Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Important Blockchain Trends (2024-2027)

You may also like:

Blockchain companies are seeing record investments from Venture Capitalists.

Unlike software companies, however, blockchain companies don’t operate on the SaaS model.

Instead, their products and services revolve around what are known as Decentralized Applications (aka dApps).

From NFT marketplaces like OpenSea to obscure derivatives trading platforms, here are the top blockchain trends we expect to see in 2024 and beyond.

1. Blockchain Gaming Gains Traction

While decentralized applications can be built to serve many functions, a quick glance at the top 20 growing blockchain startups shows most dApps fall into one of three categories:

- Blockchain Gaming

- Decentralized Finance (DeFi)

- NFT Marketplaces

What’s impressive, however, is the speed at which blockchain games continue to grow relative to DeFi protocols (in terms of active users.)

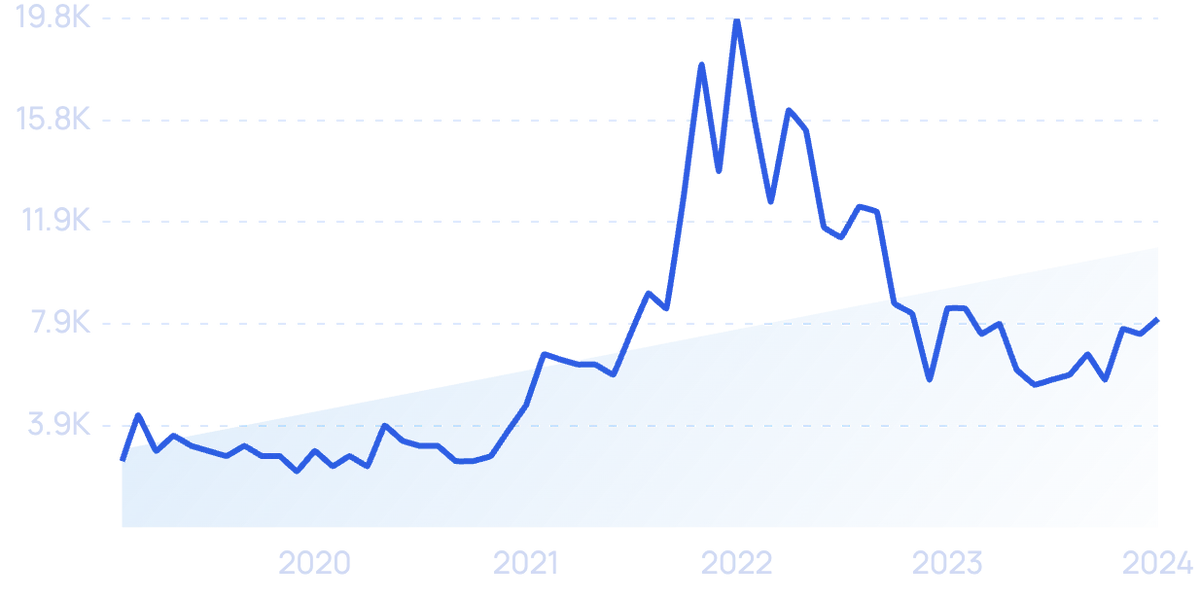

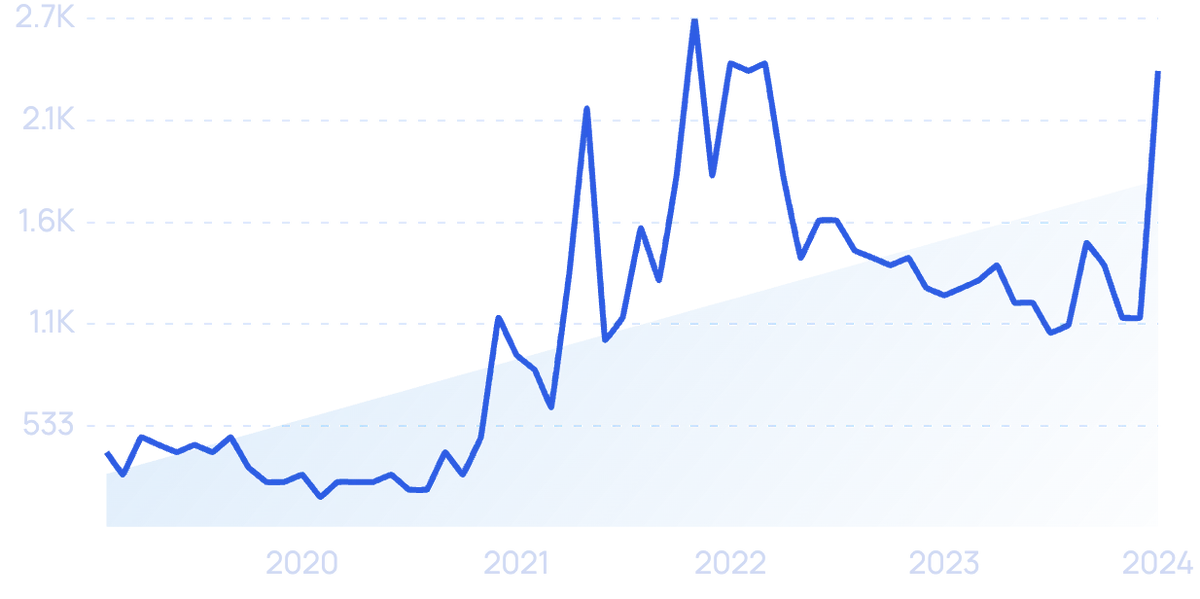

Searches for “blockchain gaming” have increased 215% in 5 years.

Along the same lines, blockchain games now account for seven of the top 10 dApps (when measured by user count).

Consumer interest in the "Mobox" blockchain game is up 215% over 5 years.

On the flip side, DeFi as a sub-niche of Web3 has been struggling.

According to Similar Web, top-ranked DeFi protocols like Lido have seen a substantial drop in website traffic since November of 2021 (when the crypto market as a whole entered correction territory).

2. DAOs Go Mainstream

As the Web3 movement grows, the transition from traditional corporate structures (like LLCs) to Decentralized Autonomous Organizations (aka DAOs) continues to gain steam.

