Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

17 Important BNPL Companies & Startups to Watch in 2024

You may also like:

- 15 Digital Payment Startups

- 5 Trends Shaping the Credit Card Industry

- 20 Trending Personal Finance Startups

BNPL (Buy Now Pay Later) companies allow customers to make purchases and pay the full amount in installments over time. Importantly, many BNPL providers don’t require any additional fees or interest rates on top of the original payment amount.

The BNPL industry is expected to continue to grow. A lot. The BNPL space is valued at $232.23 billion in 2024 and is estimated to grow to just over $1.0T by 2028.

The main driver of this growth? The popularity of BNPL among younger shoppers. Gen Z shoppers enjoy the instant gratification (and delayed pain of making a full payment) that BNPL provides.

With such strong and continued growth over time, it’s likely that more BNPL startups will launch to provide this payment option to customers worldwide. Let’s examine how key players are impacting and growing this space.

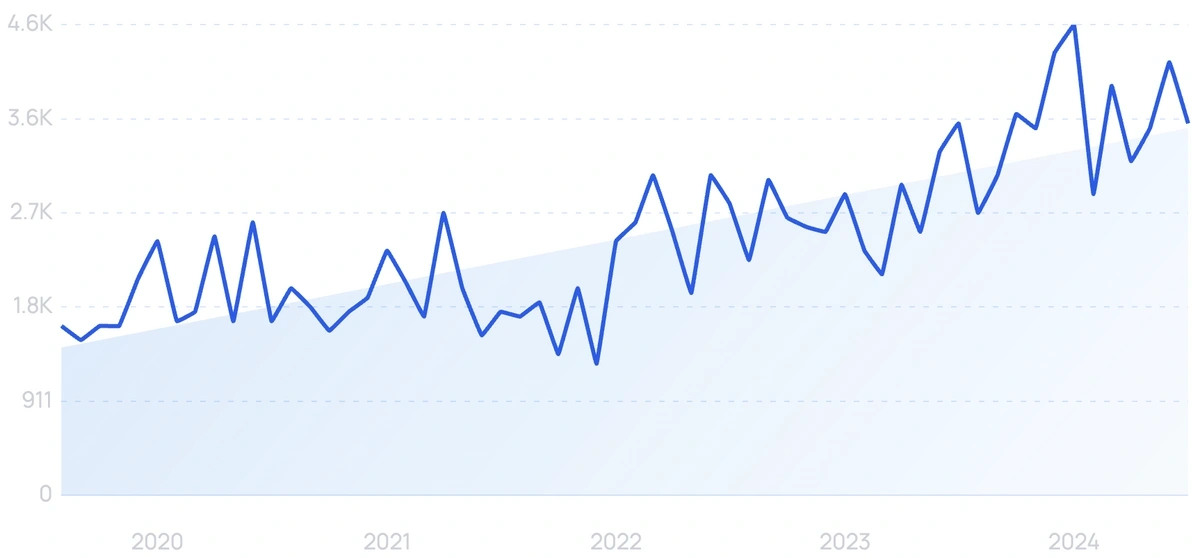

1. Sunbit

Search growth status: Exploding

Year founded: 2016

Location: Los Angeles, CA

Funding: $770M (Debt Financing)

What they do: Sunbit provides pay-over-time options for unexpected expenses, from auto repair to vet care. Used by thousands of customers, the application process is designed to approve 90% of applicants. To date, there are over 13,000 merchants who accept Sunbit for payment. In January 2024, Sunbit secured a $310 million warehouse debt facility from Citibank and Ares Capital Management.

