Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Important Macro Trends (2024-2027)

You may also like:

2022 was a rollercoaster of a year in terms of the overall business environment.

On January 3rd, 2022, the S&P 500 index hit an all-time high at $4,796.56.

As of February 2023, this index was down more than 20% from its all-time high, meaning that the market has entered bear territory.

Many believed that 2022 would be the year we finally entered a post-pandemic world, and businesses could focus on future growth and advancement.

However, 2022 brought a major international conflict that disrupted virtually every aspect of the business.

Therefore, in today’s business environment, it is of the utmost importance for companies to be aware of what is happening worldwide.

With this in mind, we present seven seismic-level macro trends that have the potential to massively shape the current business climate.

1. The Year Of Interest Rate Hikes

In December 2022 the Federal Reserve increased interest rates to the highest level in 15 years.

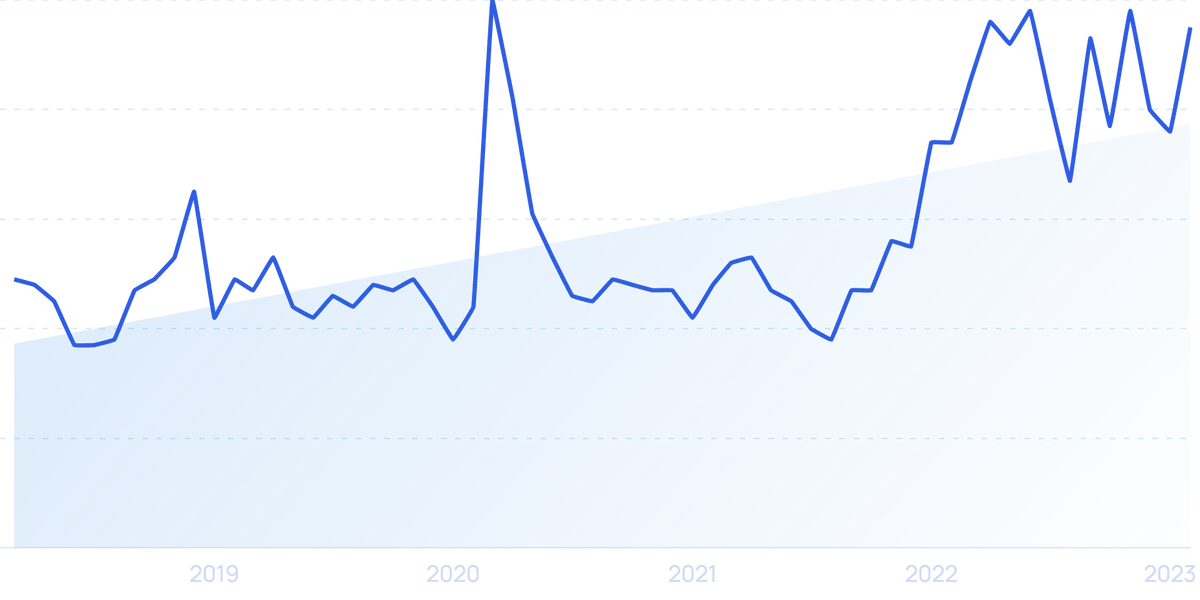

Searches for “the fed” have grown by 26% in the 5 years.

These recent hikes are some of the most aggressive Fed moves in years. In fact, these increases are even more aggressive than those during the recession of 2007-2009, when it took the Fed 2.5 years to raise rates at the same pace.

Searches for “interest rates” have grown by 66% in the last 2 years.

So what has prompted the Fed to take on such an aggressive policy?

One word – inflation!

Searches for “inflation” have grown by 97% in the last 5 years.

The US is dealing with its fastest pace of inflation in over 40 years.

This means that prices of consumer goods are increasing at the fastest rate in over four decades.

So, increasing interest rates is a way to combat inflation because higher interest rates make it more expensive for companies (and individuals) to borrow money.

This, in turn, leads to lower demand for goods. And lower demand pushes prices down.

While this seems pretty straightforward, the problem is that inflation is so high that the Fed might be forced to implement even more aggressive policies, therefore, pushing the economy into a recession.

