Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 10 Crunchbase Alternatives & Competitors (2025)

Crunchbase is a database full of valuable business information. You can look up a company of interest and learn more about its structure, investors, and even its tech stack.

These data points are particularly useful for venture capital (VC) or private equity (PE) partners looking for their next startup investment.

You can also use the platform’s data for researching new markets, keeping an eye on competitors, and even building out a sales pipeline.

This versatility makes Crunchbase well-regarded as a leader when it comes to conducting company research—but it’s not the only option.

Whether you’re looking for a startup to invest in, seeking funding for your business, or seeking new prospects, these 10 Crunchbase alternatives might also suit your needs well.

1. Exploding Topics: Best For Finding Under-The-Radar Startups

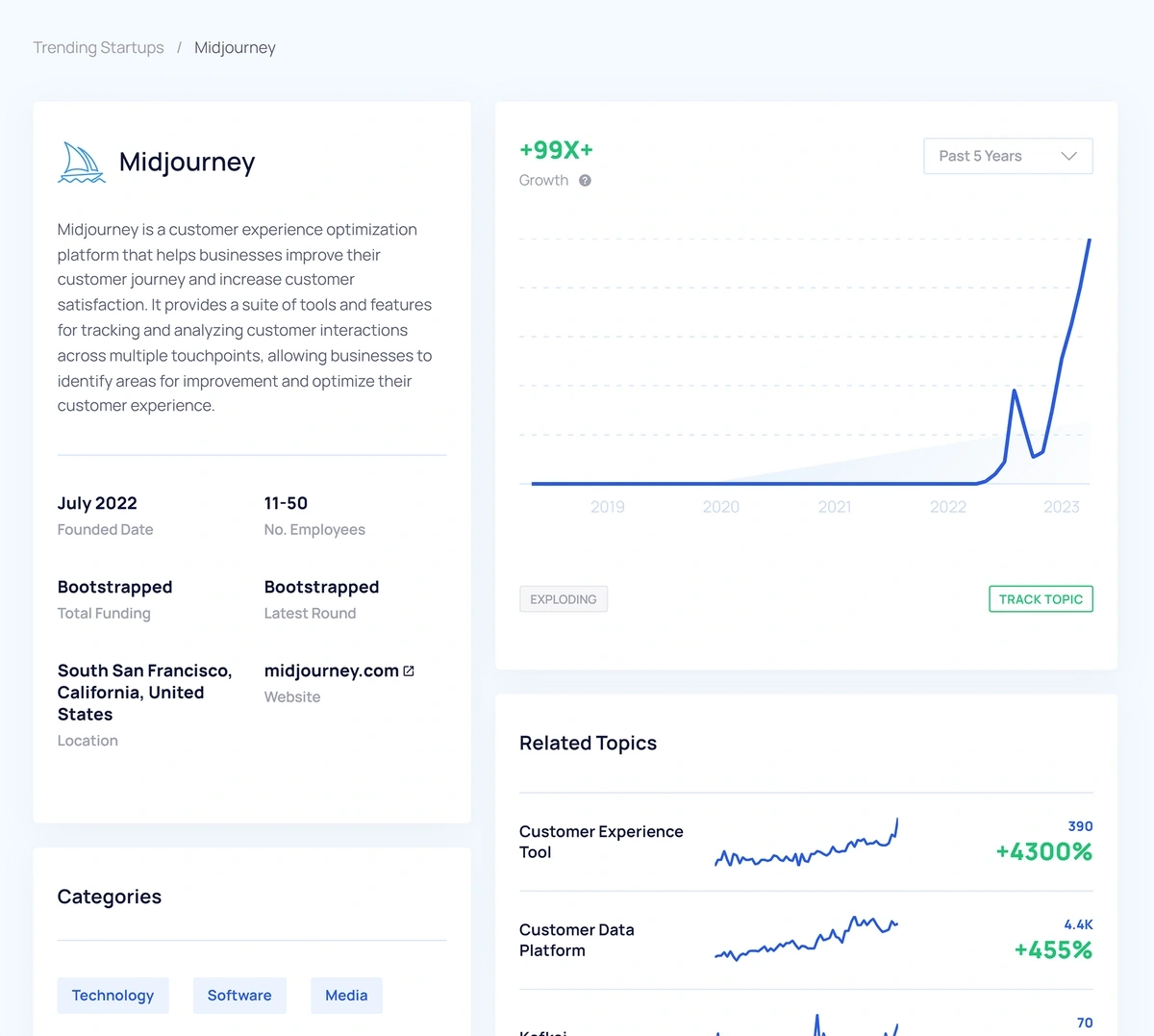

Exploding Topics has long been used by startup founders and investors to identify industry trends that can have a big impact on businesses. Now, we’re applying a similar methodology to the startup world.

