Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Important Small Business Trends (2024-2026)

You may also like:

Almost 5.5 million new businesses were started in the US in 2023. That was a record-breaking number, 56.7% higher than the one seen in 2019.

The pandemic really kick-started this surge in new enterprises. Both 2021 and 2022 also saw at least 5 million businesses founded.

Because of this, small businesses will likely have an outsized effect on the US and world economy for years to come.

To understand how this area of the economy could change in the future, read on.

1. Large Platforms Offer New Ways To Start A Business

The idea of what a small business can be is changing.

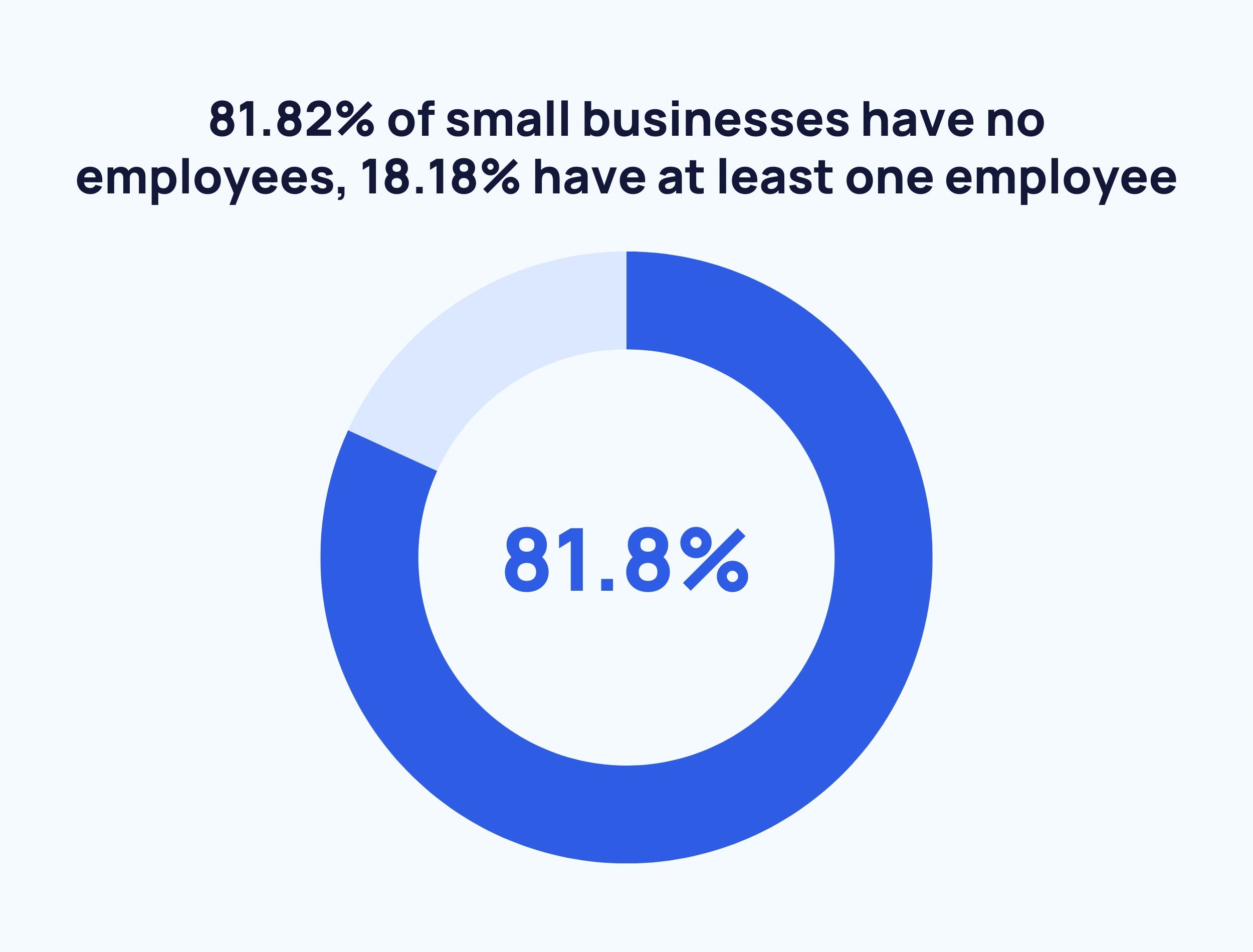

According to Pew Research, there are approximately 33 million small businesses in the US.

Of these, roughly 82% are businesses with zero employees.

And while this trend isn’t particularly new, expect it to grow in the future.

For instance, the entire Amazon ecosystem has allowed millions of solo entrepreneurs to spring up.

E-commerce retailers are some of the biggest beneficiaries. Last year, in the US alone, independent sellers sold more than 4.5 billion items.

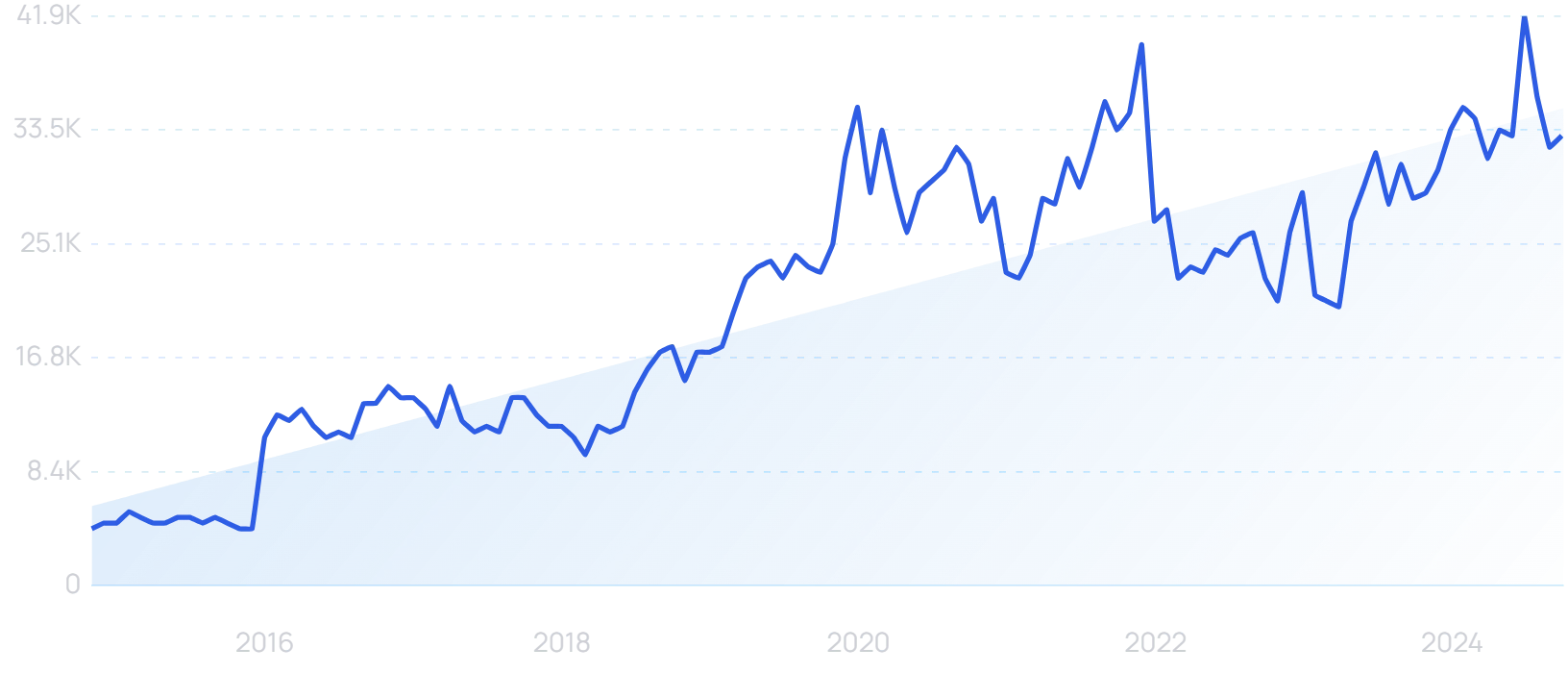

Search interest in "Amazon Marketplace" has risen by 137% over the last 5 years.

But that’s just the beginning.

Each month, Kindle Direct Publishing distributes a global fund to independent authors on the platform based on the number of pages users have read through Kindle Unlimited.

In September 2024, the fund stood at $56.4 million.

“Kindle Direct Publishing” searches are up 62% in the last 10 years.

Meanwhile, all the physical goods being ordered from Amazon require someone to deliver them. That demand has been met by a flood of small businesses.

Amazon reports that since launching its Delivery Service Partner program in 2018, more than 4,400 partners have built their own businesses.

The Apple App Store and Google Play Store ecosystems have provided similar opportunities.

With roughly 1.81 million and 2.18 million apps respectively, Apple and Google have no problem attracting developers as well as customers.

Substack is doing the same thing with online publishers.

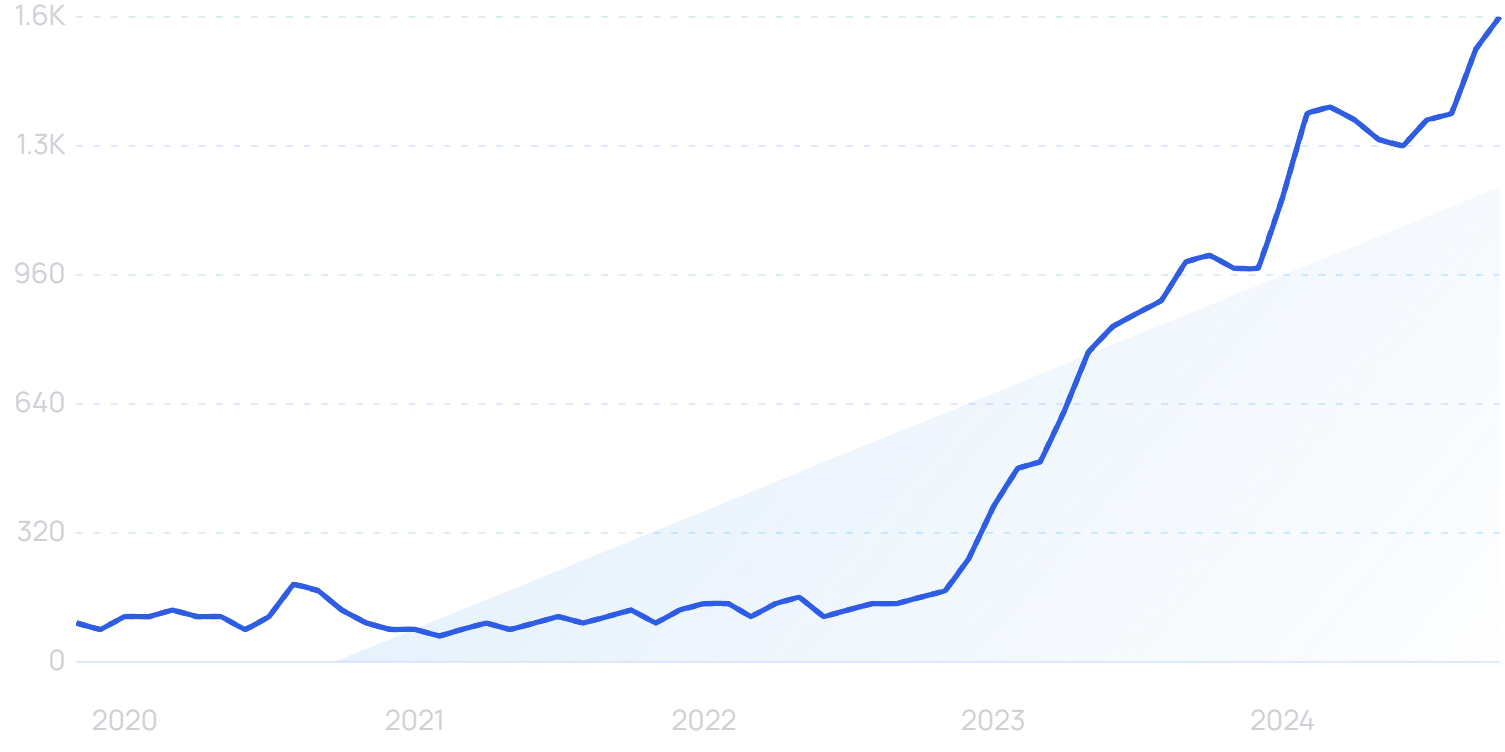

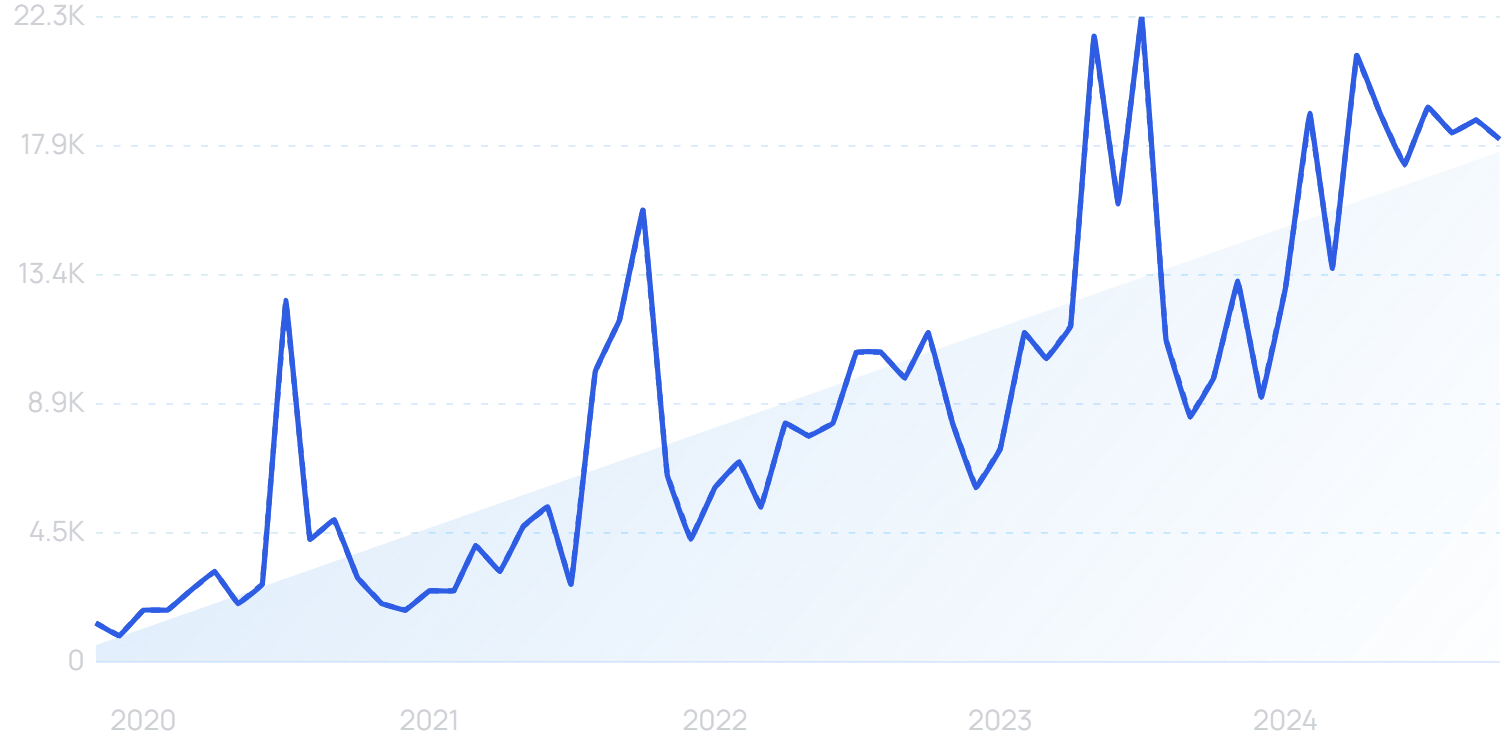

Searches for "Substack" have grown by 4,900% over the last 5 years.

