Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

49 Shocking Employee Theft Statistics (2024)

Organizations looking to protect themselves against theft might want to first look in their own offices and storefronts. Employee theft remains a significant sunk cost for businesses of all sizes.

Dishonest employees have found several ways to skim extra money from their employers. Whether it’s through years-long fraud, embezzlement schemes, or pocketing showroom merchandise, employee theft is a widespread issue.

In this article, you’ll learn about the numbers and methods behind employee theft in 2024.

Contents

- Top Employee Theft Statistics

- Employee Theft Statistics

- Retail Employee Theft

- Embezzlement Statistics

- Employee Time Theft Statistics

Top Employee Theft Statistics

Before getting into the full list of statistics, here are the top 6 employee theft stats to know:

- Employee theft costs businesses around $50 billion each year

- 57% of fraud is committed by company insiders or a combination of insiders and outsiders

- 22% of small business owners have had their employees steal from them

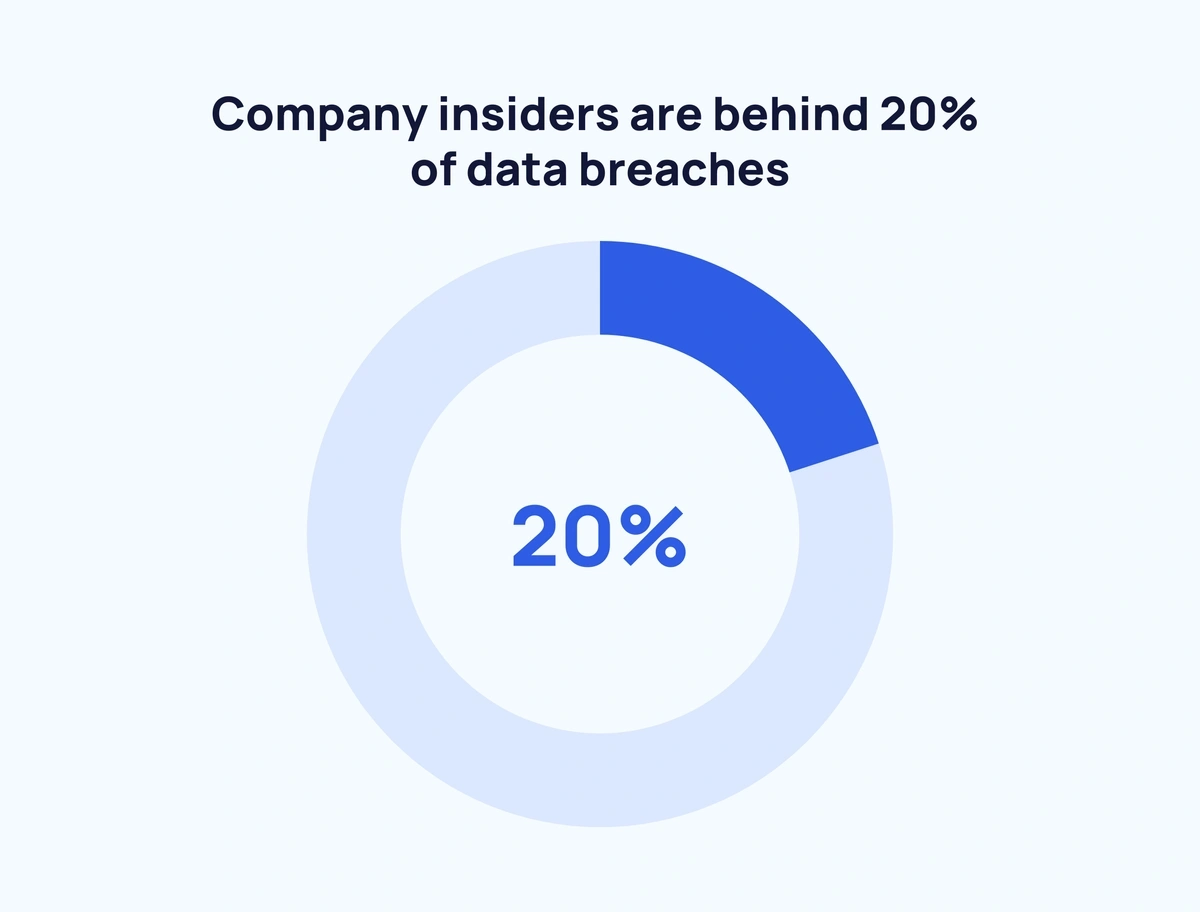

- 20% of data breaches are caused by company insiders

- The average dishonest retail employee costs their employer $1,551.66

- The average embezzlement incident leads to $357,650 in losses

- 43% of employees exaggerate how many hours they work

Clearly, employee theft causes serious financial losses to companies. Keep reading to learn more.