Our startup identification process uses a blend of artificial intelligence and expert human data analysis. This allows us to identify under-the-radar, high-potential, and fast-growing startups before anyone else does.

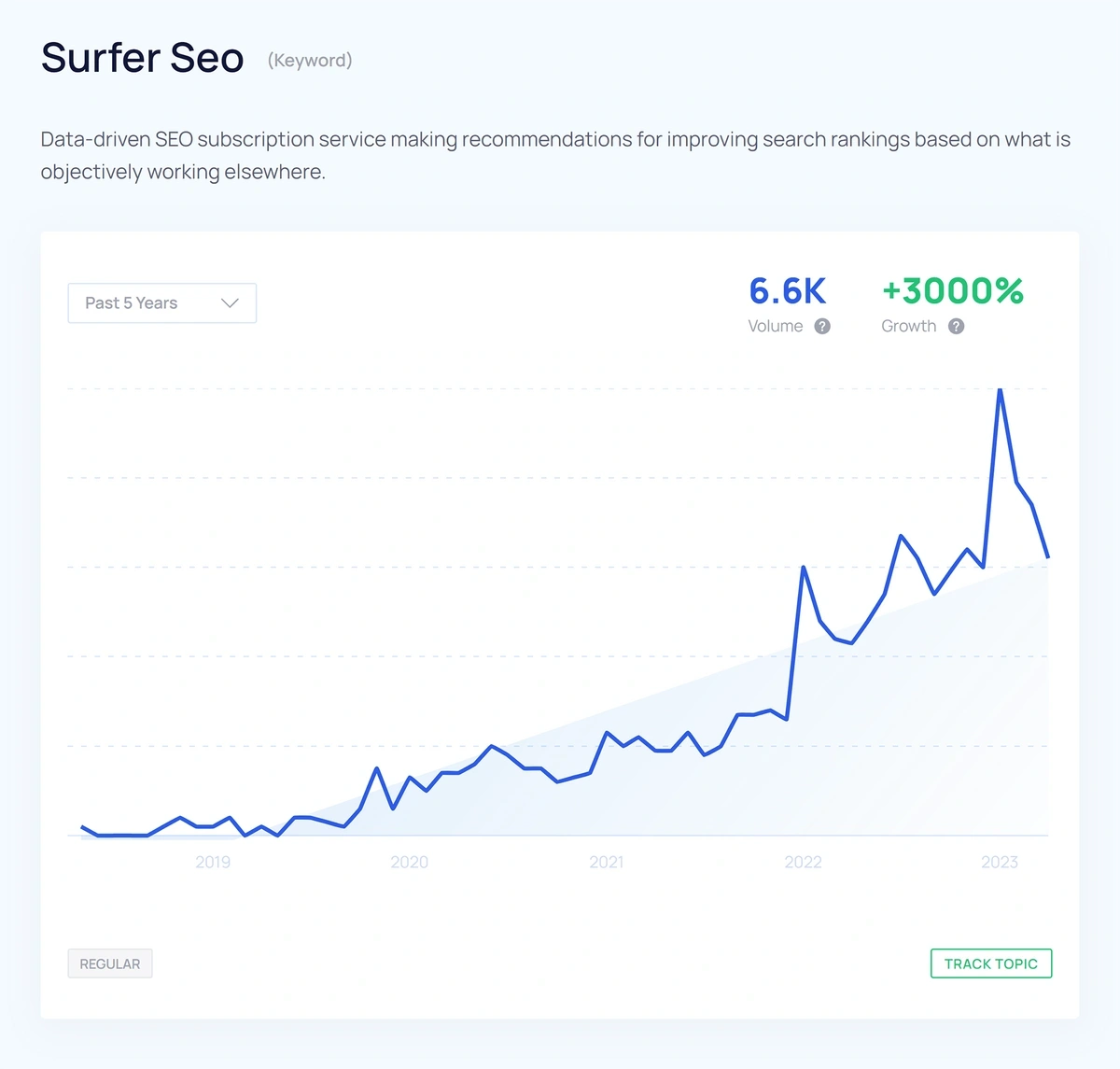

Surfer SEO is a great example. This SaaS startup has been exploding in popularity lately—take one look at X (Twitter), and you'll see countless conversations happening about this brand.