The company allows individuals to start their own newsletter businesses.

While the writer writes, Substack handles the tasks of subscription management and distribution.

This kind of platform obviously appeals to readers as well, as is evidenced by Substack’s 2 million+ paying subscribers across the platform.

Ghost, a non-profit competitor to Substack, has taken a different route.

Ghost is an alternative to Substack for publishers.

The organization provides open-source software for bloggers and media companies.

Ghost makes it easy to start a blog or media business and doesn’t take a cut of the revenue that writers generate.

Instead, the company offers a free platform, but in addition, offers several premium tiers (at monthly subscriptions) for writers, based on the amount of features and support needed.

There have been over 100 million Ghost installs since its inception in 2013.

2. Small Business Commerce Shifts Online

E-commerce already accounts for a fifth of total retail sales worldwide. By 2027, that figure is expected to be 22.7%.

This shift doesn’t just affect large retail stores or popular direct-to-consumer brands. Small businesses are increasingly looking to E-commerce to survive.

A PYMNTS survey of “Main Street” small-and-medium-sized businesses (SMBs) found that almost 8 in 10 SMBs leverage online channels in some way.

With the right SEO, small businesses can enjoy massive online success.

Semrush is a great option for small businesses looking to grow their online presence.

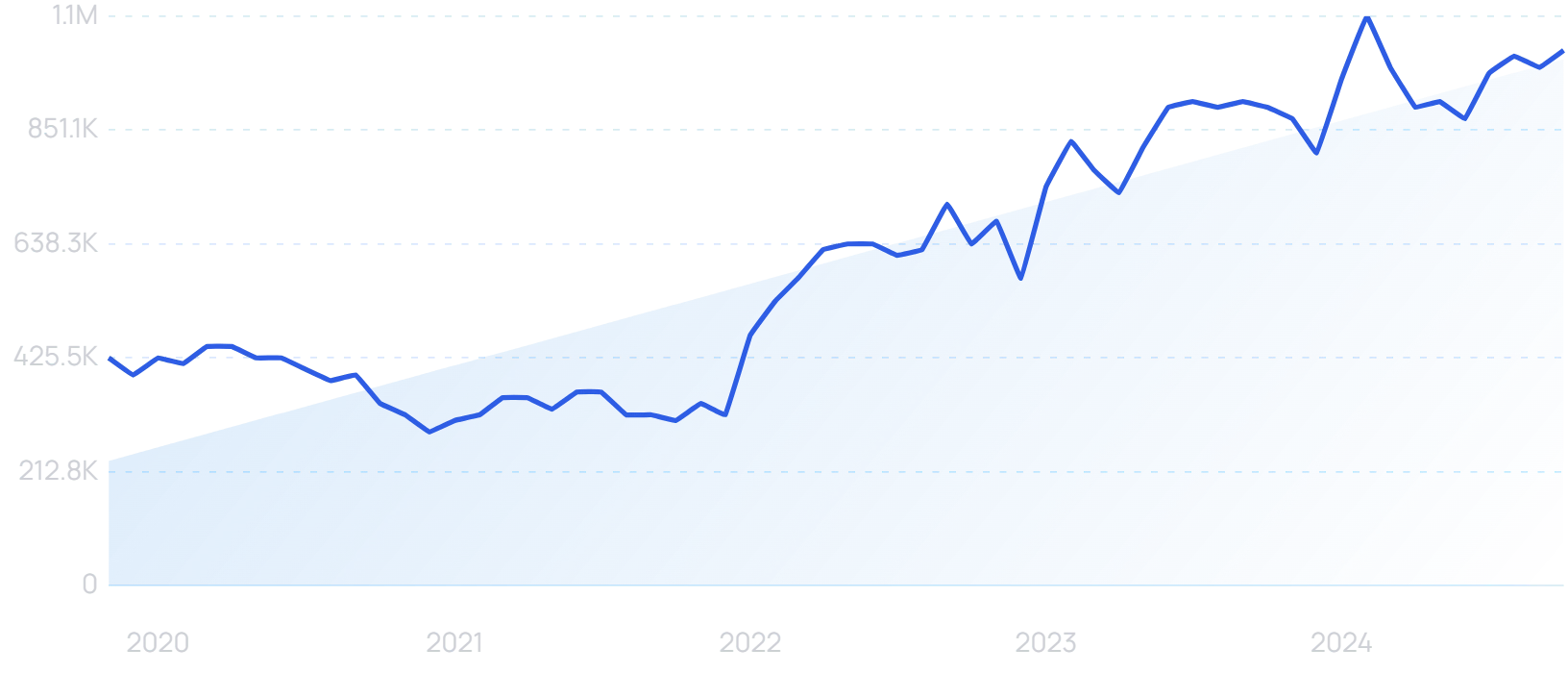

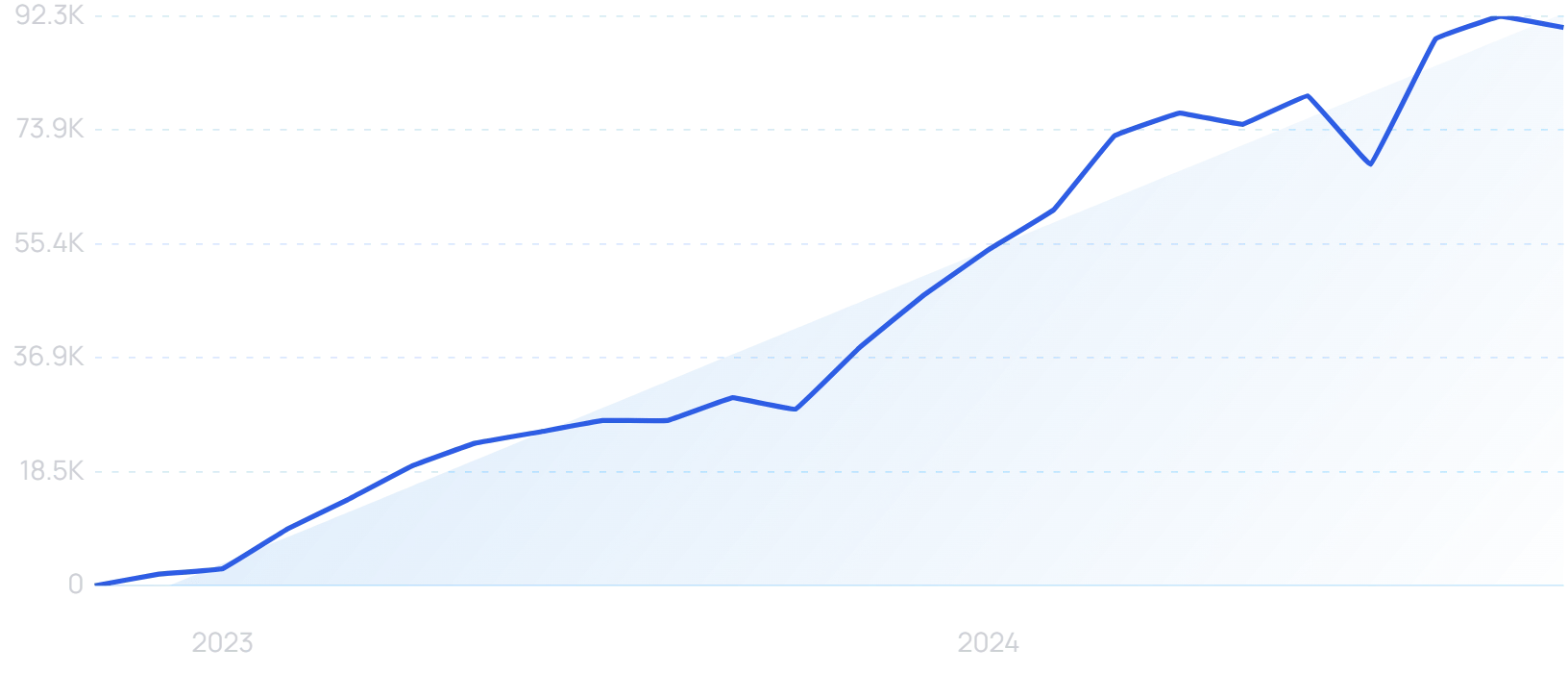

“Semrush” searches are up 135% in the last 5 years.

It’s an all-in-one SEO and content marketing platform, meaning companies on smaller budgets don’t need to shell out on a host of different software.

And the Semrush suite is a powerful one. Tools like the SEO Writing Assistant, Keyword Magic Tool and Link Building Tool all help small businesses to rank for relevant keywords.

This can ultimately lead to E-commerce sales. Just ask cat furniture brand Hepper, which increased revenue by 2964% using Semrush.

Third-party services like Shopify, Etsy and Amazon are also increasingly popular for small businesses targeting E-commerce success.