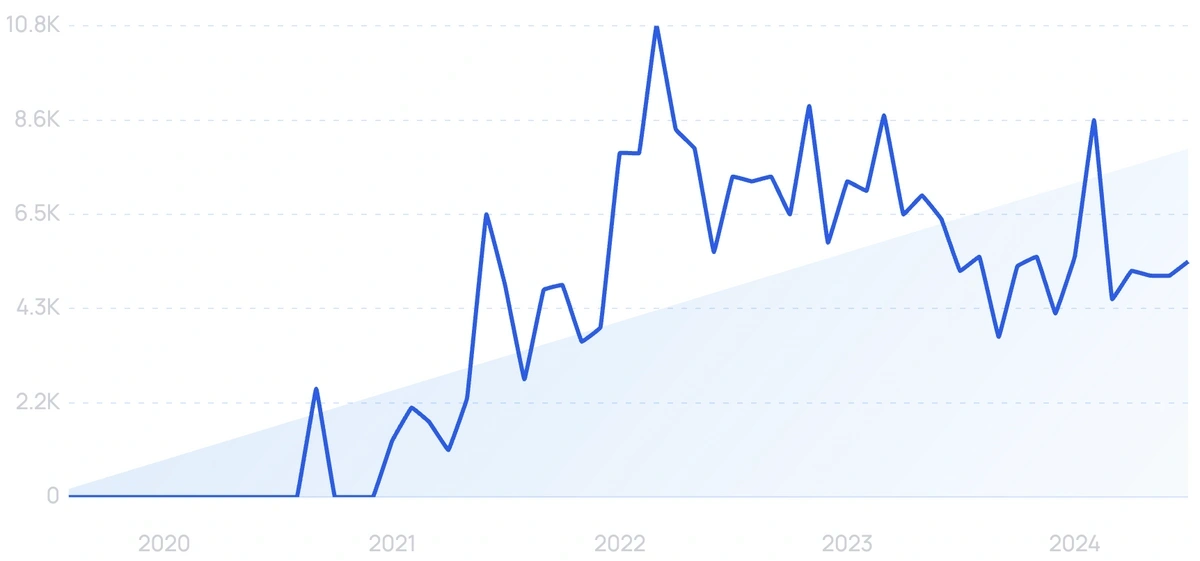

2. Affirm

Search growth status: Exploding

Year founded: 2012

Location: San Francisco, CA

Funding: $1.5B (Post-IPO Equity)

What they do: Affirm is a fintech company that provides customers with an alternative to credit cards when checking out. Partnering with over 2,000 merchants, customers are shown upfront what they will be paying each month, and there are no hidden or late fees. Some merchants, such as Amazon and Peloton, offer 0% APR.