In fact, industry outlets like Search Engine Land only just started talking about Surfer SEO in 2023.

Given the recent spike of chatter about Surfer SEO, you might think it's a new company—but it's actually been around since 2017.

Exploding Topics Pro users have known about Surfer SEO since we highlighted it for them back in June 2020.

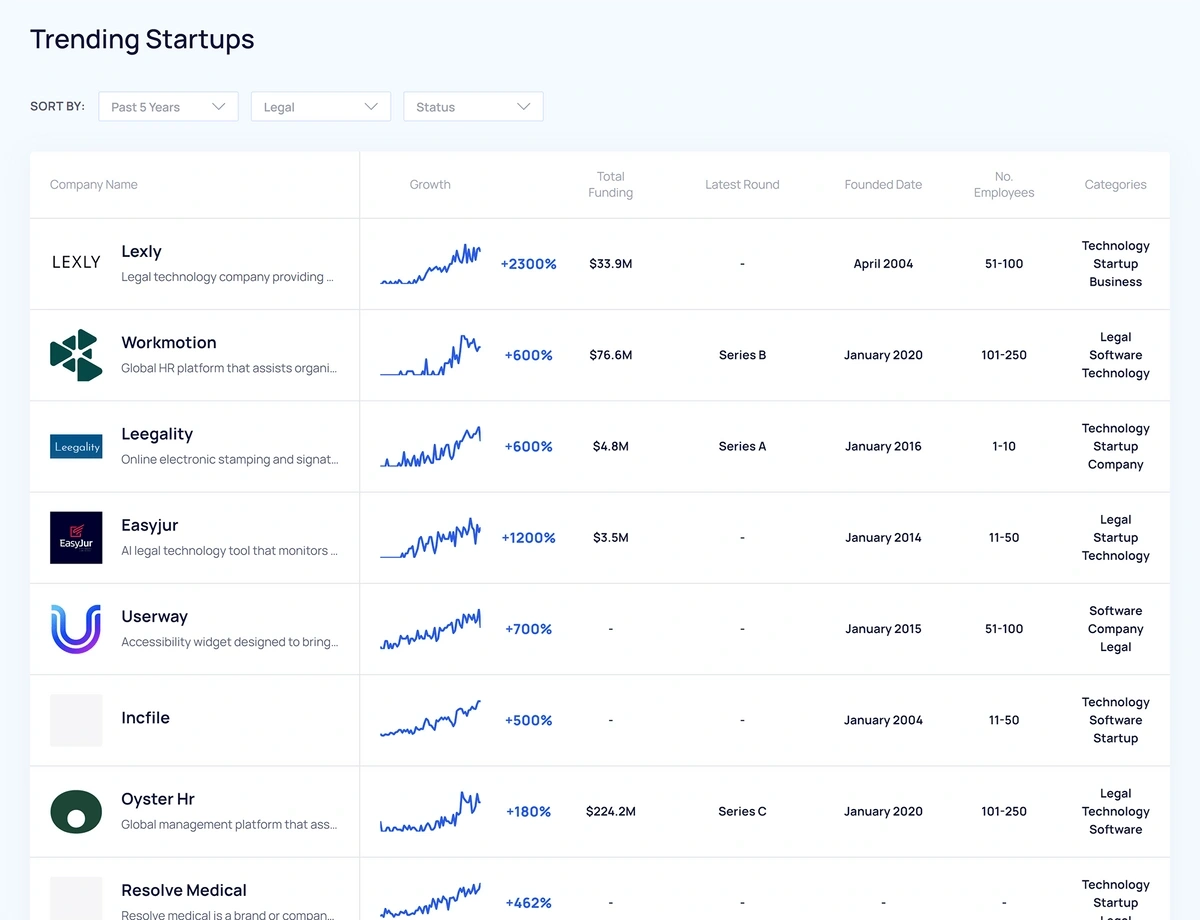

It's easy to find startups that interest you using our database—just sort the listed companies by metrics including:

- Industry

- Age

- Total funding

- Funding round

- Number of employees

- Status (regular, peaked, or exploding)

Once you’ve identified startups you’d like to track or potentially invest in, it takes just one click to access a more in-depth company profile.

This view shows you how the startup—and interest in its industry—has evolved over time.

