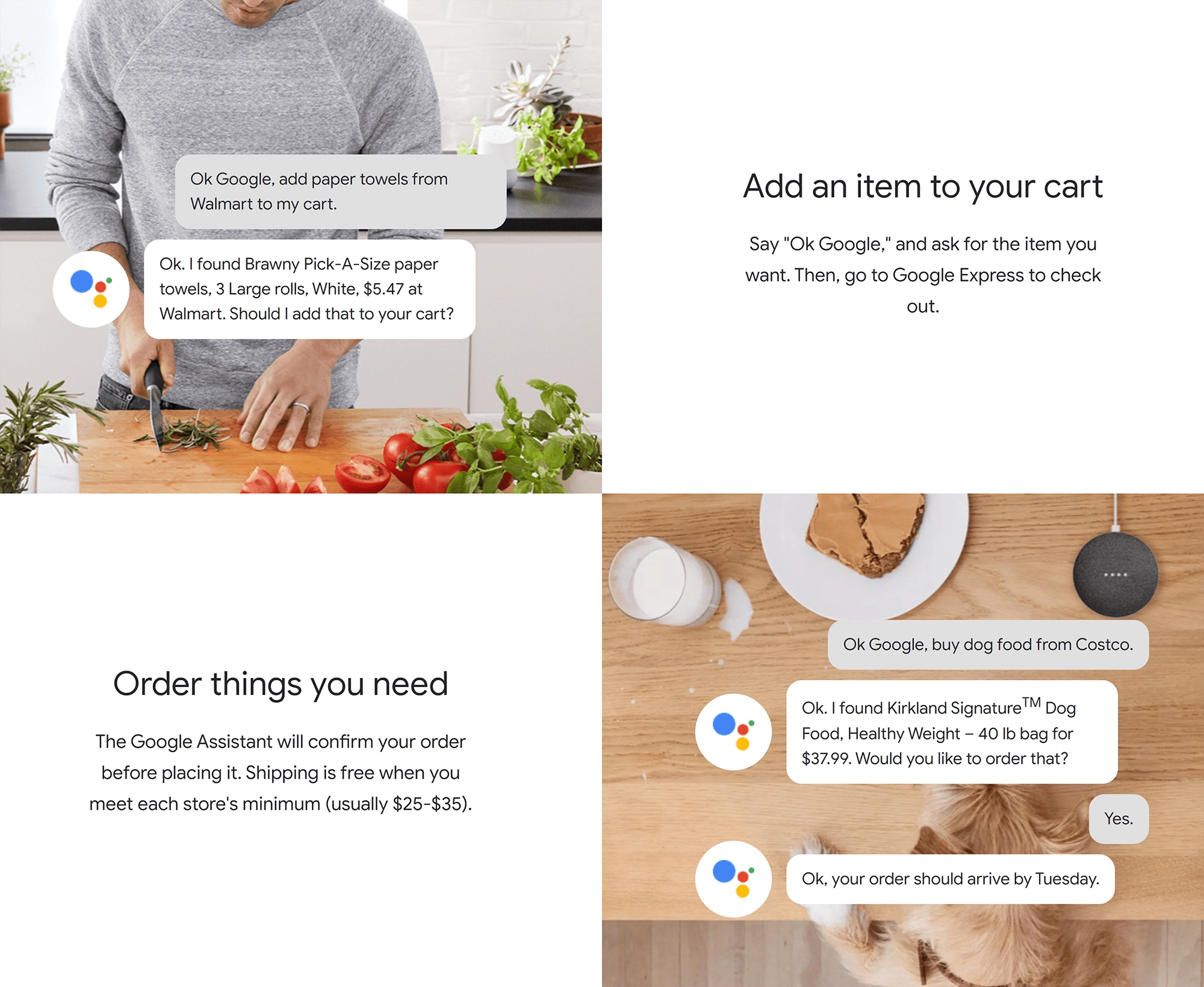

Amazon’s Alexa enables shoppers to make purchases without so much as a click or a tap.

Another major voice-enabled shopping platform is Google Assistant, which partners with a number of different retailers like Target, Walmart, Walgreens, and Costco.

Individuals with a Google Home device can order products from more than a dozen different retailers.

Apple’s Siri began a voice-activated shopping partnership with Walmart in 2019.

In fact, Walmart has been investing in voice shopping on its own terms.

The retail giant acquired Botmock, a tech company specializing in conversational applications, in 2021.

