Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Social Commerce and TikTok Shop Stats (2026)

Social commerce has become the next great disruptor in the retail industry. E-commerce fundamentally changed the way Millennials shop, and now a similarly seismic shift for Gen Z (and indeed Gen Alpha) is arriving.

34% of US consumers aged 18-34 are already making purchases through social media on a weekly basis.

They are seeing products they like within their social feeds, especially TikTok, and then buying them without ever leaving the platform.

52% of all American consumers have also made at least one lifetime purchase on a social media platform. This way of shopping might be thought of as novel, but it is clearly entering the mainstream.

So what’s behind the explosion in social commerce? Read on to explore the role of TikTok Shop, Instagram Checkout, YouTube, and visual search engines like Pinterest Lens, and discover a market now worth more than $1 billion every month.

Social Commerce Stats (Top Picks)

- 34% of US consumers aged 18-34 shop on social media every week

- US TikTok Shop sales reached $19 billion in Q3 2025

- Gen Alpha already has $28 billion of direct spending power

- Social commerce makes up 17.11% of all E-commerce

- 55% of Gen Z users prefer TikTok for product discovery

- Online beauty sales are now more than 50% social commerce

- Social commerce will be a $1 trillion industry by 2028

- More than 50% of Pinterest users view it as a place to shop

A new way of shopping

Whereas traditional E-commerce is intent-led, social commerce is discovery-led. That’s the fundamental difference.

Users have loosely personalized their own social feeds, so they know the kinds of products they might see when logging on. But with the rise of the TikTok “For You Page”, even this is ultimately determined by an algorithm rather than a conscious choice.

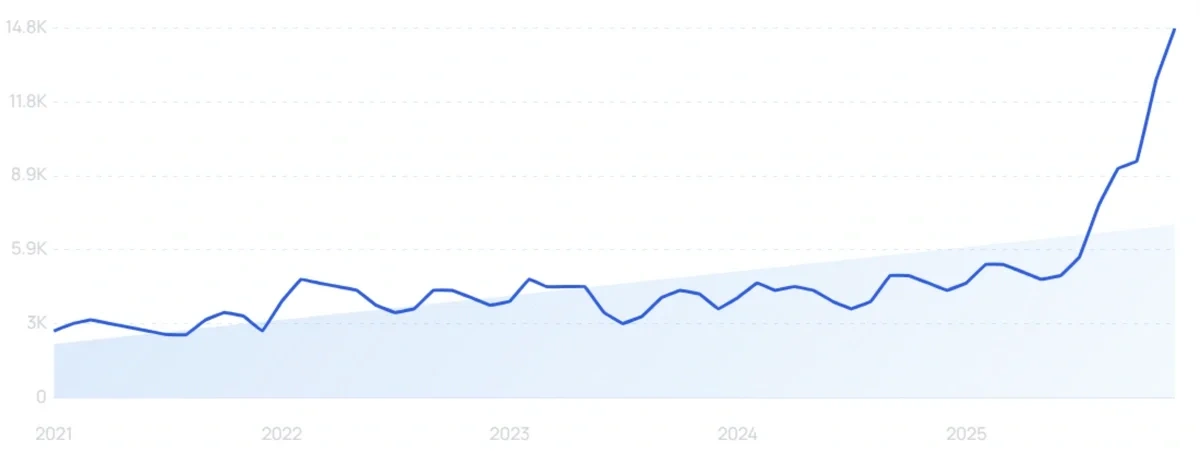

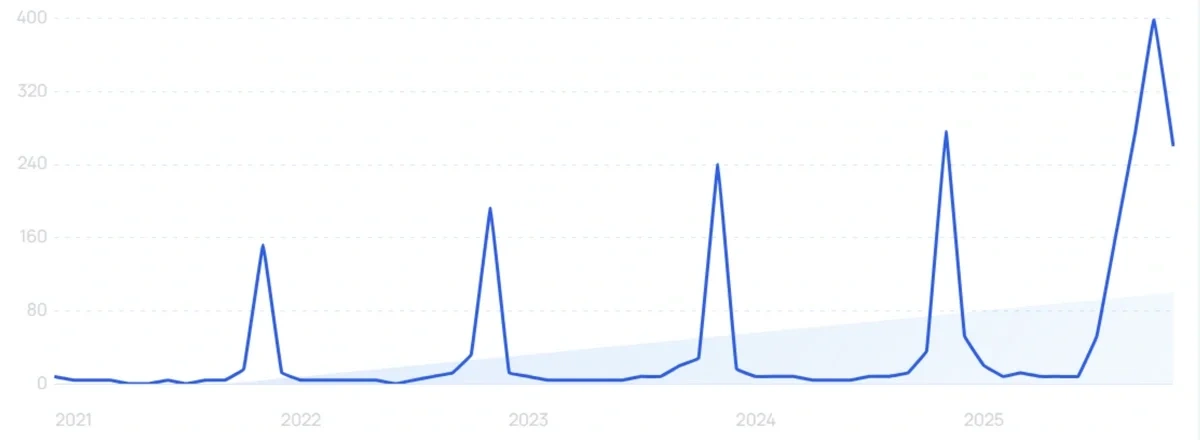

“For You Page” searches are up 456% in the last 5 years.

And users are generally not browsing with a specific intent to buy. That decision is sparked by the content they see.

This content may come directly from brands. But social commerce is an ecosystem, and influencers and affiliates play an important role within it.

Almost three-quarters of consumers have bought something based on an influencer recommendation.

And it's not all about big names. Even modest-sized affiliate creators can generate millions of dollars in revenue.

According to Kalodata, Hannah Bentley (38,500 followers) was among the top 3 TikTok Shop creators for revenue in the 30 days to January 14, 2026. She generated $1.84 million in that time.

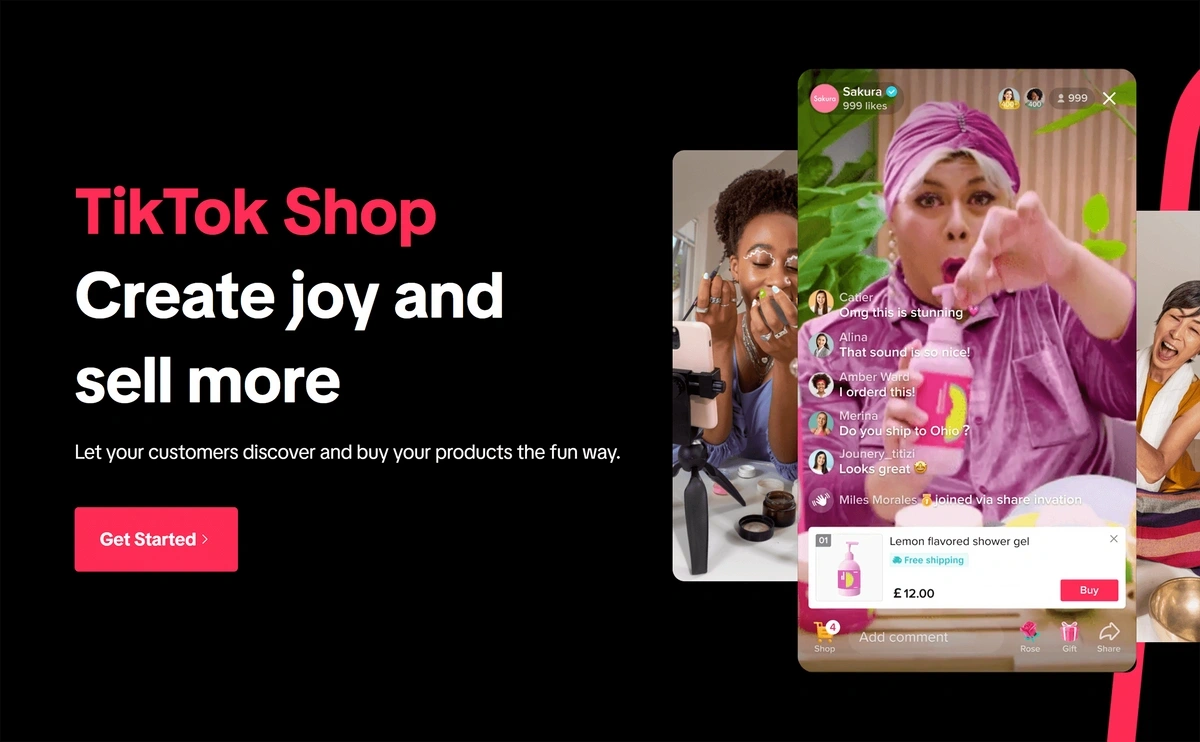

TikTok Shop ushers in new dawn of social commerce

An Aftership and Ipsos study found that 1 in 3 young Americans now shop on social media weekly, which really shows the stark rise in social commerce. And TikTok Shop is at the vanguard.