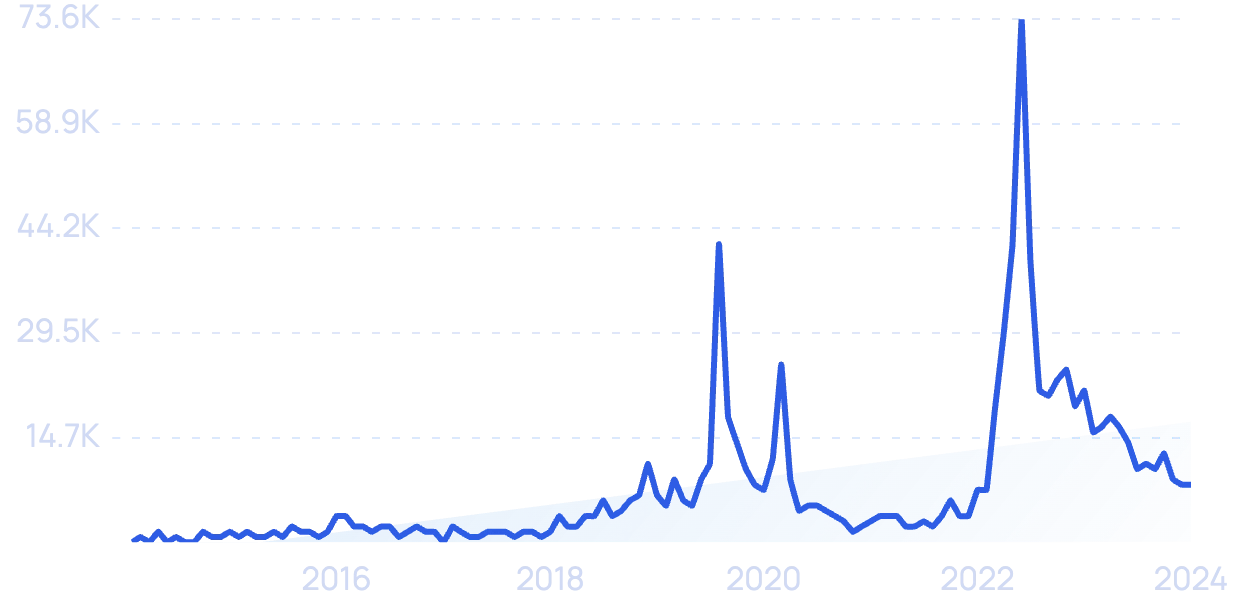

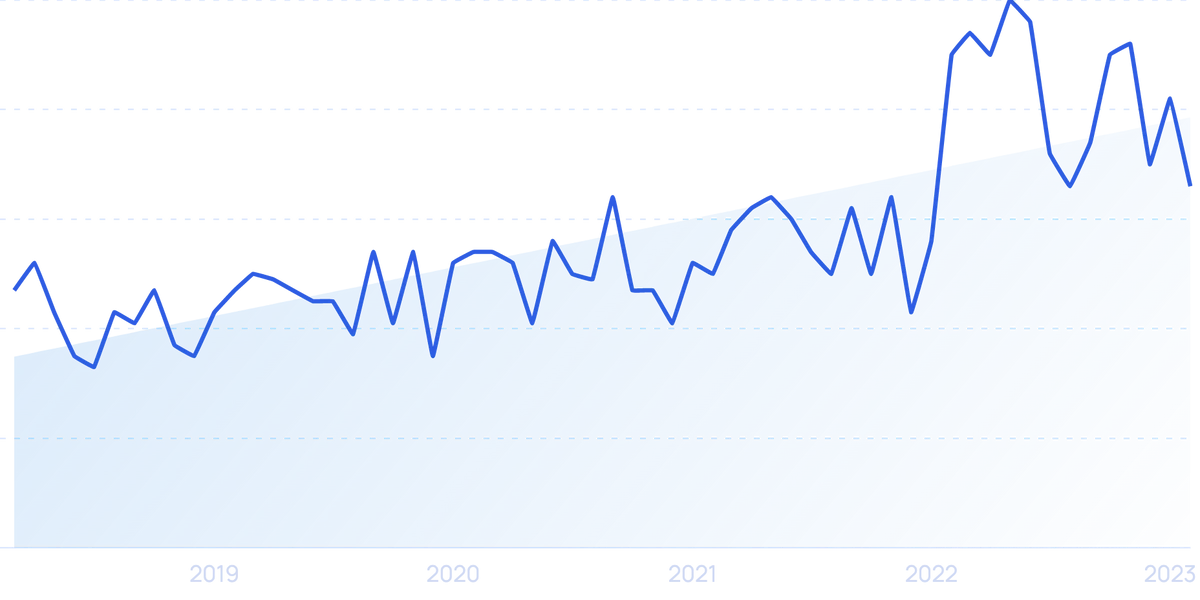

Searches for “is a recession coming” over the last 10 years.

Growth is expected to slow down further in the coming years, considering that the unemployment rate is now forecast to jump to 4.1% by 2024, up from 3.6% currently.

2. The Great Resignation Continues In Full Swing

The Great Resignation refers to an ongoing economic trend in which a massive number of employees have voluntarily quit their jobs.

This trend began in early 2021 but hit new peaks in 2022.

