Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

TikTok future in US still uncertain after Oracle deal - A look at trending alternative RedNote

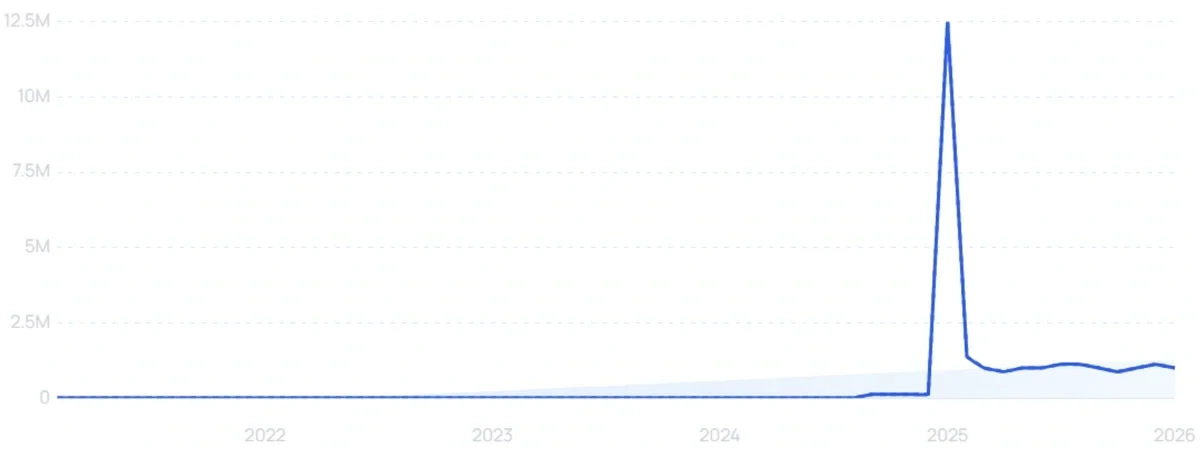

Initial talk of a TikTok ban in the US back in January 2025 caused a surge in interest for Chinese social media app RedNote (Xiahongshu), with searches shooting up 99X+ in the space of 3 months.

A year later, and TikTok looks to have been "saved", with a consortium led by Oracle set to take over US operations from ByteDance. But questions remain over whether the app will continue to operate in the country with the same user-hooking algorithm, or indeed even under the same name.

Amid this continued uncertainty, all kinds of competitors will hope to make inroads into TikTok's US market.

Much like TikTok, RedNote allows users to post short-form videos, and it also supports text and image-based posts. It briefly moved to the top of the free download charts in the Apple Store in the US in the wake of the initial ban announcement.