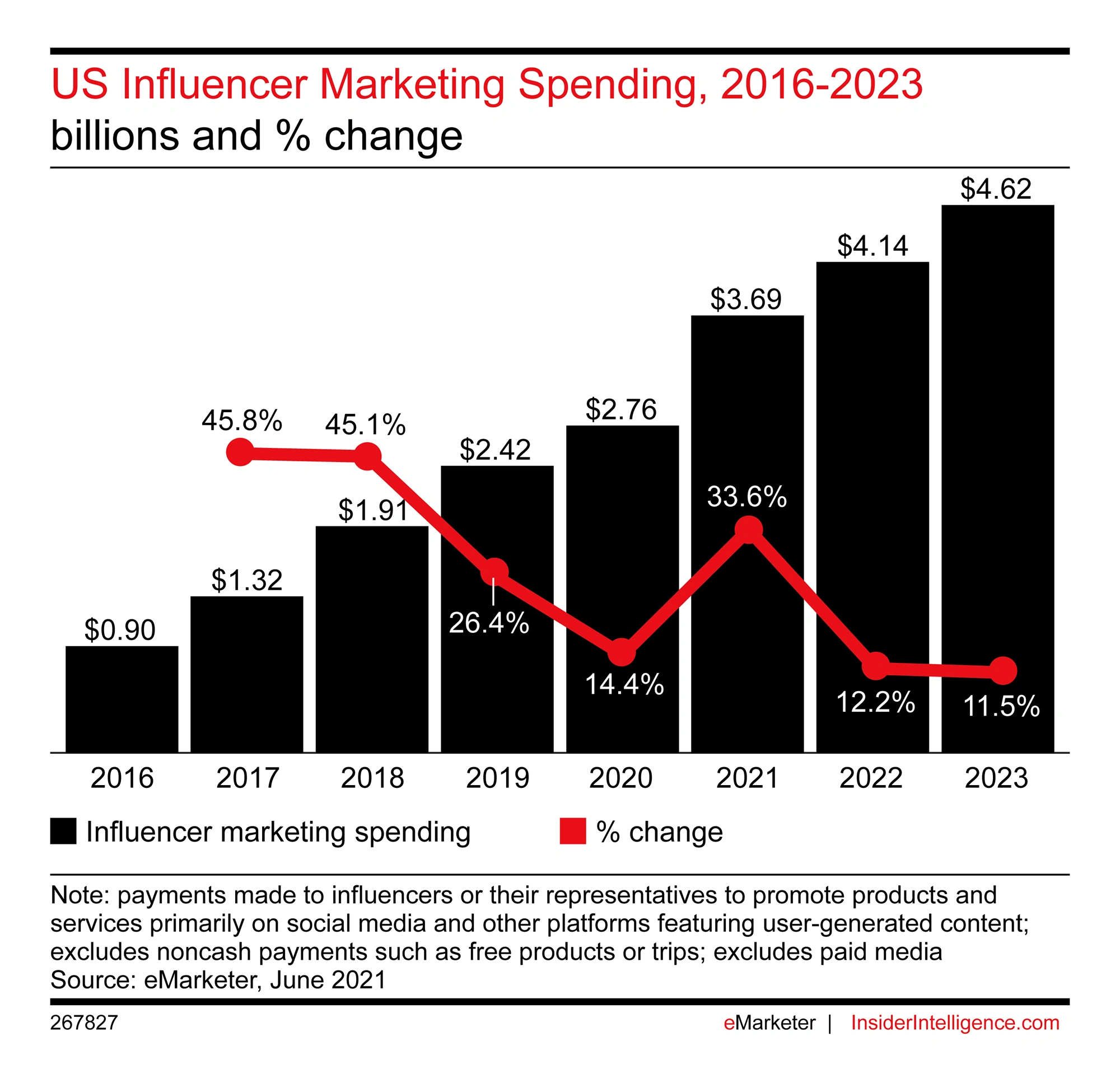

10. Shoppers depend on influencers to inform purchase decisions

One of the most important ways retailers today market their products is through social media influencers.

Nearly 90% of consumers have made a purchase after seeing a product promoted by an influencer. That’s according to a 2019 survey from Rakuten Marketing.

This trend is especially relevant when it comes to young shoppers — 97% of Gen Z shoppers say that social media is their main source of shopping inspiration.

The global influencer market is growing at an incredible rate, more than doubling since 2019. In 2021, it was valued at $13.8 billion.

In the US, brands are expected to spend more than $4 billion on influencer marketing this year.

Spending on influencer marketing was predicted to hit $4.62 billion in 2023.