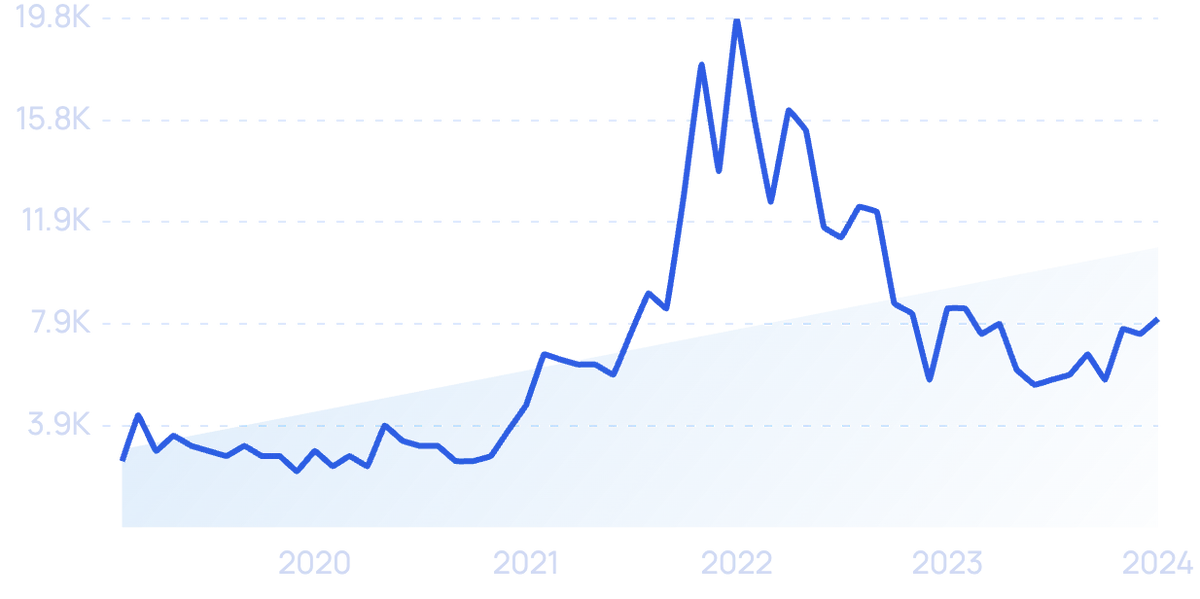

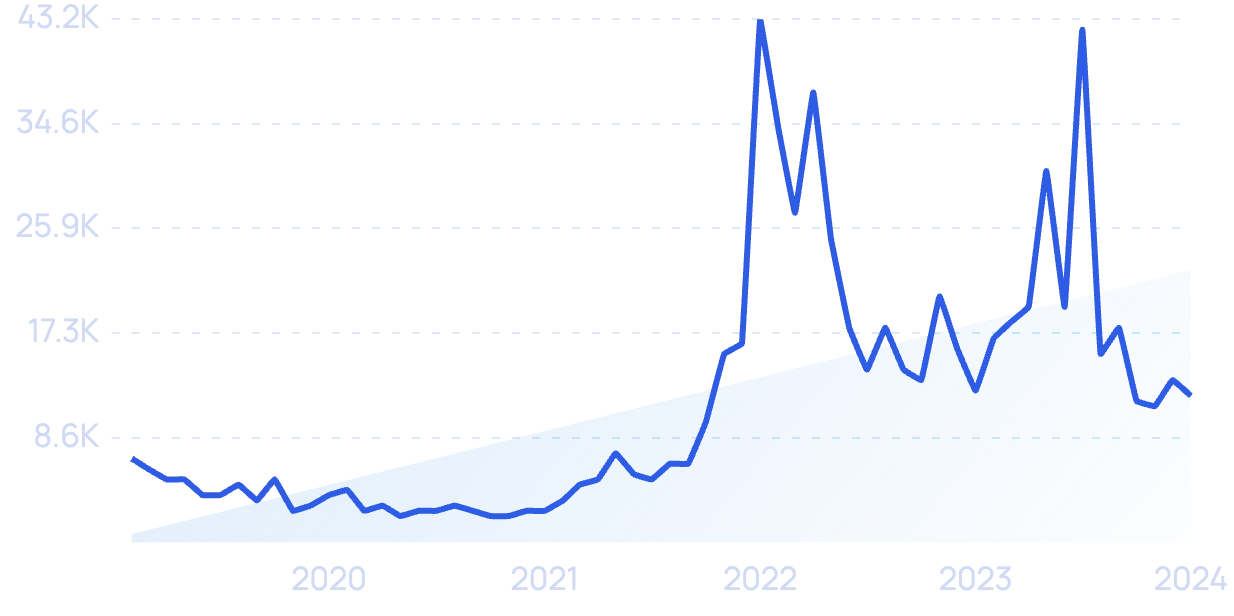

Searches for “Decentralized Autonomous Organization" (DAO) in the last 5 years.

There are multiple reasons for this. Some of which are more radical than others.

On the more extreme end, many believe the decentralized nature of DAOs will make them (and their creators) exempt from taxes, legal liability, etc.

On the more practical end, DAOs allow participants from a wide variety of countries to collaborate without succumbing to the bureaucracy involved in launching a multinational corporation or hiring foreign employees.

Because of that, DAOs have become the de facto corporate structure for many of today’s top dApp builders.

In fact, according to DeepDAO, there are now 7.5 million DAO participants, with 3.1 million of them actively participating in governing the project(s) they’re involved with.

With interest in DAOs on a clear upward trend, a growing number of companies are rolling out services focused on helping DAO founders.

As an example, Singapore-based Poko helps founders launch, raise capital, and deploy their DAO in a fraction of the time it would take to start a business in a developing country.

3. KYC Integrates into DeFi Apps

Historically, one of the primary appeals of decentralized finance (DeFi) is its inherently anonymous nature.