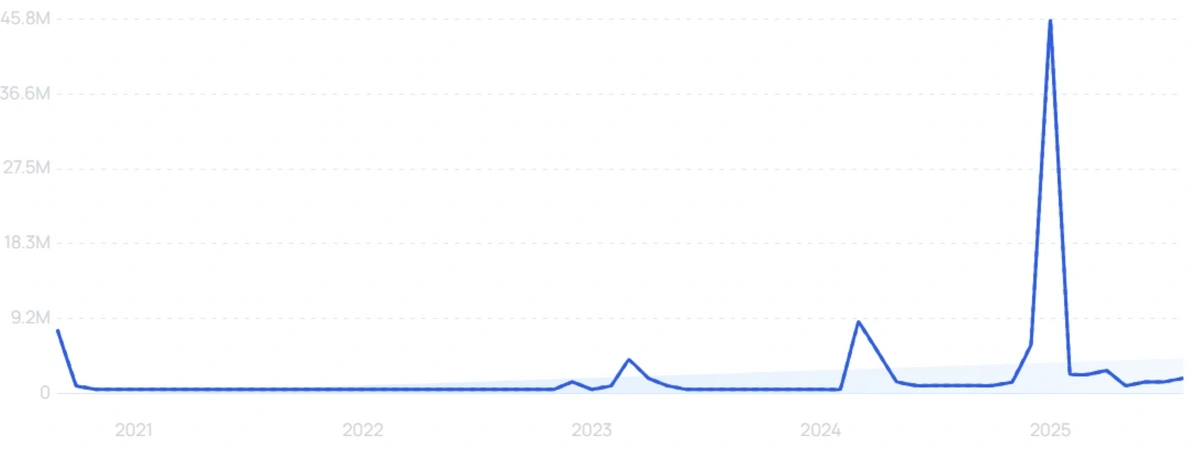

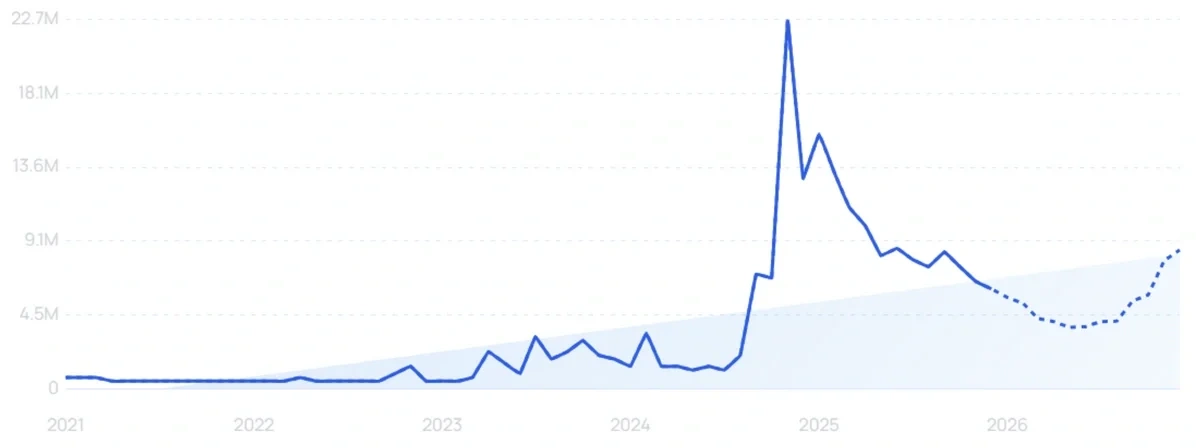

Exploding Topics data shows that RedNote searches skyrocketed in the months leading up to the original TikTok ban deadline. In the space of three months, searches increased by 99X+, with monthly search volume reaching 12.5 million last January.

“RedNote” searches spiked at the start of 2025, climbing from 125,000 searches in December 2024 to around 12.5 million the following month. Interest has settled down at around 1 million searches per month.

RedNote Stats: Top Picks

- RedNote has approximately 350 million users

- The "makeup sharing" tag on RedNote has ~1 billion posts

- Though China dominates, more than 12.5% of monthly RedNote users are from the US

- Over 43% of RedNote users are aged 18-24

- RedNote is valued at approximately $31 billion

- More than 170,000 brands have a presence on RedNote

The TikTok Ban: Timeline and State of Play

Initially, TikTok was given a deadline to sell or shut down in the US by January 19, 2025 amid concerns over links to the Chinese government. The Supreme Court heard arguments against the ban and upheld it.

However, Donald Trump repeatedly delayed implementation of the law while he worked on a “political solution”.

TikTok briefly went dark on Saturday, January 18, but service was resumed within 24 hours. That came amid assurances from President Trump.

After that, the deadline on the TikTok ban was extended to April 5th,and then re-extended for a further 75 days.

Deadlines of September 17 and then December 16 were circumvented by further extensions. But shortly after the latest extension, on December 19, 2025, a deal was announced.

A consortium of investors is set to take an 80.1% stake in a new US company that will be tasked with running TikTok operations in the country. The deal is set to take effect from January 22.

Oracle is a major partner in the new consortium, which also includes private equity firm Silver Lake. ByteDance will retain a 19.9% stake.

But while TikTok may have been saved in the US, question marks remain over what the future will look like. Its famously powerful algorithm is potentially set to be retrained on American user data, while earlier reports had indicated that users might need to migrate to an entirely new app (which may or may not keep the same name).

And even with the prospect of a genuine ban seemingly averted, RedNote has seen greatly elevated global interest, particularly among American users. The Chinese app, known natively as Xiaohongshu (Little Red Book), now has 300 million monthly active users.

What is RedNote?

RedNote is a Chinese social media platform. It's an alternative to TikTok (or Douyin, as the native version is known).

It has been described as a cross between TikTok and Instagram. There have also been comparisons to Pinterest, X, and even Tripadvisor.

