Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Find High-Potential Investment Opportunities Before Everyone Else

Find disruptive startups and emerging markets before they take off. Get reliable trend data to source better deals, validate opportunities faster, and be the first to spot the next big investment.

Source Better Deals Earlier

Common Issue

By the time most investors hear about a promising startup, competitors have already made contact and valuations have inflated.

With Exploding Topics

Identify emerging companies and market opportunities before they hit the mainstream investor radar. Source better deals earlier when competition is minimal and valuations are more favorable.

Vet Opportunities with Confidence

Common Issue

Validating market size and growth potential often relies on outdated reports or unreliable projections, making it difficult to confidently commit capital.

With Exploding Topics

Back every potential investment with concrete growth metrics, search volumes, and cross-platform trend data. Validate market opportunities with reliable growth signals before you commit capital.

What's Included In Exploding Topics Pro

Everything you need to source and validate opportunities quickly and with certainty.

Spot Underserved Niches and Adjacent Opportunities

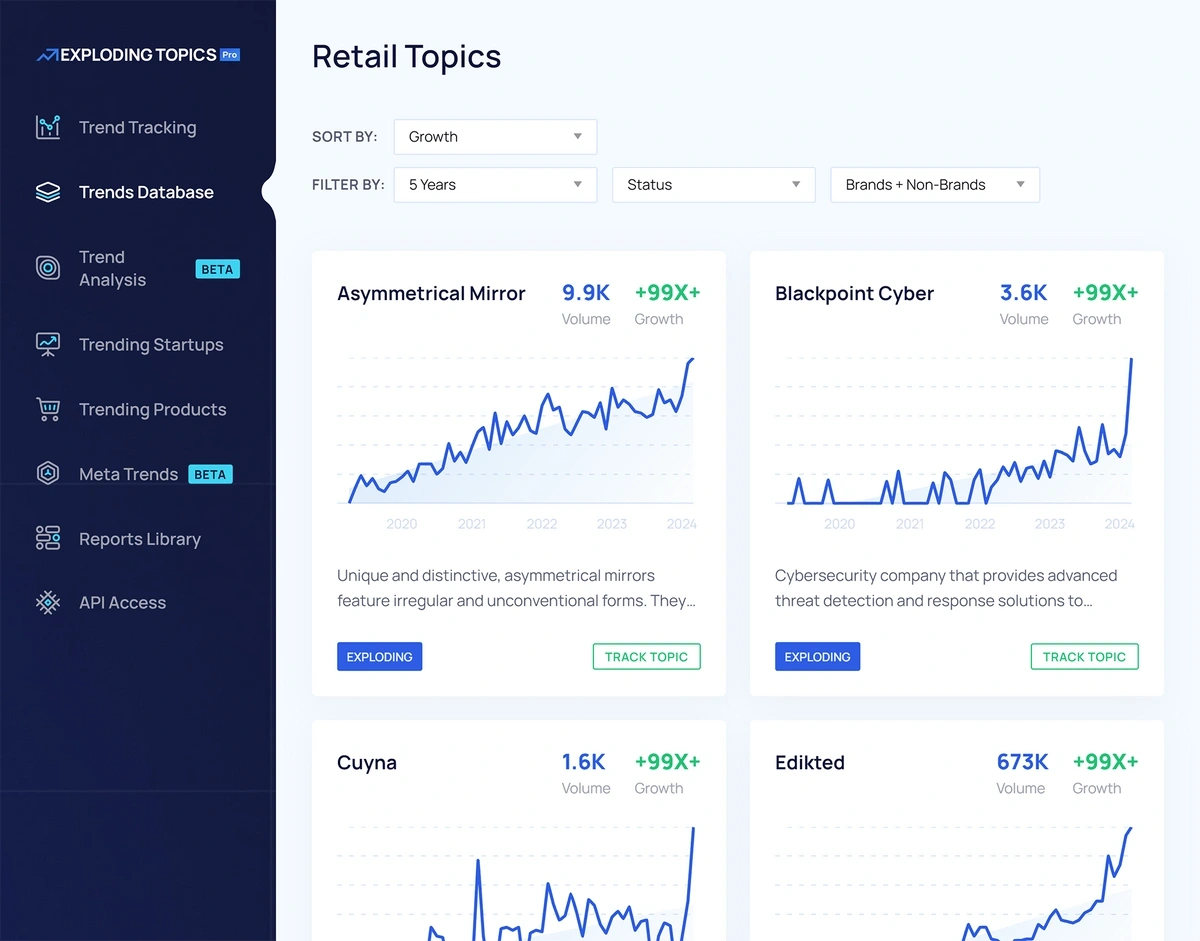

Search thousands of emerging trends to find rapidly growing niches and underserved problem areas. Identify where consumer demand is outpacing supply, find adjacent markets to your existing portfolio, and spot competitive threats or opportunities before they become obvious.