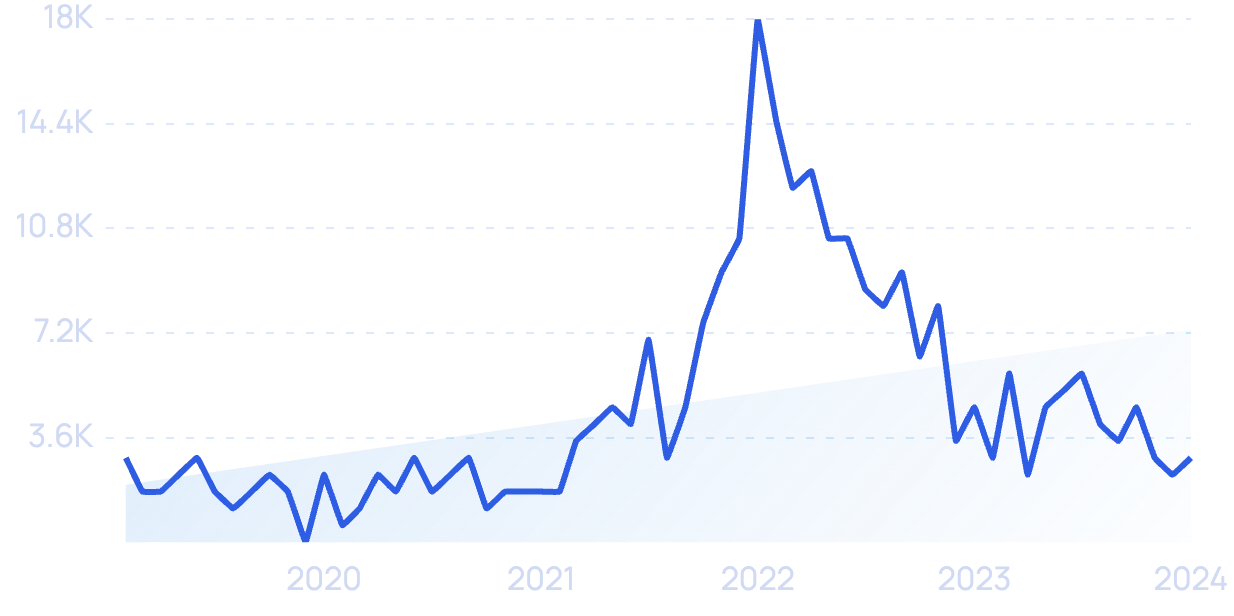

Searches for “decentralized finance” are up 640% over 5 years.

On the one hand, DeFi proponents believe the government has no business knowing what everyday citizens do with their money.

On the other side, governments have a vested interest in preventing crimes like money laundering, tax evasion, and the funding of terrorism.

Because of that, many industry experts see regulation as being inevitable.

Many crypto insiders, like Coinbase’s Brian Armstrong, are calling for regulation in the crypto space.

So, instead of questioning whether regulation would happen, the real question became: Which government is going to regulate crypto first?

In March of 2022, the European Parliament announced sweeping restrictions on anonymous crypto transactions.

The EU was one of the first governments to pass widespread regulations on crypto transactions.

While they were not the first government to do so, they were the first Western governing body (neither the US, UK, nor Australia have any regulations in place as of this writing).

Based on the March ruling, all crypto transfers between citizens of EU countries “will have to include information on the source of the asset and its [recipient]”.

