Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

15 Digital Payment Companies & Startups (2024)

You may also like:

- 10 Critical Fintech Trends

- 20 Trending Personal Finance Companies & Startups

- 9 Top Investment Trends

The total revenue in the global e-commerce market is expected to reach $4.17 trillion in 2024.

With that growth comes a serious need for new payment options, payment technology, and back-end processing infrastructure.

By 2025, BNPL (Buy Now, Pay Later) companies alone will process an estimated $680B in transaction volume, which is one of the hottest trends in the fintech space today.

We’ve assembled some of the most innovative, exciting fintech payment startups that are transforming the way people pay for the things they buy online.

1. Flutterwave

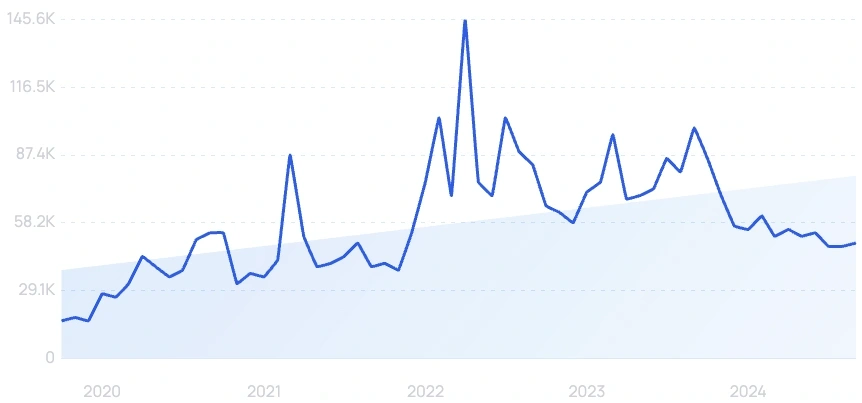

5-year search growth: 209%

Search growth status: Peaked

Year founded: 2016

Location: San Francisco, California

Funding: $509.5M (Series D)

What they do: Built for the international community and started by Nigerian entrepreneur Olugbenga Agboola, Flutterwave provides a comprehensive payment suite that allows companies to accept a wide variety of payments from around the globe (including historically underserved continents like Africa.) Working with name brands like Uber and Booking.com,$200+ million raised to date has helped put Flutterwave on the map.

2. FamPay

Search growth status: Regular

Year founded: 2019

Location: Bengaluru, India

Funding: $42.9M (Series A)

What they do: FamPay is a personal finance startup that offers a mobile payments and banking platform for teenagers and their families. Its platform provides a range of services, including payments, money transfers, and savings accounts, that aim to help teenagers learn about financial management and develop responsible spending habits. FamPay's solution also includes features for parents, such as spending controls and transaction monitoring, to ensure a safe and secure financial experience for their children.

3. Toss

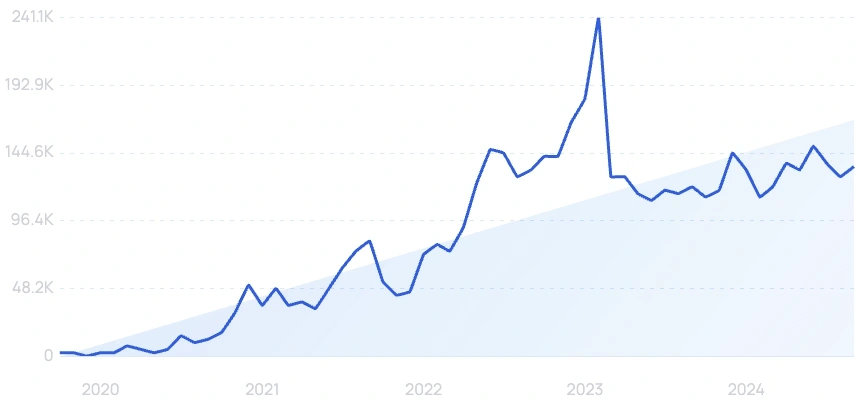

5-year search growth: 336%

Search growth status: Exploding

Year founded: 2011

Location: Seoul, Korea

Funding: $1.4B (Series G)

What they do: Toss has exploded in popularity since their founding 10 years ago, counting 21M subscribers and 1T won invested on their platform as major milestones thus far. Toss provides users based in Asia a potent alternative to Western-based personal financial apps like Robinhood, Betterment, or Stash. The team has attracted investment from PayPal, Kleiner Perkins, and Bessemer Venture Partners.