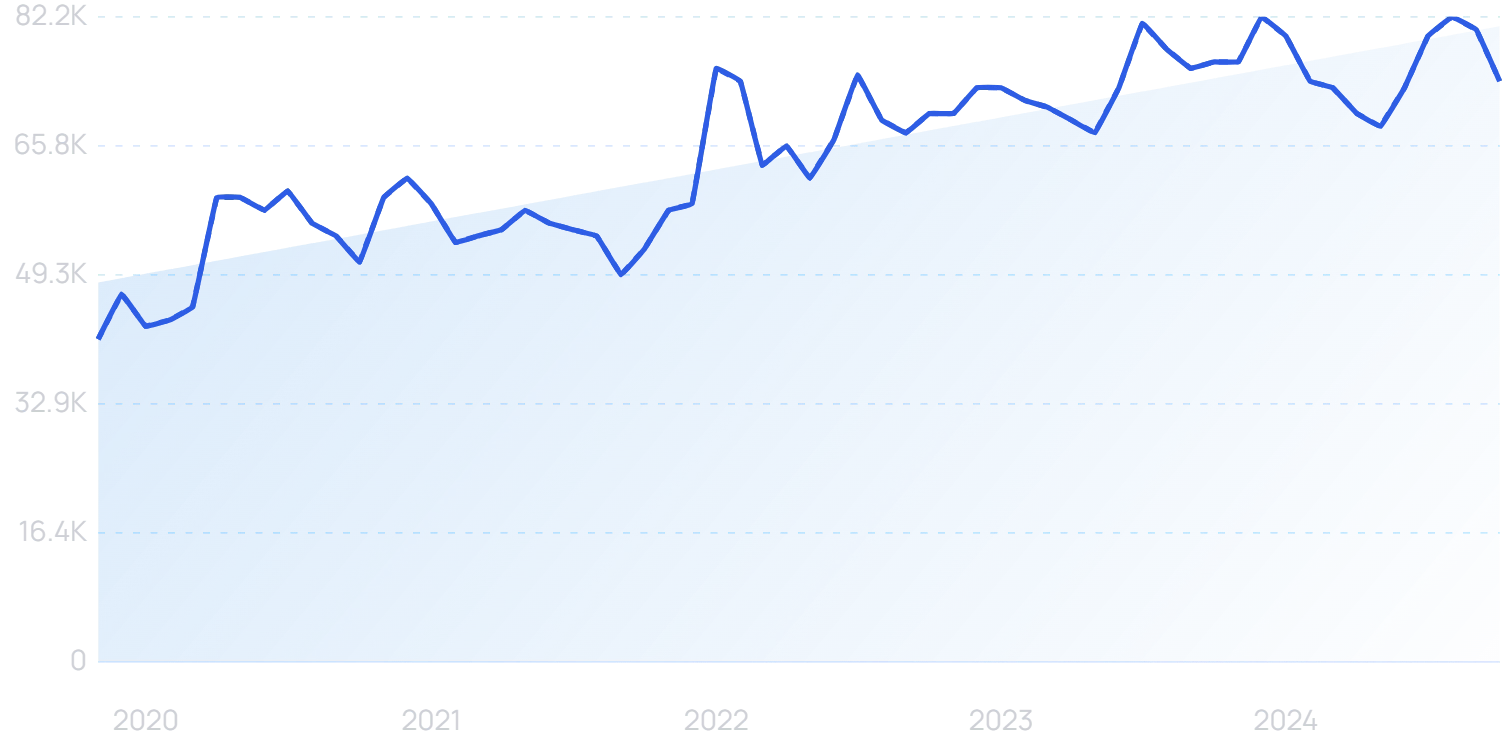

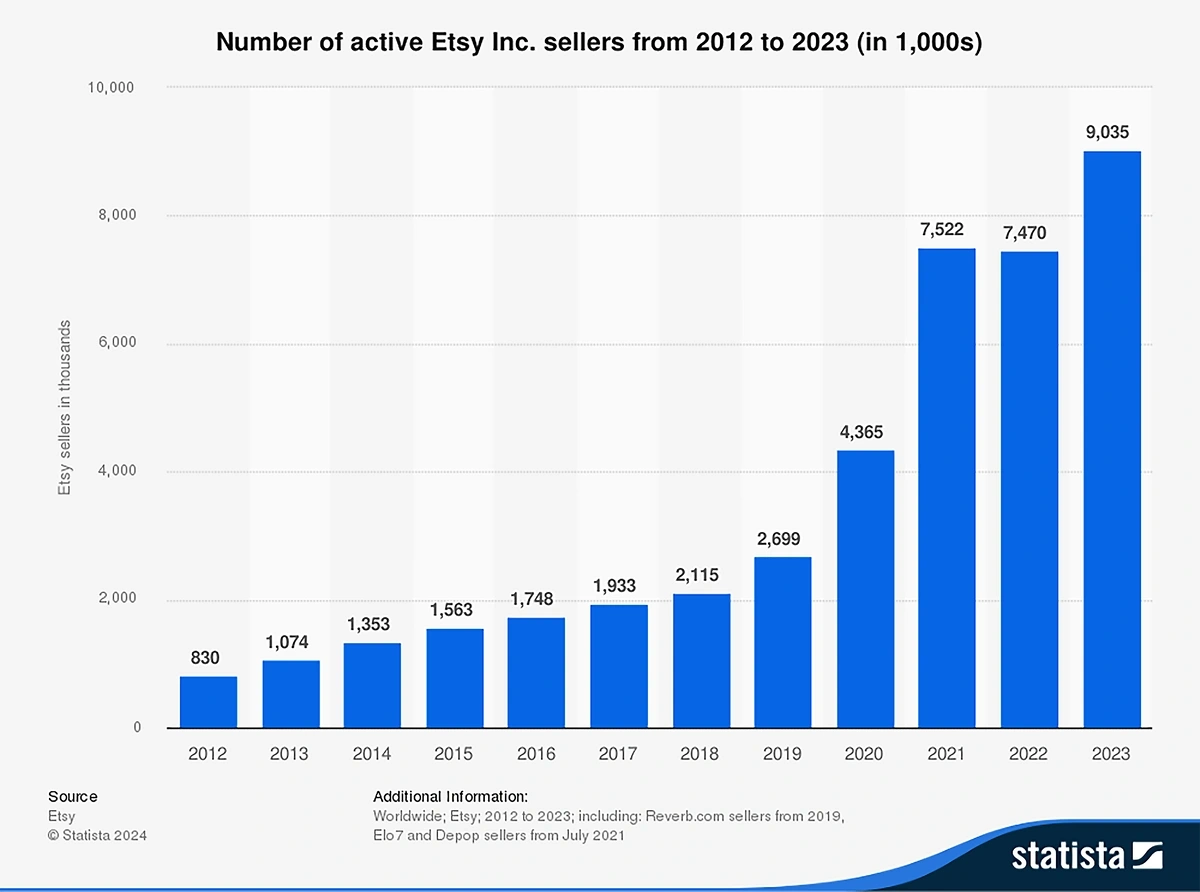

Etsy, for instance, had over 9 million active sellers last year. That was a year-over-year increase of more than 1.5 million sellers.

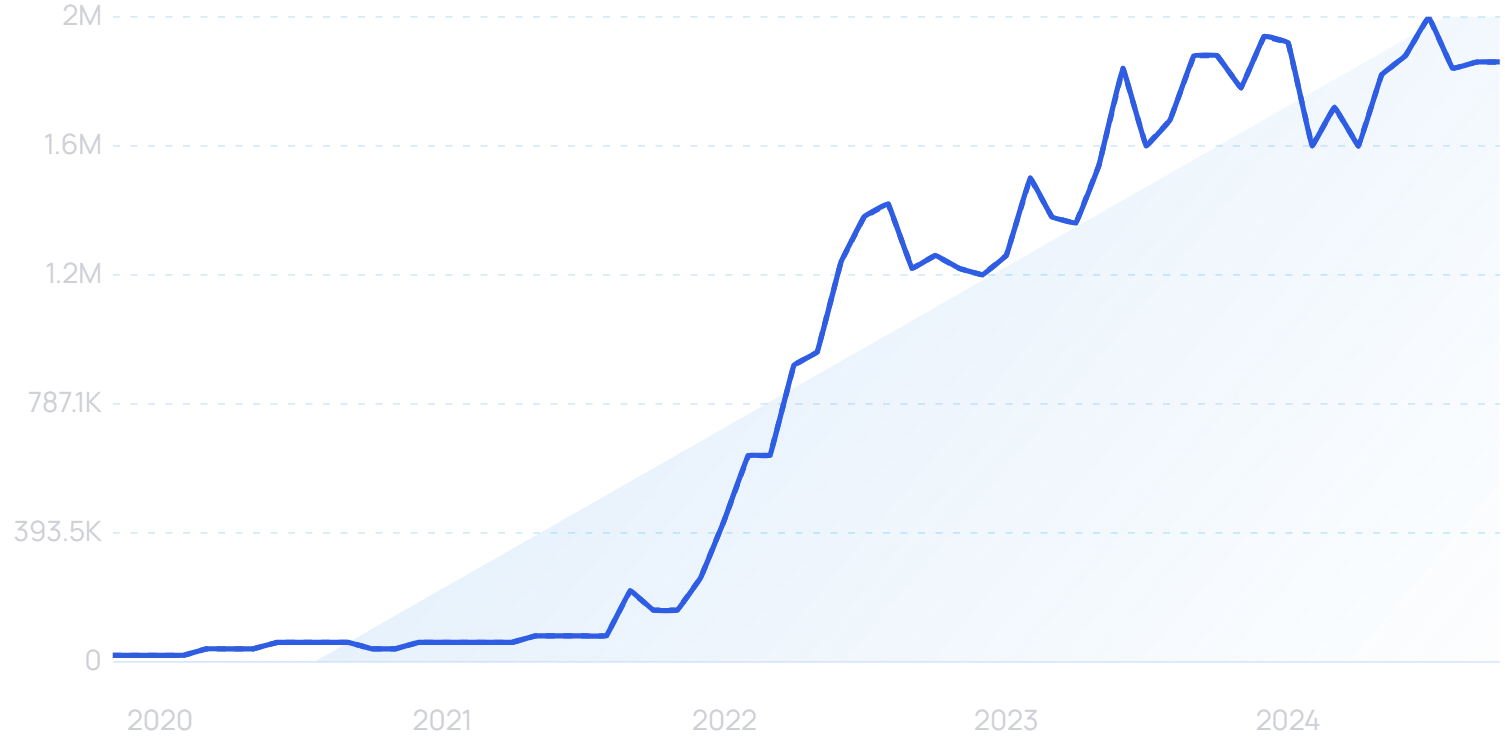

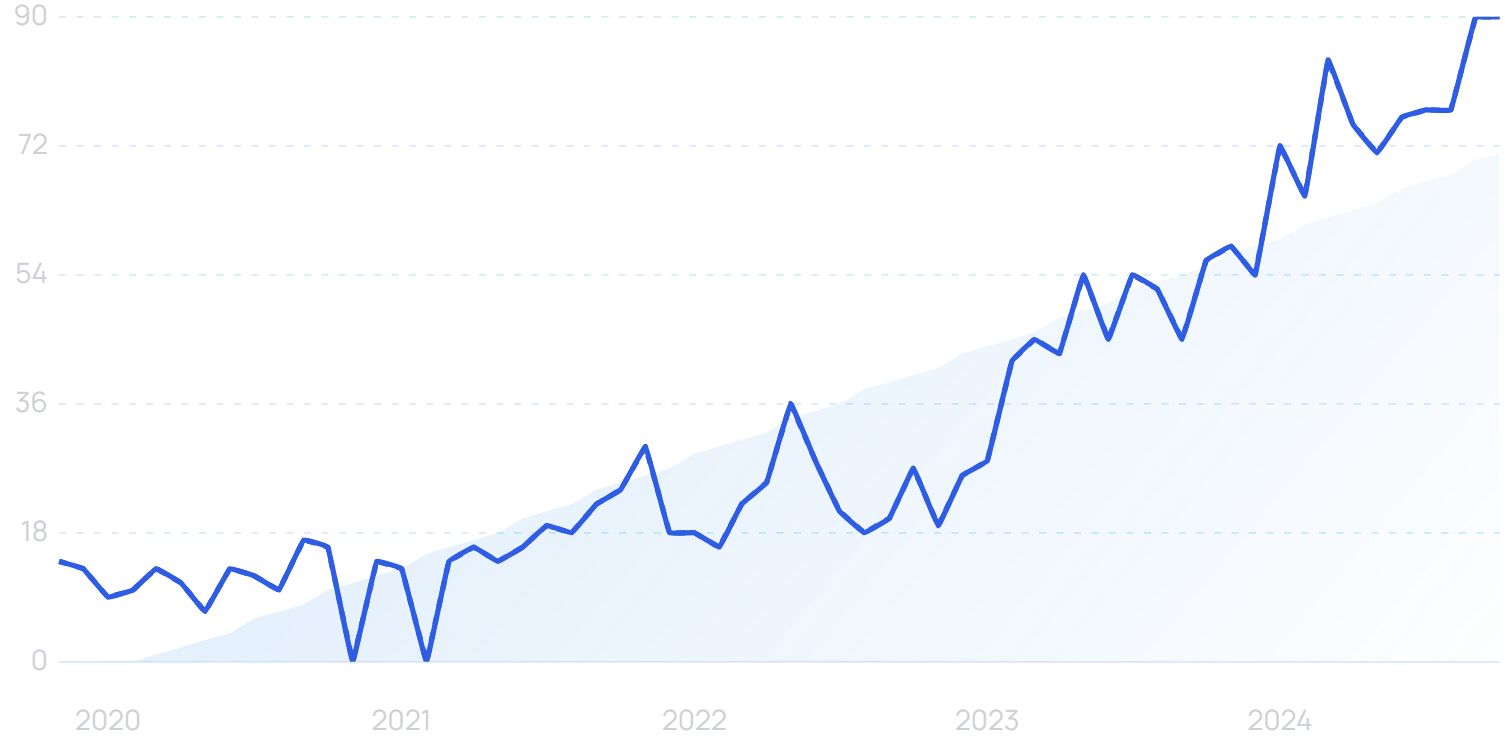

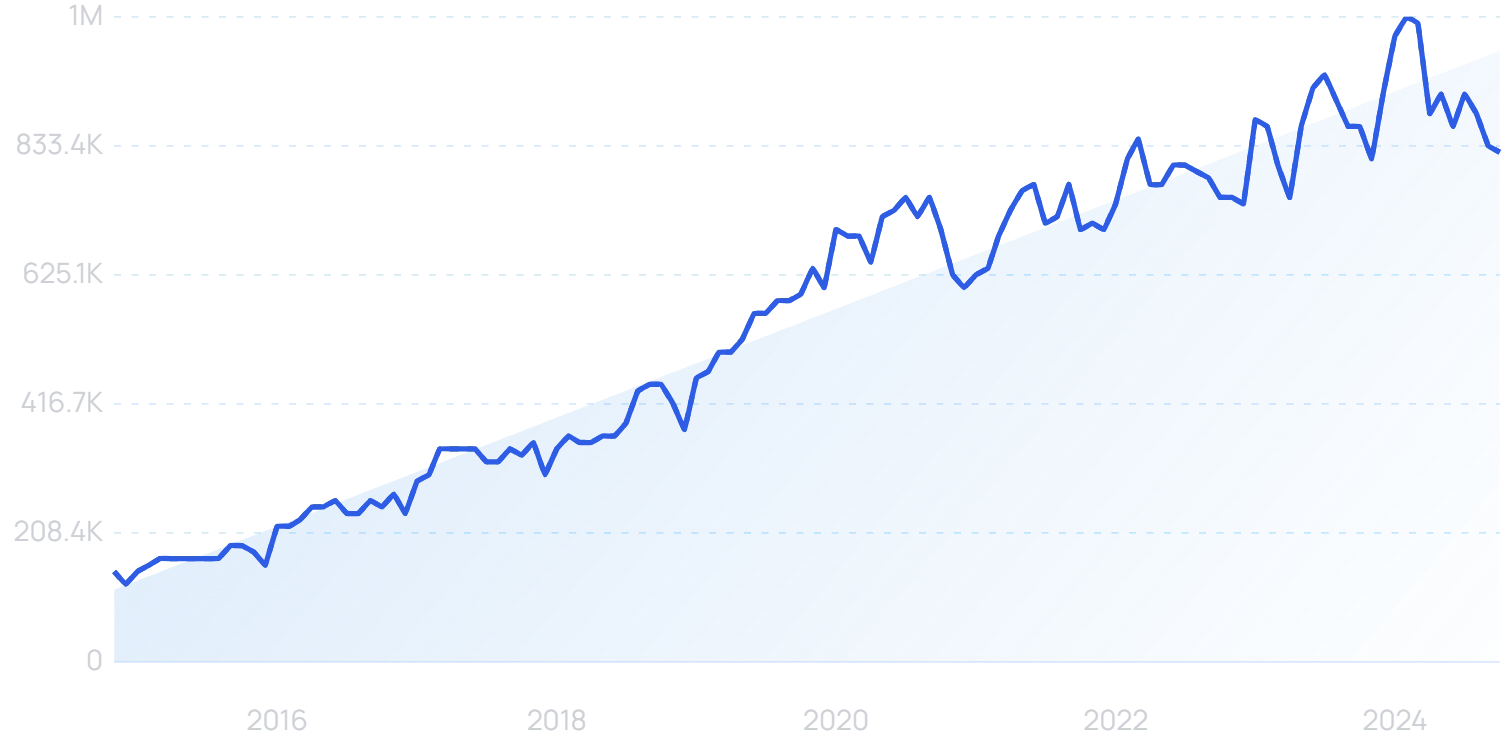

The number of active Etsy sellers has risen steeply in recent years.

The number of sellers has more than doubled since 2020.

Although it is primarily known as one of the largest businesses in America, Amazon’s third-party platform also offers a way for millions of small businesses to sell products online.

In fact, more than 60% of sales on Amazon now come from independent sellers, the majority of which are SMBs.