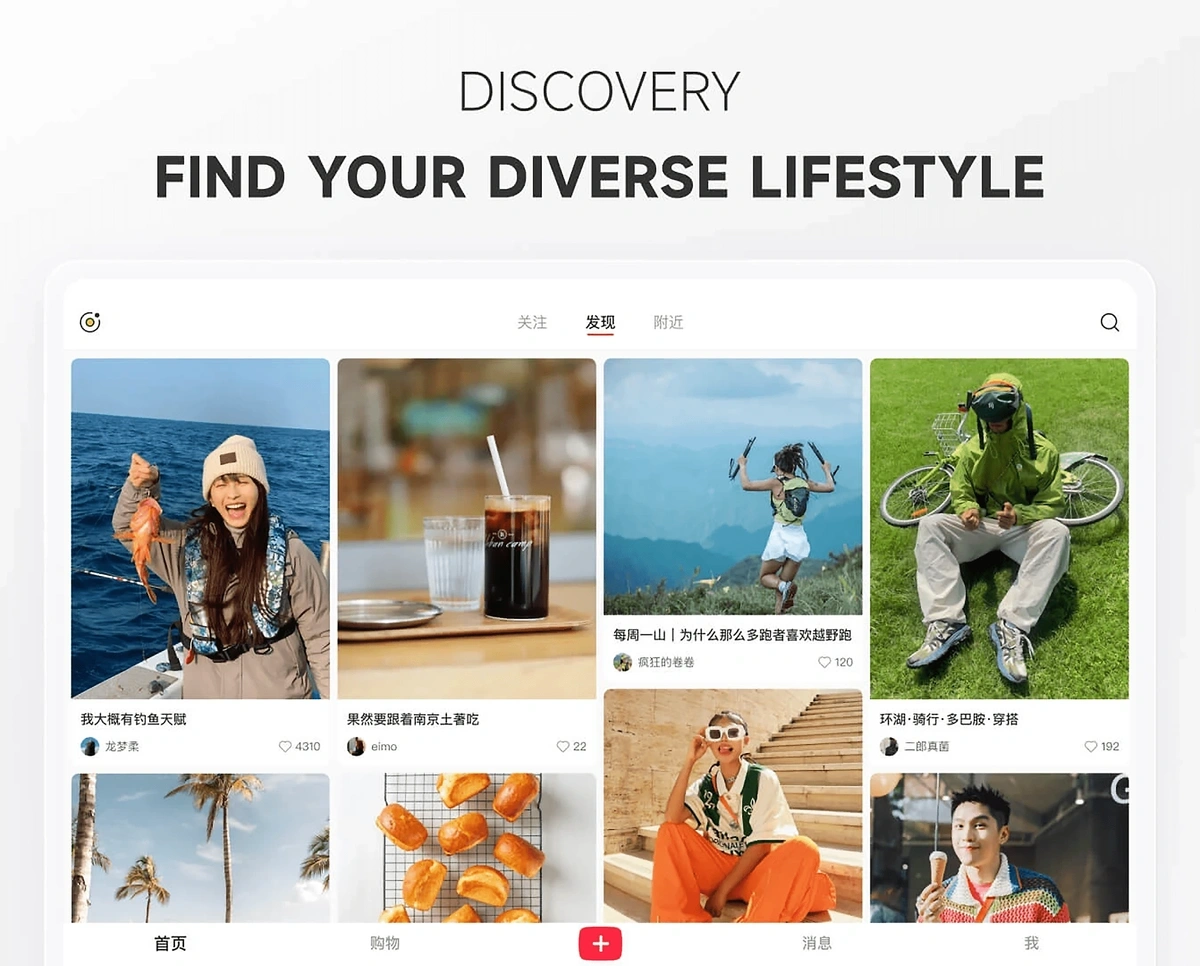

An image from the Play Store shows the RedNote interface.

Much like TikTok, it has evolved far beyond its original vision. The app was initially named “Hong Kong Shopping Guide” and was designed to serve recommendations to domestic Chinese tourists visiting the region.

Since then, RedNote has become a destination to trade lifestyle tips and short videos. It is particularly popular among young women, with beauty, fashion, food, and travel among the most-discussed topics on the app.

Major tags on posts (translated) include “new mom”, “skin protection party”, “house lover enthusiasts”, and “makeup lover party”. The “makeup sharing” tag has been used in almost 1 billion posts.

Beauty and skincare posts are popular on RedNote.

Unlike TikTok, RedNote is not split into Chinese and global versions. RedNote and Xiaohongshu are different names for the same app, with one unified user base.

How many people use RedNote?

As of January 2026, approximately 350 million people use RedNote.

143 million of those are daily active users (DAUs). The number of DAUs has grown by 32.4% in the last year.

The bulk of users are from China. The app has approximately doubled its domestic user base since December 2020, growing to around 240 million users.

3.7 million US users downloaded RedNote in Q1 2025. That was up from 508,000 in Q4 2024.

