Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

The Ultimate List of Beauty Industry Stats (2026)

The beauty industry is always evolving.

After taking a performance dip in 2020, beauty brands are finding new and innovative ways to connect with their customers. Beauty influencers and DTC brands are both influencing and adapting to buyer preferences.

Meanwhile, top industry players are expanding their product lines and web experiences to meet new demands.

So what does the beauty industry look like at the start of 2026?

In this article, we’ll cover all of the most important stats in the beauty space, from industry-wide trends to consumer behavior to the rise of e-commerce and new technologies.

Top Beauty Industry Statistics

Overall, the future looks bright for the beauty industry. Here are a few eye-opening statistics to get you started:

- The beauty industry is expected to generate more than $703 billion in revenue in 2026.

- The men's personal care market is projected to hit $67.2 billion by 2030.

- The global skincare market generated over $122 billion in 2025 and is expected to reach $194 billion by 2032.

- Beauty companies spent an estimated $7.7 billion on advertising in 2022.

- Online cosmetic sales are estimated to have been around $53 billion USD in 2025, with that number expected to grow to $70 billion by 2029.

Keep reading to discover 35+ beauty industry stats.

Beauty Industry Statistics

Let’s begin with some industry-wide statistics:

The beauty industry is expected to generate more than $703 billion in revenue worldwide in 2026 (Statista)

Our live directory of trending beauty startups highlights some of the newer players contributing to that headline revenue figure.

L'Oréal is the leading beauty products company with over $47 billion USD in global sales (Statista)

L’Oréal remains the top player in the beauty industry, with around $20 billion more in sales than second-place Unilever. Rounding out the top 5 are Estée Lauder, P&G, and Shiseido. (Statista)

| Brand | Beauty Sales |

| L’Oréal | $47.04 billion |

| Unilever | $26.63 billion |

| Estée Lauder | $15.2 billion |

| P&G | $15 billion |

| LVMH | $9.11 billion |

| Chanel | $8.54 billion |

| Beiersdorf | $8.53 billion |

| Shiseido | $6.55 billion |

| Coty | $6.1 billion |

| Puig | $4.79 billion |

Go to the Exploding Topics Analytics tools for an up-to-date list of the most-visited websites in the beauty and cosmetics space, along with details on bounce rate, average visit duration and more. As of January 2026, Sephora leads the way, followed by Ulta, Fragrantica, Boots, and QVC.

North Asia represents 35% of the global beauty market (ElectroIQ)

North Asia is the largest market for beauty and personal care products. China has risen to become the industry leader in this region.

North America makes up around 26% of the market, while Europe makes up 22%.

The beauty industry can be divided into 15 distinct sub-categories (British Beauty Council)

The British Beauty Council and Oxford Economics recently divided the beauty industry into 3 categories: personal care and maintenance, personal enhancement, and services. Within those categories are 15 subcategories:

- Personal care and maintenance: personal care and hygiene, skin and body care, hair, dental care, hair removal, sun care, and nail care.

- Personal enhancement: cosmetics, accessories and applications, fragrance and perfume, nail color, and hair enhancements.

- Services: hair services, beauty treatments, and holistic treatments.

💅 Real-Time Signals From the Beauty Industry

This post covers the biggest stats in the beauty industry. But what are consumers actually searching for right now? Here are the top trending beauty topics based on live data from the Exploding Topics engine, updated automatically.

The men's personal care market is projected to hit $276.9 billion by 2030 (Allied Market Research)

The message is clear: Men need to take care of their appearance, too. The men’s personal care market is expected to see significant growth throughout the 2020s. According to Allied Market Research, this segment of the industry is projected to grow at an 8.6% CAGR between now and 2030.