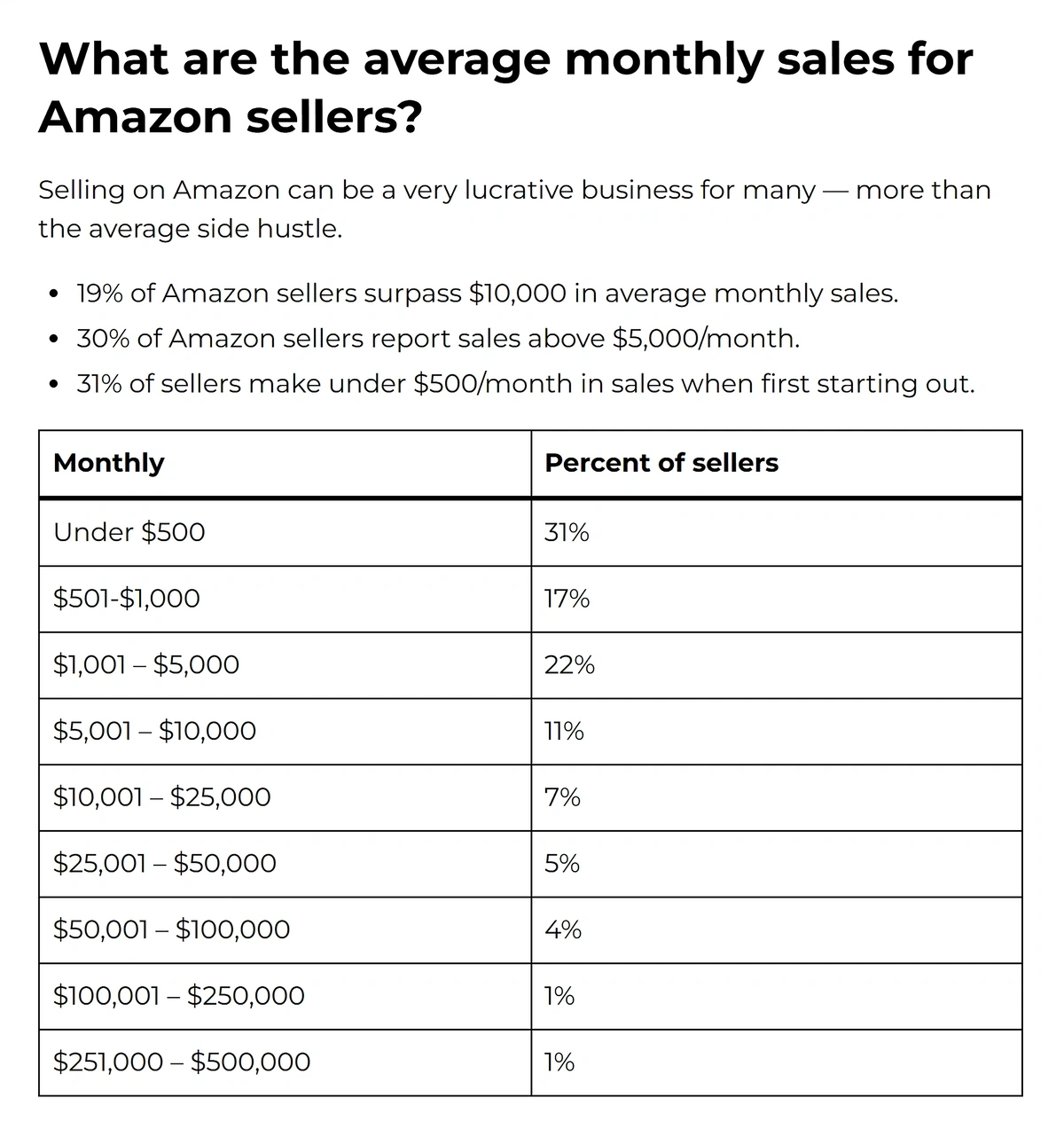

According to JungleScout, 48% of Amazon sellers make between $0 and $1000 in average monthly revenue.

Selling on Amazon can be very lucrative, but it’s still primarily the realm of small and medium-sized businesses.

But almost one in four SMBs selling on Amazon have hit lifetime sales of over $100,000.

Shopify, a platform that allows merchants to set up their own E-commerce portals, estimates that there are now more than 4.8 million businesses using its online storefronts.

Tools like our free E-commerce keyword tool can help small businesses establish an online sales niche.

The burgeoning social commerce scene is also a potential gold mine for small businesses.

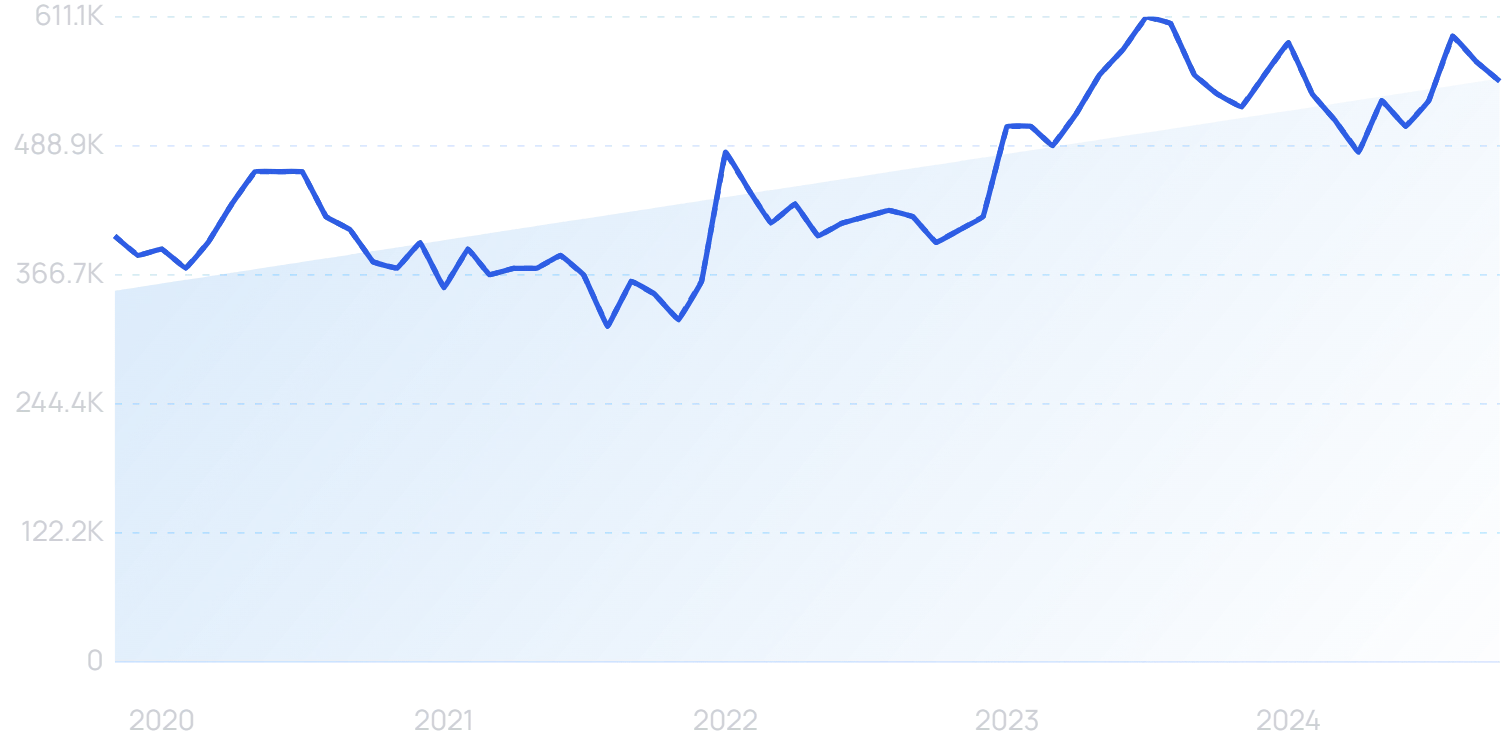

Much of Gen Z and Gen Alpha are now at home on TikTok Shop.

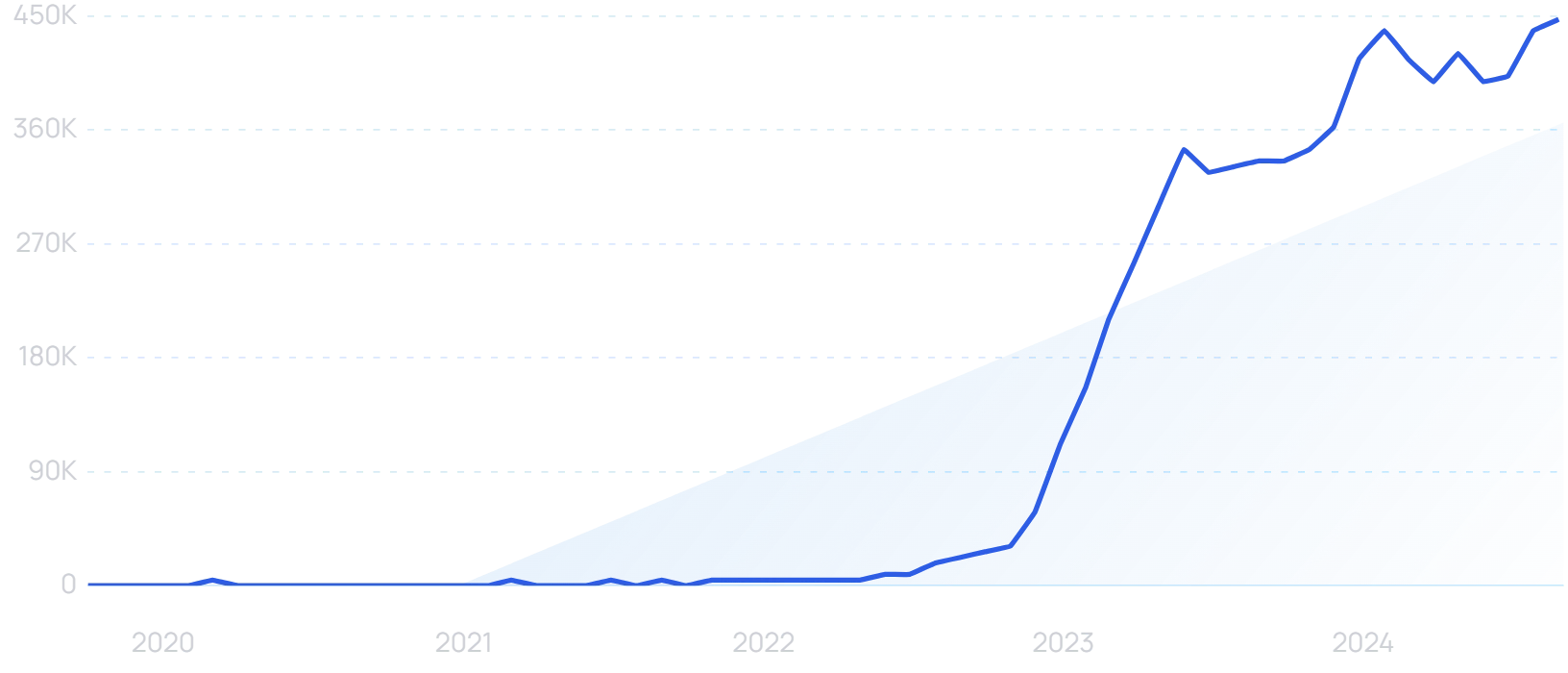

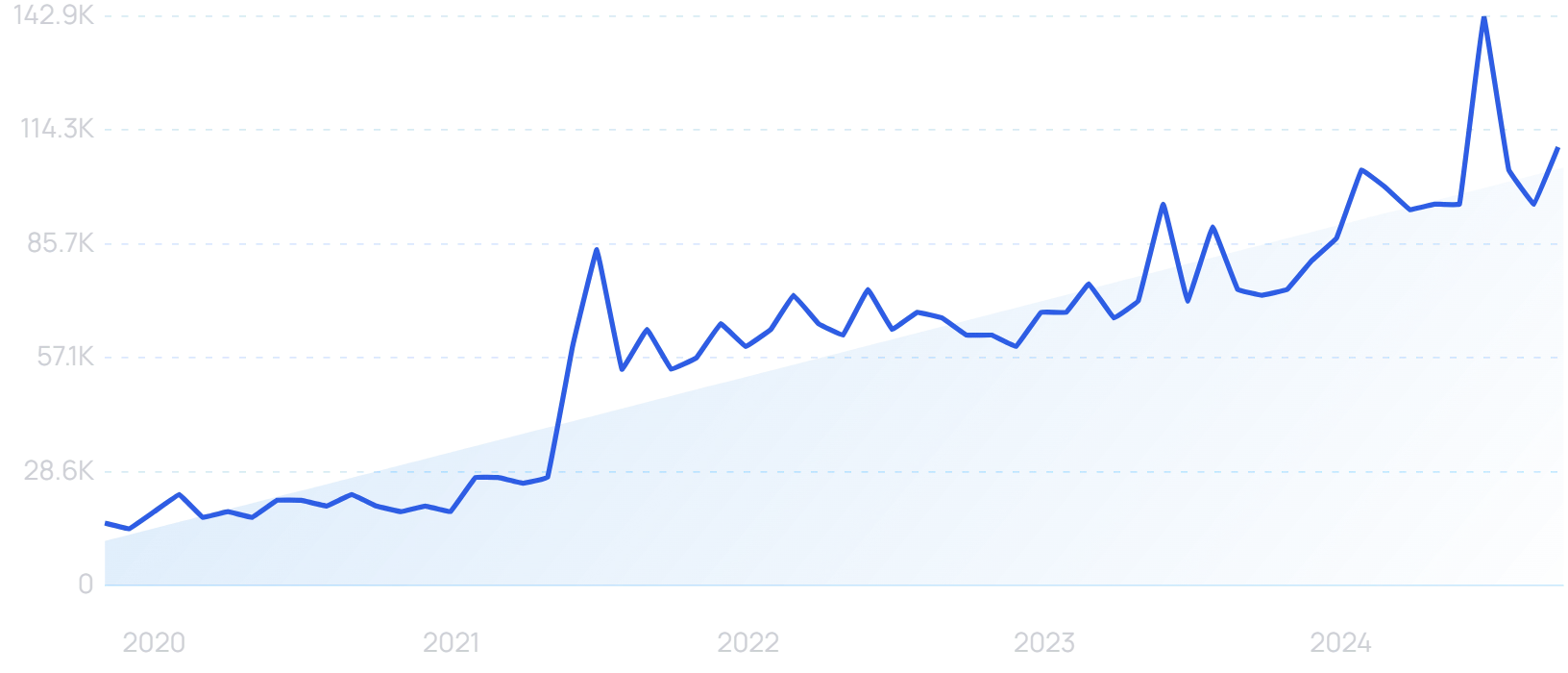

“TikTok Shop” searches are exploding.