4. Thunes

5-year search growth: 120%

Search growth status: Regular

Year founded: 2015

Location: Singapore, Singapore

Funding: $202M (Series C)

What they do: Thunes is a cross-border payment platform that allows businesses to send money internationally using 250+ payment methods in 80 currencies. The startup works with some of the biggest companies across different industries, including Uber, PayPal, and Remitly. Since launching, Thunes has processed over $50 billion in total transactions.

5. Above Lending

5-year search growth: 463%

Search growth status: Exploding

Year founded: 2011

Location: Houston, Texas

Funding: $200M (Debt Financing)

What they do: With a TrustPilot rating of 4.5/5 in the traditionally low trust space of personal loans, Above Lending has streamlined the process of getting a personal loan with their simple application process. Customers can choose relevant loan offers, apply, get approved, and receive funds instantly.

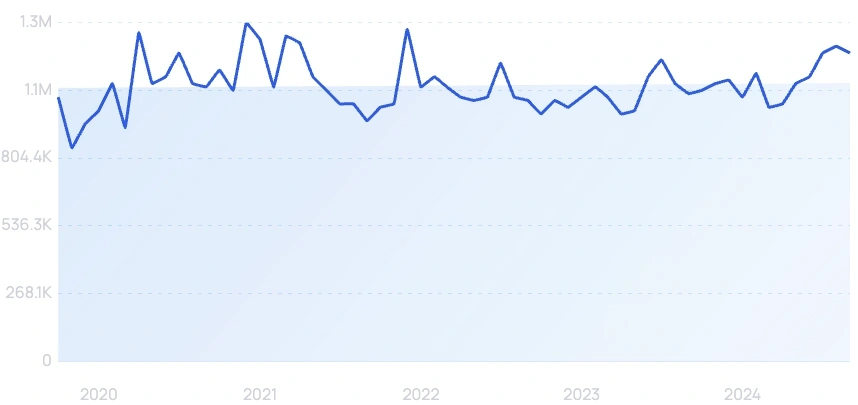

6. Revolut

5-year search growth: 162%

Search growth status: Exploding

Year founded: 2014

Location: London, England

Funding: $1.7B (Undisclosed)

What they do: Revolut is a mobile banking app and digital payment platform. It operates as a regulated and registered EU bank with a secure digital wallet payment method, Revolut Pay. Users can send and receive money from other Revolut customers or from non-Revolut banks. In 2023, Revolut surpassed 30 million customers and the startup processes 400 million transactions each month.

7. MANTL

5-year search growth: 31%

Search growth status: Regular

Year founded: 2016

Location: New York, NY

Funding: $62.3M (Series B)

What they do: MANTL claims to be the “secret behind the fastest growing credit unions and banks”. MANTL’s secret sauce is giving financial institutions a digital toolkit that helps customers open new accounts in minutes. Customers include upstarts like Cambridge Savings Bank, Cross River, and Midwest Bank Centre. According to MANTL, results achieved include $5,000 in average funding for checking accounts, 4x increase in submitted applications, less than 3 minutes to open a new account, and more.

8. Rapyd

5-year search growth: 20%

Search growth status: Regular

Year founded: 2016

Location: London, U.K.

Funding: $770M (Secondary Market)

What they do: London-based Rapyd has developed seamless ways to insert Fintech services inside any app, while also delivering cross-border payment solutions that settle transactions across differing currencies. Solving unique payment problems for customers across B2B like Grupo Modelo, Banks and Fintech startups like Paysafe, Marketplaces and Platforms like Uber, and E-commerce like Ikea, Rapyd’s comprehensive payment and collection suite has grown rapidly since 2016.

9. TrueAccord

5-year search growth: 213%

Search growth status: Regular

Year founded: 2013

Location: Lenexa, Kansas

Funding: $47.1M (Series Unknown)

What they do: Collecting debt is still one of the most time-consuming tasks for payment companies (especially those that operate with legacy technology.) TrueAccord’s platform encourages debtors to pay with their simple, seamless payment program. TrueAccord has been endorsed by top payment and debt associations, like RMAi and the Consumers Banking Association, as an industry leader in payment technology.