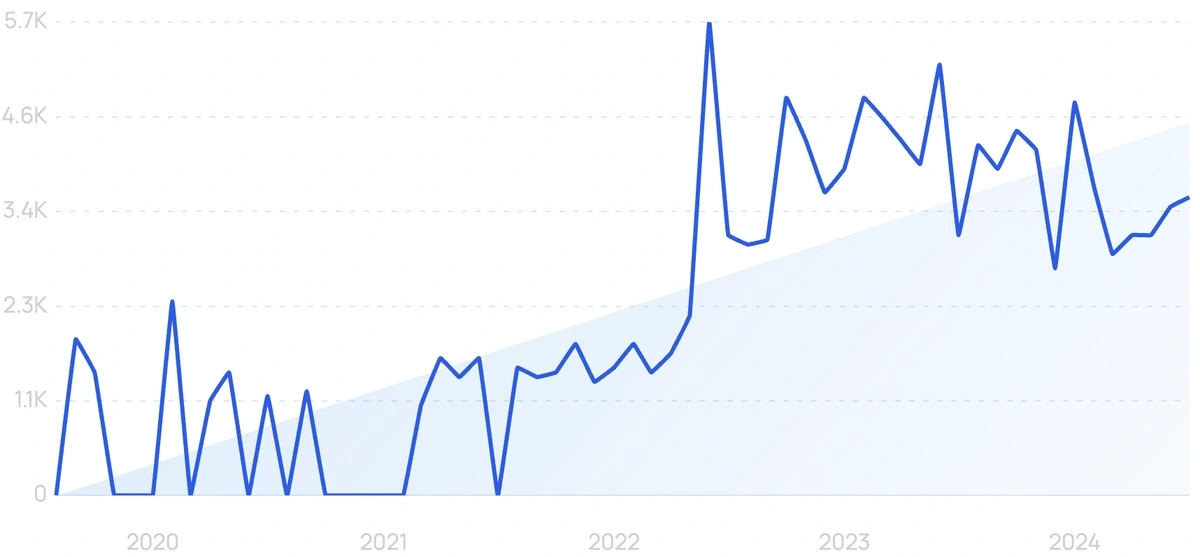

3. Scalapay

Search growth status: Exploding

Year founded: 2019

Location: Milan, Italy

Funding $727.5M (Series B)

What they do: Scalapay allows buyers to make purchases in-store and online and pay in 3-4 monthly installments. At checkout, users can choose from Visa, Mastercard or Amex. Used by over 5,000 merchants, Scalapay has increased online stores’ basket size by 48% and boosted conversions by 11%. After announcing a partnership with Marqeta, Scalapay announced they currently have over 5 million users across Europe.

4. Cashea

5-year search growth: 7,600%

Search growth status: Regular

Year founded: 2022

Location: Caracas, Venezuela

Funding: $1.3M (Seed)

What they do: Cashea is a BNPL startup that offers installment loans with 0% interest at the point of purchase in LATAM markets. More than 3,500 stores have integrated with Cashea to give consumers plenty of lending choices while shopping. In December 2023, Cashea claimed to have over 1.2 million users and expected to add another 800,000 by the end of the year.