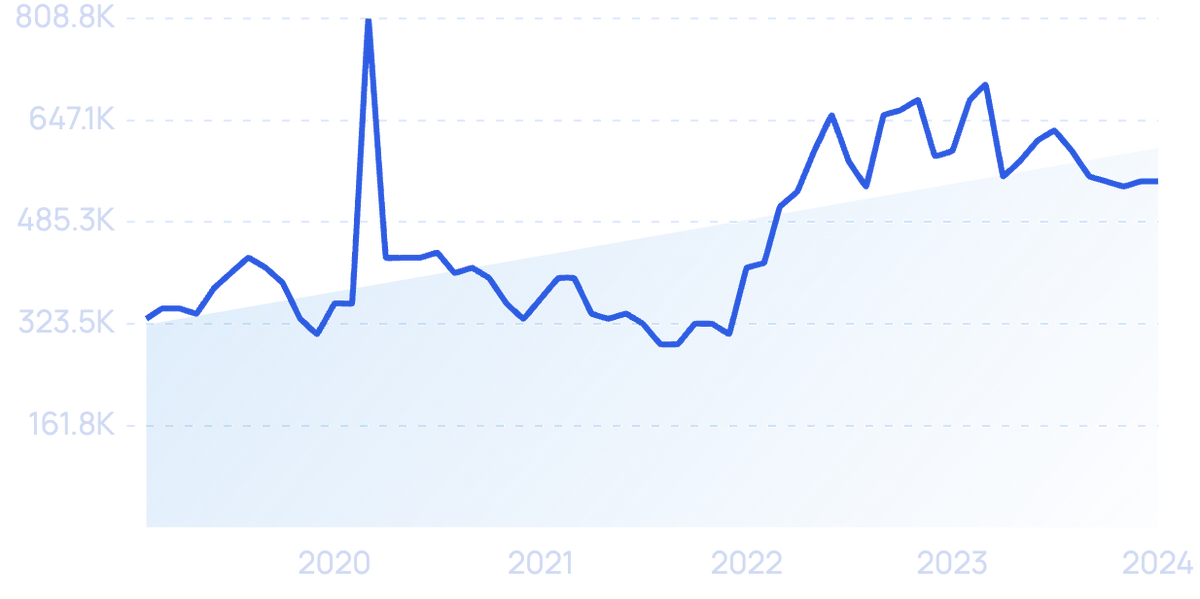

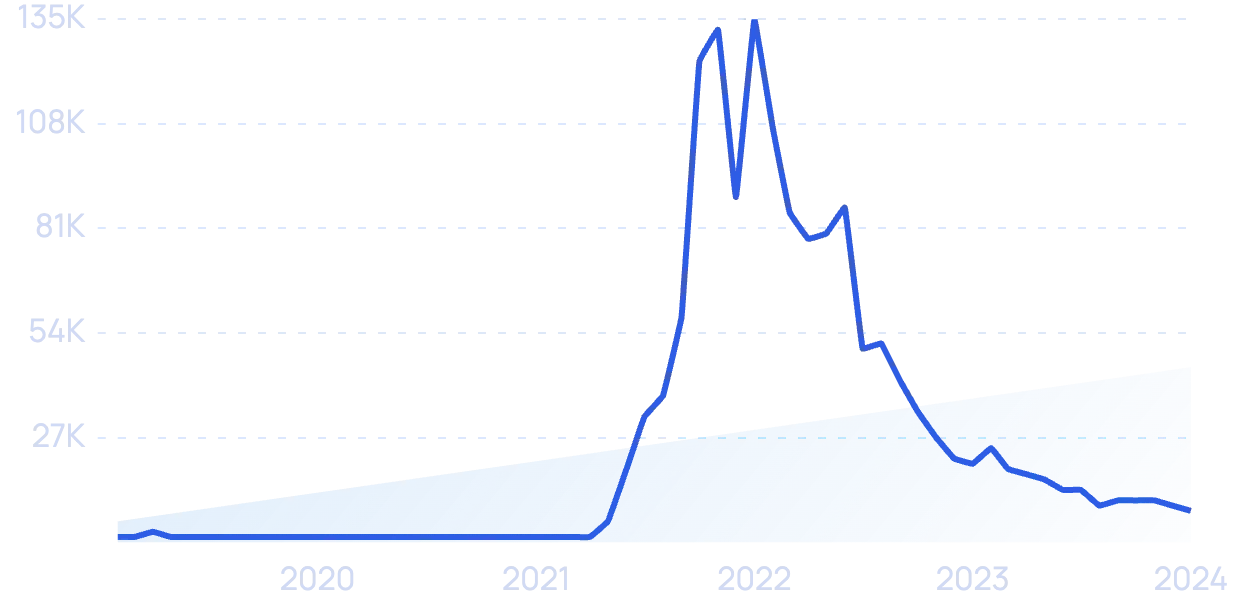

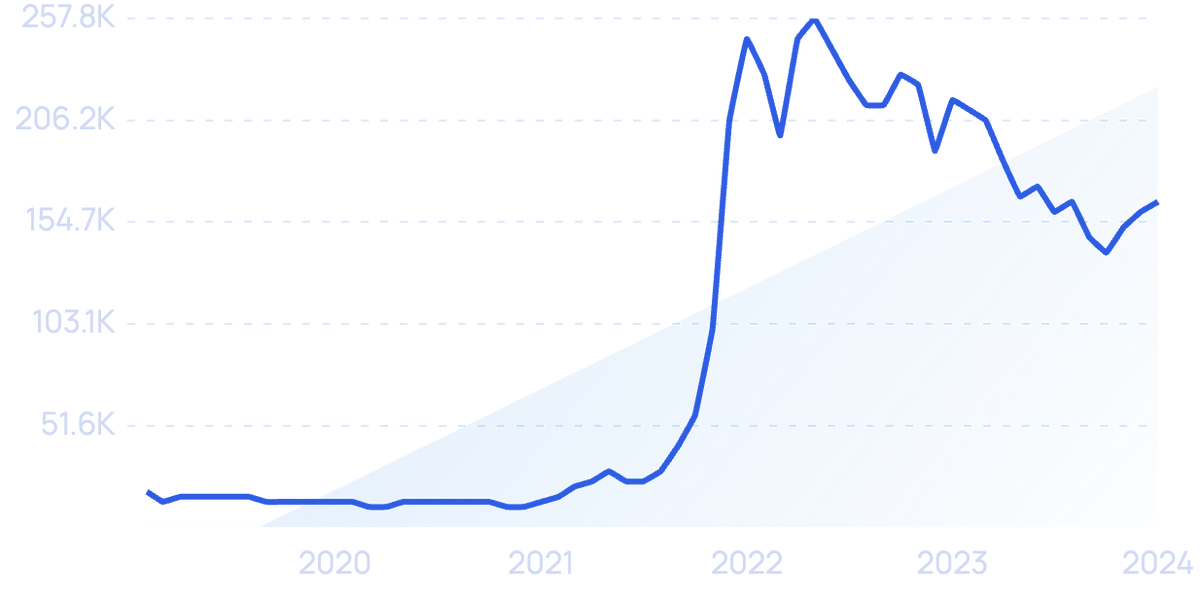

Searches for “great resignation”.

Approximately 4.4 million Americans quit or switched jobs in April of 2022.

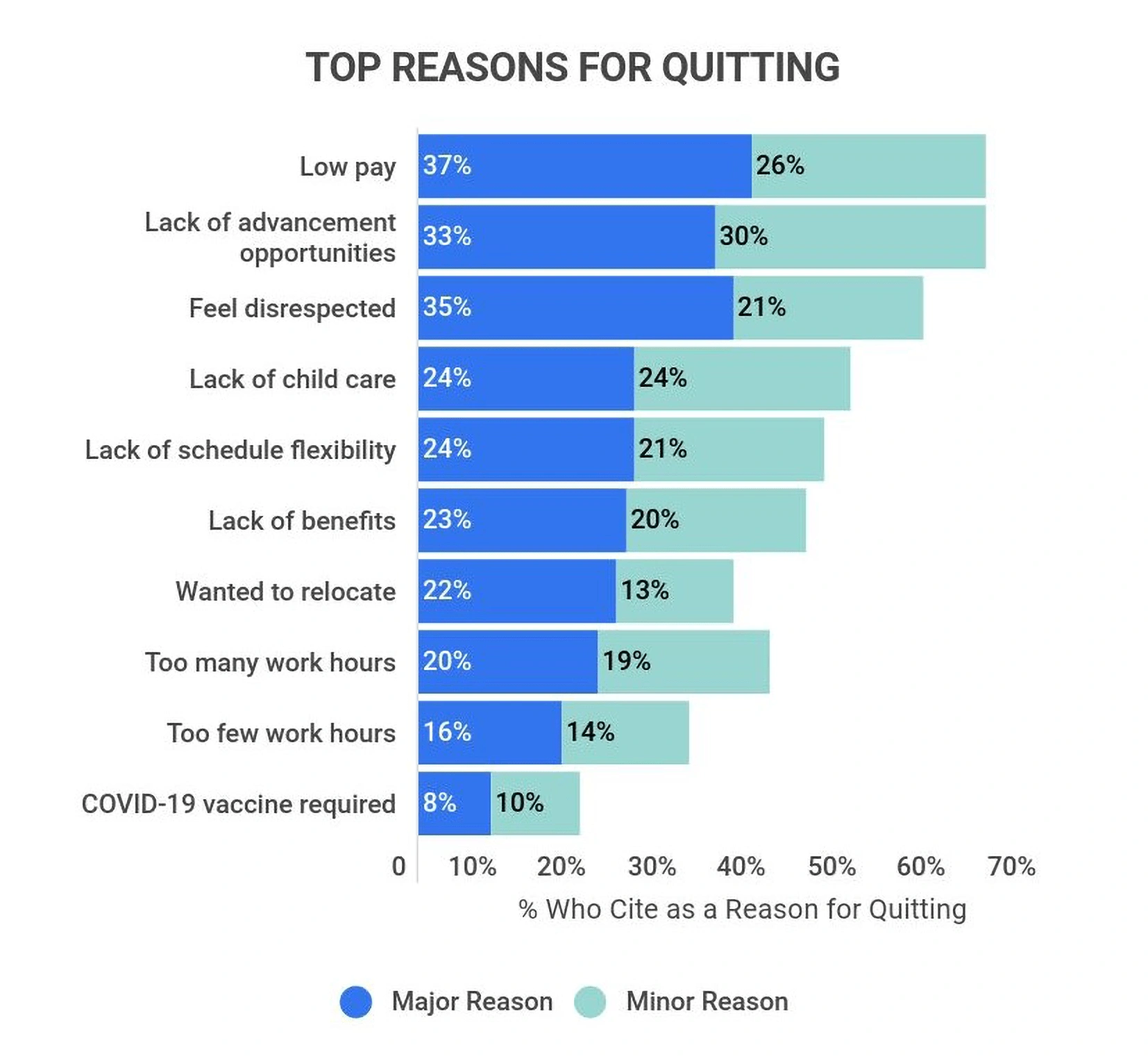

37% said low pay was the primary reason they quit their jobs (making it the most cited reason).

A feeling of disrespect and a lack of advancement opportunities round up the top three major reasons for quitting a job, at 35% and 33%, respectively.

Top 10 reasons employees are quitting their jobs.

There are now over 11 million job vacancies and only around 5.9 million unemployed people in the United States.

Meaning that companies are having a difficult time staffing their job openings.

Searches for “we are hiring” are up 88% over the last 5 years.

And this trend is not showing signs of slowing down.

A study by PwC found that approximately 1 in 5 employees planned to quit or change their job in 2023.

And 35% will be asking their employees for a raise to stay at their current job.

3. Hybrid Work Is Here To Stay

The massive shift to remote work has given rise to a new work environment called hybrid work.