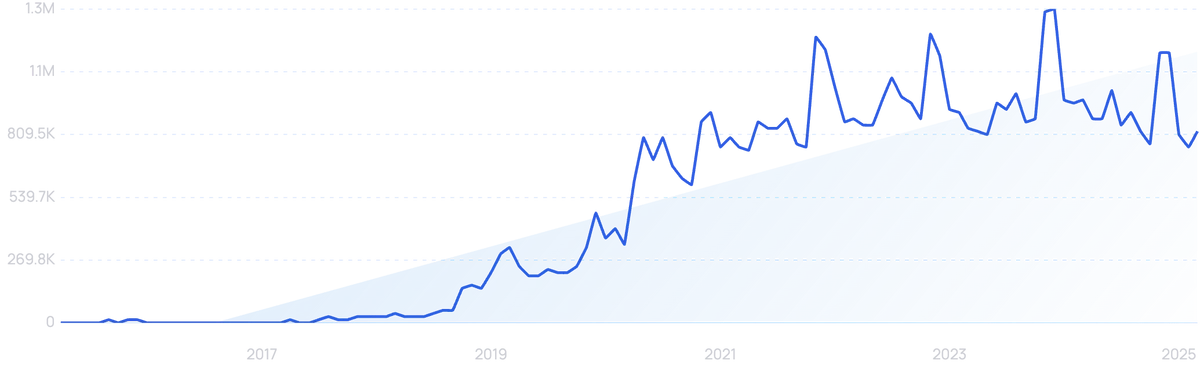

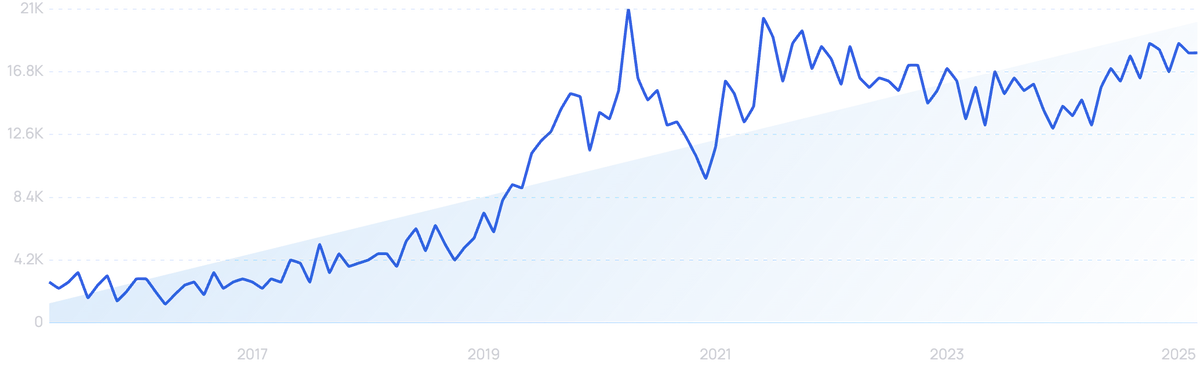

Search volume for “Manscaped”, the DTC men’s grooming brand, has exploded by 6,000% over the past 10 years.

Skincare Products Statistics

Skincare represents a significant portion of the overall beauty market. Data indicates that the use of cleansers and other skincare products is on the rise:

The skincare industry was worth $190.27 billion at the last report from 2024 (Statista)

The skincare market is vast and ever-growing. While it’s dominated by large companies (Estée Lauder reports $14.3 billion for 2025, according to Statista), niche brands are finding plenty of eager consumers.

Skincare is projected to generate up to $235.96 billion by 2030 (Statista)

New skincare products are hitting the market every day, from organic anti-aging serums to gender-neutral foundations and concealers.