Employee Theft Statistics

Employee theft affects all types of employers, from massive corporations to local small businesses. In many industries, fraud is more commonly carried out by insiders than outsiders. Keep reading to learn about the various schemes used by thieving employees and the losses they cause.

On average, employee theft costs US businesses approximately $50 billion each year (Statistic Brain)

Employee theft involving cash, assets, sensitive data, and even time is a multi-billion dollar issue in the US. Based on ACFE’s research, companies lose an average of $1.7 million per employee fraud case.

22% of small business owners have had their employees steal from them (Business.org)

Of that 22%, 35% have caught the offending party on camera and 42% have personally caught their employee stealing. Cash is the most common thing employees steal from small businesses, followed by food and beverages, clothing, time, office supplies, and electronics.

57% of fraud is committed by company insiders or a combination of insiders and outsiders (PWC)

37% of fraud is committed solely by insiders. In those cases, middle management is behind the fraud 34% of the time, operations staff 31% of the time, and senior management 26% of the time.

Insiders are behind 43% of fraud cases involving over $100 million in losses (PWC)

Frauds can cost companies millions, even billions of dollars. The top 5 types of fraud in terms of monetary loss are antitrust, insider trading, tax fraud, money laundering, and bribery and corruption.

Almost half of companies don't conduct investigations into their worst fraud incidents (PWC)

Even though 60% of companies that investigate fraud end up in a better place, almost half of organizations fail to do so.

Asset misappropriation is the most common type of employee theft (ACFE)

86% of all employee fraud cases involve some form of asset misappropriation. Asset misappropriation involves anything from outright stealing cash or inventory to running elaborate billing or payroll schemes.

Furthermore, 50% of cases involve some degree of corruption. Invoice kickbacks, illegal gratuities, and purchasing schemes are all examples of corruption in action.

Finally, financial statement fraud makes up only 9% of cases — but is the most financially damaging. The median loss from a financial statement fraud incident is $593,000, compared to $100,000 for asset misappropriation and $150,000 for corruption.

5% of fraud cases involve asset misappropriation, corruption, and financial statement fraud (ACFE)

While most cases only involve one type of fraudulent activity, 40% of perpetrators use a combination of different fraud types.

32% combine asset misappropriation and corruption.

2% combine asset misappropriation and financial statement fraud.

Just 1% combine corruption and financial statement fraud.

Employee fraud schemes have a median duration of 1 year (ACFE)

According to ACFE’s latest occupational fraud report, fraud schemes lasting less than six months made up 33% of all fraud cases. The median loss in those schemes was $47,000.

On the other end of the spectrum, 6% of fraudulent activities were carried out for 60 months or more and amounted to $800,000 in median losses.

Creating fraudulent physical documents is the most common way for employees to conceal fraud (ACFE)

Since most fraud schemes last for several months, perpetrators need to find ways to conceal their efforts. In 39% of cases, the offending party created fraudulent physical documents to cover their tracks. 32% altered existing physical documents, while 28% created fraudulent digital files. In 12% of cases, perpetrators made no efforts at all to conceal their actions.

8% of fraud schemes involve the use of cryptocurrency (ACFE)

In cases where cryptocurrency was involved, 48% used crypto to make bribes or kickback payments. 43% of offenders converted misappropriated assets into cryptocurrency. 35% used cryptocurrency as part of a money laundering scheme.

42% of occupational frauds are detected by third-party tips (ACFE)

Of the third parties who report occupational fraud, 55% are employees, 18% are customers, and 10% are vendors. In 16% of cases, the tip came from an anonymous source. Tips aren’t the only way fraud is discovered. 16% of detection comes after an internal audit, and 12% after management reviews.

Management makes up the largest portion of employees who commit fraud (ACFE)

39% of fraud is committed by managers, leading to a median loss of $125,000. 37% of fraud is committed by employees, leading to a median loss of $50,000. Owners and executives make up only 23% of fraud cases, but cause $337,000 in median losses.