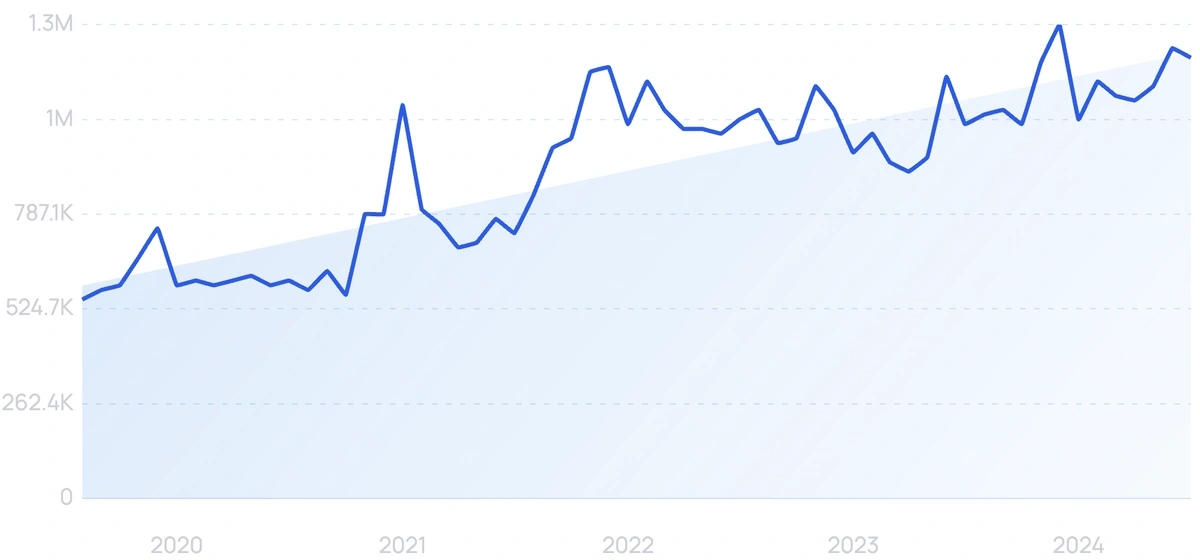

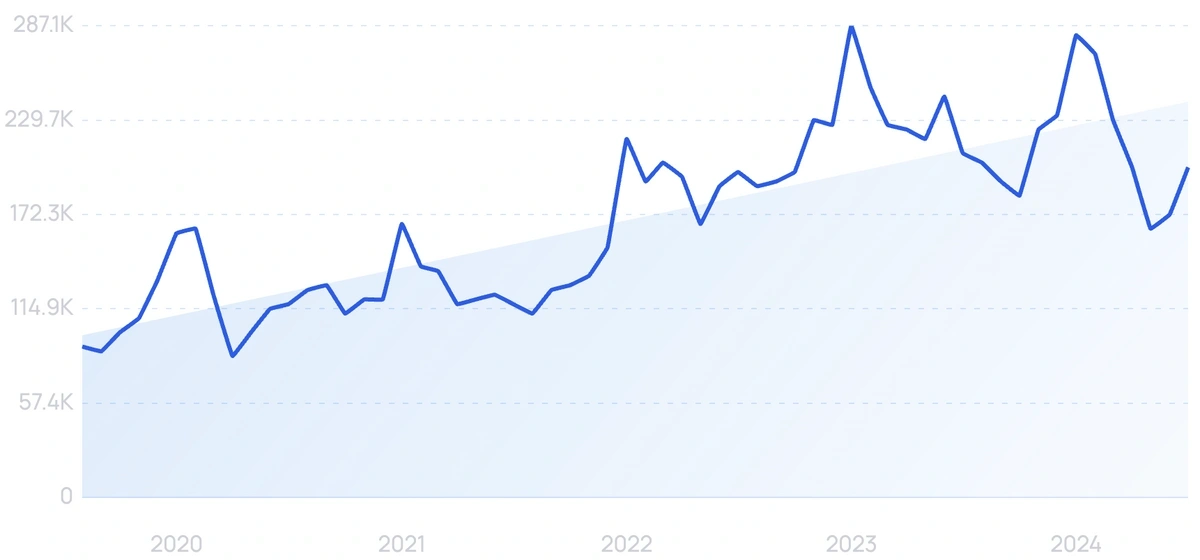

5. Klarna

5-year search growth: 100%

Search growth status: Regular

Year founded: 2005

Location: Stockholm, Sweden

Funding: $4.5B (Undisclosed)

What they do: Klarna is a BNPL platform for eCommerce companies. Users can split their transaction into 4 installments and choose when to pay, both in-person and online. Based on 1+ million reviews in the App Store, the Klarna app has been rated 4.8 stars. Today, Klarna supports 550,000+ merchants and processes over 2,500,000 transactions per day.

6. Fundiin

5-year search growth: 7,900%

Search growth status: Regular

Year founded: 2019

Location: Ho Chi Minh City, Vietnam

Funding: $6.8M (Series A)

What they do: Fundiin is a Vietnamese BNPL startup offering interest-free payment installments for retail and ecommerce businesses. Merchants using the platform see a 30% increase in revenue and a 1.8x boost in average order value. Today, Fundiin is the only BNPL provider on Shopify in Vietnam.