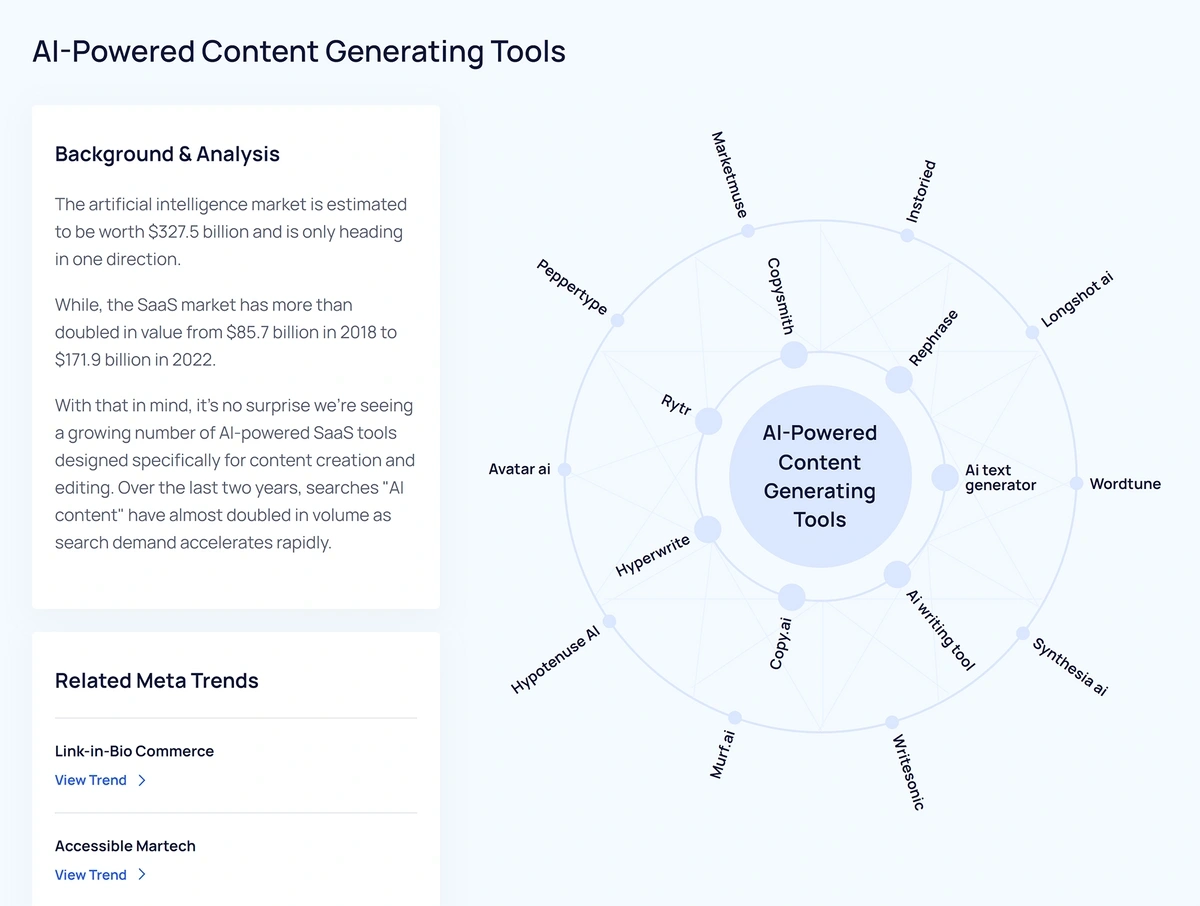

If you’d like to learn more about specific startup trends, you can dig deeper with our meta trends analysis.

The meta trends tool visualizes how different trends connect to create broad industry shifts—ones that can have far-reaching impacts on your investment prospects.

Our startup and meta trends data is exclusively available to Exploding Topics Pro users.

You'll see some Exploding Topics alternatives on the rest of this list, but we're confident that our tool stands out for investors.

Want to give it a try? Get two weeks of access for just $1.

Crunchbase vs. Exploding Topics: At a Glance

| Crunchbase | Exploding Topics Pro | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders, marketers |

| Key data points | Funding stage, funding amount, contact information | Funding stage, funding amount, headcount, location |

| Starting cost | $29 per month billed annually | $39 per month billed annually |

| API availability | Yes | Yes |

2. Dealroom: Best For Startup Founders Seeking Investors

Dealroom operates a company information database similar to Crunchbase.