Today, TikTok Shop is the platform that 40% of Gen Z are using to shop online, making it the leading online storefront for young shoppers.

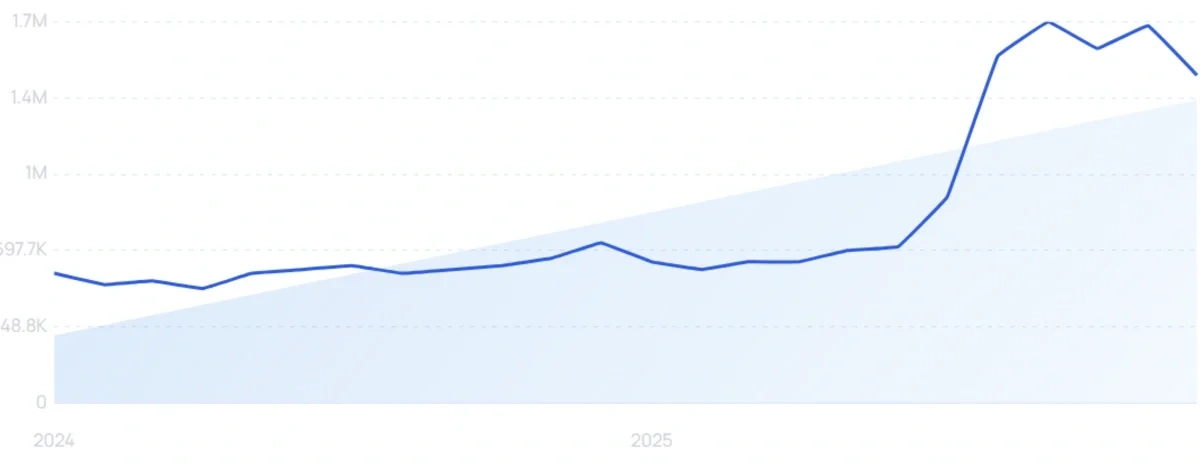

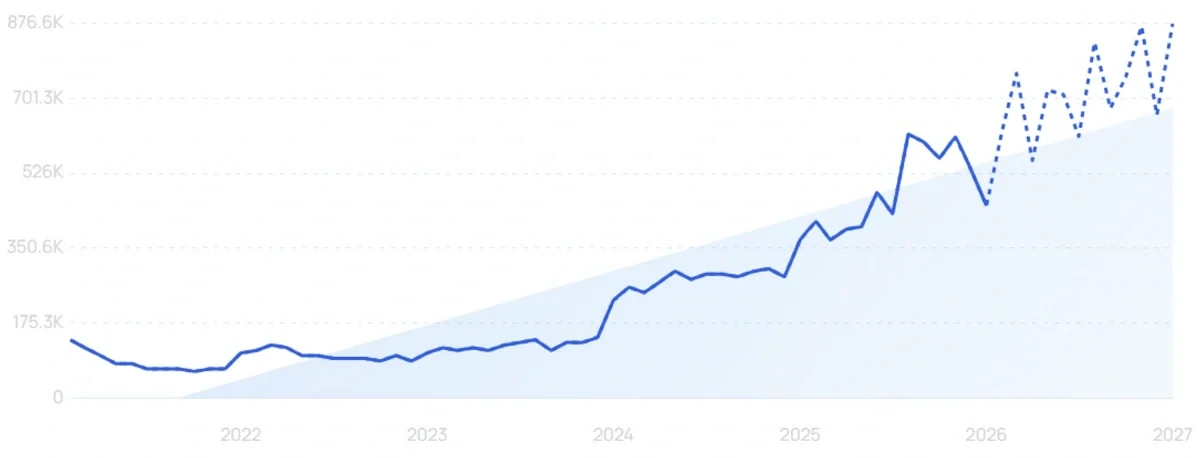

There are now 1.5 million “TikTok Shop” searches every month. Searches are up 153% in the last 2 years.

It’s not the first social media platform to develop a direct retail offering. Instagram Checkout, for instance, has been around since 2019.

But millions of younger users are on TikTok. 65.9% of its adult user base is aged 18-34.

In fact, TikTok is the third most popular platform among Gen Z for product discovery, with YouTube ranking the first in this regard.

And these shoppers are ready to embrace social commerce. According to the Aftership survey, 65% of consumers in that age group consider themselves likely to buy through a social media platform in future.

That doesn’t even account for the arrival of Gen Alpha on the social commerce scene. Born between 2010 and 2024, the oldest members of the youngest generation are certainly beginning to play a part in the economy.