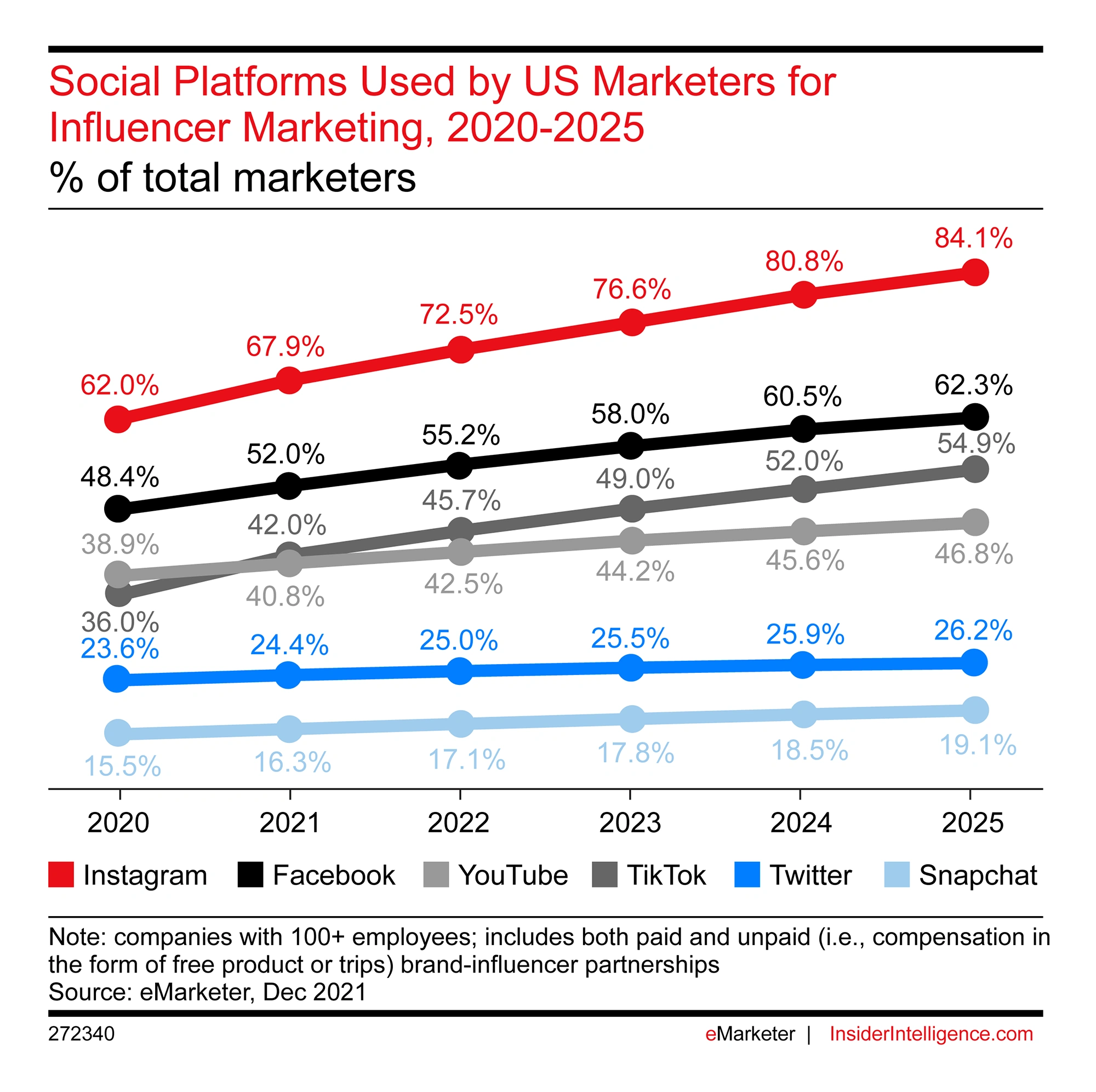

On Instagram alone, there are more than half a million influencers.

YouTube boasts around 1.5 million influencers.

TikTok is seeing a sharp increase in influencers lately. There were 16,400 influencers on the platform in 2018 and by 2020, that number was already up to 160k.

Instagram is expected to remain the most popular platform for influencers through 2025.

Partnering with influencers is proving to be an effective strategy for attracting shoppers and driving revenue for retailers.

The highest-performing marketing agencies can earn an ROI of up to $18 for every dollar spent on this strategy. Even average firms report an ROI of more than $5.

The fashion, beauty, and lifestyle sectors are the most popular avenues for influencer marketing.

Nearly 60% of companies in these categories use influencer marketing to inspire purchases and more brands are planning to use the strategy in the future.

Beauty influencers often garner tens of thousands of likes on every post.

A 2020 survey showed that consumers are most likely to act on influencer posts that involve food and beverage, health and wellness, and personal technology.

Bespoke Post is one brand that’s using influencer marketing to grow its customer base.

The brand offers a membership-based subscription box filled with products that appeal to men such as barware, clothing, and outdoor accessories.

They work with dozens of influencers across platforms and have generated more than 17 million views on their influencers’ YouTube videos.

Bespoke Post works with AJ Sarkar, a travel and lifestyle influencer, to promote their subscription boxes and products.

11. Consumers expect hyper-convenient delivery

The post-purchase expectations of consumers have changed drastically as a result of the pandemic. Convenient options like curbside pickup, BOPIS (buy online, pick up in-store), and two-day delivery have become commonplace.