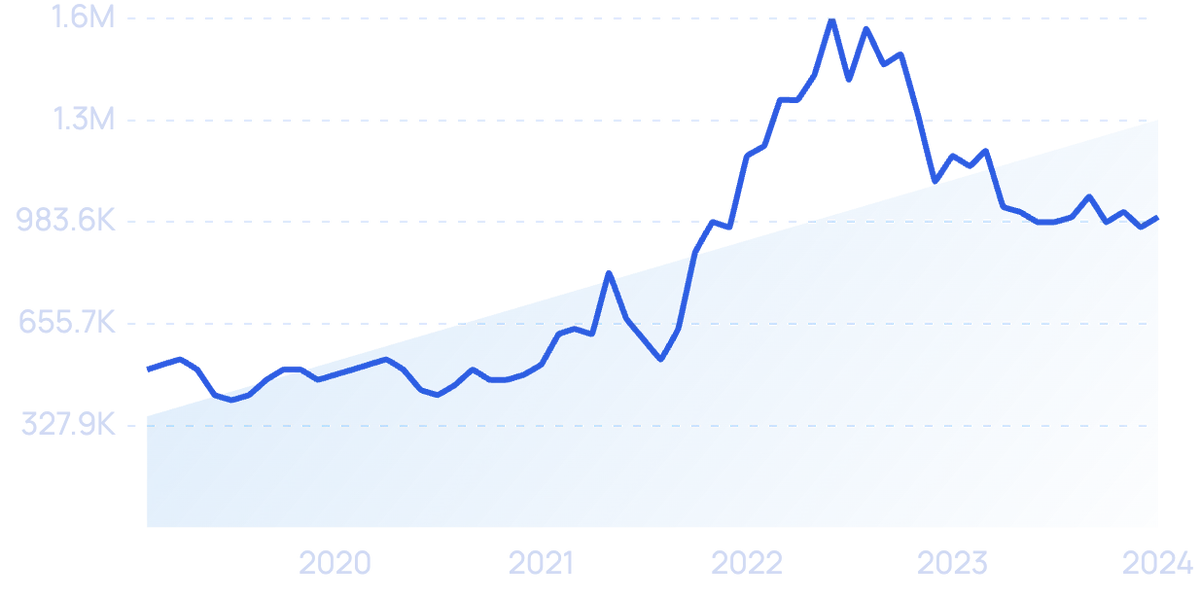

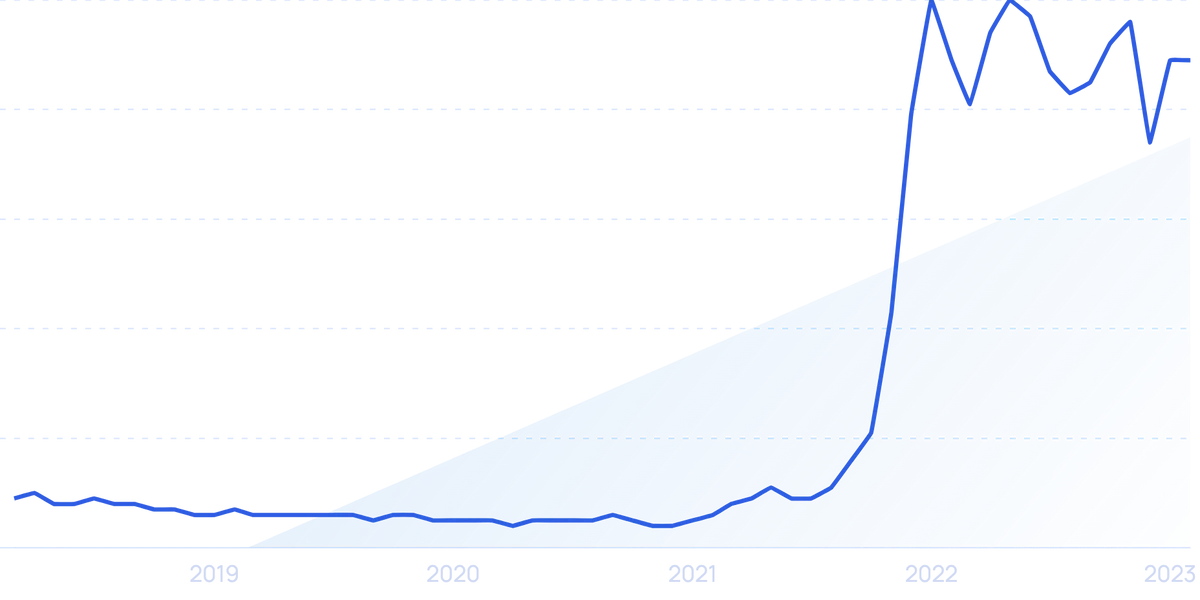

Searches for “hybrid work” have grown by 290% in the last 5 years.

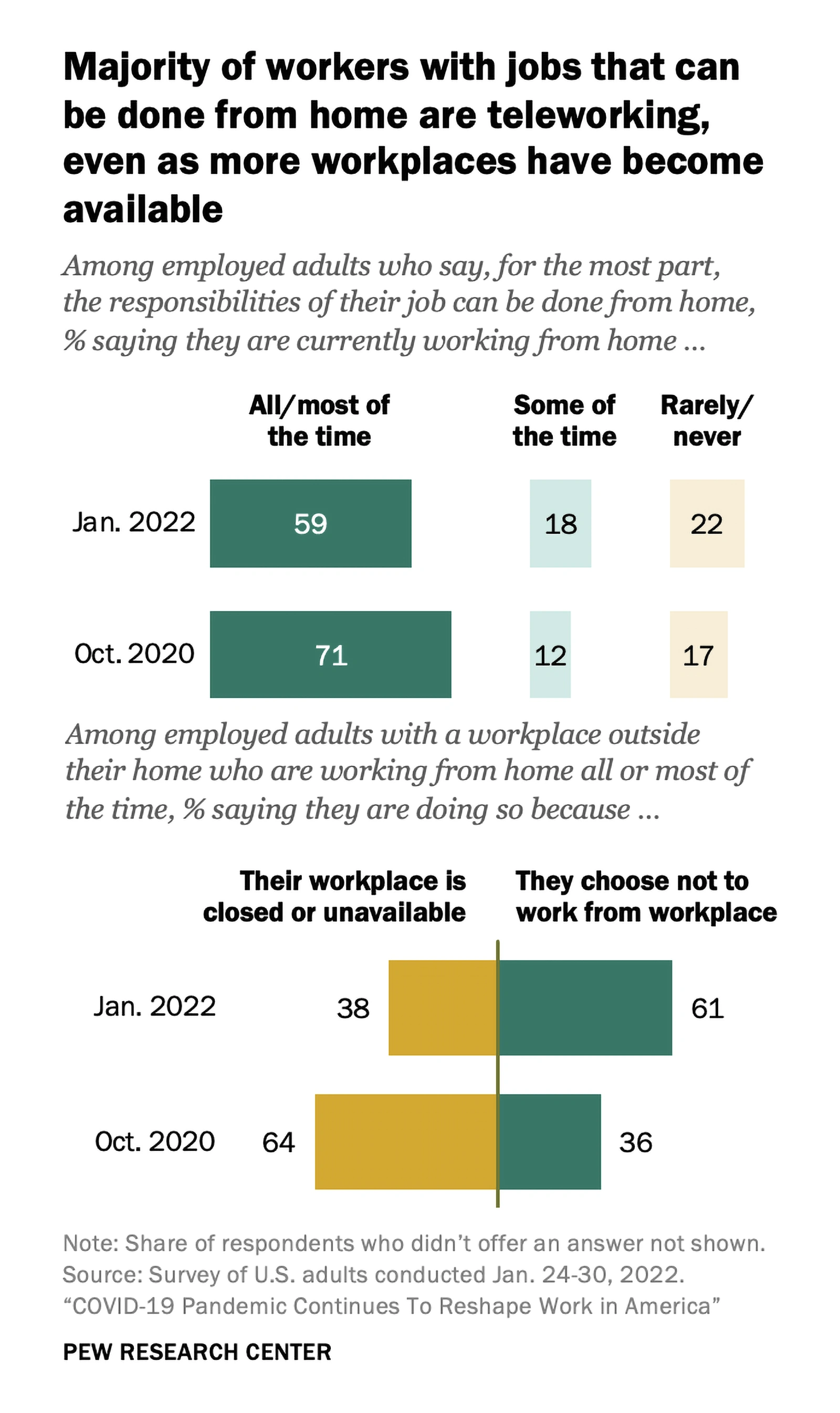

In January 2022, 59% of employees with jobs that can be done from home were working fully remote. Whereas 18% had a hybrid work routine.