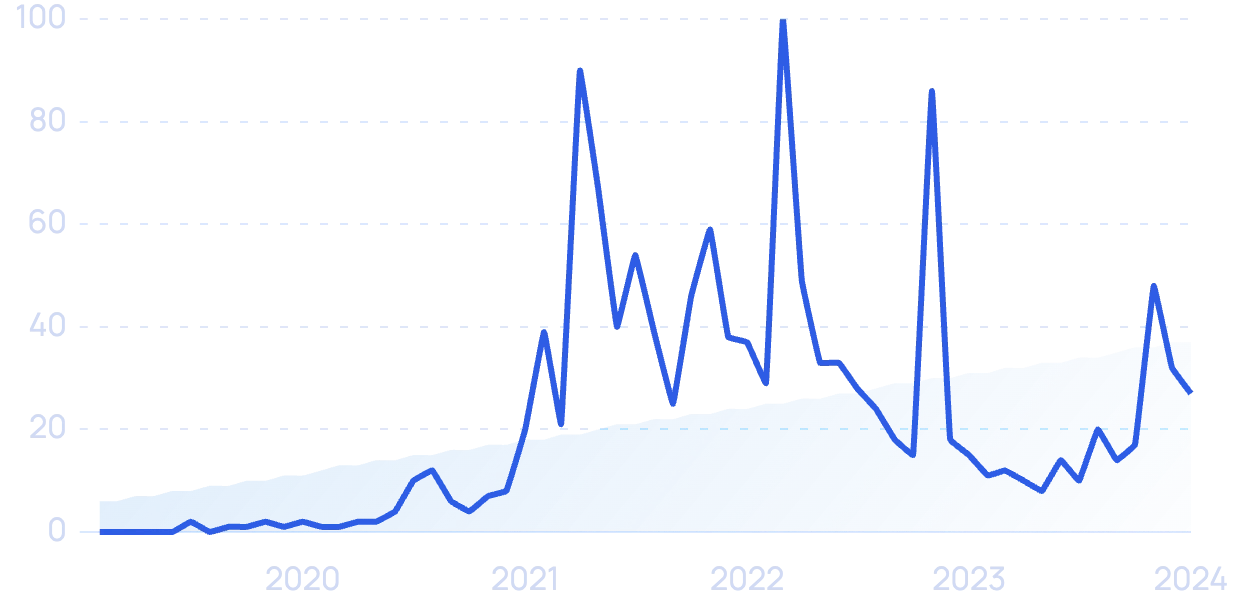

Interest In "Crypto Regulations" has surged 510% in the last 5 years.

Notably, there is no low-value transfer exemption within this law.

Instead, transfers of as little as $0.01 will require identifying information on both the person sending and the person receiving the transfer.

The question now is how developers will incorporate identity verification into their blockchain-based dApps.

In the world of centralized exchanges, most companies still use a combination of uploading one’s identity document (e.g. driver’s license or passport) and facial recognition technology.

In the world of Web3, however, having such sensitive information stored in a centralized database runs contrary to the ethos of having a decentralized financial system.

Because of that, DeFi developers are working on a new, blockchain-based (and privacy-oriented) solution known as Tokenized Identity.

While the technology is still young, it’s safe to assume that as more countries implement regulations, Tokenized Identity (and similar competing technologies) will become more prevalent inside cryptocurrency wallets.

4. dApps Launch Backend “Products”

In industries like SaaS, recurring revenue is the name of the game.

Mainly because, while acquiring a new customer can cost hundreds if not thousands of dollars, selling something else to an existing customer costs almost nothing.

Because of that, SaaS and fintech companies place a heavy emphasis on monetizing their existing users to the fullest extent possible.

With that said, most blockchain companies are still in their infancy.

However, as their meteoric revenue growth starts to peak (and in some cases plateau), established blockchain companies are putting more effort into developing back-end services.

And while blockchain is growing incredibly fast, user numbers pale in comparison to those found on social media.

As an example, there are now over 85 million blockchain wallet users. While this represents substantial growth compared to the 3 million seen during March of 2015, it pales in comparison to Facebook’s 3 billion users.

Because of this, monetizing the users they do have has become critical to the success of many dApps.

In what is one of the most obvious examples of a back-end, NFT marketplaces like Magic Eden are now rolling out NFT launchpad services.

Admittedly, not every person who buys an NFT is going to want to launch their own collection.

Some, however, will.

Further, there’s a high likelihood a buyer already understands the technology behind NFTs.

This, in turn, reduces the friction involved in onboarding buyers and converting them into sellers.

Along the same lines, decentralized exchange providers like TraderJoe have begun rolling out borrowing and lending services to complement their existing token swap services (which act as the core of their business).

5. Blockchain Companies Expand to New Chains

When it comes to building a dApp, the blockchain a developer decides to build on is incredibly important.

Searches for “multichain” are up 75% over the last 5 years.

Similar to launching a restaurant in downtown Manhattan, choosing the right blockchain can bring a near-instant flood of users.

Mainly because, as long as the value proposition is there, it’s a seamless transition for existing chain users to begin experimenting with a new dApp.

On the flip side, it’s a laborious and potentially risky process to set up a new wallet and send (or bridge) funds to a new chain.

However, as many franchises have learned over the years, dominating your local area can only get you so far.

Because once that area’s been dominated, the only option for continued growth is to expand into new territories.

And when it comes to choosing a blockchain, the same principle applies.