Shoppers value this convenience. A PwC survey from June 2021 reports that 41 % of global shoppers rank fast and reliable delivery as one of the top three most important factors while shopping online.

Shoppers say fast delivery outranks in-stock availability and good return policies.

According to a recent McKinsey report, more than 90% of shoppers view a two-day or three-day delivery time as a baseline expectation.

In another survey, only 39% of shoppers prefer to have their product deliveries consolidated to reduce the number of trips to their house, but more than 60% say they want their products shipped as quickly as possible.

Ultra-fast fulfillment and delivery has already made its mark in the grocery sector with brands like Instacart and Shipt providing the same-day services consumers are demanding.

Experts say we should be looking for it to dominate other sectors soon.

A survey from Bringg, a delivery and fulfillment platform, showed that 99% of retailers plan to offer same-day delivery within the next three years.

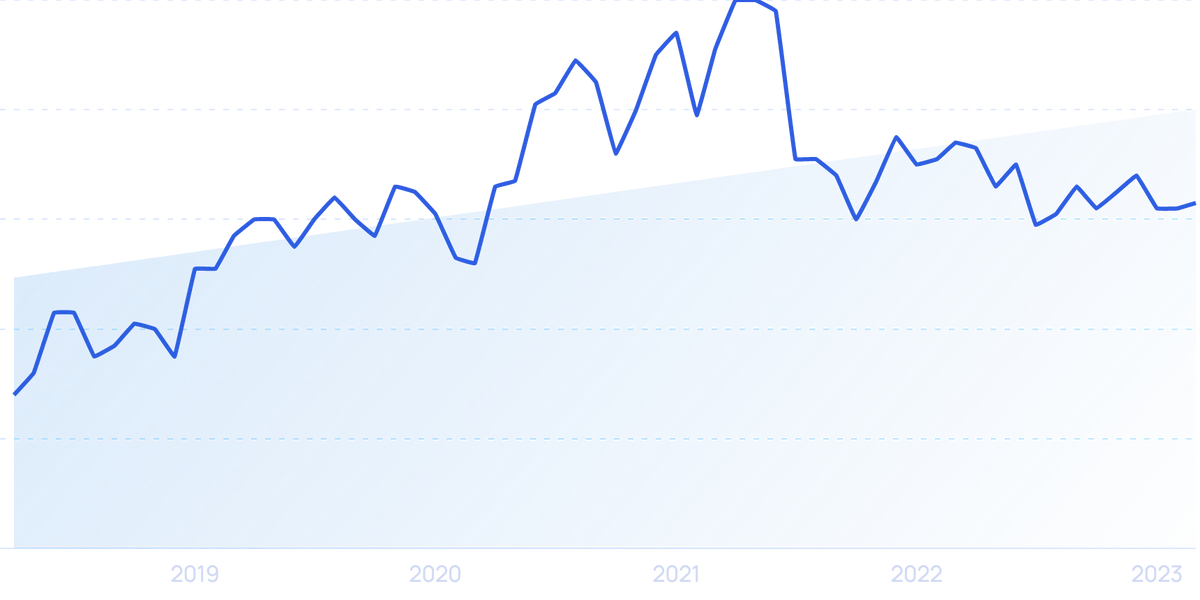

Last-mile delivery is critical in order for that prediction to become a reality.

Search volume for “last mile” is up 51% in the past 5 years.

The term “last mile” stands for the final leg of a product’s journey, the process of it getting to the shopper’s doorstep. It’s the most expensive part of the shipping process for the retailer, but the most critical part of the process for the consumer.