Its list of more than two million startups is often used by VC investors, PE firms, and private companies. You can use Dealroom to dig up information on:

- Investment opportunities

- M&A leads

- Information on new technologies

- Funding benchmarks

- VC activity

The Dealroom database also has information on 120,000 investors—so startup founders can seek out investment partnerships as well.

Dealroom acquires much of its data through machine learning tools. The company also gets information directly from government groups focused on trade and business.

All metrics go through a verification process before entering the database.

One unique feature that Dealroom offers is bespoke research help. If you aren’t sure how to begin researching opportunities for your next investment or acquisition, then this platform might be a good starting point.

There are three Dealroom plans available, each offering between three and 20 user seats.

API access is available, too—but you’ll have to contact the company and get a custom quote based on your needs.

Crunchbase vs. Dealroom: At a Glance

| Crunchbase | Dealroom | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders, governments |

| Key data points | Funding stage, funding amount, contact information | VC activity, funding benchmarks |

| Starting cost | $29 per month billed annually | Custom pricing |

| API availability | Yes | Yes |

3. PitchBook: Best For M&A

The PitchBook database offers insights into market intelligence as well as industry trends.

You can use the platform’s data to help with:

- Fundraising for a startup

- Sourcing new investment opportunities

- Carrying out due diligence

- Exploring business development opportunities

- Executing a merger and acquisition (M&A) deal

- Connecting with investors and company leaders

One of PitchBook’s nice features is its versatility. You can access VC, private equity, and M&A-related data through its:

- Desktop app

- Mobile app

- Excel plugin

- Chrome extension

- API

Because there are so many different ways to access and use PitchBook data, you have to contact the company for a custom quote.

Crunchbase vs. PitchBook: At a Glance

| Crunchbase | PitchBook | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders, M&A teams |

| Key data points | Funding stage, funding amount, contact information | Funding benchmarks, deal comps, investor lists |

| Starting cost | $29 per month billed annually | Custom pricing |

| API availability | Yes | Yes |

4. Mattermark: Best For Building a VC Portfolio

The Mattermark database sources information from websites, regulatory filings, news articles, and third-party data providers.

The resulting data sets provide insight into funding and investment opportunities likely to be of interest for anyone developing a venture capital portfolio.

Mattermark says that its purpose is to support "data-driven deal making"—and you can use it for:

- Get prospects’ contact info

- Look up funding history

- Conduct market research

- Locate companies in specific locations

- Identify startups that are ready for another round of funding

While much of Mattermark’s data is going to be useful to prospective investors, sales leaders may also like the insights into finances—and the ability to organize companies based on location.

Mattermark access starts at $49 per month and gives you access to the entire database.

If you’d like to export data, connect a Salesforce account, or access the Mattermark API, you’ll need to explore higher plan tiers and custom pricing options.

Crunchbase vs. Mattermark: At a Glance

| Crunchbase | Mattermark | |

| Used by | Investors, startup founders, sales representatives | Investors, sales representatives |

| Key data points | Funding stage, funding amount, contact information | Funding stage, location, contact information |

| Starting cost | $29 per month billed annually | Free iOS app; $49 per month for full access |

| API availability | Yes | Yes |

5. Owler: Best For Tracking Startup News

Owler is another database rich in sales and funding information—but the company takes an interesting approach to data collection.

Rather than gathering data from websites, news articles, and financial disclosures, Owler uses its community of over 3.5 million users to populate company files. This data includes:

- Company revenue

- Funding history

- Acquisitions

- Media coverage

- Notable market shifts

Once you set up the companies you’d like to follow, Owler’s algorithms will update your personalized dashboard and send daily emails with summaries of relevant business activity.

Basic Owler access is free, so it’s easy to try out. You can track up to five companies and three direct competitors at no cost.

Paid plans, starting at $35 per month (billed annually), offer additional user seats and functionality like CRM integrations.

Crunchbase vs. Owler: At a Glance

| Crunchbase | Owler | |

| Used by | Investors, startup founders, sales representatives | Sales representatives, business leaders |

| Key data points | Funding stage, funding amount, contact information | Contact information, revenue, funding history |

| Starting cost | $29 per month billed annually | Free |

| API availability | Yes | Yes |

6. Harmonic AI: Best for Early-Stage VC Startup Discovery

Harmonic is a startup discovery and deal-sourcing platform for early-stage VCs who want to track companies and founders at a more granular level.