Company insiders are behind 1 in 5 data breaches (Verizon)

Internal data breaches aren’t the most common, but they can be the most damaging. According to Verizon, the average data breach by an employee leads to 375,000 compromised files, compared to just 30,000 for external breaches.

Those figures look at the median number of files leaked per breach. But most actors are repeat offenders. The median number of files leaked per internal actor is actually 1,000,000 — spread out across multiple incidents.

Retail Employee Theft

Retail is one of the most at-risk industries for employee theft. They not only have the same fraud risks as other business types, but they also have a plethora of in-store merchandise on the line. Here are the latest stats around retail employee theft.

The average dishonest retail employee costs their employer $1,551.66 (NRF)

In NRF’s 2021 Retail Security Survey, half of the respondents reported over $1,000 in losses from employee theft. That’s almost twice as many incidents as in 2019 when only 28.8% reported over $1000 in losses.

Large retailers apprehend 361 dishonest employees per year on average (NRF)

NRF’s survey of 55 retailers shows that the average company apprehended 361.6 dishonest employees in 2021. Retail employee theft incidents led to an average of 527.3 terminations, 83 prosecutions, and 150.2 civil demands per retailer.

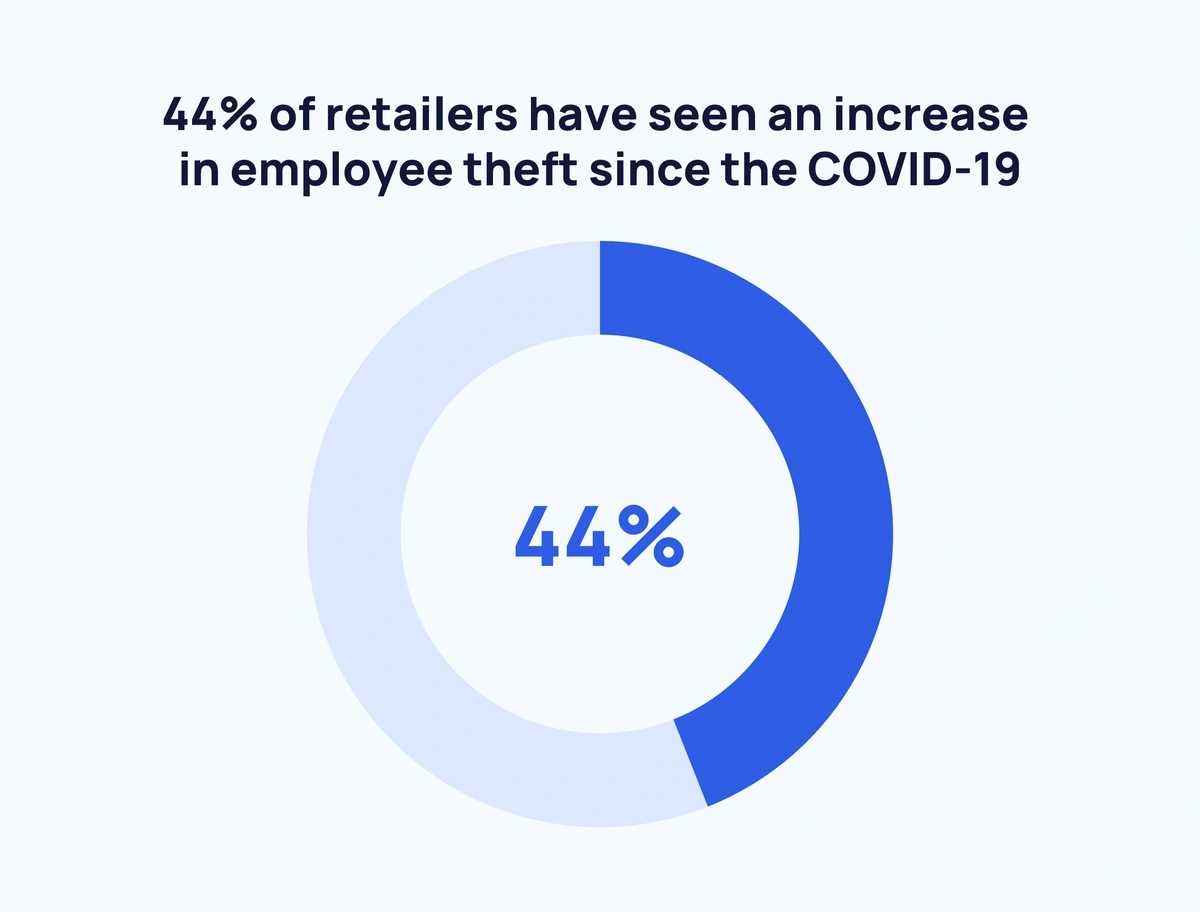

Almost half of all retailers have seen an increase in employee theft since the COVID-19 pandemic began (NRF)