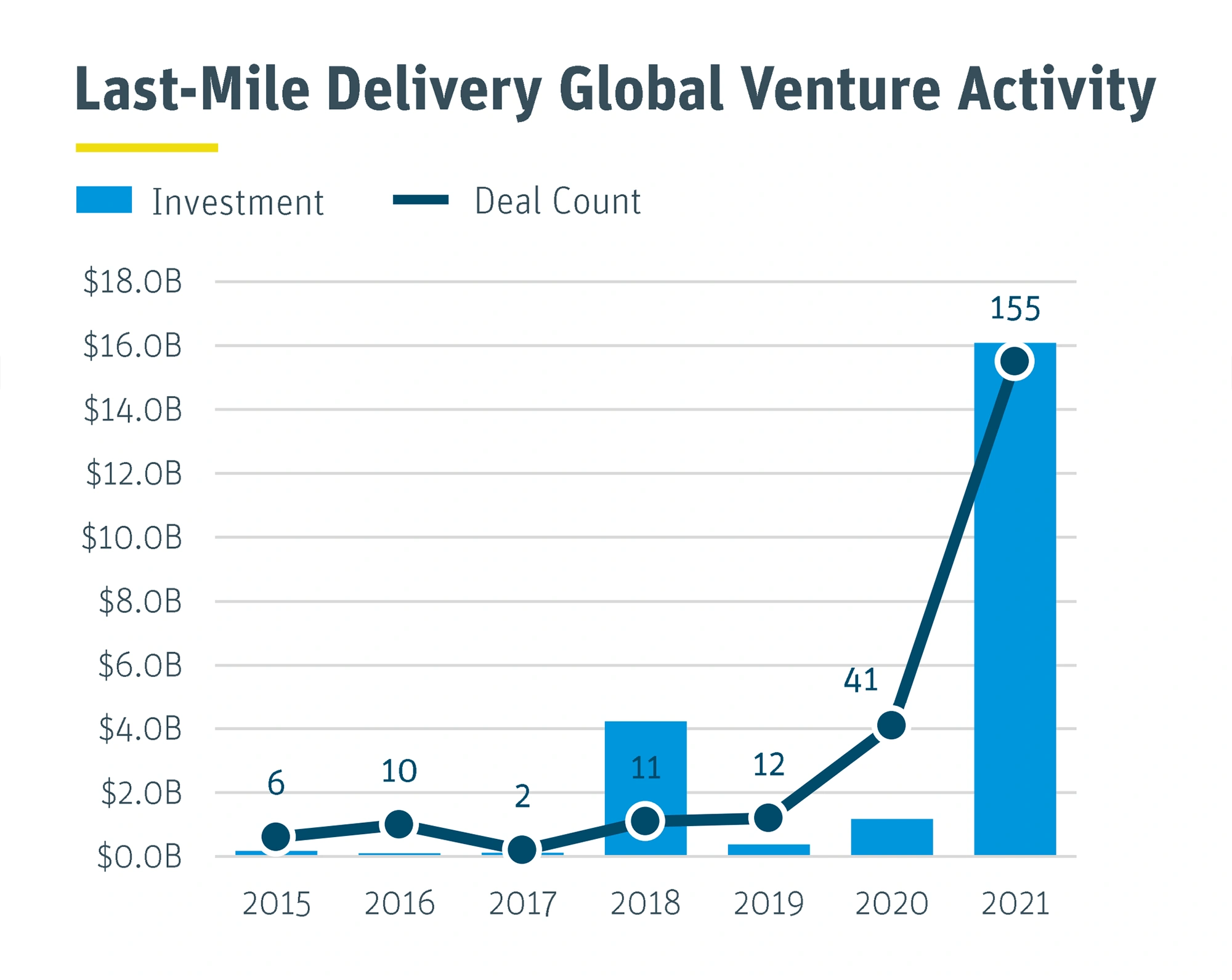

In 2021, we saw significant investment in last-mile delivery.

The Future of Retail Report shows 155 venture deals related to last-mile delivery happened in 2021.