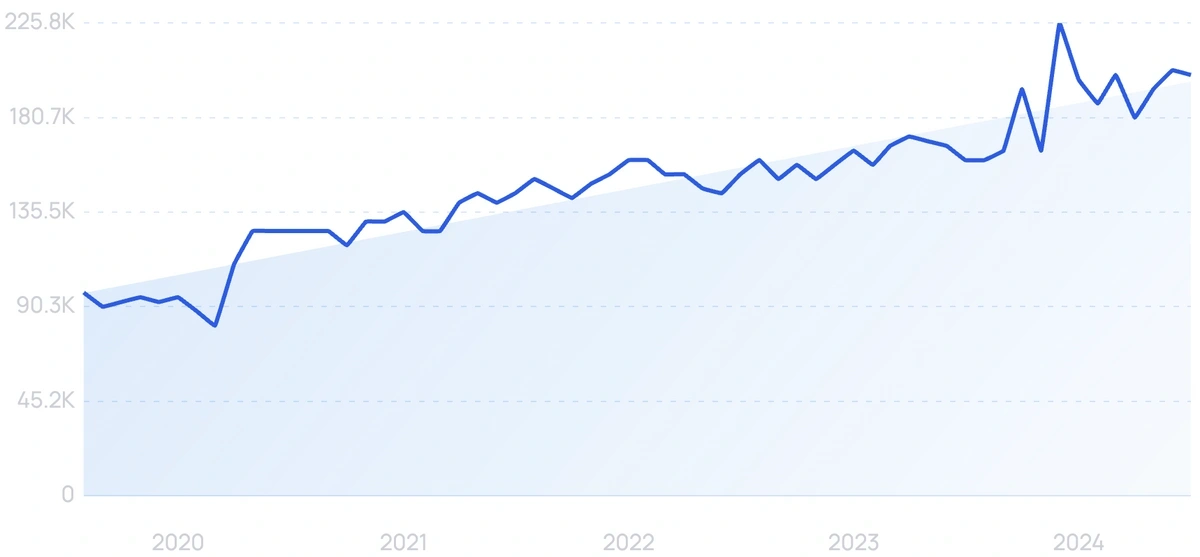

7. Tabby

5-year search growth: 138%

Search growth status: Regular

Year founded: 2019

Location: Riyadh, Saudi Arabia

Funding: $1.7B (Debt Financing)

What they do: Tabby is a financial services company that allows customers to make purchases in 4 interest-free payments. Unlike other BNPL solutions, the startup offers the Tabby Card, which also lets customers 'Pay in 4' at any store where VISA is accepted while earning 1% cashback. Today, the company partners with more than 30,000 brands to support over 10 million users.

8. Pathao

5-year search growth: 85%

Search growth status: Regular

Year founded: 2015

Location: Dhaka, Bangladesh

Funding: $14.8M (Series A)

What they do: Pathao is a digital services app that offers ride-sharing, food delivery, e-commerce logistics, and more. The startup introduced a "Pay Later" feature, making it Bangladesh's first-ever BNPL solution. This BNPL feature integrates with all in-app purchases like ordering food or requesting a ride. Today, Pathao has over 10 million users.

9. Zaver

5-year search growth: 33%

Search growth status: Regular

Year founded: 2016

Location: Stockholm, Sweden

Funding: $18.3M (Series A)

What they do: Zaver offers two checkout solutions for merchants: Zaver Checkout and Zaver Cashout. With Checkout, merchants can reduce checkout friction by using payment links to digitize physical sales and quick point-of-sale user experiences, even for small cart purchases.

Unlike alternative BNPL providers, Zaver spends its product development on advanced risk assessment algorithms to approve BNPL cart sizes of up to EUR 200,000. In March 2024, the Swedish startup raised $10 million in Series A funding to continue expanding operations.

10. Addi

Search growth status: Exploding

Year founded: 2018

Location: Bogota, Colombia

Funding: $462.3M (Debt Financing)

What they do: Addi gives customers the option to pay for their purchase in 3–24 monthly installments with 0% interest. The startup has partnered with over 13,000 brands and has helped merchants 3x their average cart size and increase sales by 20%. As of March 2024, the buy-now, pay-later app has 2 million customers.