Source High-Growth Startups Quickly and Easily

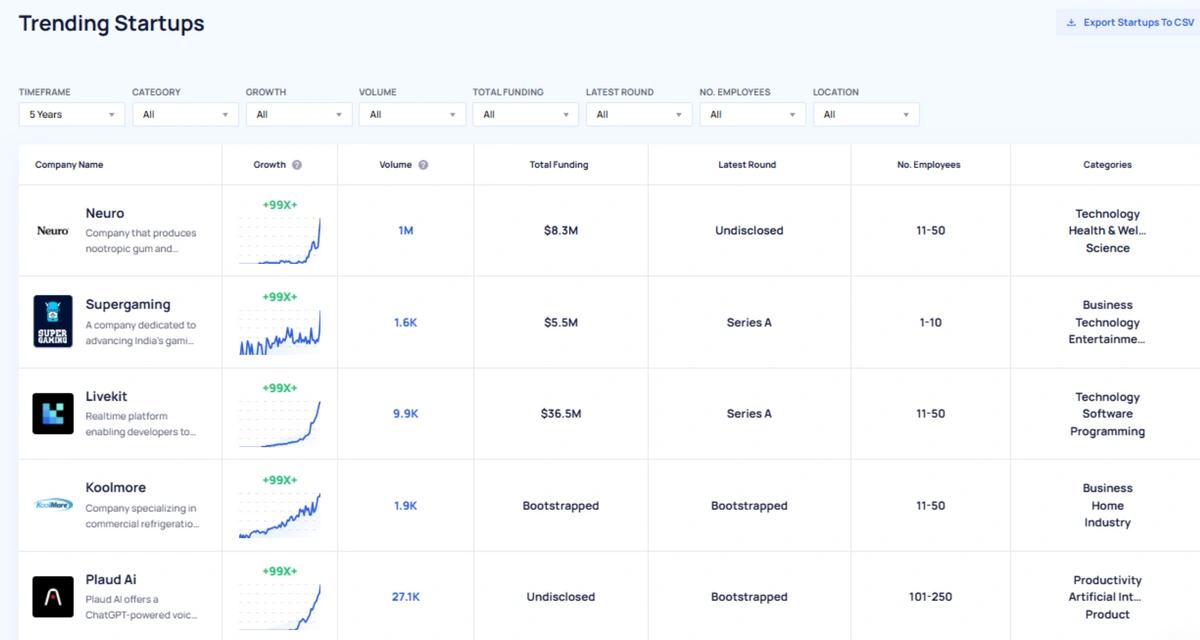

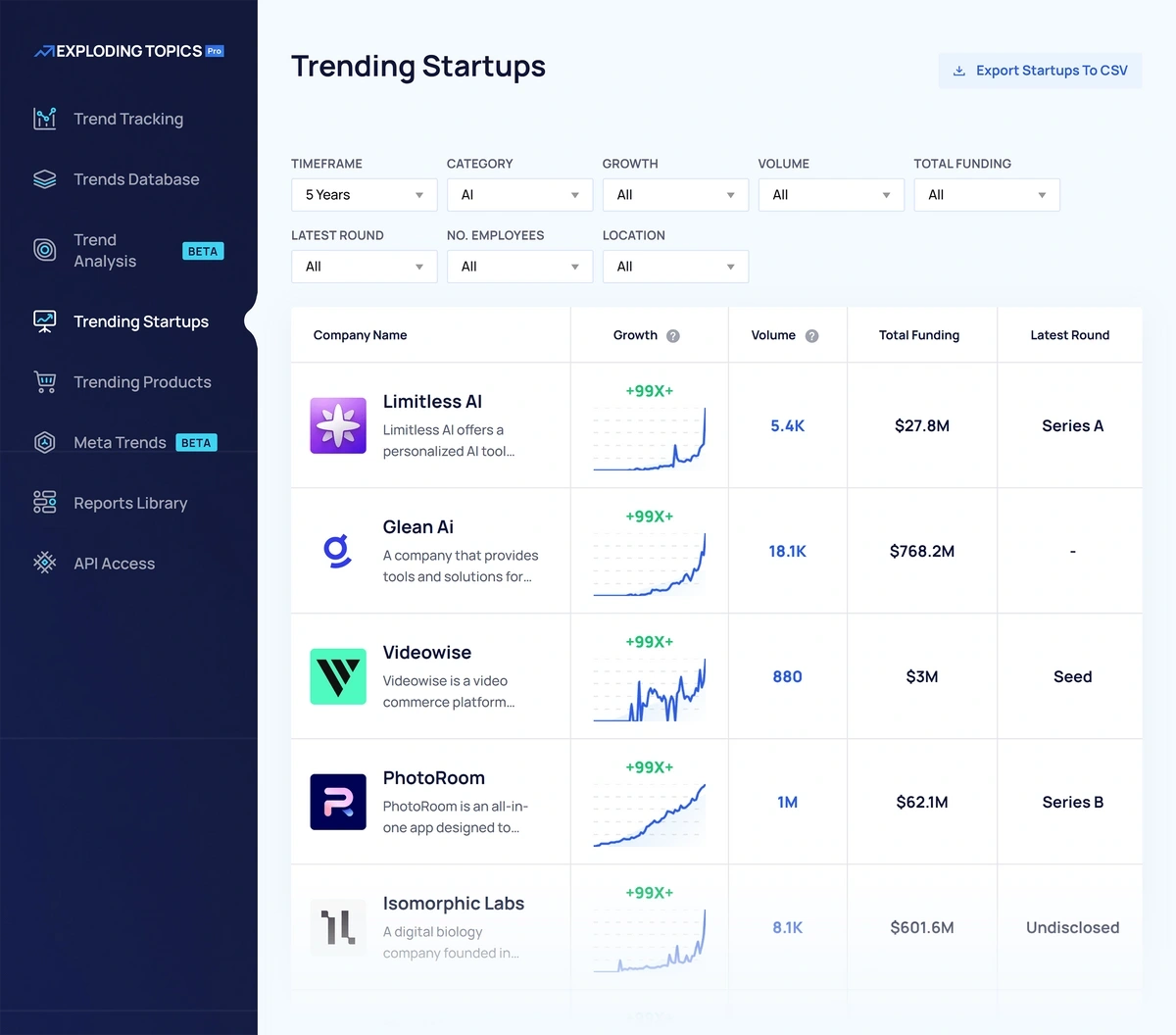

Discover high-growth startups before they hit mainstream radar. The Trending Startups database identifies companies based on brand search volume trends—a key signal of product-market fit and customer demand. Filter by growth rate, funding stage, employee headcount, and timeframe.