Here's data on RedNote downloads in the US and China from 2015:

| Date | US RedNote (Xiaohongshu) downloads | China RedNote (Xiaohongshu) downloads |

| Q1 2015 | 2,203 | 685,577 |

| Q1 2016 | 17,626 | 1,487,831 |

| Q1 2017 | N/A | 3,351,100 |

| Q1 2018 | 600 | 4,565,319 |

| Q1 2019 | 58,085 | 11,809,312 |

| Q1 2020 | 37,763 | 6,825,386 |

| Q1 2021 | 66,301 | 11,529,289 |

| Q1 2022 | 81,274 | 9,567,858 |

| Q1 2023 | 233,486 | 13,147,506 |

| Q1 2024 | 256,447 | 11,984,395 |

| Q1 2025 | 3,736,975 | 9,126,432 |

The number of RedNote downloads in the US prior to the threat of a TikTok ban is actually surprisingly high, especially from 2023 onward. Even so, the TikTok effect is both obvious and stark.

“TikTok refugees” became a trending topic on RedNote. A live chat with that title attracted more than 50,000 users from both the US and China.

But while search interest has massively dropped as the threat of a TikTok ban has receded, RedNote has continued to benefit from the boost in awareness and perceived legitimacy. In August, Apple launched an official account on the platform, quickly hitting 200,000 followers.

And the users who have stayed on the platform are highly engaged. In December 2025, Semrush traffic data showed that US users spent an average of 18 minutes and 39 seconds per visit on RedNote, accessing an average of 14.4 pages.

More than 12.5% of all visits to RedNote were from the US in December, making it the second-largest user base worldwide. China obviously leads the way.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

RedNote users by age

RedNote, much like TikTok, is favored by younger users.

In fact, in the latest data from January 2026, the share of Gen Z users actually increased. Users aged 18-24 now account for 43.8% of the entire RedNote user base.

Just 7.78% of users are aged 45 or older. While the age groups on TikTok are creeping up as existing users get older, the proportion of users agred 45+ on RedNote has actually dropped since Q1 2025 (8.2%).

RedNote is also popular with millennials. 36.89% of users are aged between 25 and 34, and 11.53% are aged 35-44.

RedNote users by gender

In China, RedNote is heavily favored by women. At one stage, the user base was 90% female.

As of the latest data, 72% of all users were women. The split has been getting gradually less pronounced over time.

| Year | Female user % on RedNote |

| 2021 | 90% |

| 2024 | 79.13% |

| 2025/26 | 72% |

It will be interesting to see how the influx of US users further affects the gender balance. The TikTok user base skews slightly in the other direction, where 54.6% of users are men.

Semrush data suggests that the gender split on RedNote has shifted to a far more even balance. 54.39% of recorded users are women, while 47.01% are men.

Who owns RedNote?

Miranda Qu and Charlwin Mao founded RedNote in 2013. Qu is its current president, and Mao is the CEO.

According to Forbes, Qu and Mao each own an estimated 10% of RedNote.

RedNote has numerous external investors. They include Chinese tech giants Alibaba and Tencent, as well as HSG (previously Sequoia Capital China).

Questions have been asked about national security in the US. The Chinese government has previously taken “golden shares” in subsidiaries of both Alibaba and Tencent, although neither company is state-owned. Likewise, there is no indication of any state involvement in RedNote.

However, there is no doubt that RedNote has been aimed at a primarily Chinese audience until now. Most of the content is in Mandarin — the language has even seen a noticeable search spike following the influx of US users on the app.