The pandemic has brought greater theft risks to retailers, both from internal and external sources. 33.3% of retailers say there’s been a slight increase in employee theft since the start of 2020, while 11.1% say there’s been a significant increase.

Embezzlement Statistics

Embezzlers spend years siphoning money away from their employers before getting caught — if they ever get caught at all. Here are the latest embezzlement statistics.

The average embezzler has worked at their company for 8 years (Hiscox)

According to Hiscox, most embezzlers join an organization without intending to steal. It’s only after they’ve been with an organization for several years that they begin their embezzlement schemes. And in many cases, the first offense is triggered by a perpetrator’s personal financial crisis.

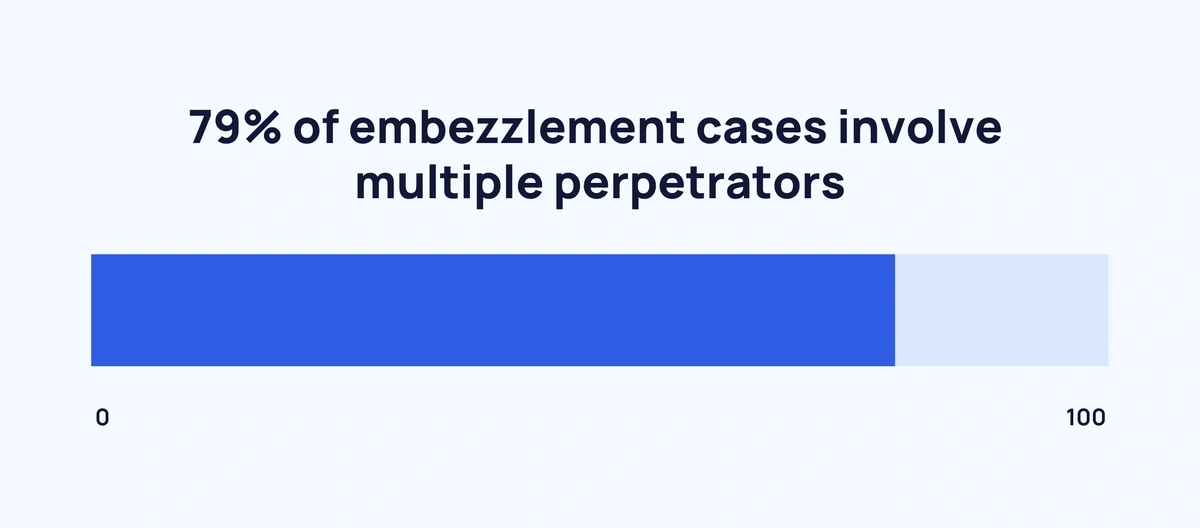

Around 4 in 5 embezzlement cases involve multiple perpetrators (Hiscox)

Just one in five embezzlement cases are perpetrated by a single individual. 46% of cases involve three or more actors. 85% of cases involve one more manager, and 20% involve C-suite executives.

Billing fraud is the most common embezzlement technique (Hiscox)

Billing fraud is present in 18% of embezzlement incidents. 15% of embezzlement cases involve stealing cash at hand. 11% include theft and larceny — stealing property from employers or other employees.

The average embezzlement incident leads to $357,650 in losses (Hiscox)

Employee theft creates more than just financial losses for an organization.

29% of embezzlement cases lead to employee layoffs.

27% lead to increased spending on audits.

And in 26% of cases, the organization loses customers, spends more time discussing security, and adds more security requirements to protect against future losses.