Using Harmonic, you can:

- Build dynamic lists of startups based on filters like industry, stage, or team growth

- Search for founders by previous company, title, or LinkedIn activity

- Access contact information and company profiles

- Save startups to watchlists and set real-time alerts when new companies match your criteria

The platform also includes an AI assistant called Scout that helps you find companies using natural language prompts, similar to ChatGPT.

Harmonic pricing is undisclosed, as they typically offer enterprise plans only.

Crunchbase vs. Harmonic AI: At a Glance

| Crunchbase | Harmonic AI | |

| Used by | Investors, startup founders, sales representatives | VCs, investors, sales teams, and founders |

| Key data points | Funding stage, funding amount, contact information | Pre-funding signals, founder history, team-level insights |

| Starting cost | $29 per month billed annually | Custom |

| API availability | Yes | Yes |

7. Acquire: Best For Guided Acquisitions

Acquire is an online marketplace for buying and selling startups.

While startup investors may use Crunchbase and similar tools to do research and due diligence, Acquire is a place they can go to actively pursue an acquisition.

There are over 100,0000 startup entrepreneurs and 120,000 buyers on the platform.

Buyers can use the platform to acquire startups of varying sizes. If the startup in question has less than $1 million in revenue, then buyers and sellers will need to negotiate and execute the sale on their own.

There’s no fee to use Acquire in this way, and you can take advantage of its various features that include:

- Startup valuation calculators

- Resources for buyers and sellers

- Information on startup financials

If you’re interested in buying a SaaS company with over $1 million in revenue, though, there’s another option: guided help from the Acquire team. If Acquire has a hand in executing the sale of a startup, they take a 5% commission fee.

Acquire is a viable option for investors who are serious about acquiring a startup in the very near future.

Anyone strictly in the research phase or seeking to purchase a stake in a company (not the whole thing) will probably be better served by one of the other Crunchbase competitors on this list.

Crunchbase vs. Acquire: At a Glance

| Crunchbase | Acquire | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders |

| Key data points | Funding stage, funding amount, contact information | Financial data, customer metrics, startup valuations |

| Starting cost | $29 per month billed annually | Free |

| API availability | Yes | No |

8. Affinity: Best For Managing Investment Contacts

Affinity is a CRM that's designed for investors, founders, and dealmakers.

While Crunchbase can help you identify founders' or investors' contact information, Affinity can help you organize it.

Affinity works by connecting to your email and calendar. Each time you message or meet with someone new, they become part of your database.

This is useful for both keeping track of who you've already met, and identifying mutual connections with new prospects.

You can then organize and use this information in several ways, including:

- Adding to contact profiles started and updated by teammates

- Viewing all of your contacts in a master list

- Sorting contacts by deal pipeline stage

Affinity also integrates with Salesforce. You can use the two tools in tandem to build out complete records of your communication with—and connection to—new people in your network.

Affinity doesn't publish their pricing publicly, so you'll need to get in touch with the company to set up a consultation and demo.

Crunchbase vs. Affinity: At a Glance

| Crunchbase | Affinity | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders |

| Key data points | Funding stage, funding amount, contact information | Contact information, connections, deal stage |