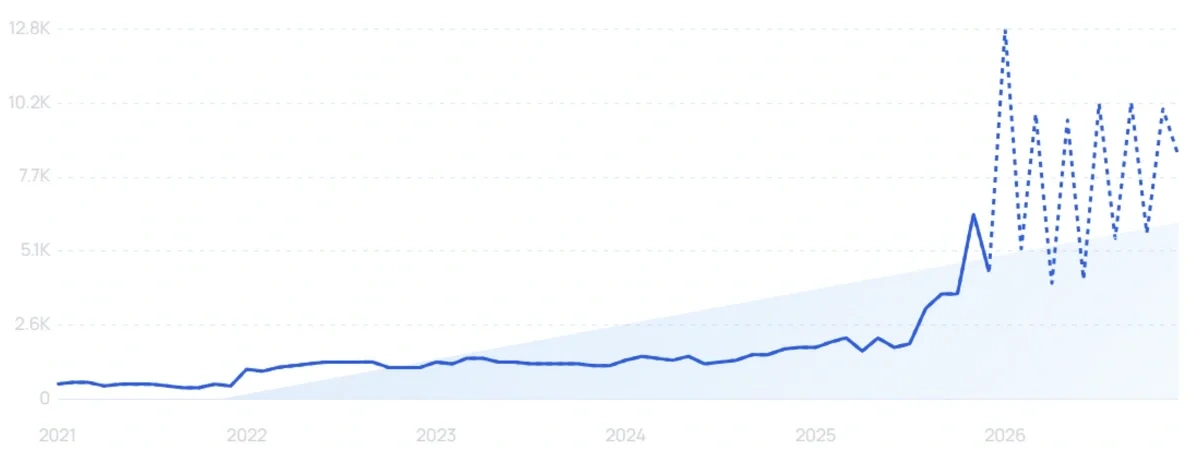

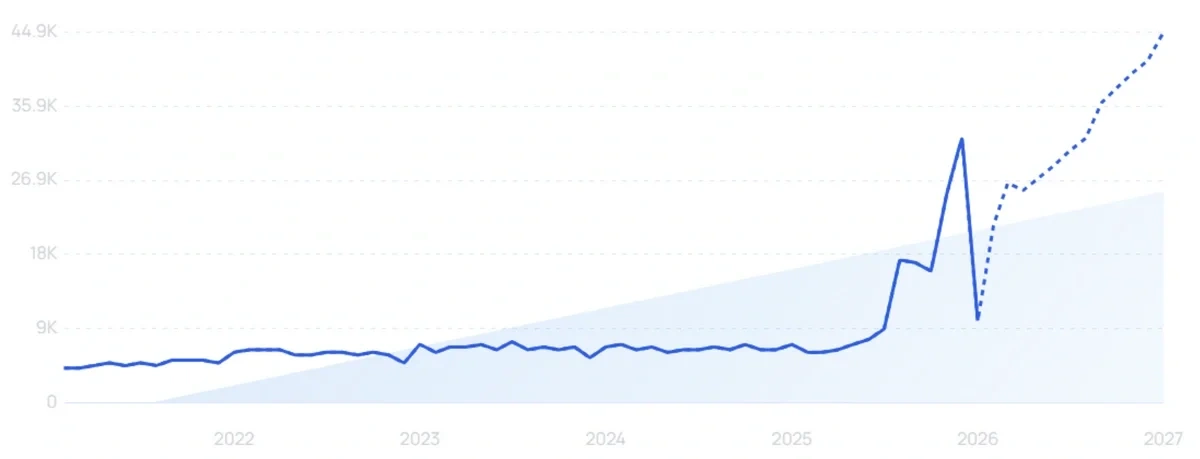

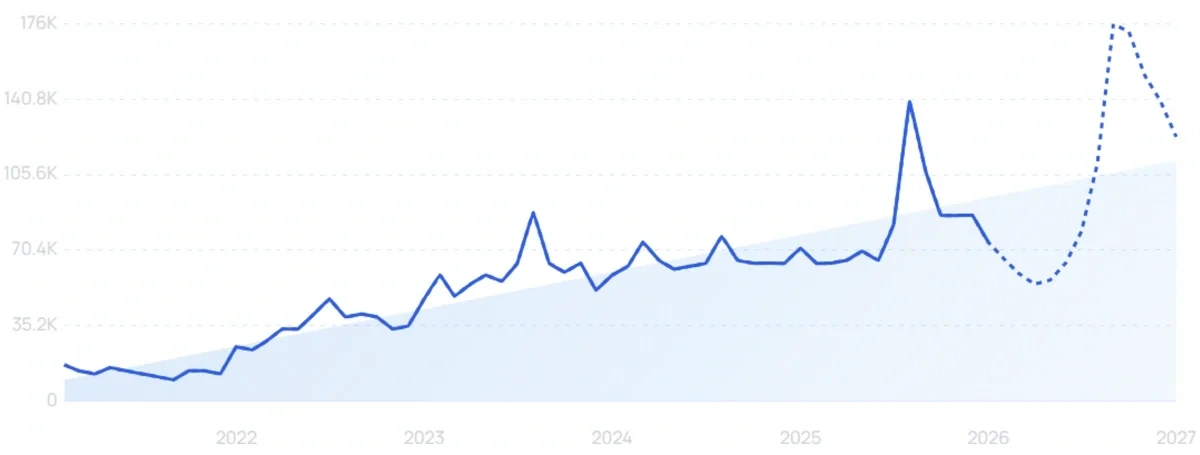

Brands should be increasingly concerned with the preferences of “Gen Alpha”. Searches are up 1,280% in 5 years, with Exploding Topics forecasting modest further growth.

Numerator calculates that in the US, through allowance money alone, Gen Alpha has about $28 billion of direct spending power.

Using the Semrush Traffic & Market tool, brands can discover the share of their audience that is on TikTok. For businesses with younger average customers, it may be that social commerce on the platform is well worth exploring.

And you can use Exploding Topics Pro to see search interest broken down by channel. That's exactly what That Sound Game did, on its way to selling more than 400,000 copies in under 3 years.

As well as its young-skewing user base, TikTok’s video-centric format lends itself well to social commerce.

Sellers can properly showcase the products they are selling. Appearing within feeds full of video content, these clips are less likely to be immediately skipped than traditional ads.

Video unlocks the possibility of live shopping too. In the UK, beauty startup P Louise set a record by selling more than $2 million worth of merchandise during a 12-hour TikTok livestream.

Example of a live TikTok Shop sale.

Harness Valuable TikTok Insights

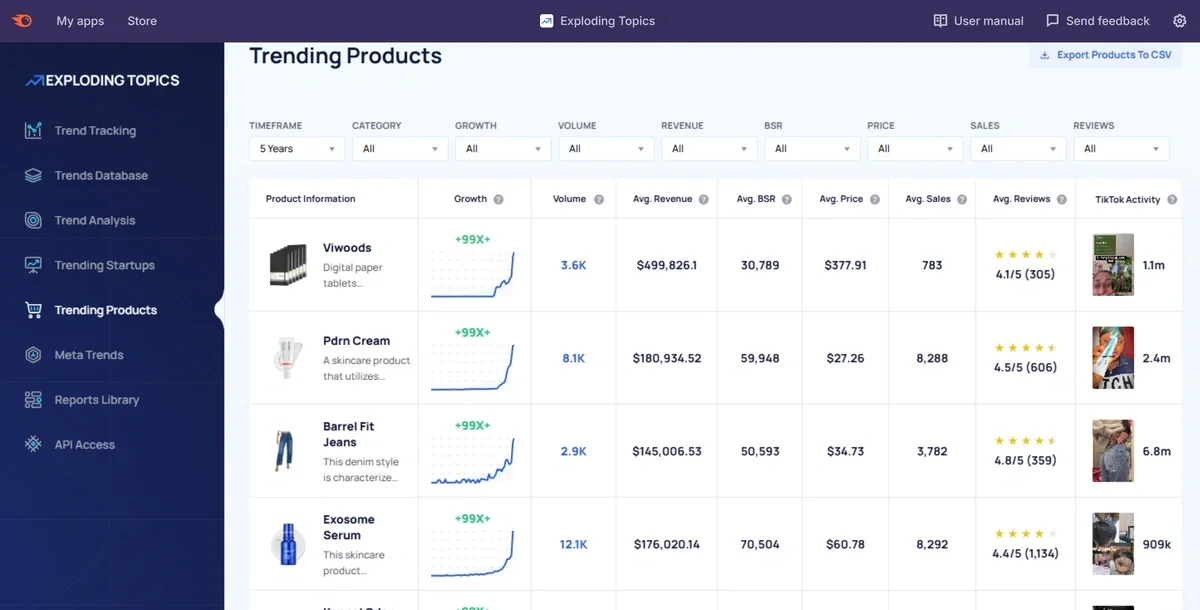

If you're looking to sell on TikTok Shop, there aren't many more powerful tools than Exploding Topics Pro.

Signing up gets you access to a vast product database. For every item, you can see TikTok activity, search growth, volume, average price, average revenue, and more.

You can even group together topics you're interested in using the Trend Tracking tool, and explore the Meta Trends influencing sales patterns. And you'll get a weekly email with hand-picked trending products and startups.

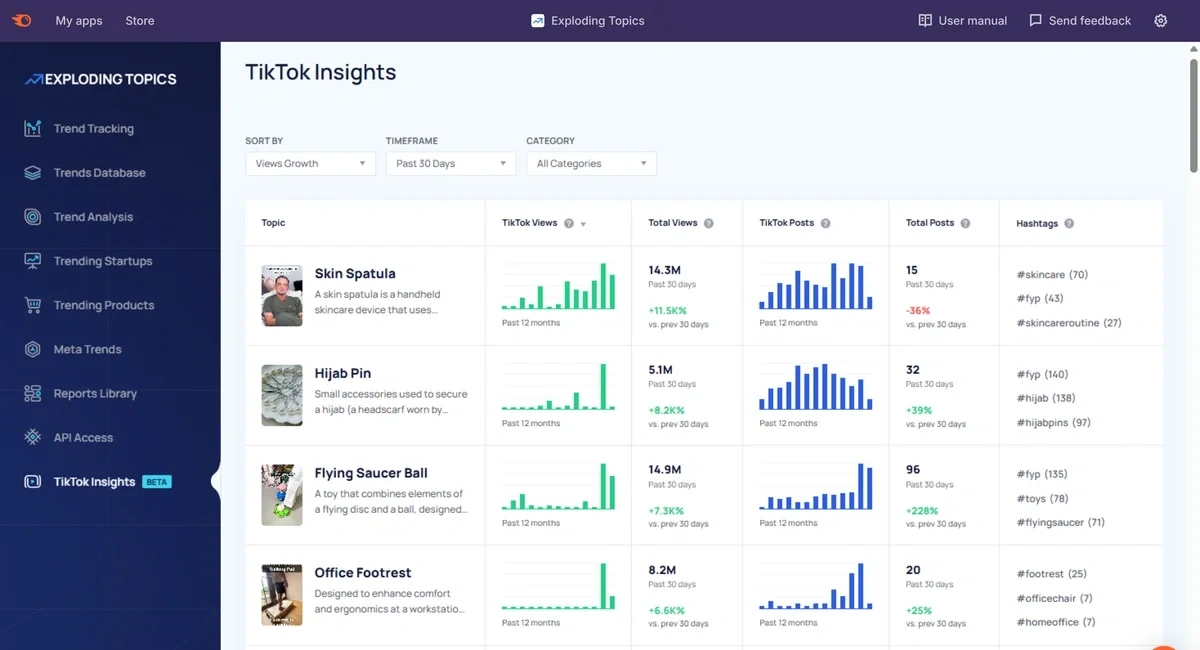

And now, there's a dedicated TikTok Insights section. It's a hyper-focused version of the Exploding Topics product database, dedicated entirely to sellable products with upward-trending TikTok momentum.

You can see exactly what products TikTok users are engaging with, backed by specific data on the number of posts and views. And you even get a ready-made list of relevant hashtags.