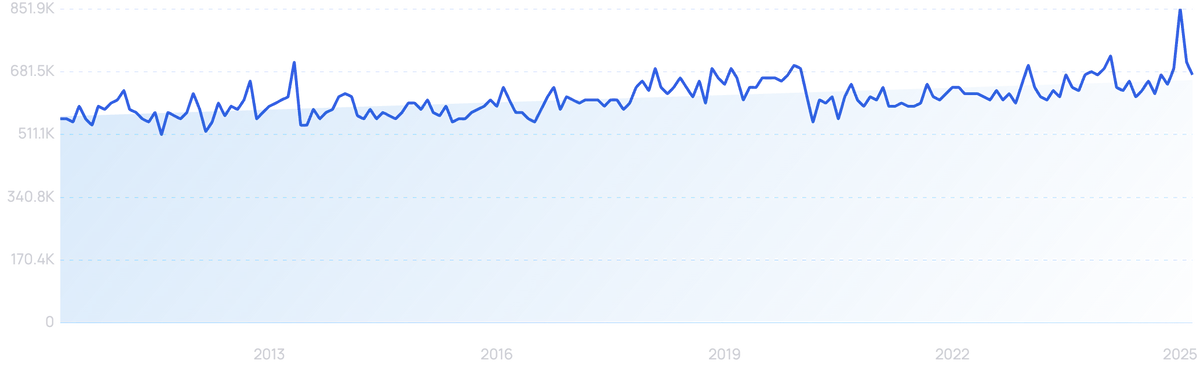

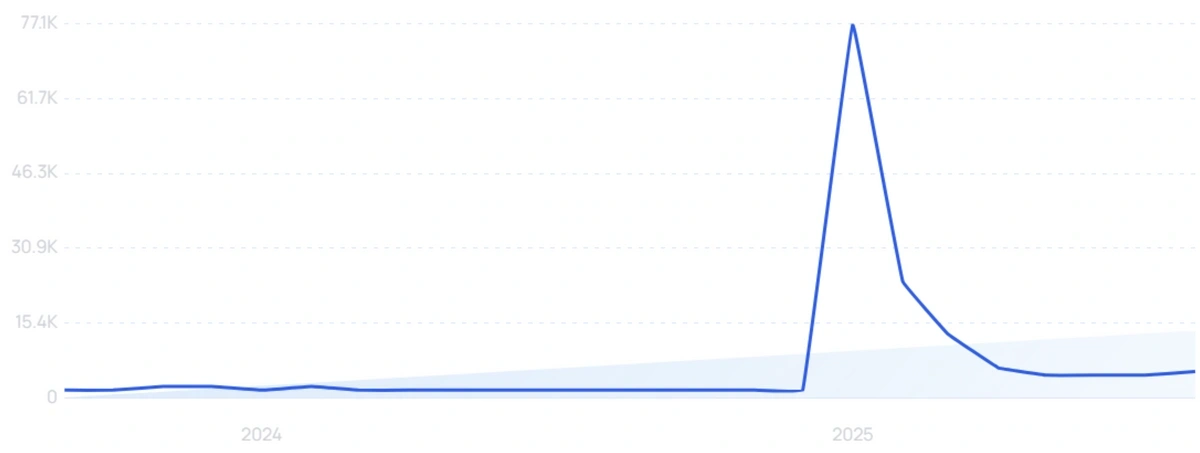

“Mandarin” searches spiked to a 15-year high at the start of 2025.

The most recent funding round valued RedNote at $17 billion. But market transactions last June implied a valuation of $26 billion.

And by September 2025, RedNote's estimated valuation had reached $31 billion, per Bloomberg.

Annual profits for 2025 were estimated in the region of $3 billion. A potential public listing has been discussed.

Social commerce on RedNote

According to Reuters, the prevalence of aspirational, luxury-focused posts on RedNote has made it fertile ground for social commerce, where users make purchases directly from the app.

(That’s also been a significant trend on TikTok, where over $1 billion of monthly revenue could have been wiped out by a US ban.)

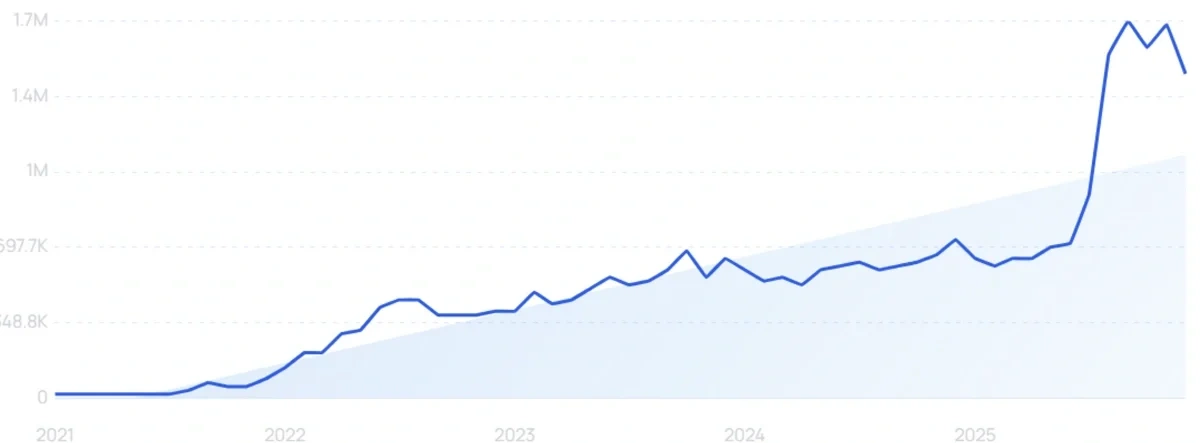

“TikTok Shop” searches are up 8500% in the last 5 years.