Earlier this year, cosmetics brand P Louise banked around $2 million on the platform in the space of 12 hours.

Expect more traditional small businesses to explore new E-commerce channels and bolster their online presence in the near future, especially as the tools to help them succeed grow ever more sophisticated.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

3. Generative AI For Small Businesses Becomes The Norm

For businesses with a small number of employees (or even none at all), efficiency gains are always going to be valuable.

So perhaps nobody stands to gain more from generative AI than small businesses.

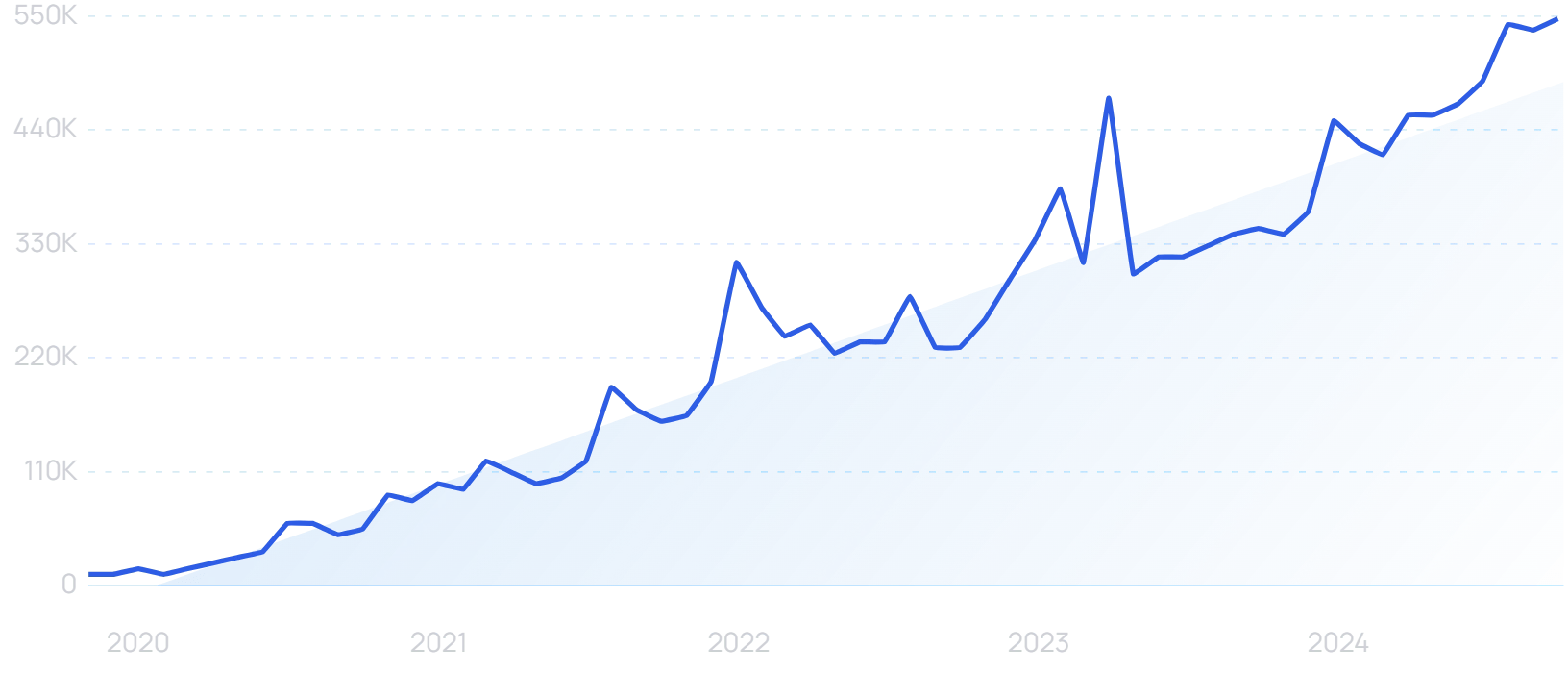

“Small business AI” searches have increased by 1800% in the last 5 years.

It’s little wonder that two out of three small business owners say they will try out generative AI within the next 12 months.

Use cases vary hugely by industry. But the common thread is a significant degree of automation.

According to one study by the Nielsen Norman Group, AI in the workplace is already improving efficiency by 66%.

That data was collated from three studies looking at very different contexts: customer service agents, experienced business professionals, and software developers.

In the world of programming, there are AI tools like Codeium.

“Codeium” searches are up 9700% in the last 2 years.

Codeium leverages generative AI as a code completion tool. It also features an AI chatbot designed to assist programmers.

It raised a $65 million Series B round earlier this year at a $500 million valuation.

As well as industry-specific tools, small businesses can use AI for relatively universal tasks, like designing a logo.

“AI logo generator” searches are up 99X+ in the last 5 years.

This decreases barriers to entry for small businesses that are just starting out. And once the logo is sorted and things are up and running, AI can continue to help with building a brand.

Designs AI is one popular platform. It helps small businesses to make a whole range of marketing materials.

The Designs AI toolkit.

There’s the logo tool. But users can also create text, images, videos, voiceovers and more.

In the past, this might have required a variety of different industry professionals. It’s clear that AI presents some valuable opportunities to small businesses.

4. Creative Financing Allows Small Businesses To Grow

Small businesses are funded in a wide variety of ways.

Traditional loan providers like banks have historically been responsible for the majority of funding decisions.

That remained the most popular method of funding in a recent Forbes Advisor survey, with 27% of entrepreneurs citing business loans as their primary source of financing.

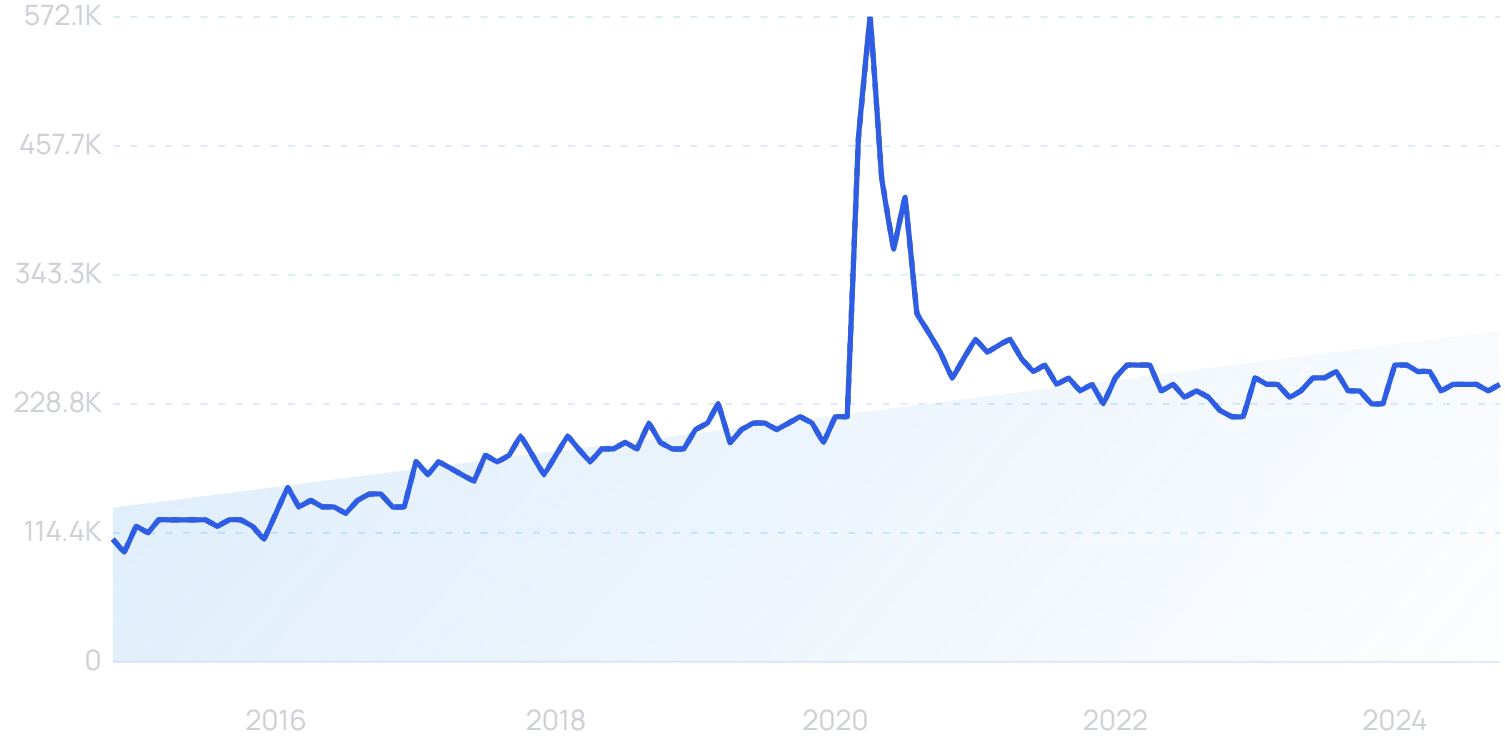

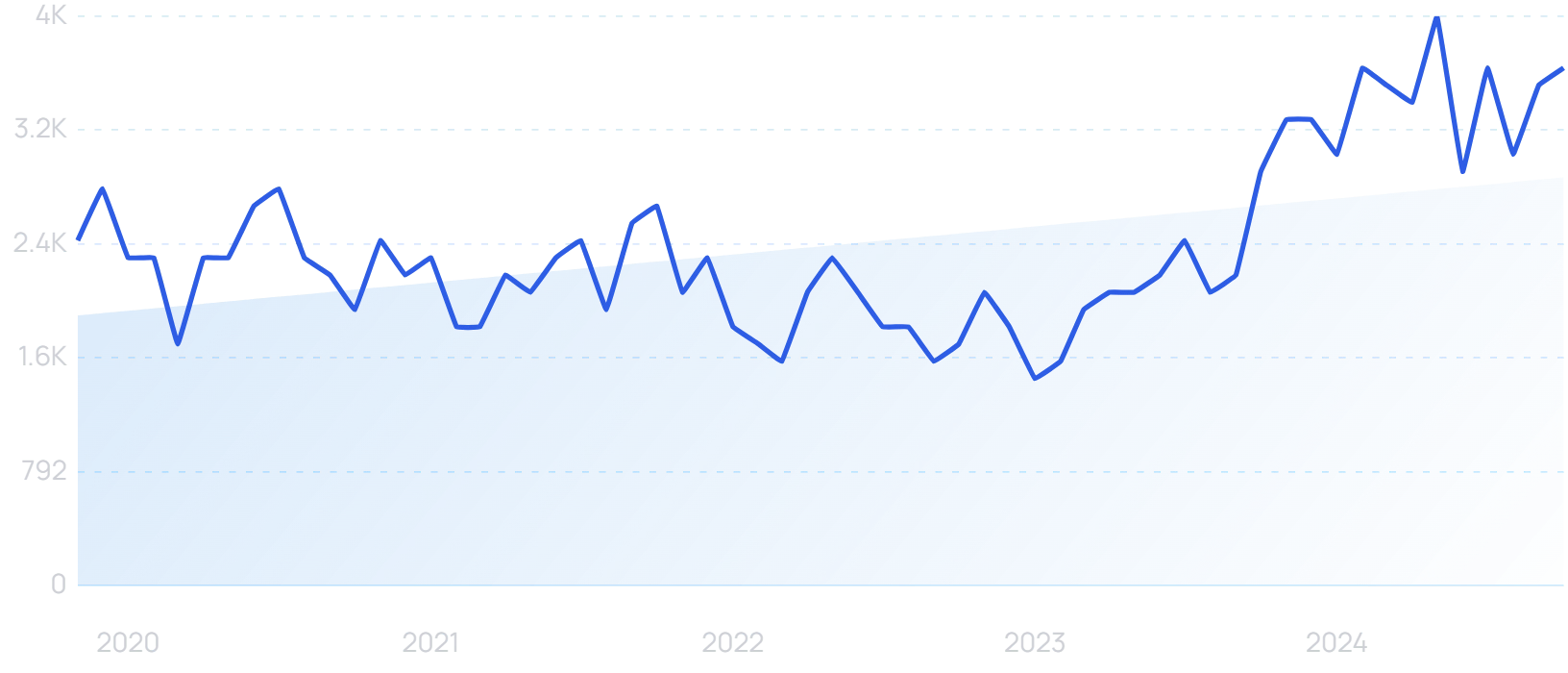

“Business loan” searches spiked at the start of the Covid-19 pandemic, when some governments were offering financial support. That aside, interest is trending gradually upward.

Put simply, privilege is also a common factor in startup funding. 20% of new businesses are funded by borrowing from family and friends, with a further 17% backed by personal savings.

But we are seeing a shake-up in business financing.

Even with the large number of banks in the US, many small businesses aren’t getting the funding they require.