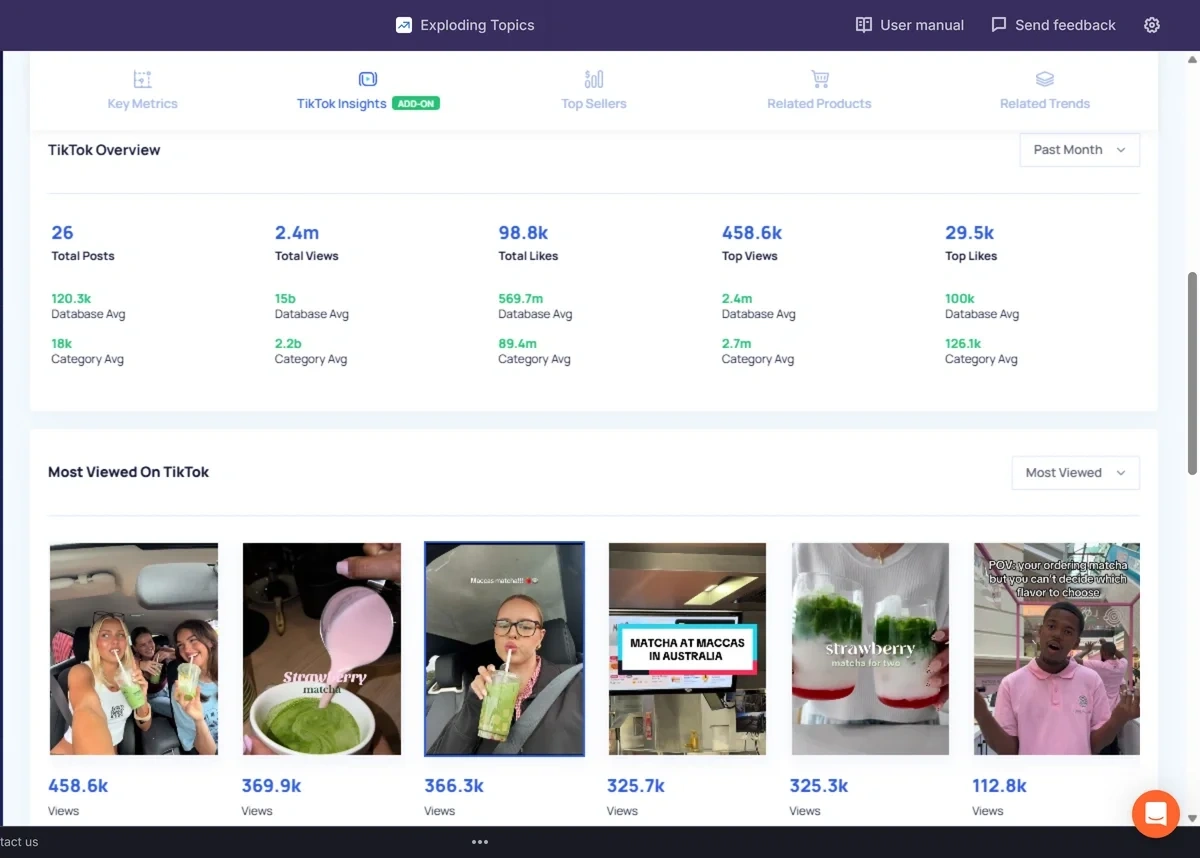

If you see an interesting product, you can click into it to get even more details. As well as the total number of posts, views, and likes in the past 30 days, you can even see the specific TikToks that are performing well.

From there, you can navigate to our other tools to see how the relevant product is performing on other channels too. There's average revenue data from Amazon, top sellers, and lists of related products and trends.

Exploding Topics TikTok Insights is an ideal tool to allow you to get selling straight away. And if you're already a TikTok Shop seller, it's a gold mine of valuable product ideas, handing you a vital edge.

Try it now from the Semrush App Center.

TikTok Shop revenue figures

TikTok Shop soft-launched in the US in July 2023, with 4,450 stores. By July 2025, there were 231,334 US TikTok Shops.

TikTok already had the playbook for this rapid growth: Douyin, the China-only version of the app, generated $490 billion GMV in 2024.

In the year to July 2025, Douyin GMV had grown by 34%.

Want to Spy on Your Competition?

Explore competitors’ website traffic stats, discover growth points, and expand your market share.

The blueprint is starting to bear fruit in the US. More than 70 million Americans made a purchase in 2025, with a forecast of 81 million in 2026.

As for US TikTok Shop revenues, they increased by 120% in the 12 months to June 2025.

In Q3 2025, global TikTok Shop GMV hit $19 billion. For context, that's within striking distance of eBay ($20.1 billion).

And Q4 will reflect holiday spending.

The platform invests heavily in becoming the go-to destination for the US holiday shopping season.

“TikTok Black Friday” searches have reached a new high in 2025.

It hosted a “Brand Palooza” event in 2024 featuring exclusive discounts and celebrity live shopping streams.

According to Reuters, US consumer spending on TikTok outstripped both Shein and Temu in the seven days leading up to Cyber Monday.

In 2025, the holidays were even bigger. TikTok Shop sales over the Black Friday period (the 4 days from Thanksgiving to Cyber Monday) hit $500 million in the US alone.

In theory, TikTok Shop is a win-win-win for TikTok, sellers, and influencers. The social platform recently upped its cut of US sales to 6% (it's 9% in the UK), and influencers negotiate their own commissions, but that’s a trade-off many retailers can accept in exchange for direct access to such a huge pool of potential customers — per Semrush data, there were 2.14 billion visits to TikTok in December 2025.

TikTok takeover

In the US, brands and creators will be keeping a very close eye on the impact of the upcoming Oracle deal.

ByteDance will take a minority stake in the newly-created US entity, created to allow TikTok to keep operating in the country. But the Oracle-led consortium will be majority shareholders.

That will lead to some changes, and there is particular uncertainty around the wildly successful algorithm. ByteDance is expected to licence its use to the new US entity, but it will be retrained on Amercian customer data.

With the algorithm such a huge part of TikTok Shop's success, this is certainly something to watch.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

What sells on TikTok Shop?

TikTok keeps track of the most popular product categories on TikTok Shop. Here are the top 10 from the last 30 days globally, ranked by the number of ad creatives featuring the category:

| Product | Popularity |

| Perfume | 47,000 |

| T-Shirts | 40,000 |

| Cases, Screen Protectors, and Stickers | 40,000 |

| Casual Dresses | 25,000 |

| Lipstick and Lip Gloss | 24,000 |

| Shampoo and Conditioner | 24,000 |

| Trousers | 24,000 |

| Serums and Essences | 24,000 |

| Women's Blouses and Shirts | 21,000 |

| Men's Shirts | 20,000 |

We can also look at the top categories by click-through rate (CTR). I’ve only included products that have been featured by at least 200 ad creatives in the last 30 days:

| Product | Click-Through Rate | Monthly Volume (Ad Creatives) |

| Candle Holders | 43.91% | 236 |

| Smart Watches | 39.62% | 243 |

| Drinking Utensils | 34.38% | 319 |

| Puzzles | 32.7% | 830 |

| Speakers | 16.65% | 548 |

| Swimming | 12.66% | 200 |

| Water Bottles | 11.92% | 4,000 |

| Toilet Brushes and Plungers | 11.58% | 814 |

| Novelty and Gag Toys | 11.56% | 412 |

TikTok goes from strength to strength

TikTok has a very distinct user base compared to other social media apps. It claims that 1 in 4 app users cannot be found on any other platforms.

It’s a unique audience, and also a large one. TikTok's billions of visits each month come from almost 2 billion unique users.

And among those TikTok users, 86% are aware of TikTok Shop.

TikTok User Age Stats

TikTok is more popular among Gen Z than other social networks. However, “Zillennial” users aged 25-34 are actually the largest single adult group on the platform, making up 40.3% of the total user base (those aged 18-24 account for 25.6%).

Meanwhile, teenagers are spending an average of almost two hours per day on TikTok.

At the other end of the spectrum, 8.5% of US TikTok users are 55 and over.

While 55% of Gen Z users use TikTok for online shopping, millennials prefer Facebook with 52% of them using it for product discovery.

Even though this generational gap in social commerce preferences is reducing, the divide is still quite prominent.

It's important for brands to understand these demographic preferences when choosing platforms for marketing to their particular target audience.

TikTok User Gender Stats

TikTok is slightly favored by men. In 2025, 45.5% of adult users worldwide are women.

The single biggest user group is men aged 25-34. They make up 23.6% of all adult users.

Males outnumber females in every age group. That might be a good thing when it comes to social commerce — according to the Aftership study, men (22%) are more likely than women (13%) to make a weekly purchase through social media.

TikTok User Country Stats

The US has the second-highest number of TikTok users worldwide. 153.1 million Americans use the platform.

That works out at a little over 50% of all adults in the US. (However, not every user necessarily equates to a unique individual.)

Per Semrush data, TikTok.com is the 18th most popular domain in the US. Unsurprisingly, the majority of visits come from mobile devices.

The average US user spends 43 hours and 53 minutes per month on TikTok. That’s well above the global average of 34 hours and 56 minutes.

Indonesia has the highest number of TikTok users. The country is home to around 180 million users.

Brazil, Mexico and Pakistan round out the top 5 countries when it comes to raw user numbers.