Identify Emerging Markets and Validate Consumer Demand

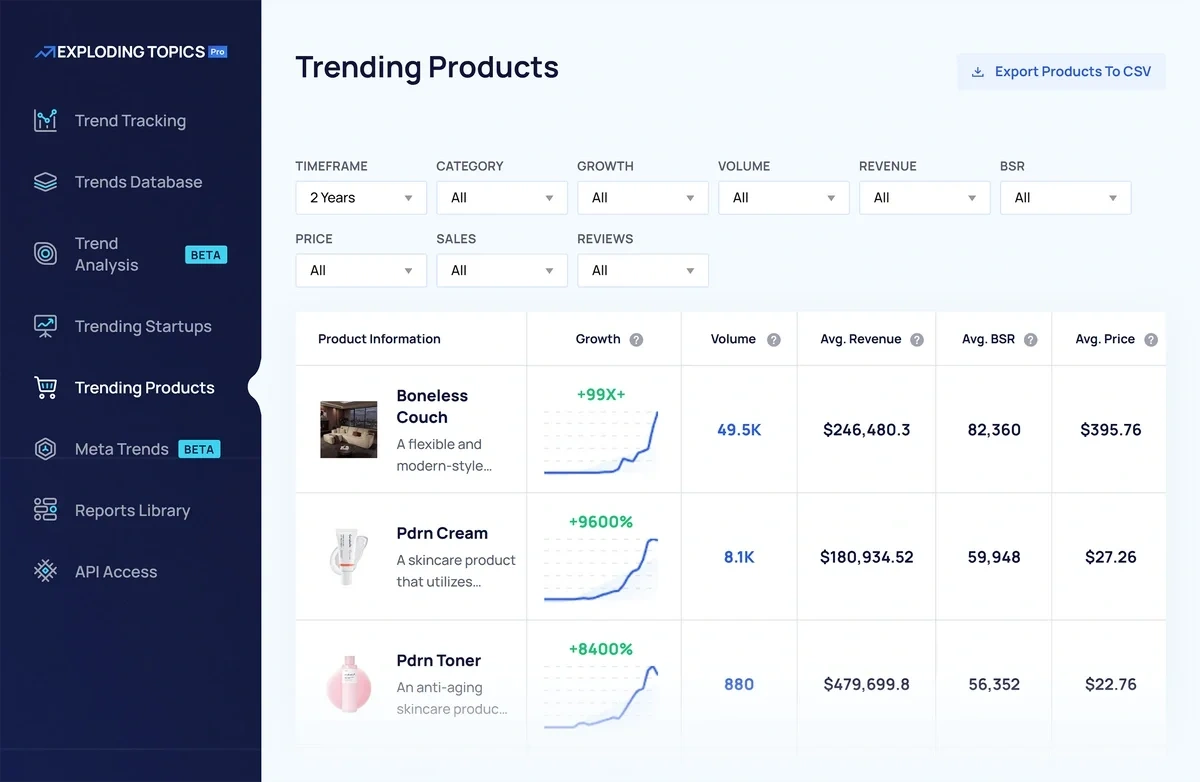

Track 3.5K+ trending products with real-time growth signals and sales data to spot opportunities early. Filter by timeframe, category, growth rate, and revenue to validate that portfolio companies are riding growing waves—or discover untapped product categories signaling new opportunities.