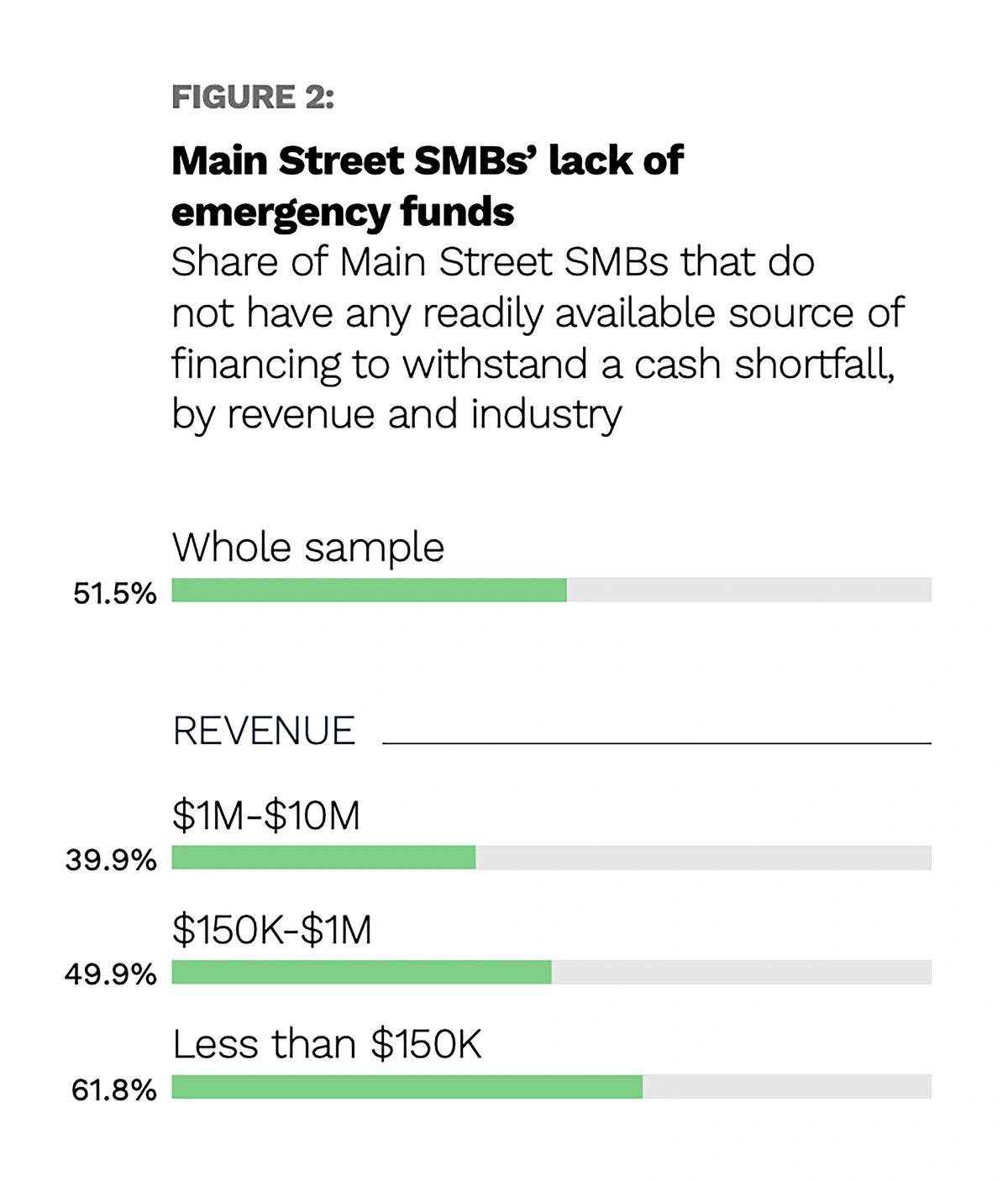

Not everyone can rely on friends or savings. More than half of SMBs in the US do not have a readily available source of funding to survive a cash flow crisis.

Almost 62% of businesses with annual revenues below $150,000 lack ready access to financing.

And a UK study found that 31% of SMBs have had to stop or pause an area of their business due to lack of financing.

It’s fairly obvious that small businesses and new entrepreneurs are in need of more capital. And there are a variety of fintech start-ups trying to solve this problem.

Automated business lending platform Kabbage was one major player in this space — before it was bought out by American Express for a rumored $850 million in 2020.

Today, DeFacto is an emerging company in this sector.

“DeFacto” is an SMB lending platform.

Powered by AI, lending decisions take less than 27 seconds on average. So far, DeFacto has loaned out more than €500m (about $540m).

“AI lending” searches are up 733% in the last 5 years.

One thing all SMB-focused fintech lenders have in common, however, is that they are not banks.

This means that they can’t offer FDIC-insured deposits. As a result, the type of lending they can do is handicapped as well.

Neo-banks have greater lending capacities. And some have been set up specifically with SMB loans in mind.

London-based Allica Bank is designed for established businesses with between 5 and 250 employees.

“Allica Bank” searches are up 1500% in the last 5 years.

To date, Allica has lent over $2.6 billion to businesses. And according to Deloitte, the bank has grown by 85,438% in three years.

Elsewhere, there’s Judo Bank in Australia, and Found in the US. The latter is not a bank, but has partnered with FDIC member Piermont Bank to insure funds up to $250,000.

But while fintechs and neo-banks are starting to make a dent in the market, they aren’t the only ones pursuing this opportunity.

Some of the top retail marketplaces in the world are taking steps to offer financing to their merchants.

Shopify Capital – Shopify’s financing arm for merchants – has lent more than $5 billion to small businesses. Loans have ranged from the low hundreds to $5 million.

Amazon has its Lending platform for sellers. US sellers can apply for a loan up to $750,000, while UK merchants can apply for anywhere up to £2 million (around $2.6 million).

While Amazon stopped underwriting its own loans in the US and UK earlier this year, it continues to run the scheme through trusted third parties.

Overall, new ways of financing are springing up to take advantage of an underserved small business market.

Don’t be surprised when more of these digitally-native small businesses start to adopt these alternative solutions as their primary financial partners.

5. Software Solutions Offer Virtual Efficiency

Nowhere is it more important to rely on software and virtual solutions than in the world of small businesses.

When your business is too small to hire in-house accountants or back-office employees, it is essential that you find a SaaS tool to help you.

In today’s business environment, that is just what small businesses are doing.

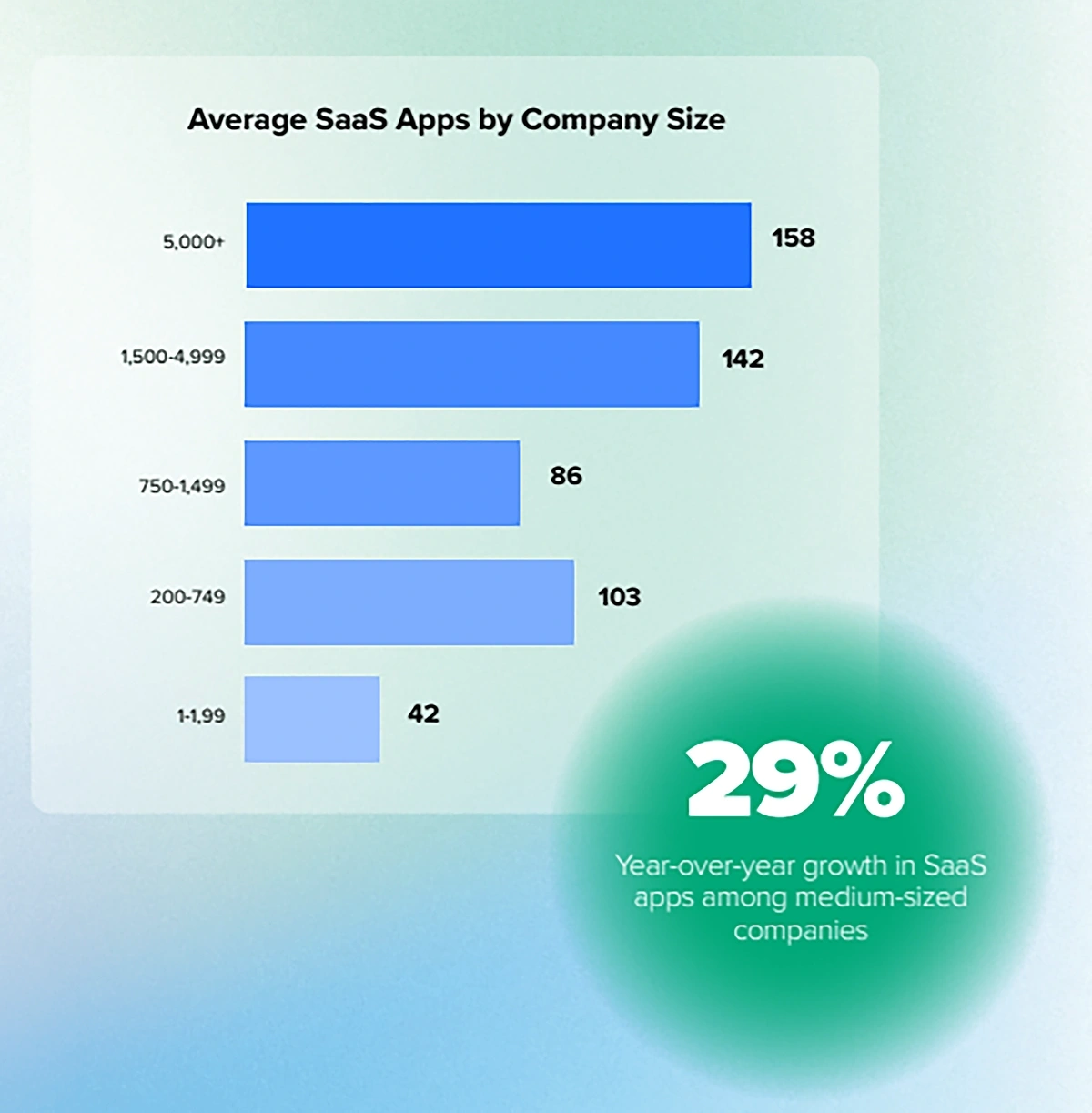

Among companies with 1-1500 employees, the average number of SaaS applications stands at 77.

Businesses with 200-749 employees average over 100 SaaS apps.

This is indicative of a growing trend. One in which small businesses don’t need many employees to operate, and rely on a large number of outside technologies.

Take Semrush, our example from earlier. Small businesses can cut costs by selecting an all-in-one SEO solution, while they also gain a wealth of expertise and industry experience that would not otherwise have been available.

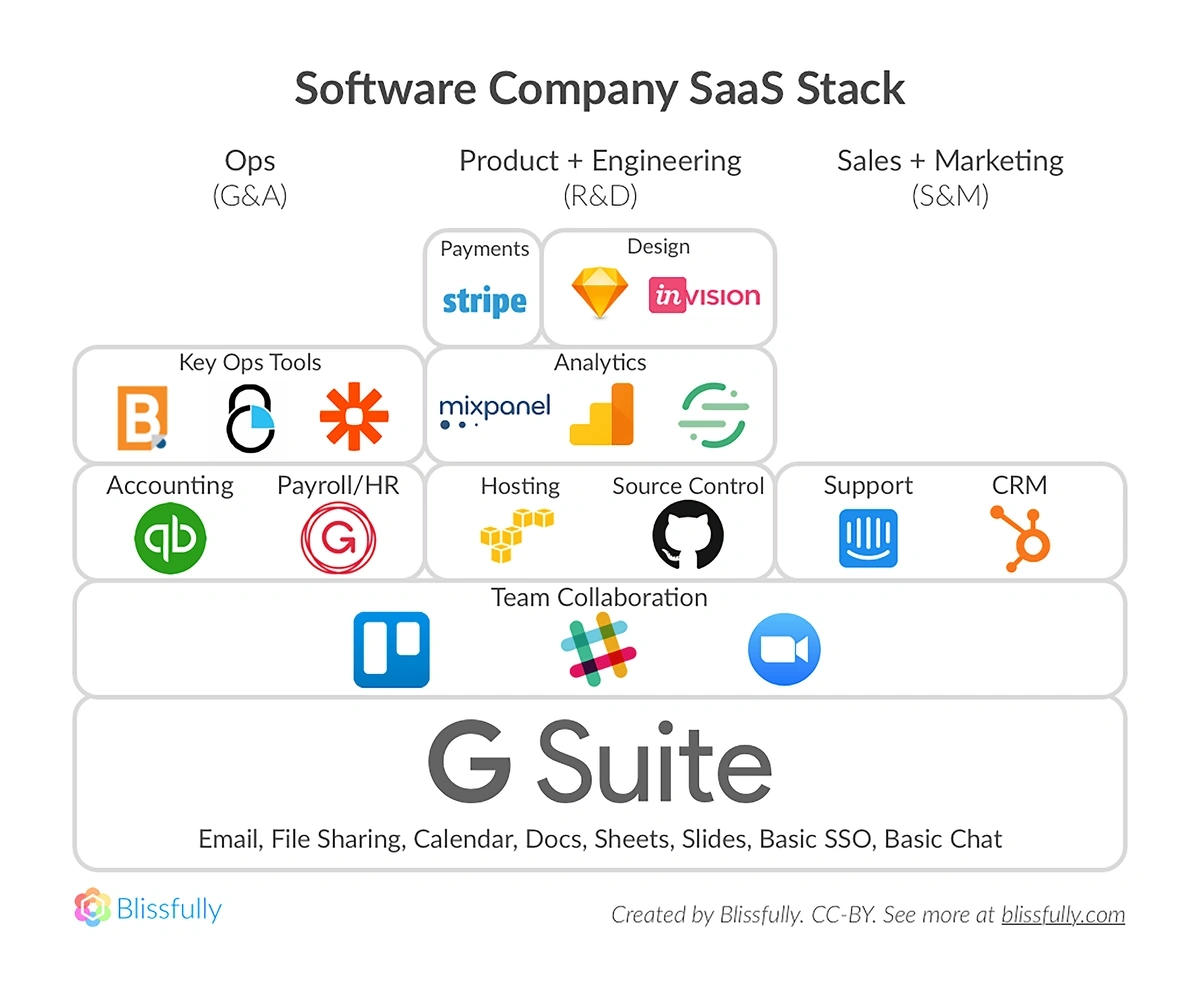

Whereas a company used to hire employees or an outside firm to handle its business functions, the new business stack looks more like this:

A look at major software products and what functions they provide to businesses.

And with products like Semrush, HubSpot, Slack, Trello, Intercom, Freshbooks, and BambooHR, it’s no wonder that some companies can completely outsource all of their major functions to software products.