Individual accounts can open up personal stores on RedNote, and sell with zero commission (but with 50% reduced search weight compared to brands). Enterprise stores pay a 3-5% commission on sales.

Companies like L'Oréal have set up stores on RedNote, and over 170,000 brands have a presence of some sort on the platform. One 2025 estimate suggested global gross merchandise value across the year would exceed $100 billion.

Hangzhou Onechance Tech Corp, a Chinese e-commerce services provider, saw its stock soar amid the surge in popularity of RedNote in the US.

Why did TikTok get banned?

There is more than a hint of irony in the fact that the TikTok ban is pushing users toward RedNote. The US sought the ban in the first place over fears about Chinese involvement.

Indeed, it seems likely that the surge in RedNote interest is at least partly a kind of protest against the ban, with US users deliberately seeking out another Chinese platform.

TikTok is owned by ByteDance, which has consistently denied links to the Chinese government. It has also argued that closing down the app would affect the free speech rights of its US users – a point supported by numerous content creators.

The bill requiring ByteDance to sell by January 19 was signed into law by Joe Biden in April 2024. Congress included the condition as part of wide-ranging legislation that determined foreign aid packages for Ukraine and Israel.

“TikTok ban” search interest spiked as the initial deadline drew nearer.

Will TikTok get banned again?

US TikTok users did see service to the app cut off for a matter of hours. It had been speculated that the ban would only initially impact the availability of TikTok on the App Store and Google Play, rather than functionality for existing users, but ByteDance shut it down entirely.

However, service was restored very quickly, with the app displaying a message that thanked Trump by name. Despite initially supporting a ban, he has since repeatedly indicated his intention to keep TikTok operational in the US.

The series of extensions to the deadline has culminated in the deal with Oracle and others, set to complete on January 22, 2026.

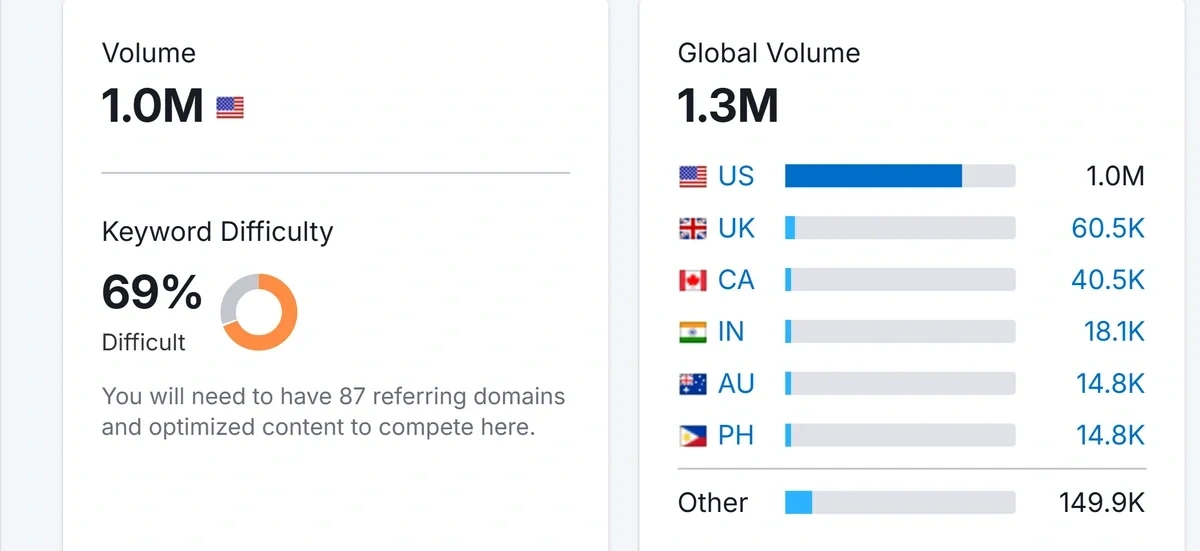

Talk of a TikTok ban has certainly caught the attention of the general public, with 1.3M monthly global searches.

“TikTok ban” search interest broken down by nation.

TikTok is not the first social media platform to get banned. We've tracked banned apps around the globe.

Could RedNote get banned?

Ironically enough, RedNote itself has also been the subject of a banning scandal recently. It has been handed a 1-year ban in Taiwan over fraud and scam allegations that supposedly cost local users $8 million.

In China itself, RedNote has faced some state pushback for focusing too much on celebrity affairs.