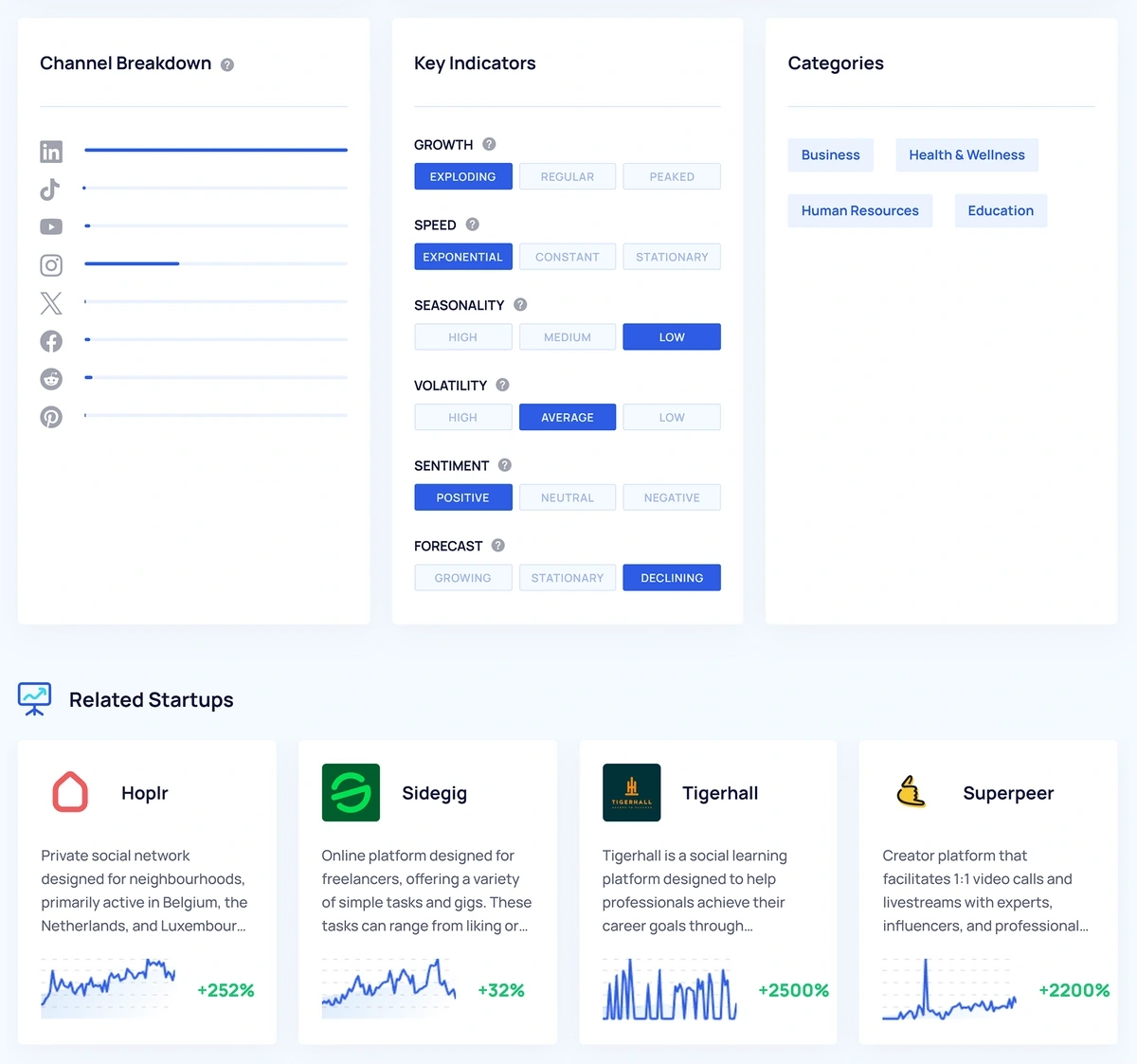

Conduct Due Diligence with Deep-Dive Data

Click into any startup, product, or trend to see a ton of intelligence for thorough vetting. View channel breakdowns across 8 platforms to understand where traction is happening, analyze key growth indicators and forecasts, and explore related trends, competing products, and adjacent startups—giving you the complete market context you need.

Exploding Topics Pro is trusted by 1,200+ teams worldwide.

How We Find Trends

We track topics across the internet to identify under-the-radar trends before they go mainstream.

Analyze

Our trend identification process begins with a comprehensive data collection from a variety of online sources.

- Social media platforms

- Search engines

- Online forums and communities

- News articles and blogs

- E-commerce websites

- Podcasts

Identify

Our proprietary machine learning models are designed to detect the absolute earliest signs of an emerging trend.

- Analyze historical data to identify growth patterns

- Predict future trends based on current data trajectories

- Detect sudden spikes in interest or activity around specific topics

Curate

While our algorithms are powerful, human expertise is crucial for contextual understanding, ensuring quality topics.

- Review the top-scoring trends identified by our models

- Validate the authenticity and relevance of these trends

- Filter out fads (movies, TV shows, celebrity gossip, etc.)

- Provide qualitative insights to complement quantitative data

Find top investment opportunities before other investors do

Discover high-growth startups and emerging markets 12+ months early with reliable trend data. Make your best investment decisions backed by data.

How to Catch Investment Deals Early (Before Valuations Increase)

By the time most investors hear about a promising startup, the opportunity is already crowded. Valuations have climbed, multiple firms are competing for allocation, and the founders hold all the negotiating power.

For early-stage investors, timing is everything.

Getting in early, when valuations are reasonable and competition is minimal, can make the difference between a 10x return and barely breaking even. But how do you identify these companies and opportunities before they hit everyone else's radar?

Why Traditional Deal Sourcing Falls Short

Many investors rely on warm introductions, accelerator demo days, or media coverage to discover opportunities. These methods share a common problem: by the time you hear about a company through these channels, so has everyone else.

- Warm introductions typically come after a company has gained traction and raised previous rounds.

- Accelerator demo days attract too many investors competing for the same deals.

- Media coverage signals that a startup is already on the radar of larger, well-funded firms.

The Data-Driven Approach to Deal Sourcing

The best investment opportunities are sourced via growth signals that most investors aren't monitoring.

Search volume is one of the earliest indicators of product-market fit. When people start searching for a company or product by name rather than generic product categories, it signals genuine customer demand and organic growth.