Percentage of employees working from home or using a hybrid system (only includes workers with jobs that can be done from home).

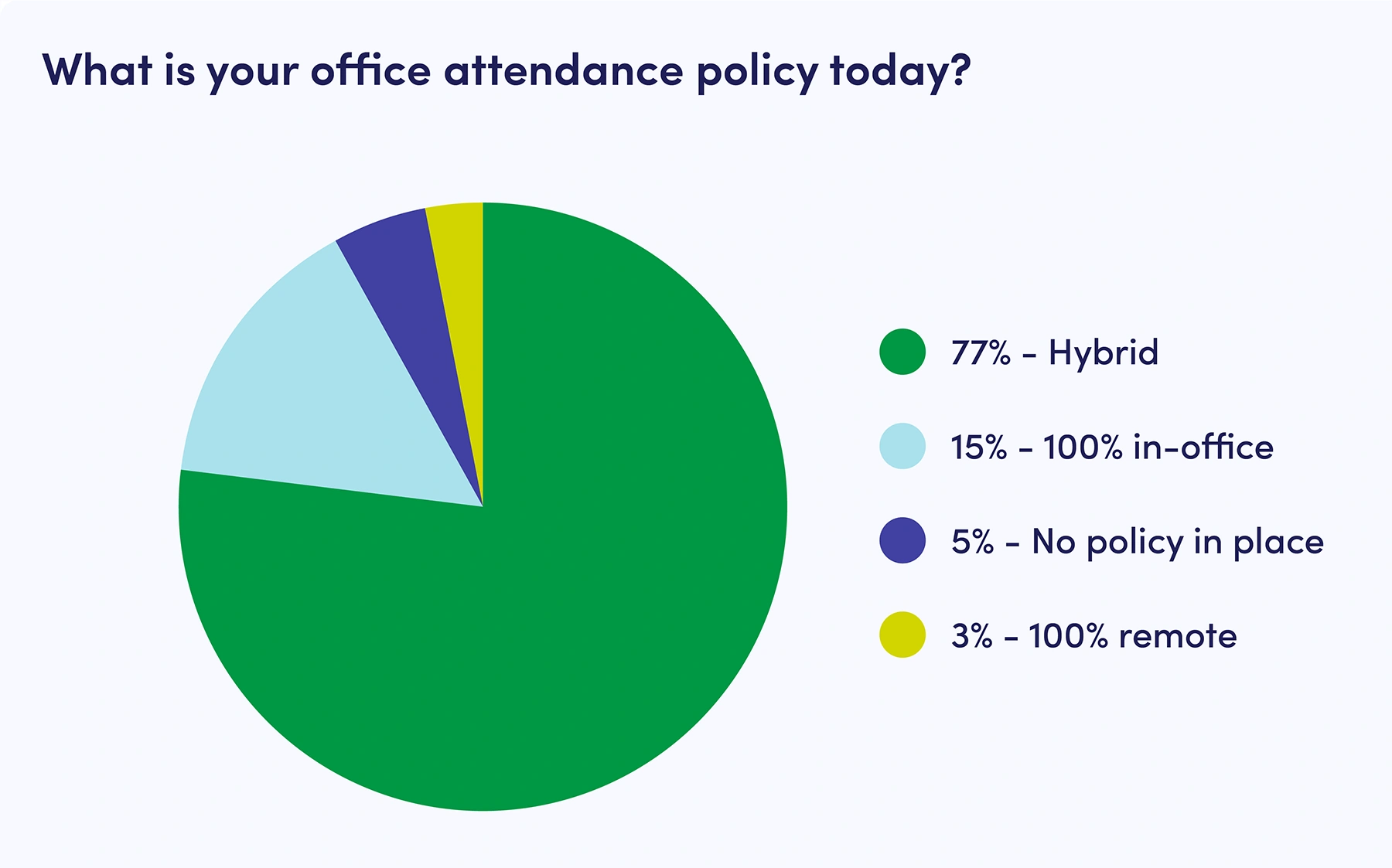

An Envoy survey conducted in April 2022 found that 77% of companies had adopted a hybrid working model.

Of those organizations, 56% had adopted a hybrid-at-will model in which employees choose what days they come into the office.

Percentage of companies adopting a specific office attendance policy.

And a study conducted by AT&T estimates that hybrid will become the working norm, with 56% of all work done offsite by 2024.

Employee satisfaction is the main driver behind this trend.

85% of workers want a hybrid work model, and some would quit if this model were to be abandoned by their company.

Twitter, Reddit, 3M, Coinbase, and Lyft are examples of some large companies that have introduced permanent hybrid work.

4. Web3 Goes From Strength to Strength

Often referred to as the future of the internet, Web3 refers to an idea of a blockchain-based web that incorporates decentralization, NFTs, DAOs, cryptocurrencies, and more.

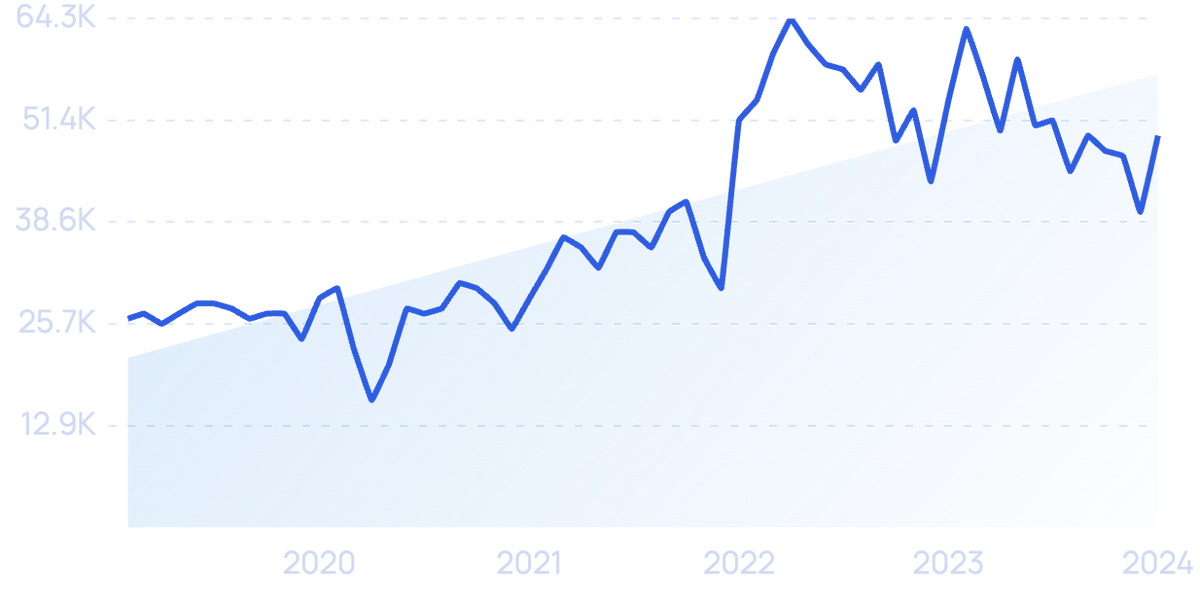

Searches for “web3” have grown by 814% in the last 5 years.