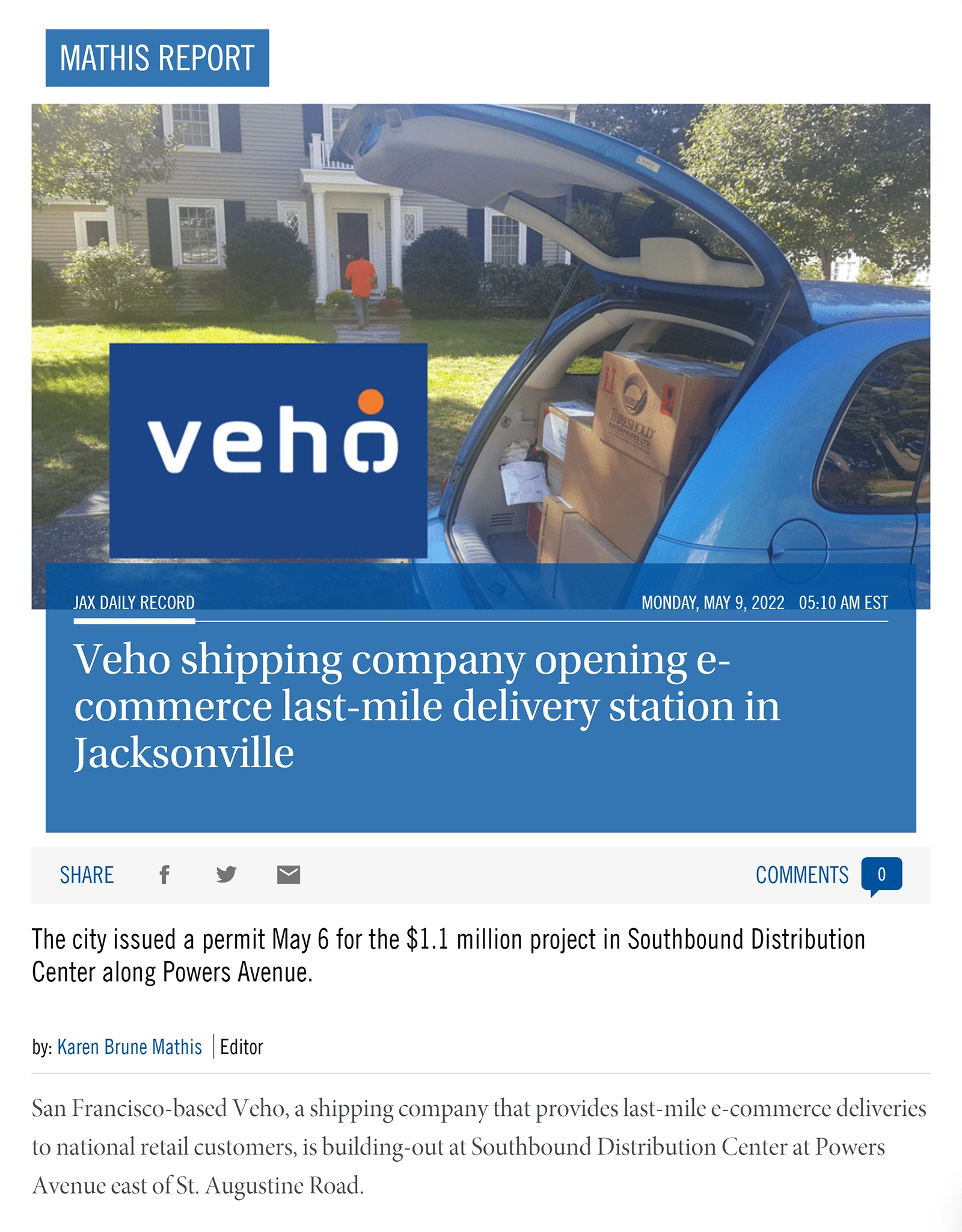

Veho is a last-mile delivery startup that was launched by a student at Harvard Business School who was fed up with traditional delivery services.

Veho is expanding.

Since mid-2020, the company has grown its revenue 40x and expanded its reach to 22 markets.

In early 2022, the company secured $170 million in Series B funding.

12. Payment methods multiply

Cash and checks are a thing of the past. Today’s shoppers have dozens of payment options.

Approximately 64% of consumers use 2.4 payment methods over the course of a year. But, 18% of consumers use five payment methods, and another 18% use seven payment methods.