10. Chime

5-year search growth: 17%

Search growth status: Exploding

Year founded: 2011

Location: San Francisco, California,

Funding: $2.3B (Secondary Market)

What they do: Chime is a fintech startup that provides banking and online payment services. Unlike traditional banks, Chime offers a fee-free banking experience with no monthly maintenance fees, minimum balance fees, or foreign transaction fees. Through the platform's mobile wallet, customers can send digital payments using the "Pay Anyone" feature with no instant cash-out fees. Currently, the company has over 14.5 million users.

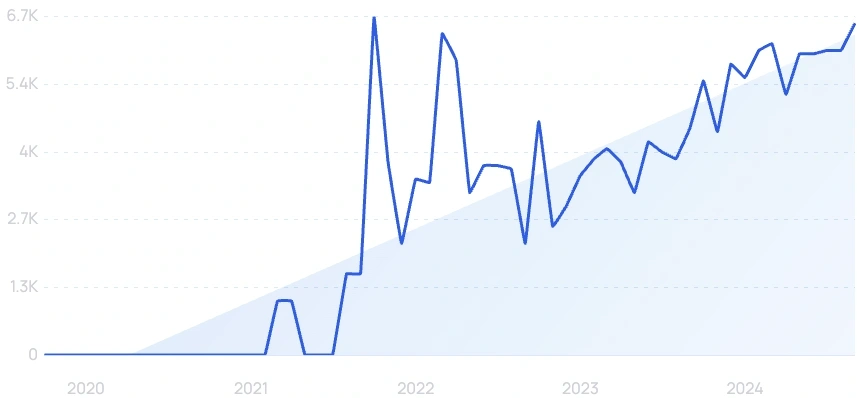

11. NowPayments

5-year search growth: 9,700%

Search growth status: Exploding

Year founded: 2019

Location: Amsterdam, Netherlands

Funding: Undisclosed

What they do: As more businesses look to accept cryptocurrency as payment, startups like NowPayments have thrived. Simple integrations with Shopify, WooCommerce, Magento and more mean that vendors can quickly get crypto payments up and running for their business.

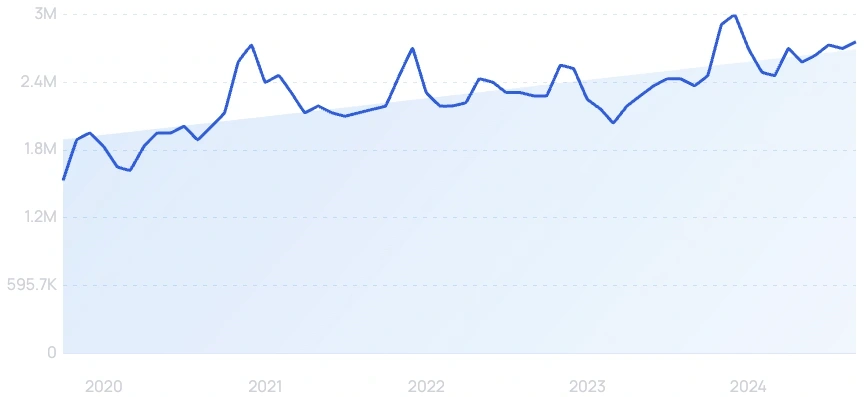

12. Klarna

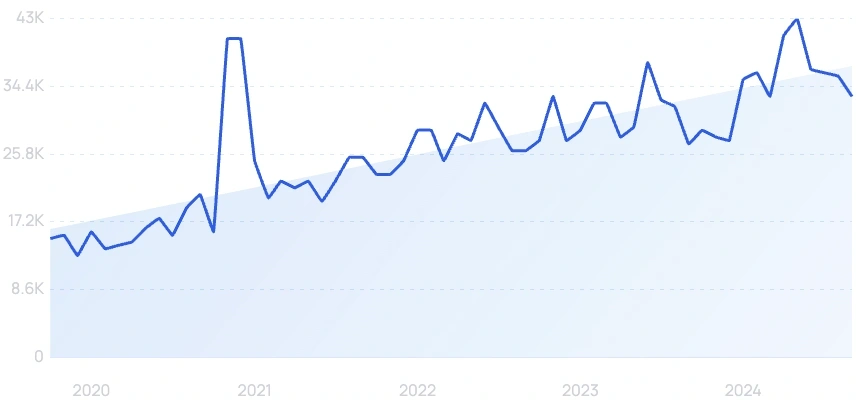

5-year search growth: 80%

Search growth status: Exploding

Year founded: 2005

Location: Stockholm, Sweden

Funding: $4.5B (Series Unknown)

What they do: Klarna has taken off as one of the premier BNPL (Buy Now Pay Later) solutions, offering e-commerce customers a flexible way to pay over time. With a mammoth valuation of over $45B, Klarna has continued to forge ahead as one of the leaders in the e-commerce payments space. Counting premier retailers like H&M, Macy’s, Sephora, Adidas, and numerous others among their client base, Klarna now has over 90M shoppers worldwide, 250K retail partners, and processes 2M daily transactions.