From 2017 to 2021, leading NFT marketplace OpenSea limited users to paying for NFTs using the cryptocurrency Ethereum ($ETH).

In the beginning, this wasn’t an issue, as fees to use the Ethereum blockchain were comparable to other alternatives.

As the use of the chain surged in 2021, however, fees to use the chain skyrocketed (to as high as $500 or more for a single transaction).

This, in turn, made using OpenSea’s platform prohibitively expensive.

To address this, OpenSea is in the process of integrating two new blockchains - Solana and Polygon - into their product suite (both of which are known for extremely low-cost fees).

In addition to solving the fees issue, this cross-chain integration helps OpenSea fight back against Solana-based competitors like Magic Eden (which began attracting customers in droves given how expensive OpenSea had become).

And it’s not just NFT marketplaces that are going cross-chain.

In the world of decentralized finance, 60% of the top 10 dApps now serve two or more blockchains.

6. DeFi and Blockchain Gaming Converge

On the surface, blockchain games are attracting a larger number of new users vs. dedicated DeFi protocols.

To achieve such rapid growth, however, many dApp builders stole a page out of the DeFi playbook.

As you may or may not know, many of today’s top blockchain games (e.g. Axie Infinity) gained mass adoption as a result of rewarding players with highly valuable cryptocurrency tokens.

In some cases, these games fall under the “Play to Earn” model, where participants earn tokens as a reward for playing. In others, dApp builders incorporated the practice of yield farming (which originated in DeFi) right into their games.

Regardless of which incentive structure they chose, the goal was the same: Attract new users by incentivizing them with free money.

Interestingly, this is the same strategy many of today’s top DeFi protocols used to achieve meteoric growth during the infamous DeFi Summer (which took place in 2020).

By combining DeFi incentives into blockchain games (in a practice known as GameFi), dApp builders are able to attract a flood of new users in a short period of time.

In fact, by incorporating a new DeFi mechanism into their existing game in March of 2022, top 20 dApp DeFi Kingdoms revived what many believed was a dying project (more than doubling their market cap in less than 30 days).

7. Blockchains Become Niche Specific

In the world of SaaS, identifying what problems a company solves — and in which niche — is paramount to a company’s success.

According to high-profile VC investor Marc Andreessen (founder of a16z):

“The life of any startup can be divided into two parts — before product/market fit and after product/market fit”.

In the late 2010s, PMF was an afterthought for many dApp builders.

Mainly because building on top of the blockchain meant learning entirely new programming languages (e.g. Solidity).

This, in turn, meant developers had to spend months (and even years) learning how to code in a new language before they could even think of testing the demand for their applications.

With that said, as the industry becomes more saturated - and developers gain more experience building dApps - the need for product-market fit is becoming increasingly important.

As an example, chains like Solana and Avalanche allocated VC money (known in Web3 as Grants) to fund everything from NFT marketplaces to blockchain gaming and DeFi protocols.

Because of this, neither platform has developed a reputation as being the “Go-To” solution for XYZ.

On the flip side, chains like Fantom Opera - and the 200+ dApps built on top of it - are focused exclusively on decentralized finance.

Because of that, the Fantom Opera chain:

- Boasts one of the strongest and most active communities in DeFi

- Has the lowest Market Cap-to-TVL ratio among the top 10 projects (with lower ratios being a sign of undervalued projects)

- And is the top choice among dApp builders looking to go multi-chain.

Further, while the market cap of competing chain Avalanche is higher than that of Fantom’s, both Fantom and Avalanche process over 500,000 transactions per day.

Along the same lines, the Wax blockchain - which focuses exclusively on blockchain gaming and NFTs - has seen similar levels of success.

In particular, Wax hosts four of the top five dApps (as measured by User Count).

8. Interchain Operability Becomes Increasingly Important

Since the introduction of Bitcoin in 2009, more than 1,000 new and unique blockchains have been launched.

While many of these projects use similar (if not identical) programming languages, many of today’s most popular chains do not.

In the early days of cryptocurrency, this was a non-issue.

Mainly because the lack of dApps made it unnecessary to move funds between chains. Instead, most tokens were purchased and held on exchanges for the purpose of speculative trading.