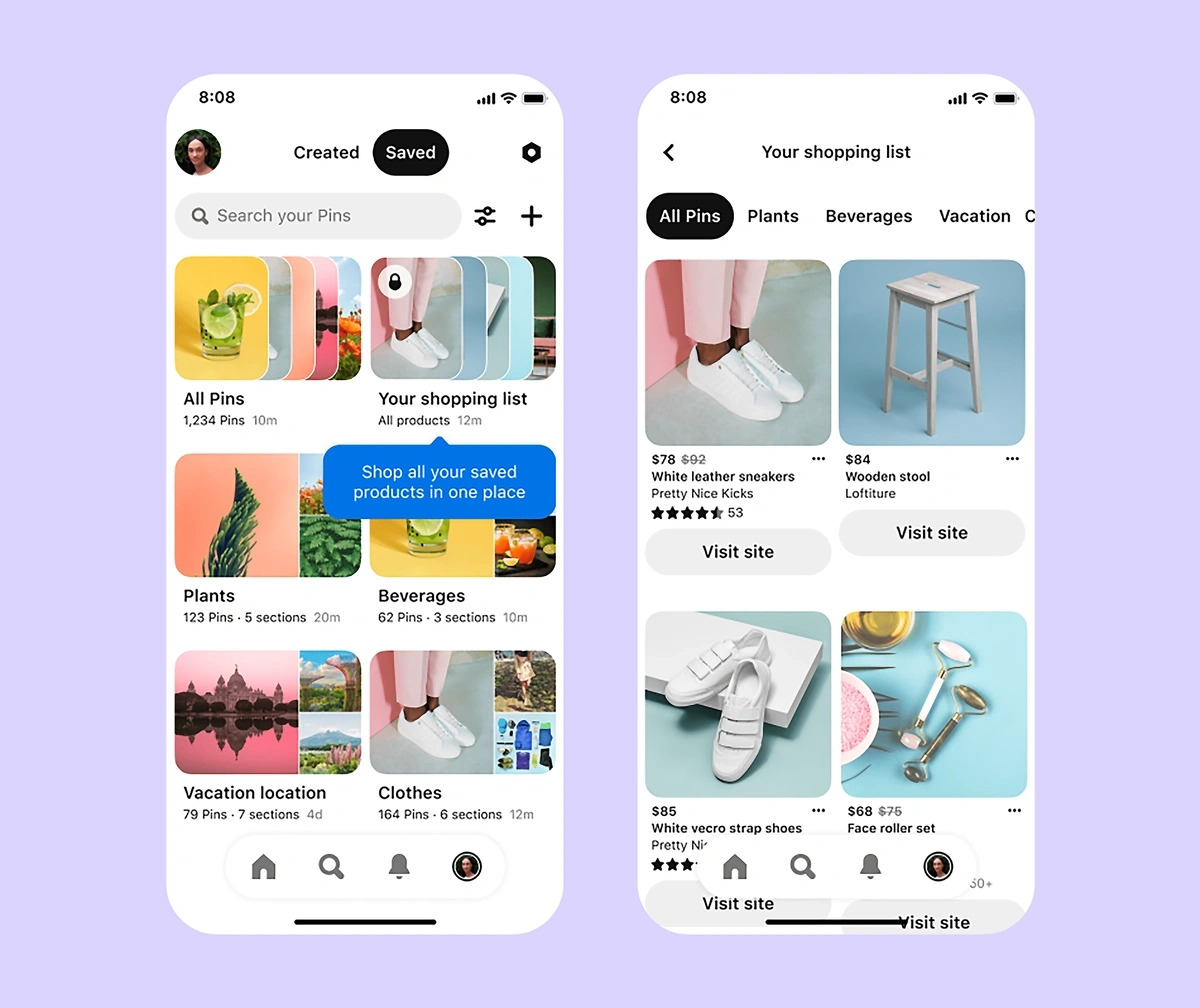

Other platforms like Pinterest pivot to social commerce

There’s no doubt that TikTok Shop has taken a lead in the social commerce space. It currently generates more than two-thirds of the total gross merchandise value in the entire sector.

It is also out-selling more traditional E-commerce giants like Shein and Sephora.

However, we can expect to see other platforms seeking a slice of the pie.

Social commerce now makes up an estimated 17.11% of all E-commerce, representing a multi-billion-dollar opportunity that is expected to keep growing. In top sectors like beauty, that figure rises over 50%.

In fact, it’s forecast that social commerce could be a $1 trillion industry by 2028.

Pinterest has the advantage of a user base predisposed to making purchases. Many people use the platform to curate what are essentially visual shopping lists.

Many Pinterest users treat the platform as a personal wishlist.

“We know users come to Pinterest to shop,” said CEO Bill Ready back in 2024. “We’ve been working to ensure our high-intent audience can find and easily take action on the content they see on Pinterest.”

He reinforced that message on the earnings call following Q1 2025:

“We’ve made Pinterest a destination for a user, particularly a shopping destination,” he said. “Pinterest is where Gen Z goes to shop.”

Unlike TikTok, Pinterest does eventually take buyers off-platform to complete purchases. But the process is being made more seamless — businesses can now insert direct shopping links to Pins.

Outbound clicks to advertisers have more than doubled year-over-year. And more than 50% of Pinterest users consider it a place to shop.

As a result, Pinterest is a valuable, if overlooked, platform on which to focus your social media efforts. The Semrush Social Poster lets you schedule directly to the visual discovery platform, even picking out the best times to post.