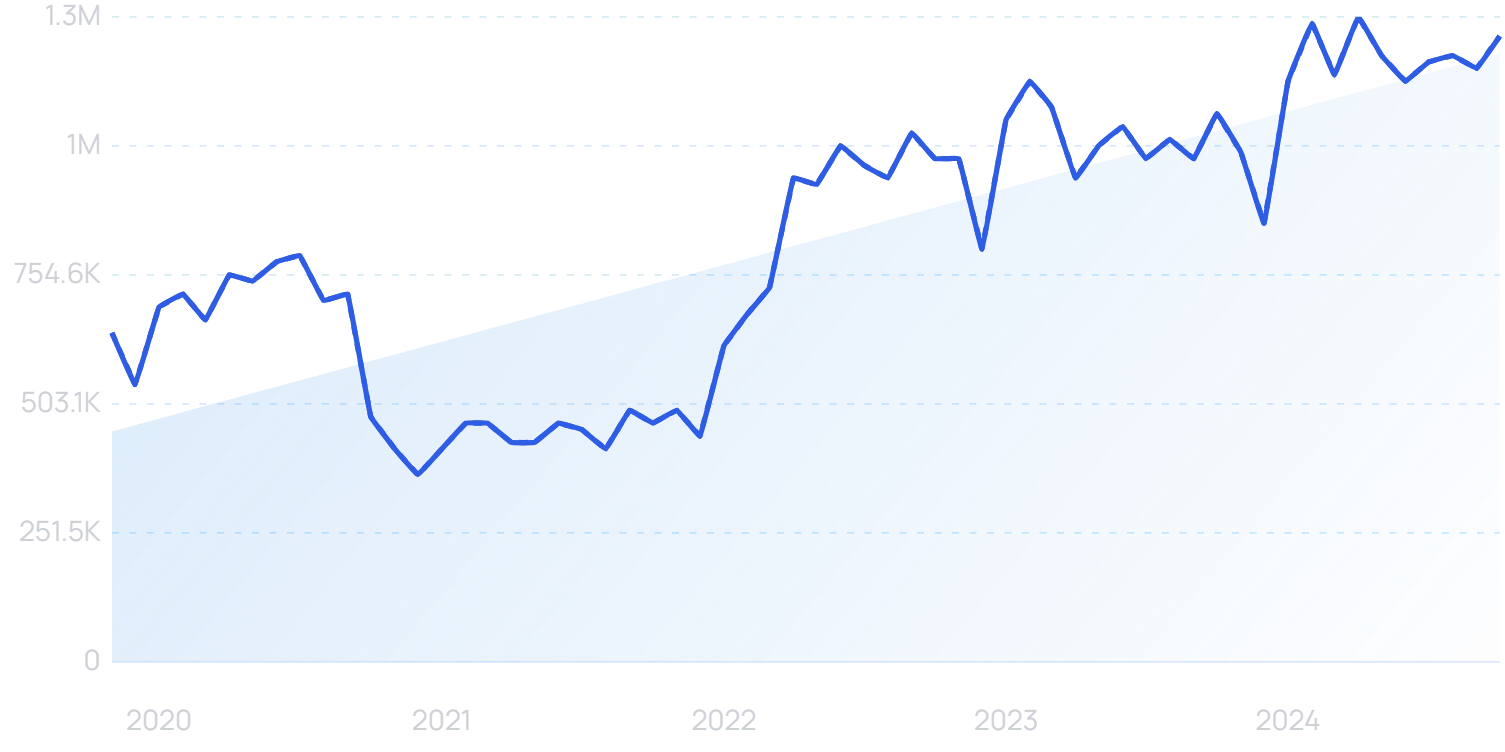

Hubspot is one of the most popular marketing and sales software products.

Searches for "Hubspot" have increased by 100% over the last 5 years.

It allows small companies to operate sales and marketing campaigns at the scale of much larger organizations.

Hubspot has over 228,000 customers around the world, and it brought in over $2.17 billion in 2023.

Trello is an all-purpose project management tool.

Remote teams can track and manage projects using Trello.

By providing what has been described as a “digital whiteboard”, Trello has gained a loyal customer base.

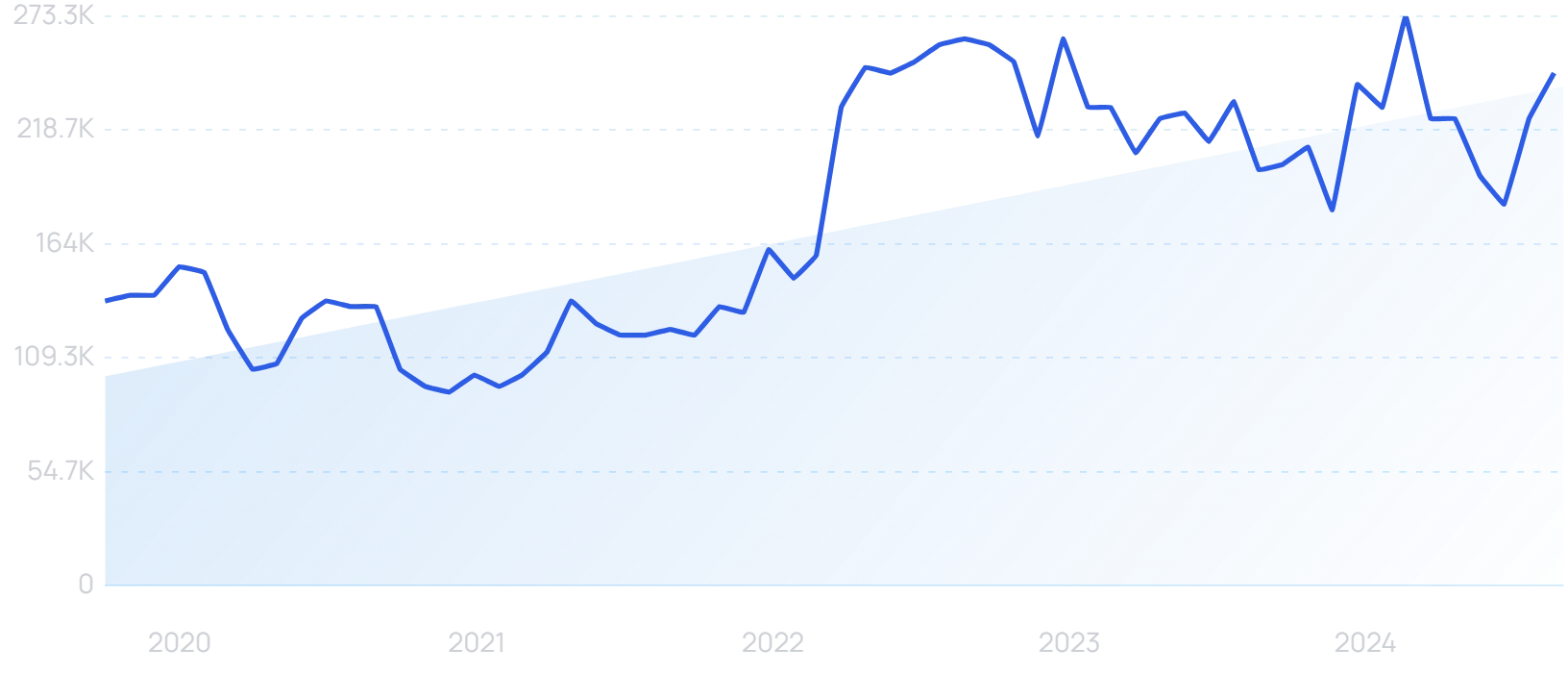

Finally, BambooHR basically creates a digital HR department for small businesses.

Searches for "BambooHR" have grown by 80% in the last 5 years.

As HR and staff compliance has become more burdensome, BambooHR has set out to make HR increasingly affordable for small businesses.

As a result, the company has experienced impressive growth. BambooHR now has over 33,000 clients and several million users.

Of course, all of these services are wonderfully useful on their own. But by combining them, many small businesses are able to operate with nothing more than an internet connection and a couple of employees (if that).

6. Local SEO And Digital Presence Become Non-Negotiables

A digital presence will be more important than ever to small businesses as an increasing number of consumers turn to E-commerce.

But as the world of small business evolves and shifts increasingly online, a strong digital presence can be just as valuable to primarily brick-and-mortar businesses.

Local SEO is not an optional expense for many small businesses these days.

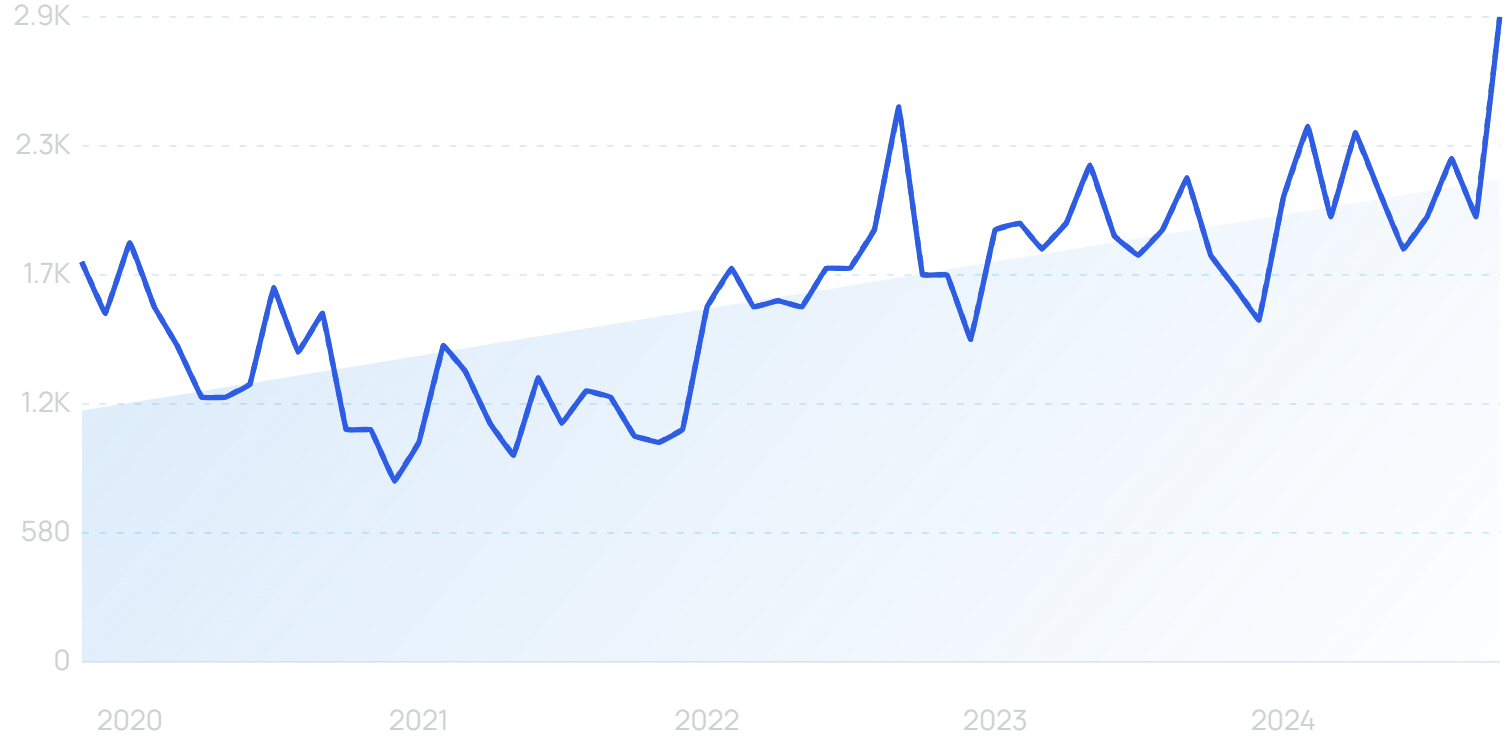

Searches for "Local SEO" have risen by 690% in 10 years.

Even local customers are likely to discover new businesses via digital channels: 8 in 10 US consumers search online for local businesses at least once a week. 32% search at least once a day.

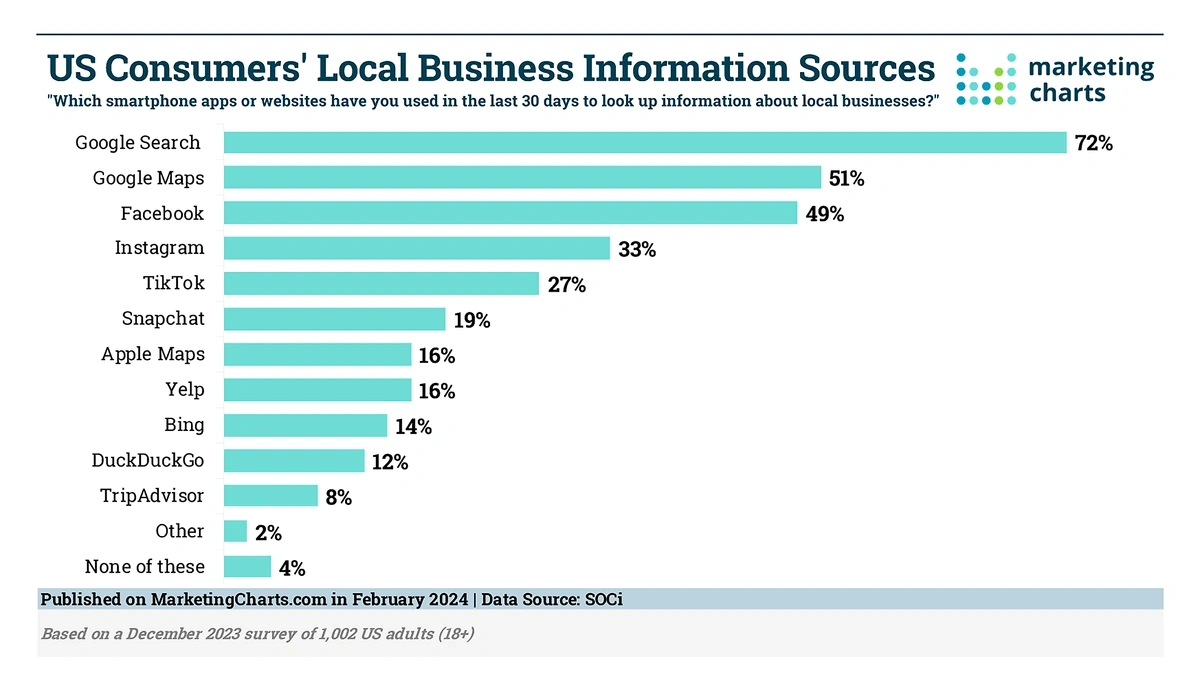

The most popular method of finding information is a Google Search. Local businesses that rank well for relevant keywords can duly unlock a significant new customer base.

Google Search is the leading way US consumers find out about local businesses.

Using Semrush tools, a local dentistry business in Liverpool, England, saw a 24x increase in customers. It shifted its focus to SEO after a big traditional ad budget did not produce returns, and now posts annual revenue of around $4.5 million (£3.5 million).

After search, Google Maps is the next-most significant source of information on local businesses. It should not be disregarded.

The Map Rank Tracker app is available through Semrush. It allows users to keep a detailed eye on their business rankings in Google Maps.

Searches for “Google Maps SEO” are up 48% in the last 5 years.

Small businesses can track how they are ranking on a regional, neighborhood or even street level, while gaining insights on competitors.