Fast forward to today and top chains like Ethereum, Binance Smart Chain, and Solana host hundreds of dApps each.

Further, many dApps - including most blockchain games - are limited to just one chain.

Because of that, the need to move funds between blockchains (known as Interoperability) is higher than ever.

On the one hand, some companies have attempted to solve this issue through the use of bridges (which “bridge” tokens from one chain to another).

Sadly, bridges are highly vulnerable to security exploits, with hackers stealing more than $1 billion from them in 2021 alone.

On the flip side, protocols like Cosmos and Thorchain - and the dApps built on top of them - are engineered from the ground up to interact with multiple chains.

Because of that, interest in Cosmos’ interoperability-focused IBC technology (and Thorchain as a whole) has skyrocketed among both dApp developers and investors alike.

In fact, as of this writing, more than 40 blockchain projects are built using Cosmos technology.

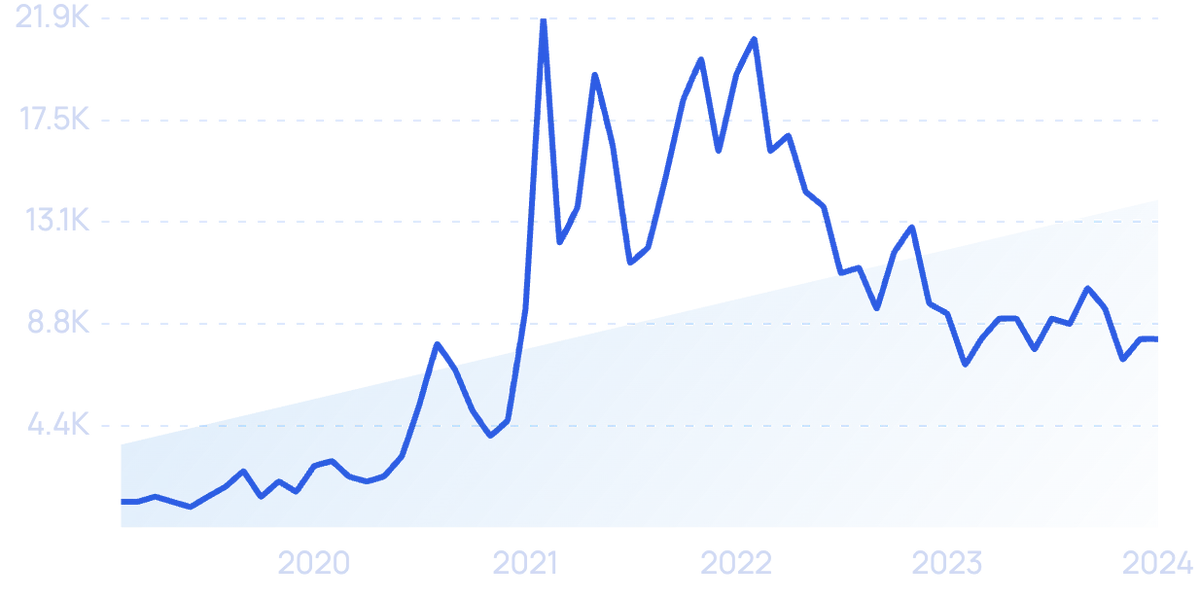

Interest in "Thorchain" is up 2,600% in 5 years.

9. User Interface Issues Get Solved

As many technology companies have learned the hard way, user experience is critical to achieving mass adoption.

From AOL to MySpace, the Internet graveyard is filled with the remnants of companies whose competitors offered an easier, more convenient User Interface (e.g. Gmail and Facebook).

And if there’s one complaint industry insiders hear about Web3, it’s how clunky, intimidating, and infuriating it is to use decentralized cryptocurrency wallets (which are required to interact with dApps).

Admittedly, with more than 30 million users, MetaMask developers are well aware of these issues.

In fact, in December 2021, MetaMask announced it would allocate a portion of its recent $65 million raise toward building a more intuitive and easier-to-grasp user interface.

With that said, some companies are taking matters into their own hands.

As an example, startup company Finnt allows DeFi investors to set up easy-to-use cryptocurrency wallets for loved ones. In doing so, they hope to onboard less savvy users by tapping the family and friends of more sophisticated DeFi investors.