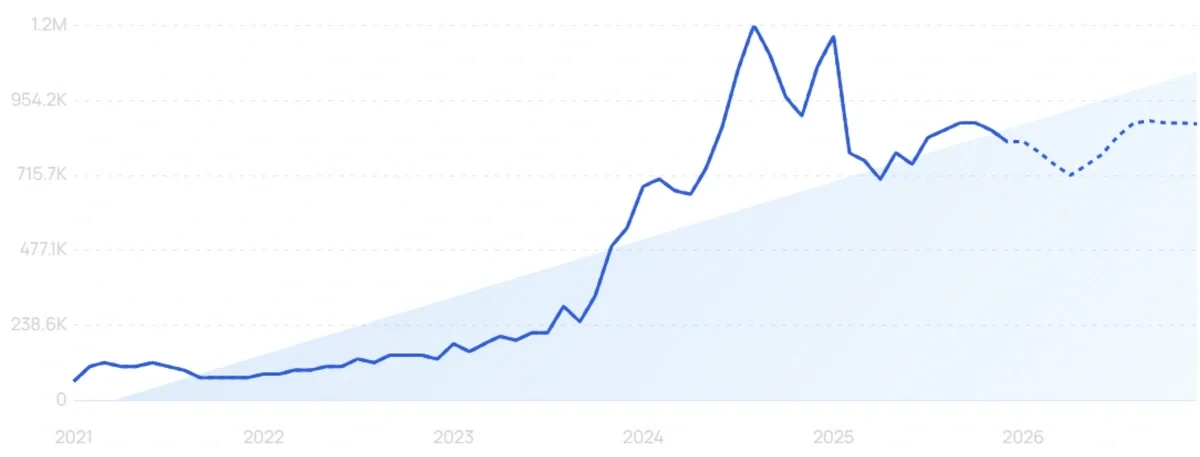

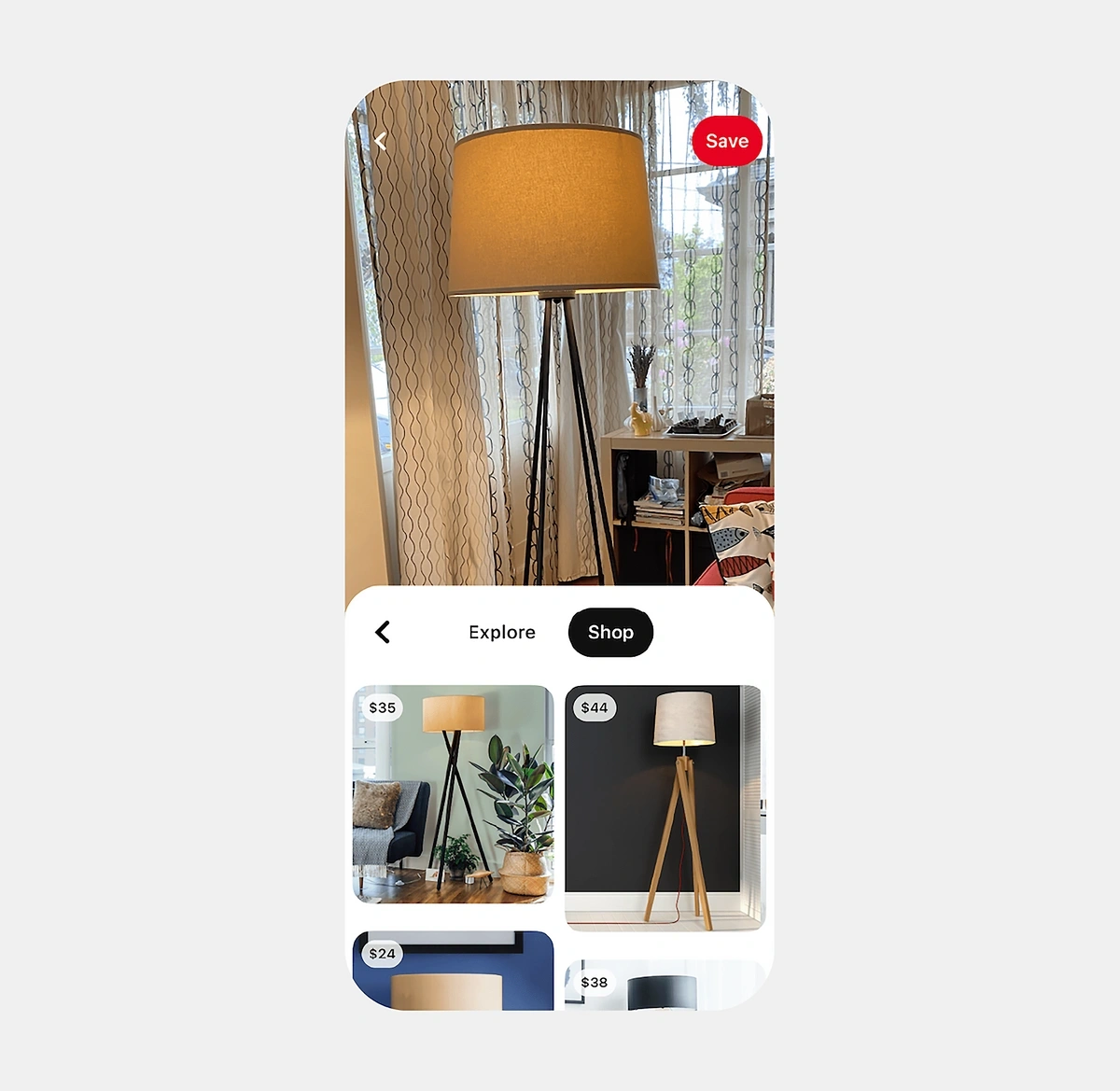

Pinterest has been a real leader when it comes to visual search.

“Pinterest Lens” searches have increased by 763% in the last 5 years.

When users see something they like, they can just point their camera at it. They are then presented with two tabs: “Explore” and “Shop”.

The shopping tab features links to a range of similar items from various online retailers. From there, it’s only a matter of a couple of clicks to leave Pinterest and order the product in question.

The “Shop” tab within Pinterest Lens.

Visual search is primarily used by younger consumers (Google Lens gets nearly 20 billion queries a month, with Gen Z the most engaged). And the Pinterest user base skews young.

Pinterest User Stats

Pinterest hit 600 million monthly active users in Q3 2025, its highest ever number of MAUs. Gen Z is its largest and most engaged audience.

In total, Gen Z makes up 42% of Pinterest’s user base. That’s around 252 million people.

Interestingly, and unlike a lot of other social media, Pinterest is heavily favored by women. Female users make up 69.4% of the total user base.

There are currently 103 million Pinterest users in the US and Canada. The Semrush Website Traffic Checker shows that it is the 32nd most popular website in the US.

India and Brazil are the next-largest markets, while the app is also popular in Europe.

In the US and Canada, average quarterly revenue per user (ARPU) is $7.64, significantly higher than elsewhere. ARPU is $1.31 in Europe, and just $0.21 in the Rest of World region.

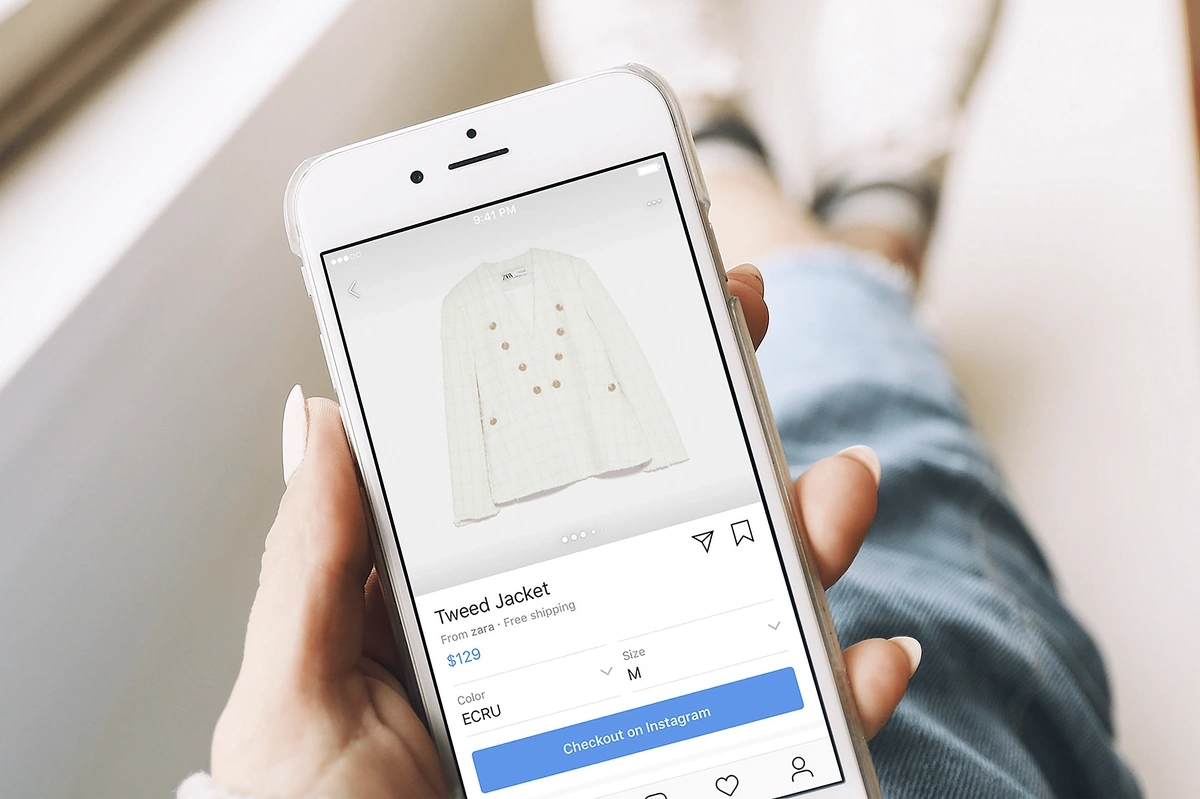

Instagram is not out of the game

It may feel like Instagram is being left behind a little amid the surge in TikTok Shop and the progress of platforms like Pinterest. But it enjoys a lot of the same advantages.

In much the same way that TikTok’s video-first format makes product videos less objectionable to consumers, Instagram is a natural home for visual ads and promoted posts.

And like Pinterest, the Meta-owned platform is packed full of high-intent users. According to Capital One, 1.4 billion people use Instagram to shop.

However, Meta is actually rowing back from some elements of social commerce.

Checkout was Instagram’s “true” social commerce offering, which allowed users to complete purchases without leaving the platform.

Instagram Checkout in use.

But by August 2025, US merchants that had enabled native checkout on Instagram (and Facebook) had all been transitioned back to external checkout.

However, that doesn't mark the end of social commerce on Instagram. It simply signals a shift to something more akin to the Pinterest model, with discovery on-platform and purchasing on the merchant site.

Instagram Shopping integrates many of the same features as the now-deprecated Checkout, allowing businesses to set up virtual storefronts on the platform and streamlining the process by which purchases can be made.

Instagram User Stats

By some counts, Instagram has been overtaken by TikTok in the battle for Gen Z audiences. But it’s close — and in a study of the US, UK, Canada, and Australia, Instagram still leads the way, with 89% of Gen Z on the platform (TikTok has 82%).

The latest 2026 data also shows that Instagram has more total users: 3 billion vs 1.99 billion.

Despite the increased competition, Instagram undoubtedly remains popular among younger people. Users aged 18-34 make up 60.8% of the total advertising audience profile.

With over 480 million users, Instagram is most popular by far in India, with the user base growing by another 1.7% in the last quarter. The US is the second-largest market, with over 180 million users.

Semrush data indicates that Instagram is the 7th most visited website in the US, and the 4th most visited worldwide.