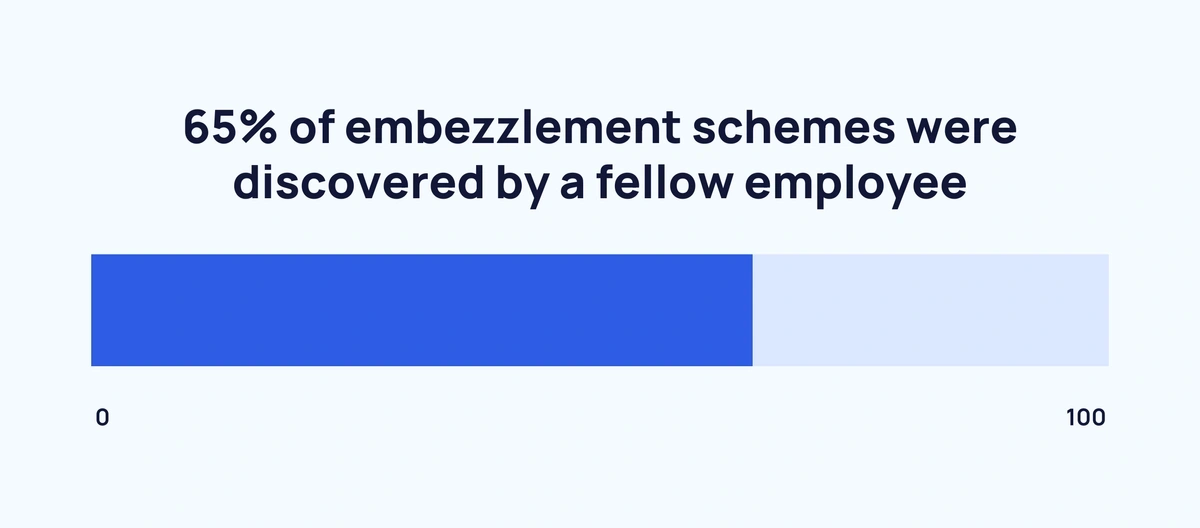

Approximately 2 in 3 embezzlement schemes were discovered by a fellow employee (Hiscox)

Most embezzlement incidents get derailed after another employee notices something is off. In fact, 40% of office professionals say they’ve witnessed two or more embezzlements over the course of their careers.

Employee Time Theft Statistics

Employee theft doesn’t always involve stealing property or cash. It can mean stealing time — often by working fewer hours than reported.

Employers lose $400 billion per year to time theft (Software Advice)

Time theft — employees getting paid for hours they didn’t actually work — affects up to 75% of all businesses. Employees steal time by exaggerating or fabricating their hours, not working while clocked in, or having co-workers clock them in.

43% of employees exaggerate how many hours they work (Software Advice)

Exaggerating hours might seem innocent at first glance. After all, what’s the harm in getting paid for an extra five minutes? But that stolen time adds up: an extra 5 minutes per day can total 20 hours per year.

False recording is the most common method of time theft (Software Advice)

45% of the time thieves use false reporting — by clocking in early and clocking out late, or simply recording false times on timesheets. 43% commit time theft by performing personal activities (like looking at their smartphones) while they’re on the clock. 42% steal time by taking frequent breaks. Finally, 23% use “buddy punching” — having a colleague clock them in when they’re not actually at work.

Buddy punching costs US employers $373 million per year (Workforce Hub)

Buddy punching affects 75% of all US employers and can make up more than 2.2% of their total payroll costs. A Pollfish survey of 1000 workers found that 16% admitted to buddy punching at least once in their career.

One-quarter of workers inflate their hours over 75% of the time (Software Advice)

Of employees who exaggerate the number of hours they work, 60% of them say they do it for less than 25% of their shifts. On the other hand, 25% inflate their hours for anywhere between 76 and 100% of their shifts.

80% of small businesses find errors on their employees’ time sheets (PPM Express)

Employee time theft is rampant in the small business world — affecting 4 out of 5 businesses. 56% of small business owners say they find errors on a quarter of their employee time sheets. 10% find errors on half of employee time sheets. 6% say they find errors on every employee's time sheet.

Wrap Up

Employee theft covers a vast array of approaches, from years-long fraud schemes to employees clocking in early. No matter how big or small, incidents of employee theft add up to billions of dollars in losses every year.

But those initial financial losses are just the beginning for most organizations. In the aftermath of employee theft, they must pay to hire and train new employees, spend money in civil court, and increase investments in security and loss prevention.

For most organizations, making an upfront investment in prevention may be the best way to avoid catastrophic losses from future theft events.

If you enjoyed reading these employee theft stats, take a look at Critical Fintech Trends and Growing Fintech Companies & Startups.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more