The global Web3 market is expected to grow at an impressive CAGR of 43.7% through 2030.

This translates to an approximately 25x increase from 2021 levels.

And venture capitalists are investing in Web3 startups to capitalize on this opportunity.

Searches for “web3 funding” have grown by 250% in the last 24 months.

According to the Pitchbook database, VC funding for Web3 companies reached $407.9 million in 2021 (a 9x increase over 2020).

More impressively, as of mid-2022, Web3 startups raised approximately $877.28 million in VC funding (a more than 2x increase over 2021’s total).

Increasing access to capital is incentivizing more developers to start working on Web3 solutions.

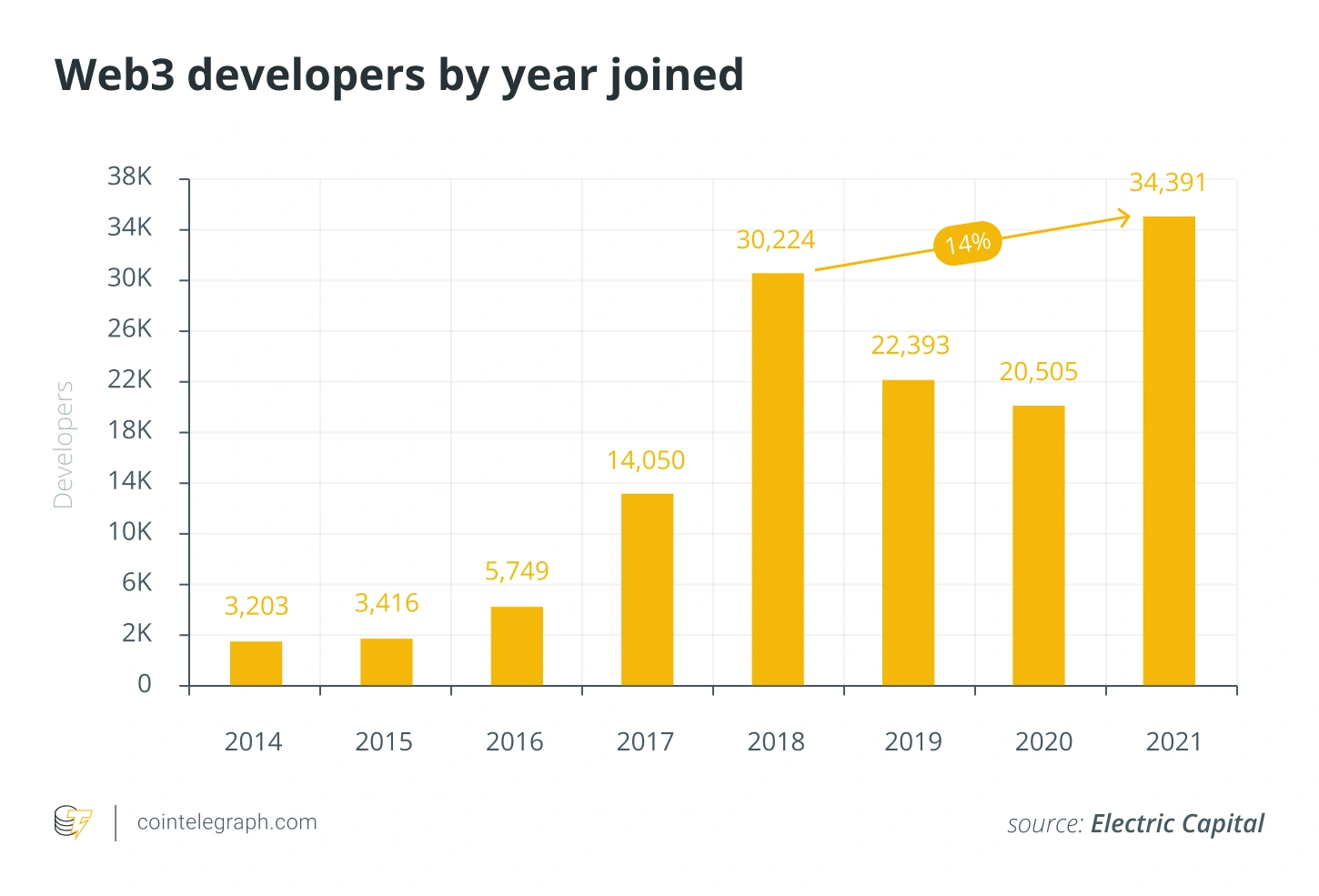

A record 34,000 new developers joined the Web3 space in 2021, marking a 67% YoY increase.

Number of developers joining Web3 by year.

December 2021 saw over 18,000 monthly active developers in this space, the highest number recorded so far.

It will be interesting to see how the 2022 crypto market crash (some cryptocurrencies have seen a 70% plunge in their price) affects further Web3 development.

5. Supply Chain Issues Lead To Massive Shortages

It seems that every other day we hear news about a new product shortage.

Tampons, sriracha, popcorn, lettuce, and baby formula are some products that experienced a shortage in 2022.

On top of this, we are still dealing with longer-term shortages of technological products like computer chips.

So it is not surprising that people are using the phrase “everything shortage” to describe this phenomenon.

These shortages are due to an increase in shipping delays and prices.

According to McKinsey, global container shipping prices have quadrupled from their 2019 levels.