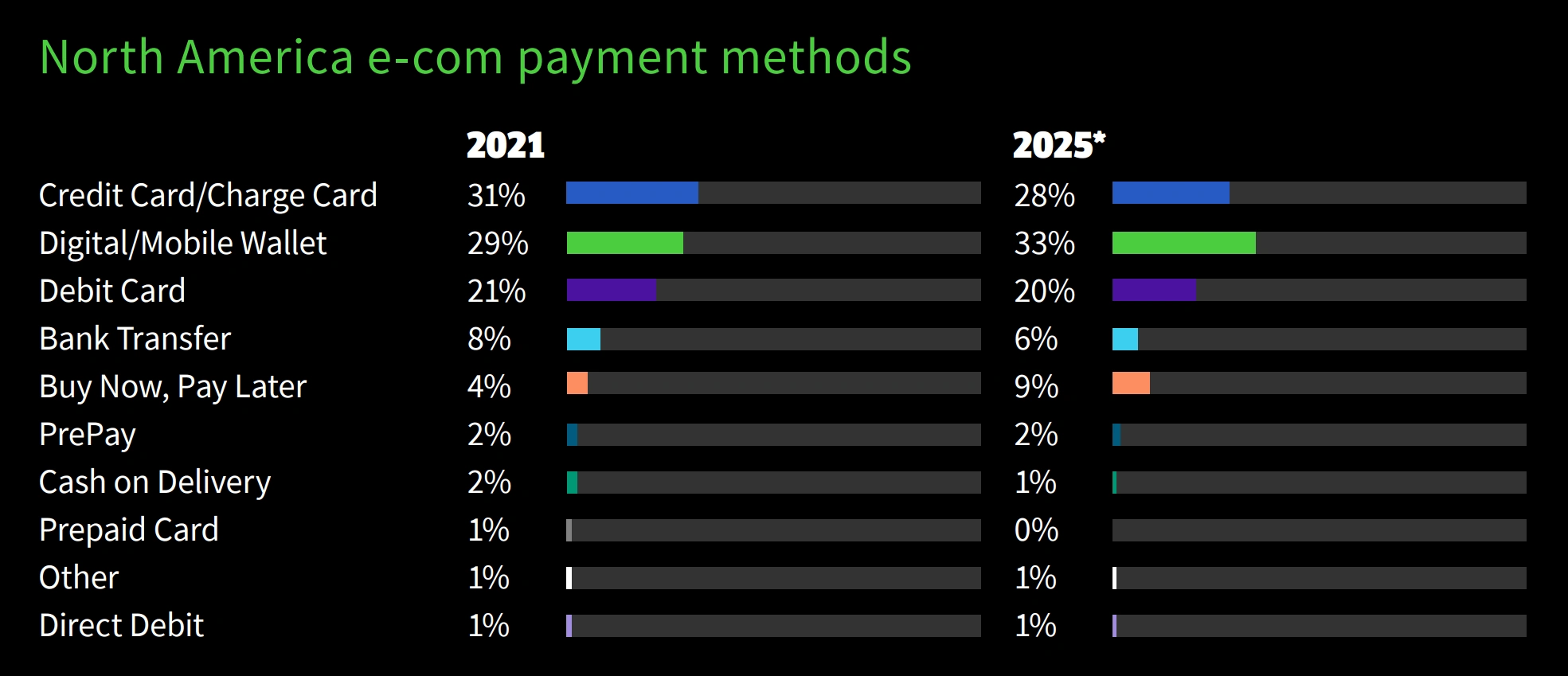

Debit and credit cards remain popular, but digital wallet platforms are coming on strong, especially among younger generations.

Digital wallets account for any payment a shopper makes via an online payment tool, usually an app. Apple Pay, Google Pay, and PayPal are the most popular options.

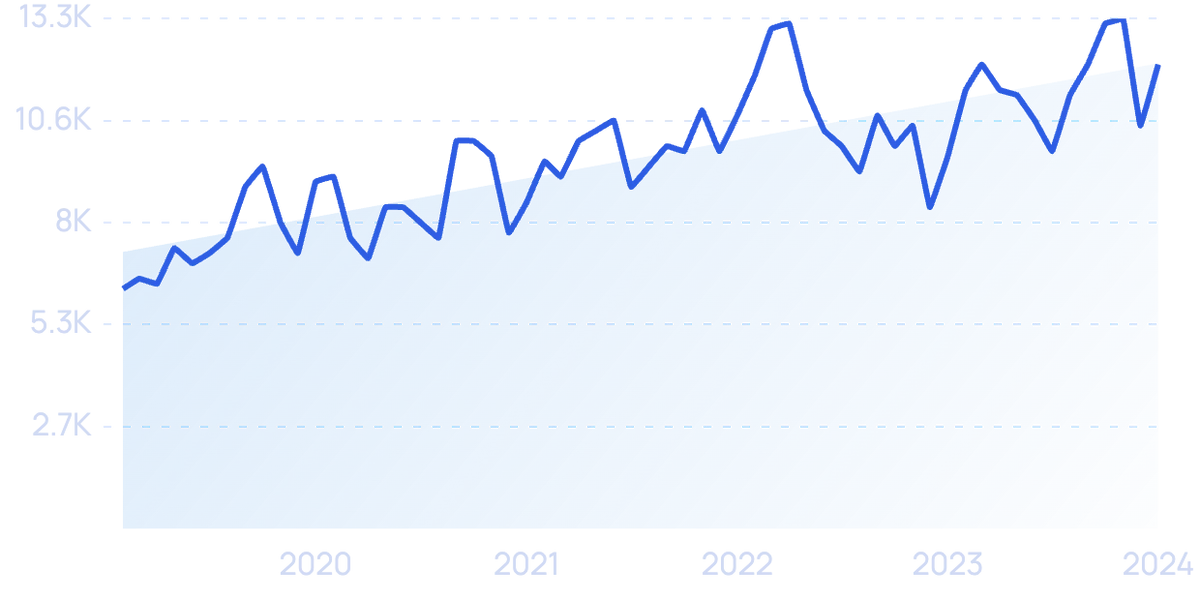

Searches for “digital wallet” have been climbing over the past 10 years (562%).

A 2022 consumer survey showed that 30% of individuals would prefer to pay with their smartphone all the time.

Digital wallets are expected to account for more ecommerce transaction value than credit cards as soon as this year and are expected to account for one-third of ecommerce spending by 2025.

The Global Payments Report from FIS shows that credit card usage is declining while digital wallet payments are increasing.

Other data shows the market for digital wallet payments will double between 2020 and 2025.

PayPal is one platform that has seen incredible growth in the past few months.

Total payment volume rose 15% year-over-year in the first quarter of 2022, and the company predicted 10 million new accounts to be added in 2022.

However, Apple Pay holds the top spot when it comes to mobile payments. As of 2021, it had nearly 44 million users and continues to grow faster than any of its competitors.

Shopper surveys prove the payment and checkout process is a critical part of the buyer’s journey.