| Starting cost | $29 per month billed annually | Custom pricing |

| API availability | Yes | Yes |

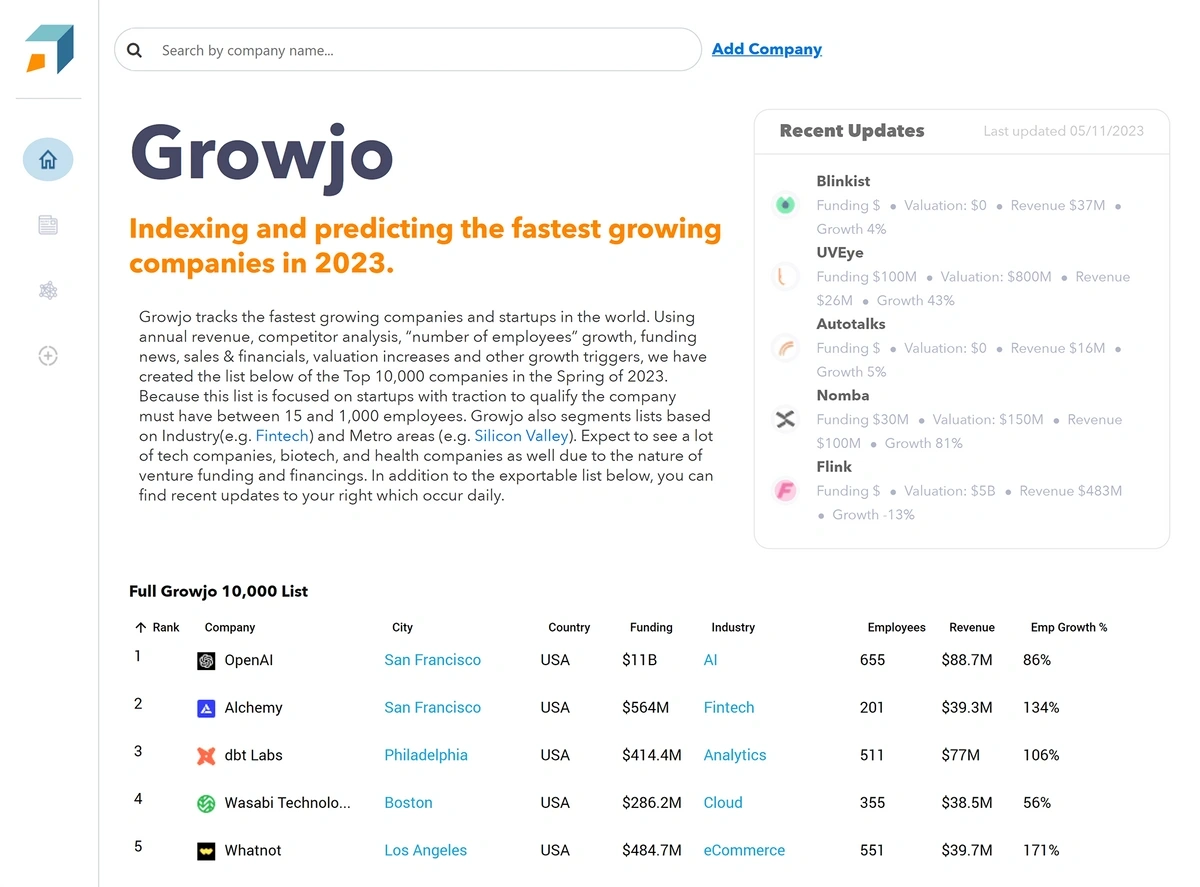

9. Growjo: Best For Free Startup Tracking

Growjo is a free database that lets you view, sort, and export key data points about startups.

You don't even need an account to use Growjo—all of the database information is freely available right on the company's homepage. It's useful for quickly looking up a company's:

- Location

- Industry

- Funding amount

- Number of employees

- Employee growth rate

- Revenue

If you choose to sign up for a free account, you'll get access to additional search filters and the ability to export data.

All in all, Growjo provides a much more top-level overview of a company's structure than Crunchbase or Pitchbook. If you're just trying to get a basic lay of the land related to a new company or industry, Growjo can be a good choice.

For in-depth company information and contact details, though, you'll want to stick with one of the other alternatives on this list.

Crunchbase vs. GrowJo: At a Glance

| Crunchbase | Growjo | |

| Used by | Investors, startup founders, sales representatives | Investors, startup founders |

| Key data points | Funding stage, funding amount, contact information | Company headcount growth rate, revenue, funding amount |