YouTube tests the social commerce waters

YouTube seems like another natural home for social commerce elements. After all, users will often use the site to specifically seek out product reviews, with the ultimate intent to purchase something.

One study from Google found that consumers actively missed YouTube when instructed to live their normal lives without it, with participants citing product review videos as an important part of how they shop.

And the video sharing site is keeping an eye on the rise of social commerce.

Rolled out in the US last year, YouTube Shopping is available to creators who are approved for monetization and have at least 1,000 subscribers. It’s a collaboration with Shopify.

Features include the ability to “tag” products in videos, with viewers then able to click through directly to make a purchase.

A YouTube creator showcases a product, with a clickable tag for viewers to buy it.

And the Affiliate Hub makes it easier to set up influencer marketing, emulating a major cornerstone of the TikTok shopping experience.

YouTube Shopping has also been extended in a slightly different guise to Indonesia, Thailand, Vietnam, Malaysia, and the Philippines, where Google has partnered with Shopee to allow users to buy products via embedded links.

“We’re certainly investing a lot in making shopping successful,” said YouTube’s VP of engineering Geoff van der Meer in March. Elements of the Shopee experiment could ultimately arrive in Western markets.

Retailers go social

Embracing social commerce can go both ways. Social media platforms are gradually adding retail functionality, but there’s nothing to prevent retailers from adopting social elements too.

To that end, ThredUp appointed Danielle Vermeer as Head of Social Commerce in late 2024. She joined the second-hand marketplace with a brief to “make resale more engaging and accessible to a wider audience through innovative shopping experiences”.

“Second hand marketplace” searches are up 138% in 5 years. ThredUp wants to combine that growth with the growth in social commerce.

Likewise, Zara has started streaming hours-long catwalk sequences, with viewers able to make live purchases. While its first broadcast in November 2023 was on Douyin, it now streams to its own website and mobile app.

Third parties fill the social commerce gap

Social commerce is an exciting space at the moment. But it’s clearly still a nascent market.

Instagram Checkout was something of a false start for Meta. While Pinterest has some nice retail features, users are still being taken off-platform to make their purchases. And YouTube is only just beginning to experiment with the functionality.

So in many ways, aside from TikTok Shop, options remain limited for creators and brands looking to monetize their social presence through sales.

While big platforms get to grips with social commerce and what it means for them, third parties have started to fill the gap. For instance, Beacons.AI seeks to give online personalities a better selling experience.

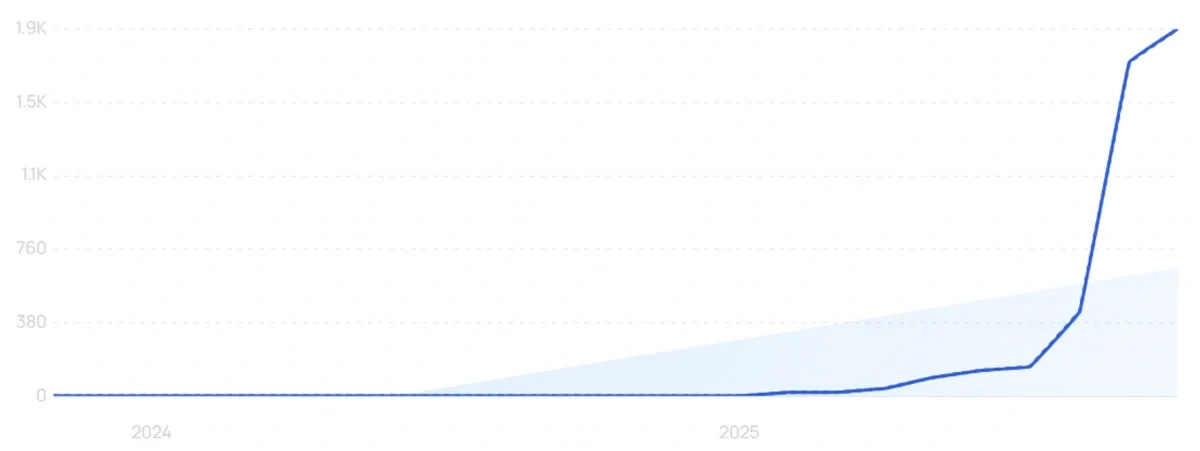

“Beacons.AI” searches have risen by 342% in the last 5 years.

It’s neither a social media platform nor a retailer, so it can’t enable true social commerce. But it recognizes the desire to be able to buy and sell more easily from existing apps like Instagram.

We’ve all seen “link in bio”. In more than 8 million cases, that is powered by Beacons, which allows creators to set up storefronts that are just one click removed from their social profiles.

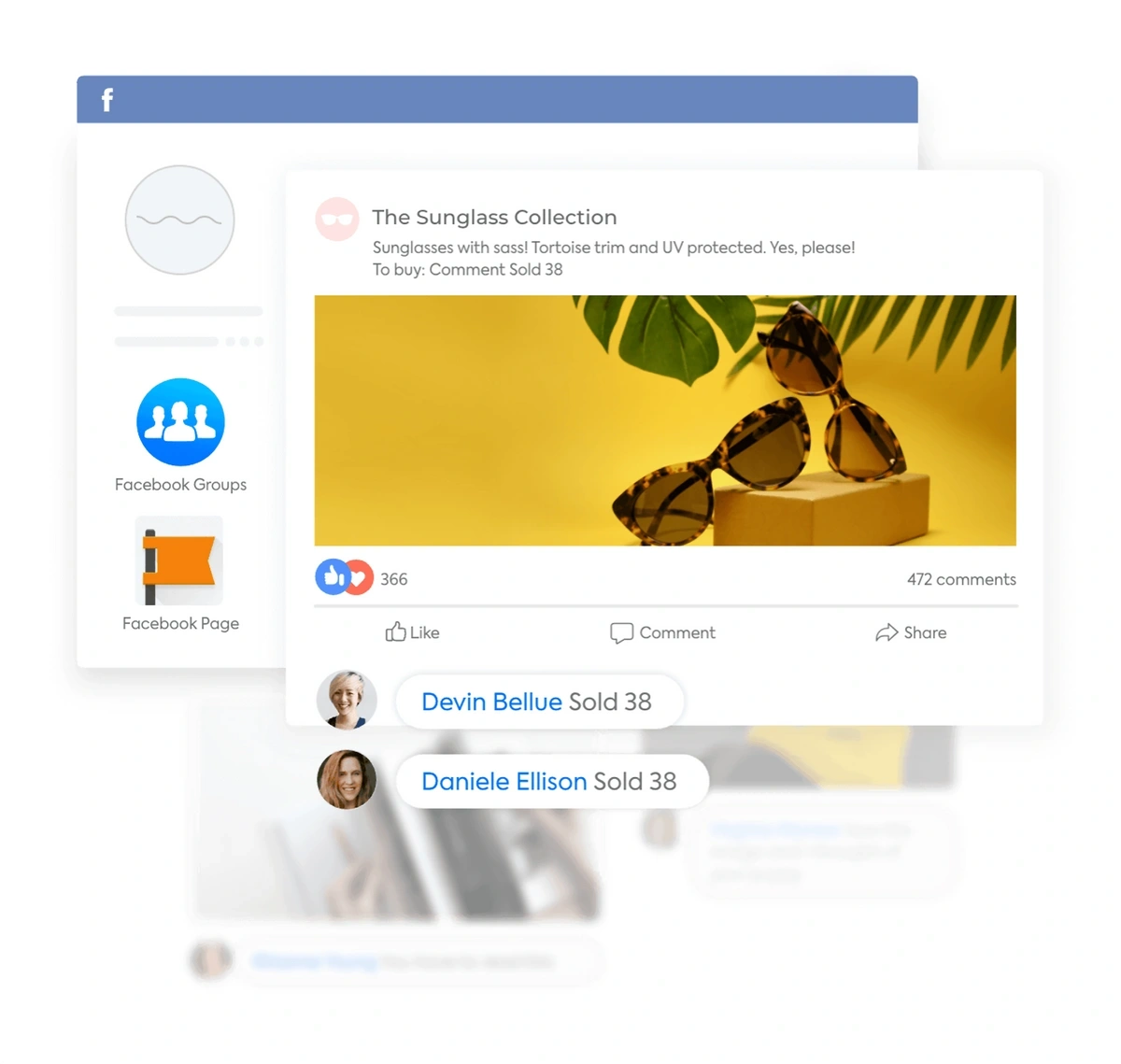

CommentSold is another third-party tool. It seeks to leverage basic existing social media infrastructures to make social commerce a reality.

As the name suggests, users simply have to comment “sold”. That creates an order without the consumer having to leave the platform.

“CommentSold” lets businesses sell from within the comments sections of social media.