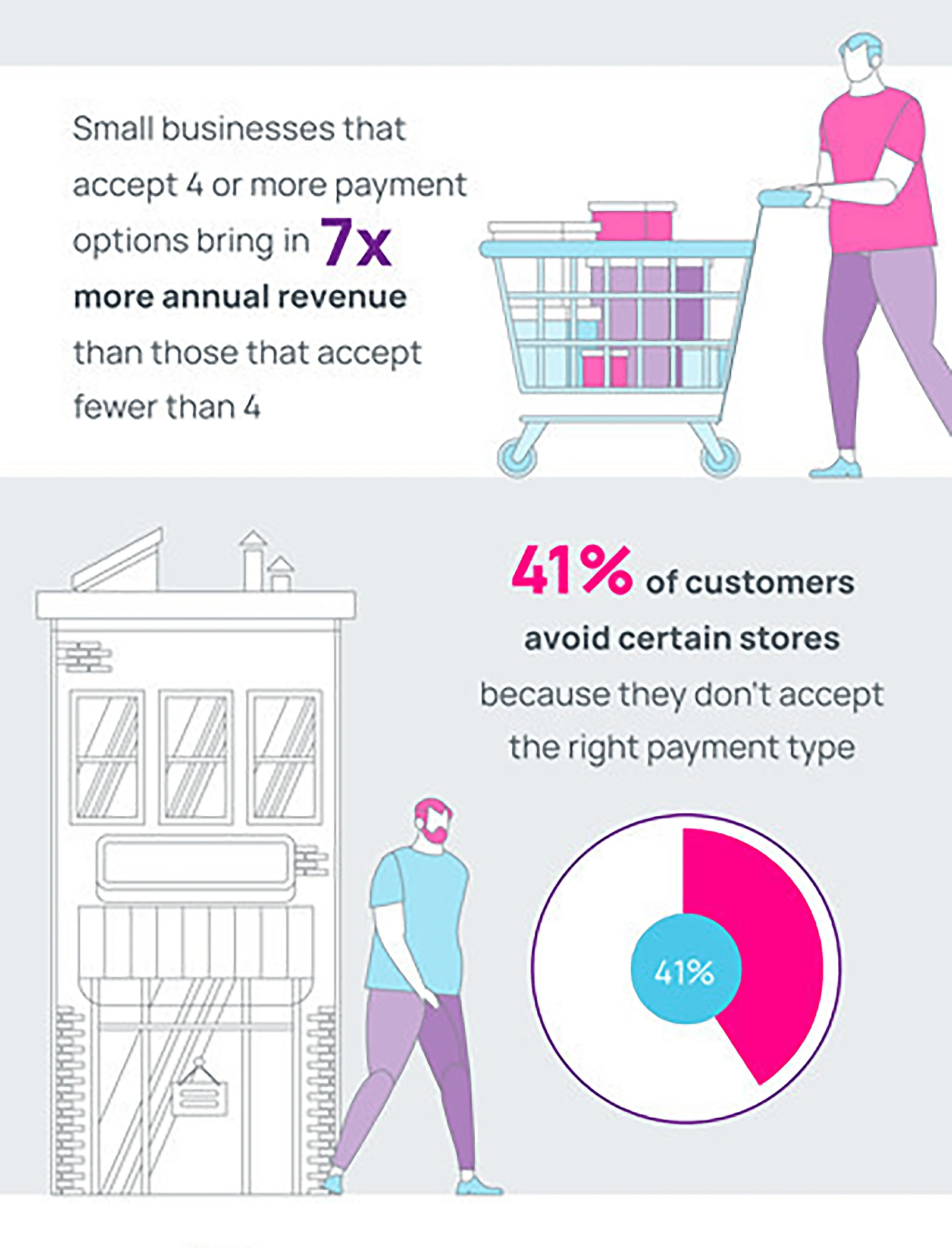

A 2020 survey showed that 58% of consumers will stop their purchase if the checkout is complicated, and 42% will stop the purchase if their favorite payment method isn’t available.

A UK survey showed that a lack of payment options deters even more customers than that. Mollie, a payment service provider, reported that 9 out of 10 shoppers will abandon a cart due to a lack of payment options.

On the other hand, a survey of small businesses showed that those retailers that accept four or more methods of payment bring in 7x more annual revenue than those who accept fewer than four options.

Consumers are more apt to shop with retailers that accept their preferred method of payment.

In addition, a 2021 survey reported that 38% of consumers will spend more when they shop with retailers who accept digital wallets.

Conclusion

That wraps up the top 12 trends we expect to impact the way people shop in the next two to three years.

Despite the uncertainties and economic challenges across the globe, eCommerce shopping continues to grow at an incredible rate. Consumers have more ways to shop than ever before. This means retailers must deploy new strategies in order to grab the attention of shoppers.

Some retailers are already leveraging social media and tech solutions in order to win new customers. Trends that we see beginning in one or two sectors are expected to filter through the entire retail sector soon. Agile brands that can gain customers’ trust are poised for rapid growth in the coming years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more