| Starting cost | $29 per month billed annually | Free |

| API availability | Yes | Yes |

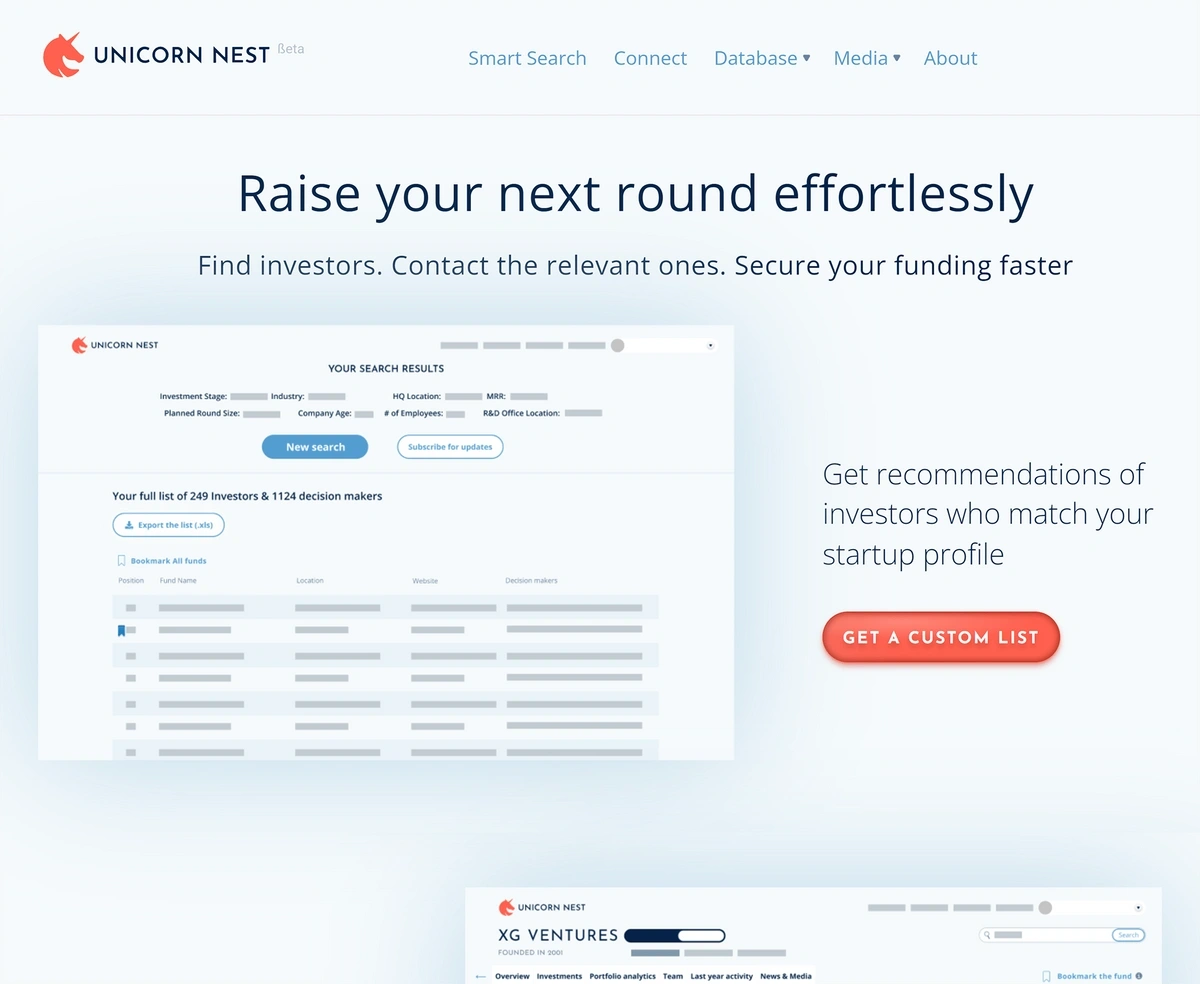

10. Unicorn Nest: Best for Founders Seeking Funding Support

Unicorn Nest is a VC database with information on investors and funds.

Every fund and investor listed in the Unicorn Nest database is verified through multiple sources and has made at least one investment in the past two years.

Like Dealroom, it's a tool that founders can use to locate potential investors.

Unicorn Nest goes one step further, though, as the company offers an assisted fundraising solution that helps founders:

- Build a fundraising strategy

- Create data rooms

- Prepare necessary documentation

- Conduct fund research

- Build an investor pipeline

The platform also includes a valuation tool to help founders compare their company to similar startups in their industry—and see who's investing in those businesses.

Investors could use this feature in Unicorn Nest, too, as it provides insights around the companies that competing VC firms may be interested in.

There's no charge to start exploring the Unicorn Nest database. To unlock unlimited platform usage and expanded datasets, you'll need a paid plan for $20 per month or $108 per year.

Access to the company's assisted fundraising solution is priced on a custom basis and requires an application.

Crunchbase vs. Unicorn Nest: At a Glance

| Crunchbase | Unicorn Nest | |

| Used by | Investors, startup founders, sales representatives | Startup founders |

| Key data points | Funding stage, funding amount, contact information | Investor activity, funding stages, startup valuations |

| Starting cost | $29 per month billed annually | Free |

| API availability | Yes | No |

Conclusion

If you're just starting out—on either side of the deal table—tools like Growjo and Unicorn Nest can help you explore your competitive landscape for an affordable price.

When you're ready to dig even deeper and continue to advance your dealmaking, you'll want to explore using Crunchbase or one of the paid alternatives on this list.

Whether you rely on Exploding Topics to find brand-new startups or build your pipeline with Harmonic and Affinity, each tool can bring you unique features and insights that support growing a startup—or investing in one.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more