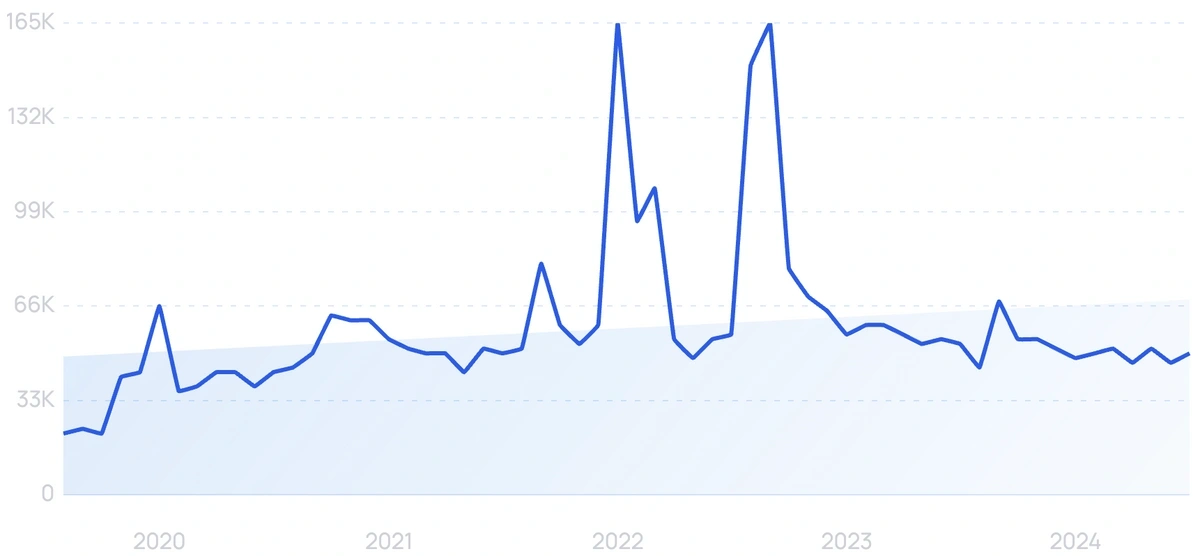

11. Paidy

Search growth status: Peaked

Year founded: 2008

Location: Minato, Japan

Funding: $397.9M (Series D)

What they do: Paidy is a Japanese BNPL platform that allows customers to shop online without a credit card or pre-registration. When customers are ready to check out, they enter their email address and phone number, receive a verification code sent via SMS, and finish transacting. Payments are due by the 10th of the following month. The company was acquired by PayPal in 2021 for $2.7 billion.

12. Tamara

5-year search growth: 64%

Search growth status: Regular

Year founded: 2020

Location: Riyadh, Saudi Arabia

Funding: $955.6M (Series C)

What they do: Tamara is a payments platform that serves customers in the MENA (Middle East and North Africa) region. Customers can make and split purchases using Tamara both in-store and online, with no additional fees or interest. Currently available in Saudi Arabia, United Arab Emirates, and Kuwait, the startup serves more than 10 million users and works with over 30,000 partner merchants.