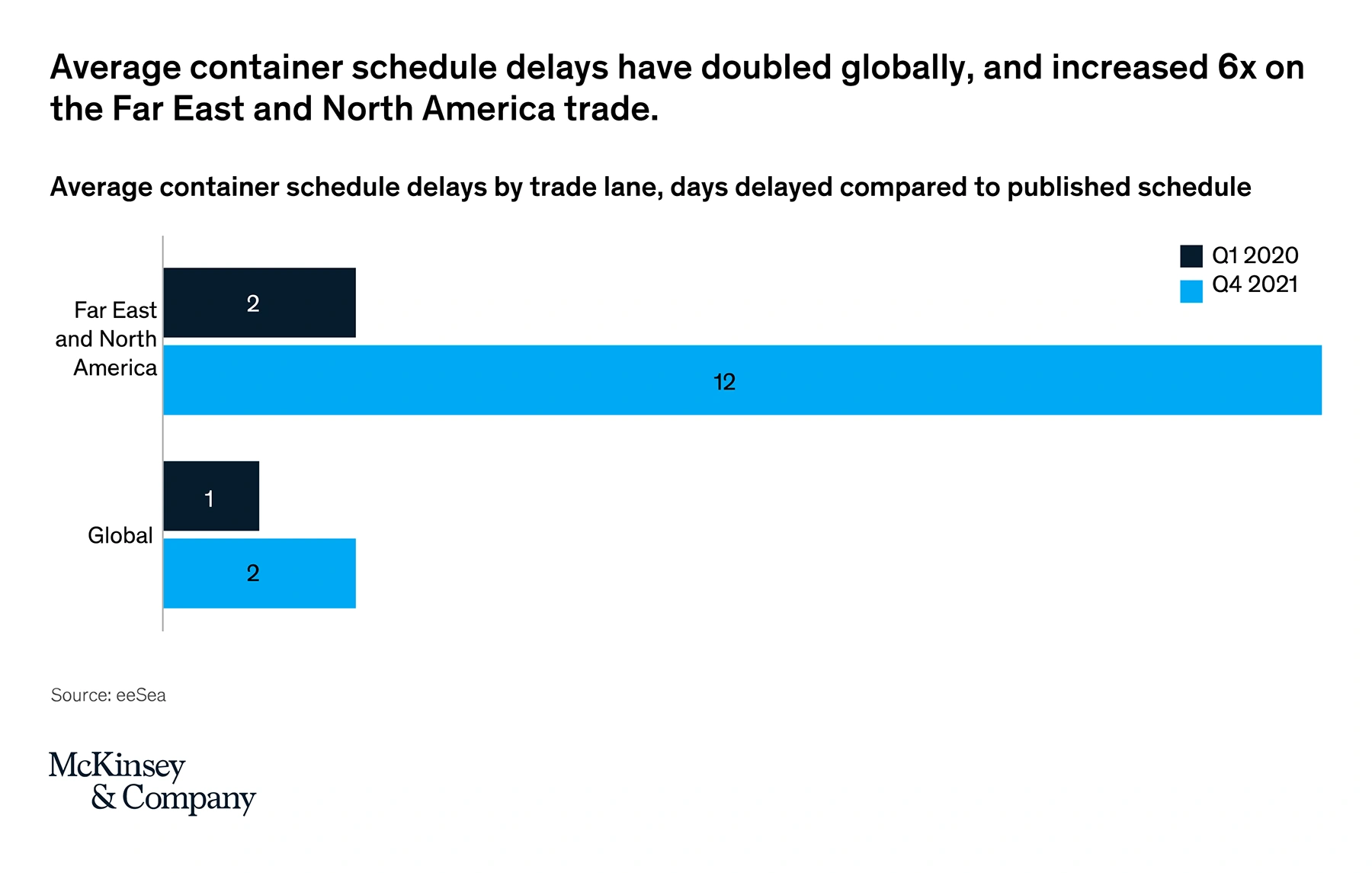

Furthermore, global shipping delay rates have doubled (with specific regions seeing a 6x spike in their delays).

Average container schedule delays in Q4 2021, compared to Q1 2020.

What led to this situation?

Well, simply put, an unprecedented combination of unfortunate events.

Initially, COVID-19 lockdowns significantly slowed production rates as many manufacturers had to shut down their plants.

With the easing of lockdowns came a level of accelerated consumer spending that nobody forecasted.

This elevated demand, combined with shipping backlogs and labor shortages, put a strain on several supply chain levels (manufacturing, transportation, distribution, retail, etc.).

Container ships waiting to be processed at the Los Angeles port.

Finally, the Ukraine-Russia conflict has made it challenging to obtain the raw material from that region, seriously impacting manufacturing for several goods.

6. Sustainability Becomes A Top Priority

Society as a whole is becoming more concerned about sustainability.

And corporations are following suit by implementing initiatives supporting the four pillars of sustainability: human, environmental, economic, and social.

Searches for “corporate sustainability” have spiked 41% in the last 5 years.

More than $1 trillion has been invested in environmental, social, and governance (ESG) investment funds in the last two years, illustrating the increasing emphasis on sustainability.

Almost all of the world’s largest companies now issue a sustainability report.

In addition to reporting sustainability, companies are now actively implementing sustainability practices and strategies.

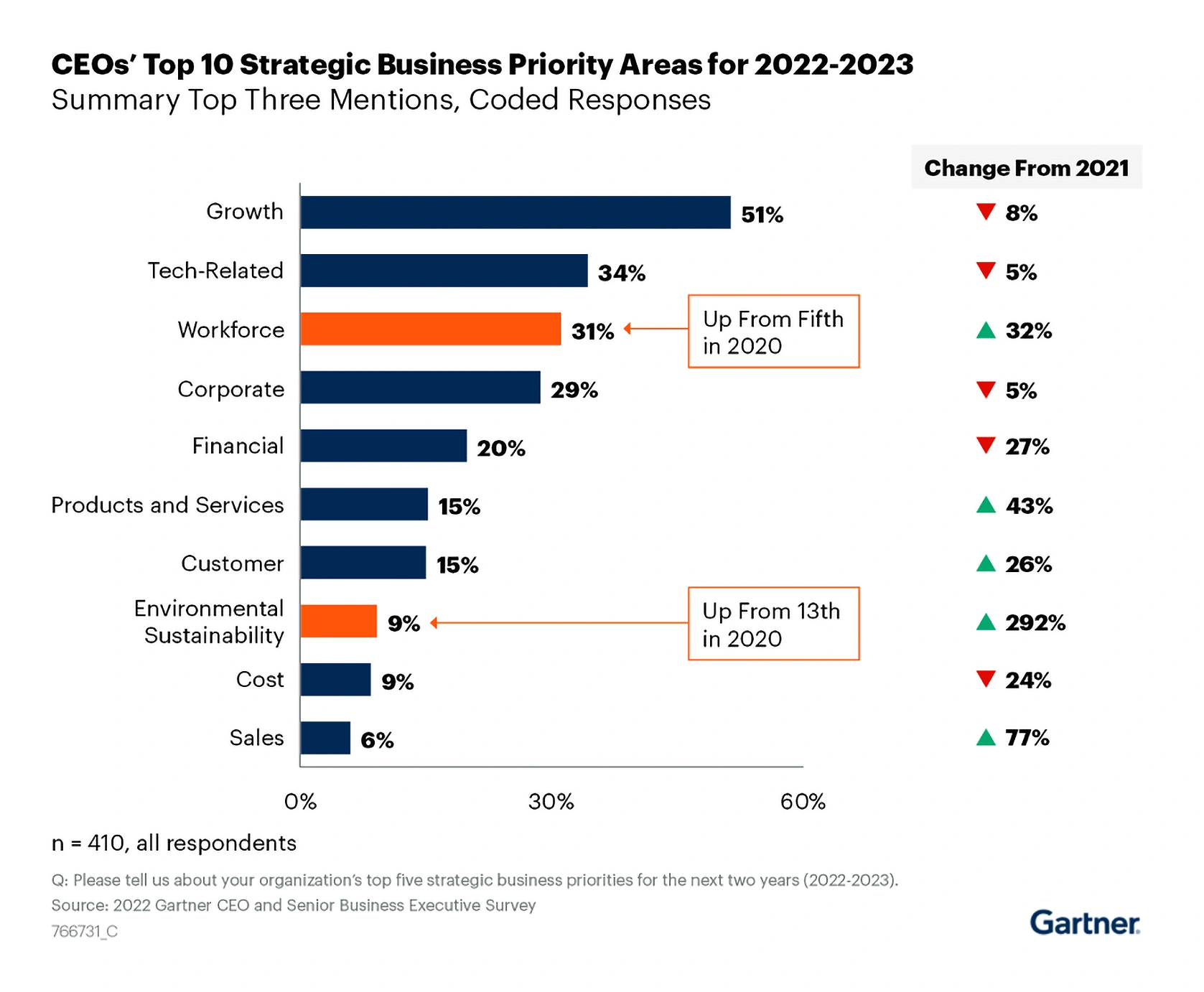

A Gartner survey revealed that, for the first time ever, CEOs placed environmental sustainability in their top 10 business priorities for 2022 and 2023 (it ranked number 8).