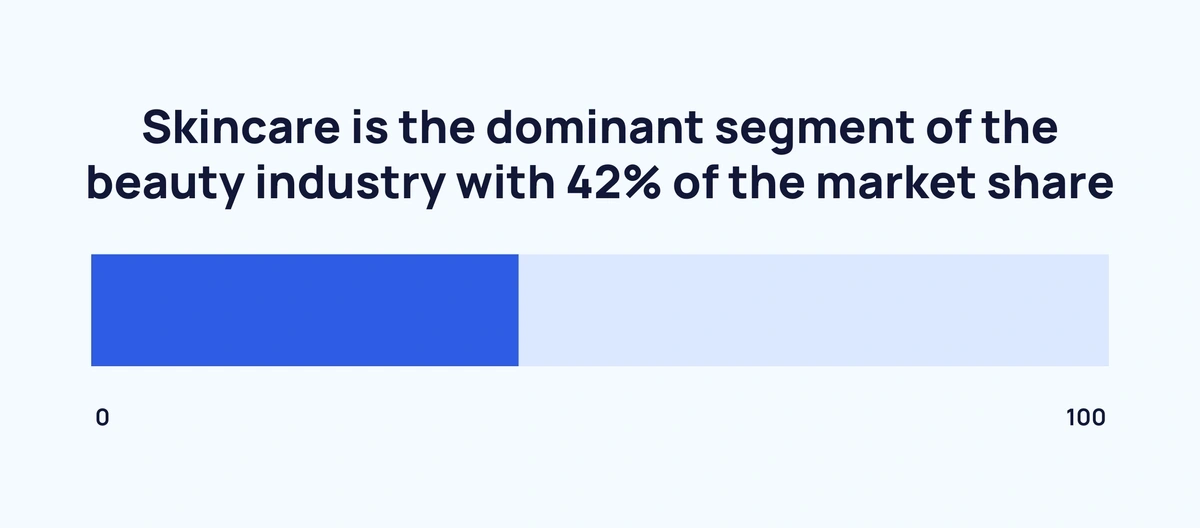

Skincare has 42% of the market share in the beauty industry (ElectroIQ)

Skincare has more beauty industry market share than hair care (22%) and make-up (18%) combined. The Asia-Pacific region is currently the global leader, owning over 40% of the market.

Beauty Marketing and Social Media Statistics

Beauty, cosmetics, and personal care influencers have some of the largest followings on social media. Brands can leverage these influencers’ reach, but they must be thoughtful in doing so.

Beauty shoppers say TikTok is their top source for beauty-related content (Statista)

The TikTok Shop has been the top place to make beauty purchases online in recent years. (Statista)

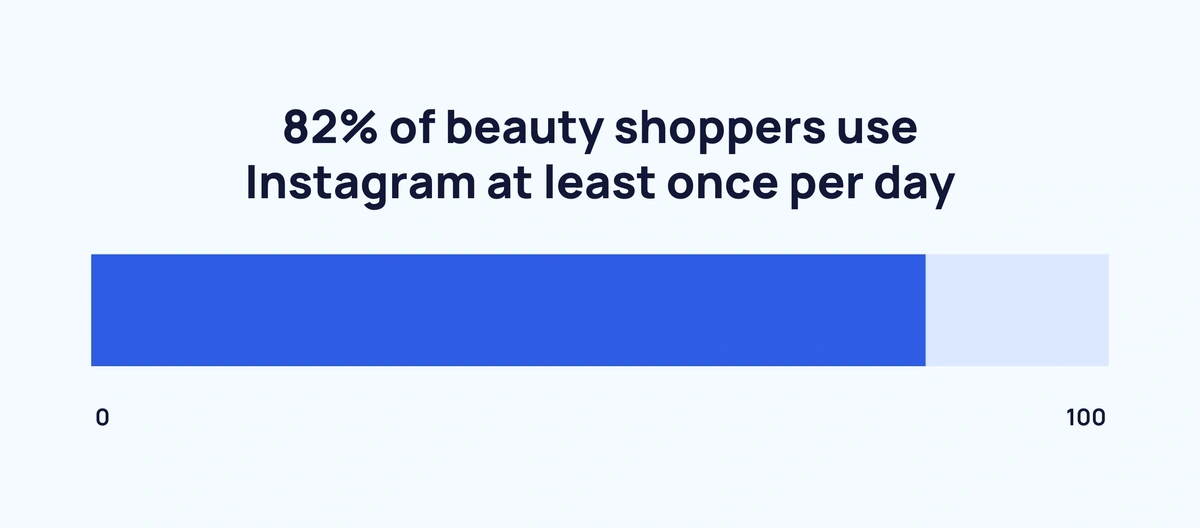

Around 4 in 5 beauty shoppers use Instagram daily (Stackinfluence)

As a visual medium, Instagram is the perfect match for beauty brands to connect with their audiences. The interactive nature of Instagram plays a key role in building a trusting, loyal following. In fact, brands report that influencer marketing is more effective than direct mail.

49% of Gen Z and millennial consumers have purchased products based on recommendations from social influencers (BeautyMatter)

Beauty influencers have tremendous reach. In fact, 84% of people say a brand that uses user-generated content (UGC) is more trustworthy than brands that don't, with 77% saying UGC directly influences their purchases. (social.plus)

Influencers play a critical role in social media marketing, but brands should tread these waters carefully. Consumers know that influencers are paid to promote, so likability and trust are crucial.

42% of consumers say they’d buy a product promoted by an influencer, while 43% said they were unsure and 15% flat-out said “no”.