Again, without the collaboration of the social media sites themselves, there eventually has to be an off-platform element. CommentSold has to prompt users to go elsewhere and actually complete the checkout process.

Searches are down, perhaps as brands finally start to get some native social commerce options. But more than 10,000 retailers have reportedly used CommentSold, generating $5.3 billion in live video commerce sales.

The role of AI in social commerce

It feels like everything is AI at the moment. But in social commerce, the revolutionary technology is actually not the driving force behind the changing consumer behaviors.

However, AI chatbots are helping brands to maintain a personal social presence at previously impossible scales. That's directly leading to more social sales.

Manychat allows businesses to automate DMs on social platforms like TikTok.

"Manychat" searches are up 232% in the last 5 years.

It says that one of its creators secured 65,000 leads in a year through automating DMs, translating to more than $1.5 million in new revenue.

Furthermore, the rise of social commerce ties into the parallel rise in agentic commerce, where consumers instruct AI agents to complete transactions on their behalf.

"Agentic commerce" searches are up 99X+ in the last 2 years.

Both social commerce and agentic commerce are about meeting users where they already are, whether that is a social platform or a chatbot.

More than ever, shopping comes to the consumer. It was a huge trend for Black Friday in 2025.

Social commerce still faces challenges

The appetite for social commerce is clearly there, particularly among younger users. So what are social media sites waiting for?

The aforementioned Aftership report reveleaed that that there are still consumer reservations about social commerce. Users are ready for the practicality, but still feel a little uncomfortable about shopping directly from social media.

52% of those who don’t currently shop via social media cite lack of trust in these platforms as a reason. Correspondingly, 44% say greater trust would persuade them to explore social commerce in the future.

Consumers also want reassurance about the security of these platforms before fully embracing social commerce. 28% say they would be motivated to buy via social media if it was more secure.

The TikTok ban and US takeover saga

Perhaps it’s no surprise that concerns about the security of social commerce are front and center of consumers’ minds when it is TikTok that has led the way.

The US has had an uneasy relationship with the Chinese-owned platform. Under the Biden administration, it told the app that it must either change ownership or shut down, amid potential security concerns.

The "ban" only ever amounted to less than a day of downtime. But while President Trump signed off on numerous extensions, TikTok has eventually been forced to divest its US operations.

However, there is a sense that political priorities have shifted. Finalized in January 2026, the eventual deal leaves ByteDance with around 20% of US operations, so the original worries have not been entirely addressed.

The average US user might still be happy to scroll through TikTok. But they may be more reluctant when it comes to sharing payment data and shipping details.

But perhaps more pertinently, it remains to be seen what kind of impact the handover to the Oracle-led consortium has on the efficacy of the algorithm, which sits at the heart of TikTok Shop's success.

RedNote (Xiaohongshu) and taking social commerce beyond Asia

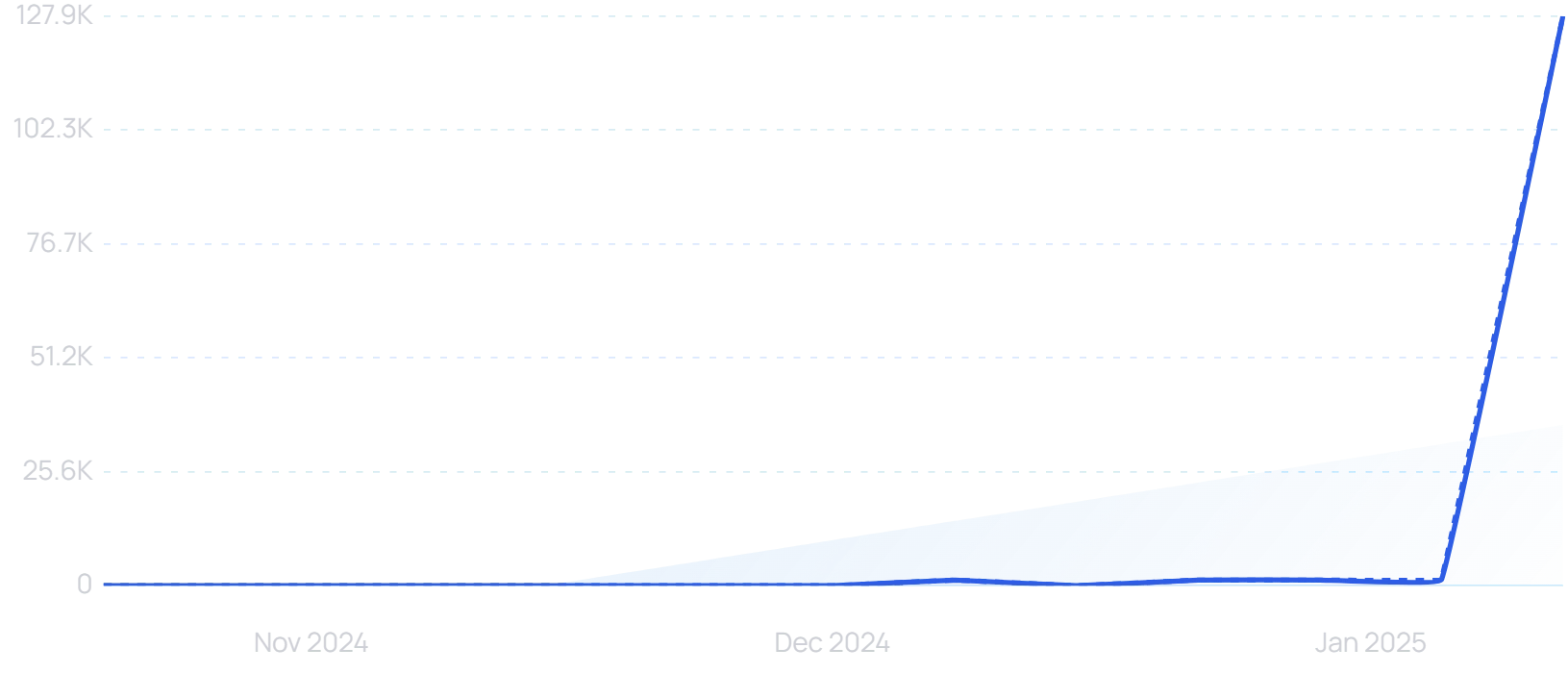

In the hours where TikTok did briefly go dark, it quickly became apparent that other platforms can always rise to fill the void. RedNote searches spiked 99X+.

“RedNote” searches jumped 99X+ amid the TikTok ban.

Social commerce is massive on RedNote as well. In fact, one estimate suggested the platform would surpass $100 billion in gross merchandise volume in 2025.

How is it that there was a second Chinese social commerce giant simply waiting in the wings? It’s down to differing consumer attitudes to shopping via social media.

The average US consumer is starting to embrace social commerce, as we have seen. But it’s still a nascent market compared to the situation in large parts of Asia.

The APAC region accounts for more than half of the world’s social media users. And more than 50% of this huge user base is keen on social commerce.

China in particular is home to the “super-app”. The idea of doing your social sharing and your shopping in one place is second nature. For social commerce to ever truly catch up in the US, consumer mindsets will have to change.

Retailer concerns about social commerce

As well as consumers, there is a reticence over social commerce from some major US brands, especially when it comes to the live shopping element. According to Marketplace Pulse, the relatively niche Goli Nutrition was by far and away the biggest seller during TikTok Shop's first year in the US, bringing in over $7 million per month.

Simply put, there are inherent risks with live content, from which the biggest players have generally so far shied away. For brands with highly established customer bases, there might also be a reluctance to hand over a cut of revenue to social platforms.

The future is social commerce

Regardless of the lingering reservations, social commerce looks set to become a major part of the retail landscape. In fact, it’s already there.

TikTok has catapulted social commerce into the mainstream. Nudged along by third party apps and services, other social media platforms are starting to catch up.

With captive audiences in the billions, it’s a no-brainer for the social giants to explore new retail avenues. As for consumers, social commerce can lead to an easier and more frictionless shopping experience.

Younger shoppers in particular have made their preferences clear: they want to be able to buy through social media. As spending power increases for Gen Z and Gen Alpha, social commerce could well become the norm, and even the most established brands may have to get on board.

With the way the wind is blowing, it is more important than ever to build and maintain a strong social presence. Semrush’s social media toolkit is a game-changer.

Semrush can generate 100+ content ideas per day, tailored specifically to your brand. And powerful analytics can make sure you’re moving in the right direction.

And the Exploding Topics Pro database is your closest ally when it comes to selling on platforms like TikTok Shop. It places hugely powerful product insights at your fingertips, helping you move ahead of the competition.

So get ready for social commerce and sign up now.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more