For example, a B2B software company seeing 25% month-over-month growth in brand searches for six consecutive months is demonstrating real traction—often before they've formally announced a fundraising round.

Early Signals vs. Late-Stage Buzz

The difference between early opportunity and late-stage hype comes down to growth patterns.

Early-stage opportunities show steady, compounding growth in brand interest before major funding announcements or media coverage. You can spot a SaaS company gaining traction through consistent search growth, social media momentum, and employee expansion, for example—all before they appear in TechCrunch.

Late-stage buzz looks different: a company suddenly appears everywhere after closing a major funding round. Search volume spikes, but so does competition among investors. By this point, valuation multiples have expanded and your negotiating position has weakened.

How to Build Your Deal Pipeline with Data

To source the best deals, you'll want to use multiple intelligence sources.

First, look at search trends. Organic demand for the company/product/trend is the first indicator that you should pay attention to.

Second, take a look at funding and employee growth data.

Third, keep an eye on social platforms. Is the company/product/trend showing up on a few different channels? Where's the buzz happening? Are social media mentions trending up?

Finally, look at related companies/products/trends. Are there larger themes there that are driving growth? What does the macro theme as a whole look like?

When you can identify a company showing strong brand search growth months before they formally raise, you have time to build a relationship with founders, conduct thorough diligence, and position yourself as a value-add investor rather than one of many competing term sheets.

Data-driven deal sourcing gives you the time advantage that makes all the difference. Start your free trial of Exploding Topics Pro today to build your pipeline before opportunities get crowded.

How to Monitor Portfolio Performance and Spot Warning Signs Early

The work doesn't end after you write the check. Between board meetings and quarterly updates, market conditions can shift dramatically—and by the time you hear about problems from founders, it may be too late to course-correct.

For investors managing active portfolios, early warning systems are essential.

That means you need a dependable way to actively monitor market trends, competitive threats, and broader industry shifts that could impact your portfolio companies.

Why Quarterly Reports Don't Tell the Full Story

If you rely on founder updates, financial statements, and board presentations to track portfolio performance, keep in mind that these sources have a few blind spots:

- Founders naturally emphasize positive metrics and downplay concerns.

- Financial statements show what already happened, not what's coming.

- Competitive threats often emerge gradually before they appear in official updates.

By the time declining performance shows up in formal reports, the market may have already shifted.

The Data-Driven Approach to Portfolio Monitoring

Smart investors track external market signals alongside internal company metrics.

If your portfolio company operates in AI-powered analytics, you should be monitoring broader trends in that category. Is search interest still growing? Are new competitors entering the space? Which platforms are driving discovery?

When you notice search volume for a portfolio company's category plateauing or declining while the company reports strong growth, that's a red flag worth investigating—their success might be coming from market share gains in a shrinking market rather than riding an expanding wave.

How to Spot Competitive Threats Before They Impact Valuation

The most valuable portfolio intelligence comes from tracking the competitive landscape in real-time.

Watch for emerging startups showing rapid growth in adjacent categories—they might be coming for your portfolio company's market. Monitor whether established players are entering the space. Track if customer search patterns are shifting toward different solutions or feature sets.

A portfolio company in the meal kit space, for example should trigger concern if plant-based meal alternatives suddenly show explosive growth while traditional meal kit searches flatten. That shift in consumer behavior could undermine your investment thesis before it shows up in retention metrics.

Building an Ongoing Intelligence System

For expert-level portfolio monitoring, track multiple signals continuously:

- Category trend analysis shows whether the overall market is growing or contracting.

- Competitive startup tracking identifies new entrants showing strong momentum.

- Search pattern shifts reveal changing customer preferences and behavior.

- Platform performance indicates where discovery and adoption are happening.

When you spot concerning signals early—a flattening category trend, a well-funded competitor gaining traction, or shifting search patterns—you have time to work with founders on strategy adjustments, consider follow-on investment decisions, or prepare for potential down rounds.

Data-driven portfolio monitoring transforms you from a reactive investor who learns about problems in board meetings to a proactive partner who helps portfolio companies navigate market shifts before they become crises. Start your free trial of Exploding Topics Pro today to stay ahead of market changes affecting your portfolio.