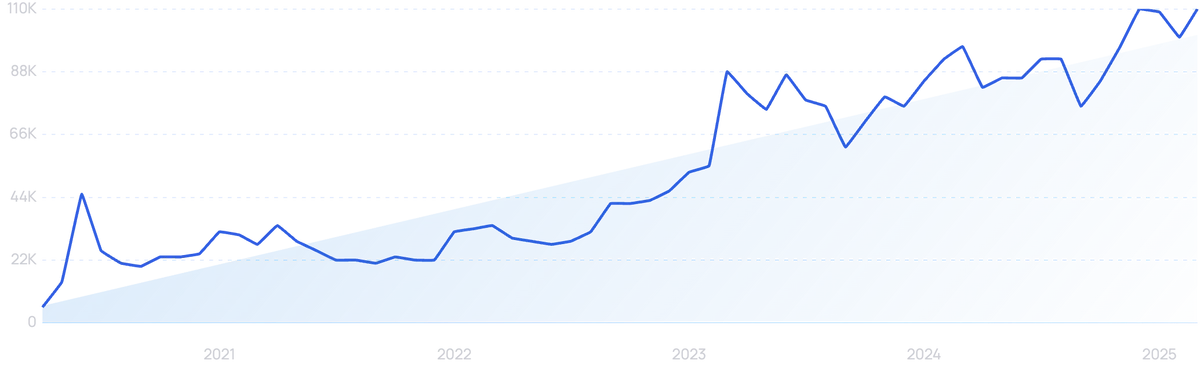

Influencer Susan Yara launched her own cosmetics brand, Naturium. The brand gets over 110,000 monthly searches, up 1,900% from 5 years ago.

Kylie Cosmetics is the most followed beauty brand on Instagram, with around 25 million followers (Trackalytics)

While established corporations lead the pack in global sales, up-and-coming brands are dominating social media. Kylie Jenner’s cosmetics brand has had a tidal wave of impact on Instagram, while her personal account has approximately 392 million followers.

Beauty eCommerce and Technology Statistics

The need to sample and try on beauty products makes generating online sales a challenge. But companies are finding new and exciting ways to give shoppers that “in-store” experience online.

Health, Beauty, and Personal Care is expected to see more than $130 billion in sales in 2025's final numbers, and to exceed $200 billion in 2026 (eMarketer)

As consumers explore more options for previewing products online, eCommerce sales are expected to climb in the coming years.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

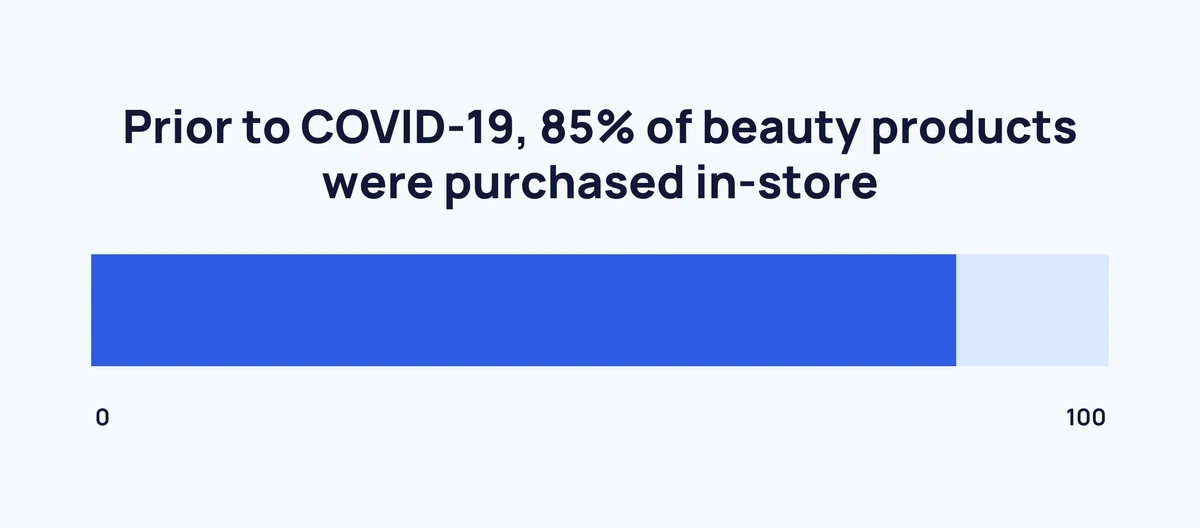

Before the pandemic, 85% of beauty products were purchased in-store (McKinsey)

The pandemic racked an industry that’s heavily reliant on consumers’ ability to test and purchase products in person. The majority of shoppers across all demographics prefer to browse and shop in-store. According to McKinsey, the increase in online sales during the pandemic did not make up for the drop in sales at brick-and-mortar locations.