This marked an impressive jump from 2020 when this initiative ranked number 13 on this list.

Top 10 business priorities for 2022-2023, as reported by CEOs.

This trend is massively driven by changing consumer habits.

Two-thirds of consumers are willing to pay more for sustainability.

And this number is estimated to grow considering that Gen Z, whose number one priority is the environment, will continue to gain a larger share of total consumer spending.

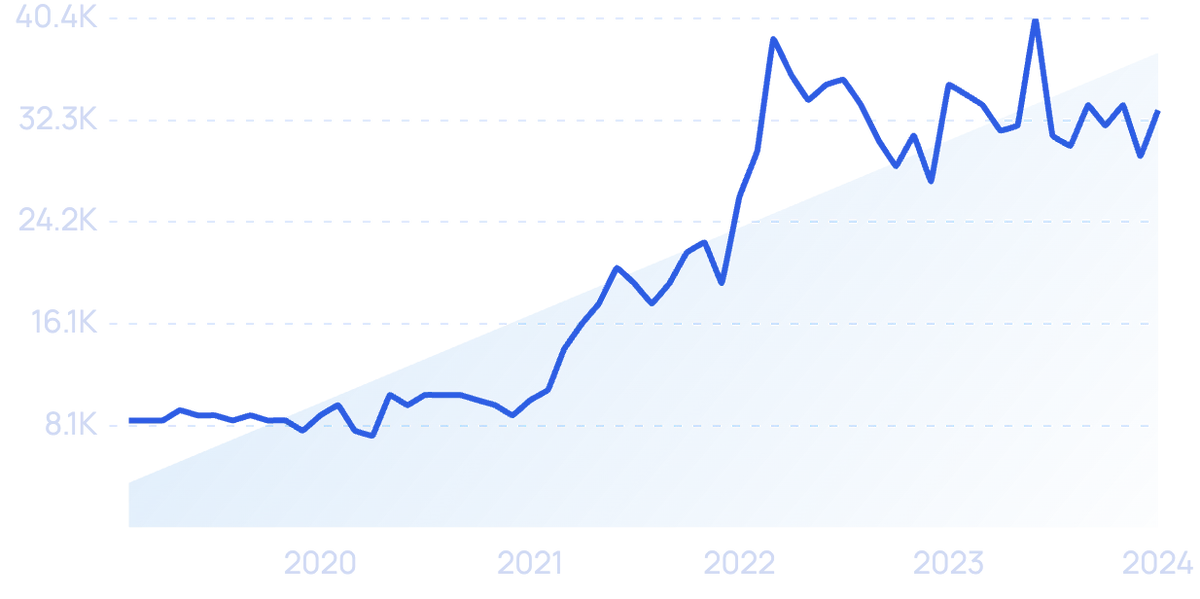

7. Buy Now Pay Later Is A Hit Among Consumers

The idea of buying now and paying it back in installments is nothing new.

But new fintech companies have put a new spin on this concept by developing digital solutions that allow any retailer to offer BNPL plans.

And interest in this solution is growing because it is seeing increasing adoption among major retailers.

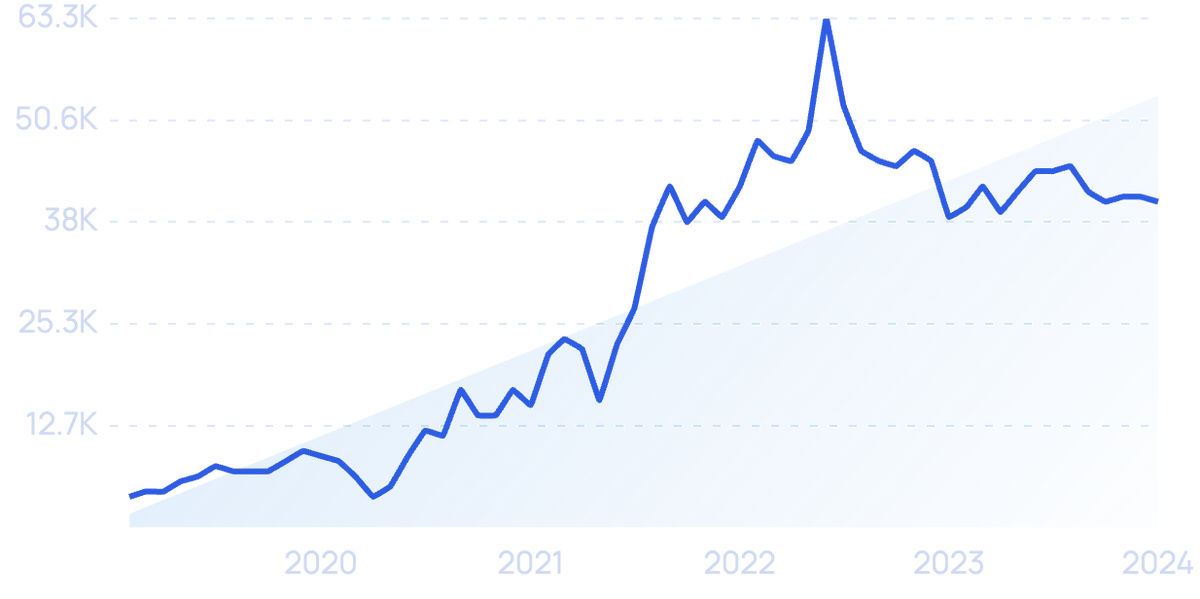

Searches for “BNPL” have increased by 83% in the last 5 years.

In 2021, Amazon announced a BNPL partnership with Affirm, Square announced plans to purchase BNPL pioneer Afterpay and Target expanded their BNPL program through partnerships with Affirm and Sezzle.

These partnerships are not surprising, considering that BNPL usage grew 2x in 2021.

Top five BNPL providers.

BNPL transaction volumes hit $120 billion in 2021, making it one of the fastest-growing segments within the consumer finance industry.

This technology is likely going to continue significantly impacting consumer spending habits, considering that the market for BNPL solutions is forecasted to increase 26x in the next eight years,

Although this growth is impressive, some researchers suggest that BNPL is a bubble waiting to burst, especially considering rising interest rates and an increase in bad debt.

Conclusion

This concludes our list of seven critical macro trends.

Further technological advancements, increased focus on sustainable practices, and the rise of hybrid work are some trends that have the potential to change how businesses operate.

More interestingly, and perhaps more importantly, the global business world is dealing with an unprecedented situation of higher consumer reliance on debt, supply chain woes, massive labor shortages, record inflation rates and historical interest rate hikes.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more