For businesses that are primarily targeting E-commerce, the big focus should be on the ongoing shift in customer acquisition channels.

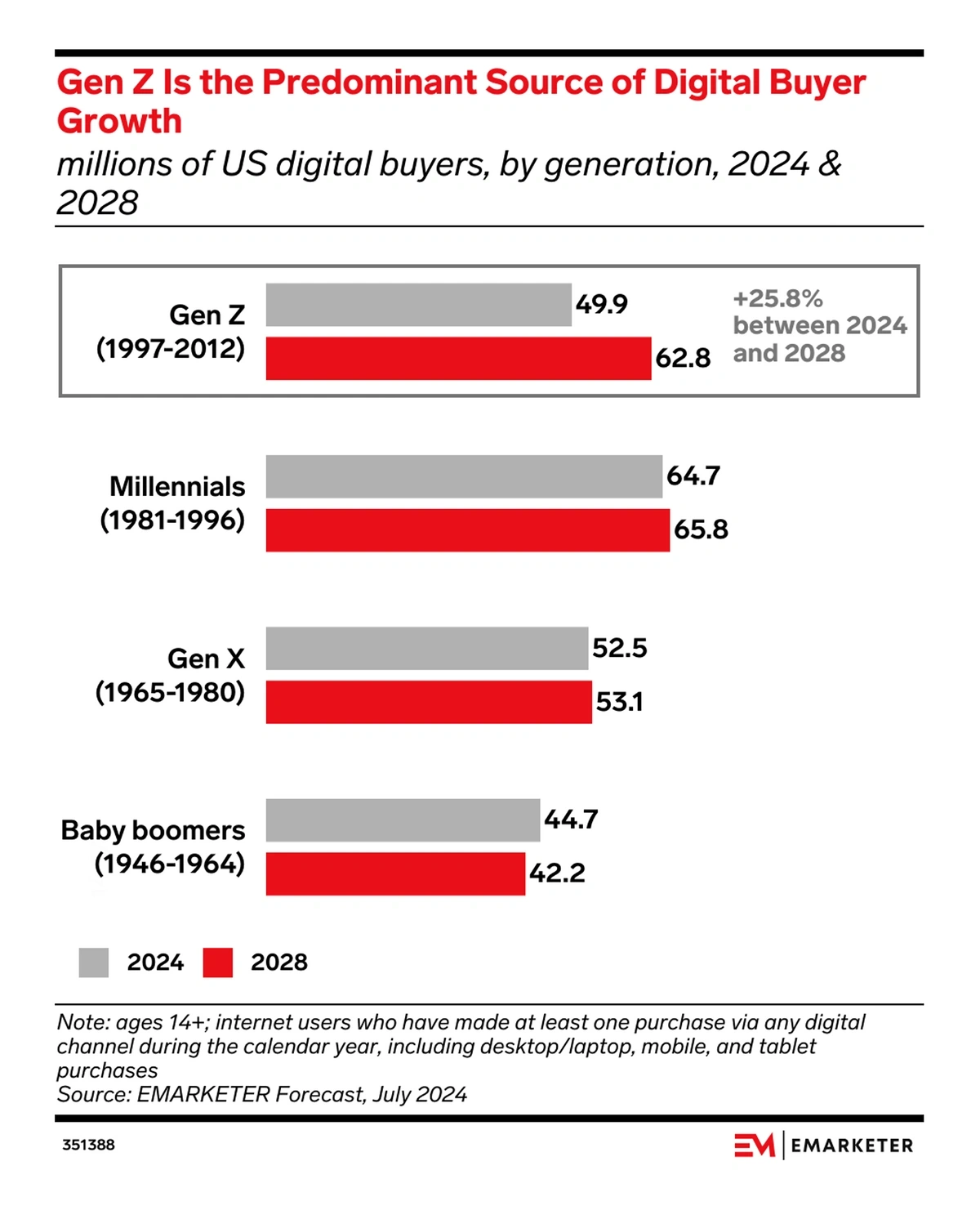

The US will see 14.7 million new digital buyers between 2024 and 2028, 90% of whom will come from Gen Z.

Gen Z (and, by some definitions, Gen Alpha) will drive an influx of digital shoppers in the US.

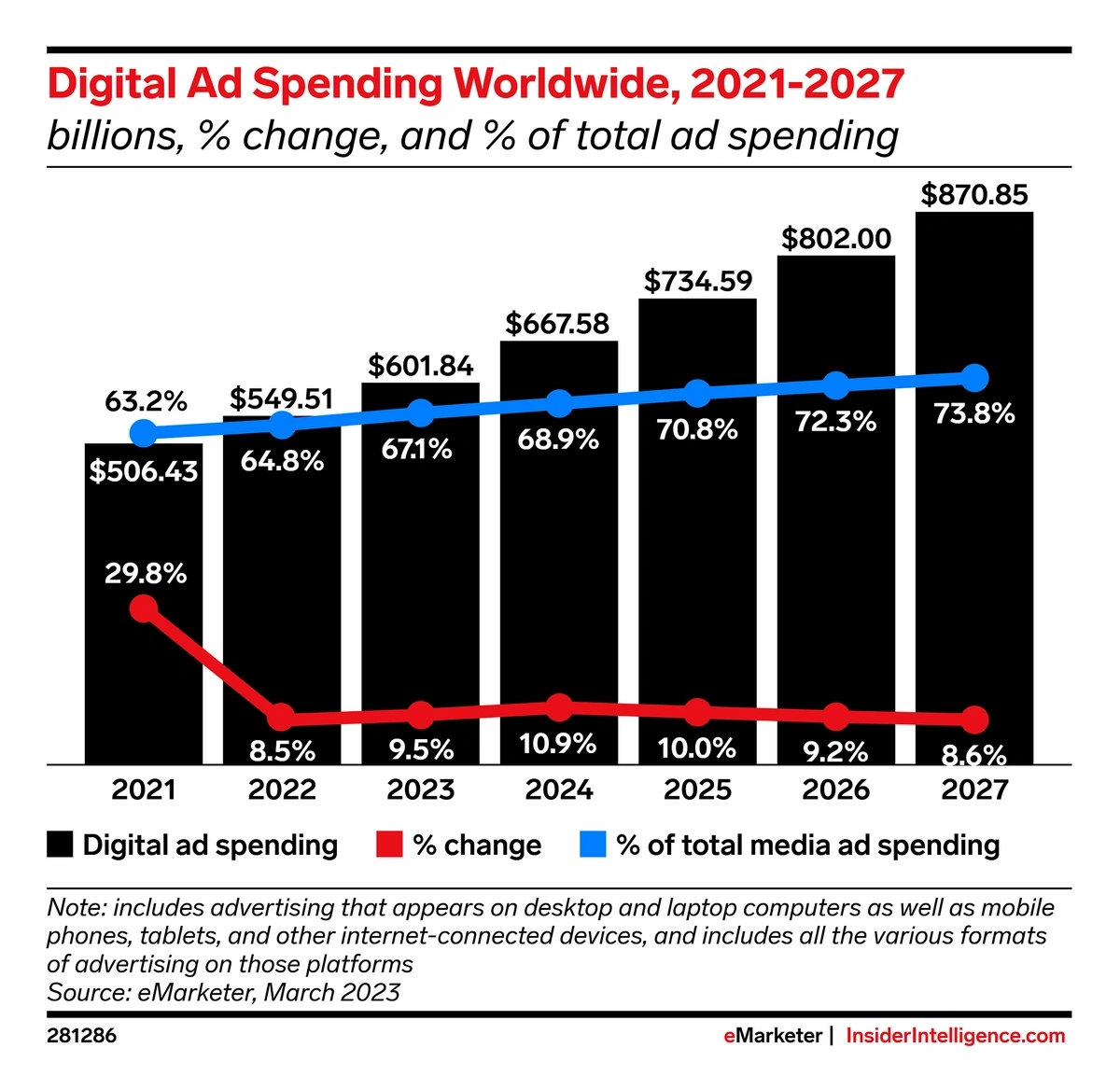

It’s no wonder, then, that a large portion of advertising is shifting online. By 2027, it’s forecast that almost three quarters of all ad budgets will be dedicated to digital.

Over $650 billion per year is already being spent on digital ads.

78% of small businesses find that digital ads generate more revenue than offline ads, according to a study conducted last year by the Connected Commerce Council.

And on average, businesses with 10 employees or fewer are already dedicating 74% of their advertising budgets to digital formats — three years ahead of the overall industry projection.

Nowhere is this demand more apparent than in the world of digital marketing agencies.

Search interest in “digital marketing” has grown by 493% over the last 10 years.

In 2023, there were almost 49,000 digital advertising agencies in the US alone.That was a 15.6% increase on 2022.

Social media is also a huge focus for small businesses.

77% of small businesses use social media to reach customers. And 41% depend on social media as a revenue driver.

As a result, social media ad spending (among all businesses) is projected to rise to over $219 billion by the end of 2024.

This area of advertising has grown at an unprecedented rate, rising from just over $50 billion in 2017.

But some small businesses still have a way to go to establish any kind of digital presence.

According to a UK survey by Forbes Advisor, 22% of small businesses currently don’t even have a website.

Yet among those that do have one, 83.5% say it “plays a big part” in their business.

69% of those without a website think they should have one.

And they’re probably right: small businesses that have websites grow twice as fast on average as those without websites.

In other words, a digital presence is likely to be an absolute imperative for small businesses in the near future, if indeed we are not already at that point.

7. Cybersecurity Becomes A Top Priority For Small Businesses

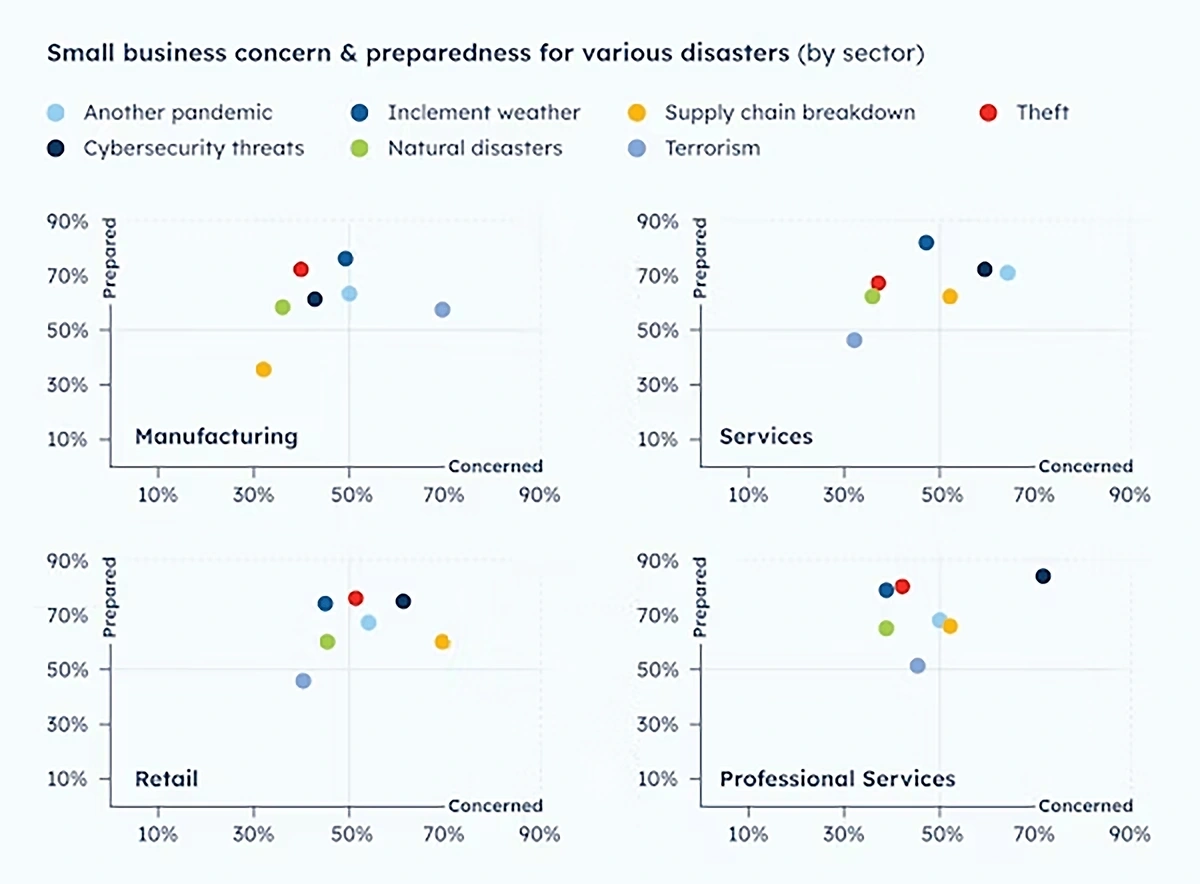

According to a 2024 survey by the US Chamber of Commerce, 60% of small businesses say cybersecurity threats are a top concern.

Small businesses in the professional services sector are the most concerned about cyber threats, but also the most prepared.

And these fears are well-founded: because of their limited means of defense, many small businesses are becoming primary targets. 43% of cyberattacks are aimed at small businesses.

One way to handle this would be through the use of cyber insurance or increased cybersecurity measures.

But just 17% of small businesses currently have cyber insurance.

Guardz is a cybersecurity and cyber insurance platform that Managed Service Providers (MSPs) can offer to small and medium-sized businesses.

“Guardz” searches are up 50% in 5 years.

First and foremost, it seeks to locate threats and prevent cyberattacks before they happen. But it’s also an insurance platform for if something does go wrong.

Earlier this year, Guardz announced a strategic partnership with SentinelOne to improve its AI-powered security solutions.

“SentinelOne” searches are up 600% in the last 5 years as interest in AI cybersecurity grows.

But while technology can help combat cyber risks, it can also make things worse. The influx of new IoT devices and SaaS tools only creates more points of potential vulnerability.

For instance, IoT malware rose by 400% in 2023.

And there is no easy answer to this problem. Among small businesses without cybersecurity measures, 19% cited cost as the reason.

In the end, it will take more time and focus to deal with this pressing issue. But as more small businesses shift online, expect cybersecurity to take precedence.

Conclusion

Small businesses are constantly changing.

In particular, they are becoming more reliant on digital tools and large tech platforms.

But if anything, their importance to the US economy is growing.

Understanding how the changing world affects small businesses will be the key to understanding how they will fare in the future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more