13. Brex

5-year search growth: 6%

Search growth status: Regular

Year founded: 2017

Location: Salt Lake City, Utah

Funding: $1.5B (Series D)

What they do: Brex might be most famous for their iconic billboard advertising campaign that smothered San Francisco. In 12 months, Brex doubled their valuation and from March 2020 to March 2021, grew its revenue and TPV (total payment volume) by 100% according to CEO Henrique Dubugras.

14. Gemini

5-year search growth: 96%

Search growth status: Exploding

Year founded: 2014

Location: New York, New York

Funding: $423.9M (Series Unknown)

What they do: Gemini is a comprehensive exchange, payment platform, and crypto broker. Gemini has emerged into one of the world’s largest fintech payment startups after a massive funding round that valued them at $7.1B. Now offering products like a Gemini Credit Card with cashback and rewards (including earning crypto), Gemini has expanded from solely being an exchange to being a complete crypto-focused financial platform.

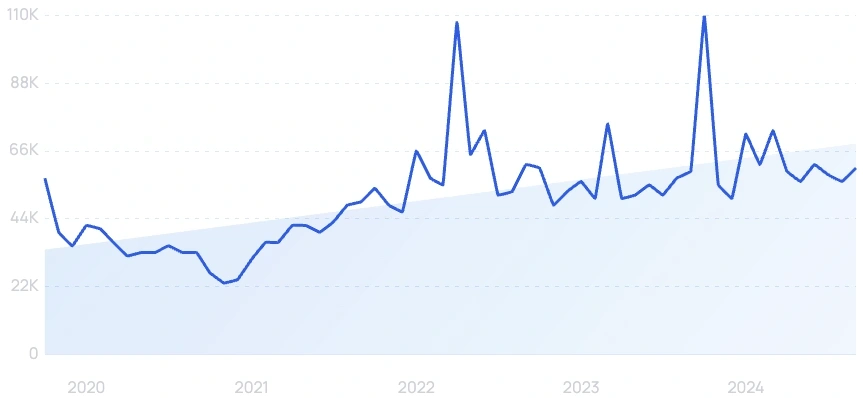

15. Razorpay

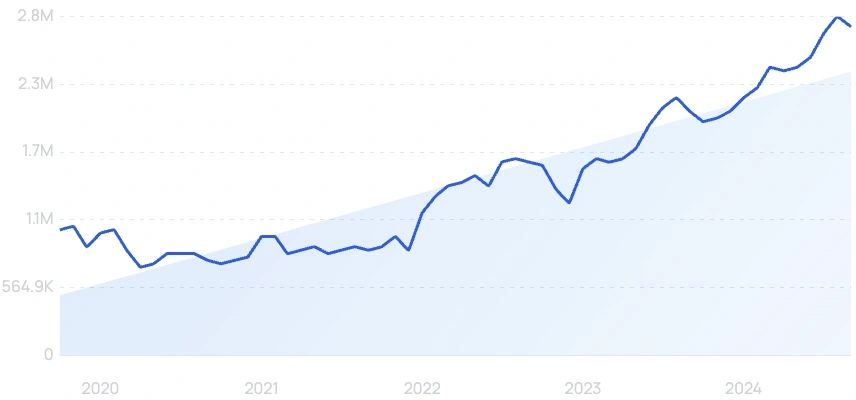

5-year search growth: 300%

Search growth status: Exploding

Year founded: 2014

Location: Bangalore, India

Funding: $816.3M (Secondary Market)

What they do: Razorpay is an India-based digital payments platform for businesses to process online transactions. Unlike other payment startups in India, Razorpay offers full-stack financial solutions, including business banking, lending, and payroll. In 2023, the company reached 450,000 customers and $226.6 million in revenue.

Conclusion

With the growth of e-commerce, fintech and crypto, (and especially the three technologies combined) the payment space is changing fast.

Keep checking in on the payment startups on our list as they continue to innovate, scale, and deliver new solutions.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more