10. NFTs Focus on Real-World Utility

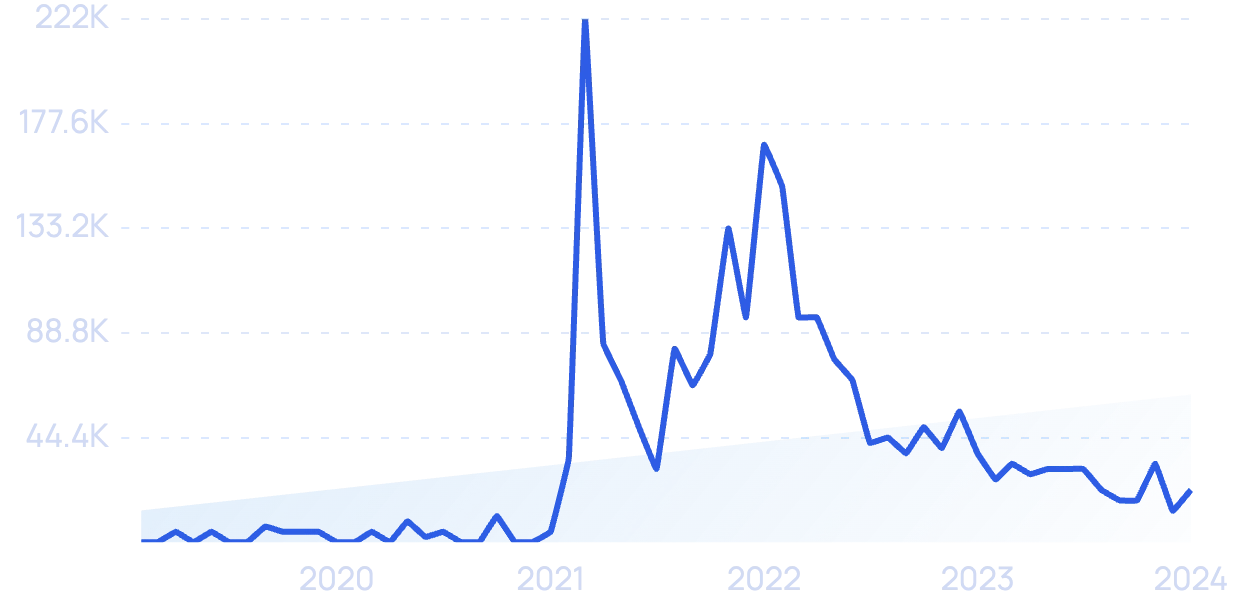

Cambridge Dictionary ranked “NFTs” as the 2021 ‘Word of the Year’.

However, fast forward to April of 2022, and interest in NFTs had plummeted.

There are two likely reasons for this.

Google search interest in "non-fungible tokens" may have peaked.

First, the NFT craze that took place during the summer of 2021 was fueled almost entirely by speculation (similar to Beanie Babies or the oft-cited Tulip Mania).

Second, NFTs benefitted from not one, but two, cryptocurrency bull markets in 2021 (the first of which started in September 2020).

Since November of 2021, however, the market has fallen into a correction (with Bitcoin losing half of its value from peak to trough).

Because of that, public interest in crypto in general - including NFTs - has dropped dramatically relative to six short months ago.

With that said, the technology behind NFTs allows for much more than speculating on the price of animal pictures.

Instead, dApp developers are leaning on NFT technology to solve real-world problems.

As an example, startup Argo helps content creators more effectively monetize their audience by allowing them to sell short-form video content as NFTs (in addition to offering a more equitable share of ad revenue relative to competitors like YouTube).

Along the same lines, startup Curios allows musicians to sell their songs and albums as NFTs, allowing artists to bypass profit-draining middlemen like record labels and streaming services.

Conclusion

That concludes our list of the most important trends in the blockchain world happening right now.

Many of today’s dApps contain a host of problems (from security flaws to user interface issues).

However, as more developers learn the ins and outs of building decentralized applications, both innovation and improvements are happening at an increasingly fast pace.

Given this, it's fair to assume the companies and DAOs behind today's top blockchain applications will move towards increased efficiency, enhanced security, and a more publicly accessible user experience.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more