As to whether it could get banned in the US, there has not been any indication to that effect so far. But if it gained greater popularity, it would presumably come under some kind of discussion.

After all, RedNote is the same app in China and in the West. In some ways, US concerns might be even greater.

However, the relatively gentle conclusion to the TikTok ban saga, with ByteDance even maintaining a significant stake, suggests that the political will to target Chinese social apps has waned. For the time being, RedNote looks safe from any action in the US.

How popular is TikTok in the US?

A potential TikTok ban in the US is highly significant. The social video app has risen to rival Instagram in terms of popularity.

TikTok currently receives 2.1 billion monthly visits. The US accounts for more than 400 million of those visits.

There are 153 million American accounts on TikTok. That's slightly less than Instagram (181.75 million), but still equates to more than half of the US adult population — although not every individual account is necessarily a unique user.

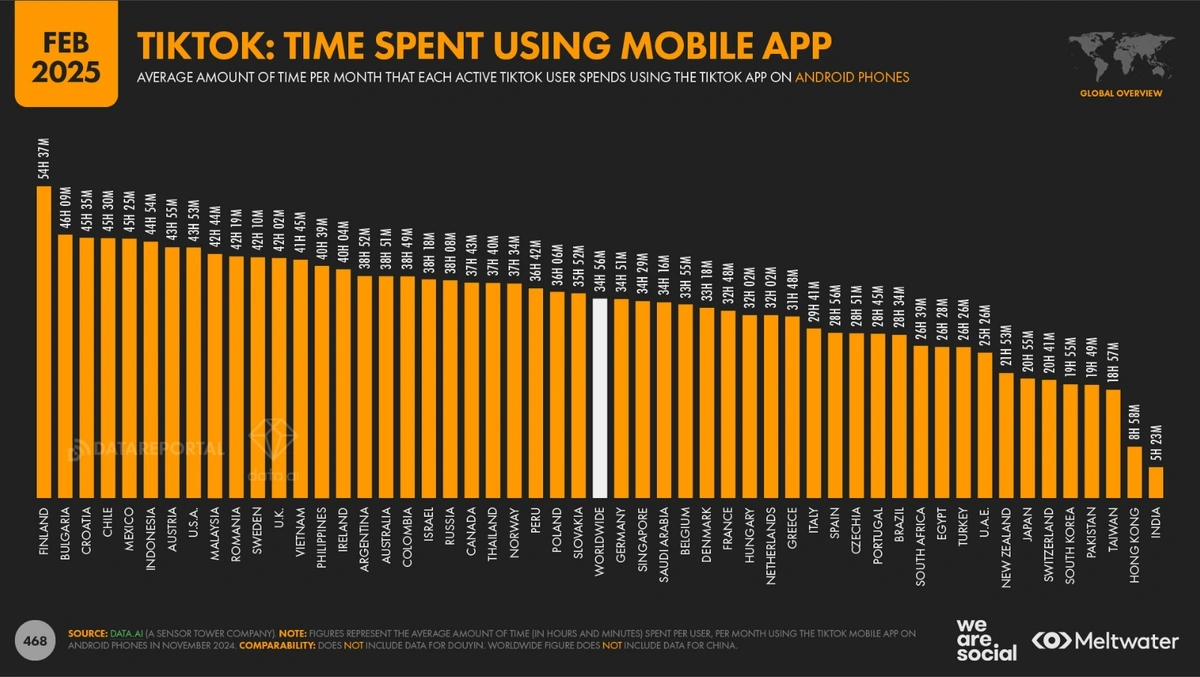

And TikTok users are highly engaged when compared to social media users more generally.

Active Instagram users in the US average 11 hours and 55 minutes on the platform per month.

As of February 2025, active TikTok users average 43 hours and 53 minutes, up from 41 hours and 42 minutes in October 2024.

Americans are way above the worldwide average when it comes to spending time on the TikTok app.

When it comes to monthly app sessions, US TikTok users have actually fallen behind the global average of 358.7 monthly sessions. Nonetheless, the latest data has shown an increase from 238.1 monthly sessions to 268.9 in the space of four months. By comparison, US Instagram users average just 202.1 monthly sessions.

And while the Asian market is still more mature when it comes to social commerce, TikTok Shop sales in the US reached $500 million over the 4-day Black Friday period in 2025. The number of users making a purchase was up almost 50% YoY.

There’s no denying that a US shift away from TikTok would be highly significant, both culturally and economically.

Bluesky, Pixelfed, and other “alternative” social platforms

A nationwide ban on a major app like TikTok would have been unprecedented. But this is not the first time that US users have found themselves looking to alternative social platforms.