Despite the rise of online purchasing, 46% of consumers say they prefer to see beauty products in person (Digital Commerce 360)

Cosmetics consumers are fickle. They want to see products in person before committing to a sale. 18% of consumers say they seek out guidance from in-store professionals, an experience that brands will need to replicate online if they want to stay competitive.

Cosmetic retailers made $62.7 billion from online sales in 2025 (Ibis World)

To bolster their online sales, brands are finding ways to give shoppers the “browsing” experience online. Virtual and augmented reality, color-picker apps, and online consultations are all strategies to help shoppers choose the best products.

A whopping 47-76% of consumers expect personalization, which can increase revenue by 10% or more. (Wisernotify)

Furthermore, Wisernotify notes that personalized content and recommendations can reduce bounce rate by up to 47%.

There is a 19.8% lift in conversions when users are served reviews, and a 108.3% increase when they interact with the reviews (Power Reviews)

Across all industries, social proof is a powerful tool for wooing new customers.

85% of consumers find UGC more authentic (Stackinfluence)

Allowing users to upload their own content — including photos and videos — is another cost-effective means to increase brand loyalty.

Augmented Reality leads the market share at 58.4% when it comes to virtual try-ons (Market.us)

Clean, Natural, and Organic Beauty Product Statistics

Concerns over harmful chemicals, environmental responsibility, and animal cruelty have all shaped consumer habits in the beauty industry.

The global clean beauty market was valued at $10.79 billion in 2025. It is expected to grow to $37.91 billion by 2034 (Fortune Business Insights)

Clean beauty has been on the rise for over three decades. As with the clean food movement, consumers are becoming more aware (and concerned) about the products they put on their bodies.

Sales of paraben-free beauty products are expected to grow 7.4% between 2025 and 2035 (Future Market Insights)

The paraben-free skincare market was valued at $11.5 billion USD in 2025, with haircare being the largest segment (34.4%). It expected to reach $23.7 billion by 2035.

74% of consumers consider organic ingredients to be important, with 65% wanting a clear ingredient list to identify harmful products (NSF)

Sustainability is a top priority for many of today’s consumers.

The organic skincare market is expected to grow by 8.9% per year to $21.16 billion through 2030 (Grand View Research)

The pandemic has helped accelerate the growth of the organic skincare market. Health concerns combined with an increase in online shopping have steered more consumers toward brands that display “organic” or “natural” on their product labels. The market is still dominated by a handful of large companies, but e-commerce brands should be able to capitalize on this trend.

The EU has banned over 150 times more ingredients than the US for use in beauty products (Chateurope)

US-based brands looking to expand into the European market should be aware of the massive gulf between the two regions’ ingredient restrictions. The EU currently prohibits 1,751 ingredients from use in cosmetic products. The FDA in the US bans only 11.

Haircare Industry Statistics

Haircare has always been a stable segment of the beauty industry, but recent trends in hair coloring point to even more growth potential:

The global haircare market size was worth over $106.91 billion in 2024 (Fortune Business Insights)

2025 numbers are expected to show growth to $113.93 billion.

The haircare market is expected to reach $213.47 billion by 2032 (Fortune Business Insights)

Some of the forces driving this trend are a demand for more organic and natural products, hair loss solutions, and dandruff-related products.

Hair coloring products make up 1/5th of the global haircare market (Fortune Business Insights)

Wildly colored hair has entered the mainstream. Hairstylists need products to serve their clients, and consumers need products to manage their colored hair at home.

Searches for “color-depositing conditioner” have gone up 562% over the past 10 years.

Key Takeaways

The future looks bright for the beauty industry.

Online experience innovations, new clean and organic product lines, and a willingness among consumers to buy premium products indicate growth opportunities across all categories.

Social media’s influence on the beauty industry and the shift from in-store to online shopping points to a potential explosion of DTC and eCommerce brands.

And while big brands like L’Oreal and Estee Lauder will still get the lion’s share of sales, there’s plenty of room at the table for up-and-comers able to get in front of the right audience.

If you enjoyed these stats, why not take a look at beauty industry trends, beauty gadgets trends, and notable beauty startups?

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more