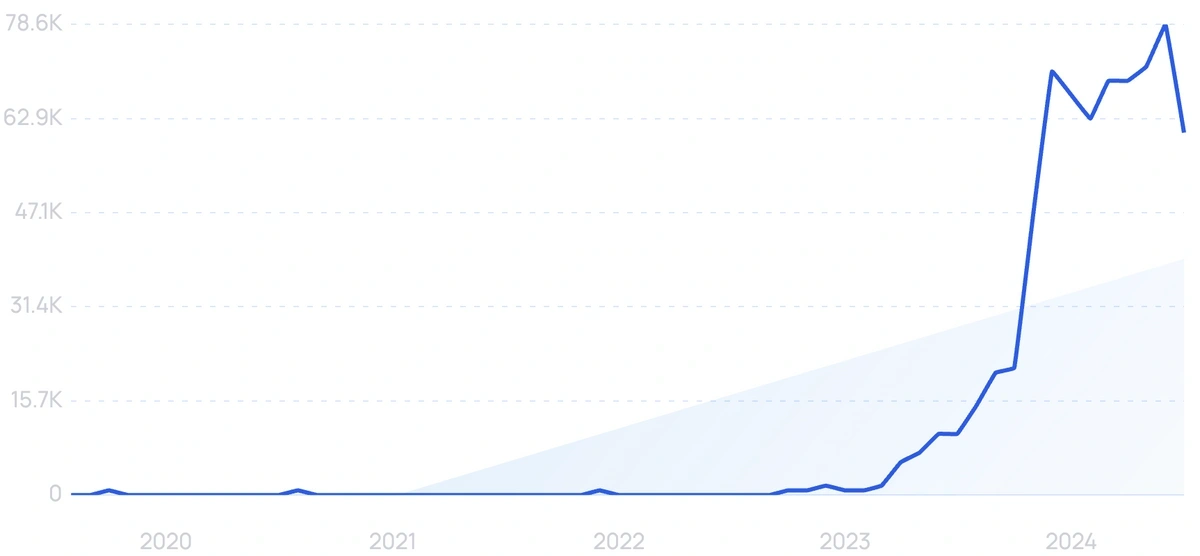

13. Capchase

5-year search growth: 5,200%

Search growth status: Regular

Year founded: 2020

Location: New York, New York

Funding: $1.1B (Debt Financing)

What they do: Capchase is a fintech and BNPL startup that provides non-dilutive financing for high-growth SaaS companies. In March 2023, Capchase entered the buy now, pay later space by launching Capchase Pay. This feature gives buyers flexible payment installments while giving the vendors the full contract value upfront.

It's estimated that Capchase did $40.5M in revenue and served 3,000 customers in 2023.

14. Hokodo

5-year search growth: 6,200%

Search growth status: Regular

Year founded: 2018

Location: London, England

Funding: $166.3M (Debt Financing)

What they do: Hokodo is a London-based BNPL payment solution for online and offline B2B sales. Buyers can choose from payment terms of 14, 30, 45, 60, 90 days, or end-of-month. Hokodo provides 100% credit and fraud risk protection and a Trade credit service that allows B2B merchants to offer credit terms to their business customers.

In April 2023, the startup secured a Series B extension from Citi to continue its expansion in Europe.

15. PayFlex

5-year search growth: 119%

Search growth status: Regular

Year founded: 2017

Location: Johannesburg, South Africa

Funding: $500K (Corporate Round)

What they do: PayFlex is a South African BNPL payment platform that enables customers to pay in 4 installments. With an Excellent rating from almost 25K customers on Trustpilot, merchants who use PayFlex have boosted their sales by 30%.

16. Sezzle

5-year search growth: 137%

Search growth status: Regular

Year founded: 2016

Location: Minneapolis, MN

Funding: $551.6M (Post-IPO Debt)

What they do: Sezzle is a payment platform that allows buyers to pay for their purchase over the course of six weeks and split it into four interest-free payments. Customers sign up, go through a quick approval process, and then shop from over 47,000 brands that have partnered with Sezzle.

In 2024, more than 31,000 merchants use Sezzle as a BNPL option on their websites to support over 2.6 million active customers.

17. Beforepay

5-year search growth: 6,800%

Search growth status: Regular

Year founded: 2019

Location: Sydney, Australia

Funding: $46.1M (Corporate Round)

What they do: Beforepay is a BNPL company that offers a Pay On Demand feature through which customers can access a portion of their earned wages before the traditional payday. For a fixed 5% fee, users can access up to $2,000 of their pay early to make purchases and then repay the amount over time. In July 2023, Beforepay reached 1 million customers and $1 billion in total pay advances.

Conclusion

That’s our list of the top BNPL companies in the space right now.

One major trend among these companies is offering zero fees and interest payment installments. Customers have grown accustomed to this key feature and would likely respond poorly to any companies that charge additional fees for using a BNPL service.

Many companies are also emphasizing pricing transparency — they’re aware that customers are skeptical of hidden fees or additional charges, so many feature language about this on their homepage to reduce customer friction.

To conclude, the BNPL business model is likely here to stay and flourish, as these companies provide payment flexibility and allow customers to make large purchases without worrying about paying the full amount upfront.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more