Pixelfed is a decentralized alternative to Instagram. The social network runs on independently-run servers rather than a centralized server owned by a specific entity, and its code is open-sourced.

There has been a recent spike in “Pixelfed” search interest.

In terms of features, Pixelfed operates a lot like Instagram. So much so, in fact, that Meta (owners of Facebook and Instagram) briefly started blocking links to it.

Meanwhile, there has been something of an exodus from X (formerly Twitter) since Elon Musk took over the platform.

In the year leading up to September 2024, the number of daily active X users in the US fell by around 20%. In the UK, that figure was close to 33%.

Bluesky has proved a highly popular alternative. Like Pixelfed, it is an example of decentralized social media.

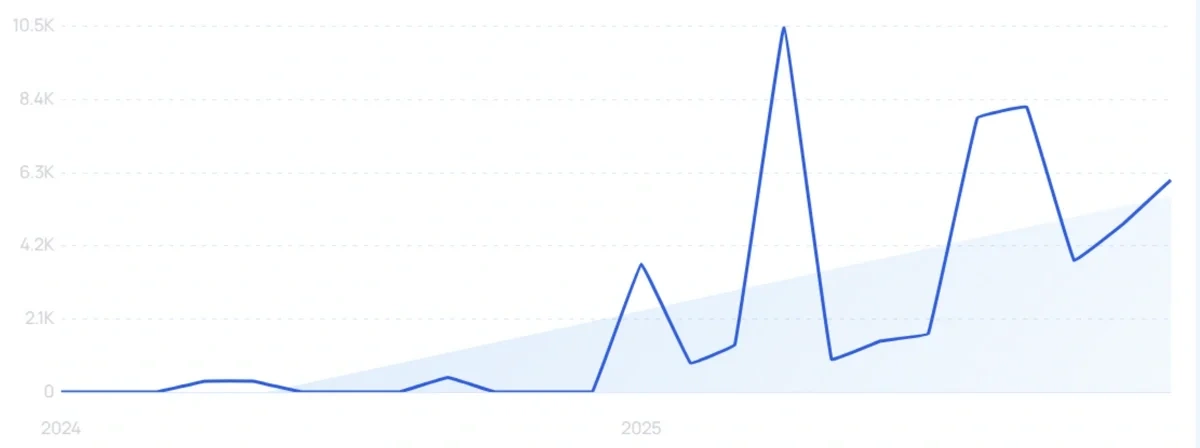

“Bluesky” searches are up 800% in the last 5 years, and the Exploding Topics algorithm forecasts steady growth after a recent dip.

It was founded by Jack Dorsey, a Twitter co-founder. It began life as an internal Twitter project before being spun off, operating similarly to the pre-Musk version of the platform.

Bluesky now boasts over 41 million users. A new user joins every 3 seconds. And Bluesky recently launched its own photo sharing app, Flashes, which could provide an Instagram alternative.

In January 2025, Bluesky launched its own video feed feature.

Another TikTok alternative garnering interest is Skylight Social.

“Skylight Social” searches are up 5700% in the last 2 years.

Built on Blueksy's AT Protocol and backed by Mark Cuban, the new social platform officially launched on April 1st, 2025.

As a result, the video-based app can instantly tap into Blueksy's growing 41 million-strong user base.

Is RedNote the new TikTok?

US social browsing habits clearly can and do change. A TikTok ban would have been a pretty significant catalyst, and even the Oracle-led handover could lead to disruption.

Even so, all things considered, RedNote is unlikely to capture vast swathes of the US TikTok user base in the long term. But it has been fascinating to observe users migrating to the platform amid the threat of a ban.

At the moment, the app is still geared firmly toward a Chinese audience. It will need to adapt quickly if it wants to attract and retain more “TikTok refugees” from the US.

RedNote is also not a completely obvious alternative to TikTok in terms of functionality. There are definite similarities, especially when it comes to elements like the integration of social commerce, but the platform was more frequently being compared to Instagram until recently.

Bluesky looks and functions almost exactly like X. Pixelfed is highly familiar to Instagram users. But RedNote is not trying to “replace” TikTok in the same fashion, so users looking for a direct alternative might be disappointed.

Finally, and most crucially, TikTok’s future in the US appears to have been saved.

But the TikTok ban saga has at the very least cast a spotlight on RedNote, which was already a major player on the Chinese social scene in its own right. It will likely continue to grow, perhaps even with an increased US and global user base.

Whatever happens with TikTok in the US, RedNote is certainly a platform worth keeping an eye on in the coming years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more